ASX Mining Giants: A Financial Performance Report (2015-2017)

VerifiedAdded on 2023/06/04

|25

|4470

|351

Report

AI Summary

This report provides a detailed financial analysis of South 32 Limited and BHP Billiton Limited, two companies listed on the Australian Securities Exchange (ASX), covering the period from 2015 to 2017. The analysis includes a review of changes in owner's equity, examining components such as share capital, reserves, treasury shares, retained earnings, and non-controlling interests. The cash flow statements of both companies are thoroughly analyzed, categorizing cash flows into operating, investing, and financing activities, and highlighting significant trends and variations. The report also addresses the other comprehensive income statement and its relevance in evaluating employee performance, alongside an overview of accounting for corporate income tax, including effective tax rates and deferred tax liabilities. The comparative analysis of these financial statements aims to provide insights into the financial health and investment potential of both companies.

Accounting

Assignment

Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: 20 th Sep 2018.

Executive Summary

1 | Page

By student name

Professor

University

Date: 20 th Sep 2018.

Executive Summary

1 | Page

2

A brief analysis on the annual report of last 3 years has been done for 2 companies which are

listed in the Australian Stock Exchange. Changes made in each line item of equity has been

analysed for 2015, 2016 & 2017. Analysis of cash flow statement of both the companies along

with the meaning of each item in the cash flow statement and the changes under all 3 categories

has been done. Comparison between the equity and debt in each company is also reflected in this

report. The report states the reason behind preparation of other comprehensive income statement

separately along with the income statement and discusses the changes made in the

comprehensive income statement. The statements have been analysed together to find whether

they should be included for evaluation of performance of employees. Lastly the tax paid by the

companies, the effective corporate tax rate, the deferred tax liabilities and total tax expenses of

both the companies has been highlighted in the accounting for corporate income tax.

2 | Page

A brief analysis on the annual report of last 3 years has been done for 2 companies which are

listed in the Australian Stock Exchange. Changes made in each line item of equity has been

analysed for 2015, 2016 & 2017. Analysis of cash flow statement of both the companies along

with the meaning of each item in the cash flow statement and the changes under all 3 categories

has been done. Comparison between the equity and debt in each company is also reflected in this

report. The report states the reason behind preparation of other comprehensive income statement

separately along with the income statement and discusses the changes made in the

comprehensive income statement. The statements have been analysed together to find whether

they should be included for evaluation of performance of employees. Lastly the tax paid by the

companies, the effective corporate tax rate, the deferred tax liabilities and total tax expenses of

both the companies has been highlighted in the accounting for corporate income tax.

2 | Page

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Contents

Executive Summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Owner’s Equity............................................................................................................................................4

Cash Flow Statement...................................................................................................................................7

Other comprehensive income statement..................................................................................................11

Accounting for Corporate Income Tax.......................................................................................................13

References.................................................................................................................................................16

Introduction

3 | Page

Contents

Executive Summary.....................................................................................................................................2

Introduction.................................................................................................................................................4

Owner’s Equity............................................................................................................................................4

Cash Flow Statement...................................................................................................................................7

Other comprehensive income statement..................................................................................................11

Accounting for Corporate Income Tax.......................................................................................................13

References.................................................................................................................................................16

Introduction

3 | Page

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

The company South 32 Limited which is listed under Australian Stock Exchange deals in mining

and metallurgy. The chief producer of zinc, alumina, nickel, silver, lead, aluminium, thermal

coal, cooking coal and manganese has been rising of late in Australia. Also listed under

Johannesburg Stock Exchange and London Stock Exchange, the company employs more than

15000 people (Andiola, et al., 2018).

On the other hand BHP Billiton Limited which deals in mining, petroleum and metal industry is

also listed under Australian Stock Exchange. The company having operations all over the globe

is also listed under London Stock Exchange, Johannesburg Stock Exchange, New York Stock

Exchange and Financial Times Stock Exchange 100. The third largest revenue making company

of Australia & the world’s largest mining company employs 65000 employees.

Overview

A brief analysis on the annual report of last 3 years has been done for 2 companies which are

listed in the Australian Stock Exchange. Changes made in each line item of equity has been

analysed for 2015, 2016 & 2017. An overall analysis of the cash flow statement, income

statement, owneers equity and the overall taxation of the two companies have been taken into

consideration. This will help the investors in analysing which company do they want to invest in.

