Analysis of Financial Statements: Ffion Ltd (2017 & 2018) Performance

VerifiedAdded on 2023/01/18

|11

|2715

|81

Report

AI Summary

This report provides a detailed financial analysis of Ffion Ltd, a hospitality company, for the years 2017 and 2018. It begins with an introduction to financial statements and the importance of ratio analysis in assessing a company's financial health. The report calculates and interprets various financial ratios, including profitability, liquidity, efficiency, and gearing ratios, to evaluate Ffion Ltd's performance. It examines the fluctuations in these ratios and discusses their implications for hotel management, highlighting the decline in profitability and the need for improved strategies to boost sales and control costs. The report also covers the pros and limitations of ratio analysis in decision-making, offering a comprehensive overview of the company's financial position and providing insights into its strengths and weaknesses.

ANALYSIS OF THE

FINANCIAL STATEMENT

FINANCIAL STATEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

a) Calculation of ratios for the year 2017 and 2018 for analysing the financial statements........1

b) Discussion on understanding of the ratios and their fluctuations in hotel management.........7

c) Pros and limitations of ratio analysis in decision making.......................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

a) Calculation of ratios for the year 2017 and 2018 for analysing the financial statements........1

b) Discussion on understanding of the ratios and their fluctuations in hotel management.........7

c) Pros and limitations of ratio analysis in decision making.......................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Financials statement of company helps in analysing the health and position. They are

prepared by ever company carrying on the business for keeping record of its transactions. For

assessing whether company is able to carry out its operations efficiently or not financial

statement are used by various users. Financial statements of the company are prepared applying

given standards and regulatory frameworks for recording the transaction of company (Han, Oh

and Kim, 2017). There are various tools and techniques used by professionals for assessing the

financial performance. One of the most commonly used term is ratio analysis that is used for

getting the actual standing of the company. In the present report ratio analysis is done of a

hospitality company Ffion for giving an understanding about financial statements. It will cover

the importance of ration analysis and their fluctuation influencing the organisations. Benefits

and limitations of ration analysis will also be discussed in the study.

TASK 1

a) Calculation of ratios for the year 2017 and 2018 for analysing the financial statements.

Ratio analysis of Ffion Ltd.

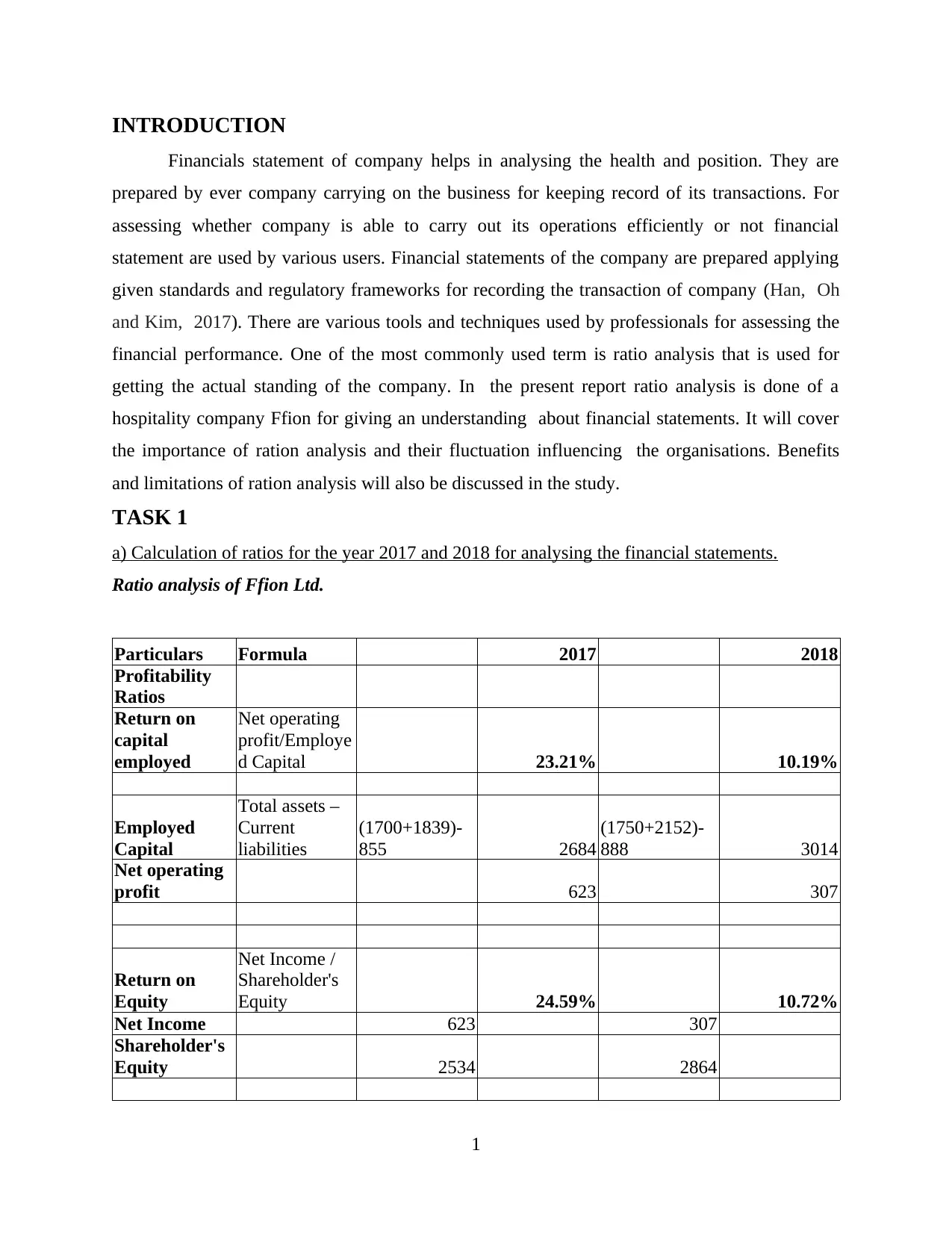

Particulars Formula 2017 2018

Profitability

Ratios

Return on

capital

employed

Net operating

profit/Employe

d Capital 23.21% 10.19%

Employed

Capital

Total assets –

Current

liabilities

(1700+1839)-

855 2684

(1750+2152)-

888 3014

Net operating

profit 623 307

Return on

Equity

Net Income /

Shareholder's

Equity 24.59% 10.72%

Net Income 623 307

Shareholder's

Equity 2534 2864

1

Financials statement of company helps in analysing the health and position. They are

prepared by ever company carrying on the business for keeping record of its transactions. For

assessing whether company is able to carry out its operations efficiently or not financial

statement are used by various users. Financial statements of the company are prepared applying

given standards and regulatory frameworks for recording the transaction of company (Han, Oh

and Kim, 2017). There are various tools and techniques used by professionals for assessing the

financial performance. One of the most commonly used term is ratio analysis that is used for

getting the actual standing of the company. In the present report ratio analysis is done of a

hospitality company Ffion for giving an understanding about financial statements. It will cover

the importance of ration analysis and their fluctuation influencing the organisations. Benefits

and limitations of ration analysis will also be discussed in the study.

TASK 1

a) Calculation of ratios for the year 2017 and 2018 for analysing the financial statements.

