Report: Financial Performance Analysis of Gatsby Grange (UK Hotel)

VerifiedAdded on 2023/01/10

|15

|2616

|44

Report

AI Summary

This report provides a comprehensive financial analysis of Gatsby Grange, a UK hotel, examining its financial performance through ratio analysis. The study calculates and interprets profitability ratios (gross profit, net profit, return on assets, return on capital employed), liquidity ratios (current ratio, quick ratio), and gearing ratios (debt to equity, debt ratio) for the years 2018 and 2019. The analysis highlights trends, such as declining gross and net profit margins in 2019, and assesses the company's liquidity and solvency positions. Furthermore, the report emphasizes the importance of understanding ratio analysis for informed decision-making in the hotel industry, discussing its benefits (e.g., identifying financial trends, facilitating comparisons, supporting investment decisions) and limitations (e.g., potential for manipulation, disregard for qualitative factors, seasonal business considerations). The report concludes by illustrating how ratio analysis can aid in evaluating the company's funding, expenditure, and operational decisions.

ANALYSIS OF

FINANCIAL

STATEMENT

FINANCIAL

STATEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The study summarises the financial performance of Gatsby Grange through computation

of different financial ratios to assess the actual financial status of corporation. This also contains

essentialness of comprehending ratios and any fluctuations in ratios with aim to analysing hotel

management. It further summarises key advantages and disadvantages of ratios with object to

understand their importance in decision making.

The study summarises the financial performance of Gatsby Grange through computation

of different financial ratios to assess the actual financial status of corporation. This also contains

essentialness of comprehending ratios and any fluctuations in ratios with aim to analysing hotel

management. It further summarises key advantages and disadvantages of ratios with object to

understand their importance in decision making.

Contents

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Task 1.....................................................................................................................................4

Task 2...................................................................................................................................13

REFERENCES..............................................................................................................................14

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Task 1.....................................................................................................................................4

Task 2...................................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

It is essential for business entities to do proper analysis of financial statement so that

managers can take suitable action for different types of decisions (Kopanja, Tadić and

Žunić,2018). The analysis of financial statements can be done by help of range of techniques

such as ratio analysis. The project report is based on financial analysis of Gatsby Grange

company which is a part of small chain of Boutique in UK. The report covers detailed

information about different kinds of ratios, role of this technique for business entities.

MAIN BODY

Task 1

(a) Calculation and analysis of financial information on the basis of ratio analysis.

Profitability ratio- It is defined as a form of ratio which is being used by companies in

order to measure level of profitability of different kinds of operations and activities.

Under this, a range of ratios are included and some of them are calculated in such

manner:

