Accounting Theory Report: Stockland Corporation Financial Analysis

VerifiedAdded on 2023/06/08

|9

|2395

|56

Report

AI Summary

This report provides a comprehensive analysis of the financial reporting practices of Stockland Corporation Limited, an Australian property development company listed on the ASX. The report examines Stockland's adherence to the Australian Accounting Standards Board (AASB), the 'true and fair' view, the conceptual framework of accounting, and relevant corporations law. It critically evaluates the company's annual report, assessing its compliance with AASB and International Accounting Standards Board (IASB) standards, including the application of qualitative characteristics such as relevance, faithful presentation, comparability, verifiability, understandability, and timeliness. Furthermore, the report compares Stockland's financial performance with that of Scentre Group, another ASX-listed real estate investment and development entity, using ratio analysis to assess profitability, asset utilization, liquidity, and market performance. Finally, the report concludes with a recommendation on whether an investment of $10,000 in Stockland is advisable, based on the analysis of its financial statements and market performance, including a discussion of share price trends and earnings per share.

Accounting Theory

Written Report – individual assessment

1

Written Report – individual assessment

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

The present report is developed to provide an understanding of the process of general

purpose financial reporting followed by business corporations within Australia. In this context, it

has undertaken an analysis of the annual report of an Australian ASX 100 listed corporation and

has examined its adherence to AASB, true and fair, conceptual framework and corporations law.

The business entity selected for the purpose is Stockland Corporation Limited, an Australian

property development company listed on ASX. The financial performance of the company is also

compared with another entity listed on the ASX. The company selected for the purpose is

Scentre Group, an ASX listed real estate investment and development entity. At last, it provides

an analysis of the investment decision within the company on the basis of examining the annual

report information.

Critical Analysis of Annual Report of Stockland Corporation Limited

Stockland Corporation Limited, an Australian property development company traded on

ASX and is involved in developing of residential communities, shopping and industrial centers.

The company is listed on ASX and therefore develops its annual reports as per the accounting

policies and standards of AASB (Australian Accounting Standards Board). The financial report

of the company has included a statement of compliance for ensuring that the financial statements

are developed as per the AASB and IASB standards. AASB has directed all the ASX listed

entities to comply with the IASB standards for reporting of their financial information. IASB

requires the business entities to adopt the conceptual framework of accounting for reporting of

the financial information (Stockland: Annual Report, 2017). The conceptual framework of

accounting has provided the qualitative characteristics that the business corporations need to

comply during preparation of their financial reports. The fundamental qualitative characteristics

are relevance and faithful presentation of information while the enhancing characteristics are

comparability, verifiability, understandability and timeliness. As such, Stockland Corporation

also needs to follow these principles of conceptual framework of accounting in order to comply

effectively with AASB standards (Conceptual Framework for Financial Reporting, 2018).

As per the relevance characteristic of the conceptual framework of accounting, the

company needs to disclose relevant information to the end-users that is able to guide them in

their decision-making process (Stockland: Annual Report, 2017). The financial information can

said to be relevant when it has both predictive and confirmatory value. It is predictive if it is able

to make future predictions based on the past and present financial information and confirmatory

that represents the confirmatory position of a firm. The company has adopted the use critical

accounting estimates and judgments for predicting the value of key financial items that are based

on past information ad adjusted as per the current market conditions. The confirmatory value is

depicted with the use of key accounting policies to representing their real and fair value that is

disclosed in the notes to financial statement section (Gaffikin, 2003).

2

The present report is developed to provide an understanding of the process of general

purpose financial reporting followed by business corporations within Australia. In this context, it

has undertaken an analysis of the annual report of an Australian ASX 100 listed corporation and

has examined its adherence to AASB, true and fair, conceptual framework and corporations law.

The business entity selected for the purpose is Stockland Corporation Limited, an Australian

property development company listed on ASX. The financial performance of the company is also

compared with another entity listed on the ASX. The company selected for the purpose is

Scentre Group, an ASX listed real estate investment and development entity. At last, it provides

an analysis of the investment decision within the company on the basis of examining the annual

report information.

Critical Analysis of Annual Report of Stockland Corporation Limited

Stockland Corporation Limited, an Australian property development company traded on

ASX and is involved in developing of residential communities, shopping and industrial centers.

The company is listed on ASX and therefore develops its annual reports as per the accounting

policies and standards of AASB (Australian Accounting Standards Board). The financial report

of the company has included a statement of compliance for ensuring that the financial statements

are developed as per the AASB and IASB standards. AASB has directed all the ASX listed

entities to comply with the IASB standards for reporting of their financial information. IASB

requires the business entities to adopt the conceptual framework of accounting for reporting of

the financial information (Stockland: Annual Report, 2017). The conceptual framework of

accounting has provided the qualitative characteristics that the business corporations need to

comply during preparation of their financial reports. The fundamental qualitative characteristics

are relevance and faithful presentation of information while the enhancing characteristics are

comparability, verifiability, understandability and timeliness. As such, Stockland Corporation

also needs to follow these principles of conceptual framework of accounting in order to comply

effectively with AASB standards (Conceptual Framework for Financial Reporting, 2018).

