Detailed Assessment of Taxation Including Medicare Levy and Income Tax

VerifiedAdded on 2020/03/07

|7

|997

|46

Homework Assignment

AI Summary

This homework assignment assesses various aspects of taxation, including the calculation of Medicare levy and Medicare levy surcharge under different scenarios, considering income thresholds and private health insurance. The assessment then delves into calculating taxable income, tax liability, and tax refunds for an individual, incorporating deductions for work clothing and the application of tax offsets. Finally, the assignment analyzes the taxation of dividend income, including fully franked, unfranked, and partially franked dividends, and determines the net tax payable after considering tax credits and personal allowances. The assignment utilizes relevant sections of the ITAA 1997 and ITRA 1986 to support its calculations.

Assessment of Taxation of Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

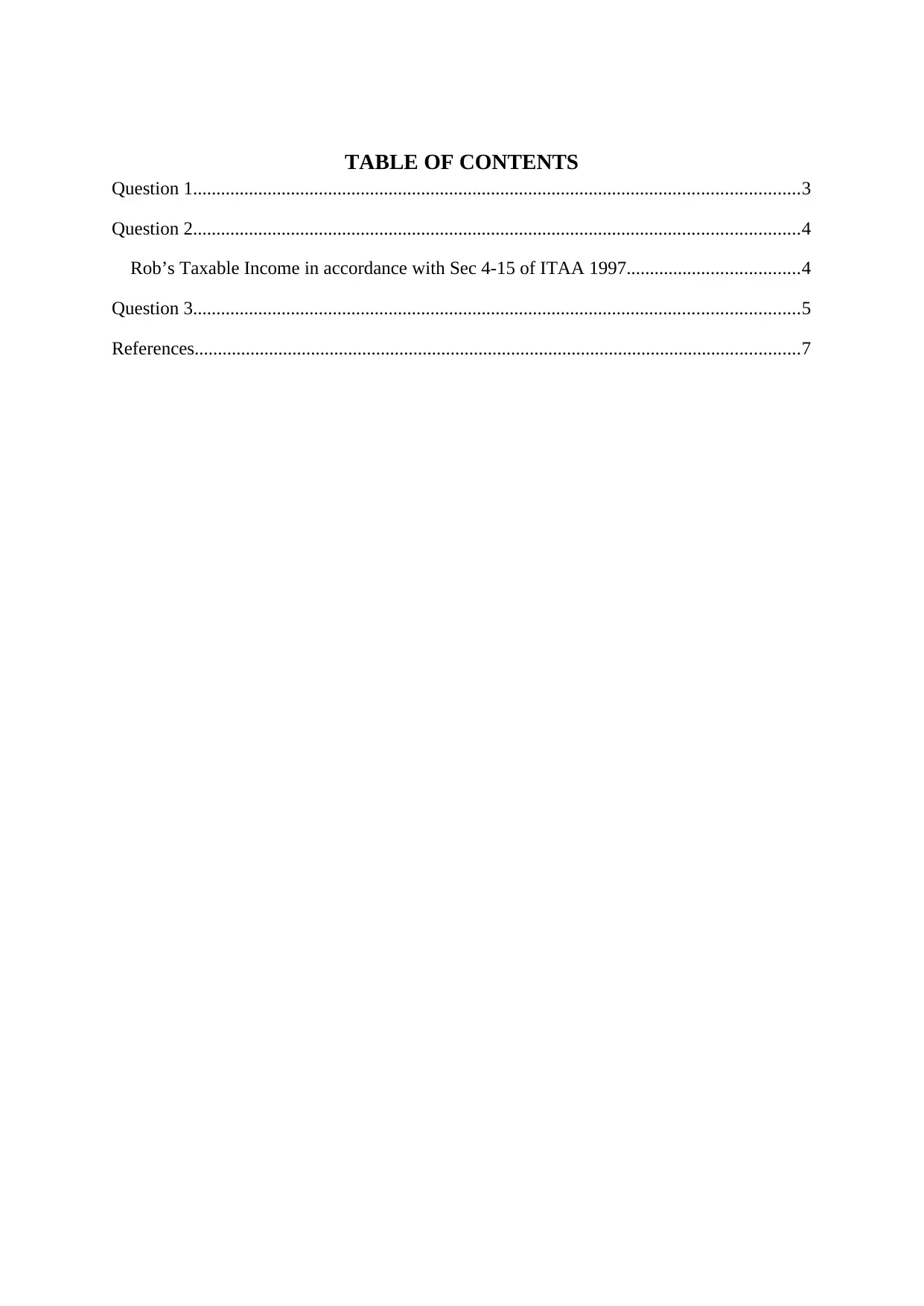

TABLE OF CONTENTS

Question 1..................................................................................................................................3

