Analysis of CBA Bank's 2017 Annual Report - Finance Report

VerifiedAdded on 2023/06/04

|12

|2317

|360

Report

AI Summary

This report provides a comprehensive analysis of the Commonwealth Bank of Australia (CBA) 2017 annual report. It examines key financial aspects, including the treatment of income tax, detailing corporate and policyholder tax expenses, current tax liabilities, and deferred tax assets and liabilities. The report also explores foreign currency risk management, outlining CBA's approach to currency translation and the handling of translation reserves. Furthermore, it delves into the accounting for intangible assets, assessing impairment losses on loans and receivables, and other financial assets. The analysis covers the impact of AASB 16 on lease accounting. The report includes calculations from the provided ONOYOKO LTD statement and provides an overview of the accounting standards used and their implications on the company's financial reporting. The analysis also includes the revaluation techniques used in the financial year 2017.

Running head: ANALYSIS OF CBA ANNUAL REPORT

1

Analysis of CBA Annual Report

Your Name

Institutional Affiliation

1

Analysis of CBA Annual Report

Your Name

Institutional Affiliation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ANALYSIS OF CBA ANNUAL REPORT 2

Analysis of CBA Annual Report

Question 1

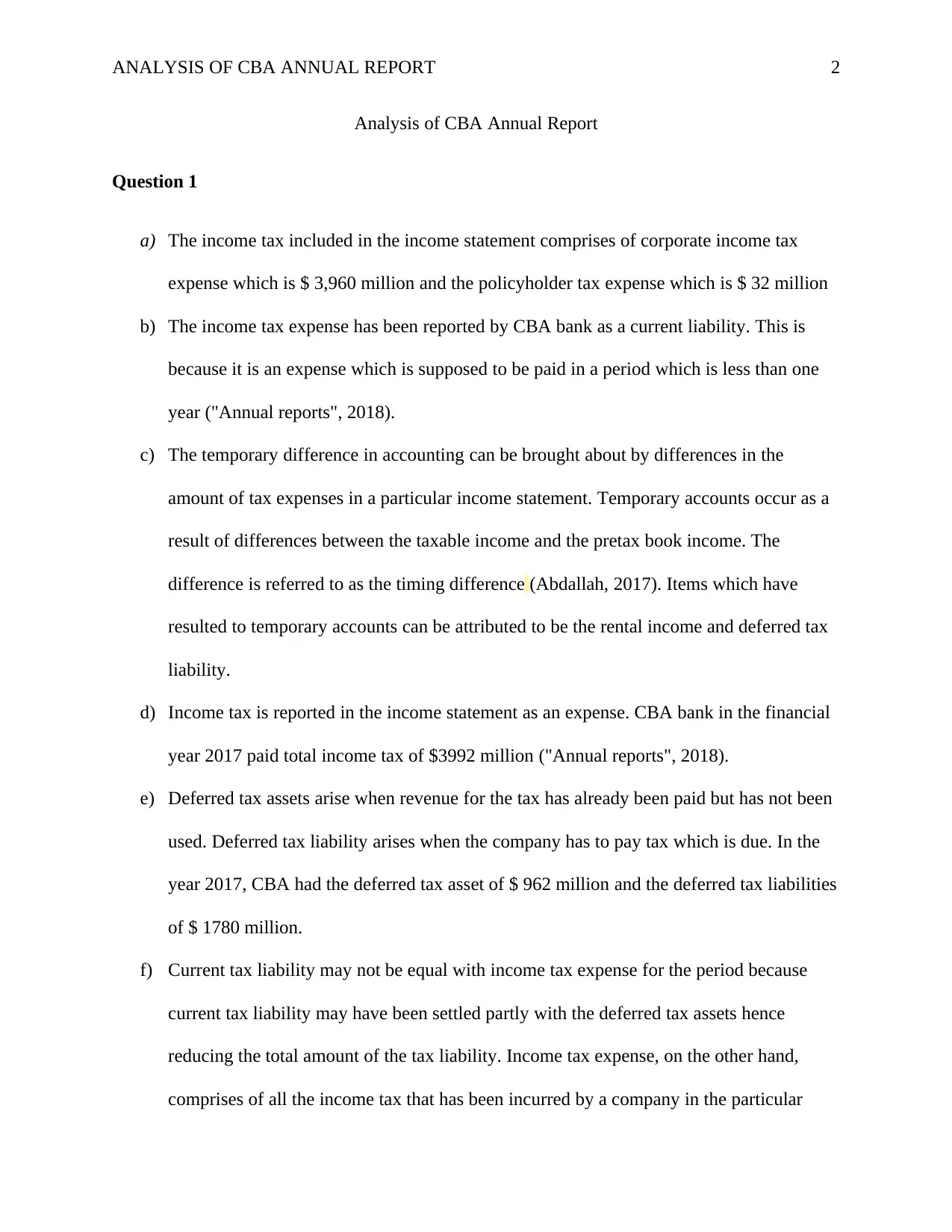

a) The income tax included in the income statement comprises of corporate income tax

expense which is $ 3,960 million and the policyholder tax expense which is $ 32 million

b) The income tax expense has been reported by CBA bank as a current liability. This is

because it is an expense which is supposed to be paid in a period which is less than one

year ("Annual reports", 2018).

c) The temporary difference in accounting can be brought about by differences in the

amount of tax expenses in a particular income statement. Temporary accounts occur as a

result of differences between the taxable income and the pretax book income. The

difference is referred to as the timing difference (Abdallah, 2017). Items which have

resulted to temporary accounts can be attributed to be the rental income and deferred tax

liability.

d) Income tax is reported in the income statement as an expense. CBA bank in the financial

year 2017 paid total income tax of $3992 million ("Annual reports", 2018).

e) Deferred tax assets arise when revenue for the tax has already been paid but has not been

used. Deferred tax liability arises when the company has to pay tax which is due. In the

year 2017, CBA had the deferred tax asset of $ 962 million and the deferred tax liabilities

of $ 1780 million.

f) Current tax liability may not be equal with income tax expense for the period because

current tax liability may have been settled partly with the deferred tax assets hence

reducing the total amount of the tax liability. Income tax expense, on the other hand,

comprises of all the income tax that has been incurred by a company in the particular

Analysis of CBA Annual Report

Question 1

a) The income tax included in the income statement comprises of corporate income tax

expense which is $ 3,960 million and the policyholder tax expense which is $ 32 million

b) The income tax expense has been reported by CBA bank as a current liability. This is

because it is an expense which is supposed to be paid in a period which is less than one

year ("Annual reports", 2018).

