Applied Business Finance: Financial Management, Statements, and Ratios

VerifiedAdded on 2023/06/18

|14

|2716

|203

AI Summary

This report discusses financial management, financial statements, and ratio analysis in Applied Business Finance. It explains the concept and importance of financial management, the main financial statements, and the usage of ratios in financial management. It also provides a business review template and suggestions on how to improve financial performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Applied Business Finance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

SECTION 1:....................................................................................................................................3

Concept and importance of financial management ....................................................................3

SECTION 2: ...................................................................................................................................4

Main financial statements and usage of ratios in financial management....................................4

SECTION 3.....................................................................................................................................6

Income statement .......................................................................................................................7

Balance sheet..............................................................................................................................7

Profitability, liquidity and efficiency ratios................................................................................9

SECTION 4...................................................................................................................................11

Explaining the processes through which businsess can improve its financial performance.....11

CONCLUSION.............................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDIX...................................................................................................................................14

INTRODUCTION...........................................................................................................................3

SECTION 1:....................................................................................................................................3

Concept and importance of financial management ....................................................................3

SECTION 2: ...................................................................................................................................4

Main financial statements and usage of ratios in financial management....................................4

SECTION 3.....................................................................................................................................6

Income statement .......................................................................................................................7

Balance sheet..............................................................................................................................7

Profitability, liquidity and efficiency ratios................................................................................9

SECTION 4...................................................................................................................................11

Explaining the processes through which businsess can improve its financial performance.....11

CONCLUSION.............................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDIX...................................................................................................................................14

INTRODUCTION

Financial Management can be defined as a complete process of planning, organising and

utilizing the funds of company in its best possible ways. It is vital for any business to manage its

finance because without funds the company cannot operate in an efficient manner. Initially, the

report will highlight basic concept and the significance of financial management. It will also

enlighten how financial management helps the organisation to achieve their goals. Further it will

give a detail overview of the financial statements of organisation and how ratios play an

important role in determining the financial position and health of entity. The report will further

prepare a 'business review template' and draft final accounts of company. Lastly, it will provide

suugestions on how business can improve its performance with the help of ratios calculated.

SECTION 1:

Concept and importance of financial management

Financial Management in simple terms means handling or controlling the finance or

funds of the company in its best possible way. It means what all resources can be tapped to

acquire the funds at low cost and applying it to give maximum output (Prihartono, and

Asandimitra, 2018). Financial management is applicable to all types of organisations irrespective

of the business they carry out. It includes 3 types of major decisions i.e. firstly, investment

decision (how to finance fixed and current assets), secondly, financial decision (what will be the

cost, source and period of finance) and lastly, dividend decision (what portion of profit will be

distributed to the shareholders in the form of dividends).

The major objectives of FM is maintain sufficient and continuous supply of funds to

enterprise, to provide appropriate returns to the investors and shareholders, to have optimum

utilization of funds at least cost possible, to make sure that funds are invested In less risky

ventures that provide acceptable return rate and finally to have a proper balance between debt

and equity.

The importance of Financial Management is as follows:

1. Firstly, it helps in assigning the funds properly to increase operational efficiency and cost

reduction of the business.

Financial Management can be defined as a complete process of planning, organising and

utilizing the funds of company in its best possible ways. It is vital for any business to manage its

finance because without funds the company cannot operate in an efficient manner. Initially, the

report will highlight basic concept and the significance of financial management. It will also

enlighten how financial management helps the organisation to achieve their goals. Further it will

give a detail overview of the financial statements of organisation and how ratios play an

important role in determining the financial position and health of entity. The report will further

prepare a 'business review template' and draft final accounts of company. Lastly, it will provide

suugestions on how business can improve its performance with the help of ratios calculated.

SECTION 1:

Concept and importance of financial management

Financial Management in simple terms means handling or controlling the finance or

funds of the company in its best possible way. It means what all resources can be tapped to

acquire the funds at low cost and applying it to give maximum output (Prihartono, and

Asandimitra, 2018). Financial management is applicable to all types of organisations irrespective

of the business they carry out. It includes 3 types of major decisions i.e. firstly, investment

decision (how to finance fixed and current assets), secondly, financial decision (what will be the

cost, source and period of finance) and lastly, dividend decision (what portion of profit will be

distributed to the shareholders in the form of dividends).

The major objectives of FM is maintain sufficient and continuous supply of funds to

enterprise, to provide appropriate returns to the investors and shareholders, to have optimum

utilization of funds at least cost possible, to make sure that funds are invested In less risky

ventures that provide acceptable return rate and finally to have a proper balance between debt

and equity.

The importance of Financial Management is as follows:

1. Firstly, it helps in assigning the funds properly to increase operational efficiency and cost

reduction of the business.

2. Proper allocation of funds supports saving opportunities to search for better investment

proposals.

3. Every company incurs some fixed costs to carry on with its business operations.

Therefore, FM helps to maintain and cut down costs and excess money can be invested in

better fruitful ventures (Delkhosh and Mousavi, 2016).

4. Financial decision once taken cannot be reversed. Therefore, this appropriately

scrutinizes the financial decision before taking it.

5. A good knowledge about how to manage finance will give you a good source of income

and will enhance your financial stability.

6. Financial management helps in pooling the capital reserves which will be of importance

in case of expansion and diversification of the company.

7. At the end of the day, every business organisation works to earn money and profits. They

are said to be successful when they havehuge profits or earned more money. FM helps

companies to measure how much they have earned and motivates them to work harder

and smarter and have huge profits.

8. With the help of FM, entereprises can track the areas of which are profitable and which

are not. This helps them to improve weaker areas and turn them into profit making

departments.

SECTION 2:

Main financial statements and usage of ratios in financial management

Financials statements reveal the financial performance and position of company. It shows from

where funds can acquired by business and in what ways it can be utilized. The company

maintains four financial statements which are as follows:

1. BALANCE SHEET: This is one of the main financial statements which shows financial

position or health of company at the year end. It showcases company's assets and how

they are capitalized either by equity or debt (loans). Organisation can use it to calculate

how the dues and obliagtions will be met and in what all ways finance can be used to

business operations (Koonce, Leitter and White, 2019). The balance sheet has two major

sides, one is Asset side which includes current assets (cash, receivbales, invnetory etc.),

proposals.

3. Every company incurs some fixed costs to carry on with its business operations.

Therefore, FM helps to maintain and cut down costs and excess money can be invested in

better fruitful ventures (Delkhosh and Mousavi, 2016).