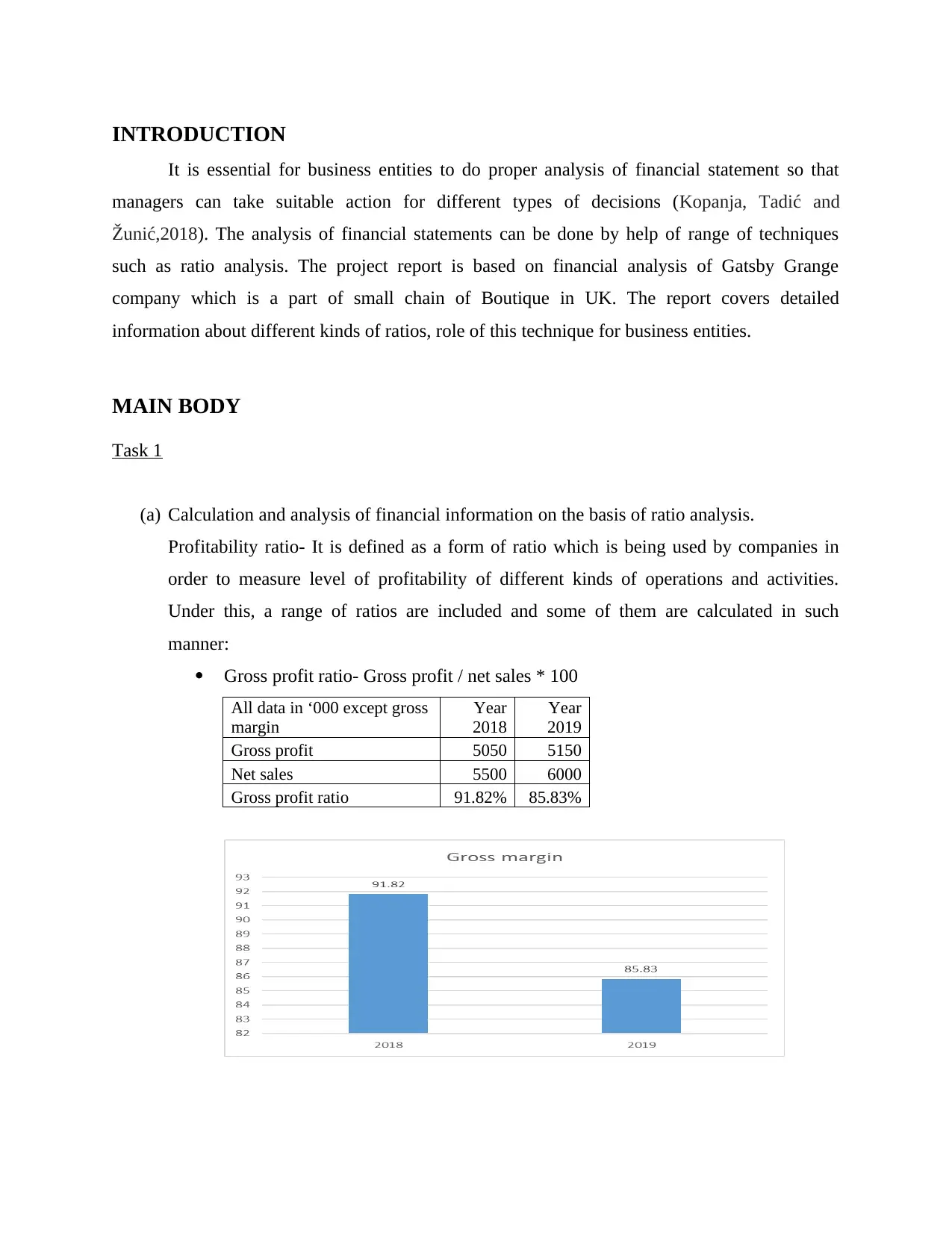

Gross profit ratio- Gross profit / net sales * 100

All data in ‘000 except gross

margin

Year

2018

Year

2019

Gross profit 5050 5150

Net sales 5500 6000

Gross profit ratio 91.82% 85.83%

It is essential for business entities to do proper analysis of financial statement so that

managers can take suitable action for different types of decisions (Kopanja, Tadić and

Žunić,2018). The analysis of financial statements can be done by help of range of techniques

such as ratio analysis. The project report is based on financial analysis of Gatsby Grange

company which is a part of small chain of Boutique in UK. The report covers detailed

information about different kinds of ratios, role of this technique for business entities.

MAIN BODY

Task 1

(a) Calculation and analysis of financial information on the basis of ratio analysis.

Profitability ratio- It is defined as a form of ratio which is being used by companies in

order to measure level of profitability of different kinds of operations and activities.

Under this, a range of ratios are included and some of them are calculated in such

manner:

Gross profit ratio- Gross profit / net sales * 100

All data in ‘000 except gross

margin

Year

2018

Year

2019

Gross profit 5050 5150

Net sales 5500 6000

Gross profit ratio 91.82% 85.83%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Analysis- The above mentioned chart is indicating that company’s gross margin

has been droped in year 2019 as compared to year 2018. This is so because of

lower increase in gross profit. Hence, company should focus on reduction of cost

of sales.