c) The temporary difference in accounting can be brought about by differences in the

amount of tax expenses in a particular income statement. Temporary accounts occur as a

result of differences between the taxable income and the pretax book income. The

difference is referred to as the timing difference (Abdallah, 2017). Items which have

resulted to temporary accounts can be attributed to be the rental income and deferred tax

liability.

d) Income tax is reported in the income statement as an expense. CBA bank in the financial

year 2017 paid total income tax of $3992 million ("Annual reports", 2018).

e) Deferred tax assets arise when revenue for the tax has already been paid but has not been

used. Deferred tax liability arises when the company has to pay tax which is due. In the

year 2017, CBA had the deferred tax asset of $ 962 million and the deferred tax liabilities

of $ 1780 million.

f) Current tax liability may not be equal with income tax expense for the period because

current tax liability may have been settled partly with the deferred tax assets hence

reducing the total amount of the tax liability. Income tax expense, on the other hand,

comprises of all the income tax that has been incurred by a company in the particular

ANALYSIS OF CBA ANNUAL REPORT 3

period of income (Shirkar, 2018). In the case of CBA bank, the current tax liability is $

1450 million and the income tax expense is $ 3960 million.

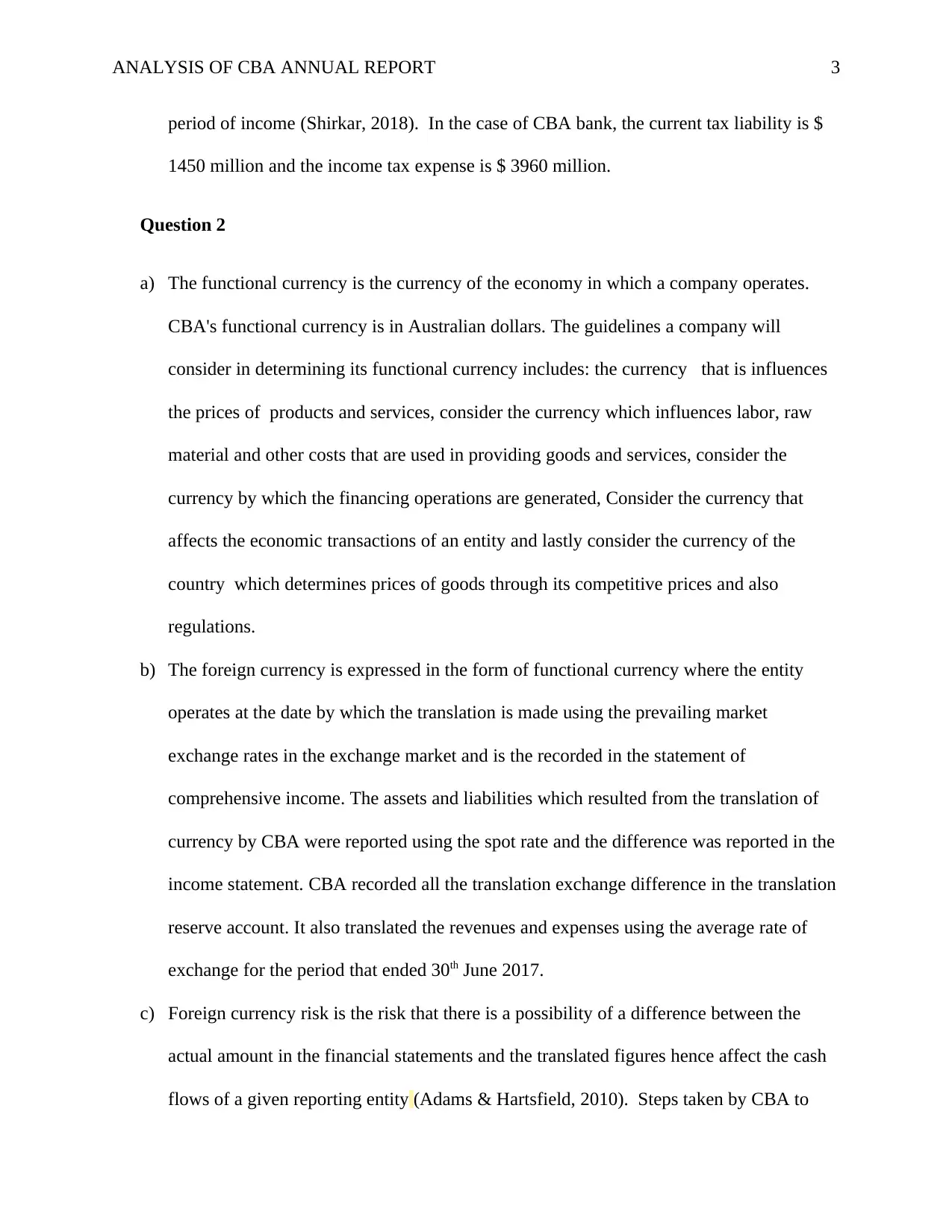

Question 2

a) The functional currency is the currency of the economy in which a company operates.

CBA's functional currency is in Australian dollars. The guidelines a company will

consider in determining its functional currency includes: the currency that is influences

the prices of products and services, consider the currency which influences labor, raw

material and other costs that are used in providing goods and services, consider the

currency by which the financing operations are generated, Consider the currency that

affects the economic transactions of an entity and lastly consider the currency of the

country which determines prices of goods through its competitive prices and also

regulations.

b) The foreign currency is expressed in the form of functional currency where the entity

operates at the date by which the translation is made using the prevailing market

exchange rates in the exchange market and is the recorded in the statement of

comprehensive income. The assets and liabilities which resulted from the translation of

currency by CBA were reported using the spot rate and the difference was reported in the

income statement. CBA recorded all the translation exchange difference in the translation

reserve account. It also translated the revenues and expenses using the average rate of

exchange for the period that ended 30th June 2017.

c) Foreign currency risk is the risk that there is a possibility of a difference between the

actual amount in the financial statements and the translated figures hence affect the cash

flows of a given reporting entity (Adams & Hartsfield, 2010). Steps taken by CBA to

period of income (Shirkar, 2018). In the case of CBA bank, the current tax liability is $

1450 million and the income tax expense is $ 3960 million.

Question 2

a) The functional currency is the currency of the economy in which a company operates.

