Auditing and Assurance Services: Risk Assessment and ASA 701

VerifiedAdded on 2023/04/22

|16

|3823

|227

Report

AI Summary

This report evaluates risk identification in two case studies, focusing on Advanced Computer Solutions Limited and Green Machine Limited, to ascertain key audit matters. For Advanced Computer Solutions Limited, the key assertions at risk include valuation/accuracy and cut-off, while for Green Machine Limited, valuation and accuracy are the primary concerns. The report details substantive audit procedures necessary for the auditors of both organizations, emphasizing compliance with ASA 701 to identify, communicate, and disclose key audit matters. The rationale for determining key audit matters involves wrong inventory valuation and critical management judgments. For Green Machine Limited, inaccurate treatment of expenses related to property, plant, and equipment is a significant risk. The report concludes by highlighting the importance of addressing these risks through appropriate audit procedures and adherence to auditing standards.

Running head: AUDITING AND ASSURANCE SERVICES

Auditing and Assurance Services

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Auditing and Assurance Services

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING AND ASSURANCE SERVICES

Executive Summary:

The current report is prepared with the objective of assessing the assertions used in two case

studies for risk identification that would assist in ascertaining the key audit matters. The

auditors are required to carry out the investigation of the critical assertions of the financial

reports. This is because it would aid the auditors to find out the key audit matters. After this,

the auditors are expected to express their audit opinion depending on the ascertainment of key

audit matters. In compliance with the above discussion, the key assertions at risk for

Advanced Computer Solutions Limited include valuation/accuracy and cut off and for Green

Machine Limited, the risky assertions constitute of valuation and accuracy. Thus, it is

necessary for the auditors of the two organisations in forming substantive audit procedures

depending on the key assertions at risk from the auditing perspective. Along with this, the

auditors are expected to maintain compliance with the norms set out in ASA 701 so that key

audit matters could be ascertained along with communicating and disclosing the same.

Executive Summary:

The current report is prepared with the objective of assessing the assertions used in two case

studies for risk identification that would assist in ascertaining the key audit matters. The

auditors are required to carry out the investigation of the critical assertions of the financial

reports. This is because it would aid the auditors to find out the key audit matters. After this,

the auditors are expected to express their audit opinion depending on the ascertainment of key

audit matters. In compliance with the above discussion, the key assertions at risk for

Advanced Computer Solutions Limited include valuation/accuracy and cut off and for Green

Machine Limited, the risky assertions constitute of valuation and accuracy. Thus, it is

necessary for the auditors of the two organisations in forming substantive audit procedures

depending on the key assertions at risk from the auditing perspective. Along with this, the

auditors are expected to maintain compliance with the norms set out in ASA 701 so that key

audit matters could be ascertained along with communicating and disclosing the same.

2AUDITING AND ASSURANCE SERVICES

Table of Contents

Introduction:...............................................................................................................................3

Question 1: Advanced Computer Solutions Limited.................................................................3

(a) Key assertions at risk:.......................................................................................................3

(b) Substantive audit procedures:...........................................................................................5

(c) ASA 701 Communicating Key Audit Matters:................................................................5

Question 2: Green Machine Limited..........................................................................................8

(a) Key assertions at risk:.......................................................................................................8

(b) Substantive audit procedures:...........................................................................................8

(c) ASA 701 Communicating Key Audit Matters:................................................................9

Conclusion:..............................................................................................................................11

References:...............................................................................................................................13

Table of Contents

Introduction:...............................................................................................................................3

Question 1: Advanced Computer Solutions Limited.................................................................3

(a) Key assertions at risk:.......................................................................................................3

(b) Substantive audit procedures:...........................................................................................5

(c) ASA 701 Communicating Key Audit Matters:................................................................5

Question 2: Green Machine Limited..........................................................................................8

(a) Key assertions at risk:.......................................................................................................8

(b) Substantive audit procedures:...........................................................................................8

(c) ASA 701 Communicating Key Audit Matters:................................................................9

Conclusion:..............................................................................................................................11

References:...............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING AND ASSURANCE SERVICES

Introduction:

In auditing profession, the primary duty of the auditors is to carry out investigation of

the financial reports of the audit clients for uncovering any material misstatements, which

might take place due to frauds or errors, since the audited financial reports help the

stakeholders in making various decisions (Alzeban and Gwilliam 2014). It has been observed

that the business organisations often utilise various assertions at the time of developing the

financial statements. These assertions in audit are either explicit or implicit representations

and declarations, which the audit clients have used in order to prepare the financial

statements and such assertions are used so that suitability and disclosure of financial

information could be maintained adequately (Alzeban and Sawan 2015).

The assertions are utilised mainly for different liabilities and assets such as inventory,

property, plant and equipment and others. For instance, some of the types of assertions

include valuation, accuracy, cut off, existence, completeness and others (Shamsabadi, Min

and Chung 2016). The auditors are required to take into account the evaluation as well as

investigation of the audit assertions so that risks could be identified in them. After risk

identification, it is crucial for the auditors to find out whether the risks have the potential of

creating key audit matters (Badara and Saidin 2014). The current report is prepared with the

objective of assessing the assertions used in two case studies for risk identification that would

assist in ascertaining the key audit matters.

Question 1: Advanced Computer Solutions Limited

(a) Key assertions at risk:

Cut off:

Introduction:

In auditing profession, the primary duty of the auditors is to carry out investigation of

the financial reports of the audit clients for uncovering any material misstatements, which

might take place due to frauds or errors, since the audited financial reports help the

stakeholders in making various decisions (Alzeban and Gwilliam 2014). It has been observed

that the business organisations often utilise various assertions at the time of developing the

financial statements. These assertions in audit are either explicit or implicit representations

and declarations, which the audit clients have used in order to prepare the financial

statements and such assertions are used so that suitability and disclosure of financial

information could be maintained adequately (Alzeban and Sawan 2015).

