Report: Analysis of the Australian Economy - ECON6000 Assessment 3

VerifiedAdded on 2022/11/01

|17

|4434

|334

Report

AI Summary

This report analyzes the Australian economy, focusing on the Reserve Bank of Australia's (RBA) monetary and fiscal policies and their impact on key economic indicators. It begins by summarizing the current economic situation, including the recent reduction in the cash rate to 1% and the governor's predictions regarding inflation and unemployment. The report then discusses the performance of the Australian economy, citing GDP growth, employment figures, and the effects of international trade disputes. It analyzes the governor's predictions in light of economic theory, including the Phillips curve, and assesses the implications of monetary and fiscal policies. The report concludes by recommending effective policy measures for sustainable economic growth and stable employment and inflation rates. The analysis incorporates academic references and statistical information to support its findings.

Running head: ANALYSIS OF THE AUSTRALIAN ECONOMY

Analysis of the Australian Economy

Name of the Student

Name of the University

Author Note

Analysis of the Australian Economy

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ANALYSIS OF THE AUSTRALIAN ECONOMY

Abstract

The objective of this paper is to analyze the pragmatic approach of the statement made by the

governor of the Reserve banks of Australia regarding recovery of the Australian economy. The

effective inclusion of the monetary policy and fiscal policy is expected to bring appropriate

outcome for the economy. Nonetheless, the paper highlights some other important issues owing

to obtain a stable economic growth.

Abstract

The objective of this paper is to analyze the pragmatic approach of the statement made by the

governor of the Reserve banks of Australia regarding recovery of the Australian economy. The

effective inclusion of the monetary policy and fiscal policy is expected to bring appropriate

outcome for the economy. Nonetheless, the paper highlights some other important issues owing

to obtain a stable economic growth.

2ANALYSIS OF THE AUSTRALIAN ECONOMY

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Justification of the governor’s prediction regarding the Australian economy............................5

Analysis regarding the policy implication on the Australian economy.......................................9

Suggestions related to the effective policy measures................................................................10

Recommendations......................................................................................................................11

Conclusion.....................................................................................................................................13

References......................................................................................................................................14

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Justification of the governor’s prediction regarding the Australian economy............................5

Analysis regarding the policy implication on the Australian economy.......................................9

Suggestions related to the effective policy measures................................................................10

Recommendations......................................................................................................................11

Conclusion.....................................................................................................................................13

References......................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ANALYSIS OF THE AUSTRALIAN ECONOMY

Introduction

Australia has recently experienced a downturn progress in the economy. The sluggish

growth rate in the housing market is considered as a vital concern for this weak economic

performance. As per the governor of the Reserve Bank of Australia, the interest rate has

currently cut down by 1% in order to boost the investment for the real estate sector. This

announcement is expected to enhance the overall revenue of the real estate market. The cut down

in the interest rate is expected to encourage aspiring home buyers to take loans from the banks.

Hence, the financial sector will enhance a growth in the accumulated capital. Further, the central

bank of Australia is aimed at improving the inflation rate within a range of 2% to 3% along with

reducing the unemployment rate to 4.5% for the upcoming years. This results in the development

of the entire economy. The government has played a key role in maintaining the overall progress

of the employment sector. The growth in employment obviously enhances the purchasing power

of the consumers. Therefore, the aggregate demand gets intensified. This results in the increment

of the average price level of the commodities and therefore, the economy is likely to face

inflation. Nonetheless, the Australian economy was able to control the lower inflation rate of

1.8% during the last year. As per the findings, the government has obtained this impressive

outcome owing to the notable amalgamation of both monetary and fiscal policies. The following

section discusses about the important roles of the Australian government in determining the

effective policies for the economic progress.

Discussion

Performance analysis of the Australian economy

Introduction

Australia has recently experienced a downturn progress in the economy. The sluggish

growth rate in the housing market is considered as a vital concern for this weak economic

performance. As per the governor of the Reserve Bank of Australia, the interest rate has

currently cut down by 1% in order to boost the investment for the real estate sector. This

announcement is expected to enhance the overall revenue of the real estate market. The cut down

in the interest rate is expected to encourage aspiring home buyers to take loans from the banks.

