Preparation of Accounting Records using Spreadsheets

VerifiedAdded on 2023/04/21

|34

|5313

|258

AI Summary

This document provides information on the preparation of accounting records using spreadsheets. It covers topics such as journal entries, T-accounts, unadjusted trial balance, and adjusting entries. The document also includes examples and formulas for each topic. If you need further assistance or study material on this topic, you can find it at Desklib.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Assessment item 1

Assignment 1

Assignment 1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

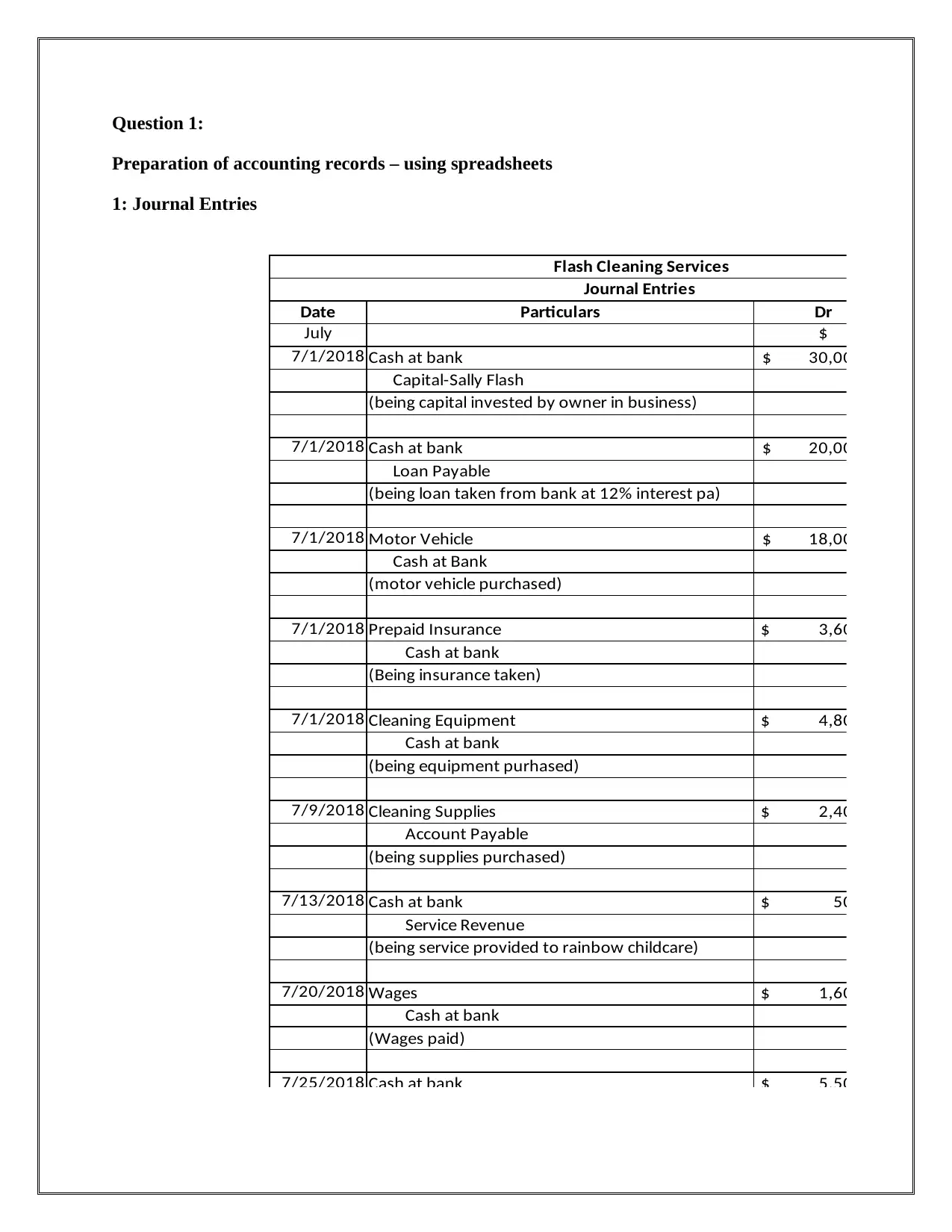

Question 1:

Preparation of accounting records – using spreadsheets

1: Journal Entries

Flash Cleaning Services

Journal Entries

Date Particulars Dr

July $

7/1/2018 Cash at bank $ 30,000.00

Capital-Sally Flash

(being capital invested by owner in business)

7/1/2018 Cash at bank $ 20,000.00

Loan Payable

(being loan taken from bank at 12% interest pa)

7/1/2018 Motor Vehicle $ 18,000.00

Cash at Bank

(motor vehicle purchased)

7/1/2018 Prepaid Insurance $ 3,600.00

Cash at bank

(Being insurance taken)

7/1/2018 Cleaning Equipment $ 4,800.00

Cash at bank

(being equipment purhased)

7/9/2018 Cleaning Supplies $ 2,400.00

Account Payable

(being supplies purchased)

7/13/2018 Cash at bank $ 500.00

Service Revenue

(being service provided to rainbow childcare)

7/20/2018 Wages $ 1,600.00

Cash at bank

(Wages paid)

7/25/2018 Cash at bank $ 5,500.00

Preparation of accounting records – using spreadsheets

1: Journal Entries

Flash Cleaning Services

Journal Entries

Date Particulars Dr

July $

7/1/2018 Cash at bank $ 30,000.00

Capital-Sally Flash

(being capital invested by owner in business)

7/1/2018 Cash at bank $ 20,000.00

Loan Payable

(being loan taken from bank at 12% interest pa)

7/1/2018 Motor Vehicle $ 18,000.00

Cash at Bank

(motor vehicle purchased)

7/1/2018 Prepaid Insurance $ 3,600.00

Cash at bank

(Being insurance taken)

7/1/2018 Cleaning Equipment $ 4,800.00

Cash at bank

(being equipment purhased)

7/9/2018 Cleaning Supplies $ 2,400.00

Account Payable

(being supplies purchased)

7/13/2018 Cash at bank $ 500.00

Service Revenue

(being service provided to rainbow childcare)

7/20/2018 Wages $ 1,600.00

Cash at bank

(Wages paid)

7/25/2018 Cash at bank $ 5,500.00

7/27/2018 Account Payable $ 2,000.00

Cash at bank $ 2,000.00

(Amount paid to supplier)

7/31/2018 Interest on loan $ 300.00

Cash at bank $ 300.00

(Interest paid)

7/31/2018 Advertising Expenses $ 1,600.00

Cash at bank $ 1,600.00

$ 90,300.00 $ 90,300.00

(Davies & Crawford, 2011)

Formula view:

Cash at bank $ 2,000.00

(Amount paid to supplier)

7/31/2018 Interest on loan $ 300.00

Cash at bank $ 300.00

(Interest paid)

7/31/2018 Advertising Expenses $ 1,600.00

Cash at bank $ 1,600.00

$ 90,300.00 $ 90,300.00

(Davies & Crawford, 2011)

Formula view:

### Cash at bank ###

Service Revenue

(being service provided to rainbow childcare)

Service Revenue

(being service provided to rainbow childcare)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