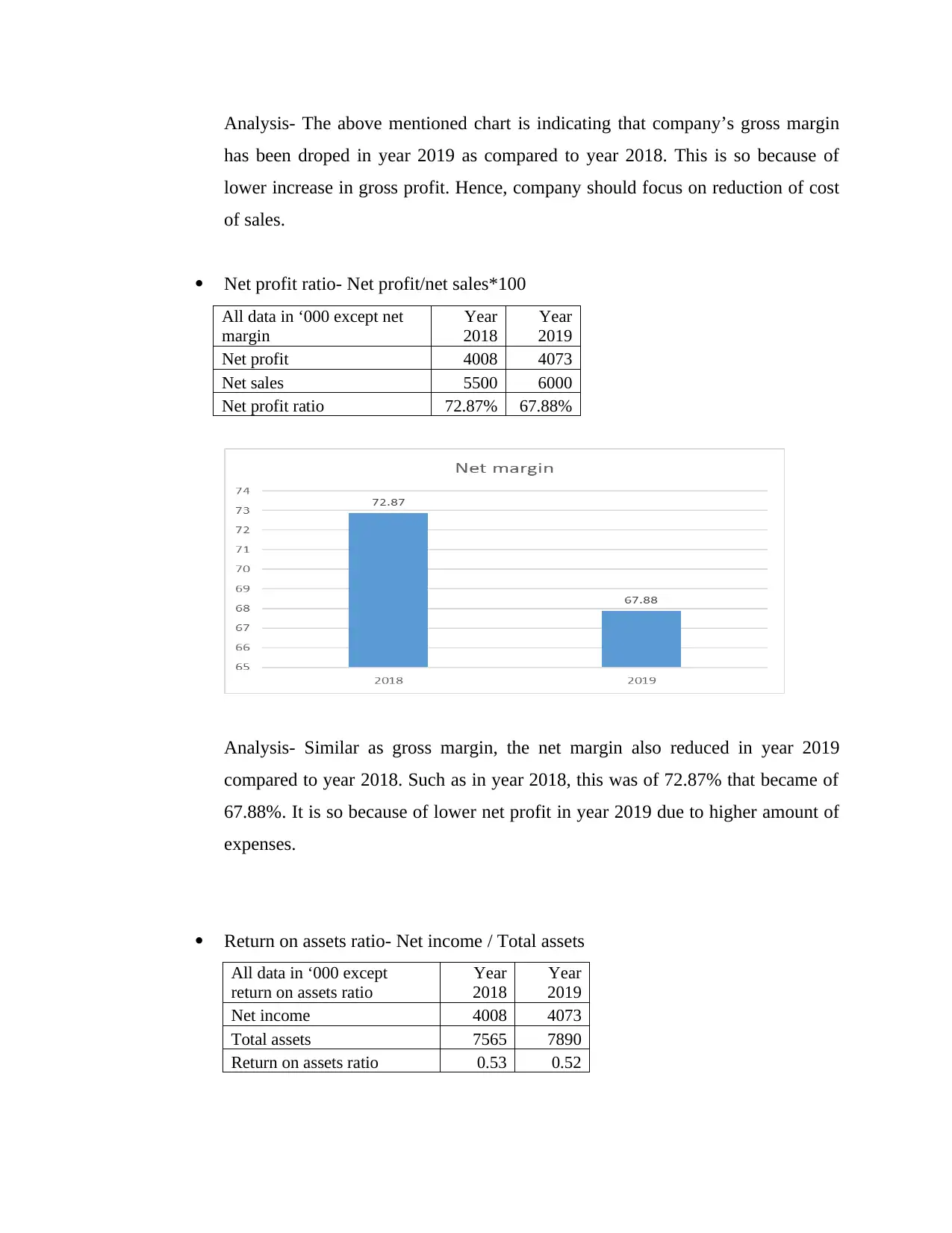

Net profit ratio- Net profit/net sales*100

All data in ‘000 except net

margin

Year

2018

Year

2019

Net profit 4008 4073

Net sales 5500 6000

Net profit ratio 72.87% 67.88%

Analysis- Similar as gross margin, the net margin also reduced in year 2019

compared to year 2018. Such as in year 2018, this was of 72.87% that became of

67.88%. It is so because of lower net profit in year 2019 due to higher amount of

expenses.

Return on assets ratio- Net income / Total assets

All data in ‘000 except

return on assets ratio

Year

2018

Year

2019

Net income 4008 4073

Total assets 7565 7890

Return on assets ratio 0.53 0.52

has been droped in year 2019 as compared to year 2018. This is so because of

lower increase in gross profit. Hence, company should focus on reduction of cost

of sales.

Net profit ratio- Net profit/net sales*100

All data in ‘000 except net

margin

Year

2018

Year

2019

Net profit 4008 4073

Net sales 5500 6000

Net profit ratio 72.87% 67.88%

Analysis- Similar as gross margin, the net margin also reduced in year 2019

compared to year 2018. Such as in year 2018, this was of 72.87% that became of

67.88%. It is so because of lower net profit in year 2019 due to higher amount of

expenses.

Return on assets ratio- Net income / Total assets

All data in ‘000 except

return on assets ratio

Year

2018

Year

2019

Net income 4008 4073

Total assets 7565 7890

Return on assets ratio 0.53 0.52

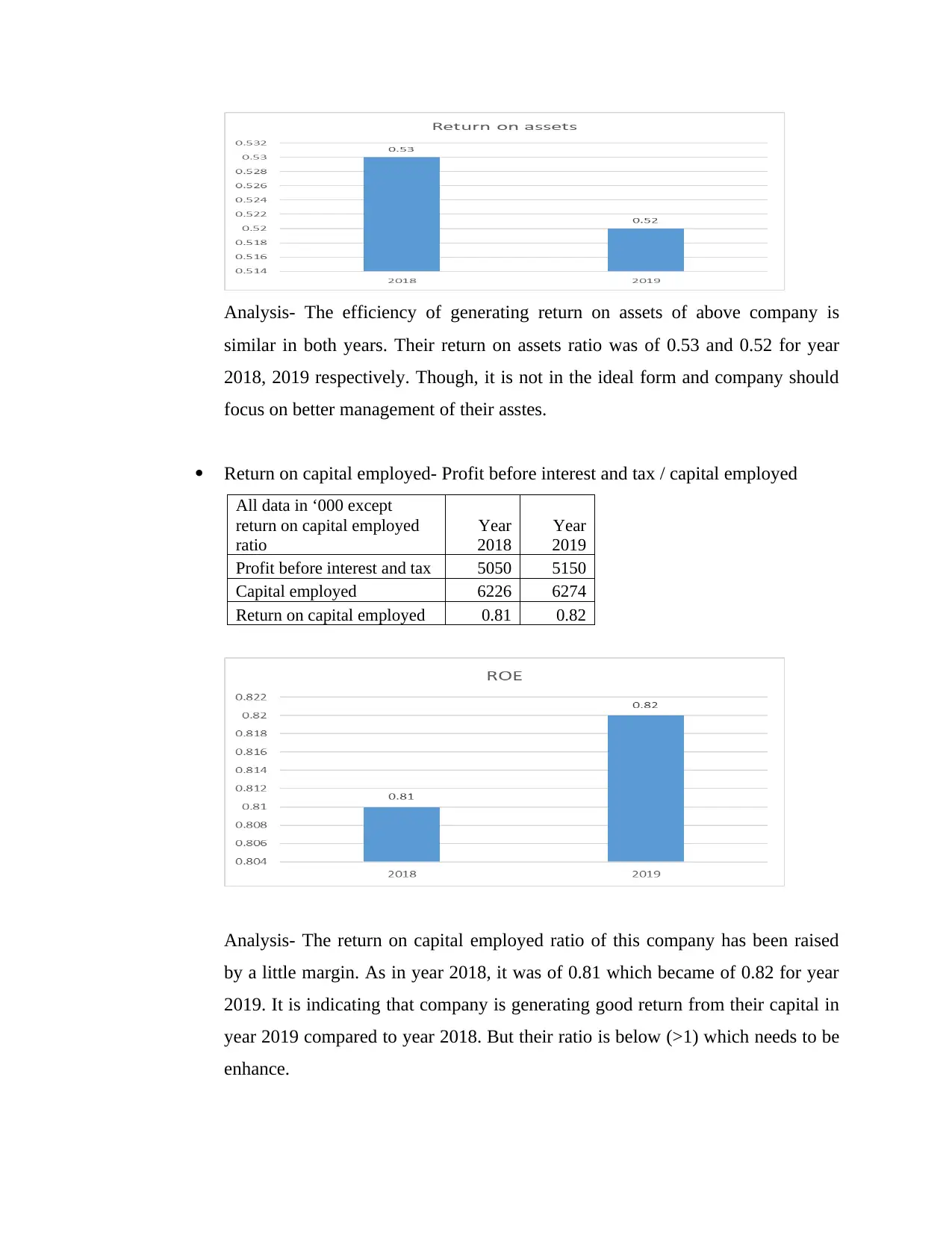

Analysis- The efficiency of generating return on assets of above company is

similar in both years. Their return on assets ratio was of 0.53 and 0.52 for year

2018, 2019 respectively. Though, it is not in the ideal form and company should

focus on better management of their asstes.