Owner’s Equity

1. The Owner’s Equity also known as the Owner’s capital is the total sum invested by the

shareholders in the company. There is huge degree of risk in the equity capital because of

which it has higher returns in comparison to the debt capital. Equity shares, Preference

4 | Page

The company South 32 Limited which is listed under Australian Stock Exchange deals in mining

and metallurgy. The chief producer of zinc, alumina, nickel, silver, lead, aluminium, thermal

coal, cooking coal and manganese has been rising of late in Australia. Also listed under

Johannesburg Stock Exchange and London Stock Exchange, the company employs more than

15000 people (Andiola, et al., 2018).

On the other hand BHP Billiton Limited which deals in mining, petroleum and metal industry is

also listed under Australian Stock Exchange. The company having operations all over the globe

is also listed under London Stock Exchange, Johannesburg Stock Exchange, New York Stock

Exchange and Financial Times Stock Exchange 100. The third largest revenue making company

of Australia & the world’s largest mining company employs 65000 employees.

Overview

A brief analysis on the annual report of last 3 years has been done for 2 companies which are

listed in the Australian Stock Exchange. Changes made in each line item of equity has been

analysed for 2015, 2016 & 2017. An overall analysis of the cash flow statement, income

statement, owneers equity and the overall taxation of the two companies have been taken into

consideration. This will help the investors in analysing which company do they want to invest in.

Owner’s Equity

1. The Owner’s Equity also known as the Owner’s capital is the total sum invested by the

shareholders in the company. There is huge degree of risk in the equity capital because of

which it has higher returns in comparison to the debt capital. Equity shares, Preference

4 | Page

5

shares, Retained earnings, Net profit, dividend and different types of reserves are the

components of this equity capital. So these are also distributable to the shareholders

(Appelbaum, et al., 2018).

Each of the items mentioned above can be described as follows:

a) Share Capital: This is the fund invested by the Owners of the company which is

divided into small denominations called shares. These shares are traded in the market

and the buyers of these shares are called the shareholders. The total shares of South

32 Limited have decreased due to the buyback of shares in 2017 whereas there is no

change in the total capital of BHP Billiton Limited over the last 3 years.

b) Reserves: These are the profits earned by the company in past years which has not

been distributed as dividends to the shareholders but are kept aside for some future

endeavours of the business. These reserves also include the amount collected on

forfeited shares and employee share awards net of employee contributions and

unexercised awards. There was no change in the reserves of South 32 Limited in last

3 years and it also remained more or less constant for BHP Billiton Limited (Axelsen,

et al., 2017).

c) Treasury Shares: These are the shares which are generally allotted to the employees

in form of ESOP or dividend reinvestment plan. The ESOP trust purchases these

shares and the employees are later on paid by the company. The Purchase by ESOP

trusts has been more than exercising the option by the employees for BHP Billiton

Limited which resulted in the decrease in the Treasury shares of the company over the

analysed period.

5 | Page

shares, Retained earnings, Net profit, dividend and different types of reserves are the

components of this equity capital. So these are also distributable to the shareholders

(Appelbaum, et al., 2018).

Each of the items mentioned above can be described as follows:

a) Share Capital: This is the fund invested by the Owners of the company which is

divided into small denominations called shares. These shares are traded in the market

and the buyers of these shares are called the shareholders. The total shares of South

32 Limited have decreased due to the buyback of shares in 2017 whereas there is no

change in the total capital of BHP Billiton Limited over the last 3 years.

b) Reserves: These are the profits earned by the company in past years which has not

been distributed as dividends to the shareholders but are kept aside for some future

endeavours of the business. These reserves also include the amount collected on

forfeited shares and employee share awards net of employee contributions and

unexercised awards. There was no change in the reserves of South 32 Limited in last

3 years and it also remained more or less constant for BHP Billiton Limited (Axelsen,

et al., 2017).

c) Treasury Shares: These are the shares which are generally allotted to the employees

in form of ESOP or dividend reinvestment plan. The ESOP trust purchases these

shares and the employees are later on paid by the company. The Purchase by ESOP

trusts has been more than exercising the option by the employees for BHP Billiton

Limited which resulted in the decrease in the Treasury shares of the company over the

analysed period.

