Financial Analysis of AstraZeneca: Investment Appraisal Case Study

VerifiedAdded on 2021/02/20

|15

|4031

|157

Case Study

AI Summary

This case study examines the financial performance of AstraZeneca Plc, a multinational pharmaceutical company, through detailed ratio analysis, including profitability, liquidity, solvency, and investment ratios, comparing its performance with Johnson & Johnson. It evaluates AstraZeneca's operational efficiency, liquidity position, and financial leverage over a five-year period. The report also delves into investment appraisal techniques, such as Net Present Value (NPV) and Internal Rate of Return (IRR), and discusses the potential of a target company for acquisition, considering synergistic gains, deal valuation, and potential impacts on performance and risk assessment. The analysis highlights AstraZeneca's strengths and weaknesses, offering insights into its financial health and strategic decisions.

Case Study

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

1. EVALUATION OF FINANCIAL ANALYSIS..........................................................................3

Profitability ratio analysis ..........................................................................................................3

Limitations of Financial ratios ...................................................................................................8

2. INVESTMENT APPRAISAL.....................................................................................................8

Net present value (NPV):............................................................................................................9

Internal rate of return (IRR):.......................................................................................................9

3.1 Rationale of selecting the target company..........................................................................11

3.2 Synergistic gains over the acquisition.................................................................................12

3.3 Valve and financing of the proposed deal of acquisition....................................................12

3.4 Potential impact on performance regarding acquisition.....................................................12

3.5 Acquisition risk assesses and challenges...........................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

1. EVALUATION OF FINANCIAL ANALYSIS..........................................................................3

Profitability ratio analysis ..........................................................................................................3

Limitations of Financial ratios ...................................................................................................8

2. INVESTMENT APPRAISAL.....................................................................................................8

Net present value (NPV):............................................................................................................9

Internal rate of return (IRR):.......................................................................................................9

3.1 Rationale of selecting the target company..........................................................................11

3.2 Synergistic gains over the acquisition.................................................................................12

3.3 Valve and financing of the proposed deal of acquisition....................................................12

3.4 Potential impact on performance regarding acquisition.....................................................12

3.5 Acquisition risk assesses and challenges...........................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

A case study is evaluation of facts and figures related to a specific phenomenon, case or a

company. This assessment can be numerical or theoretical with use and application of various

tools and techniques to determine different aspects related with performance, state and position

in industry, implication of case and others. In the present report a case study is presented over

AstraZeneca Plc which is British-Swedish multinational pharmaceutical and biopharmaceutical

organization established in 1913. The organisation have gained success in past few years and

acquiring business and firms from long, since 1939. The report includes evaluation of financial

performance of company through its ratio analysis and comparing it with one of its competitors.

Along with this, investment appraisal techniques are also explained in detail with their critical

discussion. For the last section of the report the potential of a target company are presented

which AstraZeneca is planning to acquire.

1. EVALUATION OF FINANCIAL ANALYSIS

Profitability ratio analysis

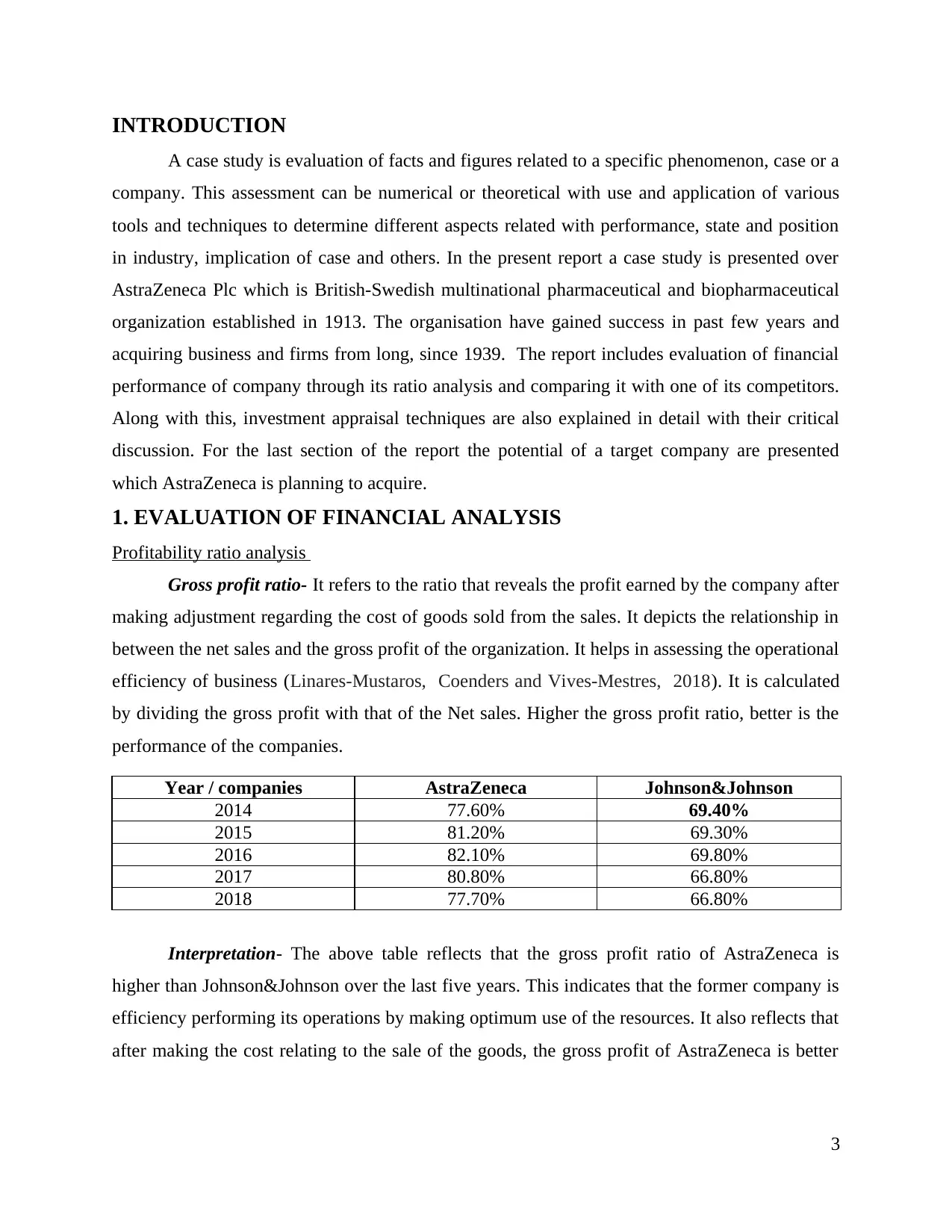

Gross profit ratio- It refers to the ratio that reveals the profit earned by the company after

making adjustment regarding the cost of goods sold from the sales. It depicts the relationship in

between the net sales and the gross profit of the organization. It helps in assessing the operational

efficiency of business (Linares-Mustaros, Coenders and Vives-Mestres, 2018). It is calculated

by dividing the gross profit with that of the Net sales. Higher the gross profit ratio, better is the

performance of the companies.

Year / companies AstraZeneca Johnson&Johnson

2014 77.60% 69.40%

2015 81.20% 69.30%

2016 82.10% 69.80%

2017 80.80% 66.80%

2018 77.70% 66.80%

Interpretation- The above table reflects that the gross profit ratio of AstraZeneca is

higher than Johnson&Johnson over the last five years. This indicates that the former company is

efficiency performing its operations by making optimum use of the resources. It also reflects that

after making the cost relating to the sale of the goods, the gross profit of AstraZeneca is better

3

A case study is evaluation of facts and figures related to a specific phenomenon, case or a

company. This assessment can be numerical or theoretical with use and application of various

tools and techniques to determine different aspects related with performance, state and position

in industry, implication of case and others. In the present report a case study is presented over

AstraZeneca Plc which is British-Swedish multinational pharmaceutical and biopharmaceutical

organization established in 1913. The organisation have gained success in past few years and

acquiring business and firms from long, since 1939. The report includes evaluation of financial

performance of company through its ratio analysis and comparing it with one of its competitors.

Along with this, investment appraisal techniques are also explained in detail with their critical

discussion. For the last section of the report the potential of a target company are presented

which AstraZeneca is planning to acquire.

