Financial Management & Control PGBM01: Exxon Mobil Company Analysis

VerifiedAdded on 2023/04/22

Paraphrase This Document

Table of Contents

Part A...............................................................................................................................................2

Part B...............................................................................................................................................7

Part C...............................................................................................................................................9

References......................................................................................................................................14

Part A

i) Analysis for the Exxon Mobil Company was done in the year 2017 thereby analysing the

financial performance of the company. Relevant data for the period 2017 was analysed for the

purpose of the analysis of Exon Mobil (ExxonMobil 2017). The financial analysis of the Exxon

Mobil Company was done by using the DuPont Analysis, which was examined with the help of

key financial ratios like Net Profitability Ratio, Total Asset Ratio and Gearing Ratio for the

company (Chang, Chichernea and HassabElnaby 2014).

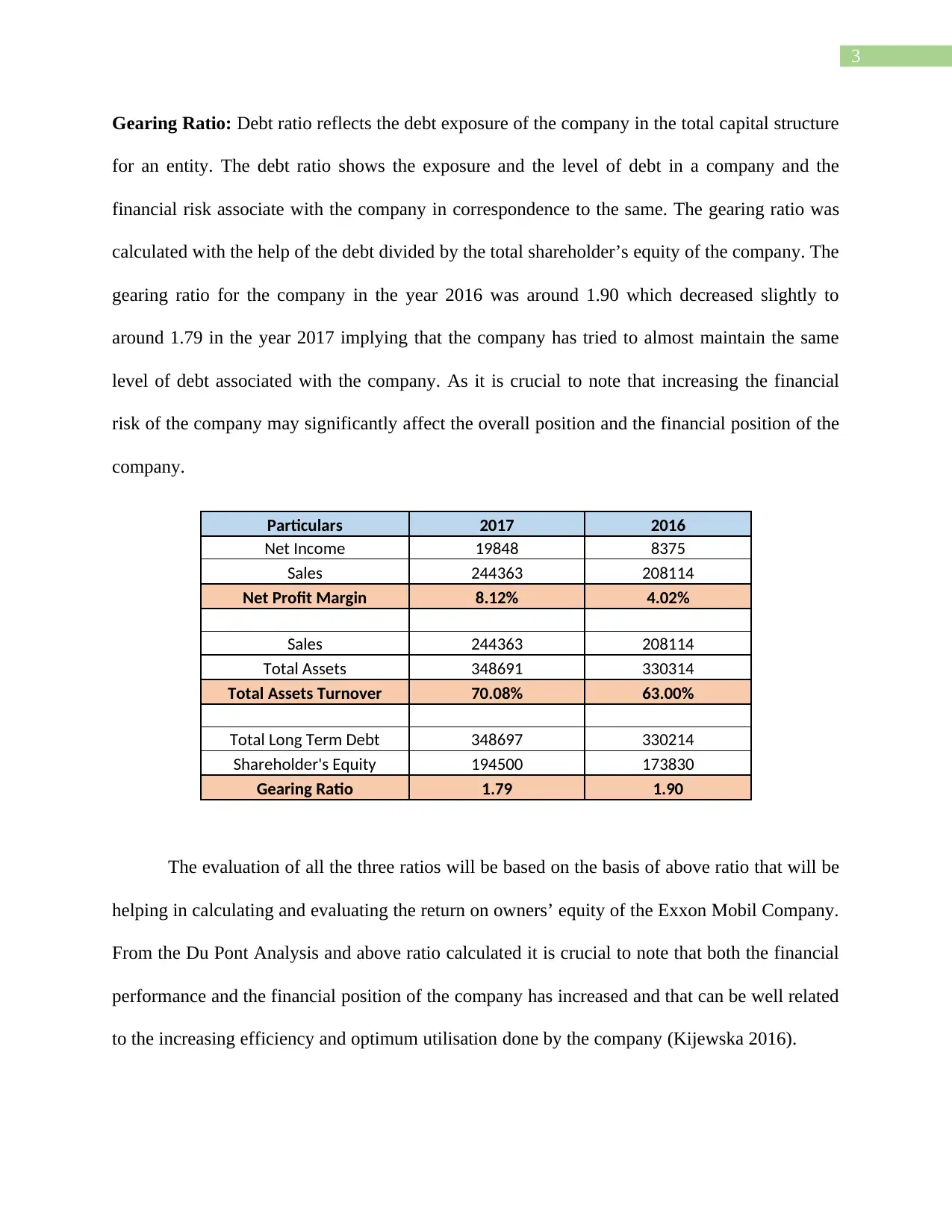

Net Profitability Margin Ratio: Profitability margin of the company shows the profitability

earned by a entity in the form of net income earned from the various operations of the company.

The net profit margin of the company was around 4.02% in the year 2016 and was around 8.12%

in the year 2017. Increase in the net profitability of the company has been seen due to the

efficiency of the company in operating the assets of the company (Curtis, Lewis-Western, and

Toynbee 2015).

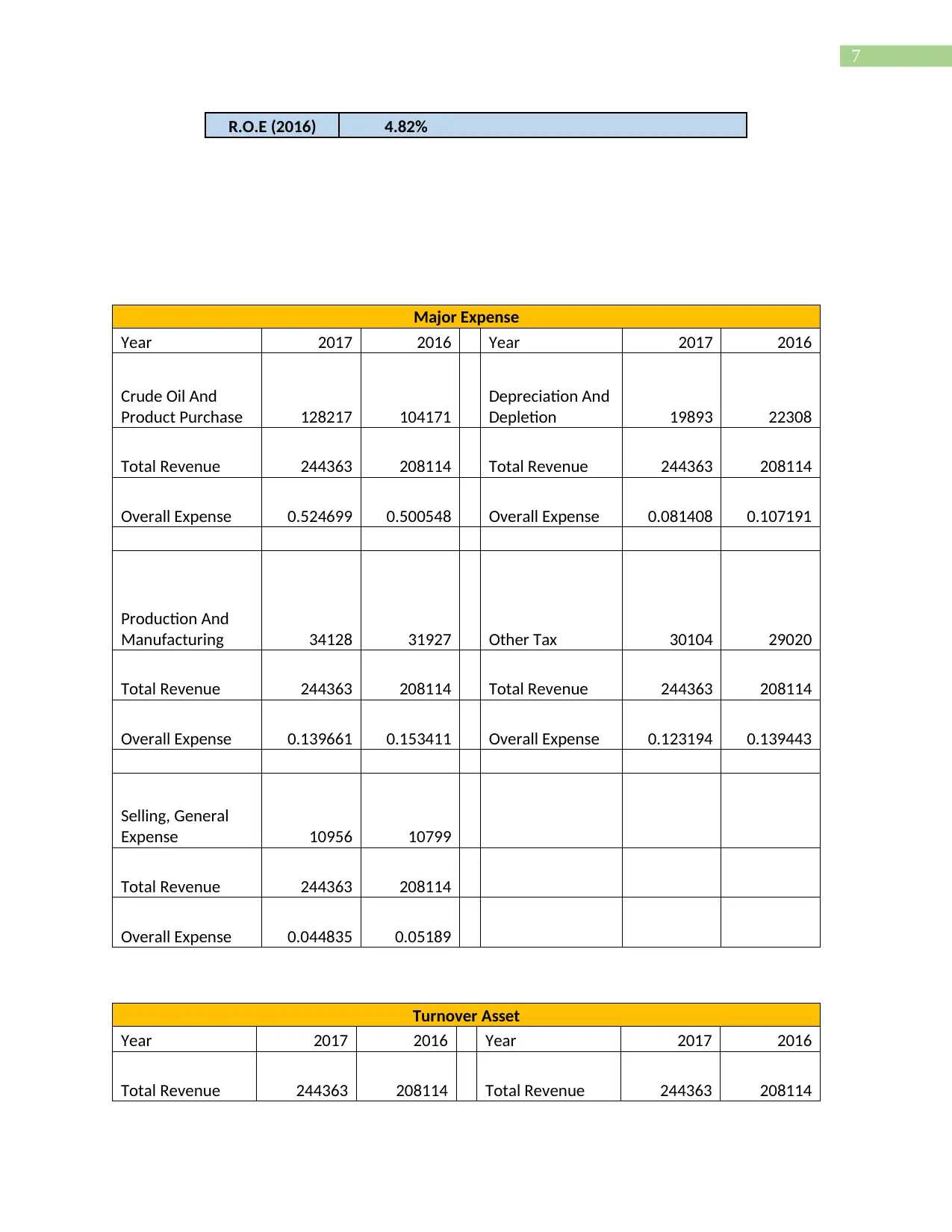

Total Asset Turnover: Total asset turnover ratio for the Exxon Mobil Company was reflected

by showing the efficiency of the company in generating revenue for company thereby utilizing

the total assets of the company. The return on total assets for the company shows the efficiency

for Exxon Mobil and the same could be well reflected with the help of the increasing revenue of

the company. The total asset turnover for Exxon Mobil was around 63% for the year 2016 that

increased consistently for the company to around 70.08% in the year 2017. The increase in the

revenue of the company could be well reflected for the increase in the total asset turnover ratio of

the company (Padake and Soni 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Gearing Ratio: Debt ratio reflects the debt exposure of the company in the total capital structure

for an entity. The debt ratio shows the exposure and the level of debt in a company and the

financial risk associate with the company in correspondence to the same. The gearing ratio was

calculated with the help of the debt divided by the total shareholder’s equity of the company. The

gearing ratio for the company in the year 2016 was around 1.90 which decreased slightly to

around 1.79 in the year 2017 implying that the company has tried to almost maintain the same

level of debt associated with the company. As it is crucial to note that increasing the financial

risk of the company may significantly affect the overall position and the financial position of the

company.