Return on capital employed- Profit before interest and tax / capital employed

All data in ‘000 except

return on capital employed

ratio

Year

2018

Year

2019

Profit before interest and tax 5050 5150

Capital employed 6226 6274

Return on capital employed 0.81 0.82

Analysis- The return on capital employed ratio of this company has been raised

by a little margin. As in year 2018, it was of 0.81 which became of 0.82 for year

2019. It is indicating that company is generating good return from their capital in

year 2019 compared to year 2018. But their ratio is below (>1) which needs to be

enhance.

similar in both years. Their return on assets ratio was of 0.53 and 0.52 for year

2018, 2019 respectively. Though, it is not in the ideal form and company should

focus on better management of their asstes.

Return on capital employed- Profit before interest and tax / capital employed

All data in ‘000 except

return on capital employed

ratio

Year

2018

Year

2019

Profit before interest and tax 5050 5150

Capital employed 6226 6274

Return on capital employed 0.81 0.82

Analysis- The return on capital employed ratio of this company has been raised

by a little margin. As in year 2018, it was of 0.81 which became of 0.82 for year

2019. It is indicating that company is generating good return from their capital in

year 2019 compared to year 2018. But their ratio is below (>1) which needs to be

enhance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Liquidity ratio- This can be understood as a form of ratio which is measured by companies in

order to know about liquidity condition for a particular time frame (Behkami, Gholami and

Bakirdere, 2017). By help of this ratio, it becomes easier for financial managers to know about

value of their current assets in order to make payment of liabilities. Under it, different types of

ratios are included and some of them are as follows:

