Financial Management Report: Capital Structure and Investment

VerifiedAdded on 2023/01/17

|15

|3336

|89

Report

AI Summary

This financial management report comprehensively examines capital structure, cost of capital, and investment appraisal techniques. It begins by assessing the Weighted Average Cost of Capital (WACC) for Kadlex Plc, using both market and book values, and analyzes the impact of proposed changes. The report then critically evaluates the integration of new capital, exploring the effects of short-termism on agency problems and bankruptcy. Furthermore, the report delves into investment appraisal techniques, specifically payback period, Accounting Rate of Return (ARR), Net Present Value (NPV), and Internal Rate of Return (IRR), applied to a case study of Love-well Limited. The report concludes with a discussion of the benefits and limitations of these investment appraisal techniques, providing a thorough understanding of financial management principles and their practical applications.

FINANCIAL

MANAGEMENT

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

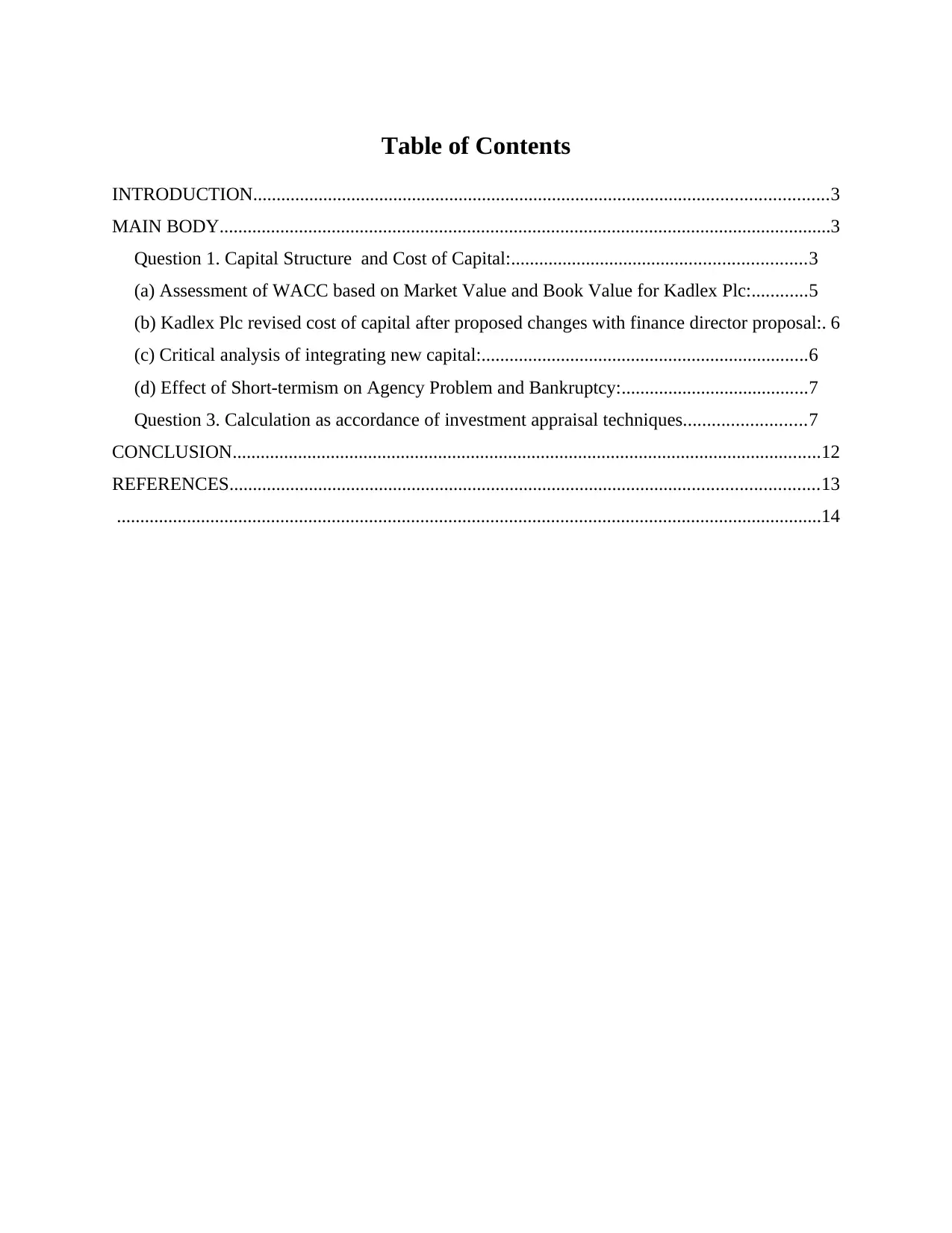

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1. Capital Structure and Cost of Capital:...............................................................3

(a) Assessment of WACC based on Market Value and Book Value for Kadlex Plc:............5

(b) Kadlex Plc revised cost of capital after proposed changes with finance director proposal:. 6

(c) Critical analysis of integrating new capital:......................................................................6

(d) Effect of Short-termism on Agency Problem and Bankruptcy:........................................7

Question 3. Calculation as accordance of investment appraisal techniques..........................7

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

.......................................................................................................................................................14

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1. Capital Structure and Cost of Capital:...............................................................3

(a) Assessment of WACC based on Market Value and Book Value for Kadlex Plc:............5

(b) Kadlex Plc revised cost of capital after proposed changes with finance director proposal:. 6

(c) Critical analysis of integrating new capital:......................................................................6

(d) Effect of Short-termism on Agency Problem and Bankruptcy:........................................7

Question 3. Calculation as accordance of investment appraisal techniques..........................7

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

.......................................................................................................................................................14

INTRODUCTION

This is defined as a type of technique that is related to process of planning, organising

and managing monetary activities in a better manner (Guess and Ma, 2015). Basically, it makes

focus on ratios and debts as well as this helps in an effective portfolio management. In addition,

this is necessary for all forms of business to manage their monetary resources whether it is small

or large. The project report is based on different calculation which are done as accordance of

given data. Such as in computation of equity financing is done as well as in the further part of

report various forms of investment appraisal techniques are implemented in order to choose

investment effectively.

