Assignment 1: Financial and Cost Accounting Analysis

VerifiedAdded on 2023/01/17

|10

|1468

|97

Homework Assignment

AI Summary

This assignment solution addresses several key concepts in cost and financial accounting. It begins with a value chain analysis, evaluating its framework for management accounting issues within an organization. The solution then delves into cost of manufacturing statements, detailing the calculation of the cost of goods manufactured, including direct materials, direct labor, and overhead costs. Further, the assignment explores departmental cost allocation using direct and step methods, along with the reciprocal method. The solution also covers the calculation of predetermined overhead rates and applying them to job costing, along with an analysis of over-applied overhead. Finally, the assignment concludes with a detailed analysis of process costing, comparing the weighted average and FIFO methods for cost of goods sold and work-in-progress inventory valuation.

Assignment 1

Name of the Student

Name of the University

Author Note

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Answer to question 1:.................................................................................................................3

Answer to question 2:.................................................................................................................4

Answer to question 3:.................................................................................................................5

Answer to question 4:.................................................................................................................7

Answer to question 5:.................................................................................................................8

Bibliography.............................................................................................................................10

Answer to question 1:.................................................................................................................3

Answer to question 2:.................................................................................................................4

Answer to question 3:.................................................................................................................5

Answer to question 4:.................................................................................................................7

Answer to question 5:.................................................................................................................8

Bibliography.............................................................................................................................10