The assertions are utilised mainly for different liabilities and assets such as inventory,

property, plant and equipment and others. For instance, some of the types of assertions

include valuation, accuracy, cut off, existence, completeness and others (Shamsabadi, Min

and Chung 2016). The auditors are required to take into account the evaluation as well as

investigation of the audit assertions so that risks could be identified in them. After risk

identification, it is crucial for the auditors to find out whether the risks have the potential of

creating key audit matters (Badara and Saidin 2014). The current report is prepared with the

objective of assessing the assertions used in two case studies for risk identification that would

assist in ascertaining the key audit matters.

Question 1: Advanced Computer Solutions Limited

(a) Key assertions at risk:

Cut off:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING AND ASSURANCE SERVICES

As per this assertion, the companies need to record inventory-related transactions at

the accurate date of the financial year (Brennan and Kirwan 2015). It implies that the

management is required to place all transactions related to inventory in the books of accounts

at the accurate date from the document receipt and supply of inventory. Moreover, it is not

right to incorporate the inventory of the previous year in the present year. The management of

Advanced Computer Solutions Limited has made this mistake by incorporating the inventory

of 2018 in 17% sales of 2017 and 26% sales of 2018. This clearly makes it apparent that

inventory has not been recorded appropriately in the accounting books of the company and

thus, errors are bound to happen in case of inventory valuation (Bunn, Pilcher and Gilchrist

2018). All these aspects have increased the risk of this assertion.

Valuation and accuracy:

According to this assertion, the companies have the liability of valuing their

inventories accurately. This necessitates the need for the companies in assuring a number of

aspects. These mainly include the following:

Accurate physical count of inventory

Computation of accurate amount of cost of revenue in the income statement by

obtaining the value from the balance sheet statement (Christopher 2015)

Based on the given information, it could be seen that Advanced Computer Solutions

Limited has transferred its inventory to six regional warehouses from a single warehouse.

Hence, this inventory movement could result in errors in the counting process of inventory.

Such aspect could influence the calculation of cost of revenue in the income statement, since

inventory is reported on the balance sheet statement depending on the outcomes in physical

count process of inventory (Griffiths 2016). Thus, this assertion is deemed to be at risk.

As per this assertion, the companies need to record inventory-related transactions at

the accurate date of the financial year (Brennan and Kirwan 2015). It implies that the

management is required to place all transactions related to inventory in the books of accounts

at the accurate date from the document receipt and supply of inventory. Moreover, it is not

right to incorporate the inventory of the previous year in the present year. The management of

Advanced Computer Solutions Limited has made this mistake by incorporating the inventory

of 2018 in 17% sales of 2017 and 26% sales of 2018. This clearly makes it apparent that

inventory has not been recorded appropriately in the accounting books of the company and

thus, errors are bound to happen in case of inventory valuation (Bunn, Pilcher and Gilchrist

2018). All these aspects have increased the risk of this assertion.

Valuation and accuracy:

According to this assertion, the companies have the liability of valuing their

inventories accurately. This necessitates the need for the companies in assuring a number of

aspects. These mainly include the following:

Accurate physical count of inventory

Computation of accurate amount of cost of revenue in the income statement by

obtaining the value from the balance sheet statement (Christopher 2015)

Based on the given information, it could be seen that Advanced Computer Solutions

Limited has transferred its inventory to six regional warehouses from a single warehouse.

Hence, this inventory movement could result in errors in the counting process of inventory.

Such aspect could influence the calculation of cost of revenue in the income statement, since

inventory is reported on the balance sheet statement depending on the outcomes in physical

count process of inventory (Griffiths 2016). Thus, this assertion is deemed to be at risk.

5AUDITING AND ASSURANCE SERVICES

(b) Substantive audit procedures:

For testing the cut off assertion related to inventory, it is necessary that the aspect

needs to be identified regarding whether inventory transactions are recorded at the accurate

date (Harrison 2015). In order to ensure this aspect, the auditors need to conduct verification

of the documents related to receipt and supply of goods.

In case of the next risk assertion, it is crucial for the auditor to undertake systematic

observation of the process of inventory valuation so that any inaccuracy could be identified in

the process (Hay, Stewart and Botica Redmayne 2017). For this process, meetings need to be

arranged with the staffs responsible for inventory in order to gather knowledge of the

physical counting process of inventory. Along with this, assurance needs to be provided for

verifying the tags of inventory count of the organisation. Most significantly, the auditor

requires testing the counting procedure of inventory in all warehouses and matching needs to

be made by confirming from the main warehouse (Kleinman, Lin and Palmon 2014).

(c) ASA 701 Communicating Key Audit Matters:

Requirements of ASA 701:

“Clause 7 of ASA 701” cites that the auditors need to follow three objectives, which

are ascertainment of key audit matters, forming opinion on financial statements and

communicating in it in the report of the auditor (Auasb.gov.au 2019).

According to “Clause 8 of ASA 701”, key audit matters are those matters having

considerable importance in the financial reports for the auditors. A discussion between the

governance committee and the auditors is required so that adequate determination of key

audit matters could be made (Auasb.gov.au 2019).

(b) Substantive audit procedures:

For testing the cut off assertion related to inventory, it is necessary that the aspect

needs to be identified regarding whether inventory transactions are recorded at the accurate

date (Harrison 2015). In order to ensure this aspect, the auditors need to conduct verification

of the documents related to receipt and supply of goods.

In case of the next risk assertion, it is crucial for the auditor to undertake systematic

observation of the process of inventory valuation so that any inaccuracy could be identified in

the process (Hay, Stewart and Botica Redmayne 2017). For this process, meetings need to be

arranged with the staffs responsible for inventory in order to gather knowledge of the

physical counting process of inventory. Along with this, assurance needs to be provided for

verifying the tags of inventory count of the organisation. Most significantly, the auditor

requires testing the counting procedure of inventory in all warehouses and matching needs to

be made by confirming from the main warehouse (Kleinman, Lin and Palmon 2014).

