Vinamilk's Plant-Based Milk: Entering the International Market

VerifiedAdded on 2024/05/05

|46

|9379

|355

Report

AI Summary

This report analyzes Vinamilk's potential entry into the international plant-based milk market, specifically focusing on the UK and India. It begins with an overview of global trends favoring healthy and sustainable lifestyles and the growing plant-based milk market. The report then provides background information on Vinamilk, its business model, and value chain. A comparison of the UK and India is conducted, considering general, political, and economic environments. Market selection models, including preliminary screening (focusing on Western Europe and Asian Pacific), BERI, and MACS, are employed to assess market attractiveness and competitive strength. The report concludes that a joint venture is the most suitable market entry mode and outlines marketing tactics, including STP strategy, benchmarking, and pricing/distribution strategies, tailored for the chosen market, with a final consideration of product standardization versus adaptation.

TRƯỜNG ĐẠI HỌC NGOẠI THƯƠNG

CƠ SỞ II TẠI THÀNH PHỐ HỒ CHÍ MINH

---------***--------

MIDTERM ASSIGNMENT

Major: International Marketing

ANALYSIS OF VINAMILK’S PLANT-BASED MILK

INTO INTERNATIONAL MARKET

Lecturer: Nguyễn Thị Thu Thảo

Class code: ML124

Group: 07

Class: K60CLC6

Group members:

Nguyễn Thanh Thảo: 2112153158

Lê Trần Khánh Ngọc: 2112153110

Đào Ngọc Quỳnh Anh: 2112153004

Hà Anh Kiệt: 2112153071

Lê Thị Bảo Trâm: 2113153062

Vũ Thị Thu Hiền: 2012256009

Nguyễn Ngọc Đông Nghi: 2112153105

Ho Chi Minh City, March 2023

CƠ SỞ II TẠI THÀNH PHỐ HỒ CHÍ MINH

---------***--------

MIDTERM ASSIGNMENT

Major: International Marketing

ANALYSIS OF VINAMILK’S PLANT-BASED MILK

INTO INTERNATIONAL MARKET

Lecturer: Nguyễn Thị Thu Thảo

Class code: ML124

Group: 07

Class: K60CLC6

Group members:

Nguyễn Thanh Thảo: 2112153158

Lê Trần Khánh Ngọc: 2112153110

Đào Ngọc Quỳnh Anh: 2112153004

Hà Anh Kiệt: 2112153071

Lê Thị Bảo Trâm: 2113153062

Vũ Thị Thu Hiền: 2012256009

Nguyễn Ngọc Đông Nghi: 2112153105

Ho Chi Minh City, March 2023

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of contents

LIST OF TABLES ...................................................................................................... 3

LIST OF GRAPHS ..................................................................................................... 4

CHAPTER 1. EXECUTIVE SUMMARY AND GLOBAL OVERVIEW ................ 5

1.1. Executive Summary ......................................................................................... 5

1.2. Global Trend Overview.................................................................................... 5

1.3. Vinamilk ........................................................................................................... 6

1.3.1 Background information ............................................................................ 6

1.3.2. Plant-based milk overview ........................................................................ 7

1.3.3. Business model.......................................................................................... 7

1.3.4 Value chain ................................................................................................. 8

CHAPTER 2. OVERVIEW OF 2 PROMISING COUNTRIES .............................. 10

2.1. Overview of The UK & India ........................................................................ 10

2.1.1. General environment ............................................................................... 10

2.1.2. Political environment .............................................................................. 10

2.1.3. Economic environment ........................................................................... 11

CHAPTER 3. MODELS FOR MARKET SELECTION.......................................... 15

3.1 Market Comparison ......................................................................................... 15

3.2 Preliminary screening ...................................................................................... 15

3.2.1 Why Western Europe & Asian Pacific .................................................... 15

3.2.2 Why United Kingdom & India ................................................................. 16

3.3.3 Business Environment Risk Index (BERI) .............................................. 17

3.3 Fine-grained screening: MACS ...................................................................... 20

3.3.1 Market attractiveness ............................................................................... 20

LIST OF TABLES ...................................................................................................... 3

LIST OF GRAPHS ..................................................................................................... 4

CHAPTER 1. EXECUTIVE SUMMARY AND GLOBAL OVERVIEW ................ 5

1.1. Executive Summary ......................................................................................... 5

1.2. Global Trend Overview.................................................................................... 5

1.3. Vinamilk ........................................................................................................... 6

1.3.1 Background information ............................................................................ 6

1.3.2. Plant-based milk overview ........................................................................ 7

1.3.3. Business model.......................................................................................... 7

1.3.4 Value chain ................................................................................................. 8

CHAPTER 2. OVERVIEW OF 2 PROMISING COUNTRIES .............................. 10

2.1. Overview of The UK & India ........................................................................ 10

2.1.1. General environment ............................................................................... 10

2.1.2. Political environment .............................................................................. 10

2.1.3. Economic environment ........................................................................... 11

CHAPTER 3. MODELS FOR MARKET SELECTION.......................................... 15

3.1 Market Comparison ......................................................................................... 15

3.2 Preliminary screening ...................................................................................... 15

3.2.1 Why Western Europe & Asian Pacific .................................................... 15

3.2.2 Why United Kingdom & India ................................................................. 16

3.3.3 Business Environment Risk Index (BERI) .............................................. 17

3.3 Fine-grained screening: MACS ...................................................................... 20

3.3.1 Market attractiveness ............................................................................... 20

3.3.2 Competitive strength ................................................................................ 22

3.4 Market Expansion Strategies and Market Choice ........................................... 24

3.4.1 Market Expansion Strategies ................................................................... 24

3.4.2 Market choice ........................................................................................... 24

CHAPTER 4. ENTRY MODE ................................................................................. 25

4.1. SWOT Analysis of Vinamilk ......................................................................... 25

4.2. Why Joint-venture in Intermediate mode? ..................................................... 27

4.3 Mid and long-term objectives ......................................................................... 27

CHAPTER 5. MARKETING TACTICS .................................................................. 29

5.1. STP Strategy ................................................................................................... 29

5.2. Benchmarking ................................................................................................ 30

5.3. Price Tactics ................................................................................................... 36