Question 2..................................................................................................................................4

Rob’s Taxable Income in accordance with Sec 4-15 of ITAA 1997.....................................4

Question 3..................................................................................................................................5

References..................................................................................................................................7

Question 1..................................................................................................................................3

Question 2..................................................................................................................................4

Rob’s Taxable Income in accordance with Sec 4-15 of ITAA 1997.....................................4

Question 3..................................................................................................................................5

References..................................................................................................................................7

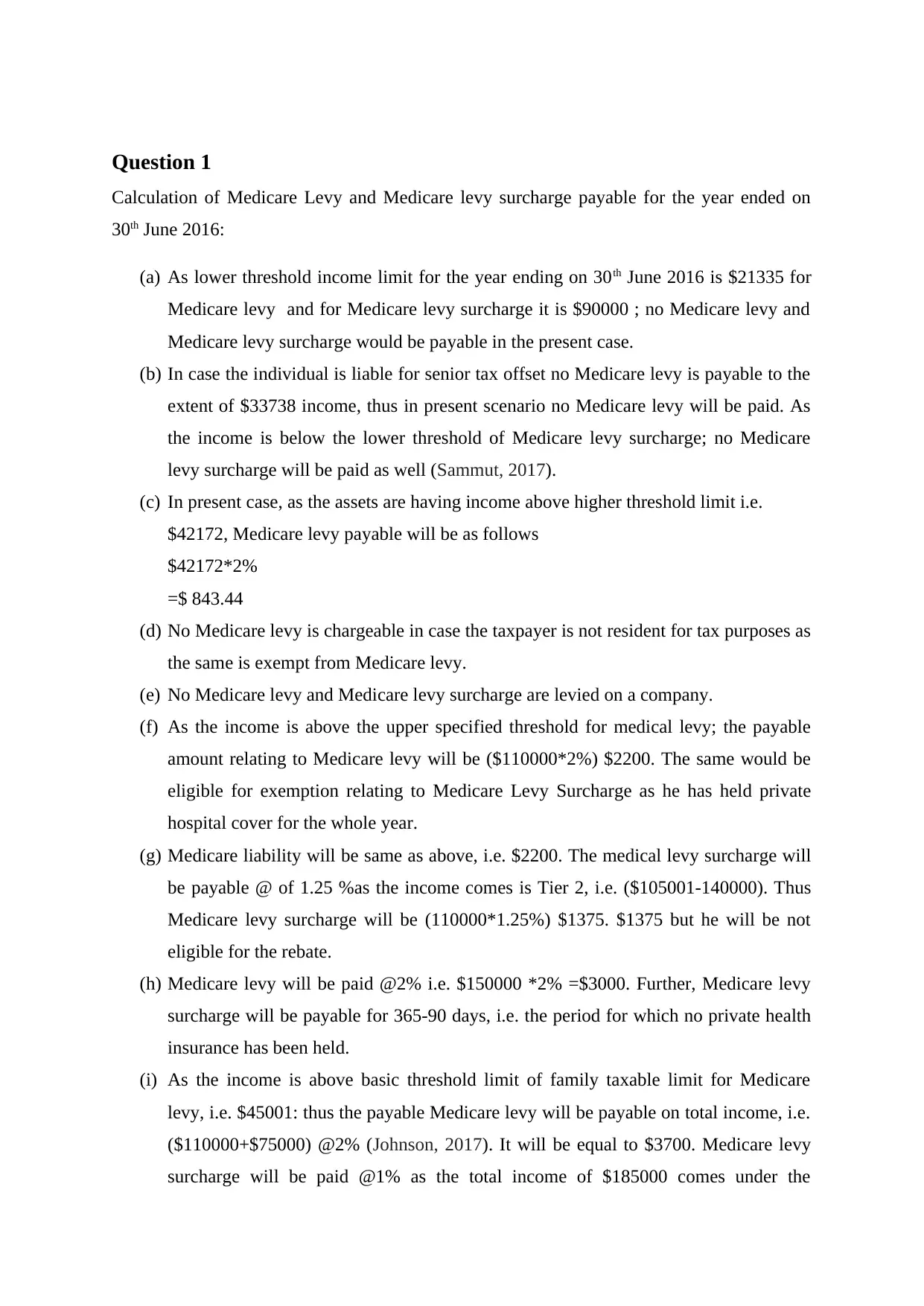

Question 1

Calculation of Medicare Levy and Medicare levy surcharge payable for the year ended on