Ratio analysis of Ffion Ltd.

Particulars Formula 2017 2018

Profitability

Ratios

Return on

capital

employed

Net operating

profit/Employe

d Capital 23.21% 10.19%

Employed

Capital

Total assets –

Current

liabilities

(1700+1839)-

855 2684

(1750+2152)-

888 3014

Net operating

profit 623 307

Return on

Equity

Net Income /

Shareholder's

Equity 24.59% 10.72%

Net Income 623 307

Shareholder's

Equity 2534 2864

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

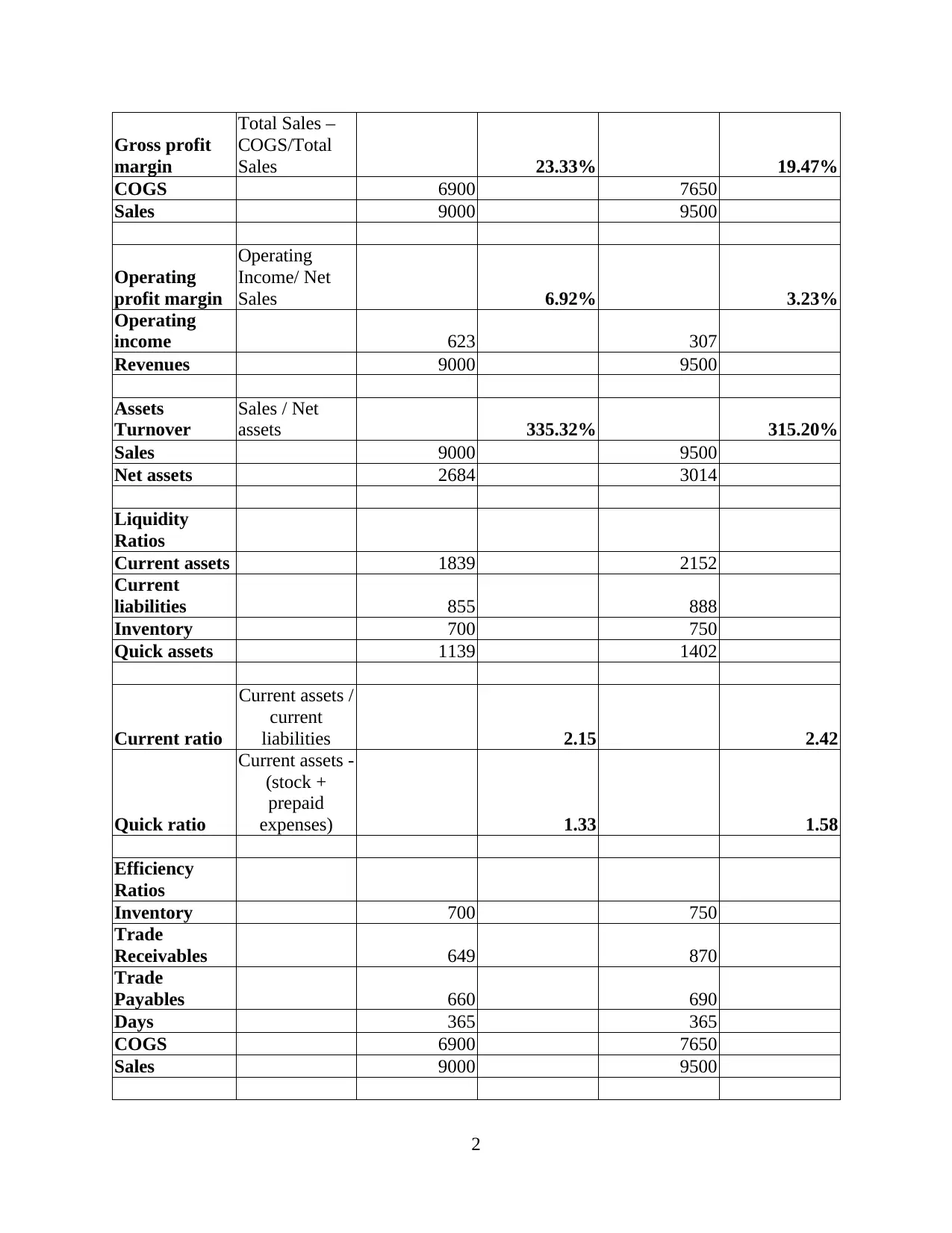

Gross profit

margin

Total Sales –

COGS/Total

Sales 23.33% 19.47%

COGS 6900 7650

Sales 9000 9500

Operating

profit margin

Operating

Income/ Net

Sales 6.92% 3.23%

Operating

income 623 307

Revenues 9000 9500

Assets

Turnover

Sales / Net

assets 335.32% 315.20%

Sales 9000 9500

Net assets 2684 3014

Liquidity

Ratios

Current assets 1839 2152

Current

liabilities 855 888

Inventory 700 750

Quick assets 1139 1402

Current ratio

Current assets /

current

liabilities 2.15 2.42

Quick ratio

Current assets -

(stock +

prepaid

expenses) 1.33 1.58

Efficiency

Ratios

Inventory 700 750

Trade

Receivables 649 870

Trade

Payables 660 690

Days 365 365

COGS 6900 7650

Sales 9000 9500

2

margin

Total Sales –

COGS/Total

Sales 23.33% 19.47%

COGS 6900 7650

Sales 9000 9500

Operating

profit margin

Operating

Income/ Net

Sales 6.92% 3.23%

Operating

income 623 307

Revenues 9000 9500

Assets