CBA's functional currency is in Australian dollars. The guidelines a company will

consider in determining its functional currency includes: the currency that is influences

the prices of products and services, consider the currency which influences labor, raw

material and other costs that are used in providing goods and services, consider the

currency by which the financing operations are generated, Consider the currency that

affects the economic transactions of an entity and lastly consider the currency of the

country which determines prices of goods through its competitive prices and also

regulations.

b) The foreign currency is expressed in the form of functional currency where the entity

operates at the date by which the translation is made using the prevailing market

exchange rates in the exchange market and is the recorded in the statement of

comprehensive income. The assets and liabilities which resulted from the translation of

currency by CBA were reported using the spot rate and the difference was reported in the

income statement. CBA recorded all the translation exchange difference in the translation

reserve account. It also translated the revenues and expenses using the average rate of

exchange for the period that ended 30th June 2017.

c) Foreign currency risk is the risk that there is a possibility of a difference between the

actual amount in the financial statements and the translated figures hence affect the cash

flows of a given reporting entity (Adams & Hartsfield, 2010). Steps taken by CBA to

You're viewing a preview

Unlock full access by subscribing today!

ANALYSIS OF CBA ANNUAL REPORT 4

manage the foreign exchange risk includes; Foreign currency is being translated by

managers using prevailing rates in the dates in which transactions take place, managers’

report the gains and losses from those translations in the statements of comprehensive

income and lastly the exchange differences that arise from such translations are

accounted for as distinct commodities of equity.

d) The balance of the foreign currency translation reserve arises from either loss or gain

from the statement of cash flow. CBA bank reports this as reserves and recognized those

gains or losses in the statement of cash flows.

e) Investment in subsidiary was A$ 310000

ONOYOKO LTD

Statement of financial position

As at 30th June 2017

S$

A $

Current assets

Inventory 205000 15375

Monetary assets 195000 146250

Total current assets 400000 161625

Noncurrent assets

Land 100000 85000

Buildings 120000 10200

Plant and equipment 110000 93500

manage the foreign exchange risk includes; Foreign currency is being translated by

managers using prevailing rates in the dates in which transactions take place, managers’

report the gains and losses from those translations in the statements of comprehensive

income and lastly the exchange differences that arise from such translations are

accounted for as distinct commodities of equity.

d) The balance of the foreign currency translation reserve arises from either loss or gain

from the statement of cash flow. CBA bank reports this as reserves and recognized those

gains or losses in the statement of cash flows.

e) Investment in subsidiary was A$ 310000

ONOYOKO LTD

Statement of financial position

As at 30th June 2017

S$

A $

Current assets

Inventory 205000 15375

Monetary assets 195000 146250

Total current assets 400000 161625

Noncurrent assets

Land 100000 85000

Buildings 120000 10200

Plant and equipment 110000 93500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ANALYSIS OF CBA ANNUAL REPORT 5

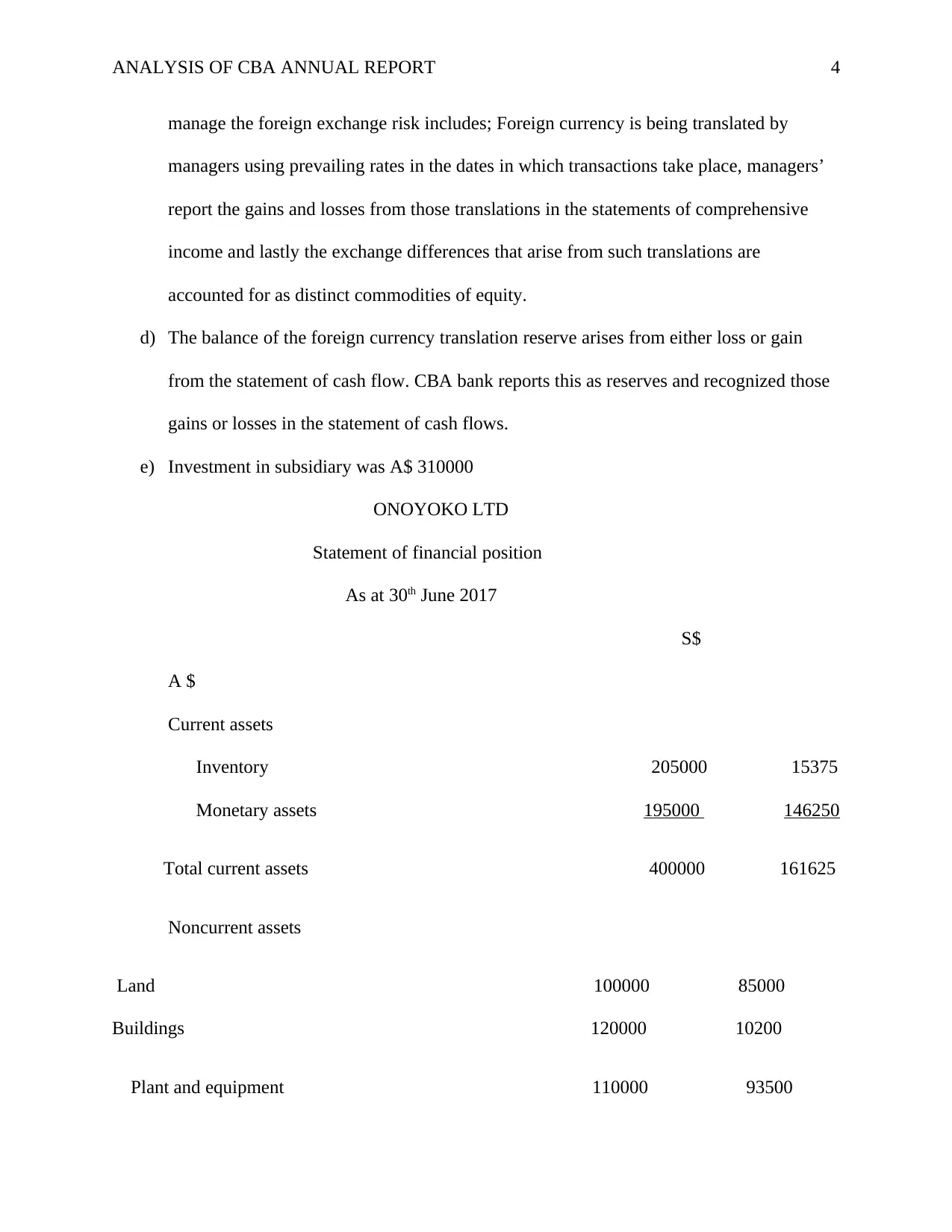

Accumulated depreciation (10000) (8500)

Deferred tax asset 10000 8500

Total noncurrent assets 330000 188700

Total assets 730000 350325

Dividends paid 29750

320575

Current liabilities

Current tax liability 70000 59500

Borrowings 50000 42500

Payables 100000 85000

Total current liabilities 220000 187000

Noncurrent liabilities

Borrowings 150,000 127500

Total liabilities 370000 314500

Net assets 360000 331287.5

Equity

Accumulated depreciation (10000) (8500)