30th June 2016:

(a) As lower threshold income limit for the year ending on 30th June 2016 is $21335 for

Medicare levy and for Medicare levy surcharge it is $90000 ; no Medicare levy and

Medicare levy surcharge would be payable in the present case.

(b) In case the individual is liable for senior tax offset no Medicare levy is payable to the

extent of $33738 income, thus in present scenario no Medicare levy will be paid. As

the income is below the lower threshold of Medicare levy surcharge; no Medicare

levy surcharge will be paid as well (Sammut, 2017).

(c) In present case, as the assets are having income above higher threshold limit i.e.

$42172, Medicare levy payable will be as follows

$42172*2%

=$ 843.44

(d) No Medicare levy is chargeable in case the taxpayer is not resident for tax purposes as

the same is exempt from Medicare levy.

(e) No Medicare levy and Medicare levy surcharge are levied on a company.

(f) As the income is above the upper specified threshold for medical levy; the payable

amount relating to Medicare levy will be ($110000*2%) $2200. The same would be

eligible for exemption relating to Medicare Levy Surcharge as he has held private

hospital cover for the whole year.

(g) Medicare liability will be same as above, i.e. $2200. The medical levy surcharge will

be payable @ of 1.25 %as the income comes is Tier 2, i.e. ($105001-140000). Thus

Medicare levy surcharge will be (110000*1.25%) $1375. $1375 but he will be not

eligible for the rebate.

(h) Medicare levy will be paid @2% i.e. $150000 *2% =$3000. Further, Medicare levy

surcharge will be payable for 365-90 days, i.e. the period for which no private health

insurance has been held.

(i) As the income is above basic threshold limit of family taxable limit for Medicare

levy, i.e. $45001: thus the payable Medicare levy will be payable on total income, i.e.

($110000+$75000) @2% (Johnson, 2017). It will be equal to $3700. Medicare levy

surcharge will be paid @1% as the total income of $185000 comes under the

Calculation of Medicare Levy and Medicare levy surcharge payable for the year ended on

30th June 2016:

(a) As lower threshold income limit for the year ending on 30th June 2016 is $21335 for

Medicare levy and for Medicare levy surcharge it is $90000 ; no Medicare levy and

Medicare levy surcharge would be payable in the present case.

(b) In case the individual is liable for senior tax offset no Medicare levy is payable to the

extent of $33738 income, thus in present scenario no Medicare levy will be paid. As

the income is below the lower threshold of Medicare levy surcharge; no Medicare

levy surcharge will be paid as well (Sammut, 2017).

(c) In present case, as the assets are having income above higher threshold limit i.e.

$42172, Medicare levy payable will be as follows

$42172*2%

=$ 843.44

(d) No Medicare levy is chargeable in case the taxpayer is not resident for tax purposes as

the same is exempt from Medicare levy.

(e) No Medicare levy and Medicare levy surcharge are levied on a company.

(f) As the income is above the upper specified threshold for medical levy; the payable

amount relating to Medicare levy will be ($110000*2%) $2200. The same would be

eligible for exemption relating to Medicare Levy Surcharge as he has held private

hospital cover for the whole year.

(g) Medicare liability will be same as above, i.e. $2200. The medical levy surcharge will

be payable @ of 1.25 %as the income comes is Tier 2, i.e. ($105001-140000). Thus

Medicare levy surcharge will be (110000*1.25%) $1375. $1375 but he will be not

eligible for the rebate.

(h) Medicare levy will be paid @2% i.e. $150000 *2% =$3000. Further, Medicare levy

surcharge will be payable for 365-90 days, i.e. the period for which no private health

insurance has been held.

(i) As the income is above basic threshold limit of family taxable limit for Medicare

levy, i.e. $45001: thus the payable Medicare levy will be payable on total income, i.e.

($110000+$75000) @2% (Johnson, 2017). It will be equal to $3700. Medicare levy

surcharge will be paid @1% as the total income of $185000 comes under the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

threshold of 1% i.e. $180000-$210000. Thus, Medicare levy surcharge payable will

be $1850.

