Comprehensive Report on Finance and Funding in Travel and Tourism

VerifiedAdded on 2020/06/06

|17

|5256

|26

Report

AI Summary

This report delves into the crucial aspects of finance and funding within the travel and tourism sector. It begins by exploring the significance of costs, volume, and profit (CVP) analysis in managing travel and tourism businesses, including various cost accounting methods like mark-up costing, total cost analysis, break-even points, and target returns. The report then examines different pricing methods used in the industry, such as cost-based, demand-based, competition-oriented, and seasonal pricing strategies. Furthermore, it analyzes the factors influencing profitability, including seasonal variations, political environments, current trends, and economic conditions. The report also covers the application of management accounting information, including investment appraisal, as a decision-making tool, and includes an interpretation of financial statements. Finally, it analyzes the sources and distribution of funding for capital projects in tourism, offering a comprehensive overview of the financial landscape of the industry.

FINANCE AND FUNDING

IN TRAVEL AND TOURISM

IN TRAVEL AND TOURISM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 The importance of costs, volume and profit in financial management of travel and tourism

business...................................................................................................................................1

1.2 Pricing methods used in the travel and tourism sector.....................................................3

1.3 Factors influencing profit for travel and tourism business...............................................5

TASK 2............................................................................................................................................6

2.1 Various type of management accounting information used in travel and tourism sector 6

2.2 Access the use of investment appraisal management accounting information as decision

making tool.............................................................................................................................7

TASK 3............................................................................................................................................9

3.1 Interpret financial statements of travel and tourism company.........................................9

TASK 4............................................................................................................................................9

4.1 Analyse source and distribution of funding for the development of capital projects

associated with tourism..........................................................................................................9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDIX....................................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 The importance of costs, volume and profit in financial management of travel and tourism

business...................................................................................................................................1

1.2 Pricing methods used in the travel and tourism sector.....................................................3

1.3 Factors influencing profit for travel and tourism business...............................................5

TASK 2............................................................................................................................................6

2.1 Various type of management accounting information used in travel and tourism sector 6

2.2 Access the use of investment appraisal management accounting information as decision

making tool.............................................................................................................................7

TASK 3............................................................................................................................................9

3.1 Interpret financial statements of travel and tourism company.........................................9

TASK 4............................................................................................................................................9

4.1 Analyse source and distribution of funding for the development of capital projects

associated with tourism..........................................................................................................9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDIX....................................................................................................................................14

INTRODUCTION

Finance and funding individually indicates towards arrangement of financial resources

and application of financial resources according to needs and requirement. This project introduce

the concept of finance and funding concept in travel and tourism sector. Travel and tourism

sector is one of the growing sector (Spenceley, 2012). It has been dramatically changed and with

this dramatic change requires proper management and operation and utilisation of financial

resources. Importance of cost volume and profit (CVP) in respect of management of travel and

tourism business. Use of management accounting informations are defined in respect of decision

making process. Interpretation of financial data of The Akaglo Tours (ATC) company done to

analyse financial performance of organisation. Sources and distribution of funding for the

development of capital projects defined in this context.

TASK 1

1.1 The importance of costs, volume and profit in financial management of travel and tourism

business

Cost factors are considered essential in respect of analysing the profitability and level of

consumption of financial resources with in organisation. Cost in travel and tourism sector

indicates towards cost of tour package, cost per tourist and visitors. Managers try to prepare cost

effective tourist plans and strategies for potential visitors and tourist. It is required to synchronise

various type of cost to make cost effective and profitable strategies and plans.

Concept of C-V-P

It simply indicates towards cost, volume and profit. These are the main factors which

remain essential for an organisation. Behaviour of cost depends upon type of product and volume

of activity in an organisation. Cost accounting and management system helps managers to

understand and analyse the aspect of C-V-P. Cost indicates towards cost incurred raw material,

labour and direct overheads (Zapata and Hall, 2012). These costs are consolidated in at single

cost centre to calculate overall manufacturing cost of products. As volume increase profit figures

increase at faster rate then cost of material cost, direct expenses and direct labour. A perfect

combination of cost, volume and profit ratio helps to sort out the issue in effective manner and

helps to lead organisation towards sustainable success of organisation. Various type of cost are

found in organisational context which are considered in cost accounting system;

1

Finance and funding individually indicates towards arrangement of financial resources

and application of financial resources according to needs and requirement. This project introduce

the concept of finance and funding concept in travel and tourism sector. Travel and tourism

sector is one of the growing sector (Spenceley, 2012). It has been dramatically changed and with

this dramatic change requires proper management and operation and utilisation of financial

resources. Importance of cost volume and profit (CVP) in respect of management of travel and

tourism business. Use of management accounting informations are defined in respect of decision

making process. Interpretation of financial data of The Akaglo Tours (ATC) company done to

analyse financial performance of organisation. Sources and distribution of funding for the

development of capital projects defined in this context.

TASK 1

1.1 The importance of costs, volume and profit in financial management of travel and tourism

business

Cost factors are considered essential in respect of analysing the profitability and level of

consumption of financial resources with in organisation. Cost in travel and tourism sector

indicates towards cost of tour package, cost per tourist and visitors. Managers try to prepare cost

effective tourist plans and strategies for potential visitors and tourist. It is required to synchronise

various type of cost to make cost effective and profitable strategies and plans.