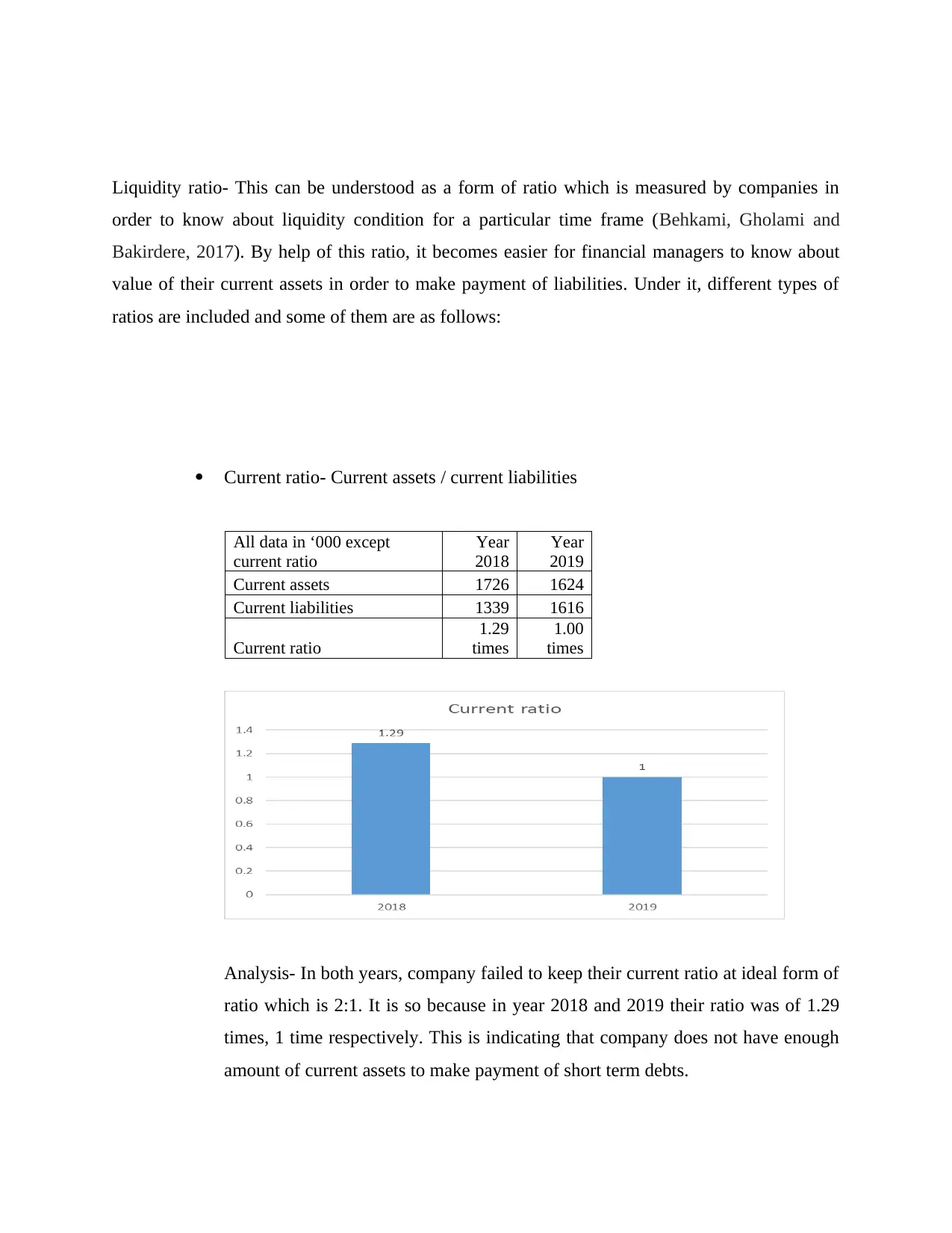

Current ratio- Current assets / current liabilities

All data in ‘000 except

current ratio

Year

2018

Year

2019

Current assets 1726 1624

Current liabilities 1339 1616

Current ratio

1.29

times

1.00

times

Analysis- In both years, company failed to keep their current ratio at ideal form of

ratio which is 2:1. It is so because in year 2018 and 2019 their ratio was of 1.29

times, 1 time respectively. This is indicating that company does not have enough

amount of current assets to make payment of short term debts.

order to know about liquidity condition for a particular time frame (Behkami, Gholami and

Bakirdere, 2017). By help of this ratio, it becomes easier for financial managers to know about

value of their current assets in order to make payment of liabilities. Under it, different types of

ratios are included and some of them are as follows:

Current ratio- Current assets / current liabilities

All data in ‘000 except

current ratio

Year

2018

Year

2019

Current assets 1726 1624

Current liabilities 1339 1616

Current ratio

1.29

times

1.00

times

Analysis- In both years, company failed to keep their current ratio at ideal form of

ratio which is 2:1. It is so because in year 2018 and 2019 their ratio was of 1.29

times, 1 time respectively. This is indicating that company does not have enough

amount of current assets to make payment of short term debts.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

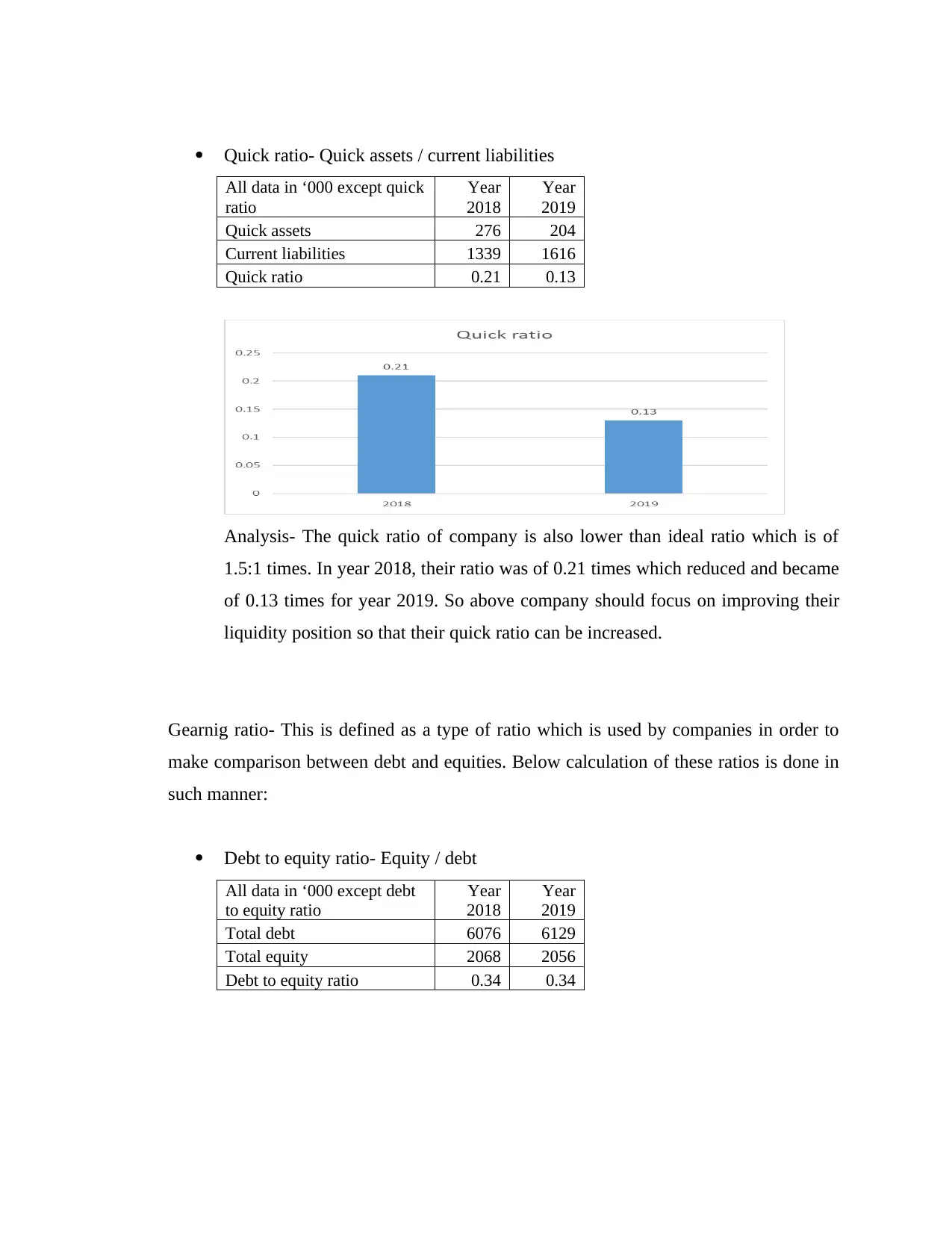

Quick ratio- Quick assets / current liabilities

All data in ‘000 except quick

ratio

Year

2018

Year

2019

Quick assets 276 204

Current liabilities 1339 1616

Quick ratio 0.21 0.13

Analysis- The quick ratio of company is also lower than ideal ratio which is of

1.5:1 times. In year 2018, their ratio was of 0.21 times which reduced and became