Particulars 2017 2016

Net Income 19848 8375

Sales 244363 208114

Net Profit Margin 8.12% 4.02%

Sales 244363 208114

Total Assets 348691 330314

Total Assets Turnover 70.08% 63.00%

Total Long Term Debt 348697 330214

Shareholder's Equity 194500 173830

Gearing Ratio 1.79 1.90

The evaluation of all the three ratios will be based on the basis of above ratio that will be

helping in calculating and evaluating the return on owners’ equity of the Exxon Mobil Company.

From the Du Pont Analysis and above ratio calculated it is crucial to note that both the financial

performance and the financial position of the company has increased and that can be well related

to the increasing efficiency and optimum utilisation done by the company (Kijewska 2016).

Paraphrase This Document

ii) The DuPont Analysis is an extended analysis and examination of the Return on Equity for the

company that would be leading for the analysis of the N.P Margin, Asset Turnover Ratio and

Leverage of company (Rogova 2014). The DuPont Analysis breaks the ROE into three and five

essential parts showing the various breakdown of the financial position of the company. The

financial breakdown can be done in the form of various financial ratio of the company (Mihola,

Kotesovcova and Wawrosz 2016). The financial analysis of the company was also conducted

with the help of ratio analysis where several ratio like the return on total assets, profitability ratio

and gearing ratio was taken into analysis for the purpose of the analysis. The Du Pont Analysis

was found in the year 1920. Du Pont Analysis is considered as a important framework for

analysing the performance of the company (Bonazzi and Iotti 2014). The Du Pont Analysis is an

important technique that will be used for the purpose of Analysis of the different decomposition

of the Return on Equity allowing the investors for focusing on the key financial metrics of the

company that would show the key strengths and weakness of the company. The three important

metrics of the company were operating assets efficiency, net profit margin and asset turnover

ratio. The leverage of the company was measured with the help of the equity multiplier (Faruk

and Alam 2014). The formula of the Du Pont Analysis was done with the help of three main

ratios:

DuPont Analysis = Net Profit Margin*Asset turnover ratio* Equity Multiplier.

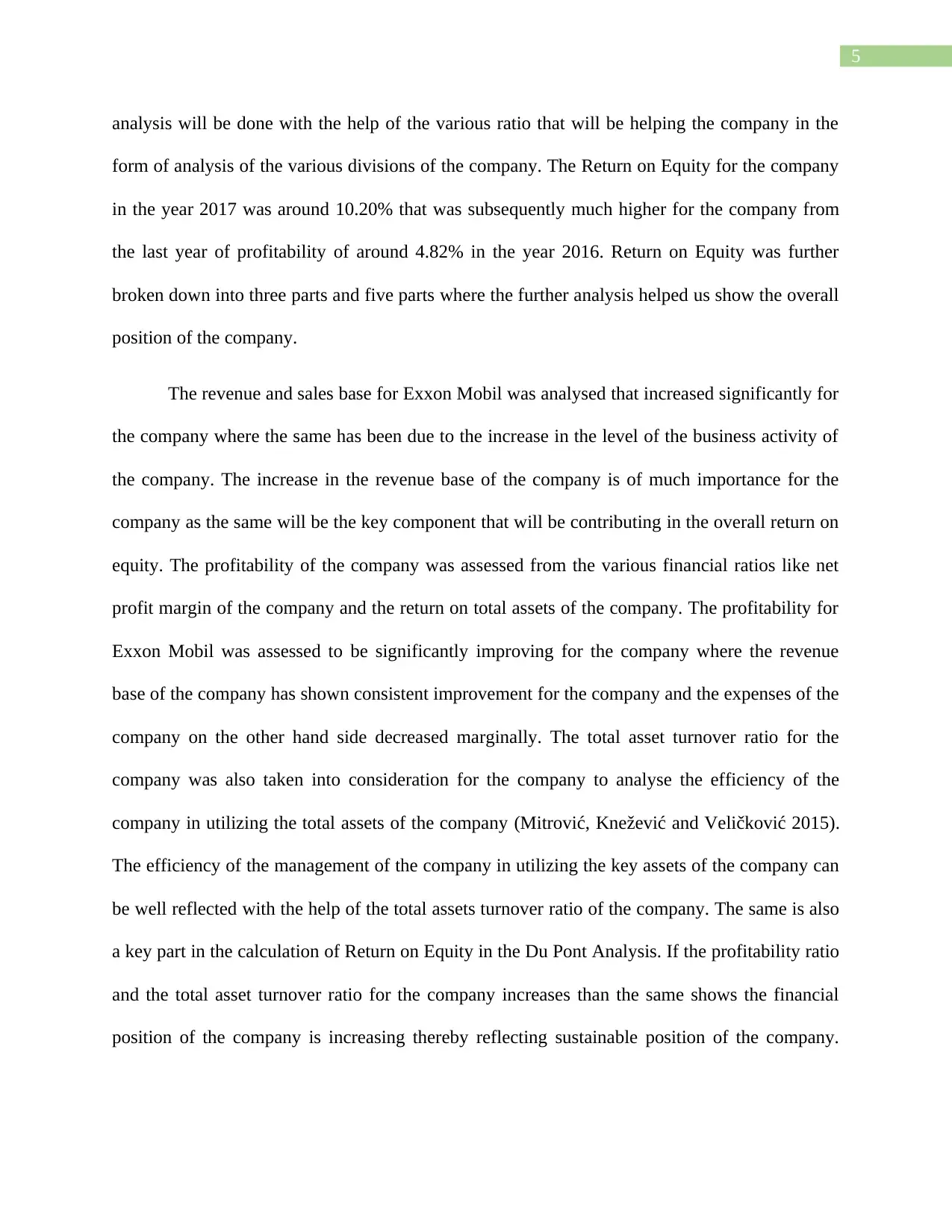

ROE is an important financial ratio that reflects the profitability generated by the

company to the equity shareholders of the company. The ratio is an important measure for

showing the returns created by the company in the form of net profitability of the company. The

return on equity is an important measurement tool that will be assessed for measuring the

financial performance of the company (Burja and Mărginean 2014). The breakdown of the ratio

analysis will be done with the help of the various ratio that will be helping the company in the

form of analysis of the various divisions of the company. The Return on Equity for the company

in the year 2017 was around 10.20% that was subsequently much higher for the company from

the last year of profitability of around 4.82% in the year 2016. Return on Equity was further

broken down into three parts and five parts where the further analysis helped us show the overall

position of the company.

The revenue and sales base for Exxon Mobil was analysed that increased significantly for

the company where the same has been due to the increase in the level of the business activity of

the company. The increase in the revenue base of the company is of much importance for the

company as the same will be the key component that will be contributing in the overall return on

equity. The profitability of the company was assessed from the various financial ratios like net

profit margin of the company and the return on total assets of the company. The profitability for

Exxon Mobil was assessed to be significantly improving for the company where the revenue

base of the company has shown consistent improvement for the company and the expenses of the

company on the other hand side decreased marginally. The total asset turnover ratio for the

company was also taken into consideration for the company to analyse the efficiency of the

company in utilizing the total assets of the company (Mitrović, Knežević and Veličković 2015).

The efficiency of the management of the company in utilizing the key assets of the company can

be well reflected with the help of the total assets turnover ratio of the company. The same is also

a key part in the calculation of Return on Equity in the Du Pont Analysis. If the profitability ratio

and the total asset turnover ratio for the company increases than the same shows the financial

position of the company is increasing thereby reflecting sustainable position of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Increasing of the profitability condition and the overall return of the company help in creation of

wealth for the shareholders of the company (Bansal 2014).

