University of Adelaide: Delta-Gamma Hedging on Newcrest Mining ASX

VerifiedAdded on 2023/06/08

|10

|1561

|64

Report

AI Summary

This report details an arbitrage strategy employing delta-gamma neutral hedging on Newcrest Mining Limited (NCM.ASX) from August to September 2018. The strategy leverages a discrepancy between calculated stock volatility (40.98%) and implied volatility (23.30%) of September call options. The implementation involves buying call options and shorting shares to create a delta-neutral portfolio, further refined by incorporating gamma hedging. The report outlines the objectives of delta-neutral hedging, including risk mitigation and continuous portfolio rebalancing. The analysis calculates the profit/loss from the hedged portfolio compared to an unhedged position, highlighting the effectiveness of the strategy in generating a profit of 838.388 AUD. The report also discusses the use of Interactive Brokers for trading and the challenges faced in simulating trades on the Australian market. It concludes that the delta-gamma neutral technique effectively minimizes risk while achieving arbitrage profit. Desklib provides a platform to access similar solved assignments and study resources for students.

PartA

By comparing several companies in the ASX we have chosen Newcrest Mining as it is having one of

the highest P/E ratio in the market(52.5) and moreover it has an active participation in the

derivatives market via the options.

Now we are giving it in a chronological manner

Date:20th August, 2018

We have got by calculating the volatility of the stock must be 40.98% but the implied volatility of the

September Call options whose exercise price is is given as as 23.30%. So here we get the option is

mispriced. We buy the Call Option and go short on Delta number of stocks. The call Price is 0.79

Share Price= 20.62

(a) From the data we got the option delta as 0.61.

Now we have to find the option gamma as part of other Greek

Change in the Price of Call= call delta * (Change in the Price of Stock) + ½ * gamma * (Change

in the stock)^2

Therefore (0.79-0.50) = 0.49* (20.62-20.11) + ½ * gamma * (20.62-20.11)^2

Or, 0.29= 0.2499+ ½* gamma * 0.51^2

Or, gamma= 0.30834

(b) We can do the delta hedging by buying one call and shorting 610 stocks

Number of short call options in order to minimise the effect of Call in Delta Hedging

Portfolio= 0.30834*1=0.30834 =0.31 approx.

So ultimately we get Go long on one Call, short 610 stocks and short 0.31 calls .

(c) The objectives of the portfolio are:

(1) It is used to combine a long position in a call with a short position in a stock so that the

portfolio does not change as the stock price changes.

(2) The main problem of delta-neutral hedging happens to be that the delta hedged asset

position becomes risk free only for a very small change in the value of the underlying stock.

As a result of which the delta-neutral portfolio should be continuously rebalanced in order to

maintain the hedge. As the underlying stock price changes, so the delta of the call option,

and thus the number of calls also need to be changed to maintain a hedged position. Hence,

continuously maintaining a delta-neutral position involves significant transaction costs.

(3)If the assumptions of the Black-Scholes Model hold, changes in the stock price will be

continuous rather than abrupt, and hence there will be no gamma risk. In this context,

gamma can be viewed as a measure of how poorly a dynamic hedge will perform when it is

not rebalanced in response to a change in the asset price. Gamma risk is therefore the risk

that stock price might abruptly jump leaving an otherwise delta-hedged portfolio unhedged.

(d) Now Fast Forward to 6th September

Call Price = 0.30

Share Price = 18.69

So Our net Profit/Loss:

Loss in Calls= (1-0.31)*(0.30-0.79)=(0.3318)=331.8AUD

Profit in Shares=610*(20.62-18.69)=1177.3AUD

So net Profit = 1262.7-33.18= 838.388 AUD

By comparing several companies in the ASX we have chosen Newcrest Mining as it is having one of

the highest P/E ratio in the market(52.5) and moreover it has an active participation in the

derivatives market via the options.

Now we are giving it in a chronological manner

Date:20th August, 2018

We have got by calculating the volatility of the stock must be 40.98% but the implied volatility of the

September Call options whose exercise price is is given as as 23.30%. So here we get the option is

mispriced. We buy the Call Option and go short on Delta number of stocks. The call Price is 0.79

Share Price= 20.62

(a) From the data we got the option delta as 0.61.

Now we have to find the option gamma as part of other Greek

Change in the Price of Call= call delta * (Change in the Price of Stock) + ½ * gamma * (Change

in the stock)^2

Therefore (0.79-0.50) = 0.49* (20.62-20.11) + ½ * gamma * (20.62-20.11)^2

Or, 0.29= 0.2499+ ½* gamma * 0.51^2

Or, gamma= 0.30834

(b) We can do the delta hedging by buying one call and shorting 610 stocks

Number of short call options in order to minimise the effect of Call in Delta Hedging

Portfolio= 0.30834*1=0.30834 =0.31 approx.

So ultimately we get Go long on one Call, short 610 stocks and short 0.31 calls .

(c) The objectives of the portfolio are:

(1) It is used to combine a long position in a call with a short position in a stock so that the

portfolio does not change as the stock price changes.

(2) The main problem of delta-neutral hedging happens to be that the delta hedged asset

position becomes risk free only for a very small change in the value of the underlying stock.

As a result of which the delta-neutral portfolio should be continuously rebalanced in order to

maintain the hedge. As the underlying stock price changes, so the delta of the call option,

and thus the number of calls also need to be changed to maintain a hedged position. Hence,

continuously maintaining a delta-neutral position involves significant transaction costs.

