Report: Arbitrage Profit Based on Delta-Gamma Hedging Technique

VerifiedAdded on 2023/06/07

|15

|2879

|115

Report

AI Summary

This report presents an analysis of an arbitrage profit strategy based on the delta-gamma hedging technique applied to a mispriced option. The study focuses on Woodside Petroleum Limited (WPL.AX) and its call options, utilizing market data from August and September 2018. The report explains the theoretical underpinnings of delta-gamma hedging, including the minimization of risk and the importance of gamma. It details the process of identifying mispricing, calculating volatility, and constructing a delta-gamma neutral portfolio. The analysis includes calculations of profit and loss, comparing the results of the hedged and unhedged portfolios. The report also examines the practical aspects of the strategy, such as the selection of a brokerage house and transaction costs, concluding that the delta-hedging strategy is superior due to its ability to hedge away risks and gain exposure to volatility. The report further discusses the challenges associated with the strategy, such as the need for continuous portfolio adjustments and the impact of transaction costs. Overall, the report demonstrates the effectiveness of the delta-gamma hedging strategy in generating arbitrage profits, offering valuable insights into option valuation and risk management.

REPORT WRITING

Title: We have prepared a report on the Arbitrage Profit based on the Delta-Gamma Hedging

technique on a mispriced option.

Introduction: Delta-hedging technique is a well-known technique to minimise the unwanted

risk in any portfolio. An arbitrage profit can be made based on this technique. To minimise

the exposure of Delta we added the gamma factor and made it a Delta-Gamma Neutral

Hedging Technique. In order to this we should have a stock which has a very high P/E so as

to get stability in the portfolio. There should be a presence of the stock in the options market.

Based on these we got Woodside Petroleum Limited (WPL.AX) as the most suitable stock.

Hence in this case it is Woodside Petroleum Limited(WPL.AX) being traded in the S&P

ASX stock market.

odB y:

PartA T e t eor e ind( h h y B h )

e a e c o en ood ide Petrole m imited P A or o r re earc p rpo e t a a eeW h v h s W s u L (W L. X) f u s h u s . I h s 52 w k

i o A ee lo o di idend ield o A t i a in a P ratio oh gh f 37.82 UD, 52-w k w f 27.847, v y f 3.79 UD. I s h v g /E f 22.6

ic i on t e i er ide o t e mar et t a e eral all and P t option ein traded in Awh h s h h gh s f h k . I h s s v C u s b g SX.

oteN :

all t i a icall a contract to an a et on a predetermined price on or e ore a partic lar dateC : I s b s y buy ss b f u .

P t t i a icall a contract to ell an a et on a predetermined price on or e ore a partic lar dateu : I s b s y s ss b f u .

n t i pro ect e p t tre on t e call option e did t e ar itra e pro it in call optionI h s j w u s ss h s. W h b g f us g s.

e a e ot t e price o option eloW h v g h f s b w:

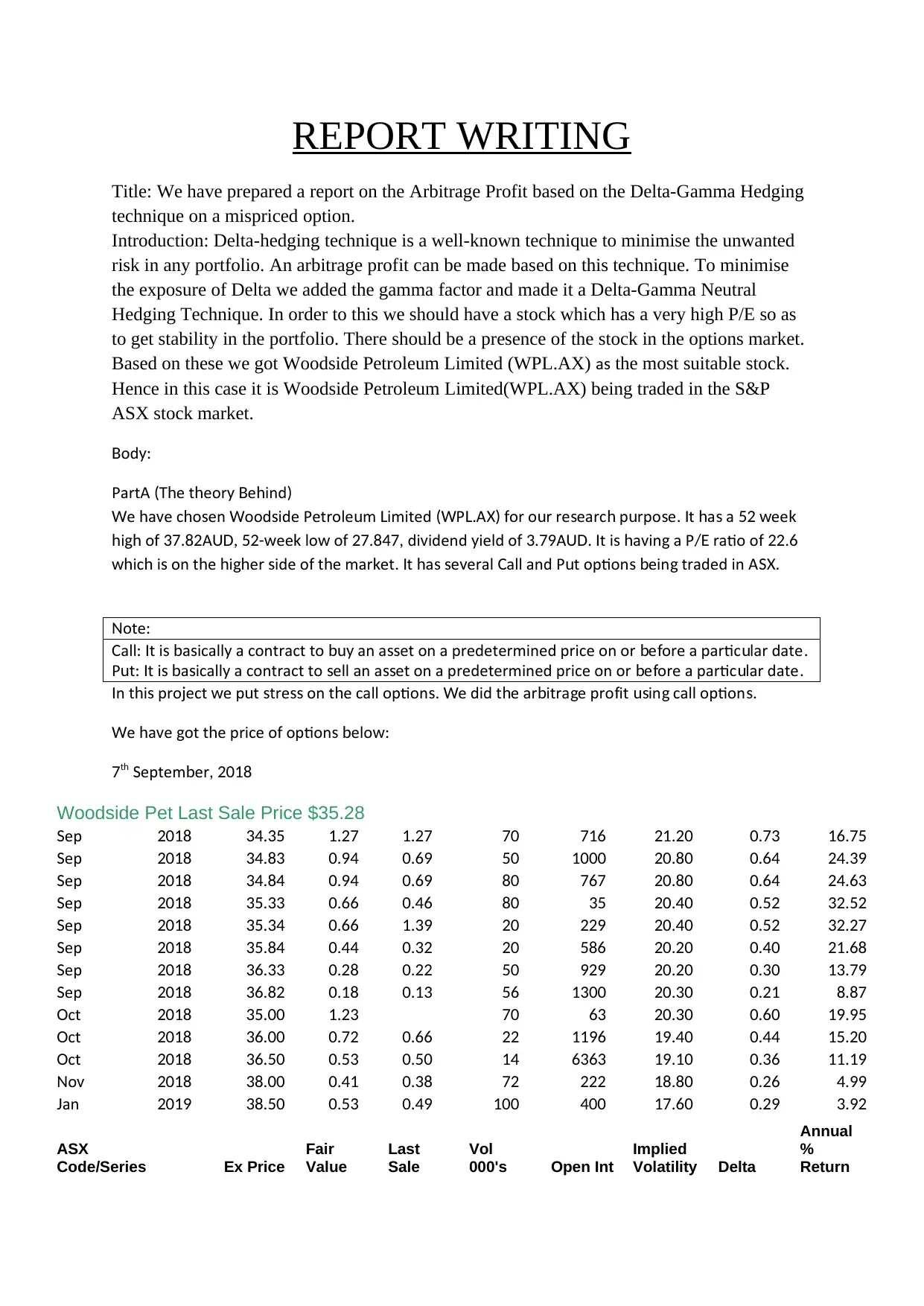

7th eptem erS b , 2018

Woodside Pet Last Sale Price $35.28

epS 2018 34.35 1.27 1.27 70 716 21.20 0.73 16.75

epS 2018 34.83 0.94 0.69 50 1000 20.80 0.64 24.39

epS 2018 34.84 0.94 0.69 80 767 20.80 0.64 24.63

epS 2018 35.33 0.66 0.46 80 35 20.40 0.52 32.52

epS 2018 35.34 0.66 1.39 20 229 20.40 0.52 32.27

epS 2018 35.84 0.44 0.32 20 586 20.20 0.40 21.68

epS 2018 36.33 0.28 0.22 50 929 20.20 0.30 13.79

epS 2018 36.82 0.18 0.13 56 1300 20.30 0.21 8.87

ctO 2018 35.00 1.23 70 63 20.30 0.60 19.95

ctO 2018 36.00 0.72 0.66 22 1196 19.40 0.44 15.20

ctO 2018 36.50 0.53 0.50 14 6363 19.10 0.36 11.19

oN v 2018 38.00 0.41 0.38 72 222 18.80 0.26 4.99

anJ 2019 38.50 0.53 0.49 100 400 17.60 0.29 3.92

ASX

Code/Series Ex Price

Fair

Value

Last

Sale

Vol

000's Open Int

Implied

Volatility Delta

Annual

%

Return

Title: We have prepared a report on the Arbitrage Profit based on the Delta-Gamma Hedging

technique on a mispriced option.

Introduction: Delta-hedging technique is a well-known technique to minimise the unwanted

risk in any portfolio. An arbitrage profit can be made based on this technique. To minimise

the exposure of Delta we added the gamma factor and made it a Delta-Gamma Neutral

Hedging Technique. In order to this we should have a stock which has a very high P/E so as

to get stability in the portfolio. There should be a presence of the stock in the options market.

Based on these we got Woodside Petroleum Limited (WPL.AX) as the most suitable stock.

Hence in this case it is Woodside Petroleum Limited(WPL.AX) being traded in the S&P

ASX stock market.

odB y:

PartA T e t eor e ind( h h y B h )

e a e c o en ood ide Petrole m imited P A or o r re earc p rpo e t a a eeW h v h s W s u L (W L. X) f u s h u s . I h s 52 w k

i o A ee lo o di idend ield o A t i a in a P ratio oh gh f 37.82 UD, 52-w k w f 27.847, v y f 3.79 UD. I s h v g /E f 22.6

ic i on t e i er ide o t e mar et t a e eral all and P t option ein traded in Awh h s h h gh s f h k . I h s s v C u s b g SX.

oteN :

all t i a icall a contract to an a et on a predetermined price on or e ore a partic lar dateC : I s b s y buy ss b f u .