MAIN BODY

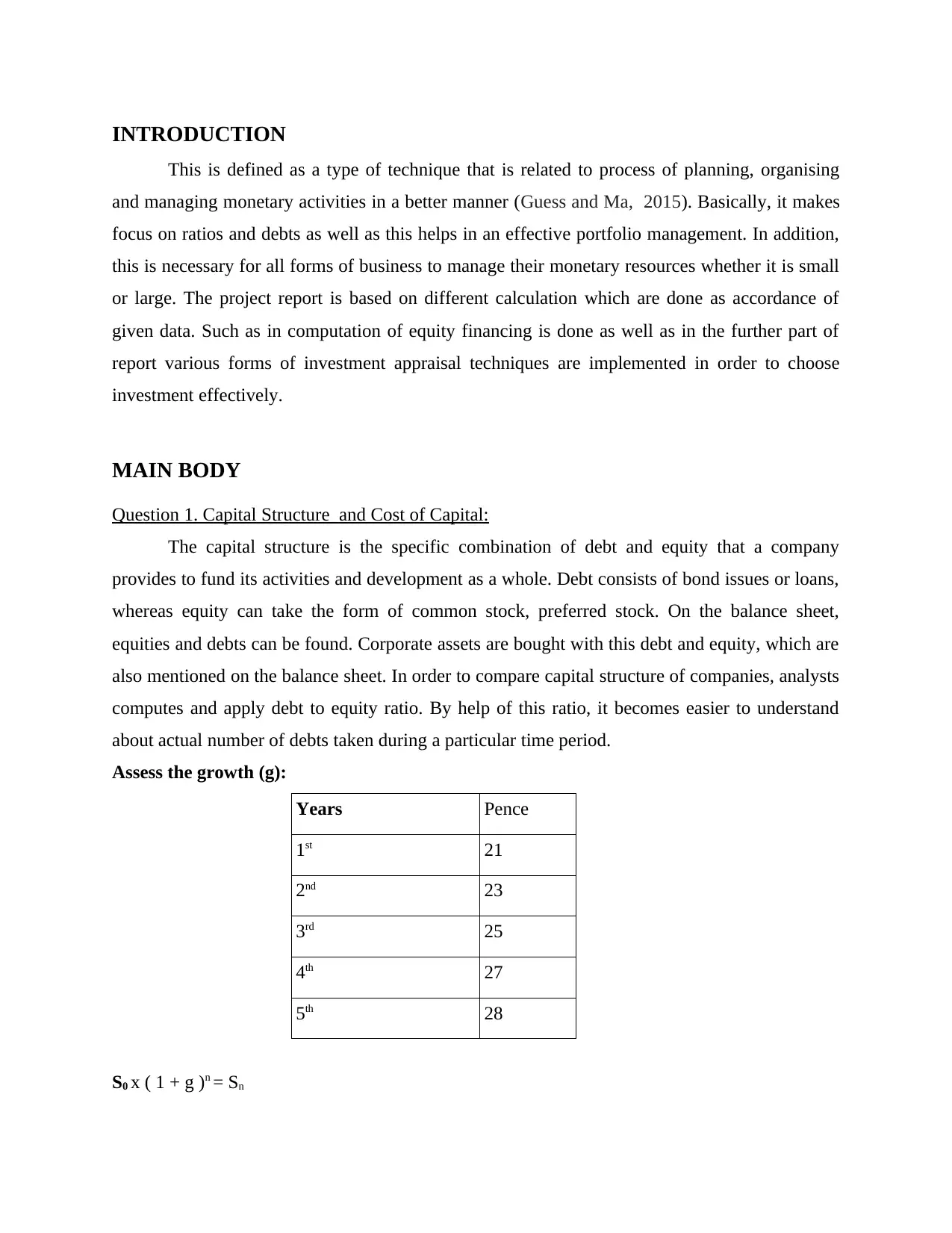

Question 1. Capital Structure and Cost of Capital:

The capital structure is the specific combination of debt and equity that a company

provides to fund its activities and development as a whole. Debt consists of bond issues or loans,

whereas equity can take the form of common stock, preferred stock. On the balance sheet,

equities and debts can be found. Corporate assets are bought with this debt and equity, which are

also mentioned on the balance sheet. In order to compare capital structure of companies, analysts

computes and apply debt to equity ratio. By help of this ratio, it becomes easier to understand

about actual number of debts taken during a particular time period.

Assess the growth (g):

Years Pence

1st 21

2nd 23

3rd 25

4th 27

5th 28

S0 x ( 1 + g )n = Sn

This is defined as a type of technique that is related to process of planning, organising

and managing monetary activities in a better manner (Guess and Ma, 2015). Basically, it makes

focus on ratios and debts as well as this helps in an effective portfolio management. In addition,

this is necessary for all forms of business to manage their monetary resources whether it is small

or large. The project report is based on different calculation which are done as accordance of

given data. Such as in computation of equity financing is done as well as in the further part of

report various forms of investment appraisal techniques are implemented in order to choose

investment effectively.

MAIN BODY

Question 1. Capital Structure and Cost of Capital:

The capital structure is the specific combination of debt and equity that a company

provides to fund its activities and development as a whole. Debt consists of bond issues or loans,

whereas equity can take the form of common stock, preferred stock. On the balance sheet,

equities and debts can be found. Corporate assets are bought with this debt and equity, which are

also mentioned on the balance sheet. In order to compare capital structure of companies, analysts

computes and apply debt to equity ratio. By help of this ratio, it becomes easier to understand

about actual number of debts taken during a particular time period.

Assess the growth (g):

Years Pence

1st 21

2nd 23

3rd 25

4th 27

5th 28

S0 x ( 1 + g )n = Sn

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 21 * ( 1 + g ) 4 = 28

= ( 1 + g ) 4 = 28 / 21

= ( 1 + g ) 4 = 1.3333

= ( 1 + g ) = ( 1.3333 ) 0.25

g = ( 1 ) - ( 1.0757 ) = 0.0757 or 7.57 %

Here, in the above formula "g" corresponds to percentages, n denotes years, while S0 is a first-

dividend, and Sn means a divided spread in previous year.

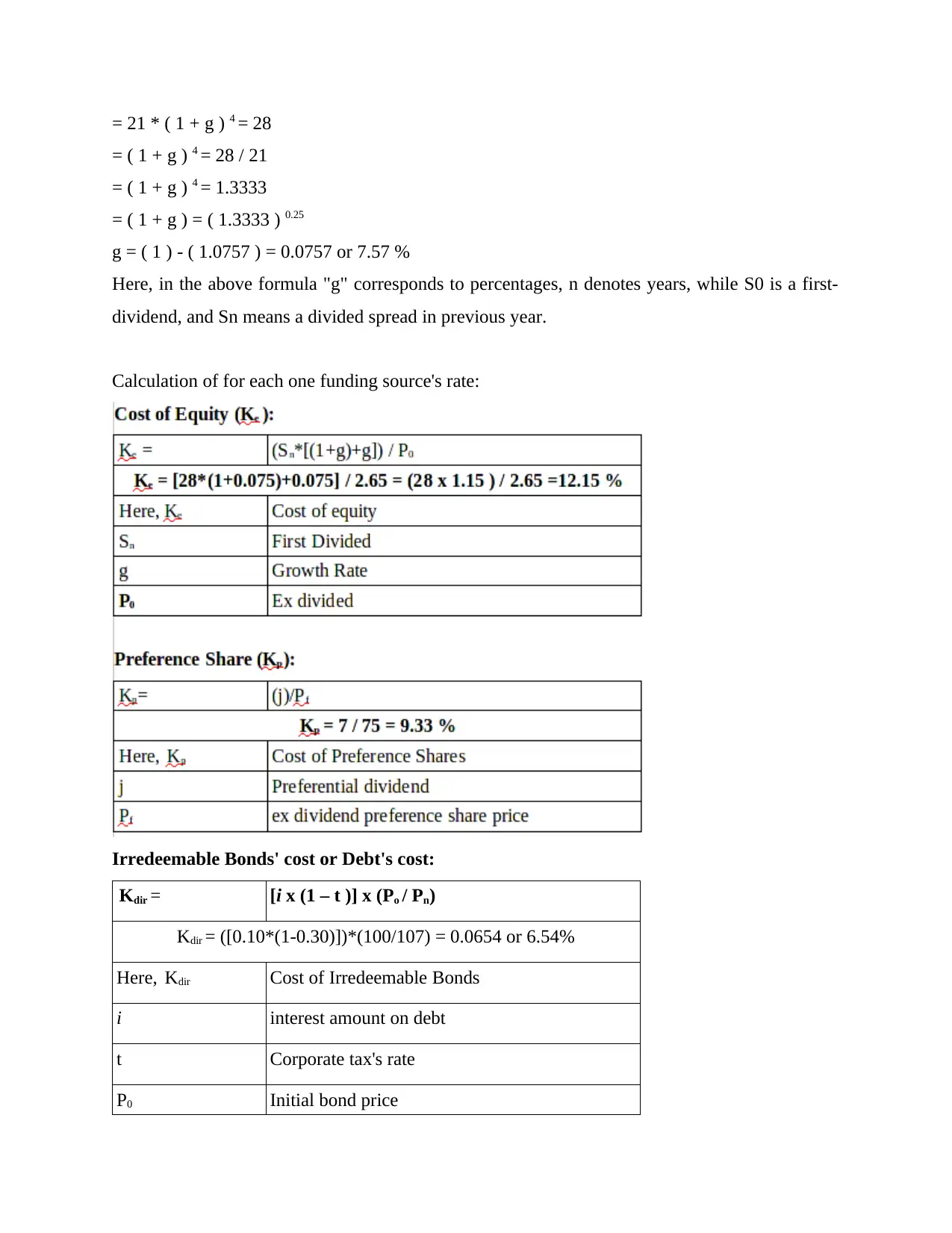

Calculation of for each one funding source's rate:

Irredeemable Bonds' cost or Debt's cost:

Kdir = [i x (1 – t )] x (Po / Pn)

Kdir = ([0.10*(1-0.30)])*(100/107) = 0.0654 or 6.54%

Here, Kdir Cost of Irredeemable Bonds

i interest amount on debt

t Corporate tax's rate

P0 Initial bond price

= ( 1 + g ) 4 = 28 / 21

= ( 1 + g ) 4 = 1.3333

= ( 1 + g ) = ( 1.3333 ) 0.25

g = ( 1 ) - ( 1.0757 ) = 0.0757 or 7.57 %

Here, in the above formula "g" corresponds to percentages, n denotes years, while S0 is a first-

dividend, and Sn means a divided spread in previous year.