5.3.1. Oatly’s current price ................................................................................ 36

5.3.2. Vinamilk’s price opportunity .................................................................. 37

5.3.3. Strategy for Vinamilk .............................................................................. 37

5.4. Distribution Tactics ........................................................................................ 37

5.4.1. Oatly’s current distribution ..................................................................... 37

5.4.2. Vinamilk’s distribution opportunity........................................................ 37

5.4.3. Strategy for Vinamilk .............................................................................. 38

CHAPTER 6. CONCLUSION .................................................................................. 39

REFERENCE ............................................................................................................ 40

3.4 Market Expansion Strategies and Market Choice ........................................... 24

3.4.1 Market Expansion Strategies ................................................................... 24

3.4.2 Market choice ........................................................................................... 24

CHAPTER 4. ENTRY MODE ................................................................................. 25

4.1. SWOT Analysis of Vinamilk ......................................................................... 25

4.2. Why Joint-venture in Intermediate mode? ..................................................... 27

4.3 Mid and long-term objectives ......................................................................... 27

CHAPTER 5. MARKETING TACTICS .................................................................. 29

5.1. STP Strategy ................................................................................................... 29

5.2. Benchmarking ................................................................................................ 30

5.3. Price Tactics ................................................................................................... 36

5.3.1. Oatly’s current price ................................................................................ 36

5.3.2. Vinamilk’s price opportunity .................................................................. 37

5.3.3. Strategy for Vinamilk .............................................................................. 37

5.4. Distribution Tactics ........................................................................................ 37

5.4.1. Oatly’s current distribution ..................................................................... 37

5.4.2. Vinamilk’s distribution opportunity........................................................ 37

5.4.3. Strategy for Vinamilk .............................................................................. 38

CHAPTER 6. CONCLUSION .................................................................................. 39

REFERENCE ............................................................................................................ 40

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LIST OF TABLES

Table 1.1: Health benefits among the global concern of consumers

Table 1.2: The business model of Vinamilk.

Table 1.3: Value chain analysis of Vinamilk

Table 3.1: BERI justification

Table 3.2: BERI scores

Table 3.3: Market attractiveness justification

Table 3.4: Market attractiveness scores

Table 3.5: Competitive strength justification

Table 3.6: Competitive strength scores

Table 4.1: Analysis of entry criteria for Vinamilk

Table 5.1: STP Strategy

Table 5.2: Benchmarking table

Table 5.3: Explanation table

Table 1.1: Health benefits among the global concern of consumers

Table 1.2: The business model of Vinamilk.

Table 1.3: Value chain analysis of Vinamilk

Table 3.1: BERI justification

Table 3.2: BERI scores

Table 3.3: Market attractiveness justification

Table 3.4: Market attractiveness scores

Table 3.5: Competitive strength justification

Table 3.6: Competitive strength scores

Table 4.1: Analysis of entry criteria for Vinamilk

Table 5.1: STP Strategy

Table 5.2: Benchmarking table

Table 5.3: Explanation table

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LIST OF GRAPHS

Figure 2.1: Health benefits among the global concern of consumers

Figure 2.2: Consumer trends regarding sustainability

Figure 3.1: General marketing screening process

Figure 3.2: Import values for grains, oilseeds, and pulses in 2021

Figure 3.3: UK dairy alternatives market estimates and forecasts, 2014-2025 (USD Million),

by Smart Protein

Figure 3.4: Market Attractiveness/Competitive Strength matrix

Figure 2.1: Health benefits among the global concern of consumers

Figure 2.2: Consumer trends regarding sustainability

Figure 3.1: General marketing screening process

Figure 3.2: Import values for grains, oilseeds, and pulses in 2021

Figure 3.3: UK dairy alternatives market estimates and forecasts, 2014-2025 (USD Million),

by Smart Protein

Figure 3.4: Market Attractiveness/Competitive Strength matrix

CHAPTER 1. EXECUTIVE SUMMARY AND GLOBAL

OVERVIEW

1.1. Executive Summary

The goal of this study is to assess the potential impact of Vinamilk's entry into the

UK market and propose appropriate strategies for market entry. To demonstrate Vinamilk's

ability to enter new markets, this study will utilize the preliminary, detailed, and MACS

models, as well as information on global consumer trends and market conditions, to

determine the most suitable country for Vinamilk to enter. Joint venture will be the most

preferable market entry mode resulting from previous analysis. Key marketing strategies,

including product and communication tactics utilized specifically in the UK will also be

demonstrated. In conclusion, the concern of the extent of product standardization or

adaptation is included in the last section.