4. Financial decision once taken cannot be reversed. Therefore, this appropriately

scrutinizes the financial decision before taking it.

5. A good knowledge about how to manage finance will give you a good source of income

and will enhance your financial stability.

6. Financial management helps in pooling the capital reserves which will be of importance

in case of expansion and diversification of the company.

7. At the end of the day, every business organisation works to earn money and profits. They

are said to be successful when they havehuge profits or earned more money. FM helps

companies to measure how much they have earned and motivates them to work harder

and smarter and have huge profits.

8. With the help of FM, entereprises can track the areas of which are profitable and which

are not. This helps them to improve weaker areas and turn them into profit making

departments.

SECTION 2:

Main financial statements and usage of ratios in financial management

Financials statements reveal the financial performance and position of company. It shows from

where funds can acquired by business and in what ways it can be utilized. The company

maintains four financial statements which are as follows:

1. BALANCE SHEET: This is one of the main financial statements which shows financial

position or health of company at the year end. It showcases company's assets and how

they are capitalized either by equity or debt (loans). Organisation can use it to calculate

how the dues and obliagtions will be met and in what all ways finance can be used to

business operations (Koonce, Leitter and White, 2019). The balance sheet has two major

sides, one is Asset side which includes current assets (cash, receivbales, invnetory etc.),

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

fixed assets (buliding, plant and machinery) and intangible assets (copyrights, patents,

etc.) and other is Liability side which comprises of current liability (acounts payable,

creditors, O/S expenses, etc.), long-term liability (loans and advances, deffered tax

liabilities, etc.). The second part of Liability side is Equity portion which consists of

shareholders funds and retained earnings. The double-entry book keeping system keeps

the two side equal.

Asset = liabilities + owner's equity

2. INCOME STATEMENTS: Income statements calculates net profit/loss earned/incuured

by the company. It includes all the income generated from operations of business and all

expenses incurred to earn that revenue. All expenses are deducted from income total to

calculate net profit or net loss of company (Muthuraman and Mawali, 2020). First of all,

gross profit is calculated by determining the net sales and COGS. After that, all the

expenses (adminstrative, advertising and promotion, depreciation, interest and dividend

expenses) are computed to find out out net profit earned after taking tax into

consideration.

3. CASH FLOW STATEMENTS: CFS is a statement that calculates complete cash inflow

and outflow during the period and shows cash position of company. It gathers the

information from financial statements to calculate the net decrease or increase in the cash

for that year (Günay and Fatih, 2020). The statement is divided into 3 parts which show

the cash generated from different activities. The first part calculates the cash generated

from basic operational activities. The second part shows cash flow from investing

activities such as sale and purchase of fixed assets and securities. The last part displays

the cash flow from financial activities which includes cash generated from selling shares

or loans and advances.

4. RATIO ANALYSIS: Financial ratios are calculated from different items of income

statement and balance sheet to draw sensible statistics about company. It provides deeper

insights about the growth prospects of company, profitability or liquidity of company.

Comparing the finaal accounts of different companies within same industry can be a

tiresome job, but inter-firm or intra-firm ratio comparison is easy and simple. It can

easily compare company's financial position within industry from different viewpoint and

spot the areas where improvement is required.

etc.) and other is Liability side which comprises of current liability (acounts payable,

creditors, O/S expenses, etc.), long-term liability (loans and advances, deffered tax

liabilities, etc.). The second part of Liability side is Equity portion which consists of

shareholders funds and retained earnings. The double-entry book keeping system keeps

the two side equal.

Asset = liabilities + owner's equity

2. INCOME STATEMENTS: Income statements calculates net profit/loss earned/incuured

by the company. It includes all the income generated from operations of business and all

expenses incurred to earn that revenue. All expenses are deducted from income total to

calculate net profit or net loss of company (Muthuraman and Mawali, 2020). First of all,

gross profit is calculated by determining the net sales and COGS. After that, all the

expenses (adminstrative, advertising and promotion, depreciation, interest and dividend

expenses) are computed to find out out net profit earned after taking tax into

consideration.

3. CASH FLOW STATEMENTS: CFS is a statement that calculates complete cash inflow

and outflow during the period and shows cash position of company. It gathers the

information from financial statements to calculate the net decrease or increase in the cash

for that year (Günay and Fatih, 2020). The statement is divided into 3 parts which show

the cash generated from different activities. The first part calculates the cash generated

from basic operational activities. The second part shows cash flow from investing

activities such as sale and purchase of fixed assets and securities. The last part displays

the cash flow from financial activities which includes cash generated from selling shares

or loans and advances.

4. RATIO ANALYSIS: Financial ratios are calculated from different items of income

statement and balance sheet to draw sensible statistics about company. It provides deeper

insights about the growth prospects of company, profitability or liquidity of company.

Comparing the finaal accounts of different companies within same industry can be a

tiresome job, but inter-firm or intra-firm ratio comparison is easy and simple. It can

easily compare company's financial position within industry from different viewpoint and

spot the areas where improvement is required.

USAGE OF RATIO ANALYSIS

Ratio analysis provides assistance in comparing, analysing and interpreting the different figures

from the financial statements. The various uses or importance of ratio analysis is as follows:

1. Scanning the financial statements: The figures of financial statements does not show true

condition of the business unless they are properly analysed and interpreted through ratio

analysis.

2. Knowledge about profitability: All the investors are interested to know how profitable the

company is in order to get the returns (dividend) on time. Net profit margin depicts how

the business is converting the sales into profits.

3. Easy comparison: Ratios can be analysed and compared with past record or with other

firms having similar business. It helps company in identifying any market gaps or

advantages, weaknesses and threats available in markets and make decisions on that basis

(Arkan, 2016).

4. Control Measure: Ratios help to identify the factors that lead to any deviations or

variances which can resolved with corrective measures taken by the company.

5. Studying the trends: Data from financial statements from last few years helps to

determine a trend line which predicts the future performance direction. It also identifies

any financial instability occuring in future so that business can take proper action to

reduce that instability.