P t t i a icall a contract to ell an a et on a predetermined price on or e ore a partic lar dateu : I s b s y s ss b f u .

n t i pro ect e p t tre on t e call option e did t e ar itra e pro it in call optionI h s j w u s ss h s. W h b g f us g s.

e a e ot t e price o option eloW h v g h f s b w:

7th eptem erS b , 2018

Woodside Pet Last Sale Price $35.28

epS 2018 34.35 1.27 1.27 70 716 21.20 0.73 16.75

epS 2018 34.83 0.94 0.69 50 1000 20.80 0.64 24.39

epS 2018 34.84 0.94 0.69 80 767 20.80 0.64 24.63

epS 2018 35.33 0.66 0.46 80 35 20.40 0.52 32.52

epS 2018 35.34 0.66 1.39 20 229 20.40 0.52 32.27

epS 2018 35.84 0.44 0.32 20 586 20.20 0.40 21.68

epS 2018 36.33 0.28 0.22 50 929 20.20 0.30 13.79

epS 2018 36.82 0.18 0.13 56 1300 20.30 0.21 8.87

ctO 2018 35.00 1.23 70 63 20.30 0.60 19.95

ctO 2018 36.00 0.72 0.66 22 1196 19.40 0.44 15.20

ctO 2018 36.50 0.53 0.50 14 6363 19.10 0.36 11.19

oN v 2018 38.00 0.41 0.38 72 222 18.80 0.26 4.99

anJ 2019 38.50 0.53 0.49 100 400 17.60 0.29 3.92

ASX

Code/Series Ex Price

Fair

Value

Last

Sale

Vol

000's Open Int

Implied

Volatility Delta

Annual

%

Return

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

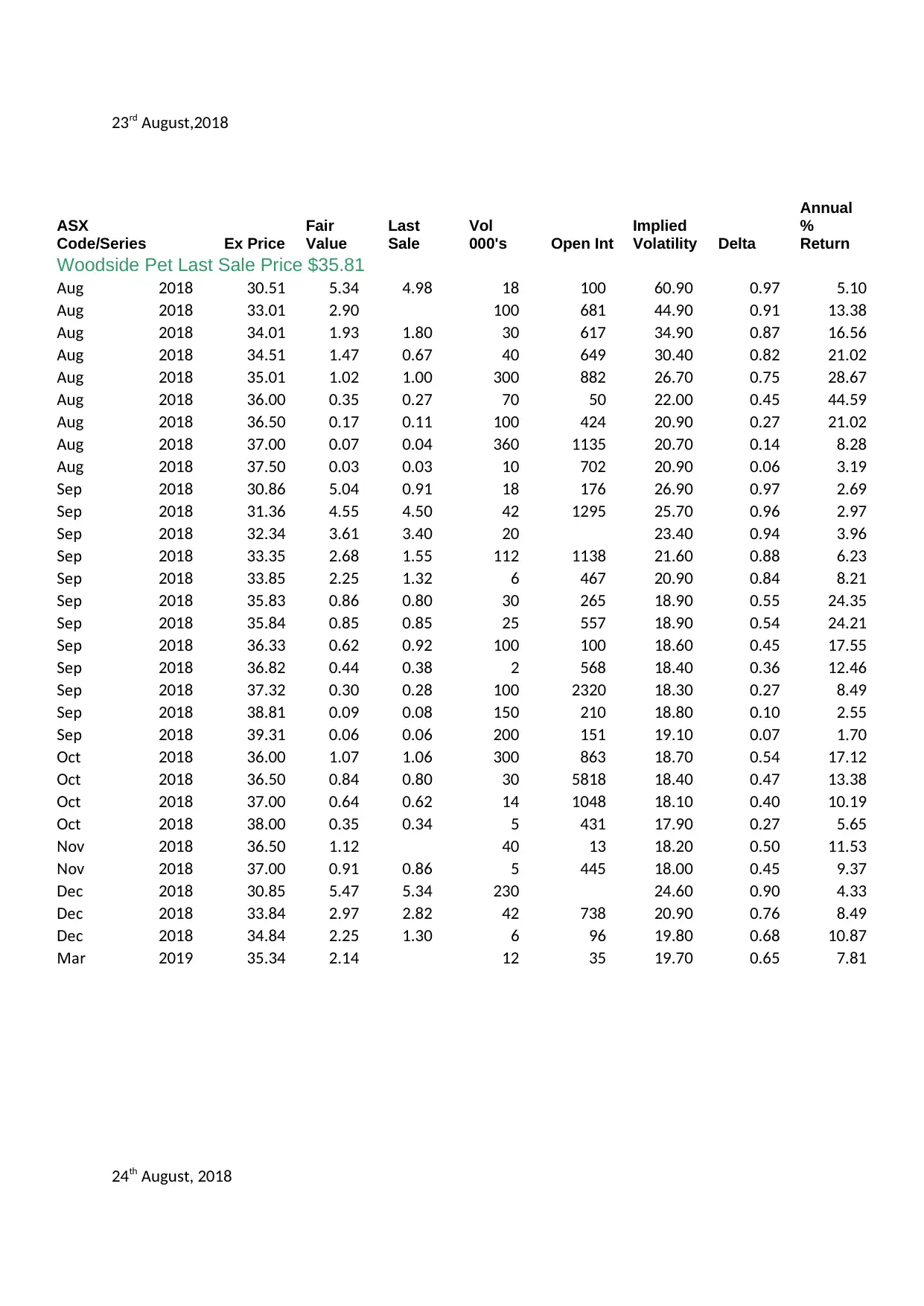

23rd A tugus ,2018

ASX

Code/Series Ex Price

Fair

Value

Last

Sale

Vol

000's Open Int

Implied

Volatility Delta

Annual

%

Return

Woodside Pet Last Sale Price $35.81

Aug 2018 30.51 5.34 4.98 18 100 60.90 0.97 5.10

Aug 2018 33.01 2.90 100 681 44.90 0.91 13.38

Aug 2018 34.01 1.93 1.80 30 617 34.90 0.87 16.56

Aug 2018 34.51 1.47 0.67 40 649 30.40 0.82 21.02

Aug 2018 35.01 1.02 1.00 300 882 26.70 0.75 28.67

Aug 2018 36.00 0.35 0.27 70 50 22.00 0.45 44.59

Aug 2018 36.50 0.17 0.11 100 424 20.90 0.27 21.02

Aug 2018 37.00 0.07 0.04 360 1135 20.70 0.14 8.28

Aug 2018 37.50 0.03 0.03 10 702 20.90 0.06 3.19

epS 2018 30.86 5.04 0.91 18 176 26.90 0.97 2.69

epS 2018 31.36 4.55 4.50 42 1295 25.70 0.96 2.97

epS 2018 32.34 3.61 3.40 20 23.40 0.94 3.96

epS 2018 33.35 2.68 1.55 112 1138 21.60 0.88 6.23

epS 2018 33.85 2.25 1.32 6 467 20.90 0.84 8.21

epS 2018 35.83 0.86 0.80 30 265 18.90 0.55 24.35

epS 2018 35.84 0.85 0.85 25 557 18.90 0.54 24.21

epS 2018 36.33 0.62 0.92 100 100 18.60 0.45 17.55

epS 2018 36.82 0.44 0.38 2 568 18.40 0.36 12.46

epS 2018 37.32 0.30 0.28 100 2320 18.30 0.27 8.49

epS 2018 38.81 0.09 0.08 150 210 18.80 0.10 2.55

epS 2018 39.31 0.06 0.06 200 151 19.10 0.07 1.70

ctO 2018 36.00 1.07 1.06 300 863 18.70 0.54 17.12

ctO 2018 36.50 0.84 0.80 30 5818 18.40 0.47 13.38

ctO 2018 37.00 0.64 0.62 14 1048 18.10 0.40 10.19

ctO 2018 38.00 0.35 0.34 5 431 17.90 0.27 5.65

oN v 2018 36.50 1.12 40 13 18.20 0.50 11.53

oN v 2018 37.00 0.91 0.86 5 445 18.00 0.45 9.37

ecD 2018 30.85 5.47 5.34 230 24.60 0.90 4.33

ecD 2018 33.84 2.97 2.82 42 738 20.90 0.76 8.49

ecD 2018 34.84 2.25 1.30 6 96 19.80 0.68 10.87

Mar 2019 35.34 2.14 12 35 19.70 0.65 7.81

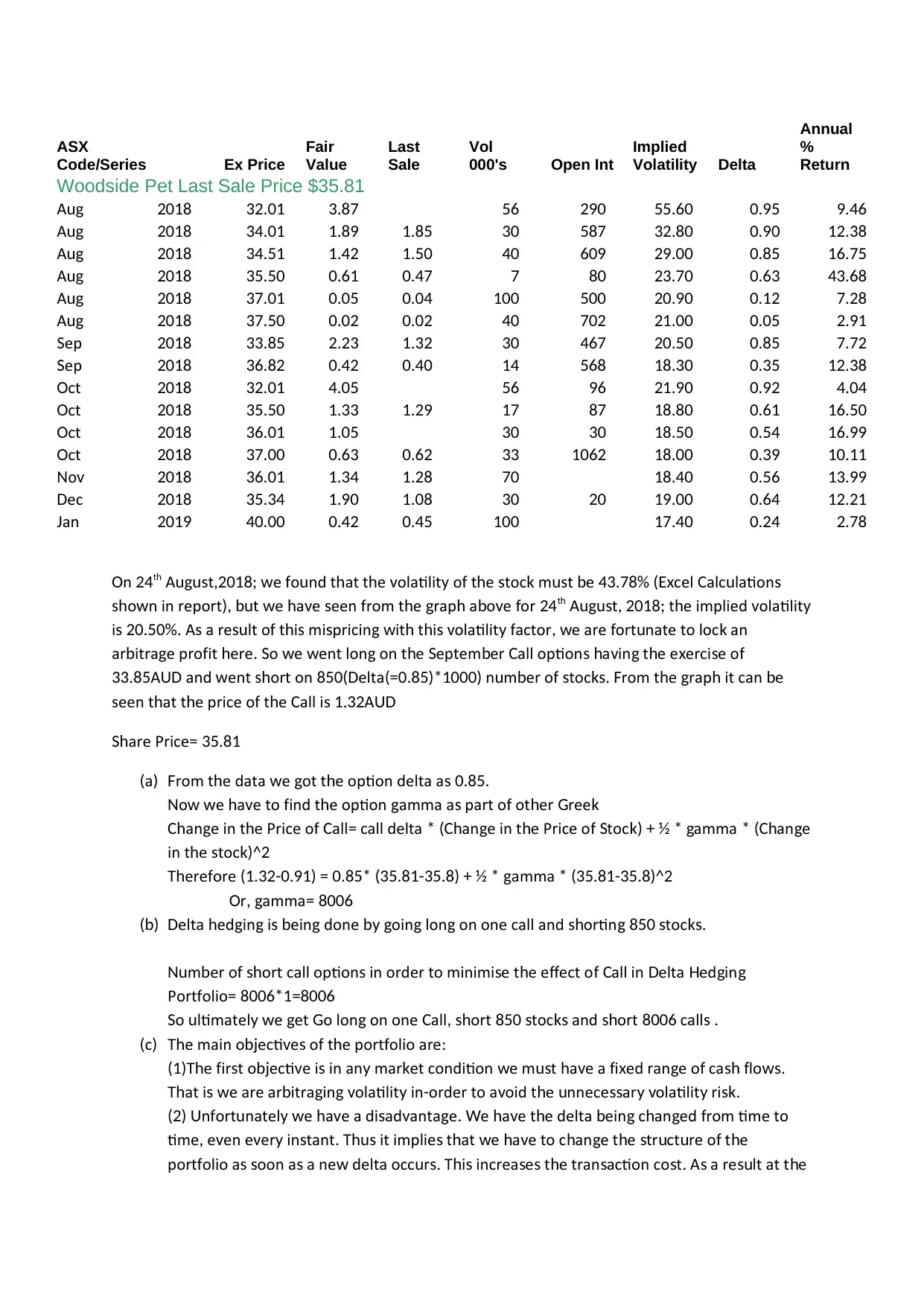

24th A tugus , 2018

ASX

Code/Series Ex Price

Fair

Value

Last

Sale

Vol

000's Open Int

Implied

Volatility Delta

Annual

%

Return

Woodside Pet Last Sale Price $35.81

Aug 2018 30.51 5.34 4.98 18 100 60.90 0.97 5.10

Aug 2018 33.01 2.90 100 681 44.90 0.91 13.38

Aug 2018 34.01 1.93 1.80 30 617 34.90 0.87 16.56

Aug 2018 34.51 1.47 0.67 40 649 30.40 0.82 21.02

Aug 2018 35.01 1.02 1.00 300 882 26.70 0.75 28.67

Aug 2018 36.00 0.35 0.27 70 50 22.00 0.45 44.59

Aug 2018 36.50 0.17 0.11 100 424 20.90 0.27 21.02

Aug 2018 37.00 0.07 0.04 360 1135 20.70 0.14 8.28