(3)If the assumptions of the Black-Scholes Model hold, changes in the stock price will be

continuous rather than abrupt, and hence there will be no gamma risk. In this context,

gamma can be viewed as a measure of how poorly a dynamic hedge will perform when it is

not rebalanced in response to a change in the asset price. Gamma risk is therefore the risk

that stock price might abruptly jump leaving an otherwise delta-hedged portfolio unhedged.

(d) Now Fast Forward to 6th September

Call Price = 0.30

Share Price = 18.69

So Our net Profit/Loss:

Loss in Calls= (1-0.31)*(0.30-0.79)=(0.3318)=331.8AUD

Profit in Shares=610*(20.62-18.69)=1177.3AUD

So net Profit = 1262.7-33.18= 838.388 AUD

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

So the hedged portfolio I should say is effective. Because we have got a good profit of about

838.388 AUD. The portfolio can be further improved by changing it as we get different delta. But it

will increase the transaction costs. And another reason of the portfolio being effective is that there

was no abrupt jump of the portfolio on that period, though we took up precautionary measure by

shorting gamma number of calls. That’s it.

PartB

Now Fast Forward to 6th September

Call Price = 0.30

Share Price = 18.69

So Our net Profit/Loss:

Loss in Calls= (1-0.31)*(0.30-0.79)=(0.3318)=331.8AUD

Profit in Shares=610*(20.62-18.69)=1177.3AUD

So net Profit = 1262.7-33.18= 838.388 AUD

Now if we had the un-hedged portfolio i.e. buying 610 shares hoping that it will rise, we could have

landed up in 610*(20.62-18.69)=(1177.3)AUD loss

We have taken 61 share by virtue of the formula below:

Number of Call options needed to delta hedge= Number of shares hedged/Delta of Call option

(Mind that it is not Call Option Contract)

i.e. Number of shares hedged= Number of Call Options to delta hedge*Delta of Call Option

=1000*0.61=610

The delta-hedging strategy is superior due to the following reasons:

1. It hedges away the unwanted risks involved.

2. It helps in gaining the exposure to volatility and not price.

3. It helps the trader to be non-directional instead of being directional, as directional trading

strategies are very risky

838.388 AUD. The portfolio can be further improved by changing it as we get different delta. But it

will increase the transaction costs. And another reason of the portfolio being effective is that there

was no abrupt jump of the portfolio on that period, though we took up precautionary measure by

shorting gamma number of calls. That’s it.

PartB

Now Fast Forward to 6th September

Call Price = 0.30

Share Price = 18.69

So Our net Profit/Loss:

Loss in Calls= (1-0.31)*(0.30-0.79)=(0.3318)=331.8AUD

Profit in Shares=610*(20.62-18.69)=1177.3AUD

So net Profit = 1262.7-33.18= 838.388 AUD

Now if we had the un-hedged portfolio i.e. buying 610 shares hoping that it will rise, we could have

landed up in 610*(20.62-18.69)=(1177.3)AUD loss

We have taken 61 share by virtue of the formula below:

Number of Call options needed to delta hedge= Number of shares hedged/Delta of Call option

(Mind that it is not Call Option Contract)

i.e. Number of shares hedged= Number of Call Options to delta hedge*Delta of Call Option

=1000*0.61=610

The delta-hedging strategy is superior due to the following reasons:

1. It hedges away the unwanted risks involved.

2. It helps in gaining the exposure to volatility and not price.

3. It helps the trader to be non-directional instead of being directional, as directional trading

strategies are very risky

REPORT WRITING

Title: A report on the arbitrage Profit made by the delta-hedging technique on the Newcrest

Mining Limited stock on the S&P ASX stock Market.

Introduction: Delta-hedging technique is a well-known technique to minimise the unwanted

risk in any portfolio. An arbitrage profit can be made based on this technique. To minimise

the exposure of Delta we added the gamma factor and made it a Delta-Gamma Neutral

Hedging Technique. In order to this we should have a stock which has a very high P/E so as

to get stability in the portfolio. There should be a presence of the stock in the options market.

Based on these we got Newcrest Mining Limited NCM.ASX as the most suitable stock

Body:

