Detailed VaR Analysis of 5 Companies' Portfolio using Simulation

VerifiedAdded on 2023/04/20

|9

|1240

|291

Report

AI Summary

This report provides a comprehensive analysis of the Value at Risk (VaR) for a portfolio consisting of five companies, employing various methodologies including Monte Carlo simulation, historical simulation (1-year, 2-year, and 3-year data), and parametric VaR. The Monte Carlo simulation reveal...

ANALYSES 5 COMPANIES’ PORTFOLIO

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Monte Carlo simulation VaR.....................................................................................................3

Historical 1 year simulation VaR...............................................................................................4

Historical 2 year simulation VaR...............................................................................................5

Historical 3 year simulation VaR...............................................................................................6

Parametric VaR..........................................................................................................................7

References..................................................................................................................................9

Monte Carlo simulation VaR.....................................................................................................3

Historical 1 year simulation VaR...............................................................................................4

Historical 2 year simulation VaR...............................................................................................5

Historical 3 year simulation VaR...............................................................................................6

Parametric VaR..........................................................................................................................7

References..................................................................................................................................9

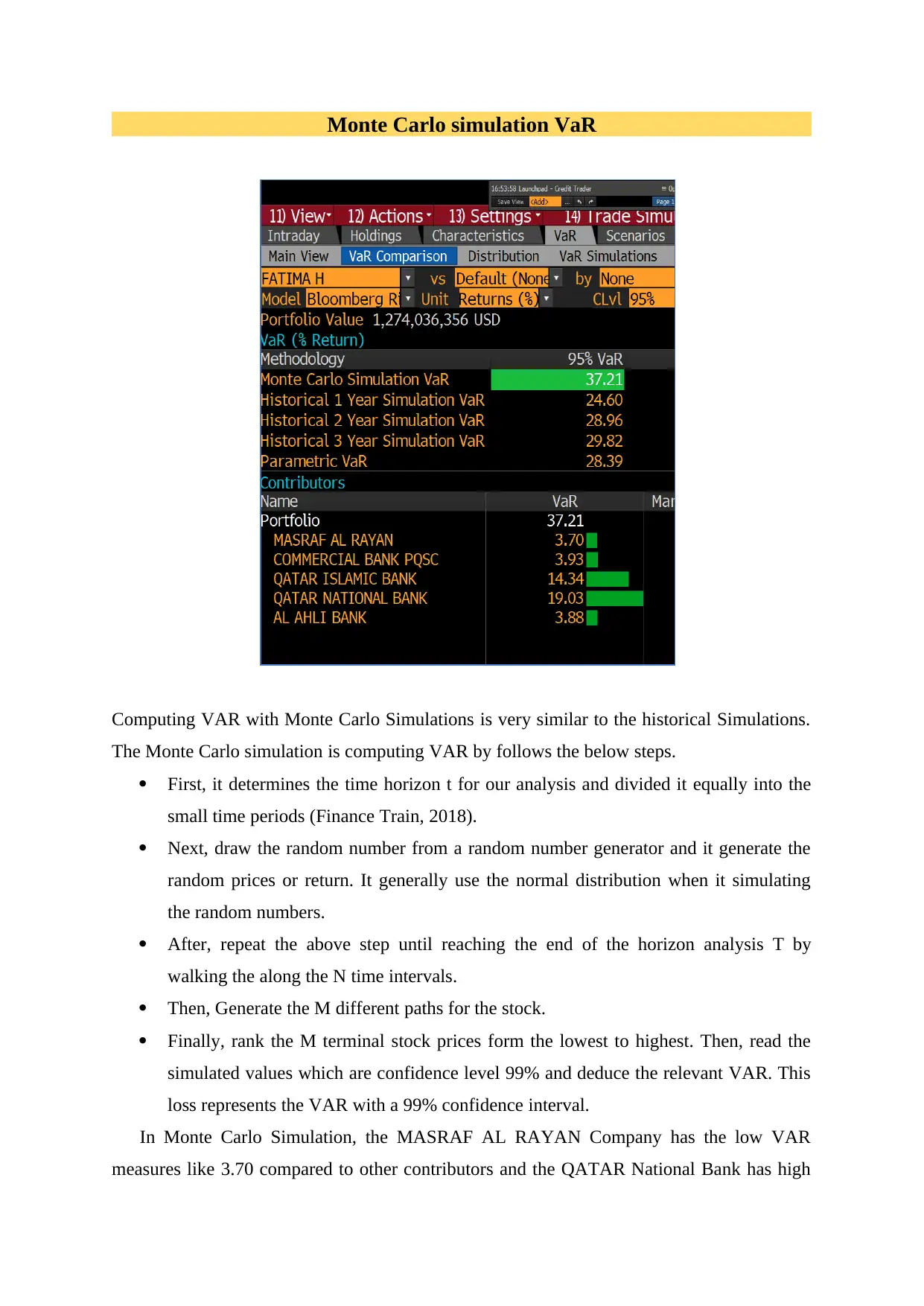

Monte Carlo simulation VaR