Aug 2018 37.50 0.03 0.03 10 702 20.90 0.06 3.19

epS 2018 30.86 5.04 0.91 18 176 26.90 0.97 2.69

epS 2018 31.36 4.55 4.50 42 1295 25.70 0.96 2.97

epS 2018 32.34 3.61 3.40 20 23.40 0.94 3.96

epS 2018 33.35 2.68 1.55 112 1138 21.60 0.88 6.23

epS 2018 33.85 2.25 1.32 6 467 20.90 0.84 8.21

epS 2018 35.83 0.86 0.80 30 265 18.90 0.55 24.35

epS 2018 35.84 0.85 0.85 25 557 18.90 0.54 24.21

epS 2018 36.33 0.62 0.92 100 100 18.60 0.45 17.55

epS 2018 36.82 0.44 0.38 2 568 18.40 0.36 12.46

epS 2018 37.32 0.30 0.28 100 2320 18.30 0.27 8.49

epS 2018 38.81 0.09 0.08 150 210 18.80 0.10 2.55

epS 2018 39.31 0.06 0.06 200 151 19.10 0.07 1.70

ctO 2018 36.00 1.07 1.06 300 863 18.70 0.54 17.12

ctO 2018 36.50 0.84 0.80 30 5818 18.40 0.47 13.38

ctO 2018 37.00 0.64 0.62 14 1048 18.10 0.40 10.19

ctO 2018 38.00 0.35 0.34 5 431 17.90 0.27 5.65

oN v 2018 36.50 1.12 40 13 18.20 0.50 11.53

oN v 2018 37.00 0.91 0.86 5 445 18.00 0.45 9.37

ecD 2018 30.85 5.47 5.34 230 24.60 0.90 4.33

ecD 2018 33.84 2.97 2.82 42 738 20.90 0.76 8.49

ecD 2018 34.84 2.25 1.30 6 96 19.80 0.68 10.87

Mar 2019 35.34 2.14 12 35 19.70 0.65 7.81

24th A tugus , 2018

ASX

Code/Series Ex Price

Fair

Value

Last

Sale

Vol

000's Open Int

Implied

Volatility Delta

Annual

%

Return

Woodside Pet Last Sale Price $35.81

Aug 2018 32.01 3.87 56 290 55.60 0.95 9.46

Aug 2018 34.01 1.89 1.85 30 587 32.80 0.90 12.38

Aug 2018 34.51 1.42 1.50 40 609 29.00 0.85 16.75

Aug 2018 35.50 0.61 0.47 7 80 23.70 0.63 43.68

Aug 2018 37.01 0.05 0.04 100 500 20.90 0.12 7.28

Aug 2018 37.50 0.02 0.02 40 702 21.00 0.05 2.91

epS 2018 33.85 2.23 1.32 30 467 20.50 0.85 7.72

epS 2018 36.82 0.42 0.40 14 568 18.30 0.35 12.38

ctO 2018 32.01 4.05 56 96 21.90 0.92 4.04

ctO 2018 35.50 1.33 1.29 17 87 18.80 0.61 16.50

ctO 2018 36.01 1.05 30 30 18.50 0.54 16.99

ctO 2018 37.00 0.63 0.62 33 1062 18.00 0.39 10.11

oN v 2018 36.01 1.34 1.28 70 18.40 0.56 13.99

ecD 2018 35.34 1.90 1.08 30 20 19.00 0.64 12.21

anJ 2019 40.00 0.42 0.45 100 17.40 0.24 2.78

nO 24th A t e o nd t at t e olatilit o t e toc m t e cel alc lationugus ,2018; w f u h h v y f h s k us b 43.78% (Ex C u s

o n in report t e a e een rom t e rap a o e orsh w ), bu w h v s f h g h b v f 24th A t t e implied olatilitugus , 2018; h v y

i A a re lt o t i mi pricin it t i olatilit actor e are ort nate to loc ans 20.50%. s su f h s s g w h h s v y f , w f u k

ar itra e pro it ere o e ent lon on t e eptem er all option a in t e e erci e ob g f h . S w w g h S b C s h v g h x s f

A and ent ort on elta n m er o toc rom t e rap it can e33.85 UD w sh 850(D (=0.85)*1000) u b f s ks. F h g h b

een t at t e price o t e all i As h h f h C s 1.32 UD

are PriceSh = 35.81

a( ) rom t e data e ot t e option delta aF h w g h s 0.85.

o e a e to ind t e option amma a part o ot er reeN w w h v f h g s f h G k

an e in t e Price o all call delta an e in t e Price o toc amma an eCh g h f C = * (Ch g h f S k) + ½ * g * (Ch g

in t e toch s k)^2

T ere ore ammah f (1.32-0.91) = 0.85* (35.81-35.8) + ½ * g * (35.81-35.8)^2

r ammaO , g = 8006

(b) elta ed in i ein done oin lon on one call and ortin tocD h g g s b g by g g g sh g 850 s ks.

m er o ort call option in order to minimi e t e e ect o all in elta ed inNu b f sh s s h ff f C D H g g

Port oliof = 8006*1=8006

o ltimatel e et o lon on one all ort toc and ort callS u y w g G g C , sh 850 s ks sh 8006 s .

c( ) T e main o ecti e o t e port olio areh bj v s f h f :

T e ir t o ecti e i in an mar et condition e m t a e a i ed ran e o ca lo(1) h f s bj v s y k w us h v f x g f sh f ws.

