Comprehensive Stock Market Analysis and Investment Strategies

VerifiedAdded on 2023/01/16

|7

|876

|87

Report

AI Summary

This report presents a detailed analysis of the stock market, encompassing various financial models and investment strategies. It begins with an examination of bond yields and interest rate calculations, followed by a histogram analysis of MXX and SOX stocks. The report then delves into portfolio performance, calculating standard deviation, expected returns, and the efficient frontier. Key financial models like CAPM (Capital Asset Pricing Model) are applied to assess the theoretical returns of ABB and AIR stocks, and the Black-Scholes option pricing model is utilized to determine call option values. The analysis provides insights into risk management, stock valuation, and portfolio optimization, offering a comprehensive overview of stock market dynamics and investment strategies. The report includes tables and figures to support the analysis.

STOCK MARKET

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

(1)...............................................................................................................................................3

(2)...............................................................................................................................................3

(3)...............................................................................................................................................6

(4)...............................................................................................................................................6

Table 1Yearly annual and semi-annual payment of interest......................................................4

Table 2Portfolio standard deviation and return..........................................................................6

Table 3CAPM of ABB...............................................................................................................8

Table 4CAPM of AIR................................................................................................................8

Table 5Black-Scholes Option Pricing Model............................................................................8

Figure 1Histogram of MXX.......................................................................................................4

Figure 2Histogram of SOX........................................................................................................4

Figure 3Scatter plot on STDEV and AVG return......................................................................5

Figure 4Efficient frontier...........................................................................................................6

(1)...............................................................................................................................................3

(2)...............................................................................................................................................3

(3)...............................................................................................................................................6

(4)...............................................................................................................................................6

Table 1Yearly annual and semi-annual payment of interest......................................................4

Table 2Portfolio standard deviation and return..........................................................................6

Table 3CAPM of ABB...............................................................................................................8

Table 4CAPM of AIR................................................................................................................8

Table 5Black-Scholes Option Pricing Model............................................................................8

Figure 1Histogram of MXX.......................................................................................................4

Figure 2Histogram of SOX........................................................................................................4

Figure 3Scatter plot on STDEV and AVG return......................................................................5

Figure 4Efficient frontier...........................................................................................................6