5 | Page

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

d) Retained Earnings: These are the total of undistributed profits & losses of the

company of past years. The company can distribute dividends to the shareholders

from time to time from these retained earnings. For South 32 Limited, it was negative

and it further decreased due to incurrence of losses in 2016. But the company paid

dividends during both the years due to cumulative profits of $1231 Mn. in 2017. Due

to the losses incurred and payment of dividends the balance decreased for BHP

Billiton in 2016. But the same increased in 2017 due to the profits earned & dividend

was paid during the year.

e) Non-Controlling Interest: Also known as Minority Interest, these shareholders do not

enjoy voting rights as they own less than 50% of shares. They do not have any control

over the decisions of the management and the net assets position of the company

determines their share of profit. South 32 Limited constantly has very low minority

interest shareholders at $1 Mn. For BHP Billiton, it has increased proportionately

with controlling interest and other shareholders (Bailey, et al., 2017).

(Amt in US$M)

South 32 - Owner's Equity

Particulars 2015 2016 2017

Share Capital 14,958 14,958

14,74

7

Treasury Shares - (3)

(2

6)

Reserves (3,557) (3,555) (3,503

6 | Page

d) Retained Earnings: These are the total of undistributed profits & losses of the

company of past years. The company can distribute dividends to the shareholders

from time to time from these retained earnings. For South 32 Limited, it was negative

and it further decreased due to incurrence of losses in 2016. But the company paid

dividends during both the years due to cumulative profits of $1231 Mn. in 2017. Due

to the losses incurred and payment of dividends the balance decreased for BHP

Billiton in 2016. But the same increased in 2017 due to the profits earned & dividend

was paid during the year.

e) Non-Controlling Interest: Also known as Minority Interest, these shareholders do not

enjoy voting rights as they own less than 50% of shares. They do not have any control

over the decisions of the management and the net assets position of the company

determines their share of profit. South 32 Limited constantly has very low minority

interest shareholders at $1 Mn. For BHP Billiton, it has increased proportionately

with controlling interest and other shareholders (Bailey, et al., 2017).

(Amt in US$M)

South 32 - Owner's Equity

Particulars 2015 2016 2017

Share Capital 14,958 14,958

14,74

7

Treasury Shares - (3)

(2

6)

Reserves (3,557) (3,555) (3,503

6 | Page

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

)

Retained Earnings (365) (1,977)

(98

2)

Total attributable to equity

shares 11,036 9,423

10,23

6

Non-controlling interest (1) (1)

(

1)

Total Equity 11,035 9,422

10,23

5

(Amt in US$M)

BHP Billiton - Owner's Equity

Particulars 2015 2016 2017

Share Capital

BHP Billiton

Ltd.

1,18

6

1,18

6

1,18

6

BHP Billiton

Plc.

1,05

7

1,05

7

1,05

7

Treasury Shares

BHP Billiton

Ltd.

(1

9)

(

7)

(

2)

BHP Billiton

Plc.

(5

7)

(2

6)

(

1)

Reserves

2,55

7

2,53

8

2,40

0

Retained Earnings 60,04 49,54 52,61

7 | Page

)

Retained Earnings (365) (1,977)

(98

2)

Total attributable to equity

shares 11,036 9,423

10,23

6

Non-controlling interest (1) (1)

(

1)

Total Equity 11,035 9,422

10,23

5

(Amt in US$M)

BHP Billiton - Owner's Equity

Particulars 2015 2016 2017

Share Capital

BHP Billiton

Ltd.

1,18

6

1,18

6

1,18

6

BHP Billiton

Plc.

1,05

7

1,05

7

1,05

7

Treasury Shares

BHP Billiton

Ltd.

(1

9)

(

7)

(

2)

BHP Billiton

Plc.

(5

7)

(2

6)

(

1)