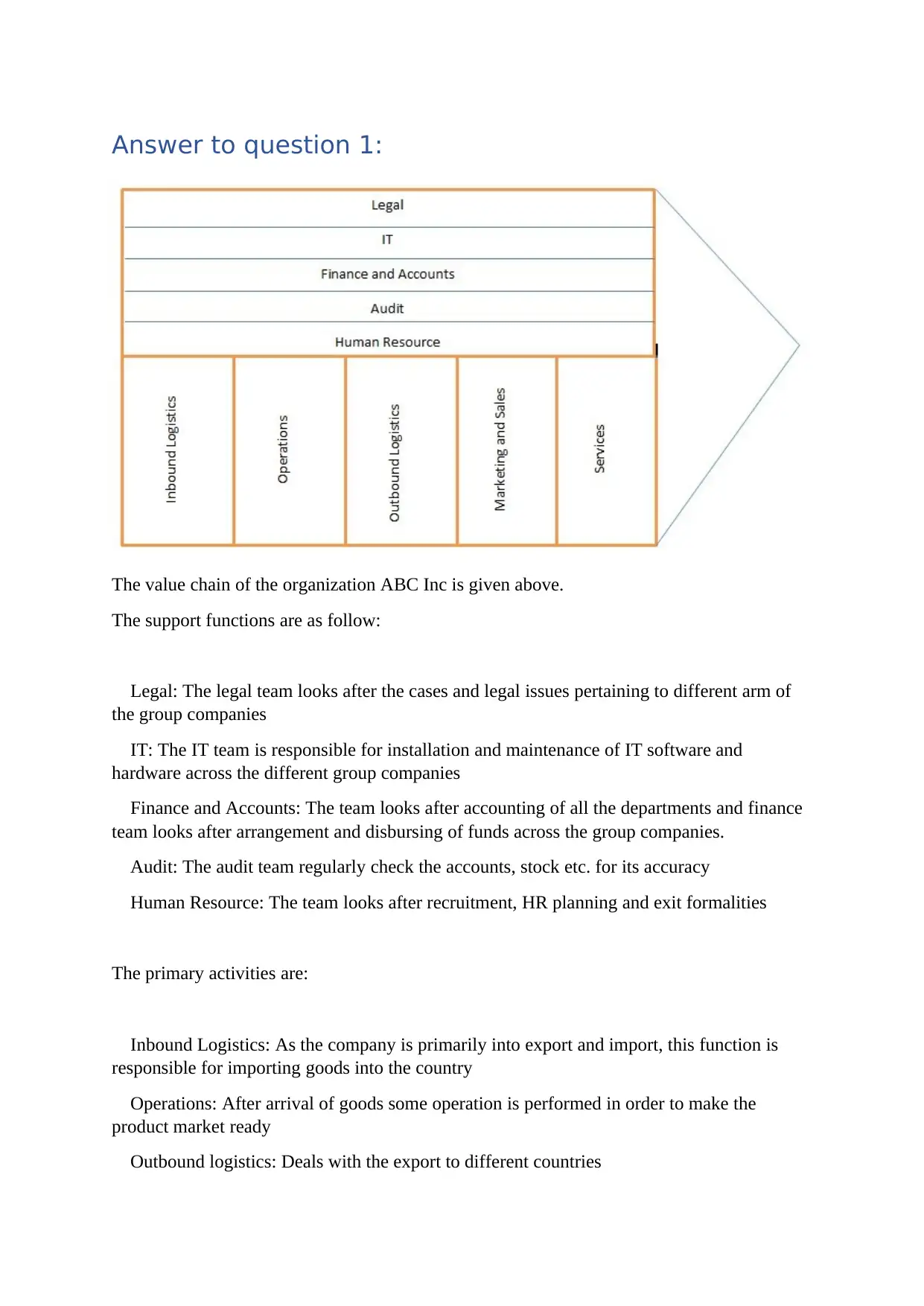

Answer to question 1:

The value chain of the organization ABC Inc is given above.

The support functions are as follow:

Legal: The legal team looks after the cases and legal issues pertaining to different arm of

the group companies

IT: The IT team is responsible for installation and maintenance of IT software and

hardware across the different group companies

Finance and Accounts: The team looks after accounting of all the departments and finance

team looks after arrangement and disbursing of funds across the group companies.

Audit: The audit team regularly check the accounts, stock etc. for its accuracy

Human Resource: The team looks after recruitment, HR planning and exit formalities

The primary activities are:

Inbound Logistics: As the company is primarily into export and import, this function is

responsible for importing goods into the country

Operations: After arrival of goods some operation is performed in order to make the

product market ready

Outbound logistics: Deals with the export to different countries

The value chain of the organization ABC Inc is given above.

The support functions are as follow:

Legal: The legal team looks after the cases and legal issues pertaining to different arm of

the group companies

IT: The IT team is responsible for installation and maintenance of IT software and

hardware across the different group companies

Finance and Accounts: The team looks after accounting of all the departments and finance

team looks after arrangement and disbursing of funds across the group companies.

Audit: The audit team regularly check the accounts, stock etc. for its accuracy

Human Resource: The team looks after recruitment, HR planning and exit formalities

The primary activities are:

Inbound Logistics: As the company is primarily into export and import, this function is

responsible for importing goods into the country

Operations: After arrival of goods some operation is performed in order to make the

product market ready

Outbound logistics: Deals with the export to different countries

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Marketing and sales: Deals with generating lead in the country

Services: It is related to the services of the product received in the country.

Key management issues identified by the value chain

Due to inbound logistics, the accounting takes care of the items received and their cost

including all the import cost. The operation activities affect the cost due to its activities. The

outbound logistics takes care of management accounting practices related to sale value and

export cost. Due to marketing and sales activities, different cost including marketing

activities is included in the accounting practices. The service cost is also included due to its

activity.

Similarly, the support activities are also cost center and included in the management

accounting.

