BMP3005 Applied Business Finance: Analyzing & Improving Performance

VerifiedAdded on 2023/06/18

|12

|2842

|431

Report

AI Summary

This report provides a comprehensive overview of financial management concepts and their importance in enhancing business performance. It defines financial management and discusses its key aspects, including long-term stability, budget estimation, decision-making, and profitability. The report details the main financial statements—profit and loss statement, statement of financial position, and cash flow statement—and explains the use of financial ratios in assessing solvency, risk, and overall financial health. A case study is used to illustrate the application of these concepts, with an analysis of profitability, liquidity, and efficiency ratios. The report concludes by discussing processes businesses can use to improve their financial performance, emphasizing the importance of wealth maximization and strategic planning. Desklib offers a range of resources, including past papers and solved assignments, to support students in their studies.

BSc (Hons) Business Management with

Foundation

BMP3005

Applied Business Finance

The concept and importance of financial

management and the processes

businesses might use to improve their

financial performance

1

Foundation

BMP3005

Applied Business Finance

The concept and importance of financial

management and the processes

businesses might use to improve their

financial performance

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction 3

Section 1: Definition and discussion of the concept and

importance of financial management 3

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

4

Section 3: Using the template provided 5-9

i. Completing the Information on the ‘Business Review

Template (Ensure that you display your calculations for this

detail)

5

ii. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study). This should be included within

your appendices 6

iii. Using Excel completing the Balance Sheet 7

iv. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of

ratio analysis 8

Section 4: Using examples from the case study describing

and discussing the processes this business might use to

improve their financial performance 9

Conclusion 9

References 10

Appendix 11

2

Introduction 3

Section 1: Definition and discussion of the concept and

importance of financial management 3

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

4

Section 3: Using the template provided 5-9

i. Completing the Information on the ‘Business Review

Template (Ensure that you display your calculations for this

detail)

5

ii. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study). This should be included within

your appendices 6

iii. Using Excel completing the Balance Sheet 7

iv. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the results of

ratio analysis 8

Section 4: Using examples from the case study describing

and discussing the processes this business might use to

improve their financial performance 9

Conclusion 9

References 10

Appendix 11

2

Introduction

Management of financial resources is one of the most critical and essential aspects of

running a business. It assures the activities in the organization run smoothly without the

disturbance in the allocation of funds (Egginton and McCumber, 2019). By facilitating all

use of revenue proportions in managerial decision - making, the report presents the relevance

and ideas of financial planning. The statement of income is also prepared with the help of the

financial statements. Then, upon that basis of the findings, different essential metrics such as

profitability, efficiency, and solvency were computed, as well as the assessment was

performed out. In furthermore, a study was conducted in order to enhance the firm's behavior

in order to further its expansion.

Section 1: Definition and discussion of the concept and

importance of financial management

Financial management refers to a concept which refers to the directing, controlling,

planning, and organizing of the monetary undertakings in the business. It similarly integrates

utilizing the principles of management to the financial resources of a company, while

additionally having a momentous consequence in economic administration.

Sustain adequate inventory of assets for the organization.

Giving guarantee to the investors for the attainment of more benefits.

Ideal and efficacious utilization of assets;

Making authentic and harmless undertaking freedoms to put their resources into.

Importance of Financial Management:

1. Long-term stability: It aids the organization in ensuring long-term viability. It helps

reduce idle expenditures by monitoring and verifying profitability, cost distribution,

and utilization of cash. It also ensures this by completing everyday duties on time that

makes the organization attractive for how it conducts its business. This ensures the

company's long-term viability and growth.

2. Budget Estimation Requirement: Financial manager must examine a firm's capital

requirements in order to conduct business. The corporation's economic policy in term

of predicted earnings and expenditures has a big impact on this. The total capital

value must be conducted in such a manner that the industry's investment generating

capacity is increased (Khera and et. al., 2020).

3. Making decisions: It calculated the cost by establishing a budget, whereby it reached a

choice by evaluating the company's financial situation. It is a critical element of every

3

Management of financial resources is one of the most critical and essential aspects of

running a business. It assures the activities in the organization run smoothly without the

disturbance in the allocation of funds (Egginton and McCumber, 2019). By facilitating all

use of revenue proportions in managerial decision - making, the report presents the relevance

and ideas of financial planning. The statement of income is also prepared with the help of the

financial statements. Then, upon that basis of the findings, different essential metrics such as

profitability, efficiency, and solvency were computed, as well as the assessment was

performed out. In furthermore, a study was conducted in order to enhance the firm's behavior

in order to further its expansion.

Section 1: Definition and discussion of the concept and

importance of financial management

Financial management refers to a concept which refers to the directing, controlling,

planning, and organizing of the monetary undertakings in the business. It similarly integrates

utilizing the principles of management to the financial resources of a company, while

additionally having a momentous consequence in economic administration.

Sustain adequate inventory of assets for the organization.

Giving guarantee to the investors for the attainment of more benefits.

Ideal and efficacious utilization of assets;

Making authentic and harmless undertaking freedoms to put their resources into.