(j) The family minimum Medicare Levy Surcharge threshold limit for the year ended on

30th June 2016 is $180000.

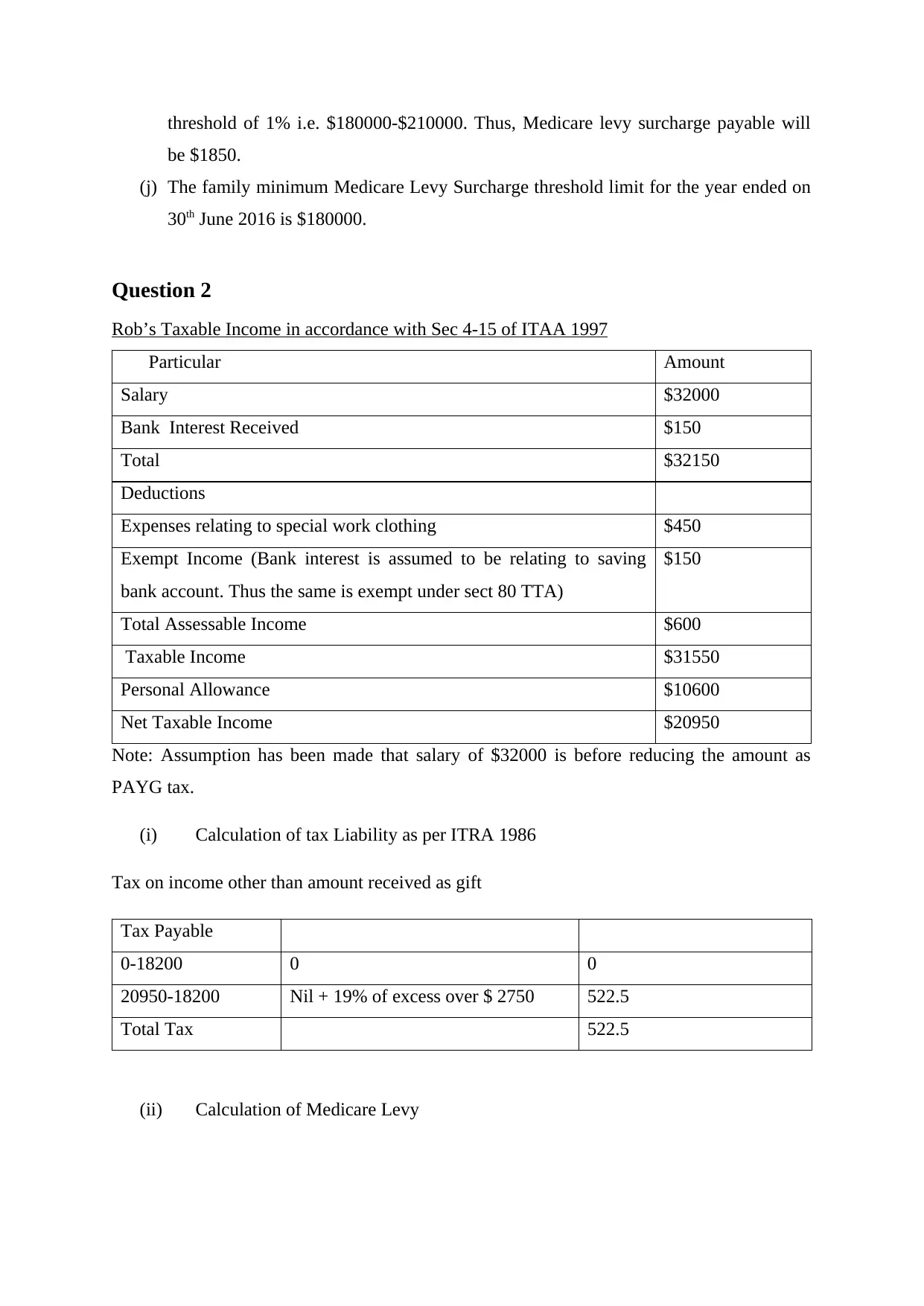

Question 2

Rob’s Taxable Income in accordance with Sec 4-15 of ITAA 1997

Particular Amount

Salary $32000

Bank Interest Received $150

Total $32150

Deductions

Expenses relating to special work clothing $450

Exempt Income (Bank interest is assumed to be relating to saving

bank account. Thus the same is exempt under sect 80 TTA)

$150

Total Assessable Income $600

Taxable Income $31550

Personal Allowance $10600

Net Taxable Income $20950

Note: Assumption has been made that salary of $32000 is before reducing the amount as

PAYG tax.