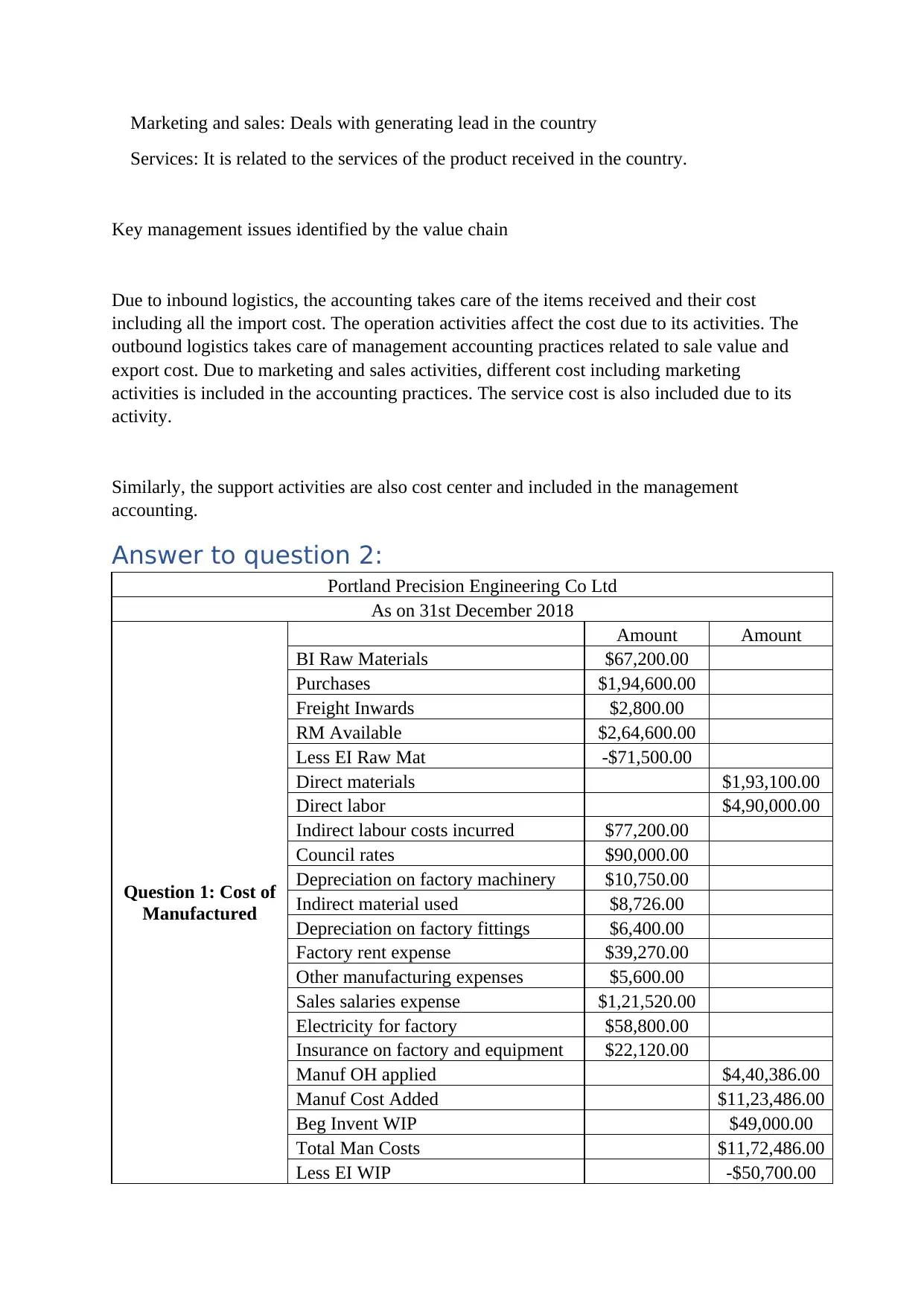

Answer to question 2:

Portland Precision Engineering Co Ltd

As on 31st December 2018

Question 1: Cost of

Manufactured

Amount Amount

BI Raw Materials $67,200.00

Purchases $1,94,600.00

Freight Inwards $2,800.00

RM Available $2,64,600.00

Less EI Raw Mat -$71,500.00

Direct materials $1,93,100.00

Direct labor $4,90,000.00

Indirect labour costs incurred $77,200.00

Council rates $90,000.00

Depreciation on factory machinery $10,750.00

Indirect material used $8,726.00

Depreciation on factory fittings $6,400.00

Factory rent expense $39,270.00

Other manufacturing expenses $5,600.00

Sales salaries expense $1,21,520.00

Electricity for factory $58,800.00

Insurance on factory and equipment $22,120.00

Manuf OH applied $4,40,386.00

Manuf Cost Added $11,23,486.00

Beg Invent WIP $49,000.00

Total Man Costs $11,72,486.00

Less EI WIP -$50,700.00

Services: It is related to the services of the product received in the country.

