International Finance Literature Review

VerifiedAdded on 2020/02/03

|13

|3936

|757

Report

AI Summary

This assignment requires a literature review on the topic of international finance. Students need to analyze and synthesize scholarly works from various sources provided in the bibliography. The selected readings cover a range of subtopics within international finance, including exchange rate fluctuations, sovereign debt management, the role of rating agencies, and the evolution of the global financial system.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

INTERNATIONAL FINANCE

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION ...............................................................................................................................3

TASK 1.................................................................................................................................................3

Financial Ratio Analysis of EasyJet Plc:.........................................................................................3

Explanation of ratios calculated and analysis of the results:...........................................................4

TASK 2.................................................................................................................................................5

A) Advantages and disadvantages of the three valuation methods..................................................5

B) Calculations using the 3 methods to determine valuations.........................................................6

C).....................................................................................................................................................8

D) Identifying the various risk exposures to FTSE 100 company indexes.....................................9

E)......................................................................................................................................................9

TASK 3.................................................................................................................................................9

CONCLUSION..................................................................................................................................10

REFERENCES...................................................................................................................................11

2

INTRODUCTION ...............................................................................................................................3

TASK 1.................................................................................................................................................3

Financial Ratio Analysis of EasyJet Plc:.........................................................................................3

Explanation of ratios calculated and analysis of the results:...........................................................4

TASK 2.................................................................................................................................................5

A) Advantages and disadvantages of the three valuation methods..................................................5

B) Calculations using the 3 methods to determine valuations.........................................................6

C).....................................................................................................................................................8

D) Identifying the various risk exposures to FTSE 100 company indexes.....................................9

E)......................................................................................................................................................9

TASK 3.................................................................................................................................................9

CONCLUSION..................................................................................................................................10

REFERENCES...................................................................................................................................11

2

INTRODUCTION

International or global finance regards to the process of monetary or financial transaction

that took place between two or more countries of the world. Looking at the present times, numbers

of companies are engaged in cross-border transactions, henceforth, need to examine and analyse the

performance of companies to make solid decisions. EasyJet is a UK-based low-cost airline situated

at London Luton Airport and run scheduled airlines at both the domestic and international level.

Present project report lay emphasizes on analysis of financial performance of EasyJet via ratio

analysis model. Moreover, its stock price will be valued using different methods comprising net

assets, price to earning multiplier and dividend valuation method. On the basis of this, Barclays

bank’s board of directors will be suggested that whether they should acquire EasyJet or not to meet

their targets.

TASK 1

EasyJet is the airline company and it is a British low-cost airline carries based at London

Luton Airport. The airline company operates domestic and international scheduled services on over

820 routes in more than 30 countries (Okawa and Van Wincoop, 2012). EasyJet plc is listed on the

London Stock Exchange and is a constituent of the FTSE 100 Indices.

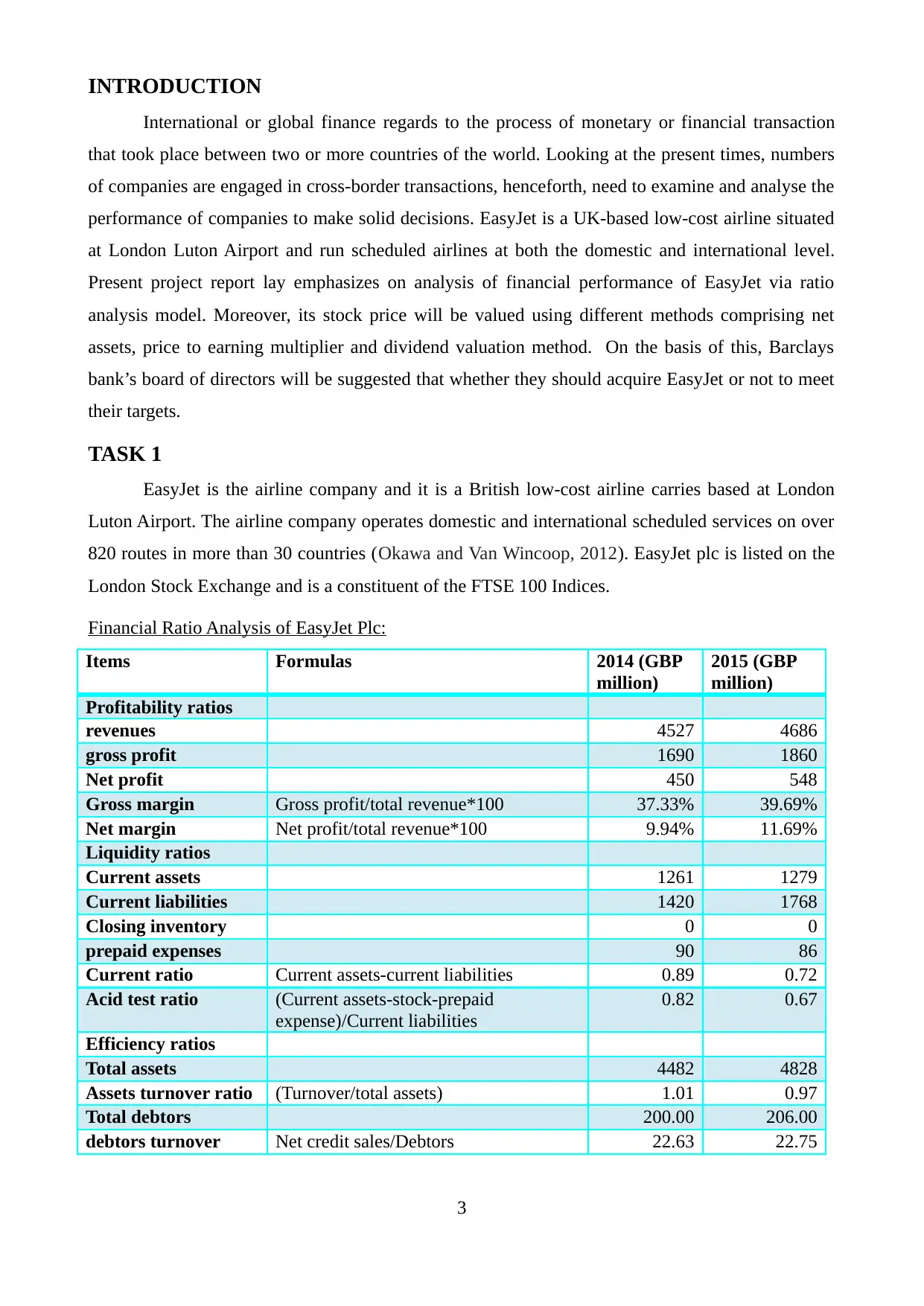

Financial Ratio Analysis of EasyJet Plc:

Items Formulas 2014 (GBP

million)

2015 (GBP

million)

Profitability ratios

revenues 4527 4686

gross profit 1690 1860

Net profit 450 548

Gross margin Gross profit/total revenue*100 37.33% 39.69%

Net margin Net profit/total revenue*100 9.94% 11.69%

Liquidity ratios

Current assets 1261 1279

Current liabilities 1420 1768

Closing inventory 0 0

prepaid expenses 90 86

Current ratio Current assets-current liabilities 0.89 0.72

Acid test ratio (Current assets-stock-prepaid

expense)/Current liabilities

0.82 0.67

Efficiency ratios

Total assets 4482 4828

Assets turnover ratio (Turnover/total assets) 1.01 0.97

Total debtors 200.00 206.00

debtors turnover Net credit sales/Debtors 22.63 22.75

3

International or global finance regards to the process of monetary or financial transaction

that took place between two or more countries of the world. Looking at the present times, numbers

of companies are engaged in cross-border transactions, henceforth, need to examine and analyse the

performance of companies to make solid decisions. EasyJet is a UK-based low-cost airline situated

at London Luton Airport and run scheduled airlines at both the domestic and international level.