As per the relevance characteristic of the conceptual framework of accounting, the

company needs to disclose relevant information to the end-users that is able to guide them in

their decision-making process (Stockland: Annual Report, 2017). The financial information can

said to be relevant when it has both predictive and confirmatory value. It is predictive if it is able

to make future predictions based on the past and present financial information and confirmatory

that represents the confirmatory position of a firm. The company has adopted the use critical

accounting estimates and judgments for predicting the value of key financial items that are based

on past information ad adjusted as per the current market conditions. The confirmatory value is

depicted with the use of key accounting policies to representing their real and fair value that is

disclosed in the notes to financial statement section (Gaffikin, 2003).

2

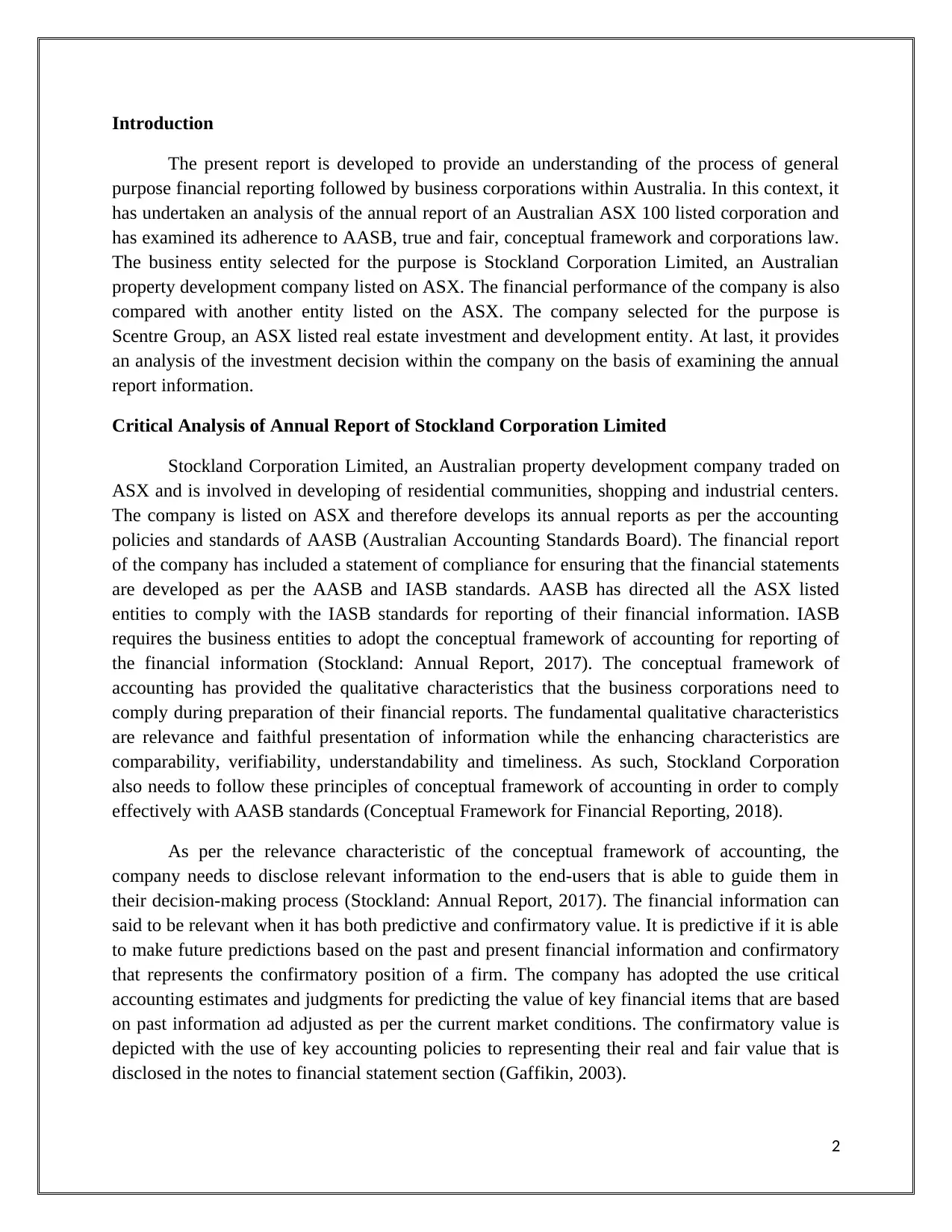

The company as per the faithful presentation of information has included the auditor’s

declaration for ensuring that it is complete, neutral and error-free as depicted below:

(Source: Annual Report Stockland Corporation 2017)