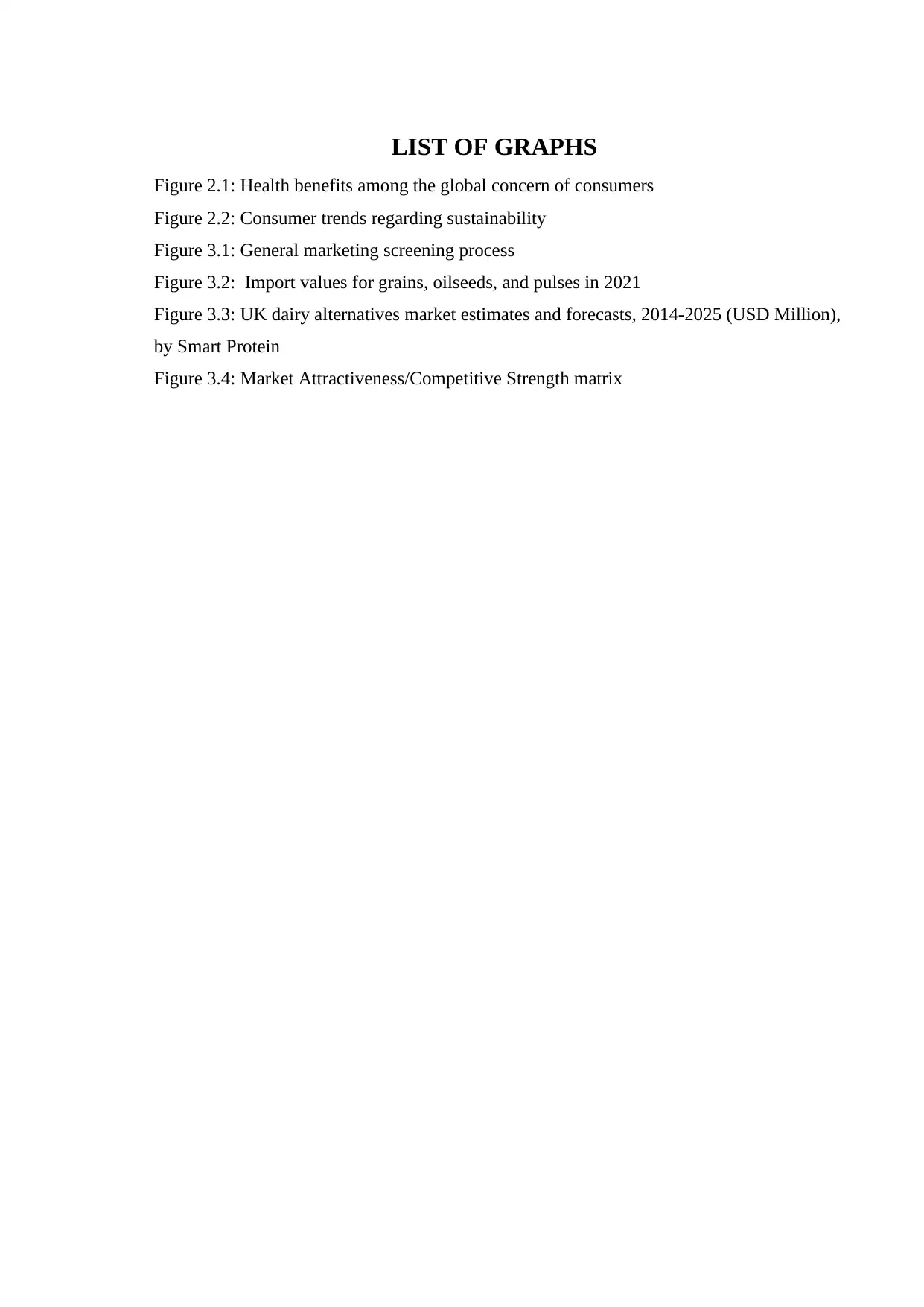

1.2. Global Trend Overview

Global consumers tend to pursue a healthy and environmental sustainability

lifestyle (Rogers, 2022). This growing trend is in alignment with Vinamilk’s core

values of sustainability initiatives.

Figure 1.1. Health benefits among the global concern of consumers

Source: Rogers, 2022

OVERVIEW

1.1. Executive Summary

The goal of this study is to assess the potential impact of Vinamilk's entry into the

UK market and propose appropriate strategies for market entry. To demonstrate Vinamilk's

ability to enter new markets, this study will utilize the preliminary, detailed, and MACS

models, as well as information on global consumer trends and market conditions, to

determine the most suitable country for Vinamilk to enter. Joint venture will be the most

preferable market entry mode resulting from previous analysis. Key marketing strategies,

including product and communication tactics utilized specifically in the UK will also be

demonstrated. In conclusion, the concern of the extent of product standardization or

adaptation is included in the last section.

1.2. Global Trend Overview

Global consumers tend to pursue a healthy and environmental sustainability

lifestyle (Rogers, 2022). This growing trend is in alignment with Vinamilk’s core

values of sustainability initiatives.

Figure 1.1. Health benefits among the global concern of consumers

Source: Rogers, 2022

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Based on this data, we can see that consumers intend to prioritize health and

wellness as a key factor driving their purchasing behavior in the coming years.