1. EVALUATION OF FINANCIAL ANALYSIS

Profitability ratio analysis

Gross profit ratio- It refers to the ratio that reveals the profit earned by the company after

making adjustment regarding the cost of goods sold from the sales. It depicts the relationship in

between the net sales and the gross profit of the organization. It helps in assessing the operational

efficiency of business (Linares-Mustaros, Coenders and Vives-Mestres, 2018). It is calculated

by dividing the gross profit with that of the Net sales. Higher the gross profit ratio, better is the

performance of the companies.

Year / companies AstraZeneca Johnson&Johnson

2014 77.60% 69.40%

2015 81.20% 69.30%

2016 82.10% 69.80%

2017 80.80% 66.80%

2018 77.70% 66.80%

Interpretation- The above table reflects that the gross profit ratio of AstraZeneca is

higher than Johnson&Johnson over the last five years. This indicates that the former company is

efficiency performing its operations by making optimum use of the resources. It also reflects that

after making the cost relating to the sale of the goods, the gross profit of AstraZeneca is better

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and showing an increasing trend which in turn shows that the company is performing with full

efficiency in comparison with its competitor.

Liquidity ratio analysis

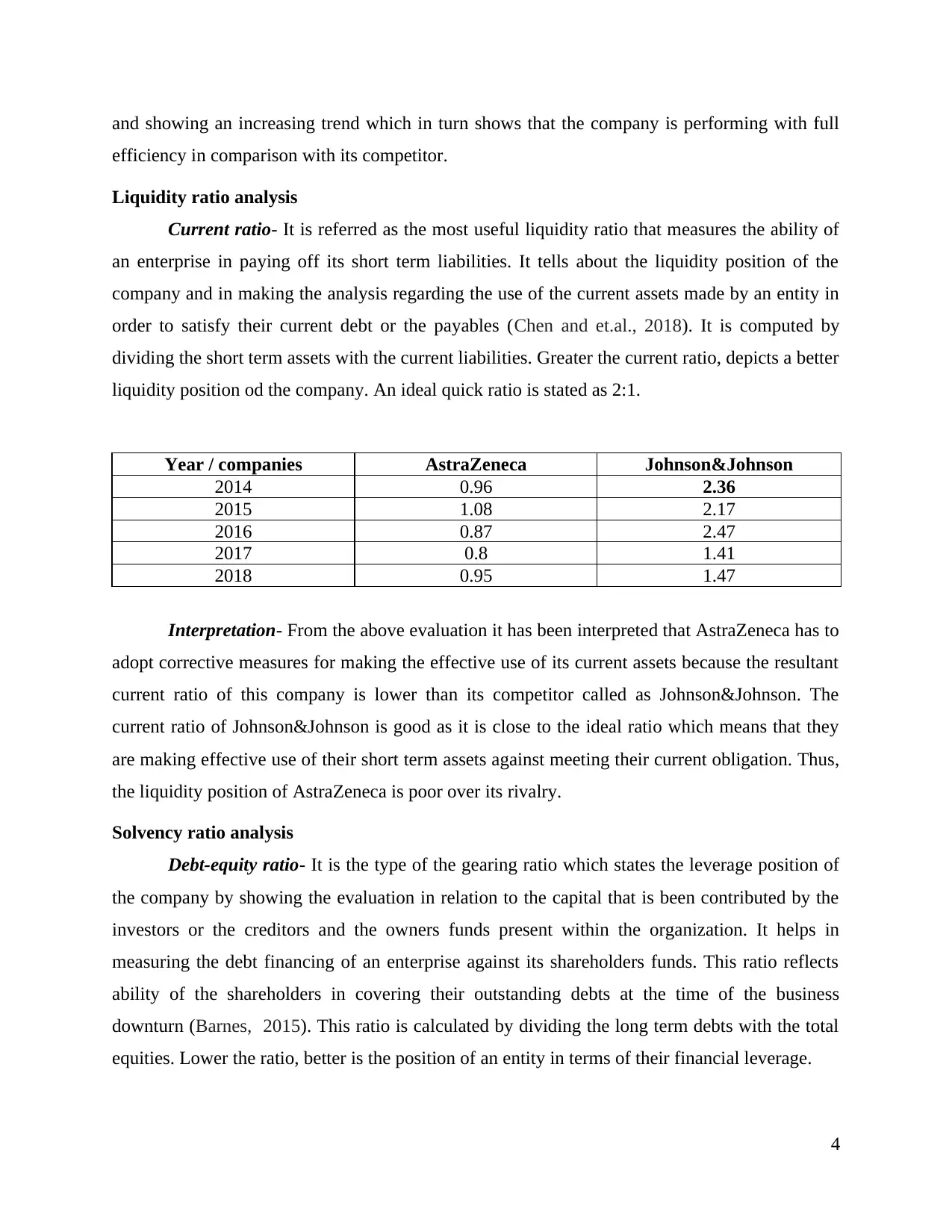

Current ratio- It is referred as the most useful liquidity ratio that measures the ability of

an enterprise in paying off its short term liabilities. It tells about the liquidity position of the

company and in making the analysis regarding the use of the current assets made by an entity in

order to satisfy their current debt or the payables (Chen and et.al., 2018). It is computed by

dividing the short term assets with the current liabilities. Greater the current ratio, depicts a better

liquidity position od the company. An ideal quick ratio is stated as 2:1.

Year / companies AstraZeneca Johnson&Johnson

2014 0.96 2.36

2015 1.08 2.17

2016 0.87 2.47

2017 0.8 1.41

2018 0.95 1.47

Interpretation- From the above evaluation it has been interpreted that AstraZeneca has to

adopt corrective measures for making the effective use of its current assets because the resultant

current ratio of this company is lower than its competitor called as Johnson&Johnson. The

current ratio of Johnson&Johnson is good as it is close to the ideal ratio which means that they

are making effective use of their short term assets against meeting their current obligation. Thus,

the liquidity position of AstraZeneca is poor over its rivalry.

Solvency ratio analysis

Debt-equity ratio- It is the type of the gearing ratio which states the leverage position of

the company by showing the evaluation in relation to the capital that is been contributed by the

investors or the creditors and the owners funds present within the organization. It helps in

measuring the debt financing of an enterprise against its shareholders funds. This ratio reflects

ability of the shareholders in covering their outstanding debts at the time of the business

downturn (Barnes, 2015). This ratio is calculated by dividing the long term debts with the total

equities. Lower the ratio, better is the position of an entity in terms of their financial leverage.

4

efficiency in comparison with its competitor.

Liquidity ratio analysis

Current ratio- It is referred as the most useful liquidity ratio that measures the ability of

an enterprise in paying off its short term liabilities. It tells about the liquidity position of the

company and in making the analysis regarding the use of the current assets made by an entity in

order to satisfy their current debt or the payables (Chen and et.al., 2018). It is computed by

dividing the short term assets with the current liabilities. Greater the current ratio, depicts a better

liquidity position od the company. An ideal quick ratio is stated as 2:1.

Year / companies AstraZeneca Johnson&Johnson

2014 0.96 2.36

2015 1.08 2.17

2016 0.87 2.47

2017 0.8 1.41

2018 0.95 1.47

Interpretation- From the above evaluation it has been interpreted that AstraZeneca has to

adopt corrective measures for making the effective use of its current assets because the resultant

current ratio of this company is lower than its competitor called as Johnson&Johnson. The

current ratio of Johnson&Johnson is good as it is close to the ideal ratio which means that they

are making effective use of their short term assets against meeting their current obligation. Thus,

the liquidity position of AstraZeneca is poor over its rivalry.