(c) ASA 701 Communicating Key Audit Matters:

Requirements of ASA 701:

“Clause 7 of ASA 701” cites that the auditors need to follow three objectives, which

are ascertainment of key audit matters, forming opinion on financial statements and

communicating in it in the report of the auditor (Auasb.gov.au 2019).

According to “Clause 8 of ASA 701”, key audit matters are those matters having

considerable importance in the financial reports for the auditors. A discussion between the

governance committee and the auditors is required so that adequate determination of key

audit matters could be made (Auasb.gov.au 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING AND ASSURANCE SERVICES

“Clause 9 of ASA 701” mentions three requirements to be considered by the auditor.

These are enumerated below:

The higher risky areas need to be considered in the financial reports having the

potential of developing material misstatements.

Analysis of the judgements used by the management and its accounting estimates is

crucial to be considered for the auditors.

Consideration needs to be made regarding the impact of major transactions or events

while auditing the financial reports of the organisations (Auasb.gov.au 2019).

In accordance with “Clause 10 of ASA 701”, the auditors have to ascertain the issues

or matters having high significance in auditing the financial statements of the entities.

Finally, “Clause 13 of ASA 701” states that the explanation of each key audit matter needs to

include a reference to the associated disclosures in the financial reports of the companies

(Auasb.gov.au 2019).

Rationale for determination:

The initial rationale is the wrong inventory valuation made by the management of

Advanced Computer Solutions Limited and this has the ability of developing material

misstatements in the financial reports of the firm. Secondly, for valuing inventory, the

management of the organisation has made critical judgements constituting of accounting

projections and others. Finally, a significant event has taken place, as the inventories are

shifted from a single location to six locations in parts and this event is expected to have

impact on the audit operations (Lenz and Hahn 2015).

Disclosure of key audit matters:

Why significant How audit addressed the key audit matters

“Clause 9 of ASA 701” mentions three requirements to be considered by the auditor.

These are enumerated below:

The higher risky areas need to be considered in the financial reports having the

potential of developing material misstatements.

Analysis of the judgements used by the management and its accounting estimates is

crucial to be considered for the auditors.

Consideration needs to be made regarding the impact of major transactions or events

while auditing the financial reports of the organisations (Auasb.gov.au 2019).

In accordance with “Clause 10 of ASA 701”, the auditors have to ascertain the issues

or matters having high significance in auditing the financial statements of the entities.

Finally, “Clause 13 of ASA 701” states that the explanation of each key audit matter needs to

include a reference to the associated disclosures in the financial reports of the companies

(Auasb.gov.au 2019).

Rationale for determination:

The initial rationale is the wrong inventory valuation made by the management of

Advanced Computer Solutions Limited and this has the ability of developing material

misstatements in the financial reports of the firm. Secondly, for valuing inventory, the

management of the organisation has made critical judgements constituting of accounting

projections and others. Finally, a significant event has taken place, as the inventories are

shifted from a single location to six locations in parts and this event is expected to have

impact on the audit operations (Lenz and Hahn 2015).

Disclosure of key audit matters:

Why significant How audit addressed the key audit matters

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING AND ASSURANCE SERVICES

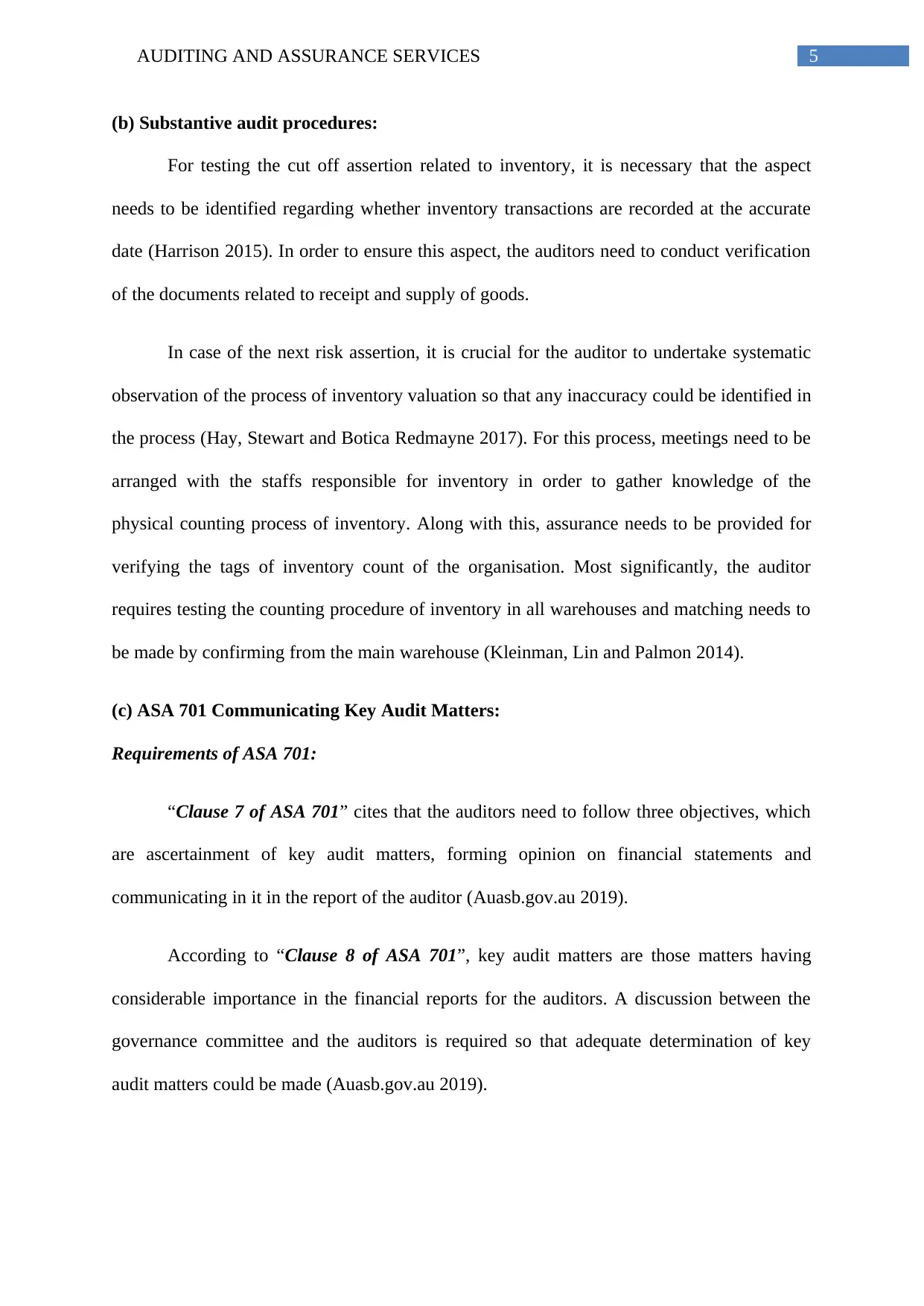

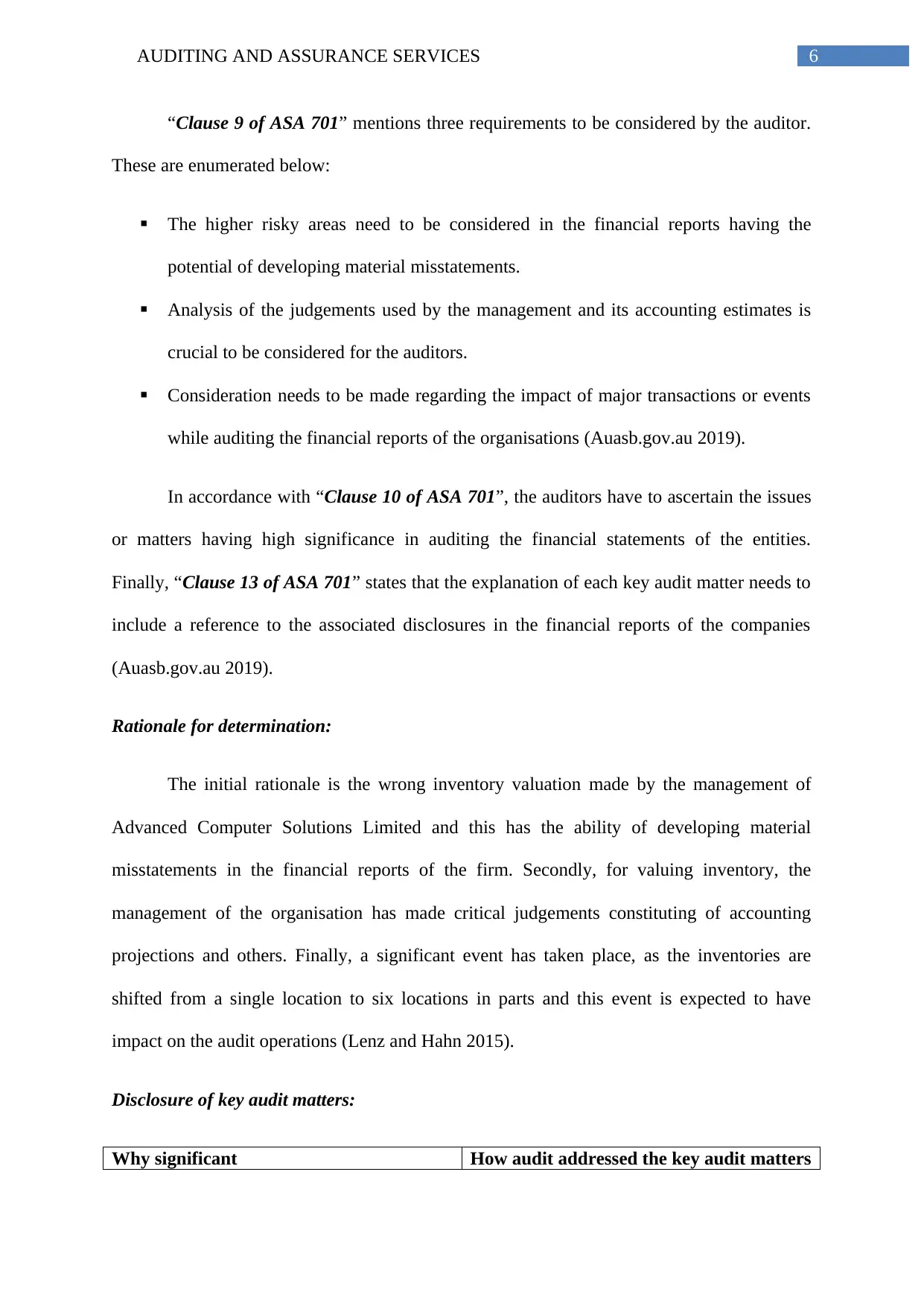

Stock-in-hand is included in sales of 2017

and 2018:

From the case study, it is clear that sales

percentage of 18% in 2017 and 26% in 2018

are there in stock-in-hand of 2018. This

might have occurred because of the errors.

Moreover, considerable judgements are made

for valuing inventory, which is material for

audit.

In order to manage this risk, the substantive

audit procedures include the following:

1. Certification of the process of inventory

valuation to realise irrational events having

the chance of slow stock movement

2. Authentication of the documents of goods

related to receipt and supply

3. Review of whether there has been any

intervention in the inventory flow owing to

management orders

Shift of inventories:

Based on the provided information, it could

be observed that inventories are shifted from

a single location to six new locations and

such shift could lead to wrong counting of

inventory. Thus, this process needs

judgements, as it is a critical audit aspect.