Importance of Financial Management:

1. Long-term stability: It aids the organization in ensuring long-term viability. It helps

reduce idle expenditures by monitoring and verifying profitability, cost distribution,

and utilization of cash. It also ensures this by completing everyday duties on time that

makes the organization attractive for how it conducts its business. This ensures the

company's long-term viability and growth.

2. Budget Estimation Requirement: Financial manager must examine a firm's capital

requirements in order to conduct business. The corporation's economic policy in term

of predicted earnings and expenditures has a big impact on this. The total capital

value must be conducted in such a manner that the industry's investment generating

capacity is increased (Khera and et. al., 2020).

3. Making decisions: It calculated the cost by establishing a budget, whereby it reached a

choice by evaluating the company's financial situation. It is a critical element of every

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

business, because all of the decisions taken will have an impact on the organization's

standing or effectiveness. Various factors determine how decisions are made.

4. Profitability: The money branch is the part of the organization's whole accounting and

ensures that it is managed fairly and correctly. It will aid in the company's current

expansion of new opportunities while also improving its competence and

effectiveness (Seifzadeh and et. al., 2020).

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

The financial overview is a collection of instances that each public company creates

to keep track of its financial and monetary data. It is essential for every organization to have

everything in order. It gives an analysis of the company's financial situation and current state.

These are mandatory to get them audited and is the responsibility of the financial manager.

These are managed intrinsically and extrinsically from the view point of the organization. It

guarantees that the report which are published by the company is not forged and are

authentic. The statements are as follows:

1. Profit and loss statement: It is an essential component of the company. As a

consequence, several accounting entries have been created. It depicts the firm's total

profit as a result of achieving its goals. This determines a variety of non-operating and

commercial sales and expenditure. Profit is calculated using these variables.

Normally, that those are prepared over the course of a year; however, business

policies may necessitate an interim statement. It shows the profitability of a company

by subtracting all expenses from revenue. It can also be used to calculate financial

ratios (Pantielieieva and et. al., 2018).

2. Statement of financial performance: It is divided into two sections: assets and

liabilities. These would be usually made towards the end of the fiscal year to

determine the financial health of the company. The assets section of such financial

accounts consists of fixed, existing, and non-current elements, which comprise

inventory, intangible resources, infrastructure, and investments. The clients are the

non-current and current commitments in liabilities. The non-current and current

commitments under liabilities are the lenders, or bills due. Shareholder funds,

acquisitions, and long-term advances are all examples of liabilities. It aids in

4

standing or effectiveness. Various factors determine how decisions are made.

4. Profitability: The money branch is the part of the organization's whole accounting and

ensures that it is managed fairly and correctly. It will aid in the company's current

expansion of new opportunities while also improving its competence and

effectiveness (Seifzadeh and et. al., 2020).

Section 2: Description and discussion of the main

financial statements and explain the use of ratios in

financial management

The financial overview is a collection of instances that each public company creates

to keep track of its financial and monetary data. It is essential for every organization to have

everything in order. It gives an analysis of the company's financial situation and current state.

These are mandatory to get them audited and is the responsibility of the financial manager.

These are managed intrinsically and extrinsically from the view point of the organization. It

guarantees that the report which are published by the company is not forged and are

authentic. The statements are as follows:

1. Profit and loss statement: It is an essential component of the company. As a

consequence, several accounting entries have been created. It depicts the firm's total

profit as a result of achieving its goals. This determines a variety of non-operating and

commercial sales and expenditure. Profit is calculated using these variables.

Normally, that those are prepared over the course of a year; however, business

policies may necessitate an interim statement. It shows the profitability of a company

by subtracting all expenses from revenue. It can also be used to calculate financial

ratios (Pantielieieva and et. al., 2018).

2. Statement of financial performance: It is divided into two sections: assets and

liabilities. These would be usually made towards the end of the fiscal year to

determine the financial health of the company. The assets section of such financial

accounts consists of fixed, existing, and non-current elements, which comprise

inventory, intangible resources, infrastructure, and investments. The clients are the

non-current and current commitments in liabilities. The non-current and current

commitments under liabilities are the lenders, or bills due. Shareholder funds,

acquisitions, and long-term advances are all examples of liabilities. It aids in

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

determining whether or not the organization is prepared to take on new projects. It

also calculated the credit risk that could arise from its resources in the future.

3. Cash flow statement: Here is where the company's financial decisions are made. All

expenditures are categorized into three parts: operating, monetary, and investment.

The operating activities account for revenue collected for the company's regular

operations. The purchasing and selling of property, as well as the investment and

repayment of a mortgages for the purpose of generating money, are examples of

investment activities. The money stock in the business as well as dividend actually

paid activities are all part of the financing operations.

Uses of ratios in Financial management:

Data Source: This is required when delivering financial results to investors since it

assists them in comprehending massive and complicated financial figures. Investors

find it tough to make comparisons at times, however indicators assist users

comprehend the current success of a company so that they may continue investing in

it (Saurabh and Nandan, 2018).

Solvency: A corporation's ability to pay back its current spending obligations is

determined by the solidity, acid test, quick ratio, as well as other factors, such as

whether the company is willing to pay its debts within a fiscal quarter. A company's

payment cycle is routinely examined using ratios in attempt to enhance it and increase

its credit worthiness.

