Analysis of ANZ's Annual Report and Financial Performance

VerifiedAdded on 2023/06/08

|12

|2456

|327

AI Summary

This report analyzes ANZ's annual report and financial performance for the period ended 30/09/2017. It includes information on the grounds of computation, auditor's opinion, risk management structure, and a comparison with Wesfarmers.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

inance AssignmentF

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

By student name

Professor

University

Date: 25 April 2018.

1 | a g eP

By student name

Professor

University

Date: 25 April 2018.

1 | a g eP

2

Contents

Analysis of the case:....................................................................................................................................3

rounds of ComputationG :..............................................................................................................................4

Auditors pinionO .........................................................................................................................................5

erformanceP ................................................................................................................................................6

Management of Risk Structure and the Model:..........................................................................................7

An planation of the ramework of Managing the RisksEx F .............................................................................8

Comparison of he annual reports of A Report with that of another company named esfarmersT NZ W .....9

References.................................................................................................................................................10

2 | a g eP

Contents

Analysis of the case:....................................................................................................................................3

rounds of ComputationG :..............................................................................................................................4

Auditors pinionO .........................................................................................................................................5

erformanceP ................................................................................................................................................6

Management of Risk Structure and the Model:..........................................................................................7

An planation of the ramework of Managing the RisksEx F .............................................................................8

Comparison of he annual reports of A Report with that of another company named esfarmersT NZ W .....9

References.................................................................................................................................................10

2 | a g eP

3

Analysis of the case:

These refers to the annual reports and books of accounts for Australia and New Zealand Banking

Group Limited (the Company) along with its managed bodies (altogether, ‘the Group’ or ‘ANZ’)

for the period ended 30/09/2017. The body is established as well as setup within Australia. The

location related to the registered office of the Company and the prime location of trade is the

“ANZ Centre, 833 Collins Street, Docklands, Victoria, Australia 3008”. By the date 2nd

November 2017, the board of directors took a resolution in order to certify the problems of these

books of accounts and annual reports (Erik & Jan, 2017). By 2017, we evaluated the details and

framework relating to the annual reports having the target for enhancing the reliability upon

shareholders. The said analysis now lead to a quantum of alterations within the annual reports

starting by the prior periods that is inclusive of:

For drafting the annual reports of the organisation, as well as to exclude them within the

financial report relating to the group.

• re-managing the disclosures into parts with general topics that are tilted with the way they run

the business;

• data regarding the Group’s recognition and computation norms and essential views and

estimations has been moved and by currently shown among important notes within the books of

accounts;

• eliminating non-material declaration; as well as

• To sum up previous period count in few statements (Goldmann, 2016).

Data in the books of accounts stays inclusive strictly within the limit it is being thought and

important to the knowledge of the annual books of accounts. The statement has known to be

bigger and important in case like illustrations:

• That money worth is bigger in quantity (quantum element);

• That money worth is bigger by quality (quantum element);

3 | a g eP

Analysis of the case:

These refers to the annual reports and books of accounts for Australia and New Zealand Banking

Group Limited (the Company) along with its managed bodies (altogether, ‘the Group’ or ‘ANZ’)

for the period ended 30/09/2017. The body is established as well as setup within Australia. The

location related to the registered office of the Company and the prime location of trade is the

“ANZ Centre, 833 Collins Street, Docklands, Victoria, Australia 3008”. By the date 2nd

November 2017, the board of directors took a resolution in order to certify the problems of these

books of accounts and annual reports (Erik & Jan, 2017). By 2017, we evaluated the details and

framework relating to the annual reports having the target for enhancing the reliability upon

shareholders. The said analysis now lead to a quantum of alterations within the annual reports

starting by the prior periods that is inclusive of:

For drafting the annual reports of the organisation, as well as to exclude them within the

financial report relating to the group.

• re-managing the disclosures into parts with general topics that are tilted with the way they run

the business;

• data regarding the Group’s recognition and computation norms and essential views and

estimations has been moved and by currently shown among important notes within the books of

accounts;

• eliminating non-material declaration; as well as

• To sum up previous period count in few statements (Goldmann, 2016).