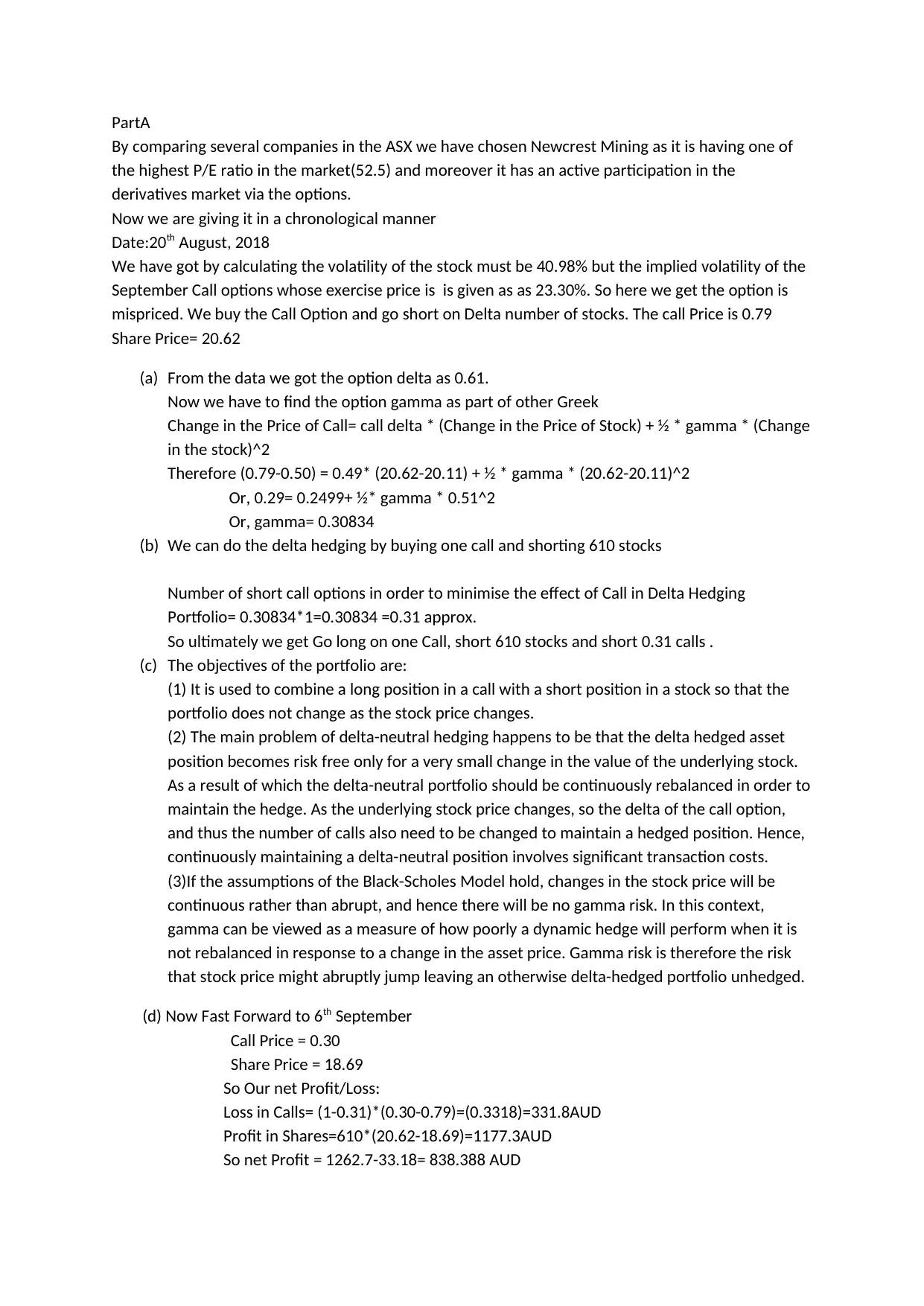

At first we took the value of the 10-yr Government Bond of Australia as the risk free rate on

20th August,2018. This happened to be 2.53% (Tradingeconomics.com, 2018).

Title: A report on the arbitrage Profit made by the delta-hedging technique on the Newcrest

Mining Limited stock on the S&P ASX stock Market.

Introduction: Delta-hedging technique is a well-known technique to minimise the unwanted

risk in any portfolio. An arbitrage profit can be made based on this technique. To minimise

the exposure of Delta we added the gamma factor and made it a Delta-Gamma Neutral

Hedging Technique. In order to this we should have a stock which has a very high P/E so as

to get stability in the portfolio. There should be a presence of the stock in the options market.

Based on these we got Newcrest Mining Limited NCM.ASX as the most suitable stock

Body:

At first we took the value of the 10-yr Government Bond of Australia as the risk free rate on

20th August,2018. This happened to be 2.53% (Tradingeconomics.com, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