Turnover

Sales / Net

assets 335.32% 315.20%

Sales 9000 9500

Net assets 2684 3014

Liquidity

Ratios

Current assets 1839 2152

Current

liabilities 855 888

Inventory 700 750

Quick assets 1139 1402

Current ratio

Current assets /

current

liabilities 2.15 2.42

Quick ratio

Current assets -

(stock +

prepaid

expenses) 1.33 1.58

Efficiency

Ratios

Inventory 700 750

Trade

Receivables 649 870

Trade

Payables 660 690

Days 365 365

COGS 6900 7650

Sales 9000 9500

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventory

days

Inventory/

COS*365 37.029 35.784

Debtor days

Debtor/

Sales*365 26.32 33.43

Creditor days

Creditor /

Sales*365 26.77 26.51

Gearing Ratio

Long-term debt 150 150

Shareholder's

equity 2534 2864

Debt-equity

ratio 0.06 0.05

Interpretations

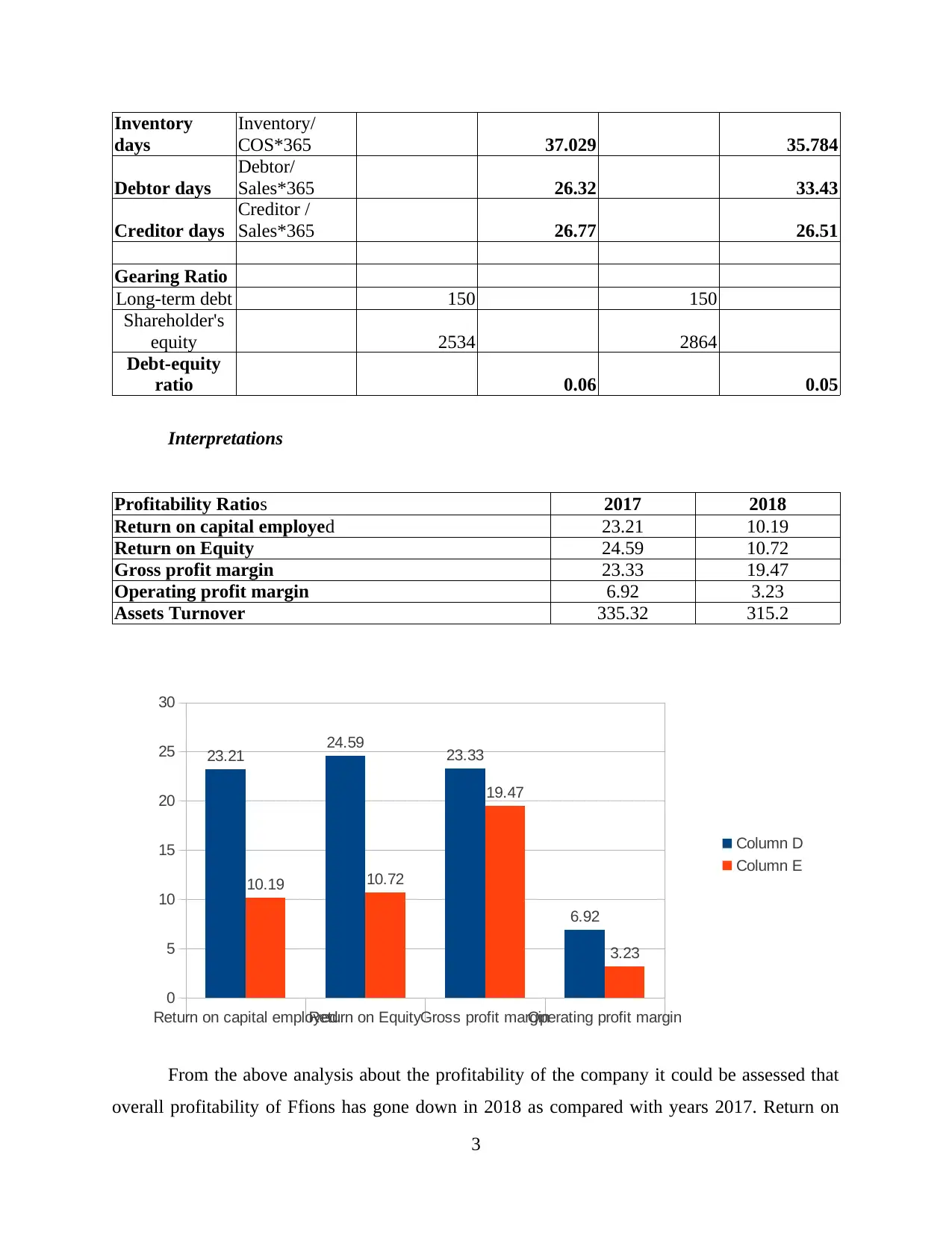

Profitability Ratios 2017 2018

Return on capital employed 23.21 10.19

Return on Equity 24.59 10.72

Gross profit margin 23.33 19.47

Operating profit margin 6.92 3.23

Assets Turnover 335.32 315.2

Return on capital employedReturn on EquityGross profit marginOperating profit margin

0

5

10

15

20

25

30

23.21 24.59 23.33

6.92

10.19 10.72

19.47

3.23

Column D

Column E

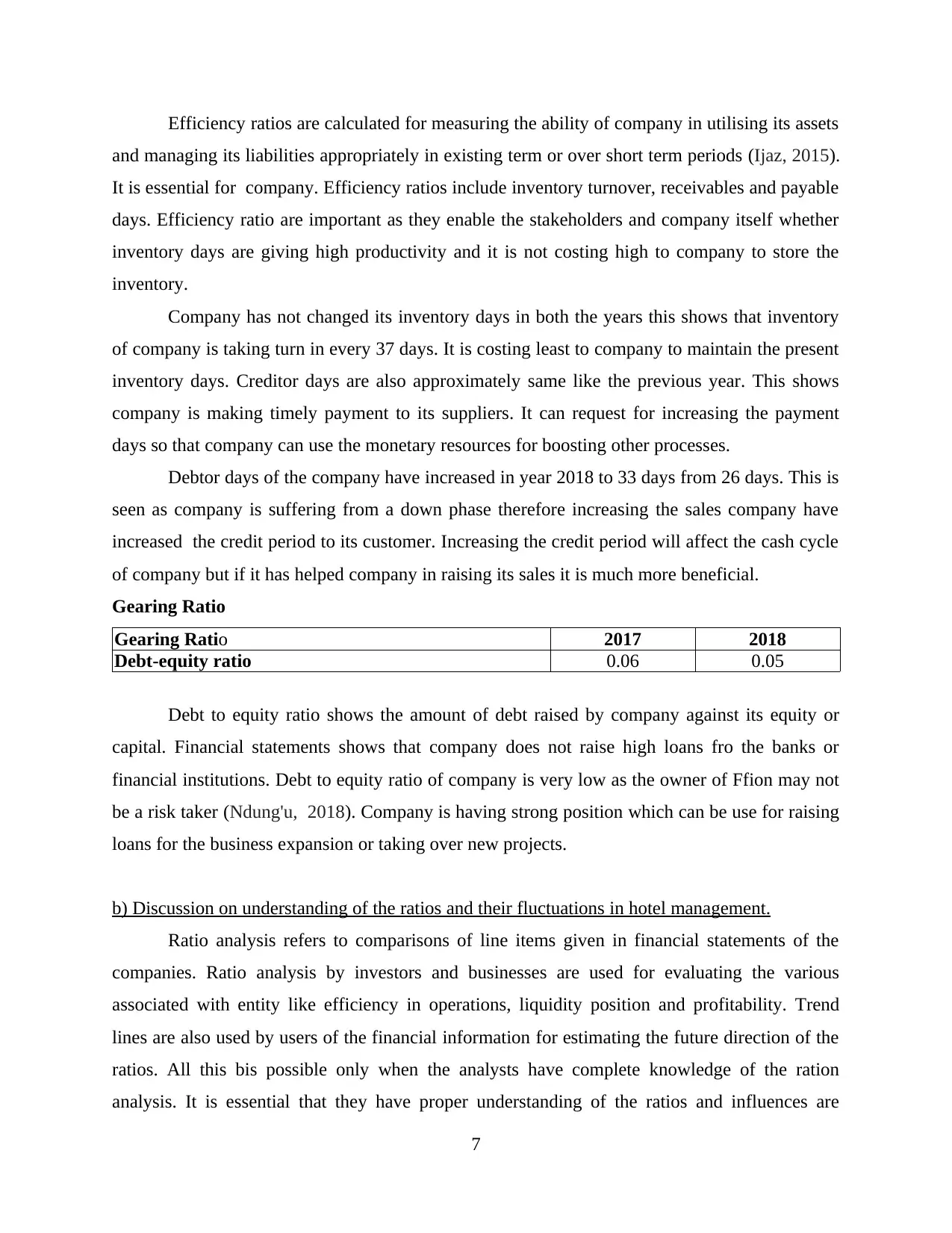

From the above analysis about the profitability of the company it could be assessed that

overall profitability of Ffions has gone down in 2018 as compared with years 2017. Return on