Calculation of for each one funding source's rate:

Irredeemable Bonds' cost or Debt's cost:

Kdir = [i x (1 – t )] x (Po / Pn)

Kdir = ([0.10*(1-0.30)])*(100/107) = 0.0654 or 6.54%

Here, Kdir Cost of Irredeemable Bonds

i interest amount on debt

t Corporate tax's rate

P0 Initial bond price

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Pn Current bond price

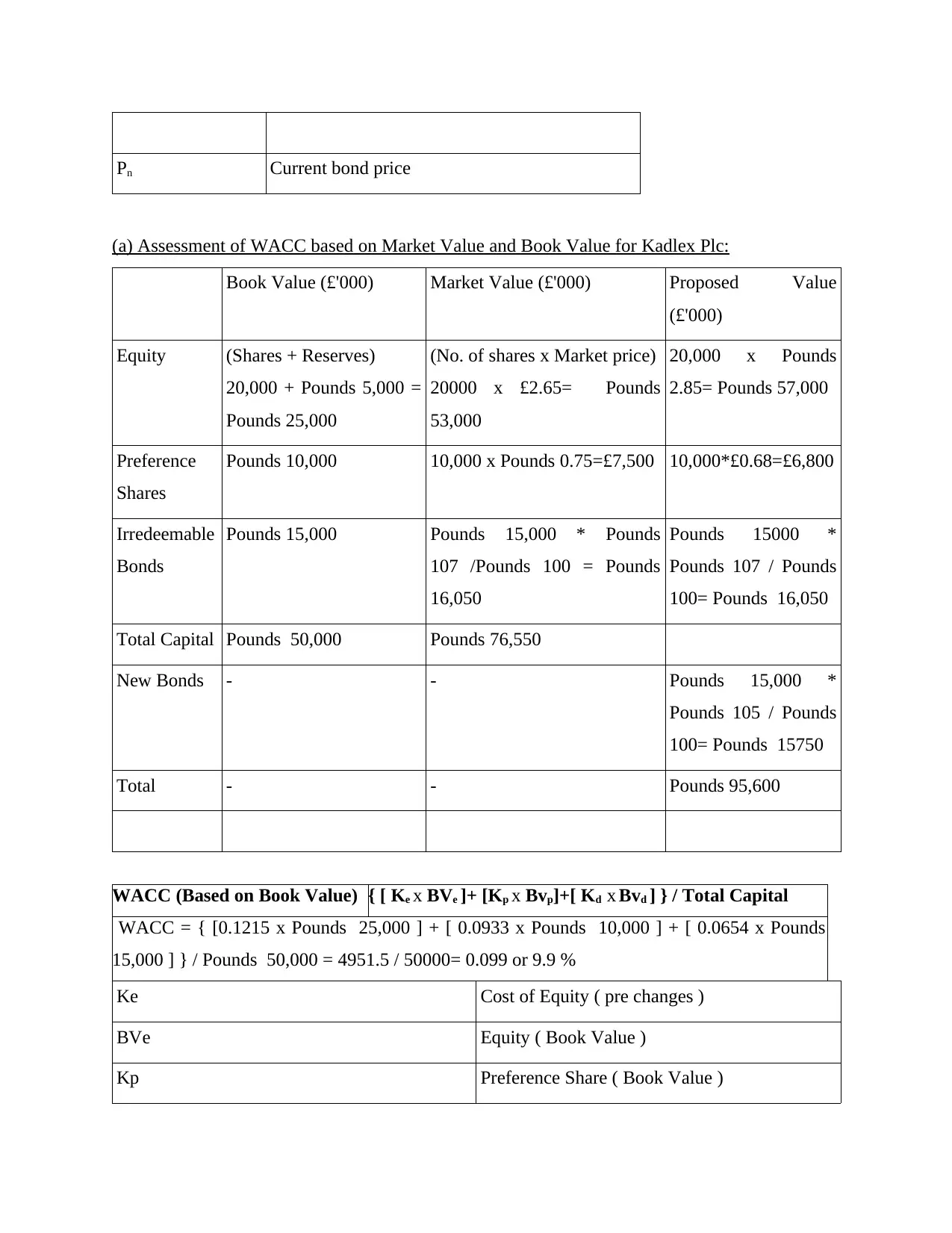

(a) Assessment of WACC based on Market Value and Book Value for Kadlex Plc:

Book Value (£'000) Market Value (£'000) Proposed Value

(£'000)

Equity (Shares + Reserves)

20,000 + Pounds 5,000 =

Pounds 25,000

(No. of shares x Market price)

20000 x £2.65= Pounds

53,000

20,000 x Pounds

2.85= Pounds 57,000

Preference

Shares

Pounds 10,000 10,000 x Pounds 0.75=£7,500 10,000*£0.68=£6,800

Irredeemable

Bonds

Pounds 15,000 Pounds 15,000 * Pounds

107 /Pounds 100 = Pounds

16,050

Pounds 15000 *

Pounds 107 / Pounds

100= Pounds 16,050

Total Capital Pounds 50,000 Pounds 76,550

New Bonds - - Pounds 15,000 *

Pounds 105 / Pounds

100= Pounds 15750

Total - - Pounds 95,600

WACC (Based on Book Value) { [ Ke x BVe ]+ [Kp x Bvp]+[ Kd x Bvd ] } / Total Capital

WACC = { [0.1215 x Pounds 25,000 ] + [ 0.0933 x Pounds 10,000 ] + [ 0.0654 x Pounds

15,000 ] } / Pounds 50,000 = 4951.5 / 50000= 0.099 or 9.9 %

Ke Cost of Equity ( pre changes )

BVe Equity ( Book Value )

Kp Preference Share ( Book Value )

(a) Assessment of WACC based on Market Value and Book Value for Kadlex Plc:

Book Value (£'000) Market Value (£'000) Proposed Value

(£'000)

Equity (Shares + Reserves)

20,000 + Pounds 5,000 =

Pounds 25,000

(No. of shares x Market price)

20000 x £2.65= Pounds

53,000

20,000 x Pounds

2.85= Pounds 57,000

Preference

Shares

Pounds 10,000 10,000 x Pounds 0.75=£7,500 10,000*£0.68=£6,800

Irredeemable

Bonds

Pounds 15,000 Pounds 15,000 * Pounds

107 /Pounds 100 = Pounds

16,050

Pounds 15000 *

Pounds 107 / Pounds

100= Pounds 16,050

Total Capital Pounds 50,000 Pounds 76,550

New Bonds - - Pounds 15,000 *

Pounds 105 / Pounds

100= Pounds 15750

Total - - Pounds 95,600

WACC (Based on Book Value) { [ Ke x BVe ]+ [Kp x Bvp]+[ Kd x Bvd ] } / Total Capital

WACC = { [0.1215 x Pounds 25,000 ] + [ 0.0933 x Pounds 10,000 ] + [ 0.0654 x Pounds

15,000 ] } / Pounds 50,000 = 4951.5 / 50000= 0.099 or 9.9 %

Ke Cost of Equity ( pre changes )

BVe Equity ( Book Value )

Kp Preference Share ( Book Value )