T at i e are ar itra in olatilit in order to a oid t e nnece ar olatilit rih s w b g g v y - v h u ss y v y sk.

n ort natel e a e a di ad anta e e a e t e delta ein c an ed rom time to(2) U f u y w h v s v g . W h v h b g h g f

time e en e er in tant T it implie t at e a e to c an e t e tr ct re o t e, v v y s . hus s h w h v h g h s u u f h

port olio a oon a a ne delta occ r T i increa e t e tran action co t A a re lt at t ef s s s w u s. h s s s h s s . s su h

Code/Series Ex Price

Fair

Value

Last

Sale

Vol

000's Open Int

Implied

Volatility Delta

Annual

%

Return

Woodside Pet Last Sale Price $35.81

Aug 2018 32.01 3.87 56 290 55.60 0.95 9.46

Aug 2018 34.01 1.89 1.85 30 587 32.80 0.90 12.38

Aug 2018 34.51 1.42 1.50 40 609 29.00 0.85 16.75

Aug 2018 35.50 0.61 0.47 7 80 23.70 0.63 43.68

Aug 2018 37.01 0.05 0.04 100 500 20.90 0.12 7.28

Aug 2018 37.50 0.02 0.02 40 702 21.00 0.05 2.91

epS 2018 33.85 2.23 1.32 30 467 20.50 0.85 7.72

epS 2018 36.82 0.42 0.40 14 568 18.30 0.35 12.38

ctO 2018 32.01 4.05 56 96 21.90 0.92 4.04

ctO 2018 35.50 1.33 1.29 17 87 18.80 0.61 16.50

ctO 2018 36.01 1.05 30 30 18.50 0.54 16.99

ctO 2018 37.00 0.63 0.62 33 1062 18.00 0.39 10.11

oN v 2018 36.01 1.34 1.28 70 18.40 0.56 13.99

ecD 2018 35.34 1.90 1.08 30 20 19.00 0.64 12.21

anJ 2019 40.00 0.42 0.45 100 17.40 0.24 2.78

nO 24th A t e o nd t at t e olatilit o t e toc m t e cel alc lationugus ,2018; w f u h h v y f h s k us b 43.78% (Ex C u s

o n in report t e a e een rom t e rap a o e orsh w ), bu w h v s f h g h b v f 24th A t t e implied olatilitugus , 2018; h v y

i A a re lt o t i mi pricin it t i olatilit actor e are ort nate to loc ans 20.50%. s su f h s s g w h h s v y f , w f u k

ar itra e pro it ere o e ent lon on t e eptem er all option a in t e e erci e ob g f h . S w w g h S b C s h v g h x s f

A and ent ort on elta n m er o toc rom t e rap it can e33.85 UD w sh 850(D (=0.85)*1000) u b f s ks. F h g h b

een t at t e price o t e all i As h h f h C s 1.32 UD

are PriceSh = 35.81

a( ) rom t e data e ot t e option delta aF h w g h s 0.85.

o e a e to ind t e option amma a part o ot er reeN w w h v f h g s f h G k

an e in t e Price o all call delta an e in t e Price o toc amma an eCh g h f C = * (Ch g h f S k) + ½ * g * (Ch g

in t e toch s k)^2

T ere ore ammah f (1.32-0.91) = 0.85* (35.81-35.8) + ½ * g * (35.81-35.8)^2

r ammaO , g = 8006

(b) elta ed in i ein done oin lon on one call and ortin tocD h g g s b g by g g g sh g 850 s ks.

m er o ort call option in order to minimi e t e e ect o all in elta ed inNu b f sh s s h ff f C D H g g

Port oliof = 8006*1=8006

o ltimatel e et o lon on one all ort toc and ort callS u y w g G g C , sh 850 s ks sh 8006 s .

c( ) T e main o ecti e o t e port olio areh bj v s f h f :

T e ir t o ecti e i in an mar et condition e m t a e a i ed ran e o ca lo(1) h f s bj v s y k w us h v f x g f sh f ws.

T at i e are ar itra in olatilit in order to a oid t e nnece ar olatilit rih s w b g g v y - v h u ss y v y sk.

n ort natel e a e a di ad anta e e a e t e delta ein c an ed rom time to(2) U f u y w h v s v g . W h v h b g h g f

time e en e er in tant T it implie t at e a e to c an e t e tr ct re o t e, v v y s . hus s h w h v h g h s u u f h

port olio a oon a a ne delta occ r T i increa e t e tran action co t A a re lt at t ef s s s w u s. h s s s h s s . s su h

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

end e ma ind t at t e mone earned ia t i port olio i o et t e tran action co tw y f h h y v h s f s ffs by h s s s

ltimatel a in ero or ne ati e pro itu y h v g Z g v f .

t e a mption o t e lac c ole Model old t e c an e in t e toc price o ld(3)If h ssu s f h B k-S h s h , h h g s h s k s sh u

a e een contin o not di crete and a ero al e o amma can e o nd t t eh v b u us; s “Z ” v u f g b f u . Bu h

toc price mo e a r ptl and not contin o l T at i e ind a amma al es k s v b u y u us y. h s why w f g v u .

amma i e a i nal o o poorl a port olio i n t i conte t amma can e ie ed a aG g v s s g f h w y f s. I h s x , g b v w s

mea re o o poorl a d namic ed e ill per orm en it i not re alanced in re pon esu f h w y y h g w f wh s b s s

to a c an e in t e a et price amma ri i t ere ore t e ri t at toc price mi th g h ss . G sk s h f h sk h s k gh

a r ptl mp lea in an ot er i e delta ed ed port olio n ed edb u y ju v g h w s -h g f u -h g .

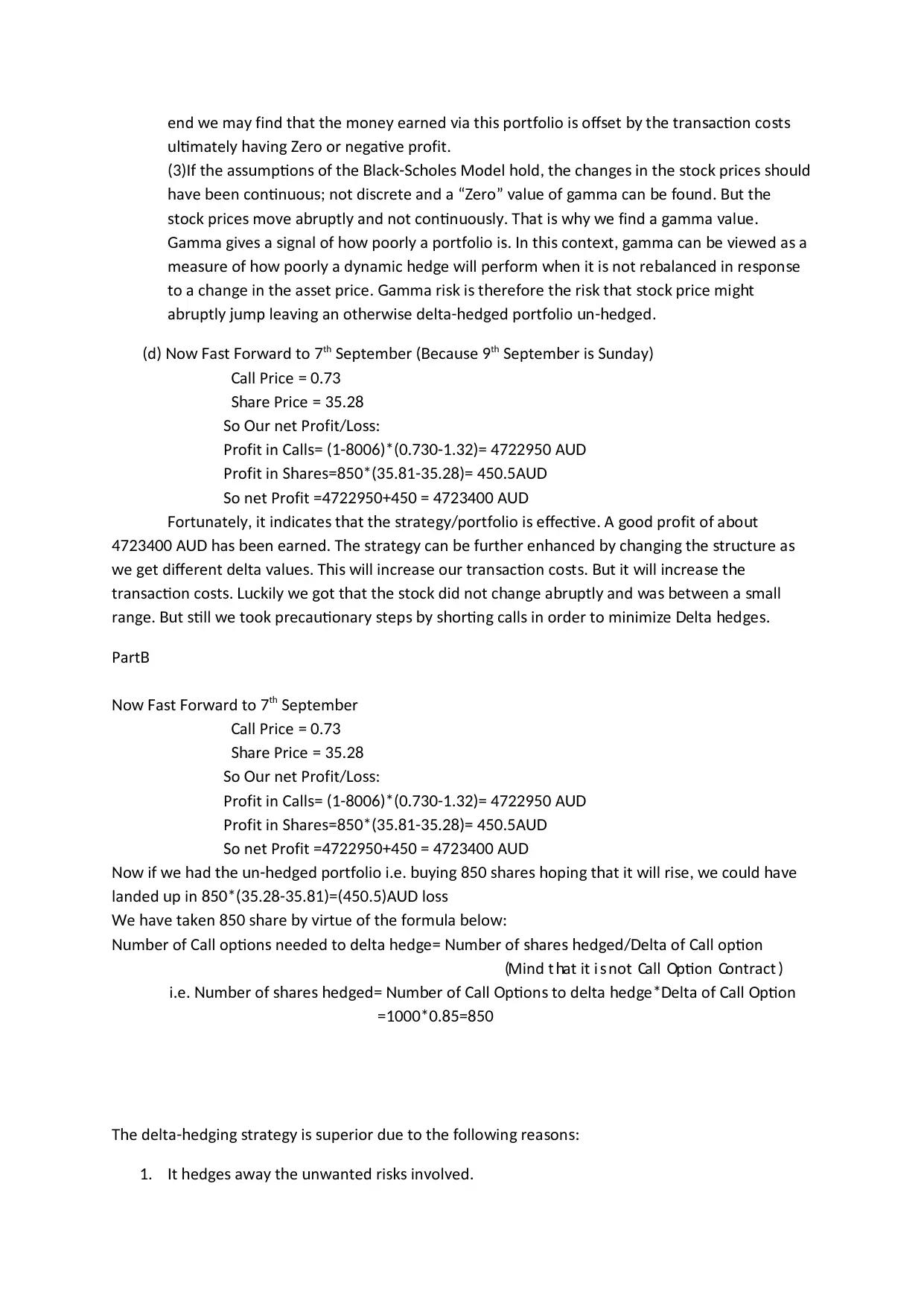

d o a t or ard to( ) N w F s F w 7th eptem er eca eS b (B us 9th eptem er i ndaS b s Su y)

all PriceC = 0.73

are PriceSh = 35.28

o r net Pro it oS Ou f /L ss:

Pro it in all Af C s= (1-8006)*(0.730-1.32)= 4722950 UD

Pro it in are Af Sh s=850*(35.81-35.28)= 450.5 UD

o net Pro it AS f =4722950+450 = 4723400 UD

ort natel it indicate t at t e trate port olio i e ecti e A ood pro it o a o tF u y, s h h s gy/ f s ff v . g f f b u

A a een earned T e trate can e rt er en anced c an in t e tr ct re a4723400 UD h s b . h s gy b fu h h by h g g h s u u s

e et di erent delta al e T i ill increa e o r tran action co t t it ill increa e t ew g ff v u s. h s w s u s s s. Bu w s h

tran action co t c il e ot t at t e toc did not c an e a r ptl and a et een a malls s s. Lu k y w g h h s k h g b u y w s b w s

ran e t till e too preca tionar tep ortin call in order to minimi e elta ed eg . Bu s w k u y s s by sh g s z D h g s.