Hence, the financial sector will enhance a growth in the accumulated capital. Further, the central

bank of Australia is aimed at improving the inflation rate within a range of 2% to 3% along with

reducing the unemployment rate to 4.5% for the upcoming years. This results in the development

of the entire economy. The government has played a key role in maintaining the overall progress

of the employment sector. The growth in employment obviously enhances the purchasing power

of the consumers. Therefore, the aggregate demand gets intensified. This results in the increment

of the average price level of the commodities and therefore, the economy is likely to face

inflation. Nonetheless, the Australian economy was able to control the lower inflation rate of

1.8% during the last year. As per the findings, the government has obtained this impressive

outcome owing to the notable amalgamation of both monetary and fiscal policies. The following

section discusses about the important roles of the Australian government in determining the

effective policies for the economic progress.

Discussion

Performance analysis of the Australian economy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ANALYSIS OF THE AUSTRALIAN ECONOMY

As per the International Monetary Fund, the GDP growth is projected at around 2% in

2019, lower than the previous year’s GDP growth rate of 2.8% in 2018. The growth rate has been

pulled down owing to the international trade dispute between the USA and China. This certain

trade issue has reduced the trade growth to about 34% during the last year. The emerging

uncertainty in the global merchandise sector has reduced the investment level in the Australian

economy (Bishop & Cassidy, 2017). However, the economy has experienced with a steady

growth in the employment sector throughout the last couple of years. In 2018, the estimated

employment percentage of the total population was around 62%. The impressive outcome

affirms the productive performance of the government policies. The central bank of Australia has

decided to slash the interest rate by 1% point owing to intensify the consumer expenditure on the

physical asset market including the estate market. In this way, the employability and productivity

related to the estate business will be improved. This results in the development of the entire

economy. The employment growth will intensify the output level as well as the job opportunity

in the economy. Meanwhile, this will encourage the purchasing power of the consumers (Baxa,

Horváth & Vašíček, 2014). The cumulative demand of the buyers will surge up. In relation to the

emerging market demand, the aggregate supply may or may not be increased. The resources

cannot be possibly altered within a short-period of time. Therefore, supply level remains

unaltered. The comprehensive price structure turns to be more expensive for the consumers.

People are compelled to pay higher price in order to buy a good (Mendes, 2017). The soaring

price level leads the economy into the inflation. In this context, both the monetary and fiscal

policies play a key role to keep the inflation rate at low level. The perfect collaboration of these

two policies can bring effective outcome for the economy. The expansionary fiscal policy

generates employment opportunity, enhances development process (Neely, 2015). The expansion

As per the International Monetary Fund, the GDP growth is projected at around 2% in

2019, lower than the previous year’s GDP growth rate of 2.8% in 2018. The growth rate has been

pulled down owing to the international trade dispute between the USA and China. This certain

trade issue has reduced the trade growth to about 34% during the last year. The emerging

uncertainty in the global merchandise sector has reduced the investment level in the Australian

economy (Bishop & Cassidy, 2017). However, the economy has experienced with a steady

growth in the employment sector throughout the last couple of years. In 2018, the estimated

employment percentage of the total population was around 62%. The impressive outcome

affirms the productive performance of the government policies. The central bank of Australia has

decided to slash the interest rate by 1% point owing to intensify the consumer expenditure on the

physical asset market including the estate market. In this way, the employability and productivity

related to the estate business will be improved. This results in the development of the entire

economy. The employment growth will intensify the output level as well as the job opportunity

in the economy. Meanwhile, this will encourage the purchasing power of the consumers (Baxa,

Horváth & Vašíček, 2014). The cumulative demand of the buyers will surge up. In relation to the

emerging market demand, the aggregate supply may or may not be increased. The resources

cannot be possibly altered within a short-period of time. Therefore, supply level remains

unaltered. The comprehensive price structure turns to be more expensive for the consumers.

People are compelled to pay higher price in order to buy a good (Mendes, 2017). The soaring

price level leads the economy into the inflation. In this context, both the monetary and fiscal

policies play a key role to keep the inflation rate at low level. The perfect collaboration of these

two policies can bring effective outcome for the economy. The expansionary fiscal policy

generates employment opportunity, enhances development process (Neely, 2015). The expansion

5ANALYSIS OF THE AUSTRALIAN ECONOMY

of the export sector is also acknowledged as an attractive outcome for an economy. This reduces

the trade deficit. The government emphasizes on the development work, which in return,

accelerates the growth in the development indicators including the human capital and standard of

living. The inhabitants of Australia are registered with high purchasing power parity.

Justification of the governor’s prediction regarding the Australian economy

According to the governor of the RBA, the authority is aimed at reducing the

unemployment rate to 4.5% along with keeping the inflation rate within a range of 2%to 3%.

