Financial Analysis: Capital Investment Appraisal Techniques Report

VerifiedAdded on 2020/04/21

|7

|1628

|189

Report

AI Summary

This report provides an in-depth analysis of capital investment decisions, focusing on techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. The report begins with an introduction to capital investment and the importance of thorough financial analysis. Part 1 presents a practical application of the NPV technique in a machine replacement decision scenario, demonstrating how to calculate and interpret NPV to determine the financial viability of an investment. Part 2 delves into the crucial elements of capital investment decisions, including cash inflows, outflows, and discount rates, and the assumptions that underpin these elements. The discussion covers the estimation of cash flows, the determination of the Weighted Average Cost of Capital (WACC), and the impact of assumptions on the final outcome. Part 3 compares and contrasts various capital investment appraisal methods, highlighting the strengths and limitations of each. The report concludes by emphasizing the importance of selecting the appropriate method based on the specific circumstances and reiterating the value of the NPV method as a suitable tool for financial analysis.

Finance: Appraisal of Capital Investment Decisions

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

The capital investment decisions involve huge sum of money therefore it is of paramount

importance for the management to make these decisions after carrying out the analysis

effectively. There are various tools and techniques being applied for the purpose of analyzing the

financial viability of a capital investment, the most prominent among them is the net present

value technique (NPV) (Atrill and McLaney, 2008). The other techniques involve internal rate of

return (IRR), payback period, and accounting rate of return. In this context, the report presented

here provides discussion on various techniques of capital investment analysis such as NPV, IRR,

Payback period etc. Further, the report also demonstrates the practical application of NPV

technique in analyzing the machine replacement decision (Atrill and McLaney, 2008).

