Corporate Strategy Report: Fiat Chrysler & Peugeot Merger Analysis

VerifiedAdded on 2022/12/30

|11

|3341

|39

Report

AI Summary

This report provides a comprehensive analysis of the corporate strategy surrounding the merger of Fiat Chrysler and Peugeot. It begins with an introduction to corporate strategy and the automotive industry context. The main body delves into external factors, utilizing PESTLE and Porter's Five Forces models to identify opportunities, threats, and industry attractiveness. Internal analysis assesses the companies' resources, identifying strengths and weaknesses. Furthermore, a VRIO analysis evaluates core competencies through the value chain. The report concludes with an evaluation of the merger's strategic implementation and SAFe criteria, offering a holistic view of the strategic implications and potential outcomes of this significant industry consolidation. The analysis considers political, economic, social, technological, environmental, and legal factors, along with competitive forces, resources, and competencies to provide a well-rounded view of the merger's strategic landscape.

Applied

Corporate

Strategy

Corporate

Strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction................................................................................................................................3

Main body..................................................................................................................................3

External analysis and different opportunities and threats provided to business....................3

Analysis of internal components providing core competency to business............................6

Strategy that company implemented recently and evaluating its SAFe criteria....................7

Conclusion..................................................................................................................................9

References................................................................................................................................10

Introduction................................................................................................................................3

Main body..................................................................................................................................3

External analysis and different opportunities and threats provided to business....................3

Analysis of internal components providing core competency to business............................6

Strategy that company implemented recently and evaluating its SAFe criteria....................7

Conclusion..................................................................................................................................9

References................................................................................................................................10

Introduction

Corporate strategy refers to a system of strategic planning within an organisation.

Organisations are now aiming at different goals and directions in order to make sure that they

are achieving all the objectives which they have decided for the organisation. It is often seen

that this objective score consisting of long run visions for the organisation. The following

report is based upon a merger between Fiat Chrysler and Peugeot Owner (Dahl and Fløttum,

2019). Fiat Chrysler is an automotive industry organisation which announced its merger with

Italian firm in 2014. The below mention report discusses various internal and external

analysis which would be done by organisation while they are consisting of people with the

following merger.

Main body

External analysis and different opportunities and threats provided to business

PESTLE analysis

Political factors: Political factors include various government policies, stability of

political parties and taxation policies in an economy. It is often seen that political factors are

highly effecting a business or industry. The merger between Fiat Chrysler automobiles and

Peugeot Owner will be highly affected by political factors of the economy. Different tax

policies and government stability of different economy will often bring in various risk for the

business as they will continue with their activities after the merger have taken place.

Threats: The political factors will impact highly on the firm which will be formed after a

merger. It is often seen that they didn’t corruption in various economy will impact the

business plan which the organisation have developed after merger for their business.

Economic factors: there are a number of different economic conditions such as the

exchange rate, taxation policy, and interest-rate and soon which are affecting a business

highly. It is often seen with organisation which is running in more than one country that they

will be affected by economic factors (Surijah, 2016). Fiat Chrysler automobile and Peugeot

Owners are successfully making sure that they can achieve highest position in the automobile

market after the merger which will be taking place. There are a number of different models

which are developed by both of this organisation focusing upon the population and the

economy where the organisation is setting up their business. It is necessary for them to make

Corporate strategy refers to a system of strategic planning within an organisation.

Organisations are now aiming at different goals and directions in order to make sure that they

are achieving all the objectives which they have decided for the organisation. It is often seen

that this objective score consisting of long run visions for the organisation. The following

report is based upon a merger between Fiat Chrysler and Peugeot Owner (Dahl and Fløttum,

2019). Fiat Chrysler is an automotive industry organisation which announced its merger with

Italian firm in 2014. The below mention report discusses various internal and external

analysis which would be done by organisation while they are consisting of people with the

following merger.

Main body

External analysis and different opportunities and threats provided to business

PESTLE analysis

Political factors: Political factors include various government policies, stability of

political parties and taxation policies in an economy. It is often seen that political factors are

highly effecting a business or industry. The merger between Fiat Chrysler automobiles and

Peugeot Owner will be highly affected by political factors of the economy. Different tax

policies and government stability of different economy will often bring in various risk for the

business as they will continue with their activities after the merger have taken place.

Threats: The political factors will impact highly on the firm which will be formed after a

merger. It is often seen that they didn’t corruption in various economy will impact the

business plan which the organisation have developed after merger for their business.