Solvency ratio analysis

Debt-equity ratio- It is the type of the gearing ratio which states the leverage position of

the company by showing the evaluation in relation to the capital that is been contributed by the

investors or the creditors and the owners funds present within the organization. It helps in

measuring the debt financing of an enterprise against its shareholders funds. This ratio reflects

ability of the shareholders in covering their outstanding debts at the time of the business

downturn (Barnes, 2015). This ratio is calculated by dividing the long term debts with the total

equities. Lower the ratio, better is the position of an entity in terms of their financial leverage.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

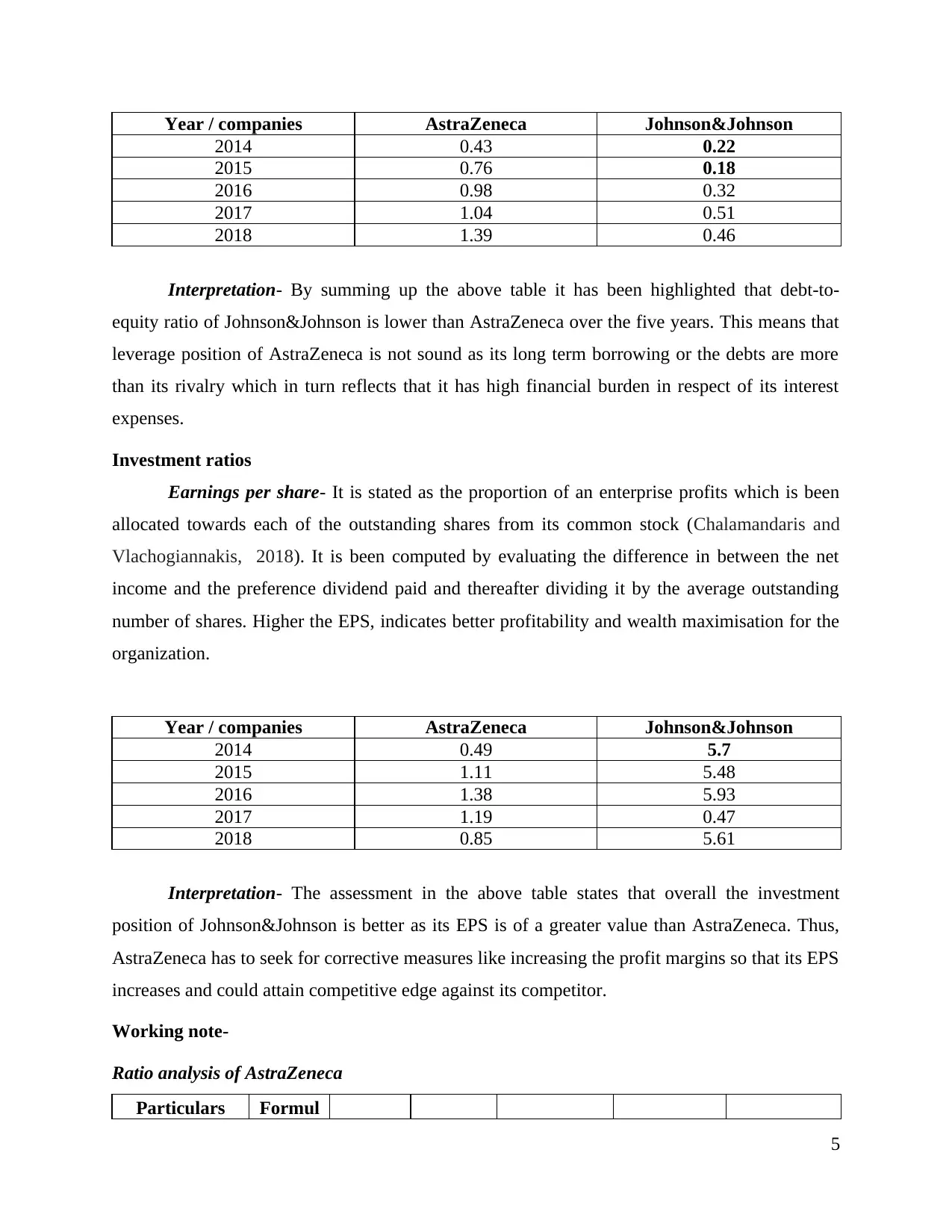

Year / companies AstraZeneca Johnson&Johnson

2014 0.43 0.22

2015 0.76 0.18

2016 0.98 0.32

2017 1.04 0.51

2018 1.39 0.46

Interpretation- By summing up the above table it has been highlighted that debt-to-

equity ratio of Johnson&Johnson is lower than AstraZeneca over the five years. This means that

leverage position of AstraZeneca is not sound as its long term borrowing or the debts are more

than its rivalry which in turn reflects that it has high financial burden in respect of its interest

expenses.

Investment ratios

Earnings per share- It is stated as the proportion of an enterprise profits which is been

allocated towards each of the outstanding shares from its common stock (Chalamandaris and

Vlachogiannakis, 2018). It is been computed by evaluating the difference in between the net

income and the preference dividend paid and thereafter dividing it by the average outstanding

number of shares. Higher the EPS, indicates better profitability and wealth maximisation for the

organization.

Year / companies AstraZeneca Johnson&Johnson

2014 0.49 5.7

2015 1.11 5.48

2016 1.38 5.93

2017 1.19 0.47

2018 0.85 5.61

Interpretation- The assessment in the above table states that overall the investment

position of Johnson&Johnson is better as its EPS is of a greater value than AstraZeneca. Thus,

AstraZeneca has to seek for corrective measures like increasing the profit margins so that its EPS

increases and could attain competitive edge against its competitor.

Working note-

Ratio analysis of AstraZeneca

Particulars Formul

5

2014 0.43 0.22

2015 0.76 0.18

2016 0.98 0.32

2017 1.04 0.51

2018 1.39 0.46

Interpretation- By summing up the above table it has been highlighted that debt-to-

equity ratio of Johnson&Johnson is lower than AstraZeneca over the five years. This means that

leverage position of AstraZeneca is not sound as its long term borrowing or the debts are more

than its rivalry which in turn reflects that it has high financial burden in respect of its interest

expenses.

Investment ratios

Earnings per share- It is stated as the proportion of an enterprise profits which is been

allocated towards each of the outstanding shares from its common stock (Chalamandaris and

Vlachogiannakis, 2018). It is been computed by evaluating the difference in between the net

income and the preference dividend paid and thereafter dividing it by the average outstanding

number of shares. Higher the EPS, indicates better profitability and wealth maximisation for the

organization.

Year / companies AstraZeneca Johnson&Johnson

2014 0.49 5.7

2015 1.11 5.48

2016 1.38 5.93

2017 1.19 0.47

2018 0.85 5.61

Interpretation- The assessment in the above table states that overall the investment

position of Johnson&Johnson is better as its EPS is of a greater value than AstraZeneca. Thus,

AstraZeneca has to seek for corrective measures like increasing the profit margins so that its EPS

increases and could attain competitive edge against its competitor.