Du Point Analysis

Particulars 2017 2016

Assets 348691 330314

Equity 194500 173830

Sales 244363 208114

EBIT 256394 229618

Pre-tax Profit 255793 229165

Net Income 19848 8375

Return on

Equity Assets/Equity Sales/Assets EBIT/Sales Pre-tax Profit/EBIT

Net Income/Pre-tax

Profit

ROE Leverage Equity Volume Impact Margin Impact

Capital Structure

Impact Tax Impact

Return on

Equity 1.792755784 0.700800996 1.049234131 0.997655951 0.077593992

R.O.E (2017) 10.20%

Return on

Equity 1.90 0.630048984 1.103327984 0.998027158 0.03654572

R.O.E (2016) 4.82%

Return on

Equity Net Profit/ Sales Sales/Assets Assets/Equity

R.O.E

Net Profit

Margin

Return on

Assets

Financial

Leverage

Return on

Equity 0.081223426 0.700800996 1.792755784

R.O.E (2017) 10.20%

Return on

Equity 0.040242367 0.630048984 1.900212852

Paraphrase This Document

R.O.E (2016) 4.82%

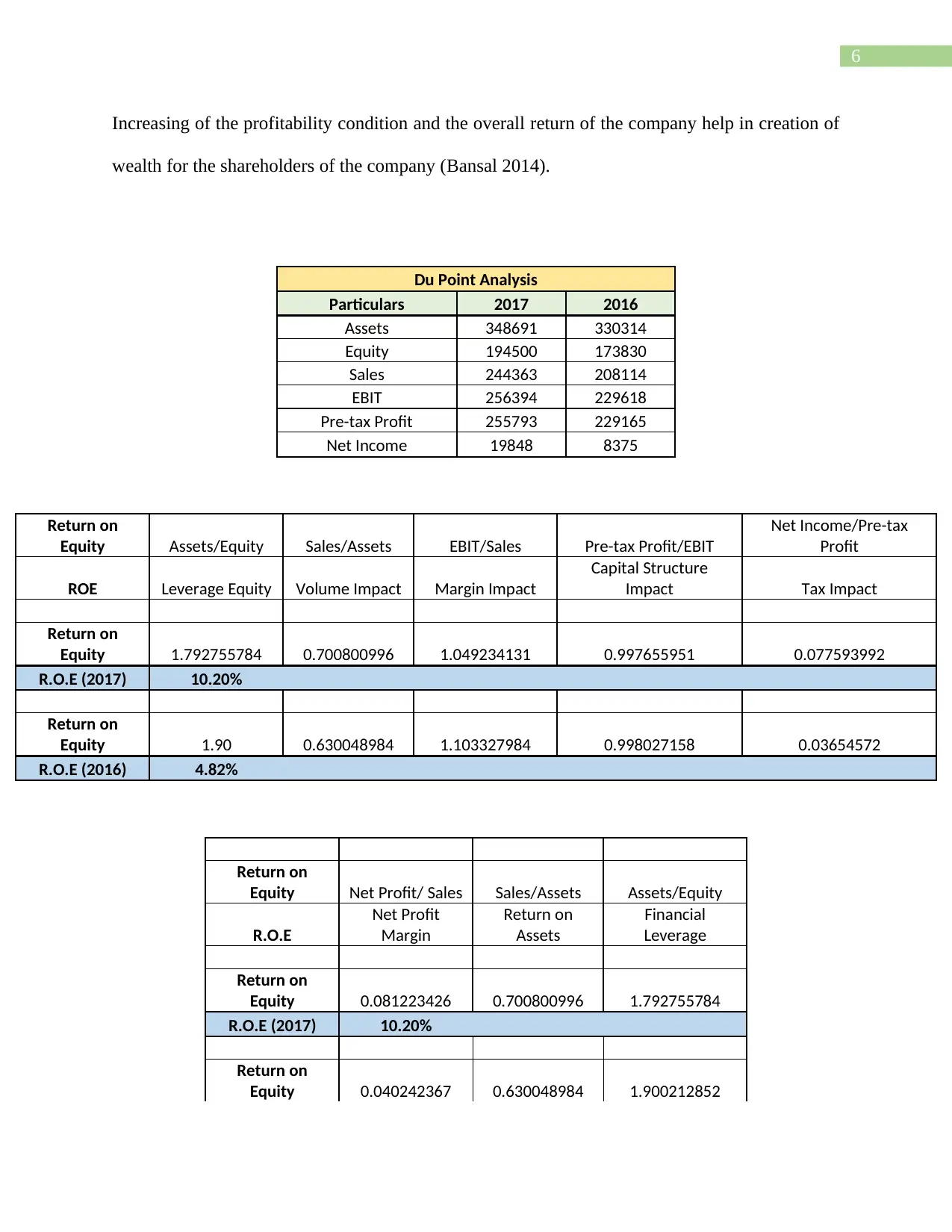

Major Expense

Year 2017 2016 Year 2017 2016

Crude Oil And

Product Purchase 128217 104171

Depreciation And

Depletion 19893 22308

Total Revenue 244363 208114 Total Revenue 244363 208114

Overall Expense 0.524699 0.500548 Overall Expense 0.081408 0.107191

Production And

Manufacturing 34128 31927 Other Tax 30104 29020

Total Revenue 244363 208114 Total Revenue 244363 208114

Overall Expense 0.139661 0.153411 Overall Expense 0.123194 0.139443

Selling, General

Expense 10956 10799

Total Revenue 244363 208114

Overall Expense 0.044835 0.05189

Turnover Asset

Year 2017 2016 Year 2017 2016

Total Revenue 244363 208114 Total Revenue 244363 208114

Non-Current

Asset 301577 288898

Account

Receivable 25597 21394

0.810284 0.720372 9.546527 9.727681

Total Revenue 244363 208114 Total Revenue 244363 208114

Current Asset 47134 41416

Crude Oil And

Other Products 12871 10877

5.184432 5.024966 18.98555 19.1334

Total Revenue 244363 208114 Total Revenue 244363 208114

Cash &

Equivalents 3177 3657

Materials and

Supplies 4121 4203

76.91627 56.90839 59.29702 49.51558

Total Revenue 244363 208114

Other Current

Asset 1368 1285

178.6279 161.9564

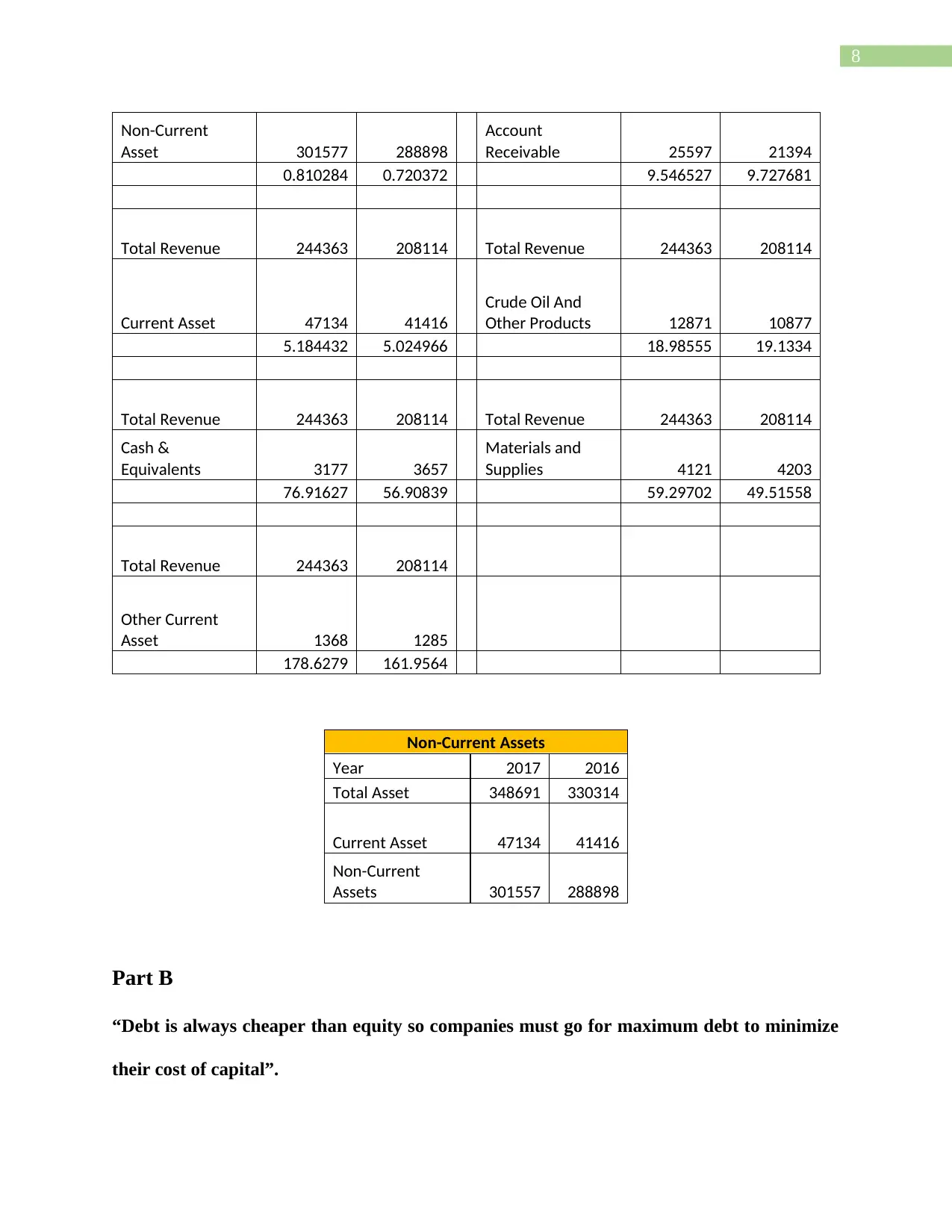

Non-Current Assets

Year 2017 2016

Total Asset 348691 330314

Current Asset 47134 41416

Non-Current

Assets 301557 288898

Part B

“Debt is always cheaper than equity so companies must go for maximum debt to minimize

their cost of capital”.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

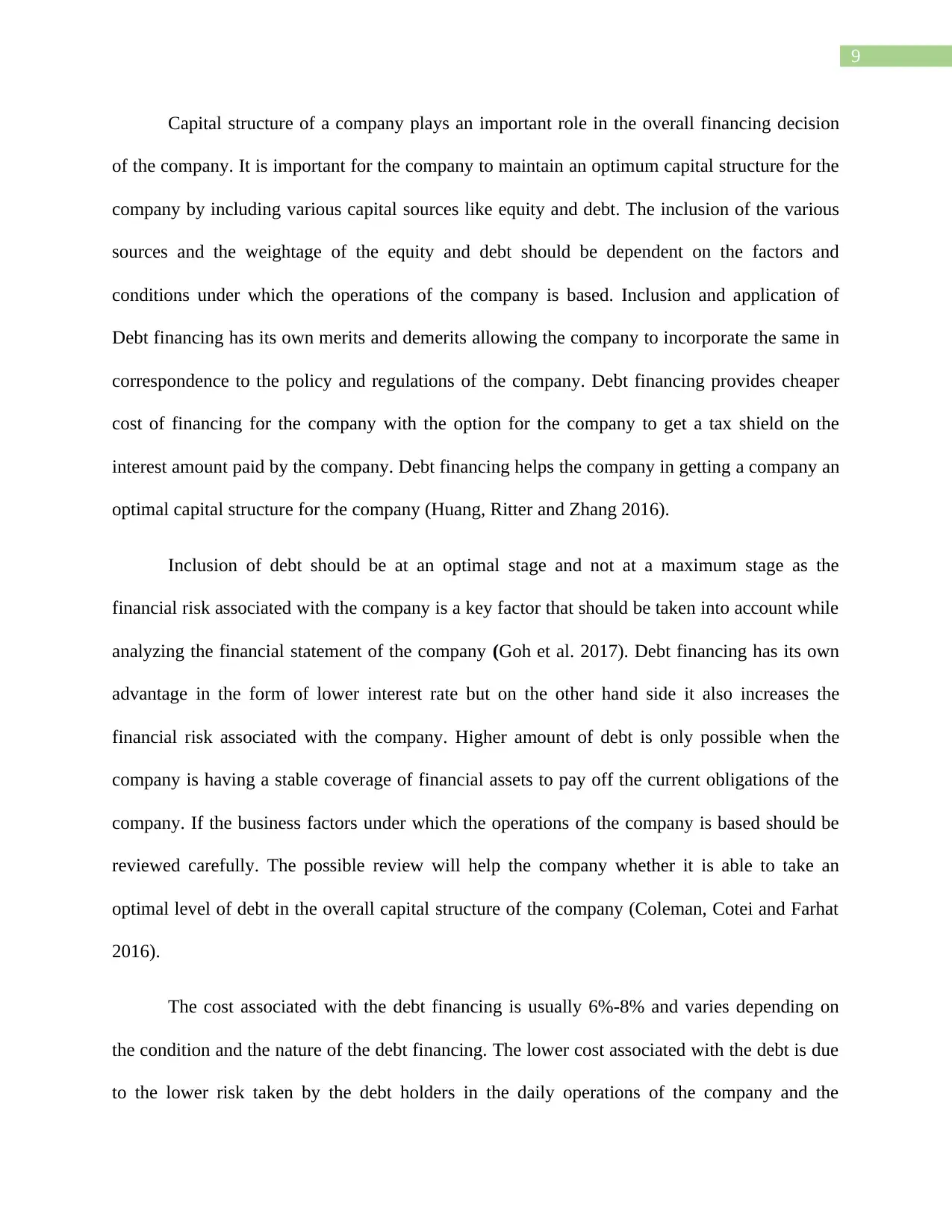