Economic factors: there are a number of different economic conditions such as the

exchange rate, taxation policy, and interest-rate and soon which are affecting a business

highly. It is often seen with organisation which is running in more than one country that they

will be affected by economic factors (Surijah, 2016). Fiat Chrysler automobile and Peugeot

Owners are successfully making sure that they can achieve highest position in the automobile

market after the merger which will be taking place. There are a number of different models

which are developed by both of this organisation focusing upon the population and the

economy where the organisation is setting up their business. It is necessary for them to make

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

sure that the economic condition of the countries in which they run business is developing or

developed to set up their functions.

Threats: Setting up a business in underdeveloped or developing company will be difficult for

the organisation as the GDP of the economy along with the foreign exchange rate will bring

in barriers for these organisations.

Social factors: There are a number of different social factors such as the changing

needs and demands of consumer and the trends in market which are affecting businesses.

When taking the auto mobile industry awareness of the individuals about the effects that auto

mobiles have on environment is increasing. It is required by both of this organisation to make

sure that they are bringing in auto mobiles with all the qualities which can fulfil the

requirements of consumer and also meet their day to day changing needs and demands.

Opportunities: Conducting proper market research in order to meet the needs and

requirements of consumer is a great way in which Fiat Chrysler automobile and Peugeot

Owner can successfully set up their business (Hardy, Lexa and Bruno, 2020). It is also

required by them to conduct proper market research from time to time to provide consumer

with the products which are trending in the market.

Technological factors: The technological factors are highly affecting organisations in

auto mobile industry. It is often seen that the technological advancement is bringing benefits

to the organisation and when taking the merger between two organisation into context they

can successfully intake all the technological advancement. The investment which is required

for these advancement is also present with the organisation which will successfully help them

in developing as one of the biggest car manufacturer in the world.

Opportunities: Both of these organisations coming together will have huge funds available

with them. These funds can be successfully used by them in order to make sure that they are

investing on research and development department. Along with this they can adopt all the

new technologies in the market which will help them to bring in products and services which

have not been offered to their consumers. The technological development will also help them

to stand the competition in the market in order to meet all their objectives and aims.

Environmental factors: The environmental factors are highly affecting automobile

industry as all the products of this industry are having some impact on the market. The

environment is getting polluted due to these auto mobiles and it is necessary for the

businesses to make sure that they are making cars which will not have a negative effect on

the environment (Brønn and Brønn, 2018). There are used pollutants released by cars in the

developed to set up their functions.

Threats: Setting up a business in underdeveloped or developing company will be difficult for

the organisation as the GDP of the economy along with the foreign exchange rate will bring

in barriers for these organisations.

Social factors: There are a number of different social factors such as the changing

needs and demands of consumer and the trends in market which are affecting businesses.

When taking the auto mobile industry awareness of the individuals about the effects that auto

mobiles have on environment is increasing. It is required by both of this organisation to make

sure that they are bringing in auto mobiles with all the qualities which can fulfil the

requirements of consumer and also meet their day to day changing needs and demands.

Opportunities: Conducting proper market research in order to meet the needs and

requirements of consumer is a great way in which Fiat Chrysler automobile and Peugeot

Owner can successfully set up their business (Hardy, Lexa and Bruno, 2020). It is also

required by them to conduct proper market research from time to time to provide consumer

with the products which are trending in the market.

Technological factors: The technological factors are highly affecting organisations in

auto mobile industry. It is often seen that the technological advancement is bringing benefits

to the organisation and when taking the merger between two organisation into context they

can successfully intake all the technological advancement. The investment which is required

for these advancement is also present with the organisation which will successfully help them

in developing as one of the biggest car manufacturer in the world.

Opportunities: Both of these organisations coming together will have huge funds available

with them. These funds can be successfully used by them in order to make sure that they are

investing on research and development department. Along with this they can adopt all the

new technologies in the market which will help them to bring in products and services which

have not been offered to their consumers. The technological development will also help them

to stand the competition in the market in order to meet all their objectives and aims.

Environmental factors: The environmental factors are highly affecting automobile

industry as all the products of this industry are having some impact on the market. The

environment is getting polluted due to these auto mobiles and it is necessary for the

businesses to make sure that they are making cars which will not have a negative effect on

the environment (Brønn and Brønn, 2018). There are used pollutants released by cars in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

environment and Fiat Chrysler need to make sure that they are taking care of all the

environmental factors affecting business after the merger.

Threats: If the organisation fails to successfully develop cars which are environmental

friendly they can face threat in future. It is required by them to work upon various ways of

developing fuel-efficient and less polluting cars for customers. If the organisation does not

fulfil these requirements they can face negative influence from government of nations along

with the consumers. The organisation can also not develop sustainably if they do not focus

upon different environmental factors.

Legal factors: There are a number of rules and regulations which are to be followed

by businesses when they are running in different nations. These rules and regulations are

developed by the ruling parties and the government in the countries for different businesses.