Data in the books of accounts stays inclusive strictly within the limit it is being thought and

important to the knowledge of the annual books of accounts. The statement has known to be

bigger and important in case like illustrations:

• That money worth is bigger in quantity (quantum element);

• That money worth is bigger by quality (quantum element);

3 | a g eP

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

• That person could not know the outcome of the Group, excluding its exact declaration (abstract

element);

• That data becomes essential for a person knowledge as the outcome of bigger alternations

within the business of the Group within the term– as an example:

Acquisitions of Business or Sale (qualitative factor);

• The data is in relation to a feature of the operations of the Group which is essential in its

coming production (the abstract element); also

• This data becomes essential within norms needs related to the Corporations Act 2001, the

Banking Act 1959 (Cth) or by the Group’s principal.

The authorities, that is inclusive with the Australian Securities and Investments Commission

(ASIC) and the Australian Prudential Regulation Authority (APRA) (Alexander, 2016).

This said part of books of accounts:

• shows the ground on which the financial statements of the Group have been drafted; and

• shows any latest standards of accounting or norms that clearly effects the books of accounts on

disclosure needs.

Grounds of Computation:

The accounting data have been drafted based on past cost ground - excluding below stated

properties as well as responsibilities that is recorded on the actual worth:

• The accounting tools of the derivative along the instances where the actual worth encircling,

the actual worth set off has been made upon its related protected subjection;

• Ready-to-sold of properties of finance (Grenier, 2017);

• Those instruments of finance that is kept on hold for trade purposes;

4 | a g eP

• That person could not know the outcome of the Group, excluding its exact declaration (abstract

element);

• That data becomes essential for a person knowledge as the outcome of bigger alternations

within the business of the Group within the term– as an example:

Acquisitions of Business or Sale (qualitative factor);

• The data is in relation to a feature of the operations of the Group which is essential in its

coming production (the abstract element); also

• This data becomes essential within norms needs related to the Corporations Act 2001, the

Banking Act 1959 (Cth) or by the Group’s principal.

The authorities, that is inclusive with the Australian Securities and Investments Commission

(ASIC) and the Australian Prudential Regulation Authority (APRA) (Alexander, 2016).

This said part of books of accounts:

• shows the ground on which the financial statements of the Group have been drafted; and

• shows any latest standards of accounting or norms that clearly effects the books of accounts on

disclosure needs.

Grounds of Computation:

The accounting data have been drafted based on past cost ground - excluding below stated

properties as well as responsibilities that is recorded on the actual worth:

• The accounting tools of the derivative along the instances where the actual worth encircling,

the actual worth set off has been made upon its related protected subjection;

• Ready-to-sold of properties of finance (Grenier, 2017);

• Those instruments of finance that is kept on hold for trade purposes;

4 | a g eP

5

• Remaining financial properties and responsibilities assigned at the fair value via income and

loss; and

• few rest properties and responsibilities kept on hold for selling purpose in place when the real

worth minus disposal cost becomes lower than the present worth (excluding for few properties

and responsibilities hold for selling that are free from this need) (Farmer, 2018).

As per the AASB 1038 Life Insurance Contracts (AASB 1038), it is being computed that the life

insurance dues are utilizing the margin on Services (MOs) model.

As per the AASB 119 Employee Benefits, it is being computed and explained the advantage of

liabilities utilizing the expected Unit Credit Method (Belton, 2017).

Auditors Opinion

The auditor’s report shows that the audited Annual Report regarding the Australia as well as

New Zealand Banking Group Limited along with the the bodies that is monitored within the end

period and from period and period within tenure of the accounting year (altogether, the Group).

As per the perception, by assisting Annual Report regarding the Group is according the

Corporations Act 2001 that is inclusive of:

• showing a correct and honest perception related to the financial status of the Group as on 30th

September 2017 also relating to the economic presentation within period ending by the said date;

• adhering to the Australian Accounting Standards and the Corporations Regulations 2001 (Das,

2017).

The Annual Report consists:

• Combined books of accounts of economic status on the 30/09/2017;

• Combined P/L A/C Statement, combined statement of all earnings, combined sheet of

alterations in capital, and combined statement of inflows and outflows of cash for the period then

ended;

5 | a g eP

• Remaining financial properties and responsibilities assigned at the fair value via income and

loss; and

• few rest properties and responsibilities kept on hold for selling purpose in place when the real

worth minus disposal cost becomes lower than the present worth (excluding for few properties

and responsibilities hold for selling that are free from this need) (Farmer, 2018).

As per the AASB 1038 Life Insurance Contracts (AASB 1038), it is being computed that the life

insurance dues are utilizing the margin on Services (MOs) model.