Present project report lay emphasizes on analysis of financial performance of EasyJet via ratio

analysis model. Moreover, its stock price will be valued using different methods comprising net

assets, price to earning multiplier and dividend valuation method. On the basis of this, Barclays

bank’s board of directors will be suggested that whether they should acquire EasyJet or not to meet

their targets.

TASK 1

EasyJet is the airline company and it is a British low-cost airline carries based at London

Luton Airport. The airline company operates domestic and international scheduled services on over

820 routes in more than 30 countries (Okawa and Van Wincoop, 2012). EasyJet plc is listed on the

London Stock Exchange and is a constituent of the FTSE 100 Indices.

Financial Ratio Analysis of EasyJet Plc:

Items Formulas 2014 (GBP

million)

2015 (GBP

million)

Profitability ratios

revenues 4527 4686

gross profit 1690 1860

Net profit 450 548

Gross margin Gross profit/total revenue*100 37.33% 39.69%

Net margin Net profit/total revenue*100 9.94% 11.69%

Liquidity ratios

Current assets 1261 1279

Current liabilities 1420 1768

Closing inventory 0 0

prepaid expenses 90 86

Current ratio Current assets-current liabilities 0.89 0.72

Acid test ratio (Current assets-stock-prepaid

expense)/Current liabilities

0.82 0.67

Efficiency ratios

Total assets 4482 4828

Assets turnover ratio (Turnover/total assets) 1.01 0.97

Total debtors 200.00 206.00

debtors turnover Net credit sales/Debtors 22.63 22.75

3

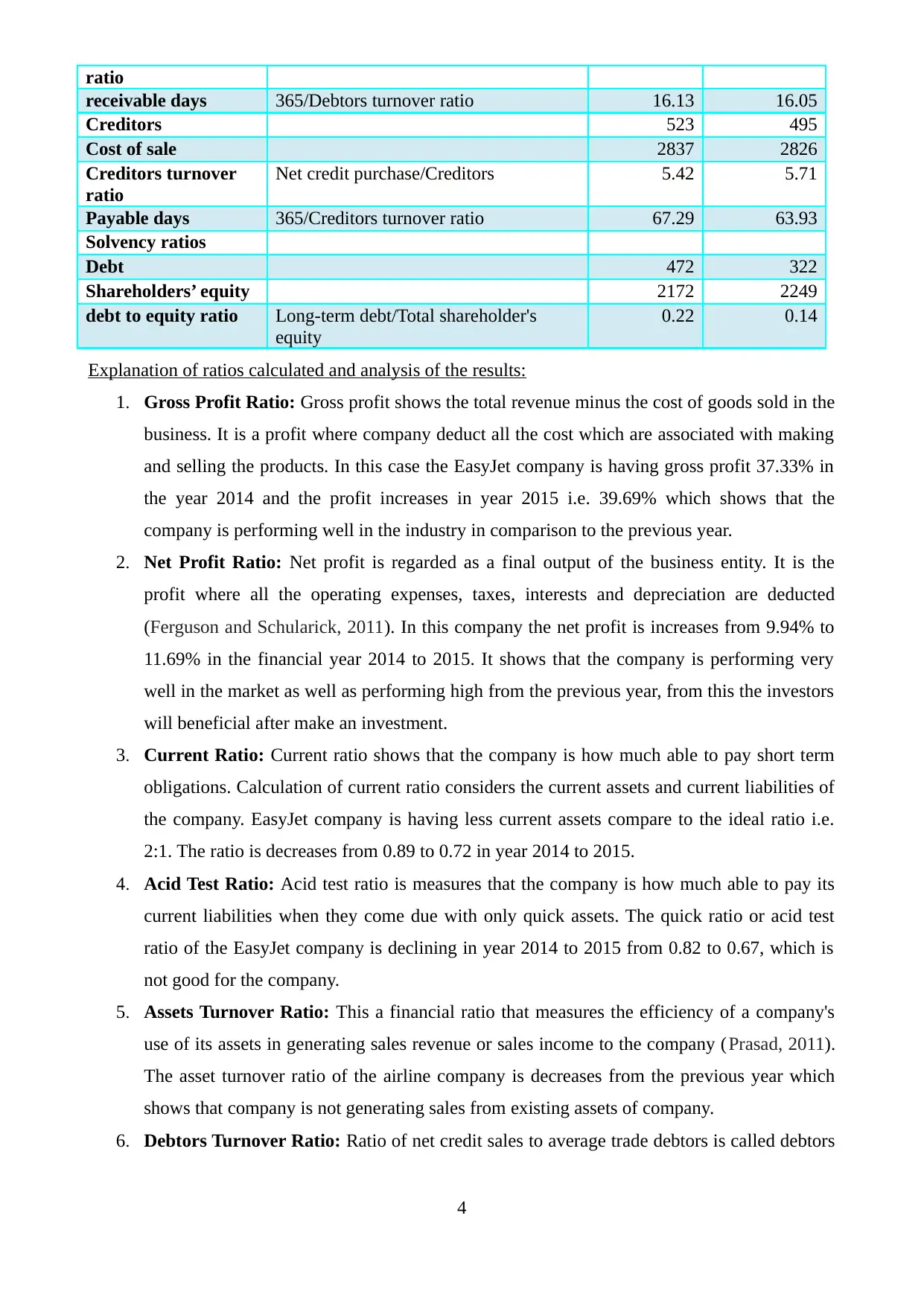

ratio

receivable days 365/Debtors turnover ratio 16.13 16.05

Creditors 523 495

Cost of sale 2837 2826

Creditors turnover

ratio

Net credit purchase/Creditors 5.42 5.71

Payable days 365/Creditors turnover ratio 67.29 63.93

Solvency ratios

Debt 472 322

Shareholders’ equity 2172 2249

debt to equity ratio Long-term debt/Total shareholder's

equity

0.22 0.14

Explanation of ratios calculated and analysis of the results:

1. Gross Profit Ratio: Gross profit shows the total revenue minus the cost of goods sold in the

business. It is a profit where company deduct all the cost which are associated with making

and selling the products. In this case the EasyJet company is having gross profit 37.33% in

the year 2014 and the profit increases in year 2015 i.e. 39.69% which shows that the

company is performing well in the industry in comparison to the previous year.