Working note-

Ratio analysis of AstraZeneca

Particulars Formul

5

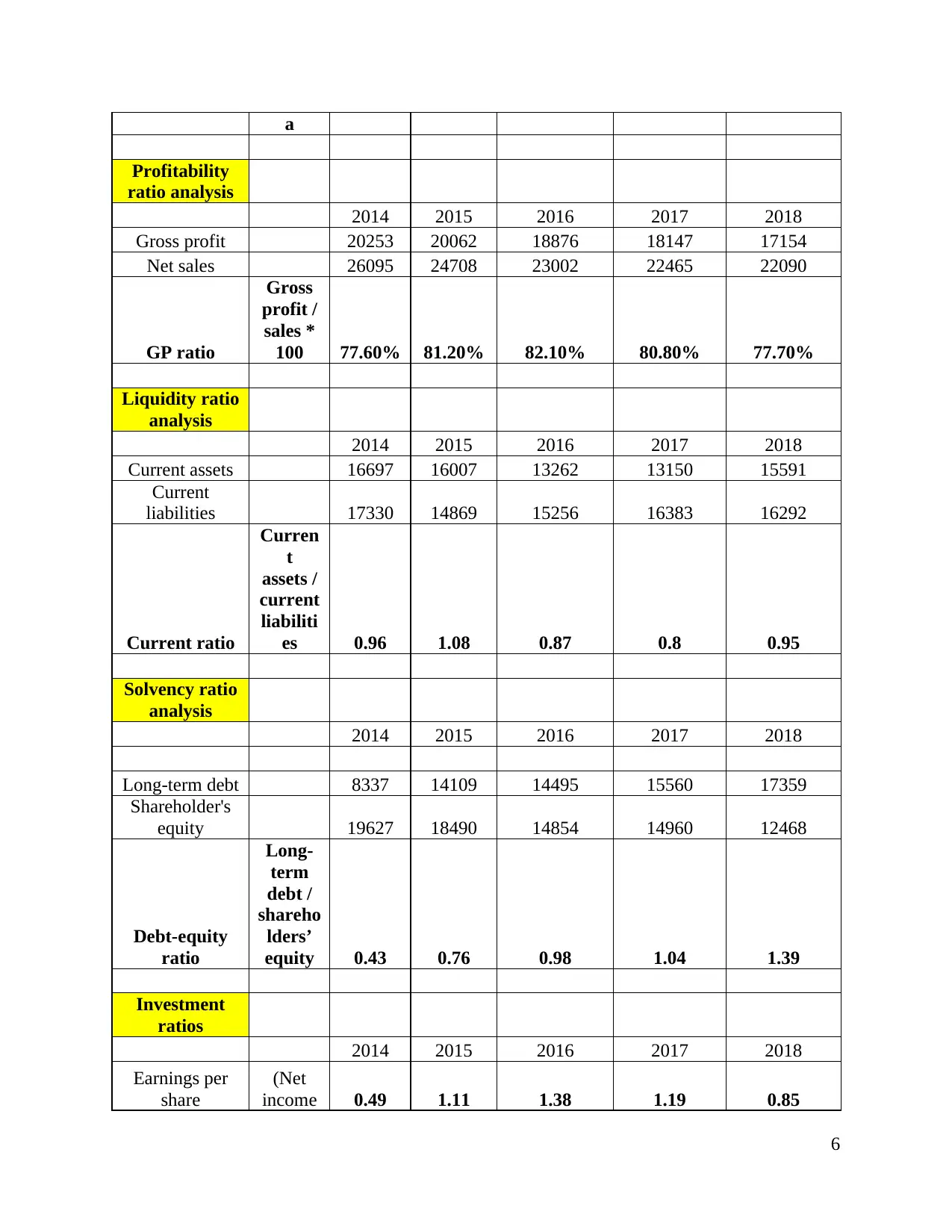

a

Profitability

ratio analysis

2014 2015 2016 2017 2018

Gross profit 20253 20062 18876 18147 17154

Net sales 26095 24708 23002 22465 22090

GP ratio

Gross

profit /

sales *

100 77.60% 81.20% 82.10% 80.80% 77.70%

Liquidity ratio

analysis

2014 2015 2016 2017 2018

Current assets 16697 16007 13262 13150 15591

Current

liabilities 17330 14869 15256 16383 16292

Current ratio

Curren

t

assets /

current

liabiliti

es 0.96 1.08 0.87 0.8 0.95

Solvency ratio

analysis

2014 2015 2016 2017 2018

Long-term debt 8337 14109 14495 15560 17359

Shareholder's

equity 19627 18490 14854 14960 12468

Debt-equity

ratio

Long-

term

debt /

shareho

lders’

equity 0.43 0.76 0.98 1.04 1.39

Investment

ratios

2014 2015 2016 2017 2018

Earnings per

share

(Net

income 0.49 1.11 1.38 1.19 0.85

6

Profitability

ratio analysis

2014 2015 2016 2017 2018

Gross profit 20253 20062 18876 18147 17154

Net sales 26095 24708 23002 22465 22090

GP ratio

Gross

profit /

sales *

100 77.60% 81.20% 82.10% 80.80% 77.70%

Liquidity ratio

analysis

2014 2015 2016 2017 2018

Current assets 16697 16007 13262 13150 15591

Current

liabilities 17330 14869 15256 16383 16292

Current ratio

Curren

t

assets /

current

liabiliti

es 0.96 1.08 0.87 0.8 0.95

Solvency ratio

analysis

2014 2015 2016 2017 2018

Long-term debt 8337 14109 14495 15560 17359

Shareholder's

equity 19627 18490 14854 14960 12468

Debt-equity

ratio

Long-

term

debt /

shareho

lders’