As per the AASB 119 Employee Benefits, it is being computed and explained the advantage of

liabilities utilizing the expected Unit Credit Method (Belton, 2017).

Auditors Opinion

The auditor’s report shows that the audited Annual Report regarding the Australia as well as

New Zealand Banking Group Limited along with the the bodies that is monitored within the end

period and from period and period within tenure of the accounting year (altogether, the Group).

As per the perception, by assisting Annual Report regarding the Group is according the

Corporations Act 2001 that is inclusive of:

• showing a correct and honest perception related to the financial status of the Group as on 30th

September 2017 also relating to the economic presentation within period ending by the said date;

• adhering to the Australian Accounting Standards and the Corporations Regulations 2001 (Das,

2017).

The Annual Report consists:

• Combined books of accounts of economic status on the 30/09/2017;

• Combined P/L A/C Statement, combined statement of all earnings, combined sheet of

alterations in capital, and combined statement of inflows and outflows of cash for the period then

ended;

5 | a g eP

6

• And the declaration of Directors (Jefferson, 2017).

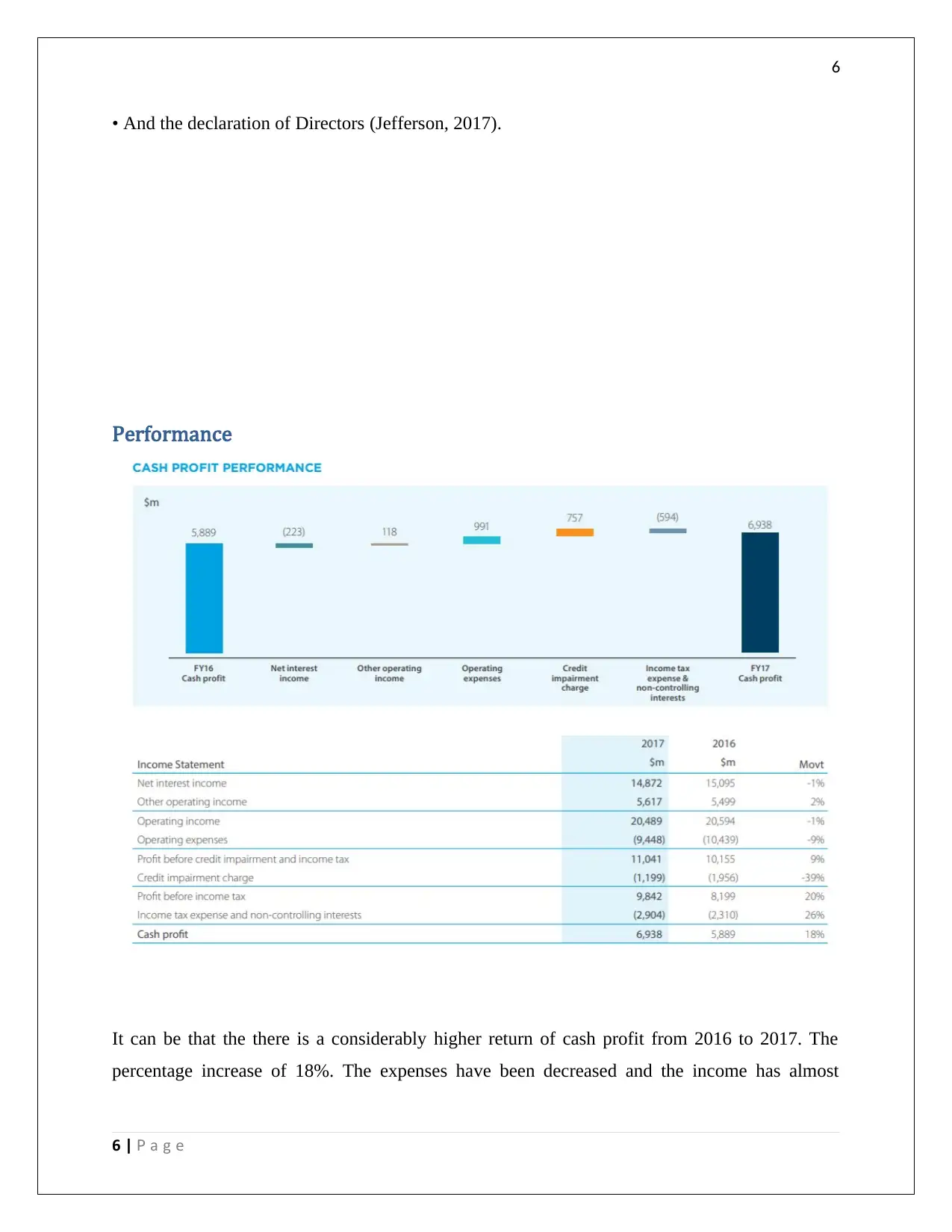

Performance

It can be that the there is a considerably higher return of cash profit from 2016 to 2017. The

percentage increase of 18%. The expenses have been decreased and the income has almost