2. Net Profit Ratio: Net profit is regarded as a final output of the business entity. It is the

profit where all the operating expenses, taxes, interests and depreciation are deducted

(Ferguson and Schularick, 2011). In this company the net profit is increases from 9.94% to

11.69% in the financial year 2014 to 2015. It shows that the company is performing very

well in the market as well as performing high from the previous year, from this the investors

will beneficial after make an investment.

3. Current Ratio: Current ratio shows that the company is how much able to pay short term

obligations. Calculation of current ratio considers the current assets and current liabilities of

the company. EasyJet company is having less current assets compare to the ideal ratio i.e.

2:1. The ratio is decreases from 0.89 to 0.72 in year 2014 to 2015.

4. Acid Test Ratio: Acid test ratio is measures that the company is how much able to pay its

current liabilities when they come due with only quick assets. The quick ratio or acid test

ratio of the EasyJet company is declining in year 2014 to 2015 from 0.82 to 0.67, which is

not good for the company.

5. Assets Turnover Ratio: This a financial ratio that measures the efficiency of a company's

use of its assets in generating sales revenue or sales income to the company (Prasad, 2011).

The asset turnover ratio of the airline company is decreases from the previous year which

shows that company is not generating sales from existing assets of company.

6. Debtors Turnover Ratio: Ratio of net credit sales to average trade debtors is called debtors

4

receivable days 365/Debtors turnover ratio 16.13 16.05

Creditors 523 495

Cost of sale 2837 2826

Creditors turnover

ratio

Net credit purchase/Creditors 5.42 5.71

Payable days 365/Creditors turnover ratio 67.29 63.93

Solvency ratios

Debt 472 322

Shareholders’ equity 2172 2249

debt to equity ratio Long-term debt/Total shareholder's

equity

0.22 0.14

Explanation of ratios calculated and analysis of the results:

1. Gross Profit Ratio: Gross profit shows the total revenue minus the cost of goods sold in the

business. It is a profit where company deduct all the cost which are associated with making

and selling the products. In this case the EasyJet company is having gross profit 37.33% in

the year 2014 and the profit increases in year 2015 i.e. 39.69% which shows that the

company is performing well in the industry in comparison to the previous year.

2. Net Profit Ratio: Net profit is regarded as a final output of the business entity. It is the

profit where all the operating expenses, taxes, interests and depreciation are deducted

(Ferguson and Schularick, 2011). In this company the net profit is increases from 9.94% to

11.69% in the financial year 2014 to 2015. It shows that the company is performing very

well in the market as well as performing high from the previous year, from this the investors

will beneficial after make an investment.

3. Current Ratio: Current ratio shows that the company is how much able to pay short term

obligations. Calculation of current ratio considers the current assets and current liabilities of

the company. EasyJet company is having less current assets compare to the ideal ratio i.e.

2:1. The ratio is decreases from 0.89 to 0.72 in year 2014 to 2015.

4. Acid Test Ratio: Acid test ratio is measures that the company is how much able to pay its

current liabilities when they come due with only quick assets. The quick ratio or acid test

ratio of the EasyJet company is declining in year 2014 to 2015 from 0.82 to 0.67, which is

not good for the company.

5. Assets Turnover Ratio: This a financial ratio that measures the efficiency of a company's

use of its assets in generating sales revenue or sales income to the company (Prasad, 2011).

The asset turnover ratio of the airline company is decreases from the previous year which

shows that company is not generating sales from existing assets of company.

6. Debtors Turnover Ratio: Ratio of net credit sales to average trade debtors is called debtors

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

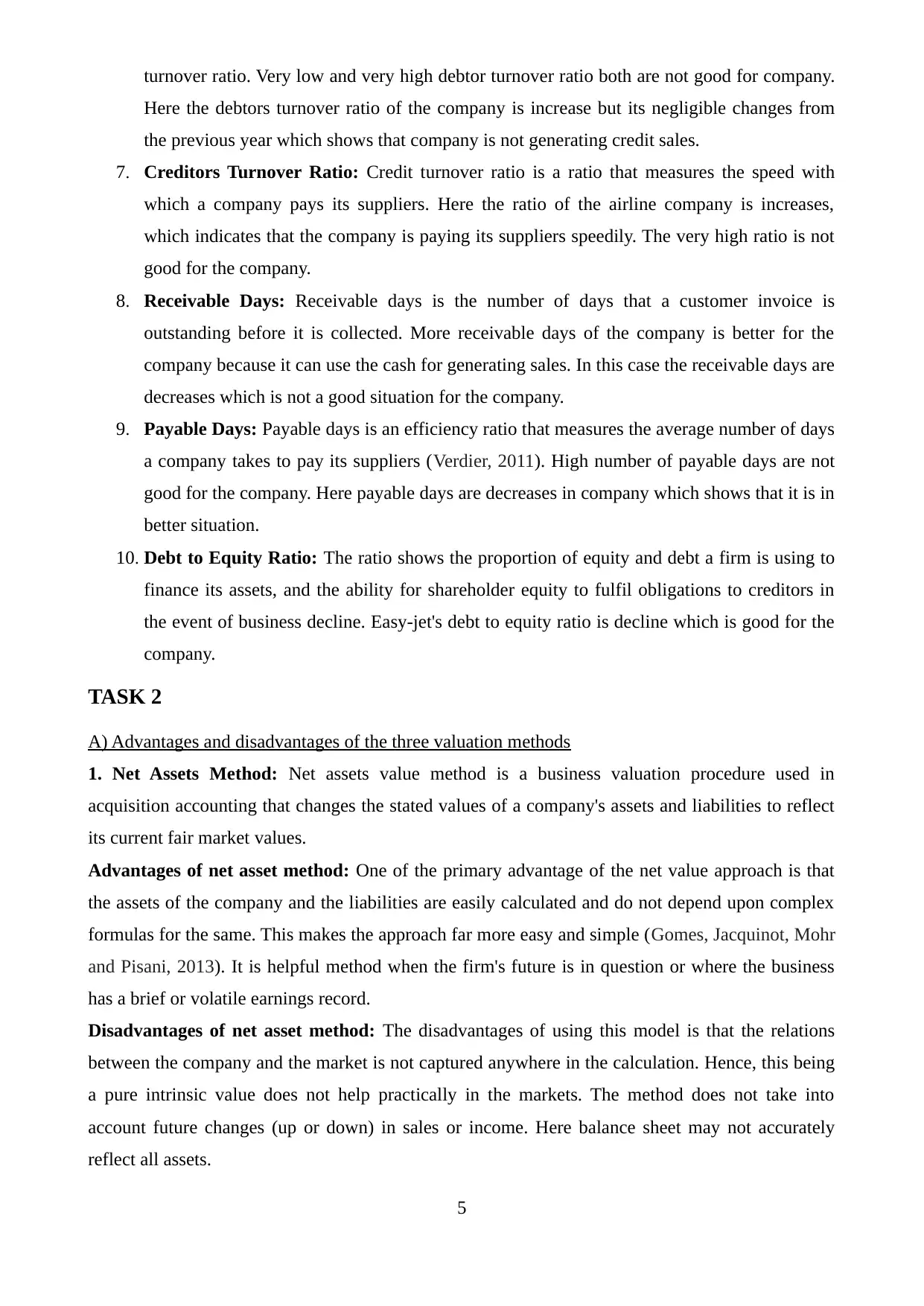

turnover ratio. Very low and very high debtor turnover ratio both are not good for company.