Risk assessment: A company that operates in a variety of business areas and

industries, some of which are risky. Risk and its numerous categories can be

examined using ratios, and remedial measures can be taken to mitigate it. The debt-to-

equity and debt-to-coverage ratios show how reliant a company is on outside funding

and how well it can repay it (Kim and et. al., 2019).

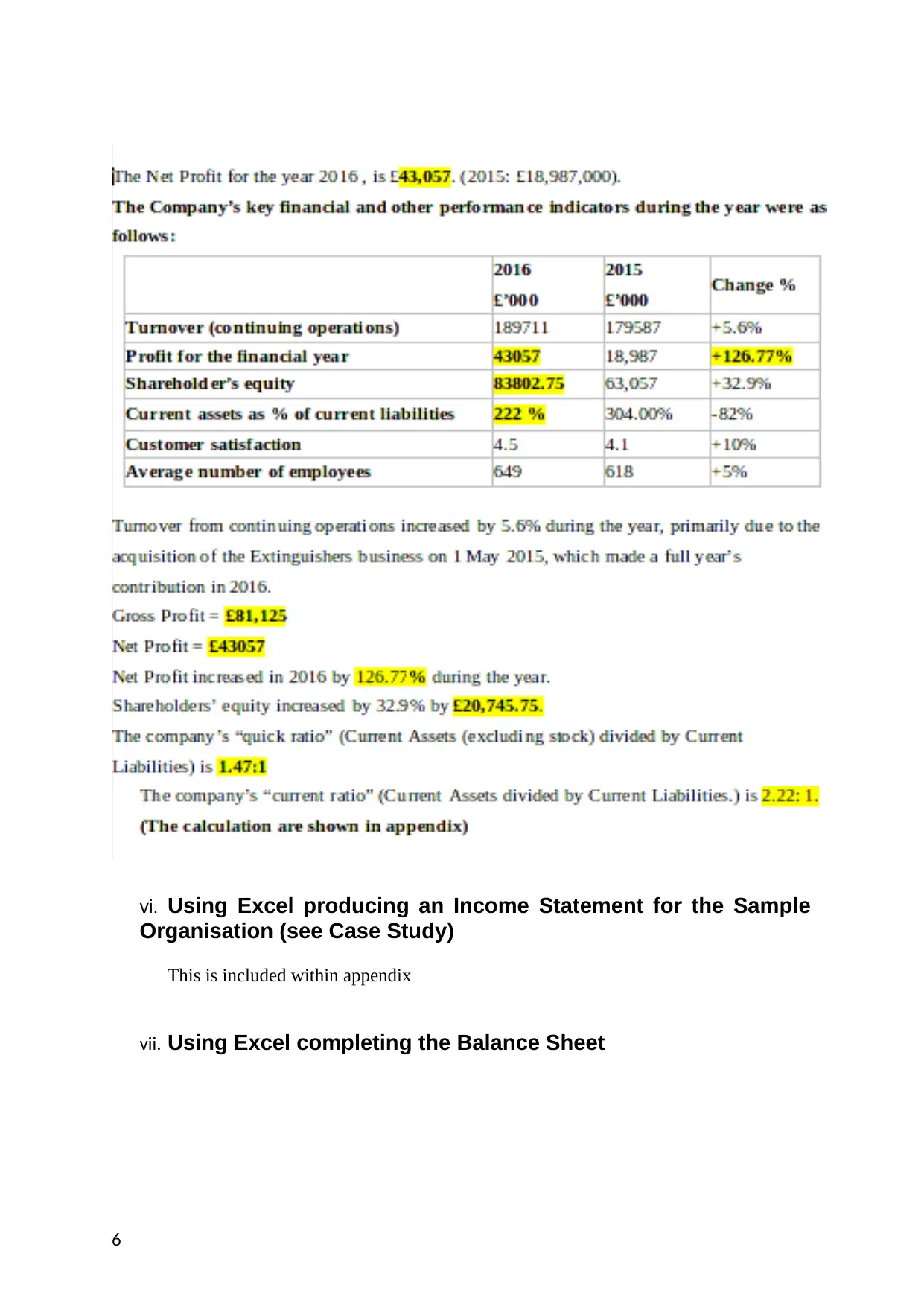

Section 3: Using the template provided:

v. Completing the Information on the ‘Business Review

Template (Ensure that you display your calculations for this

detail)

5

also calculated the credit risk that could arise from its resources in the future.

3. Cash flow statement: Here is where the company's financial decisions are made. All

expenditures are categorized into three parts: operating, monetary, and investment.

The operating activities account for revenue collected for the company's regular

operations. The purchasing and selling of property, as well as the investment and

repayment of a mortgages for the purpose of generating money, are examples of

investment activities. The money stock in the business as well as dividend actually

paid activities are all part of the financing operations.

Uses of ratios in Financial management:

Data Source: This is required when delivering financial results to investors since it

assists them in comprehending massive and complicated financial figures. Investors

find it tough to make comparisons at times, however indicators assist users

comprehend the current success of a company so that they may continue investing in

it (Saurabh and Nandan, 2018).