When taking the merger into context it is often seen that some of the countries do not support

merger of huge organisations. This is because the competition in the market is reduced and

also some of the organisations set up their monopoly through the help of this strategic

alliance. Fiat Chrysler automobile and Peugeot Owner can face this threat in a number of

different countries due to the legal rules and regulations.

Threats: The organisation may face huge threat if they fail to follow the required laws which

have been created by government in different countries. It is often seen that when an

organisation is not successfully following all the rules and regulations of a country they may

face negative impact. This can be in the form of legal proceedings against the organisation

due to which they require to pay huge fine or may also lose their license of running the

business.

Porter’s five forces model

Bargaining power of buyers: When taking into context the bargaining power of the

consumers it is often seen that after both of these organisations have joined hands they can

successfully come up with new products. These new products will be different from the

competitor and reduce the bargaining power of their consumers in the market.

Bargaining power of suppliers: The bargaining power of suppliers will also be

reduced as both of these organisations have a number of different suppliers in the market

(Schmidt and Redler, 2018). Also the suppliers of both of these organisations will want to

join hands with huge organisation after the merger which will provide them with better

relations with the suppliers.

Competitive rivalry: The competitive rivalry for the organisation after the merger will

definitely reduce. When they are joining hands the manufacturing process and technological

environmental factors affecting business after the merger.

Threats: If the organisation fails to successfully develop cars which are environmental

friendly they can face threat in future. It is required by them to work upon various ways of

developing fuel-efficient and less polluting cars for customers. If the organisation does not

fulfil these requirements they can face negative influence from government of nations along

with the consumers. The organisation can also not develop sustainably if they do not focus

upon different environmental factors.

Legal factors: There are a number of rules and regulations which are to be followed

by businesses when they are running in different nations. These rules and regulations are

developed by the ruling parties and the government in the countries for different businesses.

When taking the merger into context it is often seen that some of the countries do not support

merger of huge organisations. This is because the competition in the market is reduced and

also some of the organisations set up their monopoly through the help of this strategic

alliance. Fiat Chrysler automobile and Peugeot Owner can face this threat in a number of

different countries due to the legal rules and regulations.

Threats: The organisation may face huge threat if they fail to follow the required laws which

have been created by government in different countries. It is often seen that when an

organisation is not successfully following all the rules and regulations of a country they may

face negative impact. This can be in the form of legal proceedings against the organisation

due to which they require to pay huge fine or may also lose their license of running the

business.

Porter’s five forces model

Bargaining power of buyers: When taking into context the bargaining power of the

consumers it is often seen that after both of these organisations have joined hands they can

successfully come up with new products. These new products will be different from the

competitor and reduce the bargaining power of their consumers in the market.

Bargaining power of suppliers: The bargaining power of suppliers will also be

reduced as both of these organisations have a number of different suppliers in the market

(Schmidt and Redler, 2018). Also the suppliers of both of these organisations will want to

join hands with huge organisation after the merger which will provide them with better

relations with the suppliers.

Competitive rivalry: The competitive rivalry for the organisation after the merger will

definitely reduce. When they are joining hands the manufacturing process and technological

advancement of the organisation will help them to reduce the competition in the market

throughout the globe.

Threat from substitutes: There are a number of substitute product present in the market of

auto mobile industry (Rugman and Verbek, 2017). However providing great quality to

the consumer will help the organisation to make sure that they are reducing the threat from

substitute and differentiating their products and services for their consumers as compare to

the competitors in the market.

Threat from new entrants: The amount which is required by new entrants to enter

into automotive industry is huge. Due to this the threat from new entrants for Fiat Chrysler

and Peugeot Owner will reduce as both of them work together. The technological

advancement and investment required in research and development department is also huge

due to which most of the companies do not enter into such industry.

Analysis of internal components providing core competency to business

VRIO analysis

Valuable: these are all the resources of the organisation which are valuable for business. It is

necessary that business is managing all these resources to make sure that they are providing a

tough competition in the industry. Below mentioned are various valuable resources present

with both Fiat Chrysler auto mobile and Peugeot Owner while taking the merger into context:

Manufacturing process which is used in both of the organisation is valuable to them as

they require producing high-quality products for the consumer. It is a great advantage

in competitive environment.

Technology is also valuable resource for both of these organisations as it is required

by them to develop best quality of the new products which they will be launching in

the market. It is a great way to bring competitive advantage to the business as well.

The local and international presence of both the organisation in the market is one of

the valuable resources which will help them to gain attention from most of the

consumers.

The skilled and trained employees in both of the organisation or also valuable

resource for the organisation which will successfully help in bringing creative and

innovative ideas in future.