Concept of C-V-P

It simply indicates towards cost, volume and profit. These are the main factors which

remain essential for an organisation. Behaviour of cost depends upon type of product and volume

of activity in an organisation. Cost accounting and management system helps managers to

understand and analyse the aspect of C-V-P. Cost indicates towards cost incurred raw material,

labour and direct overheads (Zapata and Hall, 2012). These costs are consolidated in at single

cost centre to calculate overall manufacturing cost of products. As volume increase profit figures

increase at faster rate then cost of material cost, direct expenses and direct labour. A perfect

combination of cost, volume and profit ratio helps to sort out the issue in effective manner and

helps to lead organisation towards sustainable success of organisation. Various type of cost are

found in organisational context which are considered in cost accounting system;

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Mark up costing (cost plus pricing): this is the costing method which is used to analyse

the cost the by adding profit margin in manufacturing cost. This method plays vital role

in decision making process. Managers and accountants be able to decide the price of

products and services easily with the help of this method. This reduce the level of pricing

fluctuation which occurs due to demand in market.

Formula = VC+FC+PM=SP

Total cost (T.C.): this is the combination of total variable cost and total fixed cost. All

the variable and fixed cost are considered while finalising the cost and selling price of the

product (Goswami, Mattoo and Sáez, 2012).

Formula = 1 . P= TR-TC , Revenue =SP?Q (quantity)

2.TC=FC+V C Break even(Units): this is one of the technique which is used to analyse the optimum

requirement of sales units for which organisation do not face any loss and profit. It is

calculated as per following formula:

Break even point = total fixed cost / contribution

contribution is calculated such as contribution = selling price – variable cost

for example total fixed cost is £80000 and selling price of product is £200 and variable

cost is £40 then BEP is calculated as:

BEP (units): 80000 / 200-90 = 500 units

BEP (£) = 500*200 = £100000

Target return: this is one of the essential aspect considered in C-V-P. For calculating

marginal forecast to identify associated risk target return is used. For example ATC is set

to minimum target of £200000 and the marginal forecast tells that around 1000 tourist

will book the trip. Profit will be calculated in this scenario as follows:

Formula of margin profit = VC+PM=SP

Profit = sales – variable cost – total fixed cost

= 200*1000 – 1000*40- £80000

= £80000

as per above analysis if 1000 tourist book tickets then ATC will be able to generate

£80000 revenues to achieve the BEP of units.

2

the cost the by adding profit margin in manufacturing cost. This method plays vital role

in decision making process. Managers and accountants be able to decide the price of

products and services easily with the help of this method. This reduce the level of pricing

fluctuation which occurs due to demand in market.

Formula = VC+FC+PM=SP

Total cost (T.C.): this is the combination of total variable cost and total fixed cost. All

the variable and fixed cost are considered while finalising the cost and selling price of the

product (Goswami, Mattoo and Sáez, 2012).

Formula = 1 . P= TR-TC , Revenue =SP?Q (quantity)

2.TC=FC+V C Break even(Units): this is one of the technique which is used to analyse the optimum

requirement of sales units for which organisation do not face any loss and profit. It is

calculated as per following formula:

Break even point = total fixed cost / contribution

contribution is calculated such as contribution = selling price – variable cost

for example total fixed cost is £80000 and selling price of product is £200 and variable

cost is £40 then BEP is calculated as:

BEP (units): 80000 / 200-90 = 500 units

BEP (£) = 500*200 = £100000

Target return: this is one of the essential aspect considered in C-V-P. For calculating

marginal forecast to identify associated risk target return is used. For example ATC is set

to minimum target of £200000 and the marginal forecast tells that around 1000 tourist

will book the trip. Profit will be calculated in this scenario as follows:

Formula of margin profit = VC+PM=SP

Profit = sales – variable cost – total fixed cost

= 200*1000 – 1000*40- £80000

= £80000

as per above analysis if 1000 tourist book tickets then ATC will be able to generate

£80000 revenues to achieve the BEP of units.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct: this type of cost is considered the cost which is directly incurred in in operational

management. This process helps to analyse the factors which remain associated with

producing services and products. Direct emoluments, labour and direct expenses are the

examples of direct cost. Indirect: these are the type of cost which is incurred indirectly in operation and

management (Pike, 2012). Administration cost, selling and distributing, promotion

expenses are the examples of indirect cost. These are also considered as incremental cost

which increase the cost of products and services. Fixed: these type of cost factors remain constant and do not change with the variations

of products and services. Rent, interest expenses are the type of fixed cost which are

found in general organisational context. Variable cost: this cost depends upon variation of products and services. Various type of

cost indicators are considered in variable cost such as direct labour, raw material cost,

direct expenses. It is measured on the basis of change in per unit in production quantity.

Semi-fixed: this is the type of cost which remain constant at certain levels and also

remain associated with production and manufacturing process. This cost is the

combination of variable and fixed cost.

Cost indicates towards cost incurred raw material, labour and direct overheads. These

costs are consolidated in at single cost centre to calculate overall manufacturing cost of products.