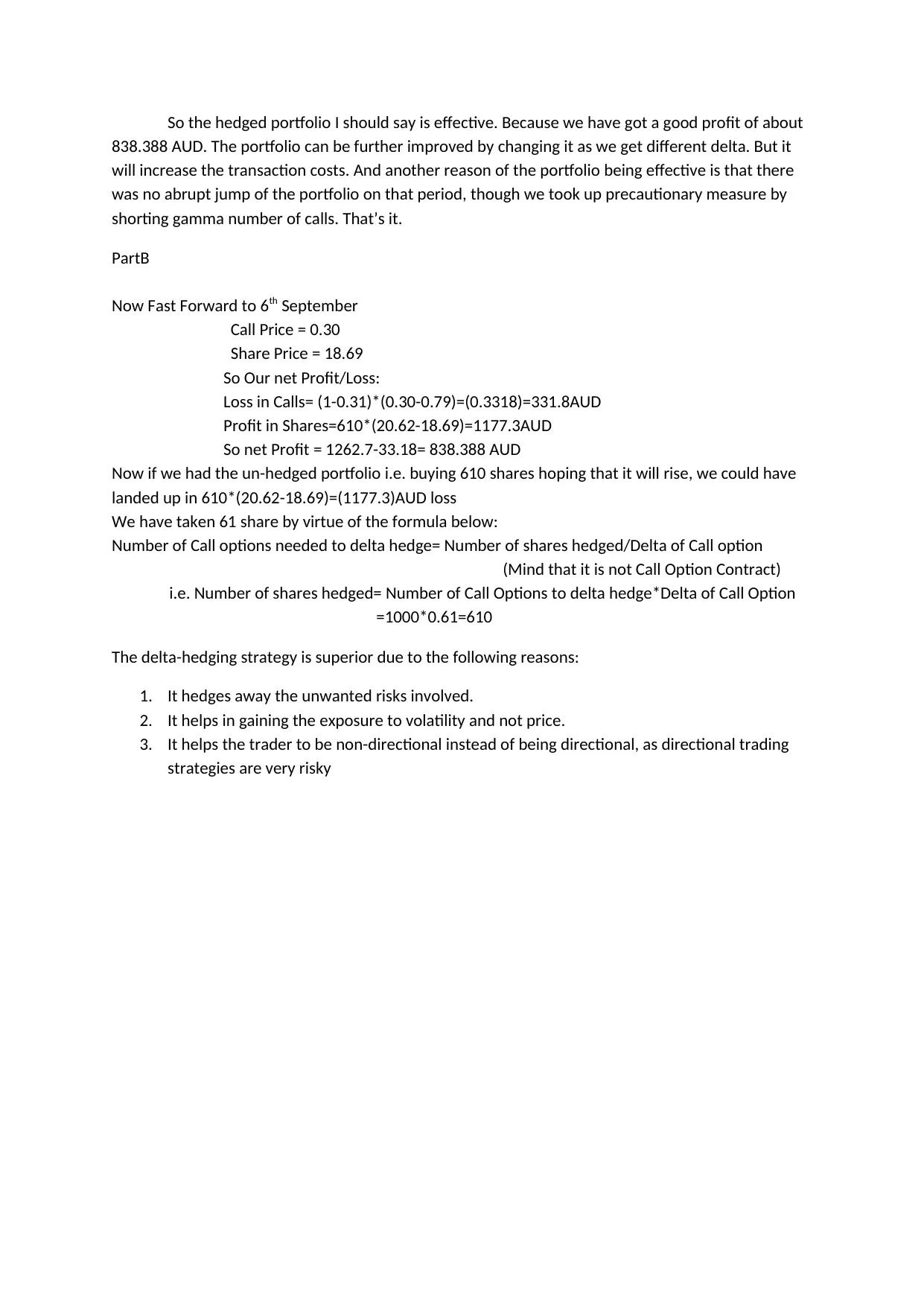

The volatility (or standard deviation) of the stock based on last 18 trading days, has been

calculated by virtue of the Microsoft Excel stdev() formula and is found to be 0.4098.

calculated by virtue of the Microsoft Excel stdev() formula and is found to be 0.4098.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

But from the market value the implied volatility is found to be 0.2330 (Financial Review,

2018).

So we found an arbitrage opportunity and as the delta is found to be 0.61, we went long on 1

Call Option contract and went short on 610 shares.

