Financial Management: Equity Finance and Investment Appraisal

VerifiedAdded on 2024/06/07

|14

|3032

|141

Report

AI Summary

This report provides a detailed analysis of equity finance and investment appraisal techniques. It begins by examining equity finance, including the number of shares to be issued, theoretical ex-right price, and earnings per share under different right issue scenarios. It then discusses the advantages for both companies and shareholders of using scrip dividends. The report also evaluates investment appraisal techniques such as the payback period, accounting rate of return (ARR), net present value (NPV), and internal rate of return (IRR), providing calculations and interpretations for each. Finally, it critically evaluates the benefits and limitations of each investment appraisal technique, supported by relevant academic research, offering a comprehensive overview of financial management strategies.

APC308 Financial Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 2 – Long-term finance: Equity finance...................................................................................3

(a)......................................................................................................................................................3

(i) Number of shares to be issued......................................................................................................3

(ii) Theoretical Ex right price............................................................................................................3

(iii) Earnings per share......................................................................................................................3

(iv).....................................................................................................................................................3

(b)......................................................................................................................................................4

Question 3 Investment Appraisal Techniques........................................................................................6

(a)......................................................................................................................................................6

(b)....................................................................................................................................................10

References...........................................................................................................................................14

2

Question 2 – Long-term finance: Equity finance...................................................................................3

(a)......................................................................................................................................................3

(i) Number of shares to be issued......................................................................................................3

(ii) Theoretical Ex right price............................................................................................................3

(iii) Earnings per share......................................................................................................................3

(iv).....................................................................................................................................................3

(b)......................................................................................................................................................4

Question 3 Investment Appraisal Techniques........................................................................................6

(a)......................................................................................................................................................6

(b)....................................................................................................................................................10

References...........................................................................................................................................14

2

Question 2 – Long-term finance: Equity finance

(a)

Particulars Formula Right Issue prices

1.8 1.6 1.4

(i) Number of shares to be

issued

Funds to be raised*Right issue

price

100000 112500 128571

Number of shares before

right issue

600000 600000 600000

Market Value before right

issue

Market Price of shares*Number

of shares before right issue

114000

0

114000

0

114000

0

Fund raised from the

Right issue

180000 180000 180000

Number of shares after

right issue

700000 712500 728571

(ii) Theoretical Ex right

price

Market value prior right

issue+fund raised through right

share/ Number of the share after

right issue

1.89 1.85 1.81

Profit After Tax 140000 140000 140000

No. of Share 700000 712500 728571

(iii) Earnings per share 0.200 0.196 0.192

(iv)

The form of the right issue is in premium with respect to the issue price of the share. The

issue price of the shares is 0.50p each whereas the issue made for each of the right issues is in

a premium being £1.80, £1.60, £1.40. The issue must be in form of existing shareholders for

the price being £1.40 so that the existing shareholders are being satisfied. The form of an

issue of £1.60 must be made to the general public so that the shareholders of the company

right are not much diluted with the issue of the right issue (Accounting-Simplified, 2017).

The right issue of £1.80 must be made to the investors and private people along with general

public in order to raise the funds.

(V)

The best option among the issue would be of £1.8 as the earning per share in this is the most

and maximum being 0.200. The theoretical ex-price of the shares is also much in right issue

3

(a)

Particulars Formula Right Issue prices

1.8 1.6 1.4

(i) Number of shares to be

issued

Funds to be raised*Right issue

price

100000 112500 128571

Number of shares before

right issue

600000 600000 600000

Market Value before right

issue

Market Price of shares*Number

of shares before right issue

114000

0

114000

0

114000

0

Fund raised from the

Right issue

180000 180000 180000

Number of shares after

right issue

700000 712500 728571

(ii) Theoretical Ex right

price

Market value prior right

issue+fund raised through right

share/ Number of the share after

right issue

1.89 1.85 1.81

Profit After Tax 140000 140000 140000

No. of Share 700000 712500 728571

(iii) Earnings per share 0.200 0.196 0.192

(iv)

The form of the right issue is in premium with respect to the issue price of the share. The

issue price of the shares is 0.50p each whereas the issue made for each of the right issues is in

a premium being £1.80, £1.60, £1.40. The issue must be in form of existing shareholders for

the price being £1.40 so that the existing shareholders are being satisfied. The form of an

issue of £1.60 must be made to the general public so that the shareholders of the company

right are not much diluted with the issue of the right issue (Accounting-Simplified, 2017).

The right issue of £1.80 must be made to the investors and private people along with general

public in order to raise the funds.