Computing VAR with Monte Carlo Simulations is very similar to the historical Simulations.

The Monte Carlo simulation is computing VAR by follows the below steps.

First, it determines the time horizon t for our analysis and divided it equally into the

small time periods (Finance Train, 2018).

Next, draw the random number from a random number generator and it generate the

random prices or return. It generally use the normal distribution when it simulating

the random numbers.

After, repeat the above step until reaching the end of the horizon analysis T by

walking the along the N time intervals.

Then, Generate the M different paths for the stock.

Finally, rank the M terminal stock prices form the lowest to highest. Then, read the

simulated values which are confidence level 99% and deduce the relevant VAR. This

loss represents the VAR with a 99% confidence interval.

In Monte Carlo Simulation, the MASRAF AL RAYAN Company has the low VAR

measures like 3.70 compared to other contributors and the QATAR National Bank has high

Computing VAR with Monte Carlo Simulations is very similar to the historical Simulations.

The Monte Carlo simulation is computing VAR by follows the below steps.

First, it determines the time horizon t for our analysis and divided it equally into the

small time periods (Finance Train, 2018).

Next, draw the random number from a random number generator and it generate the

random prices or return. It generally use the normal distribution when it simulating

the random numbers.

After, repeat the above step until reaching the end of the horizon analysis T by

walking the along the N time intervals.

Then, Generate the M different paths for the stock.

Finally, rank the M terminal stock prices form the lowest to highest. Then, read the

simulated values which are confidence level 99% and deduce the relevant VAR. This

loss represents the VAR with a 99% confidence interval.

In Monte Carlo Simulation, the MASRAF AL RAYAN Company has the low VAR

measures like 3.70 compared to other contributors and the QATAR National Bank has high

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

VAR measures like 19.03 VAR measures. Based on all the methodology, the Monte Carlo

simulation has high VAR measures like 37.41.