(i) Calculation of tax Liability as per ITRA 1986

Tax on income other than amount received as gift

Tax Payable

0-18200 0 0

20950-18200 Nil + 19% of excess over $ 2750 522.5

Total Tax 522.5

(ii) Calculation of Medicare Levy

be $1850.

(j) The family minimum Medicare Levy Surcharge threshold limit for the year ended on

30th June 2016 is $180000.

Question 2

Rob’s Taxable Income in accordance with Sec 4-15 of ITAA 1997

Particular Amount

Salary $32000

Bank Interest Received $150

Total $32150

Deductions

Expenses relating to special work clothing $450

Exempt Income (Bank interest is assumed to be relating to saving

bank account. Thus the same is exempt under sect 80 TTA)

$150

Total Assessable Income $600

Taxable Income $31550

Personal Allowance $10600

Net Taxable Income $20950

Note: Assumption has been made that salary of $32000 is before reducing the amount as

PAYG tax.

(i) Calculation of tax Liability as per ITRA 1986

Tax on income other than amount received as gift

Tax Payable

0-18200 0 0

20950-18200 Nil + 19% of excess over $ 2750 522.5

Total Tax 522.5

(ii) Calculation of Medicare Levy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In present case taxable income is more than the lower threshold limit for levying Medicare

levy, i.e. $21335. Thus the Medicare payable will be ($31550*2%) $631.00

(iii) Tax offset or tax credit:

Rob will be qualified for tax offset of $2600, i.e. the amount which has been deducted by

the employer as PAYG tax from his salary.

(iv) Calculation of Income tax payable or refundable:

Particular Amount of $

Income Tax 522.5

Medicare Levy 631.00

Total tax liability 1135.5

Tax offset 2600

Tax Refund 1464.5

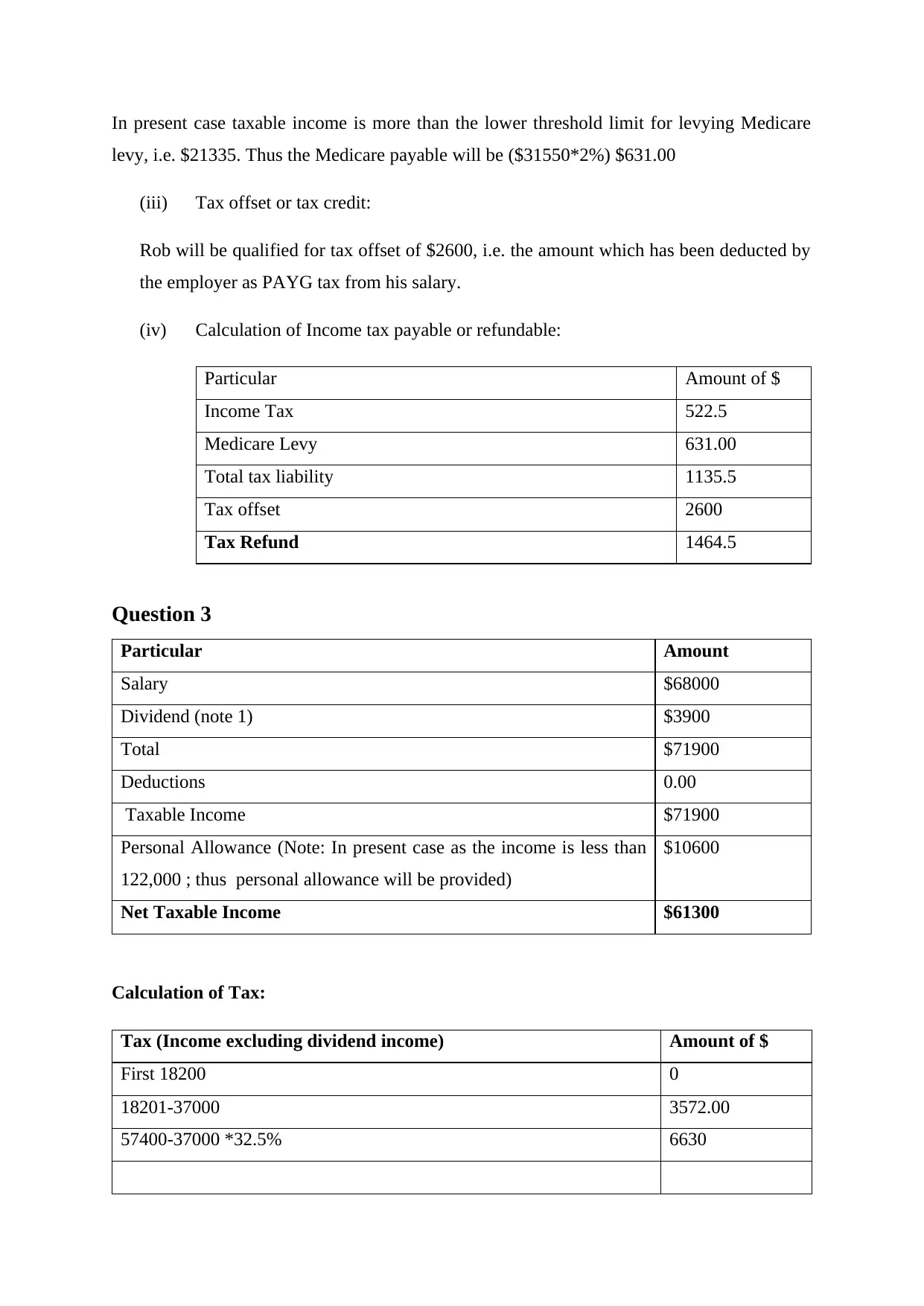

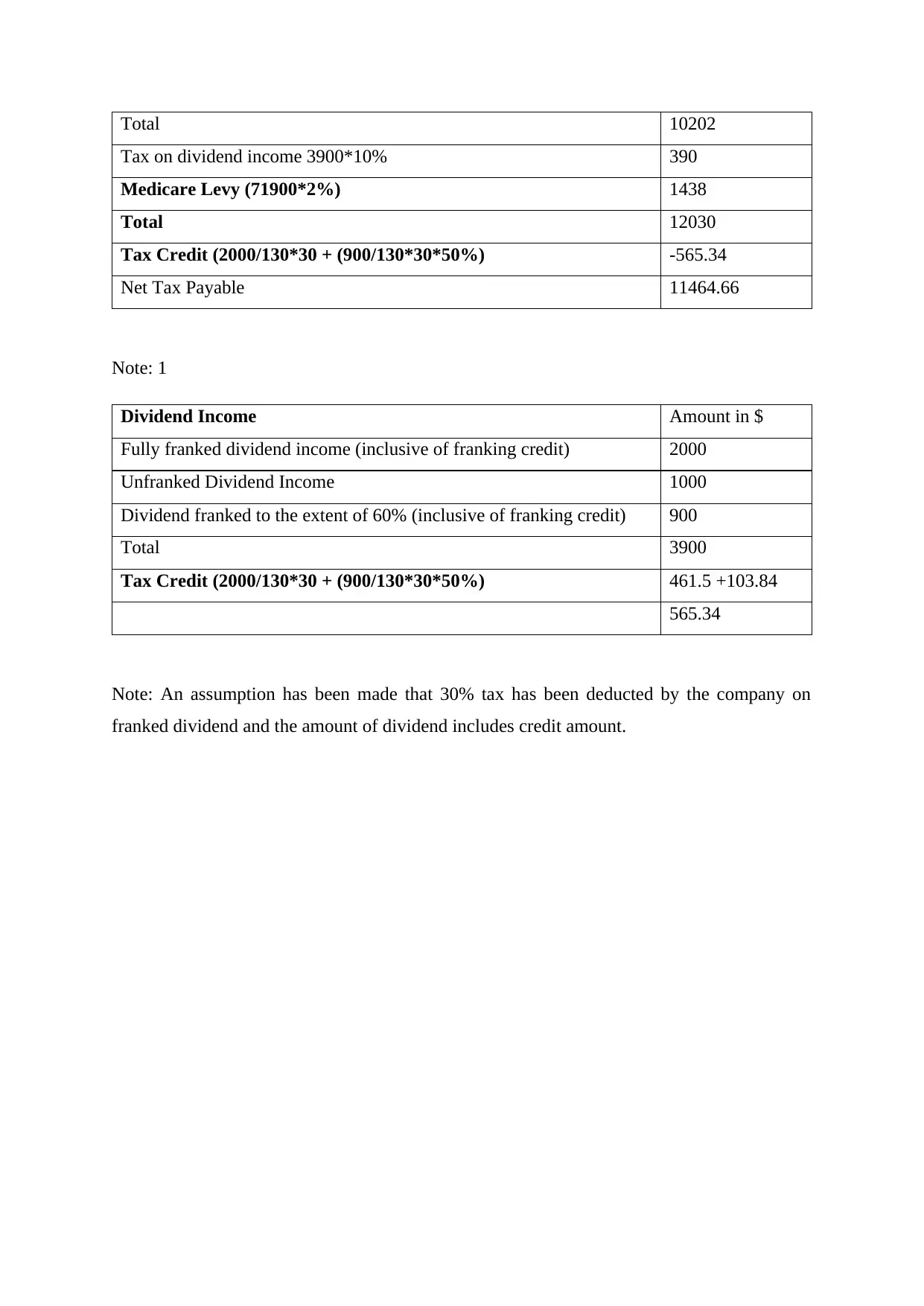

Question 3

Particular Amount

Salary $68000

Dividend (note 1) $3900

Total $71900

Deductions 0.00

Taxable Income $71900

Personal Allowance (Note: In present case as the income is less than

122,000 ; thus personal allowance will be provided)

$10600

Net Taxable Income $61300

Calculation of Tax:

Tax (Income excluding dividend income) Amount of $

First 18200 0

18201-37000 3572.00

57400-37000 *32.5% 6630

levy, i.e. $21335. Thus the Medicare payable will be ($31550*2%) $631.00

(iii) Tax offset or tax credit:

Rob will be qualified for tax offset of $2600, i.e. the amount which has been deducted by

the employer as PAYG tax from his salary.

(iv) Calculation of Income tax payable or refundable:

Particular Amount of $

Income Tax 522.5

Medicare Levy 631.00

Total tax liability 1135.5

Tax offset 2600

Tax Refund 1464.5

Question 3

Particular Amount

Salary $68000

Dividend (note 1) $3900

Total $71900

Deductions 0.00

Taxable Income $71900

Personal Allowance (Note: In present case as the income is less than

122,000 ; thus personal allowance will be provided)

$10600

Net Taxable Income $61300

Calculation of Tax:

Tax (Income excluding dividend income) Amount of $

First 18200 0

18201-37000 3572.00

57400-37000 *32.5% 6630

Total 10202

Tax on dividend income 3900*10% 390

Medicare Levy (71900*2%) 1438

Total 12030

Tax Credit (2000/130*30 + (900/130*30*50%) -565.34