Here the debtors turnover ratio of the company is increase but its negligible changes from

the previous year which shows that company is not generating credit sales.

7. Creditors Turnover Ratio: Credit turnover ratio is a ratio that measures the speed with

which a company pays its suppliers. Here the ratio of the airline company is increases,

which indicates that the company is paying its suppliers speedily. The very high ratio is not

good for the company.

8. Receivable Days: Receivable days is the number of days that a customer invoice is

outstanding before it is collected. More receivable days of the company is better for the

company because it can use the cash for generating sales. In this case the receivable days are

decreases which is not a good situation for the company.

9. Payable Days: Payable days is an efficiency ratio that measures the average number of days

a company takes to pay its suppliers (Verdier, 2011). High number of payable days are not

good for the company. Here payable days are decreases in company which shows that it is in

better situation.

10. Debt to Equity Ratio: The ratio shows the proportion of equity and debt a firm is using to

finance its assets, and the ability for shareholder equity to fulfil obligations to creditors in

the event of business decline. Easy-jet's debt to equity ratio is decline which is good for the

company.

TASK 2

A) Advantages and disadvantages of the three valuation methods

1. Net Assets Method: Net assets value method is a business valuation procedure used in

acquisition accounting that changes the stated values of a company's assets and liabilities to reflect

its current fair market values.

Advantages of net asset method: One of the primary advantage of the net value approach is that

the assets of the company and the liabilities are easily calculated and do not depend upon complex

formulas for the same. This makes the approach far more easy and simple (Gomes, Jacquinot, Mohr

and Pisani, 2013). It is helpful method when the firm's future is in question or where the business

has a brief or volatile earnings record.

Disadvantages of net asset method: The disadvantages of using this model is that the relations

between the company and the market is not captured anywhere in the calculation. Hence, this being

a pure intrinsic value does not help practically in the markets. The method does not take into

account future changes (up or down) in sales or income. Here balance sheet may not accurately

reflect all assets.

5

Here the debtors turnover ratio of the company is increase but its negligible changes from

the previous year which shows that company is not generating credit sales.

7. Creditors Turnover Ratio: Credit turnover ratio is a ratio that measures the speed with

which a company pays its suppliers. Here the ratio of the airline company is increases,

which indicates that the company is paying its suppliers speedily. The very high ratio is not

good for the company.

8. Receivable Days: Receivable days is the number of days that a customer invoice is

outstanding before it is collected. More receivable days of the company is better for the

company because it can use the cash for generating sales. In this case the receivable days are

decreases which is not a good situation for the company.

9. Payable Days: Payable days is an efficiency ratio that measures the average number of days

a company takes to pay its suppliers (Verdier, 2011). High number of payable days are not

good for the company. Here payable days are decreases in company which shows that it is in

better situation.

10. Debt to Equity Ratio: The ratio shows the proportion of equity and debt a firm is using to

finance its assets, and the ability for shareholder equity to fulfil obligations to creditors in

the event of business decline. Easy-jet's debt to equity ratio is decline which is good for the

company.

TASK 2

A) Advantages and disadvantages of the three valuation methods

1. Net Assets Method: Net assets value method is a business valuation procedure used in

acquisition accounting that changes the stated values of a company's assets and liabilities to reflect

its current fair market values.

Advantages of net asset method: One of the primary advantage of the net value approach is that

the assets of the company and the liabilities are easily calculated and do not depend upon complex

formulas for the same. This makes the approach far more easy and simple (Gomes, Jacquinot, Mohr

and Pisani, 2013). It is helpful method when the firm's future is in question or where the business

has a brief or volatile earnings record.

Disadvantages of net asset method: The disadvantages of using this model is that the relations

between the company and the market is not captured anywhere in the calculation. Hence, this being

a pure intrinsic value does not help practically in the markets. The method does not take into

account future changes (up or down) in sales or income. Here balance sheet may not accurately

reflect all assets.

5

2. Price Earning Ratio: It is one of the widely used and common stock valuation tool. It is a ratio

of company's current market share price compared to its annual earnings per share.

Advantages of PE Ratio: The main advantage of the ratio is that it is easy to understand as well as

it is not a complex method for calculate (Lane and Milesi‐Ferretti, 2011). It is used in making the

quick decisions in business. With help of the PE ratio the firm's share's current price earning can be

compared to the past performance of the company. It is much more indicative means for real value

of the share than the price alone.

Disadvantages of PE Ratio: In times of high inflation, PE ratio tends to be lower. So, company

won't get a clear picture about the valuation of the stock during a bear phase. As a company can

manipulate its earnings, so EPS as well as price to earning ratio can be distorted. It takes the past

earnings of a company into consideration (Alper, Forni and Gerard, 2013). So, this ratio won't

provide to the company a clear idea of future earning prospective of a company.

3. Dividend Valuation Method: It is the method where a procedure for valuing the price of a stock

by using the predicted dividends and discounting them back to the present value. In this the EasyJet

is considering the dividend payout ratio to calculate dividend valuation method.

Advantages of Dividend Valuation Method: The primary advantage of the dividend model is that

it is grounded theory. The model is the fact that dividends tend to stay consistent over long periods

of time. There is no ambiguity regarding the definition of dividends. Dividends are the only

measure of valuation to the minority shareholder (Klose and Weigert, 2014). The regular payment

of dividends is the sign that a company has matured in its business.

Advantages of Dividend Valuation Method: The main disadvantage of the dividend valuation

model in that it is only applicable to mature, stable companies who have a proven track record of

paying out dividends consistently. Another major disadvantage is the fact that the dividend model

implicitly assumes that the dividends paid out are correlated to earnings. The model is full of too

many assumptions. The dividend model is not applicable to large shareholder.