Reserves

2,55

7

2,53

8

2,40

0

Retained Earnings 60,04 49,54 52,61

7 | Page

8

4 2 8

Total attributable to equity

shares

64,76

8

54,29

0

57,25

8

Non-controlling interest

5,77

7

5,78

1

5,46

8

Total Equity

70,54

5

60,07

1

62,72

6

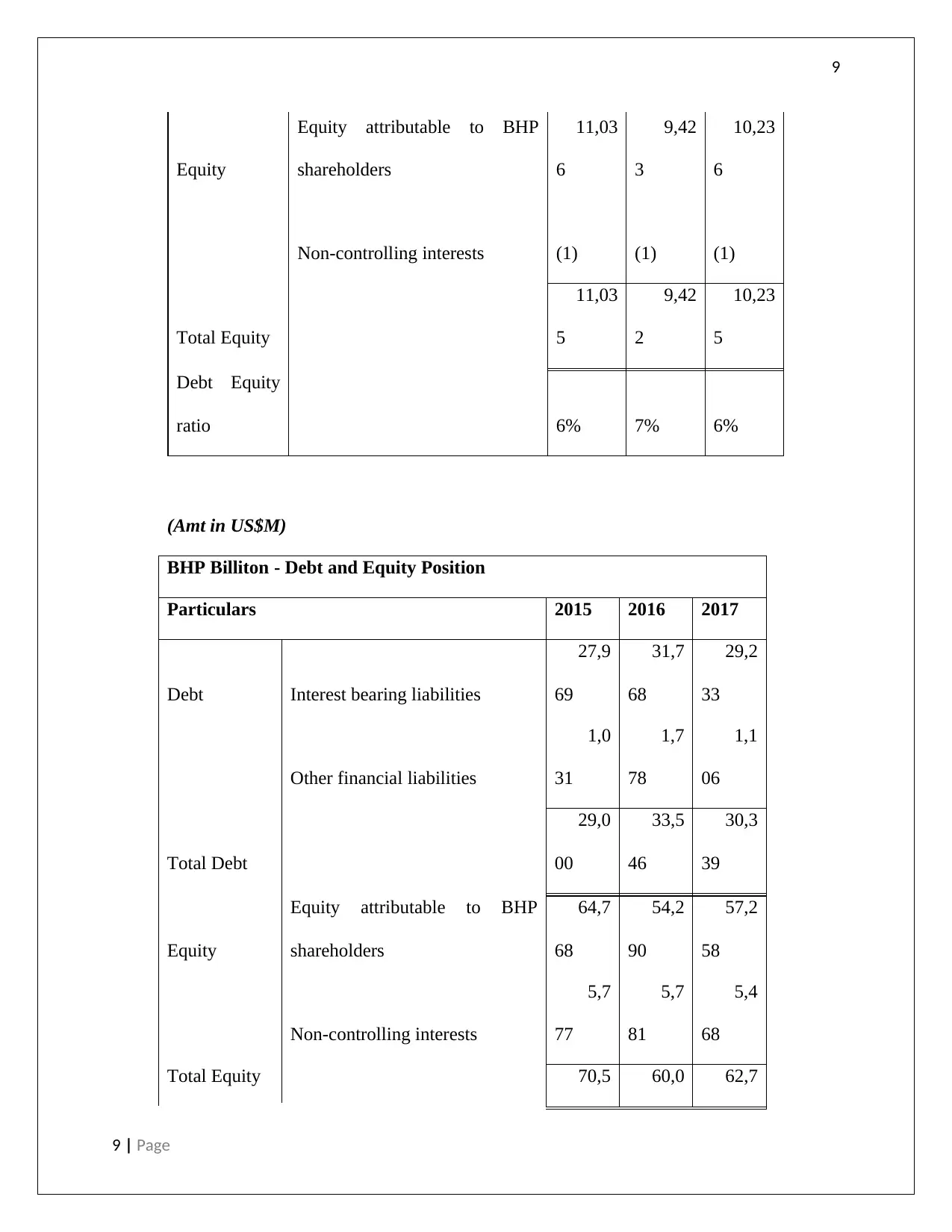

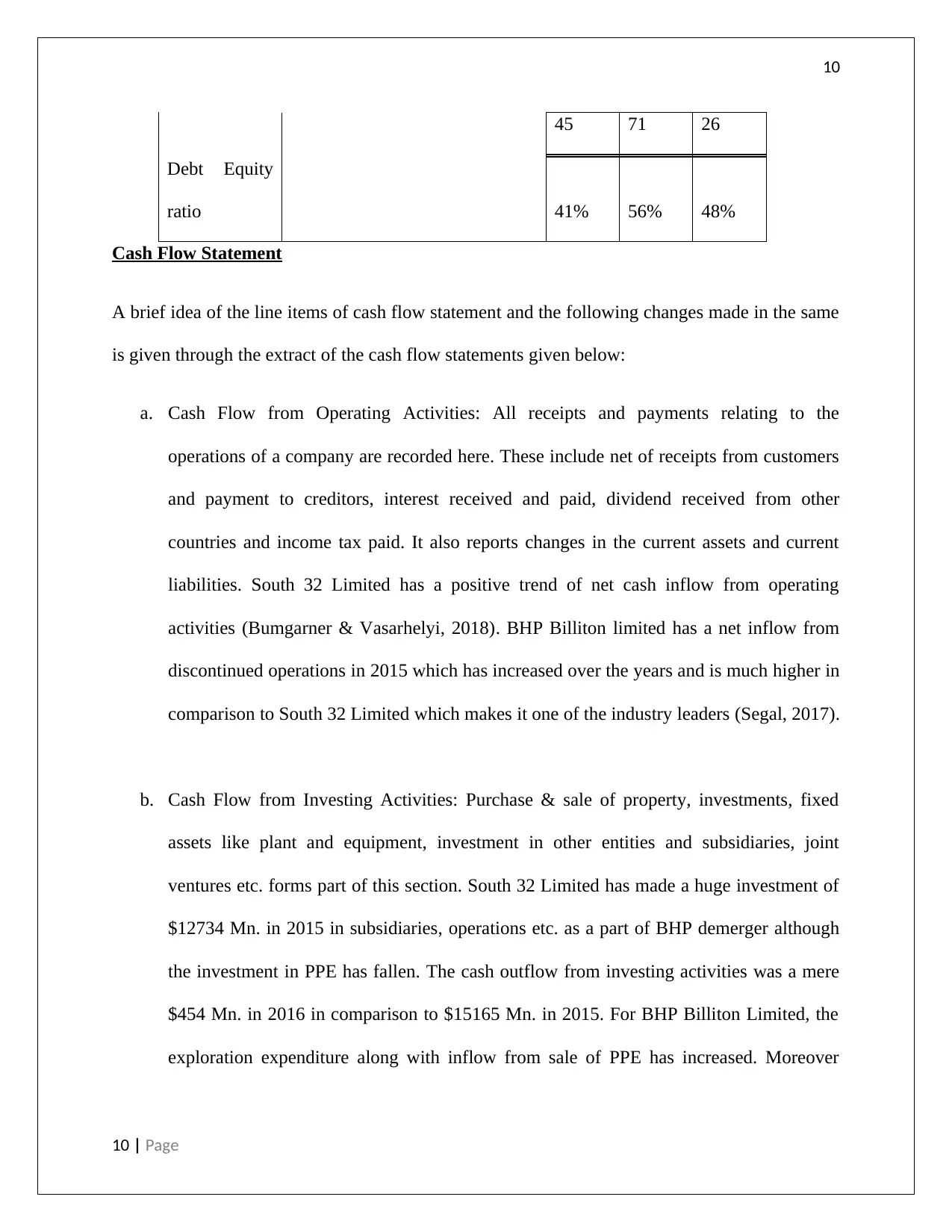

2. Analysis of equity and debt of both the companies shows that both of them has control

over the debt equity ratio and always kept a lower proportion of debt to protect the

interest of the shareholders. The debt equity ratio below shows that South 32 Limited has

specially kept the debt proportion minimal.

(Amt in US$M)

South 32 - Owner's Equity

Particulars 2015 2016 2017

Debt Interest bearing liabilities

6

82

6

31

6

44

Other financial liabilities - 16 -

Total Debt

6

82

6

47

6

44

8 | Page

4 2 8

Total attributable to equity

shares

64,76

8

54,29

0

57,25

8

Non-controlling interest

5,77

7

5,78

1

5,46

8

Total Equity

70,54

5

60,07

1

62,72

6

2. Analysis of equity and debt of both the companies shows that both of them has control

over the debt equity ratio and always kept a lower proportion of debt to protect the