equity 0.43 0.76 0.98 1.04 1.39

Investment

ratios

2014 2015 2016 2017 2018

Earnings per

share

(Net

income 0.49 1.11 1.38 1.19 0.85

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

-

preferre

d

dividen

d) /

Number

of

shares

outstand

ing

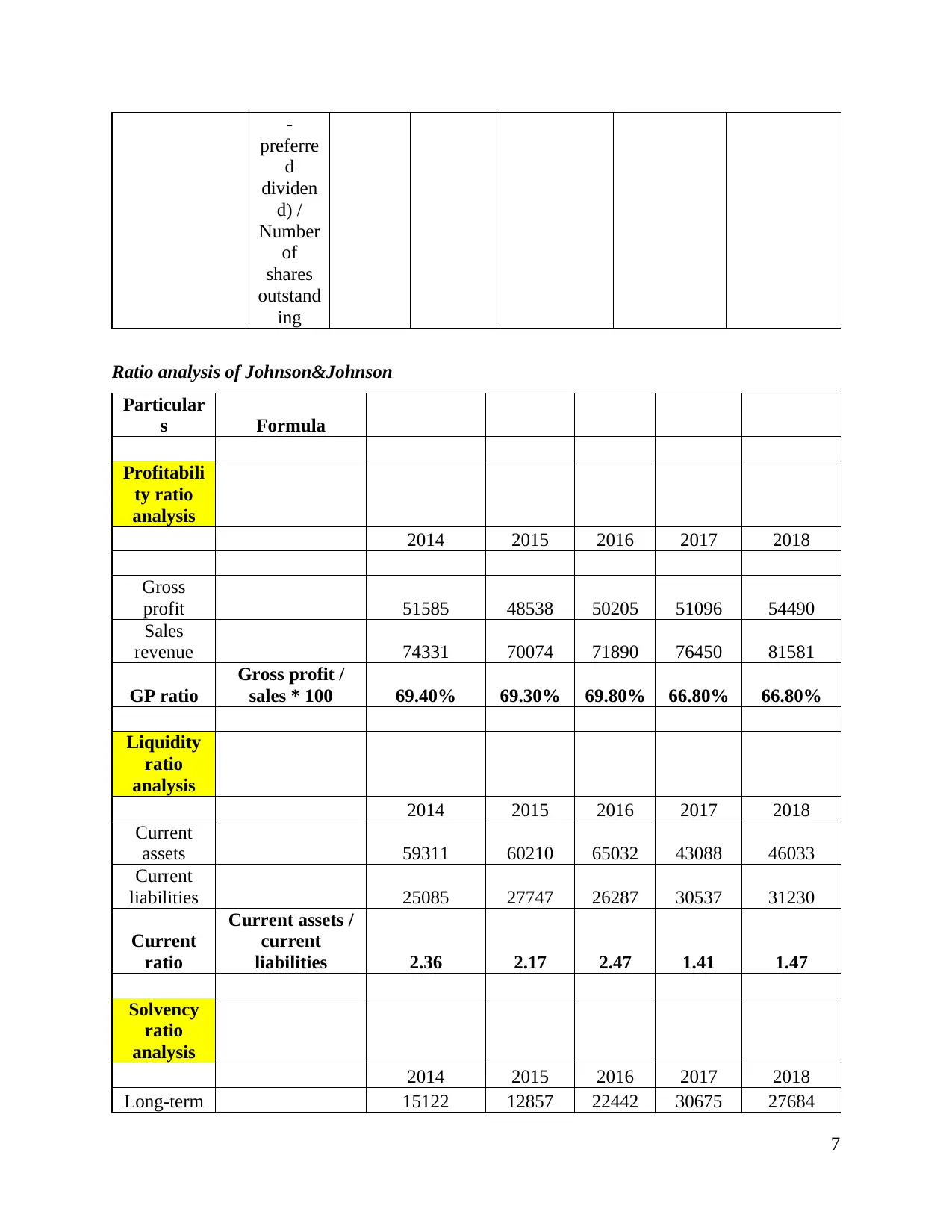

Ratio analysis of Johnson&Johnson

Particular

s Formula

Profitabili

ty ratio

analysis

2014 2015 2016 2017 2018

Gross

profit 51585 48538 50205 51096 54490

Sales

revenue 74331 70074 71890 76450 81581

GP ratio

Gross profit /

sales * 100 69.40% 69.30% 69.80% 66.80% 66.80%

Liquidity

ratio

analysis

2014 2015 2016 2017 2018

Current

assets 59311 60210 65032 43088 46033

Current

liabilities 25085 27747 26287 30537 31230

Current

ratio

Current assets /

current

liabilities 2.36 2.17 2.47 1.41 1.47

Solvency

ratio

analysis

2014 2015 2016 2017 2018

Long-term 15122 12857 22442 30675 27684

7

preferre

d

dividen

d) /

Number

of

shares

outstand

ing

Ratio analysis of Johnson&Johnson

Particular

s Formula

Profitabili

ty ratio

analysis

2014 2015 2016 2017 2018

Gross

profit 51585 48538 50205 51096 54490

Sales

revenue 74331 70074 71890 76450 81581

GP ratio

Gross profit /

sales * 100 69.40% 69.30% 69.80% 66.80% 66.80%

Liquidity

ratio

analysis

2014 2015 2016 2017 2018

Current

assets 59311 60210 65032 43088 46033

Current

liabilities 25085 27747 26287 30537 31230

Current

ratio

Current assets /

current

liabilities 2.36 2.17 2.47 1.41 1.47

Solvency

ratio

analysis

2014 2015 2016 2017 2018

Long-term 15122 12857 22442 30675 27684

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

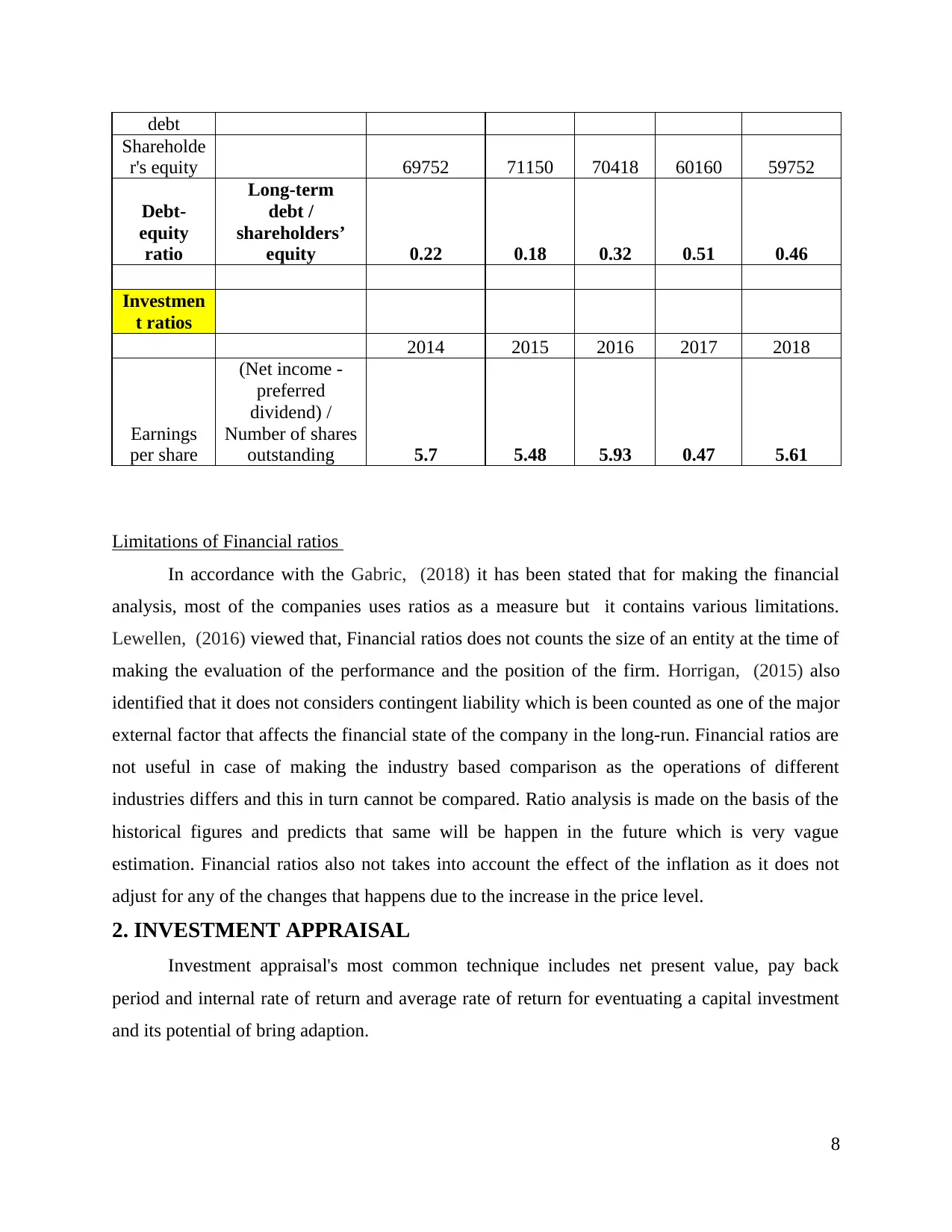

debt

Shareholde

r's equity 69752 71150 70418 60160 59752

Debt-

equity

ratio

Long-term

debt /

shareholders’

equity 0.22 0.18 0.32 0.51 0.46

Investmen

t ratios

2014 2015 2016 2017 2018

Earnings

per share

(Net income -

preferred

dividend) /

Number of shares

outstanding 5.7 5.48 5.93 0.47 5.61

Limitations of Financial ratios

In accordance with the Gabric, (2018) it has been stated that for making the financial

analysis, most of the companies uses ratios as a measure but it contains various limitations.

Lewellen, (2016) viewed that, Financial ratios does not counts the size of an entity at the time of

making the evaluation of the performance and the position of the firm. Horrigan, (2015) also

identified that it does not considers contingent liability which is been counted as one of the major

external factor that affects the financial state of the company in the long-run. Financial ratios are

not useful in case of making the industry based comparison as the operations of different

industries differs and this in turn cannot be compared. Ratio analysis is made on the basis of the

historical figures and predicts that same will be happen in the future which is very vague

estimation. Financial ratios also not takes into account the effect of the inflation as it does not

adjust for any of the changes that happens due to the increase in the price level.

2. INVESTMENT APPRAISAL

Investment appraisal's most common technique includes net present value, pay back

period and internal rate of return and average rate of return for eventuating a capital investment

and its potential of bring adaption.

8

Shareholde

r's equity 69752 71150 70418 60160 59752

Debt-

equity

ratio

Long-term

debt /

shareholders’

equity 0.22 0.18 0.32 0.51 0.46

Investmen

t ratios

2014 2015 2016 2017 2018

Earnings

per share

(Net income -

preferred

dividend) /

Number of shares

outstanding 5.7 5.48 5.93 0.47 5.61

Limitations of Financial ratios

In accordance with the Gabric, (2018) it has been stated that for making the financial

analysis, most of the companies uses ratios as a measure but it contains various limitations.

Lewellen, (2016) viewed that, Financial ratios does not counts the size of an entity at the time of

making the evaluation of the performance and the position of the firm. Horrigan, (2015) also

identified that it does not considers contingent liability which is been counted as one of the major

external factor that affects the financial state of the company in the long-run. Financial ratios are

not useful in case of making the industry based comparison as the operations of different

industries differs and this in turn cannot be compared. Ratio analysis is made on the basis of the

historical figures and predicts that same will be happen in the future which is very vague

estimation. Financial ratios also not takes into account the effect of the inflation as it does not

adjust for any of the changes that happens due to the increase in the price level.

2. INVESTMENT APPRAISAL

Investment appraisal's most common technique includes net present value, pay back

period and internal rate of return and average rate of return for eventuating a capital investment

and its potential of bring adaption.