6 | a g eP

• And the declaration of Directors (Jefferson, 2017).

Performance

It can be that the there is a considerably higher return of cash profit from 2016 to 2017. The

percentage increase of 18%. The expenses have been decreased and the income has almost

6 | a g eP

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

reached until last year, however the income is still less. We can say that the profitability of the

organization has increased and being kept on the increasing graphical curve (Trieu, 2017).

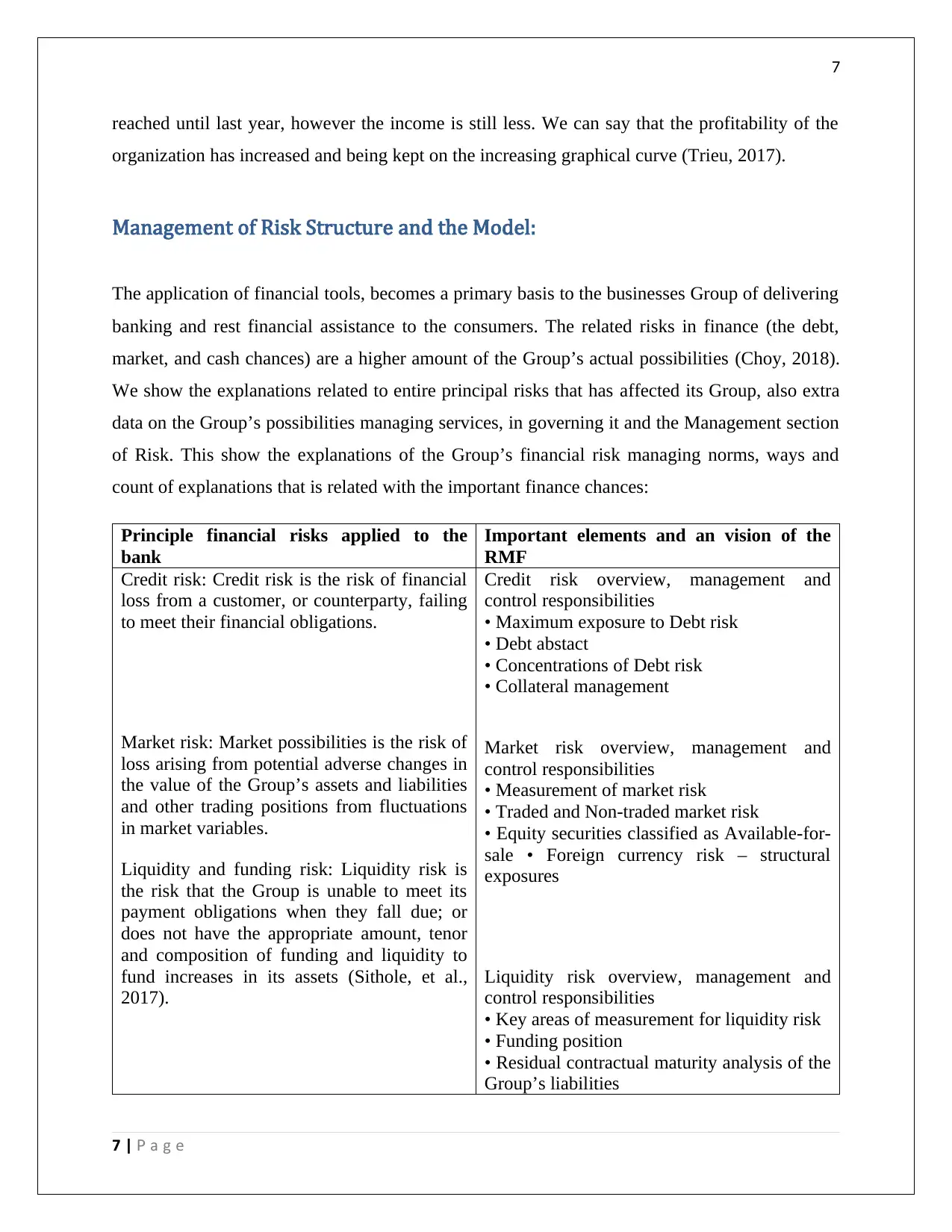

Management of Risk Structure and the Model:

The application of financial tools, becomes a primary basis to the businesses Group of delivering

banking and rest financial assistance to the consumers. The related risks in finance (the debt,

market, and cash chances) are a higher amount of the Group’s actual possibilities (Choy, 2018).