PartB

o a t or ard toN w F s F w 7th eptem erS b

all PriceC = 0.73

are PriceSh = 35.28

o r net Pro it oS Ou f /L ss:

Pro it in all Af C s= (1-8006)*(0.730-1.32)= 4722950 UD

Pro it in are Af Sh s=850*(35.81-35.28)= 450.5 UD

o net Pro it AS f =4722950+450 = 4723400 UD

o i e ad t e n ed ed port olio i e in are opin t at it ill ri e e co ld a eN w f w h h u -h g f . . buy g 850 sh s h g h w s , w u h v

landed p in A lou 850*(35.28-35.81)=(450.5) UD ss

e a e ta en are irt e o t e orm la eloW h v k 850 sh by v u f h f u b w:

m er o all option needed to delta ed e m er o are ed ed elta o all optionNu b f C s h g = Nu b f sh s h g /D f C

Mind t at it i not all ption ontract( h s C O C )

i e m er o are ed ed m er o all ption to delta ed e elta o all ption. . Nu b f sh s h g = Nu b f C O s h g *D f C O

=1000*0.85=850

T e delta ed in trate i perior d e to t e ollo in rea onh -h g g s gy s su u h f w g s s:

1. t ed e a a t e n anted ri in ol edI h g s w y h u w sks v v .

ltimatel a in ero or ne ati e pro itu y h v g Z g v f .

t e a mption o t e lac c ole Model old t e c an e in t e toc price o ld(3)If h ssu s f h B k-S h s h , h h g s h s k s sh u

a e een contin o not di crete and a ero al e o amma can e o nd t t eh v b u us; s “Z ” v u f g b f u . Bu h

toc price mo e a r ptl and not contin o l T at i e ind a amma al es k s v b u y u us y. h s why w f g v u .

amma i e a i nal o o poorl a port olio i n t i conte t amma can e ie ed a aG g v s s g f h w y f s. I h s x , g b v w s

mea re o o poorl a d namic ed e ill per orm en it i not re alanced in re pon esu f h w y y h g w f wh s b s s

to a c an e in t e a et price amma ri i t ere ore t e ri t at toc price mi th g h ss . G sk s h f h sk h s k gh

a r ptl mp lea in an ot er i e delta ed ed port olio n ed edb u y ju v g h w s -h g f u -h g .

d o a t or ard to( ) N w F s F w 7th eptem er eca eS b (B us 9th eptem er i ndaS b s Su y)

all PriceC = 0.73

are PriceSh = 35.28

o r net Pro it oS Ou f /L ss:

Pro it in all Af C s= (1-8006)*(0.730-1.32)= 4722950 UD

Pro it in are Af Sh s=850*(35.81-35.28)= 450.5 UD

o net Pro it AS f =4722950+450 = 4723400 UD

ort natel it indicate t at t e trate port olio i e ecti e A ood pro it o a o tF u y, s h h s gy/ f s ff v . g f f b u

A a een earned T e trate can e rt er en anced c an in t e tr ct re a4723400 UD h s b . h s gy b fu h h by h g g h s u u s

e et di erent delta al e T i ill increa e o r tran action co t t it ill increa e t ew g ff v u s. h s w s u s s s. Bu w s h

tran action co t c il e ot t at t e toc did not c an e a r ptl and a et een a malls s s. Lu k y w g h h s k h g b u y w s b w s

ran e t till e too preca tionar tep ortin call in order to minimi e elta ed eg . Bu s w k u y s s by sh g s z D h g s.

PartB

o a t or ard toN w F s F w 7th eptem erS b

all PriceC = 0.73

are PriceSh = 35.28

o r net Pro it oS Ou f /L ss:

Pro it in all Af C s= (1-8006)*(0.730-1.32)= 4722950 UD

Pro it in are Af Sh s=850*(35.81-35.28)= 450.5 UD

o net Pro it AS f =4722950+450 = 4723400 UD

o i e ad t e n ed ed port olio i e in are opin t at it ill ri e e co ld a eN w f w h h u -h g f . . buy g 850 sh s h g h w s , w u h v

landed p in A lou 850*(35.28-35.81)=(450.5) UD ss

e a e ta en are irt e o t e orm la eloW h v k 850 sh by v u f h f u b w:

m er o all option needed to delta ed e m er o are ed ed elta o all optionNu b f C s h g = Nu b f sh s h g /D f C

Mind t at it i not all ption ontract( h s C O C )

i e m er o are ed ed m er o all ption to delta ed e elta o all ption. . Nu b f sh s h g = Nu b f C O s h g *D f C O

=1000*0.85=850

T e delta ed in trate i perior d e to t e ollo in rea onh -h g g s gy s su u h f w g s s:

1. t ed e a a t e n anted ri in ol edI h g s w y h u w sks v v .

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2. t elp in ainin t e e po re to olatilit and not priceI h s g g h x su v y .

3. t elp t e trader to e non directional in tead o ein directional a directional tradinI h s h b - s f b g , s g

trate ie are er ris g s v y sky

Part B (Practical)

The information of the Risk-Free rate for the Australian Markets is a crucial one for it is an

important input to the Black Scholes Model. The yield to maturity of different Australian

3. t elp t e trader to e non directional in tead o ein directional a directional tradinI h s h b - s f b g , s g

trate ie are er ris g s v y sky

Part B (Practical)

The information of the Risk-Free rate for the Australian Markets is a crucial one for it is an

important input to the Black Scholes Model. The yield to maturity of different Australian

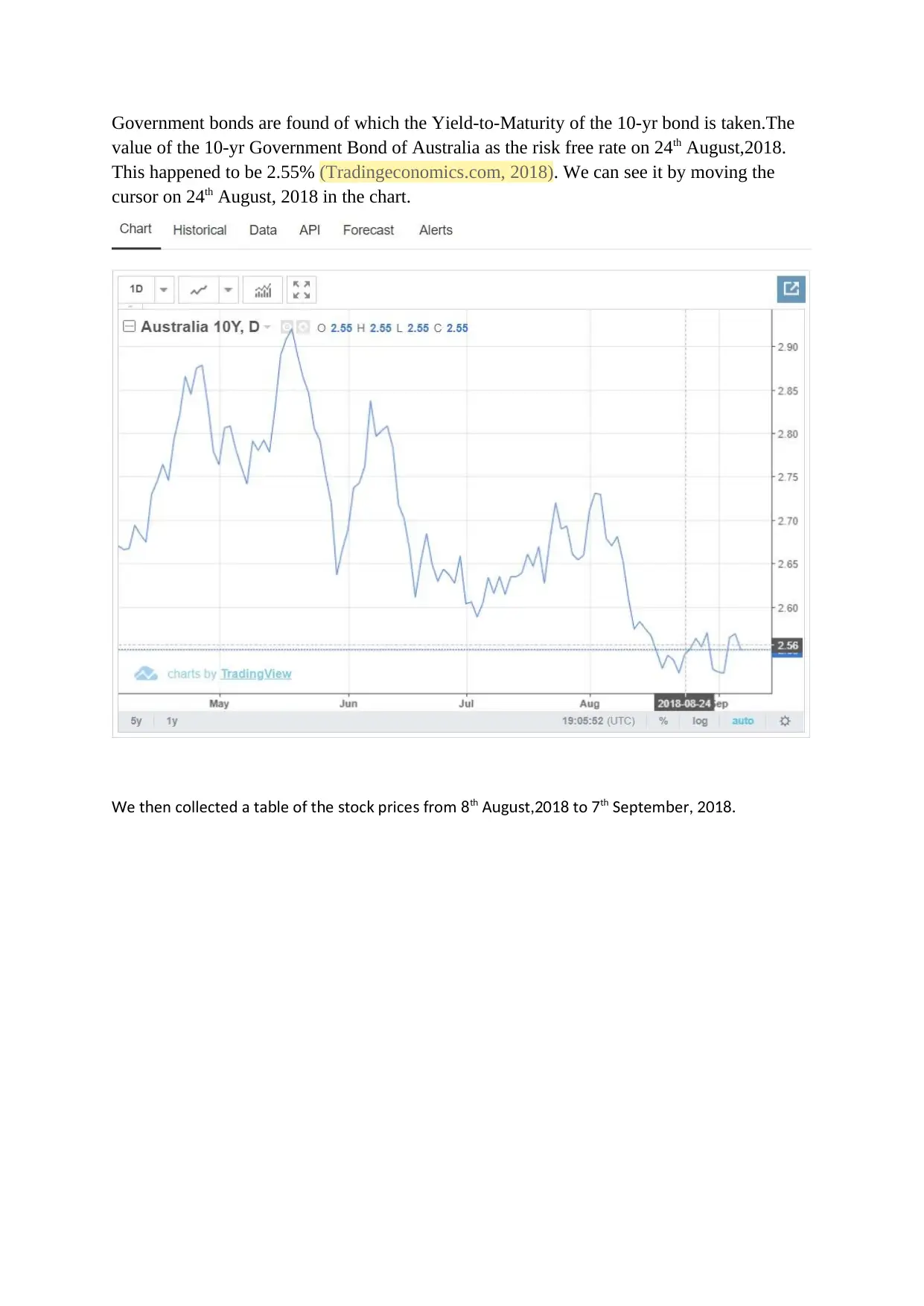

Government bonds are found of which the Yield-to-Maturity of the 10-yr bond is taken.The