of 0.13 times for year 2019. So above company should focus on improving their

liquidity position so that their quick ratio can be increased.

Gearnig ratio- This is defined as a type of ratio which is used by companies in order to

make comparison between debt and equities. Below calculation of these ratios is done in

such manner:

Debt to equity ratio- Equity / debt

All data in ‘000 except debt

to equity ratio

Year

2018

Year

2019

Total debt 6076 6129

Total equity 2068 2056

Debt to equity ratio 0.34 0.34

All data in ‘000 except quick

ratio

Year

2018

Year

2019

Quick assets 276 204

Current liabilities 1339 1616

Quick ratio 0.21 0.13

Analysis- The quick ratio of company is also lower than ideal ratio which is of

1.5:1 times. In year 2018, their ratio was of 0.21 times which reduced and became

of 0.13 times for year 2019. So above company should focus on improving their

liquidity position so that their quick ratio can be increased.

Gearnig ratio- This is defined as a type of ratio which is used by companies in order to

make comparison between debt and equities. Below calculation of these ratios is done in

such manner:

Debt to equity ratio- Equity / debt

All data in ‘000 except debt

to equity ratio

Year

2018

Year

2019

Total debt 6076 6129

Total equity 2068 2056

Debt to equity ratio 0.34 0.34

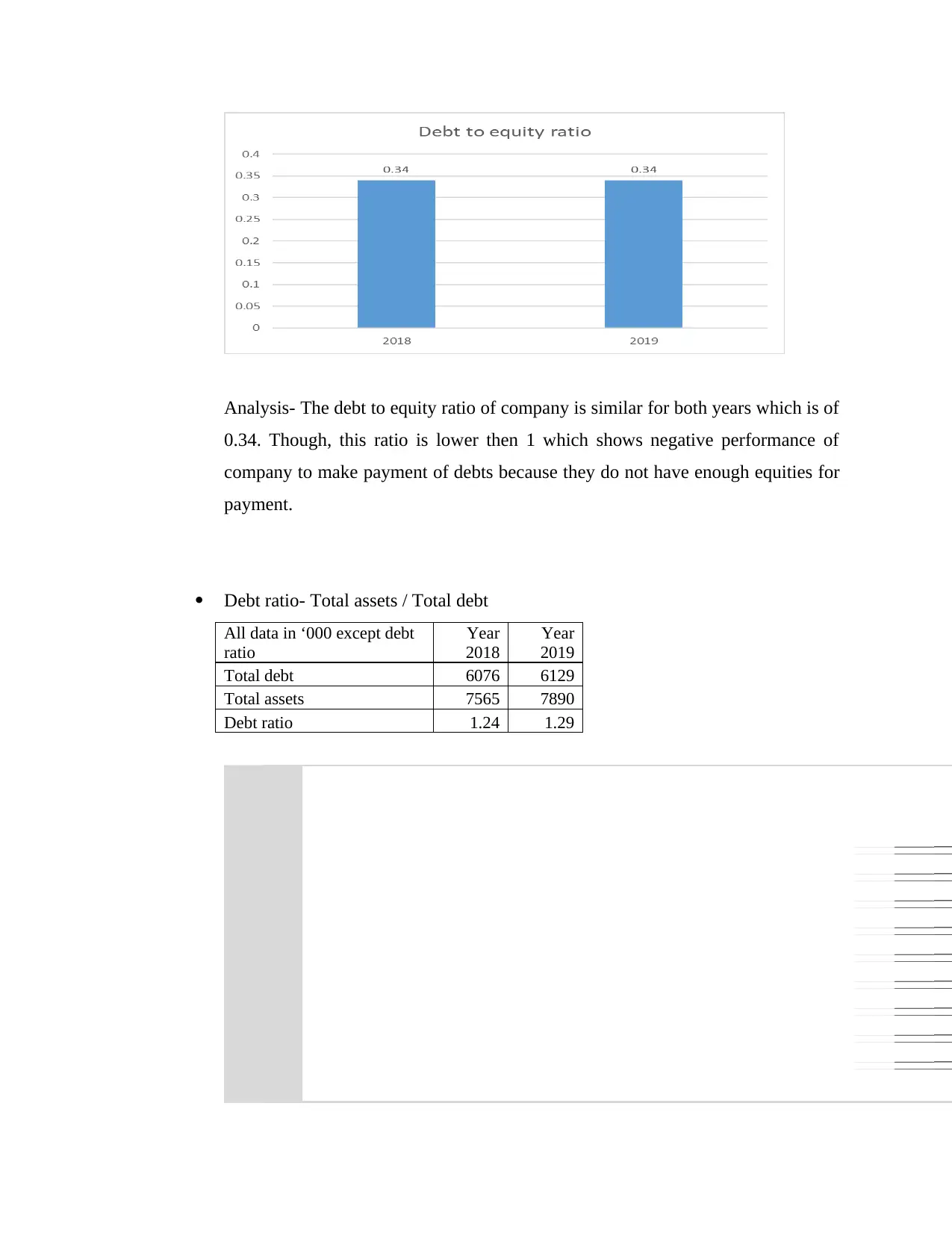

Analysis- The debt to equity ratio of company is similar for both years which is of

0.34. Though, this ratio is lower then 1 which shows negative performance of

company to make payment of debts because they do not have enough equities for

payment.