Capital structure of a company plays an important role in the overall financing decision

of the company. It is important for the company to maintain an optimum capital structure for the

company by including various capital sources like equity and debt. The inclusion of the various

sources and the weightage of the equity and debt should be dependent on the factors and

conditions under which the operations of the company is based. Inclusion and application of

Debt financing has its own merits and demerits allowing the company to incorporate the same in

correspondence to the policy and regulations of the company. Debt financing provides cheaper

cost of financing for the company with the option for the company to get a tax shield on the

interest amount paid by the company. Debt financing helps the company in getting a company an

optimal capital structure for the company (Huang, Ritter and Zhang 2016).

Inclusion of debt should be at an optimal stage and not at a maximum stage as the

financial risk associated with the company is a key factor that should be taken into account while

analyzing the financial statement of the company (Goh et al. 2017). Debt financing has its own

advantage in the form of lower interest rate but on the other hand side it also increases the

financial risk associated with the company. Higher amount of debt is only possible when the

company is having a stable coverage of financial assets to pay off the current obligations of the

company. If the business factors under which the operations of the company is based should be

reviewed carefully. The possible review will help the company whether it is able to take an

optimal level of debt in the overall capital structure of the company (Coleman, Cotei and Farhat

2016).

The cost associated with the debt financing is usually 6%-8% and varies depending on

the condition and the nature of the debt financing. The lower cost associated with the debt is due

to the lower risk taken by the debt holders in the daily operations of the company and the

Paraphrase This Document

financial risk of the company (Lewis and Tan 2016). The debt holders of the company finance

the company by creating a overall charge on the assets of an entity allowing them to have a safe

and stable financing. While financing the company “cost” plays an important role allowing the

company to measure the cost of capital under which the capital structure of the company will be

based.