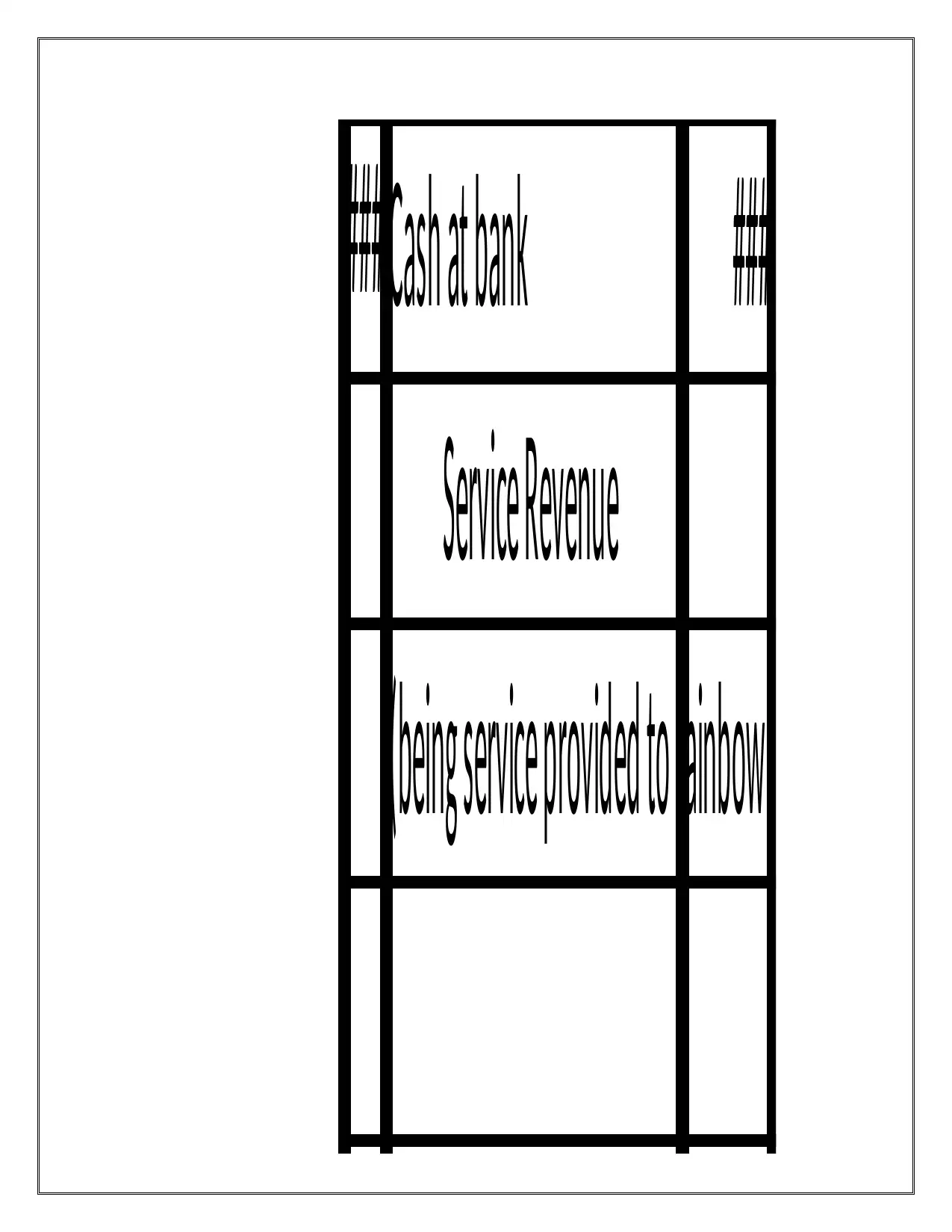

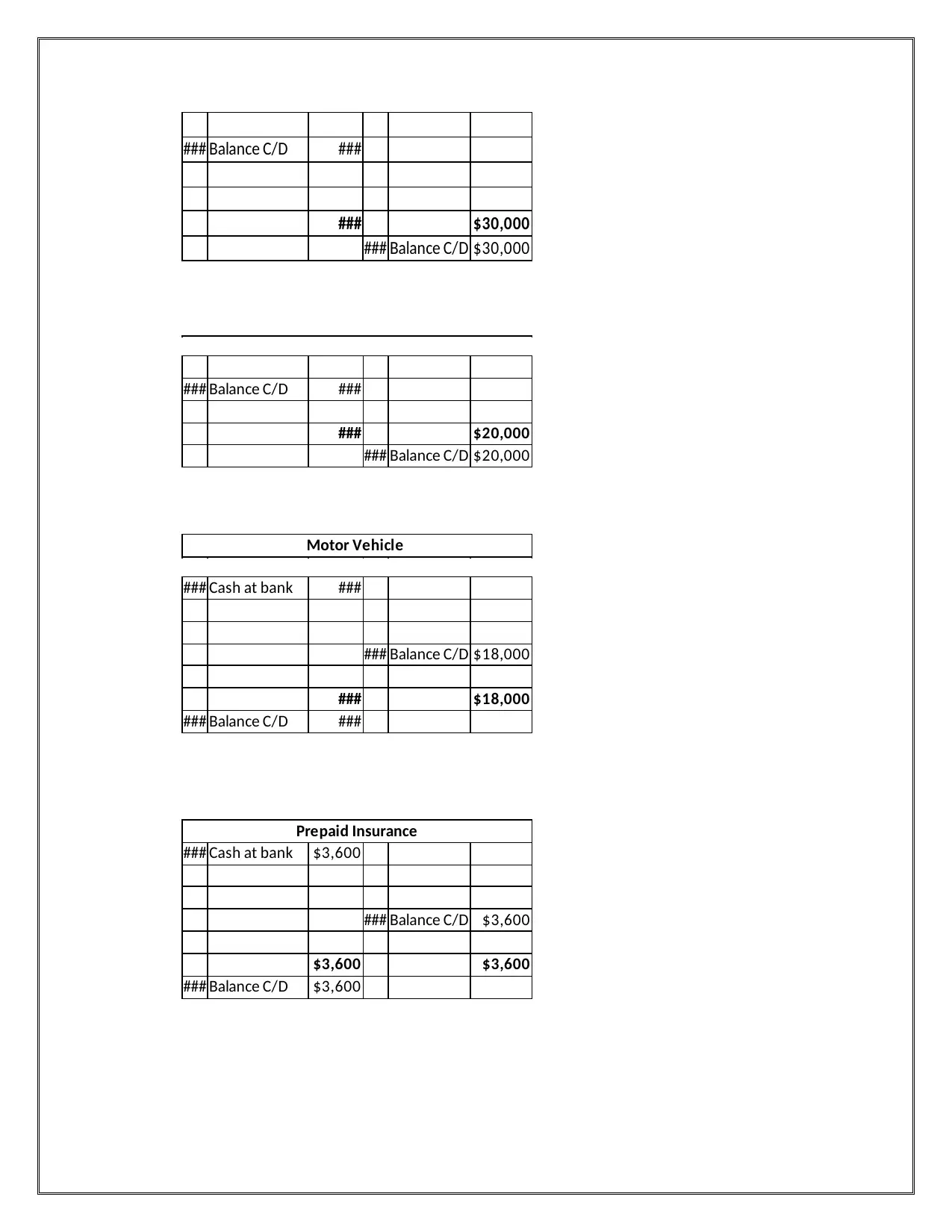

2: T-Accounts

Debit Flash Cleaning Services Credit

General Ledger for the period ending on July 2018

Cash at bank

01/07/18 Capital-Sally Flash $30,000 01/07/18 Motor Vehicle $18,000

01/07/18 Loan Payable $20,000 01/07/18 Prepaid Insurance $3,600

7/13/2018 Service Revenue $500 01/07/18 Cleaning Equipment $4,800

7/25/2018 $5,500 20/07/18 Wages $1,600

27/07/18 Account payable $2,000

31/07/18 Interest on loan $300

31/07/18 Advertising Expenses $1,600

31/07/18 Balance C/D $24,100

$56,000 $56,000

Unearned service

revenue

31/07/18 Advertising Expenses $1,600

31/07/18 Balance C/D $24,100

$56,000 $56,000

31/07/18 Balance C/D $24,100

31/07/18 Balance C/D $30,000

$30,000 $30,000

31/07/18 Balance C/D $30,000

Debit Flash Cleaning Services Credit

General Ledger for the period ending on July 2018

Cash at bank

01/07/18 Capital-Sally Flash $30,000 01/07/18 Motor Vehicle $18,000

01/07/18 Loan Payable $20,000 01/07/18 Prepaid Insurance $3,600

7/13/2018 Service Revenue $500 01/07/18 Cleaning Equipment $4,800

7/25/2018 $5,500 20/07/18 Wages $1,600

27/07/18 Account payable $2,000

31/07/18 Interest on loan $300

31/07/18 Advertising Expenses $1,600

31/07/18 Balance C/D $24,100

$56,000 $56,000

Unearned service

revenue

31/07/18 Advertising Expenses $1,600

31/07/18 Balance C/D $24,100

$56,000 $56,000

31/07/18 Balance C/D $24,100

31/07/18 Balance C/D $30,000

$30,000 $30,000

31/07/18 Balance C/D $30,000

31/07/18 Balance C/D $20,000

$20,000 $20,000

31/07/18 Balance C/D $20,000

01/07/18 Cash at bank $18,000

31/07/18 Balance C/D $18,000

$18,000 $18,000

31/07/18 Balance C/D $18,000

31/07/18 Balance C/D $3,600

$3,600 $3,600

31/07/18 Balance C/D $3,600

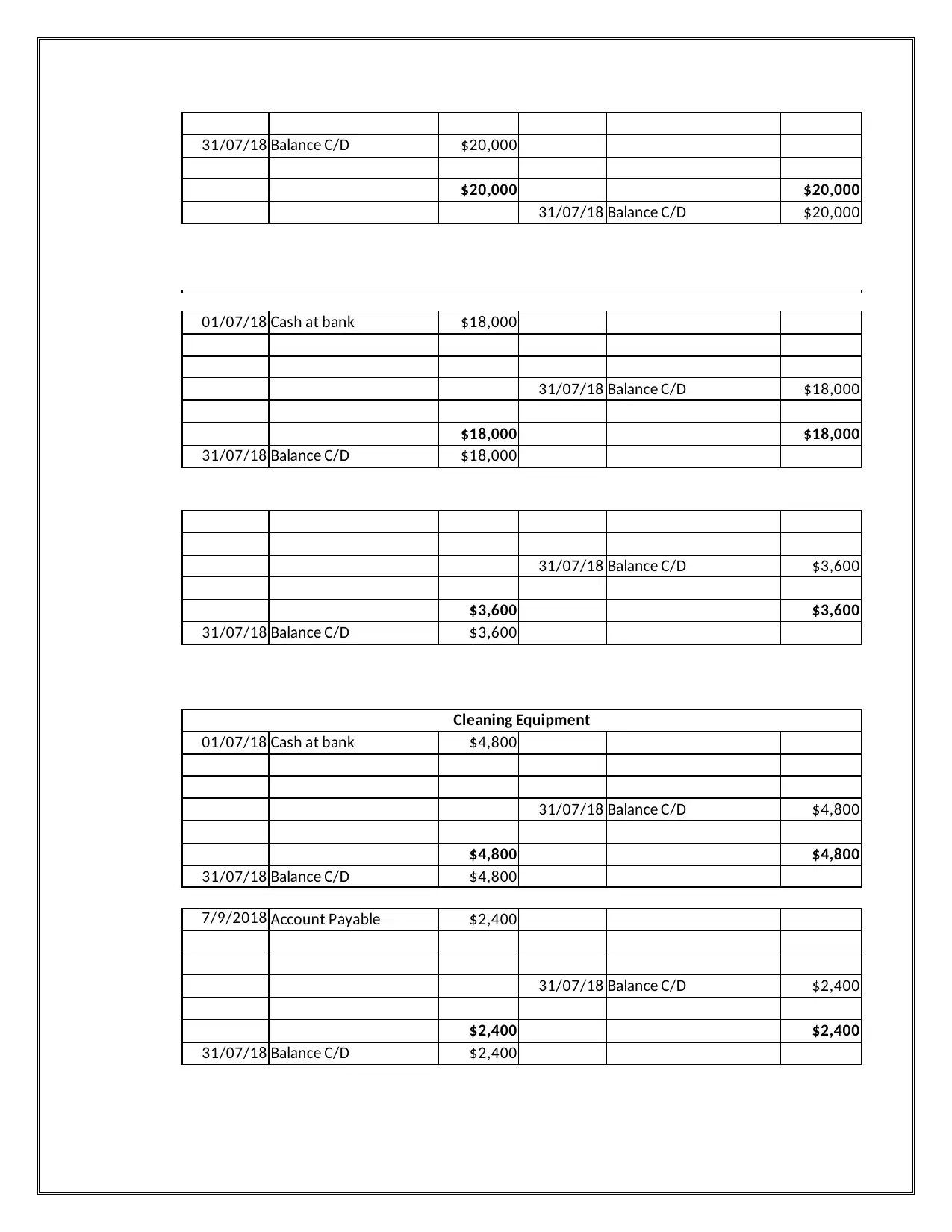

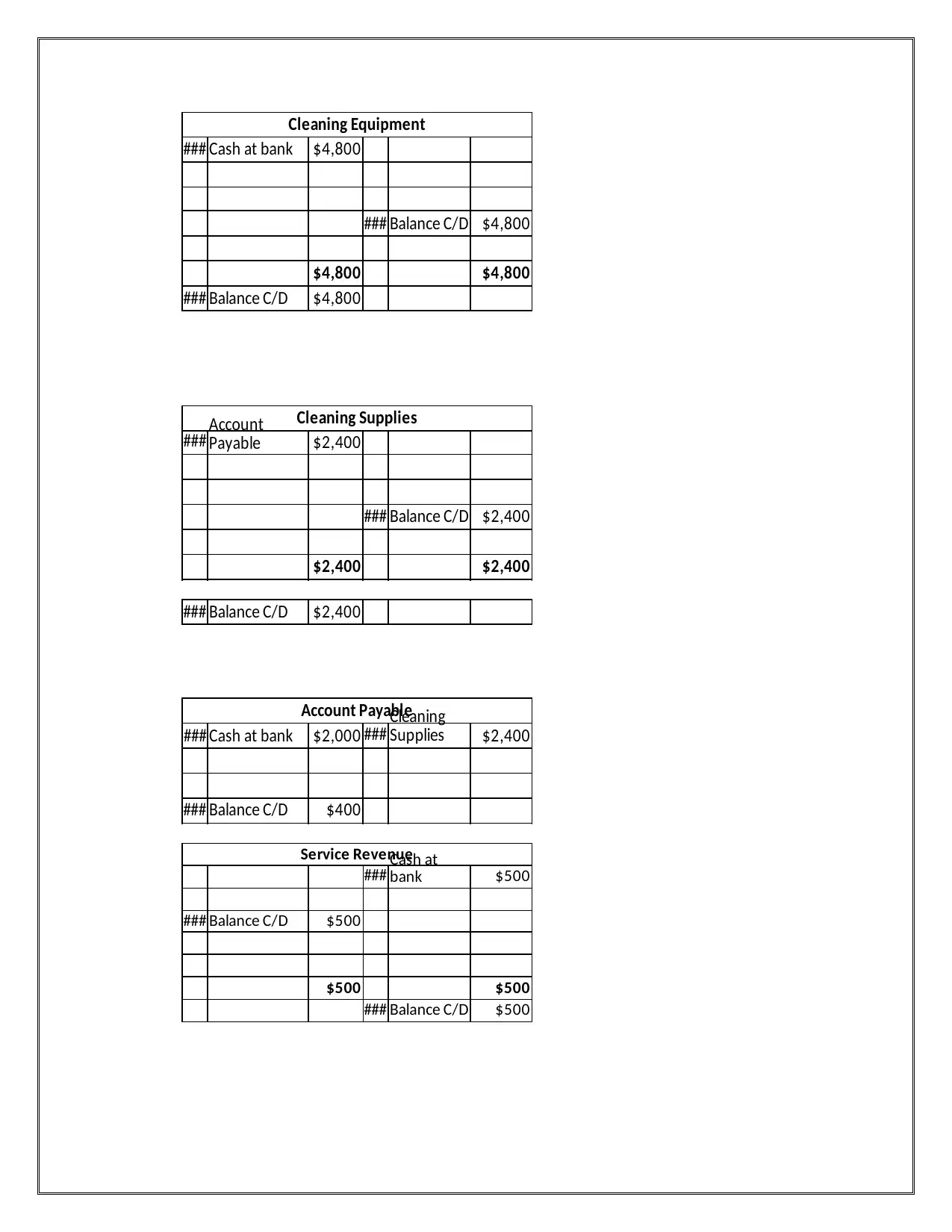

Cleaning Equipment

01/07/18 Cash at bank $4,800

31/07/18 Balance C/D $4,800

$4,800 $4,800

31/07/18 Balance C/D $4,800

7/9/2018 Account Payable $2,400

31/07/18 Balance C/D $2,400

$2,400 $2,400

31/07/18 Balance C/D $2,400

$20,000 $20,000

31/07/18 Balance C/D $20,000

01/07/18 Cash at bank $18,000

31/07/18 Balance C/D $18,000

$18,000 $18,000

31/07/18 Balance C/D $18,000

31/07/18 Balance C/D $3,600

$3,600 $3,600

31/07/18 Balance C/D $3,600

Cleaning Equipment

01/07/18 Cash at bank $4,800

31/07/18 Balance C/D $4,800

$4,800 $4,800

31/07/18 Balance C/D $4,800

7/9/2018 Account Payable $2,400

31/07/18 Balance C/D $2,400

$2,400 $2,400

31/07/18 Balance C/D $2,400

Account Payable

27/07/18 Cash at bank $2,000 7/9/2018 Cleaning Supplies $2,400

31/07/18 Balance C/D $400

$2,400 $2,400

Service Revenue

7/13/2018 Cash at bank $500

31/07/18 Balance C/D $500

Wages

20/07/18 Cash at bank $1,600

31/07/18 Balance C/D $1,600

Unearned service revenue

25/07/18 Cash at bank $5,500

31/07/18 Balance C/D $5,500

$5,500 $5,500

31/07/18 Balance C/D $300

$300 $300

31/07/18 Balance C/D $300

27/07/18 Cash at bank $2,000 7/9/2018 Cleaning Supplies $2,400

31/07/18 Balance C/D $400

$2,400 $2,400

Service Revenue

7/13/2018 Cash at bank $500

31/07/18 Balance C/D $500

Wages

20/07/18 Cash at bank $1,600

31/07/18 Balance C/D $1,600

Unearned service revenue

25/07/18 Cash at bank $5,500

31/07/18 Balance C/D $5,500

$5,500 $5,500

31/07/18 Balance C/D $300

$300 $300

31/07/18 Balance C/D $300

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Davies & Crawford, 2011)