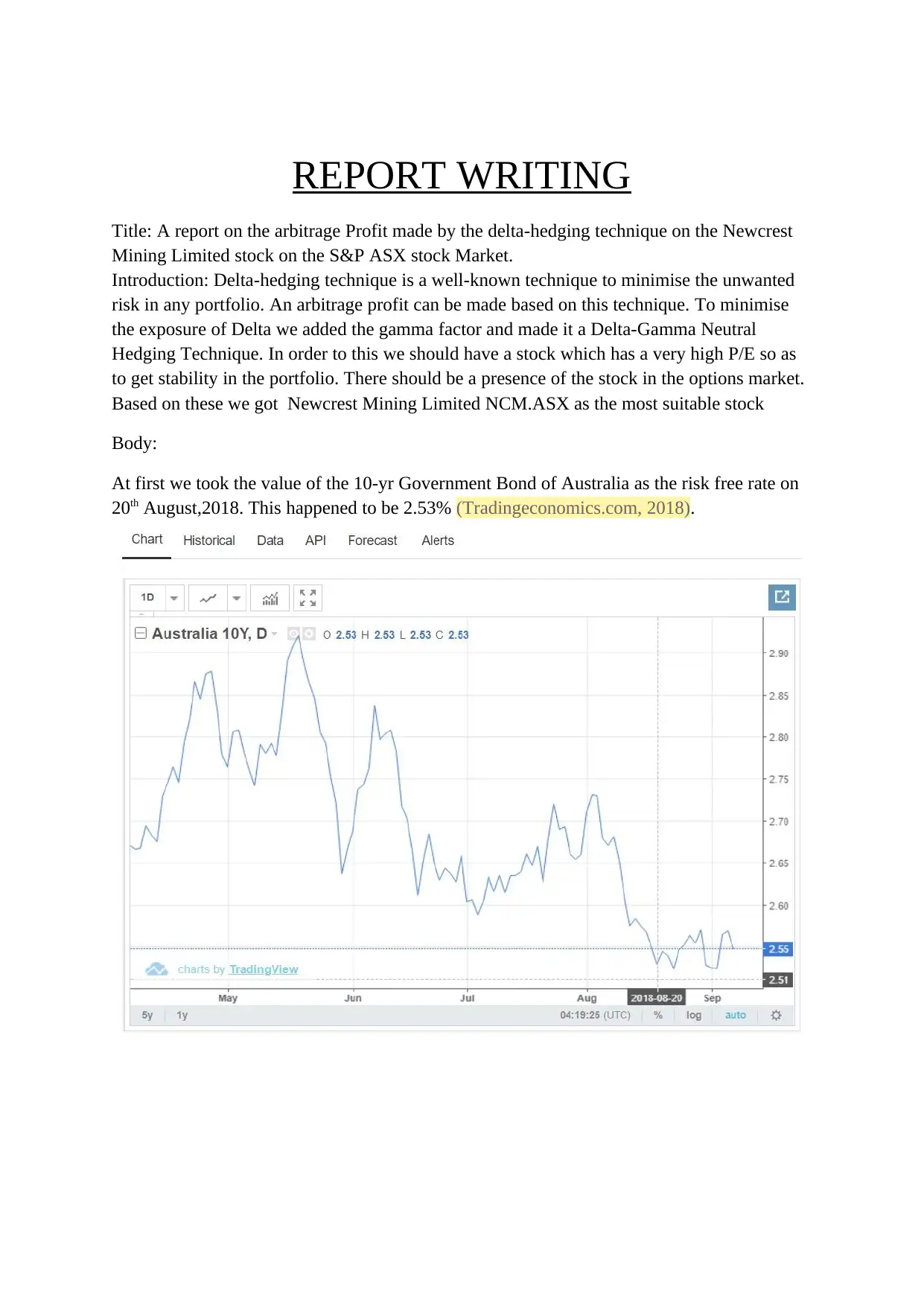

We compared several brokerage houses and found Interactive Brokers are the best one

So the overall fees for the trade = 2*(0.70*2 + 610*0.005) = 8.9AUD

We multiplied by 2 the option because once we bought for delta hedging and the other time

we did it for gamma hedging.

Again we multiplied by 2 in order to calculate for two times, once for 20th August trades and

once for 6th September trades.

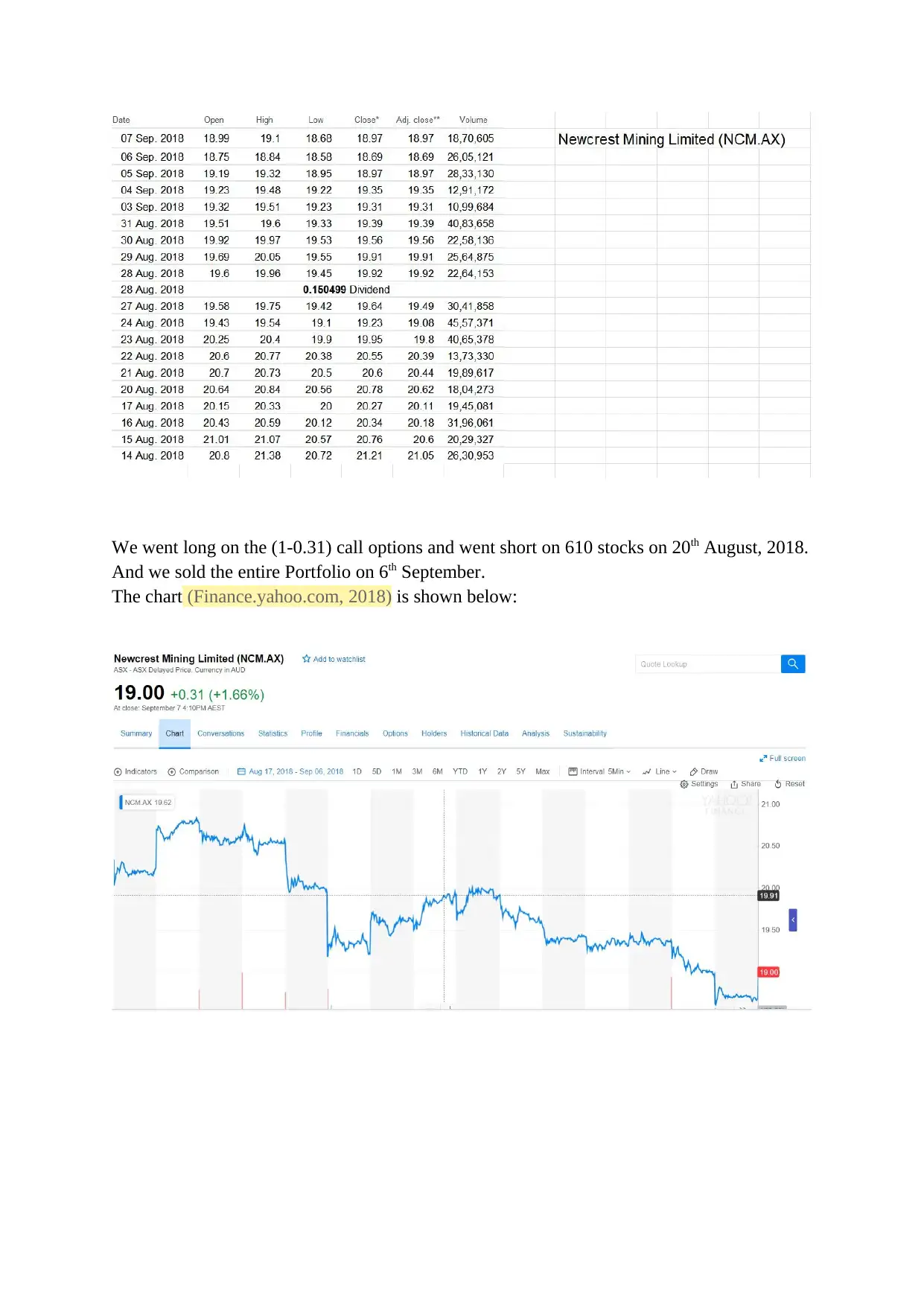

We had all the information of the stock prices from 20th August to 6th September.