Net Tax Payable 11464.66

Note: 1

Dividend Income Amount in $

Fully franked dividend income (inclusive of franking credit) 2000

Unfranked Dividend Income 1000

Dividend franked to the extent of 60% (inclusive of franking credit) 900

Total 3900

Tax Credit (2000/130*30 + (900/130*30*50%) 461.5 +103.84

565.34

Note: An assumption has been made that 30% tax has been deducted by the company on

franked dividend and the amount of dividend includes credit amount.

Tax on dividend income 3900*10% 390

Medicare Levy (71900*2%) 1438

Total 12030

Tax Credit (2000/130*30 + (900/130*30*50%) -565.34

Net Tax Payable 11464.66

Note: 1

Dividend Income Amount in $

Fully franked dividend income (inclusive of franking credit) 2000

Unfranked Dividend Income 1000

Dividend franked to the extent of 60% (inclusive of franking credit) 900

Total 3900

Tax Credit (2000/130*30 + (900/130*30*50%) 461.5 +103.84

565.34

Note: An assumption has been made that 30% tax has been deducted by the company on

franked dividend and the amount of dividend includes credit amount.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Books and journals

Johnson, C. (2017). Government had to reassure Australians about Medicare. Australian

Medicine, 29(10), 17.

Sammut, J. (2017). The real medicare levy. Policy: A Journal of Public Policy and

Ideas, 33(2), 8.

Books and journals

Johnson, C. (2017). Government had to reassure Australians about Medicare. Australian

Medicine, 29(10), 17.

Sammut, J. (2017). The real medicare levy. Policy: A Journal of Public Policy and

Ideas, 33(2), 8.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.