Apple Inc. Corporate Financial Strategy Analysis - FIN203 Assignment

VerifiedAdded on 2023/01/19

|8

|1174

|37

Homework Assignment

AI Summary

This assignment analyzes Apple Inc.'s corporate financial strategy, addressing key aspects such as cash conversion cycle, risk assessment, and stock performance. Part 1 of the assignment focuses on evaluating Apple's cash conversion cycle, comparing it with Samsung, and identifying major risks based on Apple's annual reports. It also includes an analysis of Apple's stock performance relative to market indices and examines the company's long-term debt. Part 2 involves a project evaluation, calculating free cash flow, net present value (NPV), and internal rate of return (IRR) to determine the project's financial viability. The assignment concludes with recommendations based on the calculated NPV and IRR, determining whether the project should be accepted. The analysis utilizes data from Apple's annual reports and applies financial concepts to assess the company's financial health and investment decisions.

Running head: APPLE CORPORATE FINANCIAL STRATEGY

Apple Corporate Financial Strategy

Name of Student:

Name of the University:

Author Note

Apple Corporate Financial Strategy

Name of Student:

Name of the University:

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

APPLE CORPORATE FINANCIAL STRATEGY

Table of Contents

Part 1..........................................................................................................................................3

Answer to question (a)...........................................................................................................3

Answer to question (b)...........................................................................................................4

Answer to question (c)...........................................................................................................4

Q1. Solution.......................................................................................................................4

Q2. Solution.......................................................................................................................5

Q3. Solution.......................................................................................................................5

Part 2..........................................................................................................................................5

Answer to (a)..........................................................................................................................5

Answer to (b)..........................................................................................................................5

Answer to (c)..........................................................................................................................6

Answer to (d)..........................................................................................................................6

Answer to (e)..........................................................................................................................6

References..................................................................................................................................7

APPLE CORPORATE FINANCIAL STRATEGY

Table of Contents

Part 1..........................................................................................................................................3

Answer to question (a)...........................................................................................................3

Answer to question (b)...........................................................................................................4

Answer to question (c)...........................................................................................................4

Q1. Solution.......................................................................................................................4

Q2. Solution.......................................................................................................................5

Q3. Solution.......................................................................................................................5

Part 2..........................................................................................................................................5

Answer to (a)..........................................................................................................................5

Answer to (b)..........................................................................................................................5

Answer to (c)..........................................................................................................................6

Answer to (d)..........................................................................................................................6

Answer to (e)..........................................................................................................................6

References..................................................................................................................................7

2

APPLE CORPORATE FINANCIAL STRATEGY

Part 1

Answer to question (a)