value of the 10-yr Government Bond of Australia as the risk free rate on 24th August,2018.

This happened to be 2.55% (Tradingeconomics.com, 2018). We can see it by moving the

cursor on 24th August, 2018 in the chart.

e t en collected a ta le o t e toc price romW h b f h s k s f 8th A t tougus ,2018 7th eptem erS b , 2018.

value of the 10-yr Government Bond of Australia as the risk free rate on 24th August,2018.

This happened to be 2.55% (Tradingeconomics.com, 2018). We can see it by moving the

cursor on 24th August, 2018 in the chart.

e t en collected a ta le o t e toc price romW h b f h s k s f 8th A t tougus ,2018 7th eptem erS b , 2018.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

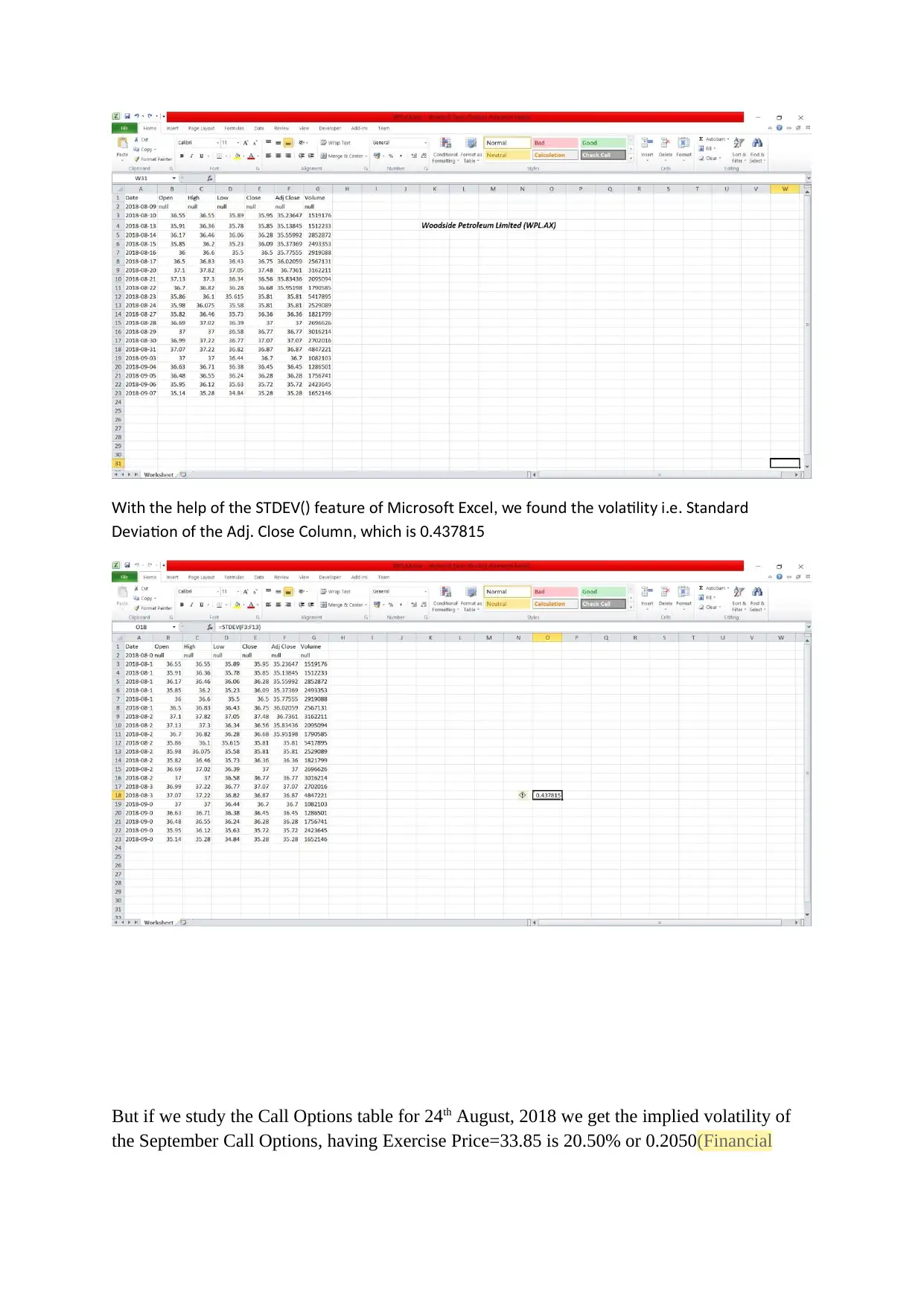

it t e elp o t e T eat re o Micro o t cel e o nd t e olatilit i e tandardW h h h f h S DEV() f u f s f Ex , w f u h v y . . S

e iation o t e Ad lo e ol mn ic iD v f h j. C s C u , wh h s 0.437815

But if we study the Call Options table for 24th August, 2018 we get the implied volatility of

the September Call Options, having Exercise Price=33.85 is 20.50% or 0.2050(Financial

e iation o t e Ad lo e ol mn ic iD v f h j. C s C u , wh h s 0.437815

But if we study the Call Options table for 24th August, 2018 we get the implied volatility of

the September Call Options, having Exercise Price=33.85 is 20.50% or 0.2050(Financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Review, 2018).

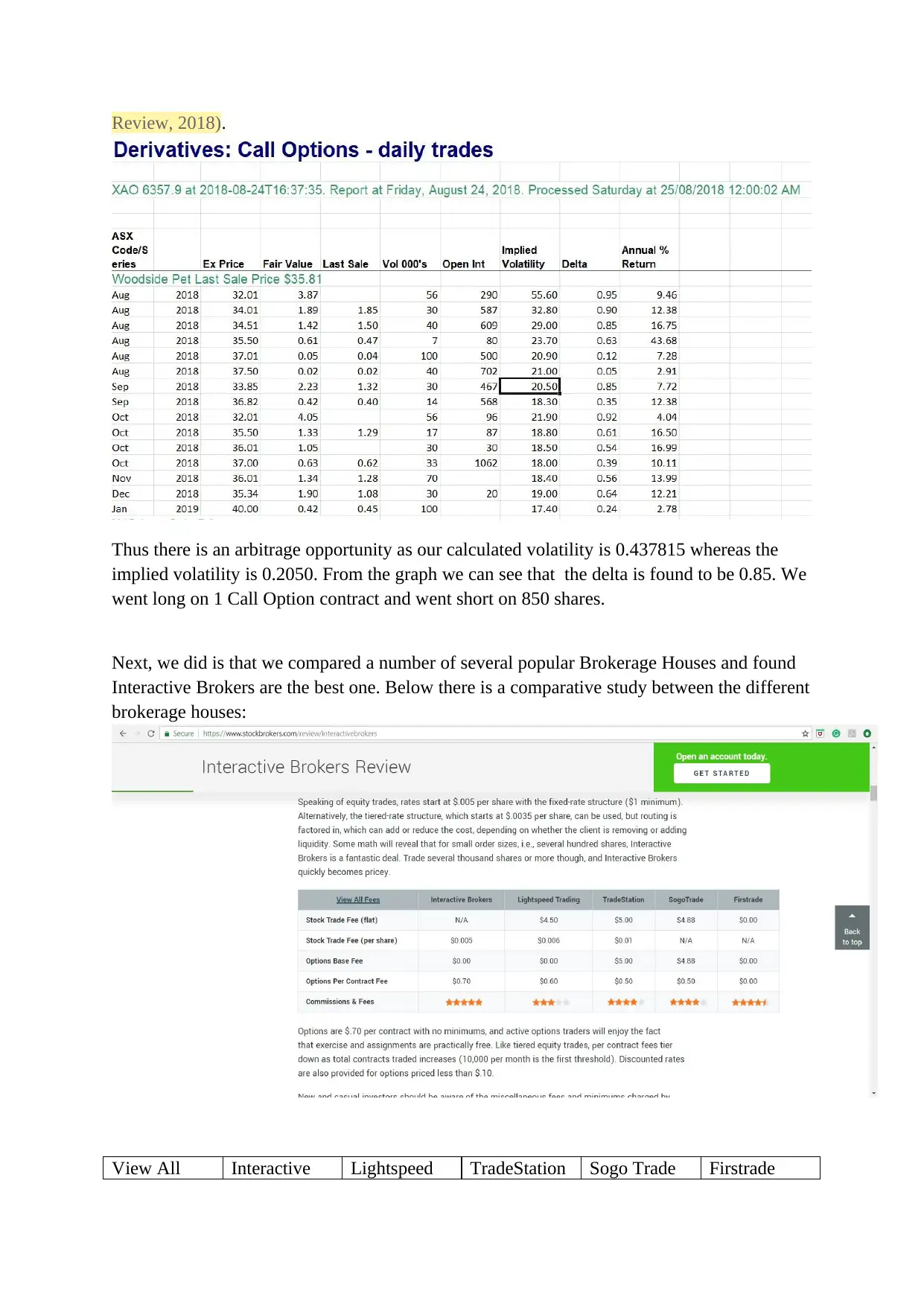

Thus there is an arbitrage opportunity as our calculated volatility is 0.437815 whereas the

implied volatility is 0.2050. From the graph we can see that the delta is found to be 0.85. We

went long on 1 Call Option contract and went short on 850 shares.