Rare: Rare resources consist of all the resources for an organisation which their competitors

cannot inherit easily. Fiat Chrysler and Peugeot Owner there are a number of resources which

throughout the globe.

Threat from substitutes: There are a number of substitute product present in the market of

auto mobile industry (Rugman and Verbek, 2017). However providing great quality to

the consumer will help the organisation to make sure that they are reducing the threat from

substitute and differentiating their products and services for their consumers as compare to

the competitors in the market.

Threat from new entrants: The amount which is required by new entrants to enter

into automotive industry is huge. Due to this the threat from new entrants for Fiat Chrysler

and Peugeot Owner will reduce as both of them work together. The technological

advancement and investment required in research and development department is also huge

due to which most of the companies do not enter into such industry.

Analysis of internal components providing core competency to business

VRIO analysis

Valuable: these are all the resources of the organisation which are valuable for business. It is

necessary that business is managing all these resources to make sure that they are providing a

tough competition in the industry. Below mentioned are various valuable resources present

with both Fiat Chrysler auto mobile and Peugeot Owner while taking the merger into context:

Manufacturing process which is used in both of the organisation is valuable to them as

they require producing high-quality products for the consumer. It is a great advantage

in competitive environment.

Technology is also valuable resource for both of these organisations as it is required

by them to develop best quality of the new products which they will be launching in

the market. It is a great way to bring competitive advantage to the business as well.

The local and international presence of both the organisation in the market is one of

the valuable resources which will help them to gain attention from most of the

consumers.

The skilled and trained employees in both of the organisation or also valuable

resource for the organisation which will successfully help in bringing creative and

innovative ideas in future.

Rare: Rare resources consist of all the resources for an organisation which their competitors

cannot inherit easily. Fiat Chrysler and Peugeot Owner there are a number of resources which

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

are rare for the organisation and it is difficult for their competitors to use these resources as

mentioned below:

Technology is one of the most real resources present with both of these organisation

as the competitors require huge fund to invest on gaining such technological

development.

The popularity of both these brands is very good in their own region. This will help

them to attain huge range of customer base as they will be working throughout the

globe.

The employees which have been trained and experienced in the organisation are one

of the major resources for the organisation. It is difficult for the competitors of

organisation to gain such talented and skilled employees.

Imitable: Imitable resources refers to all the resources which cannot be copied by the

competitors of a business (Keyes, 2016). Fiat Chrysler automobiles and Peugeot Owner are

the organisations which have various imitable resources as mentioned below:

The brand popularity is one of the most imitable resources which is bringing huge

population to the organisation which their competitors cannot. Along with the already

existing customers they are also continuously developing more consumers for them in

market.

The nature of the employs and behaviour of employees in the organisation is also one

of the resources which cannot be copied by the competitors of Fiat Chrysler and

Peugeot Owner which make them difficult to copy

Organised: It is required by organisation to make sure that they are successfully organising

all the resources available to them. These resources are organised in a manner to bring

maximum profit to the organisation. Below mentioned are some of the major resources which

are bringing profit for Fiat Chrysler and Peugeot Owner:

Employs of both the organisations are well trained and skilled. These employees are

successfully motivated and increase from time to time with a number of different

incentives and benefits they gain an organisation. In order to make sure that maximum

productivity can be gained by these employs both of the organisation and training

them and making sure that it provides them with competitive advantage.