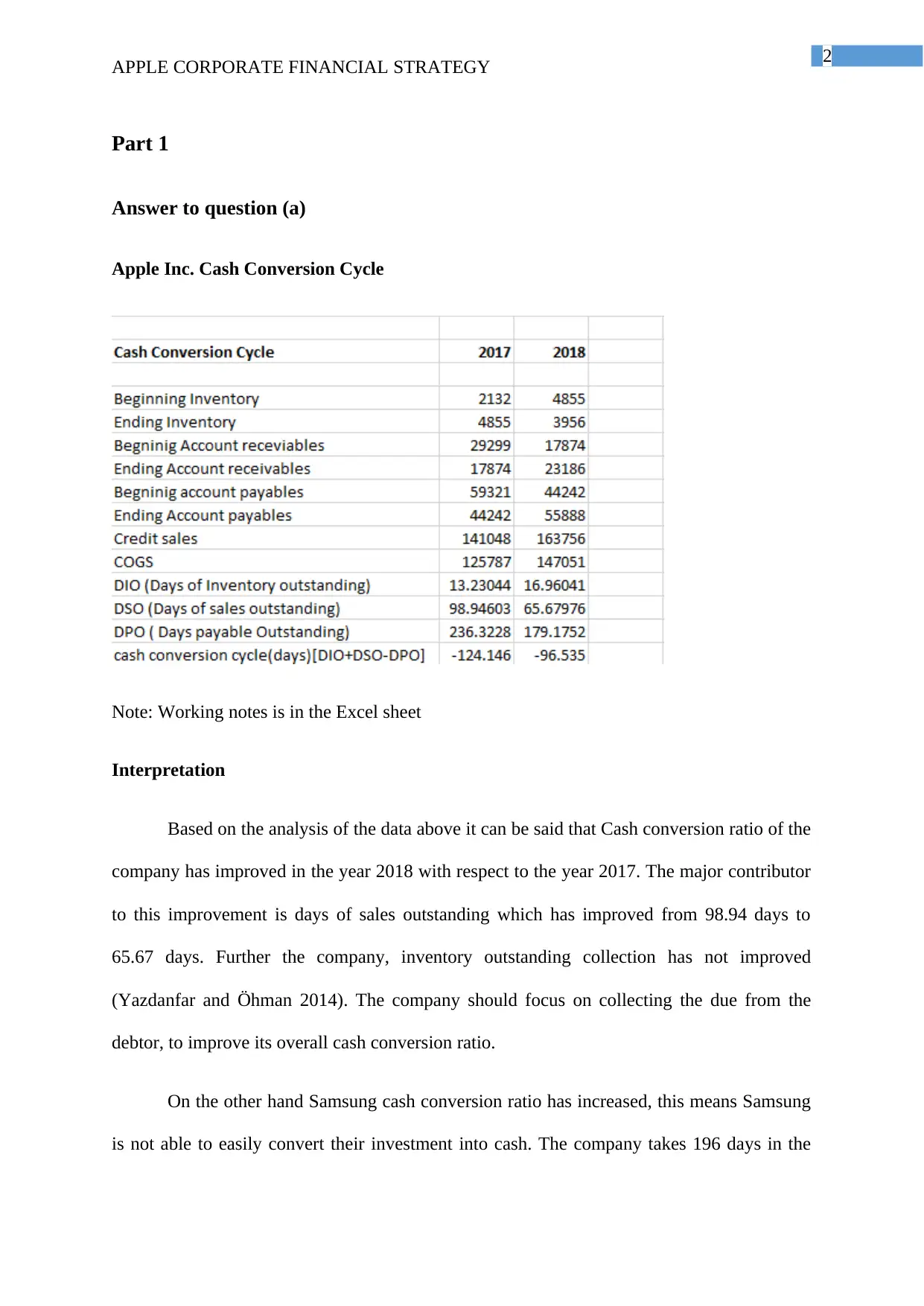

Apple Inc. Cash Conversion Cycle

Note: Working notes is in the Excel sheet

Interpretation

Based on the analysis of the data above it can be said that Cash conversion ratio of the

company has improved in the year 2018 with respect to the year 2017. The major contributor

to this improvement is days of sales outstanding which has improved from 98.94 days to

65.67 days. Further the company, inventory outstanding collection has not improved

(Yazdanfar and Öhman 2014). The company should focus on collecting the due from the

debtor, to improve its overall cash conversion ratio.

On the other hand Samsung cash conversion ratio has increased, this means Samsung

is not able to easily convert their investment into cash. The company takes 196 days in the

APPLE CORPORATE FINANCIAL STRATEGY

Part 1

Answer to question (a)

Apple Inc. Cash Conversion Cycle

Note: Working notes is in the Excel sheet

Interpretation

Based on the analysis of the data above it can be said that Cash conversion ratio of the

company has improved in the year 2018 with respect to the year 2017. The major contributor

to this improvement is days of sales outstanding which has improved from 98.94 days to

65.67 days. Further the company, inventory outstanding collection has not improved

(Yazdanfar and Öhman 2014). The company should focus on collecting the due from the

debtor, to improve its overall cash conversion ratio.

On the other hand Samsung cash conversion ratio has increased, this means Samsung

is not able to easily convert their investment into cash. The company takes 196 days in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

APPLE CORPORATE FINANCIAL STRATEGY

year 2018 which is slightly higher than the year 2017 in which the company takes only 160

days (Lahmiri, 2016).

Note: Working has been shown in the Excel sheet.