Solvency: A corporation's ability to pay back its current spending obligations is

determined by the solidity, acid test, quick ratio, as well as other factors, such as

whether the company is willing to pay its debts within a fiscal quarter. A company's

payment cycle is routinely examined using ratios in attempt to enhance it and increase

its credit worthiness.

Risk assessment: A company that operates in a variety of business areas and

industries, some of which are risky. Risk and its numerous categories can be

examined using ratios, and remedial measures can be taken to mitigate it. The debt-to-

equity and debt-to-coverage ratios show how reliant a company is on outside funding

and how well it can repay it (Kim and et. al., 2019).

Section 3: Using the template provided:

v. Completing the Information on the ‘Business Review

Template (Ensure that you display your calculations for this

detail)

5

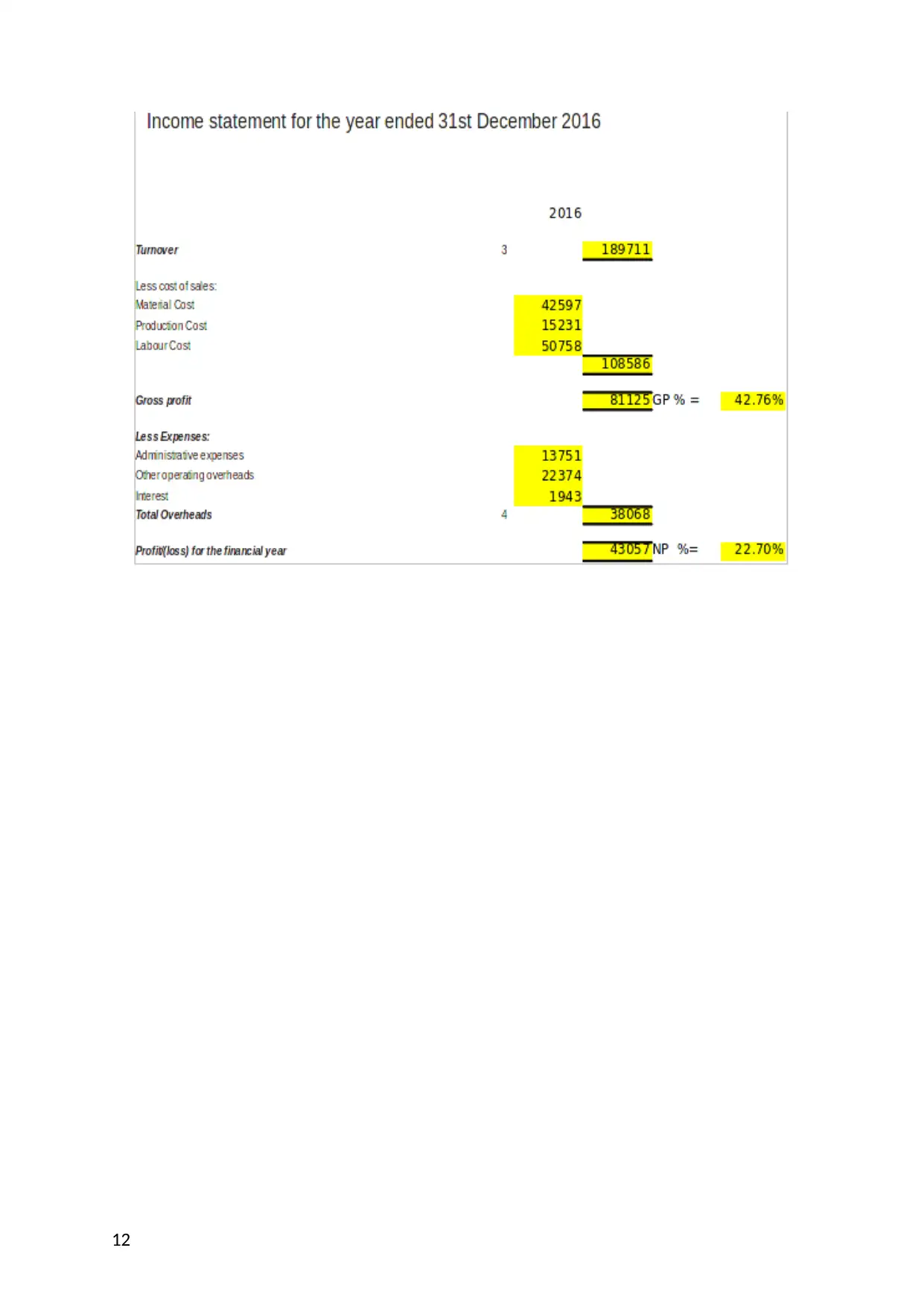

vi. Using Excel producing an Income Statement for the Sample

Organisation (see Case Study)