3

days

Inventory/

COS*365 37.029 35.784

Debtor days

Debtor/

Sales*365 26.32 33.43

Creditor days

Creditor /

Sales*365 26.77 26.51

Gearing Ratio

Long-term debt 150 150

Shareholder's

equity 2534 2864

Debt-equity

ratio 0.06 0.05

Interpretations

Profitability Ratios 2017 2018

Return on capital employed 23.21 10.19

Return on Equity 24.59 10.72

Gross profit margin 23.33 19.47

Operating profit margin 6.92 3.23

Assets Turnover 335.32 315.2

Return on capital employedReturn on EquityGross profit marginOperating profit margin

0

5

10

15

20

25

30

23.21 24.59 23.33

6.92

10.19 10.72

19.47

3.23

Column D

Column E

From the above analysis about the profitability of the company it could be assessed that

overall profitability of Ffions has gone down in 2018 as compared with years 2017. Return on

3

capital employed of company has gone down in 2018 to 10.19 from 23.21 in 2017. Change is

seen as company has purchased new assets adding to capital in year 2018 where the profits of

company has not shown increase in year 2018. Employing capital will increase the wealth of

company this but it should be further analysed whether it is increase in current asset or fixed

assets (Prabha, 2015). Company has purchased fixed assets amounting to 50000 pounds in year

2018 without any increase in profits that dropped the percentage.

Return on Equity over here refers to return over investment of the employer in the

company. In 2017 company had return of 24.59% where it reduced to 10.72% which is

significant decline it dropped almost twice from the previous year. Reason behind the drop is

investment of further capital in business but it was not able to provide sufficient returns over the

investments. These ratio are commonly used by the investors and stakeholders. Therefore it is

essential for company to improve the strategies that can give returns over the investment of

proprietor.

Gross profit ratio is calculated for assessing the effectiveness of company in managing

the operations of company (Asmirantho and Somantri, O 2017). All the direct expense of the

company related to the manufacturing of product are required to be within control and resources

are used in cost effective manner. Gross profit ration of company reduced to 19.47% in 2018

from 23.33% in 2017. The reduction shows that company has lost the effectiveness with which it

is manufacturing products. Revenues of th company have increased from previous but

production cost of company has gone up as due to increased purchase of raw material. Company

did not achieved the sales level as that against its productions thereby resulting in downfall.

Operating profit margin or net profit margin refers to the amount that is left with the

company after carrying out all the expenses of company. This is final profit that is added to the

capital of the proprietor. Net profit margin ratios shows the effectiveness of company in

managing its operation for running the business. A net decline in net profit is seen when the

expenses of company are rising but company is not able to raise its revenues in proportion to its

expenses. Profit margin of company in year 2017 is 6.92% that is not up to the desired level and

it further dropped to 3.23 % more than half from previous year. In 2018 company was not having

enough gross profit for meeting the other operational expenses of business and this repairs and

salary charges have raised as compared with previous year. Company should take promotional

4

seen as company has purchased new assets adding to capital in year 2018 where the profits of

company has not shown increase in year 2018. Employing capital will increase the wealth of

company this but it should be further analysed whether it is increase in current asset or fixed

assets (Prabha, 2015). Company has purchased fixed assets amounting to 50000 pounds in year

2018 without any increase in profits that dropped the percentage.

Return on Equity over here refers to return over investment of the employer in the

company. In 2017 company had return of 24.59% where it reduced to 10.72% which is

significant decline it dropped almost twice from the previous year. Reason behind the drop is

investment of further capital in business but it was not able to provide sufficient returns over the

investments. These ratio are commonly used by the investors and stakeholders. Therefore it is

essential for company to improve the strategies that can give returns over the investment of

proprietor.

Gross profit ratio is calculated for assessing the effectiveness of company in managing

the operations of company (Asmirantho and Somantri, O 2017). All the direct expense of the

company related to the manufacturing of product are required to be within control and resources

are used in cost effective manner. Gross profit ration of company reduced to 19.47% in 2018

from 23.33% in 2017. The reduction shows that company has lost the effectiveness with which it

is manufacturing products. Revenues of th company have increased from previous but

production cost of company has gone up as due to increased purchase of raw material. Company

did not achieved the sales level as that against its productions thereby resulting in downfall.

Operating profit margin or net profit margin refers to the amount that is left with the

company after carrying out all the expenses of company. This is final profit that is added to the

capital of the proprietor. Net profit margin ratios shows the effectiveness of company in

managing its operation for running the business. A net decline in net profit is seen when the

expenses of company are rising but company is not able to raise its revenues in proportion to its

expenses. Profit margin of company in year 2017 is 6.92% that is not up to the desired level and

it further dropped to 3.23 % more than half from previous year. In 2018 company was not having

enough gross profit for meeting the other operational expenses of business and this repairs and

salary charges have raised as compared with previous year. Company should take promotional

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

steps for increasing the sales to generate more revenues. Also the existing expenses of the

company should be controlled before it further drops to losses.

Asset turnover of the company is very high this shows that company is generating high

revenues as against that of its assets (Kurniasih, 2018). Company's turnover should be high as it

shows the capability of company to generate revenues as against that of its assets. Turnover has

dropped slightly from previous year as company has acquired new asset but revenues were not

bale to meet the budgeted forecasts.

Profitability of the company has to be high for making a positive image in the society.

Company is required to adopt new steps and strategies for enhancing its operational efficiency.

The production costs should be within control of company so that the revenues are not utilised in

meeting that costs only and not left with outcomes for meting other business costs.