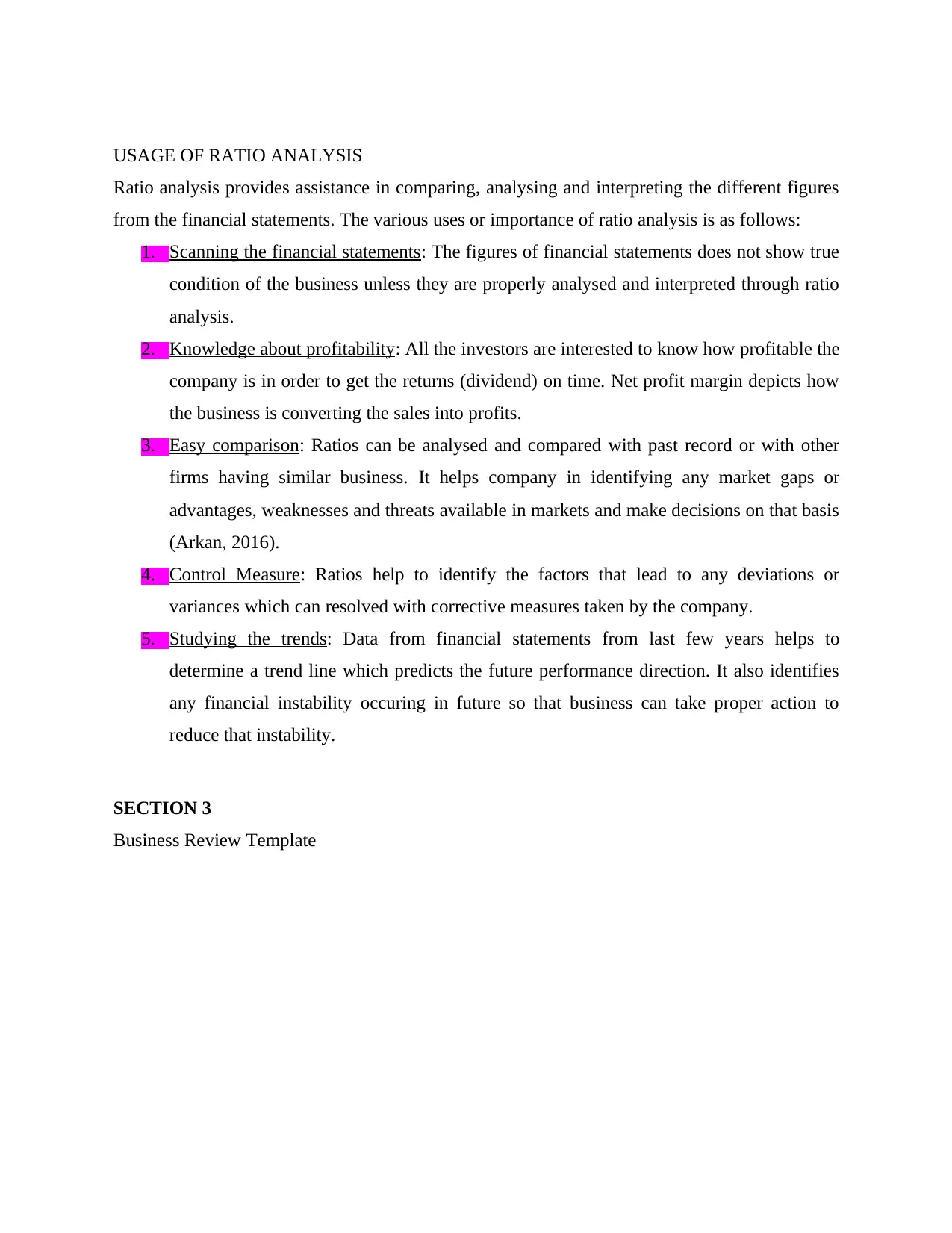

SECTION 3

Business Review Template

Ratio analysis provides assistance in comparing, analysing and interpreting the different figures

from the financial statements. The various uses or importance of ratio analysis is as follows:

1. Scanning the financial statements: The figures of financial statements does not show true

condition of the business unless they are properly analysed and interpreted through ratio

analysis.

2. Knowledge about profitability: All the investors are interested to know how profitable the

company is in order to get the returns (dividend) on time. Net profit margin depicts how

the business is converting the sales into profits.

3. Easy comparison: Ratios can be analysed and compared with past record or with other

firms having similar business. It helps company in identifying any market gaps or

advantages, weaknesses and threats available in markets and make decisions on that basis

(Arkan, 2016).

4. Control Measure: Ratios help to identify the factors that lead to any deviations or

variances which can resolved with corrective measures taken by the company.

5. Studying the trends: Data from financial statements from last few years helps to

determine a trend line which predicts the future performance direction. It also identifies

any financial instability occuring in future so that business can take proper action to

reduce that instability.