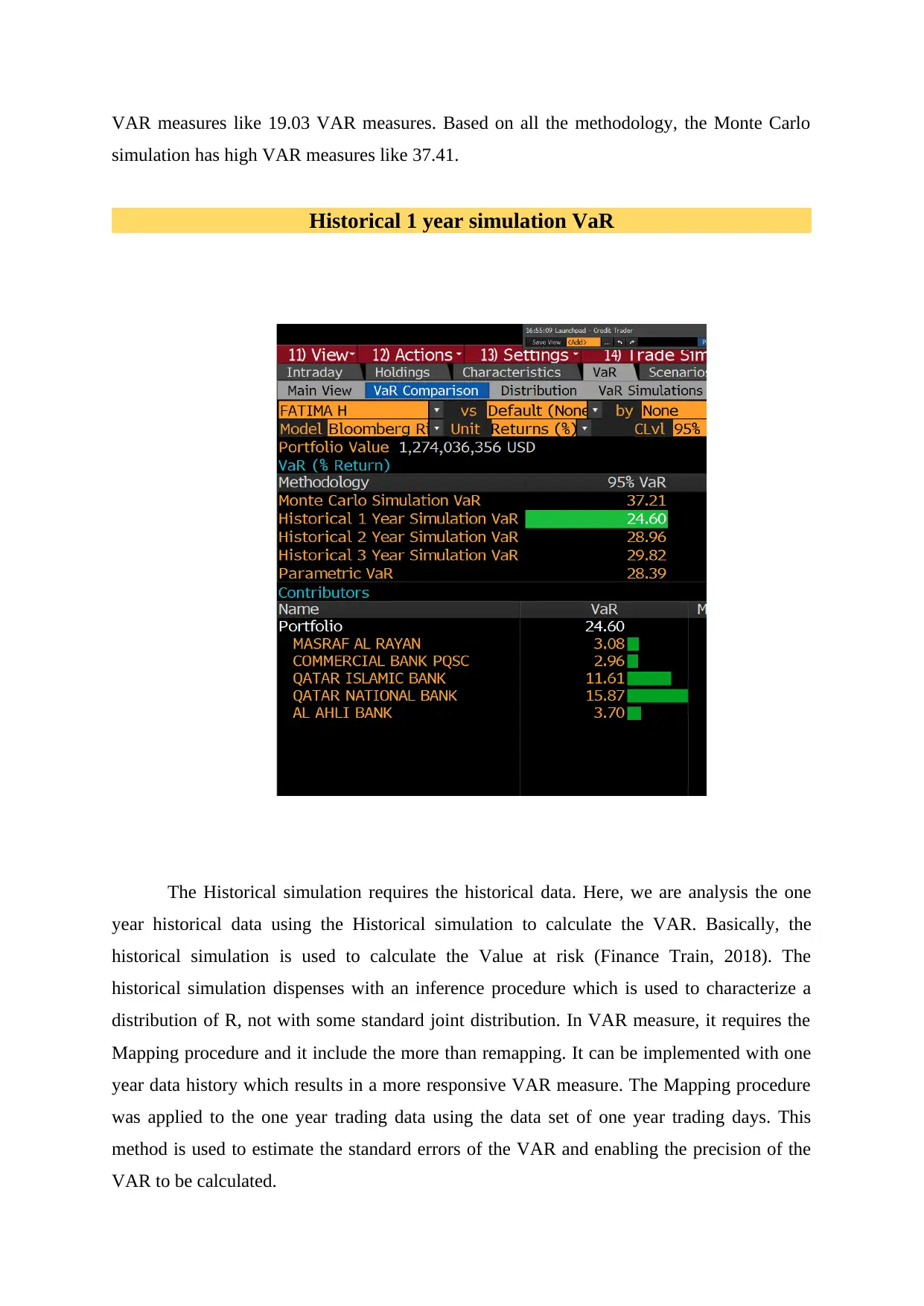

Historical 1 year simulation VaR

The Historical simulation requires the historical data. Here, we are analysis the one

year historical data using the Historical simulation to calculate the VAR. Basically, the

historical simulation is used to calculate the Value at risk (Finance Train, 2018). The

historical simulation dispenses with an inference procedure which is used to characterize a

distribution of R, not with some standard joint distribution. In VAR measure, it requires the

Mapping procedure and it include the more than remapping. It can be implemented with one

year data history which results in a more responsive VAR measure. The Mapping procedure

was applied to the one year trading data using the data set of one year trading days. This

method is used to estimate the standard errors of the VAR and enabling the precision of the

VAR to be calculated.

simulation has high VAR measures like 37.41.

Historical 1 year simulation VaR

The Historical simulation requires the historical data. Here, we are analysis the one

year historical data using the Historical simulation to calculate the VAR. Basically, the

historical simulation is used to calculate the Value at risk (Finance Train, 2018). The

historical simulation dispenses with an inference procedure which is used to characterize a

distribution of R, not with some standard joint distribution. In VAR measure, it requires the

Mapping procedure and it include the more than remapping. It can be implemented with one

year data history which results in a more responsive VAR measure. The Mapping procedure

was applied to the one year trading data using the data set of one year trading days. This

method is used to estimate the standard errors of the VAR and enabling the precision of the

VAR to be calculated.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In Historical one year simulation, it has total portfolio is 24.60 for five companies.