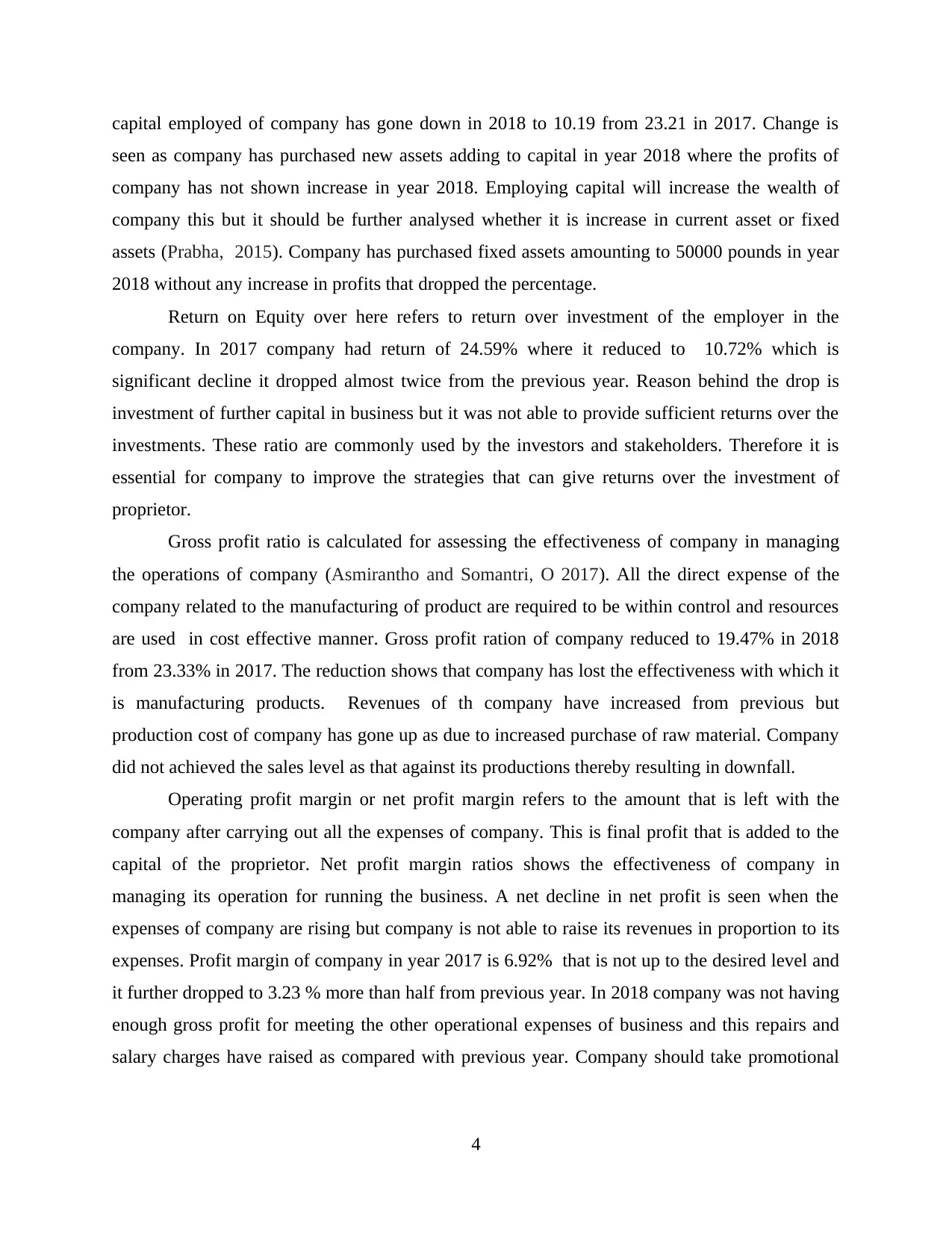

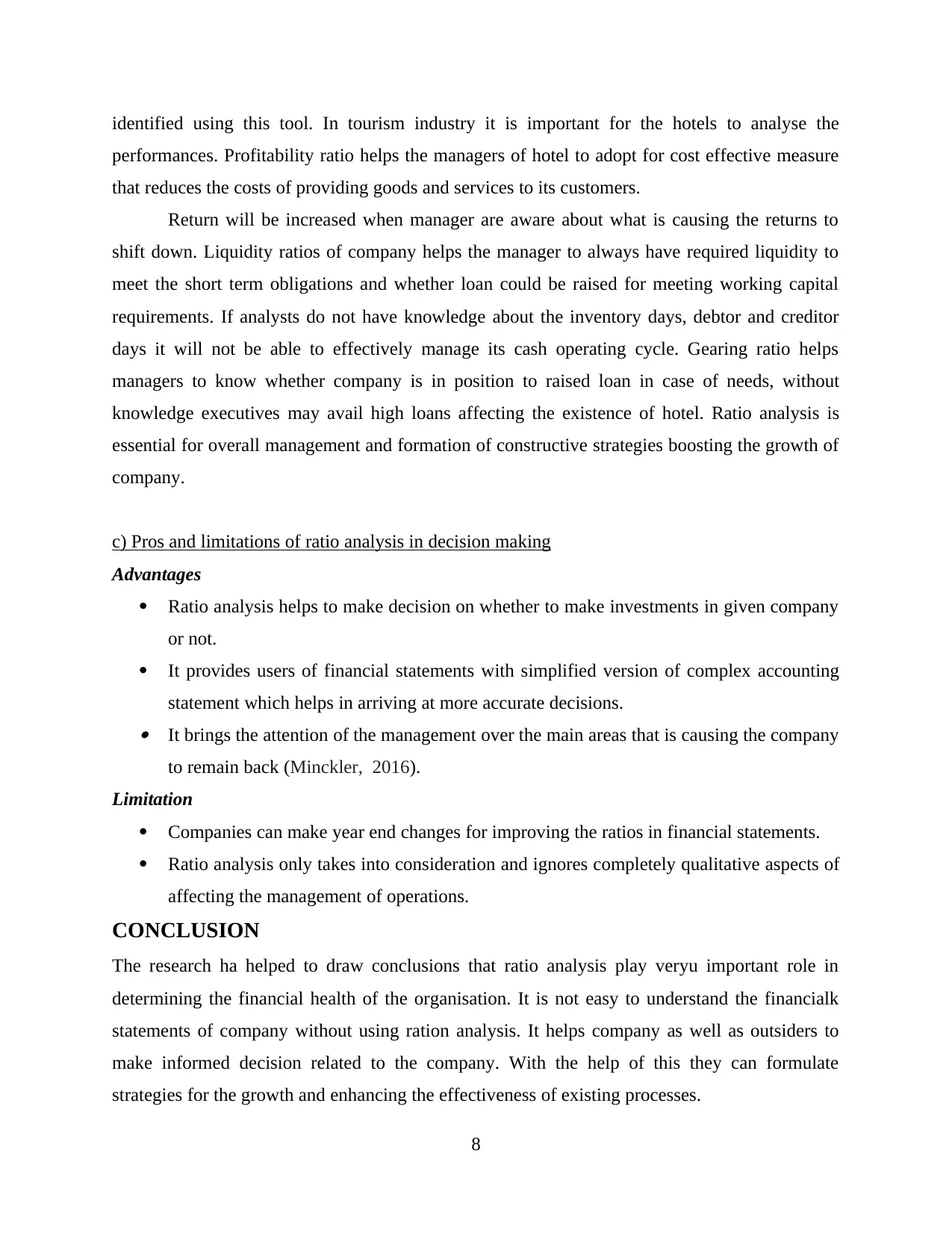

Liquidity Ratios 2017 2018

Current ratio 2.15 2.42

Quick ratio 1.33 1.58

Current ratio Quick ratio

0

0.5

1

1.5

2

2.5

3

2.15

1.33

2.42

1.58 Column D

Column E

Liquidity ratios are calculated for determining the effectiveness of managing its current

assets and liabilities. They show the capability of company to meet its short term obligations wit

the available current assets (Rahmawati, Nazar and Triyanto, 2017).

5

company should be controlled before it further drops to losses.

Asset turnover of the company is very high this shows that company is generating high

revenues as against that of its assets (Kurniasih, 2018). Company's turnover should be high as it

shows the capability of company to generate revenues as against that of its assets. Turnover has

dropped slightly from previous year as company has acquired new asset but revenues were not

bale to meet the budgeted forecasts.

Profitability of the company has to be high for making a positive image in the society.

Company is required to adopt new steps and strategies for enhancing its operational efficiency.

The production costs should be within control of company so that the revenues are not utilised in

meeting that costs only and not left with outcomes for meting other business costs.

