Financial Analysis: Kadlex Plc WACC and Investment Appraisal

VerifiedAdded on 2023/01/16

|16

|3896

|59

Report

AI Summary

This report delves into the financial management of Kadlex Plc, addressing key aspects such as Weighted Average Cost of Capital (WACC) calculations, both at book and market value, and analyzing the impact of proposed changes to the capital structure. The report explores the integration of gearing to minimize WACC and evaluates the effects of short-termism on bankruptcy and agency problems. Furthermore, it examines investment appraisal techniques, including Payback Period, Accounting Rate of Return (ARR), and Internal Rate of Return (IRR), to assess the economic feasibility of acquiring new machinery for Lovewell, a food manufacturing company. The analysis provides detailed calculations and critically evaluates the benefits and limitations of each investment appraisal method to support sound financial decision-making.

Financial

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1........................................................................................................................................3

(a) Calculate the book value and market value of cost of capital (WACC) for Kadlex Plc........3

(b) After proposed changes recalculate the cost of capital of business and reflect the change...6

(c) Critically discussed the organization by integrating a sensible level of gearing into their

capital structure and minimise (WACC)......................................................................................7

(e) Evaluate the effect of short termism on bankruptcy and find the agency problem in a

company.......................................................................................................................................7

Question 3 .......................................................................................................................................8

(a) Calculate by using following investment appraisal techniques and recommend that how it

economically feasible to acquire new machine...........................................................................8

(b) Critically evaluate the benefits as well as limitation of different investment appraisal

techniques..................................................................................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1........................................................................................................................................3

(a) Calculate the book value and market value of cost of capital (WACC) for Kadlex Plc........3

(b) After proposed changes recalculate the cost of capital of business and reflect the change...6

(c) Critically discussed the organization by integrating a sensible level of gearing into their

capital structure and minimise (WACC)......................................................................................7

(e) Evaluate the effect of short termism on bankruptcy and find the agency problem in a

company.......................................................................................................................................7

Question 3 .......................................................................................................................................8

(a) Calculate by using following investment appraisal techniques and recommend that how it

economically feasible to acquire new machine...........................................................................8

(b) Critically evaluate the benefits as well as limitation of different investment appraisal

techniques..................................................................................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION

Financial management is the process of planning, managing, controlling and directing

various financial activities which help the managers to maximise the productivity as well as

profitability of the company (Bagh, 2016). They also implement various accounting principle in

order to manage their financial resources. Every organization should financially managed and

ensure that business able to perform their operational activities. This assessment based on 1st and

3rd question which is about the WAAC of the company at book or market value. In addition, it

includes the different investment appraisal technique which is used to calculate that investment

in the new machinery is suitable for the company or not.

MAIN BODY

Question 1

(a) Calculate the book value and market value of cost of capital (WACC) for Kadlex Plc

Every organization should manage their capital structure which is the combination of

equity or debt. It is used by the business to fund their activities and ensure that each activity

performed well to achieve their goals & objectives. Equity generated through issuing shares and

debt is the loans (Banerjee and et. al., 2016). Further it incudes the bonds, preference shares, etc.

In Kadlex Plc, finance director analyse that WACC of the company is very less so they planned

to issue more debts from market. So management need to identify the change in the WACC and

its calculation are as follow:

Calculation of Growth:

From 1st to 5th year growth of the company are 21, 23, 25, 27 and 28p respectively. It

further calculation mentioned below:

Formula:

Sn = S0*(1+g)n

28 = 21 * (1 + g)4

28 / 21 = (1 + g)4

1.33 = (1 + g)4

(1.33)0.25= (1 + g)

g = 1 – 1.0757

= 0.0757 or 7.57%

Financial management is the process of planning, managing, controlling and directing

various financial activities which help the managers to maximise the productivity as well as

profitability of the company (Bagh, 2016). They also implement various accounting principle in

order to manage their financial resources. Every organization should financially managed and

ensure that business able to perform their operational activities. This assessment based on 1st and

3rd question which is about the WAAC of the company at book or market value. In addition, it

includes the different investment appraisal technique which is used to calculate that investment

in the new machinery is suitable for the company or not.

MAIN BODY

Question 1

(a) Calculate the book value and market value of cost of capital (WACC) for Kadlex Plc

Every organization should manage their capital structure which is the combination of

equity or debt. It is used by the business to fund their activities and ensure that each activity

performed well to achieve their goals & objectives. Equity generated through issuing shares and

debt is the loans (Banerjee and et. al., 2016). Further it incudes the bonds, preference shares, etc.

In Kadlex Plc, finance director analyse that WACC of the company is very less so they planned

to issue more debts from market. So management need to identify the change in the WACC and

its calculation are as follow:

Calculation of Growth:

From 1st to 5th year growth of the company are 21, 23, 25, 27 and 28p respectively. It

further calculation mentioned below:

Formula:

Sn = S0*(1+g)n

28 = 21 * (1 + g)4

28 / 21 = (1 + g)4

1.33 = (1 + g)4

(1.33)0.25= (1 + g)

g = 1 – 1.0757

= 0.0757 or 7.57%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Here,

Sn = Last dividend

S0 = First dividend

n = Number of years

g = growth

Calculation of growth rate for the securities:

Cost of irredeemable bonds:

Formula:

Kd = [ j * (1 – CT) ] * (Po / Pn)

Kd = [ 0.10 * (1 – 0.30)] * (100 / 107)

= 0.0654

= 6.54 %

Here:

Kd = Cost of Irredeemable Bonds

j = Rate of interest on bonds

CT = Rate of Corporate tax rate

P0 = Initial Price

Pn = Current Price

Cost of preference share:

Formula for calculations: Kp= (j)/Pf

= 7 / 75

= 0.0933 or 9.33%

Here, Kp = Total cost of Preference Shares

j = Dividend on preference shares

Pf = Current [rice of preference share excluding dividend

Cots of equities:

Formula:

Ke = [Sn * (1 + g) + g ) / P0

Ke = [28 * (1 + 0.075 ) + 0.075] / 2.65

= (28 * 1.15) / 2.65

=12.15 %

Sn = Last dividend

S0 = First dividend

n = Number of years

g = growth

Calculation of growth rate for the securities:

Cost of irredeemable bonds:

Formula:

Kd = [ j * (1 – CT) ] * (Po / Pn)

Kd = [ 0.10 * (1 – 0.30)] * (100 / 107)

= 0.0654

= 6.54 %

Here:

Kd = Cost of Irredeemable Bonds

j = Rate of interest on bonds

CT = Rate of Corporate tax rate

P0 = Initial Price

Pn = Current Price

Cost of preference share:

Formula for calculations: Kp= (j)/Pf

= 7 / 75

= 0.0933 or 9.33%

Here, Kp = Total cost of Preference Shares

j = Dividend on preference shares

Pf = Current [rice of preference share excluding dividend

Cots of equities:

Formula:

Ke = [Sn * (1 + g) + g ) / P0

Ke = [28 * (1 + 0.075 ) + 0.075] / 2.65

= (28 * 1.15) / 2.65

=12.15 %

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Here,

Ke = Cost of Equity

Sn = First dividend

g = Growth rate

P0 = Current share price of equity shares excluding dividend

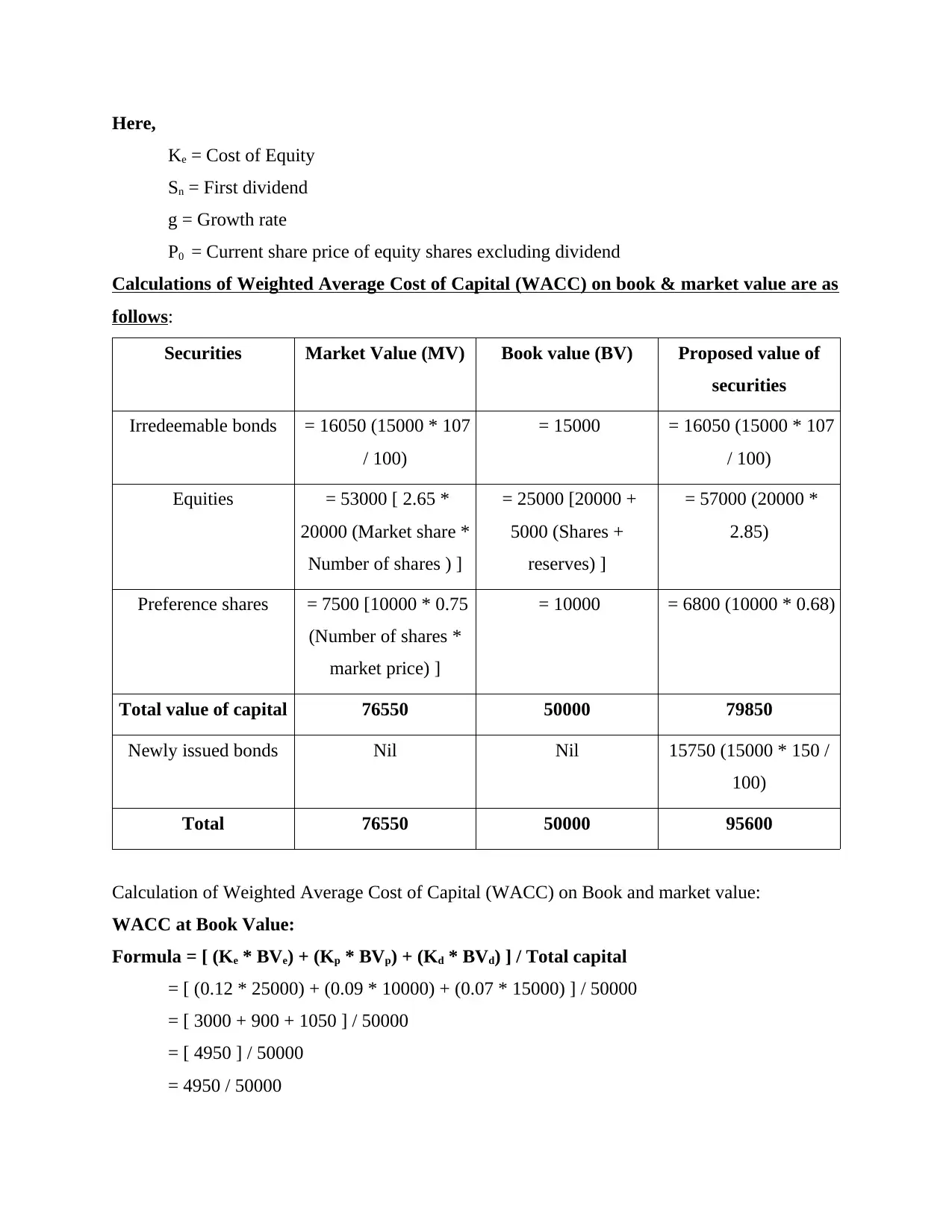

Calculations of Weighted Average Cost of Capital (WACC) on book & market value are as

follows:

Securities Market Value (MV) Book value (BV) Proposed value of

securities

Irredeemable bonds = 16050 (15000 * 107

/ 100)

= 15000 = 16050 (15000 * 107

/ 100)

Equities = 53000 [ 2.65 *

20000 (Market share *

Number of shares ) ]

= 25000 [20000 +

5000 (Shares +

reserves) ]

= 57000 (20000 *

2.85)

Preference shares = 7500 [10000 * 0.75

(Number of shares *

market price) ]

= 10000 = 6800 (10000 * 0.68)

Total value of capital 76550 50000 79850

Newly issued bonds Nil Nil 15750 (15000 * 150 /

100)

Total 76550 50000 95600

Calculation of Weighted Average Cost of Capital (WACC) on Book and market value:

WACC at Book Value:

Formula = [ (Ke * BVe) + (Kp * BVp) + (Kd * BVd) ] / Total capital

= [ (0.12 * 25000) + (0.09 * 10000) + (0.07 * 15000) ] / 50000

= [ 3000 + 900 + 1050 ] / 50000

= [ 4950 ] / 50000

= 4950 / 50000

Ke = Cost of Equity

Sn = First dividend

g = Growth rate

P0 = Current share price of equity shares excluding dividend

Calculations of Weighted Average Cost of Capital (WACC) on book & market value are as

follows:

Securities Market Value (MV) Book value (BV) Proposed value of

securities

Irredeemable bonds = 16050 (15000 * 107

/ 100)

= 15000 = 16050 (15000 * 107

/ 100)

Equities = 53000 [ 2.65 *

20000 (Market share *

Number of shares ) ]

= 25000 [20000 +

5000 (Shares +

reserves) ]

= 57000 (20000 *

2.85)

Preference shares = 7500 [10000 * 0.75

(Number of shares *

market price) ]

= 10000 = 6800 (10000 * 0.68)

Total value of capital 76550 50000 79850

Newly issued bonds Nil Nil 15750 (15000 * 150 /

100)

Total 76550 50000 95600

Calculation of Weighted Average Cost of Capital (WACC) on Book and market value:

WACC at Book Value:

Formula = [ (Ke * BVe) + (Kp * BVp) + (Kd * BVd) ] / Total capital

= [ (0.12 * 25000) + (0.09 * 10000) + (0.07 * 15000) ] / 50000

= [ 3000 + 900 + 1050 ] / 50000

= [ 4950 ] / 50000

= 4950 / 50000

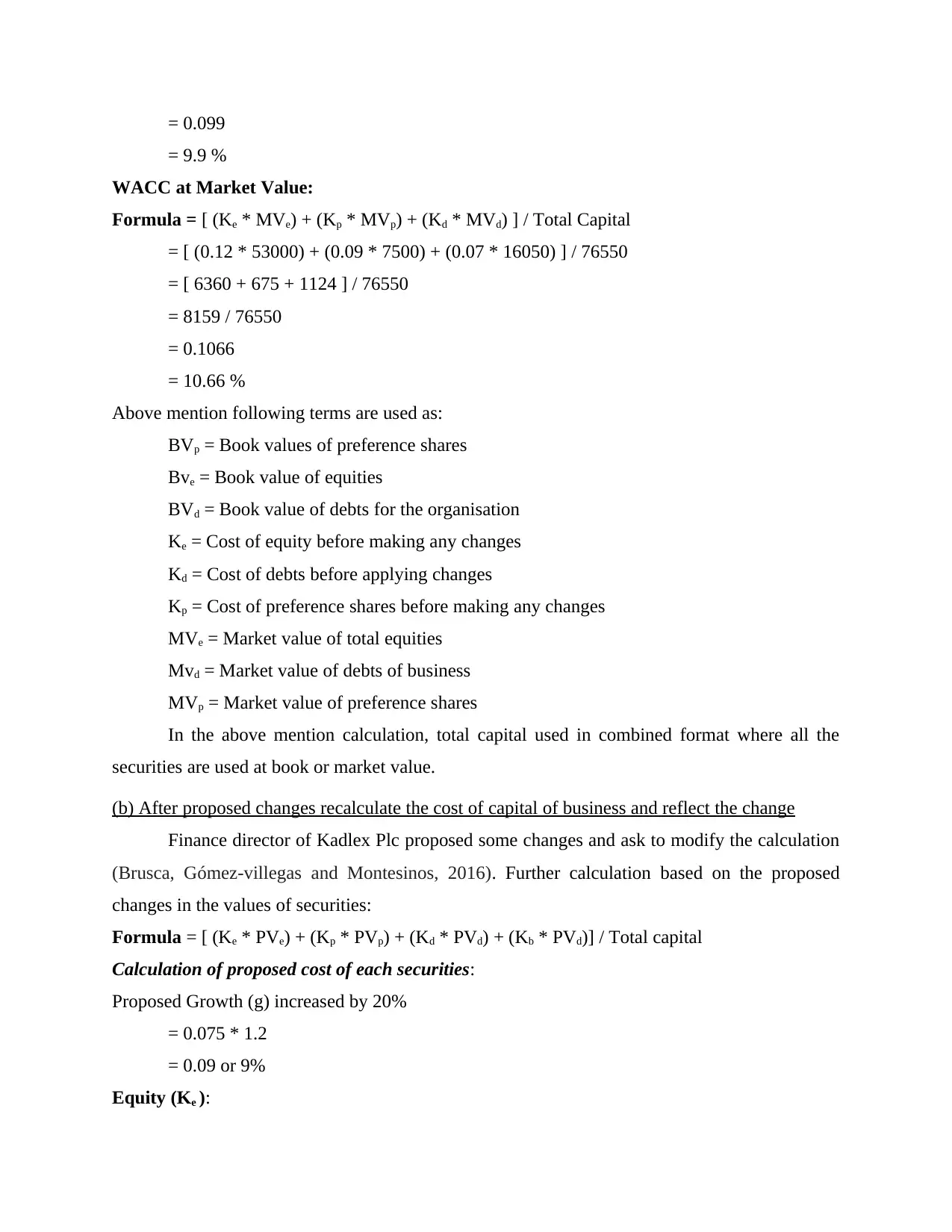

= 0.099

= 9.9 %

WACC at Market Value:

Formula = [ (Ke * MVe) + (Kp * MVp) + (Kd * MVd) ] / Total Capital

= [ (0.12 * 53000) + (0.09 * 7500) + (0.07 * 16050) ] / 76550

= [ 6360 + 675 + 1124 ] / 76550

= 8159 / 76550

= 0.1066

= 10.66 %

Above mention following terms are used as:

BVp = Book values of preference shares

Bve = Book value of equities

BVd = Book value of debts for the organisation

Ke = Cost of equity before making any changes

Kd = Cost of debts before applying changes

Kp = Cost of preference shares before making any changes

MVe = Market value of total equities

Mvd = Market value of debts of business

MVp = Market value of preference shares

In the above mention calculation, total capital used in combined format where all the

securities are used at book or market value.

(b) After proposed changes recalculate the cost of capital of business and reflect the change

Finance director of Kadlex Plc proposed some changes and ask to modify the calculation

(Brusca, Gómez‐villegas and Montesinos, 2016). Further calculation based on the proposed

changes in the values of securities:

Formula = [ (Ke * PVe) + (Kp * PVp) + (Kd * PVd) + (Kb * PVd)] / Total capital

Calculation of proposed cost of each securities:

Proposed Growth (g) increased by 20%

= 0.075 * 1.2

= 0.09 or 9%

Equity (Ke ):

= 9.9 %

WACC at Market Value:

Formula = [ (Ke * MVe) + (Kp * MVp) + (Kd * MVd) ] / Total Capital

= [ (0.12 * 53000) + (0.09 * 7500) + (0.07 * 16050) ] / 76550

= [ 6360 + 675 + 1124 ] / 76550

= 8159 / 76550

= 0.1066

= 10.66 %

Above mention following terms are used as:

BVp = Book values of preference shares

Bve = Book value of equities

BVd = Book value of debts for the organisation

Ke = Cost of equity before making any changes

Kd = Cost of debts before applying changes

Kp = Cost of preference shares before making any changes

MVe = Market value of total equities

Mvd = Market value of debts of business

MVp = Market value of preference shares

In the above mention calculation, total capital used in combined format where all the

securities are used at book or market value.

(b) After proposed changes recalculate the cost of capital of business and reflect the change

Finance director of Kadlex Plc proposed some changes and ask to modify the calculation

(Brusca, Gómez‐villegas and Montesinos, 2016). Further calculation based on the proposed

changes in the values of securities:

Formula = [ (Ke * PVe) + (Kp * PVp) + (Kd * PVd) + (Kb * PVd)] / Total capital

Calculation of proposed cost of each securities:

Proposed Growth (g) increased by 20%

= 0.075 * 1.2

= 0.09 or 9%

Equity (Ke ):