Key management issues identified by the value chain

Due to inbound logistics, the accounting takes care of the items received and their cost

including all the import cost. The operation activities affect the cost due to its activities. The

outbound logistics takes care of management accounting practices related to sale value and

export cost. Due to marketing and sales activities, different cost including marketing

activities is included in the accounting practices. The service cost is also included due to its

activity.

Similarly, the support activities are also cost center and included in the management

accounting.

Answer to question 2:

Portland Precision Engineering Co Ltd

As on 31st December 2018

Question 1: Cost of

Manufactured

Amount Amount

BI Raw Materials $67,200.00

Purchases $1,94,600.00

Freight Inwards $2,800.00

RM Available $2,64,600.00

Less EI Raw Mat -$71,500.00

Direct materials $1,93,100.00

Direct labor $4,90,000.00

Indirect labour costs incurred $77,200.00

Council rates $90,000.00

Depreciation on factory machinery $10,750.00

Indirect material used $8,726.00

Depreciation on factory fittings $6,400.00

Factory rent expense $39,270.00

Other manufacturing expenses $5,600.00

Sales salaries expense $1,21,520.00

Electricity for factory $58,800.00

Insurance on factory and equipment $22,120.00

Manuf OH applied $4,40,386.00

Manuf Cost Added $11,23,486.00

Beg Invent WIP $49,000.00

Total Man Costs $11,72,486.00

Less EI WIP -$50,700.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost Goods Manufactured $11,21,786.00