In order to manage this risk, the substantive

audit procedures include the following:

1. Arrangement of meeting with the staffs

working in inventory section so that

information could be gathered about the

stock counting process

2. Systematic review of the valuation process

of inventory

3. Certification of the tags related to count of

inventory

Stock-in-hand is included in sales of 2017

and 2018:

From the case study, it is clear that sales

percentage of 18% in 2017 and 26% in 2018

are there in stock-in-hand of 2018. This

might have occurred because of the errors.

Moreover, considerable judgements are made

for valuing inventory, which is material for

audit.

In order to manage this risk, the substantive

audit procedures include the following:

1. Certification of the process of inventory

valuation to realise irrational events having

the chance of slow stock movement

2. Authentication of the documents of goods

related to receipt and supply

3. Review of whether there has been any

intervention in the inventory flow owing to

management orders

Shift of inventories:

Based on the provided information, it could

be observed that inventories are shifted from

a single location to six new locations and

such shift could lead to wrong counting of

inventory. Thus, this process needs

judgements, as it is a critical audit aspect.

In order to manage this risk, the substantive

audit procedures include the following:

1. Arrangement of meeting with the staffs

working in inventory section so that

information could be gathered about the

stock counting process

2. Systematic review of the valuation process

of inventory

3. Certification of the tags related to count of

inventory

8AUDITING AND ASSURANCE SERVICES

4. Test of the entire process in all locations

and count needs to be matched with the

numbers despatched from the main location

Question 2: Green Machine Limited

(a) Key assertions at risk:

Accuracy:

In accordance with this assertion, it is the duty of the management of any organisation

to enter all transactions pertaining to property, plant and equipment in an accurate manner.

These include appropriate classification of both capital and revenue expenditures associated

with the asset (Lessambo 2016). From the provided information of Green Machine Limited,

accurate treatment of expenses associated with property, plant and equipment is not made

accurately due to the inclusion of capital expenditures in the consolidated income statement

along with capitalisation of revenue expenditures. Such inaccurate treatment could lead to

material effect; thus, placing this assertion at risk (Malaescu and Sutton 2014).

(b) Substantive audit procedures:

In case of the first risk assertion, the auditor has to conduct methodical observation of

the depreciation treatment process of the property charged on property, plant and equipment.

Afterwards, the auditor is required to calculate the revised depreciation rate again for the

concerned property, plant and equipment (Mat Zain, Zaman and Mohamed 2015). For

fulfilling this purpose, the auditors have to consider the analysis of the residual amounts

pertaining to property, plant and equipment as well as any loss suffered or gain made from

the sale of the concerned asset. After the completion of this step, it is necessary to compare

4. Test of the entire process in all locations

and count needs to be matched with the

numbers despatched from the main location

Question 2: Green Machine Limited

(a) Key assertions at risk:

Accuracy:

In accordance with this assertion, it is the duty of the management of any organisation

to enter all transactions pertaining to property, plant and equipment in an accurate manner.

These include appropriate classification of both capital and revenue expenditures associated

with the asset (Lessambo 2016). From the provided information of Green Machine Limited,

accurate treatment of expenses associated with property, plant and equipment is not made

accurately due to the inclusion of capital expenditures in the consolidated income statement

along with capitalisation of revenue expenditures. Such inaccurate treatment could lead to

material effect; thus, placing this assertion at risk (Malaescu and Sutton 2014).

(b) Substantive audit procedures:

In case of the first risk assertion, the auditor has to conduct methodical observation of

the depreciation treatment process of the property charged on property, plant and equipment.

Afterwards, the auditor is required to calculate the revised depreciation rate again for the

concerned property, plant and equipment (Mat Zain, Zaman and Mohamed 2015). For

fulfilling this purpose, the auditors have to consider the analysis of the residual amounts

pertaining to property, plant and equipment as well as any loss suffered or gain made from

the sale of the concerned asset. After the completion of this step, it is necessary to compare

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING AND ASSURANCE SERVICES

the depreciation rates for the auditor. Moreover, the auditor is required to assure the

certification of compliance with the required depreciation standards from the organisational

perspective (Weight 2014).

In order to address the second assertion at risk, the auditor of the concerned

organisation needs to ensure re-investigation of the procedures of the organisation to

capitalise expenditures in relation to property, plant and equipment. This could be ensured

after the auditor has gathered the list of property, plant and equipment owned by the

organisation (Nicoll 2016). This procedure would assist the auditor in recognising the

expenditures, which are capitalised inaccurately and the ones that are included inaccurately in

the consolidated income statement. Finally, the auditor is required to investigate the

management judgements in relation to expenditures as well (Nuijten, Van Twist and Van Der

Steen 2015).

