University Applied Mathematics Homework: Financial Problem Solutions

VerifiedAdded on 2020/04/07

|9

|1006

|358

Homework Assignment

AI Summary

This assignment solution provides detailed answers to a series of applied mathematics problems with a focus on financial applications. The solutions cover a range of topics, including calculating gross earnings based on base salary and commission, determining sales revenue and tax remittances, and comparing prices across different tax jurisdictions. Further problems address break-even analysis, calculating contribution margins, and determining break-even points under various scenarios. The assignment also includes solutions to problems involving discounts, markups, and markdowns, and explores concepts such as overhead, profit margins, and the calculation of selling prices. The solutions are comprehensive and step-by-step, making it a valuable resource for students studying applied mathematics and finance.

Applied Mathematics

Name

University

21st September 2017

1

Name

University

21st September 2017

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 30:

Q16: Silvio’s gross earnings for last week were $328.54. His remuneration consists of a base

salary of $280 plus a commission of 6% on net sales exceeding his weekly quota of $5000. What

were Silvio’s gross sales for the week if sales returns and allowances were $136?

Solution

Let gross sales be s;

280+0.06 (s−136−5000)=$ 328.54280+0.06 s−308.16=328.54 0.06 s−28.16=328.54 ,

S=$ 5945=Gross sales .

Q18: Ramona’s Dry Cleaning shows sales revenue of $76,000 for the year. Romano’s GST-

taxable expenses were $14,960. How much should she remit to the government at the end of the

year?

Solution

Tax on GST =0.05∗14 ,960=$ 748

Tax on Sales revenue=0.08∗76,000=$ 6,080

Total amount ¿ remit =$ 6,080+$ 748=$ 6,828

Q20: A store located in Kelowna, B.C., sells a computer for $1868 plus GST and PST. If the

same model is sold at the same price in a store in Kenora, Ontario, what is the difference in the

prices paid by customers in the two stores?

Solution

In Kelowna BC, total tax rate = PST + GST = 7% + 5% = 12%

Similarly

In Kenora Ontario, total tax rate = HST + GST = 8% + 5% = 13%

Therefore in Kelowna BC,

Consumer would pay $1868 + 12% of $1868 = 1868 + 224.16 = $2092.16

Also in Kenora

Consumer would pay $1868 + 13% of $1868 = 1868 + 242.84 = $2110.84

Difference in price = $2110.84 - $2092.16 = $18.68

Page 116-117:

2

Q16: Silvio’s gross earnings for last week were $328.54. His remuneration consists of a base

salary of $280 plus a commission of 6% on net sales exceeding his weekly quota of $5000. What

were Silvio’s gross sales for the week if sales returns and allowances were $136?

Solution

Let gross sales be s;

280+0.06 (s−136−5000)=$ 328.54280+0.06 s−308.16=328.54 0.06 s−28.16=328.54 ,

S=$ 5945=Gross sales .

Q18: Ramona’s Dry Cleaning shows sales revenue of $76,000 for the year. Romano’s GST-

taxable expenses were $14,960. How much should she remit to the government at the end of the

year?

Solution

Tax on GST =0.05∗14 ,960=$ 748

Tax on Sales revenue=0.08∗76,000=$ 6,080

Total amount ¿ remit =$ 6,080+$ 748=$ 6,828

Q20: A store located in Kelowna, B.C., sells a computer for $1868 plus GST and PST. If the

same model is sold at the same price in a store in Kenora, Ontario, what is the difference in the

prices paid by customers in the two stores?

Solution

In Kelowna BC, total tax rate = PST + GST = 7% + 5% = 12%

Similarly

In Kenora Ontario, total tax rate = HST + GST = 8% + 5% = 13%

Therefore in Kelowna BC,

Consumer would pay $1868 + 12% of $1868 = 1868 + 224.16 = $2092.16

Also in Kenora

Consumer would pay $1868 + 13% of $1868 = 1868 + 242.84 = $2110.84

Difference in price = $2110.84 - $2092.16 = $18.68

Page 116-117:

2

Q2: The following information is available from the accounting records of Eva Corporation:

Fixed costs per period are $4800. Sales volume for the last period was $19,360, and variable

costs were $13,552. Capacity per period is a sales volume of $32,000.

(a) Compute

(i) The contribution margin;

Contribution margin=Revenue – Variable cost

Contribution margin=$ 19,360 – $ 13,552

Contribution margin=$ 5,808

(ii) The contribution rate

Solution

Contribution rate=Contribution margin

Revenue = $ 5808

$ 19360 =30 %

(b) Compute the break-even point

(i) In sales dollars;

Solution

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 4800

0.3 =$ 16 , 000

(ii) As a percent of capacity.