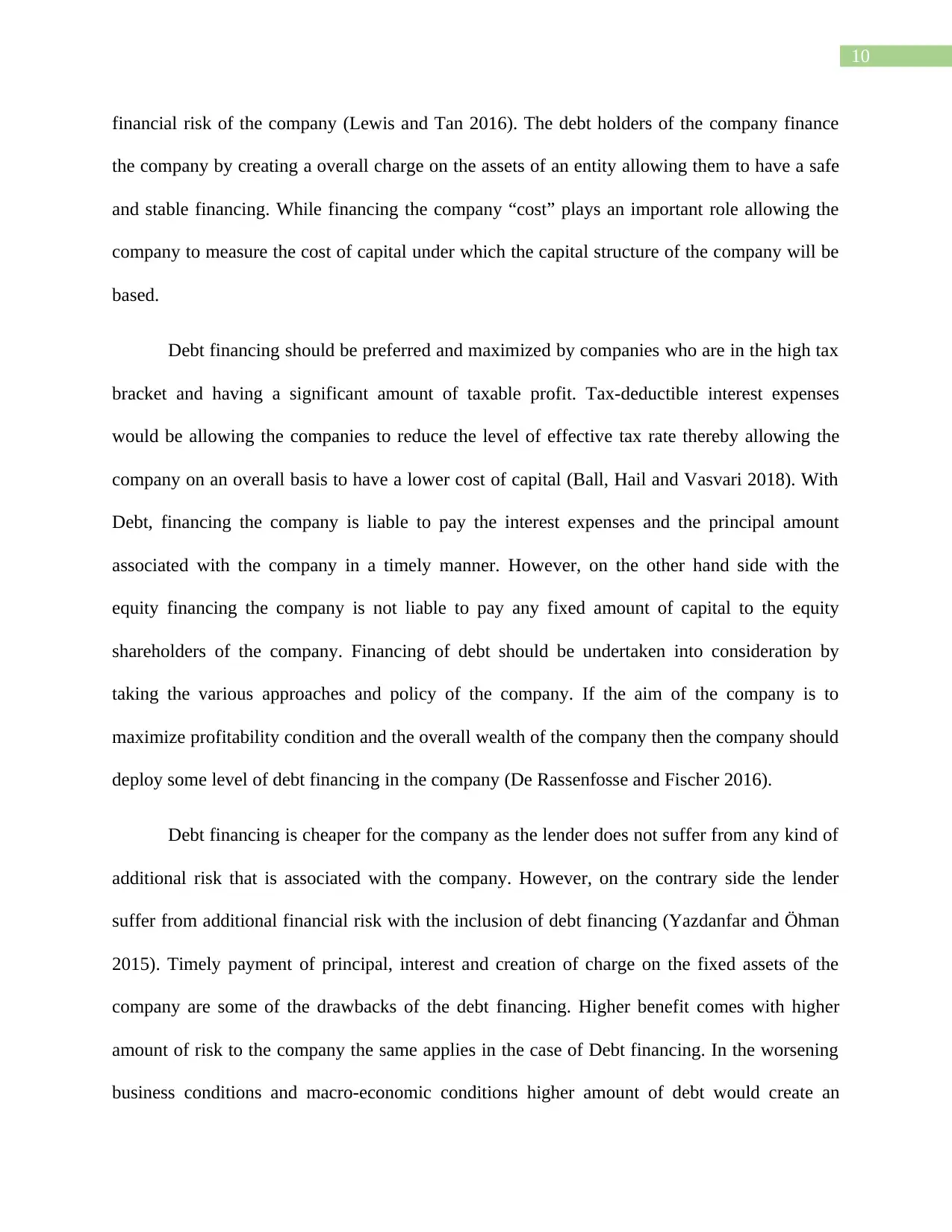

Debt financing should be preferred and maximized by companies who are in the high tax

bracket and having a significant amount of taxable profit. Tax-deductible interest expenses

would be allowing the companies to reduce the level of effective tax rate thereby allowing the

company on an overall basis to have a lower cost of capital (Ball, Hail and Vasvari 2018). With

Debt, financing the company is liable to pay the interest expenses and the principal amount

associated with the company in a timely manner. However, on the other hand side with the

equity financing the company is not liable to pay any fixed amount of capital to the equity

shareholders of the company. Financing of debt should be undertaken into consideration by

taking the various approaches and policy of the company. If the aim of the company is to

maximize profitability condition and the overall wealth of the company then the company should

deploy some level of debt financing in the company (De Rassenfosse and Fischer 2016).

Debt financing is cheaper for the company as the lender does not suffer from any kind of

additional risk that is associated with the company. However, on the contrary side the lender

suffer from additional financial risk with the inclusion of debt financing (Yazdanfar and Öhman

2015). Timely payment of principal, interest and creation of charge on the fixed assets of the

company are some of the drawbacks of the debt financing. Higher benefit comes with higher

amount of risk to the company the same applies in the case of Debt financing. In the worsening

business conditions and macro-economic conditions higher amount of debt would create an

additional pressure in the daily working and operations of the company affecting the total asset

and overall financial stability position of the company (Florou and Kosi 2015). Debt financing is

optimal at a certain beneficial point of time but after that over-leveraging of debt becomes too

expensive for the company in the form of raising additional debt. Taxation Rate also plays an

important role in the inclusion of debt financing in the overall capital structure of the company.

Equity financing is the primary need in the overall net capital structure that is taken in respect to

the nature and characteristics of the financing (Turner 2017).

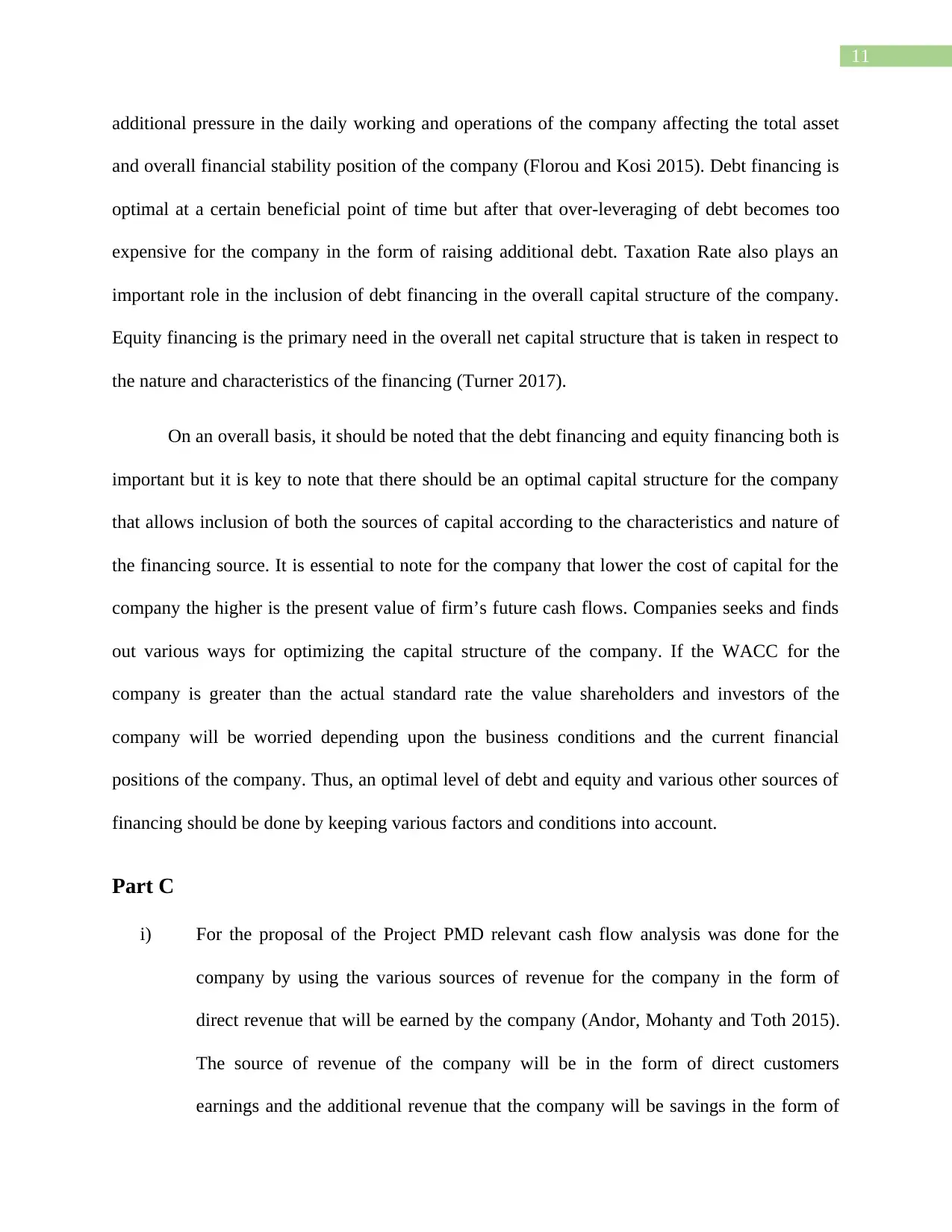

On an overall basis, it should be noted that the debt financing and equity financing both is

important but it is key to note that there should be an optimal capital structure for the company

that allows inclusion of both the sources of capital according to the characteristics and nature of

the financing source. It is essential to note for the company that lower the cost of capital for the

company the higher is the present value of firm’s future cash flows. Companies seeks and finds

out various ways for optimizing the capital structure of the company. If the WACC for the

company is greater than the actual standard rate the value shareholders and investors of the

company will be worried depending upon the business conditions and the current financial

positions of the company. Thus, an optimal level of debt and equity and various other sources of

financing should be done by keeping various factors and conditions into account.