Begin Invent FG $21,000.00

FG Avail for Sale $11,42,786.00

Less EI Fin Goods -$2,01,500.00

Cost of Goods Sold $9,41,286.00

Income Statement

Revenues $14,00,000.00

Cost of Goods Sold -$9,41,286.00

Gross Margin $4,58,714.00

Selling and Administrative expenses -$22,880.00

Advertising expense -$20,800.00

Income tax expense -$32,400.00

Net Profit $3,82,634.00

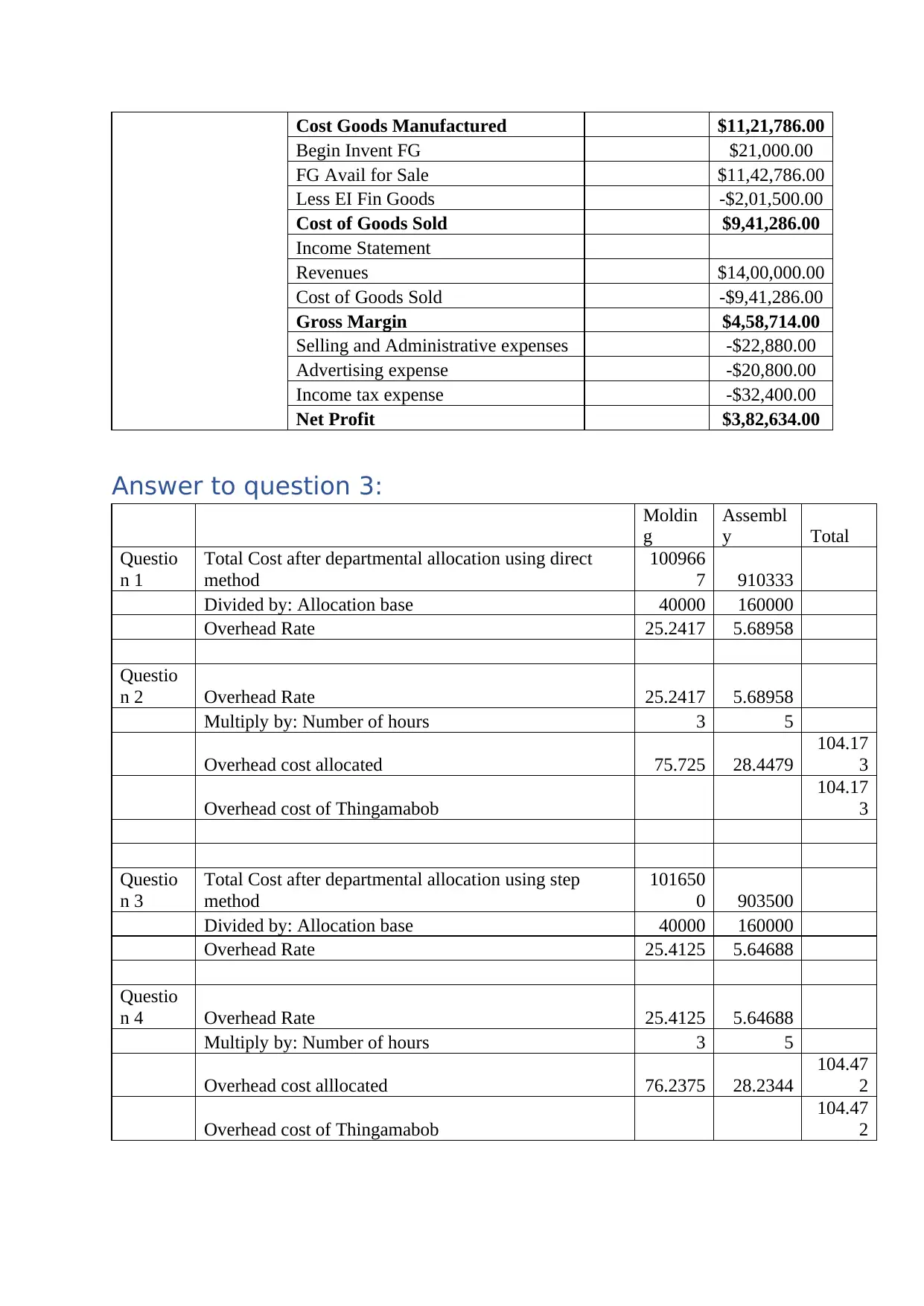

Answer to question 3:

Moldin

g

Assembl

y Total

Questio

n 1

Total Cost after departmental allocation using direct

method

100966

7 910333

Divided by: Allocation base 40000 160000

Overhead Rate 25.2417 5.68958

Questio

n 2 Overhead Rate 25.2417 5.68958

Multiply by: Number of hours 3 5

Overhead cost allocated 75.725 28.4479

104.17

3

Overhead cost of Thingamabob

104.17

3

Questio

n 3

Total Cost after departmental allocation using step

method

101650

0 903500

Divided by: Allocation base 40000 160000

Overhead Rate 25.4125 5.64688

Questio

n 4 Overhead Rate 25.4125 5.64688

Multiply by: Number of hours 3 5

Overhead cost alllocated 76.2375 28.2344

104.47

2

Overhead cost of Thingamabob

104.47

2

Begin Invent FG $21,000.00

FG Avail for Sale $11,42,786.00

Less EI Fin Goods -$2,01,500.00

Cost of Goods Sold $9,41,286.00

Income Statement

Revenues $14,00,000.00

Cost of Goods Sold -$9,41,286.00

Gross Margin $4,58,714.00

Selling and Administrative expenses -$22,880.00

Advertising expense -$20,800.00

Income tax expense -$32,400.00

Net Profit $3,82,634.00

Answer to question 3:

Moldin

g

Assembl

y Total

Questio

n 1

Total Cost after departmental allocation using direct

method

100966

7 910333

Divided by: Allocation base 40000 160000

Overhead Rate 25.2417 5.68958

Questio

n 2 Overhead Rate 25.2417 5.68958

Multiply by: Number of hours 3 5

Overhead cost allocated 75.725 28.4479

104.17

3

Overhead cost of Thingamabob

104.17

3

Questio

n 3

Total Cost after departmental allocation using step

method

101650

0 903500

Divided by: Allocation base 40000 160000

Overhead Rate 25.4125 5.64688

Questio

n 4 Overhead Rate 25.4125 5.64688

Multiply by: Number of hours 3 5

Overhead cost alllocated 76.2375 28.2344

104.47

2

Overhead cost of Thingamabob

104.47

2

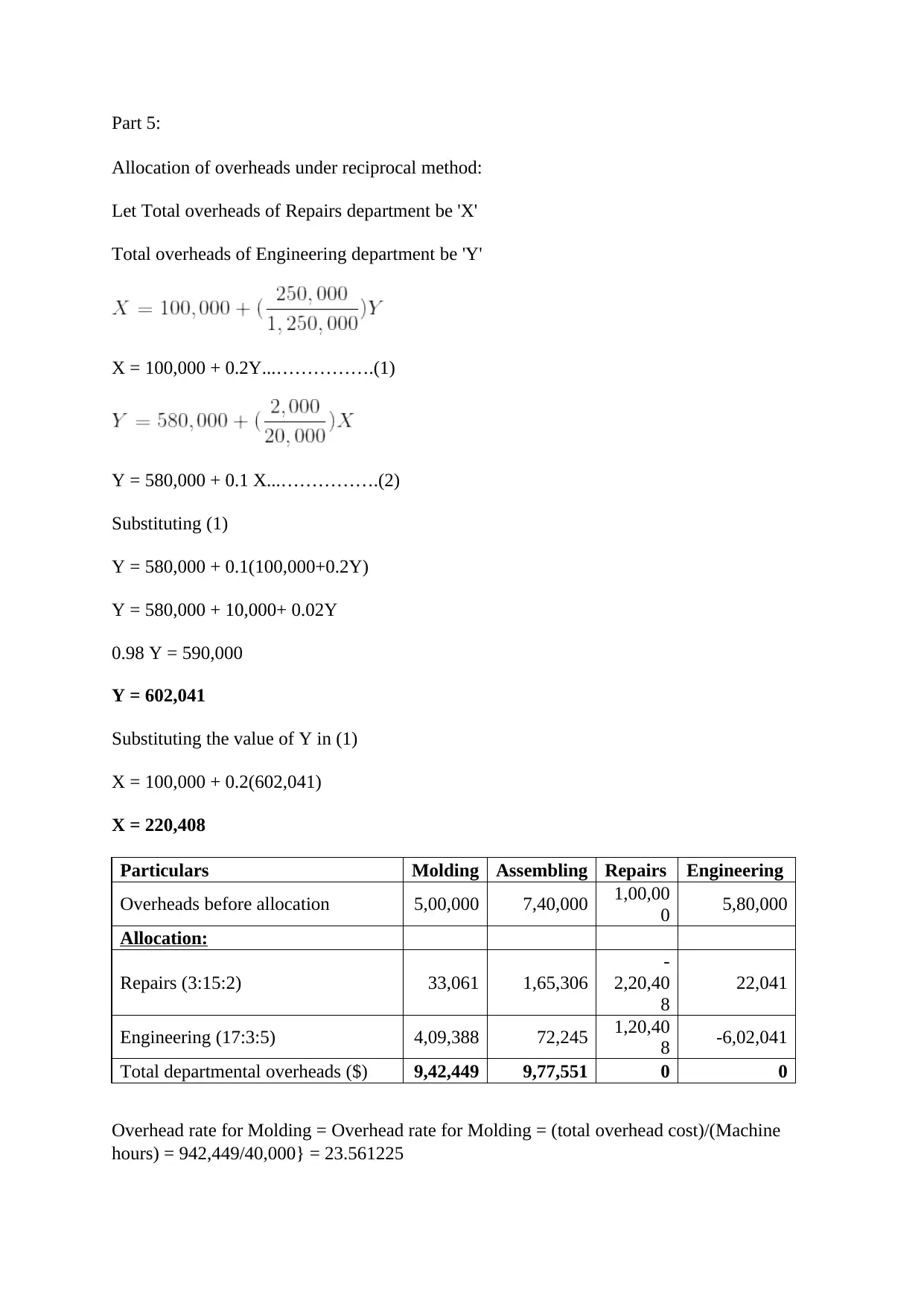

Part 5:

Allocation of overheads under reciprocal method:

Let Total overheads of Repairs department be 'X'

Total overheads of Engineering department be 'Y'

X = 100,000 + 0.2Y...…………….(1)

Y = 580,000 + 0.1 X...…………….(2)