Answer to question (b)

The three major risk as identified in the Apple annual reports are discussed below:-

Global market for the company’s product and services are highly competitive and

subject to rapid technological change, and the company may be unable to compete

effectively in these market9 (Anser, and Malik, 2013).

To remain competitive and stimulate customer demand, the company must

successfully manage frequent introductions and transition of products and services.

The company depends on the performance of the carriers, retailers, wholesalers and

other resellers.

The risk discussed above are related to the unsystematic risk, this risk is associated with

the particular industry say Apple. The unsystematic risk can be eliminated through

diversification of portfolio (Chen and Ann 2016).

Answer to question (c)

Q1. Solution

Apple stock price has performed well as compared with the market, the company

share price has been above the industry average as compared with the S&P500, Dows &

Jones US Technology Super sector Index, S&P information technology Index (Nobanee and

Al Hajjar, 2014).

APPLE CORPORATE FINANCIAL STRATEGY

year 2018 which is slightly higher than the year 2017 in which the company takes only 160

days (Lahmiri, 2016).

Note: Working has been shown in the Excel sheet.

Answer to question (b)

The three major risk as identified in the Apple annual reports are discussed below:-

Global market for the company’s product and services are highly competitive and

subject to rapid technological change, and the company may be unable to compete

effectively in these market9 (Anser, and Malik, 2013).

To remain competitive and stimulate customer demand, the company must

successfully manage frequent introductions and transition of products and services.

The company depends on the performance of the carriers, retailers, wholesalers and

other resellers.

The risk discussed above are related to the unsystematic risk, this risk is associated with

the particular industry say Apple. The unsystematic risk can be eliminated through

diversification of portfolio (Chen and Ann 2016).

Answer to question (c)

Q1. Solution

Apple stock price has performed well as compared with the market, the company

share price has been above the industry average as compared with the S&P500, Dows &

Jones US Technology Super sector Index, S&P information technology Index (Nobanee and

Al Hajjar, 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

APPLE CORPORATE FINANCIAL STRATEGY

Q2. Solution

From the year 2014 to 2018, the company has increased its long term debt from

$28987 to $93735. This is because the company was in the need of the fund to develop its

business operation, Research and development of its project (Garanina, and Belova, 2015).