Part-1

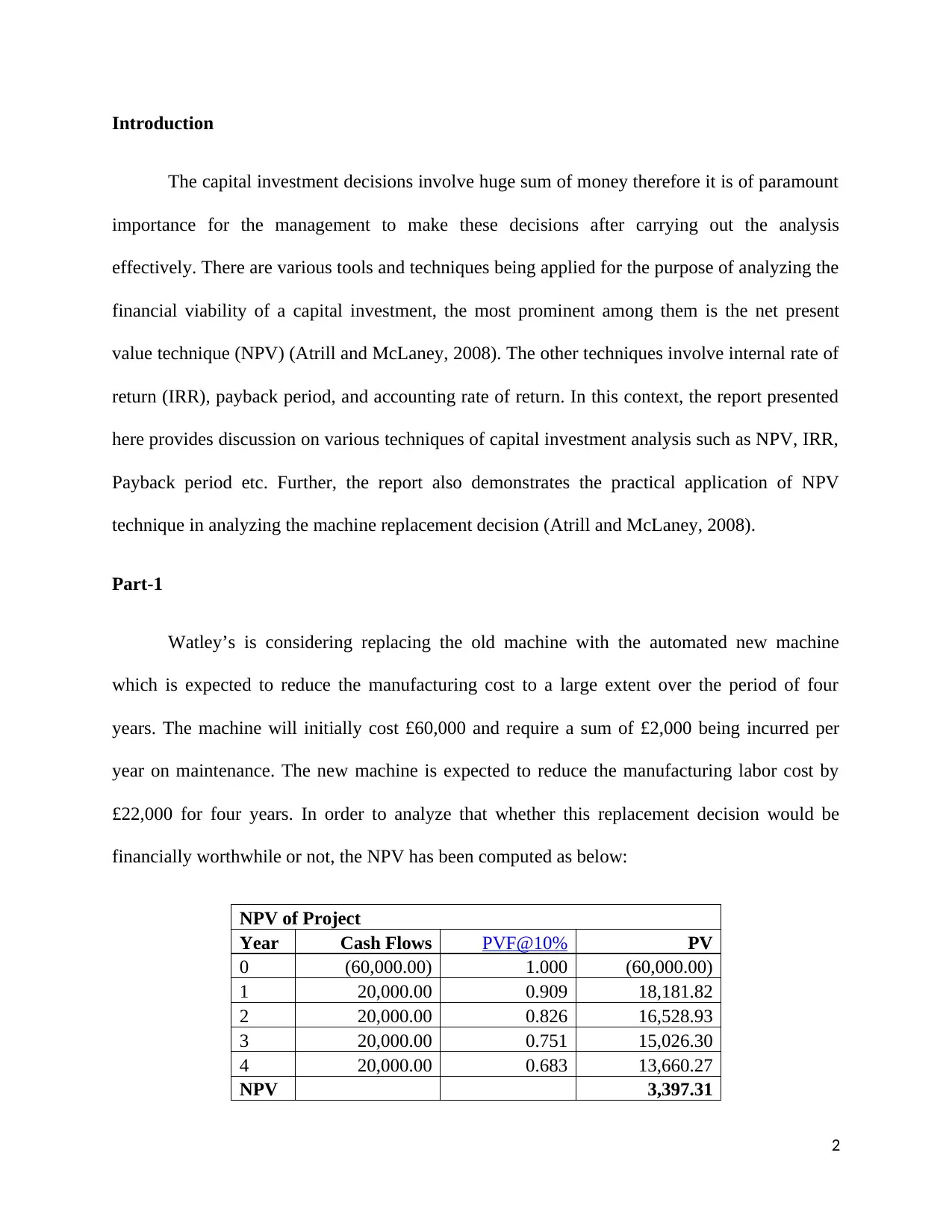

Watley’s is considering replacing the old machine with the automated new machine

which is expected to reduce the manufacturing cost to a large extent over the period of four

years. The machine will initially cost £60,000 and require a sum of £2,000 being incurred per

year on maintenance. The new machine is expected to reduce the manufacturing labor cost by

£22,000 for four years. In order to analyze that whether this replacement decision would be

financially worthwhile or not, the NPV has been computed as below:

NPV of Project

Year Cash Flows PVF@10% PV

0 (60,000.00) 1.000 (60,000.00)

1 20,000.00 0.909 18,181.82

2 20,000.00 0.826 16,528.93

3 20,000.00 0.751 15,026.30

4 20,000.00 0.683 13,660.27

NPV 3,397.31

2

The capital investment decisions involve huge sum of money therefore it is of paramount

importance for the management to make these decisions after carrying out the analysis

effectively. There are various tools and techniques being applied for the purpose of analyzing the

financial viability of a capital investment, the most prominent among them is the net present

value technique (NPV) (Atrill and McLaney, 2008). The other techniques involve internal rate of

return (IRR), payback period, and accounting rate of return. In this context, the report presented

here provides discussion on various techniques of capital investment analysis such as NPV, IRR,

Payback period etc. Further, the report also demonstrates the practical application of NPV

technique in analyzing the machine replacement decision (Atrill and McLaney, 2008).

Part-1

Watley’s is considering replacing the old machine with the automated new machine

which is expected to reduce the manufacturing cost to a large extent over the period of four

years. The machine will initially cost £60,000 and require a sum of £2,000 being incurred per

year on maintenance. The new machine is expected to reduce the manufacturing labor cost by

£22,000 for four years. In order to analyze that whether this replacement decision would be

financially worthwhile or not, the NPV has been computed as below:

NPV of Project

Year Cash Flows PVF@10% PV

0 (60,000.00) 1.000 (60,000.00)

1 20,000.00 0.909 18,181.82

2 20,000.00 0.826 16,528.93

3 20,000.00 0.751 15,026.30

4 20,000.00 0.683 13,660.27

NPV 3,397.31

2

It can be observed from the computations shown in the table given above that the NPV of

replacement is £3,397.31. The positive NPV of replacement decision reflects that it would be

worthwhile to implement the replacement of the machine. Thus, it is advised that the company

should go for replacement of old machine with the new automated machine.

Part-2

There are three crucial elements found in any capital investment decisions such as cash

inflows, outflows, and discount rate. In order to compute cash inflows, outflows, and discount

rate, there are made a number of assumptions. The capital investment decision is futuristic and

thus, assumptions are made about the future outlook in respect of these three crucial elements

(Röhrich, 2014). The computation of cash inflows requires estimation about the sale units and

unit price. Similarly, estimations are made in respect of costs to arrive at the cash outflows.

Further, the determination of discount rate requires various assumptions about the risk and

expected return of the investors (Röhrich, 2014).

The discounting of cash flows is normally done at the desired rate of return of the

investors which in the case of a company is taken as WACC. Further, the computation of WACC

is based on the estimations of cost of equity and after tax cost of debt. The estimation of cost of

debt is however simple and requires less assumptions but the same is not the case with cost of

equity. The cost of equity is computed based on various assumptions, for example, assumption

about future dividend payment, growth rate, risk free rate, and market risk premium. Further, the

assumptions are also required to be made about the life span of the project in which capital

investment is being made (Röhrich, 2014).

3

replacement is £3,397.31. The positive NPV of replacement decision reflects that it would be

worthwhile to implement the replacement of the machine. Thus, it is advised that the company

should go for replacement of old machine with the new automated machine.