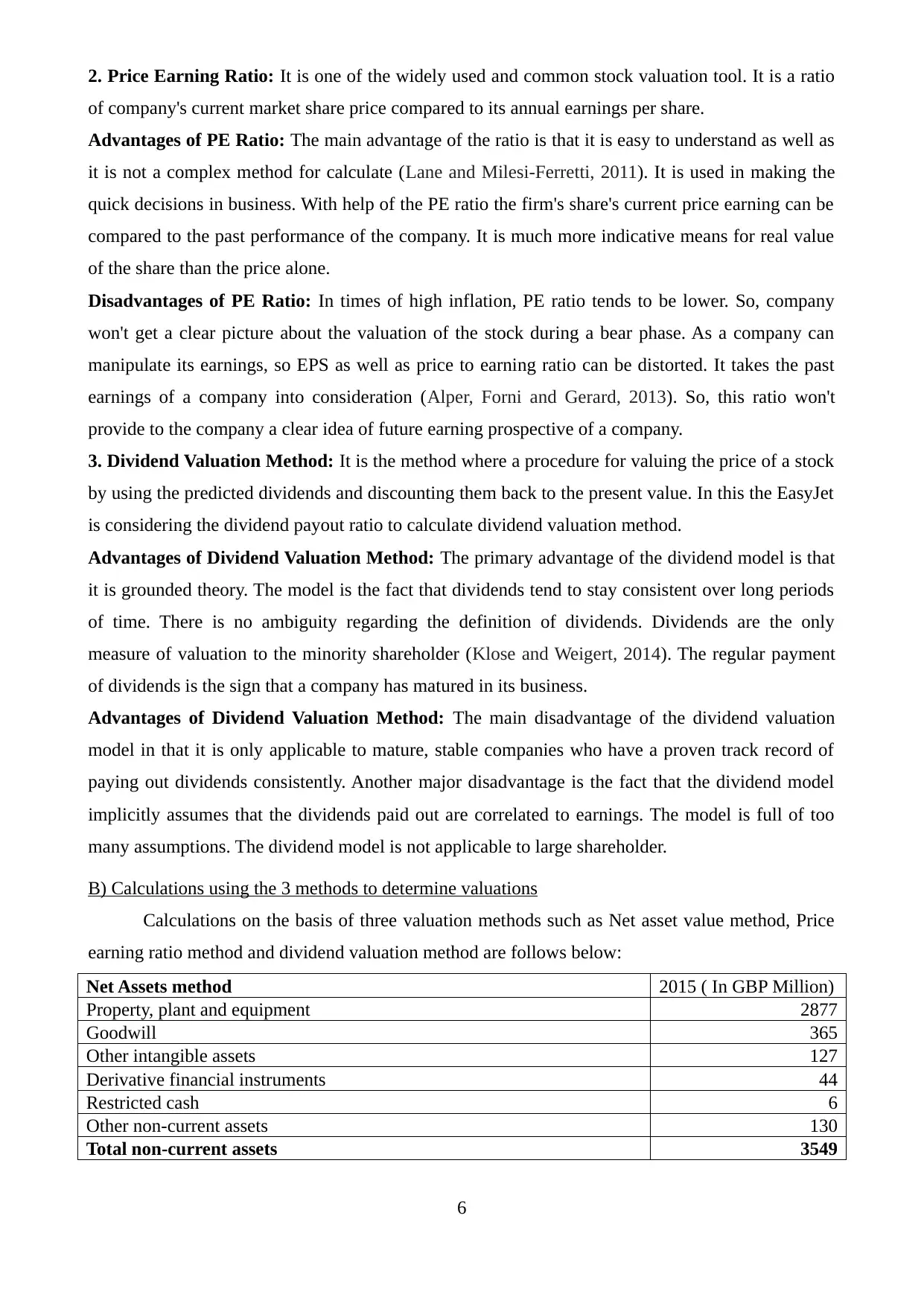

B) Calculations using the 3 methods to determine valuations

Calculations on the basis of three valuation methods such as Net asset value method, Price

earning ratio method and dividend valuation method are follows below:

Net Assets method 2015 ( In GBP Million)

Property, plant and equipment 2877

Goodwill 365

Other intangible assets 127

Derivative financial instruments 44

Restricted cash 6

Other non-current assets 130

Total non-current assets 3549

6

of company's current market share price compared to its annual earnings per share.

Advantages of PE Ratio: The main advantage of the ratio is that it is easy to understand as well as

it is not a complex method for calculate (Lane and Milesi‐Ferretti, 2011). It is used in making the

quick decisions in business. With help of the PE ratio the firm's share's current price earning can be

compared to the past performance of the company. It is much more indicative means for real value

of the share than the price alone.

Disadvantages of PE Ratio: In times of high inflation, PE ratio tends to be lower. So, company

won't get a clear picture about the valuation of the stock during a bear phase. As a company can

manipulate its earnings, so EPS as well as price to earning ratio can be distorted. It takes the past

earnings of a company into consideration (Alper, Forni and Gerard, 2013). So, this ratio won't

provide to the company a clear idea of future earning prospective of a company.

3. Dividend Valuation Method: It is the method where a procedure for valuing the price of a stock

by using the predicted dividends and discounting them back to the present value. In this the EasyJet

is considering the dividend payout ratio to calculate dividend valuation method.

Advantages of Dividend Valuation Method: The primary advantage of the dividend model is that

it is grounded theory. The model is the fact that dividends tend to stay consistent over long periods

of time. There is no ambiguity regarding the definition of dividends. Dividends are the only

measure of valuation to the minority shareholder (Klose and Weigert, 2014). The regular payment

of dividends is the sign that a company has matured in its business.

Advantages of Dividend Valuation Method: The main disadvantage of the dividend valuation

model in that it is only applicable to mature, stable companies who have a proven track record of

paying out dividends consistently. Another major disadvantage is the fact that the dividend model

implicitly assumes that the dividends paid out are correlated to earnings. The model is full of too

many assumptions. The dividend model is not applicable to large shareholder.

B) Calculations using the 3 methods to determine valuations

Calculations on the basis of three valuation methods such as Net asset value method, Price

earning ratio method and dividend valuation method are follows below:

Net Assets method 2015 ( In GBP Million)

Property, plant and equipment 2877

Goodwill 365

Other intangible assets 127

Derivative financial instruments 44

Restricted cash 6

Other non-current assets 130

Total non-current assets 3549

6

Current assets

Trade and other receivables 206

Derivative financial instruments 128

Restricted cash 6

Money market deposits 289

Cash and its equivalents 650

Total current assets 1279

Total assets 4828

Less: Current liabilities

Trade and other payables 495

Unearned revenues 619

Borrowings 182

Derivative financial instruments 368

Current tax payables 43

provisions for liabilities and charges 61

Total current liabilities 1768

Non-current liabilities

Borrowings 322

Derivative financial instruments 101

Non-current deferred income 47

provisions for liabilities and charges 165

Deferred tax 176

Total non-current liabilities 811

Total liabilities 2579

Net assets 2249

Number of shares outstanding (In Million) 99

NAVPS (Net assets value per share) 22.72

Net Asset Method: Net assets refers to the value of a company's assets minus its liabilities. The

method is considers mainly two values of company that is net asset value and outstanding shares of

the EasyJet. The company is having net asset value per share is 22.72 GBP which shows that

company is not performing well in the industry. It is very low value of per share of the EasyJet

company. The company is not better for the acquiring decision.