Abatement of both the unemployment level and the inflation rate is the vital concern for every

economist. The policy makers seek proper amalgamation of financial policies in order to obtain

the desirable outcome (Kuttner & Shim, 2016). In the context of the Australian economy, the

governor has directed the Treasure to apply fiscal policy along with the expansionary monetary

policy to encourage the economic progress. The expansionary monetary policy is expected to

enhance the purchasing power of the consumer as the supply of money increases. Followed by

that average quantity of demand and supply soars up. This results in the improvement of the total

output level of the economy (Bjørnland & Halvorsen, 2014). On the other hand, the fiscal policy

amplifies the government expenditure in order to intensify the development process. The

adjustment of the tax rate is the key tool in determining the level of the government expenditure.

Nonetheless, the simultaneous diminution in the inflation rate and the unemployment level raise

questions on the validity of the economic laws. The decrease in the inflation rate lowers the

nominal wage and therefore, the employment rate does not get improved (Gillitzer & Simon,

2015). The unemployment rate continues to increase as inflation drops down. The rise in

inflation is likely to intensify the wage rate, which in return, allures the works to get employed.

In this way, the rising inflation results in the improvement of the employment rate. However, the

of the export sector is also acknowledged as an attractive outcome for an economy. This reduces

the trade deficit. The government emphasizes on the development work, which in return,

accelerates the growth in the development indicators including the human capital and standard of

living. The inhabitants of Australia are registered with high purchasing power parity.

Justification of the governor’s prediction regarding the Australian economy

According to the governor of the RBA, the authority is aimed at reducing the

unemployment rate to 4.5% along with keeping the inflation rate within a range of 2%to 3%.

Abatement of both the unemployment level and the inflation rate is the vital concern for every

economist. The policy makers seek proper amalgamation of financial policies in order to obtain

the desirable outcome (Kuttner & Shim, 2016). In the context of the Australian economy, the

governor has directed the Treasure to apply fiscal policy along with the expansionary monetary

policy to encourage the economic progress. The expansionary monetary policy is expected to

enhance the purchasing power of the consumer as the supply of money increases. Followed by

that average quantity of demand and supply soars up. This results in the improvement of the total

output level of the economy (Bjørnland & Halvorsen, 2014). On the other hand, the fiscal policy

amplifies the government expenditure in order to intensify the development process. The

adjustment of the tax rate is the key tool in determining the level of the government expenditure.

Nonetheless, the simultaneous diminution in the inflation rate and the unemployment level raise

questions on the validity of the economic laws. The decrease in the inflation rate lowers the

nominal wage and therefore, the employment rate does not get improved (Gillitzer & Simon,

2015). The unemployment rate continues to increase as inflation drops down. The rise in

inflation is likely to intensify the wage rate, which in return, allures the works to get employed.

In this way, the rising inflation results in the improvement of the employment rate. However, the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ANALYSIS OF THE AUSTRALIAN ECONOMY