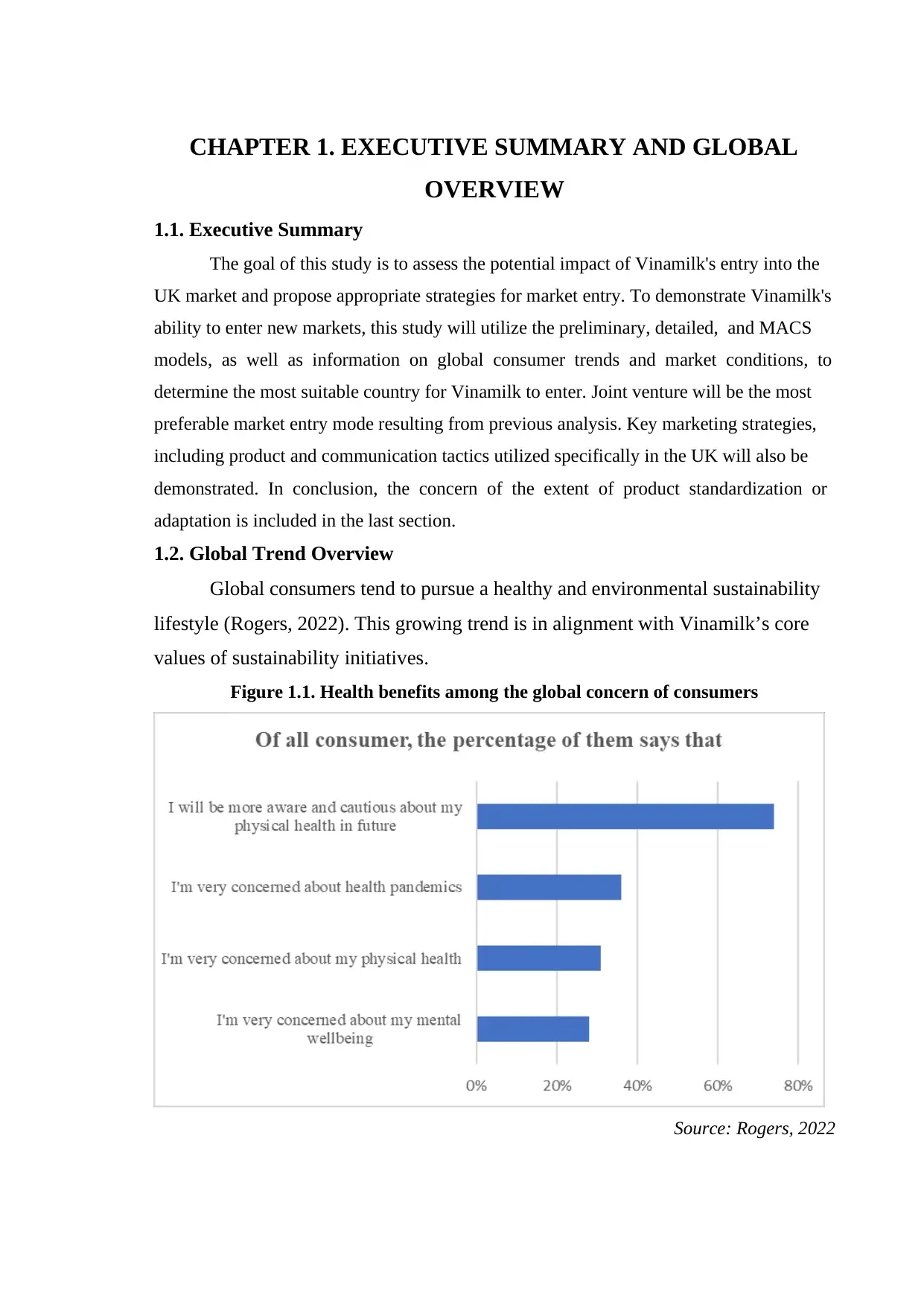

Figure 1.2. Consumer trends regarding sustainability

Source: Rogers, 2022

From this data, we can see that consumers are highly interested in ethically produced

goods, and 56% are willing to pay more for sustainable products.

Besides, the market for plant-based milk is very promising. The global plant-based

milk market was valued at USD 16.3 billion in 2020 and is projected to reach USD

45.2 billion by 2027. The almond segment dominates the global market for plant-

based beverages (MarketsandMarkets).

1.3. Vinamilk

1.3.1 Background information

Vinamilk is the Vietnamese largest dairy producer. They manufacture and sell

liquid, powdered, condensed, and plant-based milk, yogurt, cheese, and ice cream

with 13 farms in Vietnam (>160,000 cows); exports to over 50 nations (US, Japan,

Australia, etc.)

Vinamilk is a popular dairy player in Vietnam and worldwide thanks to their

commitment to innovation, quality, and sustainability. Vinamilk has won numerous

wellness as a key factor driving their purchasing behavior in the coming years.

Figure 1.2. Consumer trends regarding sustainability

Source: Rogers, 2022

From this data, we can see that consumers are highly interested in ethically produced

goods, and 56% are willing to pay more for sustainable products.

Besides, the market for plant-based milk is very promising. The global plant-based

milk market was valued at USD 16.3 billion in 2020 and is projected to reach USD

45.2 billion by 2027. The almond segment dominates the global market for plant-

based beverages (MarketsandMarkets).

1.3. Vinamilk

1.3.1 Background information

Vinamilk is the Vietnamese largest dairy producer. They manufacture and sell

liquid, powdered, condensed, and plant-based milk, yogurt, cheese, and ice cream

with 13 farms in Vietnam (>160,000 cows); exports to over 50 nations (US, Japan,

Australia, etc.)

Vinamilk is a popular dairy player in Vietnam and worldwide thanks to their

commitment to innovation, quality, and sustainability. Vinamilk has won numerous

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

awards, including Forbes Asia's "Fabulous 50" in 2015, 2016, and 2018; ASEAN

Corporate Sustainability Award, Top 50 Best Listed Companies in Vietnam for

Sustainability Report (2020) and become one of the top five milk brands worldwide

(Global Food and Beverage Industry Report).

1.3.2. Plant-based milk overview

Regarding volume growth, Millennials’ organic interest results in 369

million liters consumption in Q1/2020 (GSO).

Distribution networks, grocery shopping, supermarkets, and health food

stores. During Covid-19, home delivery for busy, high-income young consumers

drove online sales.

Concerning exportation, Vinamilk exported 85 containers to Korea in 2020

and 10 containers of seed milk to China in 2021.