Earning multiplier

Share valuation as per price to earning ratio

Items Amount

Market value per share at the end of 30th Sept, 2015 1748

Earning per share (Pence) 5.52

Price earning ratio (P/E multiple) 316.67

7

Trade and other receivables 206

Derivative financial instruments 128

Restricted cash 6

Money market deposits 289

Cash and its equivalents 650

Total current assets 1279

Total assets 4828

Less: Current liabilities

Trade and other payables 495

Unearned revenues 619

Borrowings 182

Derivative financial instruments 368

Current tax payables 43

provisions for liabilities and charges 61

Total current liabilities 1768

Non-current liabilities

Borrowings 322

Derivative financial instruments 101

Non-current deferred income 47

provisions for liabilities and charges 165

Deferred tax 176

Total non-current liabilities 811

Total liabilities 2579

Net assets 2249

Number of shares outstanding (In Million) 99

NAVPS (Net assets value per share) 22.72

Net Asset Method: Net assets refers to the value of a company's assets minus its liabilities. The

method is considers mainly two values of company that is net asset value and outstanding shares of

the EasyJet. The company is having net asset value per share is 22.72 GBP which shows that

company is not performing well in the industry. It is very low value of per share of the EasyJet

company. The company is not better for the acquiring decision.

Earning multiplier

Share valuation as per price to earning ratio

Items Amount

Market value per share at the end of 30th Sept, 2015 1748

Earning per share (Pence) 5.52

Price earning ratio (P/E multiple) 316.67

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

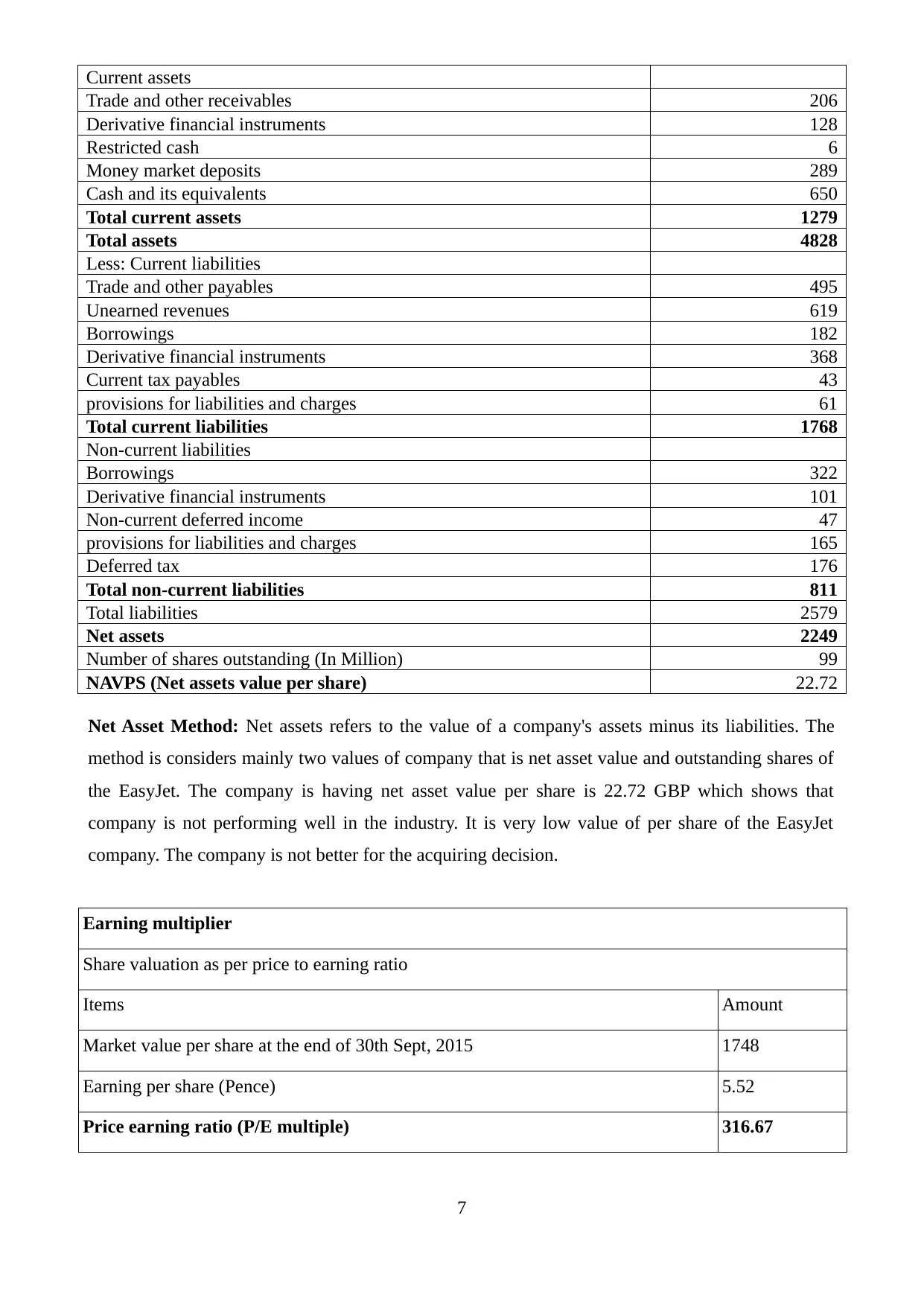

Price Earning Ratio: From the PE ratio the company can evaluate that the stock price of company

is good or not (Bertoni and Lugo, 2013). The PE ratio of the EasyJet company is 316.67 GBP,

which shows that the value is too much higher and overvalued in comparison to the market or

industry. This is not better situation for the company and not able to acquire. The company is over

performing compare to the industry which is not good.

Items

Stock price formula D/(k-g)

D Dividend payout ratio

K Required rate of return

g Dividend growth rate

Formula of dividend payout ratio DPS/EPS

DPS Dividend per share

EPS Earning per share

DPS 1.76

EPS 5.52

Dividend payout ratio 31.88%

Expected growth rate in dividend 2.50%

Calculations of cost of equity as per CAPM

Risk -free rate of return 1.25

beta 0.4173

Market return 3.50%

K (cost of equity) 0.74

Easyjet's share price 2.45

Dividend Valuation Method: It is method of valuing a company's stock based on the theory that its

stock is worth the sum of all of its future dividend payments. Here in this case the company is

paying the dividend to its shareholders but in compare to this the company's share value is too much

low. The company is overall not performing well in the industry, so it is not beneficial for acquiring.

8

is good or not (Bertoni and Lugo, 2013). The PE ratio of the EasyJet company is 316.67 GBP,

which shows that the value is too much higher and overvalued in comparison to the market or

industry. This is not better situation for the company and not able to acquire. The company is over

performing compare to the industry which is not good.