As volume increase profit figures increase at faster rate then cost of material cost, direct

expenses and direct labour. A perfect combination of cost, volume and profit ratio helps to sort

out the issue in effective manner and helps to lead organisation towards sustainable success of

organisation.

1.2 Pricing methods used in the travel and tourism sector

It is the duty of the management of organisation is to decide the prices. ATC company

corporation is travel and tourism organisation. Travel and tourism is one of the biggest sector

which contributes in the growth of national economy (Koutra and Edwards, 2012). In today's

world, large number of individuals are curious to for travel on holidays. To improve their

business profits ATC company corporation provides large number of offers to individuals

according to their different requirements. Price is one of the important factor which helps in

influencing the behaviour and attraction of the large number of customers. It is an obligation

3

management. This process helps to analyse the factors which remain associated with

producing services and products. Direct emoluments, labour and direct expenses are the

examples of direct cost. Indirect: these are the type of cost which is incurred indirectly in operation and

management (Pike, 2012). Administration cost, selling and distributing, promotion

expenses are the examples of indirect cost. These are also considered as incremental cost

which increase the cost of products and services. Fixed: these type of cost factors remain constant and do not change with the variations

of products and services. Rent, interest expenses are the type of fixed cost which are

found in general organisational context. Variable cost: this cost depends upon variation of products and services. Various type of

cost indicators are considered in variable cost such as direct labour, raw material cost,

direct expenses. It is measured on the basis of change in per unit in production quantity.

Semi-fixed: this is the type of cost which remain constant at certain levels and also

remain associated with production and manufacturing process. This cost is the

combination of variable and fixed cost.

Cost indicates towards cost incurred raw material, labour and direct overheads. These

costs are consolidated in at single cost centre to calculate overall manufacturing cost of products.

As volume increase profit figures increase at faster rate then cost of material cost, direct

expenses and direct labour. A perfect combination of cost, volume and profit ratio helps to sort

out the issue in effective manner and helps to lead organisation towards sustainable success of

organisation.

1.2 Pricing methods used in the travel and tourism sector

It is the duty of the management of organisation is to decide the prices. ATC company

corporation is travel and tourism organisation. Travel and tourism is one of the biggest sector

which contributes in the growth of national economy (Koutra and Edwards, 2012). In today's

world, large number of individuals are curious to for travel on holidays. To improve their

business profits ATC company corporation provides large number of offers to individuals

according to their different requirements. Price is one of the important factor which helps in

influencing the behaviour and attraction of the large number of customers. It is an obligation

3

upon management to adopt different pricing techniques according to the time and situation. For

this purpose, manager need to divide the market on the basis of tastes of customers which helps

in identification of their different demands. It helps in fixing of best prices which makes their

journey more memorable and comfortable (Peric, Mujacevic and Simunic, 2011). This will

provides the large number of benefits to ATC company corporation like competitive advantage,

attraction of large number of customers, higher profitability etc. The different kind of pricing

techniques which are available in travel and tourism sector to use are mentioned below:

Cost based pricing: It is one the easiest method to decide the prices about their different

offers on the basis of the cost which are incur by them in actual. This method includes various

segments which are defined below:

Full cost pricing method consider both fixed and variable component while fixing the

prices of their offers.

Direct cost pricing this will considers variable components in addition to to total

percentage of markup.

Cost plus pricing is one of the important technique which is used in actual by ATC for

earning large number of profits.

Skimming pricing: Under this method, high price are charged at the initial stage of trip.

This method is choose by high class individuals.

Demand based pricing: This includes the process of deciding the prices on the basis of

the demand which is present in market about their different offers. Low demand forces

management of organisation is to decide the affordable prices to attract and influence their

behaviour.

Competition oriented pricing: This pricing technique includes determination of the

pricing policies of their competitors. This technique helps in penetration in the market and drive

their competitors out of the market. Here the preferences of customers are not ascertained.

Different pricing which are included in this are:

Premium pricing

Discounted pricing

Parity pricing

4

this purpose, manager need to divide the market on the basis of tastes of customers which helps

in identification of their different demands. It helps in fixing of best prices which makes their

journey more memorable and comfortable (Peric, Mujacevic and Simunic, 2011). This will

provides the large number of benefits to ATC company corporation like competitive advantage,

attraction of large number of customers, higher profitability etc. The different kind of pricing

techniques which are available in travel and tourism sector to use are mentioned below:

Cost based pricing: It is one the easiest method to decide the prices about their different

offers on the basis of the cost which are incur by them in actual. This method includes various

segments which are defined below:

Full cost pricing method consider both fixed and variable component while fixing the

prices of their offers.

Direct cost pricing this will considers variable components in addition to to total

percentage of markup.

Cost plus pricing is one of the important technique which is used in actual by ATC for

earning large number of profits.

Skimming pricing: Under this method, high price are charged at the initial stage of trip.

This method is choose by high class individuals.

Demand based pricing: This includes the process of deciding the prices on the basis of

the demand which is present in market about their different offers. Low demand forces

management of organisation is to decide the affordable prices to attract and influence their

behaviour.

Competition oriented pricing: This pricing technique includes determination of the

pricing policies of their competitors. This technique helps in penetration in the market and drive

their competitors out of the market. Here the preferences of customers are not ascertained.