Deferred tax asset 10000 8500

Total noncurrent assets 330000 188700

Total assets 730000 350325

Dividends paid 29750

320575

Current liabilities

Current tax liability 70000 59500

Borrowings 50000 42500

Payables 100000 85000

Total current liabilities 220000 187000

Noncurrent liabilities

Borrowings 150,000 127500

Total liabilities 370000 314500

Net assets 360000 331287.5

Equity

ANALYSIS OF CBA ANNUAL REPORT 6

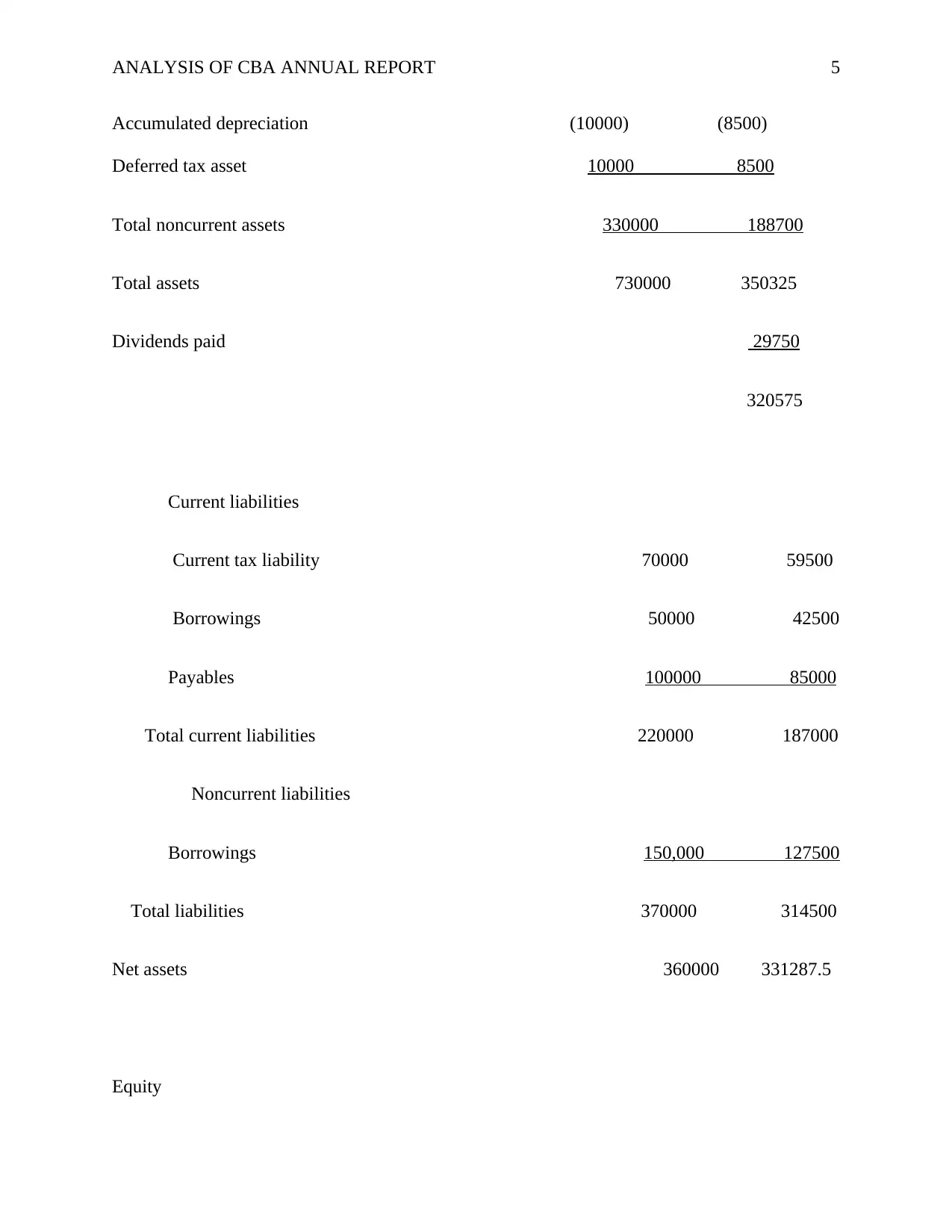

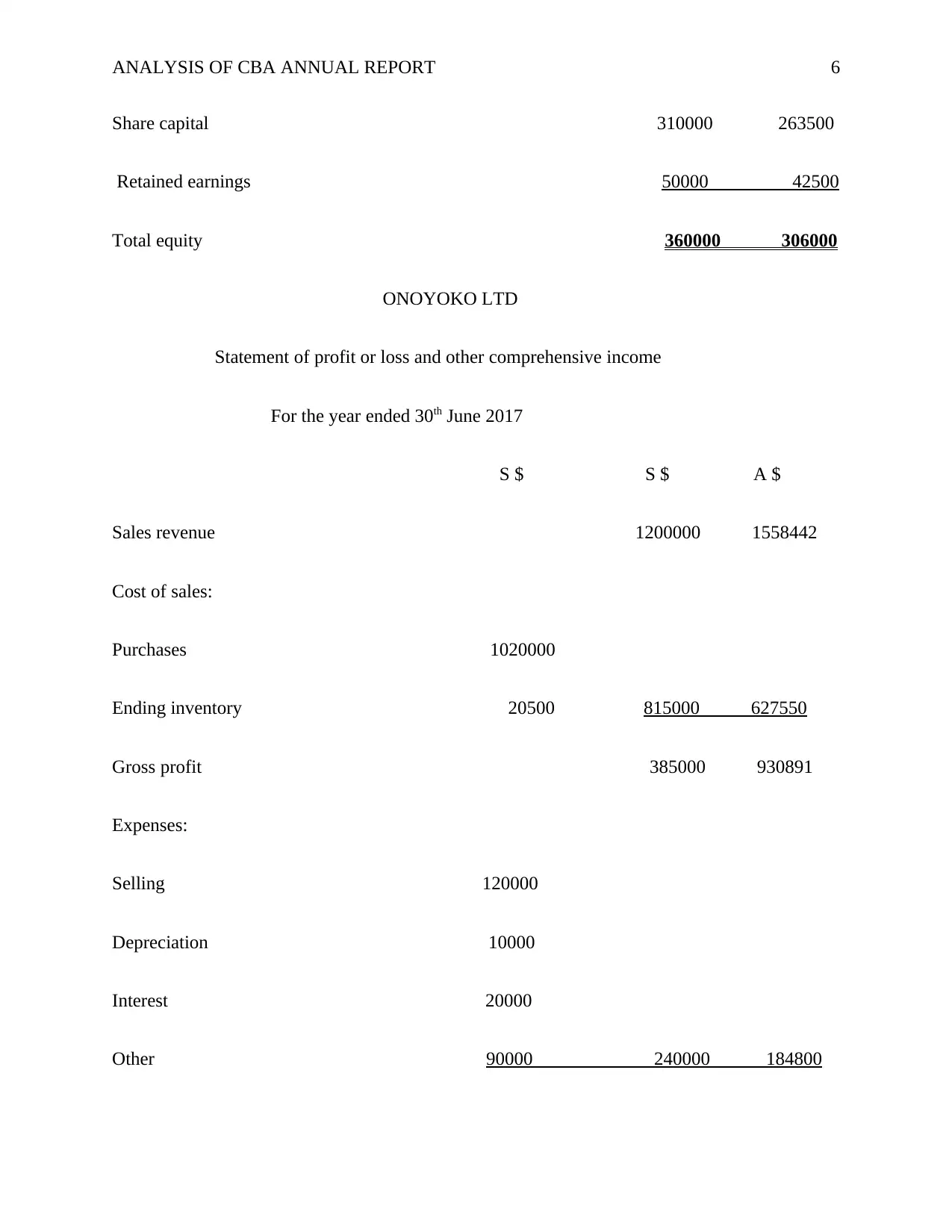

Share capital 310000 263500

Retained earnings 50000 42500

Total equity 360000 306000

ONOYOKO LTD

Statement of profit or loss and other comprehensive income

For the year ended 30th June 2017

S $ S $ A $

Sales revenue 1200000 1558442

Cost of sales:

Purchases 1020000

Ending inventory 20500 815000 627550

Gross profit 385000 930891

Expenses:

Selling 120000

Depreciation 10000

Interest 20000

Other 90000 240000 184800

Share capital 310000 263500

Retained earnings 50000 42500

Total equity 360000 306000

ONOYOKO LTD