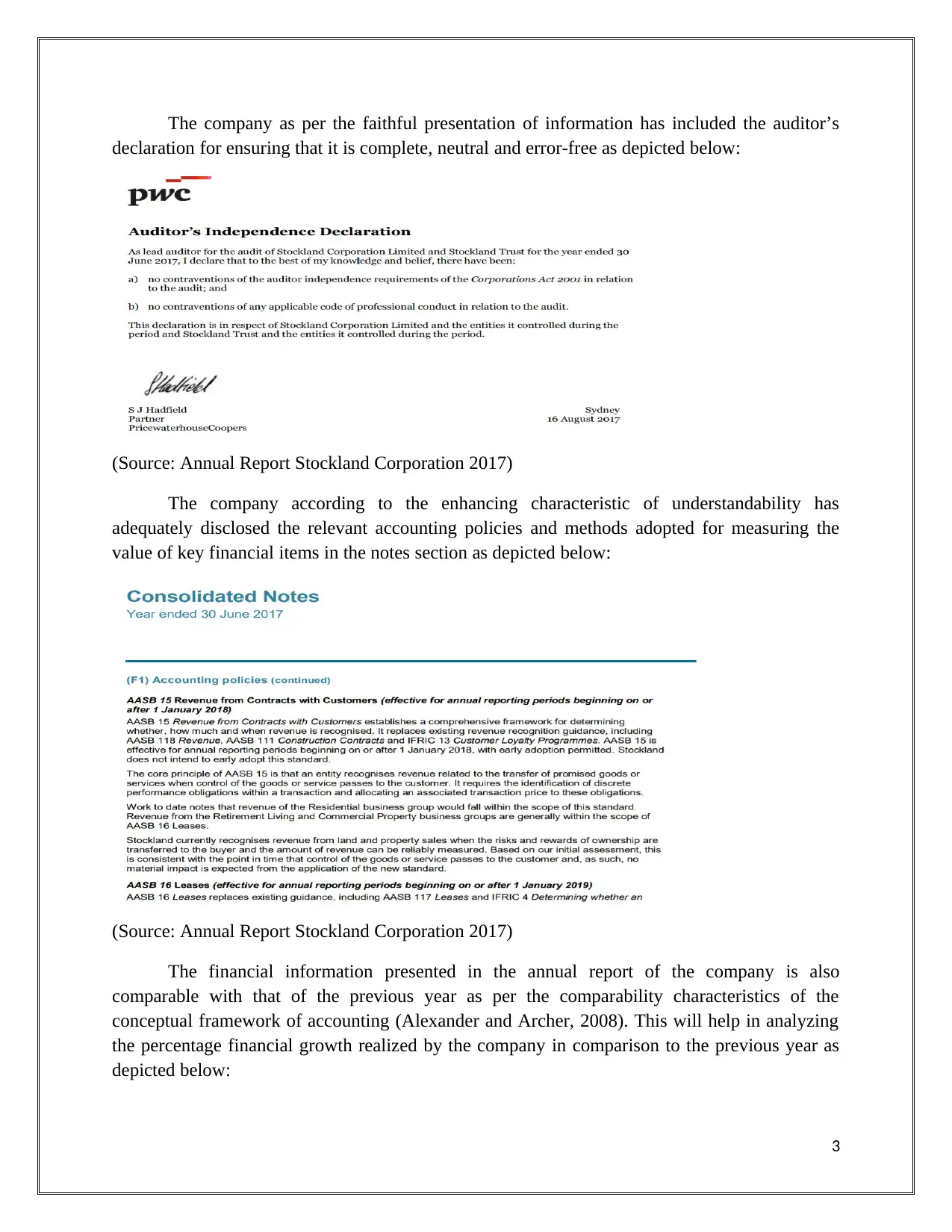

The company according to the enhancing characteristic of understandability has

adequately disclosed the relevant accounting policies and methods adopted for measuring the

value of key financial items in the notes section as depicted below:

(Source: Annual Report Stockland Corporation 2017)

