Business Management and Strategic Finance Report: DB125 Module

VerifiedAdded on 2023/04/23

|8

|1402

|361

Report

AI Summary

This report analyzes business management and strategic finance, focusing on the real estate market in England and Wales from 1999-2018. It examines factors influencing house prices, including economic performance, property markets, and government policies. The report highlights regional variations in real estate growth, with London showing the highest growth rate. It also discusses the impact of fiscal policy on household income and the importance of financial planning. The study concludes by emphasizing the need to consider economic, political, and social factors in financial decision-making. Desklib provides access to this document and many other study resources for students.

Running head: BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Finance

Name of the Student:

Name of the University:

Author’s Note:

Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Table of Contents

Part A...............................................................................................................................................2

Part B...............................................................................................................................................3

Part C...............................................................................................................................................4

References........................................................................................................................................6

Table of Contents

Part A...............................................................................................................................................2

Part B...............................................................................................................................................3

Part C...............................................................................................................................................4

References........................................................................................................................................6

2BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Part A

The average price in the England and Wales was taken into consideration for the purpose

of the analysis in the movement of the price level of these real estate prices. The trend period

taken into consideration was for the period of 1999-2018. The various parts of England and

Wales was taken into consideration for the purpose of the analysis and relevant analysis on the

same basis was done. Various factors should be taken into consideration for the purpose of the

analysis. Both the business and the macro economic factors affect the movement of the real

estate industry in the England and Wales. Factors affecting the movement of the prices of the

real estate industry were the change in the political, social and macro-economic environment

under which the operations of the company is based. Real estate industry is highly volatile with

the changes in the overall economy rate and is highly correlated with the performance of the

economy (Choudhry 2018). The correlation of the performance of the economy and the real

estate industry is high. After analysing the given data for the given time period it is key to note

that the house price movement in the trend period has shown a growth of about 6%-7% (Hines

2017). While analysing the various parts of England that showed a growth trend it was key to

note that the real estate price in the London was the highest which has been due to the positive

factors like better connectivity, infrastructural facilities, growth and overall development. Real

estate prices in London showed an average growth rate of about 8.22%. While prices in the

North East England showed the lowest, price movement in the trend period and moved an

average by about 5.67% in the period (Tan et al. 2018).

Growth in Real estate prices in England was around 6.75% however on the other hand

side the growth in the Wales Region was around 6.06%. Various factors and environment under

Part A

The average price in the England and Wales was taken into consideration for the purpose

of the analysis in the movement of the price level of these real estate prices. The trend period

taken into consideration was for the period of 1999-2018. The various parts of England and

Wales was taken into consideration for the purpose of the analysis and relevant analysis on the

same basis was done. Various factors should be taken into consideration for the purpose of the

analysis. Both the business and the macro economic factors affect the movement of the real

estate industry in the England and Wales. Factors affecting the movement of the prices of the

real estate industry were the change in the political, social and macro-economic environment

under which the operations of the company is based. Real estate industry is highly volatile with

the changes in the overall economy rate and is highly correlated with the performance of the

economy (Choudhry 2018). The correlation of the performance of the economy and the real

estate industry is high. After analysing the given data for the given time period it is key to note

that the house price movement in the trend period has shown a growth of about 6%-7% (Hines

2017). While analysing the various parts of England that showed a growth trend it was key to

note that the real estate price in the London was the highest which has been due to the positive

factors like better connectivity, infrastructural facilities, growth and overall development. Real

estate prices in London showed an average growth rate of about 8.22%. While prices in the

North East England showed the lowest, price movement in the trend period and moved an

average by about 5.67% in the period (Tan et al. 2018).