Solution

Break−even point as a percentage of capacity= Break−even point ∈units

C apacity for the period = $ 16 000

$ 32000 ∗100 %=50

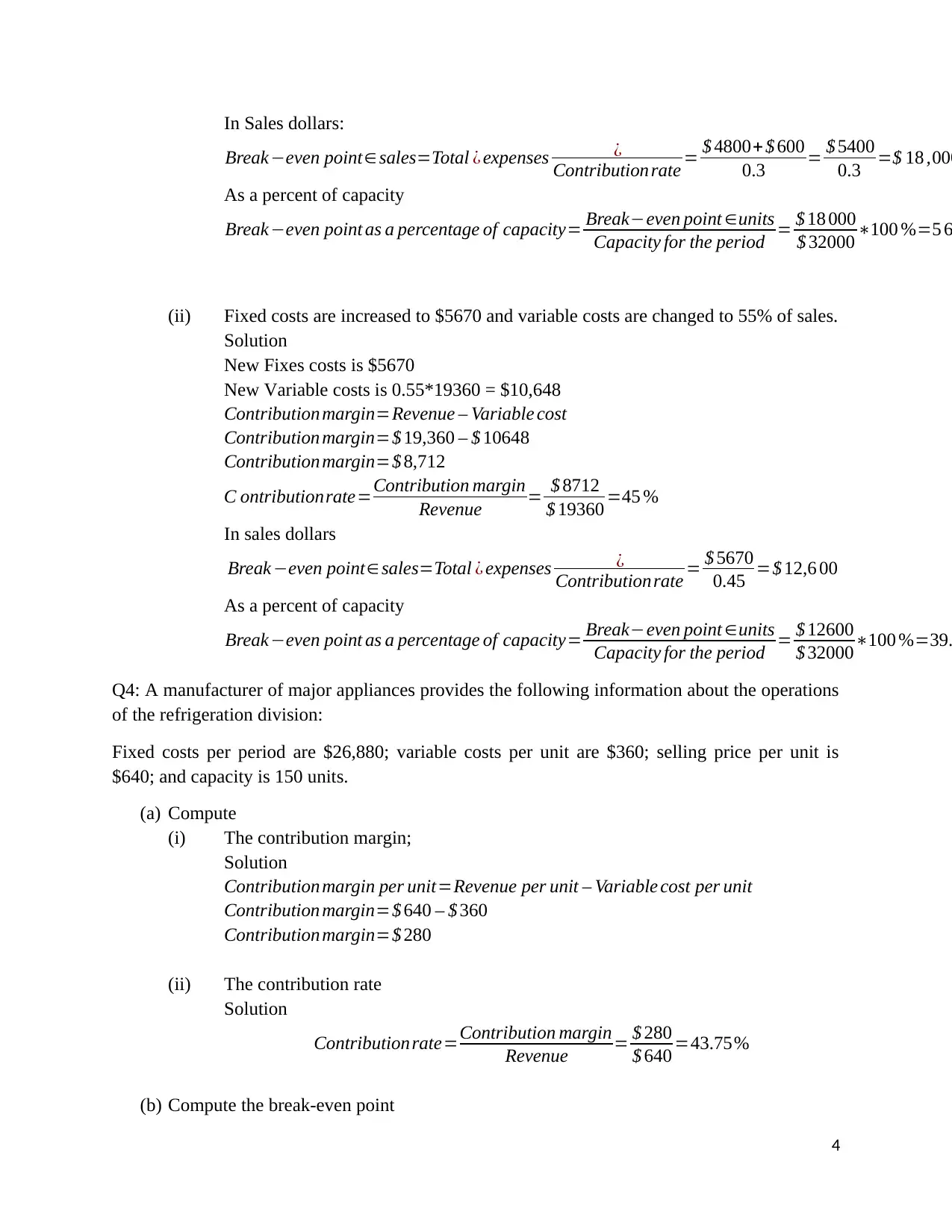

(c) Draw a detailed break-even chart.

Solution

(d) For each of the following independent situations, determine the break-even point:

(i) Fixed costs are decreased by $600;

Solution

3

Fixed costs per period are $4800. Sales volume for the last period was $19,360, and variable

costs were $13,552. Capacity per period is a sales volume of $32,000.

(a) Compute

(i) The contribution margin;

Contribution margin=Revenue – Variable cost

Contribution margin=$ 19,360 – $ 13,552

Contribution margin=$ 5,808

(ii) The contribution rate

Solution

Contribution rate=Contribution margin

Revenue = $ 5808

$ 19360 =30 %

(b) Compute the break-even point

(i) In sales dollars;

Solution

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 4800

0.3 =$ 16 , 000

(ii) As a percent of capacity.

Solution

Break−even point as a percentage of capacity= Break−even point ∈units

C apacity for the period = $ 16 000

$ 32000 ∗100 %=50

(c) Draw a detailed break-even chart.

Solution

(d) For each of the following independent situations, determine the break-even point:

(i) Fixed costs are decreased by $600;

Solution

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In Sales dollars:

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 4800+ $ 600

0.3 = $ 5400

0.3 =$ 18 ,000

As a percent of capacity

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = $ 18 000

$ 32000 ∗100 %=5 6

(ii) Fixed costs are increased to $5670 and variable costs are changed to 55% of sales.