Items

Stock price formula D/(k-g)

D Dividend payout ratio

K Required rate of return

g Dividend growth rate

Formula of dividend payout ratio DPS/EPS

DPS Dividend per share

EPS Earning per share

DPS 1.76

EPS 5.52

Dividend payout ratio 31.88%

Expected growth rate in dividend 2.50%

Calculations of cost of equity as per CAPM

Risk -free rate of return 1.25

beta 0.4173

Market return 3.50%

K (cost of equity) 0.74

Easyjet's share price 2.45

Dividend Valuation Method: It is method of valuing a company's stock based on the theory that its

stock is worth the sum of all of its future dividend payments. Here in this case the company is

paying the dividend to its shareholders but in compare to this the company's share value is too much

low. The company is overall not performing well in the industry, so it is not beneficial for acquiring.

8

C)

In these case, the valuation methods are using for derive value of the company. All valuation

methods are having different values of the particular company (Nikolsko‐Rzhevskyy and Papell,

2013). The valuation of different methods are different because all methods are not considering the

same factors to calculate the value of the business. Some methods are considering the time value,

some are considering the earning per share, some method is considers the growth and some method

considers the financial statements of the company. Due to considering different value for the

calculation of the business value, the values are differed (Hillier, Grinblatt and Titman, 2011). The

market rate fluctuation is also impact on the value of the business.

D) Identifying the various risk exposures to FTSE 100 company indexes

There are several risk exposures which are facing by Easy Jet due to the fluctuations which

take place in the price level. The reason behind this market fluctuation has direct impact on the

share price and return. Economic and political changes take place in the country has direct impact

on the returns which are offered by the companies listed on London stock exchange. Along with

this, competition is another main factors which impose threat in front of Easy jet (Baylis, Smith

and Owens, 2013). With the aim to build and sustain competitive edge over others Ryanair focuses

on large number of research projects. Along with this, Ryanair also lays emphasis on evaluating the

most effectual ways to perform the tasks which may result into offering of the cost effectual

services. Further, changes which take place in the prices of fuel also impose major threat in front of

Easy Jet. Moreover, fuel price changes closely affects the cost and price of the services offered to

the significant level (International Finance and Economic Policy,2016). Thus, Easy jet needs to

consider all these aspects while framing strategies and policies.

E)

The particular circumstances such as current trading difficulties, need for change of

management and disposal of identifiable assets are the factors which surrounding the acquisition.

From this all things the acquisition decision is influence to every business. When the management

change in the business than the profit and other elements are also fluctuated to the business which

leads to changing then acquisition decision (Poniachek, 2012). The trading difficulties are also

influence to the valuation method. When the market rate and other things are fluctuated than the

value which are considering for calculate the valuation are also changed than it will also influence

to the choice of the valuation method. When any factor such as financial conditions, share market

price fluctuations etc. are lead to influence the choice of valuation methods.

9

In these case, the valuation methods are using for derive value of the company. All valuation

methods are having different values of the particular company (Nikolsko‐Rzhevskyy and Papell,

2013). The valuation of different methods are different because all methods are not considering the

same factors to calculate the value of the business. Some methods are considering the time value,

some are considering the earning per share, some method is considers the growth and some method

considers the financial statements of the company. Due to considering different value for the

calculation of the business value, the values are differed (Hillier, Grinblatt and Titman, 2011). The

market rate fluctuation is also impact on the value of the business.

D) Identifying the various risk exposures to FTSE 100 company indexes

There are several risk exposures which are facing by Easy Jet due to the fluctuations which

take place in the price level. The reason behind this market fluctuation has direct impact on the

share price and return. Economic and political changes take place in the country has direct impact

on the returns which are offered by the companies listed on London stock exchange. Along with

this, competition is another main factors which impose threat in front of Easy jet (Baylis, Smith

and Owens, 2013). With the aim to build and sustain competitive edge over others Ryanair focuses

on large number of research projects. Along with this, Ryanair also lays emphasis on evaluating the

most effectual ways to perform the tasks which may result into offering of the cost effectual

services. Further, changes which take place in the prices of fuel also impose major threat in front of

Easy Jet. Moreover, fuel price changes closely affects the cost and price of the services offered to

the significant level (International Finance and Economic Policy,2016). Thus, Easy jet needs to

consider all these aspects while framing strategies and policies.

E)

The particular circumstances such as current trading difficulties, need for change of

management and disposal of identifiable assets are the factors which surrounding the acquisition.

From this all things the acquisition decision is influence to every business. When the management

change in the business than the profit and other elements are also fluctuated to the business which

leads to changing then acquisition decision (Poniachek, 2012). The trading difficulties are also

influence to the valuation method. When the market rate and other things are fluctuated than the

value which are considering for calculate the valuation are also changed than it will also influence

to the choice of the valuation method. When any factor such as financial conditions, share market

price fluctuations etc. are lead to influence the choice of valuation methods.

9

TASK 3

In this EasyJet airlines company's case the company is not performing in the market or in the

industry where it operates and serving the products and services to the consumers. The

recommendation to the acquirer that they should not acquire the company because its profitability

ratio is low as well as it is not generating the sales compare to the previous year. The company is

not using its assets and creditors to generate the sales. On the basis of the liquidity ratio also is not

performing well, its current assets are very low compare to the ideal ratio. Hence, it can be

recommend to the acquirer company that they should not acquire EasyJet airline company.

CONCLUSION

After summarizing the report, it can be concluded that although profitability performance of

EasyJet got improved in 2015, but still, its creditworthiness and managerial efficiency to utilize

optimally business assets came down. Henceforth, it can be suggested that financial position or

health of EasyJet is not sound. Moreover, fluctuation in market conditions vary gives different

results regarding stock valuation on the basis of net assets, dividend and price to earning method.

Henceforth, it is considered advisable to Barclays Bank to not acquire EasyJet as it is

underperforming currently.

10

In this EasyJet airlines company's case the company is not performing in the market or in the

industry where it operates and serving the products and services to the consumers. The

recommendation to the acquirer that they should not acquire the company because its profitability

ratio is low as well as it is not generating the sales compare to the previous year. The company is

not using its assets and creditors to generate the sales. On the basis of the liquidity ratio also is not

performing well, its current assets are very low compare to the ideal ratio. Hence, it can be

recommend to the acquirer company that they should not acquire EasyJet airline company.

CONCLUSION

After summarizing the report, it can be concluded that although profitability performance of

EasyJet got improved in 2015, but still, its creditworthiness and managerial efficiency to utilize

optimally business assets came down. Henceforth, it can be suggested that financial position or

health of EasyJet is not sound. Moreover, fluctuation in market conditions vary gives different

results regarding stock valuation on the basis of net assets, dividend and price to earning method.

Henceforth, it is considered advisable to Barclays Bank to not acquire EasyJet as it is

underperforming currently.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Alper C.E., Forni L. and Gerard M., 2013. Pricing of sovereign credit risk: Evidence from advanced

economies during the financial crisis. International Finance. 16(2). pp.161-188.

Baylis J., Smith S. and Owens P., 2013. The globalization of world politics: An introduction to

international relations. Oxford University Press.

Bayne N. and Woolcock S. eds., 2011. The new economic diplomacy: decision-making and

negotiation in international economic relations. Ashgate Publishing, Ltd.