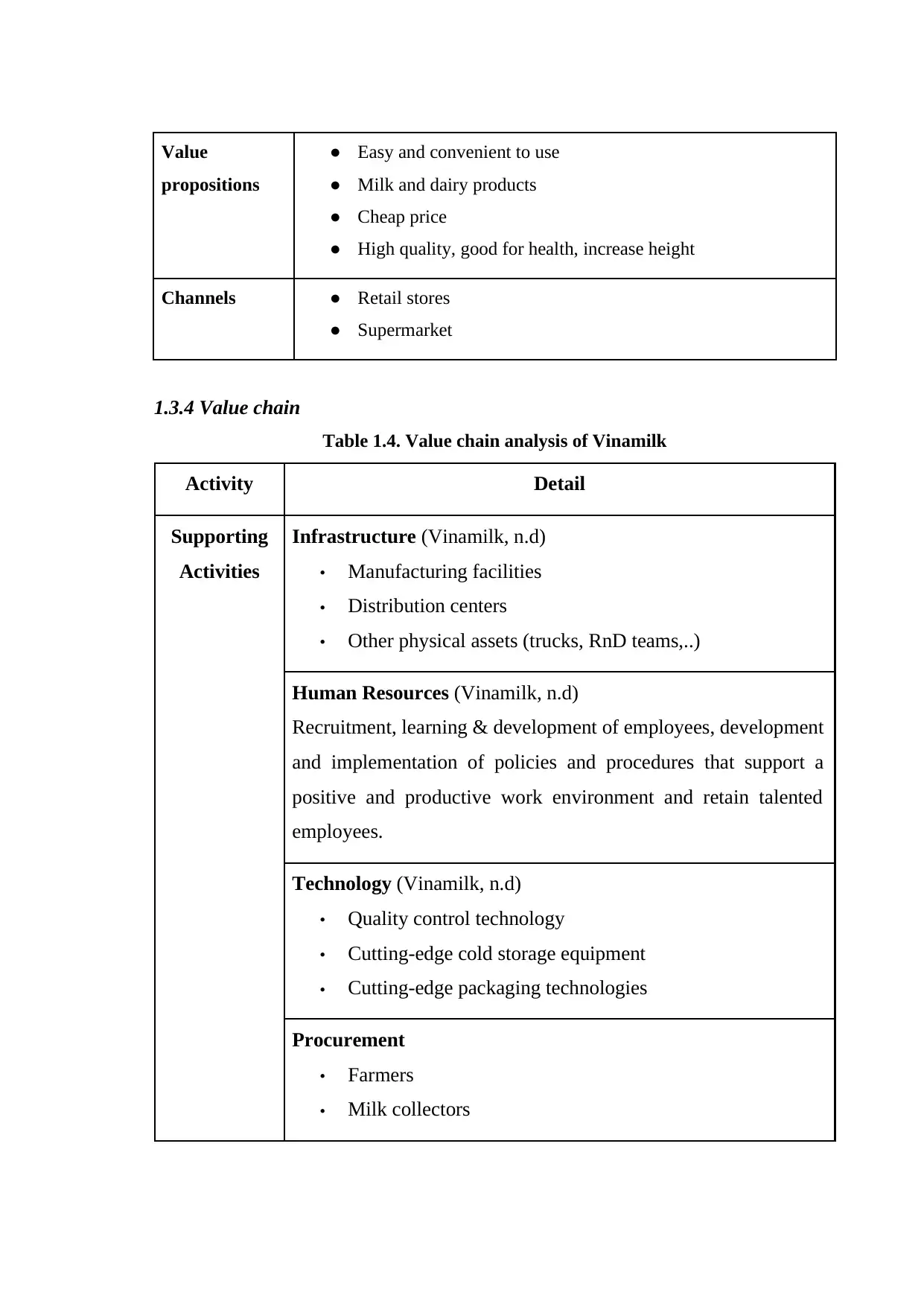

1.3.3. Business model

Table 1.3. The business model of Vinamilk.

Aspect Details

Key partners ● Importing and exporting companies

● Retail stores

● Farmers

● Government

Key activities ● Exporting & importing milk

● Produce milk

● Advertisement

Key resources ● Farms, cow

● Factories

● Employees

● Equipment

● Brand values

Corporate Sustainability Award, Top 50 Best Listed Companies in Vietnam for

Sustainability Report (2020) and become one of the top five milk brands worldwide

(Global Food and Beverage Industry Report).

1.3.2. Plant-based milk overview

Regarding volume growth, Millennials’ organic interest results in 369

million liters consumption in Q1/2020 (GSO).

Distribution networks, grocery shopping, supermarkets, and health food

stores. During Covid-19, home delivery for busy, high-income young consumers

drove online sales.

Concerning exportation, Vinamilk exported 85 containers to Korea in 2020

and 10 containers of seed milk to China in 2021.

1.3.3. Business model

Table 1.3. The business model of Vinamilk.