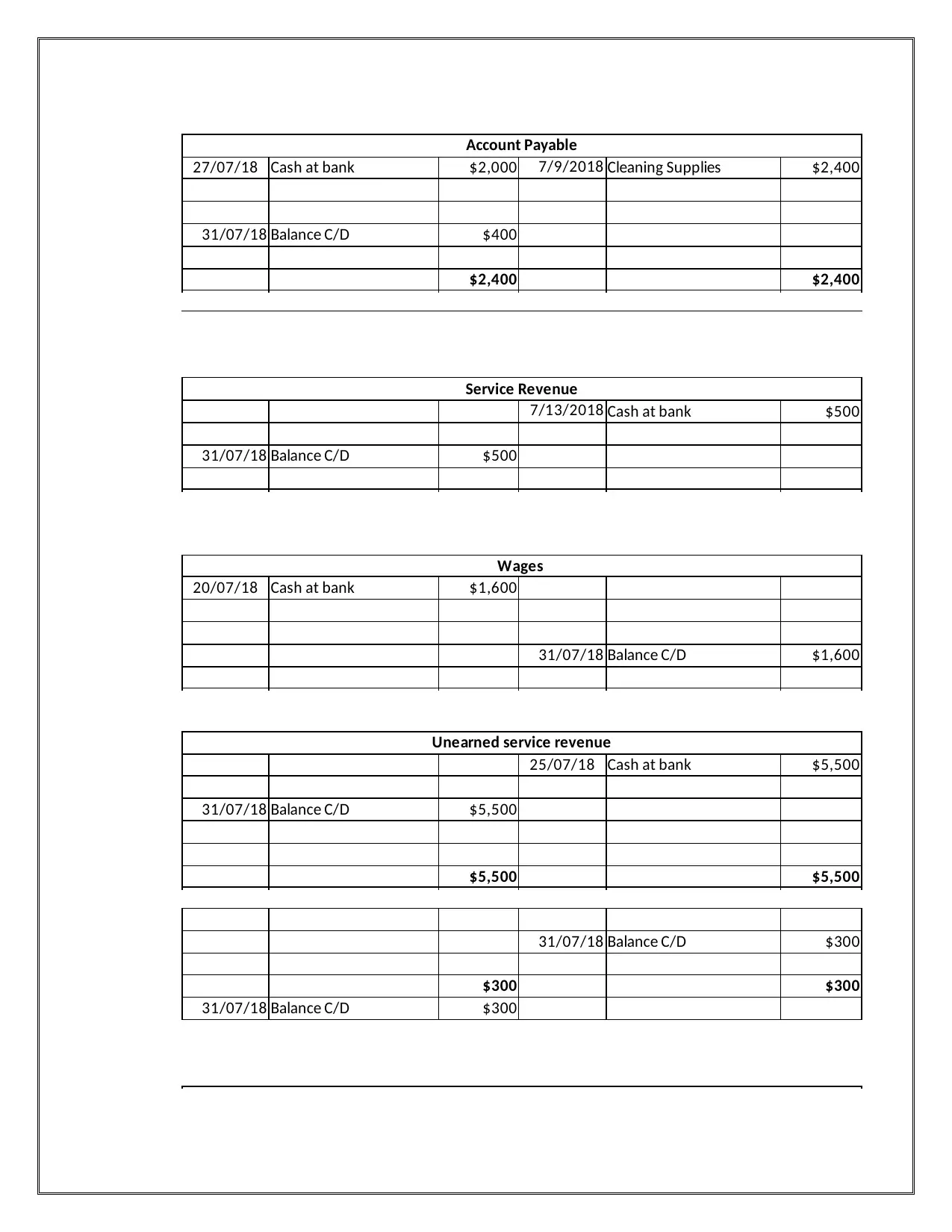

Formula view of T-Accounts

Flash Cleaning Services Credit

Cash at bank

### ### ### $18,000

### Loan Payable ### ### $3,600

### $500 ### $4,800

### $5,500 ### Wages $1,600

### Account pay $2,000

### Interest on l $300

### Advertising $1,600

### Balance C/D $24,100

### $56,000

### Balance C/D ###

Capital-Sally Flash

### $30,000

### Balance C/D ###

De

bit General Ledger for the period

ending on July 2018

Capital-Sally

Flash

Motor

VehiclePrepaid

InsuranceService

Revenue

Cleaning

Equipment

Unearned

service

revenue

Cash at

bank

### Balance C/D $24,100

### $56,000

### Balance C/D ###

Capital-Sally Flash

### $30,000

Cash at

bank

Flash Cleaning Services Credit

Cash at bank

### ### ### $18,000

### Loan Payable ### ### $3,600

### $500 ### $4,800

### $5,500 ### Wages $1,600

### Account pay $2,000

### Interest on l $300

### Advertising $1,600

### Balance C/D $24,100

### $56,000

### Balance C/D ###

Capital-Sally Flash

### $30,000

### Balance C/D ###

De

bit General Ledger for the period

ending on July 2018

Capital-Sally

Flash

Motor

VehiclePrepaid

InsuranceService

Revenue

Cleaning

Equipment

Unearned

service

revenue

Cash at

bank

### Balance C/D $24,100

### $56,000

### Balance C/D ###

Capital-Sally Flash

### $30,000

Cash at

bank

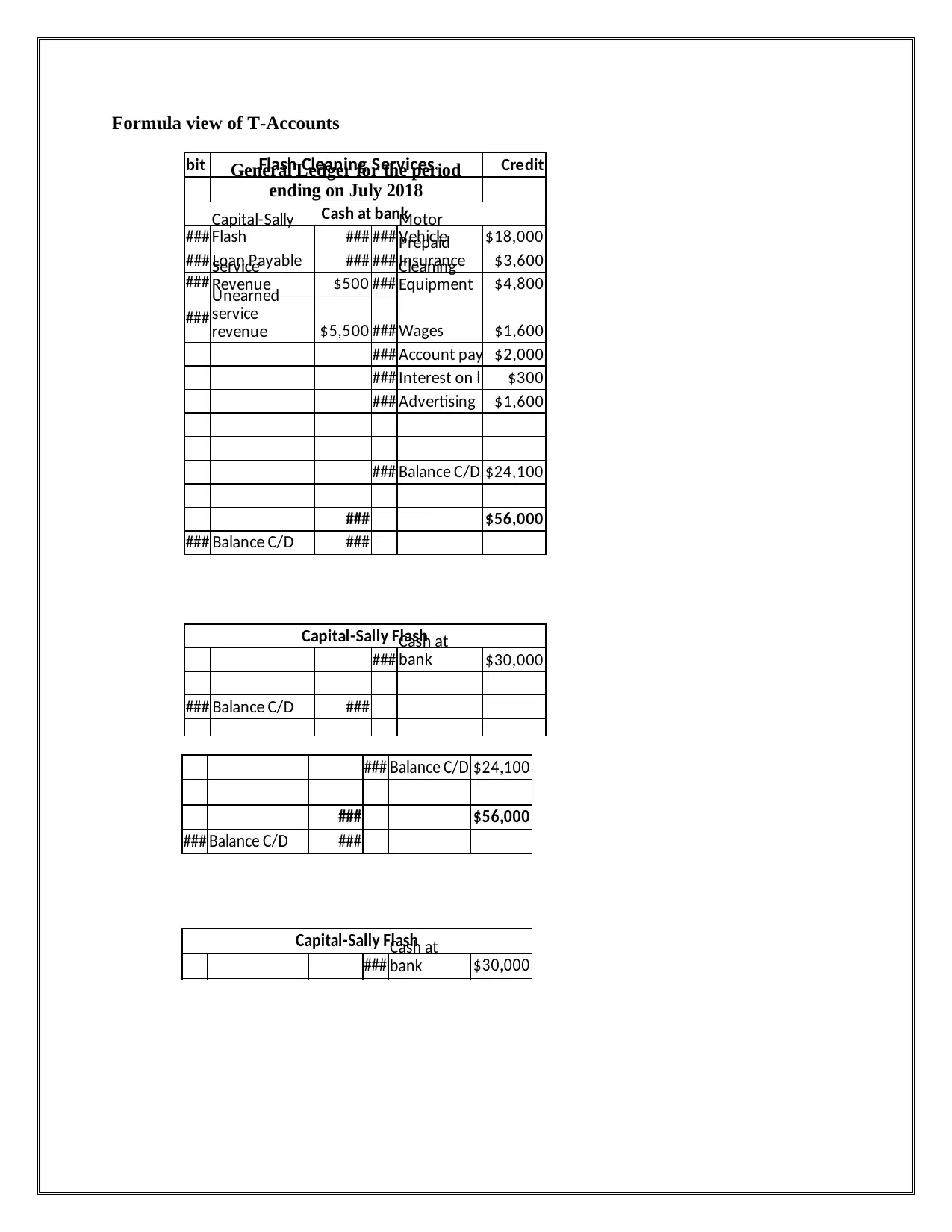

### Balance C/D ###

### $30,000

### Balance C/D $30,000

### Balance C/D ###

### $20,000

### Balance C/D $20,000

Motor Vehicle

### Cash at bank ###

### Balance C/D $18,000

### $18,000

### Balance C/D ###

Prepaid Insurance

### Cash at bank $3,600

### Balance C/D $3,600

$3,600 $3,600

### Balance C/D $3,600

### $30,000

### Balance C/D $30,000

### Balance C/D ###

### $20,000

### Balance C/D $20,000

Motor Vehicle

### Cash at bank ###

### Balance C/D $18,000

### $18,000

### Balance C/D ###

Prepaid Insurance

### Cash at bank $3,600

### Balance C/D $3,600

$3,600 $3,600

### Balance C/D $3,600

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cleaning Equipment

### Cash at bank $4,800

### Balance C/D $4,800

$4,800 $4,800

### Balance C/D $4,800

Cleaning Supplies

### $2,400

### Balance C/D $2,400

$2,400 $2,400

Account

Payable

### Balance C/D $2,400

Account Payable

### Cash at bank $2,000 ### $2,400

### Balance C/D $400

Cleaning

Supplies

Service Revenue

### $500

### Balance C/D $500

$500 $500

### Balance C/D $500

Cash at

bank

### Cash at bank $4,800

### Balance C/D $4,800

$4,800 $4,800

### Balance C/D $4,800

Cleaning Supplies

### $2,400

### Balance C/D $2,400

$2,400 $2,400

Account

Payable

### Balance C/D $2,400

Account Payable

### Cash at bank $2,000 ### $2,400

### Balance C/D $400

Cleaning

Supplies

Service Revenue

### $500

### Balance C/D $500

$500 $500

### Balance C/D $500

Cash at

bank

### Balance C/D $1,600

$1,600 $1,600

### Balance C/D $1,600

Unearned service revenue

### $5,500

Cash at

bank

$5,500 $5,500

### Balance C/D $5,500

Interest on loan

### Cash at bank $300

$300 $300

### Balance C/D $300

Advertising Expenses

### Cash at bank $1,600

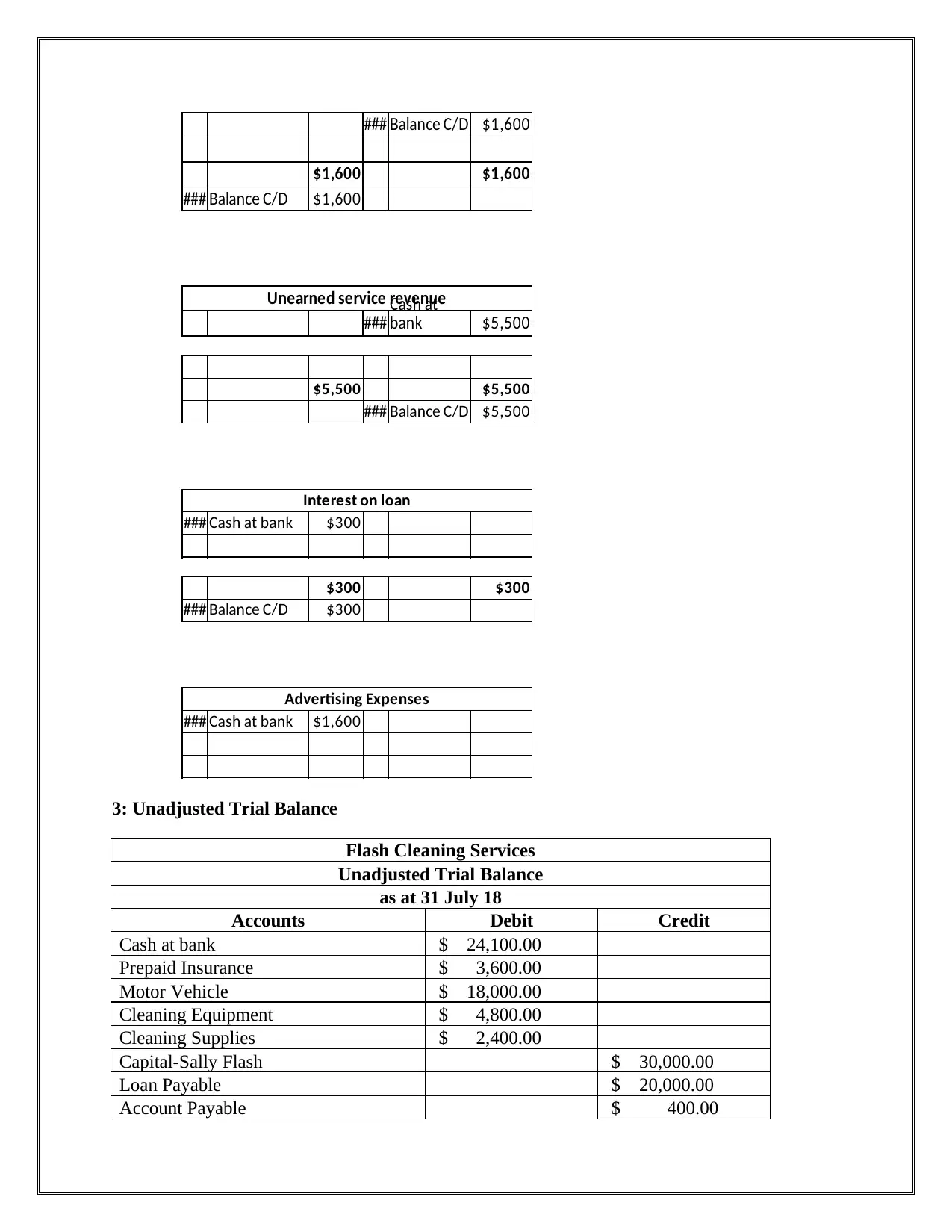

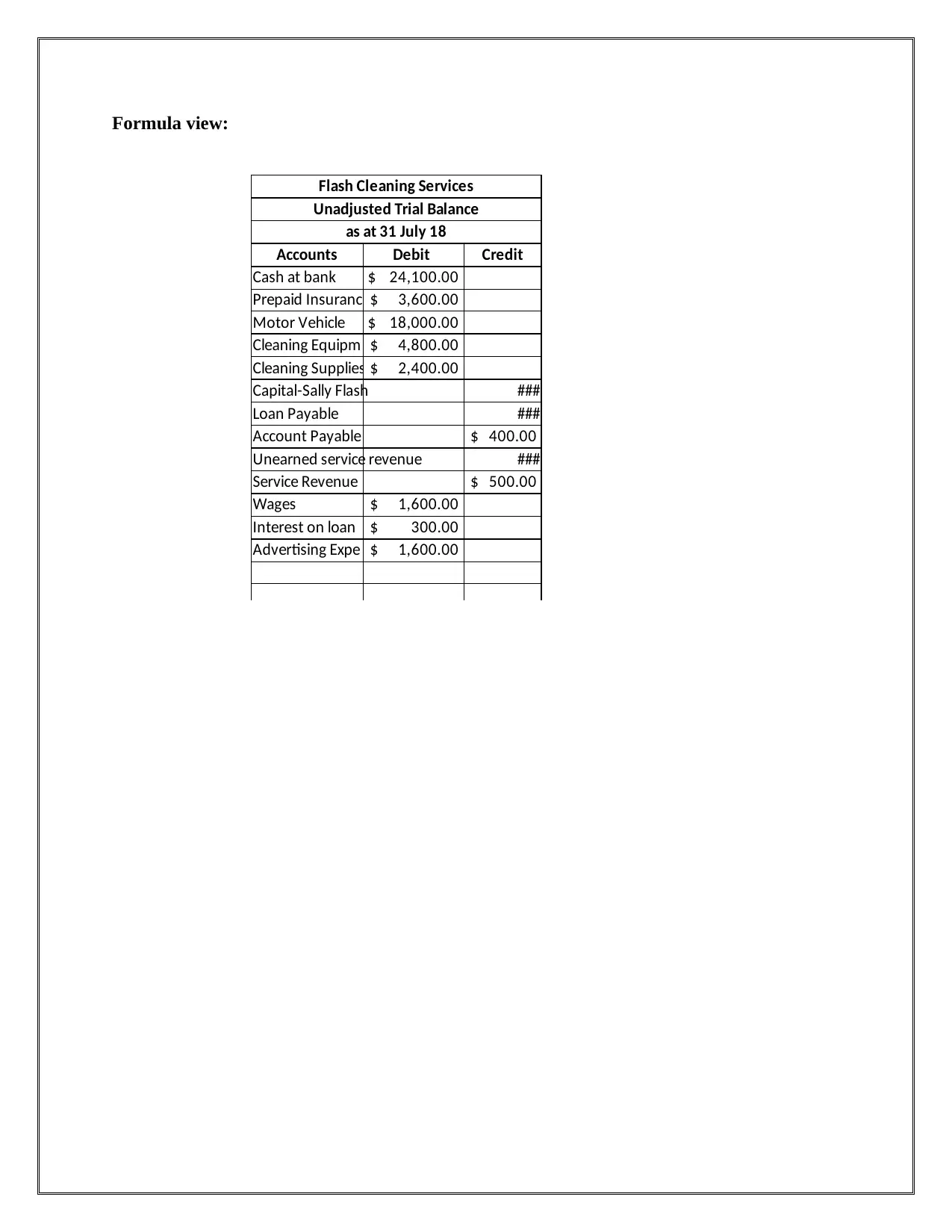

3: Unadjusted Trial Balance

Flash Cleaning Services

Unadjusted Trial Balance

as at 31 July 18

Accounts Debit Credit

Cash at bank $ 24,100.00

Prepaid Insurance $ 3,600.00

Motor Vehicle $ 18,000.00

Cleaning Equipment $ 4,800.00

Cleaning Supplies $ 2,400.00

Capital-Sally Flash $ 30,000.00

Loan Payable $ 20,000.00

Account Payable $ 400.00

$1,600 $1,600

### Balance C/D $1,600

Unearned service revenue

### $5,500

Cash at

bank

$5,500 $5,500

### Balance C/D $5,500

Interest on loan

### Cash at bank $300

$300 $300

### Balance C/D $300

Advertising Expenses

### Cash at bank $1,600

3: Unadjusted Trial Balance

Flash Cleaning Services

Unadjusted Trial Balance

as at 31 July 18

Accounts Debit Credit

Cash at bank $ 24,100.00

Prepaid Insurance $ 3,600.00

Motor Vehicle $ 18,000.00

Cleaning Equipment $ 4,800.00

Cleaning Supplies $ 2,400.00

Capital-Sally Flash $ 30,000.00

Loan Payable $ 20,000.00

Account Payable $ 400.00

Unearned service revenue $ 5,500.00

Service Revenue $ 500.00

Wages $ 1,600.00

Interest on loan $ 300.00

Advertising Expenses $ 1,600.00

$ 56,400.00 $ 56,400.00

(Davies & Crawford, 2011)

Service Revenue $ 500.00

Wages $ 1,600.00

Interest on loan $ 300.00

Advertising Expenses $ 1,600.00

$ 56,400.00 $ 56,400.00

(Davies & Crawford, 2011)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

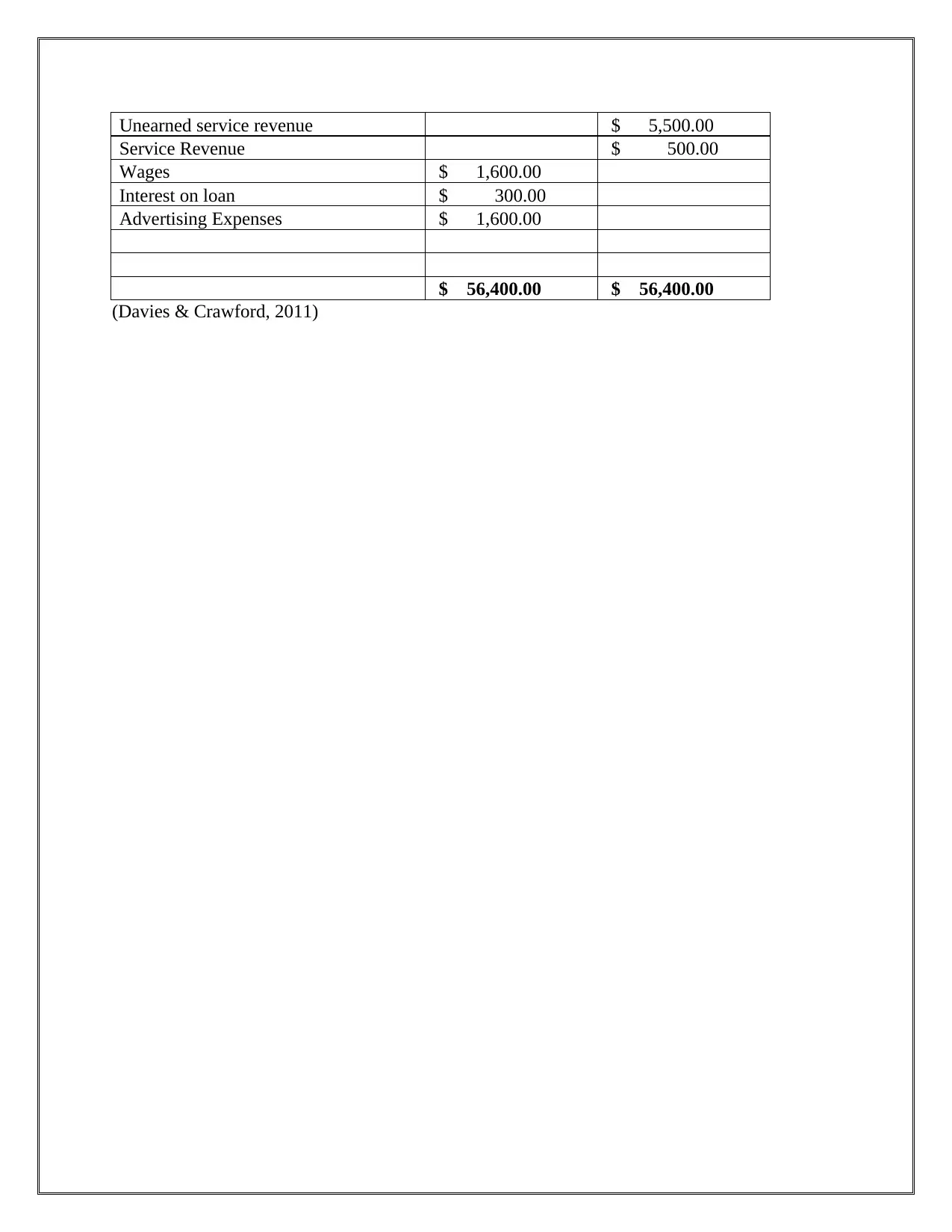

Formula view:

Flash Cleaning Services

Unadjusted Trial Balance

as at 31 July 18

Accounts Debit Credit

Cash at bank $ 24,100.00

Prepaid Insuranc $ 3,600.00

Motor Vehicle $ 18,000.00

Cleaning Equipm $ 4,800.00

Cleaning Supplies $ 2,400.00

Capital-Sally Flash ###

Loan Payable ###

Account Payable $ 400.00

Unearned service revenue ###

Service Revenue $ 500.00

Wages $ 1,600.00

Interest on loan $ 300.00

Advertising Expe $ 1,600.00

Flash Cleaning Services

Unadjusted Trial Balance

as at 31 July 18

Accounts Debit Credit

Cash at bank $ 24,100.00

Prepaid Insuranc $ 3,600.00

Motor Vehicle $ 18,000.00

Cleaning Equipm $ 4,800.00

Cleaning Supplies $ 2,400.00

Capital-Sally Flash ###

Loan Payable ###

Account Payable $ 400.00

Unearned service revenue ###

Service Revenue $ 500.00

Wages $ 1,600.00

Interest on loan $ 300.00

Advertising Expe $ 1,600.00

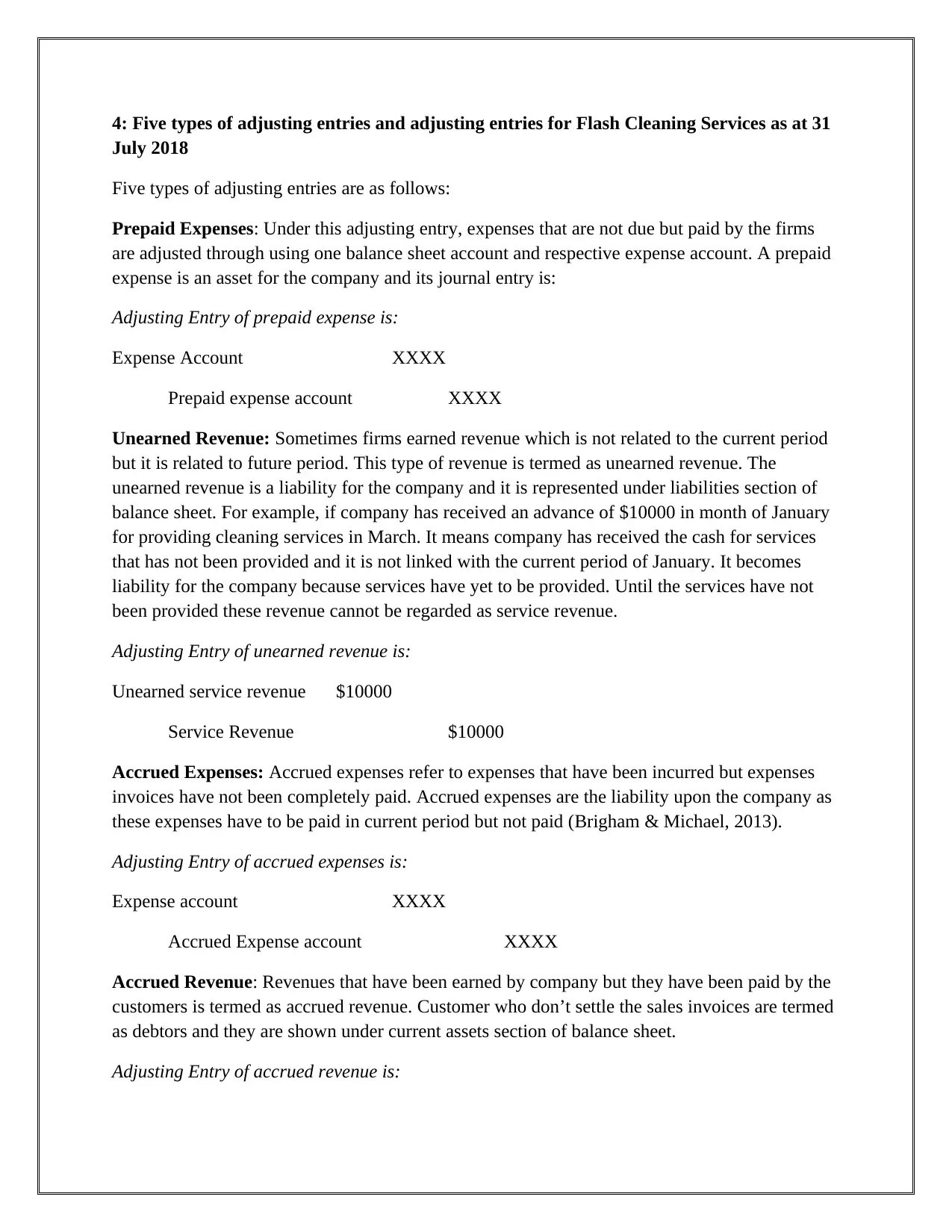

4: Five types of adjusting entries and adjusting entries for Flash Cleaning Services as at 31

July 2018

Five types of adjusting entries are as follows:

Prepaid Expenses: Under this adjusting entry, expenses that are not due but paid by the firms

are adjusted through using one balance sheet account and respective expense account. A prepaid

expense is an asset for the company and its journal entry is:

Adjusting Entry of prepaid expense is:

Expense Account XXXX

Prepaid expense account XXXX

Unearned Revenue: Sometimes firms earned revenue which is not related to the current period

but it is related to future period. This type of revenue is termed as unearned revenue. The

unearned revenue is a liability for the company and it is represented under liabilities section of

balance sheet. For example, if company has received an advance of $10000 in month of January

for providing cleaning services in March. It means company has received the cash for services

that has not been provided and it is not linked with the current period of January. It becomes

liability for the company because services have yet to be provided. Until the services have not

been provided these revenue cannot be regarded as service revenue.

Adjusting Entry of unearned revenue is:

Unearned service revenue $10000

Service Revenue $10000

Accrued Expenses: Accrued expenses refer to expenses that have been incurred but expenses

invoices have not been completely paid. Accrued expenses are the liability upon the company as

these expenses have to be paid in current period but not paid (Brigham & Michael, 2013).

Adjusting Entry of accrued expenses is:

Expense account XXXX

Accrued Expense account XXXX

Accrued Revenue: Revenues that have been earned by company but they have been paid by the

customers is termed as accrued revenue. Customer who don’t settle the sales invoices are termed

as debtors and they are shown under current assets section of balance sheet.

Adjusting Entry of accrued revenue is:

July 2018

Five types of adjusting entries are as follows:

Prepaid Expenses: Under this adjusting entry, expenses that are not due but paid by the firms

are adjusted through using one balance sheet account and respective expense account. A prepaid

expense is an asset for the company and its journal entry is:

Adjusting Entry of prepaid expense is:

Expense Account XXXX

Prepaid expense account XXXX

Unearned Revenue: Sometimes firms earned revenue which is not related to the current period

but it is related to future period. This type of revenue is termed as unearned revenue. The

unearned revenue is a liability for the company and it is represented under liabilities section of

balance sheet. For example, if company has received an advance of $10000 in month of January

for providing cleaning services in March. It means company has received the cash for services

that has not been provided and it is not linked with the current period of January. It becomes

liability for the company because services have yet to be provided. Until the services have not

been provided these revenue cannot be regarded as service revenue.

Adjusting Entry of unearned revenue is:

Unearned service revenue $10000

Service Revenue $10000

Accrued Expenses: Accrued expenses refer to expenses that have been incurred but expenses

invoices have not been completely paid. Accrued expenses are the liability upon the company as

these expenses have to be paid in current period but not paid (Brigham & Michael, 2013).

Adjusting Entry of accrued expenses is:

Expense account XXXX

Accrued Expense account XXXX

Accrued Revenue: Revenues that have been earned by company but they have been paid by the

customers is termed as accrued revenue. Customer who don’t settle the sales invoices are termed

as debtors and they are shown under current assets section of balance sheet.

Adjusting Entry of accrued revenue is:

Account Receivable account XXXX

Revenue Account XXXX

Depreciation expense: Depreciation expense refers to the expense which is related to cost of

plant, machinery and equipment. Total cost of depreciable tangible non-current assets is deferred

to life of the assets in form of depreciation and it is charged to profit & loss statement every year

or month (Damodaran, 2011).

Adjusting entry of depreciation expense is:

Depreciation expense account XXXX

Accumulated depreciation account XXXX

Revenue Account XXXX

Depreciation expense: Depreciation expense refers to the expense which is related to cost of

plant, machinery and equipment. Total cost of depreciable tangible non-current assets is deferred

to life of the assets in form of depreciation and it is charged to profit & loss statement every year

or month (Damodaran, 2011).

Adjusting entry of depreciation expense is:

Depreciation expense account XXXX

Accumulated depreciation account XXXX

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

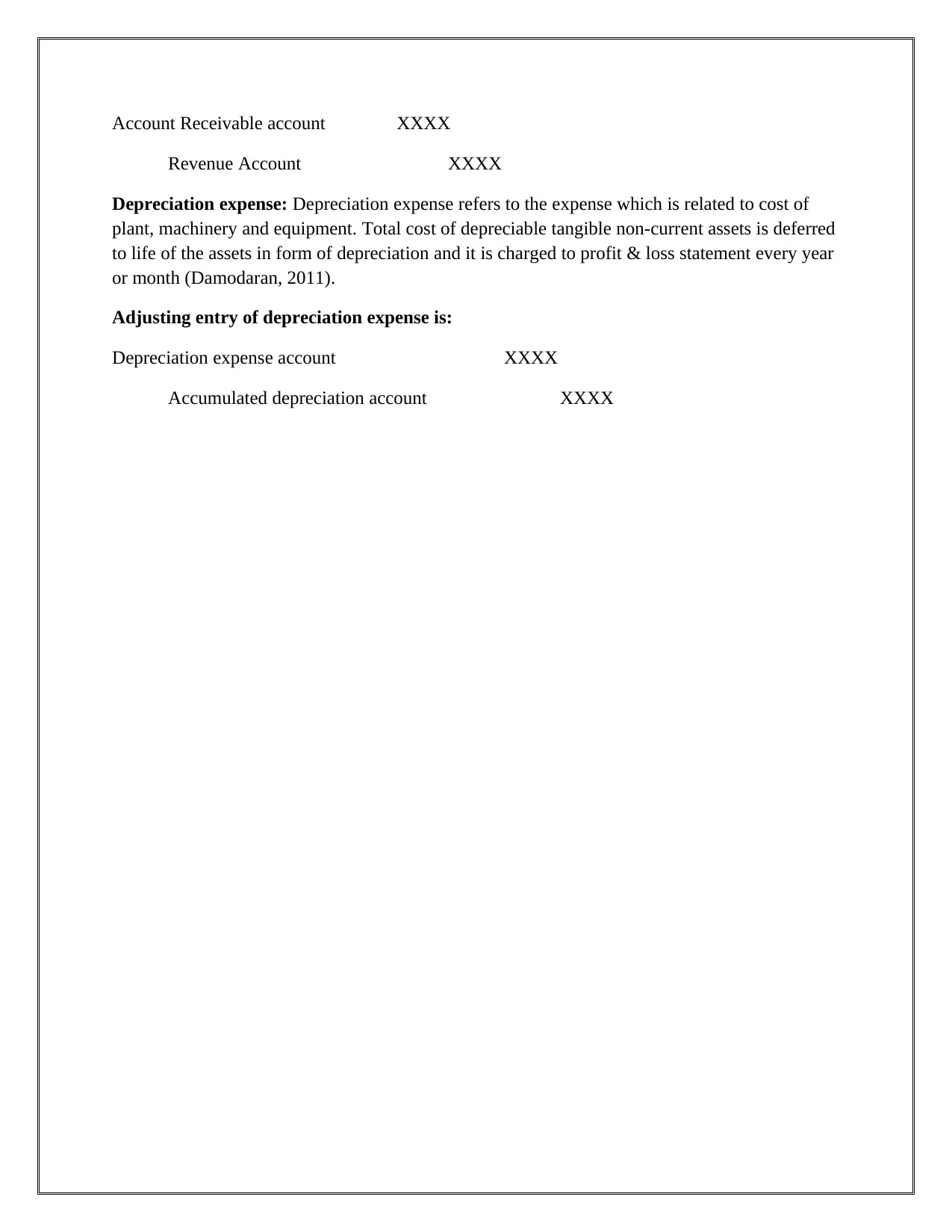

7/31/2018 Fuel Expenses $ 190.00

Fuel Expenses Accured

(Expenses Accured)

7/31/2018 Telephone Expenses $ 100.00

Telephones Expenses Accured

(Expenses Accured)

7/31/2018 Cleaning Supplies Expenses $ 300.00

Cleaning Supplies

(Supplies Used)

7/31/2018 Unearned service revenue $ 500.00

Service Revenue

(Unearned services provided)

7/31/2018 Depreciation Expenses $208.33

Accumalated Depreciation on Motor Vehicle

7/31/2018 Insurance Expenses $ 300.00

Prepaid insurance Expenses

(Insurance expense of the month)

$ 15,890.00

($18000-$3000)/6 = $2500 and $2500/12 months =

$208.33 per month

Fuel Expenses Accured

(Expenses Accured)

7/31/2018 Telephone Expenses $ 100.00

Telephones Expenses Accured

(Expenses Accured)

7/31/2018 Cleaning Supplies Expenses $ 300.00

Cleaning Supplies

(Supplies Used)

7/31/2018 Unearned service revenue $ 500.00

Service Revenue

(Unearned services provided)

7/31/2018 Depreciation Expenses $208.33

Accumalated Depreciation on Motor Vehicle

7/31/2018 Insurance Expenses $ 300.00

Prepaid insurance Expenses

(Insurance expense of the month)