MASRAF AL RAYAN has 3.08 VAR measures, Commercial Bank PQSC has 2.96 VAR

measures, QATAR Islamic bank has 11.61, Qatar national bank has 15.87 VAR measures

and AL ahli bank has 3.70 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 15.87 based on Historical 1 year simulation.

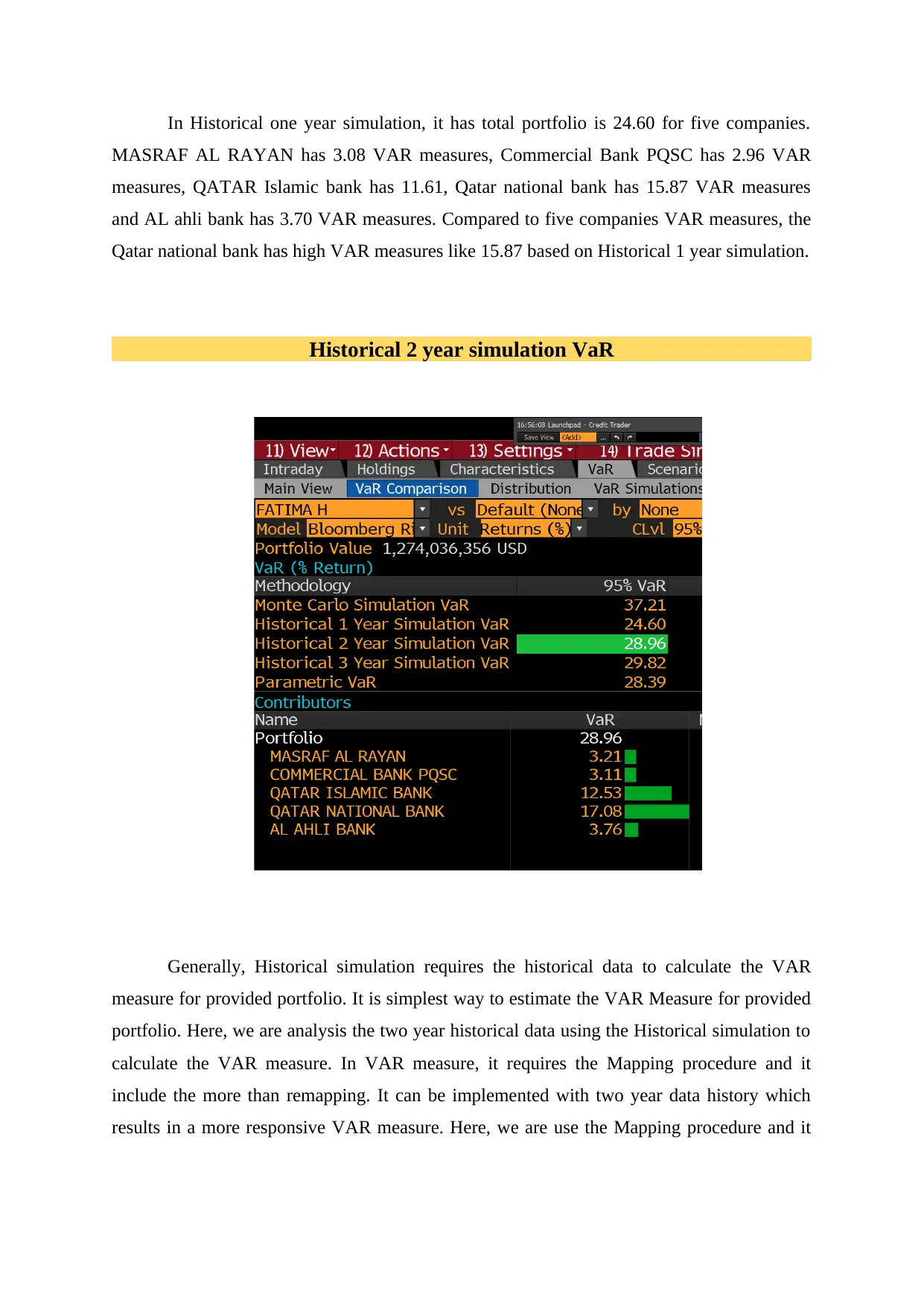

Historical 2 year simulation VaR

Generally, Historical simulation requires the historical data to calculate the VAR

measure for provided portfolio. It is simplest way to estimate the VAR Measure for provided

portfolio. Here, we are analysis the two year historical data using the Historical simulation to

calculate the VAR measure. In VAR measure, it requires the Mapping procedure and it

include the more than remapping. It can be implemented with two year data history which

results in a more responsive VAR measure. Here, we are use the Mapping procedure and it

MASRAF AL RAYAN has 3.08 VAR measures, Commercial Bank PQSC has 2.96 VAR

measures, QATAR Islamic bank has 11.61, Qatar national bank has 15.87 VAR measures

and AL ahli bank has 3.70 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 15.87 based on Historical 1 year simulation.

Historical 2 year simulation VaR

Generally, Historical simulation requires the historical data to calculate the VAR

measure for provided portfolio. It is simplest way to estimate the VAR Measure for provided

portfolio. Here, we are analysis the two year historical data using the Historical simulation to

calculate the VAR measure. In VAR measure, it requires the Mapping procedure and it

include the more than remapping. It can be implemented with two year data history which

results in a more responsive VAR measure. Here, we are use the Mapping procedure and it

was applied to the two trading data using the data set of two year trading days. This method

successfully calculated the Historical one year simulation VAR is 28.96.

In Historical two year simulation, it has total portfolio is 28.96 for five companies.

MASRAF AL RAYAN has 3.21 VAR measures, Commercial Bank PQSC has 3.11 VAR

measures, QATAR Islamic bank has 12.53, Qatar national bank has 17.08 VAR measures

and AL ahli bank has 3.76 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 17.08 based on Historical 2 year simulation.