Aspect Details

Key partners ● Importing and exporting companies

● Retail stores

● Farmers

● Government

Key activities ● Exporting & importing milk

● Produce milk

● Advertisement

Key resources ● Farms, cow

● Factories

● Employees

● Equipment

● Brand values

Value

propositions

● Easy and convenient to use

● Milk and dairy products

● Cheap price

● High quality, good for health, increase height

Channels ● Retail stores

● Supermarket

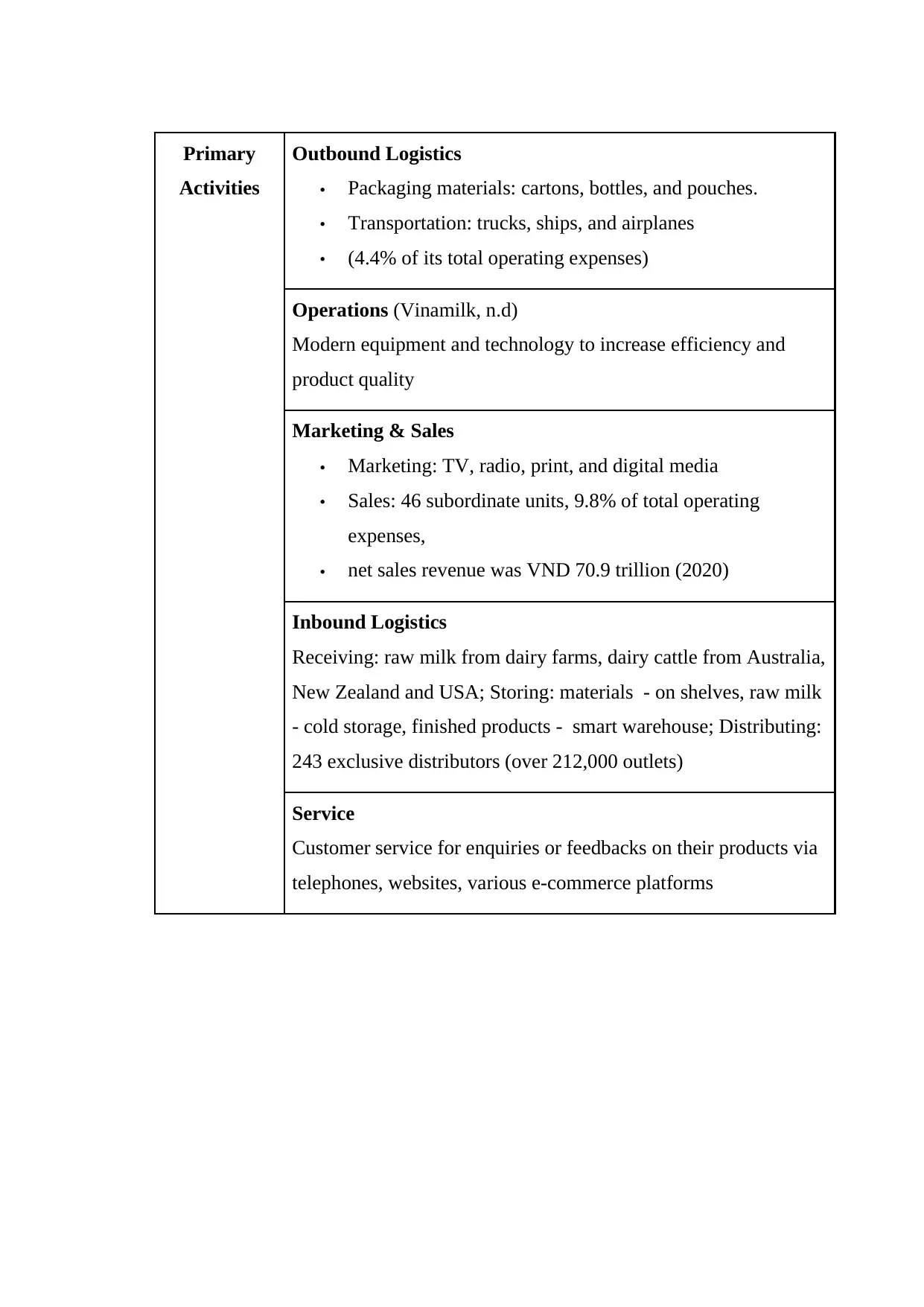

1.3.4 Value chain

Table 1.4. Value chain analysis of Vinamilk

Activity Detail

Supporting

Activities

Infrastructure (Vinamilk, n.d)

• Manufacturing facilities

• Distribution centers

• Other physical assets (trucks, RnD teams,..)

Human Resources (Vinamilk, n.d)

Recruitment, learning & development of employees, development

and implementation of policies and procedures that support a

positive and productive work environment and retain talented

employees.

Technology (Vinamilk, n.d)

• Quality control technology

• Cutting-edge cold storage equipment

• Cutting-edge packaging technologies

Procurement

• Farmers

• Milk collectors

propositions

● Easy and convenient to use

● Milk and dairy products

● Cheap price

● High quality, good for health, increase height

Channels ● Retail stores

● Supermarket

1.3.4 Value chain

Table 1.4. Value chain analysis of Vinamilk

Activity Detail

Supporting

Activities

Infrastructure (Vinamilk, n.d)

• Manufacturing facilities

• Distribution centers

• Other physical assets (trucks, RnD teams,..)

Human Resources (Vinamilk, n.d)

Recruitment, learning & development of employees, development

and implementation of policies and procedures that support a

positive and productive work environment and retain talented

employees.

Technology (Vinamilk, n.d)

• Quality control technology

• Cutting-edge cold storage equipment

• Cutting-edge packaging technologies

Procurement

• Farmers

• Milk collectors

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Primary

Activities

Outbound Logistics

• Packaging materials: cartons, bottles, and pouches.

• Transportation: trucks, ships, and airplanes

• (4.4% of its total operating expenses)

Operations (Vinamilk, n.d)

Modern equipment and technology to increase efficiency and

product quality

Marketing & Sales

• Marketing: TV, radio, print, and digital media

• Sales: 46 subordinate units, 9.8% of total operating

expenses,

• net sales revenue was VND 70.9 trillion (2020)

Inbound Logistics

Receiving: raw milk from dairy farms, dairy cattle from Australia,

New Zealand and USA; Storing: materials - on shelves, raw milk

- cold storage, finished products - smart warehouse; Distributing:

243 exclusive distributors (over 212,000 outlets)

Service

Customer service for enquiries or feedbacks on their products via

telephones, websites, various e-commerce platforms

Activities

Outbound Logistics

• Packaging materials: cartons, bottles, and pouches.

• Transportation: trucks, ships, and airplanes

• (4.4% of its total operating expenses)

Operations (Vinamilk, n.d)

Modern equipment and technology to increase efficiency and

product quality

Marketing & Sales

• Marketing: TV, radio, print, and digital media

• Sales: 46 subordinate units, 9.8% of total operating

expenses,

• net sales revenue was VND 70.9 trillion (2020)

Inbound Logistics

Receiving: raw milk from dairy farms, dairy cattle from Australia,

New Zealand and USA; Storing: materials - on shelves, raw milk

- cold storage, finished products - smart warehouse; Distributing:

243 exclusive distributors (over 212,000 outlets)

Service

Customer service for enquiries or feedbacks on their products via

telephones, websites, various e-commerce platforms

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CHAPTER 2. OVERVIEW OF 2 PROMISING COUNTRIES