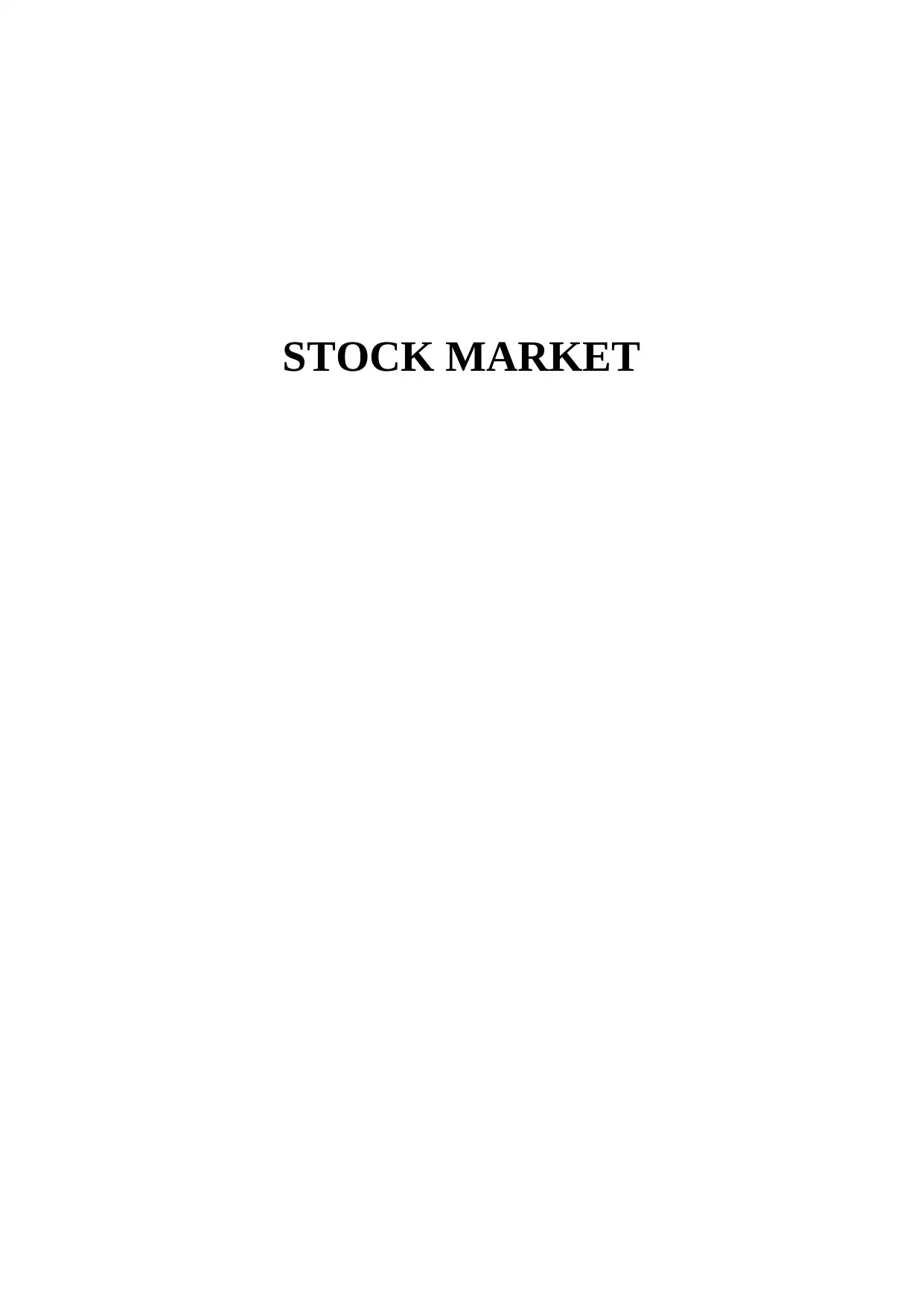

(1)

Table 1Yearly annual and semi-annual payment of interest

Year 12

Bond value 1000

Annual coupon rate 2.65%

Current price 965.4

Interest rare

Annual interest 26.5

(Par value-Market price)/Number of years of maturity 2.883333

Annual interest + (Par value-Market price)/Number of years of

maturity 29.38333

(Par value+Market price)/2 982.7

YTM 3%

Semi-annual interest rate 6%

Annual payment of interest is 3% on the bond and if interest is paid on semi annual basis then

in that case interest rate is 6%. There is close connection between yield to maturity and

frequency of interest. If interest is paid semi annually then in that case yield to maturity will

be high. On other hand, if interest is paid on yearly basis then in that case yield to maturity

will be low.

(2)