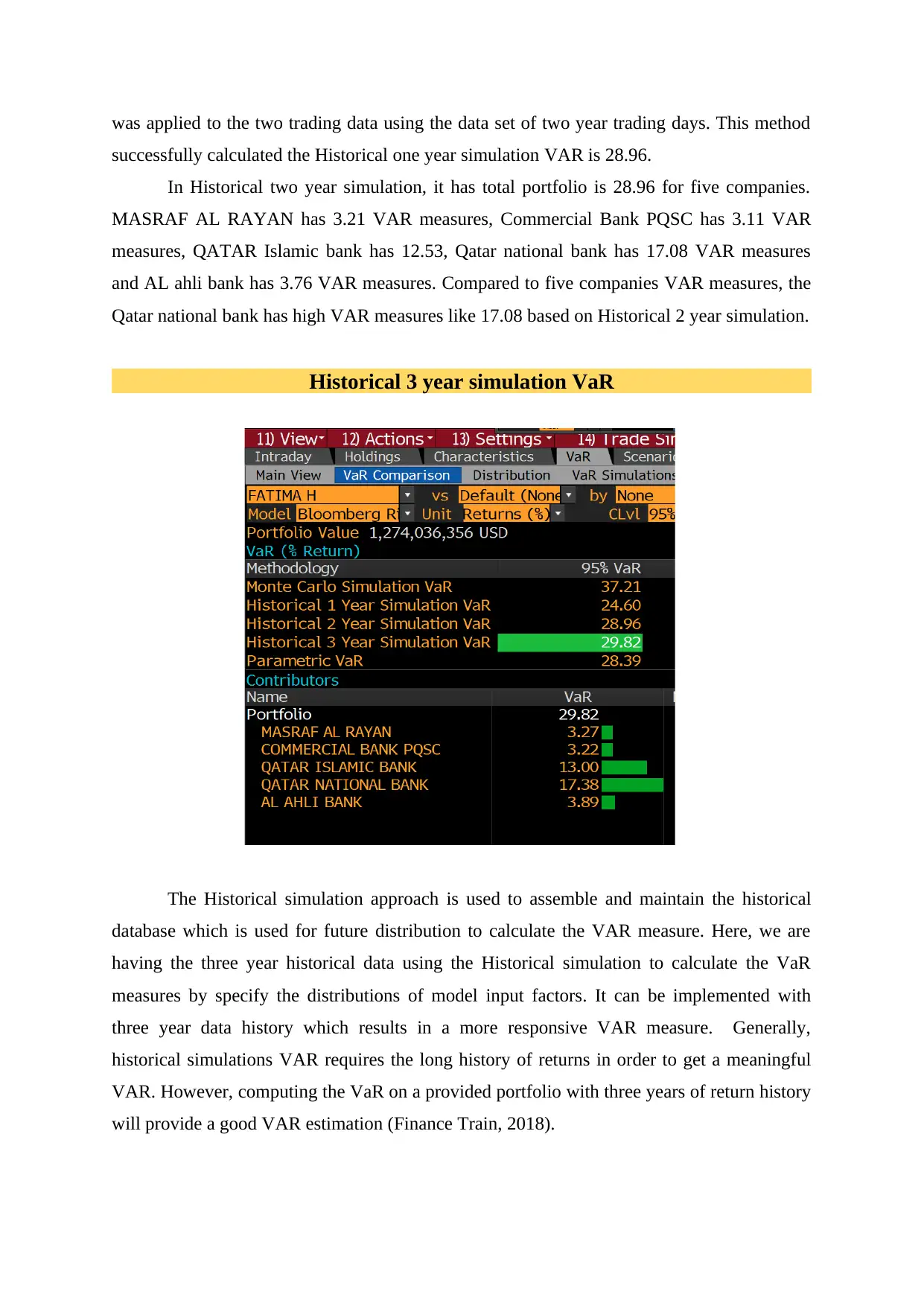

Historical 3 year simulation VaR

The Historical simulation approach is used to assemble and maintain the historical

database which is used for future distribution to calculate the VAR measure. Here, we are

having the three year historical data using the Historical simulation to calculate the VaR

measures by specify the distributions of model input factors. It can be implemented with

three year data history which results in a more responsive VAR measure. Generally,

historical simulations VAR requires the long history of returns in order to get a meaningful

VAR. However, computing the VaR on a provided portfolio with three years of return history

will provide a good VAR estimation (Finance Train, 2018).

successfully calculated the Historical one year simulation VAR is 28.96.

In Historical two year simulation, it has total portfolio is 28.96 for five companies.

MASRAF AL RAYAN has 3.21 VAR measures, Commercial Bank PQSC has 3.11 VAR

measures, QATAR Islamic bank has 12.53, Qatar national bank has 17.08 VAR measures

and AL ahli bank has 3.76 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 17.08 based on Historical 2 year simulation.

Historical 3 year simulation VaR

The Historical simulation approach is used to assemble and maintain the historical

database which is used for future distribution to calculate the VAR measure. Here, we are

having the three year historical data using the Historical simulation to calculate the VaR

measures by specify the distributions of model input factors. It can be implemented with

three year data history which results in a more responsive VAR measure. Generally,

historical simulations VAR requires the long history of returns in order to get a meaningful

VAR. However, computing the VaR on a provided portfolio with three years of return history

will provide a good VAR estimation (Finance Train, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In Historical three year simulation, it has total portfolio is 29.82 for five companies.

MASRAF AL RAYAN has 3.27 VAR measures, Commercial Bank PQSC has 3.22 VAR

measures, QATAR Islamic bank has 13.00, Qatar national bank has 17.38 VAR measures

and AL ahli bank has 3.89 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 17.38 based on Historical 3 year simulation.