Statement of profit or loss and other comprehensive income

For the year ended 30th June 2017

S $ S $ A $

Sales revenue 1200000 1558442

Cost of sales:

Purchases 1020000

Ending inventory 20500 815000 627550

Gross profit 385000 930891

Expenses:

Selling 120000

Depreciation 10000

Interest 20000

Other 90000 240000 184800

You're viewing a preview

Unlock full access by subscribing today!

ANALYSIS OF CBA ANNUAL REPORT 7

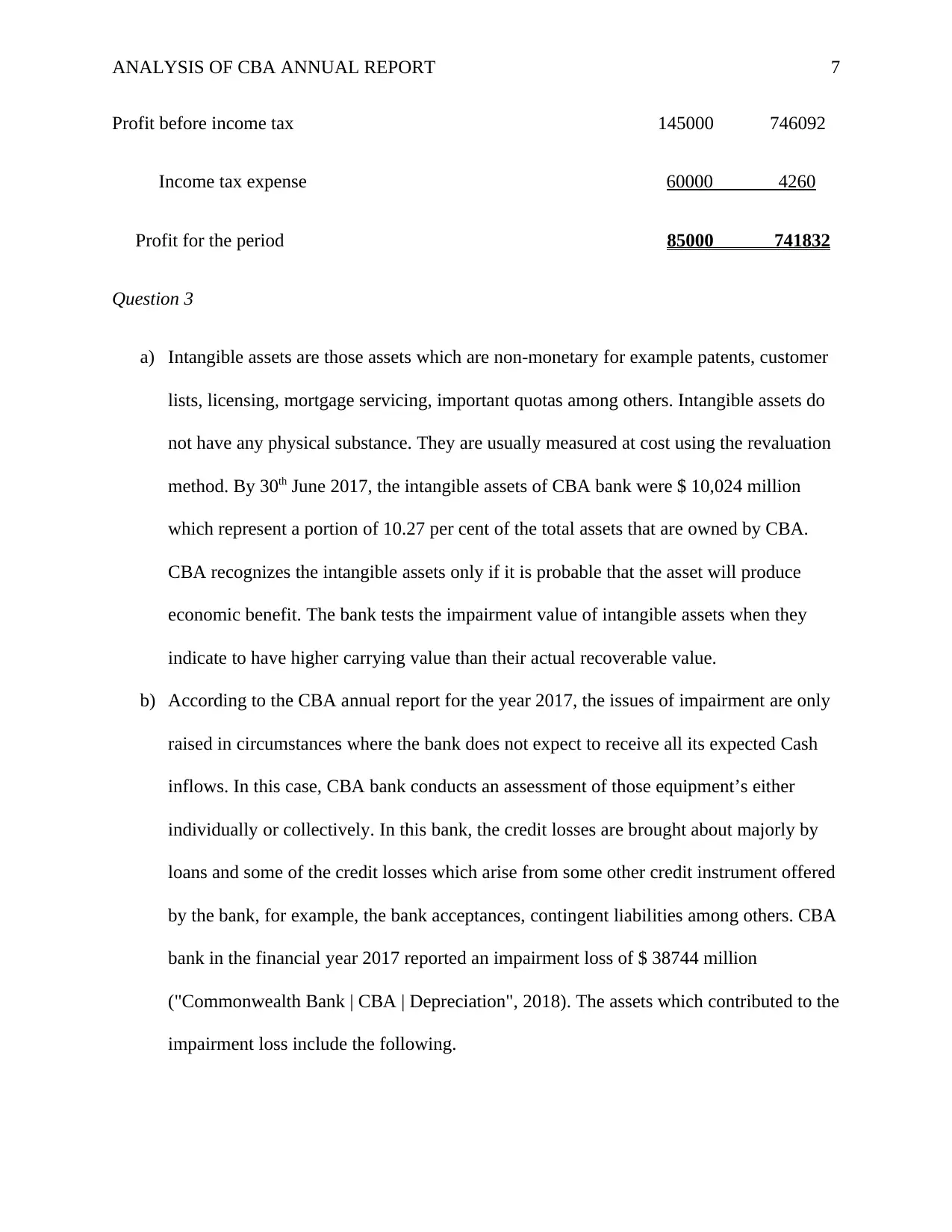

Profit before income tax 145000 746092

Income tax expense 60000 4260

Profit for the period 85000 741832

Question 3

a) Intangible assets are those assets which are non-monetary for example patents, customer

lists, licensing, mortgage servicing, important quotas among others. Intangible assets do

not have any physical substance. They are usually measured at cost using the revaluation

method. By 30th June 2017, the intangible assets of CBA bank were $ 10,024 million

which represent a portion of 10.27 per cent of the total assets that are owned by CBA.