0.171706482

More

0.417812123

-0.074399158

-0.320504799

0

4

8

0.00%

40.00%

80.00%

120.00%

Histogram

Frequency

Cumulative %

Bin

Frequency

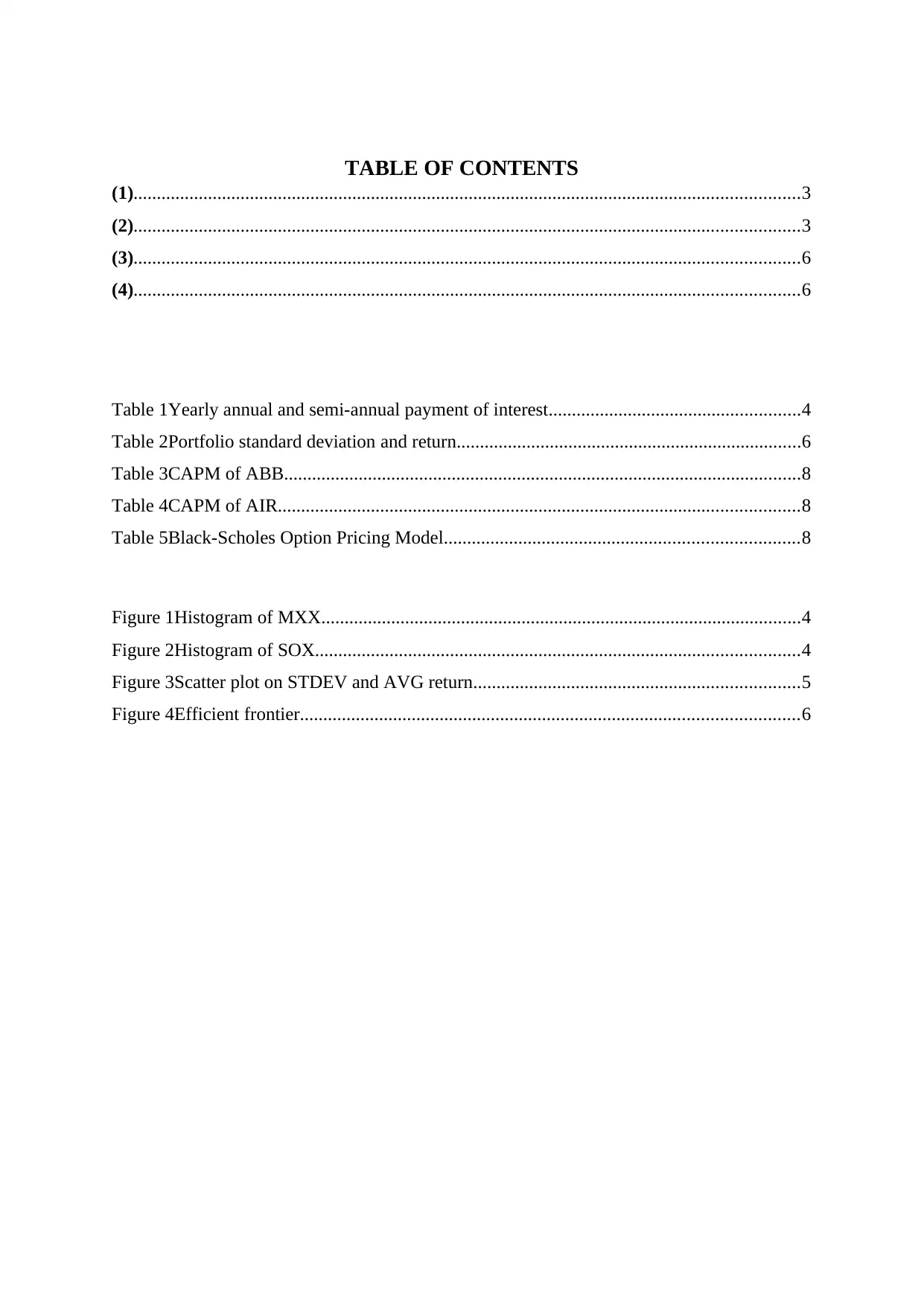

Figure 1Histogram of MXX

Table 1Yearly annual and semi-annual payment of interest

Year 12

Bond value 1000

Annual coupon rate 2.65%

Current price 965.4

Interest rare

Annual interest 26.5

(Par value-Market price)/Number of years of maturity 2.883333

Annual interest + (Par value-Market price)/Number of years of

maturity 29.38333

(Par value+Market price)/2 982.7

YTM 3%

Semi-annual interest rate 6%

Annual payment of interest is 3% on the bond and if interest is paid on semi annual basis then

in that case interest rate is 6%. There is close connection between yield to maturity and

frequency of interest. If interest is paid semi annually then in that case yield to maturity will

be high. On other hand, if interest is paid on yearly basis then in that case yield to maturity

will be low.

(2)