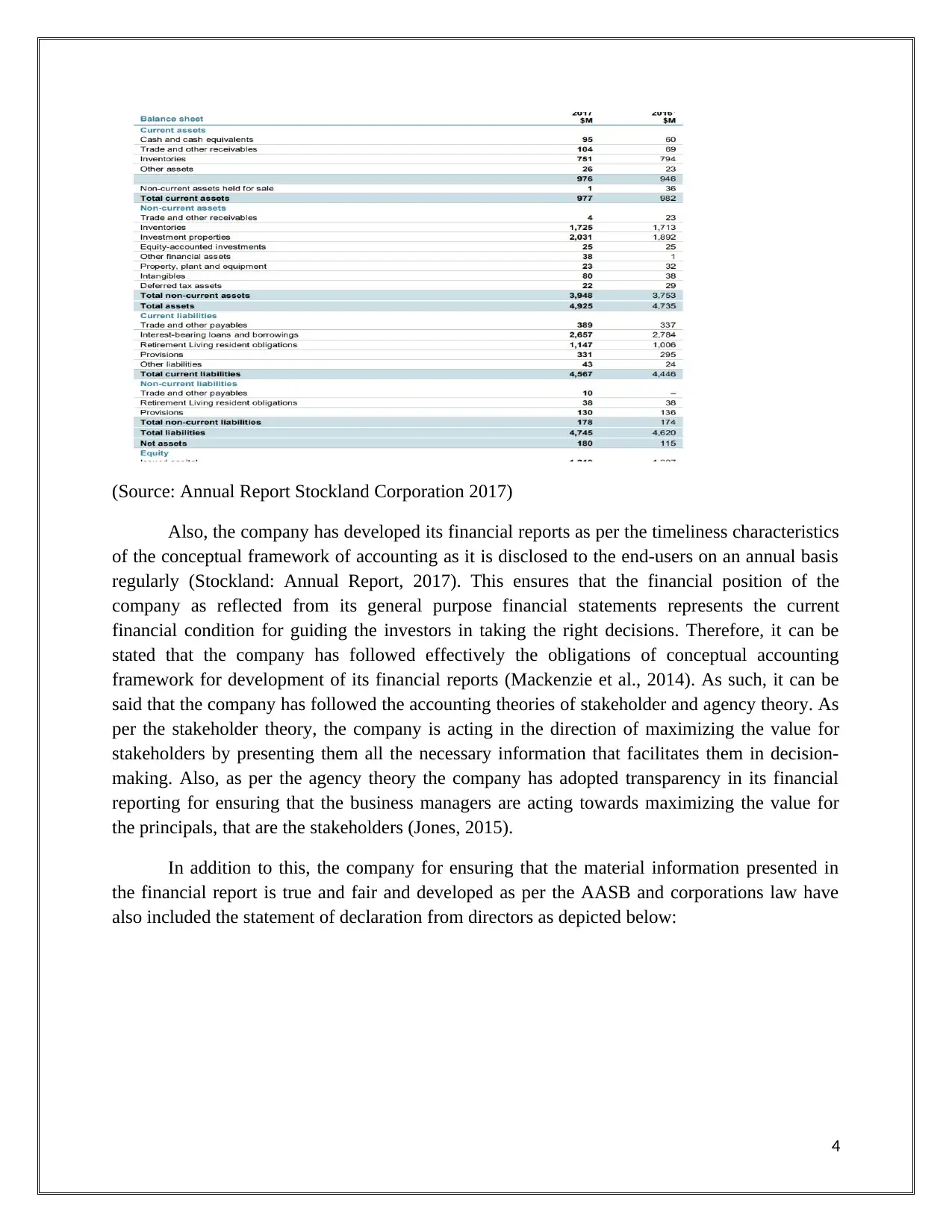

The financial information presented in the annual report of the company is also

comparable with that of the previous year as per the comparability characteristics of the

conceptual framework of accounting (Alexander and Archer, 2008). This will help in analyzing

the percentage financial growth realized by the company in comparison to the previous year as

depicted below:

3

declaration for ensuring that it is complete, neutral and error-free as depicted below:

(Source: Annual Report Stockland Corporation 2017)

The company according to the enhancing characteristic of understandability has

adequately disclosed the relevant accounting policies and methods adopted for measuring the

value of key financial items in the notes section as depicted below:

(Source: Annual Report Stockland Corporation 2017)

The financial information presented in the annual report of the company is also

comparable with that of the previous year as per the comparability characteristics of the

conceptual framework of accounting (Alexander and Archer, 2008). This will help in analyzing

the percentage financial growth realized by the company in comparison to the previous year as

depicted below:

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Source: Annual Report Stockland Corporation 2017)

Also, the company has developed its financial reports as per the timeliness characteristics

of the conceptual framework of accounting as it is disclosed to the end-users on an annual basis

regularly (Stockland: Annual Report, 2017). This ensures that the financial position of the

company as reflected from its general purpose financial statements represents the current

financial condition for guiding the investors in taking the right decisions. Therefore, it can be

stated that the company has followed effectively the obligations of conceptual accounting

framework for development of its financial reports (Mackenzie et al., 2014). As such, it can be

said that the company has followed the accounting theories of stakeholder and agency theory. As

per the stakeholder theory, the company is acting in the direction of maximizing the value for

stakeholders by presenting them all the necessary information that facilitates them in decision-

making. Also, as per the agency theory the company has adopted transparency in its financial

reporting for ensuring that the business managers are acting towards maximizing the value for

the principals, that are the stakeholders (Jones, 2015).

In addition to this, the company for ensuring that the material information presented in

the financial report is true and fair and developed as per the AASB and corporations law have

also included the statement of declaration from directors as depicted below:

4

Also, the company has developed its financial reports as per the timeliness characteristics

of the conceptual framework of accounting as it is disclosed to the end-users on an annual basis

regularly (Stockland: Annual Report, 2017). This ensures that the financial position of the

company as reflected from its general purpose financial statements represents the current

financial condition for guiding the investors in taking the right decisions. Therefore, it can be

stated that the company has followed effectively the obligations of conceptual accounting

framework for development of its financial reports (Mackenzie et al., 2014). As such, it can be

said that the company has followed the accounting theories of stakeholder and agency theory. As

per the stakeholder theory, the company is acting in the direction of maximizing the value for

stakeholders by presenting them all the necessary information that facilitates them in decision-

making. Also, as per the agency theory the company has adopted transparency in its financial

reporting for ensuring that the business managers are acting towards maximizing the value for

the principals, that are the stakeholders (Jones, 2015).

In addition to this, the company for ensuring that the material information presented in

the financial report is true and fair and developed as per the AASB and corporations law have

also included the statement of declaration from directors as depicted below:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As stated by the statement of director’s declaration, the company has followed the

Corporations Act 2001 and the IFRS standards in development of the financial reports. The

financial information presented through the report is true and fair and depicts the actual financial

position of the company (Carmichael and Graham, 2012).