Part C

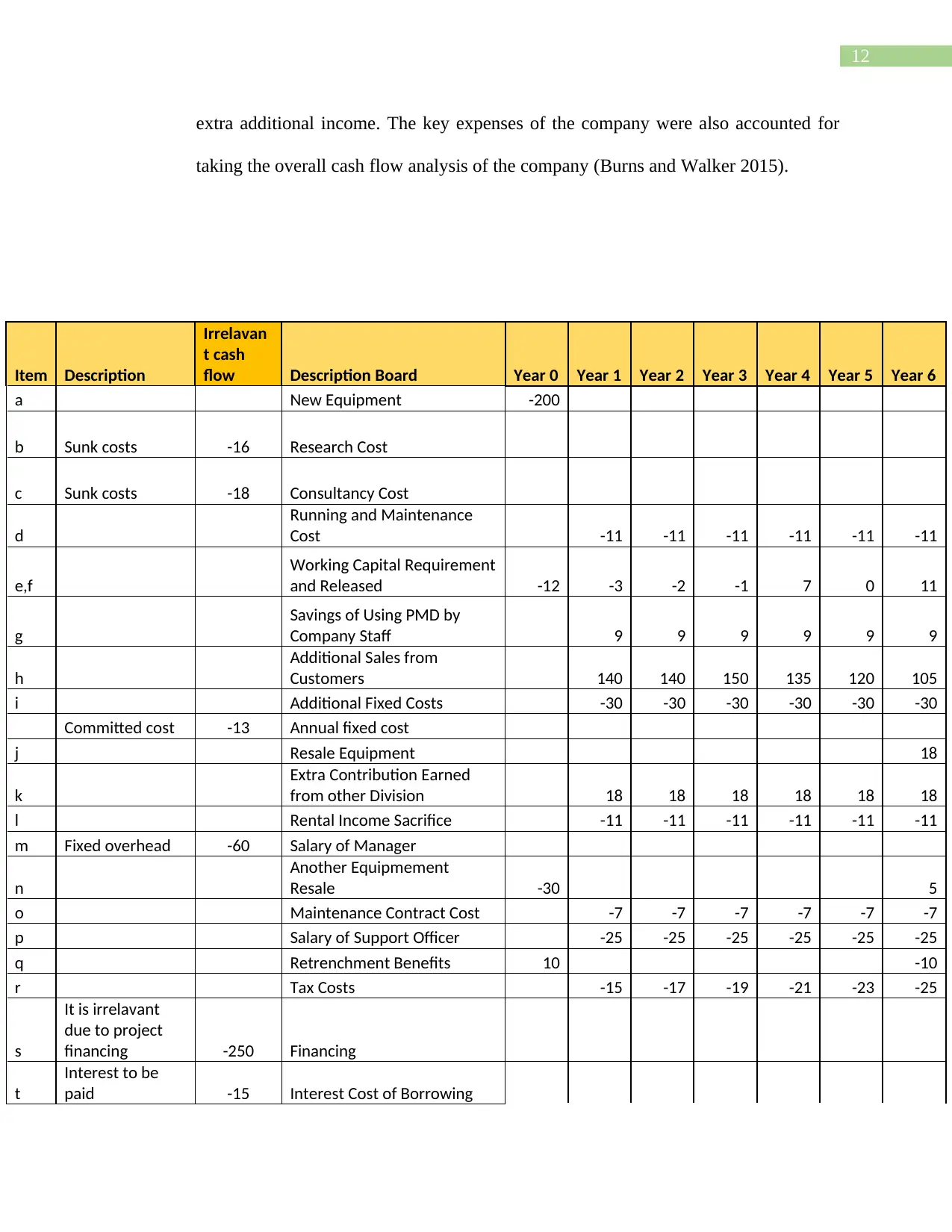

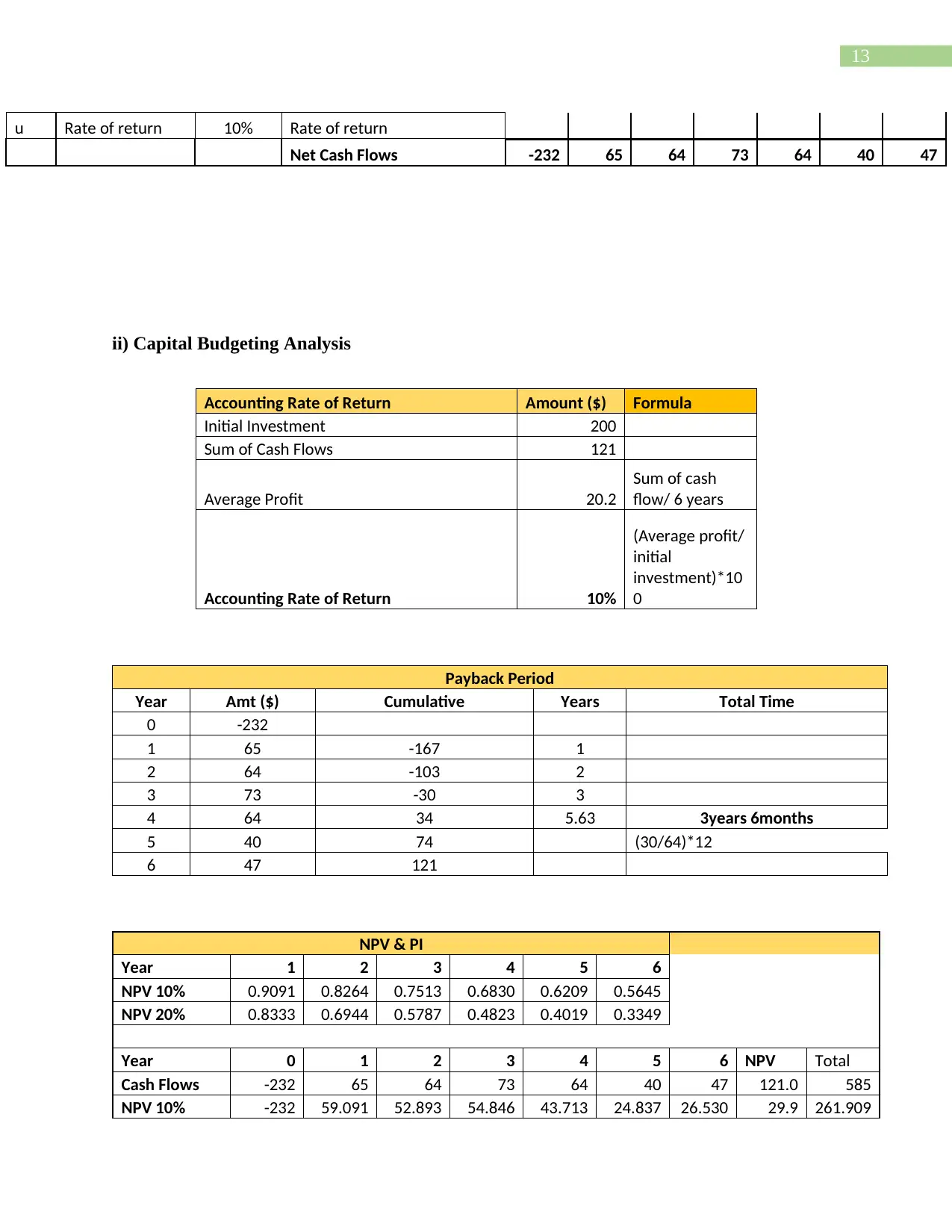

i) For the proposal of the Project PMD relevant cash flow analysis was done for the

company by using the various sources of revenue for the company in the form of

direct revenue that will be earned by the company (Andor, Mohanty and Toth 2015).

The source of revenue of the company will be in the form of direct customers

earnings and the additional revenue that the company will be savings in the form of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

extra additional income. The key expenses of the company were also accounted for

taking the overall cash flow analysis of the company (Burns and Walker 2015).