0.171706482

More

0.417812123

-0.074399158

-0.320504799

0

4

8

0.00%

40.00%

80.00%

120.00%

Histogram

Frequency

Cumulative %

Bin

Frequency

Figure 1Histogram of MXX

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0.541397944

0.189666819

-0.162064307

More

-0.513795433

0

1

2

3

4

5

6

7

8

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Histogram

Frequency

Cumulative %

Bin

Frequency

Figure 2Histogram of SOX

12% 13% 14% 15% 16% 17%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

27%

40%

Scatter plot on STDEV and AVG return

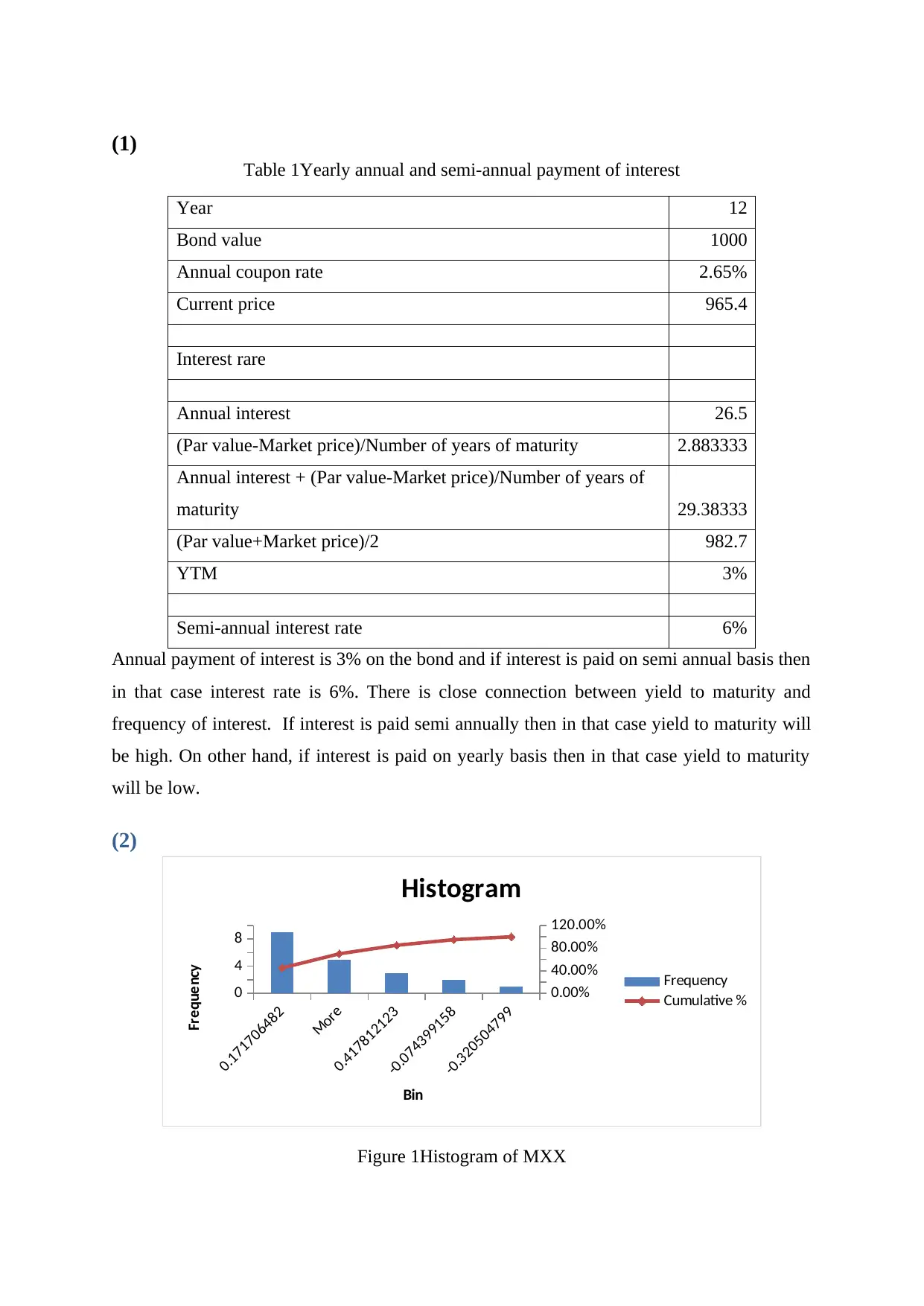

Figure 3Scatter plot on STDEV and AVG return

Table 2Portfolio standard deviation and return

Weight of MXX 0.50

Weight of SOX 0.50

STDEV of MXX 0.27

STDEV of SOX 0.40

0.189666819

-0.162064307

More

-0.513795433

0

1

2

3

4

5

6

7

8

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Histogram

Frequency

Cumulative %

Bin

Frequency

Figure 2Histogram of SOX

12% 13% 14% 15% 16% 17%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

27%

40%

Scatter plot on STDEV and AVG return