CBA recognizes the intangible assets only if it is probable that the asset will produce

economic benefit. The bank tests the impairment value of intangible assets when they

indicate to have higher carrying value than their actual recoverable value.

b) According to the CBA annual report for the year 2017, the issues of impairment are only

raised in circumstances where the bank does not expect to receive all its expected Cash

inflows. In this case, CBA bank conducts an assessment of those equipment’s either

individually or collectively. In this bank, the credit losses are brought about majorly by

loans and some of the credit losses which arise from some other credit instrument offered

by the bank, for example, the bank acceptances, contingent liabilities among others. CBA

bank in the financial year 2017 reported an impairment loss of $ 38744 million

("Commonwealth Bank | CBA | Depreciation", 2018). The assets which contributed to the

impairment loss include the following.

Profit before income tax 145000 746092

Income tax expense 60000 4260

Profit for the period 85000 741832

Question 3

a) Intangible assets are those assets which are non-monetary for example patents, customer

lists, licensing, mortgage servicing, important quotas among others. Intangible assets do

not have any physical substance. They are usually measured at cost using the revaluation

method. By 30th June 2017, the intangible assets of CBA bank were $ 10,024 million

which represent a portion of 10.27 per cent of the total assets that are owned by CBA.

CBA recognizes the intangible assets only if it is probable that the asset will produce

economic benefit. The bank tests the impairment value of intangible assets when they

indicate to have higher carrying value than their actual recoverable value.

b) According to the CBA annual report for the year 2017, the issues of impairment are only

raised in circumstances where the bank does not expect to receive all its expected Cash

inflows. In this case, CBA bank conducts an assessment of those equipment’s either

individually or collectively. In this bank, the credit losses are brought about majorly by

loans and some of the credit losses which arise from some other credit instrument offered

by the bank, for example, the bank acceptances, contingent liabilities among others. CBA

bank in the financial year 2017 reported an impairment loss of $ 38744 million

("Commonwealth Bank | CBA | Depreciation", 2018). The assets which contributed to the

impairment loss include the following.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ANALYSIS OF CBA ANNUAL REPORT 8

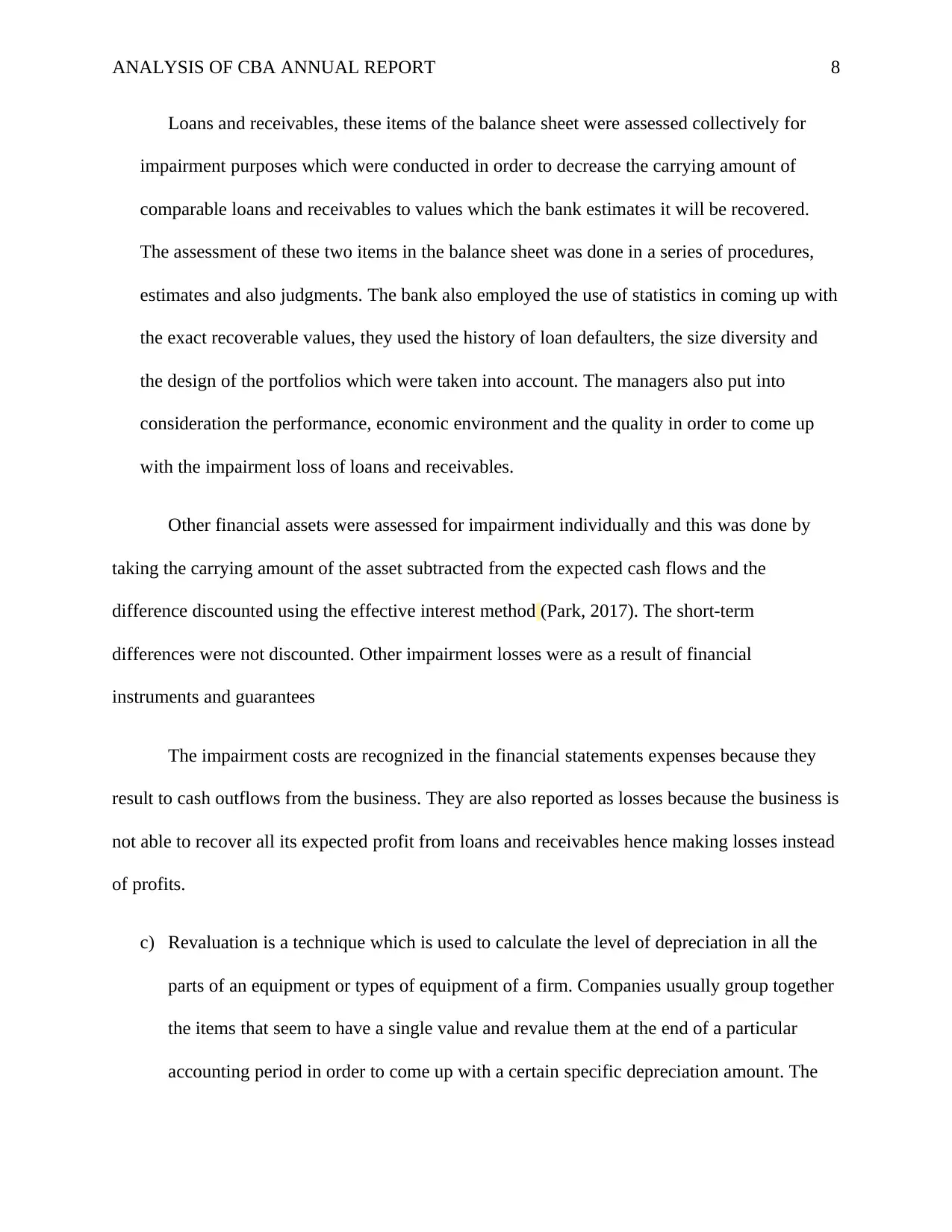

Loans and receivables, these items of the balance sheet were assessed collectively for

impairment purposes which were conducted in order to decrease the carrying amount of

comparable loans and receivables to values which the bank estimates it will be recovered.

The assessment of these two items in the balance sheet was done in a series of procedures,

estimates and also judgments. The bank also employed the use of statistics in coming up with

the exact recoverable values, they used the history of loan defaulters, the size diversity and

the design of the portfolios which were taken into account. The managers also put into

consideration the performance, economic environment and the quality in order to come up

with the impairment loss of loans and receivables.