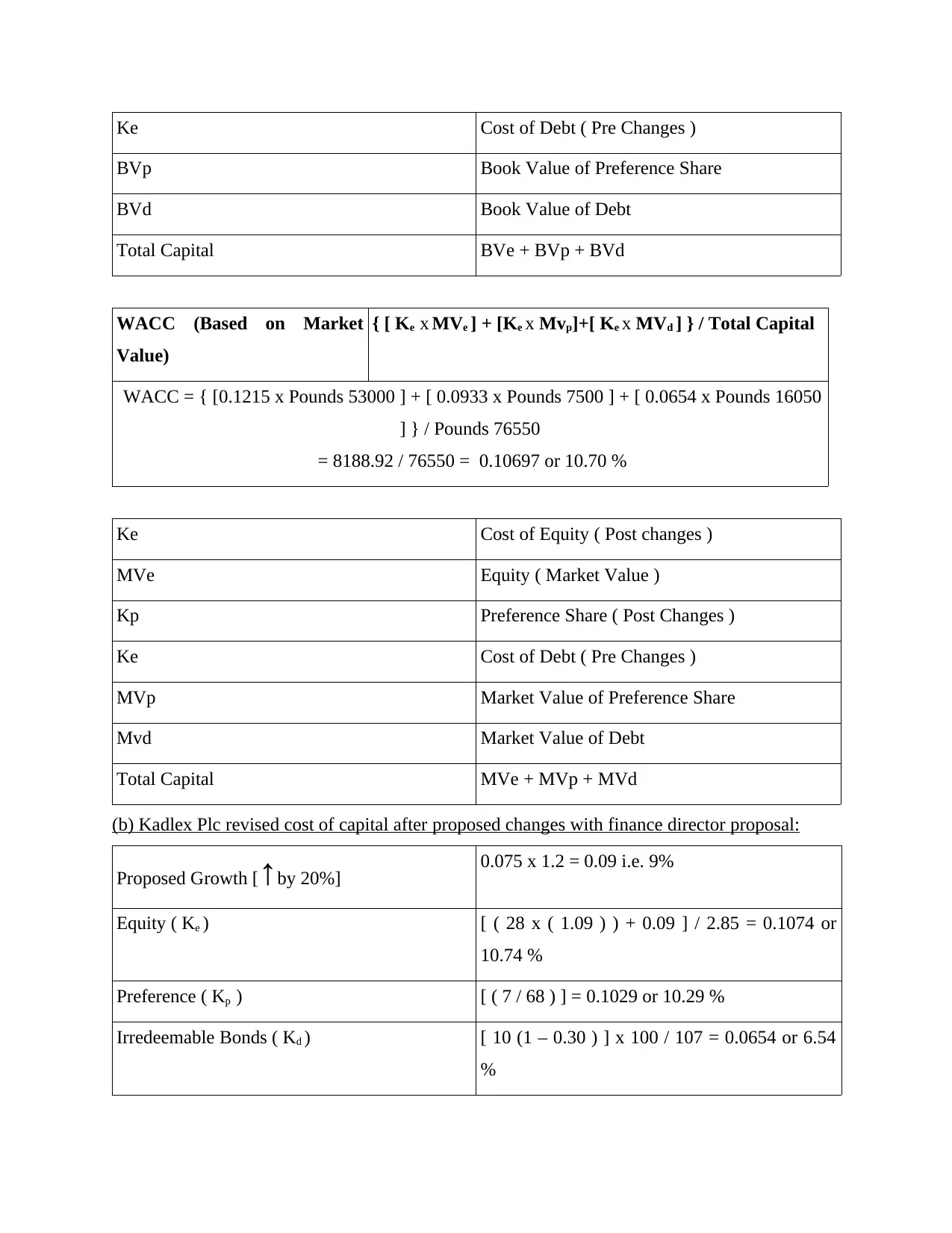

Ke Cost of Debt ( Pre Changes )

BVp Book Value of Preference Share

BVd Book Value of Debt

Total Capital BVe + BVp + BVd

WACC (Based on Market

Value)

{ [ Ke x MVe ] + [Ke x Mvp]+[ Ke x MVd ] } / Total Capital

WACC = { [0.1215 x Pounds 53000 ] + [ 0.0933 x Pounds 7500 ] + [ 0.0654 x Pounds 16050

] } / Pounds 76550

= 8188.92 / 76550 = 0.10697 or 10.70 %

Ke Cost of Equity ( Post changes )

MVe Equity ( Market Value )

Kp Preference Share ( Post Changes )

Ke Cost of Debt ( Pre Changes )

MVp Market Value of Preference Share

Mvd Market Value of Debt

Total Capital MVe + MVp + MVd

(b) Kadlex Plc revised cost of capital after proposed changes with finance director proposal:

Proposed Growth [↑by 20%] 0.075 x 1.2 = 0.09 i.e. 9%

Equity ( Ke ) [ ( 28 x ( 1.09 ) ) + 0.09 ] / 2.85 = 0.1074 or

10.74 %

Preference ( Kp ) [ ( 7 / 68 ) ] = 0.1029 or 10.29 %

Irredeemable Bonds ( Kd ) [ 10 (1 – 0.30 ) ] x 100 / 107 = 0.0654 or 6.54

%

BVp Book Value of Preference Share

BVd Book Value of Debt

Total Capital BVe + BVp + BVd

WACC (Based on Market

Value)

{ [ Ke x MVe ] + [Ke x Mvp]+[ Ke x MVd ] } / Total Capital

WACC = { [0.1215 x Pounds 53000 ] + [ 0.0933 x Pounds 7500 ] + [ 0.0654 x Pounds 16050

] } / Pounds 76550

= 8188.92 / 76550 = 0.10697 or 10.70 %

Ke Cost of Equity ( Post changes )

MVe Equity ( Market Value )

Kp Preference Share ( Post Changes )

Ke Cost of Debt ( Pre Changes )

MVp Market Value of Preference Share

Mvd Market Value of Debt

Total Capital MVe + MVp + MVd

(b) Kadlex Plc revised cost of capital after proposed changes with finance director proposal:

Proposed Growth [↑by 20%] 0.075 x 1.2 = 0.09 i.e. 9%

Equity ( Ke ) [ ( 28 x ( 1.09 ) ) + 0.09 ] / 2.85 = 0.1074 or

10.74 %

Preference ( Kp ) [ ( 7 / 68 ) ] = 0.1029 or 10.29 %

Irredeemable Bonds ( Kd ) [ 10 (1 – 0.30 ) ] x 100 / 107 = 0.0654 or 6.54

%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

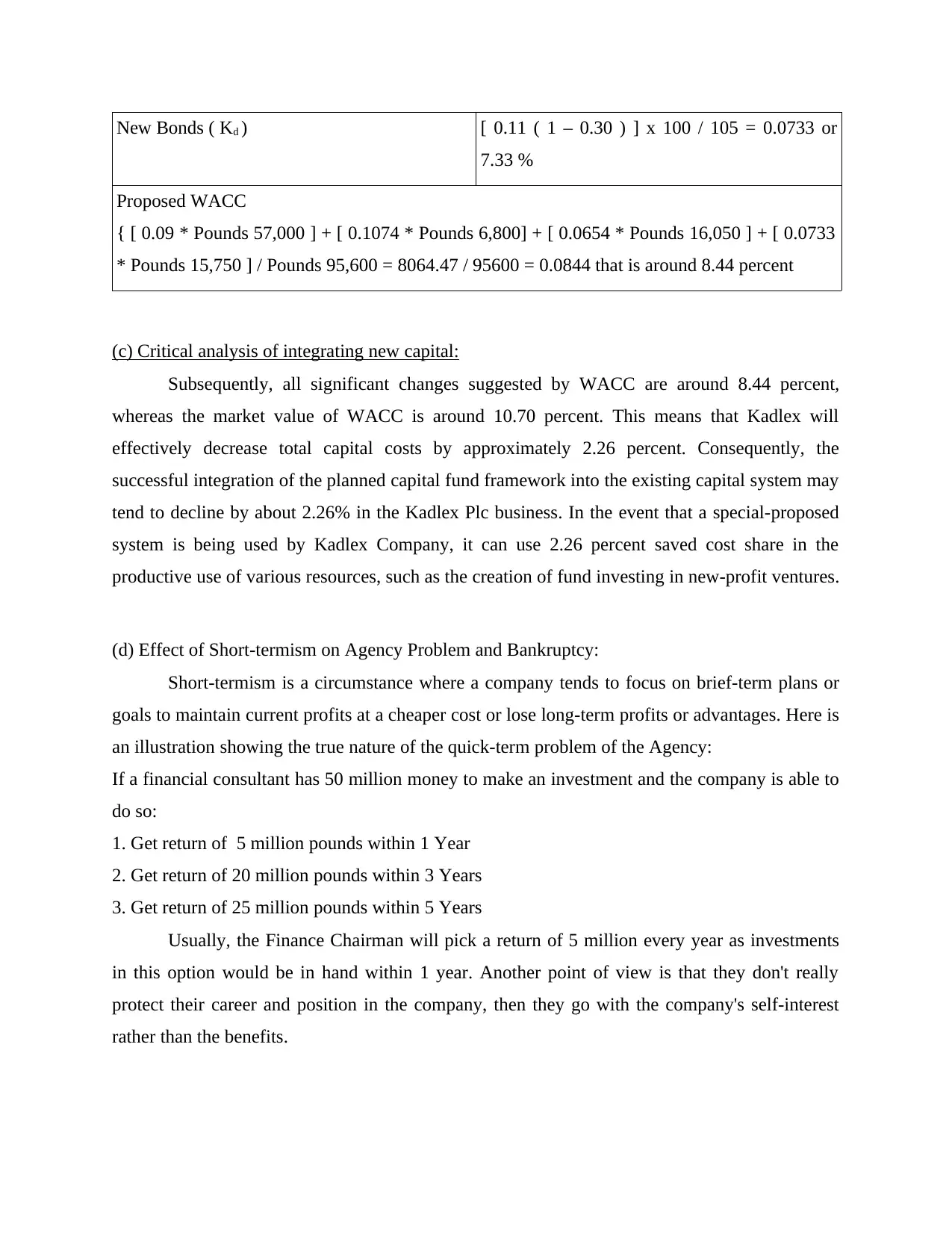

New Bonds ( Kd ) [ 0.11 ( 1 – 0.30 ) ] x 100 / 105 = 0.0733 or

7.33 %

Proposed WACC

{ [ 0.09 * Pounds 57,000 ] + [ 0.1074 * Pounds 6,800] + [ 0.0654 * Pounds 16,050 ] + [ 0.0733