SECTION 3

Business Review Template

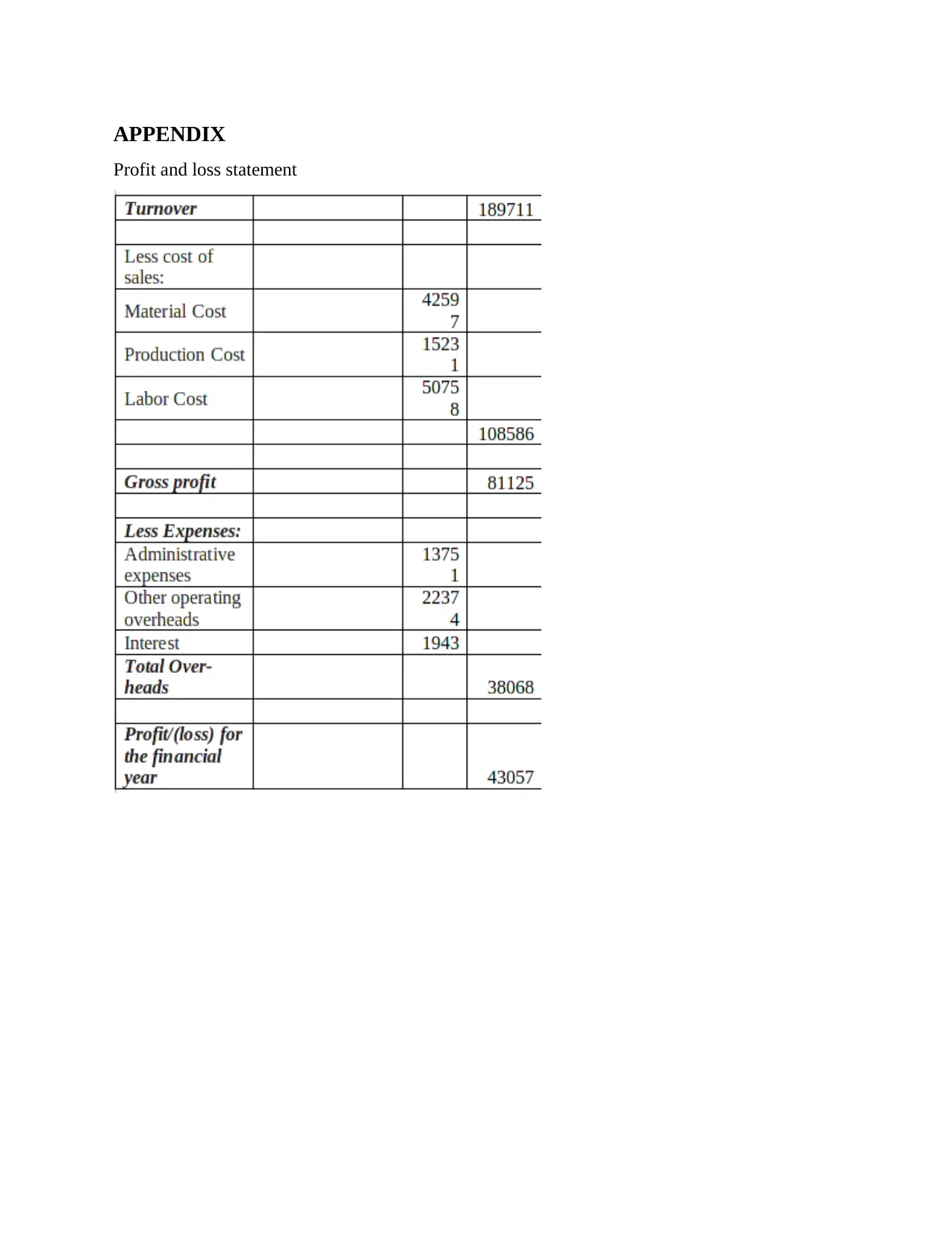

Income statement

Attached in appendix

Attached in appendix

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

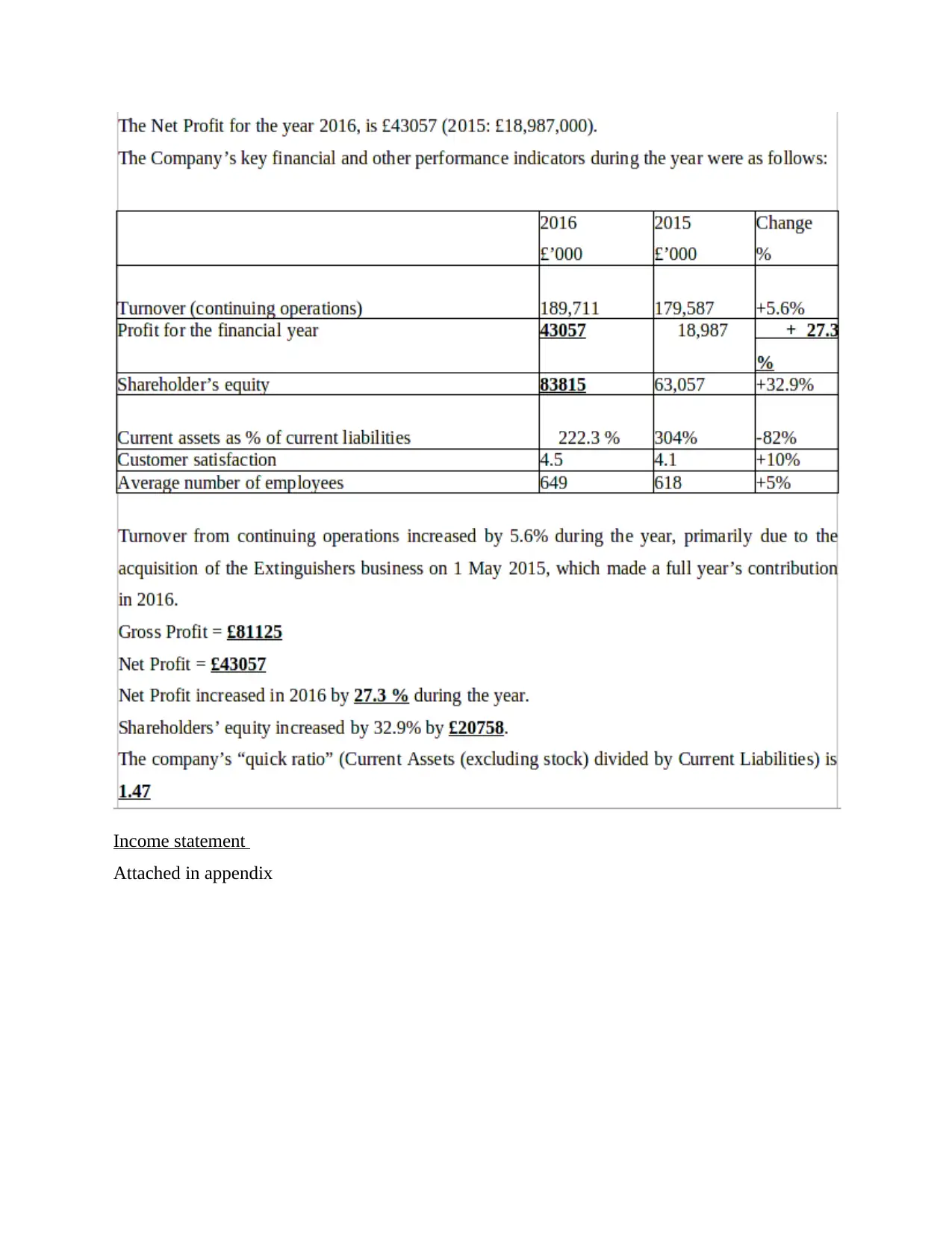

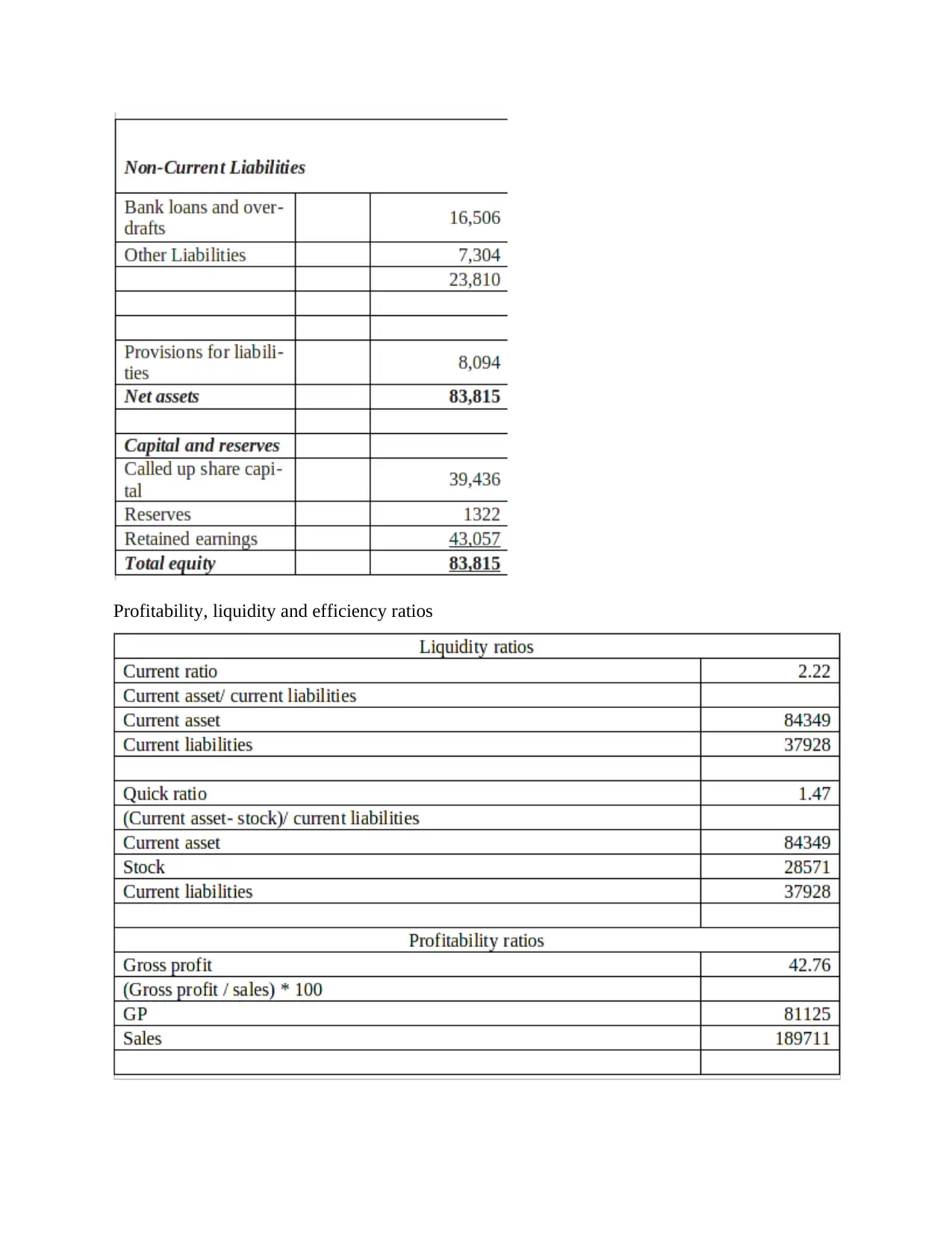