interest of the shareholders. The debt equity ratio below shows that South 32 Limited has

specially kept the debt proportion minimal.

(Amt in US$M)

South 32 - Owner's Equity

Particulars 2015 2016 2017

Debt Interest bearing liabilities

6

82

6

31

6

44

Other financial liabilities - 16 -

Total Debt

6

82

6

47

6

44

8 | Page

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Equity

Equity attributable to BHP

shareholders

11,03

6

9,42

3

10,23

6

Non-controlling interests (1) (1) (1)

Total Equity

11,03

5

9,42

2

10,23

5

Debt Equity

ratio 6% 7% 6%

(Amt in US$M)

BHP Billiton - Debt and Equity Position

Particulars 2015 2016 2017

Debt Interest bearing liabilities

27,9

69

31,7

68

29,2

33

Other financial liabilities

1,0

31

1,7

78

1,1

06

Total Debt

29,0

00

33,5

46

30,3

39

Equity

Equity attributable to BHP

shareholders

64,7

68

54,2

90

57,2

58

Non-controlling interests

5,7

77

5,7

81

5,4

68

Total Equity 70,5 60,0 62,7

9 | Page

Equity

Equity attributable to BHP

shareholders

11,03

6

9,42

3

10,23

6

Non-controlling interests (1) (1) (1)

Total Equity

11,03

5

9,42

2

10,23

5

Debt Equity

ratio 6% 7% 6%

(Amt in US$M)