Other financial assets were assessed for impairment individually and this was done by

taking the carrying amount of the asset subtracted from the expected cash flows and the

difference discounted using the effective interest method (Park, 2017). The short-term

differences were not discounted. Other impairment losses were as a result of financial

instruments and guarantees

The impairment costs are recognized in the financial statements expenses because they

result to cash outflows from the business. They are also reported as losses because the business is

not able to recover all its expected profit from loans and receivables hence making losses instead

of profits.

c) Revaluation is a technique which is used to calculate the level of depreciation in all the

parts of an equipment or types of equipment of a firm. Companies usually group together

the items that seem to have a single value and revalue them at the end of a particular

accounting period in order to come up with a certain specific depreciation amount. The

Loans and receivables, these items of the balance sheet were assessed collectively for

impairment purposes which were conducted in order to decrease the carrying amount of

comparable loans and receivables to values which the bank estimates it will be recovered.

The assessment of these two items in the balance sheet was done in a series of procedures,

estimates and also judgments. The bank also employed the use of statistics in coming up with

the exact recoverable values, they used the history of loan defaulters, the size diversity and

the design of the portfolios which were taken into account. The managers also put into

consideration the performance, economic environment and the quality in order to come up

with the impairment loss of loans and receivables.

Other financial assets were assessed for impairment individually and this was done by

taking the carrying amount of the asset subtracted from the expected cash flows and the

difference discounted using the effective interest method (Park, 2017). The short-term

differences were not discounted. Other impairment losses were as a result of financial

instruments and guarantees

The impairment costs are recognized in the financial statements expenses because they

result to cash outflows from the business. They are also reported as losses because the business is

not able to recover all its expected profit from loans and receivables hence making losses instead

of profits.

c) Revaluation is a technique which is used to calculate the level of depreciation in all the

parts of an equipment or types of equipment of a firm. Companies usually group together

the items that seem to have a single value and revalue them at the end of a particular

accounting period in order to come up with a certain specific depreciation amount. The

ANALYSIS OF CBA ANNUAL REPORT 9

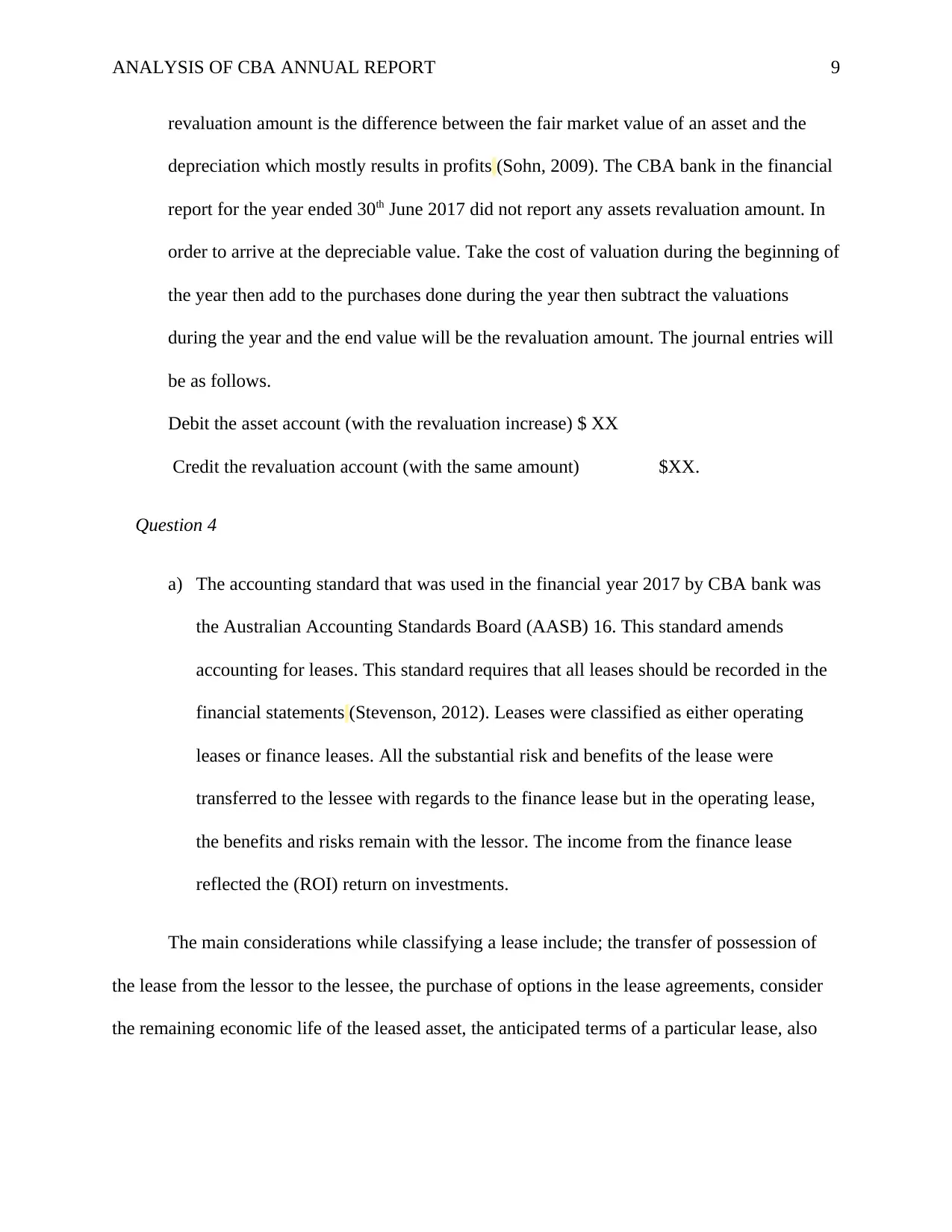

revaluation amount is the difference between the fair market value of an asset and the

depreciation which mostly results in profits (Sohn, 2009). The CBA bank in the financial

report for the year ended 30th June 2017 did not report any assets revaluation amount. In

order to arrive at the depreciable value. Take the cost of valuation during the beginning of

the year then add to the purchases done during the year then subtract the valuations

during the year and the end value will be the revaluation amount. The journal entries will

be as follows.

Debit the asset account (with the revaluation increase) $ XX

Credit the revaluation account (with the same amount) $XX.

Question 4

a) The accounting standard that was used in the financial year 2017 by CBA bank was

the Australian Accounting Standards Board (AASB) 16. This standard amends

accounting for leases. This standard requires that all leases should be recorded in the

financial statements (Stevenson, 2012). Leases were classified as either operating

leases or finance leases. All the substantial risk and benefits of the lease were

transferred to the lessee with regards to the finance lease but in the operating lease,

the benefits and risks remain with the lessor. The income from the finance lease

reflected the (ROI) return on investments.