* Pounds 15,750 ] / Pounds 95,600 = 8064.47 / 95600 = 0.0844 that is around 8.44 percent

(c) Critical analysis of integrating new capital:

Subsequently, all significant changes suggested by WACC are around 8.44 percent,

whereas the market value of WACC is around 10.70 percent. This means that Kadlex will

effectively decrease total capital costs by approximately 2.26 percent. Consequently, the

successful integration of the planned capital fund framework into the existing capital system may

tend to decline by about 2.26% in the Kadlex Plc business. In the event that a special-proposed

system is being used by Kadlex Company, it can use 2.26 percent saved cost share in the

productive use of various resources, such as the creation of fund investing in new-profit ventures.

(d) Effect of Short-termism on Agency Problem and Bankruptcy:

Short-termism is a circumstance where a company tends to focus on brief-term plans or

goals to maintain current profits at a cheaper cost or lose long-term profits or advantages. Here is

an illustration showing the true nature of the quick-term problem of the Agency:

If a financial consultant has 50 million money to make an investment and the company is able to

do so:

1. Get return of 5 million pounds within 1 Year

2. Get return of 20 million pounds within 3 Years

3. Get return of 25 million pounds within 5 Years

Usually, the Finance Chairman will pick a return of 5 million every year as investments

in this option would be in hand within 1 year. Another point of view is that they don't really

protect their career and position in the company, then they go with the company's self-interest

rather than the benefits.

7.33 %

Proposed WACC

{ [ 0.09 * Pounds 57,000 ] + [ 0.1074 * Pounds 6,800] + [ 0.0654 * Pounds 16,050 ] + [ 0.0733

* Pounds 15,750 ] / Pounds 95,600 = 8064.47 / 95600 = 0.0844 that is around 8.44 percent

(c) Critical analysis of integrating new capital:

Subsequently, all significant changes suggested by WACC are around 8.44 percent,

whereas the market value of WACC is around 10.70 percent. This means that Kadlex will

effectively decrease total capital costs by approximately 2.26 percent. Consequently, the

successful integration of the planned capital fund framework into the existing capital system may

tend to decline by about 2.26% in the Kadlex Plc business. In the event that a special-proposed

system is being used by Kadlex Company, it can use 2.26 percent saved cost share in the

productive use of various resources, such as the creation of fund investing in new-profit ventures.

(d) Effect of Short-termism on Agency Problem and Bankruptcy:

Short-termism is a circumstance where a company tends to focus on brief-term plans or

goals to maintain current profits at a cheaper cost or lose long-term profits or advantages. Here is

an illustration showing the true nature of the quick-term problem of the Agency:

If a financial consultant has 50 million money to make an investment and the company is able to

do so:

1. Get return of 5 million pounds within 1 Year

2. Get return of 20 million pounds within 3 Years

3. Get return of 25 million pounds within 5 Years

Usually, the Finance Chairman will pick a return of 5 million every year as investments

in this option would be in hand within 1 year. Another point of view is that they don't really

protect their career and position in the company, then they go with the company's self-interest

rather than the benefits.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

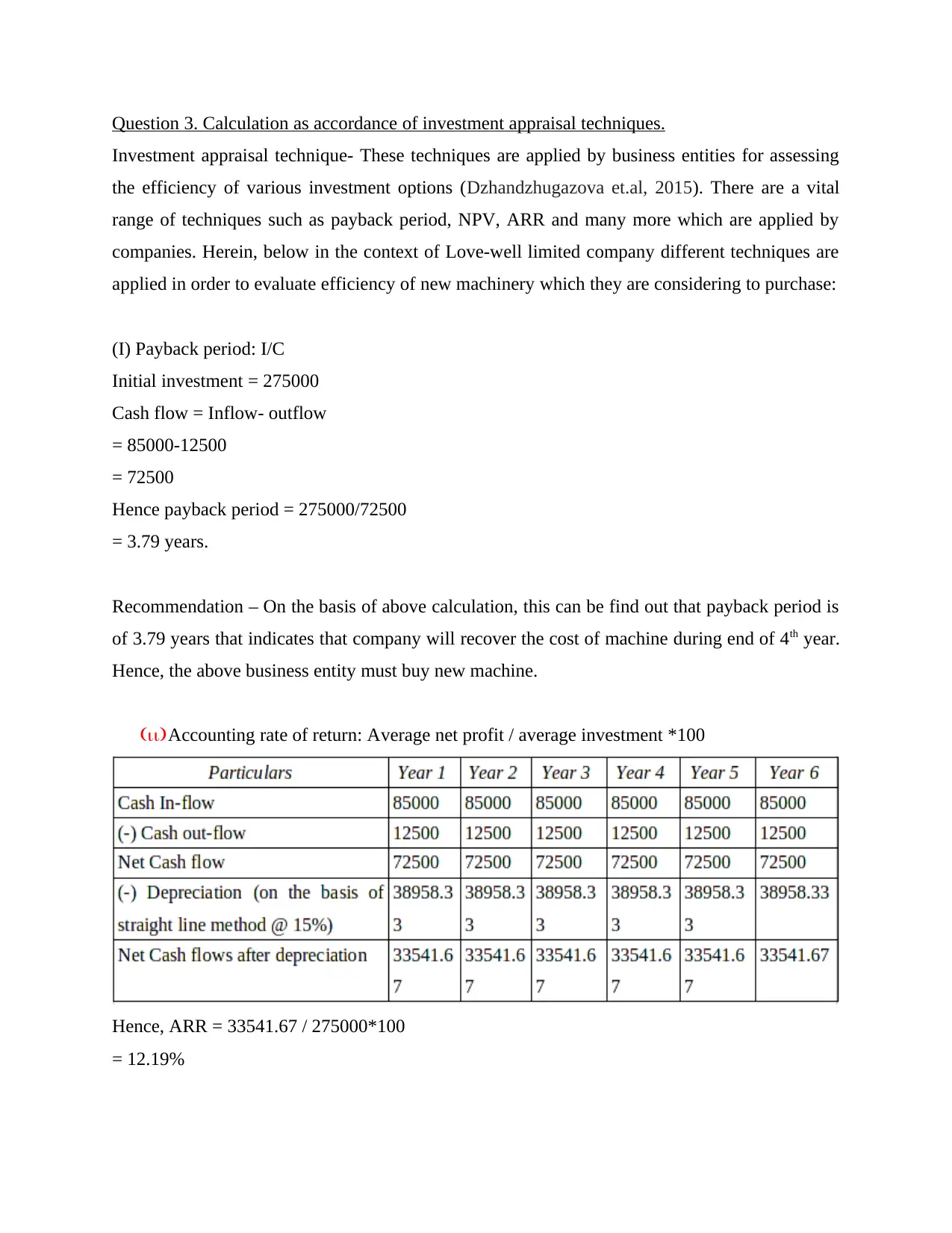

Question 3. Calculation as accordance of investment appraisal techniques.

Investment appraisal technique- These techniques are applied by business entities for assessing

the efficiency of various investment options (Dzhandzhugazova et.al, 2015). There are a vital

range of techniques such as payback period, NPV, ARR and many more which are applied by

companies. Herein, below in the context of Love-well limited company different techniques are

applied in order to evaluate efficiency of new machinery which they are considering to purchase:

(I) Payback period: I/C

Initial investment = 275000

Cash flow = Inflow- outflow

= 85000-12500

= 72500

Hence payback period = 275000/72500

= 3.79 years.