8

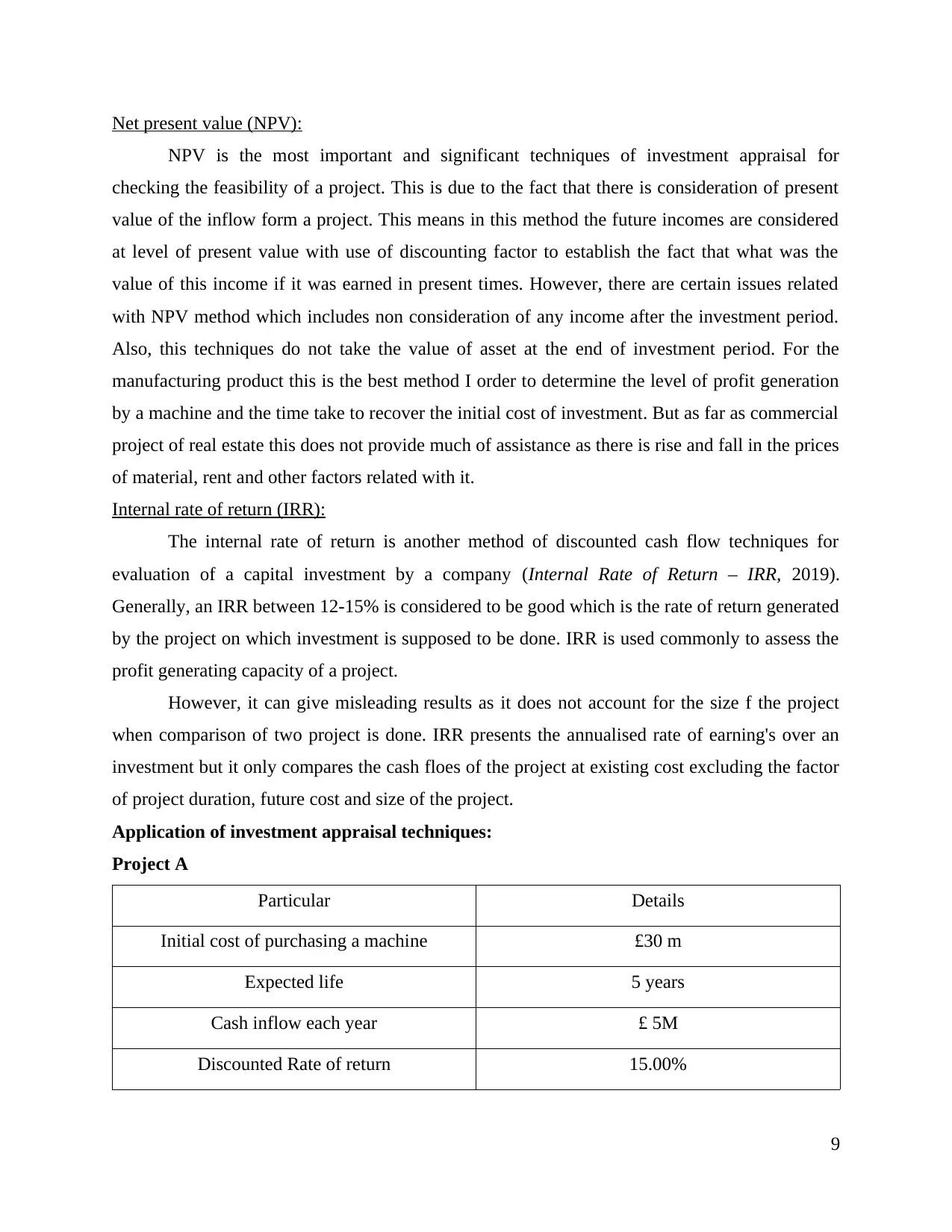

Net present value (NPV):

NPV is the most important and significant techniques of investment appraisal for

checking the feasibility of a project. This is due to the fact that there is consideration of present

value of the inflow form a project. This means in this method the future incomes are considered

at level of present value with use of discounting factor to establish the fact that what was the

value of this income if it was earned in present times. However, there are certain issues related

with NPV method which includes non consideration of any income after the investment period.

Also, this techniques do not take the value of asset at the end of investment period. For the

manufacturing product this is the best method I order to determine the level of profit generation

by a machine and the time take to recover the initial cost of investment. But as far as commercial

project of real estate this does not provide much of assistance as there is rise and fall in the prices

of material, rent and other factors related with it.

Internal rate of return (IRR):

The internal rate of return is another method of discounted cash flow techniques for

evaluation of a capital investment by a company (Internal Rate of Return – IRR, 2019).

Generally, an IRR between 12-15% is considered to be good which is the rate of return generated

by the project on which investment is supposed to be done. IRR is used commonly to assess the

profit generating capacity of a project.

However, it can give misleading results as it does not account for the size f the project

when comparison of two project is done. IRR presents the annualised rate of earning's over an

investment but it only compares the cash floes of the project at existing cost excluding the factor

of project duration, future cost and size of the project.

Application of investment appraisal techniques:

Project A

Particular Details

Initial cost of purchasing a machine £30 m

Expected life 5 years

Cash inflow each year £ 5M

Discounted Rate of return 15.00%

9

NPV is the most important and significant techniques of investment appraisal for

checking the feasibility of a project. This is due to the fact that there is consideration of present

value of the inflow form a project. This means in this method the future incomes are considered

at level of present value with use of discounting factor to establish the fact that what was the

value of this income if it was earned in present times. However, there are certain issues related

with NPV method which includes non consideration of any income after the investment period.

Also, this techniques do not take the value of asset at the end of investment period. For the

manufacturing product this is the best method I order to determine the level of profit generation

by a machine and the time take to recover the initial cost of investment. But as far as commercial

project of real estate this does not provide much of assistance as there is rise and fall in the prices

of material, rent and other factors related with it.

Internal rate of return (IRR):

The internal rate of return is another method of discounted cash flow techniques for

evaluation of a capital investment by a company (Internal Rate of Return – IRR, 2019).

Generally, an IRR between 12-15% is considered to be good which is the rate of return generated

by the project on which investment is supposed to be done. IRR is used commonly to assess the

profit generating capacity of a project.

However, it can give misleading results as it does not account for the size f the project

when comparison of two project is done. IRR presents the annualised rate of earning's over an

investment but it only compares the cash floes of the project at existing cost excluding the factor

of project duration, future cost and size of the project.

Application of investment appraisal techniques:

Project A

Particular Details

Initial cost of purchasing a machine £30 m

Expected life 5 years

Cash inflow each year £ 5M

Discounted Rate of return 15.00%

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Time Cash flow DF (15%) Present value