Item Description

Irrelavan

t cash

flow Description Board Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

a New Equipment -200

b Sunk costs -16 Research Cost

c Sunk costs -18 Consultancy Cost

d

Running and Maintenance

Cost -11 -11 -11 -11 -11 -11

e,f

Working Capital Requirement

and Released -12 -3 -2 -1 7 0 11

g

Savings of Using PMD by

Company Staff 9 9 9 9 9 9

h

Additional Sales from

Customers 140 140 150 135 120 105

i Additional Fixed Costs -30 -30 -30 -30 -30 -30

Committed cost -13 Annual fixed cost

j Resale Equipment 18

k

Extra Contribution Earned

from other Division 18 18 18 18 18 18

l Rental Income Sacrifice -11 -11 -11 -11 -11 -11

m Fixed overhead -60 Salary of Manager

n

Another Equipmement

Resale -30 5

o Maintenance Contract Cost -7 -7 -7 -7 -7 -7

p Salary of Support Officer -25 -25 -25 -25 -25 -25

q Retrenchment Benefits 10 -10

r Tax Costs -15 -17 -19 -21 -23 -25

s

It is irrelavant

due to project

financing -250 Financing

t

Interest to be

paid -15 Interest Cost of Borrowing

Paraphrase This Document

u Rate of return 10% Rate of return

Net Cash Flows -232 65 64 73 64 40 47

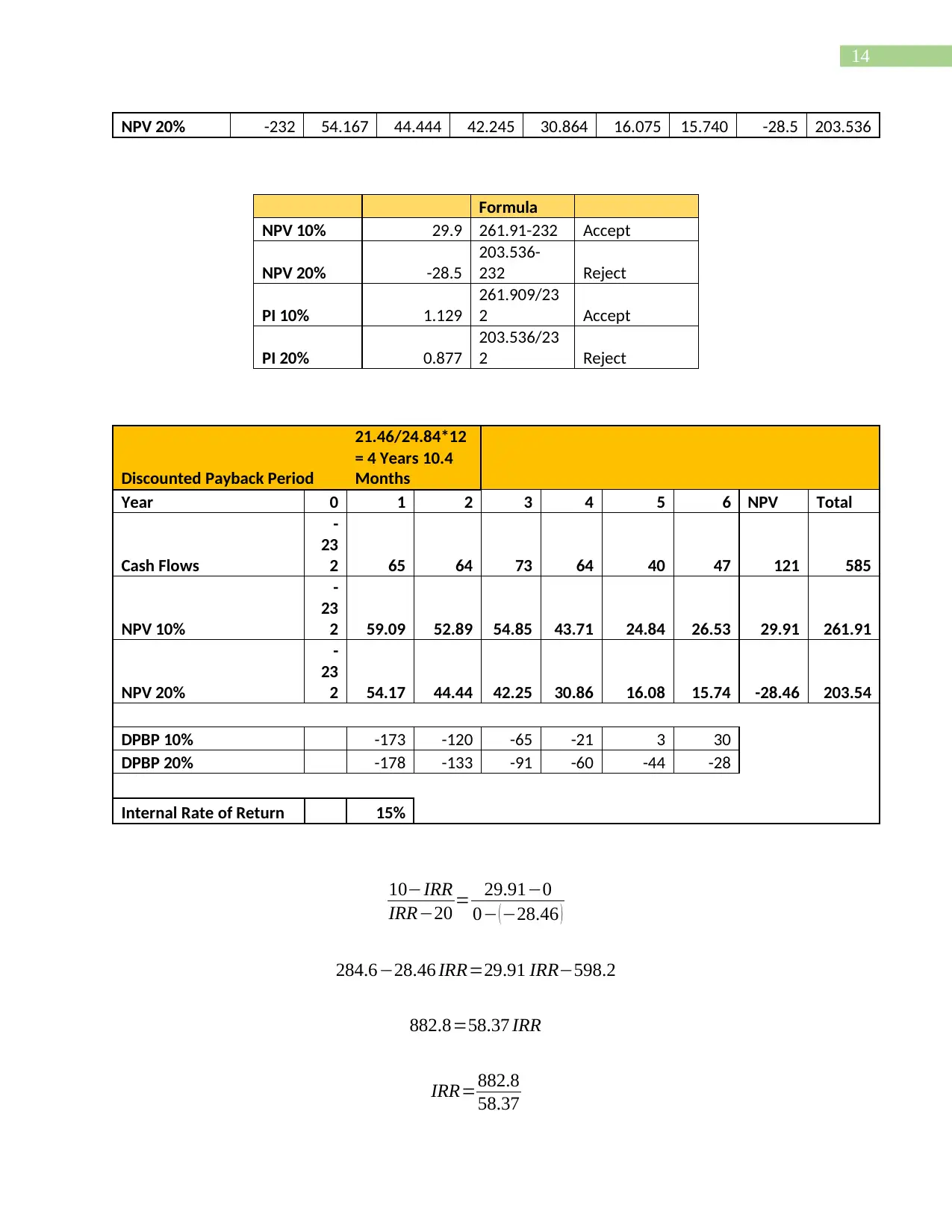

ii) Capital Budgeting Analysis

Accounting Rate of Return Amount ($) Formula

Initial Investment 200

Sum of Cash Flows 121

Average Profit 20.2

Sum of cash

flow/ 6 years

Accounting Rate of Return 10%

(Average profit/

initial

investment)*10

0

Payback Period

Year Amt ($) Cumulative Years Total Time

0 -232

1 65 -167 1

2 64 -103 2

3 73 -30 3

4 64 34 5.63 3years 6months

5 40 74 (30/64)*12

6 47 121

NPV & PI

Year 1 2 3 4 5 6

NPV 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645

NPV 20% 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349

Year 0 1 2 3 4 5 6 NPV Total

Cash Flows -232 65 64 73 64 40 47 121.0 585

NPV 10% -232 59.091 52.893 54.846 43.713 24.837 26.530 29.9 261.909

NPV 20% -232 54.167 44.444 42.245 30.864 16.075 15.740 -28.5 203.536

Formula

NPV 10% 29.9 261.91-232 Accept

NPV 20% -28.5

203.536-

232 Reject

PI 10% 1.129

261.909/23

2 Accept

PI 20% 0.877

203.536/23

2 Reject

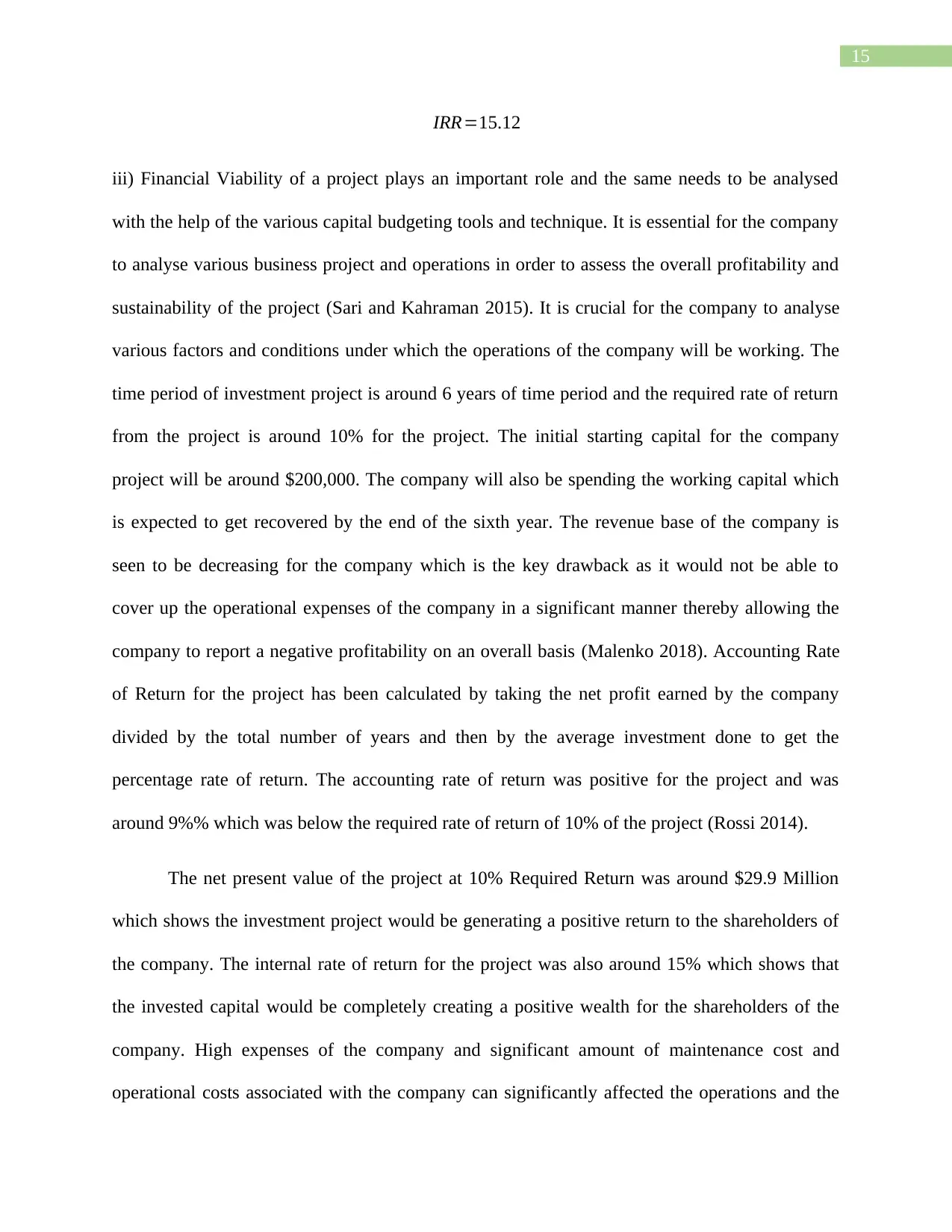

Discounted Payback Period

21.46/24.84*12

= 4 Years 10.4

Months

Year 0 1 2 3 4 5 6 NPV Total

Cash Flows

-

23

2 65 64 73 64 40 47 121 585

NPV 10%

-

23

2 59.09 52.89 54.85 43.71 24.84 26.53 29.91 261.91

NPV 20%

-

23

2 54.17 44.44 42.25 30.86 16.08 15.74 -28.46 203.54

DPBP 10% -173 -120 -65 -21 3 30

DPBP 20% -178 -133 -91 -60 -44 -28

Internal Rate of Return 15%

10−IRR

IRR−20 = 29.91−0

0− ( −28.46 )