2.1. Overview of The UK & India

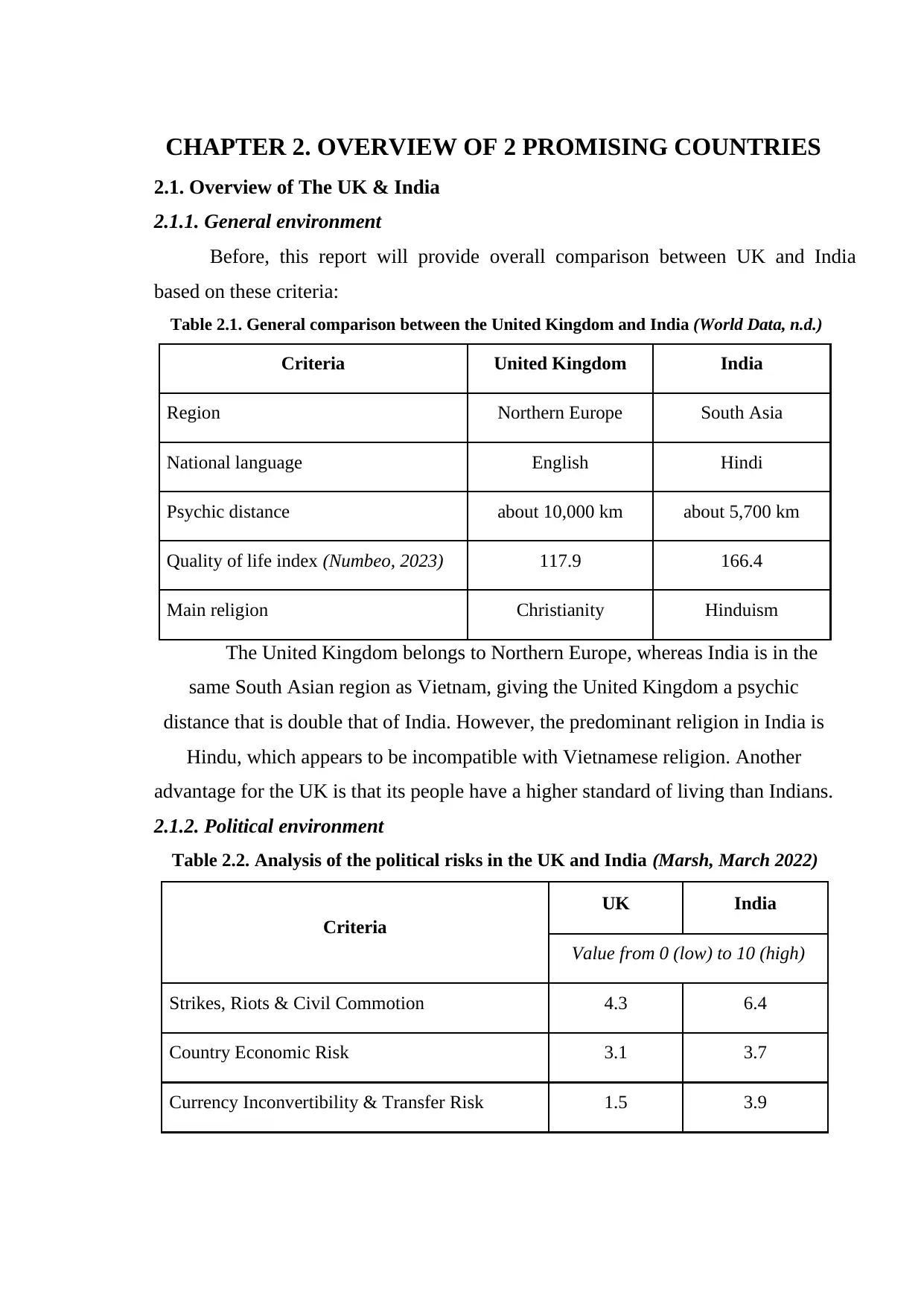

2.1.1. General environment

Before, this report will provide overall comparison between UK and India

based on these criteria:

Table 2.1. General comparison between the United Kingdom and India (World Data, n.d.)

Criteria United Kingdom India

Region Northern Europe South Asia

National language English Hindi

Psychic distance about 10,000 km about 5,700 km

Quality of life index (Numbeo, 2023) 117.9 166.4

Main religion Christianity Hinduism

The United Kingdom belongs to Northern Europe, whereas India is in the

same South Asian region as Vietnam, giving the United Kingdom a psychic

distance that is double that of India. However, the predominant religion in India is

Hindu, which appears to be incompatible with Vietnamese religion. Another

advantage for the UK is that its people have a higher standard of living than Indians.