Liquidity Ratios 2017 2018

Current ratio 2.15 2.42

Quick ratio 1.33 1.58

Current ratio Quick ratio

0

0.5

1

1.5

2

2.5

3

2.15

1.33

2.42

1.58 Column D

Column E

Liquidity ratios are calculated for determining the effectiveness of managing its current

assets and liabilities. They show the capability of company to meet its short term obligations wit

the available current assets (Rahmawati, Nazar and Triyanto, 2017).

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Current ratio of company for 2017 was 2.15 and it increased to 2.42 in 2018. Current

ratios are calculated assessing the ability of company to meet it its short term liabilities as against

its current assets. Standard ratio is 2:1 and company is effectively maintaining its standard. It is

having the ratios above the standards in both thy year and in 2018 it has even more raised.

Current assets of company debtors, stock and cash at bank have raised from the previous the

previous year. Company has not raised bank overdraft limits or incurred any other short term

loan this year therefore the current liabilities did not raised. This helped company to raise its

ratio due ton increase in current assets . This shows that company can appropriately meet its

short term obligations with available current assets(King, 2015).

Quick ratio is also used for assessing the liquidity position of company excluding the

inventory. In this ratio inventory is excluded because inventories cannot be liquidated on urgent

basis. Therefore investors and analysts exclude inventory for checking the liquidity position of

company. Liquidity position of company is strong after deducting inventory also. In event of

urgent requirement of liquid assets company will not have to find other resources for meeting the

short term liabilities.