Recommendation – On the basis of above calculation, this can be find out that payback period is

of 3.79 years that indicates that company will recover the cost of machine during end of 4th year.

Hence, the above business entity must buy new machine.

(ii)Accounting rate of return: Average net profit / average investment *100

Hence, ARR = 33541.67 / 275000*100

= 12.19%

Investment appraisal technique- These techniques are applied by business entities for assessing

the efficiency of various investment options (Dzhandzhugazova et.al, 2015). There are a vital

range of techniques such as payback period, NPV, ARR and many more which are applied by

companies. Herein, below in the context of Love-well limited company different techniques are

applied in order to evaluate efficiency of new machinery which they are considering to purchase:

(I) Payback period: I/C

Initial investment = 275000

Cash flow = Inflow- outflow

= 85000-12500

= 72500

Hence payback period = 275000/72500

= 3.79 years.

Recommendation – On the basis of above calculation, this can be find out that payback period is

of 3.79 years that indicates that company will recover the cost of machine during end of 4th year.

Hence, the above business entity must buy new machine.

(ii)Accounting rate of return: Average net profit / average investment *100

Hence, ARR = 33541.67 / 275000*100

= 12.19%

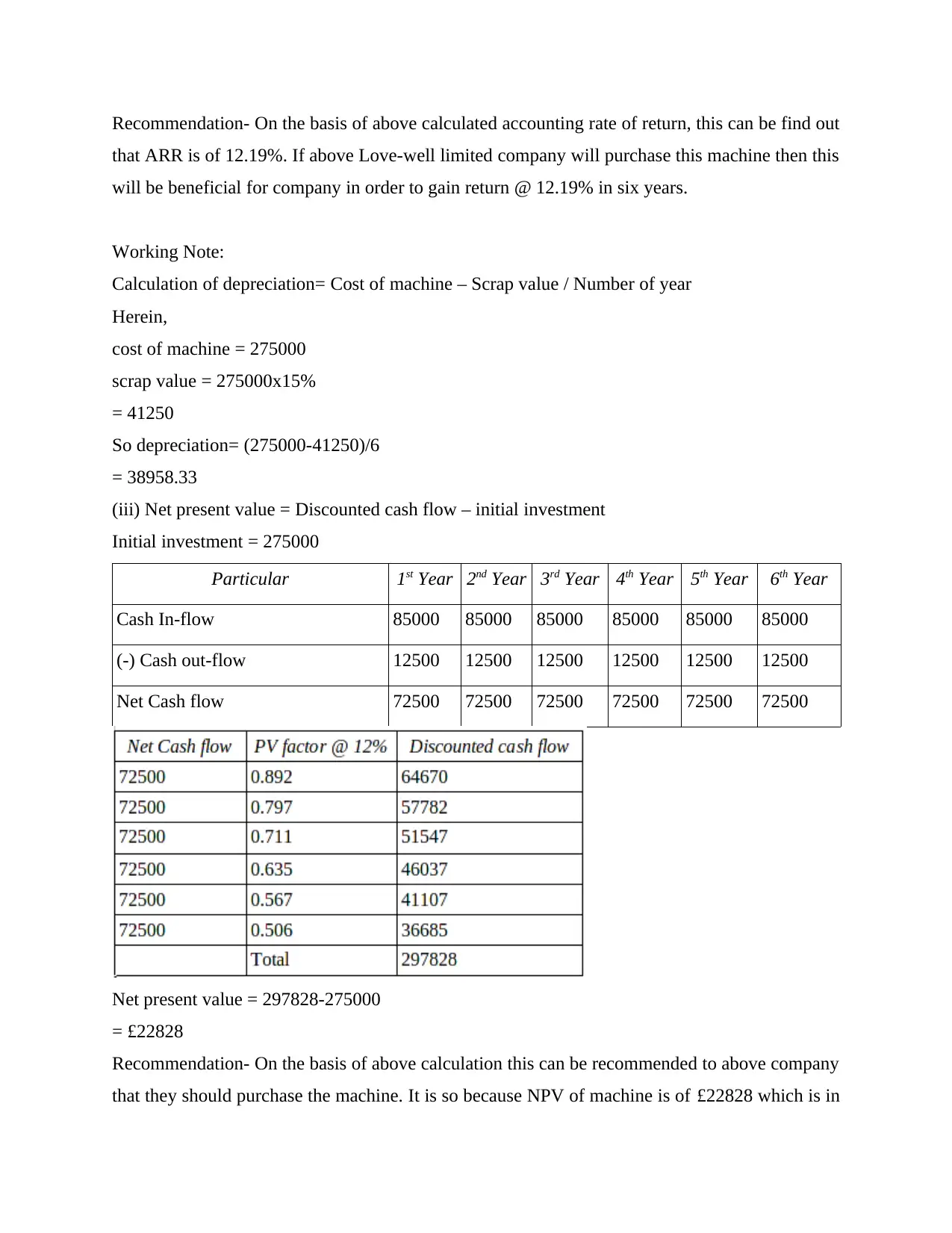

Recommendation- On the basis of above calculated accounting rate of return, this can be find out

that ARR is of 12.19%. If above Love-well limited company will purchase this machine then this

will be beneficial for company in order to gain return @ 12.19% in six years.

Working Note:

Calculation of depreciation= Cost of machine – Scrap value / Number of year

Herein,

cost of machine = 275000

scrap value = 275000x15%

= 41250

So depreciation= (275000-41250)/6

= 38958.33

(iii) Net present value = Discounted cash flow – initial investment

Initial investment = 275000

Particular 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th Year

Cash In-flow 85000 85000 85000 85000 85000 85000

(-) Cash out-flow 12500 12500 12500 12500 12500 12500

Net Cash flow 72500 72500 72500 72500 72500 72500

Net present value = 297828-275000

= £22828

Recommendation- On the basis of above calculation this can be recommended to above company

that they should purchase the machine. It is so because NPV of machine is of £22828 which is in

that ARR is of 12.19%. If above Love-well limited company will purchase this machine then this

will be beneficial for company in order to gain return @ 12.19% in six years.

Working Note:

Calculation of depreciation= Cost of machine – Scrap value / Number of year

Herein,

cost of machine = 275000

scrap value = 275000x15%

= 41250

So depreciation= (275000-41250)/6

= 38958.33

(iii) Net present value = Discounted cash flow – initial investment

Initial investment = 275000

Particular 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th Year

Cash In-flow 85000 85000 85000 85000 85000 85000

(-) Cash out-flow 12500 12500 12500 12500 12500 12500

Net Cash flow 72500 72500 72500 72500 72500 72500

Net present value = 297828-275000

= £22828

Recommendation- On the basis of above calculation this can be recommended to above company

that they should purchase the machine. It is so because NPV of machine is of £22828 which is in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

positive value. Hence, the buying of machinery will be beneficial as accordance of net present

value method.