Balance sheet

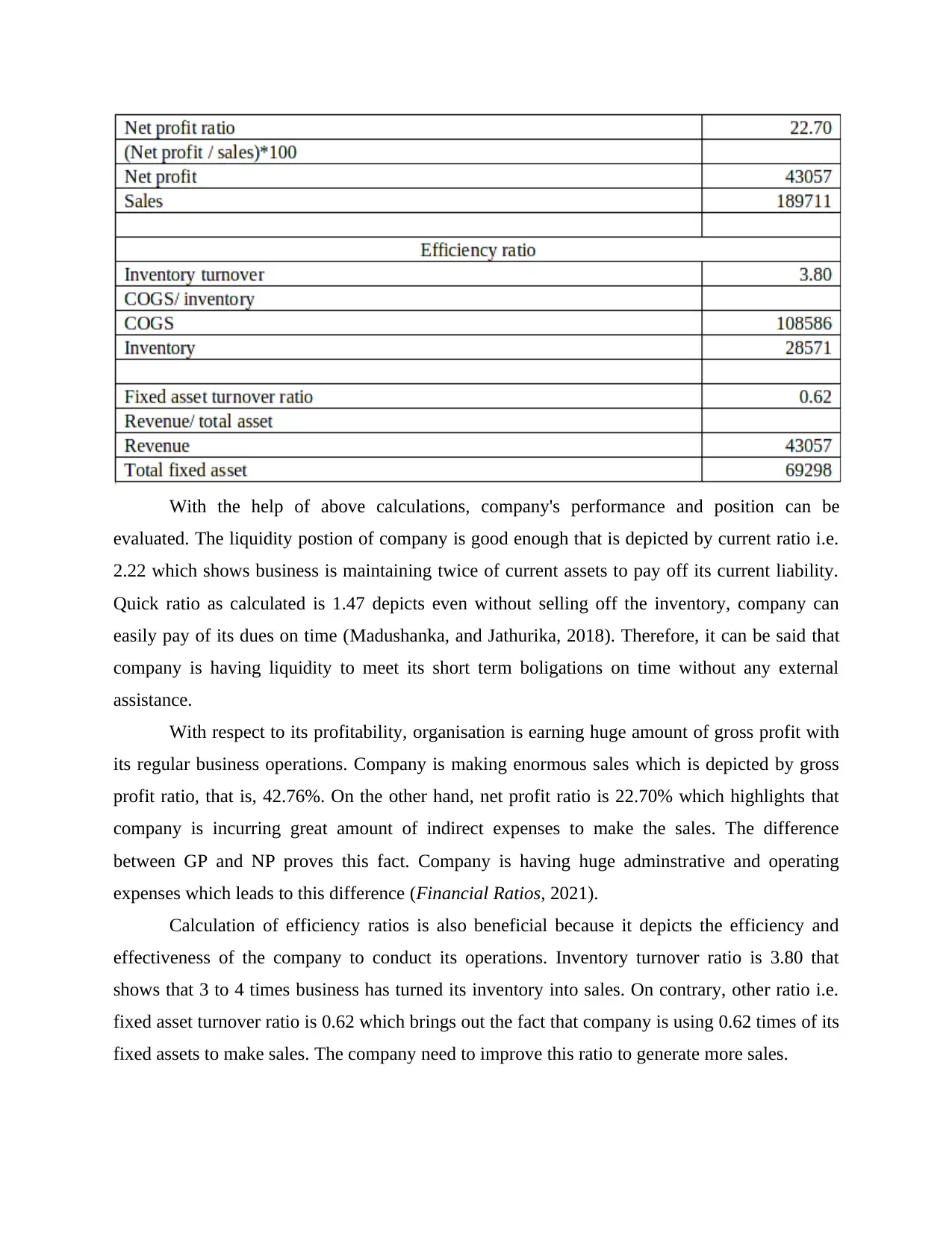

Profitability, liquidity and efficiency ratios

With the help of above calculations, company's performance and position can be

evaluated. The liquidity postion of company is good enough that is depicted by current ratio i.e.

