Analysis of Management Accounting- Doc

VerifiedAdded on 2021/05/30

|11

|2264

|30

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGEMENT ACCOUNTING

Management accounting

University Name

Student Name

Authors’ Note

Management accounting

University Name

Student Name

Authors’ Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2MANAGEMENT ACCOUNTING

Table of Contents

Answer to Part A:.......................................................................................................................3

Answer to Part B:.......................................................................................................................5

Introduction:...............................................................................................................................5

Discussion:.................................................................................................................................6

Conclusion:................................................................................................................................7

Answer to Part C:.......................................................................................................................8

References list:.........................................................................................................................10

Table of Contents

Answer to Part A:.......................................................................................................................3

Answer to Part B:.......................................................................................................................5

Introduction:...............................................................................................................................5

Discussion:.................................................................................................................................6

Conclusion:................................................................................................................................7

Answer to Part C:.......................................................................................................................8

References list:.........................................................................................................................10

3MANAGEMENT ACCOUNTING

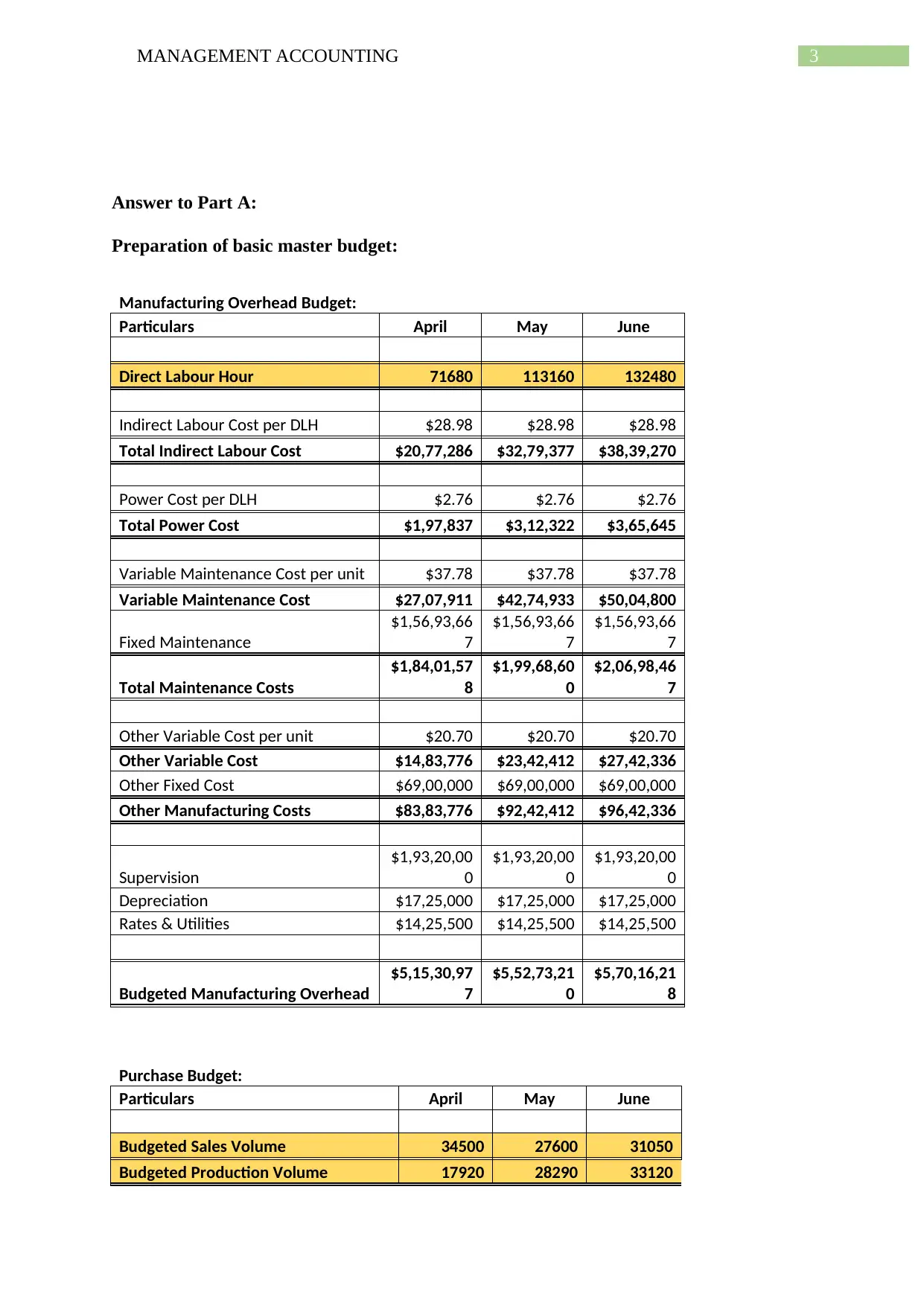

Answer to Part A:

Preparation of basic master budget:

Manufacturing Overhead Budget:

Particulars April May June

Direct Labour Hour 71680 113160 132480

Indirect Labour Cost per DLH $28.98 $28.98 $28.98

Total Indirect Labour Cost $20,77,286 $32,79,377 $38,39,270

Power Cost per DLH $2.76 $2.76 $2.76

Total Power Cost $1,97,837 $3,12,322 $3,65,645

Variable Maintenance Cost per unit $37.78 $37.78 $37.78

Variable Maintenance Cost $27,07,911 $42,74,933 $50,04,800

Fixed Maintenance

$1,56,93,66

7

$1,56,93,66

7

$1,56,93,66

7

Total Maintenance Costs

$1,84,01,57

8

$1,99,68,60

0

$2,06,98,46

7

Other Variable Cost per unit $20.70 $20.70 $20.70

Other Variable Cost $14,83,776 $23,42,412 $27,42,336

Other Fixed Cost $69,00,000 $69,00,000 $69,00,000

Other Manufacturing Costs $83,83,776 $92,42,412 $96,42,336

Supervision

$1,93,20,00

0

$1,93,20,00

0

$1,93,20,00

0

Depreciation $17,25,000 $17,25,000 $17,25,000

Rates & Utilities $14,25,500 $14,25,500 $14,25,500

Budgeted Manufacturing Overhead

$5,15,30,97

7

$5,52,73,21

0

$5,70,16,21

8

Purchase Budget:

Particulars April May June

Budgeted Sales Volume 34500 27600 31050

Budgeted Production Volume 17920 28290 33120

Answer to Part A:

Preparation of basic master budget:

Manufacturing Overhead Budget:

Particulars April May June

Direct Labour Hour 71680 113160 132480

Indirect Labour Cost per DLH $28.98 $28.98 $28.98

Total Indirect Labour Cost $20,77,286 $32,79,377 $38,39,270

Power Cost per DLH $2.76 $2.76 $2.76

Total Power Cost $1,97,837 $3,12,322 $3,65,645

Variable Maintenance Cost per unit $37.78 $37.78 $37.78

Variable Maintenance Cost $27,07,911 $42,74,933 $50,04,800

Fixed Maintenance

$1,56,93,66

7

$1,56,93,66

7

$1,56,93,66

7

Total Maintenance Costs

$1,84,01,57

8

$1,99,68,60

0

$2,06,98,46

7

Other Variable Cost per unit $20.70 $20.70 $20.70

Other Variable Cost $14,83,776 $23,42,412 $27,42,336

Other Fixed Cost $69,00,000 $69,00,000 $69,00,000

Other Manufacturing Costs $83,83,776 $92,42,412 $96,42,336

Supervision

$1,93,20,00

0

$1,93,20,00

0

$1,93,20,00

0

Depreciation $17,25,000 $17,25,000 $17,25,000

Rates & Utilities $14,25,500 $14,25,500 $14,25,500

Budgeted Manufacturing Overhead

$5,15,30,97

7

$5,52,73,21

0

$5,70,16,21

8

Purchase Budget:

Particulars April May June

Budgeted Sales Volume 34500 27600 31050

Budgeted Production Volume 17920 28290 33120

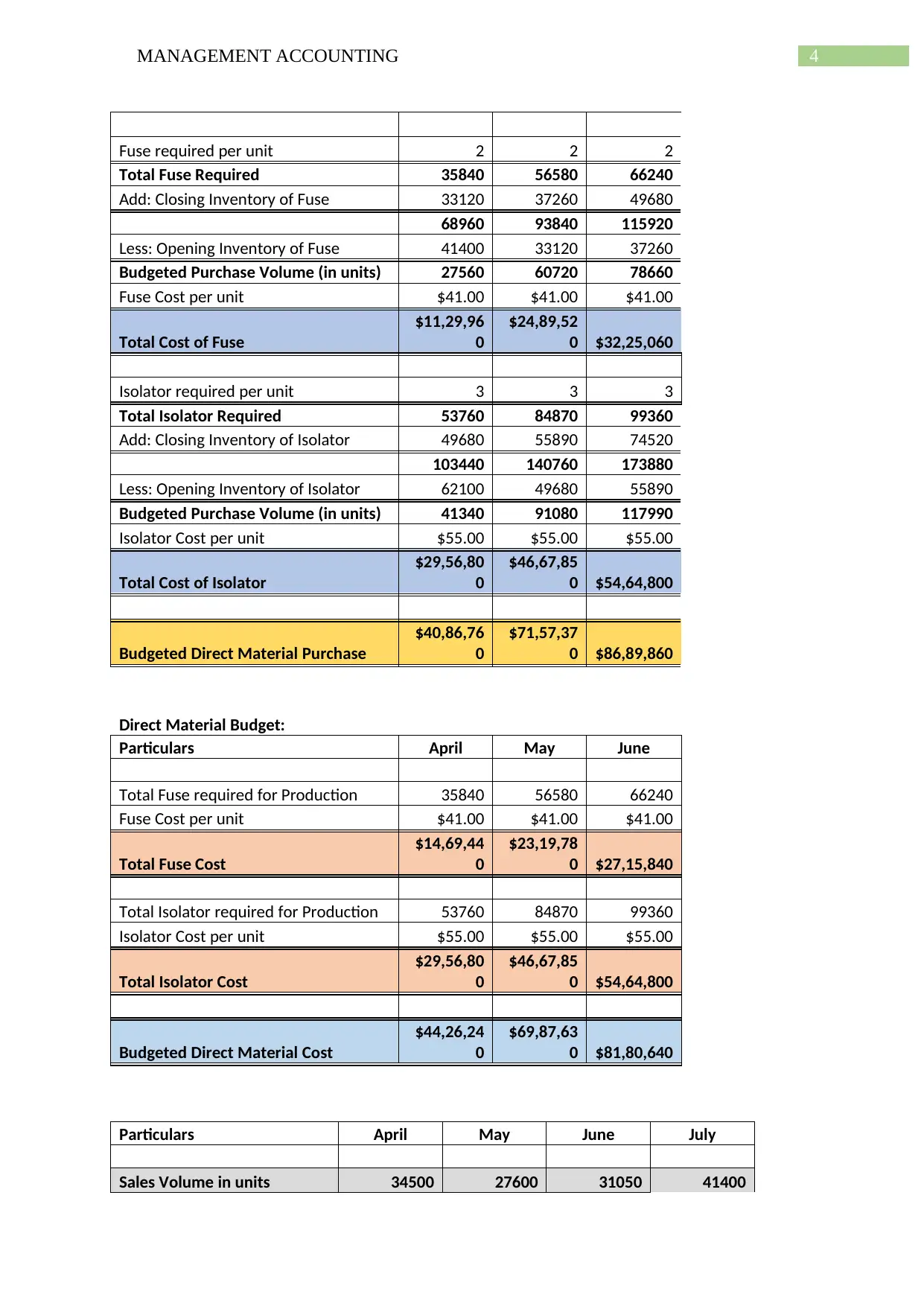

4MANAGEMENT ACCOUNTING

Fuse required per unit 2 2 2

Total Fuse Required 35840 56580 66240

Add: Closing Inventory of Fuse 33120 37260 49680

68960 93840 115920

Less: Opening Inventory of Fuse 41400 33120 37260

Budgeted Purchase Volume (in units) 27560 60720 78660

Fuse Cost per unit $41.00 $41.00 $41.00

Total Cost of Fuse

$11,29,96

0

$24,89,52

0 $32,25,060

Isolator required per unit 3 3 3

Total Isolator Required 53760 84870 99360

Add: Closing Inventory of Isolator 49680 55890 74520

103440 140760 173880

Less: Opening Inventory of Isolator 62100 49680 55890

Budgeted Purchase Volume (in units) 41340 91080 117990

Isolator Cost per unit $55.00 $55.00 $55.00

Total Cost of Isolator

$29,56,80

0

$46,67,85

0 $54,64,800

Budgeted Direct Material Purchase

$40,86,76

0

$71,57,37

0 $86,89,860

Direct Material Budget:

Particulars April May June

Total Fuse required for Production 35840 56580 66240

Fuse Cost per unit $41.00 $41.00 $41.00

Total Fuse Cost

$14,69,44

0

$23,19,78

0 $27,15,840

Total Isolator required for Production 53760 84870 99360

Isolator Cost per unit $55.00 $55.00 $55.00

Total Isolator Cost

$29,56,80

0

$46,67,85

0 $54,64,800

Budgeted Direct Material Cost

$44,26,24

0

$69,87,63

0 $81,80,640

Particulars April May June July

Sales Volume in units 34500 27600 31050 41400

Fuse required per unit 2 2 2

Total Fuse Required 35840 56580 66240

Add: Closing Inventory of Fuse 33120 37260 49680

68960 93840 115920

Less: Opening Inventory of Fuse 41400 33120 37260

Budgeted Purchase Volume (in units) 27560 60720 78660

Fuse Cost per unit $41.00 $41.00 $41.00

Total Cost of Fuse

$11,29,96

0

$24,89,52

0 $32,25,060

Isolator required per unit 3 3 3

Total Isolator Required 53760 84870 99360

Add: Closing Inventory of Isolator 49680 55890 74520

103440 140760 173880

Less: Opening Inventory of Isolator 62100 49680 55890

Budgeted Purchase Volume (in units) 41340 91080 117990

Isolator Cost per unit $55.00 $55.00 $55.00

Total Cost of Isolator

$29,56,80

0

$46,67,85

0 $54,64,800

Budgeted Direct Material Purchase

$40,86,76

0

$71,57,37

0 $86,89,860

Direct Material Budget:

Particulars April May June

Total Fuse required for Production 35840 56580 66240

Fuse Cost per unit $41.00 $41.00 $41.00

Total Fuse Cost

$14,69,44

0

$23,19,78

0 $27,15,840

Total Isolator required for Production 53760 84870 99360

Isolator Cost per unit $55.00 $55.00 $55.00

Total Isolator Cost

$29,56,80

0

$46,67,85

0 $54,64,800

Budgeted Direct Material Cost

$44,26,24

0

$69,87,63

0 $81,80,640

Particulars April May June July

Sales Volume in units 34500 27600 31050 41400

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

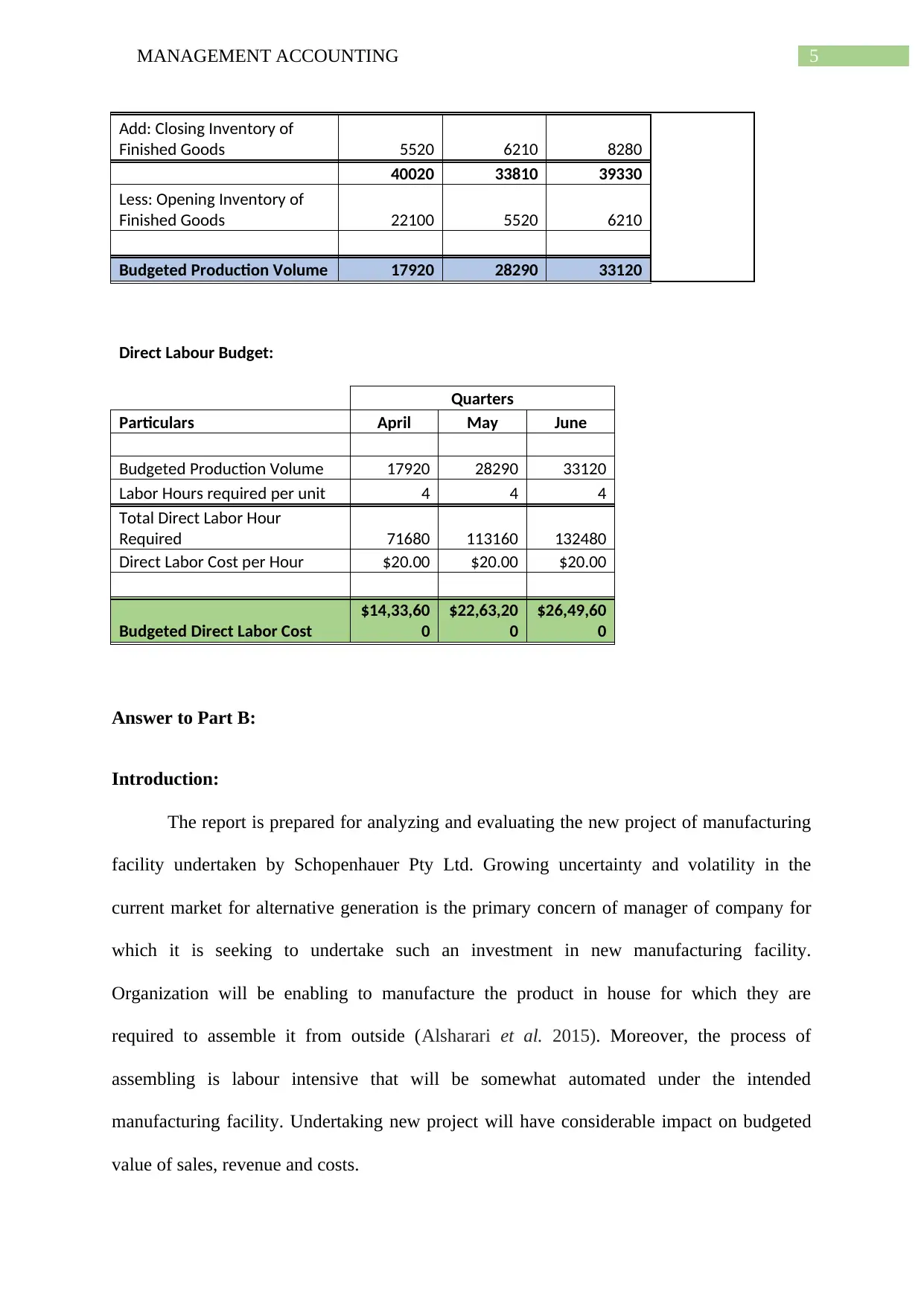

5MANAGEMENT ACCOUNTING

Add: Closing Inventory of

Finished Goods 5520 6210 8280

40020 33810 39330

Less: Opening Inventory of

Finished Goods 22100 5520 6210

Budgeted Production Volume 17920 28290 33120

Direct Labour Budget:

Quarters

Particulars April May June

Budgeted Production Volume 17920 28290 33120

Labor Hours required per unit 4 4 4

Total Direct Labor Hour

Required 71680 113160 132480

Direct Labor Cost per Hour $20.00 $20.00 $20.00

Budgeted Direct Labor Cost

$14,33,60

0

$22,63,20

0

$26,49,60

0

Answer to Part B:

Introduction:

The report is prepared for analyzing and evaluating the new project of manufacturing

facility undertaken by Schopenhauer Pty Ltd. Growing uncertainty and volatility in the

current market for alternative generation is the primary concern of manager of company for

which it is seeking to undertake such an investment in new manufacturing facility.

Organization will be enabling to manufacture the product in house for which they are

required to assemble it from outside (Alsharari et al. 2015). Moreover, the process of

assembling is labour intensive that will be somewhat automated under the intended

manufacturing facility. Undertaking new project will have considerable impact on budgeted

value of sales, revenue and costs.

Add: Closing Inventory of

Finished Goods 5520 6210 8280

40020 33810 39330

Less: Opening Inventory of

Finished Goods 22100 5520 6210

Budgeted Production Volume 17920 28290 33120

Direct Labour Budget:

Quarters

Particulars April May June

Budgeted Production Volume 17920 28290 33120

Labor Hours required per unit 4 4 4

Total Direct Labor Hour

Required 71680 113160 132480

Direct Labor Cost per Hour $20.00 $20.00 $20.00

Budgeted Direct Labor Cost

$14,33,60

0

$22,63,20

0

$26,49,60

0

Answer to Part B:

Introduction:

The report is prepared for analyzing and evaluating the new project of manufacturing

facility undertaken by Schopenhauer Pty Ltd. Growing uncertainty and volatility in the

current market for alternative generation is the primary concern of manager of company for

which it is seeking to undertake such an investment in new manufacturing facility.

Organization will be enabling to manufacture the product in house for which they are

required to assemble it from outside (Alsharari et al. 2015). Moreover, the process of

assembling is labour intensive that will be somewhat automated under the intended

manufacturing facility. Undertaking new project will have considerable impact on budgeted

value of sales, revenue and costs.

6MANAGEMENT ACCOUNTING

Discussion:

With the implementation of new manufacturing facility by Schopenhauer Pty Ltd,

there will be change in direct and material cost. The various budgets is prepared by

employment of flexible budgeting system and some of the budgets that have been prepared

by organization incorporates direct labour budget, cost of goods manufactured statement,

production budget, direct material budget, cash collection from debtors account, budgetary

income statement and purchase budget. There is a likelihood that direct labour and material

cost would reduce by 25% and increase in fixed manufacturing overhead by 50% resulting

from increase in production capacity. In event of any cash shortage, company will be relying

on external borrowing for which they are entitled to pay borrowed cost along with interest

amount.

When looking at the sales budget, it can be seen that the budgeted sales revenue has

decreased initially from $ 12523500 in the month of April to $ 112711500 in month of June

and thereafter it increased to $ 15028200 in month of July. It is depicted from the production

budget that the budgeted production volume has increased considerably from 17920 in month

of April to 33120 in month of July. The budgeted direct labour cost has witnessed a

considerable increase from $ 1433600 in month of April to $ 2263200 in month of May and

further to $ 2469600 in month of June as indicated by direct labour budget.