Debt ratio- Total assets / Total debt

All data in ‘000 except debt

ratio

Year

2018

Year

2019

Total debt 6076 6129

Total assets 7565 7890

Debt ratio 1.24 1.29

0.34. Though, this ratio is lower then 1 which shows negative performance of

company to make payment of debts because they do not have enough equities for

payment.

Debt ratio- Total assets / Total debt

All data in ‘000 except debt

ratio

Year

2018

Year

2019

Total debt 6076 6129

Total assets 7565 7890

Debt ratio 1.24 1.29

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis- The debt ratio of company is in good condition because they have more

amount of assets in order to make payment of their debts. Like in year 2018, their

ratio was of 1.24 which raised and became of 1.29 in year 2019. This is showing

that company has good financial situation to pay their debts in both financial

years.

(b) Why understanding of ratio analysis is important.

Under ratio analysis, different types of ratios are included and each of them plays a key

role for understanding trends in financial position of a company. In the above part of report, three

types of ratios have been calculated and analyzed which are profitability, liquidity and gearing

ratio. Herein, below importance of these ratios in regards with above compay is mentioned in

such manner-

The analysis of ratios and their fluctuation play a key role for hotel management

industries. It is so because if a company becomes able to identify variation in

financial performance during two years and then they can apply effective

strategies accordingly (Helmy and Arslan, 2018). Like in above Gatsby Grange

company, different types of ratios are calculated by help of prepared financial

statements. By help of these ratios, they can assess those areas in which their

performance is weak. As well as for next year they can implement effective

strategies and policies to overcome from weaknesses.

In addition, the ratio analysis also plays a key role to companies to make proper

evaluation of financial performance in less time. It is so bcause this can become

difficult for companies to understand their each financial statement and making

analysis accordingly. The ratio analysis gives a proper overview of each aspect

including profitability, gearing efficiency etc. Such as in the above Gatsby Grange

company, they have computed different types of ratios and each of them provide a

detailed overview of various kinds of aspects. While in the absence of ratio

analysis, company may face different types of obstacles such consumption of time

in order to evaluation financial performance by help of financial statements.

amount of assets in order to make payment of their debts. Like in year 2018, their

ratio was of 1.24 which raised and became of 1.29 in year 2019. This is showing

that company has good financial situation to pay their debts in both financial

years.

(b) Why understanding of ratio analysis is important.

Under ratio analysis, different types of ratios are included and each of them plays a key

role for understanding trends in financial position of a company. In the above part of report, three

types of ratios have been calculated and analyzed which are profitability, liquidity and gearing

ratio. Herein, below importance of these ratios in regards with above compay is mentioned in

such manner-

The analysis of ratios and their fluctuation play a key role for hotel management

industries. It is so because if a company becomes able to identify variation in

financial performance during two years and then they can apply effective

strategies accordingly (Helmy and Arslan, 2018). Like in above Gatsby Grange

company, different types of ratios are calculated by help of prepared financial

statements. By help of these ratios, they can assess those areas in which their

performance is weak. As well as for next year they can implement effective

strategies and policies to overcome from weaknesses.

In addition, the ratio analysis also plays a key role to companies to make proper

evaluation of financial performance in less time. It is so bcause this can become

difficult for companies to understand their each financial statement and making

analysis accordingly. The ratio analysis gives a proper overview of each aspect

including profitability, gearing efficiency etc. Such as in the above Gatsby Grange

company, they have computed different types of ratios and each of them provide a

detailed overview of various kinds of aspects. While in the absence of ratio

analysis, company may face different types of obstacles such consumption of time

in order to evaluation financial performance by help of financial statements.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

One of the key feature of ratio analysis is that under this technique financial

performance of two different types of years is computed (Li, Chang and Yang,

2017). By help of this, it becomes easier to managers to find out variation in

performance. As in the above company, they computed different kinds of ratios

regards to a range of aspects. Due to which, it became helpful for them to

understand trends in financial performance of year 2018 and 2019.

(c) Benefits and limitations related to application of ratios analysis to support or help in decision

making within tourism or hotel Industry:

When properly applied, the ratio analysis sheds light on many of company's challenges

and even identifies some promising ones. In fact, ratios are informants, they attract the attention

of management to problems that need attention. Here are several key advantages of evaluating

the ratios in context of Tourism and Hotel industry, as discussed below:

Analysis of financial ratios can aid to justify or disprove the company's funding,

expenditure and operational decisions (Mo, Du and Yang, 2017). They translate the

financial reports into comparative statistics, thus allowing management to effectively

compare and measure the company’s financial situation and impact of certain decisions.

• This simplifies complicated financial accounts and financial details into normal operating

ratios, business results, liquidity, long-term financial positions etc.