(V)

The best option among the issue would be of £1.8 as the earning per share in this is the most

and maximum being 0.200. The theoretical ex-price of the shares is also much in right issue

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

at £1.80 as it is not dissolving the right of the existing shareholders of the company. It is in

best option for the company as it is benefiting the existing shareholders also by increasing the

value but the number of bonus share not increasing very much.

(b)

In the business, there are dividends which are paid in the accounting period and for that, there

are several methods which can be followed. One of them is scrip dividend in which instead of

making the cash payment for the dividend, there is the option which is provided to the

shareholders in which they can opt for the shares in place of the cash amount of dividend. By

the use of this there are various benefits which will be obtained by both the company as well

as the shareholders and for the better understanding of the same they are provided below:

Advantages for the company:

Under the scrip dividend there will be several advantages which will be received by the

company and due to that, they are opting for this method. There will be no payment which

will have to be made by the company in cash form and so the requirement to arrange the cash

for the payment of the dividend will be eliminated. By this, they will not be required to

maintain the cash reserve and the cost which is incurred in this respect will also be saved

which reduces the overall cost thereby increasing the profitability for the company (Noori

and Aslani, 2014). There will be adequate cash position which will be maintained for the

business. There will also be saving of the tax which will be made in a certain situation which

is very beneficial. There will be an issue of the share which will be made and by that the

gearing ratio of the business will be declining. This gives rise to the opportunity for the

enhancing of the borrowing capacity. There will be more funds which can be borrowed and

that will be used for some other purpose by which it will be possible to gain the additional

advantage.

The cash which will be saved due to this can be reinvested by the company and by that there

will be an additional source of the income which will be generated and the overall increase in

the income of the business will be achieved. They can undertake new projects which will be

helpful in the expansion of the business which will be yielding the long-term returns for the

business and this way the sustainability of the business will be ensured which is very

4

best option for the company as it is benefiting the existing shareholders also by increasing the

value but the number of bonus share not increasing very much.

(b)

In the business, there are dividends which are paid in the accounting period and for that, there

are several methods which can be followed. One of them is scrip dividend in which instead of

making the cash payment for the dividend, there is the option which is provided to the

shareholders in which they can opt for the shares in place of the cash amount of dividend. By

the use of this there are various benefits which will be obtained by both the company as well

as the shareholders and for the better understanding of the same they are provided below:

Advantages for the company:

Under the scrip dividend there will be several advantages which will be received by the

company and due to that, they are opting for this method. There will be no payment which

will have to be made by the company in cash form and so the requirement to arrange the cash

for the payment of the dividend will be eliminated. By this, they will not be required to

maintain the cash reserve and the cost which is incurred in this respect will also be saved

which reduces the overall cost thereby increasing the profitability for the company (Noori

and Aslani, 2014). There will be adequate cash position which will be maintained for the

business. There will also be saving of the tax which will be made in a certain situation which

is very beneficial. There will be an issue of the share which will be made and by that the

gearing ratio of the business will be declining. This gives rise to the opportunity for the

enhancing of the borrowing capacity. There will be more funds which can be borrowed and

that will be used for some other purpose by which it will be possible to gain the additional

advantage.

The cash which will be saved due to this can be reinvested by the company and by that there

will be an additional source of the income which will be generated and the overall increase in

the income of the business will be achieved. They can undertake new projects which will be

helpful in the expansion of the business which will be yielding the long-term returns for the

business and this way the sustainability of the business will be ensured which is very

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

important. The share price will also not be diluted with the help of this as there will be an

issue which will be made and the decline will be there only in some of the significant cases.

Overall it can be said that company is taking the proper decision by using this mode of

making the dividend distribution.

Advantages for the shareholders:

The issues which are made under the scrip dividend are also beneficial for the shareholders in

many ways. As there will be no cash which will be received by them and only the shares will

be allotted to them so by this they will be able to make the saving of the tax as there will be

various tax benefits which will be obtained by them. There are several investors who want to

increase their holding in the company and for that, they are required to make the purchase of

the shares (Wesson, 2015). But they are not able to do so due to lack of the funds. In this

case, they will be allotted the shares and there will be no cost which will have to be incurred

by them in this respect. So it can be said that they will be able to increase their holding in the

business without being required to make any kind of expenditure. There will be a rise in their

share and they will be more important now for the company.

This will also develop the interest of the investors as they will be keen on receiving the new

shares which will be making the growth possible for them. There will be no cash which will

be received by them but in place of that shares will be obtained which will be more beneficial

for them as this will be providing them with the long-term advantages in the company and

they will be able to maintain their position in the business for long.

All of this is the part of the financial management which will be made and will be undertaken

in such manner that the benefit will be long lasting and will be increasing the value of the

business and also a number of investors will be attracted who will be interested in making the

investment in the company.

5

issue which will be made and the decline will be there only in some of the significant cases.