The purchase budget depicts the figures of budgeted production volume, budgeted

sales volume and budgeted direct material purchase. There is increase in budgeted sales

volume 34500 in the month of April to 41400 in the month of July. However, the budgeted

sales volume declined in the initial months of operation. In addition to this, the volume of

budgeted production has increased from 17920 in the month of April to 28290 in the month

Discussion:

With the implementation of new manufacturing facility by Schopenhauer Pty Ltd,

there will be change in direct and material cost. The various budgets is prepared by

employment of flexible budgeting system and some of the budgets that have been prepared

by organization incorporates direct labour budget, cost of goods manufactured statement,

production budget, direct material budget, cash collection from debtors account, budgetary

income statement and purchase budget. There is a likelihood that direct labour and material

cost would reduce by 25% and increase in fixed manufacturing overhead by 50% resulting

from increase in production capacity. In event of any cash shortage, company will be relying

on external borrowing for which they are entitled to pay borrowed cost along with interest

amount.

When looking at the sales budget, it can be seen that the budgeted sales revenue has

decreased initially from $ 12523500 in the month of April to $ 112711500 in month of June

and thereafter it increased to $ 15028200 in month of July. It is depicted from the production

budget that the budgeted production volume has increased considerably from 17920 in month

of April to 33120 in month of July. The budgeted direct labour cost has witnessed a

considerable increase from $ 1433600 in month of April to $ 2263200 in month of May and

further to $ 2469600 in month of June as indicated by direct labour budget.

The purchase budget depicts the figures of budgeted production volume, budgeted

sales volume and budgeted direct material purchase. There is increase in budgeted sales

volume 34500 in the month of April to 41400 in the month of July. However, the budgeted

sales volume declined in the initial months of operation. In addition to this, the volume of

budgeted production has increased from 17920 in the month of April to 28290 in the month

7MANAGEMENT ACCOUNTING

of May and further to 33120 in the June month. Furthermore, the budgeted direct material

purchase has increased significantly from $ 4086760 to $ 8689870.

Now, looking at the direct material budget, the cost of direct material budget has

increased from $ 4426240 in April month to $ 6987630 in the month of May and further to $

8180640 in the month of June.

Organization has also prepared manufacturing budget overhead that reveals there is

consistent increase in total number of labour hours worked. It is depicted from the figures that

the total direct labour cost has also increased significantly to $ 20698467. Other

manufacturing cost has increased by fewer amount $ 9242412 in month of May to $ 9642336.

The total budgeted manufacturing overhead has increased from $ 51530977 in month of April

to $ 57016218 in the month of June.

Total amount of cash that has been collected from debtors has initially increased from

$ 96436000 to $ 112711500 and thereafter it has reduced to $ 103193640. In addition to this,

the cash payment for selling and administration expenses has initially reduced to $ 22459500

and thereafter it has increased to $ 26080965 respectively. Looking at the cash budget, it can

be seen that cash flow from operating activities has increased initially to $ 23137820 and has

reduced drastically to $ 5818422. The amount of closing cash balance has increased to $

35754583 as against $ 23633005 in month of June.

Furthermore, the decision of making investment in the project is analyzed by looking

at the figure of net operating income that is deduced from computation of income statement

(Schaltegger and Zvezdov 2015). The total amount of net operating income stood at - $

3089351. Since the operating income is negative, it is not viable to make investment in new

manufacturing facility.

of May and further to 33120 in the June month. Furthermore, the budgeted direct material

purchase has increased significantly from $ 4086760 to $ 8689870.

Now, looking at the direct material budget, the cost of direct material budget has

increased from $ 4426240 in April month to $ 6987630 in the month of May and further to $

8180640 in the month of June.

Organization has also prepared manufacturing budget overhead that reveals there is

consistent increase in total number of labour hours worked. It is depicted from the figures that

the total direct labour cost has also increased significantly to $ 20698467. Other

manufacturing cost has increased by fewer amount $ 9242412 in month of May to $ 9642336.

The total budgeted manufacturing overhead has increased from $ 51530977 in month of April

to $ 57016218 in the month of June.

Total amount of cash that has been collected from debtors has initially increased from

$ 96436000 to $ 112711500 and thereafter it has reduced to $ 103193640. In addition to this,

the cash payment for selling and administration expenses has initially reduced to $ 22459500

and thereafter it has increased to $ 26080965 respectively. Looking at the cash budget, it can

be seen that cash flow from operating activities has increased initially to $ 23137820 and has

reduced drastically to $ 5818422. The amount of closing cash balance has increased to $

35754583 as against $ 23633005 in month of June.