Growth in Real estate prices in England was around 6.75% however on the other hand

side the growth in the Wales Region was around 6.06%. Various factors and environment under

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

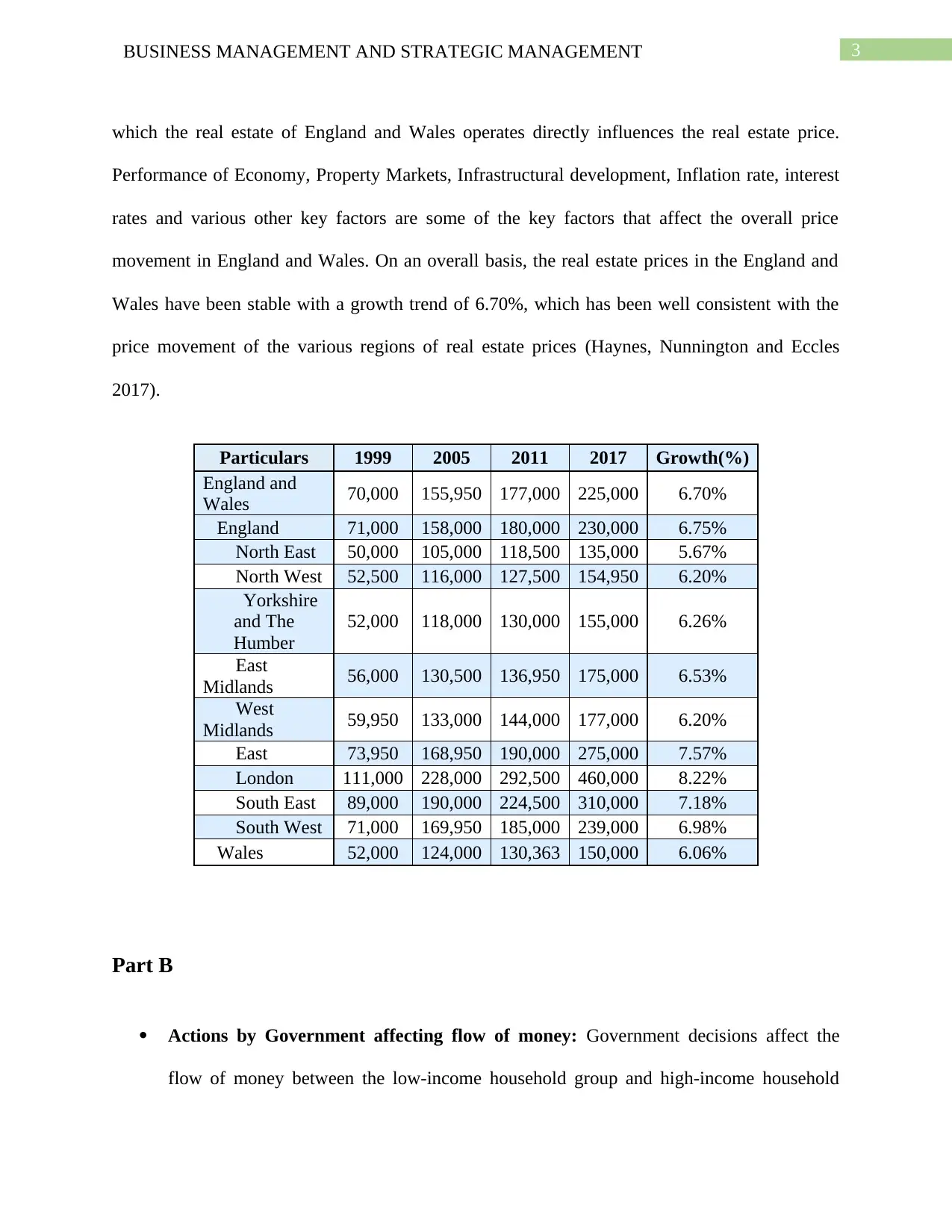

which the real estate of England and Wales operates directly influences the real estate price.

Performance of Economy, Property Markets, Infrastructural development, Inflation rate, interest

rates and various other key factors are some of the key factors that affect the overall price

movement in England and Wales. On an overall basis, the real estate prices in the England and

Wales have been stable with a growth trend of 6.70%, which has been well consistent with the

price movement of the various regions of real estate prices (Haynes, Nunnington and Eccles

2017).