Figure 3Scatter plot on STDEV and AVG return

Table 2Portfolio standard deviation and return

Weight of MXX 0.50

Weight of SOX 0.50

STDEV of MXX 0.27

STDEV of SOX 0.40

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Correlation 0.629335

Portfolio STDEV 0.300152

Weight of MXX 0.50

Weight of SOX 0.50

Expected return on

MXX 16%

Expected return on

SOX 13%

Portfolio return 15%

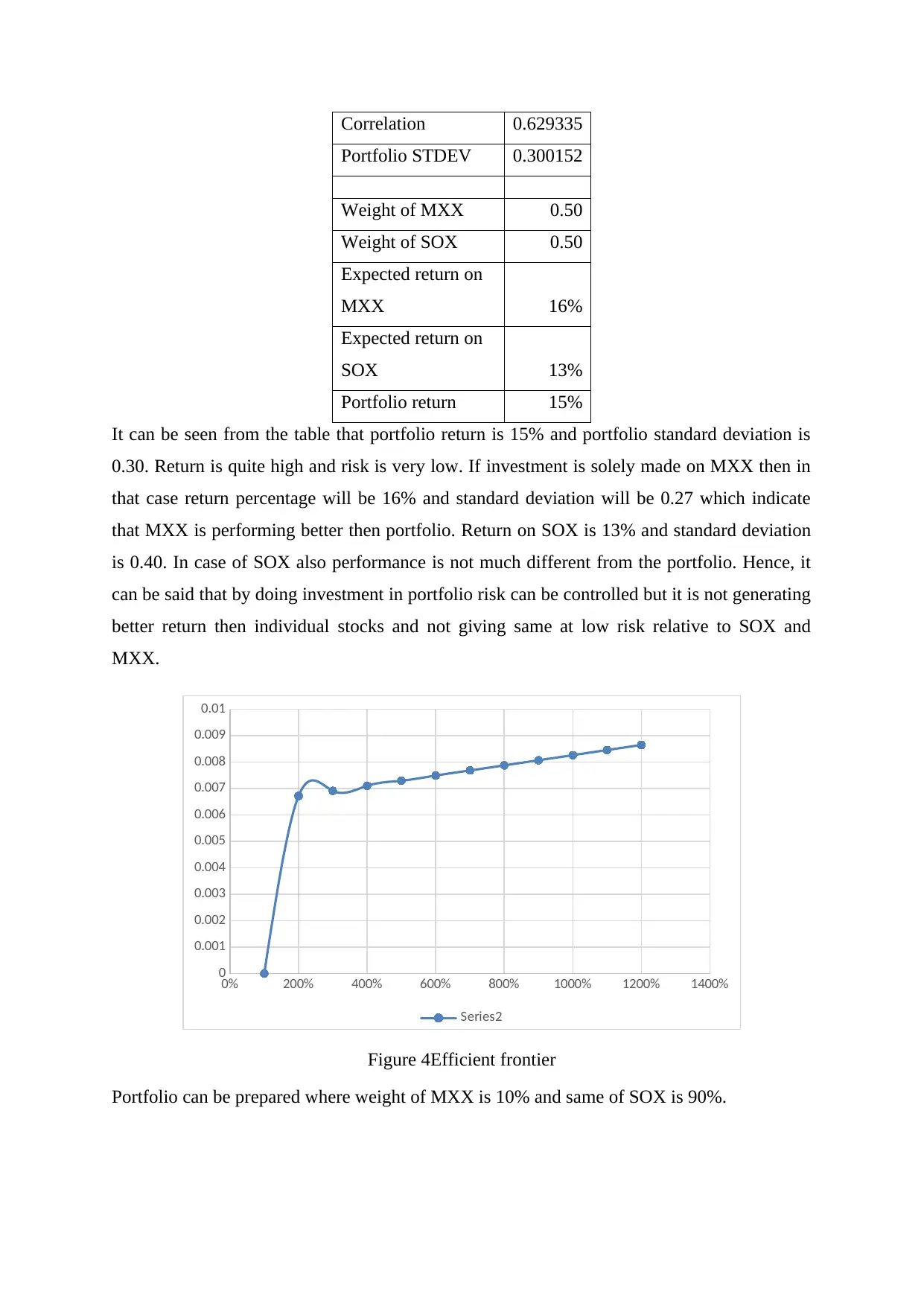

It can be seen from the table that portfolio return is 15% and portfolio standard deviation is

0.30. Return is quite high and risk is very low. If investment is solely made on MXX then in

that case return percentage will be 16% and standard deviation will be 0.27 which indicate

that MXX is performing better then portfolio. Return on SOX is 13% and standard deviation

is 0.40. In case of SOX also performance is not much different from the portfolio. Hence, it

can be said that by doing investment in portfolio risk can be controlled but it is not generating

better return then individual stocks and not giving same at low risk relative to SOX and

MXX.