2.22 which shows business is maintaining twice of current assets to pay off its current liability.

Quick ratio as calculated is 1.47 depicts even without selling off the inventory, company can

easily pay of its dues on time (Madushanka, and Jathurika, 2018). Therefore, it can be said that

company is having liquidity to meet its short term boligations on time without any external

assistance.

With respect to its profitability, organisation is earning huge amount of gross profit with

its regular business operations. Company is making enormous sales which is depicted by gross

profit ratio, that is, 42.76%. On the other hand, net profit ratio is 22.70% which highlights that

company is incurring great amount of indirect expenses to make the sales. The difference

between GP and NP proves this fact. Company is having huge adminstrative and operating

expenses which leads to this difference (Financial Ratios, 2021).

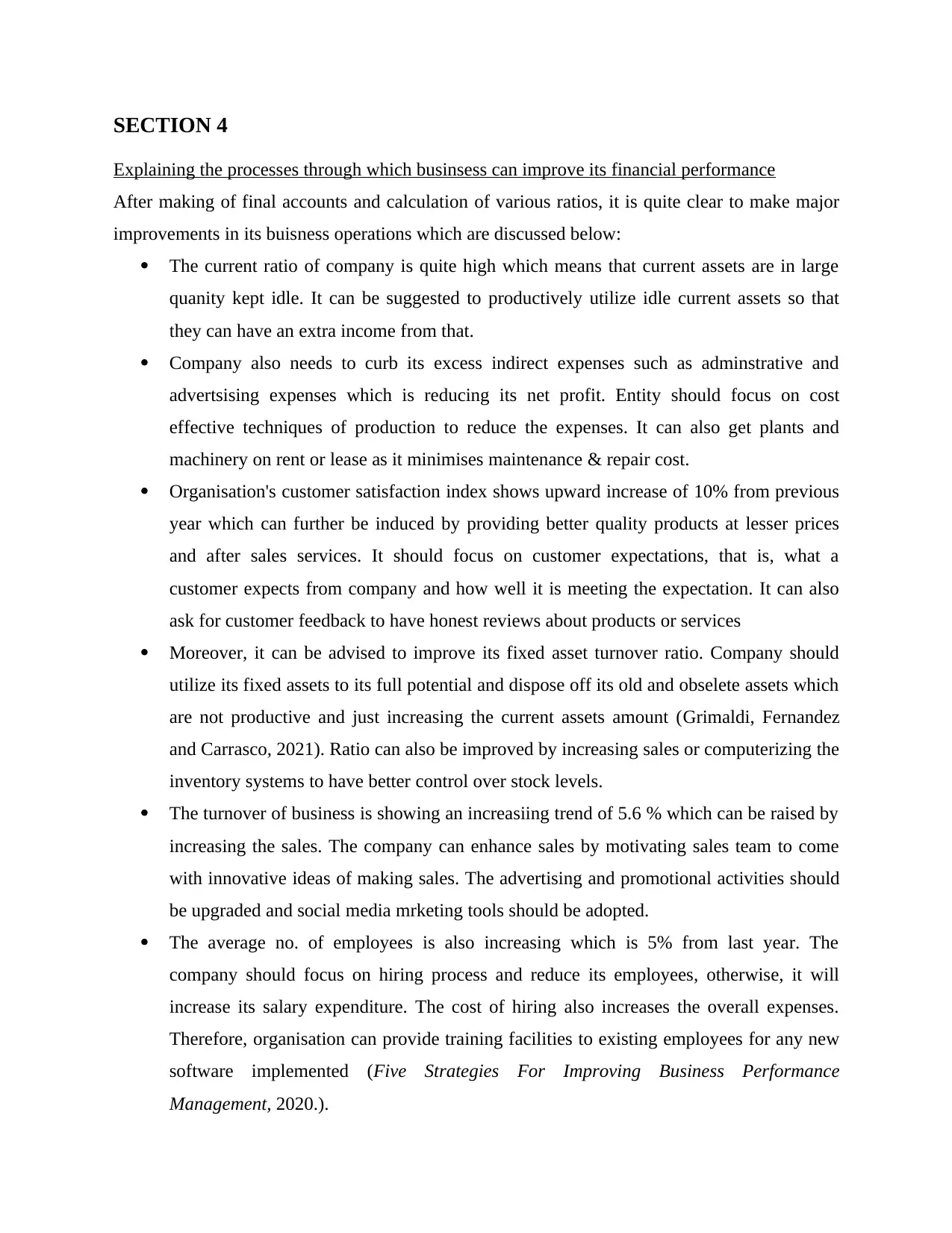

Calculation of efficiency ratios is also beneficial because it depicts the efficiency and

effectiveness of the company to conduct its operations. Inventory turnover ratio is 3.80 that

shows that 3 to 4 times business has turned its inventory into sales. On contrary, other ratio i.e.

fixed asset turnover ratio is 0.62 which brings out the fact that company is using 0.62 times of its

fixed assets to make sales. The company need to improve this ratio to generate more sales.

evaluated. The liquidity postion of company is good enough that is depicted by current ratio i.e.

2.22 which shows business is maintaining twice of current assets to pay off its current liability.

Quick ratio as calculated is 1.47 depicts even without selling off the inventory, company can

easily pay of its dues on time (Madushanka, and Jathurika, 2018). Therefore, it can be said that

company is having liquidity to meet its short term boligations on time without any external

assistance.

With respect to its profitability, organisation is earning huge amount of gross profit with

its regular business operations. Company is making enormous sales which is depicted by gross

profit ratio, that is, 42.76%. On the other hand, net profit ratio is 22.70% which highlights that

company is incurring great amount of indirect expenses to make the sales. The difference

between GP and NP proves this fact. Company is having huge adminstrative and operating

expenses which leads to this difference (Financial Ratios, 2021).