Particulars 1999 2005 2011 2017 Growth(%)

England and

Wales 70,000 155,950 177,000 225,000 6.70%

England 71,000 158,000 180,000 230,000 6.75%

North East 50,000 105,000 118,500 135,000 5.67%

North West 52,500 116,000 127,500 154,950 6.20%

Yorkshire

and The

Humber

52,000 118,000 130,000 155,000 6.26%

East

Midlands 56,000 130,500 136,950 175,000 6.53%

West

Midlands 59,950 133,000 144,000 177,000 6.20%

East 73,950 168,950 190,000 275,000 7.57%

London 111,000 228,000 292,500 460,000 8.22%

South East 89,000 190,000 224,500 310,000 7.18%

South West 71,000 169,950 185,000 239,000 6.98%

Wales 52,000 124,000 130,363 150,000 6.06%

Part B

Actions by Government affecting flow of money: Government decisions affect the

flow of money between the low-income household group and high-income household

which the real estate of England and Wales operates directly influences the real estate price.

Performance of Economy, Property Markets, Infrastructural development, Inflation rate, interest

rates and various other key factors are some of the key factors that affect the overall price

movement in England and Wales. On an overall basis, the real estate prices in the England and

Wales have been stable with a growth trend of 6.70%, which has been well consistent with the

price movement of the various regions of real estate prices (Haynes, Nunnington and Eccles

2017).

Particulars 1999 2005 2011 2017 Growth(%)

England and

Wales 70,000 155,950 177,000 225,000 6.70%

England 71,000 158,000 180,000 230,000 6.75%

North East 50,000 105,000 118,500 135,000 5.67%

North West 52,500 116,000 127,500 154,950 6.20%

Yorkshire

and The

Humber

52,000 118,000 130,000 155,000 6.26%

East

Midlands 56,000 130,500 136,950 175,000 6.53%

West

Midlands 59,950 133,000 144,000 177,000 6.20%

East 73,950 168,950 190,000 275,000 7.57%

London 111,000 228,000 292,500 460,000 8.22%

South East 89,000 190,000 224,500 310,000 7.18%

South West 71,000 169,950 185,000 239,000 6.98%

Wales 52,000 124,000 130,363 150,000 6.06%

Part B

Actions by Government affecting flow of money: Government decisions affect the

flow of money between the low-income household group and high-income household

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

group. Fiscal Policy is the key policy in which the Government decides various factors

and conditions that influences the economy in various ways (O'connor 2017). One such

key government decision that would affect the household will be the reduction in the tax

rate by the government. The flow of money would be affected if there is a reduction in

the tax rate that would be directly affecting that would transfer the income flow from

government to both the household groups (Cimadomo 2016). Higher savings in the form

of lower tax rate would be directly increasing the cash flow level in an economy. It is

essential the policies and actions taken by the government to be analysed that would be

directly affecting the level of operations in the economy. Fiscal Policy is the key policy

that is controlled and influenced by the government thus the policy should be balanced

one that would provide a stable business and macro environment for all.

Secondary effect of government decisions: The secondary effect of the fiscal policies

undertaken by the government would be directly affecting and influencing the level of

activities in the economy. The reduction in the tax rate in the economy would be directly

affecting the level of cash flow in the economy (Bergman, Hutchison and Jensen 2016).

The cash flow will be flowing directly from the government to the direct consumers that

would be positively influencing the level of income of the household group. Government

would be reducing the taxation rate whereby the level of cash flows would be increasing

in the economy. High level of income household would then have to pay a lower rate of

tax and the low level of the income group would be savings tax amount in the form of

lower effective tax rate.

group. Fiscal Policy is the key policy in which the Government decides various factors

and conditions that influences the economy in various ways (O'connor 2017). One such

key government decision that would affect the household will be the reduction in the tax

rate by the government. The flow of money would be affected if there is a reduction in

the tax rate that would be directly affecting that would transfer the income flow from

government to both the household groups (Cimadomo 2016). Higher savings in the form

of lower tax rate would be directly increasing the cash flow level in an economy. It is

essential the policies and actions taken by the government to be analysed that would be

directly affecting the level of operations in the economy. Fiscal Policy is the key policy

that is controlled and influenced by the government thus the policy should be balanced

one that would provide a stable business and macro environment for all.

Secondary effect of government decisions: The secondary effect of the fiscal policies

undertaken by the government would be directly affecting and influencing the level of

activities in the economy. The reduction in the tax rate in the economy would be directly

affecting the level of cash flow in the economy (Bergman, Hutchison and Jensen 2016).