$ 15,890.00

($18000-$3000)/6 = $2500 and $2500/12 months =

$208.33 per month

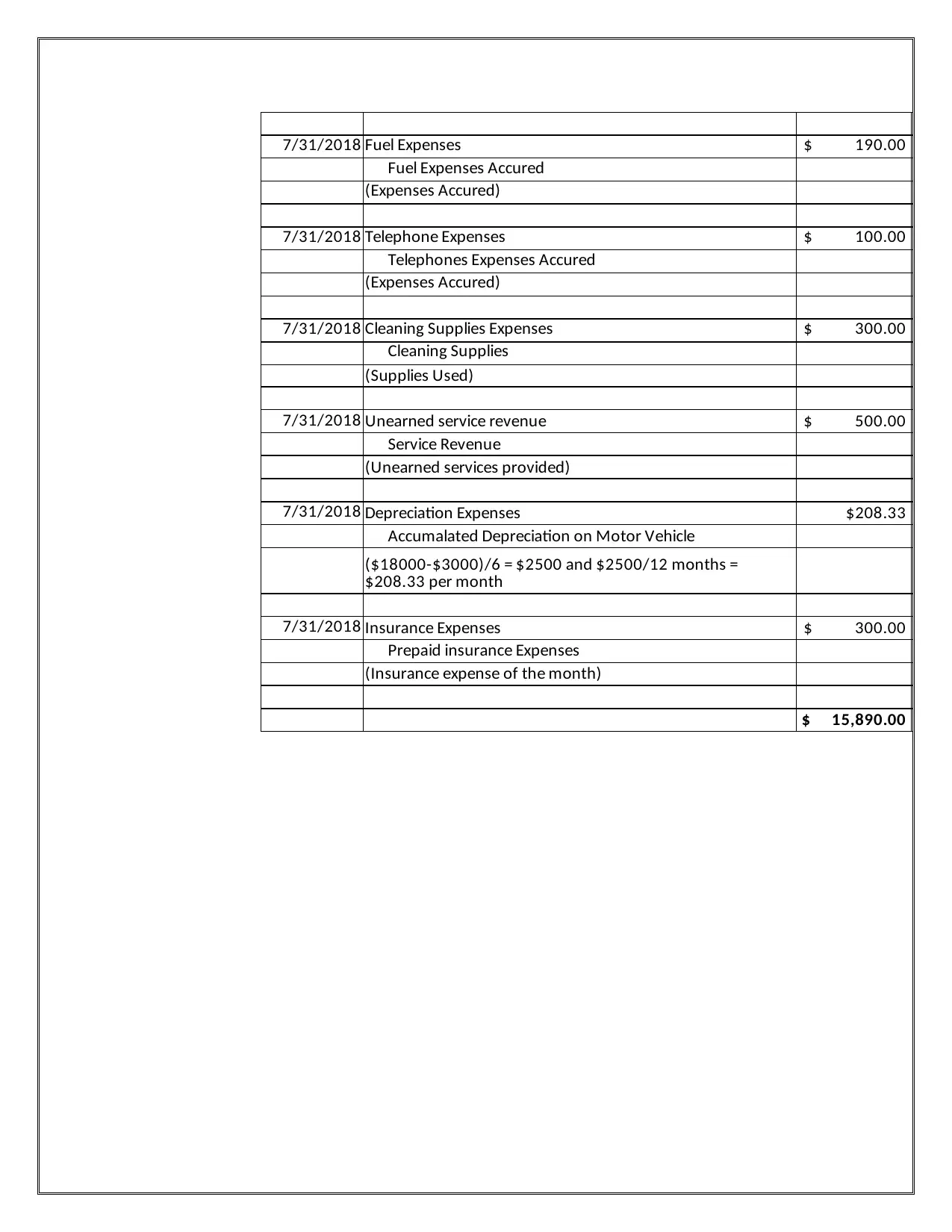

Formula view:

Service revenue ###

### Fuel Expenses $ 190.00

$190.00

(Expenses Accured)

### Telephone Expenses $ 100.00

$100.00

(Expenses Accured)

### $ 300.00

Cleaning Supplies $300.00

(Supplies Used)

### Unearned service reven $ 500.00

Service Revenue $500.00

(Unearned services provided)

### Depreciation Expenses $208.33

Accumalated Depreciation on M$208.33

### Insurance Expenses $ 300.00

$300.00

### ###

(Income earned but

not received)

Fuel Expenses

Accured

Telephones

Expenses Accured

Cleaning Supplies

Expenses

($18000-$3000)/6 =

$2500 and $2500/12

months = $208.33 per

month

Prepaid insurance

Expenses

(Insurance expense of

the month)

Service revenue ###

### Fuel Expenses $ 190.00

$190.00

(Expenses Accured)

### Telephone Expenses $ 100.00

$100.00

(Expenses Accured)

### $ 300.00

Cleaning Supplies $300.00

(Supplies Used)

### Unearned service reven $ 500.00

Service Revenue $500.00

(Unearned services provided)

### Depreciation Expenses $208.33

Accumalated Depreciation on M$208.33

### Insurance Expenses $ 300.00

$300.00

### ###

(Income earned but

not received)

Fuel Expenses

Accured

Telephones

Expenses Accured

Cleaning Supplies

Expenses

($18000-$3000)/6 =

$2500 and $2500/12

months = $208.33 per

month

Prepaid insurance

Expenses

(Insurance expense of

the month)

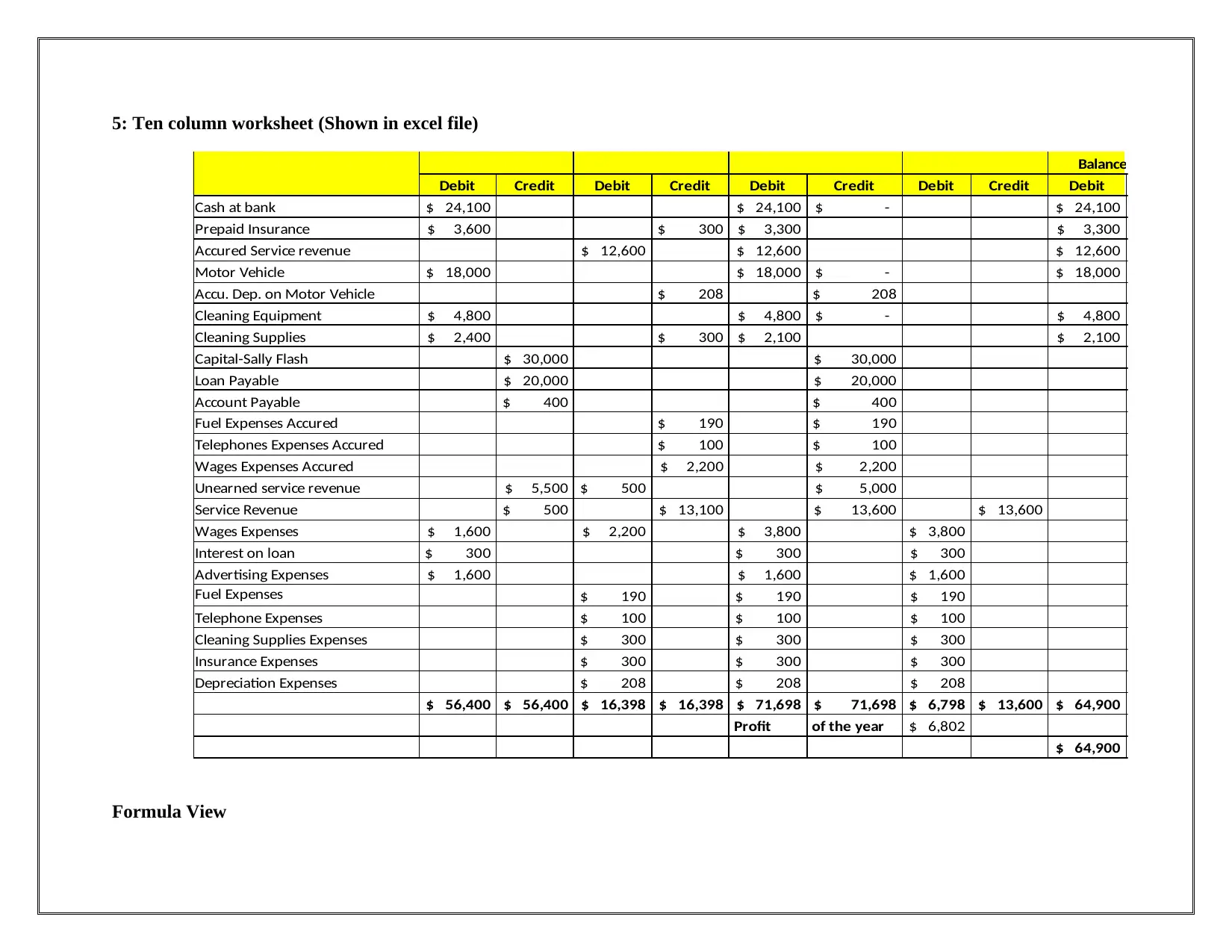

5: Ten column worksheet (Shown in excel file)

Trial Balance Adjustments Adjusted Trial Balance Income Statement

Balance Sheet

Debit Credit Debit Credit Debit Credit Debit Credit Debit

Cash at bank $ 24,100 $ 24,100 $ - $ 24,100

Prepaid Insurance $ 3,600 $ 300 $ 3,300 $ 3,300

Accured Service revenue $ 12,600 $ 12,600 $ 12,600

Motor Vehicle $ 18,000 $ 18,000 $ - $ 18,000

Accu. Dep. on Motor Vehicle $ 208 $ 208

Cleaning Equipment $ 4,800 $ 4,800 $ - $ 4,800

Cleaning Supplies $ 2,400 $ 300 $ 2,100 $ 2,100

Capital-Sally Flash $ 30,000 $ 30,000

Loan Payable $ 20,000 $ 20,000

Account Payable $ 400 $ 400

Fuel Expenses Accured $ 190 $ 190

Telephones Expenses Accured $ 100 $ 100

Wages Expenses Accured $ 2,200 $ 2,200

Unearned service revenue $ 5,500 $ 500 $ 5,000

Service Revenue $ 500 $ 13,100 $ 13,600 $ 13,600

Wages Expenses $ 1,600 $ 2,200 $ 3,800 $ 3,800

Interest on loan $ 300 $ 300 $ 300

Advertising Expenses $ 1,600 $ 1,600 $ 1,600

Fuel Expenses $ 190 $ 190 $ 190

Telephone Expenses $ 100 $ 100 $ 100

Cleaning Supplies Expenses $ 300 $ 300 $ 300

Insurance Expenses $ 300 $ 300 $ 300

Depreciation Expenses $ 208 $ 208 $ 208

$ 56,400 $ 56,400 $ 16,398 $ 16,398 $ 71,698 $ 71,698 $ 6,798 $ 13,600 $ 64,900

Profit of the year $ 6,802

$ 64,900

Formula View

Trial Balance Adjustments Adjusted Trial Balance Income Statement

Balance Sheet

Debit Credit Debit Credit Debit Credit Debit Credit Debit

Cash at bank $ 24,100 $ 24,100 $ - $ 24,100

Prepaid Insurance $ 3,600 $ 300 $ 3,300 $ 3,300

Accured Service revenue $ 12,600 $ 12,600 $ 12,600

Motor Vehicle $ 18,000 $ 18,000 $ - $ 18,000

Accu. Dep. on Motor Vehicle $ 208 $ 208

Cleaning Equipment $ 4,800 $ 4,800 $ - $ 4,800

Cleaning Supplies $ 2,400 $ 300 $ 2,100 $ 2,100

Capital-Sally Flash $ 30,000 $ 30,000

Loan Payable $ 20,000 $ 20,000

Account Payable $ 400 $ 400

Fuel Expenses Accured $ 190 $ 190

Telephones Expenses Accured $ 100 $ 100

Wages Expenses Accured $ 2,200 $ 2,200

Unearned service revenue $ 5,500 $ 500 $ 5,000

Service Revenue $ 500 $ 13,100 $ 13,600 $ 13,600

Wages Expenses $ 1,600 $ 2,200 $ 3,800 $ 3,800

Interest on loan $ 300 $ 300 $ 300

Advertising Expenses $ 1,600 $ 1,600 $ 1,600

Fuel Expenses $ 190 $ 190 $ 190

Telephone Expenses $ 100 $ 100 $ 100

Cleaning Supplies Expenses $ 300 $ 300 $ 300

Insurance Expenses $ 300 $ 300 $ 300

Depreciation Expenses $ 208 $ 208 $ 208

$ 56,400 $ 56,400 $ 16,398 $ 16,398 $ 71,698 $ 71,698 $ 6,798 $ 13,600 $ 64,900

Profit of the year $ 6,802

$ 64,900

Formula View

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Account

DebitCreditDebitCreditDebitCreditDebitCreditDebitCredit

Cash at bank ### ### $ - ###

### ### ### ###

### ### ###

### ### $ - ###

### ### ###

### ### $ - ###

### ### ### ###

### ### ###

Loan Payable ### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ### ###

### ### ### ###

### ### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ### ### ### ### ### ### ### ###

Trial

Balance

Adjustmen

ts

Adjusted

Trial

Balance

Income

Statement Balance

Sheet

Prepaid

Insurance

Accured

Service

revenueMotor

Vehicle

Accu. Dep. on

Motor

VehicleCleaning

EquipmentCleaning

SuppliesCapital-Sally

Flash

Account

Payable

Fuel

Expenses

Accured

Telephones

Expenses

Accured

Wages

Expenses

Accured

Unearned

service

revenueService

RevenueWages

ExpensesInterest on

loanAdvertising

Expenses

Fuel

ExpensesTelephone

Expenses

Cleaning

Supplies

ExpensesInsurance

ExpensesDepreciation

Expenses

(Davies & Crawford, 2011)

DebitCreditDebitCreditDebitCreditDebitCreditDebitCredit

Cash at bank ### ### $ - ###

### ### ### ###

### ### ###

### ### $ - ###

### ### ###

### ### $ - ###

### ### ### ###

### ### ###

Loan Payable ### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ### ###

### ### ### ###

### ### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ###

### ### ### ### ### ### ### ### ### ###

Trial

Balance

Adjustmen

ts

Adjusted

Trial

Balance

Income

Statement Balance

Sheet

Prepaid

Insurance

Accured

Service

revenueMotor

Vehicle

Accu. Dep. on

Motor

VehicleCleaning

EquipmentCleaning

SuppliesCapital-Sally

Flash

Account

Payable

Fuel

Expenses

Accured

Telephones

Expenses

Accured

Wages

Expenses

Accured

Unearned

service

revenueService

RevenueWages

ExpensesInterest on

loanAdvertising

Expenses

Fuel

ExpensesTelephone

Expenses

Cleaning

Supplies

ExpensesInsurance

ExpensesDepreciation

Expenses

(Davies & Crawford, 2011)

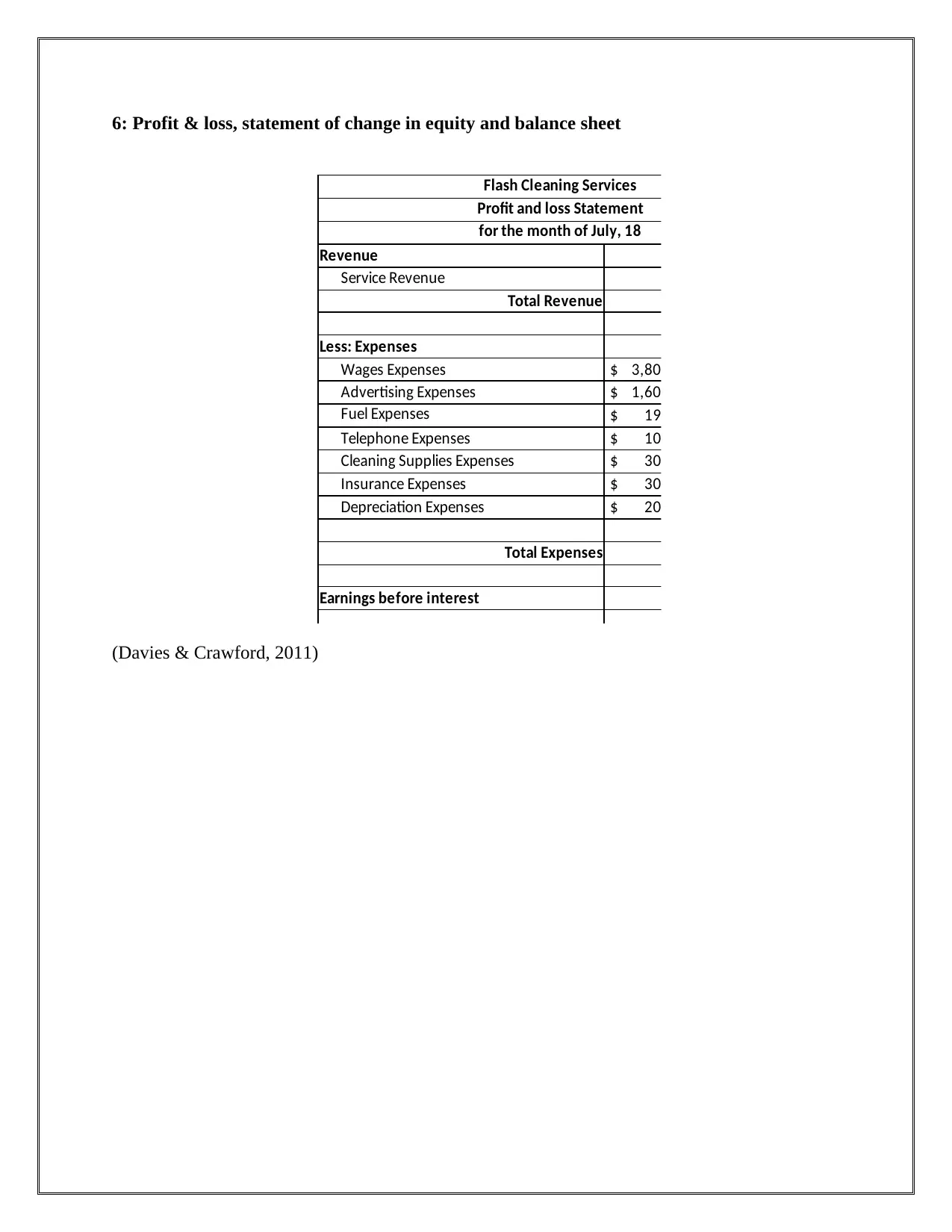

6: Profit & loss, statement of change in equity and balance sheet

Flash Cleaning Services

Profit and loss Statement

for the month of July, 18

Revenue

Service Revenue

Total Revenue

Less: Expenses

Wages Expenses $ 3,800.00

Advertising Expenses $ 1,600.00

Fuel Expenses $ 190.00

Telephone Expenses $ 100.00

Cleaning Supplies Expenses $ 300.00

Insurance Expenses $ 300.00

Depreciation Expenses $ 208.33

Total Expenses

Earnings before interest

(Davies & Crawford, 2011)