This is shown below:

2018).

So we found an arbitrage opportunity and as the delta is found to be 0.61, we went long on 1

Call Option contract and went short on 610 shares.

We compared several brokerage houses and found Interactive Brokers are the best one

So the overall fees for the trade = 2*(0.70*2 + 610*0.005) = 8.9AUD

We multiplied by 2 the option because once we bought for delta hedging and the other time

we did it for gamma hedging.

Again we multiplied by 2 in order to calculate for two times, once for 20th August trades and

once for 6th September trades.

We had all the information of the stock prices from 20th August to 6th September.

This is shown below:

We went long on the (1-0.31) call options and went short on 610 stocks on 20th August, 2018.

And we sold the entire Portfolio on 6th September.

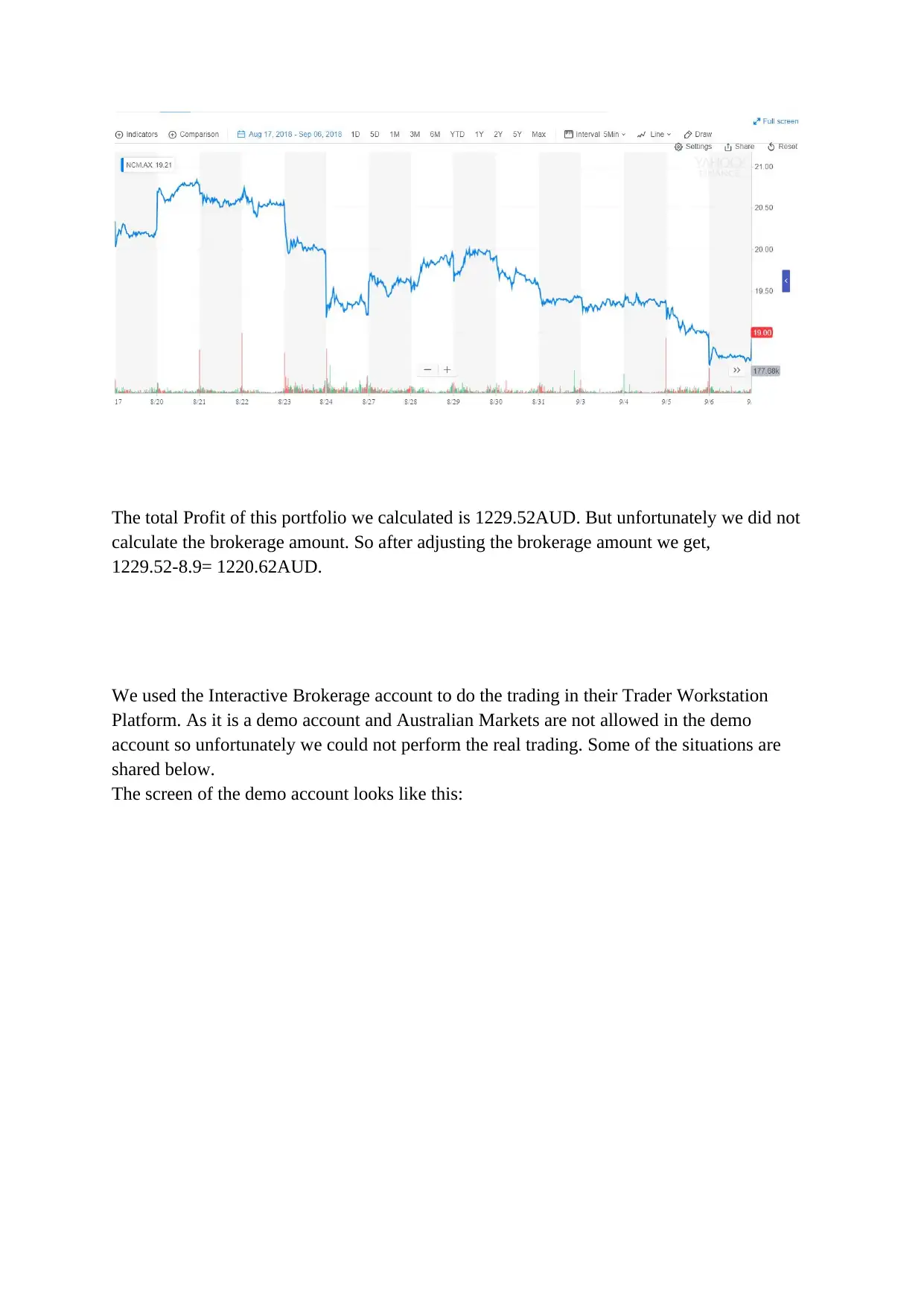

The chart (Finance.yahoo.com, 2018) is shown below:

And we sold the entire Portfolio on 6th September.

The chart (Finance.yahoo.com, 2018) is shown below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The total Profit of this portfolio we calculated is 1229.52AUD. But unfortunately we did not

calculate the brokerage amount. So after adjusting the brokerage amount we get,

1229.52-8.9= 1220.62AUD.