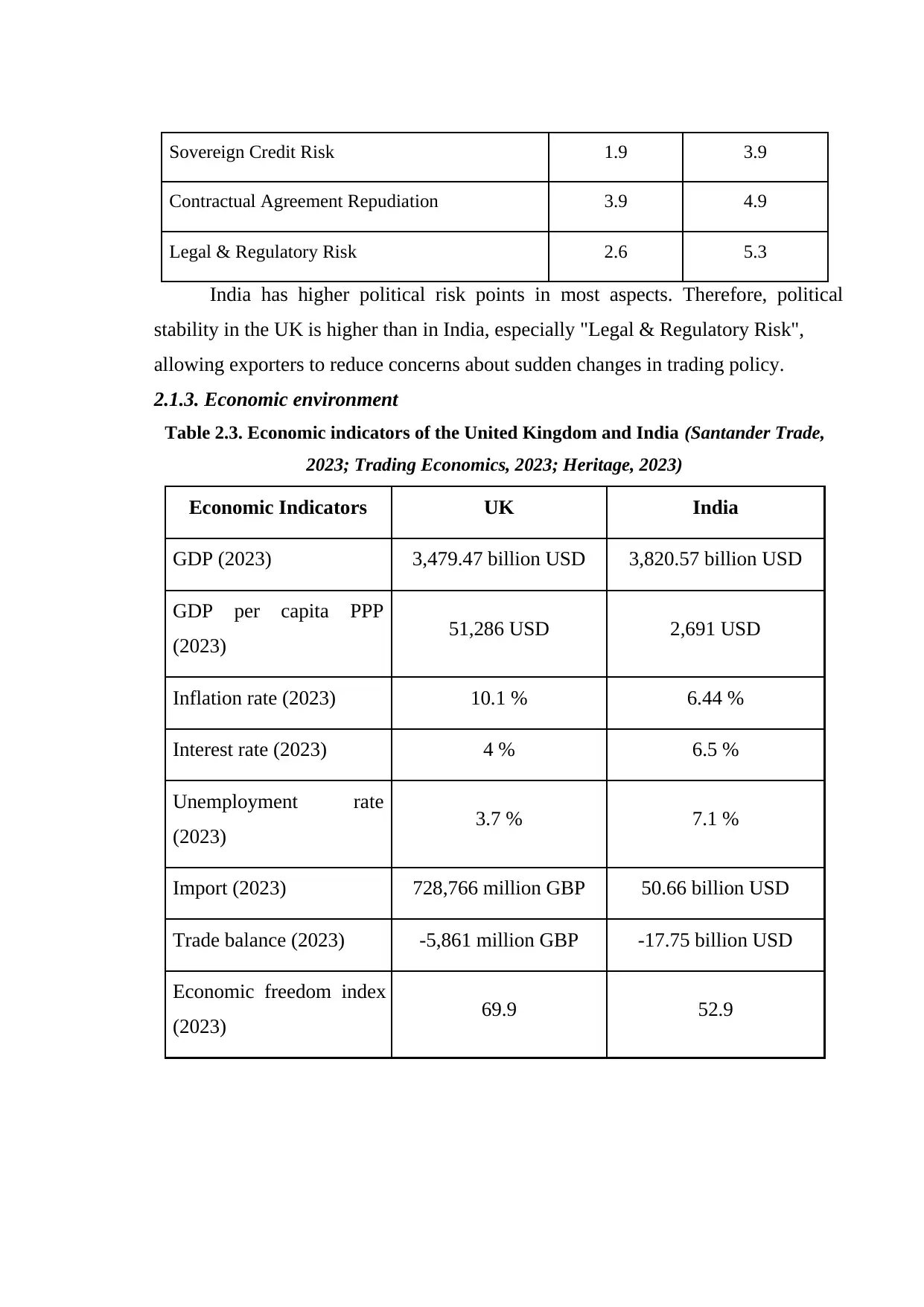

2.1.2. Political environment

Table 2.2. Analysis of the political risks in the UK and India (Marsh, March 2022)

Criteria

UK India

Value from 0 (low) to 10 (high)

Strikes, Riots & Civil Commotion 4.3 6.4

Country Economic Risk 3.1 3.7

Currency Inconvertibility & Transfer Risk 1.5 3.9

2.1. Overview of The UK & India

2.1.1. General environment

Before, this report will provide overall comparison between UK and India

based on these criteria:

Table 2.1. General comparison between the United Kingdom and India (World Data, n.d.)

Criteria United Kingdom India

Region Northern Europe South Asia

National language English Hindi

Psychic distance about 10,000 km about 5,700 km

Quality of life index (Numbeo, 2023) 117.9 166.4

Main religion Christianity Hinduism

The United Kingdom belongs to Northern Europe, whereas India is in the

same South Asian region as Vietnam, giving the United Kingdom a psychic

distance that is double that of India. However, the predominant religion in India is

Hindu, which appears to be incompatible with Vietnamese religion. Another

advantage for the UK is that its people have a higher standard of living than Indians.

2.1.2. Political environment

Table 2.2. Analysis of the political risks in the UK and India (Marsh, March 2022)

Criteria

UK India

Value from 0 (low) to 10 (high)

Strikes, Riots & Civil Commotion 4.3 6.4

Country Economic Risk 3.1 3.7

Currency Inconvertibility & Transfer Risk 1.5 3.9

Sovereign Credit Risk 1.9 3.9

Contractual Agreement Repudiation 3.9 4.9

Legal & Regulatory Risk 2.6 5.3

India has higher political risk points in most aspects. Therefore, political

stability in the UK is higher than in India, especially "Legal & Regulatory Risk",

allowing exporters to reduce concerns about sudden changes in trading policy.

2.1.3. Economic environment

Table 2.3. Economic indicators of the United Kingdom and India (Santander Trade,

2023; Trading Economics, 2023; Heritage, 2023)

Economic Indicators UK India

GDP (2023) 3,479.47 billion USD 3,820.57 billion USD

GDP per capita PPP

(2023) 51,286 USD 2,691 USD

Inflation rate (2023) 10.1 % 6.44 %

Interest rate (2023) 4 % 6.5 %

Unemployment rate

(2023) 3.7 % 7.1 %

Import (2023) 728,766 million GBP 50.66 billion USD

Trade balance (2023) -5,861 million GBP -17.75 billion USD

Economic freedom index

(2023) 69.9 52.9

Contractual Agreement Repudiation 3.9 4.9

Legal & Regulatory Risk 2.6 5.3

India has higher political risk points in most aspects. Therefore, political

stability in the UK is higher than in India, especially "Legal & Regulatory Risk",

allowing exporters to reduce concerns about sudden changes in trading policy.

2.1.3. Economic environment

Table 2.3. Economic indicators of the United Kingdom and India (Santander Trade,

2023; Trading Economics, 2023; Heritage, 2023)

Economic Indicators UK India

GDP (2023) 3,479.47 billion USD 3,820.57 billion USD

GDP per capita PPP

(2023) 51,286 USD 2,691 USD

Inflation rate (2023) 10.1 % 6.44 %

Interest rate (2023) 4 % 6.5 %

Unemployment rate

(2023) 3.7 % 7.1 %

Import (2023) 728,766 million GBP 50.66 billion USD

Trade balance (2023) -5,861 million GBP -17.75 billion USD

Economic freedom index

(2023) 69.9 52.9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 46

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.