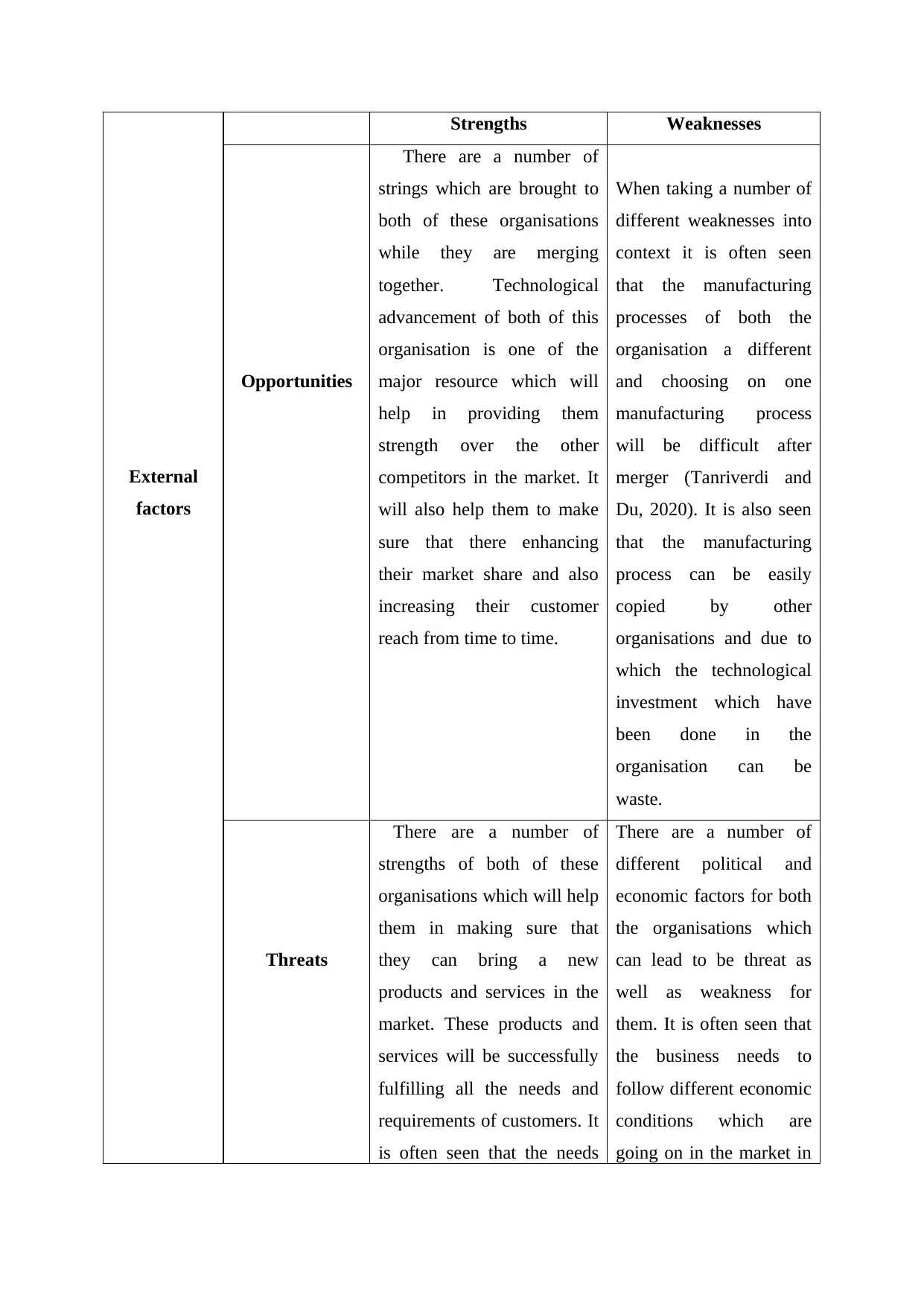

Strategy that company implemented recently and evaluating its SAFe criteria

TOWS analysis

Internal factors

mentioned below:

Technology is one of the most real resources present with both of these organisation

as the competitors require huge fund to invest on gaining such technological

development.

The popularity of both these brands is very good in their own region. This will help

them to attain huge range of customer base as they will be working throughout the

globe.

The employees which have been trained and experienced in the organisation are one

of the major resources for the organisation. It is difficult for the competitors of

organisation to gain such talented and skilled employees.

Imitable: Imitable resources refers to all the resources which cannot be copied by the

competitors of a business (Keyes, 2016). Fiat Chrysler automobiles and Peugeot Owner are

the organisations which have various imitable resources as mentioned below:

The brand popularity is one of the most imitable resources which is bringing huge

population to the organisation which their competitors cannot. Along with the already

existing customers they are also continuously developing more consumers for them in

market.

The nature of the employs and behaviour of employees in the organisation is also one

of the resources which cannot be copied by the competitors of Fiat Chrysler and

Peugeot Owner which make them difficult to copy

Organised: It is required by organisation to make sure that they are successfully organising

all the resources available to them. These resources are organised in a manner to bring

maximum profit to the organisation. Below mentioned are some of the major resources which

are bringing profit for Fiat Chrysler and Peugeot Owner:

Employs of both the organisations are well trained and skilled. These employees are

successfully motivated and increase from time to time with a number of different

incentives and benefits they gain an organisation. In order to make sure that maximum

productivity can be gained by these employs both of the organisation and training

them and making sure that it provides them with competitive advantage.