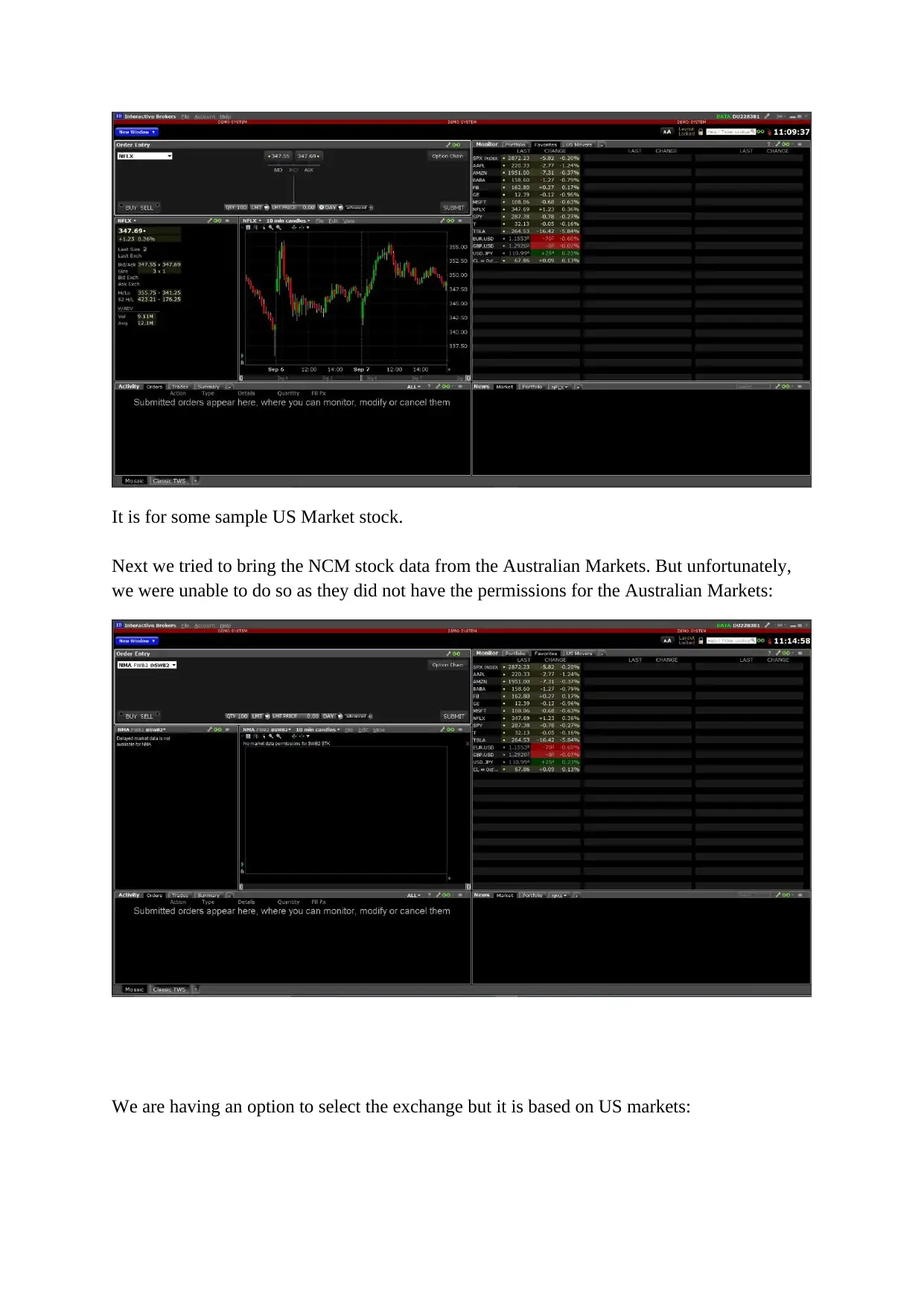

We used the Interactive Brokerage account to do the trading in their Trader Workstation

Platform. As it is a demo account and Australian Markets are not allowed in the demo

account so unfortunately we could not perform the real trading. Some of the situations are

shared below.

The screen of the demo account looks like this:

calculate the brokerage amount. So after adjusting the brokerage amount we get,

1229.52-8.9= 1220.62AUD.

We used the Interactive Brokerage account to do the trading in their Trader Workstation

Platform. As it is a demo account and Australian Markets are not allowed in the demo

account so unfortunately we could not perform the real trading. Some of the situations are

shared below.

The screen of the demo account looks like this:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It is for some sample US Market stock.