Overall it can be said that company is taking the proper decision by using this mode of

making the dividend distribution.

Advantages for the shareholders:

The issues which are made under the scrip dividend are also beneficial for the shareholders in

many ways. As there will be no cash which will be received by them and only the shares will

be allotted to them so by this they will be able to make the saving of the tax as there will be

various tax benefits which will be obtained by them. There are several investors who want to

increase their holding in the company and for that, they are required to make the purchase of

the shares (Wesson, 2015). But they are not able to do so due to lack of the funds. In this

case, they will be allotted the shares and there will be no cost which will have to be incurred

by them in this respect. So it can be said that they will be able to increase their holding in the

business without being required to make any kind of expenditure. There will be a rise in their

share and they will be more important now for the company.

This will also develop the interest of the investors as they will be keen on receiving the new

shares which will be making the growth possible for them. There will be no cash which will

be received by them but in place of that shares will be obtained which will be more beneficial

for them as this will be providing them with the long-term advantages in the company and

they will be able to maintain their position in the business for long.

All of this is the part of the financial management which will be made and will be undertaken

in such manner that the benefit will be long lasting and will be increasing the value of the

business and also a number of investors will be attracted who will be interested in making the

investment in the company.

5

Question 3 Investment Appraisal Techniques

(a)

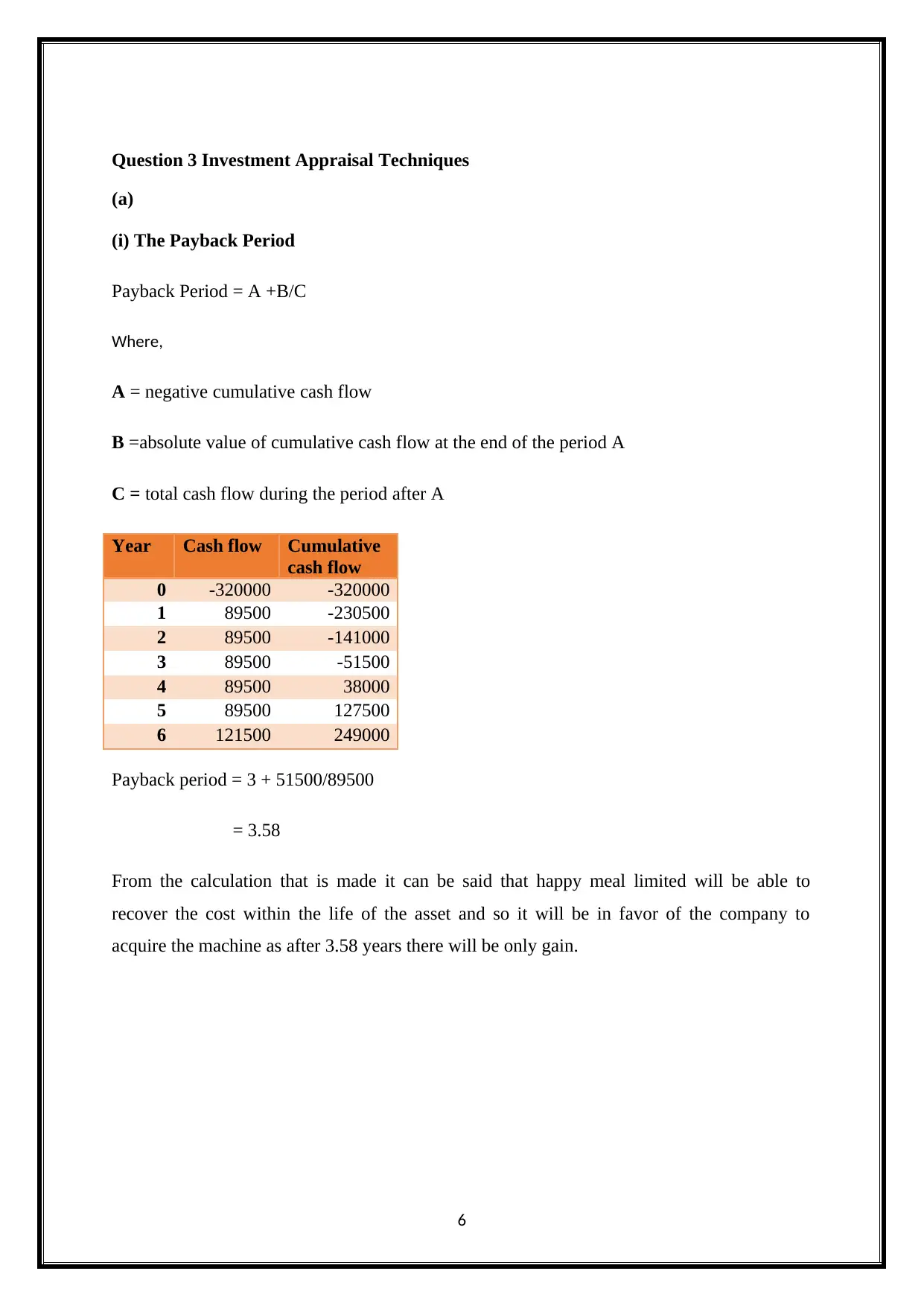

(i) The Payback Period

Payback Period = A +B/C

Where,

A = negative cumulative cash flow

B =absolute value of cumulative cash flow at the end of the period A

C = total cash flow during the period after A

Year Cash flow Cumulative

cash flow

0 -320000 -320000

1 89500 -230500

2 89500 -141000

3 89500 -51500

4 89500 38000

5 89500 127500

6 121500 249000

Payback period = 3 + 51500/89500

= 3.58

From the calculation that is made it can be said that happy meal limited will be able to

recover the cost within the life of the asset and so it will be in favor of the company to

acquire the machine as after 3.58 years there will be only gain.

6

(a)

(i) The Payback Period

Payback Period = A +B/C

Where,

A = negative cumulative cash flow

B =absolute value of cumulative cash flow at the end of the period A

C = total cash flow during the period after A

Year Cash flow Cumulative

cash flow

0 -320000 -320000

1 89500 -230500

2 89500 -141000

3 89500 -51500

4 89500 38000

5 89500 127500

6 121500 249000

Payback period = 3 + 51500/89500

= 3.58

From the calculation that is made it can be said that happy meal limited will be able to

recover the cost within the life of the asset and so it will be in favor of the company to

acquire the machine as after 3.58 years there will be only gain.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