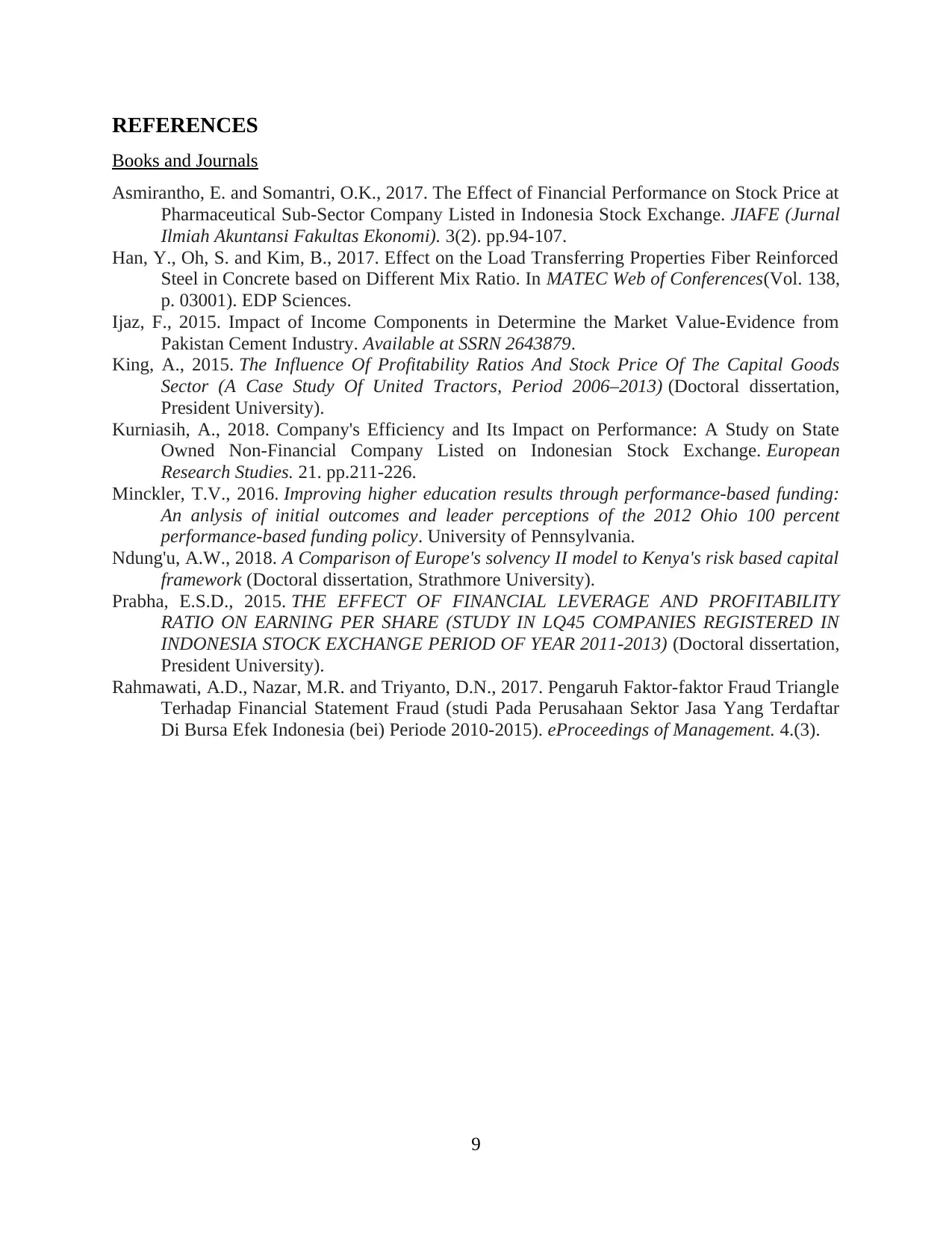

Efficiency Ratio

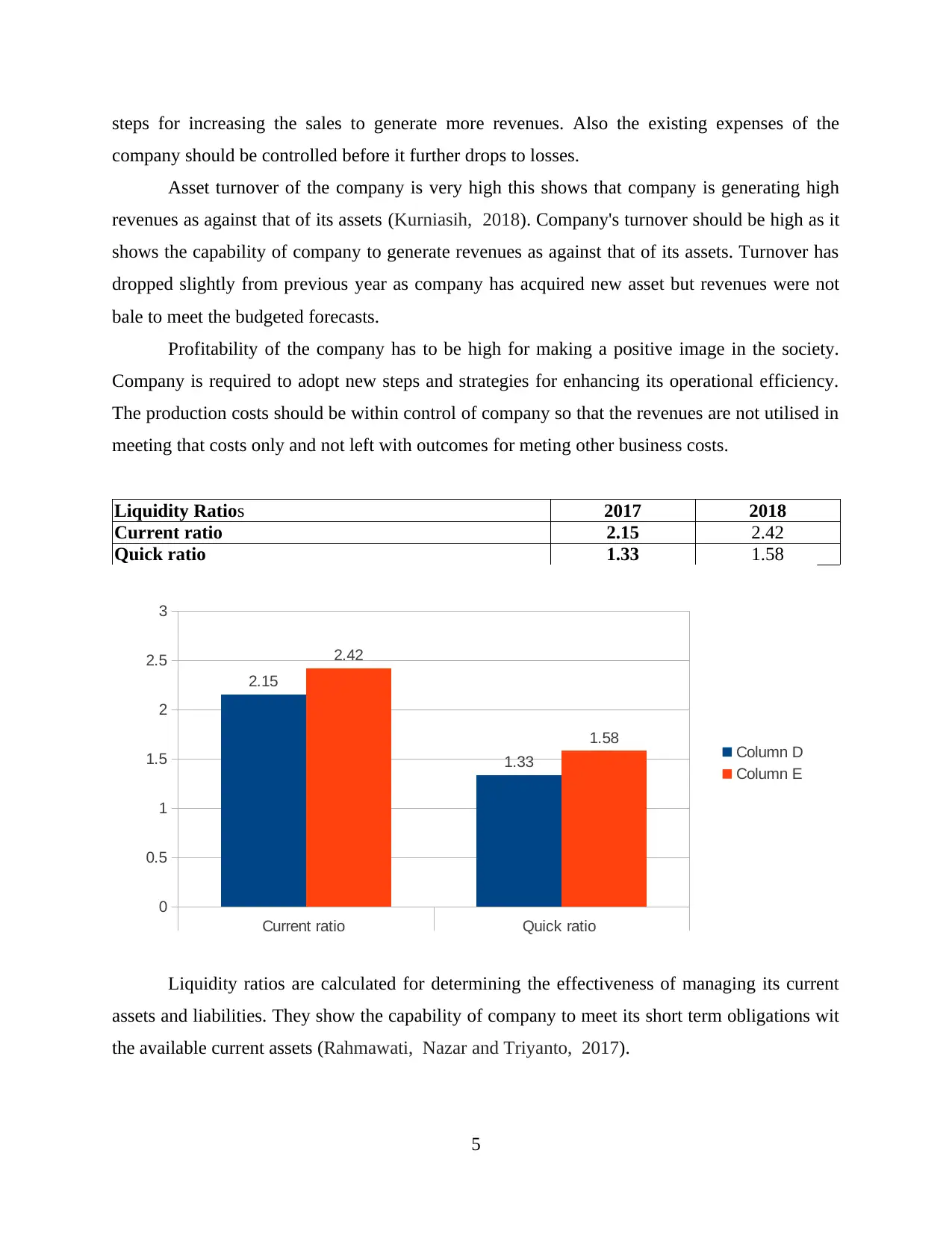

Efficiency Ratios 2017 2018

Inventory days 37 36

Debtor days 26 33

Creditor days 27 26

Inventory days Debtor days Creditor days

0

5

10

15

20

25

30

35

40 37

26 27

36

33

26

Column D

Column E

6

ratios are calculated assessing the ability of company to meet it its short term liabilities as against

its current assets. Standard ratio is 2:1 and company is effectively maintaining its standard. It is

having the ratios above the standards in both thy year and in 2018 it has even more raised.

Current assets of company debtors, stock and cash at bank have raised from the previous the

previous year. Company has not raised bank overdraft limits or incurred any other short term

loan this year therefore the current liabilities did not raised. This helped company to raise its

ratio due ton increase in current assets . This shows that company can appropriately meet its

short term obligations with available current assets(King, 2015).

Quick ratio is also used for assessing the liquidity position of company excluding the

inventory. In this ratio inventory is excluded because inventories cannot be liquidated on urgent

basis. Therefore investors and analysts exclude inventory for checking the liquidity position of

company. Liquidity position of company is strong after deducting inventory also. In event of

urgent requirement of liquid assets company will not have to find other resources for meeting the

short term liabilities.

Efficiency Ratio

Efficiency Ratios 2017 2018

Inventory days 37 36

Debtor days 26 33

Creditor days 27 26

Inventory days Debtor days Creditor days

0

5

10

15

20

25

30

35

40 37

26 27

36

33

26

Column D

Column E

6

Efficiency ratios are calculated for measuring the ability of company in utilising its assets

and managing its liabilities appropriately in existing term or over short term periods (Ijaz, 2015).

It is essential for company. Efficiency ratios include inventory turnover, receivables and payable

days. Efficiency ratio are important as they enable the stakeholders and company itself whether

inventory days are giving high productivity and it is not costing high to company to store the

inventory.

Company has not changed its inventory days in both the years this shows that inventory

of company is taking turn in every 37 days. It is costing least to company to maintain the present

inventory days. Creditor days are also approximately same like the previous year. This shows

company is making timely payment to its suppliers. It can request for increasing the payment

days so that company can use the monetary resources for boosting other processes.

Debtor days of the company have increased in year 2018 to 33 days from 26 days. This is

seen as company is suffering from a down phase therefore increasing the sales company have

increased the credit period to its customer. Increasing the credit period will affect the cash cycle

of company but if it has helped company in raising its sales it is much more beneficial.

Gearing Ratio

Gearing Ratio 2017 2018

Debt-equity ratio 0.06 0.05

Debt to equity ratio shows the amount of debt raised by company against its equity or

capital. Financial statements shows that company does not raise high loans fro the banks or

financial institutions. Debt to equity ratio of company is very low as the owner of Ffion may not

be a risk taker (Ndung'u, 2018). Company is having strong position which can be use for raising

loans for the business expansion or taking over new projects.

b) Discussion on understanding of the ratios and their fluctuations in hotel management.

Ratio analysis refers to comparisons of line items given in financial statements of the

companies. Ratio analysis by investors and businesses are used for evaluating the various

associated with entity like efficiency in operations, liquidity position and profitability. Trend

lines are also used by users of the financial information for estimating the future direction of the

ratios. All this bis possible only when the analysts have complete knowledge of the ration

analysis. It is essential that they have proper understanding of the ratios and influences are

7

and managing its liabilities appropriately in existing term or over short term periods (Ijaz, 2015).

It is essential for company. Efficiency ratios include inventory turnover, receivables and payable

days. Efficiency ratio are important as they enable the stakeholders and company itself whether

inventory days are giving high productivity and it is not costing high to company to store the

inventory.

Company has not changed its inventory days in both the years this shows that inventory

of company is taking turn in every 37 days. It is costing least to company to maintain the present

inventory days. Creditor days are also approximately same like the previous year. This shows

company is making timely payment to its suppliers. It can request for increasing the payment

days so that company can use the monetary resources for boosting other processes.

Debtor days of the company have increased in year 2018 to 33 days from 26 days. This is

seen as company is suffering from a down phase therefore increasing the sales company have

increased the credit period to its customer. Increasing the credit period will affect the cash cycle

of company but if it has helped company in raising its sales it is much more beneficial.

Gearing Ratio

Gearing Ratio 2017 2018

Debt-equity ratio 0.06 0.05

Debt to equity ratio shows the amount of debt raised by company against its equity or

capital. Financial statements shows that company does not raise high loans fro the banks or

financial institutions. Debt to equity ratio of company is very low as the owner of Ffion may not

be a risk taker (Ndung'u, 2018). Company is having strong position which can be use for raising

loans for the business expansion or taking over new projects.

b) Discussion on understanding of the ratios and their fluctuations in hotel management.

Ratio analysis refers to comparisons of line items given in financial statements of the

companies. Ratio analysis by investors and businesses are used for evaluating the various

associated with entity like efficiency in operations, liquidity position and profitability. Trend

lines are also used by users of the financial information for estimating the future direction of the

ratios. All this bis possible only when the analysts have complete knowledge of the ration

analysis. It is essential that they have proper understanding of the ratios and influences are

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

identified using this tool. In tourism industry it is important for the hotels to analyse the

performances. Profitability ratio helps the managers of hotel to adopt for cost effective measure

that reduces the costs of providing goods and services to its customers.