Flash Cleaning Services

Profit and loss Statement

for the month of July, 18

Revenue

Service Revenue

Total Revenue

Less: Expenses

Wages Expenses $ 3,800.00

Advertising Expenses $ 1,600.00

Fuel Expenses $ 190.00

Telephone Expenses $ 100.00

Cleaning Supplies Expenses $ 300.00

Insurance Expenses $ 300.00

Depreciation Expenses $ 208.33

Total Expenses

Earnings before interest

(Davies & Crawford, 2011)

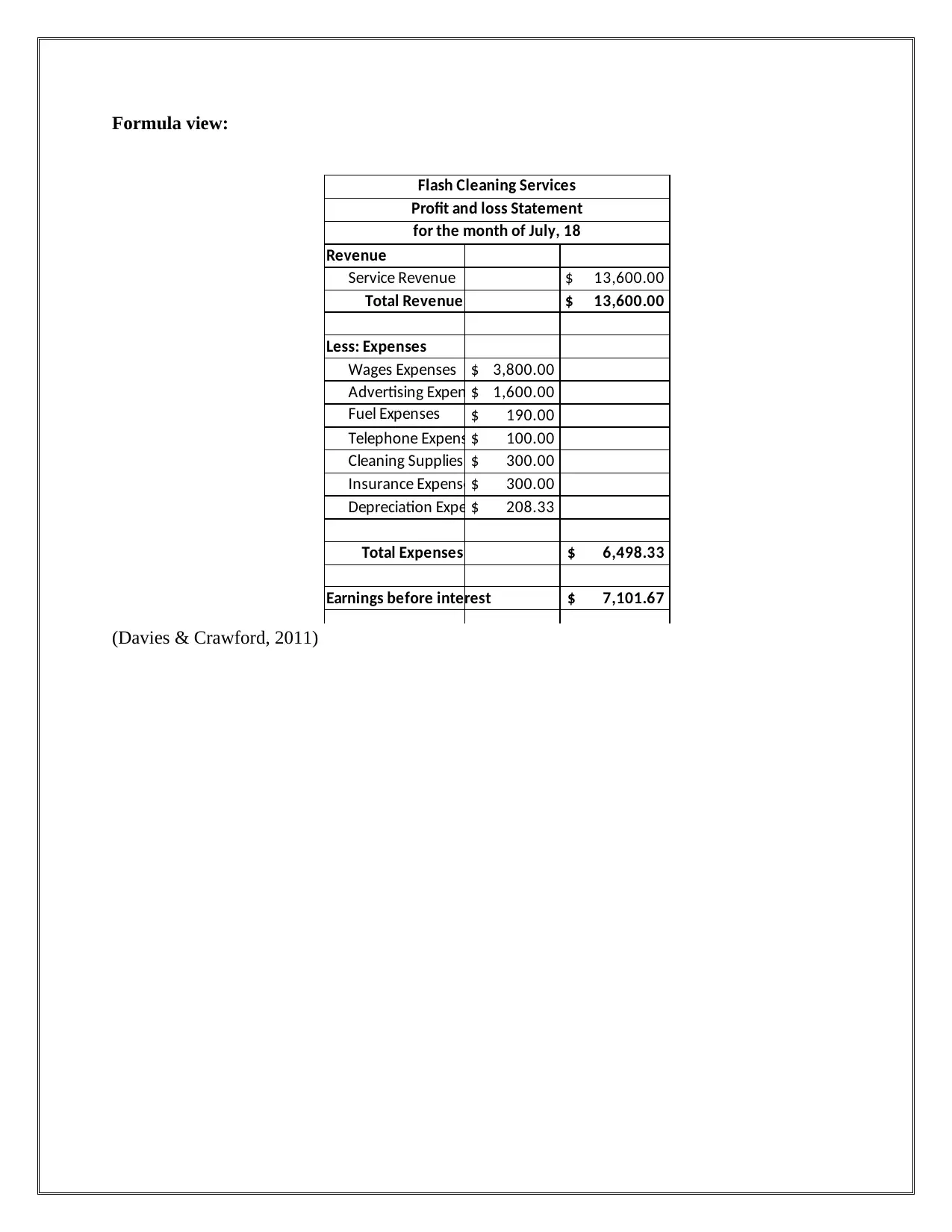

Formula view:

Flash Cleaning Services

Profit and loss Statement

for the month of July, 18

Revenue

Service Revenue $ 13,600.00

Total Revenue $ 13,600.00

Less: Expenses

Wages Expenses $ 3,800.00

Advertising Expen $ 1,600.00

Fuel Expenses $ 190.00

Telephone Expens $ 100.00

Cleaning Supplies $ 300.00

Insurance Expense$ 300.00

Depreciation Expe $ 208.33

Total Expenses $ 6,498.33

Earnings before interest $ 7,101.67

(Davies & Crawford, 2011)

Flash Cleaning Services

Profit and loss Statement

for the month of July, 18

Revenue

Service Revenue $ 13,600.00

Total Revenue $ 13,600.00

Less: Expenses

Wages Expenses $ 3,800.00

Advertising Expen $ 1,600.00

Fuel Expenses $ 190.00

Telephone Expens $ 100.00

Cleaning Supplies $ 300.00

Insurance Expense$ 300.00

Depreciation Expe $ 208.33

Total Expenses $ 6,498.33

Earnings before interest $ 7,101.67

(Davies & Crawford, 2011)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

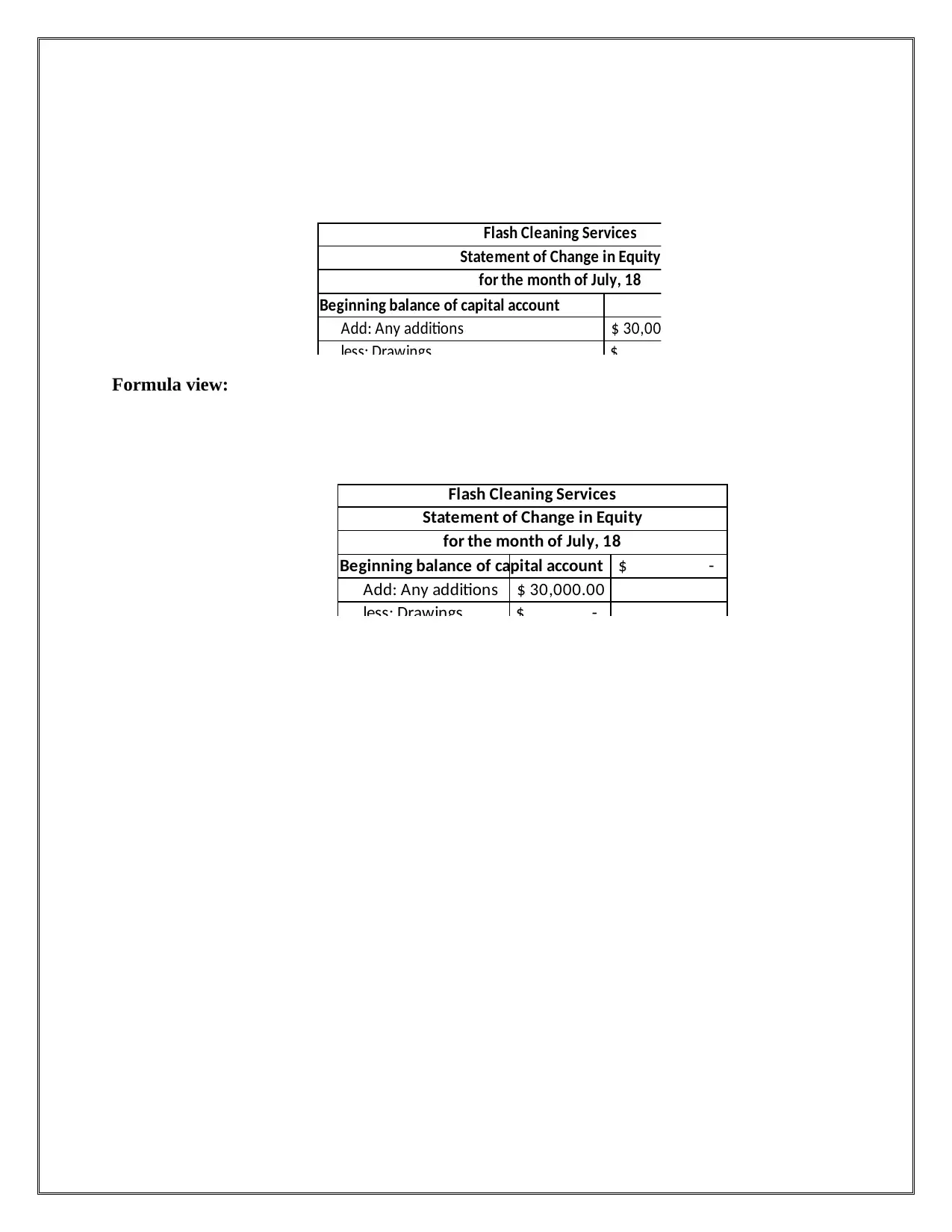

Flash Cleaning Services

Statement of Change in Equity

for the month of July, 18

Beginning balance of capital account

Add: Any additions $ 30,000.00

less: Drawings $ -

Formula view:

Flash Cleaning Services

Statement of Change in Equity

for the month of July, 18

Beginning balance of capital account $ -

Add: Any additions $ 30,000.00

less: Drawings $ -

Statement of Change in Equity

for the month of July, 18

Beginning balance of capital account

Add: Any additions $ 30,000.00

less: Drawings $ -

Formula view:

Flash Cleaning Services

Statement of Change in Equity

for the month of July, 18

Beginning balance of capital account $ -

Add: Any additions $ 30,000.00

less: Drawings $ -

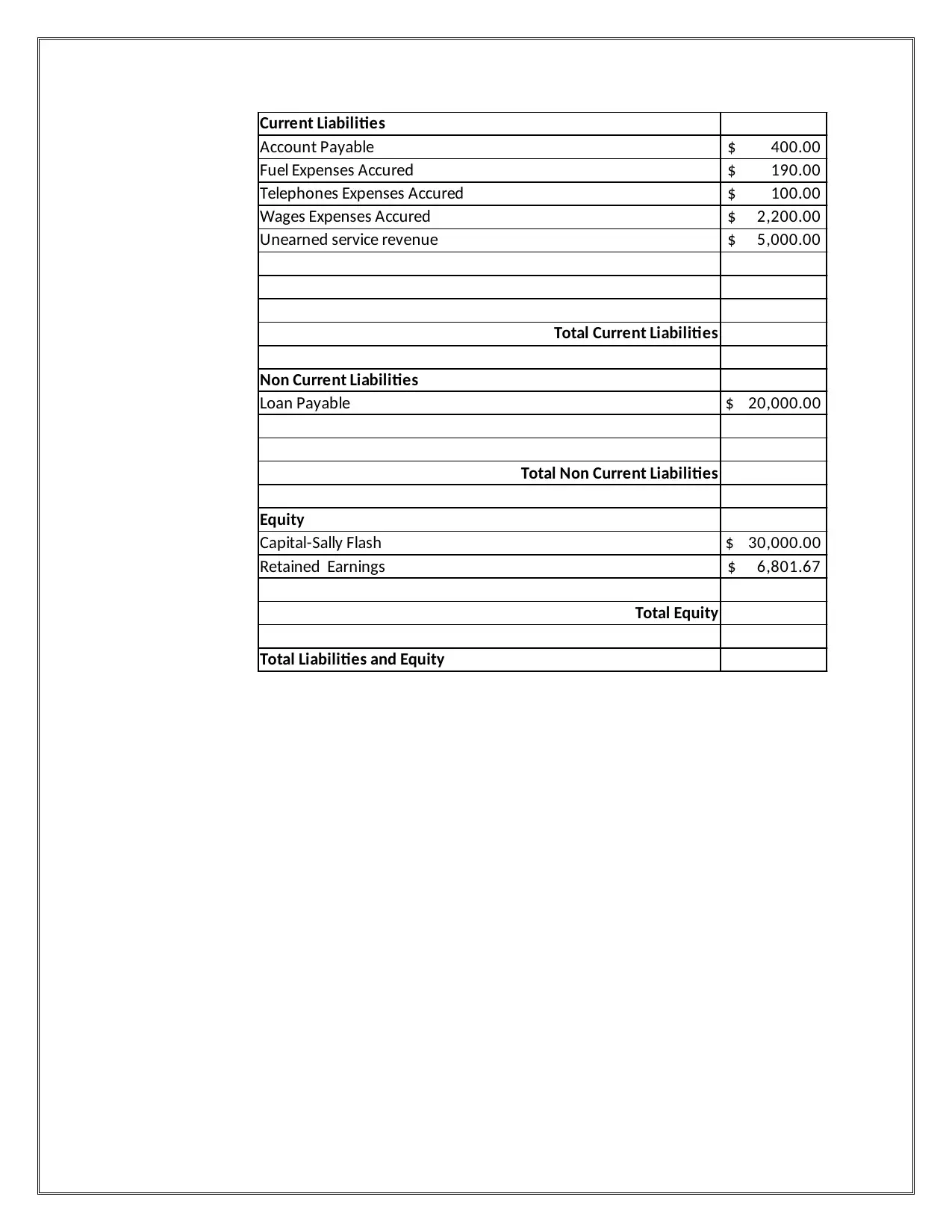

Current Liabilities

Account Payable $ 400.00

Fuel Expenses Accured $ 190.00

Telephones Expenses Accured $ 100.00

Wages Expenses Accured $ 2,200.00

Unearned service revenue $ 5,000.00

Total Current Liabilities

Non Current Liabilities

Loan Payable $ 20,000.00

Total Non Current Liabilities

Equity

Capital-Sally Flash $ 30,000.00

Retained Earnings $ 6,801.67

Total Equity

Total Liabilities and Equity

Account Payable $ 400.00

Fuel Expenses Accured $ 190.00

Telephones Expenses Accured $ 100.00

Wages Expenses Accured $ 2,200.00

Unearned service revenue $ 5,000.00

Total Current Liabilities

Non Current Liabilities

Loan Payable $ 20,000.00

Total Non Current Liabilities

Equity

Capital-Sally Flash $ 30,000.00

Retained Earnings $ 6,801.67

Total Equity

Total Liabilities and Equity

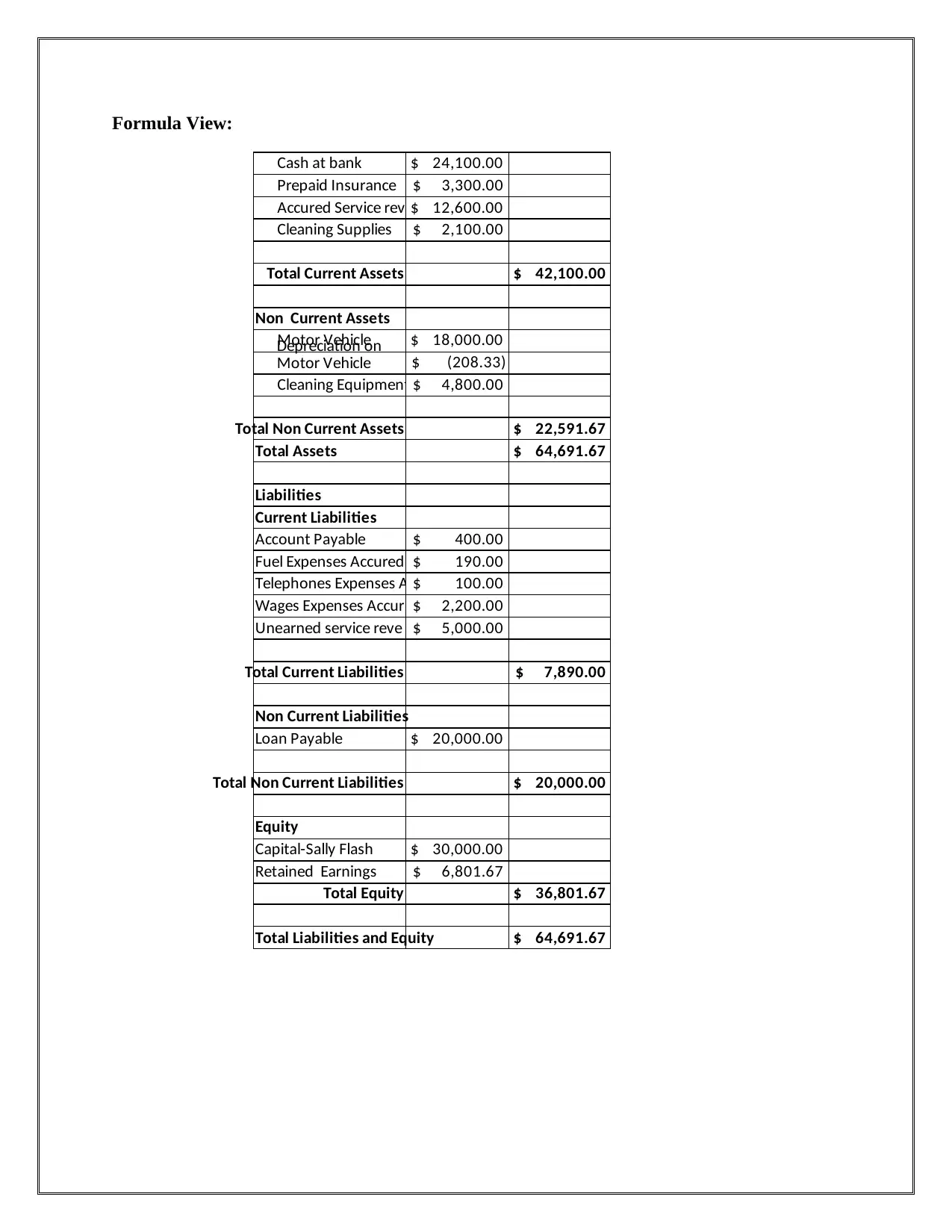

Formula View:

Cash at bank $ 24,100.00

Prepaid Insurance $ 3,300.00

Accured Service rev $ 12,600.00

Cleaning Supplies $ 2,100.00

Total Current Assets $ 42,100.00

Non Current Assets

Motor Vehicle $ 18,000.00

$ (208.33)

Cleaning Equipment $ 4,800.00

Total Non Current Assets $ 22,591.67

Total Assets $ 64,691.67

Liabilities

Current Liabilities

Account Payable $ 400.00

Fuel Expenses Accured $ 190.00

Telephones Expenses A $ 100.00

Wages Expenses Accur $ 2,200.00

Unearned service reve $ 5,000.00

Total Current Liabilities $ 7,890.00

Non Current Liabilities

Loan Payable $ 20,000.00

Total Non Current Liabilities $ 20,000.00

Equity

Capital-Sally Flash $ 30,000.00

Retained Earnings $ 6,801.67

Total Equity $ 36,801.67

Total Liabilities and Equity $ 64,691.67

Depreciation on

Motor Vehicle

Cash at bank $ 24,100.00

Prepaid Insurance $ 3,300.00

Accured Service rev $ 12,600.00

Cleaning Supplies $ 2,100.00

Total Current Assets $ 42,100.00

Non Current Assets

Motor Vehicle $ 18,000.00

$ (208.33)

Cleaning Equipment $ 4,800.00

Total Non Current Assets $ 22,591.67

Total Assets $ 64,691.67

Liabilities

Current Liabilities

Account Payable $ 400.00

Fuel Expenses Accured $ 190.00

Telephones Expenses A $ 100.00

Wages Expenses Accur $ 2,200.00

Unearned service reve $ 5,000.00

Total Current Liabilities $ 7,890.00

Non Current Liabilities

Loan Payable $ 20,000.00

Total Non Current Liabilities $ 20,000.00

Equity

Capital-Sally Flash $ 30,000.00

Retained Earnings $ 6,801.67

Total Equity $ 36,801.67

Total Liabilities and Equity $ 64,691.67

Depreciation on

Motor Vehicle

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

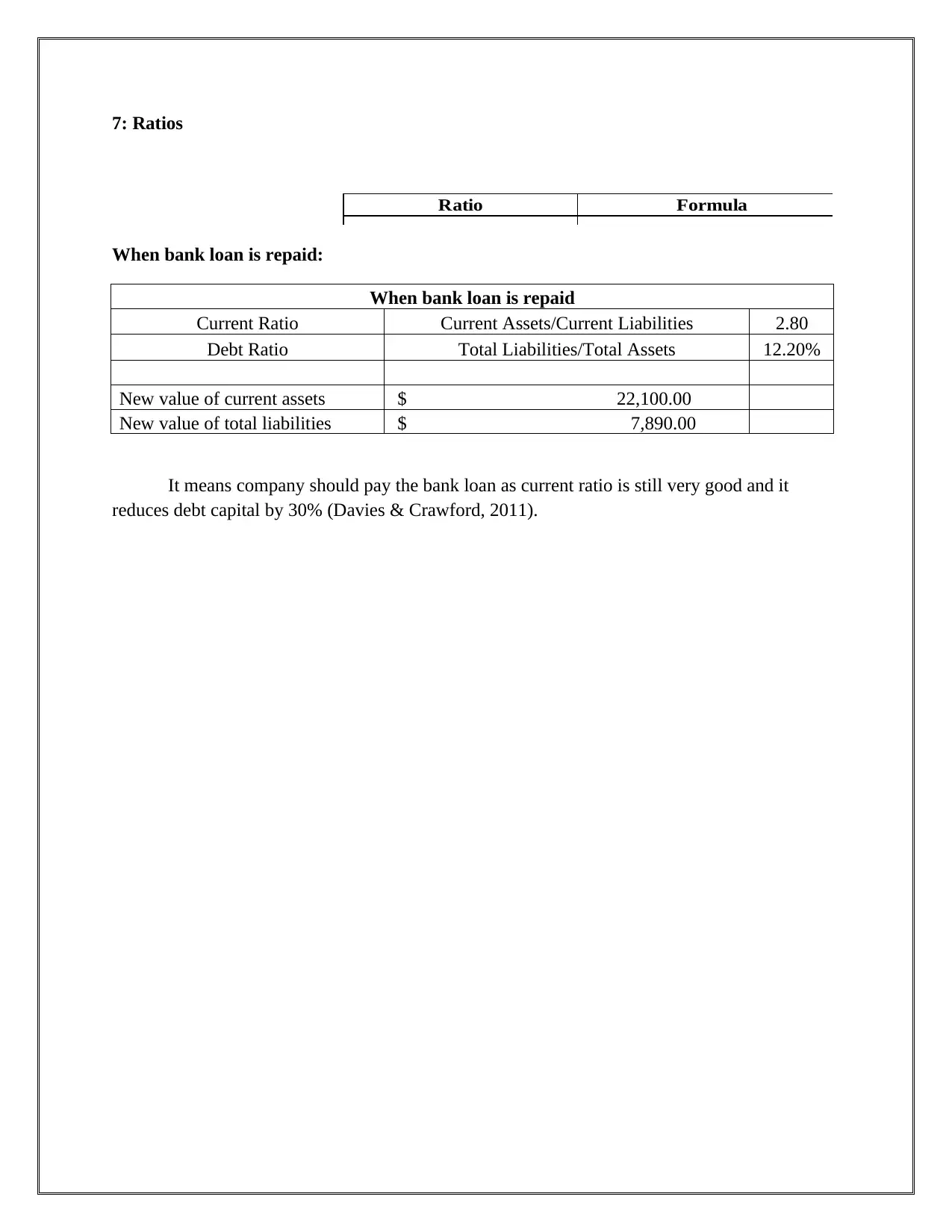

7: Ratios

Ratio Formula

When bank loan is repaid:

When bank loan is repaid

Current Ratio Current Assets/Current Liabilities 2.80

Debt Ratio Total Liabilities/Total Assets 12.20%

New value of current assets $ 22,100.00

New value of total liabilities $ 7,890.00

It means company should pay the bank loan as current ratio is still very good and it

reduces debt capital by 30% (Davies & Crawford, 2011).

Ratio Formula

When bank loan is repaid:

When bank loan is repaid

Current Ratio Current Assets/Current Liabilities 2.80

Debt Ratio Total Liabilities/Total Assets 12.20%

New value of current assets $ 22,100.00

New value of total liabilities $ 7,890.00

It means company should pay the bank loan as current ratio is still very good and it

reduces debt capital by 30% (Davies & Crawford, 2011).

Question 2:

Essay on the Origins of Double-Entry Bookkeeping

Introduction

The accounting practices have undergone significant changes over the past few years and

evolved in a significant manner. In this context, the essay has presented discussion regarding the

origins of double entry-bookkeeping by providing an explanation of its importance in the world

of accounting and its difference from the earlier bookkeeping methods.

Origins and Importance of Double-Entry Bookkeeping and its Difference from Earlier

Bookkeeping Methods

The method of bookkeeping can be regarded as a part of accounting history over a long

period of time that involves recording of daily financial activities. However, as the business

organizations become to grow and flourish it lead to evolvement of double-entry bookkeeping

system to meet the need of recording complex business transactions. Luca Pacioli has written the

first book on the method of double-entry bookkeeping system in the year 1494 and since then it

has gained larger prevalence among the accountants. Pacioli is regarded to be ‘father of

accounting’ and has been used by the bookkeepers and accountants for recording of the financial

transactions. Luca Pacioli though has not invented the method of double-entry bookkeeping but

his work has regarded as the most influential regarding the development and acceptance of such

system. The accounting system has been largely used by the merchants of countries such as

Venice but the book of Pacioli has introduced the system in Europe and other countries of the

world (Gleeson-White, 2011).

The double entry system of accounting or bookkeeping is based on recording a financial

transaction impacts the two accounts. The method is used largely for maintaining accuracy and

reliability n presenting the accounting information. Each financial transaction of a business

brings two financial changes in businesses that are known as debits or credits. The system of

double entry in accounting refers that each debit entry must have a corresponding credit entry

and the two blanches must always remain equal. The ‘debit’ is regarded as a financial transaction

that leads to increase in assets and decrease the liabilities whereas ‘credit’ is regarded to be

Essay on the Origins of Double-Entry Bookkeeping

Introduction

The accounting practices have undergone significant changes over the past few years and

evolved in a significant manner. In this context, the essay has presented discussion regarding the

origins of double entry-bookkeeping by providing an explanation of its importance in the world

of accounting and its difference from the earlier bookkeeping methods.

Origins and Importance of Double-Entry Bookkeeping and its Difference from Earlier

Bookkeeping Methods

The method of bookkeeping can be regarded as a part of accounting history over a long

period of time that involves recording of daily financial activities. However, as the business

organizations become to grow and flourish it lead to evolvement of double-entry bookkeeping

system to meet the need of recording complex business transactions. Luca Pacioli has written the

first book on the method of double-entry bookkeeping system in the year 1494 and since then it

has gained larger prevalence among the accountants. Pacioli is regarded to be ‘father of

accounting’ and has been used by the bookkeepers and accountants for recording of the financial

transactions. Luca Pacioli though has not invented the method of double-entry bookkeeping but

his work has regarded as the most influential regarding the development and acceptance of such

system. The accounting system has been largely used by the merchants of countries such as

Venice but the book of Pacioli has introduced the system in Europe and other countries of the

world (Gleeson-White, 2011).

The double entry system of accounting or bookkeeping is based on recording a financial

transaction impacts the two accounts. The method is used largely for maintaining accuracy and

reliability n presenting the accounting information. Each financial transaction of a business

brings two financial changes in businesses that are known as debits or credits. The system of

double entry in accounting refers that each debit entry must have a corresponding credit entry

and the two blanches must always remain equal. The ‘debit’ is regarded as a financial transaction

that leads to increase in assets and decrease the liabilities whereas ‘credit’ is regarded to be

financial transaction that leads to increase in liability and decline in the assets and expenses

(Walshaw, 2018). The method of double-entry system of bookkeeping consists of the following

stages:

Original records: The financial transactions of an entity are initially recorded within

journal and that is further divided into various individual journals such as cash or

purchase journal.

Classification: This involves development of ledge that involves recording of all the

transactions into a single account.

Summary of Profit and Loss Account: The statement known as trial balance is developed

after balancing ledger that is used further for developing profit and loss account.

The major advantage of double-entry bookkeeping system can be stated as follows:

Improving Reliability: The double entry system of bookkeeping involved recording each

transaction two times and this leads in creation of equilibrium within the financial

records. The credit and debit side balance can be easy verified and therefore it leads to

reduction in error and fraud occurrence. As such, it leads in improving the reliability of

the accounting information developed and presented by a business entity to its investors

and other stakeholders.

Useful in Developing the Financial Statements: The system of double entry bookkeeping

involves creation of trial balance that is used further by the accountants in developing the

financial statements such as income statement and balance sheet. Thus, it can be said that

this method of accounting proves to be largely useful in determining the financial

performance of an entity.

Promoting Comparability of Financial Information: The system is known to be the most

advanced method that is used for maintaining the financial records and is used largely by

the companies across the world. Therefore, it provides an easy method for comparing the

financial information of two companies and thus facilitating the decision-making of

investors (Wolfe, 2019)

Promotes Quick Decision-Making: The system is highly systematic and records financial

transactions on the basis of specific rules and procedures. Therefore, it is relatively easy

for the investors and business managers to locate information about a financial

(Walshaw, 2018). The method of double-entry system of bookkeeping consists of the following

stages:

Original records: The financial transactions of an entity are initially recorded within

journal and that is further divided into various individual journals such as cash or

purchase journal.

Classification: This involves development of ledge that involves recording of all the

transactions into a single account.

Summary of Profit and Loss Account: The statement known as trial balance is developed

after balancing ledger that is used further for developing profit and loss account.

The major advantage of double-entry bookkeeping system can be stated as follows:

Improving Reliability: The double entry system of bookkeeping involved recording each

transaction two times and this leads in creation of equilibrium within the financial

records. The credit and debit side balance can be easy verified and therefore it leads to

reduction in error and fraud occurrence. As such, it leads in improving the reliability of

the accounting information developed and presented by a business entity to its investors

and other stakeholders.

Useful in Developing the Financial Statements: The system of double entry bookkeeping

involves creation of trial balance that is used further by the accountants in developing the

financial statements such as income statement and balance sheet. Thus, it can be said that

this method of accounting proves to be largely useful in determining the financial

performance of an entity.