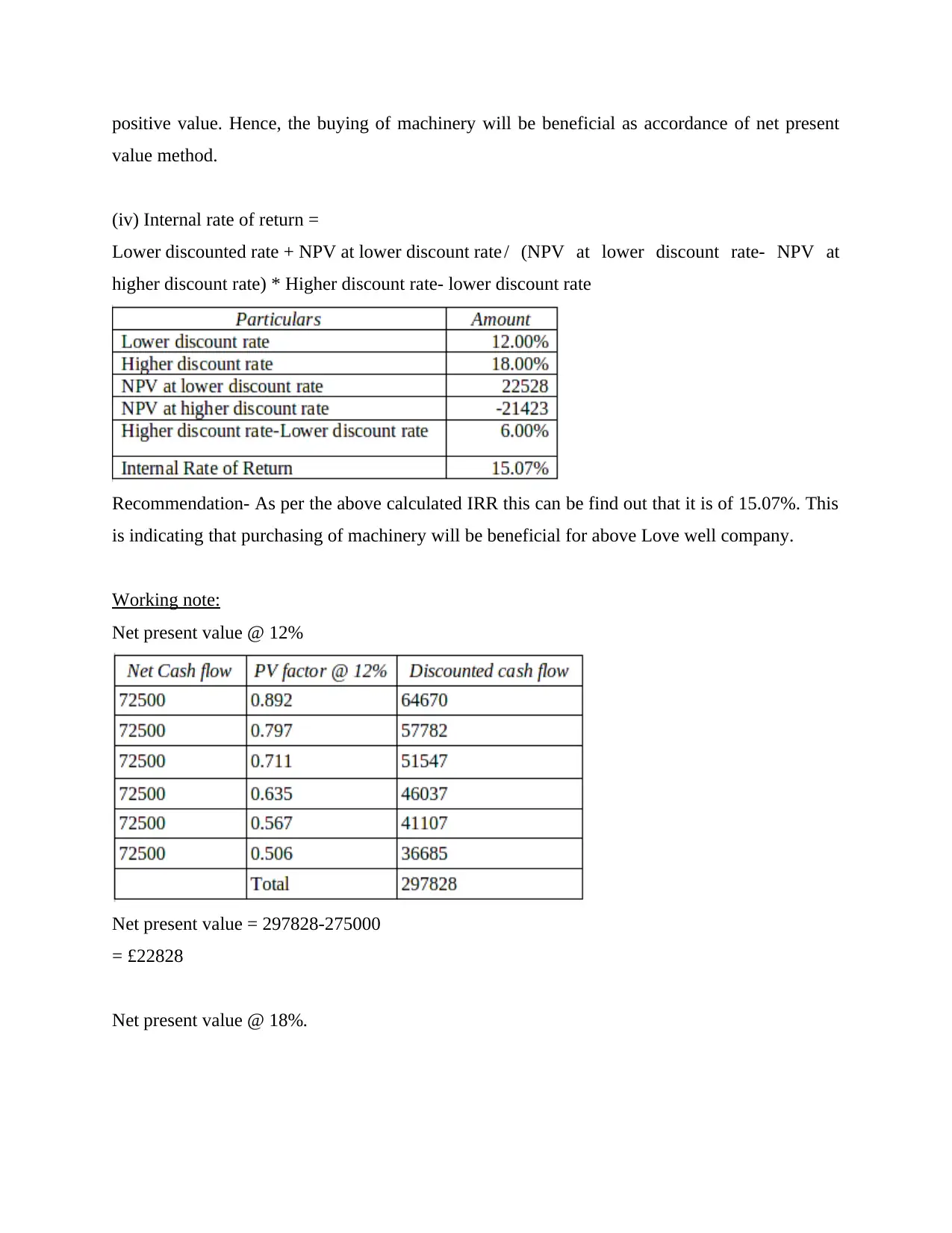

(iv) Internal rate of return =

Lower discounted rate + NPV at lower discount rate / (NPV at lower discount rate- NPV at

higher discount rate) * Higher discount rate- lower discount rate

Recommendation- As per the above calculated IRR this can be find out that it is of 15.07%. This

is indicating that purchasing of machinery will be beneficial for above Love well company.

Working note:

Net present value @ 12%

Net present value = 297828-275000

= £22828

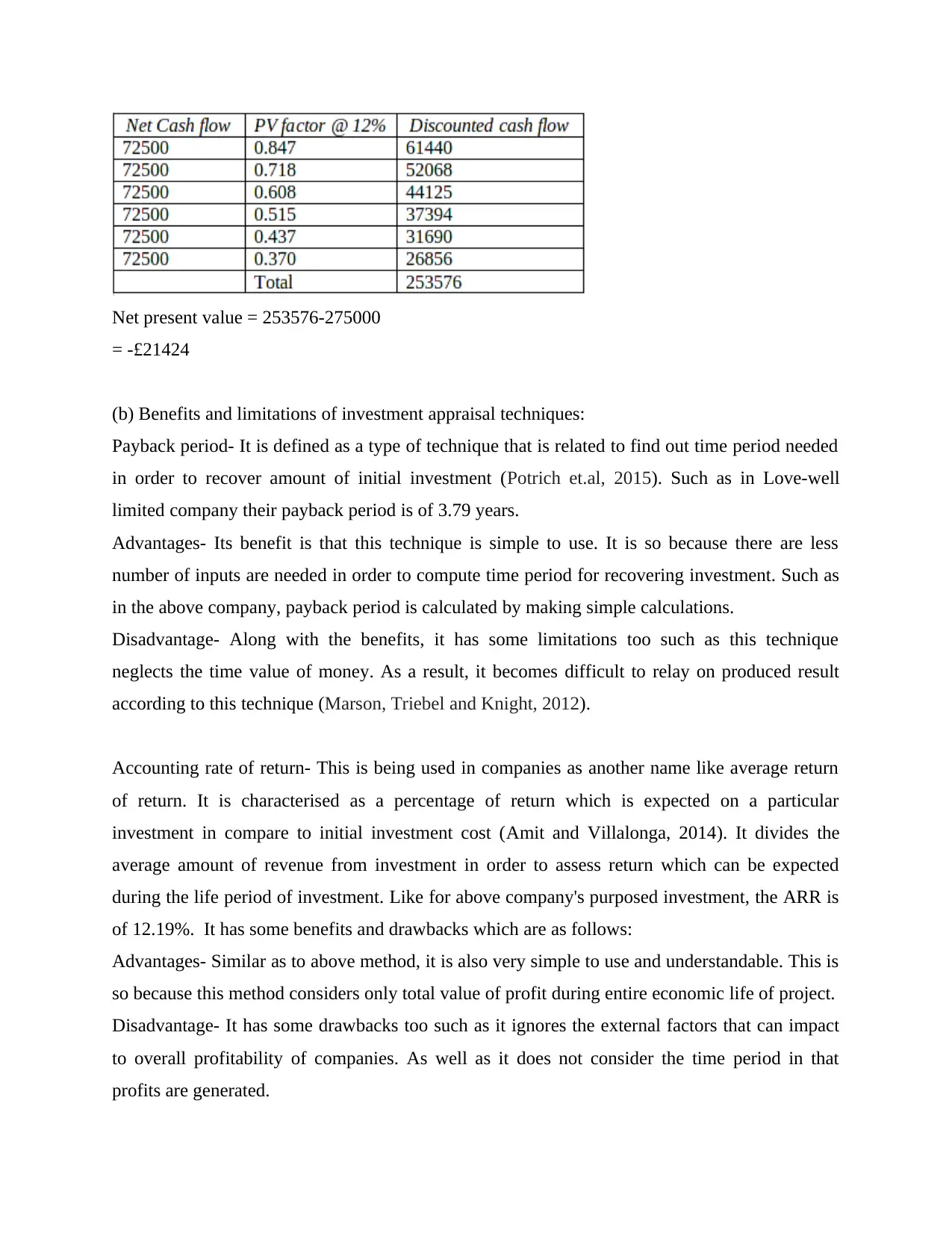

Net present value @ 18%.

value method.

(iv) Internal rate of return =

Lower discounted rate + NPV at lower discount rate / (NPV at lower discount rate- NPV at

higher discount rate) * Higher discount rate- lower discount rate

Recommendation- As per the above calculated IRR this can be find out that it is of 15.07%. This

is indicating that purchasing of machinery will be beneficial for above Love well company.

Working note:

Net present value @ 12%

Net present value = 297828-275000

= £22828

Net present value @ 18%.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net present value = 253576-275000