The cash flow will be flowing directly from the government to the direct consumers that

would be positively influencing the level of income of the household group. Government

would be reducing the taxation rate whereby the level of cash flows would be increasing

in the economy. High level of income household would then have to pay a lower rate of

tax and the low level of the income group would be savings tax amount in the form of

lower effective tax rate.

5BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Part C

Various factors that would be affecting the level of operations are the changing

economic, political and social factors was studied in the assignment. The relationship between

the individuals and household in the economy was also studied. However, Financial Planning

and concepts should be more studied in a detailed manner. The financial decisions made by the

households are inevitably affected by the changes in the environment and the importance of the

financial planning was also taken into consideration for the assignment. Changes in the financial

services industry is not static and the importance of the same in the growing and developing

economies should be also taken into consideration. Changes in the public policy was also taken

into consideration in the analysis. Financial decision should also be undertaken by incorporating

various factors and environment so that the same are incorporated in the decision making

process. The relationship of the financial factors also need to be incorporated into the analysis.

Part C

Various factors that would be affecting the level of operations are the changing

economic, political and social factors was studied in the assignment. The relationship between

the individuals and household in the economy was also studied. However, Financial Planning

and concepts should be more studied in a detailed manner. The financial decisions made by the

households are inevitably affected by the changes in the environment and the importance of the

financial planning was also taken into consideration for the assignment. Changes in the financial

services industry is not static and the importance of the same in the growing and developing

economies should be also taken into consideration. Changes in the public policy was also taken

into consideration in the analysis. Financial decision should also be undertaken by incorporating

various factors and environment so that the same are incorporated in the decision making

process. The relationship of the financial factors also need to be incorporated into the analysis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

References

Bergman, U.M., Hutchison, M.M. and Jensen, S.E.H., 2016. Promoting sustainable public

finances in the European Union: The role of fiscal rules and government efficiency. European

Journal of Political Economy, 44, pp.1-19.

Choudhry, T., 2018. Economic Policy Uncertainty and House Prices: Evidence from

Geographical Regions of England and Wales. Real Estate Economics

Cimadomo, J., 2016. Real‐time data and fiscal policy analysis: A survey of the literature.

Journal of economic Surveys, 30(2), pp.302-326.

Haynes, B., Nunnington, N. and Eccles, T., 2017. Procurement: Selecting appropriate real estate

options that support the strategic and financial requirements of the corporate occupier. In

Corporate Real Estate Asset Management (pp. 118-172). Routledge.

Hines, M.A., 2017. International real estate investment. In The Most Important Concepts in

Finance. Edward Elgar Publishing.

O'connor, J., 2017. The fiscal crisis of the state. Routledge.

Tan, L.M., Arbabi, H., Li, Q., Sheng, Y., Tingley, D.D., Mayfield, M. and Coca, D., 2018.

Ecological network analysis on intra-city metabolism of functional urban areas in England and

Wales. Resources, Conservation and Recycling, 138, pp.172-182.

References

Bergman, U.M., Hutchison, M.M. and Jensen, S.E.H., 2016. Promoting sustainable public

finances in the European Union: The role of fiscal rules and government efficiency. European

Journal of Political Economy, 44, pp.1-19.

Choudhry, T., 2018. Economic Policy Uncertainty and House Prices: Evidence from

Geographical Regions of England and Wales. Real Estate Economics

Cimadomo, J., 2016. Real‐time data and fiscal policy analysis: A survey of the literature.

Journal of economic Surveys, 30(2), pp.302-326.

Haynes, B., Nunnington, N. and Eccles, T., 2017. Procurement: Selecting appropriate real estate

options that support the strategic and financial requirements of the corporate occupier. In

Corporate Real Estate Asset Management (pp. 118-172). Routledge.

Hines, M.A., 2017. International real estate investment. In The Most Important Concepts in

Finance. Edward Elgar Publishing.

O'connor, J., 2017. The fiscal crisis of the state. Routledge.

Tan, L.M., Arbabi, H., Li, Q., Sheng, Y., Tingley, D.D., Mayfield, M. and Coca, D., 2018.

Ecological network analysis on intra-city metabolism of functional urban areas in England and

Wales. Resources, Conservation and Recycling, 138, pp.172-182.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.