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

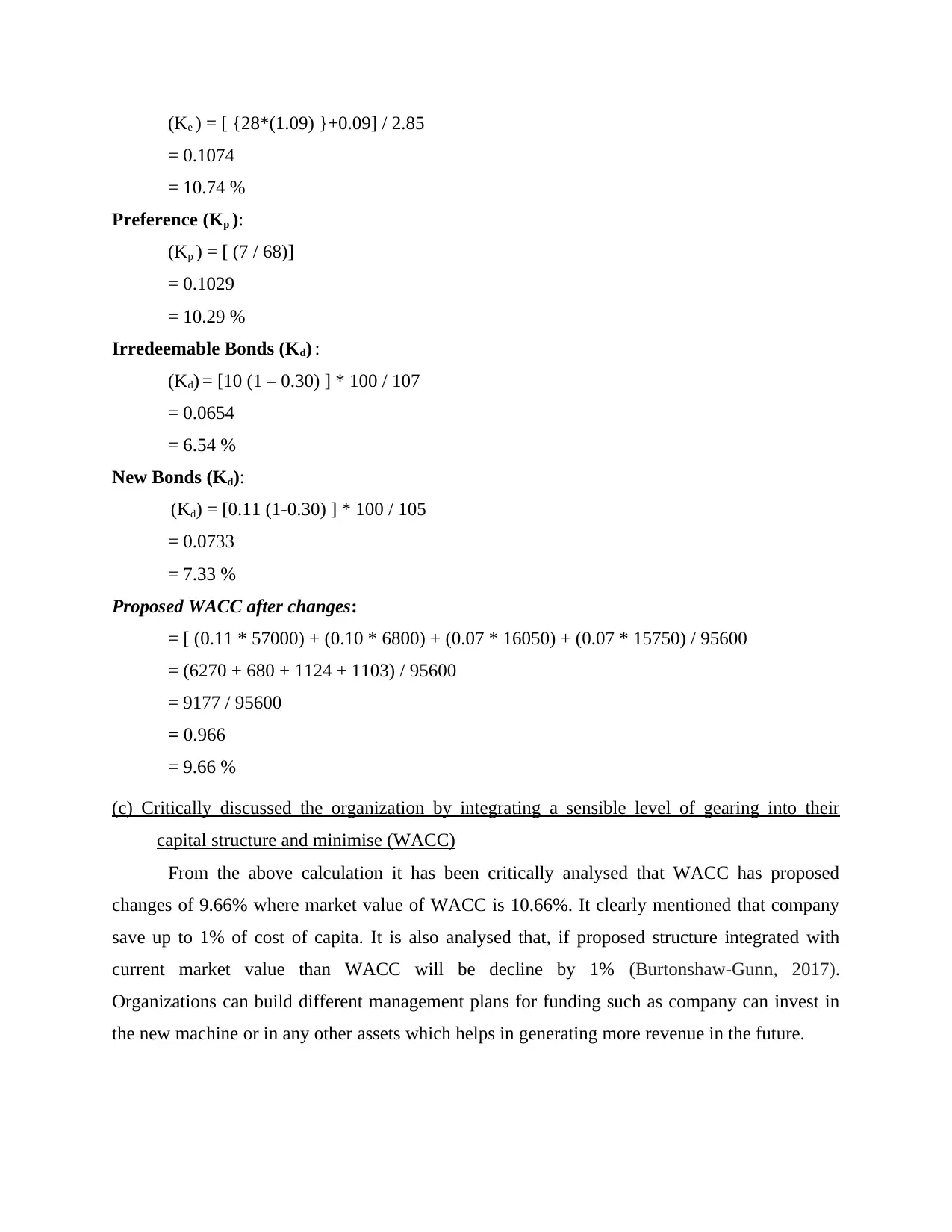

(Ke ) = [ {28*(1.09) }+0.09] / 2.85

= 0.1074

= 10.74 %

Preference (Kp ):

(Kp ) = [ (7 / 68)]

= 0.1029

= 10.29 %

Irredeemable Bonds (Kd) :

(Kd) = [10 (1 – 0.30) ] * 100 / 107

= 0.0654

= 6.54 %

New Bonds (Kd):

(Kd) = [0.11 (1-0.30) ] * 100 / 105

= 0.0733

= 7.33 %

Proposed WACC after changes:

= [ (0.11 * 57000) + (0.10 * 6800) + (0.07 * 16050) + (0.07 * 15750) / 95600

= (6270 + 680 + 1124 + 1103) / 95600

= 9177 / 95600

= 0.966

= 9.66 %

(c) Critically discussed the organization by integrating a sensible level of gearing into their

capital structure and minimise (WACC)

From the above calculation it has been critically analysed that WACC has proposed

changes of 9.66% where market value of WACC is 10.66%. It clearly mentioned that company

save up to 1% of cost of capita. It is also analysed that, if proposed structure integrated with

current market value than WACC will be decline by 1% (Burtonshaw-Gunn, 2017).

Organizations can build different management plans for funding such as company can invest in

the new machine or in any other assets which helps in generating more revenue in the future.

= 0.1074

= 10.74 %

Preference (Kp ):

(Kp ) = [ (7 / 68)]

= 0.1029

= 10.29 %

Irredeemable Bonds (Kd) :

(Kd) = [10 (1 – 0.30) ] * 100 / 107

= 0.0654

= 6.54 %

New Bonds (Kd):

(Kd) = [0.11 (1-0.30) ] * 100 / 105

= 0.0733

= 7.33 %

Proposed WACC after changes:

= [ (0.11 * 57000) + (0.10 * 6800) + (0.07 * 16050) + (0.07 * 15750) / 95600

= (6270 + 680 + 1124 + 1103) / 95600

= 9177 / 95600

= 0.966

= 9.66 %

(c) Critically discussed the organization by integrating a sensible level of gearing into their

capital structure and minimise (WACC)

From the above calculation it has been critically analysed that WACC has proposed

changes of 9.66% where market value of WACC is 10.66%. It clearly mentioned that company

save up to 1% of cost of capita. It is also analysed that, if proposed structure integrated with

current market value than WACC will be decline by 1% (Burtonshaw-Gunn, 2017).

Organizations can build different management plans for funding such as company can invest in

the new machine or in any other assets which helps in generating more revenue in the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