We show the explanations related to entire principal risks that has affected its Group, also extra

data on the Group’s possibilities managing services, in governing it and the Management section

of Risk. This show the explanations of the Group’s financial risk managing norms, ways and

count of explanations that is related with the important finance chances:

Principle financial risks applied to the

bank

Important elements and an vision of the

RMF

Credit risk: Credit risk is the risk of financial

loss from a customer, or counterparty, failing

to meet their financial obligations.

Market risk: Market possibilities is the risk of

loss arising from potential adverse changes in

the value of the Group’s assets and liabilities

and other trading positions from fluctuations

in market variables.

Liquidity and funding risk: Liquidity risk is

the risk that the Group is unable to meet its

payment obligations when they fall due; or

does not have the appropriate amount, tenor

and composition of funding and liquidity to

fund increases in its assets (Sithole, et al.,

2017).

Credit risk overview, management and

control responsibilities

• Maximum exposure to Debt risk

• Debt abstact

• Concentrations of Debt risk

• Collateral management

Market risk overview, management and

control responsibilities

• Measurement of market risk

• Traded and Non-traded market risk

• Equity securities classified as Available-for-

sale • Foreign currency risk – structural

exposures

Liquidity risk overview, management and

control responsibilities

• Key areas of measurement for liquidity risk

• Funding position

• Residual contractual maturity analysis of the

Group’s liabilities

7 | a g eP

reached until last year, however the income is still less. We can say that the profitability of the

organization has increased and being kept on the increasing graphical curve (Trieu, 2017).

Management of Risk Structure and the Model:

The application of financial tools, becomes a primary basis to the businesses Group of delivering

banking and rest financial assistance to the consumers. The related risks in finance (the debt,

market, and cash chances) are a higher amount of the Group’s actual possibilities (Choy, 2018).

We show the explanations related to entire principal risks that has affected its Group, also extra

data on the Group’s possibilities managing services, in governing it and the Management section

of Risk. This show the explanations of the Group’s financial risk managing norms, ways and

count of explanations that is related with the important finance chances:

Principle financial risks applied to the

bank

Important elements and an vision of the

RMF

Credit risk: Credit risk is the risk of financial

loss from a customer, or counterparty, failing

to meet their financial obligations.

Market risk: Market possibilities is the risk of

loss arising from potential adverse changes in

the value of the Group’s assets and liabilities

and other trading positions from fluctuations

in market variables.

Liquidity and funding risk: Liquidity risk is

the risk that the Group is unable to meet its

payment obligations when they fall due; or

does not have the appropriate amount, tenor

and composition of funding and liquidity to

fund increases in its assets (Sithole, et al.,

2017).

Credit risk overview, management and

control responsibilities

• Maximum exposure to Debt risk

• Debt abstact

• Concentrations of Debt risk

• Collateral management

Market risk overview, management and

control responsibilities

• Measurement of market risk

• Traded and Non-traded market risk

• Equity securities classified as Available-for-

sale • Foreign currency risk – structural

exposures

Liquidity risk overview, management and

control responsibilities

• Key areas of measurement for liquidity risk

• Funding position

• Residual contractual maturity analysis of the

Group’s liabilities

7 | a g eP

8

An Explanation of the Framework of Managing the Risks

These details are given to help the users of the books of accounts to know the actual related basis

of the financial explanations essential within AASB 7 Financial Instruments:

The Disclosure: This shall be understood in relation to the governing and the risk managing

purposes. The responsibility of the board is to establish and look after the Risk Management

Framework (RMF) of the Group. The Authority now gave away the power in the hands of Board

Risk Committee (BRC) in order for making as well as controlling the rules and norms of the risk

management norms of the Group. The Board Risk Committee sends report on a regular basis to

the Board related to the performances.