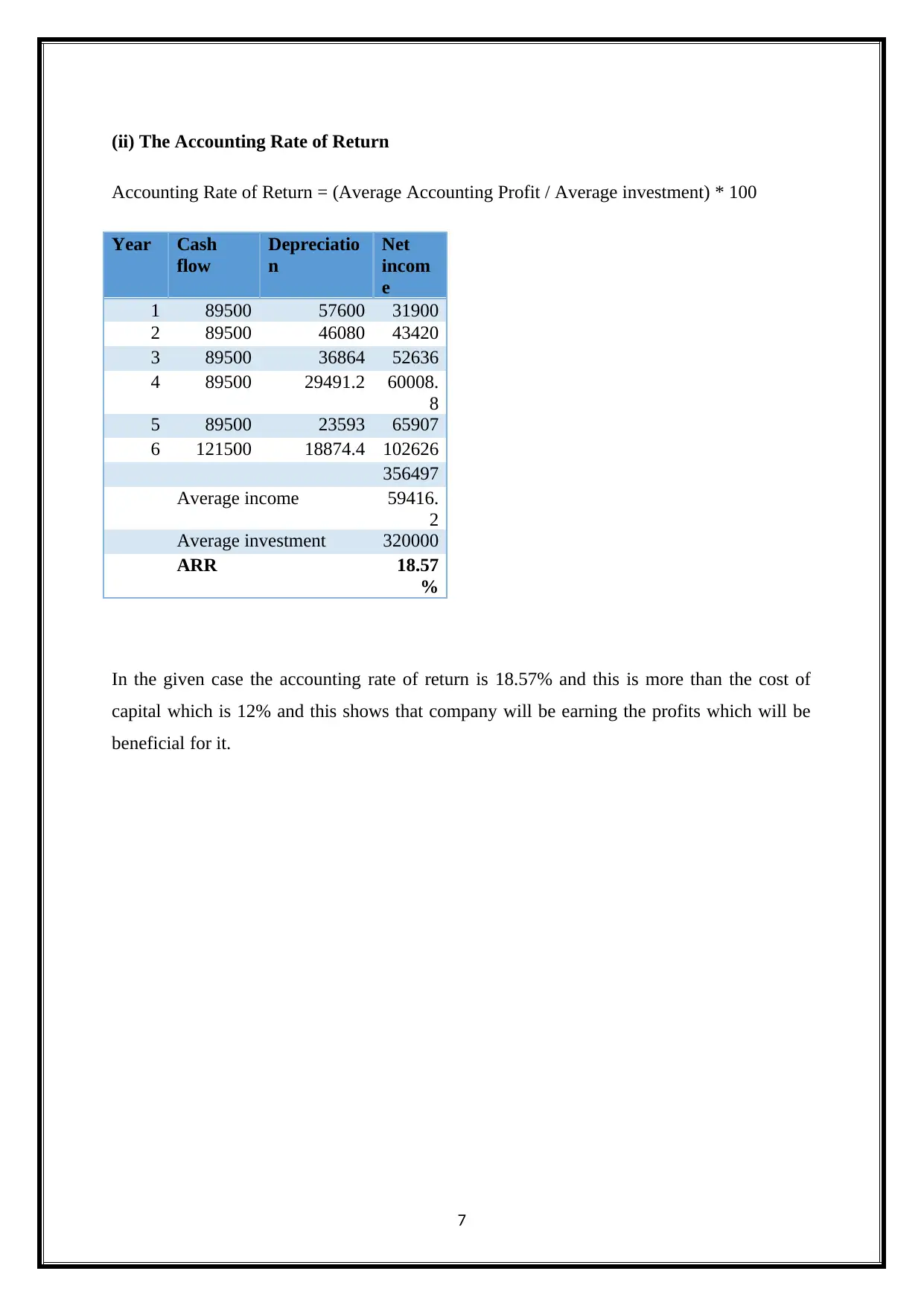

(ii) The Accounting Rate of Return

Accounting Rate of Return = (Average Accounting Profit / Average investment) * 100

Year Cash

flow

Depreciatio

n

Net

incom

e

1 89500 57600 31900

2 89500 46080 43420

3 89500 36864 52636

4 89500 29491.2 60008.

8

5 89500 23593 65907

6 121500 18874.4 102626

356497

Average income 59416.

2

Average investment 320000

ARR 18.57

%

In the given case the accounting rate of return is 18.57% and this is more than the cost of

capital which is 12% and this shows that company will be earning the profits which will be

beneficial for it.

7

Accounting Rate of Return = (Average Accounting Profit / Average investment) * 100

Year Cash

flow

Depreciatio

n

Net

incom

e

1 89500 57600 31900

2 89500 46080 43420

3 89500 36864 52636

4 89500 29491.2 60008.

8

5 89500 23593 65907

6 121500 18874.4 102626

356497

Average income 59416.

2

Average investment 320000

ARR 18.57

%

In the given case the accounting rate of return is 18.57% and this is more than the cost of

capital which is 12% and this shows that company will be earning the profits which will be