This is included within appendix

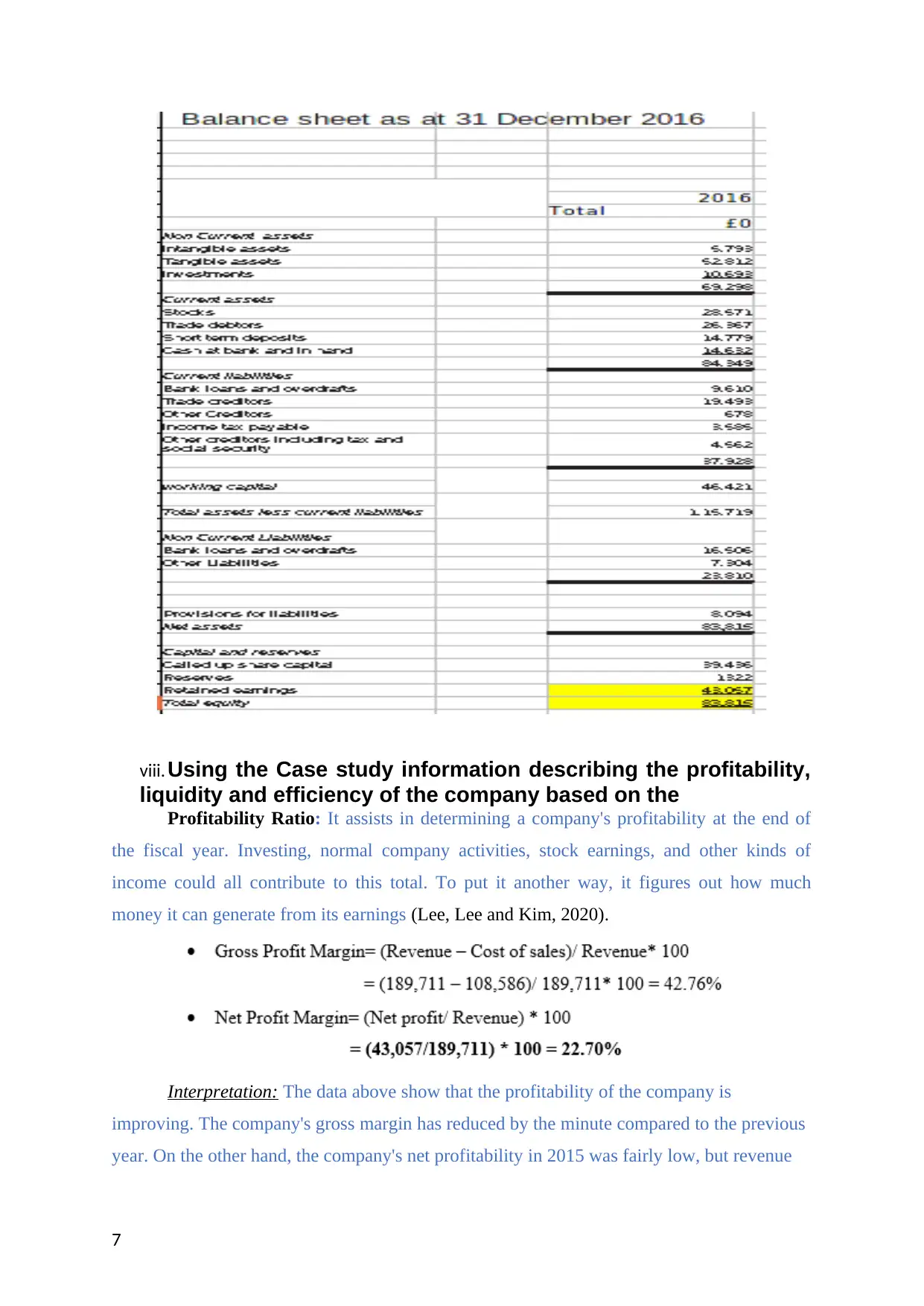

vii. Using Excel completing the Balance Sheet

6

Organisation (see Case Study)