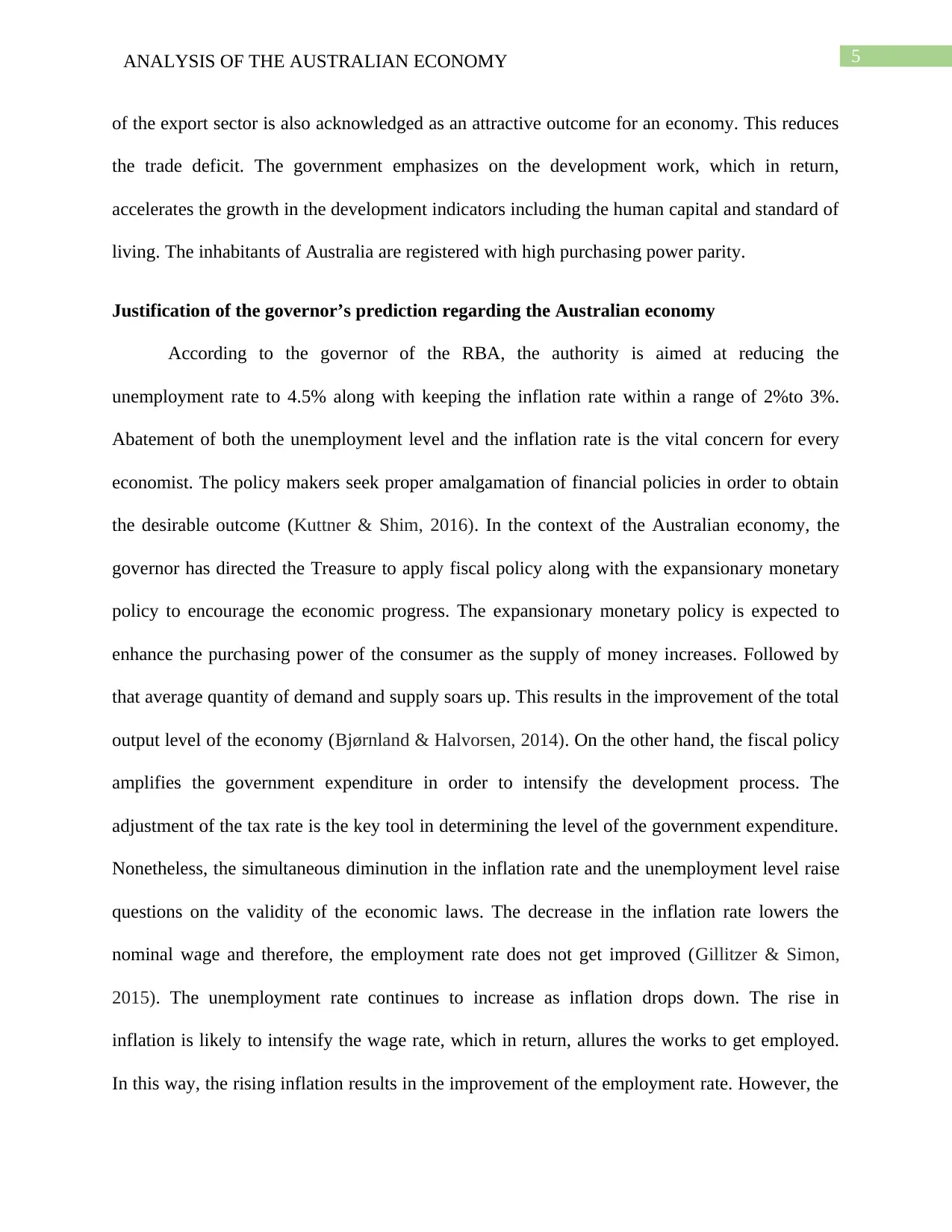

incremental impact on the employment level dose not persist for the long-term (Wu & Xia,

2016). The employment level remains stable at a certain level with respect to the long term. This

economic phenomenon has been explained by the renowned economist, named as A.W. Phillips.

As per the economist, there exists inverse relationship between the unemployment rate and the

inflation.

Figure 1: The Phillips curve

Source: (Created by the author)

The figure1 enlightens the inverse association with the help of the Phillips curve. The

curve shows that inflation together with the unemployment do not move towards the same

direction. Growing rate of inflation initially calls for the climbing wage rate. This causes a hike

in the number of employees (Monnin, 2014). The wage earners are willingly engaged in the jobs

without realizing the real purchasing power of the commodities. Meanwhile, these employees

gradually realize their real wage in the long term compared to the short term. The wage earners

incremental impact on the employment level dose not persist for the long-term (Wu & Xia,

2016). The employment level remains stable at a certain level with respect to the long term. This

economic phenomenon has been explained by the renowned economist, named as A.W. Phillips.

As per the economist, there exists inverse relationship between the unemployment rate and the

inflation.

Figure 1: The Phillips curve

Source: (Created by the author)

The figure1 enlightens the inverse association with the help of the Phillips curve. The

curve shows that inflation together with the unemployment do not move towards the same

direction. Growing rate of inflation initially calls for the climbing wage rate. This causes a hike

in the number of employees (Monnin, 2014). The wage earners are willingly engaged in the jobs

without realizing the real purchasing power of the commodities. Meanwhile, these employees

gradually realize their real wage in the long term compared to the short term. The wage earners

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ANALYSIS OF THE AUSTRALIAN ECONOMY

understand that incremental wage rate is unable to enhance their choice of commodities (Kudrna,

Tran & Woodland, 2015). Due to the cumulative impact of the abrupt growth in the price level,

the employers initially raise the wage rate to retain the existing employability. The number of

employees also get enhanced. In the figure 1, the unemployment rate is U1 in correspondence

with the inflation rate of P1%. Further, increase in the inflation rate to P2% lowers the

unemployment rate, resulting in that number of employees gets enhanced. This theory is

applicable for the short period. Conversely, the long terms provides enough time to the wage

earner to realize their own real strength of the purchasing power.