beneficial for it.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

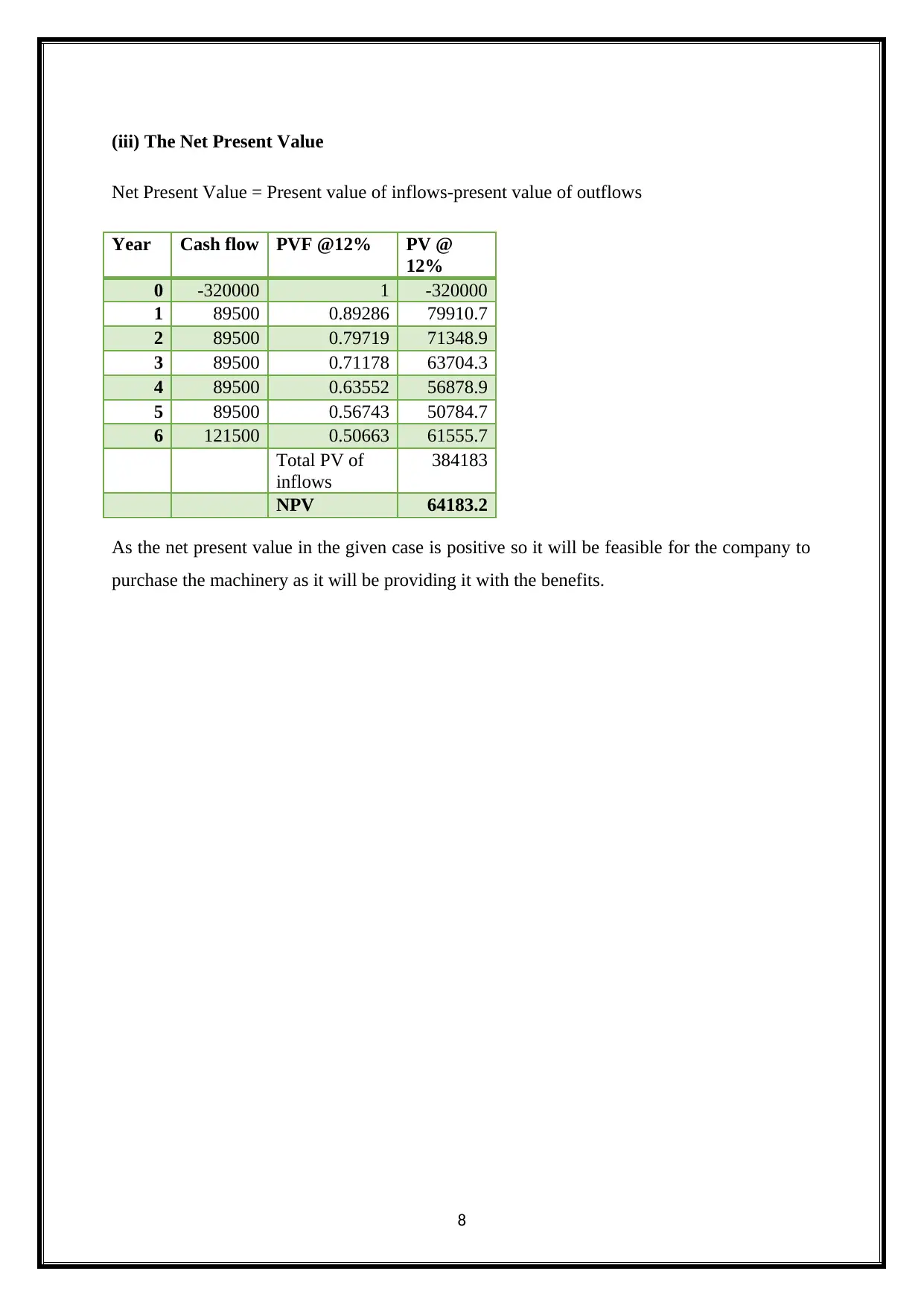

(iii) The Net Present Value

Net Present Value = Present value of inflows-present value of outflows

Year Cash flow PVF @12% PV @

12%

0 -320000 1 -320000

1 89500 0.89286 79910.7

2 89500 0.79719 71348.9

3 89500 0.71178 63704.3

4 89500 0.63552 56878.9

5 89500 0.56743 50784.7

6 121500 0.50663 61555.7

Total PV of

inflows

384183

NPV 64183.2

As the net present value in the given case is positive so it will be feasible for the company to

purchase the machinery as it will be providing it with the benefits.

8

Net Present Value = Present value of inflows-present value of outflows

Year Cash flow PVF @12% PV @

12%

0 -320000 1 -320000

1 89500 0.89286 79910.7

2 89500 0.79719 71348.9

3 89500 0.71178 63704.3

4 89500 0.63552 56878.9

5 89500 0.56743 50784.7

6 121500 0.50663 61555.7

Total PV of

inflows

384183

NPV 64183.2

As the net present value in the given case is positive so it will be feasible for the company to

purchase the machinery as it will be providing it with the benefits.