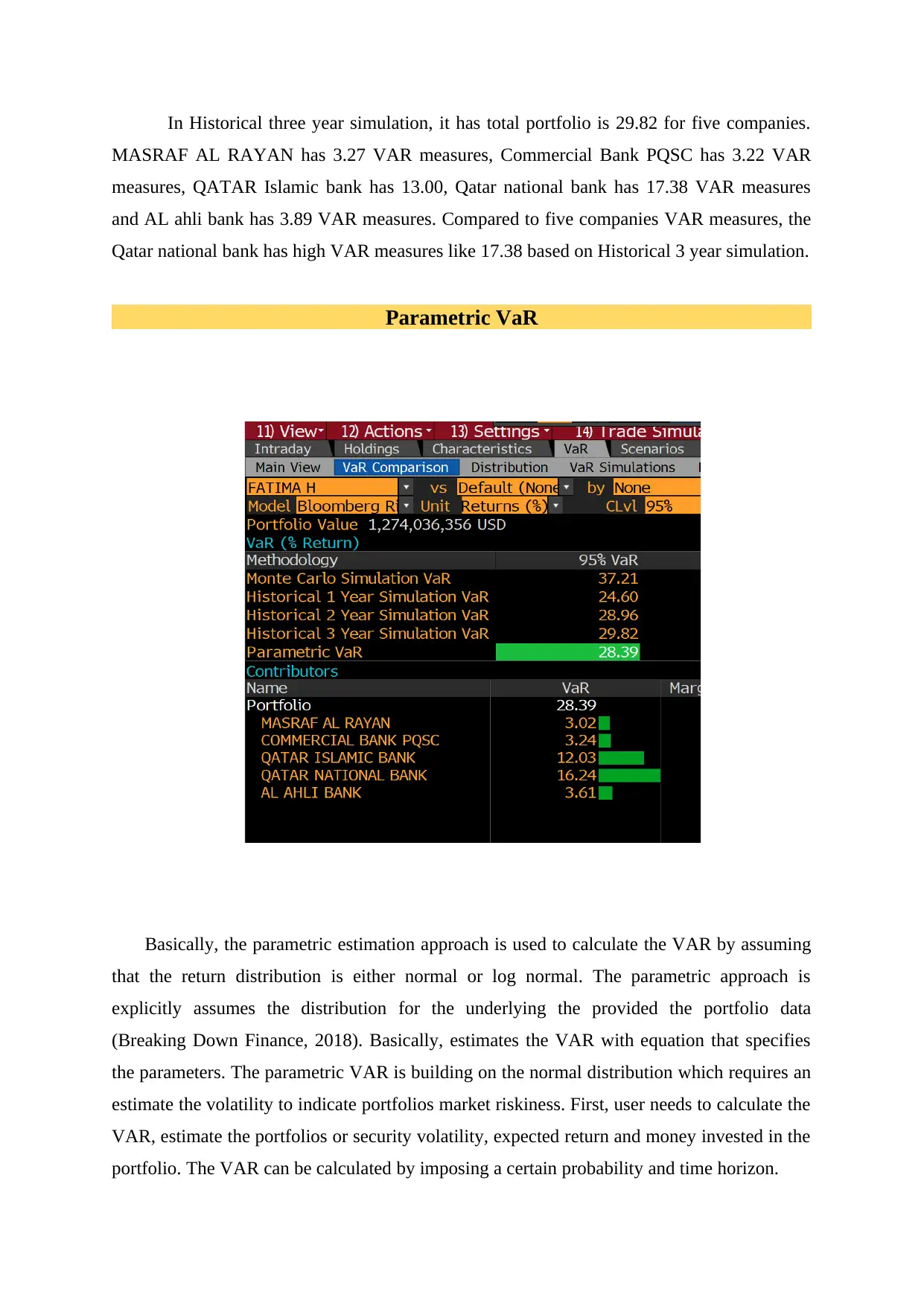

Parametric VaR

Basically, the parametric estimation approach is used to calculate the VAR by assuming

that the return distribution is either normal or log normal. The parametric approach is

explicitly assumes the distribution for the underlying the provided the portfolio data

(Breaking Down Finance, 2018). Basically, estimates the VAR with equation that specifies

the parameters. The parametric VAR is building on the normal distribution which requires an

estimate the volatility to indicate portfolios market riskiness. First, user needs to calculate the

VAR, estimate the portfolios or security volatility, expected return and money invested in the

portfolio. The VAR can be calculated by imposing a certain probability and time horizon.