= -£21424

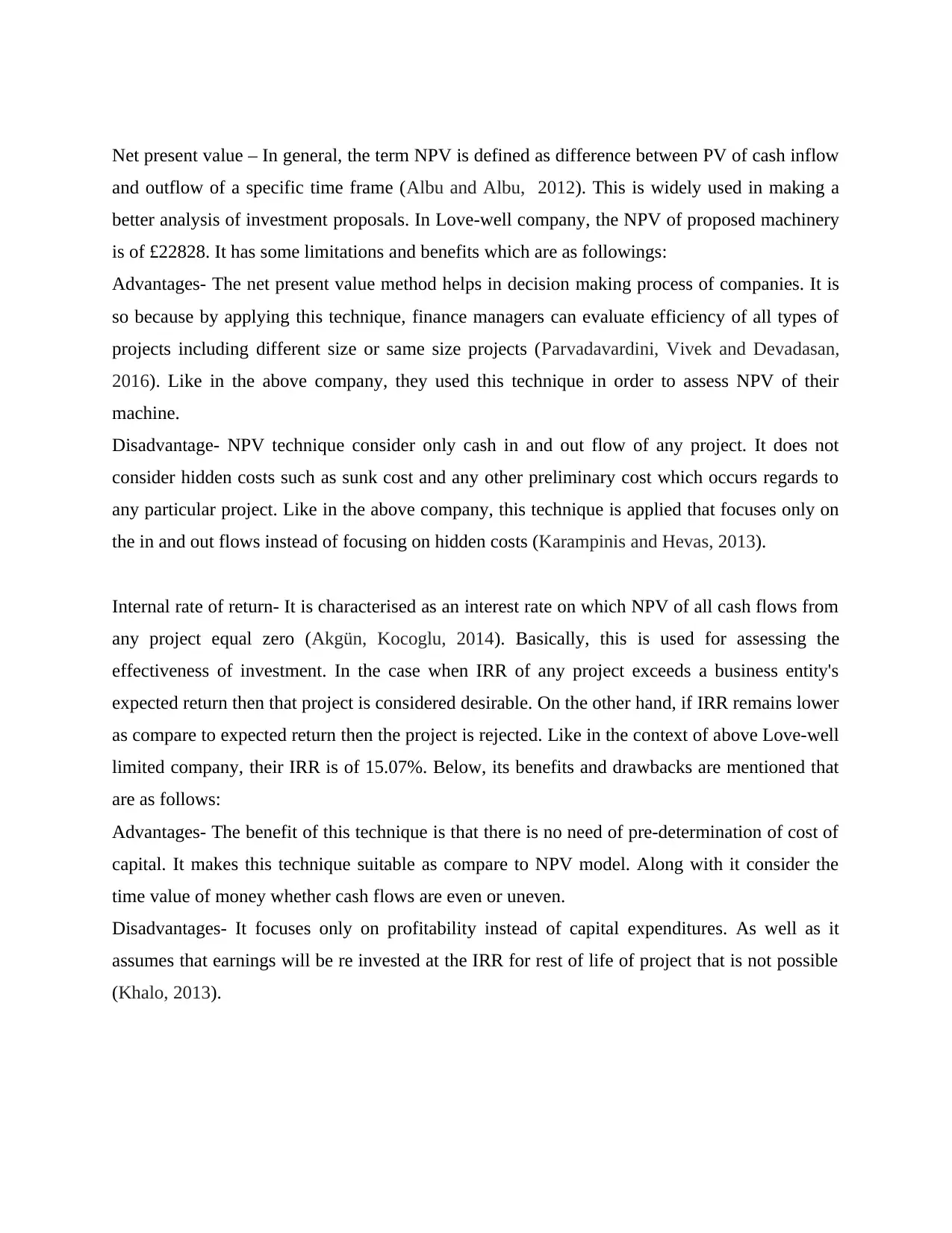

(b) Benefits and limitations of investment appraisal techniques:

Payback period- It is defined as a type of technique that is related to find out time period needed

in order to recover amount of initial investment (Potrich et.al, 2015). Such as in Love-well

limited company their payback period is of 3.79 years.

Advantages- Its benefit is that this technique is simple to use. It is so because there are less

number of inputs are needed in order to compute time period for recovering investment. Such as

in the above company, payback period is calculated by making simple calculations.

Disadvantage- Along with the benefits, it has some limitations too such as this technique

neglects the time value of money. As a result, it becomes difficult to relay on produced result

according to this technique (Marson, Triebel and Knight, 2012).

Accounting rate of return- This is being used in companies as another name like average return

of return. It is characterised as a percentage of return which is expected on a particular

investment in compare to initial investment cost (Amit and Villalonga, 2014). It divides the

average amount of revenue from investment in order to assess return which can be expected

during the life period of investment. Like for above company's purposed investment, the ARR is

of 12.19%. It has some benefits and drawbacks which are as follows:

Advantages- Similar as to above method, it is also very simple to use and understandable. This is

so because this method considers only total value of profit during entire economic life of project.

Disadvantage- It has some drawbacks too such as it ignores the external factors that can impact

to overall profitability of companies. As well as it does not consider the time period in that

profits are generated.

= -£21424

(b) Benefits and limitations of investment appraisal techniques:

Payback period- It is defined as a type of technique that is related to find out time period needed

in order to recover amount of initial investment (Potrich et.al, 2015). Such as in Love-well

limited company their payback period is of 3.79 years.

Advantages- Its benefit is that this technique is simple to use. It is so because there are less

number of inputs are needed in order to compute time period for recovering investment. Such as

in the above company, payback period is calculated by making simple calculations.

Disadvantage- Along with the benefits, it has some limitations too such as this technique

neglects the time value of money. As a result, it becomes difficult to relay on produced result

according to this technique (Marson, Triebel and Knight, 2012).

Accounting rate of return- This is being used in companies as another name like average return

of return. It is characterised as a percentage of return which is expected on a particular

investment in compare to initial investment cost (Amit and Villalonga, 2014). It divides the

average amount of revenue from investment in order to assess return which can be expected

during the life period of investment. Like for above company's purposed investment, the ARR is

of 12.19%. It has some benefits and drawbacks which are as follows:

Advantages- Similar as to above method, it is also very simple to use and understandable. This is

so because this method considers only total value of profit during entire economic life of project.

Disadvantage- It has some drawbacks too such as it ignores the external factors that can impact

to overall profitability of companies. As well as it does not consider the time period in that

profits are generated.

Net present value – In general, the term NPV is defined as difference between PV of cash inflow

and outflow of a specific time frame (Albu and Albu, 2012). This is widely used in making a

better analysis of investment proposals. In Love-well company, the NPV of proposed machinery

is of £22828. It has some limitations and benefits which are as followings:

Advantages- The net present value method helps in decision making process of companies. It is

so because by applying this technique, finance managers can evaluate efficiency of all types of

projects including different size or same size projects (Parvadavardini, Vivek and Devadasan,

2016). Like in the above company, they used this technique in order to assess NPV of their

machine.

Disadvantage- NPV technique consider only cash in and out flow of any project. It does not

consider hidden costs such as sunk cost and any other preliminary cost which occurs regards to

any particular project. Like in the above company, this technique is applied that focuses only on

the in and out flows instead of focusing on hidden costs (Karampinis and Hevas, 2013).

Internal rate of return- It is characterised as an interest rate on which NPV of all cash flows from

any project equal zero (Akgün, Kocoglu, 2014). Basically, this is used for assessing the

effectiveness of investment. In the case when IRR of any project exceeds a business entity's

expected return then that project is considered desirable. On the other hand, if IRR remains lower

as compare to expected return then the project is rejected. Like in the context of above Love-well

limited company, their IRR is of 15.07%. Below, its benefits and drawbacks are mentioned that

are as follows:

Advantages- The benefit of this technique is that there is no need of pre-determination of cost of

capital. It makes this technique suitable as compare to NPV model. Along with it consider the

time value of money whether cash flows are even or uneven.

Disadvantages- It focuses only on profitability instead of capital expenditures. As well as it

assumes that earnings will be re invested at the IRR for rest of life of project that is not possible

(Khalo, 2013).

and outflow of a specific time frame (Albu and Albu, 2012). This is widely used in making a

better analysis of investment proposals. In Love-well company, the NPV of proposed machinery

is of £22828. It has some limitations and benefits which are as followings:

Advantages- The net present value method helps in decision making process of companies. It is

so because by applying this technique, finance managers can evaluate efficiency of all types of

projects including different size or same size projects (Parvadavardini, Vivek and Devadasan,

2016). Like in the above company, they used this technique in order to assess NPV of their

machine.

Disadvantage- NPV technique consider only cash in and out flow of any project. It does not

consider hidden costs such as sunk cost and any other preliminary cost which occurs regards to

any particular project. Like in the above company, this technique is applied that focuses only on

the in and out flows instead of focusing on hidden costs (Karampinis and Hevas, 2013).

Internal rate of return- It is characterised as an interest rate on which NPV of all cash flows from

any project equal zero (Akgün, Kocoglu, 2014). Basically, this is used for assessing the

effectiveness of investment. In the case when IRR of any project exceeds a business entity's

expected return then that project is considered desirable. On the other hand, if IRR remains lower

as compare to expected return then the project is rejected. Like in the context of above Love-well

limited company, their IRR is of 15.07%. Below, its benefits and drawbacks are mentioned that

are as follows:

Advantages- The benefit of this technique is that there is no need of pre-determination of cost of

capital. It makes this technique suitable as compare to NPV model. Along with it consider the

time value of money whether cash flows are even or uneven.

Disadvantages- It focuses only on profitability instead of capital expenditures. As well as it

assumes that earnings will be re invested at the IRR for rest of life of project that is not possible

(Khalo, 2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15