Solution

New Fixes costs is $5670

New Variable costs is 0.55*19360 = $10,648

Contribution margin=Revenue – Variable cost

Contribution margin=$ 19,360 – $ 10648

Contribution margin=$ 8,712

C ontributionrate=Contribution margin

Revenue = $ 8712

$ 19360 =45 %

In sales dollars

Break−even point∈sales=Total ¿ expenses ¿

Contribution rate = $ 5670

0.45 =$ 12,6 00

As a percent of capacity

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = $ 12600

$ 32000∗100 %=39.

Q4: A manufacturer of major appliances provides the following information about the operations

of the refrigeration division:

Fixed costs per period are $26,880; variable costs per unit are $360; selling price per unit is

$640; and capacity is 150 units.

(a) Compute

(i) The contribution margin;

Solution

Contribution margin per unit=Revenue per unit – Variable cost per unit

Contribution margin=$ 640 – $ 360

Contribution margin=$ 280

(ii) The contribution rate

Solution

Contribution rate=Contribution margin

Revenue = $ 280

$ 640 =43.75%

(b) Compute the break-even point

4

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 4800+ $ 600

0.3 = $ 5400

0.3 =$ 18 ,000

As a percent of capacity

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = $ 18 000

$ 32000 ∗100 %=5 6

(ii) Fixed costs are increased to $5670 and variable costs are changed to 55% of sales.

Solution

New Fixes costs is $5670

New Variable costs is 0.55*19360 = $10,648

Contribution margin=Revenue – Variable cost

Contribution margin=$ 19,360 – $ 10648

Contribution margin=$ 8,712

C ontributionrate=Contribution margin

Revenue = $ 8712

$ 19360 =45 %

In sales dollars

Break−even point∈sales=Total ¿ expenses ¿

Contribution rate = $ 5670

0.45 =$ 12,6 00

As a percent of capacity

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = $ 12600

$ 32000∗100 %=39.

Q4: A manufacturer of major appliances provides the following information about the operations

of the refrigeration division:

Fixed costs per period are $26,880; variable costs per unit are $360; selling price per unit is

$640; and capacity is 150 units.

(a) Compute

(i) The contribution margin;

Solution

Contribution margin per unit=Revenue per unit – Variable cost per unit

Contribution margin=$ 640 – $ 360

Contribution margin=$ 280

(ii) The contribution rate

Solution

Contribution rate=Contribution margin

Revenue = $ 280

$ 640 =43.75%

(b) Compute the break-even point

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(i) In units;

Solution

Break−even point∈units=Total ¿ expenses ¿

Contribution per unit = $ 26880

$ 280 =96

(ii) As a percent of capacity;

Solution

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = 96

15 0∗100 %=64 %

(iii) In sales dollars.

Solution

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 2688 0

0.4375 =$ 61,440

(c) Determine the break-even point in sales dollars if fixed costs are increased to $32,200

Solution

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 3220 0

0.4375 =$ 73,600

(d) Determine the break-even point as a percent of capacity of fixed costs are reduced to

$23,808, while variable costs are increased to 60% of sales.

Solution

New Fixed costs is $23808

New Variable costs is 0.6*640 = $384

Contribution margin=Revenue – Variable cost

Contribution margin=$ 640 – $ 384

Contribution margin=$ 256

ontribution rate=Contribution margin

Revenue = $ 256

$ 640 =40 %

In sales dollars

Break−even point∈units=Total ¿ expenses ¿

Contribution per unit = $ 2380 8

$ 256 =93

As a percent of capacity

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = 93

150∗100 %=6 2 %

5

Solution

Break−even point∈units=Total ¿ expenses ¿

Contribution per unit = $ 26880

$ 280 =96

(ii) As a percent of capacity;

Solution

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = 96

15 0∗100 %=64 %

(iii) In sales dollars.

Solution

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 2688 0

0.4375 =$ 61,440

(c) Determine the break-even point in sales dollars if fixed costs are increased to $32,200

Solution

Break−even point∈ sales=Total ¿ expenses ¿

Contribution rate = $ 3220 0

0.4375 =$ 73,600

(d) Determine the break-even point as a percent of capacity of fixed costs are reduced to

$23,808, while variable costs are increased to 60% of sales.