0% 200% 400% 600% 800% 1000% 1200% 1400%

0

0.001

0.002

0.003

0.004

0.005

0.006

0.007

0.008

0.009

0.01

Series2

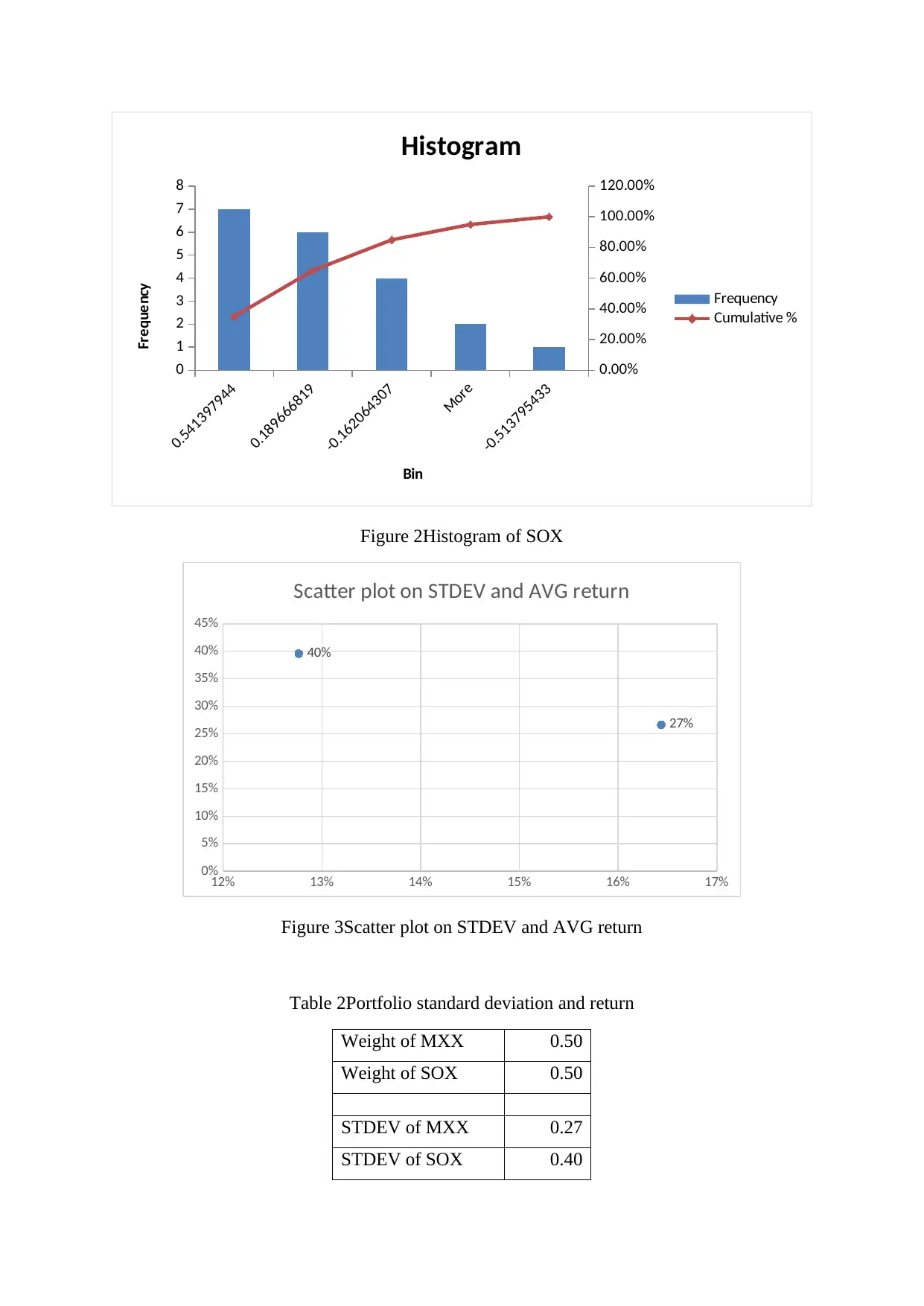

Figure 4Efficient frontier

Portfolio can be prepared where weight of MXX is 10% and same of SOX is 90%.

Portfolio STDEV 0.300152

Weight of MXX 0.50

Weight of SOX 0.50

Expected return on

MXX 16%

Expected return on

SOX 13%

Portfolio return 15%

It can be seen from the table that portfolio return is 15% and portfolio standard deviation is

0.30. Return is quite high and risk is very low. If investment is solely made on MXX then in

that case return percentage will be 16% and standard deviation will be 0.27 which indicate

that MXX is performing better then portfolio. Return on SOX is 13% and standard deviation

is 0.40. In case of SOX also performance is not much different from the portfolio. Hence, it

can be said that by doing investment in portfolio risk can be controlled but it is not generating

better return then individual stocks and not giving same at low risk relative to SOX and

MXX.

0% 200% 400% 600% 800% 1000% 1200% 1400%

0

0.001

0.002

0.003

0.004

0.005

0.006

0.007

0.008

0.009

0.01

Series2

Figure 4Efficient frontier

Portfolio can be prepared where weight of MXX is 10% and same of SOX is 90%.