The Board now certifies the planning motive of the Group that is inclusive of:

• we see that the Risk Appetite Statement (RAS), shows the Authority’s targets related to level

with the possibilities that ANZ being groomed for achieving in the way of the planning as well

as vision motives along with plan of the business; along with Risk Management Strategy (RMS),

that explains the plan of ANZ’s related to the management chances also the important things and

parts of the Framework of Management of Risk (RMF), that shows outcome in the planning way

(Kim, et al., 2017). This is inclusive of details of every bigger chances/losses, and an explanation

as to the way the RMF sees every possibilities, along with the relation to the important norms,

classes and ways. It is also inclusive of the data related to the quantum as to the manner ANZ

sees the probable ways, evaluation, controlling, reporting and monitoring or eliminates the

bigger possibilities.

8 | a g eP

An Explanation of the Framework of Managing the Risks

These details are given to help the users of the books of accounts to know the actual related basis

of the financial explanations essential within AASB 7 Financial Instruments:

The Disclosure: This shall be understood in relation to the governing and the risk managing

purposes. The responsibility of the board is to establish and look after the Risk Management

Framework (RMF) of the Group. The Authority now gave away the power in the hands of Board

Risk Committee (BRC) in order for making as well as controlling the rules and norms of the risk

management norms of the Group. The Board Risk Committee sends report on a regular basis to

the Board related to the performances.

The Board now certifies the planning motive of the Group that is inclusive of:

• we see that the Risk Appetite Statement (RAS), shows the Authority’s targets related to level

with the possibilities that ANZ being groomed for achieving in the way of the planning as well

as vision motives along with plan of the business; along with Risk Management Strategy (RMS),

that explains the plan of ANZ’s related to the management chances also the important things and

parts of the Framework of Management of Risk (RMF), that shows outcome in the planning way

(Kim, et al., 2017). This is inclusive of details of every bigger chances/losses, and an explanation

as to the way the RMF sees every possibilities, along with the relation to the important norms,

classes and ways. It is also inclusive of the data related to the quantum as to the manner ANZ

sees the probable ways, evaluation, controlling, reporting and monitoring or eliminates the

bigger possibilities.