0 -30 1.000 -30

1 5 0.870 4.35

2 5 0.756 3.78

3 5 0.658 3.29

4 5 0.572 2.86

5 5 0.497 2.49

NPV= Cash inflow -cash outflow -18.33

IRR= NPV/ -18.07%

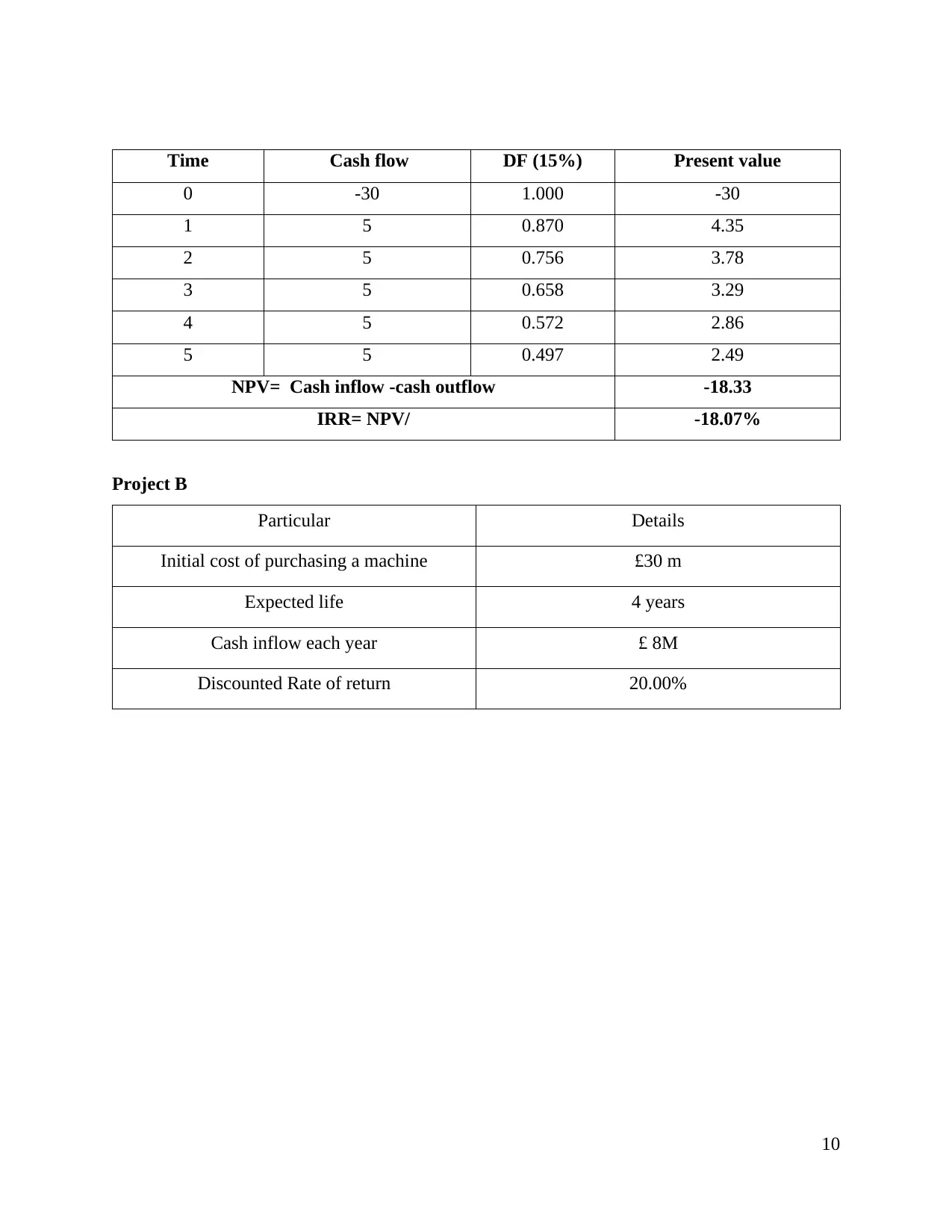

Project B

Particular Details

Initial cost of purchasing a machine £30 m

Expected life 4 years

Cash inflow each year £ 8M

Discounted Rate of return 20.00%

10

0 -30 1.000 -30

1 5 0.870 4.35

2 5 0.756 3.78

3 5 0.658 3.29

4 5 0.572 2.86

5 5 0.497 2.49

NPV= Cash inflow -cash outflow -18.33

IRR= NPV/ -18.07%

Project B

Particular Details

Initial cost of purchasing a machine £30 m

Expected life 4 years

Cash inflow each year £ 8M

Discounted Rate of return 20.00%

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

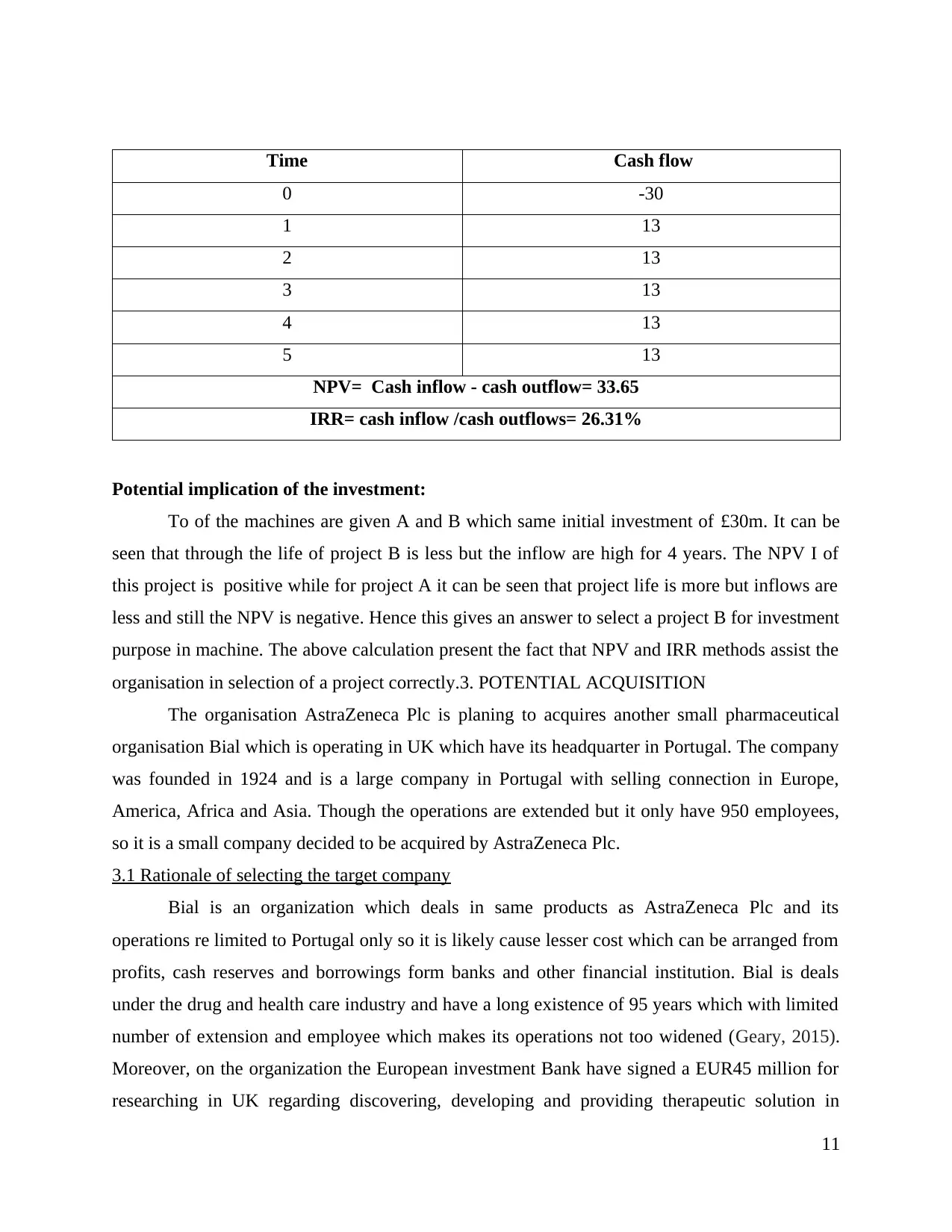

Time Cash flow

0 -30

1 13

2 13

3 13

4 13

5 13

NPV= Cash inflow - cash outflow= 33.65

IRR= cash inflow /cash outflows= 26.31%

Potential implication of the investment:

To of the machines are given A and B which same initial investment of £30m. It can be

seen that through the life of project B is less but the inflow are high for 4 years. The NPV I of

this project is positive while for project A it can be seen that project life is more but inflows are

less and still the NPV is negative. Hence this gives an answer to select a project B for investment

purpose in machine. The above calculation present the fact that NPV and IRR methods assist the