This is included within appendix

vii. Using Excel completing the Balance Sheet

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

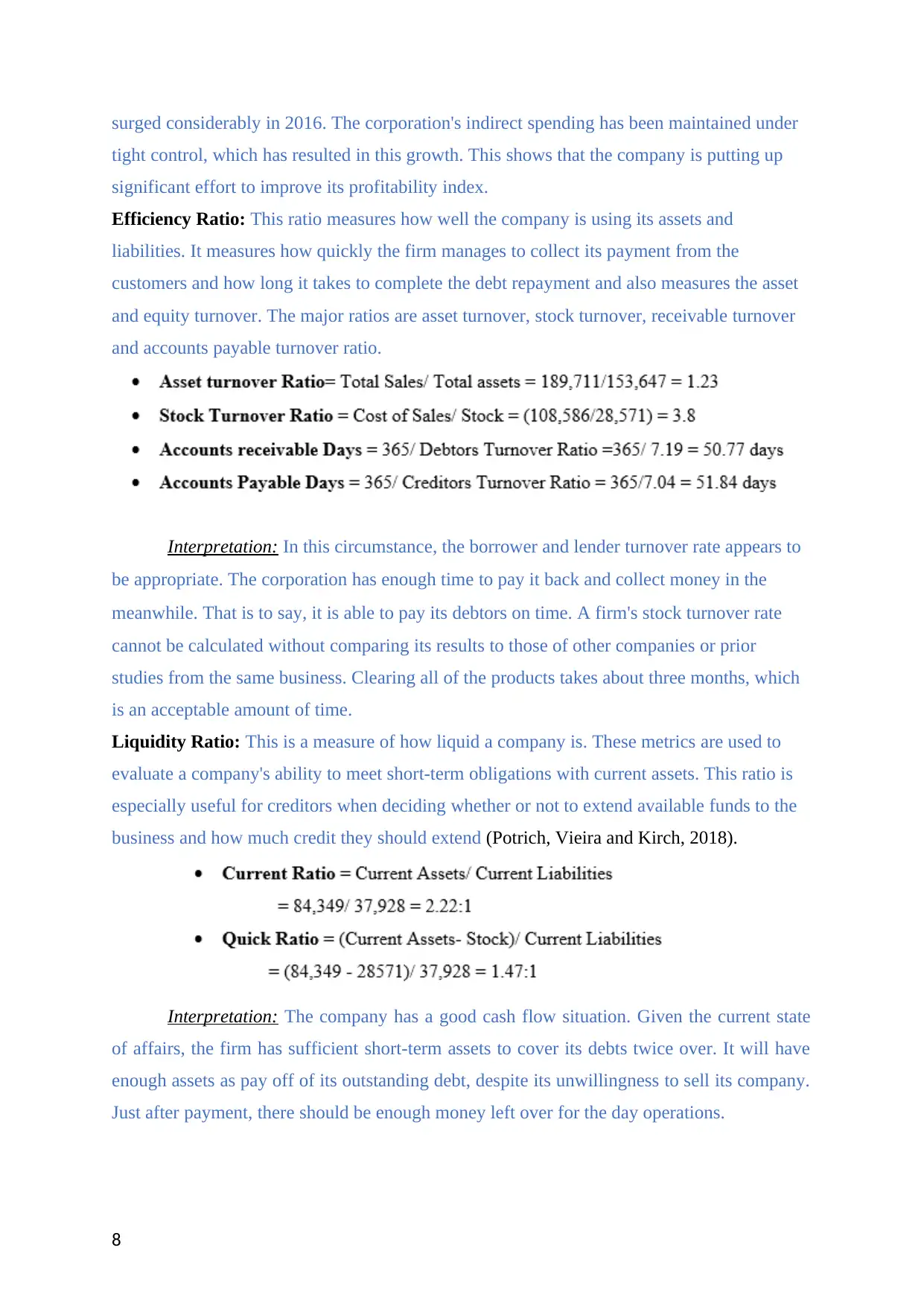

viii. Using the Case study information describing the profitability,

liquidity and efficiency of the company based on the

Profitability Ratio: It assists in determining a company's profitability at the end of

the fiscal year. Investing, normal company activities, stock earnings, and other kinds of

income could all contribute to this total. To put it another way, it figures out how much

money it can generate from its earnings (Lee, Lee and Kim, 2020).

Interpretation: The data above show that the profitability of the company is

improving. The company's gross margin has reduced by the minute compared to the previous

year. On the other hand, the company's net profitability in 2015 was fairly low, but revenue

7

liquidity and efficiency of the company based on the

Profitability Ratio: It assists in determining a company's profitability at the end of

the fiscal year. Investing, normal company activities, stock earnings, and other kinds of

income could all contribute to this total. To put it another way, it figures out how much

money it can generate from its earnings (Lee, Lee and Kim, 2020).

Interpretation: The data above show that the profitability of the company is

improving. The company's gross margin has reduced by the minute compared to the previous

year. On the other hand, the company's net profitability in 2015 was fairly low, but revenue

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

surged considerably in 2016. The corporation's indirect spending has been maintained under

tight control, which has resulted in this growth. This shows that the company is putting up

significant effort to improve its profitability index.

Efficiency Ratio: This ratio measures how well the company is using its assets and

liabilities. It measures how quickly the firm manages to collect its payment from the

customers and how long it takes to complete the debt repayment and also measures the asset

and equity turnover. The major ratios are asset turnover, stock turnover, receivable turnover

and accounts payable turnover ratio.

Interpretation: In this circumstance, the borrower and lender turnover rate appears to

be appropriate. The corporation has enough time to pay it back and collect money in the

meanwhile. That is to say, it is able to pay its debtors on time. A firm's stock turnover rate

cannot be calculated without comparing its results to those of other companies or prior

studies from the same business. Clearing all of the products takes about three months, which

is an acceptable amount of time.

Liquidity Ratio: This is a measure of how liquid a company is. These metrics are used to

evaluate a company's ability to meet short-term obligations with current assets. This ratio is

especially useful for creditors when deciding whether or not to extend available funds to the

business and how much credit they should extend (Potrich, Vieira and Kirch, 2018).

Interpretation: The company has a good cash flow situation. Given the current state

of affairs, the firm has sufficient short-term assets to cover its debts twice over. It will have

enough assets as pay off of its outstanding debt, despite its unwillingness to sell its company.

Just after payment, there should be enough money left over for the day operations.

8

tight control, which has resulted in this growth. This shows that the company is putting up

significant effort to improve its profitability index.