Figure 2: Long-run Philips curve

Source: (Created by the author)

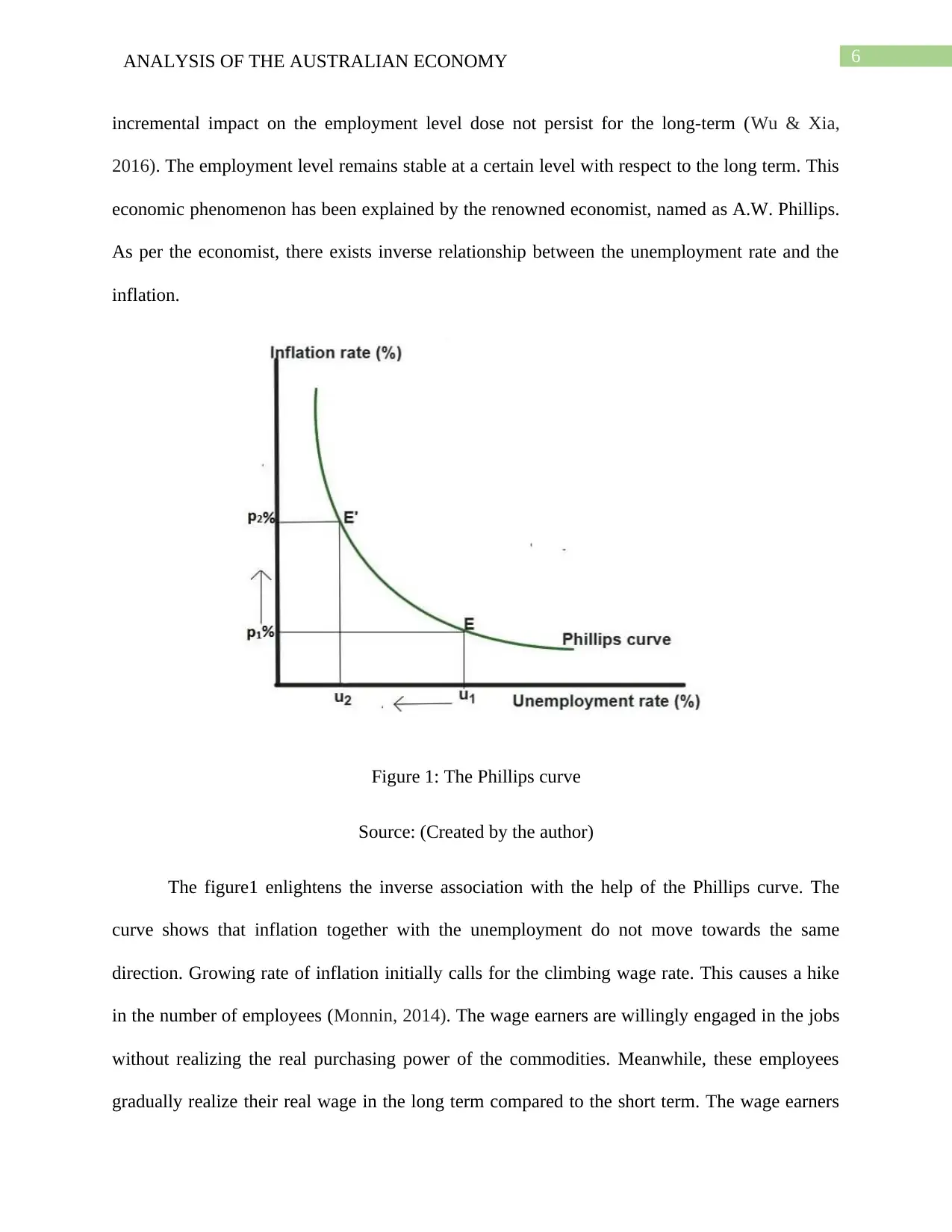

Referring to the figure 2, the long run Philips curve is parallel to the perpendicular axis. This

implies that change in the inflation rate is unable to bring any impact on the unemployment rate.

The unemployment rate remains constant at Un whether the inflation rate is at P1% or P2%. The

understand that incremental wage rate is unable to enhance their choice of commodities (Kudrna,

Tran & Woodland, 2015). Due to the cumulative impact of the abrupt growth in the price level,

the employers initially raise the wage rate to retain the existing employability. The number of

employees also get enhanced. In the figure 1, the unemployment rate is U1 in correspondence

with the inflation rate of P1%. Further, increase in the inflation rate to P2% lowers the

unemployment rate, resulting in that number of employees gets enhanced. This theory is

applicable for the short period. Conversely, the long terms provides enough time to the wage

earner to realize their own real strength of the purchasing power.