8

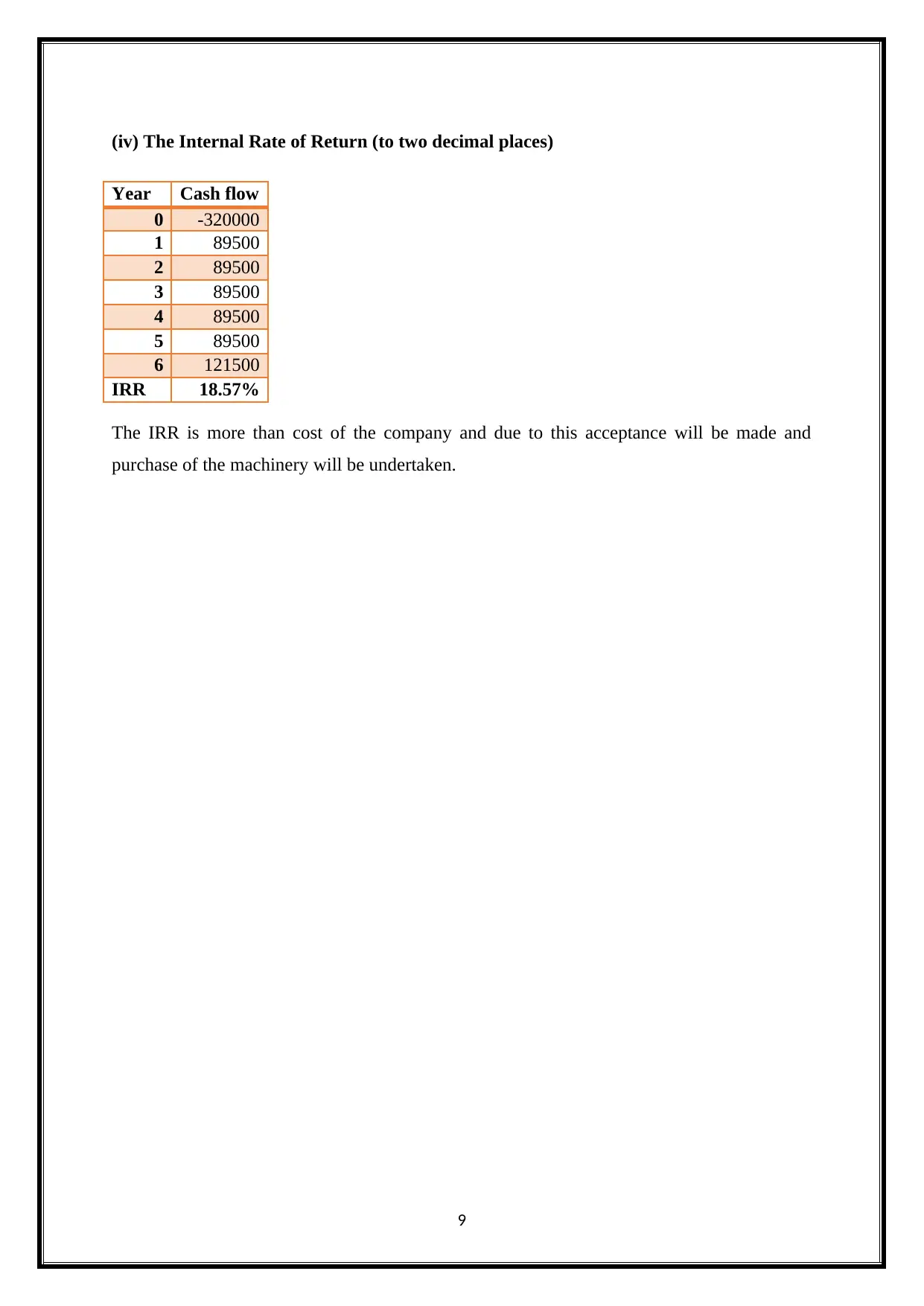

(iv) The Internal Rate of Return (to two decimal places)

Year Cash flow

0 -320000

1 89500

2 89500

3 89500

4 89500

5 89500

6 121500

IRR 18.57%

The IRR is more than cost of the company and due to this acceptance will be made and

purchase of the machinery will be undertaken.

9

Year Cash flow

0 -320000

1 89500

2 89500

3 89500

4 89500

5 89500

6 121500

IRR 18.57%

The IRR is more than cost of the company and due to this acceptance will be made and

purchase of the machinery will be undertaken.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(b) Critically evaluate the benefits and limitations of each of the different investment

appraisal techniques, ensuring the response is supported by relevant academic research.

In the business, there are various investment appraisals techniques which are used so that all

the investments which are made can be evaluated in an appropriate manner. By the help of

this, it will be possible for the business that appropriate decisions are made and there is no

loss which is faced by the company (Kolawole, 2016). Due to this the advantages and

disadvantages in relation to several techniques are provided hereunder.

Payback period:

In the company, there are various projects which are undertaken and it is required to identify

that whether they will be beneficial for the company or not. There will need to calculate the

time which will be taken by any proposal for the recovery of the investment which has been

made (Jabet, et. al., 2016). That period is known as the payback period.

Advantages:

The main benefit is that it is very simple and so will be understood by all and they

will be able to implement it in a successful manner.

If there is the uncertainty which is faced by the business then it will be considered and

by that the chances of the losses in future will be eliminated.

In case of the various proposals, it will be possible to compare all and rank them so

that appropriate decision can be taken and the best among all will be chosen.