Efficiency Ratio: This ratio measures how well the company is using its assets and

liabilities. It measures how quickly the firm manages to collect its payment from the

customers and how long it takes to complete the debt repayment and also measures the asset

and equity turnover. The major ratios are asset turnover, stock turnover, receivable turnover

and accounts payable turnover ratio.

Interpretation: In this circumstance, the borrower and lender turnover rate appears to

be appropriate. The corporation has enough time to pay it back and collect money in the

meanwhile. That is to say, it is able to pay its debtors on time. A firm's stock turnover rate

cannot be calculated without comparing its results to those of other companies or prior

studies from the same business. Clearing all of the products takes about three months, which

is an acceptable amount of time.

Liquidity Ratio: This is a measure of how liquid a company is. These metrics are used to

evaluate a company's ability to meet short-term obligations with current assets. This ratio is

especially useful for creditors when deciding whether or not to extend available funds to the

business and how much credit they should extend (Potrich, Vieira and Kirch, 2018).

Interpretation: The company has a good cash flow situation. Given the current state

of affairs, the firm has sufficient short-term assets to cover its debts twice over. It will have

enough assets as pay off of its outstanding debt, despite its unwillingness to sell its company.

Just after payment, there should be enough money left over for the day operations.

8

Section 4: Using examples from the case study describing

and discussing the processes this business might use to

improve their financial performance.

The aforementioned ratios are used to assess a company's financial productivity.

Investors can utilize this data to make decisions and choose investments that will grow in

earnings, solvency, and efficacy. It aids organizations by allowing them to plan and manage

their economic challenges by anticipating the company's predicted position. As a result,

determining proportions and analyzing the financial health of the organization are essential.

Maximizing wealth is critical because it ensures the strategic and long-term sustainability of

an organization, which is defined by its revenues.

Fulfilling a company's requirements is, in fact, a metric that can be used to improve

the company's performance. This can be done by employing advertising techniques and

studying managerial practices. It concentrates on accounting ratios, which is useful for

determining a company's financial performance, appraisal, and stability.

It concentrates on improving its public relations strategies in order to gain more

clientele. It will expand its customer base while also generating revenue. On the other hand,

the project's earnings will be depleted as a result of this. This will have an influence on the

firm's assets as a result of the progressiveness duty (Bongomin and et. al., 2017).

The financial viability of the organization is determined by the decisions made by the

finance department. All expenditures should be visible from all angles and broken down to

determine if they are justifiable.

Conclusion

Financial statements are a basic and highly crucial feature of any business

organization, as the accompanying paper summarizes. It will assist management in allocating

funds to areas to help the firm grow and expand. The notion of financial planning has shown

that it is mostly used in crucial decision-making. It will assist in predicting business

conditions and preparing for any prospective organizational issues. Finance ratios are also

produced, which will aid in evaluating the company's financial performance and enabling for

comparison research. Performance-enhancing methods are also available.

9

and discussing the processes this business might use to

improve their financial performance.

The aforementioned ratios are used to assess a company's financial productivity.

Investors can utilize this data to make decisions and choose investments that will grow in

earnings, solvency, and efficacy. It aids organizations by allowing them to plan and manage

their economic challenges by anticipating the company's predicted position. As a result,

determining proportions and analyzing the financial health of the organization are essential.

Maximizing wealth is critical because it ensures the strategic and long-term sustainability of

an organization, which is defined by its revenues.

Fulfilling a company's requirements is, in fact, a metric that can be used to improve

the company's performance. This can be done by employing advertising techniques and

studying managerial practices. It concentrates on accounting ratios, which is useful for

determining a company's financial performance, appraisal, and stability.

It concentrates on improving its public relations strategies in order to gain more

clientele. It will expand its customer base while also generating revenue. On the other hand,

the project's earnings will be depleted as a result of this. This will have an influence on the

firm's assets as a result of the progressiveness duty (Bongomin and et. al., 2017).

The financial viability of the organization is determined by the decisions made by the

finance department. All expenditures should be visible from all angles and broken down to

determine if they are justifiable.

Conclusion

Financial statements are a basic and highly crucial feature of any business

organization, as the accompanying paper summarizes. It will assist management in allocating

funds to areas to help the firm grow and expand. The notion of financial planning has shown

that it is mostly used in crucial decision-making. It will assist in predicting business

conditions and preparing for any prospective organizational issues. Finance ratios are also

produced, which will aid in evaluating the company's financial performance and enabling for

comparison research. Performance-enhancing methods are also available.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Egginton, J.F. and McCumber, W.R., 2019. Executive network centrality and stock liquidity.

Financial Management. 48(3). pp.849-871.

Khera, N. and et. al., 2020. Current practices for screening and management of financial

distress at NCCN member institutions. Journal of the National Comprehensive

Cancer Network. 18(7). pp.825-831.

Seifzadeh, M. and et. al., 2020. The relationship between management characteristics and

financial statement readability. EuroMed Journal of Business.

Pantielieieva, N. and et. al., 2018, October. FinTech, transformation of financial

intermediation and financial stability. In 2018 International Scientific-Practical

Conference Problems of Infocommunications. Science and Technology (PIC S&T).

(pp. 553-559). IEEE.