Promoting Comparability of Financial Information: The system is known to be the most

advanced method that is used for maintaining the financial records and is used largely by

the companies across the world. Therefore, it provides an easy method for comparing the

financial information of two companies and thus facilitating the decision-making of

investors (Wolfe, 2019)

Promotes Quick Decision-Making: The system is highly systematic and records financial

transactions on the basis of specific rules and procedures. Therefore, it is relatively easy

for the investors and business managers to locate information about a financial

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

transaction and thus promotes quick decision-making both internally and externally for

an entity

Compliance with Accounting Regulations: The use of double-entry bookkeeping

promotes effective compliance of a company as per the accounting standards and

policies. The accounting standards and policies require the use of double entry

accounting method and as such it use enhances the credibility of the financial results in

the eyes of auditors and other financial analysts (Gleeson-White, 2011).

There exist larger difference between the single and double entry bookkeeping system.

Single entry system requires recording of a financial transaction only in one account whereas

double entry requires it to be recorded in two accounts. Single entry system is rather simple

whereas double entry system is relatively difficult to be applied. This is largely because single

system of entering financial transaction does not involves full recording of transaction. It

involves either recording a debit or credit entry for recoding a financial transaction. On the other

hand, recording of financial transaction involves entering both debit and credit side entry and

therefore is rather complex and time-consuming in comparison to single entry system. Single

entry system of record keeping does not require high accounting knowledge and does not involve

the development of journals, ledgers and trial balance. On the other hand, double entry

bookkeeping system is a systematic method that involves high accounting knowledge for

developing journals, ledgers and trial balance (Wolfe, 2019). The double entry bookkeeping

system involves fewer chances of frauds as financial transactions that are recorded completely

and the entries are re-checked for maintaining equilibrium between debit and credit side. As

such, double entry bookkeeping is considered superior because single entry system can result in

occurrence of more errors and reduces reliability of accounting information (Andreica, 2016).

Conclusion

It can be said from the overall discussion held within the essay that double entry

bookkeeping accounting method since its establishment has been largely adopted by the

accountants to develop accurate financial records.

an entity

Compliance with Accounting Regulations: The use of double-entry bookkeeping

promotes effective compliance of a company as per the accounting standards and

policies. The accounting standards and policies require the use of double entry

accounting method and as such it use enhances the credibility of the financial results in

the eyes of auditors and other financial analysts (Gleeson-White, 2011).

There exist larger difference between the single and double entry bookkeeping system.

Single entry system requires recording of a financial transaction only in one account whereas

double entry requires it to be recorded in two accounts. Single entry system is rather simple

whereas double entry system is relatively difficult to be applied. This is largely because single

system of entering financial transaction does not involves full recording of transaction. It

involves either recording a debit or credit entry for recoding a financial transaction. On the other

hand, recording of financial transaction involves entering both debit and credit side entry and

therefore is rather complex and time-consuming in comparison to single entry system. Single

entry system of record keeping does not require high accounting knowledge and does not involve

the development of journals, ledgers and trial balance. On the other hand, double entry

bookkeeping system is a systematic method that involves high accounting knowledge for

developing journals, ledgers and trial balance (Wolfe, 2019). The double entry bookkeeping

system involves fewer chances of frauds as financial transactions that are recorded completely

and the entries are re-checked for maintaining equilibrium between debit and credit side. As

such, double entry bookkeeping is considered superior because single entry system can result in

occurrence of more errors and reduces reliability of accounting information (Andreica, 2016).

Conclusion

It can be said from the overall discussion held within the essay that double entry

bookkeeping accounting method since its establishment has been largely adopted by the

accountants to develop accurate financial records.

Question 3:

ABC Learning Case Study

1: Reasons for ABC leaning’s Failure and Potential Warning Signs in its financial reports

ABC learning was established in the year 1988 as a childcare centre in Australia that was

mainly a non-profit organization and carries out its operations by the help of government

subsidy. The company became major player within the childcare centre sector within Australia in

the year 1996. The company depicted major growth and expansion since the year 1997 after

Australian government granted subsidy direct in the form of payment to families. The company

utilized this opportunity for acquisition of properties in major locations and rapidly increased the

number of its childcare centers. The company depicted exponential growth after being listed on

the Australian Stock Exchange (ASX). The company shares traded at about $8.80 at the end of

the year 2006 but fall down to about $0.54 during the period of financial crisis in the year 2007.

The economic and financial problems during the period of financial crisis eventually led to the

collapse of the company. The major reasons that are responsible for the failure of the company

are manipulation and lack of transparency in the financial reporting system (Teen, 2012).

The Company has not maintained properly recorded its financial books and there were

inaccuracies in its financial figures of revenue and expenses as reported by the audit of the

company. It borrowed large amount of money for rapidly expanding its operations in Australia

and overseas locations. As such, in the condition of financial crisis it was not able to meet its

debt obligations which eventually led to its collapse (Thomson, 2008). In addition to this, there

was lack of adequate management within the company as the senior managers and the board

members were mainly politicians and thus do not have any adequate expertise for taking accurate

decisions. As a result, there was lack of adequate risk management system within the company

which eventually led to the creation of high debts on the company. This resulted in creating huge

loans on the company for promoting its internal expansion and they exceeded is capacity for

replaying. The company adopted the fraudulent method of financial reporting that is based

completely on realization of future cash flows and thus artificially created higher shareholder

value. As such, it misleads its investors by reporting manipulated accounting information

(Kruger, 2009).

ABC Learning Case Study

1: Reasons for ABC leaning’s Failure and Potential Warning Signs in its financial reports

ABC learning was established in the year 1988 as a childcare centre in Australia that was

mainly a non-profit organization and carries out its operations by the help of government

subsidy. The company became major player within the childcare centre sector within Australia in

the year 1996. The company depicted major growth and expansion since the year 1997 after

Australian government granted subsidy direct in the form of payment to families. The company

utilized this opportunity for acquisition of properties in major locations and rapidly increased the

number of its childcare centers. The company depicted exponential growth after being listed on

the Australian Stock Exchange (ASX). The company shares traded at about $8.80 at the end of

the year 2006 but fall down to about $0.54 during the period of financial crisis in the year 2007.

The economic and financial problems during the period of financial crisis eventually led to the

collapse of the company. The major reasons that are responsible for the failure of the company

are manipulation and lack of transparency in the financial reporting system (Teen, 2012).

The Company has not maintained properly recorded its financial books and there were

inaccuracies in its financial figures of revenue and expenses as reported by the audit of the

company. It borrowed large amount of money for rapidly expanding its operations in Australia

and overseas locations. As such, in the condition of financial crisis it was not able to meet its

debt obligations which eventually led to its collapse (Thomson, 2008). In addition to this, there

was lack of adequate management within the company as the senior managers and the board

members were mainly politicians and thus do not have any adequate expertise for taking accurate

decisions. As a result, there was lack of adequate risk management system within the company

which eventually led to the creation of high debts on the company. This resulted in creating huge

loans on the company for promoting its internal expansion and they exceeded is capacity for

replaying. The company adopted the fraudulent method of financial reporting that is based

completely on realization of future cash flows and thus artificially created higher shareholder

value. As such, it misleads its investors by reporting manipulated accounting information

(Kruger, 2009).

The early warning signs present in the financial reports of the company that indicated its

troublesome situation was he increase in its market capitalization. The company since its

establishment has only market capitalization of about $25 million but it increased to about $2.5

billion in few years mainly due to its aggressive acquisition policies. Also, It has been reported

by the new auditors of the company, that is, Ernst &Young that it reported about 50% of its

intangible assets on the asset side of its balance sheet that were actually its operating leases. As

such, the arid increase in the market share of the company should have raised questions about the

underlying value of assets by its auditors (Business Review, 2019).

2: Ethical issues from the Case Study

The three major ethical issues that were identified from the case study can be described

as follows:

Lack of Effective Corporate Governance System: It has been identified from the overall

analysis of the case study that the company does not have the presence of an effective

corporate governance system. As such, there were lack f ethical policies and procedures

to identify the discrepancies in the financial reporting system of the company. The

company as such does not have the presence of an effective risk management system for

identifying the financial risk in advance and as such it lead to its liquidation with

accumulation of higher amount of debt. Therefore, it can be said that business entities

need to develop an effective corporate system for regularly monitoring and reviewing the

company’s operations as per the ethical code of conduct and identifying any gap in

performance in advance (Walsh, 2009).

Lack of integrity and Objectivity: The Company has not followed the ethical principles of

integrated objectivity as senior managers of the company were involved in pursuing

higher growths strategies and placed less attention on carrying out their job in an

integrated manner (Teen, 2012).. The senior managers were unable to develop an ethical

business model that guides the daily operational activities of the company in an ethical

manner. The business operations of ABC Learning were not carried in transparent

manner and there was lack of clarity regarding the costs associated with each f its centre.

As such, it can be said that there was lack of integration in the business operations and

troublesome situation was he increase in its market capitalization. The company since its

establishment has only market capitalization of about $25 million but it increased to about $2.5

billion in few years mainly due to its aggressive acquisition policies. Also, It has been reported

by the new auditors of the company, that is, Ernst &Young that it reported about 50% of its

intangible assets on the asset side of its balance sheet that were actually its operating leases. As

such, the arid increase in the market share of the company should have raised questions about the

underlying value of assets by its auditors (Business Review, 2019).

2: Ethical issues from the Case Study

The three major ethical issues that were identified from the case study can be described

as follows:

Lack of Effective Corporate Governance System: It has been identified from the overall

analysis of the case study that the company does not have the presence of an effective

corporate governance system. As such, there were lack f ethical policies and procedures

to identify the discrepancies in the financial reporting system of the company. The

company as such does not have the presence of an effective risk management system for

identifying the financial risk in advance and as such it lead to its liquidation with

accumulation of higher amount of debt. Therefore, it can be said that business entities

need to develop an effective corporate system for regularly monitoring and reviewing the

company’s operations as per the ethical code of conduct and identifying any gap in

performance in advance (Walsh, 2009).

Lack of integrity and Objectivity: The Company has not followed the ethical principles of

integrated objectivity as senior managers of the company were involved in pursuing

higher growths strategies and placed less attention on carrying out their job in an

integrated manner (Teen, 2012).. The senior managers were unable to develop an ethical

business model that guides the daily operational activities of the company in an ethical

manner. The business operations of ABC Learning were not carried in transparent

manner and there was lack of clarity regarding the costs associated with each f its centre.

As such, it can be said that there was lack of integration in the business operations and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

there were determined only for achieving higher growth objectives and ignored the

welfare of its various stakeholders (Thomson, 2008).

Professional Competence and Due Care: The inflation of earnings by the use of

fraudulent accounting practices has reflected that accountants have not acted with utmost

care and professional competence in preparation of the financial statements. Also, the

discrepancies in the financial reporting system were unidentified by the auditor of the

company which reflected lack of independence on their part. The auditors of the company

has not carried out their work responsibilities effectively which lead to un-identification

of such fraudulent accounting practices within the company. The auditors have not

complied with the standard auditing policies that regulate the working of their profession.

They have acted against the interest of the third parties such as investors and creditors f

the company. As such, it can be said from the analysis of the case study of the company

that auditors need to carry out their work in an ethical manner for protecting the interest

of the end-users. They should abide by the ethical policies and procedures during

reviewing the financial information of a company and should report any discrepancies

found in advance (Arens, 2013).

welfare of its various stakeholders (Thomson, 2008).

Professional Competence and Due Care: The inflation of earnings by the use of

fraudulent accounting practices has reflected that accountants have not acted with utmost

care and professional competence in preparation of the financial statements. Also, the

discrepancies in the financial reporting system were unidentified by the auditor of the

company which reflected lack of independence on their part. The auditors of the company

has not carried out their work responsibilities effectively which lead to un-identification

of such fraudulent accounting practices within the company. The auditors have not

complied with the standard auditing policies that regulate the working of their profession.

They have acted against the interest of the third parties such as investors and creditors f

the company. As such, it can be said from the analysis of the case study of the company

that auditors need to carry out their work in an ethical manner for protecting the interest

of the end-users. They should abide by the ethical policies and procedures during

reviewing the financial information of a company and should report any discrepancies

found in advance (Arens, 2013).

References

Andreica, I. (2016). Double-entry Bookkeeping versus Simple-entry Bookkeeping. Horticulture

73(2), 282-290.

Arens, A.A. (2013). Auditing, Assurance Services and Ethics in Australia. Queensland: P.Ed

Australia.

Brigham, F., & Michael C. (2013). Financial management: Theory & practice. Canada: Cengage

Learning.

Business Review. (2019). The ABC of policy failure. Retrieved 2 April, 2019, from

https://www.theaustralian.com.au/business/business-spectator/news-story/the-abc-of-

policy-failure/e5f9cb130150525aba97487de2a91c9d

Damodaran, A, (2011). Applied corporate finance. USA: John Wiley & sons.

Davies, T. & Crawford, I. (2011). Business accounting and finance. USA: Pearson.

Gleeson-White, J. (2011). Double Entry: How the merchants of Venice shaped the modern world

- and how their invention could make or break the planet. Sydney: Allen & Unwin.

Kruger, C. (2009). Lessons to be learnt from ABC Learning's collapse. Retrieved 2 April, 2019,

from https://www.smh.com.au/business/lessons-to-be-learnt-from-abc-learnings-collapse-

20090101-78f8.html

Teen, M. (2012). The ABC of a corporate collapse. Retrieved 2 April, 2019, from

https://governanceforstakeholders.com/2012/12/28/the-abc-of-a-corporate-collapse/

Thomson, J. (2008). Five lessons from the spectacular fall of Eddy Groves. Retrieved 2 April,

2019, from https://www.smartcompany.com.au/finance/five-lessons-from-the-

spectacular-fall-of-eddy-groves/

Walsh, L. (2009). Key corporate governance systems 'missing' from ABC. Retrieved 2 April,

2019, from https://www.couriermail.com.au/news/key-corporate-governance-systems-

Andreica, I. (2016). Double-entry Bookkeeping versus Simple-entry Bookkeeping. Horticulture

73(2), 282-290.

Arens, A.A. (2013). Auditing, Assurance Services and Ethics in Australia. Queensland: P.Ed

Australia.

Brigham, F., & Michael C. (2013). Financial management: Theory & practice. Canada: Cengage

Learning.

Business Review. (2019). The ABC of policy failure. Retrieved 2 April, 2019, from

https://www.theaustralian.com.au/business/business-spectator/news-story/the-abc-of-

policy-failure/e5f9cb130150525aba97487de2a91c9d

Damodaran, A, (2011). Applied corporate finance. USA: John Wiley & sons.

Davies, T. & Crawford, I. (2011). Business accounting and finance. USA: Pearson.

Gleeson-White, J. (2011). Double Entry: How the merchants of Venice shaped the modern world

- and how their invention could make or break the planet. Sydney: Allen & Unwin.

Kruger, C. (2009). Lessons to be learnt from ABC Learning's collapse. Retrieved 2 April, 2019,

from https://www.smh.com.au/business/lessons-to-be-learnt-from-abc-learnings-collapse-

20090101-78f8.html

Teen, M. (2012). The ABC of a corporate collapse. Retrieved 2 April, 2019, from

https://governanceforstakeholders.com/2012/12/28/the-abc-of-a-corporate-collapse/

Thomson, J. (2008). Five lessons from the spectacular fall of Eddy Groves. Retrieved 2 April,

2019, from https://www.smartcompany.com.au/finance/five-lessons-from-the-

spectacular-fall-of-eddy-groves/

Walsh, L. (2009). Key corporate governance systems 'missing' from ABC. Retrieved 2 April,

2019, from https://www.couriermail.com.au/news/key-corporate-governance-systems-

missing-from-abc/news-story/f601d3e4242f16efbc70610f9707de05?

sv=96f188f44e8845619b7d48fa7cf73f91

Walshaw, T. (2018). Double Entry Bookkeeping. Lulu.com.

Wolfe, L. 2019. Double-Entry Bookkeeping vs Single-Entry Accounting. Retrieved 2 April,

2019, from https://www.thebalancecareers.com/double-vs-single-entry-3515788

sv=96f188f44e8845619b7d48fa7cf73f91

Walshaw, T. (2018). Double Entry Bookkeeping. Lulu.com.

Wolfe, L. 2019. Double-Entry Bookkeeping vs Single-Entry Accounting. Retrieved 2 April,

2019, from https://www.thebalancecareers.com/double-vs-single-entry-3515788

1 out of 34

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.