Disadvantages:

Under this method, the company ignores the cash flow which is thereafter the payback

period and so this is one of the demerits of this.

The cost of capital which is included in business is completely ignored in this and that

is one of the most important factors which shall be considered in any investments.

Under this, the time value of the money is ignored as the amount which is received in

the earlier phase are considered on priority basis.

10

appraisal techniques, ensuring the response is supported by relevant academic research.

In the business, there are various investment appraisals techniques which are used so that all

the investments which are made can be evaluated in an appropriate manner. By the help of

this, it will be possible for the business that appropriate decisions are made and there is no

loss which is faced by the company (Kolawole, 2016). Due to this the advantages and

disadvantages in relation to several techniques are provided hereunder.

Payback period:

In the company, there are various projects which are undertaken and it is required to identify

that whether they will be beneficial for the company or not. There will need to calculate the

time which will be taken by any proposal for the recovery of the investment which has been

made (Jabet, et. al., 2016). That period is known as the payback period.

Advantages:

The main benefit is that it is very simple and so will be understood by all and they

will be able to implement it in a successful manner.

If there is the uncertainty which is faced by the business then it will be considered and

by that the chances of the losses in future will be eliminated.

In case of the various proposals, it will be possible to compare all and rank them so

that appropriate decision can be taken and the best among all will be chosen.

Disadvantages:

Under this method, the company ignores the cash flow which is thereafter the payback

period and so this is one of the demerits of this.