Saurabh, K. and Nandan, T., 2018. Role of financial risk attitude and financial behavior as

mediators in financial satisfaction: Empirical evidence from India. South Asian

Journal of Business Studies.

Kim, C. and et. al., 2019. Policy uncertainty and the dual role of corporate political

strategies. Financial Management. 48(2). pp.473-504.

Lee, J.M., Lee, J. and Kim, K.T., 2020. Consumer financial well-being: Knowledge is not

enough. Journal of Family and Economic Issues. 41(2). pp.218-228.

Potrich, A.C.G., Vieira, K.M. and Kirch, G., 2018. How well do women do when it comes to

financial literacy? Proposition of an indicator and analysis of gender differences.

Journal of Behavioral and Experimental Finance. 17. pp.28-41.

Mangantar, M., 2018. An Analysis of the Government Financial Performance Influence on

Community Welfare in North Sulawesi Province Indonesia. International Journal of

Economics and Financial Issues. 8(6). p.137.

Bongomin, G.O.C. and et. al., 2017. The relationship between access to finance and growth

of SMEs in developing economies: Financial literacy as a moderator. Review of

International Business and strategy.

10

Egginton, J.F. and McCumber, W.R., 2019. Executive network centrality and stock liquidity.

Financial Management. 48(3). pp.849-871.

Khera, N. and et. al., 2020. Current practices for screening and management of financial

distress at NCCN member institutions. Journal of the National Comprehensive

Cancer Network. 18(7). pp.825-831.

Seifzadeh, M. and et. al., 2020. The relationship between management characteristics and

financial statement readability. EuroMed Journal of Business.

Pantielieieva, N. and et. al., 2018, October. FinTech, transformation of financial

intermediation and financial stability. In 2018 International Scientific-Practical

Conference Problems of Infocommunications. Science and Technology (PIC S&T).

(pp. 553-559). IEEE.

Saurabh, K. and Nandan, T., 2018. Role of financial risk attitude and financial behavior as

mediators in financial satisfaction: Empirical evidence from India. South Asian

Journal of Business Studies.

Kim, C. and et. al., 2019. Policy uncertainty and the dual role of corporate political

strategies. Financial Management. 48(2). pp.473-504.

Lee, J.M., Lee, J. and Kim, K.T., 2020. Consumer financial well-being: Knowledge is not

enough. Journal of Family and Economic Issues. 41(2). pp.218-228.

Potrich, A.C.G., Vieira, K.M. and Kirch, G., 2018. How well do women do when it comes to

financial literacy? Proposition of an indicator and analysis of gender differences.

Journal of Behavioral and Experimental Finance. 17. pp.28-41.

Mangantar, M., 2018. An Analysis of the Government Financial Performance Influence on

Community Welfare in North Sulawesi Province Indonesia. International Journal of

Economics and Financial Issues. 8(6). p.137.

Bongomin, G.O.C. and et. al., 2017. The relationship between access to finance and growth

of SMEs in developing economies: Financial literacy as a moderator. Review of

International Business and strategy.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Appendix:

Calculations performed for the above case study

Net Profit of 2016= Revenue- Cost of goods sold- non-operating expenses

= 189,711 – 108,586 – 38,068 = 43,05

Change in profit %= (Current year– previous year profit)/ Previous year Profit

= (43,057 – 18,987) / 18,987 = 126.77%

Shareholder's equity = 63,057*32.9% = 20745.75

= 63,057+20,745.75 = 83802.75

Current assets as % of current liabilities = 324% - 82% = 222%

Gross Profit = Net profit+ non-operating expenses

= 43,057+ 38,068 = 81,125

Quick Ratio = Current Assets - Stock/ Current Liabilities

= 84,349 - 28,571/ 37,928 = 1.47:1

Current ratio = Current Assets/ Current Liabilities = 84,349/ 37,928 = 2.22:1

Debtors Turnover Ratio = (Net Sales/ Debtors) = 189,711/ 26,367 = 7.19

Creditors Turnover Ratio = Cost of Sales+ Stock/ Creditors

= 108,586+ 28571/ 19,493= 7.03

Income Statement

11

Calculations performed for the above case study

Net Profit of 2016= Revenue- Cost of goods sold- non-operating expenses

= 189,711 – 108,586 – 38,068 = 43,05

Change in profit %= (Current year– previous year profit)/ Previous year Profit

= (43,057 – 18,987) / 18,987 = 126.77%

Shareholder's equity = 63,057*32.9% = 20745.75

= 63,057+20,745.75 = 83802.75

Current assets as % of current liabilities = 324% - 82% = 222%

Gross Profit = Net profit+ non-operating expenses

= 43,057+ 38,068 = 81,125

Quick Ratio = Current Assets - Stock/ Current Liabilities

= 84,349 - 28,571/ 37,928 = 1.47:1

Current ratio = Current Assets/ Current Liabilities = 84,349/ 37,928 = 2.22:1

Debtors Turnover Ratio = (Net Sales/ Debtors) = 189,711/ 26,367 = 7.19

Creditors Turnover Ratio = Cost of Sales+ Stock/ Creditors

= 108,586+ 28571/ 19,493= 7.03

Income Statement

11

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.