Figure 2: Long-run Philips curve

Source: (Created by the author)

Referring to the figure 2, the long run Philips curve is parallel to the perpendicular axis. This

implies that change in the inflation rate is unable to bring any impact on the unemployment rate.

The unemployment rate remains constant at Un whether the inflation rate is at P1% or P2%. The

8ANALYSIS OF THE AUSTRALIAN ECONOMY

fluctuation rate in the inflation cannot influence the employment situation. Moreover, the lower

inflation rate does not encourage the hike in the number of the service people (Lothian, 2017).

Altogether, this economic law raises questions on the validity of the statement made by the

governor of the RBA. From the pragmatic point of view, this statement will not yield stable

outcome for the Australian economy. The diminution impact on the unemployment level and

inflation rate is impossible to be realized in terms of the economic development (Morris &

Wilson, 2014).. The authority may be able to pull down the inflation rate with the help of

effective policy, though, the improvement in the unemployment rate is yet considered as a cause

of concern to the policy makers.

As a part of the monetary policy, the RBA has decided to decline the interest rate in order

to enhance the purchasing power of the consumer. The improvement in the purchasing power

intensify the cumulative demand. Owing to meet the emerging demand, the suppliers will

escalate the production process amplifying the employment level (Bauer & Neely, 2014).

However, the reduction in the interest rate is unable to yield persisting positive impact on the

employment growth. In this case, the Australian government has also decided to keep the

aggregate demand at high level with the help of the fiscal policy. The fiscal policy can fetch the

effective solution as per the long-term basis. The fiscal policy can keep the aggregate demand

high on the means of cutting tax rate or giving subsidies. The cut in the tax rate enhances the

disposable income of the buyer, resulting in that the purchasing power gets enhanced. Both the

aggregate demand along with the cumulative production level do not fall down (Rey, 2015).

Subsequently, the economy will be able to retain the desirable output level in addition to the

lower inflation rate with the help of the limiting money supply policy. Considering the pragmatic

view of the Australian economy, the application of monetary policy is more effective compared

fluctuation rate in the inflation cannot influence the employment situation. Moreover, the lower

inflation rate does not encourage the hike in the number of the service people (Lothian, 2017).

Altogether, this economic law raises questions on the validity of the statement made by the

governor of the RBA. From the pragmatic point of view, this statement will not yield stable

outcome for the Australian economy. The diminution impact on the unemployment level and

inflation rate is impossible to be realized in terms of the economic development (Morris &

Wilson, 2014).. The authority may be able to pull down the inflation rate with the help of

effective policy, though, the improvement in the unemployment rate is yet considered as a cause

of concern to the policy makers.

As a part of the monetary policy, the RBA has decided to decline the interest rate in order

to enhance the purchasing power of the consumer. The improvement in the purchasing power

intensify the cumulative demand. Owing to meet the emerging demand, the suppliers will

escalate the production process amplifying the employment level (Bauer & Neely, 2014).

However, the reduction in the interest rate is unable to yield persisting positive impact on the

employment growth. In this case, the Australian government has also decided to keep the

aggregate demand at high level with the help of the fiscal policy. The fiscal policy can fetch the

effective solution as per the long-term basis. The fiscal policy can keep the aggregate demand

high on the means of cutting tax rate or giving subsidies. The cut in the tax rate enhances the

disposable income of the buyer, resulting in that the purchasing power gets enhanced. Both the

aggregate demand along with the cumulative production level do not fall down (Rey, 2015).

Subsequently, the economy will be able to retain the desirable output level in addition to the

lower inflation rate with the help of the limiting money supply policy. Considering the pragmatic

view of the Australian economy, the application of monetary policy is more effective compared

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ANALYSIS OF THE AUSTRALIAN ECONOMY

to the fiscal policy. The government can enhance the employment level by means of decreasing

interest rate, whereas, it can regulate the growing inflation rate through tightening money supply

(Hajkowicz et al., 2016). In respect of the fiscal policy, the government finds it difficult to

implement in terms of incurring the huge cost and lack of time required for the effective

outcome. Nonetheless, the monetary policy is easy to implement and less time consuming.