Comparison of selected corporation with other corporation listed on the ASX

In order to compare the performance of Stockland Corporation with any other company

listed on ASX, Scentre Group has been selected. Scentre Group has been listed on ASX100. The

companies listed on ASX uses Australian Accounting Standards as the basis for preparation of

financial statements that helps in comparing one corporation with another corporation easily. In

this section performance of Stockland has been compared with the performance of Scentre

Group. In order to compare the performance there must be similarity that both companies have

applied same accounting standards for measurement of revenues, expenses, assets, liabilities and

equity as all these elements of financial statements help to judge the performance of any

company (Brigham and Michael, 2013).

To compare the performance of Stockland with Scentre Group, it is essential to compare

financial performance of both companies. Financial performance can be evaluated through

applying ratio analysis approach for both selected corporations.

In ratio analysis there will be analysis of profitability, liquidity, efficiency and market

performance of the company for year 2017.

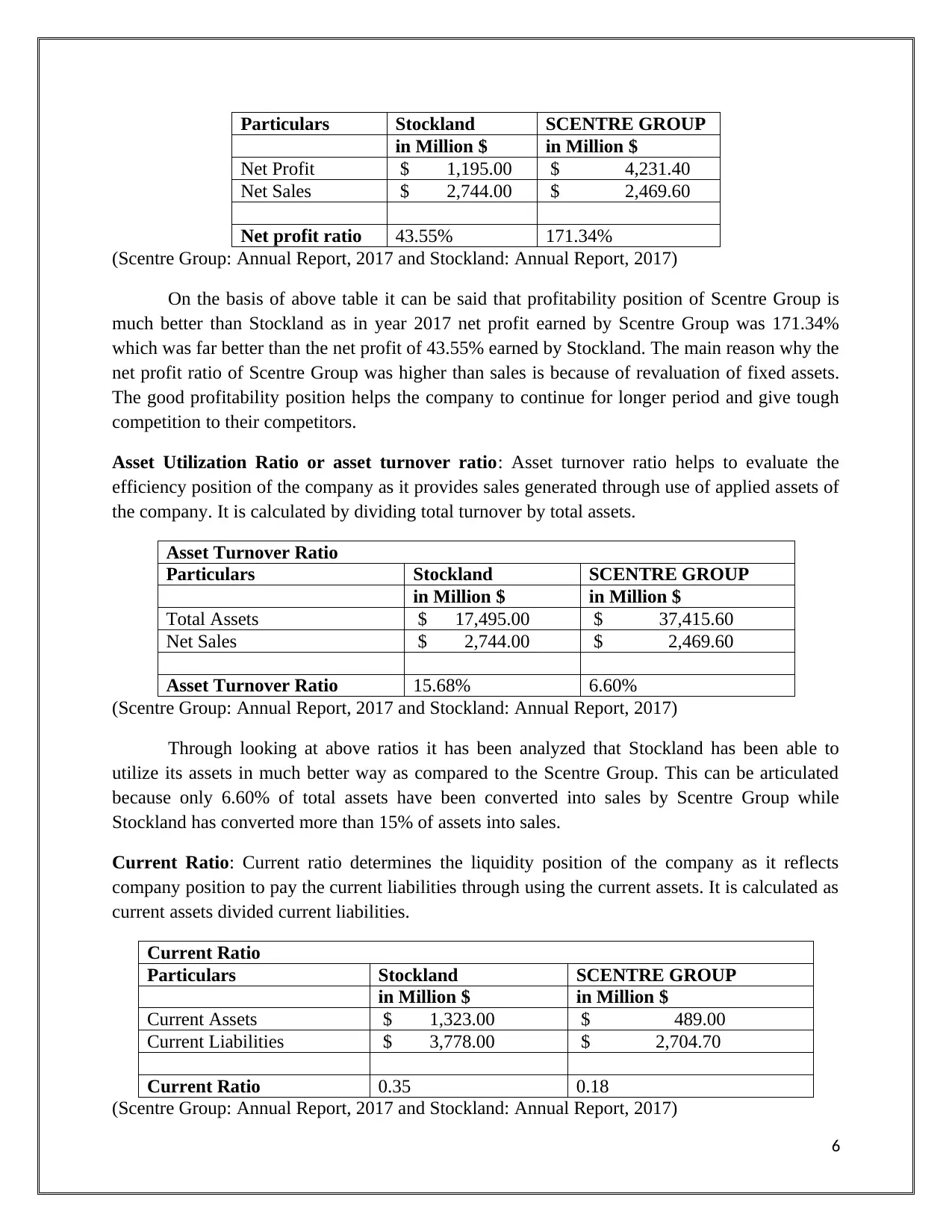

Net profit ratio: This ratio determines the profitability performance of the company as it shows

percentage of net profit earned on net sales. This ratio is calculated as net profit divided net sales.

Net Profit Ratio

5

Corporations Act 2001 and the IFRS standards in development of the financial reports. The

financial information presented through the report is true and fair and depicts the actual financial

position of the company (Carmichael and Graham, 2012).