Bertoni F. and Lugo S., 2013. Testing the strategic asset allocation of stabilization sovereign wealth

funds. International Finance. 16(1). pp. 95-119.

Brealey R.A., Myers S.C., Allen F. and Mohanty P., 2012. Principles of corporate finance. Tata

McGraw-Hill Education.

Claessens S. and Forbes K. eds., 2013. International financial contagion. Springer Science &

Business Media.

Ferguson N. and Schularick M., 2011. The end of Chimerica. International Finance. 14(1). pp. 1-

26.

Frieden J., 2015. Banking on the world: the politics of American international finance. Routledge.

Gilpin R., 2011. Global political economy: Understanding the international economic order.

Princeton University Press.

Gilpin R., 2016. The political economy of international relations. Princeton University Press.

Gomes S., Jacquinot P., Mohr M. and Pisani M., 2013. Structural reforms and macroeconomic

performance in the Euro Area countries: a model‐based assessment. International Finance.

16(1), pp. 23-44.

Helleiner E. and Kirshner J. eds., 2012. The future of the dollar. Cornell University Press.

Hillier D., Grinblatt M. and Titman S., 2011. Financial markets and corporate strategy. McGraw

Hill.

Hunter W.C., Kaufman G.G. and Krueger T.H. Eds., 2012. The Asian financial crisis: origins,

implications, and solutions. Springer Science & Business Media.

Klose J. and Weigert B., 2014. Sovereign yield spreads during the euro crisis: Fundamental factors

versus redenomination risk. International Finance. 17(1). pp.25-50.

11

Books and Journals

Alper C.E., Forni L. and Gerard M., 2013. Pricing of sovereign credit risk: Evidence from advanced

economies during the financial crisis. International Finance. 16(2). pp.161-188.

Baylis J., Smith S. and Owens P., 2013. The globalization of world politics: An introduction to

international relations. Oxford University Press.

Bayne N. and Woolcock S. eds., 2011. The new economic diplomacy: decision-making and

negotiation in international economic relations. Ashgate Publishing, Ltd.

Bertoni F. and Lugo S., 2013. Testing the strategic asset allocation of stabilization sovereign wealth

funds. International Finance. 16(1). pp. 95-119.

Brealey R.A., Myers S.C., Allen F. and Mohanty P., 2012. Principles of corporate finance. Tata

McGraw-Hill Education.

Claessens S. and Forbes K. eds., 2013. International financial contagion. Springer Science &

Business Media.

Ferguson N. and Schularick M., 2011. The end of Chimerica. International Finance. 14(1). pp. 1-

26.

Frieden J., 2015. Banking on the world: the politics of American international finance. Routledge.

Gilpin R., 2011. Global political economy: Understanding the international economic order.

Princeton University Press.

Gilpin R., 2016. The political economy of international relations. Princeton University Press.

Gomes S., Jacquinot P., Mohr M. and Pisani M., 2013. Structural reforms and macroeconomic

performance in the Euro Area countries: a model‐based assessment. International Finance.

16(1), pp. 23-44.

Helleiner E. and Kirshner J. eds., 2012. The future of the dollar. Cornell University Press.

Hillier D., Grinblatt M. and Titman S., 2011. Financial markets and corporate strategy. McGraw

Hill.

Hunter W.C., Kaufman G.G. and Krueger T.H. Eds., 2012. The Asian financial crisis: origins,

implications, and solutions. Springer Science & Business Media.

Klose J. and Weigert B., 2014. Sovereign yield spreads during the euro crisis: Fundamental factors

versus redenomination risk. International Finance. 17(1). pp.25-50.

11

Krol R., 2014. Economic policy uncertainty and exchange rate volatility. International Finance.

17(2). pp. 241-256.

Lane P.R. and Milesi‐Ferretti G.M., 2011. Cross‐Border Investment in Small International Financial

Centres. International Finance. 14(2). pp. 301-330.

Levich R.M., Majnoni G. and Reinhart C., 2012. Ratings, rating agencies and the global financial

system. Springer Science & Business Media.

Lewis W.A., 2015. The evolution of the international economic order. Princeton University Press.

Melvin M., 2012. International money and finance. Academic Press.

Mingst K.A. and Arreguín-Toft I.M., 2013. Essentials of International Relations: Sixth

International Student Edition. WW Norton & Company.

Nikolsko‐Rzhevskyy A. and Papell D.H., 2013. Taylor's Rule versus Taylor Rules. International

Finance. 16(1). pp.71-93.

Okawa Y. and Van Wincoop E., 2012. Gravity in international finance. Journal of international

Economics. 87(2). pp. 205-215.

Poniachek H.A., 2012. International Corporate Finance: Markets, Transactions and Financial

Management. Routledge.

Prasad E.S., 2011. Rebalancing growth in Asia. International Finance. 14(1). pp. 27-66.

Schwartz R.A. ed., 2012. The electronic call auction: Market mechanism and trading: Building a

better stock market. Springer Science & Business Media.

Verdier P.H., 2011. Mutual Recognition in International Finance. Harvard International Law

Journal. 52(1). pp. 57-89.

Online

International Finance and Economic Policy, 2016. [pdf]. Available through:

<https://sipa.columbia.edu/academics/concentrations/international-finance-and-economic-policy>

[Accessed on 24 November 2016].

12

17(2). pp. 241-256.

Lane P.R. and Milesi‐Ferretti G.M., 2011. Cross‐Border Investment in Small International Financial

Centres. International Finance. 14(2). pp. 301-330.

Levich R.M., Majnoni G. and Reinhart C., 2012. Ratings, rating agencies and the global financial

system. Springer Science & Business Media.

Lewis W.A., 2015. The evolution of the international economic order. Princeton University Press.

Melvin M., 2012. International money and finance. Academic Press.

Mingst K.A. and Arreguín-Toft I.M., 2013. Essentials of International Relations: Sixth

International Student Edition. WW Norton & Company.

Nikolsko‐Rzhevskyy A. and Papell D.H., 2013. Taylor's Rule versus Taylor Rules. International

Finance. 16(1). pp.71-93.

Okawa Y. and Van Wincoop E., 2012. Gravity in international finance. Journal of international

Economics. 87(2). pp. 205-215.

Poniachek H.A., 2012. International Corporate Finance: Markets, Transactions and Financial

Management. Routledge.

Prasad E.S., 2011. Rebalancing growth in Asia. International Finance. 14(1). pp. 27-66.

Schwartz R.A. ed., 2012. The electronic call auction: Market mechanism and trading: Building a

better stock market. Springer Science & Business Media.

Verdier P.H., 2011. Mutual Recognition in International Finance. Harvard International Law

Journal. 52(1). pp. 57-89.

Online

International Finance and Economic Policy, 2016. [pdf]. Available through:

<https://sipa.columbia.edu/academics/concentrations/international-finance-and-economic-policy>

[Accessed on 24 November 2016].

12

13

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.