8 | a g eP

9

Comparison of The annual reports of ANZ Report with that of another

company named Wesfarmers

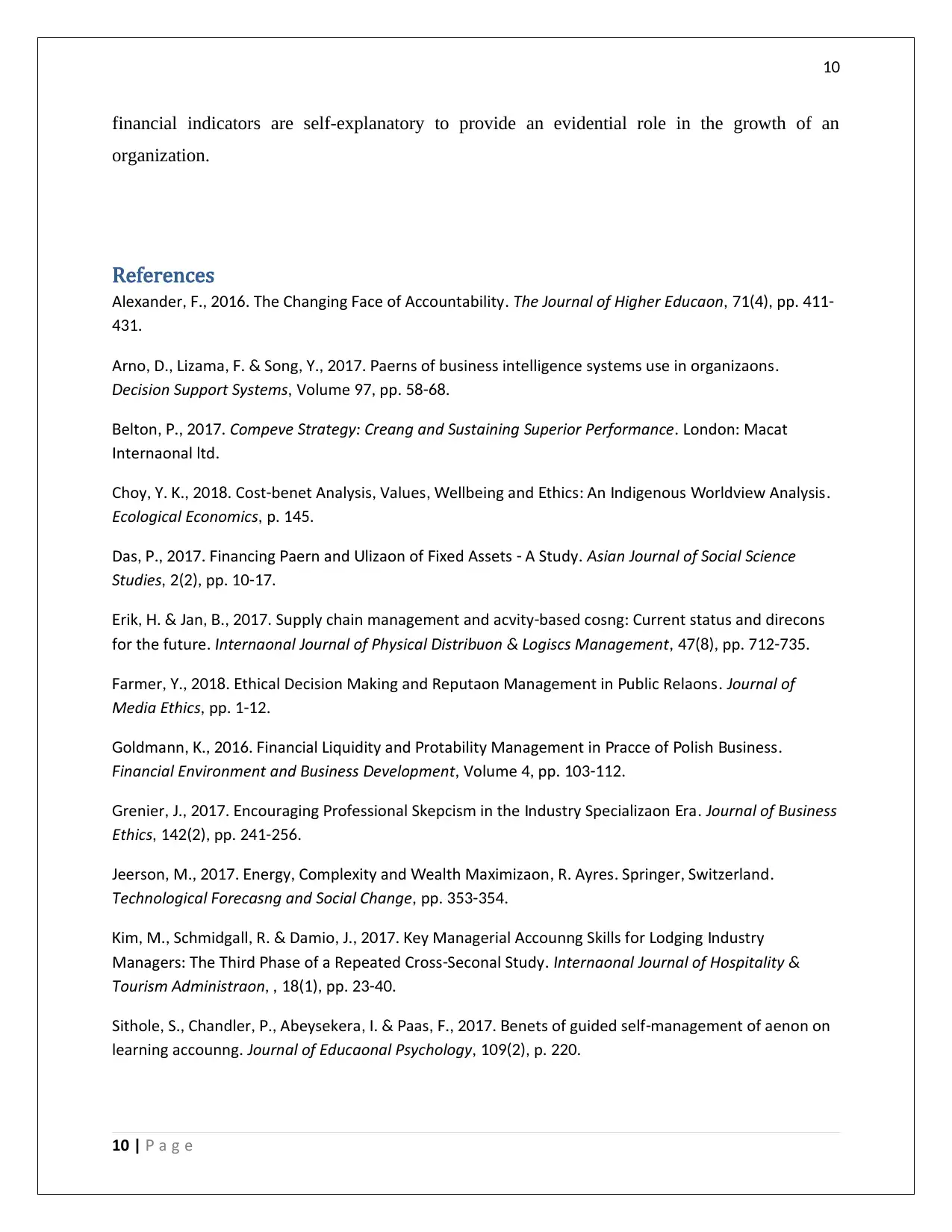

The first and core motive of the Wesfarmers is to deliver satisfaction full return to the

stakeholders. It gave away $2.23 as the dividends in the current year, $2.1b of the taxes of the

government and the royalties, and have employed around 23000 employees and gave away $8.7b

in the form of salary, wages and in many other forms of benefits (Werner, 2017). We can also

see a full depiction of the revenue, which can be studied in the snapshot below:

The above snapshot of the profitability of the Wesfarmers. We can clearly analyse with the help

of this picture, that the profitability of the Wesfarmers is comparatively higher. It has shown

almost a double growth from the 2013 until 2017. Hence, investing the sum of $10000 shall be

well evident to be made investment in the Wesfarmers itself (Arnott, et al., 2017). The key

9 | a g eP

Comparison of The annual reports of ANZ Report with that of another

company named Wesfarmers

The first and core motive of the Wesfarmers is to deliver satisfaction full return to the

stakeholders. It gave away $2.23 as the dividends in the current year, $2.1b of the taxes of the

government and the royalties, and have employed around 23000 employees and gave away $8.7b

in the form of salary, wages and in many other forms of benefits (Werner, 2017). We can also

see a full depiction of the revenue, which can be studied in the snapshot below:

The above snapshot of the profitability of the Wesfarmers. We can clearly analyse with the help

of this picture, that the profitability of the Wesfarmers is comparatively higher. It has shown

almost a double growth from the 2013 until 2017. Hence, investing the sum of $10000 shall be

well evident to be made investment in the Wesfarmers itself (Arnott, et al., 2017). The key

9 | a g eP

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

financial indicators are self-explanatory to provide an evidential role in the growth of an

organization.

References

Ale ander he Changing ace of Accountabilityx , F., 2016. T F . he ournal of Higher EducationT J , pp71(4), . 411-

431.

Arnott D izama Song atterns of business intelligence systems use in organizations, ., L , F. & , Y., 2017. P .

ecision upport ystemsD S S , Volume pp97, . 58-68.

eltonB , P., 2017. Competitive trategy Creating and ustaining uperior PerformanceS : S S . ondon MacatL :

nternational ltdI .

Choy Cost benefit Analysis Values ellbeing and thics An ndigenous orldview Analysis, Y. K., 2018. - , , W E : I W .

Ecological Economics, p. 145.