Strategy that company implemented recently and evaluating its SAFe criteria

TOWS analysis

Internal factors

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

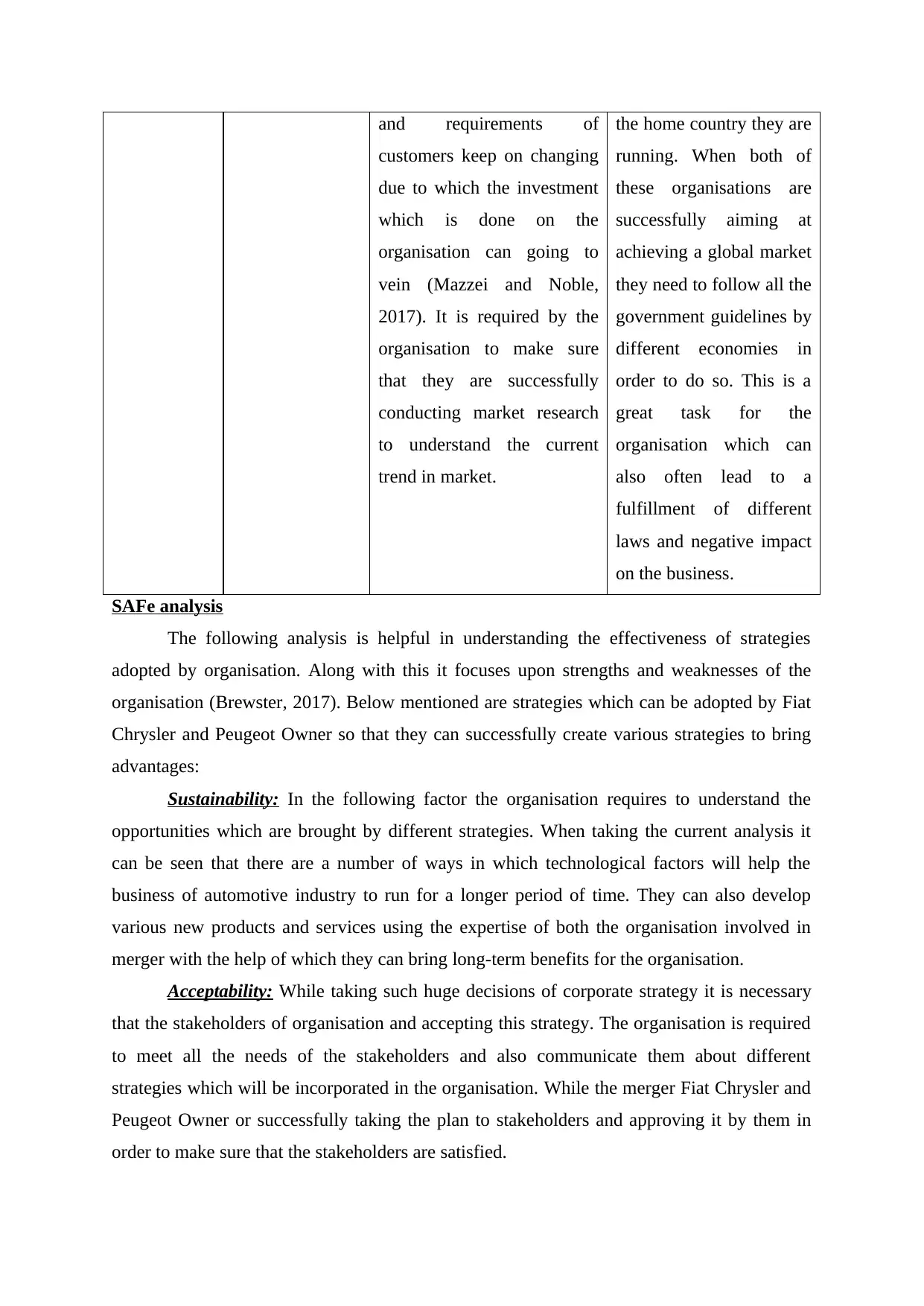

External

factors

Strengths Weaknesses

Opportunities

There are a number of

strings which are brought to

both of these organisations

while they are merging

together. Technological

advancement of both of this

organisation is one of the

major resource which will

help in providing them

strength over the other

competitors in the market. It

will also help them to make

sure that there enhancing

their market share and also

increasing their customer

reach from time to time.

When taking a number of

different weaknesses into

context it is often seen

that the manufacturing

processes of both the

organisation a different

and choosing on one

manufacturing process

will be difficult after

merger (Tanriverdi and

Du, 2020). It is also seen

that the manufacturing

process can be easily

copied by other

organisations and due to

which the technological

investment which have

been done in the

organisation can be

waste.

Threats

There are a number of

strengths of both of these

organisations which will help

them in making sure that

they can bring a new

products and services in the

market. These products and

services will be successfully

fulfilling all the needs and

requirements of customers. It

is often seen that the needs

There are a number of

different political and

economic factors for both

the organisations which

can lead to be threat as

well as weakness for

them. It is often seen that

the business needs to

follow different economic

conditions which are

going on in the market in

factors

Strengths Weaknesses

Opportunities

There are a number of

strings which are brought to

both of these organisations

while they are merging

together. Technological

advancement of both of this

organisation is one of the

major resource which will

help in providing them

strength over the other

competitors in the market. It

will also help them to make

sure that there enhancing

their market share and also

increasing their customer

reach from time to time.