Calculation of efficiency ratios is also beneficial because it depicts the efficiency and

effectiveness of the company to conduct its operations. Inventory turnover ratio is 3.80 that

shows that 3 to 4 times business has turned its inventory into sales. On contrary, other ratio i.e.

fixed asset turnover ratio is 0.62 which brings out the fact that company is using 0.62 times of its

fixed assets to make sales. The company need to improve this ratio to generate more sales.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

SECTION 4

Explaining the processes through which businsess can improve its financial performance

After making of final accounts and calculation of various ratios, it is quite clear to make major

improvements in its buisness operations which are discussed below:

The current ratio of company is quite high which means that current assets are in large

quanity kept idle. It can be suggested to productively utilize idle current assets so that

they can have an extra income from that.

Company also needs to curb its excess indirect expenses such as adminstrative and

advertsising expenses which is reducing its net profit. Entity should focus on cost

effective techniques of production to reduce the expenses. It can also get plants and

machinery on rent or lease as it minimises maintenance & repair cost.

Organisation's customer satisfaction index shows upward increase of 10% from previous

year which can further be induced by providing better quality products at lesser prices

and after sales services. It should focus on customer expectations, that is, what a

customer expects from company and how well it is meeting the expectation. It can also

ask for customer feedback to have honest reviews about products or services

Moreover, it can be advised to improve its fixed asset turnover ratio. Company should

utilize its fixed assets to its full potential and dispose off its old and obselete assets which

are not productive and just increasing the current assets amount (Grimaldi, Fernandez

and Carrasco, 2021). Ratio can also be improved by increasing sales or computerizing the

inventory systems to have better control over stock levels.

The turnover of business is showing an increasiing trend of 5.6 % which can be raised by

increasing the sales. The company can enhance sales by motivating sales team to come

with innovative ideas of making sales. The advertising and promotional activities should

be upgraded and social media mrketing tools should be adopted.

The average no. of employees is also increasing which is 5% from last year. The

company should focus on hiring process and reduce its employees, otherwise, it will

increase its salary expenditure. The cost of hiring also increases the overall expenses.

Therefore, organisation can provide training facilities to existing employees for any new

software implemented (Five Strategies For Improving Business Performance

Management, 2020.).

Explaining the processes through which businsess can improve its financial performance

After making of final accounts and calculation of various ratios, it is quite clear to make major

improvements in its buisness operations which are discussed below:

The current ratio of company is quite high which means that current assets are in large

quanity kept idle. It can be suggested to productively utilize idle current assets so that

they can have an extra income from that.

Company also needs to curb its excess indirect expenses such as adminstrative and

advertsising expenses which is reducing its net profit. Entity should focus on cost

effective techniques of production to reduce the expenses. It can also get plants and

machinery on rent or lease as it minimises maintenance & repair cost.

Organisation's customer satisfaction index shows upward increase of 10% from previous

year which can further be induced by providing better quality products at lesser prices

and after sales services. It should focus on customer expectations, that is, what a

customer expects from company and how well it is meeting the expectation. It can also

ask for customer feedback to have honest reviews about products or services

Moreover, it can be advised to improve its fixed asset turnover ratio. Company should

utilize its fixed assets to its full potential and dispose off its old and obselete assets which

are not productive and just increasing the current assets amount (Grimaldi, Fernandez

and Carrasco, 2021). Ratio can also be improved by increasing sales or computerizing the

inventory systems to have better control over stock levels.

The turnover of business is showing an increasiing trend of 5.6 % which can be raised by

increasing the sales. The company can enhance sales by motivating sales team to come

with innovative ideas of making sales. The advertising and promotional activities should

be upgraded and social media mrketing tools should be adopted.

The average no. of employees is also increasing which is 5% from last year. The

company should focus on hiring process and reduce its employees, otherwise, it will

increase its salary expenditure. The cost of hiring also increases the overall expenses.

Therefore, organisation can provide training facilities to existing employees for any new

software implemented (Five Strategies For Improving Business Performance

Management, 2020.).