284.6−28.46 IRR=29.91 IRR−598.2

882.8=58.37 IRR

IRR=882.8

58.37

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

IRR=15.12

iii) Financial Viability of a project plays an important role and the same needs to be analysed

with the help of the various capital budgeting tools and technique. It is essential for the company

to analyse various business project and operations in order to assess the overall profitability and

sustainability of the project (Sari and Kahraman 2015). It is crucial for the company to analyse

various factors and conditions under which the operations of the company will be working. The

time period of investment project is around 6 years of time period and the required rate of return

from the project is around 10% for the project. The initial starting capital for the company

project will be around $200,000. The company will also be spending the working capital which

is expected to get recovered by the end of the sixth year. The revenue base of the company is

seen to be decreasing for the company which is the key drawback as it would not be able to

cover up the operational expenses of the company in a significant manner thereby allowing the

company to report a negative profitability on an overall basis (Malenko 2018). Accounting Rate

of Return for the project has been calculated by taking the net profit earned by the company

divided by the total number of years and then by the average investment done to get the

percentage rate of return. The accounting rate of return was positive for the project and was

around 9%% which was below the required rate of return of 10% of the project (Rossi 2014).

The net present value of the project at 10% Required Return was around $29.9 Million

which shows the investment project would be generating a positive return to the shareholders of

the company. The internal rate of return for the project was also around 15% which shows that

the invested capital would be completely creating a positive wealth for the shareholders of the

company. High expenses of the company and significant amount of maintenance cost and

operational costs associated with the company can significantly affected the operations and the

Paraphrase This Document

profitability of the investment project (Chittenden and Derregia 2015). The payback period and

the discounted payback period for the project was determined at various required return and

highlighted in the table given above. In both the case, which shows that the investment capital of

the company will be recovered in the six year of time frame according to payback period of

investment (Daunfeldt and Hartwig 2014). The financial viability of the project is considered

viable as the profitability and the time taken by the investment project for returning back the

initial capital invested is certain when assessed from the required rate of return of around 10%

scenario for the project. It is advisable that the company should go ahead with the investment

project thereby creating the wealth of the shareholders of the company. Thus it should also be

noted that there are various factors and conditions that should be analysed and introspected while

analysing the financial viability and sustainability of the project.

References

Andor, G., Mohanty, S.K. and Toth, T., 2015. Capital budgeting practices: A survey of Central

and Eastern European firms. Emerging Markets Review, 23, pp.148-172.

Ball, R.T., Hail, L. and Vasvari, F.P., 2018. Equity cross-listings in the US and the price of debt.

Review of Accounting Studies, 23(2), pp.385-421.

Bansal, R., 2014. A Comparative Analysis of the Financial Ratios of Selected Banks in the India

for the period of 2011-2014. Research Journal of Finance and Accounting, 5, pp.153-167.

Bonazzi, G. and Iotti, M., 2014. Agricultural cooperative firms: Budgetary adjustments and

analysis of credit access applying scoring systems. Am. J. Appl. Sci, 11(7), pp.1181-1192.

Burja, V. and Mărginean, R., 2014. The study of factors that may influence the performance by

the Dupont analysis in the furniture industry. Procedia Economics and Finance, 16, pp.213-223.

Burns, R. and Walker, J., 2015. Capital budgeting surveys: the future is now.

Chang, K.J., Chichernea, D.C. and HassabElnaby, H.R., 2014. On the DuPont analysis in the

health care industry. Journal of Accounting and Public Policy, 33(1), pp.83-103.

Chittenden, F. and Derregia, M., 2015. Uncertainty, irreversibility and the use of ‘rules of

thumb’in capital budgeting. The British Accounting Review, 47(3), pp.225-236.

Coleman, S., Cotei, C. and Farhat, J., 2016. The debt-equity financing decisions of US startup

firms. Journal of Economics and Finance, 40(1), pp.105-126.

Curtis, A., Lewis-Western, M.F. and Toynbee, S., 2015. Historical cost measurement and the use

of DuPont analysis by market participants. Review of Accounting Studies, 20(3), pp.1210-1245.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Daunfeldt, S.O. and Hartwig, F., 2014. What determines the use of capital budgeting methods?:

Evidence from Swedish listed companies. Journal of Finance and Economics, 2(4), pp.101-112.

de Andrés, P., de Fuente, G. and San Martín, P., 2015. Capital budgeting practices in

Spain. BRQ Business Research Quarterly, 18(1), pp.37-56.

De Rassenfosse, G. and Fischer, T., 2016. Venture debt financing: Determinants of the lending

decision. Strategic Entrepreneurship Journal, 10(3), pp.235-256.

ExxonMobil. (2017). Digital Annual Report | ExxonMobil. [online] Available at:

https://corporate.exxonmobil.com/en/Investors/Annual-Report [Accessed 28 Feb. 2019].

Faruk, M.O. and Alam, R., 2014. A Comparative financial performance analysis of Bangladeshi

private commercial banks. International Journal of Information, Business and

Management, 6(1), p.129.

Florou, A. and Kosi, U., 2015. Does mandatory IFRS adoption facilitate debt financing?. Review

of Accounting Studies, 20(4), pp.1407-1456.

Goh, B.W., Lim, C.Y., Lobo, G.J. and Tong, Y.H., 2017. Conditional conservatism and debt

versus equity financing. Contemporary Accounting Research, 34(1), pp.216-251.

Huang, R., Ritter, J.R. and Zhang, D., 2016. Private equity firms’ reputational concerns and the

costs of debt financing. Journal of Financial and Quantitative Analysis, 51(1), pp.29-54

Kijewska, A., 2016. Determinants of the return on equity ratio (ROE) on the example of

companies from metallurgy and mining sector in Poland. Metalurgija, 55(2), pp.285-288.

Lewis, C.M. and Tan, Y., 2016. Debt-equity choices, R&D investment and market timing.

Journal of Financial Economics, 119(3), pp.599-610.

Paraphrase This Document

Malenko, A., 2018. Optimal dynamic capital budgeting. Available at SSRN 1710884.

Mihola, J., Kotesovcova, J. and Wawrosz, P., 2016. Intensity and Extensity of Firm

Development and Dynamic Dupont Analysis. European Research Studies, 19(4), p.53.

Mitrović, A., Knežević, S. and Veličković, M., 2015. RATIO ANALYSIS SPECIFICS OF THE

FAMILY DAIRIES’FINANCIAL STATEMENTS. Economics of Agriculture, 62(4), pp.1061-

1078.

Padake, V. and Soni, R., 2015. Measurement of efficiency of top 12 banks in India using DuPont

analysis. IUP Journal of Bank Management, 14(4), p.59.

Rogova, E., 2014. Dupont analysis of the efficiency and investment appeal of russian oil-

extracting companies.

Rossi, M., 2014. Capital budgeting in Europe: confronting theory with practice. International

Journal of Managerial and Financial Accounting, 6(4), pp.341-356.

Sari, I.U. and Kahraman, C., 2015. Interval type-2 fuzzy capital budgeting. International Journal

of Fuzzy Systems, 17(4), pp.635-646.

Turner, A., 2017. Between debt and the devil: Money, credit, and fixing global finance. Princeton

University Press.

Yazdanfar, D. and Öhman, P., 2015. Debt financing and firm performance: an empirical study

based on Swedish data. The Journal of Risk Finance, 16(1), pp.102-118.

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.