Analysis regarding the policy implication on the Australian economy

In case of the monetary policy, the authority controls the inflation rate and supply of

liquid money. The government increases the interest rate owing to either control the inflation rate

or the investment level. The rise in the interest rate discourages the people in the case of taking

loans from the financial institutions (Atkin & La Cava, 2017). This pulls down the investment

level. In contrast, the banks decide to cut down the interest rate to boost the investment level.

The lowering interest rate encourages the loan activity. As a consequence of falling interest rate,

the liquid money and the purchasing power get intensified in the money market. Overall, the

aggregate price level faces a sharp rise owing to increase in the cumulative demand (Raess &

Pontusson, 2015). Owing to the limited source of supply, the suppliers increase the product price

to meet the emerging demand for the product. This situation leads the economy to the inflation

and therefore, the real purchasing power gets declined. Income disparity, growing unemployment

rate and falling saving-investment ratio are the common phenomenon when there is a high

inflation rate in the economy (Ballantyne & Langcake, 2016). To control the sudden growth in

the aggregate demand the monetary authority increases the interest rate. This results in the

contraction in the investment level and the liquid money. The saving amount in the banks gets

enhanced.

to the fiscal policy. The government can enhance the employment level by means of decreasing

interest rate, whereas, it can regulate the growing inflation rate through tightening money supply

(Hajkowicz et al., 2016). In respect of the fiscal policy, the government finds it difficult to

implement in terms of incurring the huge cost and lack of time required for the effective

outcome. Nonetheless, the monetary policy is easy to implement and less time consuming.

Analysis regarding the policy implication on the Australian economy

In case of the monetary policy, the authority controls the inflation rate and supply of

liquid money. The government increases the interest rate owing to either control the inflation rate

or the investment level. The rise in the interest rate discourages the people in the case of taking

loans from the financial institutions (Atkin & La Cava, 2017). This pulls down the investment

level. In contrast, the banks decide to cut down the interest rate to boost the investment level.

The lowering interest rate encourages the loan activity. As a consequence of falling interest rate,

the liquid money and the purchasing power get intensified in the money market. Overall, the

aggregate price level faces a sharp rise owing to increase in the cumulative demand (Raess &

Pontusson, 2015). Owing to the limited source of supply, the suppliers increase the product price

to meet the emerging demand for the product. This situation leads the economy to the inflation

and therefore, the real purchasing power gets declined. Income disparity, growing unemployment

rate and falling saving-investment ratio are the common phenomenon when there is a high

inflation rate in the economy (Ballantyne & Langcake, 2016). To control the sudden growth in

the aggregate demand the monetary authority increases the interest rate. This results in the

contraction in the investment level and the liquid money. The saving amount in the banks gets

enhanced.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ANALYSIS OF THE AUSTRALIAN ECONOMY

On the account of reviving the economic situation, the government applies two types of

fiscal policy, such that, expansionary and contractionary fiscal policy. Referring to the

contractionary fiscal policy, the government reduces the government expenditure owing to

control the aggregate demand and supply (Perry & Rowe, 2015). The government expenditure is

done in terms of giving subsidies and providing special types of monetary allowances. This

reduces the purchasing power of the consumers. This results in the contraction in the output level

and enhancement in the employment level. The government applies contractinary fiscal policy to

abate the detrimental impact of the inflation. During the course of inflation, the commodity price

increases at abrupt level (Miyazaki, 2014). The standard of living as well as the purchasing

power of the consumer get declined. In contrast, the expansionary fiscal policy is applicable to

enhance the output growth in the economy. On the means of the expansionary fiscal policy, the

government increases the government expenditure owing to influence the economic progress.

The development work gets enhanced in order to improve the output level (Downes, Hanslow &

Tulip, 2014). The overall development infrastructure helps in improving the standard of living

and purchasing power of the buyers. Both the employability and employment are the favorable

outcomes of this situation. The employment to the total population ration gets improved owing to

the increase in the fiscal expenditure. Further, this is able to bring effective outcome during the

course of stagflation. In the case of stagflation, the output level remains constant. This results in

the stagnant outcome in the cumulative demand and supply. The economic activities get

apparently stopped. The unemployment level aggravates (Carvalho, 2015). In this case, the

expansionary fiscal policy infuse capital in the economy, which in return, intensifies the

economic activities. The economic activities enhance both the cumulative demand and supply.

As a consequence of that, the market price level gets enhanced.