Part-2

There are three crucial elements found in any capital investment decisions such as cash

inflows, outflows, and discount rate. In order to compute cash inflows, outflows, and discount

rate, there are made a number of assumptions. The capital investment decision is futuristic and

thus, assumptions are made about the future outlook in respect of these three crucial elements

(Röhrich, 2014). The computation of cash inflows requires estimation about the sale units and

unit price. Similarly, estimations are made in respect of costs to arrive at the cash outflows.

Further, the determination of discount rate requires various assumptions about the risk and

expected return of the investors (Röhrich, 2014).

The discounting of cash flows is normally done at the desired rate of return of the

investors which in the case of a company is taken as WACC. Further, the computation of WACC

is based on the estimations of cost of equity and after tax cost of debt. The estimation of cost of

debt is however simple and requires less assumptions but the same is not the case with cost of

equity. The cost of equity is computed based on various assumptions, for example, assumption

about future dividend payment, growth rate, risk free rate, and market risk premium. Further, the

assumptions are also required to be made about the life span of the project in which capital

investment is being made (Röhrich, 2014).

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In regards to the replacement of old cutting machine with the new automated machine,

the two crucial assumptions are savings in the labor cost and useful life of machine. It has been

assumed that the new machine will cause savings in the labor cost of £22,000 annually. Further,

it has been assumed that the machine will require annual maintenance incurring a sum of £2,000.

These assumptions are based on the initial estimates only and thus, there always remains

possibility of variance (Drury, 2008). It may be possible that the maintenance cost is increased in

future and thus, the company may incur additional money or it may decrease also resulting in

increase in savings. Further, it has been assumed that the new machine will be in a workable

condition for 4 years. However, it may or may not or it may end up with more years (Drury,

2008).

It is essential to note that the assumptions should be made in such a way that the

possibility of variance is reduced. If the assumptions are made precisely, the possibility of

achieving the desired outcome is increased. For example, if the life of new machine is not

estimated precisely and suppose if the machine is retired from use after three years, the resultant

NPV would be less than £3,397.31 which might make the replacement decision less attractive.

Thus, it is crucial to make the assumption precisely considering the past and future performance

(Chapman, Hopwood, and Shields, 2011).

Part-3

It has already been discussed that there are various capital investment appraisal

method/techniques. Some of them involve the use of time value of money and some do not. For

example, the NPV and IRR techniques use the concept of time value of money while the

4

the two crucial assumptions are savings in the labor cost and useful life of machine. It has been

assumed that the new machine will cause savings in the labor cost of £22,000 annually. Further,

it has been assumed that the machine will require annual maintenance incurring a sum of £2,000.

These assumptions are based on the initial estimates only and thus, there always remains

possibility of variance (Drury, 2008). It may be possible that the maintenance cost is increased in

future and thus, the company may incur additional money or it may decrease also resulting in

increase in savings. Further, it has been assumed that the new machine will be in a workable

condition for 4 years. However, it may or may not or it may end up with more years (Drury,

2008).

It is essential to note that the assumptions should be made in such a way that the

possibility of variance is reduced. If the assumptions are made precisely, the possibility of

achieving the desired outcome is increased. For example, if the life of new machine is not

estimated precisely and suppose if the machine is retired from use after three years, the resultant

NPV would be less than £3,397.31 which might make the replacement decision less attractive.

Thus, it is crucial to make the assumption precisely considering the past and future performance

(Chapman, Hopwood, and Shields, 2011).

Part-3

It has already been discussed that there are various capital investment appraisal

method/techniques. Some of them involve the use of time value of money and some do not. For

example, the NPV and IRR techniques use the concept of time value of money while the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

payback period and accounting rate of return are the techniques that do not implicate the use of

time value of money (Chapman, Hopwood, and Shields, 2011).

The net present value technique requires the calculation of present value of net cash

inflows and comparing the same with the initial capital outlay. If the initial capital outlay is less

than the present value of net cash inflows, the NPV is positive and hence the project becomes

acceptable. On the other hand, if the initial capital outlay is greater than the present value of net

cash inflows, the NPV is negative and hence the project is liable to be rejected. Keeping the NPV

aside, the project can also be appraised using the IRR technique. The internal rate of return is the

breakeven return that the project must earn in order to be called financially worthwhile. The

internal rate of return is compared with the cost of capital and if the IRR is greater than the cost

of capital, the project is accepted else it is rejected (Chapman, Hopwood, and Shields, 2011).

The internal rate of return technique is also widely used but it suffers from certain

limitations which restricts its use in the special circumstances. For instance, when the series of

cash flows involves cash outflows at more than one occasion, it may result in multiple IRRs

giving conflicting views (Gotze, Northcott, and Schuster, 2016). However, when it comes on

comparing more than one mutually exclusive project with each other; the IRR is considered

better than NPV. Further, the payback period is also used in analyzing the financial viability of

the project. The payback period computes the time duration within which the amount of initial

investment would be recovered. In most of the cases, the payback period method is used in

conjunction with other methods such as NPV and IRR. The payback period used singly in

analyzing the project’s financial worth would be less useful (Gotze, Northcott, and Schuster,

2016).