Furthermore, the decision of making investment in the project is analyzed by looking

at the figure of net operating income that is deduced from computation of income statement

(Schaltegger and Zvezdov 2015). The total amount of net operating income stood at - $

3089351. Since the operating income is negative, it is not viable to make investment in new

manufacturing facility.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8MANAGEMENT ACCOUNTING

Conclusion:

From the above analysis of the new manufacturing facility that seeks to be undertaken

by Schopenhauer Pty Ltd, it can be seen the net operating income generated by the project is

negative. Therefore, it can be inferred that it is not worthy to undertake investment in new

manufacturing facility.

Answer to Part C:

The overall performance of organization and behaviour of employees is

significantly affected by preparation of budget. Any organization generally relies on suing

two types of approach for preparation of budget that involves participatory budget and

imposed budget. Under imposed budget, the preparation of budget is the responsibility of

senior management who are entitled to set the parameters for decision making (Smith and

Driscoll 2017). There is little involvement of middle or lower level managers in the decision

making of budget. However, there is no effective utilization of human resources despite the

fact that they form an important source of input in budgetary preparation. One of the

disadvantages of imposed budget is that they lead to much budgetary slack and results in

occurrence of waste and efficiency if there is no proper scrutinization of the budgets

(Lindholm et al. 2014). There should be carefully reviewing of the budgets before the

outcomes are accepted.

Under participatory budget, there is active involvement of employees from different

department with the intention of providing advantage in terms of performance and benefits of

employees. The participatory budget has the implications on employees in terms of

communication between employees, achievement of gaols and motivation. Since employees

at all levels participate in the budget preparation, flow of communication and involvement is

enhanced. An organization is able to design budget by determining and setting realistic

targets when there is increased employees participation. Any undesirable behaviour on part of

Conclusion:

From the above analysis of the new manufacturing facility that seeks to be undertaken

by Schopenhauer Pty Ltd, it can be seen the net operating income generated by the project is

negative. Therefore, it can be inferred that it is not worthy to undertake investment in new

manufacturing facility.

Answer to Part C:

The overall performance of organization and behaviour of employees is

significantly affected by preparation of budget. Any organization generally relies on suing

two types of approach for preparation of budget that involves participatory budget and

imposed budget. Under imposed budget, the preparation of budget is the responsibility of

senior management who are entitled to set the parameters for decision making (Smith and

Driscoll 2017). There is little involvement of middle or lower level managers in the decision

making of budget. However, there is no effective utilization of human resources despite the

fact that they form an important source of input in budgetary preparation. One of the

disadvantages of imposed budget is that they lead to much budgetary slack and results in

occurrence of waste and efficiency if there is no proper scrutinization of the budgets

(Lindholm et al. 2014). There should be carefully reviewing of the budgets before the

outcomes are accepted.

Under participatory budget, there is active involvement of employees from different

department with the intention of providing advantage in terms of performance and benefits of

employees. The participatory budget has the implications on employees in terms of

communication between employees, achievement of gaols and motivation. Since employees

at all levels participate in the budget preparation, flow of communication and involvement is

enhanced. An organization is able to design budget by determining and setting realistic

targets when there is increased employees participation. Any undesirable behaviour on part of

9MANAGEMENT ACCOUNTING

employees can be well addressed if the organization adopts the approach of participatory

approach (Cinquini and Tenucci 2016). Employees at individual level are able to set their

budgetary goals as they are motivated from such participation.

It can be well inferred from the analysis of the two types of budget that the

participatory budget helps in addressing the behavioural concerns of employees. This is so

because implementation of this particular approach helps in facilitating the communication

flow between employees at different levels. A budget is capable of producing favourable

outcome when preparation of budget incorporates input from all employees, staff and upper

and lower level management. Employees experiencing any issues relating to the behaviour

within the organization can seek for the employment of participatory budget that would lead

to better decision making (Nørreklit 2014). When the budgets are prepared by seeking the

information from subordinates, there will be facilitation of framing realistic objectives that

will be achieved accurately. This is so because if the information are sourced from

subordinates, they are able to provide with the facts and figures about day to day operations

of business. Therefore, it is desirable on part of organization to employ participatory budget

in the preparation of budget as it would involve wide range of employees from all the

departments and helps in setting realistic budgetary goals.

employees can be well addressed if the organization adopts the approach of participatory

approach (Cinquini and Tenucci 2016). Employees at individual level are able to set their

budgetary goals as they are motivated from such participation.