MASRAF AL RAYAN has 3.27 VAR measures, Commercial Bank PQSC has 3.22 VAR

measures, QATAR Islamic bank has 13.00, Qatar national bank has 17.38 VAR measures

and AL ahli bank has 3.89 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 17.38 based on Historical 3 year simulation.

Parametric VaR

Basically, the parametric estimation approach is used to calculate the VAR by assuming

that the return distribution is either normal or log normal. The parametric approach is

explicitly assumes the distribution for the underlying the provided the portfolio data

(Breaking Down Finance, 2018). Basically, estimates the VAR with equation that specifies

the parameters. The parametric VAR is building on the normal distribution which requires an

estimate the volatility to indicate portfolios market riskiness. First, user needs to calculate the

VAR, estimate the portfolios or security volatility, expected return and money invested in the

portfolio. The VAR can be calculated by imposing a certain probability and time horizon.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In Parametric VAR simulation, it has total portfolio is 29.39 for five companies.

MASRAF AL RAYAN has 3.02 VAR measures, Commercial Bank PQSC has 3.24 VAR

measures, QATAR Islamic bank has 12.03, Qatar national bank has 16.24 VAR measures

and AL ahli bank has 3.61 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 16.24 based on Parametric VAR simulation.

MASRAF AL RAYAN has 3.02 VAR measures, Commercial Bank PQSC has 3.24 VAR

measures, QATAR Islamic bank has 12.03, Qatar national bank has 16.24 VAR measures

and AL ahli bank has 3.61 VAR measures. Compared to five companies VAR measures, the

Qatar national bank has high VAR measures like 16.24 based on Parametric VAR simulation.

References

Breaking Down Finance. (2018). Parametric value-at-risk - Breaking Down Finance.

[online] Available at:

https://breakingdownfinance.com/finance-topics/risk-management/market-risk/parametric-

value-at-risk/ [Accessed 22 Dec. 2018].

Finance Train. (2018). Calculating VaR Using Historical Simulation - Finance Train.

[online] Available at: https://financetrain.com/calculating-var-using-historical-simulation/

[Accessed 22 Dec. 2018].

Finance Train. (2018). Calculating VaR using Monte Carlo Simulation - Finance Train.

[online] Available at: https://financetrain.com/calculating-var-using-monte-carlo-simulation/

[Accessed 22 Dec. 2018].

Finance Train. (2018). Three Methodologies for Calculating VaR - Finance Train. [online]

Available at: https://financetrain.com/three-methodologies-for-calculating-var/ [Accessed 22

Dec. 2018].

Breaking Down Finance. (2018). Parametric value-at-risk - Breaking Down Finance.

[online] Available at:

https://breakingdownfinance.com/finance-topics/risk-management/market-risk/parametric-

value-at-risk/ [Accessed 22 Dec. 2018].

Finance Train. (2018). Calculating VaR Using Historical Simulation - Finance Train.

[online] Available at: https://financetrain.com/calculating-var-using-historical-simulation/

[Accessed 22 Dec. 2018].

Finance Train. (2018). Calculating VaR using Monte Carlo Simulation - Finance Train.

[online] Available at: https://financetrain.com/calculating-var-using-monte-carlo-simulation/

[Accessed 22 Dec. 2018].

Finance Train. (2018). Three Methodologies for Calculating VaR - Finance Train. [online]

Available at: https://financetrain.com/three-methodologies-for-calculating-var/ [Accessed 22

Dec. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.