Different pricing which are included in this are:

Premium pricing

Discounted pricing

Parity pricing

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Seasonal pricing: There are different seasons in which the number of tourists are

changed. It is the duty of the management of ATC to oversee such different seasons while fix the

prices which are defined below:

Summer pricing: It is a season when large number of tourist are like to travel at different

destinations. In this season, there is huge demand of of tourism organisations like ATC.

This will provides the opportunity to charge high prices and earn large number of profits.

Winter pricing: In this season, individuals not like to travel more. Due to having low

demand the prices charged by ATC is also low in comparison to summer season.

1.3 Factors influencing profit for travel and tourism business

There are various factors or elements that cause fluctuation in the overall profit and growth of

tourism industry. This is mainly possible because of seasonal variation, currency fluctuation,

high demand, off season etc. All these factors either have direct or indirect influence on the

entire operation and function of the business. Along with that there are others factors like

economical and political factors also affect its profit and growth. Following is the detailed

analysis of all these factors:

1. Seasonal Variation: It is one of the most common factor that cause variation in the

profitability of referred firm. Attraction of visitor is sometimes depend upon the season of

that particular country where they wishes to travel (Rodríguez, Williamsand and Hall,

2014). For instance: Most of the visitors prefer to plan their holidays during summer

vacation. Moreover, Business volume may vary as per the seasons. Best time to visit

England is summer.

2. Political Environment: Situation like Brexit also affect the overall profitability of

tourism industry. Therefore for smooth functioning of tourism sector it is important to

have political stability in the country. For instance, Post Brexit Visa process of UK is

going to be tangled as visitors needs to apply for different visa instead of one for

travelling in entire United Kingdom.

3. Current Trend: In today's era, UK visitor's choose to travel by cruise rather than going

on road trip. This is mainly because demand of travelling by cruise is increasing rapidly

in UK which creates an urge among consumers for the same. Moreover UK's resident

believes that only rich can travel through cruise, normal people cannot which becomes

another factor that causes variation in overall profit and growth of the firm.

5

changed. It is the duty of the management of ATC to oversee such different seasons while fix the

prices which are defined below:

Summer pricing: It is a season when large number of tourist are like to travel at different

destinations. In this season, there is huge demand of of tourism organisations like ATC.

This will provides the opportunity to charge high prices and earn large number of profits.

Winter pricing: In this season, individuals not like to travel more. Due to having low

demand the prices charged by ATC is also low in comparison to summer season.

1.3 Factors influencing profit for travel and tourism business

There are various factors or elements that cause fluctuation in the overall profit and growth of

tourism industry. This is mainly possible because of seasonal variation, currency fluctuation,

high demand, off season etc. All these factors either have direct or indirect influence on the

entire operation and function of the business. Along with that there are others factors like

economical and political factors also affect its profit and growth. Following is the detailed

analysis of all these factors:

1. Seasonal Variation: It is one of the most common factor that cause variation in the

profitability of referred firm. Attraction of visitor is sometimes depend upon the season of

that particular country where they wishes to travel (Rodríguez, Williamsand and Hall,

2014). For instance: Most of the visitors prefer to plan their holidays during summer

vacation. Moreover, Business volume may vary as per the seasons. Best time to visit

England is summer.

2. Political Environment: Situation like Brexit also affect the overall profitability of

tourism industry. Therefore for smooth functioning of tourism sector it is important to

have political stability in the country. For instance, Post Brexit Visa process of UK is

going to be tangled as visitors needs to apply for different visa instead of one for

travelling in entire United Kingdom.

3. Current Trend: In today's era, UK visitor's choose to travel by cruise rather than going

on road trip. This is mainly because demand of travelling by cruise is increasing rapidly

in UK which creates an urge among consumers for the same. Moreover UK's resident

believes that only rich can travel through cruise, normal people cannot which becomes

another factor that causes variation in overall profit and growth of the firm.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4. Economical Environment: Economical changes deals with the change in exchange rate

or change in interest rate that ultimately affect the monetary transaction of the business

entity (Witt,Brooke and Buckley, 2013). The economic growth of European Union is

relatively low which depicts that, large proportion of consumer prefer to spend their

income on purchasing essential product or services. This often lead to reduce the

profitability of the firm. Moreover, referred firm needs to expand their business more in

Asia Region as resident of that region prefer or wiling to spend more on travelling.

5. Bad-Debt: It refers to the amount that hasn't been paid by the company and which

creates bad image of the firm in the eyes of customer which indirectly affect its overall

profitability and sales generation.

TASK 2

2.1 Various type of management accounting information used in travel and tourism sector

In every business sector, whether related with tourism sector or any manufacturing

industry. It is crucial to have perfect management accounting system. By the help of this

managers can easily record there everyday financial transaction those are done during an

accounting period. It is mainly used for the purpose of planning, controlling and making crucial

decision regarding their overall financial position of ATC company. It is primary responsibility

of accountant to make analysis of companies financial statements which consists of profit and

loss, balance sheet and cash flow statements. While they also uses various types of accounting

reports in evaluating companies vital data. It is continuous process which is related with the

internal managers of an organisation. In accordance with determining growth for the company, it

is crucial to make appropriate decisions by using accounting techniques. Under these system,

different types of reports are formed which are related with the managers in reaching in better

decision making to maker proper comparisons by taking previous records.