It can be well inferred from the analysis of the two types of budget that the

participatory budget helps in addressing the behavioural concerns of employees. This is so

because implementation of this particular approach helps in facilitating the communication

flow between employees at different levels. A budget is capable of producing favourable

outcome when preparation of budget incorporates input from all employees, staff and upper

and lower level management. Employees experiencing any issues relating to the behaviour

within the organization can seek for the employment of participatory budget that would lead

to better decision making (Nørreklit 2014). When the budgets are prepared by seeking the

information from subordinates, there will be facilitation of framing realistic objectives that

will be achieved accurately. This is so because if the information are sourced from

subordinates, they are able to provide with the facts and figures about day to day operations

of business. Therefore, it is desirable on part of organization to employ participatory budget

in the preparation of budget as it would involve wide range of employees from all the

departments and helps in setting realistic budgetary goals.

10MANAGEMENT ACCOUNTING

References list:

Alsharari, N.M., Dixon, R. and Youssef, M.A.E.A., 2015. Management accounting change:

critical review and a new contextual framework. Journal of Accounting & Organizational

Change, 11(4), pp.476-502.s

Charifzadeh, M. and Taschner, A., 2017. Management accounting and control: tools and

concepts in a Central European context. John Wiley & Sons.

Cinquini, L. and Tenucci, A., 2016. Challenges to management accounting in the new

paradigm of service (pp. 49-71). CRC Press.

Lindholm, A., Laine, T.J. and Suomala, P., 2017. The potential of management accounting

and control in global operations: Profitability-driven service business development. Journal

of Service Theory and Practice, 27(2), pp.496-514.

Maheshwari, S., 2014. Management Accounting And Control. Vikas Publishing House Pvt

Ltd..

Nørreklit, H., 2014. Quality in qualitative management accounting research. Qualitative

Research in Accounting & Management, 11(1), pp.29-39.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Schaltegger, S. and Zvezdov, D., 2015. Expanding material flow cost accounting.

Framework, review and potentials. Journal of Cleaner Production, 108, pp.1333-1341.

References list:

Alsharari, N.M., Dixon, R. and Youssef, M.A.E.A., 2015. Management accounting change:

critical review and a new contextual framework. Journal of Accounting & Organizational

Change, 11(4), pp.476-502.s

Charifzadeh, M. and Taschner, A., 2017. Management accounting and control: tools and

concepts in a Central European context. John Wiley & Sons.

Cinquini, L. and Tenucci, A., 2016. Challenges to management accounting in the new

paradigm of service (pp. 49-71). CRC Press.

Lindholm, A., Laine, T.J. and Suomala, P., 2017. The potential of management accounting

and control in global operations: Profitability-driven service business development. Journal

of Service Theory and Practice, 27(2), pp.496-514.

Maheshwari, S., 2014. Management Accounting And Control. Vikas Publishing House Pvt

Ltd..

Nørreklit, H., 2014. Quality in qualitative management accounting research. Qualitative

Research in Accounting & Management, 11(1), pp.29-39.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research, 31, pp.45-62.

Schaltegger, S. and Zvezdov, D., 2015. Expanding material flow cost accounting.

Framework, review and potentials. Journal of Cleaner Production, 108, pp.1333-1341.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11MANAGEMENT ACCOUNTING

Smith, D. and Driscoll, T., 2017. Key skill sets for management accounting. Strategic

Finance, 98(12), pp.62-64.

Soderstrom, K.M., Soderstrom, N.S. and Stewart, C.R., 2017. Sustainability/CSR research in

management accounting: A review of the literature. In Advances in Management

Accounting (pp. 59-85). Emerald Publishing Limited.

Sungatullina, L. and Sokolov, A., 2015. Management accounting of production overheads by

groups of equipment.

Zaleha Abdul Rasid, S., Ruhana Isa, C. and Khairuzzaman Wan Ismail, W., 2014.

Management accounting systems, enterprise risk management and organizational

performance in financial institutions. Asian Review of Accounting, 22(2), pp.128-144.

Smith, D. and Driscoll, T., 2017. Key skill sets for management accounting. Strategic

Finance, 98(12), pp.62-64.

Soderstrom, K.M., Soderstrom, N.S. and Stewart, C.R., 2017. Sustainability/CSR research in

management accounting: A review of the literature. In Advances in Management

Accounting (pp. 59-85). Emerald Publishing Limited.

Sungatullina, L. and Sokolov, A., 2015. Management accounting of production overheads by

groups of equipment.

Zaleha Abdul Rasid, S., Ruhana Isa, C. and Khairuzzaman Wan Ismail, W., 2014.

Management accounting systems, enterprise risk management and organizational

performance in financial institutions. Asian Review of Accounting, 22(2), pp.128-144.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.