Substituting (1)

Y = 580,000 + 0.1(100,000+0.2Y)

Y = 580,000 + 10,000+ 0.02Y

0.98 Y = 590,000

Y = 602,041

Substituting the value of Y in (1)

X = 100,000 + 0.2(602,041)

X = 220,408

Particulars Molding Assembling Repairs Engineering

Overheads before allocation 5,00,000 7,40,000 1,00,00

0 5,80,000

Allocation:

Repairs (3:15:2) 33,061 1,65,306

-

2,20,40

8

22,041

Engineering (17:3:5) 4,09,388 72,245 1,20,40

8 -6,02,041

Total departmental overheads ($) 9,42,449 9,77,551 0 0

Overhead rate for Molding = Overhead rate for Molding = (total overhead cost)/(Machine

hours) = 942,449/40,000} = 23.561225

Allocation of overheads under reciprocal method:

Let Total overheads of Repairs department be 'X'

Total overheads of Engineering department be 'Y'

X = 100,000 + 0.2Y...…………….(1)

Y = 580,000 + 0.1 X...…………….(2)

Substituting (1)

Y = 580,000 + 0.1(100,000+0.2Y)

Y = 580,000 + 10,000+ 0.02Y

0.98 Y = 590,000

Y = 602,041

Substituting the value of Y in (1)

X = 100,000 + 0.2(602,041)

X = 220,408

Particulars Molding Assembling Repairs Engineering

Overheads before allocation 5,00,000 7,40,000 1,00,00

0 5,80,000

Allocation:

Repairs (3:15:2) 33,061 1,65,306

-

2,20,40

8

22,041

Engineering (17:3:5) 4,09,388 72,245 1,20,40

8 -6,02,041

Total departmental overheads ($) 9,42,449 9,77,551 0 0

Overhead rate for Molding = Overhead rate for Molding = (total overhead cost)/(Machine