Solution

New Fixed costs is $23808

New Variable costs is 0.6*640 = $384

Contribution margin=Revenue – Variable cost

Contribution margin=$ 640 – $ 384

Contribution margin=$ 256

ontribution rate=Contribution margin

Revenue = $ 256

$ 640 =40 %

In sales dollars

Break−even point∈units=Total ¿ expenses ¿

Contribution per unit = $ 2380 8

$ 256 =93

As a percent of capacity

Break−even point as a percentage of capacity= Break−even point ∈units

Capacity for the period = 93

150∗100 %=6 2 %

5

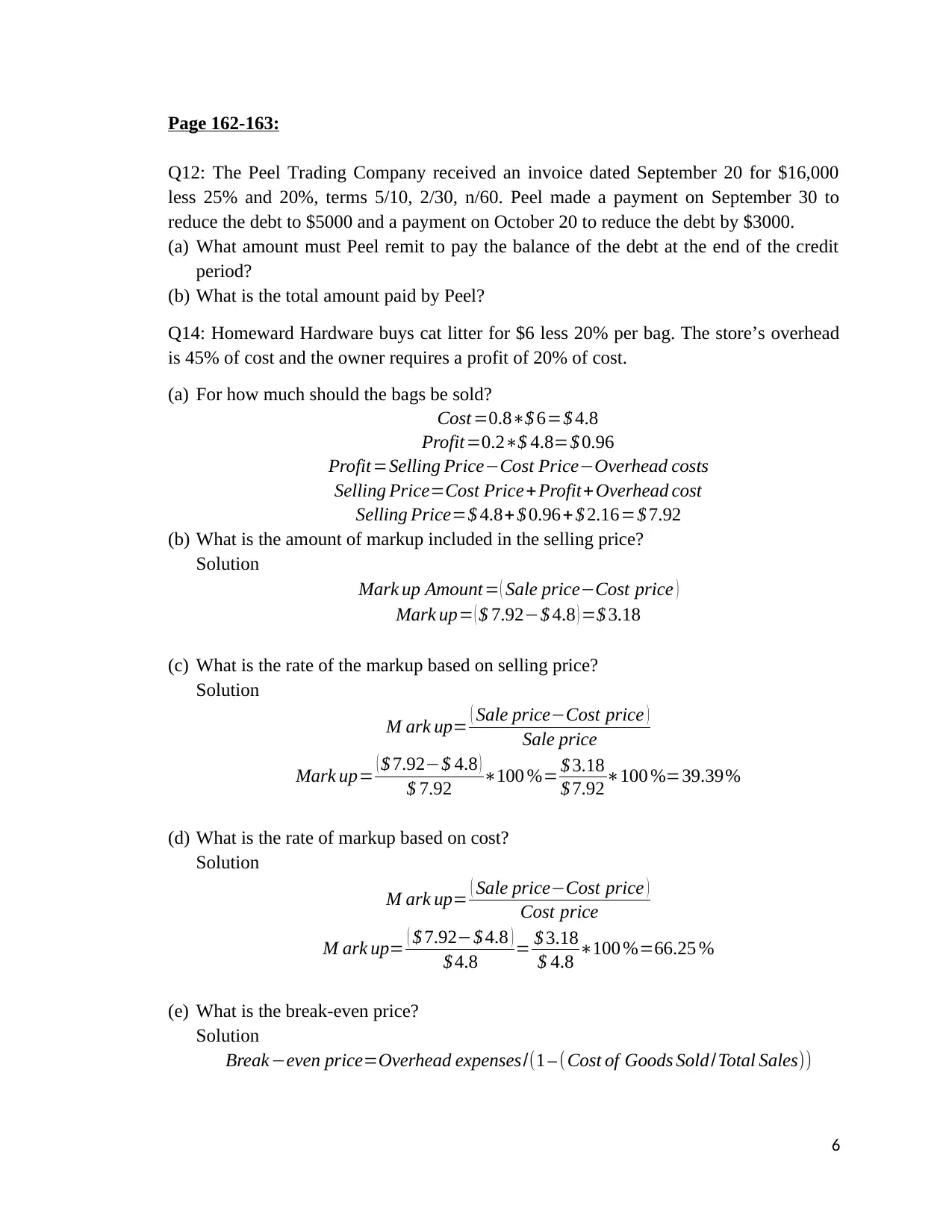

Page 162-163:

Q12: The Peel Trading Company received an invoice dated September 20 for $16,000

less 25% and 20%, terms 5/10, 2/30, n/60. Peel made a payment on September 30 to

reduce the debt to $5000 and a payment on October 20 to reduce the debt by $3000.

(a) What amount must Peel remit to pay the balance of the debt at the end of the credit

period?

(b) What is the total amount paid by Peel?

Q14: Homeward Hardware buys cat litter for $6 less 20% per bag. The store’s overhead

is 45% of cost and the owner requires a profit of 20% of cost.

(a) For how much should the bags be sold?

Cost =0.8∗$ 6=$ 4.8

Profit=0.2∗$ 4.8=$ 0.96

Profit=Selling Price−Cost Price−Overhead costs

Selling Price=Cost Price+ Profit+Overhead cost

Selling Price=$ 4.8+ $ 0.96+ $ 2.16=$ 7.92

(b) What is the amount of markup included in the selling price?

Solution

Mark up Amount= ( Sale price−Cost price )

Mark up= ( $ 7.92−$ 4.8 ) =$ 3.18

(c) What is the rate of the markup based on selling price?

Solution

M ark up= ( Sale price−Cost price )

Sale price

Mark up= ( $ 7.92−$ 4.8 )

$ 7.92 ∗100 %= $ 3.18

$ 7.92∗100 %=39.39%

(d) What is the rate of markup based on cost?