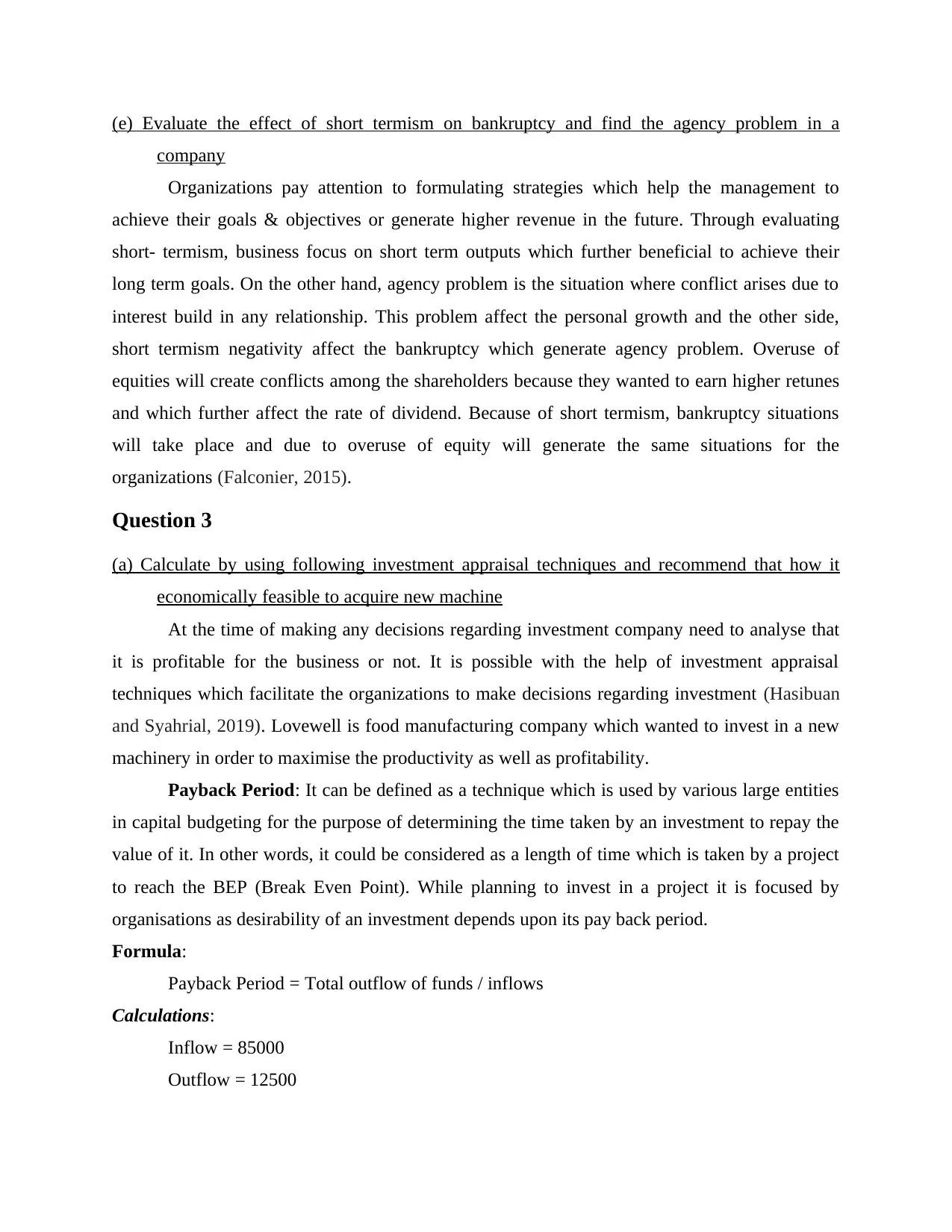

(e) Evaluate the effect of short termism on bankruptcy and find the agency problem in a

company

Organizations pay attention to formulating strategies which help the management to

achieve their goals & objectives or generate higher revenue in the future. Through evaluating

short- termism, business focus on short term outputs which further beneficial to achieve their

long term goals. On the other hand, agency problem is the situation where conflict arises due to

interest build in any relationship. This problem affect the personal growth and the other side,

short termism negativity affect the bankruptcy which generate agency problem. Overuse of

equities will create conflicts among the shareholders because they wanted to earn higher retunes

and which further affect the rate of dividend. Because of short termism, bankruptcy situations

will take place and due to overuse of equity will generate the same situations for the

organizations (Falconier, 2015).

Question 3

(a) Calculate by using following investment appraisal techniques and recommend that how it

economically feasible to acquire new machine

At the time of making any decisions regarding investment company need to analyse that

it is profitable for the business or not. It is possible with the help of investment appraisal

techniques which facilitate the organizations to make decisions regarding investment (Hasibuan

and Syahrial, 2019). Lovewell is food manufacturing company which wanted to invest in a new

machinery in order to maximise the productivity as well as profitability.

Payback Period: It can be defined as a technique which is used by various large entities

in capital budgeting for the purpose of determining the time taken by an investment to repay the

value of it. In other words, it could be considered as a length of time which is taken by a project

to reach the BEP (Break Even Point). While planning to invest in a project it is focused by

organisations as desirability of an investment depends upon its pay back period.

Formula:

Payback Period = Total outflow of funds / inflows

Calculations:

Inflow = 85000

Outflow = 12500

company

Organizations pay attention to formulating strategies which help the management to

achieve their goals & objectives or generate higher revenue in the future. Through evaluating

short- termism, business focus on short term outputs which further beneficial to achieve their

long term goals. On the other hand, agency problem is the situation where conflict arises due to

interest build in any relationship. This problem affect the personal growth and the other side,

short termism negativity affect the bankruptcy which generate agency problem. Overuse of

equities will create conflicts among the shareholders because they wanted to earn higher retunes

and which further affect the rate of dividend. Because of short termism, bankruptcy situations

will take place and due to overuse of equity will generate the same situations for the

organizations (Falconier, 2015).

Question 3

(a) Calculate by using following investment appraisal techniques and recommend that how it

economically feasible to acquire new machine

At the time of making any decisions regarding investment company need to analyse that

it is profitable for the business or not. It is possible with the help of investment appraisal

techniques which facilitate the organizations to make decisions regarding investment (Hasibuan

and Syahrial, 2019). Lovewell is food manufacturing company which wanted to invest in a new

machinery in order to maximise the productivity as well as profitability.

Payback Period: It can be defined as a technique which is used by various large entities

in capital budgeting for the purpose of determining the time taken by an investment to repay the

value of it. In other words, it could be considered as a length of time which is taken by a project

to reach the BEP (Break Even Point). While planning to invest in a project it is focused by

organisations as desirability of an investment depends upon its pay back period.

Formula:

Payback Period = Total outflow of funds / inflows

Calculations:

Inflow = 85000

Outflow = 12500

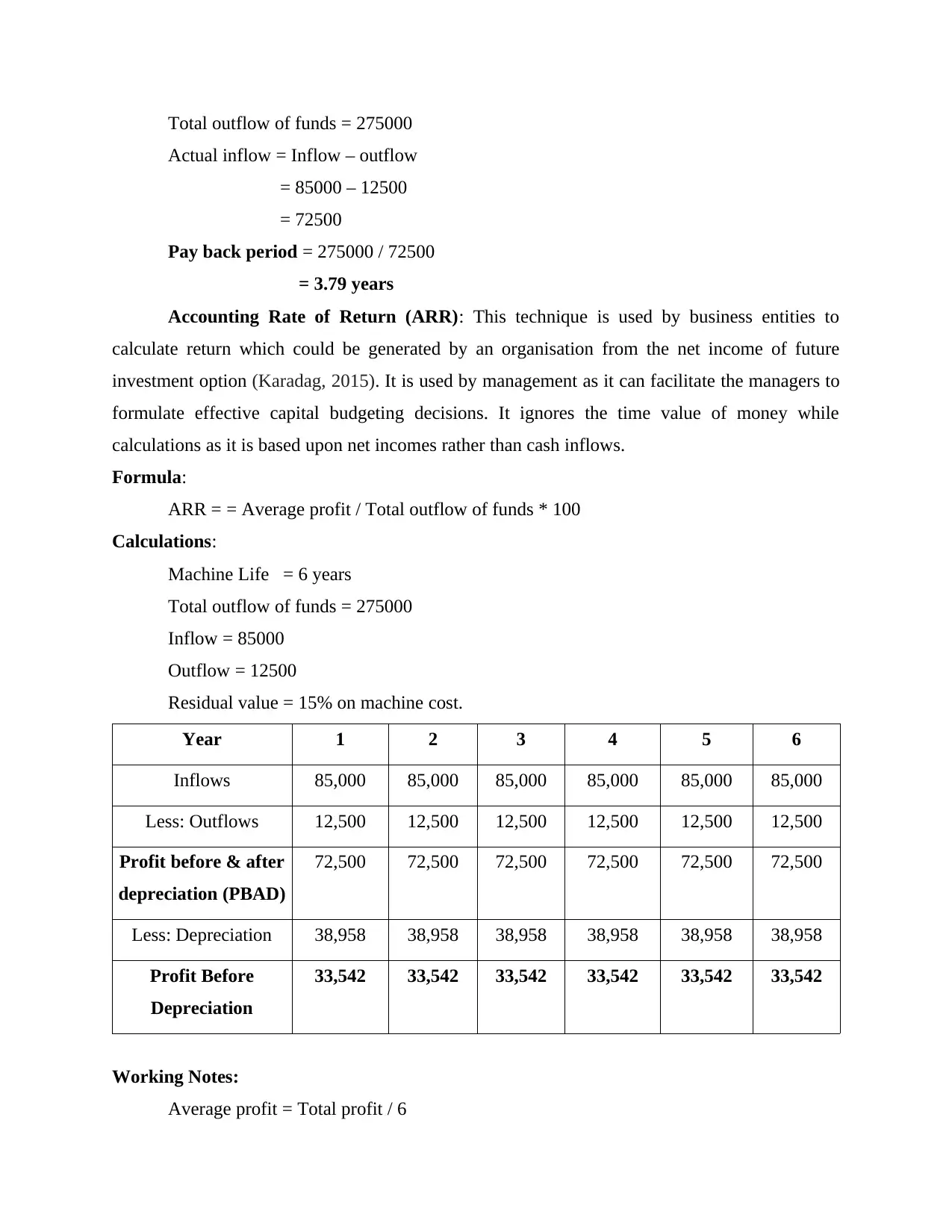

Total outflow of funds = 275000

Actual inflow = Inflow – outflow

= 85000 – 12500

= 72500

Pay back period = 275000 / 72500

= 3.79 years

Accounting Rate of Return (ARR): This technique is used by business entities to

calculate return which could be generated by an organisation from the net income of future

investment option (Karadag, 2015). It is used by management as it can facilitate the managers to

formulate effective capital budgeting decisions. It ignores the time value of money while

calculations as it is based upon net incomes rather than cash inflows.

Formula:

ARR = = Average profit / Total outflow of funds * 100

Calculations:

Machine Life = 6 years

Total outflow of funds = 275000

Inflow = 85000

Outflow = 12500

Residual value = 15% on machine cost.

Year 1 2 3 4 5 6

Inflows 85,000 85,000 85,000 85,000 85,000 85,000

Less: Outflows 12,500 12,500 12,500 12,500 12,500 12,500

Profit before & after

depreciation (PBAD)

72,500 72,500 72,500 72,500 72,500 72,500

Less: Depreciation 38,958 38,958 38,958 38,958 38,958 38,958

Profit Before

Depreciation

33,542 33,542 33,542 33,542 33,542 33,542

Working Notes:

Average profit = Total profit / 6

Actual inflow = Inflow – outflow

= 85000 – 12500

= 72500

Pay back period = 275000 / 72500

= 3.79 years

Accounting Rate of Return (ARR): This technique is used by business entities to

calculate return which could be generated by an organisation from the net income of future

investment option (Karadag, 2015). It is used by management as it can facilitate the managers to

formulate effective capital budgeting decisions. It ignores the time value of money while

calculations as it is based upon net incomes rather than cash inflows.

Formula:

ARR = = Average profit / Total outflow of funds * 100

Calculations:

Machine Life = 6 years

Total outflow of funds = 275000

Inflow = 85000

Outflow = 12500

Residual value = 15% on machine cost.

Year 1 2 3 4 5 6

Inflows 85,000 85,000 85,000 85,000 85,000 85,000

Less: Outflows 12,500 12,500 12,500 12,500 12,500 12,500

Profit before & after

depreciation (PBAD)

72,500 72,500 72,500 72,500 72,500 72,500

Less: Depreciation 38,958 38,958 38,958 38,958 38,958 38,958

Profit Before

Depreciation

33,542 33,542 33,542 33,542 33,542 33,542

Working Notes:

Average profit = Total profit / 6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= (33,542 +33,542 +33,542 +33,542 +33,542 +33,542) / 6

= 33,542

Depreciation = Total outflow of funds – residual value / total life of project

= 2,75,000 – 41,250 / 6

= 38,958

ARR = 33542 / 275000 * 100

= 0.1220 *100

= 12.20 %

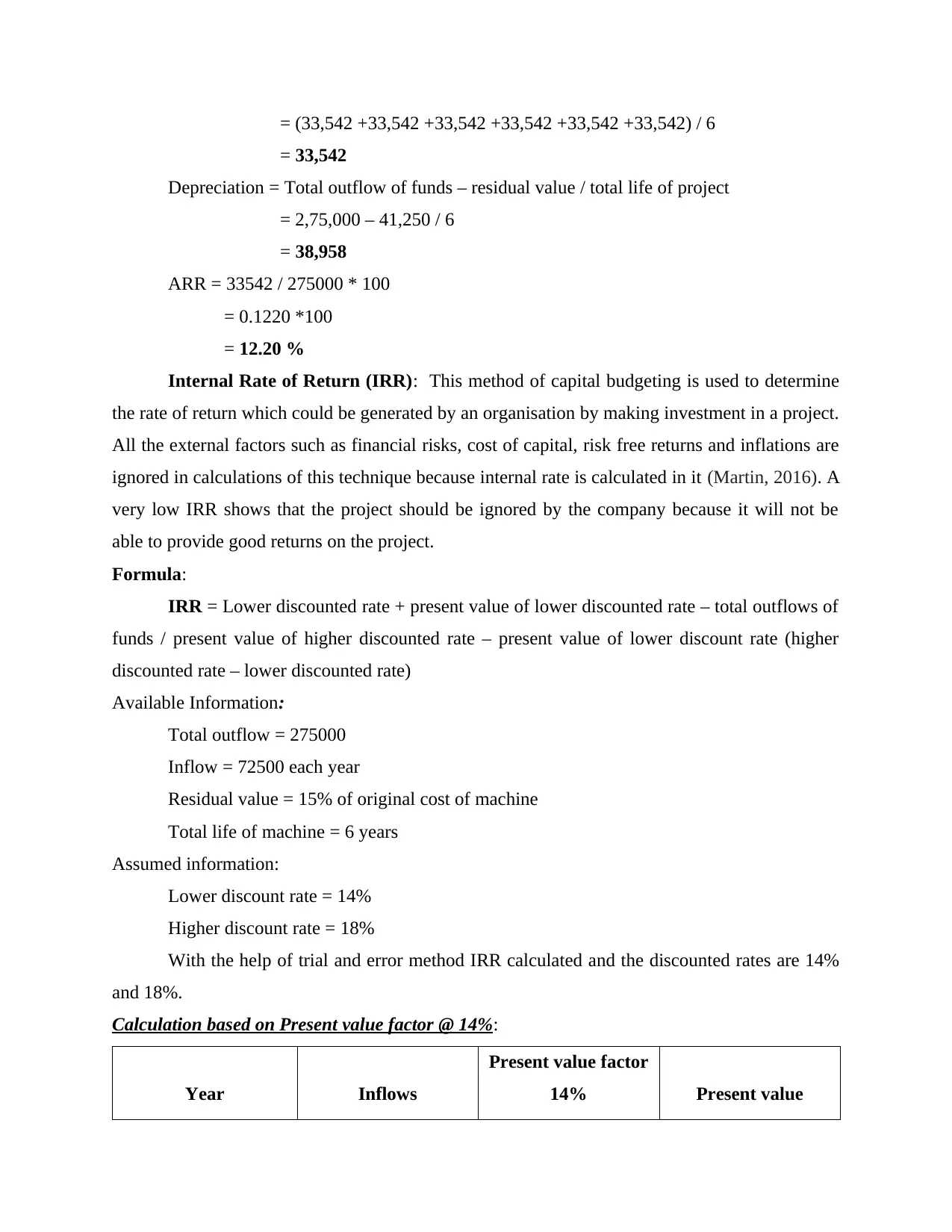

Internal Rate of Return (IRR): This method of capital budgeting is used to determine

the rate of return which could be generated by an organisation by making investment in a project.