In refers to ATC business operations, they need to make use of different tools are used to

attain major aims and objectives in more effective manner. Some vital accounting tools are being

utilised in more positive manner. Those are mentioned underneath:

Budget reports: In order to set certain limit among a specific project the best ways is to

keep control of total expenses and costs those are being going to be incur by the company in

promoting tourism sectors (Eagles, 2014). In refers to an organisation different types of budgets

is used by the department which assists in keeping overall control of total cash flows. The

6

or change in interest rate that ultimately affect the monetary transaction of the business

entity (Witt,Brooke and Buckley, 2013). The economic growth of European Union is

relatively low which depicts that, large proportion of consumer prefer to spend their

income on purchasing essential product or services. This often lead to reduce the

profitability of the firm. Moreover, referred firm needs to expand their business more in

Asia Region as resident of that region prefer or wiling to spend more on travelling.

5. Bad-Debt: It refers to the amount that hasn't been paid by the company and which

creates bad image of the firm in the eyes of customer which indirectly affect its overall

profitability and sales generation.

TASK 2

2.1 Various type of management accounting information used in travel and tourism sector

In every business sector, whether related with tourism sector or any manufacturing

industry. It is crucial to have perfect management accounting system. By the help of this

managers can easily record there everyday financial transaction those are done during an

accounting period. It is mainly used for the purpose of planning, controlling and making crucial

decision regarding their overall financial position of ATC company. It is primary responsibility

of accountant to make analysis of companies financial statements which consists of profit and

loss, balance sheet and cash flow statements. While they also uses various types of accounting

reports in evaluating companies vital data. It is continuous process which is related with the

internal managers of an organisation. In accordance with determining growth for the company, it

is crucial to make appropriate decisions by using accounting techniques. Under these system,

different types of reports are formed which are related with the managers in reaching in better

decision making to maker proper comparisons by taking previous records.

In refers to ATC business operations, they need to make use of different tools are used to

attain major aims and objectives in more effective manner. Some vital accounting tools are being

utilised in more positive manner. Those are mentioned underneath:

Budget reports: In order to set certain limit among a specific project the best ways is to

keep control of total expenses and costs those are being going to be incur by the company in

promoting tourism sectors (Eagles, 2014). In refers to an organisation different types of budgets

is used by the department which assists in keeping overall control of total cash flows. The

6

primary motive of preparing budget is to make utilisation of resources in best and effective

manner. In travel and tourism sector, early budget planning is required to be made before starting

of vacations.

Financial statements: In accordance with managing various costs and expenses of the

company. Managers needs to make record of every transaction those are being done during an

accounting year. The source of data collection would be taken from income statements, balance

sheet and cash flow statements. The total record of incomes generating from providing facilities

to various tourists are recorded in these formats.

Variance analysis: It is known as an important tools and techniques which will be

helpful in determining total outcomes collected from actual data of total tourist and standard

estimation of people those are visiting to any places. By the help of this analysis managers can

easily be determine desire outcomes during the time. This would be more crucial for evaluating

effective position of the company.

Forecasting: In case of ATC this process is associated with determining overall mission

and vision in more effective manner. It is known as future needs of a particular products and

services which is based on previous year data.

MIS ( Management information system): It is said to be an effective techniques which

is use to determine overall performance of agents those are responsible for examine demand of

various tourists (Hernández-Maestro and González-Benito, 2014). These are mostly role of tours

operators those are having power to make control of every information about tourists those are

going to visits various destinations.

2.2 Access the use of investment appraisal management accounting information as decision

making tool

In order to make analysis of project outcomes, company need to make use of investment

appraisal techniques. It is an effective means of assessing whether an investments made in

tourism sectors is worthwhile for longer period of time. Investment in tourism sectors can be

related with providing tour package for the various customers. There are various tools and

techniques which will be helpful in evaluating overall gains which is being collected from a

project plan.

Investment appraisal techniques as decision making tools

7

manner. In travel and tourism sector, early budget planning is required to be made before starting

of vacations.

Financial statements: In accordance with managing various costs and expenses of the

company. Managers needs to make record of every transaction those are being done during an

accounting year. The source of data collection would be taken from income statements, balance

sheet and cash flow statements. The total record of incomes generating from providing facilities

to various tourists are recorded in these formats.

Variance analysis: It is known as an important tools and techniques which will be

helpful in determining total outcomes collected from actual data of total tourist and standard

estimation of people those are visiting to any places. By the help of this analysis managers can

easily be determine desire outcomes during the time. This would be more crucial for evaluating

effective position of the company.

Forecasting: In case of ATC this process is associated with determining overall mission

and vision in more effective manner. It is known as future needs of a particular products and

services which is based on previous year data.

MIS ( Management information system): It is said to be an effective techniques which

is use to determine overall performance of agents those are responsible for examine demand of

various tourists (Hernández-Maestro and González-Benito, 2014). These are mostly role of tours

operators those are having power to make control of every information about tourists those are

going to visits various destinations.