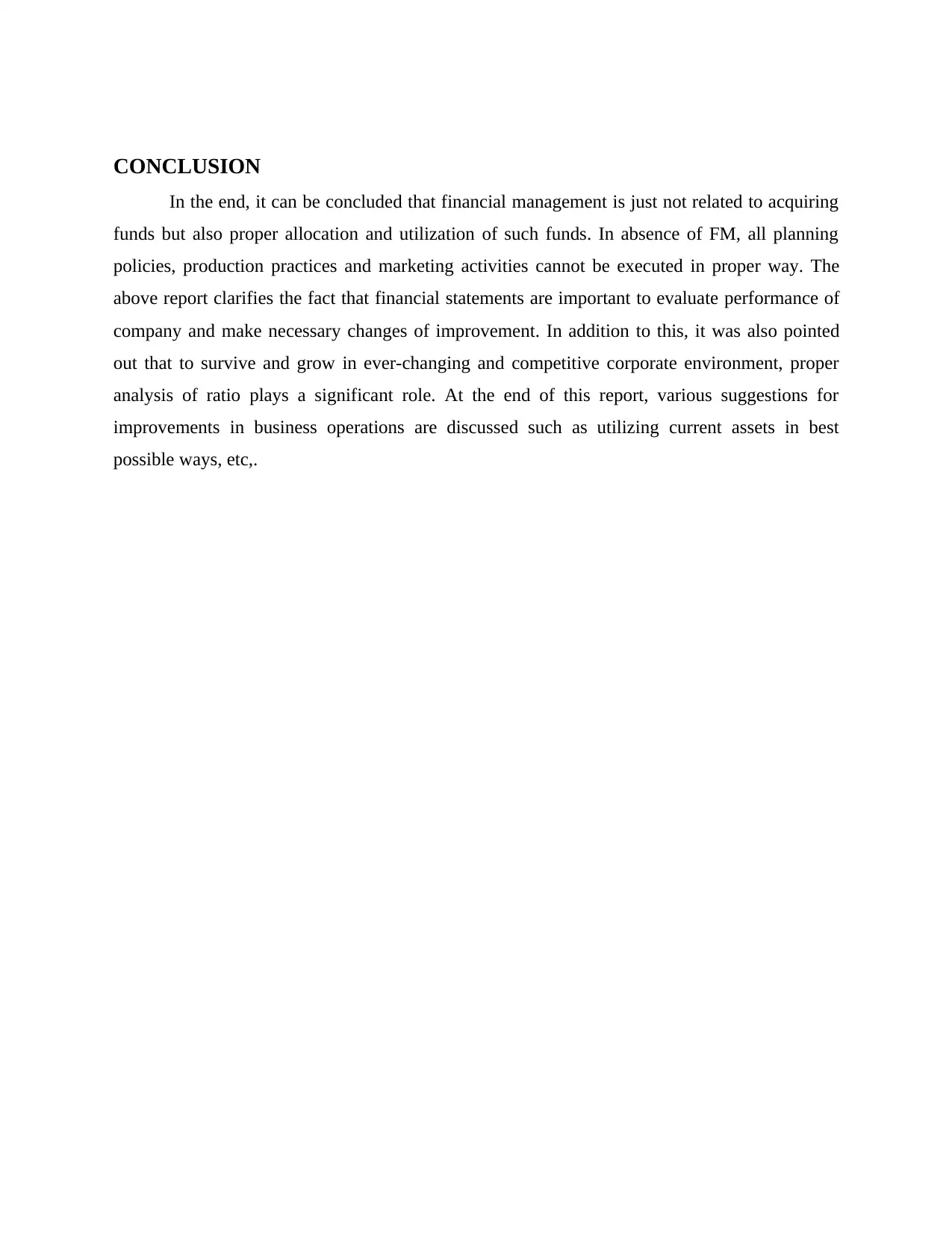

CONCLUSION

In the end, it can be concluded that financial management is just not related to acquiring

funds but also proper allocation and utilization of such funds. In absence of FM, all planning

policies, production practices and marketing activities cannot be executed in proper way. The

above report clarifies the fact that financial statements are important to evaluate performance of

company and make necessary changes of improvement. In addition to this, it was also pointed

out that to survive and grow in ever-changing and competitive corporate environment, proper

analysis of ratio plays a significant role. At the end of this report, various suggestions for

improvements in business operations are discussed such as utilizing current assets in best

possible ways, etc,.

In the end, it can be concluded that financial management is just not related to acquiring

funds but also proper allocation and utilization of such funds. In absence of FM, all planning

policies, production practices and marketing activities cannot be executed in proper way. The

above report clarifies the fact that financial statements are important to evaluate performance of

company and make necessary changes of improvement. In addition to this, it was also pointed

out that to survive and grow in ever-changing and competitive corporate environment, proper

analysis of ratio plays a significant role. At the end of this report, various suggestions for

improvements in business operations are discussed such as utilizing current assets in best

possible ways, etc,.

REFERENCES

Books and Journals

Arkan, T., 2016. The importance of financial ratios in predicting stock price trends: A case study

in emerging markets. Finanse, Rynki Finansowe, Ubezpieczenia. (79). pp.13-26.

Delkhosh, M. and Mousavi, H., 2016. Strategic financial management review on the financial

success of an organization. Mediterranean Journal of Social Sciences. 7(2 S2). p.30.

Grimaldi, D., Fernandez, V. and Carrasco, C., 2021. Exploring data conditions to improve

business performance. Journal of the Operational Research Society. 72(5). pp.1087-

1098.

Günay, F. and Fatih, E. C. E. R., 2020. Cash flow based financial performance of Borsa İstanbul

tourism companies by Entropy-MAIRCA integrated model. Journal of

multidisciplinary academic tourism. 5(1). pp.29-37.

Koonce, L., Leitter, Z. and White, B.J., 2019. Linked balance sheet presentation. Journal of

Accounting and Economics. 68(1). p.101237.

Madushanka, K. H. I. and Jathurika, M., 2018. The impact of liquidity ratios on

profitability. International Research Journal of Advanced Engineering and Science.

3(4). pp.157-161.

Muthuraman, B. and Mawali, A. K. S. A., 2020. Historical Analysis of Income Statement–A

Case Study Salalah Mills Company Oman. International Journal of Research in

Entrepreneurship & Business Studies. 1(2). pp.22-28.

Prihartono, M. R. D. and Asandimitra, N., 2018. Analysis factors influencing financial

management behaviour. International Journal of Academic Research in Business and

Social Sciences. 8(8). pp.308-326.

Online

Financial Ratios. 2021. [Online]. Available through:

<https://www.accountingcoach.com/financial-ratios/explanation>

Five Strategies For Improving Business Performance Management. 2020. [Online]. Available

through: <https://www.heflo.com/blog/business-management/improving-business-

performance/>

Books and Journals

Arkan, T., 2016. The importance of financial ratios in predicting stock price trends: A case study

in emerging markets. Finanse, Rynki Finansowe, Ubezpieczenia. (79). pp.13-26.

Delkhosh, M. and Mousavi, H., 2016. Strategic financial management review on the financial

success of an organization. Mediterranean Journal of Social Sciences. 7(2 S2). p.30.

Grimaldi, D., Fernandez, V. and Carrasco, C., 2021. Exploring data conditions to improve

business performance. Journal of the Operational Research Society. 72(5). pp.1087-

1098.

Günay, F. and Fatih, E. C. E. R., 2020. Cash flow based financial performance of Borsa İstanbul

tourism companies by Entropy-MAIRCA integrated model. Journal of

multidisciplinary academic tourism. 5(1). pp.29-37.

Koonce, L., Leitter, Z. and White, B.J., 2019. Linked balance sheet presentation. Journal of

Accounting and Economics. 68(1). p.101237.

Madushanka, K. H. I. and Jathurika, M., 2018. The impact of liquidity ratios on

profitability. International Research Journal of Advanced Engineering and Science.

3(4). pp.157-161.

Muthuraman, B. and Mawali, A. K. S. A., 2020. Historical Analysis of Income Statement–A

Case Study Salalah Mills Company Oman. International Journal of Research in

Entrepreneurship & Business Studies. 1(2). pp.22-28.

Prihartono, M. R. D. and Asandimitra, N., 2018. Analysis factors influencing financial

management behaviour. International Journal of Academic Research in Business and

Social Sciences. 8(8). pp.308-326.

Online

Financial Ratios. 2021. [Online]. Available through:

<https://www.accountingcoach.com/financial-ratios/explanation>

Five Strategies For Improving Business Performance Management. 2020. [Online]. Available

through: <https://www.heflo.com/blog/business-management/improving-business-

performance/>

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

APPENDIX

Profit and loss statement

Profit and loss statement

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.