Solution

M ark up= ( Sale price−Cost price )

Cost price

M ark up= ( $ 7.92−$ 4.8 )

$ 4.8 = $ 3.18

$ 4.8 ∗100 %=66.25 %

(e) What is the break-even price?

Solution

Break−even price=Overhead expenses/(1 – (Cost of Goods Sold/Total Sales))

6

Q12: The Peel Trading Company received an invoice dated September 20 for $16,000

less 25% and 20%, terms 5/10, 2/30, n/60. Peel made a payment on September 30 to

reduce the debt to $5000 and a payment on October 20 to reduce the debt by $3000.

(a) What amount must Peel remit to pay the balance of the debt at the end of the credit

period?

(b) What is the total amount paid by Peel?

Q14: Homeward Hardware buys cat litter for $6 less 20% per bag. The store’s overhead

is 45% of cost and the owner requires a profit of 20% of cost.

(a) For how much should the bags be sold?

Cost =0.8∗$ 6=$ 4.8

Profit=0.2∗$ 4.8=$ 0.96

Profit=Selling Price−Cost Price−Overhead costs

Selling Price=Cost Price+ Profit+Overhead cost

Selling Price=$ 4.8+ $ 0.96+ $ 2.16=$ 7.92

(b) What is the amount of markup included in the selling price?

Solution

Mark up Amount= ( Sale price−Cost price )

Mark up= ( $ 7.92−$ 4.8 ) =$ 3.18

(c) What is the rate of the markup based on selling price?

Solution

M ark up= ( Sale price−Cost price )

Sale price

Mark up= ( $ 7.92−$ 4.8 )

$ 7.92 ∗100 %= $ 3.18

$ 7.92∗100 %=39.39%

(d) What is the rate of markup based on cost?

Solution

M ark up= ( Sale price−Cost price )

Cost price

M ark up= ( $ 7.92−$ 4.8 )

$ 4.8 = $ 3.18

$ 4.8 ∗100 %=66.25 %

(e) What is the break-even price?

Solution

Break−even price=Overhead expenses/(1 – (Cost of Goods Sold/Total Sales))