The main considerations while classifying a lease include; the transfer of possession of

the lease from the lessor to the lessee, the purchase of options in the lease agreements, consider

the remaining economic life of the leased asset, the anticipated terms of a particular lease, also

revaluation amount is the difference between the fair market value of an asset and the

depreciation which mostly results in profits (Sohn, 2009). The CBA bank in the financial

report for the year ended 30th June 2017 did not report any assets revaluation amount. In

order to arrive at the depreciable value. Take the cost of valuation during the beginning of

the year then add to the purchases done during the year then subtract the valuations

during the year and the end value will be the revaluation amount. The journal entries will

be as follows.

Debit the asset account (with the revaluation increase) $ XX

Credit the revaluation account (with the same amount) $XX.

Question 4

a) The accounting standard that was used in the financial year 2017 by CBA bank was

the Australian Accounting Standards Board (AASB) 16. This standard amends

accounting for leases. This standard requires that all leases should be recorded in the

financial statements (Stevenson, 2012). Leases were classified as either operating

leases or finance leases. All the substantial risk and benefits of the lease were

transferred to the lessee with regards to the finance lease but in the operating lease,

the benefits and risks remain with the lessor. The income from the finance lease

reflected the (ROI) return on investments.

The main considerations while classifying a lease include; the transfer of possession of

the lease from the lessor to the lessee, the purchase of options in the lease agreements, consider

the remaining economic life of the leased asset, the anticipated terms of a particular lease, also

You're viewing a preview

Unlock full access by subscribing today!

ANALYSIS OF CBA ANNUAL REPORT 10

consider the lease payments, the fair market value of the leased asset and lastly consider the lease

implicit rates (Hussey, 2017).

b) Adoption of AASB 16 is likely to have material effects to the company reporting

especially on the side of the lessee because this standard changes the rules of

reporting in the books of the lessee. In reporting the lease in the books of the lessor,

the accounting rules do not change hence the effect will be small (He, Evans & He,

2016). This standard removes the difference that exists between an operating lease

and finance lease hence this will bring about material effects in the company

reporting.

consider the lease payments, the fair market value of the leased asset and lastly consider the lease

implicit rates (Hussey, 2017).

b) Adoption of AASB 16 is likely to have material effects to the company reporting

especially on the side of the lessee because this standard changes the rules of

reporting in the books of the lessee. In reporting the lease in the books of the lessor,

the accounting rules do not change hence the effect will be small (He, Evans & He,

2016). This standard removes the difference that exists between an operating lease

and finance lease hence this will bring about material effects in the company

reporting.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ANALYSIS OF CBA ANNUAL REPORT 11

References

Abdallah, A. (2017). The Conformity Level of Income Tax Accounting in Jordan with the

Requirements of the International Accounting Standard IAS (12) in Terms of Taxable

Temporary Differences’ Recognition. SSRN Electronic Journal. doi:

10.2139/ssrn.3221069

Adams, J., & Hartsfield, F. (2010). Foreign currency exchange rates and mutual fund cash flows.

Journal Of Asset Management, 11(5), 314-320. doi: 10.1057/jam.2009.37

Annual reports. (2018). Retrieved from

https://www.commbank.com.au/about-us/investors/annual-reportsv.html

Commonwealth Bank | CBA | Depreciation. (2018). Retrieved from

https://tradingeconomics.com/cba:au:depreciation

He, L., Evans, E., & He, R. (2016). The Impact of AASB 8Operating Segmentson Analysts’

Earnings Forecasts: Australian Evidence. Australian Accounting Review, 26(4), 330-340.

doi: 10.1111/auar.12132

Hussey, R. (2017). Accounting for Leases and the Failure of Convergence. Athens Journal Of

Business & Economics, 4(1), 7-24. doi: 10.30958/ajbe.4.1.1

Park, H. (2017). Intangible assets and the book-to-market effect. European Financial

Management. doi: 10.1111/eufm.12148

References

Abdallah, A. (2017). The Conformity Level of Income Tax Accounting in Jordan with the

Requirements of the International Accounting Standard IAS (12) in Terms of Taxable

Temporary Differences’ Recognition. SSRN Electronic Journal. doi:

10.2139/ssrn.3221069

Adams, J., & Hartsfield, F. (2010). Foreign currency exchange rates and mutual fund cash flows.

Journal Of Asset Management, 11(5), 314-320. doi: 10.1057/jam.2009.37

Annual reports. (2018). Retrieved from

https://www.commbank.com.au/about-us/investors/annual-reportsv.html

Commonwealth Bank | CBA | Depreciation. (2018). Retrieved from

https://tradingeconomics.com/cba:au:depreciation

He, L., Evans, E., & He, R. (2016). The Impact of AASB 8Operating Segmentson Analysts’

Earnings Forecasts: Australian Evidence. Australian Accounting Review, 26(4), 330-340.

doi: 10.1111/auar.12132

Hussey, R. (2017). Accounting for Leases and the Failure of Convergence. Athens Journal Of

Business & Economics, 4(1), 7-24. doi: 10.30958/ajbe.4.1.1

Park, H. (2017). Intangible assets and the book-to-market effect. European Financial

Management. doi: 10.1111/eufm.12148

ANALYSIS OF CBA ANNUAL REPORT 12

Sohn, J. (2009). Consideration to the Depreciation Method using Accumulated Depreciation Rate

Function. The Journal Of The Korea Contents Association, 9(1), 304-311. doi:

10.5392/jkca.2009.9.1.304

Stevenson, K. (2012). The Changing IASB and AASB Relationship. Australian Accounting

Review, 22(3), 239-243. doi: 10.1111/j.1835-2561.2012.00182.x

Shirkar, W. (2018). Deferred Tax Assets and Deferred Tax Expense Against Tax Planning Profit

Management. Shirkah: Journal Of Economics And Business, 2(2). doi:

10.22515/shirkah.v2i2.166

Sohn, J. (2009). Consideration to the Depreciation Method using Accumulated Depreciation Rate

Function. The Journal Of The Korea Contents Association, 9(1), 304-311. doi:

10.5392/jkca.2009.9.1.304

Stevenson, K. (2012). The Changing IASB and AASB Relationship. Australian Accounting

Review, 22(3), 239-243. doi: 10.1111/j.1835-2561.2012.00182.x

Shirkar, W. (2018). Deferred Tax Assets and Deferred Tax Expense Against Tax Planning Profit

Management. Shirkah: Journal Of Economics And Business, 2(2). doi:

10.22515/shirkah.v2i2.166

You're viewing a preview

Unlock full access by subscribing today!

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.