Das inancing attern and ti lization of i ed Assets A Study, P., 2017. F P U F x - . sian ournal of ocial cienceA J S S

tudiesS , pp2(2), . 10-17.

rik an Supply chain management and activity based costing Current status and directionsE , H. & J , B., 2017. - :

for the future. nternational ournal of Physical istri ution ogistics ManagementI J D b & L , pp47(8), . 712-735.

armer thical Decision Making and Reputation Management in ublic RelationsF , Y., 2018. E P . ournal ofJ

Media Ethics, pp. 1-12.

oldmann inancial iquidity and rofitability Management in ractice of olish usinessG , K., 2016. F L P P P B .

inancial Environment and usiness evelopmentF B D , Volume pp4, . 103-112.

renier ncouraging rofessional Skepticism in the ndustry Specialization raG , J., 2017. E P I E . ournal of usinessJ B

Ethics, pp142(2), . 241-256.

efferson M nergy Comple ity and ealth Ma imization R Ayres Springer SwitzerlandJ , ., 2017. E , x W x , . . , .

echnological orecasting and ocial ChangeT F S , pp. 353-354.

im M Schmidgall R Damitio ey Managerial Accounting Skills for odging ndustryK , ., , . & , J., 2017. K L I

Managers he hird hase of a Repeated Cross Sectional Study: T T P - . nternational ournal of HospitalityI J &

ourism dministrationT A , , pp18(1), . 23-40.

Sithole S Chandler Abeysekera aas enefits of guided self management of attention on, ., , P., , I. & P , F., 2017. B -

learning accounting. ournal of Educational PsychologyJ , p109(2), . 220.

10 | a g eP

financial indicators are self-explanatory to provide an evidential role in the growth of an

organization.

References

Ale ander he Changing ace of Accountabilityx , F., 2016. T F . he ournal of Higher EducationT J , pp71(4), . 411-

431.

Arnott D izama Song atterns of business intelligence systems use in organizations, ., L , F. & , Y., 2017. P .

ecision upport ystemsD S S , Volume pp97, . 58-68.

eltonB , P., 2017. Competitive trategy Creating and ustaining uperior PerformanceS : S S . ondon MacatL :

nternational ltdI .

Choy Cost benefit Analysis Values ellbeing and thics An ndigenous orldview Analysis, Y. K., 2018. - , , W E : I W .

Ecological Economics, p. 145.

Das inancing attern and ti lization of i ed Assets A Study, P., 2017. F P U F x - . sian ournal of ocial cienceA J S S

tudiesS , pp2(2), . 10-17.

rik an Supply chain management and activity based costing Current status and directionsE , H. & J , B., 2017. - :

for the future. nternational ournal of Physical istri ution ogistics ManagementI J D b & L , pp47(8), . 712-735.

armer thical Decision Making and Reputation Management in ublic RelationsF , Y., 2018. E P . ournal ofJ

Media Ethics, pp. 1-12.

oldmann inancial iquidity and rofitability Management in ractice of olish usinessG , K., 2016. F L P P P B .

inancial Environment and usiness evelopmentF B D , Volume pp4, . 103-112.

renier ncouraging rofessional Skepticism in the ndustry Specialization raG , J., 2017. E P I E . ournal of usinessJ B

Ethics, pp142(2), . 241-256.

efferson M nergy Comple ity and ealth Ma imization R Ayres Springer SwitzerlandJ , ., 2017. E , x W x , . . , .

echnological orecasting and ocial ChangeT F S , pp. 353-354.

im M Schmidgall R Damitio ey Managerial Accounting Skills for odging ndustryK , ., , . & , J., 2017. K L I

Managers he hird hase of a Repeated Cross Sectional Study: T T P - . nternational ournal of HospitalityI J &

ourism dministrationT A , , pp18(1), . 23-40.

Sithole S Chandler Abeysekera aas enefits of guided self management of attention on, ., , P., , I. & P , F., 2017. B -

learning accounting. ournal of Educational PsychologyJ , p109(2), . 220.

10 | a g eP

11

rieu V etting value from usiness ntelligence systems A review and research agendaT , ., 2017. G B I : . ecisionD

upport ystemsS S , Volume pp93, . 111-124.

erner M inancial process mining Accounting data structure dependent control fl ow inferenceW , ., 2017. F - .

nternational ournal of ccounting nformation ystemsI J A I S , Volume pp25, . 57-80.

11 | a g eP

rieu V etting value from usiness ntelligence systems A review and research agendaT , ., 2017. G B I : . ecisionD

upport ystemsS S , Volume pp93, . 111-124.

erner M inancial process mining Accounting data structure dependent control fl ow inferenceW , ., 2017. F - .

nternational ournal of ccounting nformation ystemsI J A I S , Volume pp25, . 57-80.

11 | a g eP

1 out of 12

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.