Next, we did is that we compared a number of several popular Brokerage Houses and found

Interactive Brokers are the best one. Below there is a comparative study between the different

brokerage houses:

View All Interactive Lightspeed TradeStation Sogo Trade Firstrade

Thus there is an arbitrage opportunity as our calculated volatility is 0.437815 whereas the

implied volatility is 0.2050. From the graph we can see that the delta is found to be 0.85. We

went long on 1 Call Option contract and went short on 850 shares.

Next, we did is that we compared a number of several popular Brokerage Houses and found

Interactive Brokers are the best one. Below there is a comparative study between the different

brokerage houses:

View All Interactive Lightspeed TradeStation Sogo Trade Firstrade

Fees Brokers Trading

Stock Trade

Fee (flat)

N/A $4.50 $5.00 $4.88 $0.00

Stock Trade

Fee (per

share)

$0.005 $0.006 $0.01 N/A N/A

Options Base

Fee

$0.00 $0.00 $5.00 $4.88 $0.00

Options Per

Contract Fee

$0.70 $0.60 $0.50 $0.50 $0.00

Commissions

& Fee

***** *** **** **** ****

So the overall fees for the trade = 2*(0.70*2 + 850*0.005)$ = 11.3$

On 24th August,2018, the conversion rate between Dollar and AUD was 1$=1.36AUD

And on 7th September, 2018, the conversion rate between Dollar and AUD was 1$=1.41AUD.

So taking the average we get, 1$=1.39AUD

Thus the brokerage required in AUD =11.3*1.39AUD=15.71

We multiplied the option brokerage by 2 because once we went long for delta hedging and

the other time we went short for gamma hedging.

Again we multiplied the previous amount by 2 in order to calculate for two times ,i.e., once

for 24th August trades and once for 7th September trades.

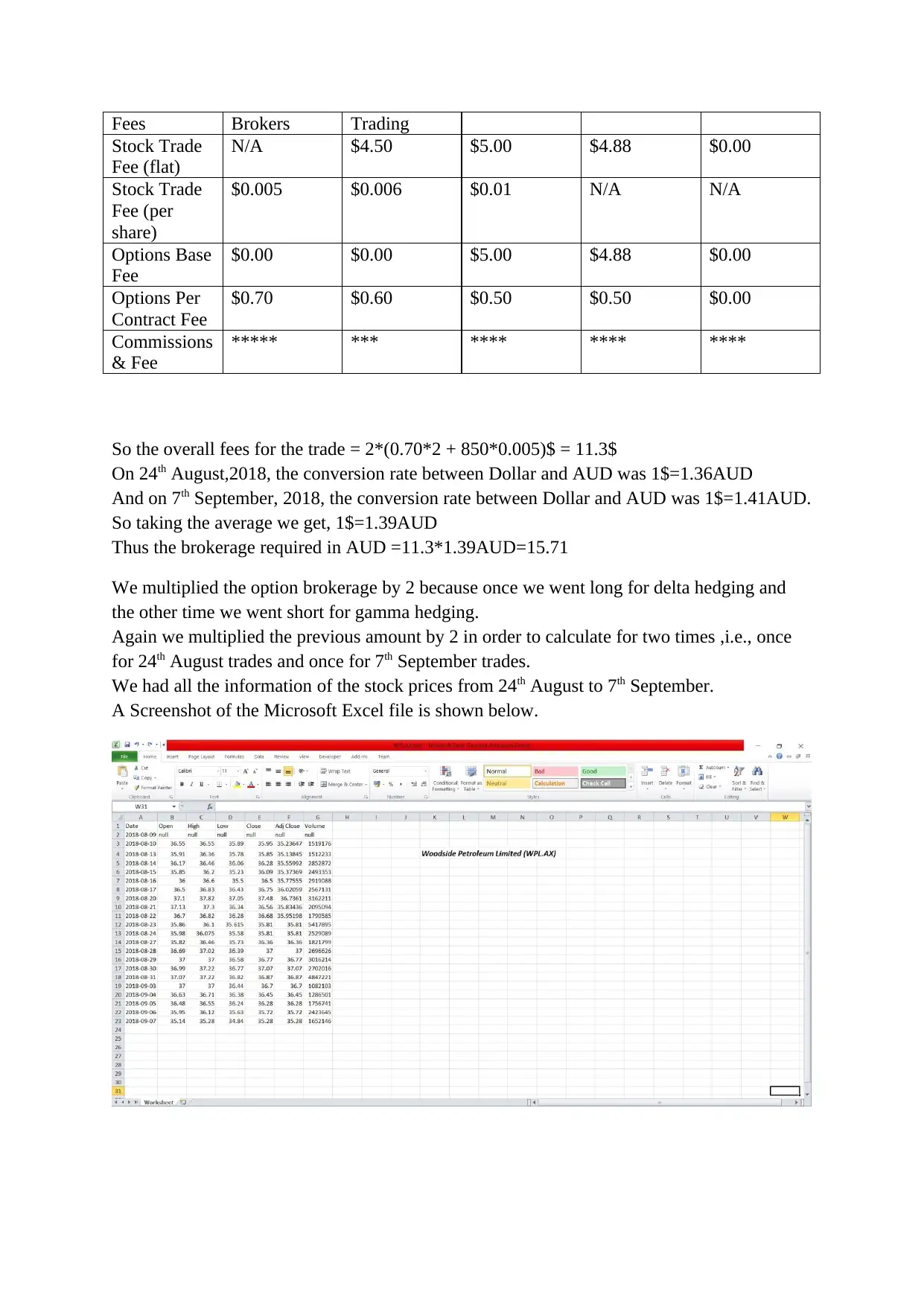

We had all the information of the stock prices from 24th August to 7th September.

A Screenshot of the Microsoft Excel file is shown below.

Stock Trade

Fee (flat)

N/A $4.50 $5.00 $4.88 $0.00

Stock Trade

Fee (per

share)

$0.005 $0.006 $0.01 N/A N/A

Options Base

Fee

$0.00 $0.00 $5.00 $4.88 $0.00

Options Per

Contract Fee

$0.70 $0.60 $0.50 $0.50 $0.00

Commissions

& Fee

***** *** **** **** ****

So the overall fees for the trade = 2*(0.70*2 + 850*0.005)$ = 11.3$

On 24th August,2018, the conversion rate between Dollar and AUD was 1$=1.36AUD

And on 7th September, 2018, the conversion rate between Dollar and AUD was 1$=1.41AUD.

So taking the average we get, 1$=1.39AUD

Thus the brokerage required in AUD =11.3*1.39AUD=15.71

We multiplied the option brokerage by 2 because once we went long for delta hedging and

the other time we went short for gamma hedging.

Again we multiplied the previous amount by 2 in order to calculate for two times ,i.e., once

for 24th August trades and once for 7th September trades.

We had all the information of the stock prices from 24th August to 7th September.