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

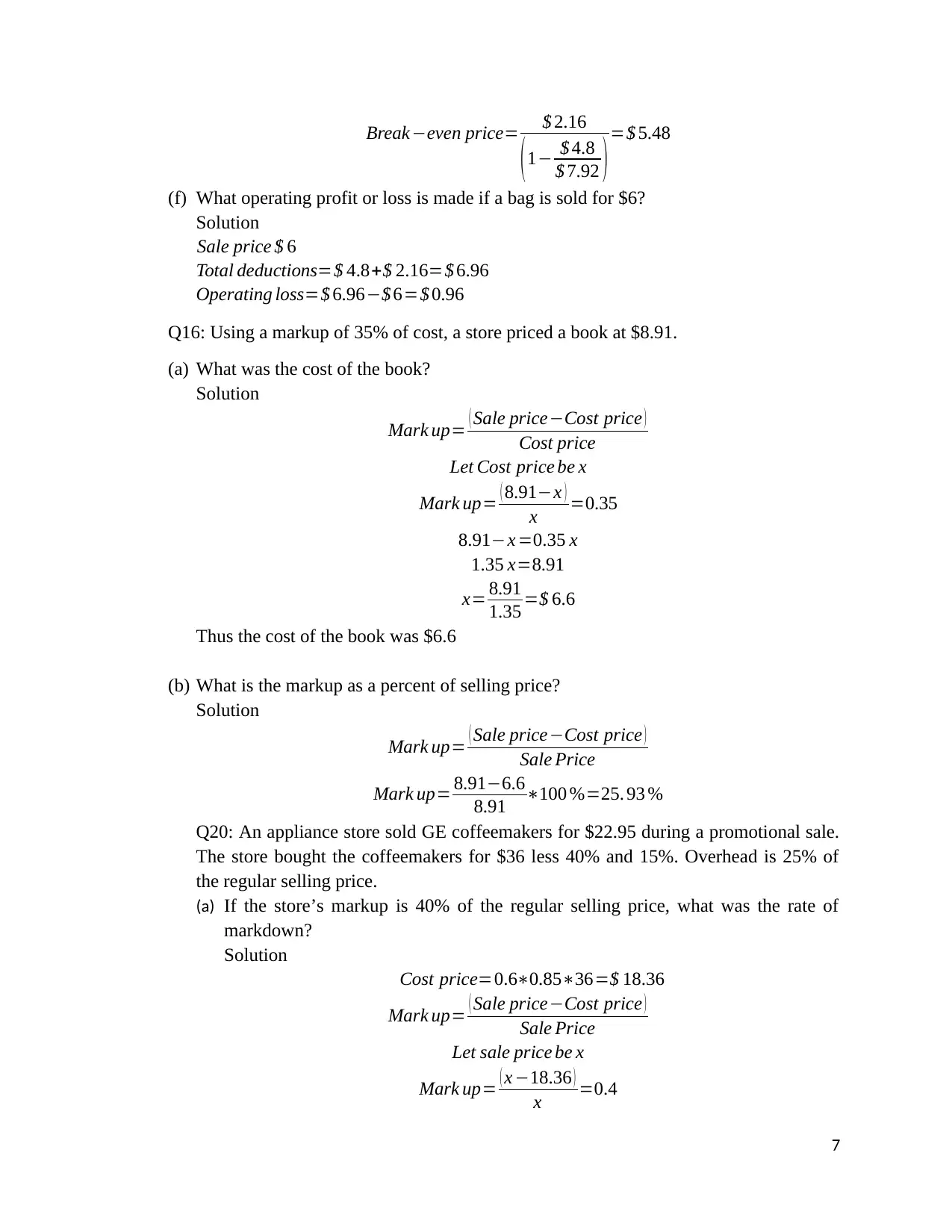

Break−even price= $ 2.16

(1− $ 4.8

$ 7.92 )=$ 5.48

(f) What operating profit or loss is made if a bag is sold for $6?

Solution

Sale price $ 6

Total deductions=$ 4.8+$ 2.16=$ 6.96

Operating loss=$ 6.96−$ 6=$ 0.96

Q16: Using a markup of 35% of cost, a store priced a book at $8.91.

(a) What was the cost of the book?

Solution

Mark up= ( Sale price−Cost price )

Cost price

Let Cost price be x

Mark up= ( 8.91−x )

x =0.35

8.91−x =0.35 x

1.35 x=8.91

x= 8.91

1.35 =$ 6.6

Thus the cost of the book was $6.6

(b) What is the markup as a percent of selling price?

Solution

Mark up= ( Sale price−Cost price )

Sale Price

Mark up= 8.91−6.6

8.91 ∗100 %=25. 93 %

Q20: An appliance store sold GE coffeemakers for $22.95 during a promotional sale.

The store bought the coffeemakers for $36 less 40% and 15%. Overhead is 25% of

the regular selling price.

(a) If the store’s markup is 40% of the regular selling price, what was the rate of

markdown?

Solution

Cost price=0.6∗0.85∗36=$ 18.36

Mark up= ( Sale price−Cost price )

Sale Price

Let sale price be x

Mark up= ( x −18.36 )

x =0.4

7

(1− $ 4.8

$ 7.92 )=$ 5.48

(f) What operating profit or loss is made if a bag is sold for $6?

Solution

Sale price $ 6

Total deductions=$ 4.8+$ 2.16=$ 6.96

Operating loss=$ 6.96−$ 6=$ 0.96

Q16: Using a markup of 35% of cost, a store priced a book at $8.91.

(a) What was the cost of the book?

Solution

Mark up= ( Sale price−Cost price )

Cost price

Let Cost price be x

Mark up= ( 8.91−x )

x =0.35

8.91−x =0.35 x

1.35 x=8.91

x= 8.91

1.35 =$ 6.6

Thus the cost of the book was $6.6

(b) What is the markup as a percent of selling price?

Solution

Mark up= ( Sale price−Cost price )

Sale Price

Mark up= 8.91−6.6

8.91 ∗100 %=25. 93 %

Q20: An appliance store sold GE coffeemakers for $22.95 during a promotional sale.

The store bought the coffeemakers for $36 less 40% and 15%. Overhead is 25% of

the regular selling price.

(a) If the store’s markup is 40% of the regular selling price, what was the rate of

markdown?

Solution

Cost price=0.6∗0.85∗36=$ 18.36

Mark up= ( Sale price−Cost price )

Sale Price

Let sale price be x

Mark up= ( x −18.36 )