Comparison of selected corporation with other corporation listed on the ASX

In order to compare the performance of Stockland Corporation with any other company

listed on ASX, Scentre Group has been selected. Scentre Group has been listed on ASX100. The

companies listed on ASX uses Australian Accounting Standards as the basis for preparation of

financial statements that helps in comparing one corporation with another corporation easily. In

this section performance of Stockland has been compared with the performance of Scentre

Group. In order to compare the performance there must be similarity that both companies have

applied same accounting standards for measurement of revenues, expenses, assets, liabilities and

equity as all these elements of financial statements help to judge the performance of any

company (Brigham and Michael, 2013).

To compare the performance of Stockland with Scentre Group, it is essential to compare

financial performance of both companies. Financial performance can be evaluated through

applying ratio analysis approach for both selected corporations.

In ratio analysis there will be analysis of profitability, liquidity, efficiency and market

performance of the company for year 2017.

Net profit ratio: This ratio determines the profitability performance of the company as it shows

percentage of net profit earned on net sales. This ratio is calculated as net profit divided net sales.

Net Profit Ratio

5

Particulars Stockland SCENTRE GROUP

in Million $ in Million $

Net Profit $ 1,195.00 $ 4,231.40

Net Sales $ 2,744.00 $ 2,469.60

Net profit ratio 43.55% 171.34%

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

On the basis of above table it can be said that profitability position of Scentre Group is

much better than Stockland as in year 2017 net profit earned by Scentre Group was 171.34%

which was far better than the net profit of 43.55% earned by Stockland. The main reason why the

net profit ratio of Scentre Group was higher than sales is because of revaluation of fixed assets.

The good profitability position helps the company to continue for longer period and give tough

competition to their competitors.

Asset Utilization Ratio or asset turnover ratio: Asset turnover ratio helps to evaluate the

efficiency position of the company as it provides sales generated through use of applied assets of

the company. It is calculated by dividing total turnover by total assets.

Asset Turnover Ratio

Particulars Stockland SCENTRE GROUP

in Million $ in Million $

Total Assets $ 17,495.00 $ 37,415.60

Net Sales $ 2,744.00 $ 2,469.60

Asset Turnover Ratio 15.68% 6.60%

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

Through looking at above ratios it has been analyzed that Stockland has been able to

utilize its assets in much better way as compared to the Scentre Group. This can be articulated

because only 6.60% of total assets have been converted into sales by Scentre Group while

Stockland has converted more than 15% of assets into sales.

Current Ratio: Current ratio determines the liquidity position of the company as it reflects

company position to pay the current liabilities through using the current assets. It is calculated as

current assets divided current liabilities.

Current Ratio

Particulars Stockland SCENTRE GROUP

in Million $ in Million $

Current Assets $ 1,323.00 $ 489.00

Current Liabilities $ 3,778.00 $ 2,704.70

Current Ratio 0.35 0.18

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

6

in Million $ in Million $

Net Profit $ 1,195.00 $ 4,231.40

Net Sales $ 2,744.00 $ 2,469.60

Net profit ratio 43.55% 171.34%

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

On the basis of above table it can be said that profitability position of Scentre Group is

much better than Stockland as in year 2017 net profit earned by Scentre Group was 171.34%

which was far better than the net profit of 43.55% earned by Stockland. The main reason why the

net profit ratio of Scentre Group was higher than sales is because of revaluation of fixed assets.

The good profitability position helps the company to continue for longer period and give tough

competition to their competitors.

Asset Utilization Ratio or asset turnover ratio: Asset turnover ratio helps to evaluate the

efficiency position of the company as it provides sales generated through use of applied assets of

the company. It is calculated by dividing total turnover by total assets.

Asset Turnover Ratio

Particulars Stockland SCENTRE GROUP

in Million $ in Million $

Total Assets $ 17,495.00 $ 37,415.60

Net Sales $ 2,744.00 $ 2,469.60

Asset Turnover Ratio 15.68% 6.60%

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

Through looking at above ratios it has been analyzed that Stockland has been able to

utilize its assets in much better way as compared to the Scentre Group. This can be articulated

because only 6.60% of total assets have been converted into sales by Scentre Group while

Stockland has converted more than 15% of assets into sales.

Current Ratio: Current ratio determines the liquidity position of the company as it reflects

company position to pay the current liabilities through using the current assets. It is calculated as

current assets divided current liabilities.

Current Ratio

Particulars Stockland SCENTRE GROUP

in Million $ in Million $

Current Assets $ 1,323.00 $ 489.00

Current Liabilities $ 3,778.00 $ 2,704.70

Current Ratio 0.35 0.18

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

On the basis of above table it can be said that liquidity position of Stockland is better than

Scentre Group but overall liquidity position of both companies are not up to satisfactory level.