5

time value of money (Chapman, Hopwood, and Shields, 2011).

The net present value technique requires the calculation of present value of net cash

inflows and comparing the same with the initial capital outlay. If the initial capital outlay is less

than the present value of net cash inflows, the NPV is positive and hence the project becomes

acceptable. On the other hand, if the initial capital outlay is greater than the present value of net

cash inflows, the NPV is negative and hence the project is liable to be rejected. Keeping the NPV

aside, the project can also be appraised using the IRR technique. The internal rate of return is the

breakeven return that the project must earn in order to be called financially worthwhile. The

internal rate of return is compared with the cost of capital and if the IRR is greater than the cost

of capital, the project is accepted else it is rejected (Chapman, Hopwood, and Shields, 2011).

The internal rate of return technique is also widely used but it suffers from certain

limitations which restricts its use in the special circumstances. For instance, when the series of

cash flows involves cash outflows at more than one occasion, it may result in multiple IRRs

giving conflicting views (Gotze, Northcott, and Schuster, 2016). However, when it comes on

comparing more than one mutually exclusive project with each other; the IRR is considered

better than NPV. Further, the payback period is also used in analyzing the financial viability of

the project. The payback period computes the time duration within which the amount of initial

investment would be recovered. In most of the cases, the payback period method is used in

conjunction with other methods such as NPV and IRR. The payback period used singly in

analyzing the project’s financial worth would be less useful (Gotze, Northcott, and Schuster,

2016).

5

In the current case, there is single project under consideration. The financial viability of a

single project could be assessed applying any of the three methods such as NPV, IRR, and

payback period. The results of all three methods would lead to same conclusion about acceptance

or rejection of the project. The NPV method has been applied in assessing that whether the

replacement decision is financially worthwhile or not. If the IRR or payback period is applied,

the result would be same i.e. the project would be acceptable (Gotze, Northcott, and Schuster,

2016).

Conclusion

In analyzing the project’s financial viability, the management of the company may

consider applying a number of methods such as NPV, IRR, and payback period. The

management should consider that these methods have different characteristics and some specific

situations may require use of specific method. However, the NPV method is commonly applied

and it is considered as one of the most appropriate and suitable to all conditions method. In

analyzing the replacement decision of Watley, the NPV method has been applied which shows a

positive NPV of £3,397.31.

6

single project could be assessed applying any of the three methods such as NPV, IRR, and

payback period. The results of all three methods would lead to same conclusion about acceptance

or rejection of the project. The NPV method has been applied in assessing that whether the

replacement decision is financially worthwhile or not. If the IRR or payback period is applied,

the result would be same i.e. the project would be acceptable (Gotze, Northcott, and Schuster,

2016).

Conclusion

In analyzing the project’s financial viability, the management of the company may

consider applying a number of methods such as NPV, IRR, and payback period. The

management should consider that these methods have different characteristics and some specific

situations may require use of specific method. However, the NPV method is commonly applied

and it is considered as one of the most appropriate and suitable to all conditions method. In

analyzing the replacement decision of Watley, the NPV method has been applied which shows a

positive NPV of £3,397.31.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Atrill, P. and E. J. McLaney. 2008. Accounting and Finance for Non-specialists. Prentice Hall

Financial Times.

Chapman, C.S., Hopwood, A.G., and Shields, M.D. 2011. Handbook of Management Accounting

Research. Elsevier.

Drury, C. 2008. Management and Cost Accounting. Cengage Learning EMEA.

Gotze, U., Northcott, D. and Schuster, P., 2016. Investment appraisal. Springer-verlag berlin an.

Röhrich, M. 2014. Fundamentals of Investment Appraisal: An Illustration based on a Case

Study. Walter de Gruyter GmbH & Co KG.

7

Atrill, P. and E. J. McLaney. 2008. Accounting and Finance for Non-specialists. Prentice Hall

Financial Times.

Chapman, C.S., Hopwood, A.G., and Shields, M.D. 2011. Handbook of Management Accounting

Research. Elsevier.

Drury, C. 2008. Management and Cost Accounting. Cengage Learning EMEA.

Gotze, U., Northcott, D. and Schuster, P., 2016. Investment appraisal. Springer-verlag berlin an.

Röhrich, M. 2014. Fundamentals of Investment Appraisal: An Illustration based on a Case

Study. Walter de Gruyter GmbH & Co KG.

7

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.