2.2 Access the use of investment appraisal management accounting information as decision

making tool

In order to make analysis of project outcomes, company need to make use of investment

appraisal techniques. It is an effective means of assessing whether an investments made in

tourism sectors is worthwhile for longer period of time. Investment in tourism sectors can be

related with providing tour package for the various customers. There are various tools and

techniques which will be helpful in evaluating overall gains which is being collected from a

project plan.

Investment appraisal techniques as decision making tools

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Organisations use investment appraisal techniques in order to determine best and

effective capital investment projects (Investment appraisal techniques, 2017). ATC can company

can use following investment appraisal techniques for identify best and optimum capital

expenditure such as:

Net present value method (NPV): this is one of the essential method used to analyse

and evaluate profitability and desirability of investment and projects.

where C indicates towards the cash receipts at the end of year t and I indicates towards

initial investment outlay, r signifies the minimum rate of return and n indicates towards project

investment duration in years. This method helps to determine the time period up to which the

invested amount is earned by organisation from project.

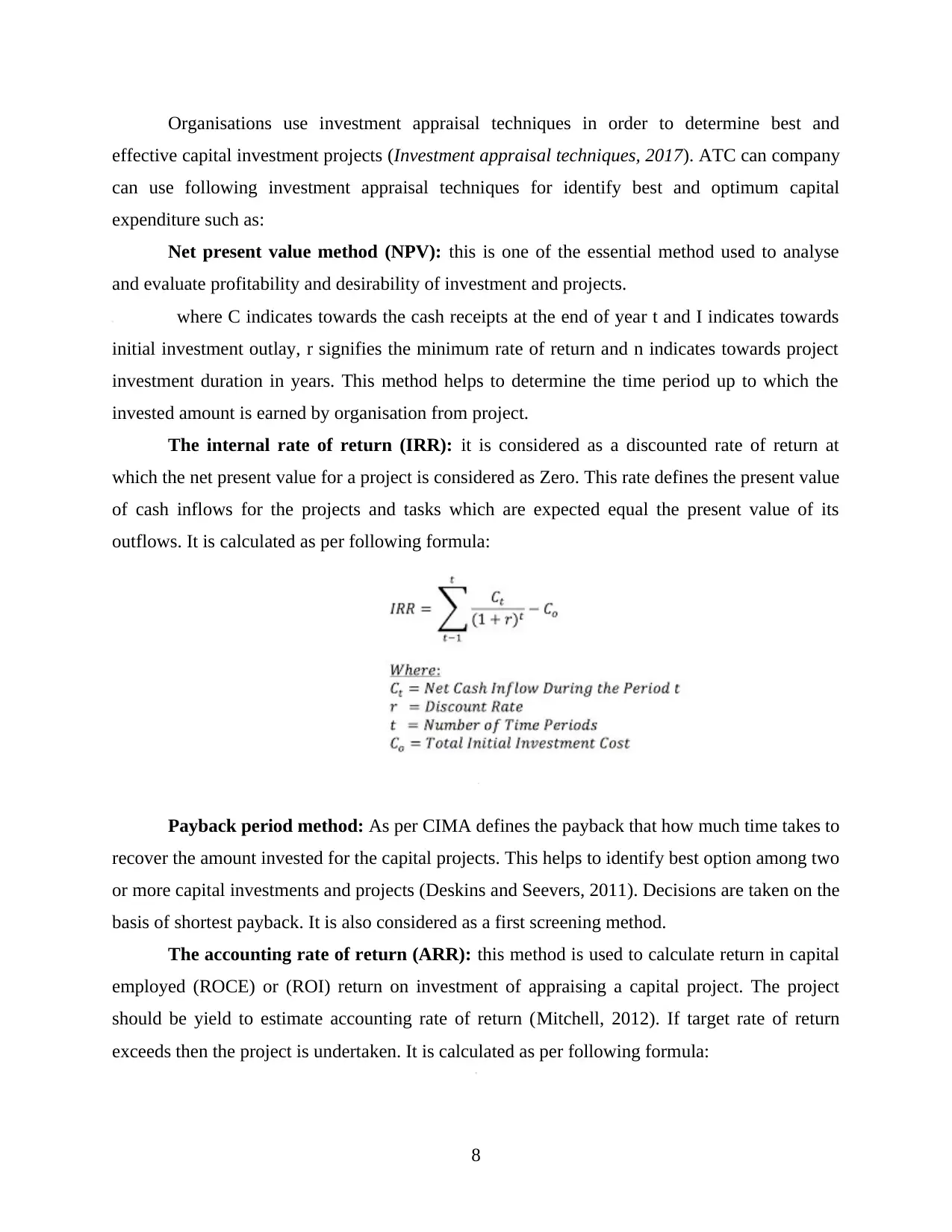

The internal rate of return (IRR): it is considered as a discounted rate of return at

which the net present value for a project is considered as Zero. This rate defines the present value

of cash inflows for the projects and tasks which are expected equal the present value of its

outflows. It is calculated as per following formula:

Payback period method: As per CIMA defines the payback that how much time takes to

recover the amount invested for the capital projects. This helps to identify best option among two

or more capital investments and projects (Deskins and Seevers, 2011). Decisions are taken on the

basis of shortest payback. It is also considered as a first screening method.