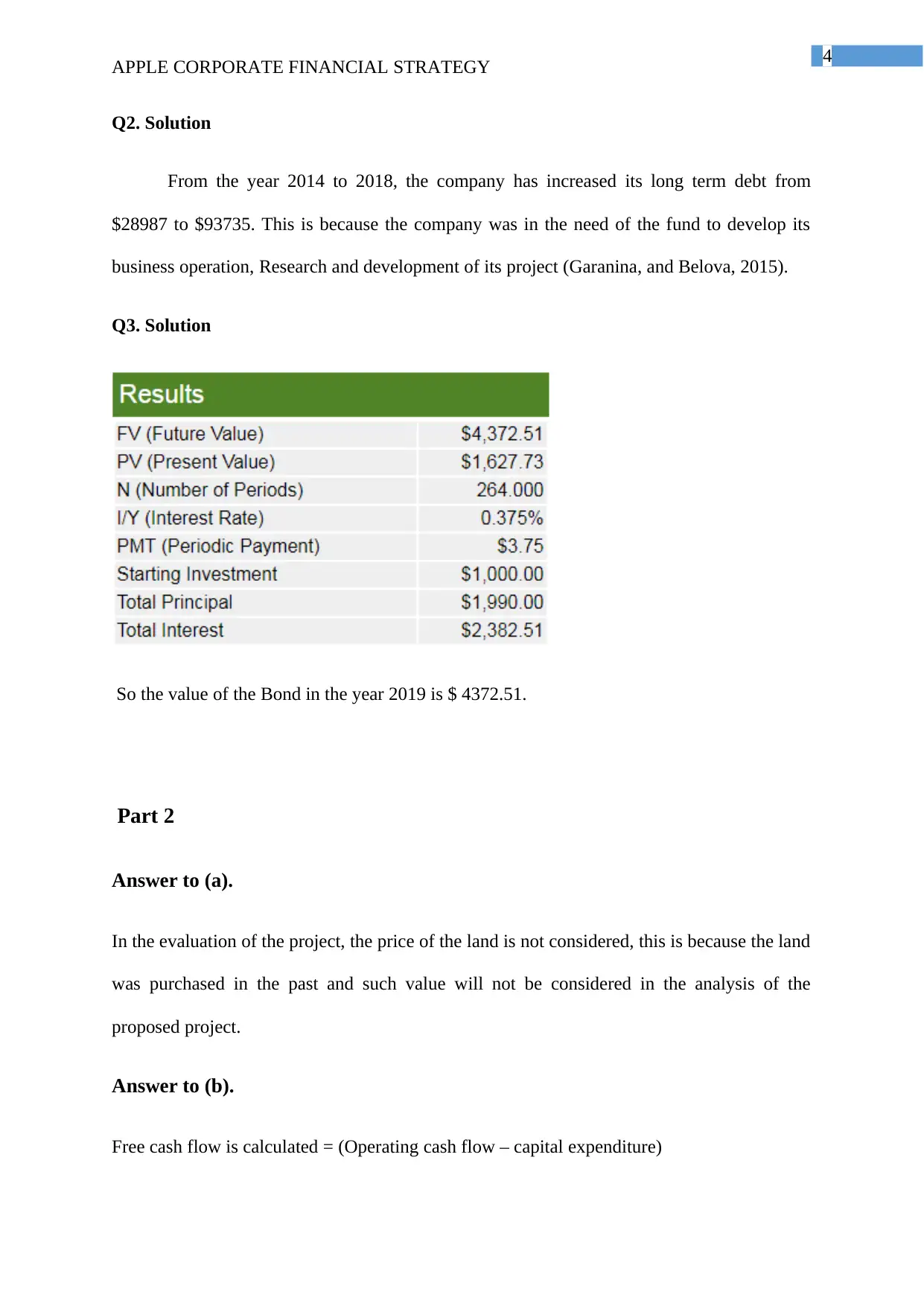

Q3. Solution

So the value of the Bond in the year 2019 is $ 4372.51.

Part 2

Answer to (a).

In the evaluation of the project, the price of the land is not considered, this is because the land

was purchased in the past and such value will not be considered in the analysis of the

proposed project.

Answer to (b).

Free cash flow is calculated = (Operating cash flow – capital expenditure)

APPLE CORPORATE FINANCIAL STRATEGY

Q2. Solution

From the year 2014 to 2018, the company has increased its long term debt from

$28987 to $93735. This is because the company was in the need of the fund to develop its

business operation, Research and development of its project (Garanina, and Belova, 2015).

Q3. Solution

So the value of the Bond in the year 2019 is $ 4372.51.

Part 2

Answer to (a).

In the evaluation of the project, the price of the land is not considered, this is because the land

was purchased in the past and such value will not be considered in the analysis of the

proposed project.

Answer to (b).

Free cash flow is calculated = (Operating cash flow – capital expenditure)

5

APPLE CORPORATE FINANCIAL STRATEGY

22.2 Million USD

Working shown in the Excel Sheet.

Therefore, on calculating the free cash flow is 22.2 million US Dollar.

Answer to (c).

The NPV of the project is ($ 44.12) million. Since the NPV of the project is negative

therefore the project is not acceptable because the project generate a negative return (Chen,

and Ann, 2016).

Working of the calculation in shown in the Excel sheet.

Answer to (d).

The project IRR is calculated to be 4.06 % which is less than cost of capital of 5.94

%. This means that the project will generate a return which is less than the cost of capital.

Therefore the project should not be accepted.

Answer to (e)

The project NPV and IRR is calculated to be ($44.12) million USD and the IRR is

4.06%. The project should not be accepted on the ground that the NPV is negative and the

IRR is than the company cost of capital (Heracleous, 2013).

APPLE CORPORATE FINANCIAL STRATEGY

22.2 Million USD

Working shown in the Excel Sheet.

Therefore, on calculating the free cash flow is 22.2 million US Dollar.

Answer to (c).

The NPV of the project is ($ 44.12) million. Since the NPV of the project is negative

therefore the project is not acceptable because the project generate a negative return (Chen,

and Ann, 2016).