On the account of reviving the economic situation, the government applies two types of

fiscal policy, such that, expansionary and contractionary fiscal policy. Referring to the

contractionary fiscal policy, the government reduces the government expenditure owing to

control the aggregate demand and supply (Perry & Rowe, 2015). The government expenditure is

done in terms of giving subsidies and providing special types of monetary allowances. This

reduces the purchasing power of the consumers. This results in the contraction in the output level

and enhancement in the employment level. The government applies contractinary fiscal policy to

abate the detrimental impact of the inflation. During the course of inflation, the commodity price

increases at abrupt level (Miyazaki, 2014). The standard of living as well as the purchasing

power of the consumer get declined. In contrast, the expansionary fiscal policy is applicable to

enhance the output growth in the economy. On the means of the expansionary fiscal policy, the

government increases the government expenditure owing to influence the economic progress.

The development work gets enhanced in order to improve the output level (Downes, Hanslow &

Tulip, 2014). The overall development infrastructure helps in improving the standard of living

and purchasing power of the buyers. Both the employability and employment are the favorable

outcomes of this situation. The employment to the total population ration gets improved owing to

the increase in the fiscal expenditure. Further, this is able to bring effective outcome during the

course of stagflation. In the case of stagflation, the output level remains constant. This results in

the stagnant outcome in the cumulative demand and supply. The economic activities get

apparently stopped. The unemployment level aggravates (Carvalho, 2015). In this case, the

expansionary fiscal policy infuse capital in the economy, which in return, intensifies the

economic activities. The economic activities enhance both the cumulative demand and supply.

As a consequence of that, the market price level gets enhanced.

11ANALYSIS OF THE AUSTRALIAN ECONOMY

Suggestions related to the effective policy measures

In order to make the polices to be imperative, the government must understand the

genuine necessities of the domestic economy as well as the international economy. The

government should formulate the effective strategies to obtain desirable output. The foremost

function of the policy makers is to develop a preference doable list in accordance with the

urgency of the objectives. The fiscal policy together with the monetary policy play a significant

role in developing a productive outcome for the economy. The nature of the choice of the policy,

such that, contractionary or expansionary depends on the urgency of the country’s requirements.

The same condition is also applicable for the monetary policy. The economy should adopt the

expansionary kind of policies when the economy is experiencing the sluggish growth rate. The

employment growth deeps down, which in turn, slow the economic progress. In this case,

expansionary monetary policy including reduction in the interest rate and augmented money

supply is highly approachable. In contrast, the contraction in the money supply is applicable

when the inflation rate is increasing. Money supply needs to be controlled owing to pull down

the inflation rate (Mishra & Ray, 2014). Meanwhile, the expansionary fiscal policy acts as a

relevant tool in order to boost the economic development. The government declines the tax rate

as to enhance the aggregate demand. The cumulative purchasing capacity consequently

intensifies increases the cumulative supplied amount. Altogether, the economy is capable of

enhancing better output level for the economy (Eccleston & Woolley, 2014). In contrast, the

government should minimize the public expenditure during the course of the recession period as

the economy produces output below its capacity. In this case, the resources are not utilized at

optimum level. Overall, the productivity and employability get declined all through such a

Suggestions related to the effective policy measures

In order to make the polices to be imperative, the government must understand the

genuine necessities of the domestic economy as well as the international economy. The

government should formulate the effective strategies to obtain desirable output. The foremost

function of the policy makers is to develop a preference doable list in accordance with the

urgency of the objectives. The fiscal policy together with the monetary policy play a significant

role in developing a productive outcome for the economy. The nature of the choice of the policy,

such that, contractionary or expansionary depends on the urgency of the country’s requirements.

The same condition is also applicable for the monetary policy. The economy should adopt the

expansionary kind of policies when the economy is experiencing the sluggish growth rate. The

employment growth deeps down, which in turn, slow the economic progress. In this case,

expansionary monetary policy including reduction in the interest rate and augmented money

supply is highly approachable. In contrast, the contraction in the money supply is applicable

when the inflation rate is increasing. Money supply needs to be controlled owing to pull down

the inflation rate (Mishra & Ray, 2014). Meanwhile, the expansionary fiscal policy acts as a

relevant tool in order to boost the economic development. The government declines the tax rate

as to enhance the aggregate demand. The cumulative purchasing capacity consequently

intensifies increases the cumulative supplied amount. Altogether, the economy is capable of

enhancing better output level for the economy (Eccleston & Woolley, 2014). In contrast, the

government should minimize the public expenditure during the course of the recession period as

the economy produces output below its capacity. In this case, the resources are not utilized at

optimum level. Overall, the productivity and employability get declined all through such a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.