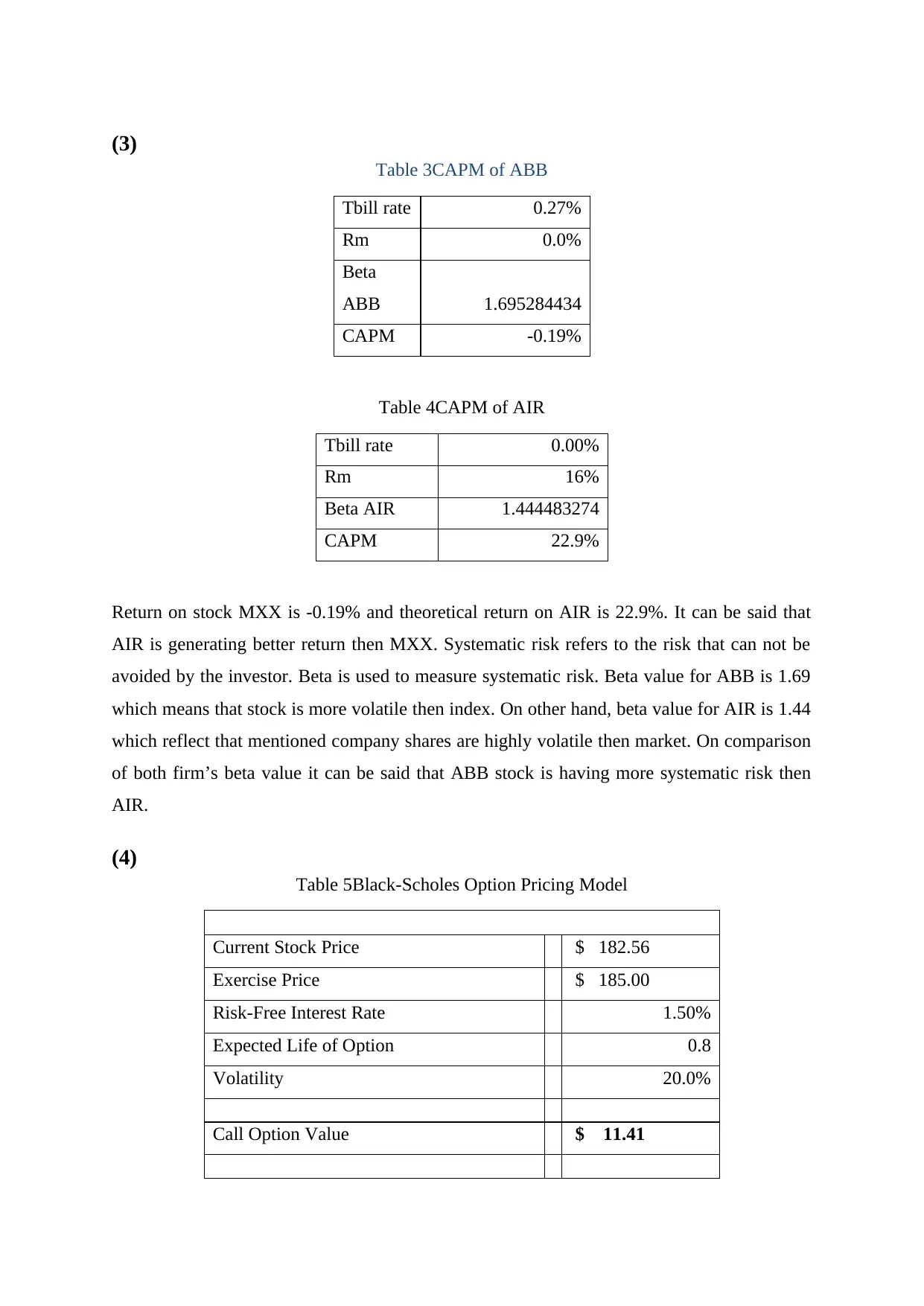

(3)

Table 3CAPM of ABB

Tbill rate 0.27%

Rm 0.0%

Beta

ABB 1.695284434

CAPM -0.19%

Table 4CAPM of AIR

Tbill rate 0.00%

Rm 16%

Beta AIR 1.444483274

CAPM 22.9%

Return on stock MXX is -0.19% and theoretical return on AIR is 22.9%. It can be said that

AIR is generating better return then MXX. Systematic risk refers to the risk that can not be

avoided by the investor. Beta is used to measure systematic risk. Beta value for ABB is 1.69

which means that stock is more volatile then index. On other hand, beta value for AIR is 1.44

which reflect that mentioned company shares are highly volatile then market. On comparison

of both firm’s beta value it can be said that ABB stock is having more systematic risk then

AIR.