• The management also has an interest in the aggregate profitability level or degree of the

business. They would like to recognize if the company has the capabilities to fulfil both

its shorter-term and longer-term obligations towards its lenders, to ensure a satisfactory

return to its stockholders and to achieve optimal use of the company's assets. This is

conceivable when considering all of the ratios together.

• Evaluation of ratio helps define weak points and gives management focus to those areas.

Many of the details in the complicated financial reports are missing, and averages can

help define those issues.

• Enables the organization to make comparative analysis with other companies, industry

norms, intra-firm comparisons etc. That will allow the company better grasp its economic

fiscal status.

performance of two different types of years is computed (Li, Chang and Yang,

2017). By help of this, it becomes easier to managers to find out variation in

performance. As in the above company, they computed different kinds of ratios

regards to a range of aspects. Due to which, it became helpful for them to

understand trends in financial performance of year 2018 and 2019.

(c) Benefits and limitations related to application of ratios analysis to support or help in decision

making within tourism or hotel Industry:

When properly applied, the ratio analysis sheds light on many of company's challenges

and even identifies some promising ones. In fact, ratios are informants, they attract the attention

of management to problems that need attention. Here are several key advantages of evaluating

the ratios in context of Tourism and Hotel industry, as discussed below:

Analysis of financial ratios can aid to justify or disprove the company's funding,

expenditure and operational decisions (Mo, Du and Yang, 2017). They translate the

financial reports into comparative statistics, thus allowing management to effectively

compare and measure the company’s financial situation and impact of certain decisions.

• This simplifies complicated financial accounts and financial details into normal operating

ratios, business results, liquidity, long-term financial positions etc.

• The management also has an interest in the aggregate profitability level or degree of the

business. They would like to recognize if the company has the capabilities to fulfil both

its shorter-term and longer-term obligations towards its lenders, to ensure a satisfactory

return to its stockholders and to achieve optimal use of the company's assets. This is

conceivable when considering all of the ratios together.

• Evaluation of ratio helps define weak points and gives management focus to those areas.

Many of the details in the complicated financial reports are missing, and averages can

help define those issues.

• Enables the organization to make comparative analysis with other companies, industry

norms, intra-firm comparisons etc. That will allow the company better grasp its economic

fiscal status.

• Analysis of financial ratios show the extent of productivity of its assets handling or

management and use. The operating efficiency is demonstrated by different

operational ratios. In fact, a company's solvency relies on revenues generated through the

usage of its assets.

• Further, ratio analysis being used to evaluate a company's long-term debts-paying

capability. Any borrower’s longer-term solvency status is a primary concern for long-

term investors, security analysts and business' present and future owners (Jeong, Kang

and Lee, 2018). This is evaluated by leverage / capital framework and profit margin ratios

indicating earning power and effectiveness of its operations. Ratio analysis depicts key

strengths as well as weakness of corporation in this regard.

Limitations of Ratio Analysis:

Although ratios are quite vital aspects in financial analysis, these have certain drawbacks in

context of Tourism and Hotel industry, such as:

• To enhance their ratios, a company may make certain year-end adjustments to its

financial statements. Instead the ratios will eventually wind up and is nothing more than

window dressing.

• Ratios neglect adjustments in price levels due to inflation. Many calculations are

measured using historical prices, and the shifts in price levels between years are ignored.

That does not represent financial situation correctly.

• Financial ratios disregard the company's qualitative aspects altogether. They just take into

account the money - related (quantitative) elements.

• The ratios do not have standard definitions. Thus businesses may use different equations

for different ratios (Hondro, 2018). One such instance is Current Ratio, wherein some

companies consider all current obligations into account, while others neglect banking

overdrafts from current obligations when determining company's current ratio.

• Adequate care should be exercised when evaluating measured financial ratio for hotel

industry seasonal business. A Hotel in specific, for instance, attain higher sales in specific

season and its sales is 35 percent of seasonal sales for remaining year. Gross margin and

net profits are thus giving a biased image.

management and use. The operating efficiency is demonstrated by different

operational ratios. In fact, a company's solvency relies on revenues generated through the

usage of its assets.

• Further, ratio analysis being used to evaluate a company's long-term debts-paying

capability. Any borrower’s longer-term solvency status is a primary concern for long-

term investors, security analysts and business' present and future owners (Jeong, Kang

and Lee, 2018). This is evaluated by leverage / capital framework and profit margin ratios

indicating earning power and effectiveness of its operations. Ratio analysis depicts key

strengths as well as weakness of corporation in this regard.

Limitations of Ratio Analysis:

Although ratios are quite vital aspects in financial analysis, these have certain drawbacks in

context of Tourism and Hotel industry, such as:

• To enhance their ratios, a company may make certain year-end adjustments to its

financial statements. Instead the ratios will eventually wind up and is nothing more than

window dressing.

• Ratios neglect adjustments in price levels due to inflation. Many calculations are

measured using historical prices, and the shifts in price levels between years are ignored.

That does not represent financial situation correctly.

• Financial ratios disregard the company's qualitative aspects altogether. They just take into

account the money - related (quantitative) elements.

• The ratios do not have standard definitions. Thus businesses may use different equations

for different ratios (Hondro, 2018). One such instance is Current Ratio, wherein some

companies consider all current obligations into account, while others neglect banking

overdrafts from current obligations when determining company's current ratio.

• Adequate care should be exercised when evaluating measured financial ratio for hotel

industry seasonal business. A Hotel in specific, for instance, attain higher sales in specific

season and its sales is 35 percent of seasonal sales for remaining year. Gross margin and

net profits are thus giving a biased image.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.