The cost of capital which is included in business is completely ignored in this and that

is one of the most important factors which shall be considered in any investments.

Under this, the time value of the money is ignored as the amount which is received in

the earlier phase are considered on priority basis.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting rate of return:

The profits are made by the business and it is required to ascertain the rate at which they are

made in comparison to the amount which has been invested (Hunjra, et. al., 2012). The rate

which is determined will be called the accounting rate of return.

Advantages:

All the profits and incomes which are earned in the business during a particular

period are taken into consideration. Also, the method is very easy so can be used

by all.

As the profitability is the main element which is considered by the owner so with

the help of this it will be taken into consideration and project will be evaluated by

considering it.

The performance of the company in the current period will be measured by the use

of this technique.

Disadvantages:

All the external factors which are involved and will be affecting the company’s

profitability are not taken into account which is not beneficial for them.

The inflows in the business are more important but they are not considered and only

the profits are taken into account.

The time factor is not taken into consideration and so the other uses of the funds are

not included which is very much relevant in the company.

Net Present value:

Net present value is another tool in which the net present value which will be earned by the

company will be ascertained and then it will be possible for the company to decide whether to

undertake the investment (Petković, 2015).

Advantages:

Under this time value of money is given importance as the present value of the cash

flows are included. By this, all the future aspects will be considered.

11

The profits are made by the business and it is required to ascertain the rate at which they are

made in comparison to the amount which has been invested (Hunjra, et. al., 2012). The rate

which is determined will be called the accounting rate of return.

Advantages:

All the profits and incomes which are earned in the business during a particular

period are taken into consideration. Also, the method is very easy so can be used

by all.

As the profitability is the main element which is considered by the owner so with

the help of this it will be taken into consideration and project will be evaluated by

considering it.

The performance of the company in the current period will be measured by the use

of this technique.

Disadvantages:

All the external factors which are involved and will be affecting the company’s

profitability are not taken into account which is not beneficial for them.

The inflows in the business are more important but they are not considered and only

the profits are taken into account.

The time factor is not taken into consideration and so the other uses of the funds are

not included which is very much relevant in the company.

Net Present value:

Net present value is another tool in which the net present value which will be earned by the

company will be ascertained and then it will be possible for the company to decide whether to

undertake the investment (Petković, 2015).

Advantages:

Under this time value of money is given importance as the present value of the cash

flows are included. By this, all the future aspects will be considered.

11

The profitability and risk which is involved in the business are taken into account

under this and by that, it will be possible to include them in advance so that they can

be dealt properly (Gotze, et. al., 2016).

By the use of this the value of the business is maximized.

Disadvantages:

The process which is involved in the calculation of this is complex and this makes it

difficult for all to use it. There will be skills which will be required to take this in use.

The discount rate will be required in the calculation of this and it is not easy to

ascertain that inappropriate manner. If the wrong discount rate is chosen then the

whole calculation will be a failure.

If the amount and the life of the several projects are not equal then, in that case, there

will be an improper decision which will be made and this affects the position of the

company.

The internal rate of return:

The internal rate of return is the rate at which the company will be in the situation where the

net present value is 0 (Weygandt, et. al., 2015). This shows that there will be neither the

profits nor the losses.

Advantages:

All the cash flows which are included in the project are given the equal amount of the

importance and by that, the proper results will be obtained so that they can be used in

making of the best decisions.

The profitability will be maintained as the point of the no loss and profit will be

identified which will be used in carrying out further operations in the required

manner.

The return which is made on the actual amount of investment is evaluated in this

which is very essential.

12

under this and by that, it will be possible to include them in advance so that they can

be dealt properly (Gotze, et. al., 2016).

By the use of this the value of the business is maximized.

Disadvantages:

The process which is involved in the calculation of this is complex and this makes it

difficult for all to use it. There will be skills which will be required to take this in use.

The discount rate will be required in the calculation of this and it is not easy to

ascertain that inappropriate manner. If the wrong discount rate is chosen then the

whole calculation will be a failure.

If the amount and the life of the several projects are not equal then, in that case, there

will be an improper decision which will be made and this affects the position of the

company.

The internal rate of return:

The internal rate of return is the rate at which the company will be in the situation where the

net present value is 0 (Weygandt, et. al., 2015). This shows that there will be neither the

profits nor the losses.

Advantages:

All the cash flows which are included in the project are given the equal amount of the

importance and by that, the proper results will be obtained so that they can be used in

making of the best decisions.

The profitability will be maintained as the point of the no loss and profit will be

identified which will be used in carrying out further operations in the required

manner.

The return which is made on the actual amount of investment is evaluated in this

which is very essential.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.