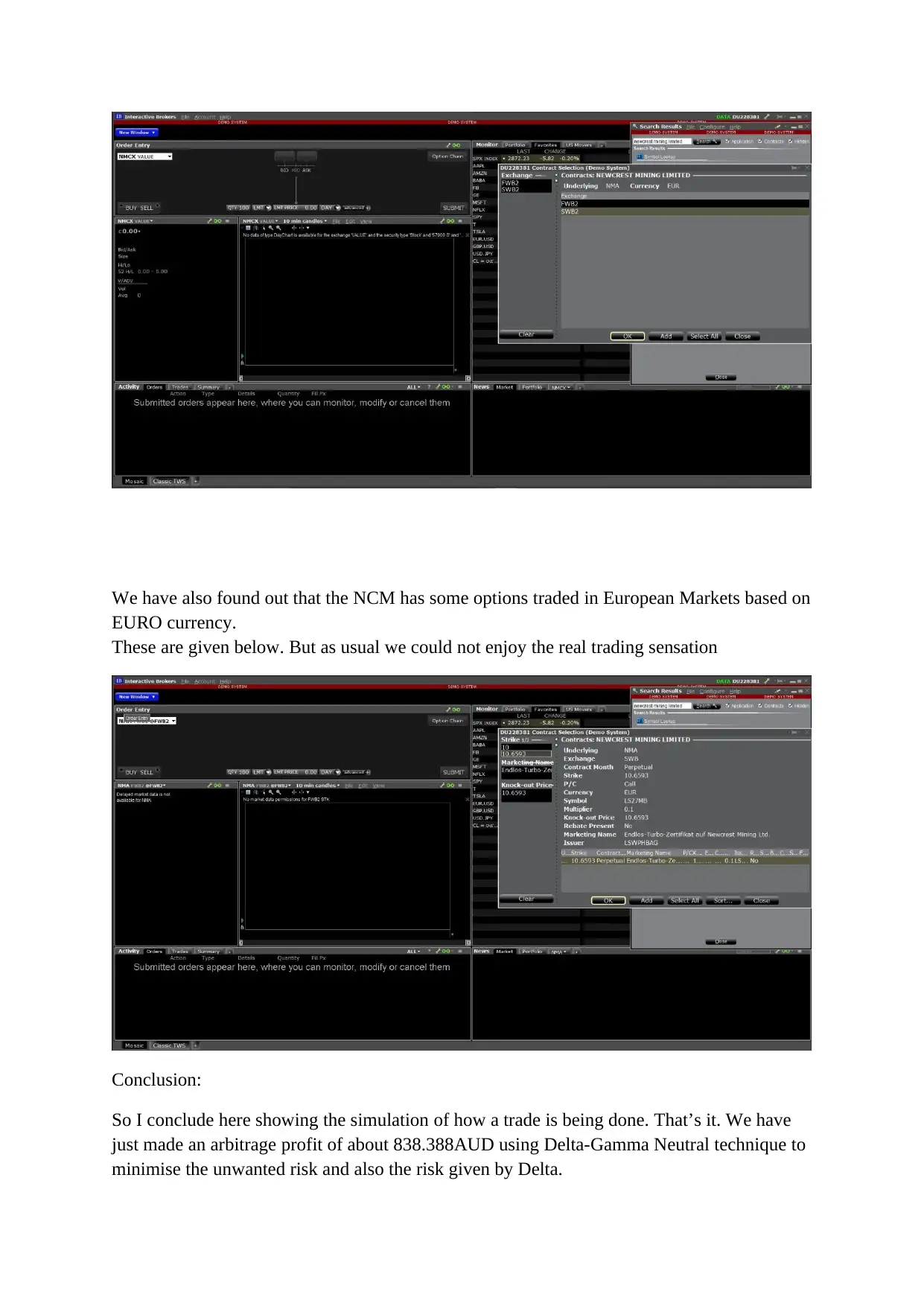

Next we tried to bring the NCM stock data from the Australian Markets. But unfortunately,

we were unable to do so as they did not have the permissions for the Australian Markets:

We are having an option to select the exchange but it is based on US markets:

Next we tried to bring the NCM stock data from the Australian Markets. But unfortunately,

we were unable to do so as they did not have the permissions for the Australian Markets:

We are having an option to select the exchange but it is based on US markets:

We have also found out that the NCM has some options traded in European Markets based on

EURO currency.

These are given below. But as usual we could not enjoy the real trading sensation

Conclusion:

So I conclude here showing the simulation of how a trade is being done. That’s it. We have

just made an arbitrage profit of about 838.388AUD using Delta-Gamma Neutral technique to

minimise the unwanted risk and also the risk given by Delta.

EURO currency.

These are given below. But as usual we could not enjoy the real trading sensation

Conclusion:

So I conclude here showing the simulation of how a trade is being done. That’s it. We have

just made an arbitrage profit of about 838.388AUD using Delta-Gamma Neutral technique to

minimise the unwanted risk and also the risk given by Delta.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References:

Tradingeconomics.com. (2018). Australia Government Bond 10Y | 1969-2018 | Data |

Chart | Calendar. [online] Available at:

https://tradingeconomics.com/australia/government-bond-yield [Accessed 8 Sep. 2018].

Financial Review. (2018).ASX Share Tables [online] Available at:

http://www.afr.com/share-tables [Accessed 8 Sep. 2018].

Finance.yahoo.com. (2018). Yahoo Finance NML.AX. [online] Available at:

https://finance.yahoo.com/quote/NCM.AX/history?p=NCM.AX [Accessed 8 Sep. 2018].

Tradingeconomics.com. (2018). Australia Government Bond 10Y | 1969-2018 | Data |

Chart | Calendar. [online] Available at:

https://tradingeconomics.com/australia/government-bond-yield [Accessed 8 Sep. 2018].

Financial Review. (2018).ASX Share Tables [online] Available at:

http://www.afr.com/share-tables [Accessed 8 Sep. 2018].

Finance.yahoo.com. (2018). Yahoo Finance NML.AX. [online] Available at:

https://finance.yahoo.com/quote/NCM.AX/history?p=NCM.AX [Accessed 8 Sep. 2018].

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.