All the external factors such as financial risks, cost of capital, risk free returns and inflations are

ignored in calculations of this technique because internal rate is calculated in it (Martin, 2016). A

very low IRR shows that the project should be ignored by the company because it will not be

able to provide good returns on the project.

Formula:

IRR = Lower discounted rate + present value of lower discounted rate – total outflows of

funds / present value of higher discounted rate – present value of lower discount rate (higher

discounted rate – lower discounted rate)

Available Information:

Total outflow = 275000

Inflow = 72500 each year

Residual value = 15% of original cost of machine

Total life of machine = 6 years

Assumed information:

Lower discount rate = 14%

Higher discount rate = 18%

With the help of trial and error method IRR calculated and the discounted rates are 14%

and 18%.

Calculation based on Present value factor @ 14%:

Year Inflows

Present value factor

14% Present value

= 33,542

Depreciation = Total outflow of funds – residual value / total life of project

= 2,75,000 – 41,250 / 6

= 38,958

ARR = 33542 / 275000 * 100

= 0.1220 *100

= 12.20 %

Internal Rate of Return (IRR): This method of capital budgeting is used to determine

the rate of return which could be generated by an organisation by making investment in a project.

All the external factors such as financial risks, cost of capital, risk free returns and inflations are

ignored in calculations of this technique because internal rate is calculated in it (Martin, 2016). A

very low IRR shows that the project should be ignored by the company because it will not be

able to provide good returns on the project.

Formula:

IRR = Lower discounted rate + present value of lower discounted rate – total outflows of

funds / present value of higher discounted rate – present value of lower discount rate (higher

discounted rate – lower discounted rate)

Available Information:

Total outflow = 275000

Inflow = 72500 each year

Residual value = 15% of original cost of machine

Total life of machine = 6 years

Assumed information:

Lower discount rate = 14%

Higher discount rate = 18%

With the help of trial and error method IRR calculated and the discounted rates are 14%

and 18%.

Calculation based on Present value factor @ 14%:

Year Inflows

Present value factor

14% Present value

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

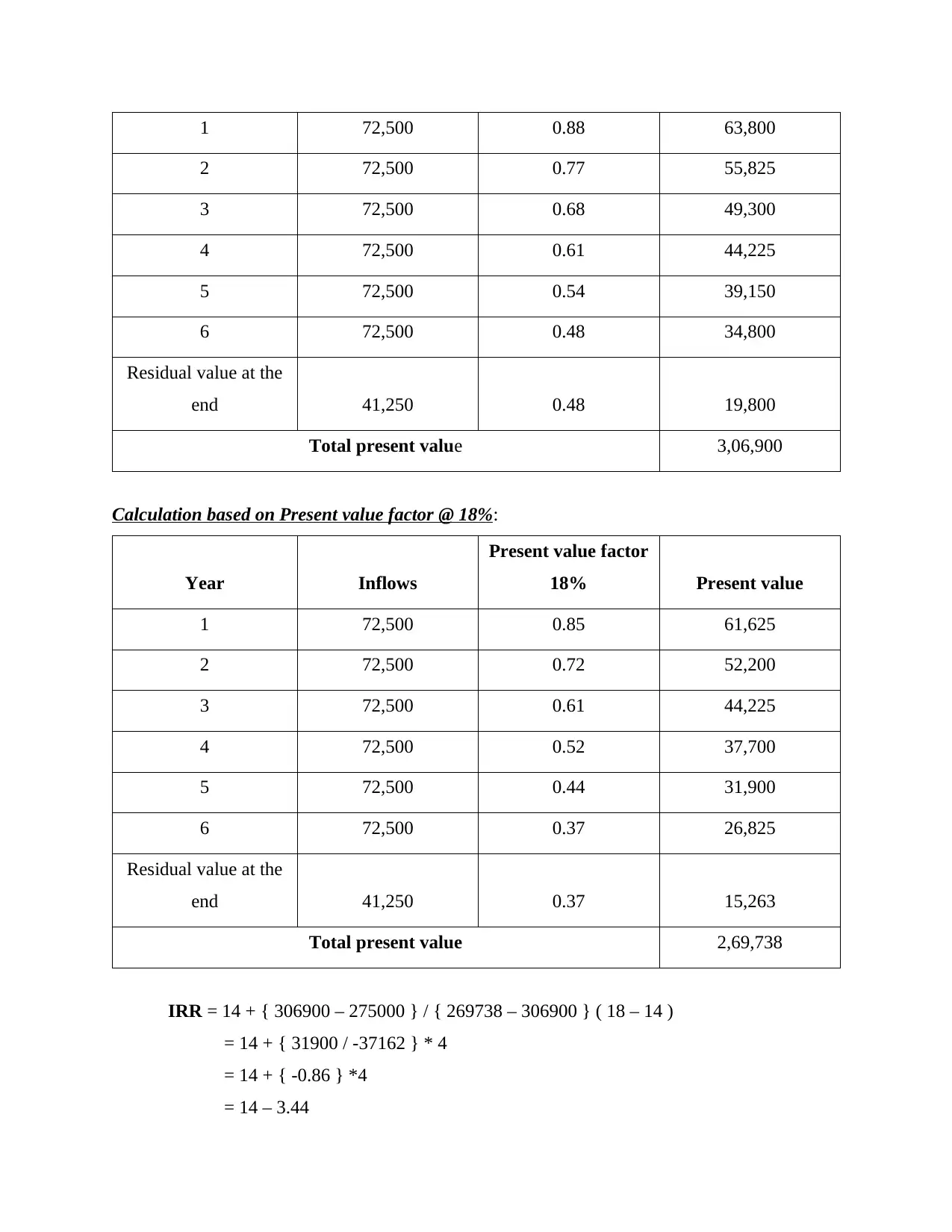

1 72,500 0.88 63,800

2 72,500 0.77 55,825

3 72,500 0.68 49,300

4 72,500 0.61 44,225

5 72,500 0.54 39,150

6 72,500 0.48 34,800

Residual value at the

end 41,250 0.48 19,800

Total present value 3,06,900

Calculation based on Present value factor @ 18%:

Year Inflows

Present value factor

18% Present value

1 72,500 0.85 61,625

2 72,500 0.72 52,200

3 72,500 0.61 44,225

4 72,500 0.52 37,700

5 72,500 0.44 31,900

6 72,500 0.37 26,825

Residual value at the

end 41,250 0.37 15,263

Total present value 2,69,738

IRR = 14 + { 306900 – 275000 } / { 269738 – 306900 } ( 18 – 14 )

= 14 + { 31900 / -37162 } * 4

= 14 + { -0.86 } *4

= 14 – 3.44

2 72,500 0.77 55,825

3 72,500 0.68 49,300

4 72,500 0.61 44,225

5 72,500 0.54 39,150

6 72,500 0.48 34,800

Residual value at the

end 41,250 0.48 19,800

Total present value 3,06,900

Calculation based on Present value factor @ 18%:

Year Inflows

Present value factor

18% Present value

1 72,500 0.85 61,625

2 72,500 0.72 52,200

3 72,500 0.61 44,225

4 72,500 0.52 37,700

5 72,500 0.44 31,900

6 72,500 0.37 26,825

Residual value at the

end 41,250 0.37 15,263

Total present value 2,69,738

IRR = 14 + { 306900 – 275000 } / { 269738 – 306900 } ( 18 – 14 )

= 14 + { 31900 / -37162 } * 4

= 14 + { -0.86 } *4

= 14 – 3.44

= 10.56 %

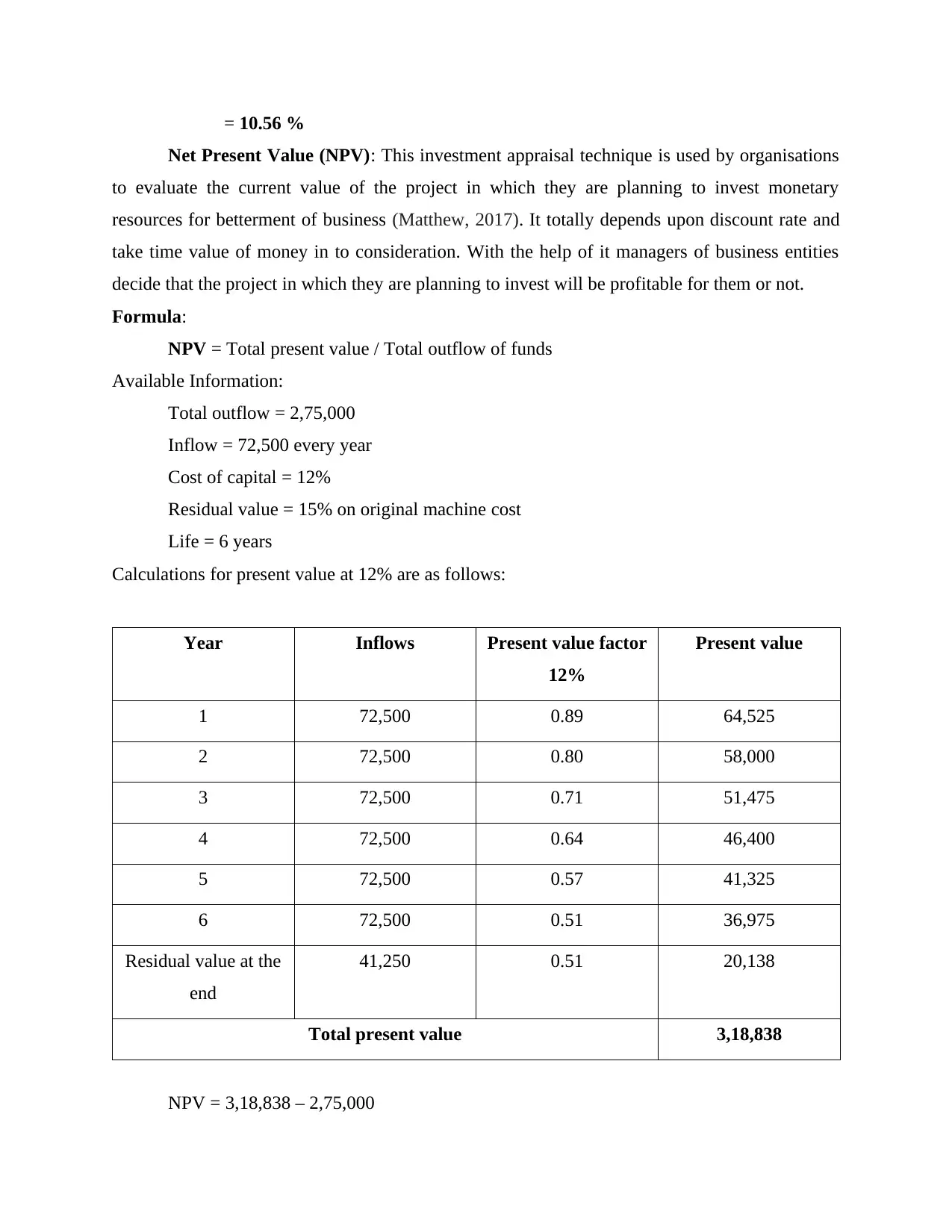

Net Present Value (NPV): This investment appraisal technique is used by organisations

to evaluate the current value of the project in which they are planning to invest monetary

resources for betterment of business (Matthew, 2017). It totally depends upon discount rate and

take time value of money in to consideration. With the help of it managers of business entities

decide that the project in which they are planning to invest will be profitable for them or not.

Formula:

NPV = Total present value / Total outflow of funds

Available Information:

Total outflow = 2,75,000

Inflow = 72,500 every year

Cost of capital = 12%

Residual value = 15% on original machine cost

Life = 6 years

Calculations for present value at 12% are as follows:

Year Inflows Present value factor

12%

Present value

1 72,500 0.89 64,525

2 72,500 0.80 58,000

3 72,500 0.71 51,475

4 72,500 0.64 46,400

5 72,500 0.57 41,325

6 72,500 0.51 36,975

Residual value at the

end

41,250 0.51 20,138

Total present value 3,18,838

NPV = 3,18,838 – 2,75,000

Net Present Value (NPV): This investment appraisal technique is used by organisations

to evaluate the current value of the project in which they are planning to invest monetary

resources for betterment of business (Matthew, 2017). It totally depends upon discount rate and

take time value of money in to consideration. With the help of it managers of business entities

decide that the project in which they are planning to invest will be profitable for them or not.

Formula:

NPV = Total present value / Total outflow of funds

Available Information:

Total outflow = 2,75,000

Inflow = 72,500 every year

Cost of capital = 12%

Residual value = 15% on original machine cost

Life = 6 years

Calculations for present value at 12% are as follows:

Year Inflows Present value factor

12%

Present value

1 72,500 0.89 64,525

2 72,500 0.80 58,000

3 72,500 0.71 51,475

4 72,500 0.64 46,400

5 72,500 0.57 41,325

6 72,500 0.51 36,975

Residual value at the

end

41,250 0.51 20,138

Total present value 3,18,838

NPV = 3,18,838 – 2,75,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.