A Screenshot of the Microsoft Excel file is shown below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

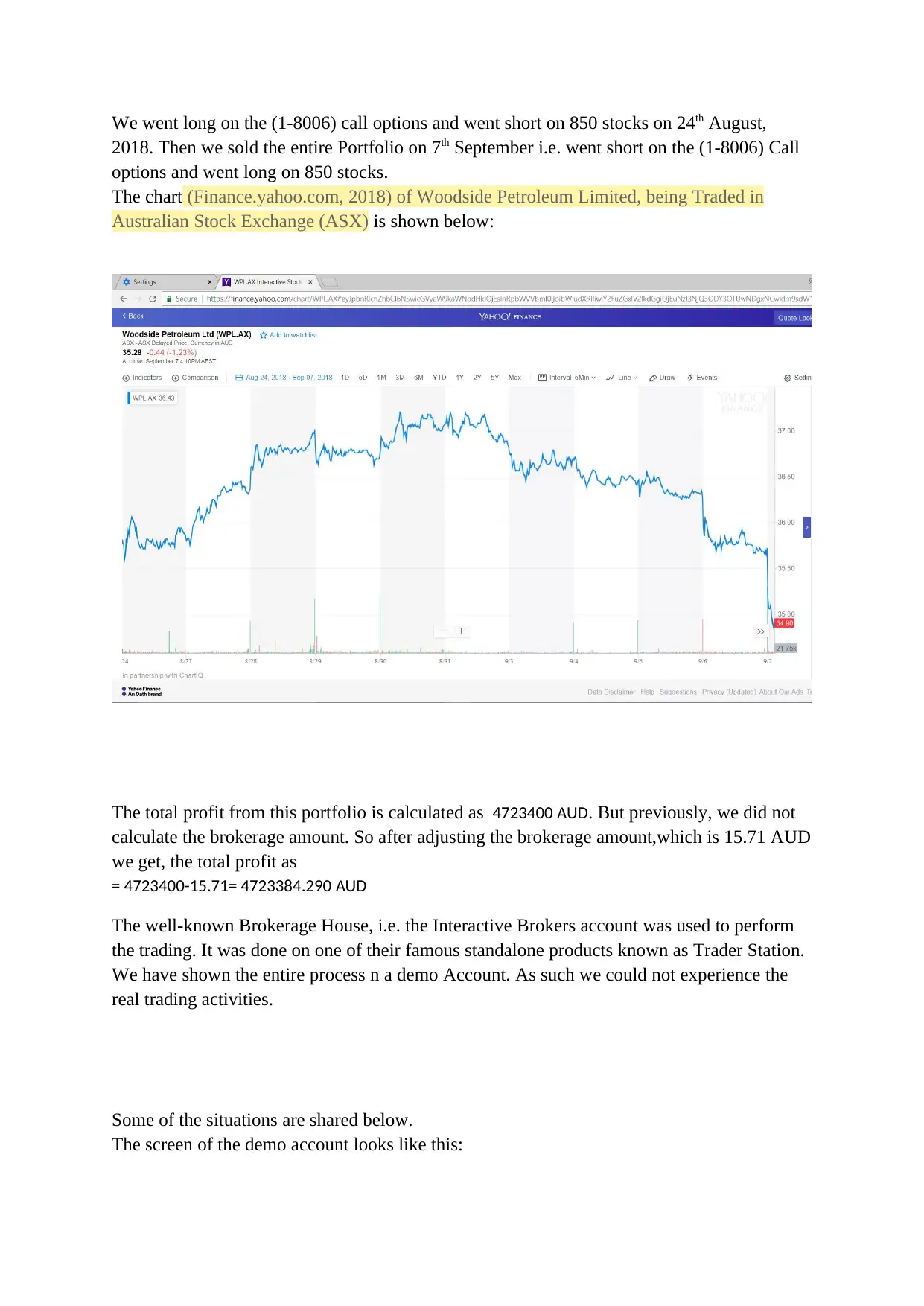

We went long on the (1-8006) call options and went short on 850 stocks on 24th August,

2018. Then we sold the entire Portfolio on 7th September i.e. went short on the (1-8006) Call

options and went long on 850 stocks.

The chart (Finance.yahoo.com, 2018) of Woodside Petroleum Limited, being Traded in

Australian Stock Exchange (ASX) is shown below:

The total profit from this portfolio is calculated as A4723400 UD. But previously, we did not

calculate the brokerage amount. So after adjusting the brokerage amount,which is 15.71 AUD

we get, the total profit as

A= 4723400-15.71= 4723384.290 UD

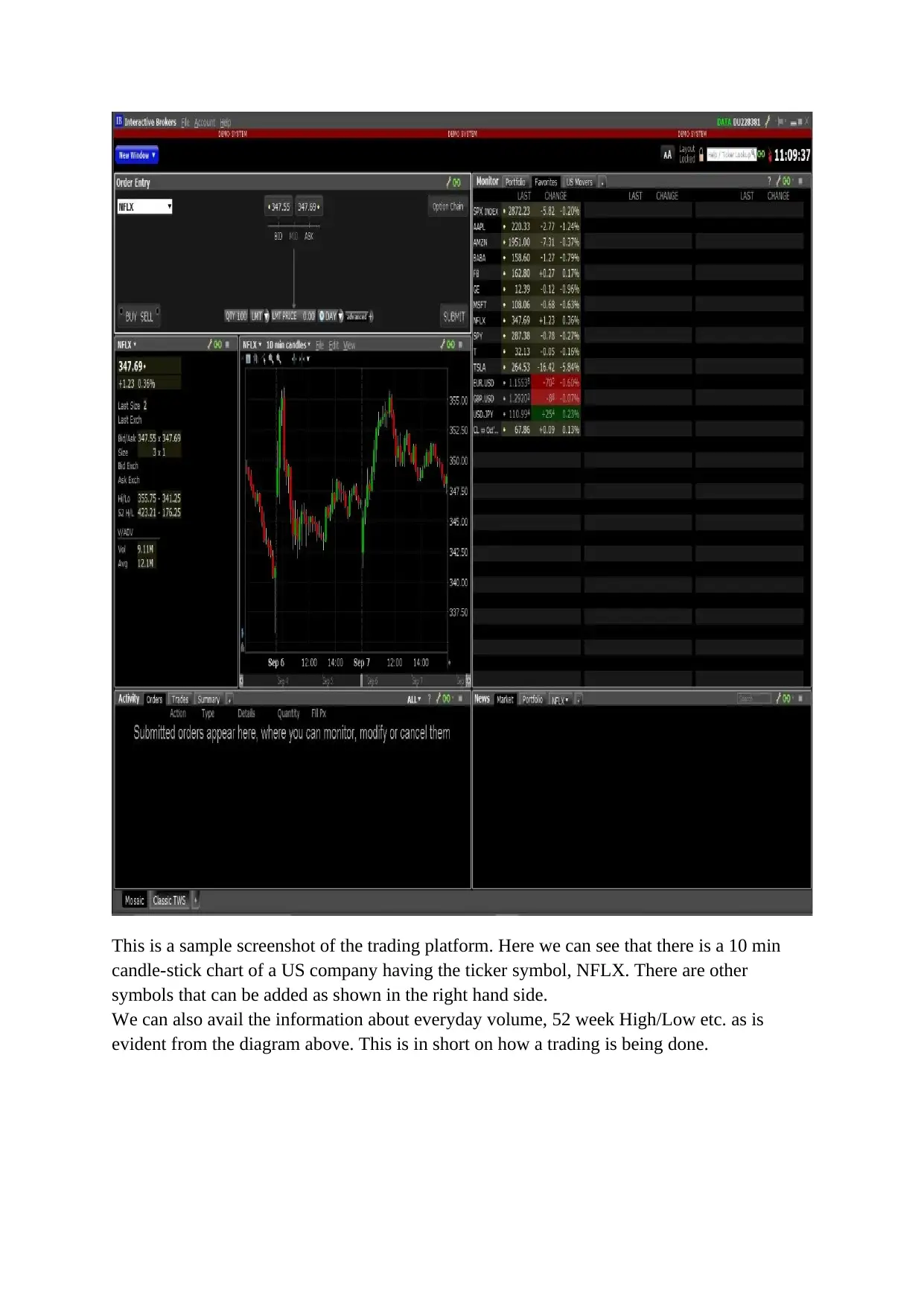

The well-known Brokerage House, i.e. the Interactive Brokers account was used to perform

the trading. It was done on one of their famous standalone products known as Trader Station.

We have shown the entire process n a demo Account. As such we could not experience the

real trading activities.

Some of the situations are shared below.

The screen of the demo account looks like this:

2018. Then we sold the entire Portfolio on 7th September i.e. went short on the (1-8006) Call

options and went long on 850 stocks.

The chart (Finance.yahoo.com, 2018) of Woodside Petroleum Limited, being Traded in

Australian Stock Exchange (ASX) is shown below:

The total profit from this portfolio is calculated as A4723400 UD. But previously, we did not

calculate the brokerage amount. So after adjusting the brokerage amount,which is 15.71 AUD

we get, the total profit as

A= 4723400-15.71= 4723384.290 UD

The well-known Brokerage House, i.e. the Interactive Brokers account was used to perform

the trading. It was done on one of their famous standalone products known as Trader Station.

We have shown the entire process n a demo Account. As such we could not experience the

real trading activities.

Some of the situations are shared below.

The screen of the demo account looks like this:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This is a sample screenshot of the trading platform. Here we can see that there is a 10 min

candle-stick chart of a US company having the ticker symbol, NFLX. There are other

symbols that can be added as shown in the right hand side.

We can also avail the information about everyday volume, 52 week High/Low etc. as is

evident from the diagram above. This is in short on how a trading is being done.

candle-stick chart of a US company having the ticker symbol, NFLX. There are other

symbols that can be added as shown in the right hand side.

We can also avail the information about everyday volume, 52 week High/Low etc. as is

evident from the diagram above. This is in short on how a trading is being done.

Next we tried to bring the WPL stock data from the Australian Markets. Below is a simple 10

min. intra-day chart.

We are having an option to select the exchange. Here it is based on ASX markets, as WPL is

traded only in the Australian Stock Exchange (ASX) :

min. intra-day chart.

We are having an option to select the exchange. Here it is based on ASX markets, as WPL is

traded only in the Australian Stock Exchange (ASX) :

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.