organisation in selection of a project correctly.3. POTENTIAL ACQUISITION

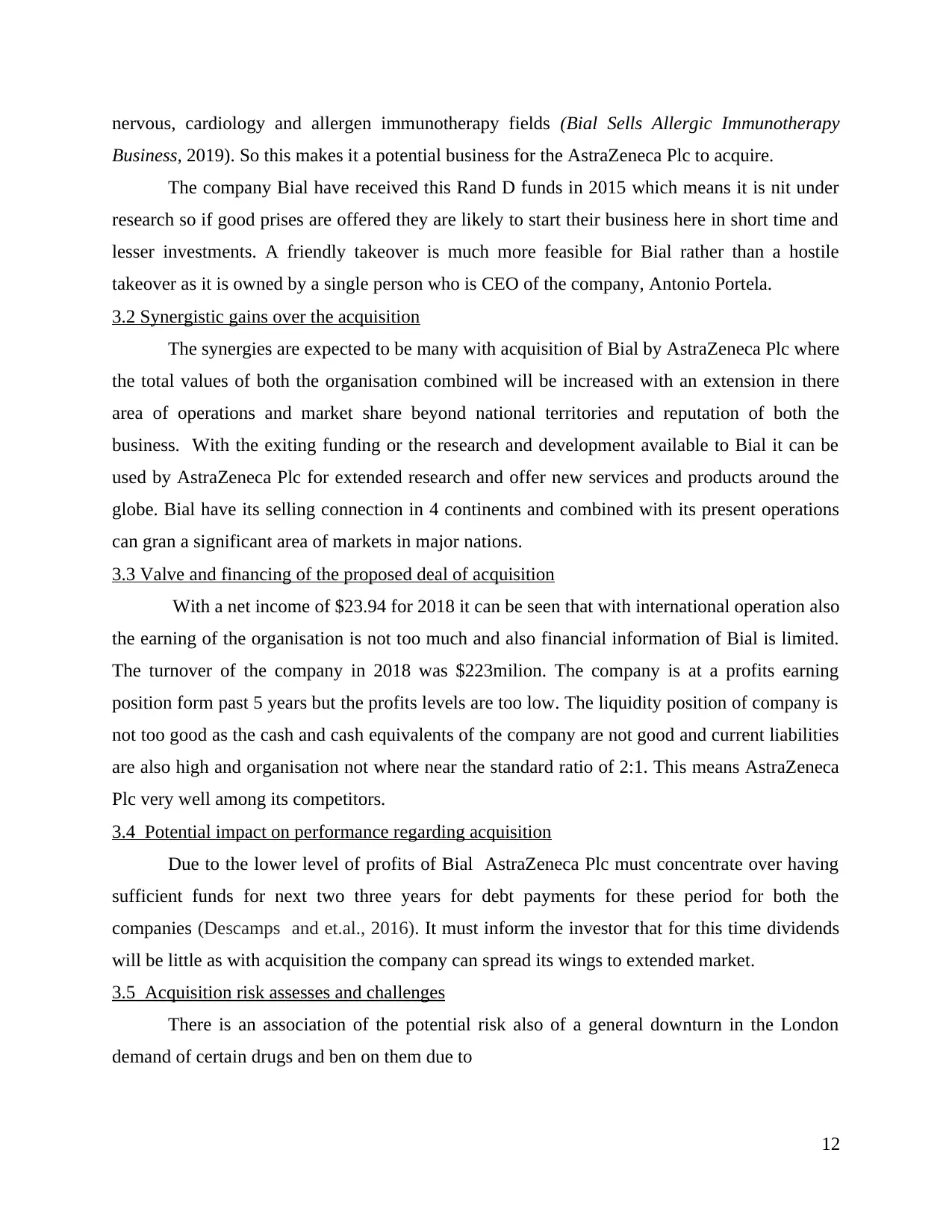

The organisation AstraZeneca Plc is planing to acquires another small pharmaceutical

organisation Bial which is operating in UK which have its headquarter in Portugal. The company

was founded in 1924 and is a large company in Portugal with selling connection in Europe,

America, Africa and Asia. Though the operations are extended but it only have 950 employees,

so it is a small company decided to be acquired by AstraZeneca Plc.

3.1 Rationale of selecting the target company

Bial is an organization which deals in same products as AstraZeneca Plc and its

operations re limited to Portugal only so it is likely cause lesser cost which can be arranged from

profits, cash reserves and borrowings form banks and other financial institution. Bial is deals

under the drug and health care industry and have a long existence of 95 years which with limited

number of extension and employee which makes its operations not too widened (Geary, 2015).

Moreover, on the organization the European investment Bank have signed a EUR45 million for

researching in UK regarding discovering, developing and providing therapeutic solution in

11

0 -30

1 13

2 13

3 13

4 13

5 13

NPV= Cash inflow - cash outflow= 33.65

IRR= cash inflow /cash outflows= 26.31%

Potential implication of the investment:

To of the machines are given A and B which same initial investment of £30m. It can be

seen that through the life of project B is less but the inflow are high for 4 years. The NPV I of

this project is positive while for project A it can be seen that project life is more but inflows are

less and still the NPV is negative. Hence this gives an answer to select a project B for investment

purpose in machine. The above calculation present the fact that NPV and IRR methods assist the

organisation in selection of a project correctly.3. POTENTIAL ACQUISITION

The organisation AstraZeneca Plc is planing to acquires another small pharmaceutical

organisation Bial which is operating in UK which have its headquarter in Portugal. The company

was founded in 1924 and is a large company in Portugal with selling connection in Europe,

America, Africa and Asia. Though the operations are extended but it only have 950 employees,

so it is a small company decided to be acquired by AstraZeneca Plc.

3.1 Rationale of selecting the target company

Bial is an organization which deals in same products as AstraZeneca Plc and its

operations re limited to Portugal only so it is likely cause lesser cost which can be arranged from

profits, cash reserves and borrowings form banks and other financial institution. Bial is deals

under the drug and health care industry and have a long existence of 95 years which with limited

number of extension and employee which makes its operations not too widened (Geary, 2015).

Moreover, on the organization the European investment Bank have signed a EUR45 million for

researching in UK regarding discovering, developing and providing therapeutic solution in

11

nervous, cardiology and allergen immunotherapy fields (Bial Sells Allergic Immunotherapy

Business, 2019). So this makes it a potential business for the AstraZeneca Plc to acquire.

The company Bial have received this Rand D funds in 2015 which means it is nit under

research so if good prises are offered they are likely to start their business here in short time and

lesser investments. A friendly takeover is much more feasible for Bial rather than a hostile

takeover as it is owned by a single person who is CEO of the company, Antonio Portela.

3.2 Synergistic gains over the acquisition

The synergies are expected to be many with acquisition of Bial by AstraZeneca Plc where

the total values of both the organisation combined will be increased with an extension in there

area of operations and market share beyond national territories and reputation of both the

business. With the exiting funding or the research and development available to Bial it can be

used by AstraZeneca Plc for extended research and offer new services and products around the

globe. Bial have its selling connection in 4 continents and combined with its present operations

can gran a significant area of markets in major nations.

3.3 Valve and financing of the proposed deal of acquisition

With a net income of $23.94 for 2018 it can be seen that with international operation also

the earning of the organisation is not too much and also financial information of Bial is limited.

The turnover of the company in 2018 was $223milion. The company is at a profits earning

position form past 5 years but the profits levels are too low. The liquidity position of company is

not too good as the cash and cash equivalents of the company are not good and current liabilities

are also high and organisation not where near the standard ratio of 2:1. This means AstraZeneca

Plc very well among its competitors.

3.4 Potential impact on performance regarding acquisition

Due to the lower level of profits of Bial AstraZeneca Plc must concentrate over having

sufficient funds for next two three years for debt payments for these period for both the

companies (Descamps and et.al., 2016). It must inform the investor that for this time dividends

will be little as with acquisition the company can spread its wings to extended market.

3.5 Acquisition risk assesses and challenges

There is an association of the potential risk also of a general downturn in the London

demand of certain drugs and ben on them due to

12

Business, 2019). So this makes it a potential business for the AstraZeneca Plc to acquire.

The company Bial have received this Rand D funds in 2015 which means it is nit under

research so if good prises are offered they are likely to start their business here in short time and

lesser investments. A friendly takeover is much more feasible for Bial rather than a hostile

takeover as it is owned by a single person who is CEO of the company, Antonio Portela.

3.2 Synergistic gains over the acquisition

The synergies are expected to be many with acquisition of Bial by AstraZeneca Plc where

the total values of both the organisation combined will be increased with an extension in there

area of operations and market share beyond national territories and reputation of both the

business. With the exiting funding or the research and development available to Bial it can be

used by AstraZeneca Plc for extended research and offer new services and products around the

globe. Bial have its selling connection in 4 continents and combined with its present operations

can gran a significant area of markets in major nations.

3.3 Valve and financing of the proposed deal of acquisition

With a net income of $23.94 for 2018 it can be seen that with international operation also

the earning of the organisation is not too much and also financial information of Bial is limited.

The turnover of the company in 2018 was $223milion. The company is at a profits earning

position form past 5 years but the profits levels are too low. The liquidity position of company is

not too good as the cash and cash equivalents of the company are not good and current liabilities

are also high and organisation not where near the standard ratio of 2:1. This means AstraZeneca

Plc very well among its competitors.

3.4 Potential impact on performance regarding acquisition

Due to the lower level of profits of Bial AstraZeneca Plc must concentrate over having

sufficient funds for next two three years for debt payments for these period for both the

companies (Descamps and et.al., 2016). It must inform the investor that for this time dividends

will be little as with acquisition the company can spread its wings to extended market.

3.5 Acquisition risk assesses and challenges

There is an association of the potential risk also of a general downturn in the London

demand of certain drugs and ben on them due to

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.