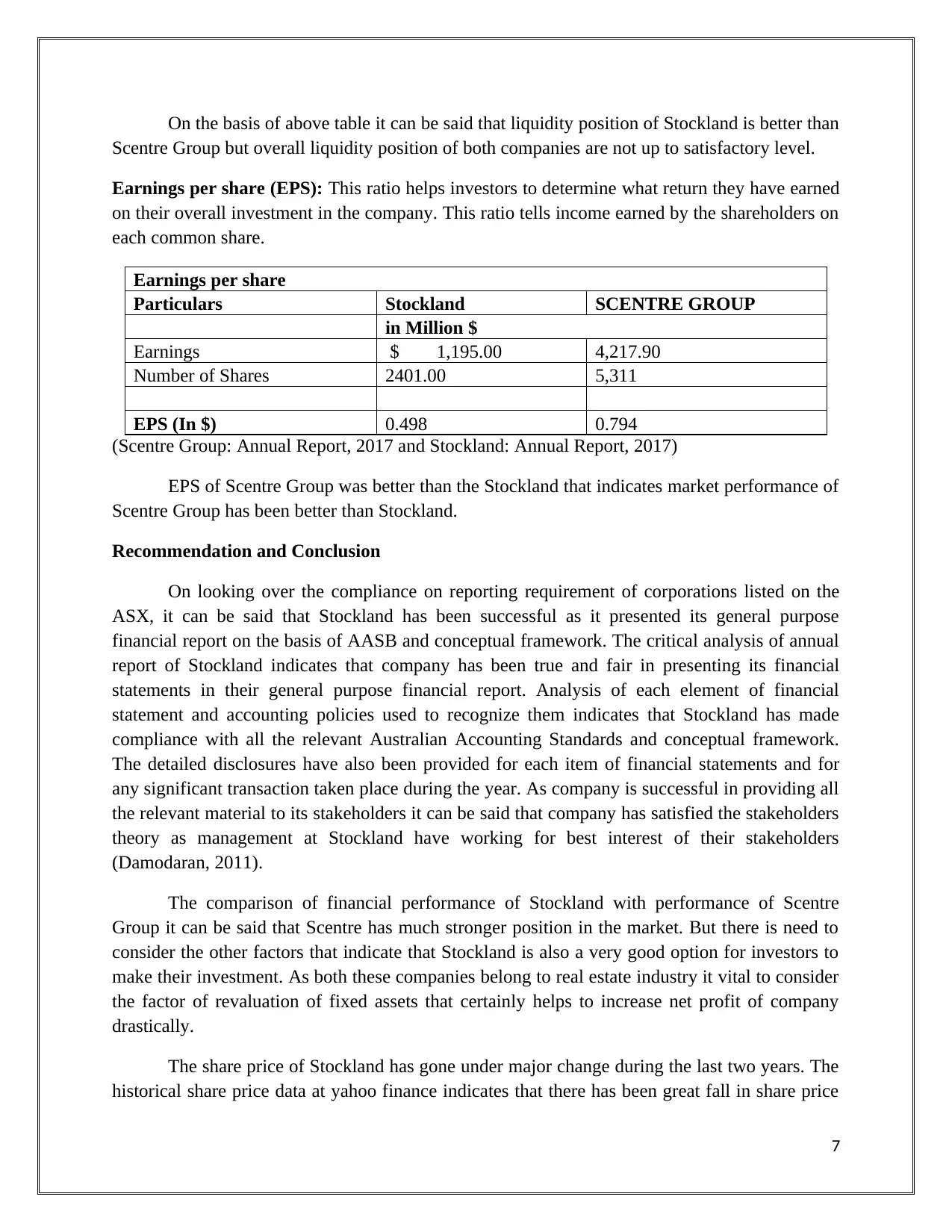

Earnings per share (EPS): This ratio helps investors to determine what return they have earned

on their overall investment in the company. This ratio tells income earned by the shareholders on

each common share.

Earnings per share

Particulars Stockland SCENTRE GROUP

in Million $

Earnings $ 1,195.00 4,217.90

Number of Shares 2401.00 5,311

EPS (In $) 0.498 0.794

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

EPS of Scentre Group was better than the Stockland that indicates market performance of

Scentre Group has been better than Stockland.

Recommendation and Conclusion

On looking over the compliance on reporting requirement of corporations listed on the

ASX, it can be said that Stockland has been successful as it presented its general purpose

financial report on the basis of AASB and conceptual framework. The critical analysis of annual

report of Stockland indicates that company has been true and fair in presenting its financial

statements in their general purpose financial report. Analysis of each element of financial

statement and accounting policies used to recognize them indicates that Stockland has made

compliance with all the relevant Australian Accounting Standards and conceptual framework.

The detailed disclosures have also been provided for each item of financial statements and for

any significant transaction taken place during the year. As company is successful in providing all

the relevant material to its stakeholders it can be said that company has satisfied the stakeholders

theory as management at Stockland have working for best interest of their stakeholders

(Damodaran, 2011).

The comparison of financial performance of Stockland with performance of Scentre

Group it can be said that Scentre has much stronger position in the market. But there is need to

consider the other factors that indicate that Stockland is also a very good option for investors to

make their investment. As both these companies belong to real estate industry it vital to consider

the factor of revaluation of fixed assets that certainly helps to increase net profit of company

drastically.

The share price of Stockland has gone under major change during the last two years. The

historical share price data at yahoo finance indicates that there has been great fall in share price

7

Scentre Group but overall liquidity position of both companies are not up to satisfactory level.

Earnings per share (EPS): This ratio helps investors to determine what return they have earned

on their overall investment in the company. This ratio tells income earned by the shareholders on

each common share.

Earnings per share

Particulars Stockland SCENTRE GROUP

in Million $

Earnings $ 1,195.00 4,217.90

Number of Shares 2401.00 5,311

EPS (In $) 0.498 0.794

(Scentre Group: Annual Report, 2017 and Stockland: Annual Report, 2017)

EPS of Scentre Group was better than the Stockland that indicates market performance of

Scentre Group has been better than Stockland.