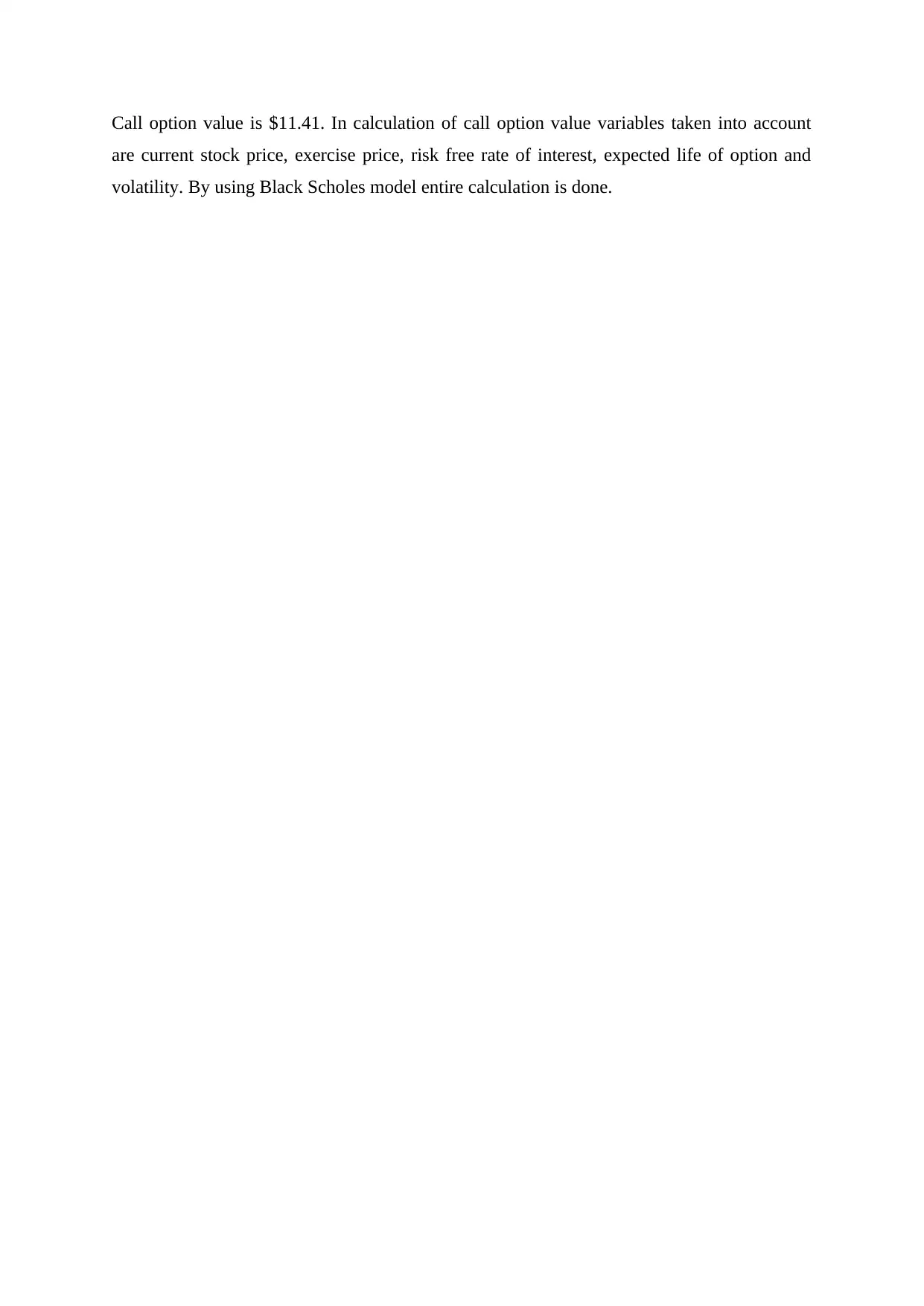

(4)

Table 5Black-Scholes Option Pricing Model

Current Stock Price $ 182.56

Exercise Price $ 185.00

Risk-Free Interest Rate 1.50%

Expected Life of Option 0.8

Volatility 20.0%

Call Option Value $ 11.41

Table 3CAPM of ABB

Tbill rate 0.27%

Rm 0.0%

Beta

ABB 1.695284434

CAPM -0.19%

Table 4CAPM of AIR

Tbill rate 0.00%

Rm 16%

Beta AIR 1.444483274

CAPM 22.9%

Return on stock MXX is -0.19% and theoretical return on AIR is 22.9%. It can be said that

AIR is generating better return then MXX. Systematic risk refers to the risk that can not be

avoided by the investor. Beta is used to measure systematic risk. Beta value for ABB is 1.69

which means that stock is more volatile then index. On other hand, beta value for AIR is 1.44

which reflect that mentioned company shares are highly volatile then market. On comparison

of both firm’s beta value it can be said that ABB stock is having more systematic risk then

AIR.

(4)

Table 5Black-Scholes Option Pricing Model

Current Stock Price $ 182.56

Exercise Price $ 185.00

Risk-Free Interest Rate 1.50%

Expected Life of Option 0.8

Volatility 20.0%

Call Option Value $ 11.41

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Call option value is $11.41. In calculation of call option value variables taken into account

are current stock price, exercise price, risk free rate of interest, expected life of option and

volatility. By using Black Scholes model entire calculation is done.

are current stock price, exercise price, risk free rate of interest, expected life of option and

volatility. By using Black Scholes model entire calculation is done.

1 out of 7

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.