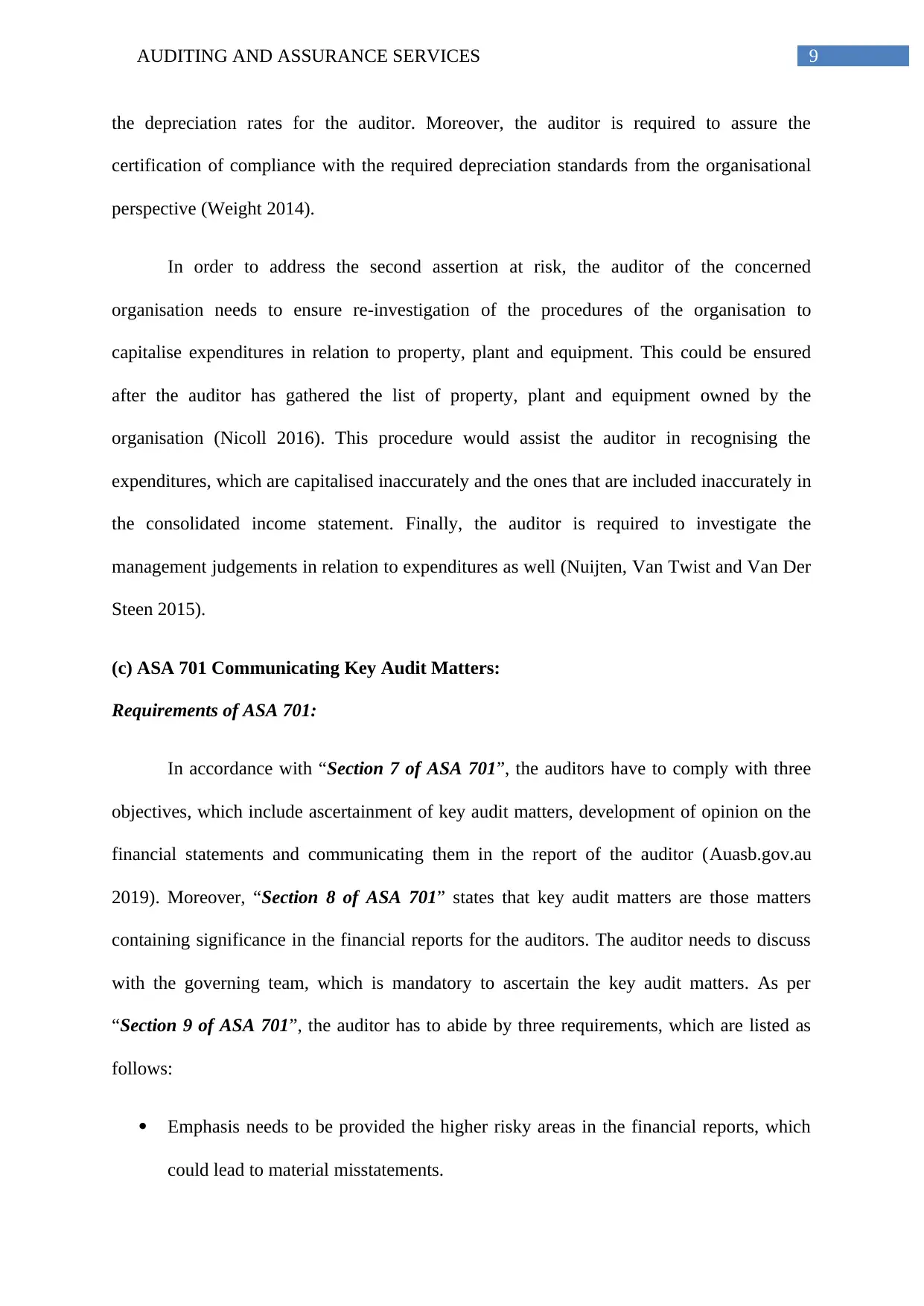

(c) ASA 701 Communicating Key Audit Matters:

Requirements of ASA 701:

In accordance with “Section 7 of ASA 701”, the auditors have to comply with three

objectives, which include ascertainment of key audit matters, development of opinion on the

financial statements and communicating them in the report of the auditor (Auasb.gov.au

2019). Moreover, “Section 8 of ASA 701” states that key audit matters are those matters

containing significance in the financial reports for the auditors. The auditor needs to discuss

with the governing team, which is mandatory to ascertain the key audit matters. As per

“Section 9 of ASA 701”, the auditor has to abide by three requirements, which are listed as

follows:

Emphasis needs to be provided the higher risky areas in the financial reports, which

could lead to material misstatements.

the depreciation rates for the auditor. Moreover, the auditor is required to assure the

certification of compliance with the required depreciation standards from the organisational

perspective (Weight 2014).

In order to address the second assertion at risk, the auditor of the concerned

organisation needs to ensure re-investigation of the procedures of the organisation to

capitalise expenditures in relation to property, plant and equipment. This could be ensured

after the auditor has gathered the list of property, plant and equipment owned by the

organisation (Nicoll 2016). This procedure would assist the auditor in recognising the

expenditures, which are capitalised inaccurately and the ones that are included inaccurately in

the consolidated income statement. Finally, the auditor is required to investigate the

management judgements in relation to expenditures as well (Nuijten, Van Twist and Van Der

Steen 2015).

(c) ASA 701 Communicating Key Audit Matters:

Requirements of ASA 701:

In accordance with “Section 7 of ASA 701”, the auditors have to comply with three

objectives, which include ascertainment of key audit matters, development of opinion on the

financial statements and communicating them in the report of the auditor (Auasb.gov.au

2019). Moreover, “Section 8 of ASA 701” states that key audit matters are those matters

containing significance in the financial reports for the auditors. The auditor needs to discuss

with the governing team, which is mandatory to ascertain the key audit matters. As per

“Section 9 of ASA 701”, the auditor has to abide by three requirements, which are listed as

follows:

Emphasis needs to be provided the higher risky areas in the financial reports, which

could lead to material misstatements.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING AND ASSURANCE SERVICES

The auditor needs to start evaluating the used judgements of the management as well

as accounting estimates.

Consideration needs to be provided to the consequence of main transactions or events

while auditing the financial reports of the organisations (Auasb.gov.au 2019).

From “Section 10 of ASA 701”, it could be observed that the auditors possess the

liability of finding out the issues, which are deemed to be the most vital during the

conduction of auditing the financial statements of the business organisations. Lastly, “Clause

13 of ASA 701” states that the explanation of each key audit matter needs to include a

reference to the associated disclosures in the financial reports of the companies

(Auasb.gov.au 2019).

Rationale for determination:

According to the initial rationale, there has been incorrect distribution of expenses and

application of depreciation method and these errors might lead to material effect on the

financial reports of Green Machine Limited. According to the next rationale, the management

of the concerned organisation has made a number of assumptions and judgements for valuing

its property, plant and equipment, which could be at the risk of uncertainty. Finally, in

accordance with the final rationale, the critical transactions or events affecting audit

operations are the applicable behind the minimised depreciation rate and inaccurate division

of expenditures (Pilcher 2014).