Working of the calculation in shown in the Excel sheet.

Answer to (d).

The project IRR is calculated to be 4.06 % which is less than cost of capital of 5.94

%. This means that the project will generate a return which is less than the cost of capital.

Therefore the project should not be accepted.

Answer to (e)

The project NPV and IRR is calculated to be ($44.12) million USD and the IRR is

4.06%. The project should not be accepted on the ground that the NPV is negative and the

IRR is than the company cost of capital (Heracleous, 2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

APPLE CORPORATE FINANCIAL STRATEGY

References

Anser, R. and Malik, Q.A., 2013. Cash conversion cycle and firms profitability–a study of

listed manufacturing companies of Pakistan. IOSR Journal of Business and

Management, 8(2), pp.83-87.

Chen, C.M. and Ann, B.Y., 2016. Efficiencies vs. importance-performance analysis for the

leading smartphone brands of Apple, Samsung and HTC. Total Quality Management &

Business Excellence, 27(3-4), pp.227-249.

Chen, C.M. and Ann, B.Y., 2016. Efficiencies vs. importance-performance analysis for the

leading smartphone brands of Apple, Samsung and HTC. Total Quality Management &

Business Excellence, 27(3-4), pp.227-249.

Garanina, T.A. and Belova, O.A., 2015. Liquidity, cash conversion cycle and financial

performance: case of Russian companies.

Heracleous, L., 2013. Quantum strategy at apple inc. Organizational Dynamics, 42(2), pp.92-

99.

Lahmiri, S., 2016. Intraday stock price forecasting based on variational mode

decomposition. Journal of Computational Science, 12, pp.23-27.

Nobanee, H. and Al Hajjar, M., 2014. An optimal cash conversion cycle. International

Research Journal of Finance and Economics. March (120), pp.13-22.

Wani, M.H., Paul, R.K., Bazaz, N.H. and Manzoor, M., 2015. Market integration and price

forecasting of apple in India. Indian Journal of Agricultural Economics, 70(902-2016-

68375), p.169.

APPLE CORPORATE FINANCIAL STRATEGY

References

Anser, R. and Malik, Q.A., 2013. Cash conversion cycle and firms profitability–a study of

listed manufacturing companies of Pakistan. IOSR Journal of Business and

Management, 8(2), pp.83-87.

Chen, C.M. and Ann, B.Y., 2016. Efficiencies vs. importance-performance analysis for the

leading smartphone brands of Apple, Samsung and HTC. Total Quality Management &

Business Excellence, 27(3-4), pp.227-249.

Chen, C.M. and Ann, B.Y., 2016. Efficiencies vs. importance-performance analysis for the

leading smartphone brands of Apple, Samsung and HTC. Total Quality Management &

Business Excellence, 27(3-4), pp.227-249.

Garanina, T.A. and Belova, O.A., 2015. Liquidity, cash conversion cycle and financial

performance: case of Russian companies.

Heracleous, L., 2013. Quantum strategy at apple inc. Organizational Dynamics, 42(2), pp.92-

99.

Lahmiri, S., 2016. Intraday stock price forecasting based on variational mode

decomposition. Journal of Computational Science, 12, pp.23-27.

Nobanee, H. and Al Hajjar, M., 2014. An optimal cash conversion cycle. International

Research Journal of Finance and Economics. March (120), pp.13-22.

Wani, M.H., Paul, R.K., Bazaz, N.H. and Manzoor, M., 2015. Market integration and price

forecasting of apple in India. Indian Journal of Agricultural Economics, 70(902-2016-

68375), p.169.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

APPLE CORPORATE FINANCIAL STRATEGY

Yazdanfar, D. and Öhman, P., 2014. The impact of cash conversion cycle on firm

profitability: An empirical study based on Swedish data. International Journal of Managerial

Finance, 10(4), pp.442-452.

APPLE CORPORATE FINANCIAL STRATEGY

Yazdanfar, D. and Öhman, P., 2014. The impact of cash conversion cycle on firm

profitability: An empirical study based on Swedish data. International Journal of Managerial

Finance, 10(4), pp.442-452.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.