x =0.4

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

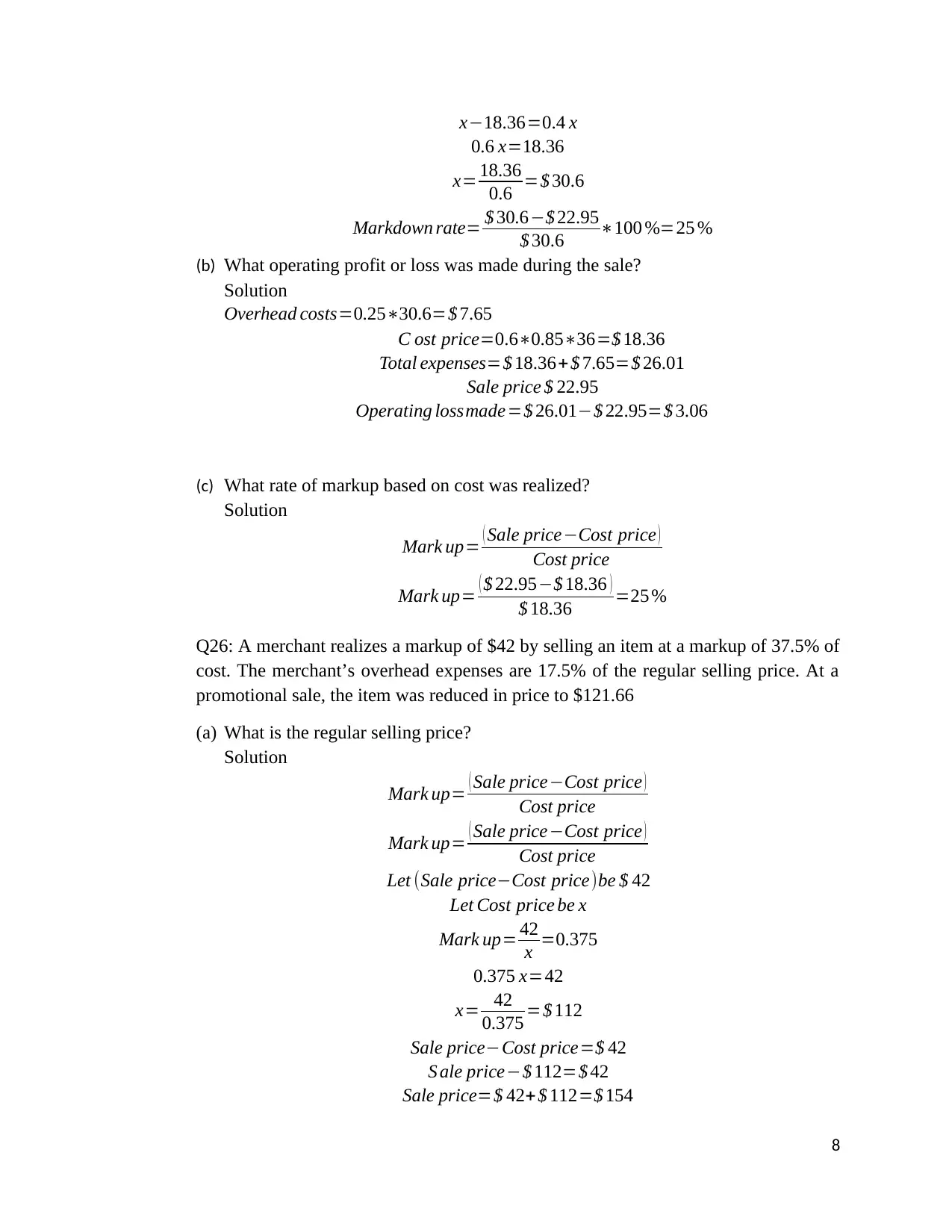

x−18.36=0.4 x

0.6 x=18.36

x= 18.36

0.6 =$ 30.6

Markdown rate= $ 30.6−$ 22.95

$ 30.6 ∗100 %=25 %

(b) What operating profit or loss was made during the sale?

Solution

Overhead costs=0.25∗30.6=$ 7.65

C ost price=0.6∗0.85∗36=$ 18.36

Total expenses=$ 18.36+$ 7.65=$ 26.01

Sale price $ 22.95

Operating lossmade=$ 26.01−$ 22.95=$ 3.06

(c) What rate of markup based on cost was realized?

Solution

Mark up= ( Sale price−Cost price )

Cost price

Mark up= ( $ 22.95−$ 18.36 )

$ 18.36 =25 %

Q26: A merchant realizes a markup of $42 by selling an item at a markup of 37.5% of

cost. The merchant’s overhead expenses are 17.5% of the regular selling price. At a

promotional sale, the item was reduced in price to $121.66

(a) What is the regular selling price?

Solution

Mark up= ( Sale price−Cost price )

Cost price

Mark up= ( Sale price−Cost price )

Cost price

Let (Sale price−Cost price)be $ 42

Let Cost price be x

Mark up= 42

x =0.375

0.375 x=42

x= 42

0.375 =$ 112

Sale price−Cost price=$ 42

S ale price−$ 112=$ 42

Sale price=$ 42+$ 112=$ 154

8

0.6 x=18.36

x= 18.36

0.6 =$ 30.6

Markdown rate= $ 30.6−$ 22.95

$ 30.6 ∗100 %=25 %

(b) What operating profit or loss was made during the sale?

Solution

Overhead costs=0.25∗30.6=$ 7.65

C ost price=0.6∗0.85∗36=$ 18.36

Total expenses=$ 18.36+$ 7.65=$ 26.01

Sale price $ 22.95

Operating lossmade=$ 26.01−$ 22.95=$ 3.06

(c) What rate of markup based on cost was realized?

Solution

Mark up= ( Sale price−Cost price )

Cost price

Mark up= ( $ 22.95−$ 18.36 )

$ 18.36 =25 %

Q26: A merchant realizes a markup of $42 by selling an item at a markup of 37.5% of

cost. The merchant’s overhead expenses are 17.5% of the regular selling price. At a

promotional sale, the item was reduced in price to $121.66

(a) What is the regular selling price?