When taking a number of

different weaknesses into

context it is often seen

that the manufacturing

processes of both the

organisation a different

and choosing on one

manufacturing process

will be difficult after

merger (Tanriverdi and

Du, 2020). It is also seen

that the manufacturing

process can be easily

copied by other

organisations and due to

which the technological

investment which have

been done in the

organisation can be

waste.

Threats

There are a number of

strengths of both of these

organisations which will help

them in making sure that

they can bring a new

products and services in the

market. These products and

services will be successfully

fulfilling all the needs and

requirements of customers. It

is often seen that the needs

There are a number of

different political and

economic factors for both

the organisations which

can lead to be threat as

well as weakness for

them. It is often seen that

the business needs to

follow different economic

conditions which are

going on in the market in

and requirements of

customers keep on changing

due to which the investment

which is done on the

organisation can going to

vein (Mazzei and Noble,

2017). It is required by the

organisation to make sure

that they are successfully

conducting market research

to understand the current

trend in market.

the home country they are

running. When both of

these organisations are

successfully aiming at

achieving a global market

they need to follow all the

government guidelines by

different economies in

order to do so. This is a

great task for the

organisation which can

also often lead to a

fulfillment of different

laws and negative impact

on the business.

SAFe analysis

The following analysis is helpful in understanding the effectiveness of strategies

adopted by organisation. Along with this it focuses upon strengths and weaknesses of the

organisation (Brewster, 2017). Below mentioned are strategies which can be adopted by Fiat

Chrysler and Peugeot Owner so that they can successfully create various strategies to bring

advantages:

Sustainability: In the following factor the organisation requires to understand the

opportunities which are brought by different strategies. When taking the current analysis it

can be seen that there are a number of ways in which technological factors will help the

business of automotive industry to run for a longer period of time. They can also develop

various new products and services using the expertise of both the organisation involved in

merger with the help of which they can bring long-term benefits for the organisation.

Acceptability: While taking such huge decisions of corporate strategy it is necessary

that the stakeholders of organisation and accepting this strategy. The organisation is required

to meet all the needs of the stakeholders and also communicate them about different

strategies which will be incorporated in the organisation. While the merger Fiat Chrysler and

Peugeot Owner or successfully taking the plan to stakeholders and approving it by them in

order to make sure that the stakeholders are satisfied.

customers keep on changing

due to which the investment

which is done on the

organisation can going to

vein (Mazzei and Noble,

2017). It is required by the

organisation to make sure

that they are successfully

conducting market research

to understand the current

trend in market.

the home country they are

running. When both of

these organisations are

successfully aiming at

achieving a global market

they need to follow all the

government guidelines by

different economies in

order to do so. This is a

great task for the

organisation which can

also often lead to a

fulfillment of different

laws and negative impact

on the business.

SAFe analysis

The following analysis is helpful in understanding the effectiveness of strategies

adopted by organisation. Along with this it focuses upon strengths and weaknesses of the

organisation (Brewster, 2017). Below mentioned are strategies which can be adopted by Fiat

Chrysler and Peugeot Owner so that they can successfully create various strategies to bring

advantages:

Sustainability: In the following factor the organisation requires to understand the

opportunities which are brought by different strategies. When taking the current analysis it

can be seen that there are a number of ways in which technological factors will help the

business of automotive industry to run for a longer period of time. They can also develop

various new products and services using the expertise of both the organisation involved in

merger with the help of which they can bring long-term benefits for the organisation.

Acceptability: While taking such huge decisions of corporate strategy it is necessary

that the stakeholders of organisation and accepting this strategy. The organisation is required

to meet all the needs of the stakeholders and also communicate them about different

strategies which will be incorporated in the organisation. While the merger Fiat Chrysler and

Peugeot Owner or successfully taking the plan to stakeholders and approving it by them in

order to make sure that the stakeholders are satisfied.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Feasibility: The last aspect of the following analysis is feasibility in which it is

necessary to understand the resources present with both the organisations to carry out the

merger. It is necessary that the employees of the organisation and all other resources of the

organisation in merger are supporting the decision (Köhler and Zerfass, 2019). Fiat Chrysler

automobiles and Peugeot Owners are launching new car which will help them to generate

huge profits in the market. It is required by them to analyse the customers of both the

organisation and also employs of both the organisation that will be carrying out this

execution.