The accounting rate of return (ARR): this method is used to calculate return in capital

employed (ROCE) or (ROI) return on investment of appraising a capital project. The project

should be yield to estimate accounting rate of return (Mitchell, 2012). If target rate of return

exceeds then the project is undertaken. It is calculated as per following formula:

8

effective capital investment projects (Investment appraisal techniques, 2017). ATC can company

can use following investment appraisal techniques for identify best and optimum capital

expenditure such as:

Net present value method (NPV): this is one of the essential method used to analyse

and evaluate profitability and desirability of investment and projects.

where C indicates towards the cash receipts at the end of year t and I indicates towards

initial investment outlay, r signifies the minimum rate of return and n indicates towards project

investment duration in years. This method helps to determine the time period up to which the

invested amount is earned by organisation from project.

The internal rate of return (IRR): it is considered as a discounted rate of return at

which the net present value for a project is considered as Zero. This rate defines the present value

of cash inflows for the projects and tasks which are expected equal the present value of its

outflows. It is calculated as per following formula:

Payback period method: As per CIMA defines the payback that how much time takes to

recover the amount invested for the capital projects. This helps to identify best option among two

or more capital investments and projects (Deskins and Seevers, 2011). Decisions are taken on the

basis of shortest payback. It is also considered as a first screening method.

The accounting rate of return (ARR): this method is used to calculate return in capital

employed (ROCE) or (ROI) return on investment of appraising a capital project. The project

should be yield to estimate accounting rate of return (Mitchell, 2012). If target rate of return

exceeds then the project is undertaken. It is calculated as per following formula:

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

3.1 Interpret financial statements of travel and tourism company

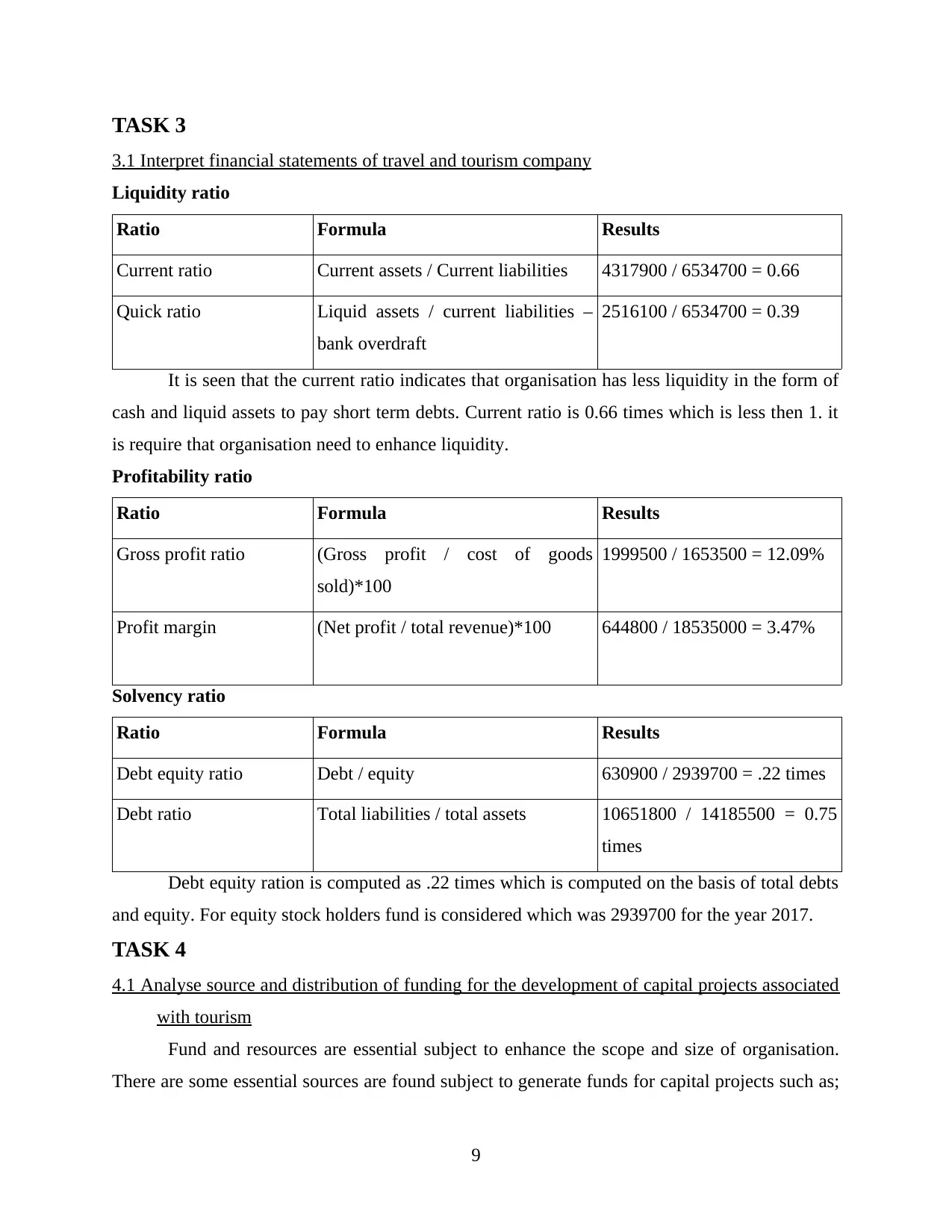

Liquidity ratio

Ratio Formula Results

Current ratio Current assets / Current liabilities 4317900 / 6534700 = 0.66

Quick ratio Liquid assets / current liabilities –

bank overdraft

2516100 / 6534700 = 0.39

It is seen that the current ratio indicates that organisation has less liquidity in the form of

cash and liquid assets to pay short term debts. Current ratio is 0.66 times which is less then 1. it

is require that organisation need to enhance liquidity.