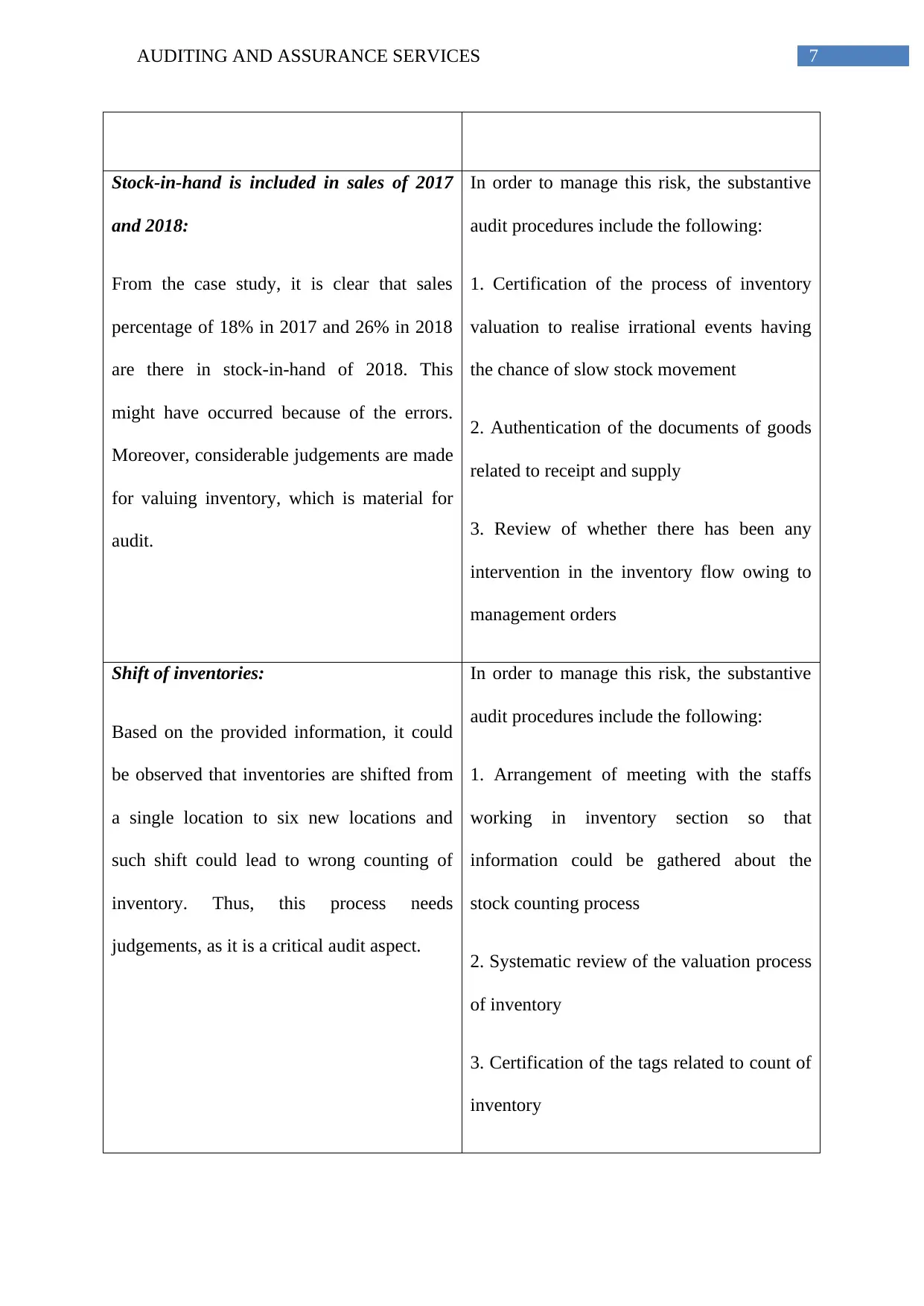

Disclosure of key audit matters:

Why significant How audit addressed the key audit matters

Use of minimised depreciation rate:

It is evident from the provided case study that

the organisation has used minimised

depreciation rate and this could develop

In order to manage this risk, the substantive

audit procedures include the following:

1. Effort to compute the corrected rate of

The auditor needs to start evaluating the used judgements of the management as well

as accounting estimates.

Consideration needs to be provided to the consequence of main transactions or events

while auditing the financial reports of the organisations (Auasb.gov.au 2019).

From “Section 10 of ASA 701”, it could be observed that the auditors possess the

liability of finding out the issues, which are deemed to be the most vital during the

conduction of auditing the financial statements of the business organisations. Lastly, “Clause

13 of ASA 701” states that the explanation of each key audit matter needs to include a

reference to the associated disclosures in the financial reports of the companies

(Auasb.gov.au 2019).

Rationale for determination:

According to the initial rationale, there has been incorrect distribution of expenses and

application of depreciation method and these errors might lead to material effect on the

financial reports of Green Machine Limited. According to the next rationale, the management

of the concerned organisation has made a number of assumptions and judgements for valuing

its property, plant and equipment, which could be at the risk of uncertainty. Finally, in

accordance with the final rationale, the critical transactions or events affecting audit

operations are the applicable behind the minimised depreciation rate and inaccurate division

of expenditures (Pilcher 2014).