Conclusion

With the help of the following report it can be concluded that there are various factors in

internal and external environment that are affecting a business. While making big decisions

like merger it is necessary for business to analyse all these factors to successfully conduct all

the activities in merger. There are also a number of different threats and opportunities which

will be brought by organisation while they are following this strategic plan and it is necessary

for management to list down the drawbacks and benefits of all these steps. Fulfilling all these

requirements organisation can successfully go for merger and achieve all their future aims

and objectives.

necessary to understand the resources present with both the organisations to carry out the

merger. It is necessary that the employees of the organisation and all other resources of the

organisation in merger are supporting the decision (Köhler and Zerfass, 2019). Fiat Chrysler

automobiles and Peugeot Owners are launching new car which will help them to generate

huge profits in the market. It is required by them to analyse the customers of both the

organisation and also employs of both the organisation that will be carrying out this

execution.

Conclusion

With the help of the following report it can be concluded that there are various factors in

internal and external environment that are affecting a business. While making big decisions

like merger it is necessary for business to analyse all these factors to successfully conduct all

the activities in merger. There are also a number of different threats and opportunities which

will be brought by organisation while they are following this strategic plan and it is necessary

for management to list down the drawbacks and benefits of all these steps. Fulfilling all these

requirements organisation can successfully go for merger and achieve all their future aims

and objectives.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Books and Journals

Tanriverdi, H. and Du, K., 2020. Corporate strategy changes and information technology

control effectiveness in multibusiness firms. Management Information Systems

Quarterly, 44(4), pp.1573-1617.

Mazzei, M.J. and Noble, D., 2017. Big data dreams: A framework for corporate

strategy. Business Horizons, 60(3), pp.405-414.

Brewster, C., 2017. The integration of human resource management and corporate

strategy. Policy and practice in European human resource management, pp.22-35.

Köhler, K. and Zerfass, A., 2019. Communicating the corporate strategy. Journal of

Communication Management.

Keyes, J., 2016. Implementing the IT balanced scorecard: Aligning IT with corporate

strategy. CRC Press.

Rugman, A.M. and Verbeke, A., 2017. Global corporate strategy and trade policy (Vol. 12).

Routledge.

Schmidt, H.J. and Redler, J., 2018. How diverse is corporate brand management research?

Comparing schools of corporate brand management with approaches to corporate

strategy. Journal of Product & Brand Management.

Brønn, C. and Brønn, P.S., 2018. Corporate strategy. The International Encyclopedia of

Strategic Communication, pp.1-18.

Hardy, S.M., Lexa, F.J. and Bruno, M.A., 2020. Potential implications of current corporate

strategy for the US radiology industry. Journal of the American College of

Radiology, 17(3), pp.361-364.

Surijah, A.B., 2016. GLOBAL ENVIRONMENT, CORPORATE STRATEGY, LEARNING

CULTURE AND HUMAN CAPITAL: A THEORETICAL

REVIEW. International Journal of Organizational Innovation, 8(4).

Dahl, T. and Fløttum, K., 2019. Climate change as a corporate strategy issue. Corporate

Communications: An International Journal.

Books and Journals

Tanriverdi, H. and Du, K., 2020. Corporate strategy changes and information technology

control effectiveness in multibusiness firms. Management Information Systems

Quarterly, 44(4), pp.1573-1617.

Mazzei, M.J. and Noble, D., 2017. Big data dreams: A framework for corporate

strategy. Business Horizons, 60(3), pp.405-414.

Brewster, C., 2017. The integration of human resource management and corporate

strategy. Policy and practice in European human resource management, pp.22-35.

Köhler, K. and Zerfass, A., 2019. Communicating the corporate strategy. Journal of

Communication Management.

Keyes, J., 2016. Implementing the IT balanced scorecard: Aligning IT with corporate

strategy. CRC Press.

Rugman, A.M. and Verbeke, A., 2017. Global corporate strategy and trade policy (Vol. 12).

Routledge.

Schmidt, H.J. and Redler, J., 2018. How diverse is corporate brand management research?

Comparing schools of corporate brand management with approaches to corporate

strategy. Journal of Product & Brand Management.

Brønn, C. and Brønn, P.S., 2018. Corporate strategy. The International Encyclopedia of

Strategic Communication, pp.1-18.

Hardy, S.M., Lexa, F.J. and Bruno, M.A., 2020. Potential implications of current corporate

strategy for the US radiology industry. Journal of the American College of

Radiology, 17(3), pp.361-364.

Surijah, A.B., 2016. GLOBAL ENVIRONMENT, CORPORATE STRATEGY, LEARNING

CULTURE AND HUMAN CAPITAL: A THEORETICAL

REVIEW. International Journal of Organizational Innovation, 8(4).

Dahl, T. and Fløttum, K., 2019. Climate change as a corporate strategy issue. Corporate

Communications: An International Journal.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.