BHP Billiton - Debt and Equity Position

Particulars 2015 2016 2017

Debt Interest bearing liabilities

27,9

69

31,7

68

29,2

33

Other financial liabilities

1,0

31

1,7

78

1,1

06

Total Debt

29,0

00

33,5

46

30,3

39

Equity

Equity attributable to BHP

shareholders

64,7

68

54,2

90

57,2

58

Non-controlling interests

5,7

77

5,7

81

5,4

68

Total Equity 70,5 60,0 62,7

9 | Page

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

45 71 26

Debt Equity

ratio 41% 56% 48%

Cash Flow Statement

A brief idea of the line items of cash flow statement and the following changes made in the same

is given through the extract of the cash flow statements given below:

a. Cash Flow from Operating Activities: All receipts and payments relating to the

operations of a company are recorded here. These include net of receipts from customers

and payment to creditors, interest received and paid, dividend received from other

countries and income tax paid. It also reports changes in the current assets and current

liabilities. South 32 Limited has a positive trend of net cash inflow from operating

activities (Bumgarner & Vasarhelyi, 2018). BHP Billiton limited has a net inflow from

discontinued operations in 2015 which has increased over the years and is much higher in

comparison to South 32 Limited which makes it one of the industry leaders (Segal, 2017).

b. Cash Flow from Investing Activities: Purchase & sale of property, investments, fixed

assets like plant and equipment, investment in other entities and subsidiaries, joint

ventures etc. forms part of this section. South 32 Limited has made a huge investment of

$12734 Mn. in 2015 in subsidiaries, operations etc. as a part of BHP demerger although

the investment in PPE has fallen. The cash outflow from investing activities was a mere

$454 Mn. in 2016 in comparison to $15165 Mn. in 2015. For BHP Billiton Limited, the

exploration expenditure along with inflow from sale of PPE has increased. Moreover

10 | Page

45 71 26

Debt Equity

ratio 41% 56% 48%

Cash Flow Statement

A brief idea of the line items of cash flow statement and the following changes made in the same

is given through the extract of the cash flow statements given below:

a. Cash Flow from Operating Activities: All receipts and payments relating to the

operations of a company are recorded here. These include net of receipts from customers

and payment to creditors, interest received and paid, dividend received from other

countries and income tax paid. It also reports changes in the current assets and current

liabilities. South 32 Limited has a positive trend of net cash inflow from operating

activities (Bumgarner & Vasarhelyi, 2018). BHP Billiton limited has a net inflow from

discontinued operations in 2015 which has increased over the years and is much higher in

comparison to South 32 Limited which makes it one of the industry leaders (Segal, 2017).

b. Cash Flow from Investing Activities: Purchase & sale of property, investments, fixed

assets like plant and equipment, investment in other entities and subsidiaries, joint

ventures etc. forms part of this section. South 32 Limited has made a huge investment of

$12734 Mn. in 2015 in subsidiaries, operations etc. as a part of BHP demerger although

the investment in PPE has fallen. The cash outflow from investing activities was a mere

$454 Mn. in 2016 in comparison to $15165 Mn. in 2015. For BHP Billiton Limited, the

exploration expenditure along with inflow from sale of PPE has increased. Moreover

10 | Page

11

there is a decrease in purchase of plant and equipment and property during the analysed

period (Fukukawa & Mock, 2011).

c. Cash Flow from Financing Activities: this section includes cash flow from issue of shares

& debentures, payment of dividends & interest, redemption of shares etc. Unlike 2016,

South 32 Limited bought back equity shares, raised debt and paid dividends in 2017

(Garon, 2018). BHP Billiton Limited raised debt and interest bearing liabilities of $ 7239

Mn. in 2016 which was mostly repaid in 2017. The dividend payment has decreased over

the years although there was constant inflow and outflow.

Cash Flow Statement of South 32 Limited

11 | Page

there is a decrease in purchase of plant and equipment and property during the analysed

period (Fukukawa & Mock, 2011).

c. Cash Flow from Financing Activities: this section includes cash flow from issue of shares

& debentures, payment of dividends & interest, redemption of shares etc. Unlike 2016,

South 32 Limited bought back equity shares, raised debt and paid dividends in 2017

(Garon, 2018). BHP Billiton Limited raised debt and interest bearing liabilities of $ 7239

Mn. in 2016 which was mostly repaid in 2017. The dividend payment has decreased over

the years although there was constant inflow and outflow.

Cash Flow Statement of South 32 Limited

11 | Page

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.