Disclosure of key audit matters:

Why significant How audit addressed the key audit matters

Use of minimised depreciation rate:

It is evident from the provided case study that

the organisation has used minimised

depreciation rate and this could develop

In order to manage this risk, the substantive

audit procedures include the following:

1. Effort to compute the corrected rate of

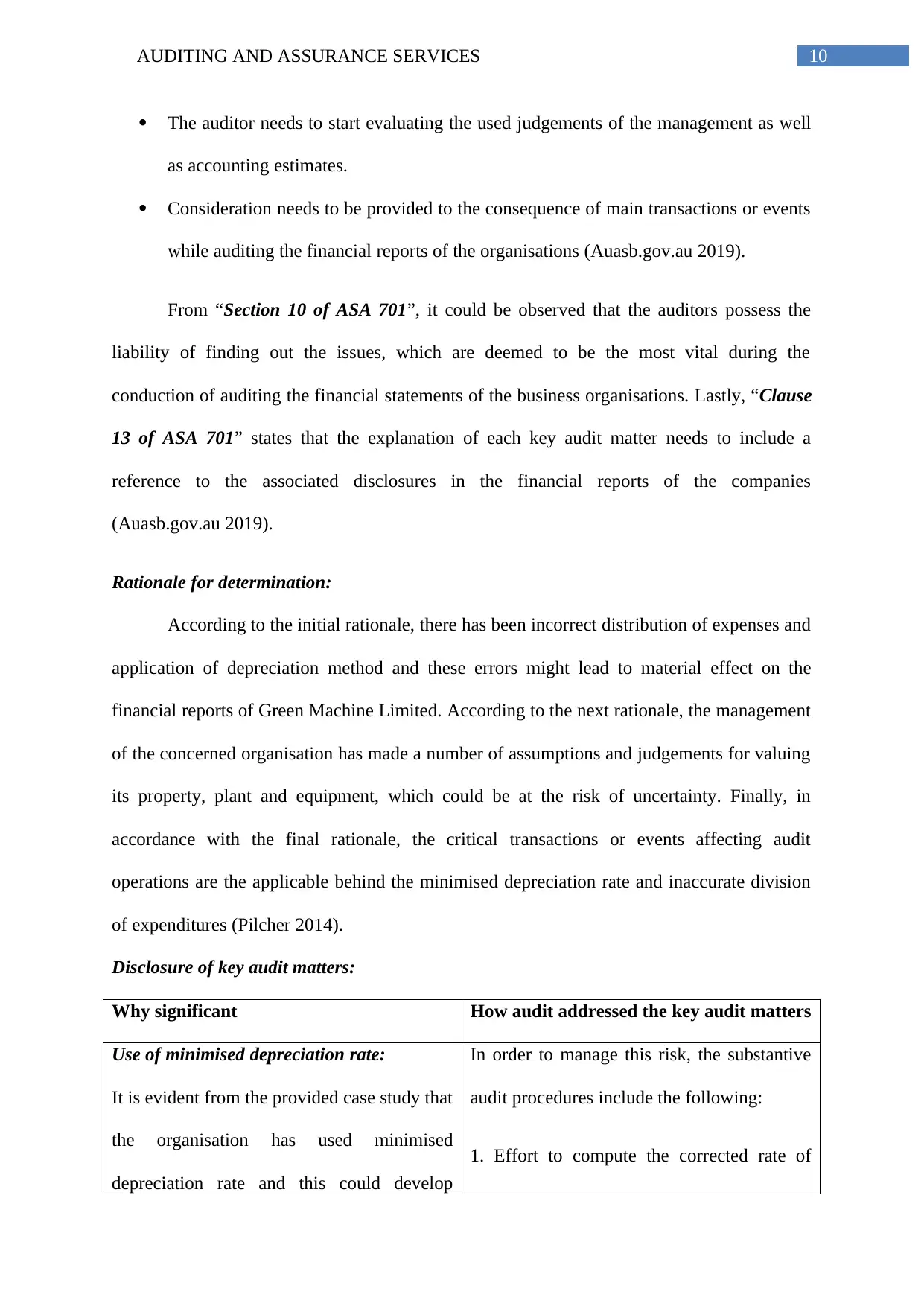

11AUDITING AND ASSURANCE SERVICES

material misstatements in the financial

reports. Along with this, the incorporation of

critical estimates and judgements has made

the same a significant audit matter.

depreciation

2. Examination of the charging process of

depreciation of the organisation in relation to

property, plant and equipment

3. Analysis of the residual amounts of

property, plant and equipment as well as any

gain or loss made from selling a portion of

the mentioned asset

Inaccurate division of expenses:

The organisation has not capitalised correctly

the revenue expenses and it has incorporated

capital expenditures in the consolidated

income statement. As a result, material

impact could be created on auditing the

financial statements of the organisation. In

addition, the disclosure of critical projections

and judgements has made this issue a critical

audit matter.

In order to manage this risk, the substantive

audit procedures include the following:

1. Investigation of the procedures of the

organisation in order to capitalise

expenditures again for property, plant and

equipment

2. Gathering the list related to property, plant

and equipment

3. Re-examination of the judgements made

by the management of the firm in relation to

the concerned expenses

Conclusion:

To conclude, the auditors are required to carry out the investigation of the critical

assertions of the financial reports. This is because it would aid the auditors to find out the key

audit matters. After this, the auditors are expected to express their audit opinion depending on

material misstatements in the financial

reports. Along with this, the incorporation of

critical estimates and judgements has made

the same a significant audit matter.

depreciation

2. Examination of the charging process of

depreciation of the organisation in relation to

property, plant and equipment

3. Analysis of the residual amounts of

property, plant and equipment as well as any

gain or loss made from selling a portion of

the mentioned asset

Inaccurate division of expenses:

The organisation has not capitalised correctly

the revenue expenses and it has incorporated

capital expenditures in the consolidated

income statement. As a result, material

impact could be created on auditing the

financial statements of the organisation. In

addition, the disclosure of critical projections

and judgements has made this issue a critical

audit matter.

In order to manage this risk, the substantive

audit procedures include the following:

1. Investigation of the procedures of the

organisation in order to capitalise

expenditures again for property, plant and

equipment

2. Gathering the list related to property, plant

and equipment

3. Re-examination of the judgements made

by the management of the firm in relation to

the concerned expenses

Conclusion:

To conclude, the auditors are required to carry out the investigation of the critical

assertions of the financial reports. This is because it would aid the auditors to find out the key

audit matters. After this, the auditors are expected to express their audit opinion depending on

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.