Profitability ratio

Ratio Formula Results

Gross profit ratio (Gross profit / cost of goods

sold)*100

1999500 / 1653500 = 12.09%

Profit margin (Net profit / total revenue)*100 644800 / 18535000 = 3.47%

Solvency ratio

Ratio Formula Results

Debt equity ratio Debt / equity 630900 / 2939700 = .22 times

Debt ratio Total liabilities / total assets 10651800 / 14185500 = 0.75

times

Debt equity ration is computed as .22 times which is computed on the basis of total debts

and equity. For equity stock holders fund is considered which was 2939700 for the year 2017.

TASK 4

4.1 Analyse source and distribution of funding for the development of capital projects associated

with tourism

Fund and resources are essential subject to enhance the scope and size of organisation.

There are some essential sources are found subject to generate funds for capital projects such as;

9

3.1 Interpret financial statements of travel and tourism company

Liquidity ratio

Ratio Formula Results

Current ratio Current assets / Current liabilities 4317900 / 6534700 = 0.66

Quick ratio Liquid assets / current liabilities –

bank overdraft

2516100 / 6534700 = 0.39

It is seen that the current ratio indicates that organisation has less liquidity in the form of

cash and liquid assets to pay short term debts. Current ratio is 0.66 times which is less then 1. it

is require that organisation need to enhance liquidity.

Profitability ratio

Ratio Formula Results

Gross profit ratio (Gross profit / cost of goods

sold)*100

1999500 / 1653500 = 12.09%

Profit margin (Net profit / total revenue)*100 644800 / 18535000 = 3.47%

Solvency ratio

Ratio Formula Results

Debt equity ratio Debt / equity 630900 / 2939700 = .22 times

Debt ratio Total liabilities / total assets 10651800 / 14185500 = 0.75

times

Debt equity ration is computed as .22 times which is computed on the basis of total debts

and equity. For equity stock holders fund is considered which was 2939700 for the year 2017.

TASK 4

4.1 Analyse source and distribution of funding for the development of capital projects associated

with tourism

Fund and resources are essential subject to enhance the scope and size of organisation.

There are some essential sources are found subject to generate funds for capital projects such as;

9

culture, media and sports, social fund, sources and payment and grants received from non

governmental public bodies (Brooker and Joppe, 2014). Type of two major sources are found in

organisational context

Internal source of finance

Retain earnings: some of the profit earning and successful organisations utilise profit

with in organisation in order to attain desired objectives.

Advantages

Organisation need not to pay cost to retain the cost.

This is one of the attractive source of funding and It avoid the possibilities and the

taxation position of company.

Disadvantages

It reduces the share to pay in the form of dividend

For start up organisation it become difficult to retain earnings for start up organisations

Personal Funds: this is one of the internal source of finance. Funds are raised by owners

by their own. Directors, sole proprietors, business partners put amount in amount in business by

their own (Source of finance, 2017).

Advantages

Cost effective source of fund need not to pay any extra cost

Funds are generated by own strength and stability

Disadvantages

Lack of potential capital investors

Decrease the profitability due to distribution of profit share to owner

Provisions: organisations make provisions for future events and programs. A separate

funds are prepared for a specific duration and utilised when requirement.

Advantages

Fulfil advance requirement of funds and investment

Helps to met the predetermined targets and plans

Disadvantages

Separate funds are retain form profit share without having interest income

Provisions are made for specific events which can not be used for further use

10

governmental public bodies (Brooker and Joppe, 2014). Type of two major sources are found in

organisational context

Internal source of finance

Retain earnings: some of the profit earning and successful organisations utilise profit

with in organisation in order to attain desired objectives.

Advantages

Organisation need not to pay cost to retain the cost.

This is one of the attractive source of funding and It avoid the possibilities and the

taxation position of company.

Disadvantages

It reduces the share to pay in the form of dividend

For start up organisation it become difficult to retain earnings for start up organisations

Personal Funds: this is one of the internal source of finance. Funds are raised by owners

by their own. Directors, sole proprietors, business partners put amount in amount in business by

their own (Source of finance, 2017).

Advantages

Cost effective source of fund need not to pay any extra cost

Funds are generated by own strength and stability

Disadvantages

Lack of potential capital investors

Decrease the profitability due to distribution of profit share to owner

Provisions: organisations make provisions for future events and programs. A separate

funds are prepared for a specific duration and utilised when requirement.

Advantages

Fulfil advance requirement of funds and investment

Helps to met the predetermined targets and plans

Disadvantages

Separate funds are retain form profit share without having interest income

Provisions are made for specific events which can not be used for further use

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.