Recommendation and Conclusion

On looking over the compliance on reporting requirement of corporations listed on the

ASX, it can be said that Stockland has been successful as it presented its general purpose

financial report on the basis of AASB and conceptual framework. The critical analysis of annual

report of Stockland indicates that company has been true and fair in presenting its financial

statements in their general purpose financial report. Analysis of each element of financial

statement and accounting policies used to recognize them indicates that Stockland has made

compliance with all the relevant Australian Accounting Standards and conceptual framework.

The detailed disclosures have also been provided for each item of financial statements and for

any significant transaction taken place during the year. As company is successful in providing all

the relevant material to its stakeholders it can be said that company has satisfied the stakeholders

theory as management at Stockland have working for best interest of their stakeholders

(Damodaran, 2011).

The comparison of financial performance of Stockland with performance of Scentre

Group it can be said that Scentre has much stronger position in the market. But there is need to

consider the other factors that indicate that Stockland is also a very good option for investors to

make their investment. As both these companies belong to real estate industry it vital to consider

the factor of revaluation of fixed assets that certainly helps to increase net profit of company

drastically.

The share price of Stockland has gone under major change during the last two years. The

historical share price data at yahoo finance indicates that there has been great fall in share price

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of company. The share price was $4.760 on 1 September 2016 and it was $ 4.180 at the starting

of August 2018 that clearly indicates major downfall in the share price of the company

(Historical Price, 2018).

On the basis of critically analysis of financial statements of Stockland it can be said that it

not worth to invest $10,000 in the company as shareholding period return will reduce over the

time. It has been said because share price had decreased a lot during last two years and EPS was

also not good as compared to other companies in the same industry.

8

of August 2018 that clearly indicates major downfall in the share price of the company

(Historical Price, 2018).

On the basis of critically analysis of financial statements of Stockland it can be said that it

not worth to invest $10,000 in the company as shareholding period return will reduce over the

time. It has been said because share price had decreased a lot during last two years and EPS was

also not good as compared to other companies in the same industry.

8

References

Historical Price. 2018. Yahoo Finance: Stockland Stapled Securities (SGP.AX). [Online].

Available at: https://in.finance.yahoo.com/quote/SGP.AX/history?

period1=1472581800&period2=1535653800&interval=1mo&filter=history&frequency=1mo

[Accessed on: 31 August, 2018].

Scentre Group: Annual Report. 2017. [Online]. Available at:

https://www.scentregroup.com/getmedia/a06dc91f-7127-447d-a5e0-727dd6d2c28a/

Annual_Financial_Report_2017.pdf [Accessed on: 31 August, 2018].

Stockland: Annual Report. 2017. [Online]. Available at: https://www.stockland.com.au/investor-

centre [Accessed on: 31 August, 2018].

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. John Wiley & sons.

Conceptual Framework for Financial Reporting. 2018. [Online]. Available at:

http://www.ctcp.gov.co/_files/documents/1522788672-5065.pdf [Accessed on: 31 August 2018].

Jones, S. 2015. The Routledge Companion to Financial Accounting Theory. Routledge.

Carmichael, D.R. and Graham, L. 2012. Accountants' Handbook, Financial Accounting and

General Topics. John Wiley & Sons.

Mackenzie, B. et al. 2014. Wiley IFRS 2014: Interpretation and Application of International

Financial Reporting Standards. John Wiley & Sons.

Alexander, D. and Archer, S. 2008. International Accounting/Financial Reporting Standards.

CCH.

Gaffikin, M. 2003. Corporate Accounting in Australia. UNSW Press.

9

Historical Price. 2018. Yahoo Finance: Stockland Stapled Securities (SGP.AX). [Online].

Available at: https://in.finance.yahoo.com/quote/SGP.AX/history?

period1=1472581800&period2=1535653800&interval=1mo&filter=history&frequency=1mo

[Accessed on: 31 August, 2018].

Scentre Group: Annual Report. 2017. [Online]. Available at:

https://www.scentregroup.com/getmedia/a06dc91f-7127-447d-a5e0-727dd6d2c28a/

Annual_Financial_Report_2017.pdf [Accessed on: 31 August, 2018].

Stockland: Annual Report. 2017. [Online]. Available at: https://www.stockland.com.au/investor-

centre [Accessed on: 31 August, 2018].

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. John Wiley & sons.

Conceptual Framework for Financial Reporting. 2018. [Online]. Available at:

http://www.ctcp.gov.co/_files/documents/1522788672-5065.pdf [Accessed on: 31 August 2018].

Jones, S. 2015. The Routledge Companion to Financial Accounting Theory. Routledge.

Carmichael, D.R. and Graham, L. 2012. Accountants' Handbook, Financial Accounting and

General Topics. John Wiley & Sons.

Mackenzie, B. et al. 2014. Wiley IFRS 2014: Interpretation and Application of International

Financial Reporting Standards. John Wiley & Sons.

Alexander, D. and Archer, S. 2008. International Accounting/Financial Reporting Standards.

CCH.

Gaffikin, M. 2003. Corporate Accounting in Australia. UNSW Press.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.