Return will be increased when manager are aware about what is causing the returns to

shift down. Liquidity ratios of company helps the manager to always have required liquidity to

meet the short term obligations and whether loan could be raised for meeting working capital

requirements. If analysts do not have knowledge about the inventory days, debtor and creditor

days it will not be able to effectively manage its cash operating cycle. Gearing ratio helps

managers to know whether company is in position to raised loan in case of needs, without

knowledge executives may avail high loans affecting the existence of hotel. Ratio analysis is

essential for overall management and formation of constructive strategies boosting the growth of

company.

c) Pros and limitations of ratio analysis in decision making

Advantages

Ratio analysis helps to make decision on whether to make investments in given company

or not.

It provides users of financial statements with simplified version of complex accounting

statement which helps in arriving at more accurate decisions. It brings the attention of the management over the main areas that is causing the company

to remain back (Minckler, 2016).

Limitation

Companies can make year end changes for improving the ratios in financial statements.

Ratio analysis only takes into consideration and ignores completely qualitative aspects of

affecting the management of operations.

CONCLUSION

The research ha helped to draw conclusions that ratio analysis play veryu important role in

determining the financial health of the organisation. It is not easy to understand the financialk

statements of company without using ration analysis. It helps company as well as outsiders to

make informed decision related to the company. With the help of this they can formulate

strategies for the growth and enhancing the effectiveness of existing processes.

8

performances. Profitability ratio helps the managers of hotel to adopt for cost effective measure

that reduces the costs of providing goods and services to its customers.

Return will be increased when manager are aware about what is causing the returns to

shift down. Liquidity ratios of company helps the manager to always have required liquidity to

meet the short term obligations and whether loan could be raised for meeting working capital

requirements. If analysts do not have knowledge about the inventory days, debtor and creditor

days it will not be able to effectively manage its cash operating cycle. Gearing ratio helps

managers to know whether company is in position to raised loan in case of needs, without

knowledge executives may avail high loans affecting the existence of hotel. Ratio analysis is

essential for overall management and formation of constructive strategies boosting the growth of

company.

c) Pros and limitations of ratio analysis in decision making

Advantages

Ratio analysis helps to make decision on whether to make investments in given company

or not.

It provides users of financial statements with simplified version of complex accounting

statement which helps in arriving at more accurate decisions. It brings the attention of the management over the main areas that is causing the company

to remain back (Minckler, 2016).

Limitation

Companies can make year end changes for improving the ratios in financial statements.

Ratio analysis only takes into consideration and ignores completely qualitative aspects of

affecting the management of operations.

CONCLUSION

The research ha helped to draw conclusions that ratio analysis play veryu important role in

determining the financial health of the organisation. It is not easy to understand the financialk

statements of company without using ration analysis. It helps company as well as outsiders to

make informed decision related to the company. With the help of this they can formulate

strategies for the growth and enhancing the effectiveness of existing processes.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Asmirantho, E. and Somantri, O.K., 2017. The Effect of Financial Performance on Stock Price at

Pharmaceutical Sub-Sector Company Listed in Indonesia Stock Exchange. JIAFE (Jurnal

Ilmiah Akuntansi Fakultas Ekonomi). 3(2). pp.94-107.

Han, Y., Oh, S. and Kim, B., 2017. Effect on the Load Transferring Properties Fiber Reinforced

Steel in Concrete based on Different Mix Ratio. In MATEC Web of Conferences(Vol. 138,

p. 03001). EDP Sciences.

Ijaz, F., 2015. Impact of Income Components in Determine the Market Value-Evidence from

Pakistan Cement Industry. Available at SSRN 2643879.

King, A., 2015. The Influence Of Profitability Ratios And Stock Price Of The Capital Goods

Sector (A Case Study Of United Tractors, Period 2006–2013) (Doctoral dissertation,

President University).

Kurniasih, A., 2018. Company's Efficiency and Its Impact on Performance: A Study on State

Owned Non-Financial Company Listed on Indonesian Stock Exchange. European

Research Studies. 21. pp.211-226.

Minckler, T.V., 2016. Improving higher education results through performance-based funding:

An anlysis of initial outcomes and leader perceptions of the 2012 Ohio 100 percent

performance-based funding policy. University of Pennsylvania.

Ndung'u, A.W., 2018. A Comparison of Europe's solvency II model to Kenya's risk based capital

framework (Doctoral dissertation, Strathmore University).

Prabha, E.S.D., 2015. THE EFFECT OF FINANCIAL LEVERAGE AND PROFITABILITY

RATIO ON EARNING PER SHARE (STUDY IN LQ45 COMPANIES REGISTERED IN

INDONESIA STOCK EXCHANGE PERIOD OF YEAR 2011-2013) (Doctoral dissertation,

President University).

Rahmawati, A.D., Nazar, M.R. and Triyanto, D.N., 2017. Pengaruh Faktor-faktor Fraud Triangle

Terhadap Financial Statement Fraud (studi Pada Perusahaan Sektor Jasa Yang Terdaftar

Di Bursa Efek Indonesia (bei) Periode 2010-2015). eProceedings of Management. 4.(3).

9

Books and Journals

Asmirantho, E. and Somantri, O.K., 2017. The Effect of Financial Performance on Stock Price at

Pharmaceutical Sub-Sector Company Listed in Indonesia Stock Exchange. JIAFE (Jurnal

Ilmiah Akuntansi Fakultas Ekonomi). 3(2). pp.94-107.

Han, Y., Oh, S. and Kim, B., 2017. Effect on the Load Transferring Properties Fiber Reinforced

Steel in Concrete based on Different Mix Ratio. In MATEC Web of Conferences(Vol. 138,

p. 03001). EDP Sciences.

Ijaz, F., 2015. Impact of Income Components in Determine the Market Value-Evidence from

Pakistan Cement Industry. Available at SSRN 2643879.

King, A., 2015. The Influence Of Profitability Ratios And Stock Price Of The Capital Goods

Sector (A Case Study Of United Tractors, Period 2006–2013) (Doctoral dissertation,

President University).

Kurniasih, A., 2018. Company's Efficiency and Its Impact on Performance: A Study on State

Owned Non-Financial Company Listed on Indonesian Stock Exchange. European

Research Studies. 21. pp.211-226.

Minckler, T.V., 2016. Improving higher education results through performance-based funding:

An anlysis of initial outcomes and leader perceptions of the 2012 Ohio 100 percent

performance-based funding policy. University of Pennsylvania.

Ndung'u, A.W., 2018. A Comparison of Europe's solvency II model to Kenya's risk based capital

framework (Doctoral dissertation, Strathmore University).

Prabha, E.S.D., 2015. THE EFFECT OF FINANCIAL LEVERAGE AND PROFITABILITY

RATIO ON EARNING PER SHARE (STUDY IN LQ45 COMPANIES REGISTERED IN

INDONESIA STOCK EXCHANGE PERIOD OF YEAR 2011-2013) (Doctoral dissertation,

President University).

Rahmawati, A.D., Nazar, M.R. and Triyanto, D.N., 2017. Pengaruh Faktor-faktor Fraud Triangle

Terhadap Financial Statement Fraud (studi Pada Perusahaan Sektor Jasa Yang Terdaftar

Di Bursa Efek Indonesia (bei) Periode 2010-2015). eProceedings of Management. 4.(3).

9

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.