Solution

Mark up= ( Sale price−Cost price )

Cost price

Mark up= ( Sale price−Cost price )

Cost price

Let (Sale price−Cost price)be $ 42

Let Cost price be x

Mark up= 42

x =0.375

0.375 x=42

x= 42

0.375 =$ 112

Sale price−Cost price=$ 42

S ale price−$ 112=$ 42

Sale price=$ 42+$ 112=$ 154

8

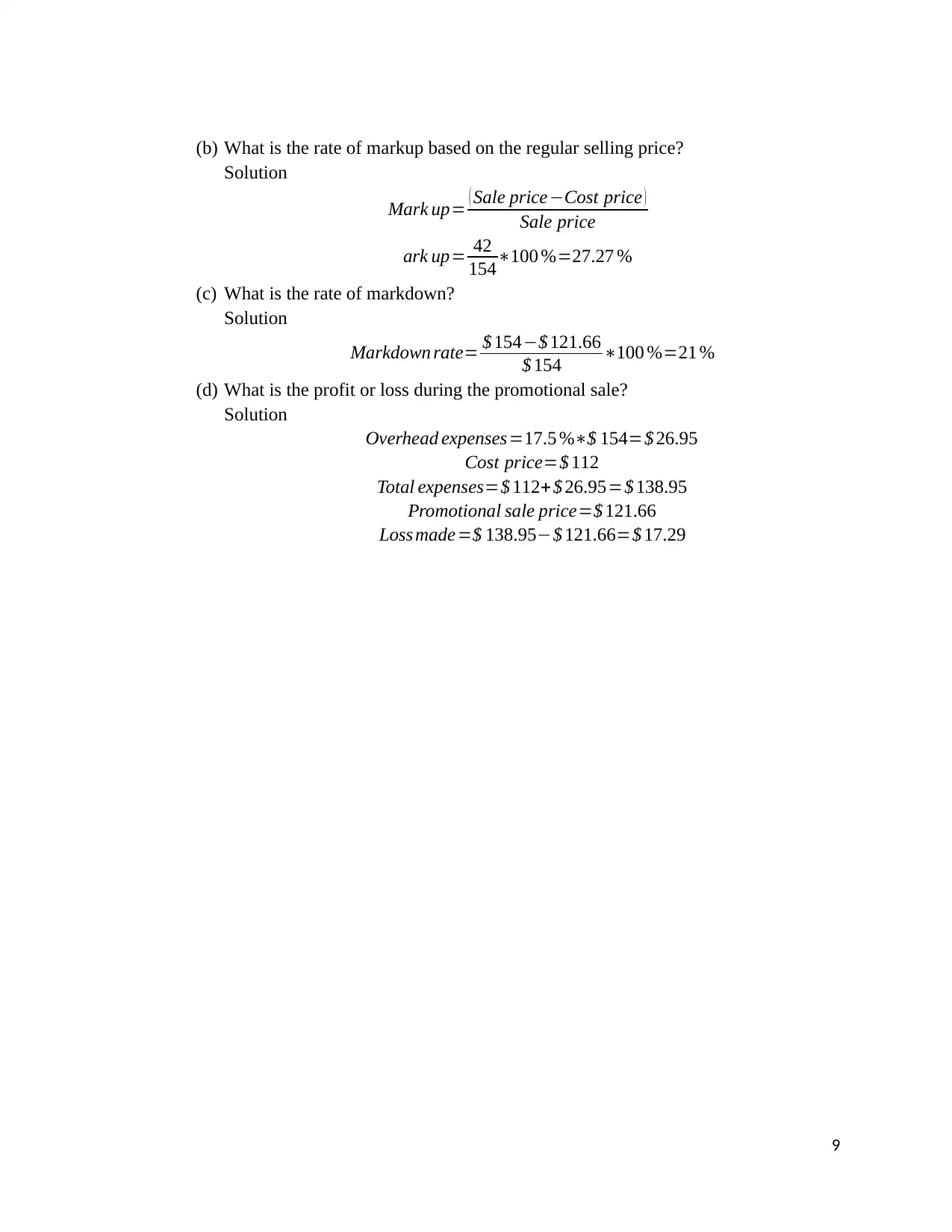

(b) What is the rate of markup based on the regular selling price?

Solution

Mark up= ( Sale price−Cost price )

Sale price

ark up= 42

154∗100 %=27.27 %

(c) What is the rate of markdown?

Solution

Markdown rate= $ 154−$ 121.66

$ 154 ∗100 %=21 %

(d) What is the profit or loss during the promotional sale?

Solution

Overhead expenses=17.5 %∗$ 154=$ 26.95

Cost price=$ 112

Total expenses=$ 112+$ 26.95=$ 138.95

Promotional sale price=$ 121.66

Loss made=$ 138.95−$ 121.66=$ 17.29

9

Solution

Mark up= ( Sale price−Cost price )

Sale price

ark up= 42

154∗100 %=27.27 %

(c) What is the rate of markdown?

Solution

Markdown rate= $ 154−$ 121.66

$ 154 ∗100 %=21 %

(d) What is the profit or loss during the promotional sale?

Solution

Overhead expenses=17.5 %∗$ 154=$ 26.95

Cost price=$ 112

Total expenses=$ 112+$ 26.95=$ 138.95

Promotional sale price=$ 121.66

Loss made=$ 138.95−$ 121.66=$ 17.29

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.