hours) = 942,449/40,000} = 23.561225

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

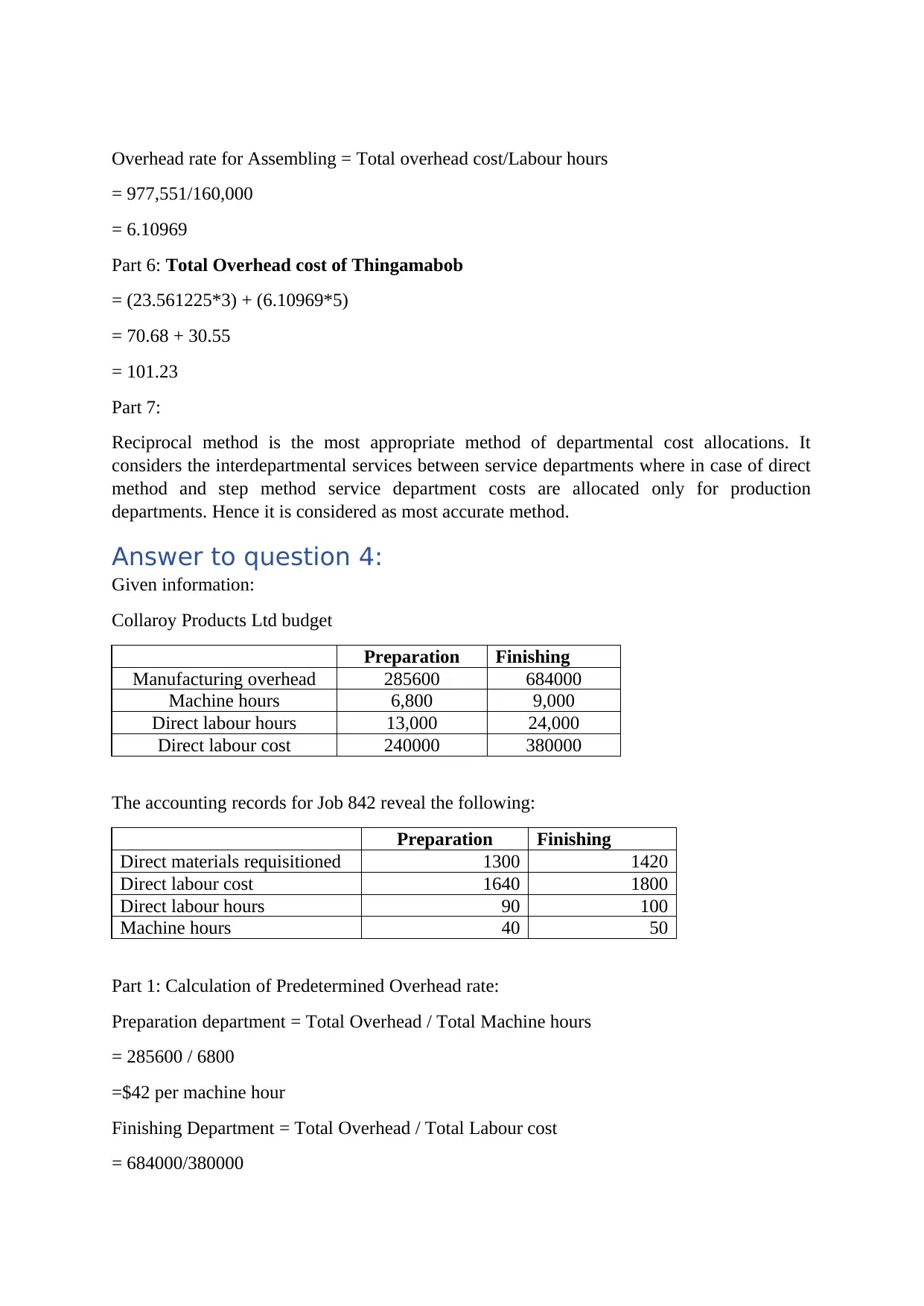

Overhead rate for Assembling = Total overhead cost/Labour hours

= 977,551/160,000

= 6.10969

Part 6: Total Overhead cost of Thingamabob

= (23.561225*3) + (6.10969*5)

= 70.68 + 30.55

= 101.23

Part 7:

Reciprocal method is the most appropriate method of departmental cost allocations. It

considers the interdepartmental services between service departments where in case of direct

method and step method service department costs are allocated only for production

departments. Hence it is considered as most accurate method.

Answer to question 4:

Given information:

Collaroy Products Ltd budget

Preparation Finishing

Manufacturing overhead 285600 684000

Machine hours 6,800 9,000

Direct labour hours 13,000 24,000

Direct labour cost 240000 380000

The accounting records for Job 842 reveal the following:

Preparation Finishing

Direct materials requisitioned 1300 1420

Direct labour cost 1640 1800

Direct labour hours 90 100

Machine hours 40 50

Part 1: Calculation of Predetermined Overhead rate:

Preparation department = Total Overhead / Total Machine hours

= 285600 / 6800

=$42 per machine hour

Finishing Department = Total Overhead / Total Labour cost

= 684000/380000

= 977,551/160,000

= 6.10969

Part 6: Total Overhead cost of Thingamabob

= (23.561225*3) + (6.10969*5)

= 70.68 + 30.55

= 101.23

Part 7:

Reciprocal method is the most appropriate method of departmental cost allocations. It

considers the interdepartmental services between service departments where in case of direct

method and step method service department costs are allocated only for production

departments. Hence it is considered as most accurate method.

Answer to question 4:

Given information:

Collaroy Products Ltd budget

Preparation Finishing

Manufacturing overhead 285600 684000

Machine hours 6,800 9,000

Direct labour hours 13,000 24,000

Direct labour cost 240000 380000

The accounting records for Job 842 reveal the following:

Preparation Finishing

Direct materials requisitioned 1300 1420

Direct labour cost 1640 1800

Direct labour hours 90 100

Machine hours 40 50

Part 1: Calculation of Predetermined Overhead rate:

Preparation department = Total Overhead / Total Machine hours

= 285600 / 6800

=$42 per machine hour

Finishing Department = Total Overhead / Total Labour cost

= 684000/380000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

=$1.8 per $ of labour cost

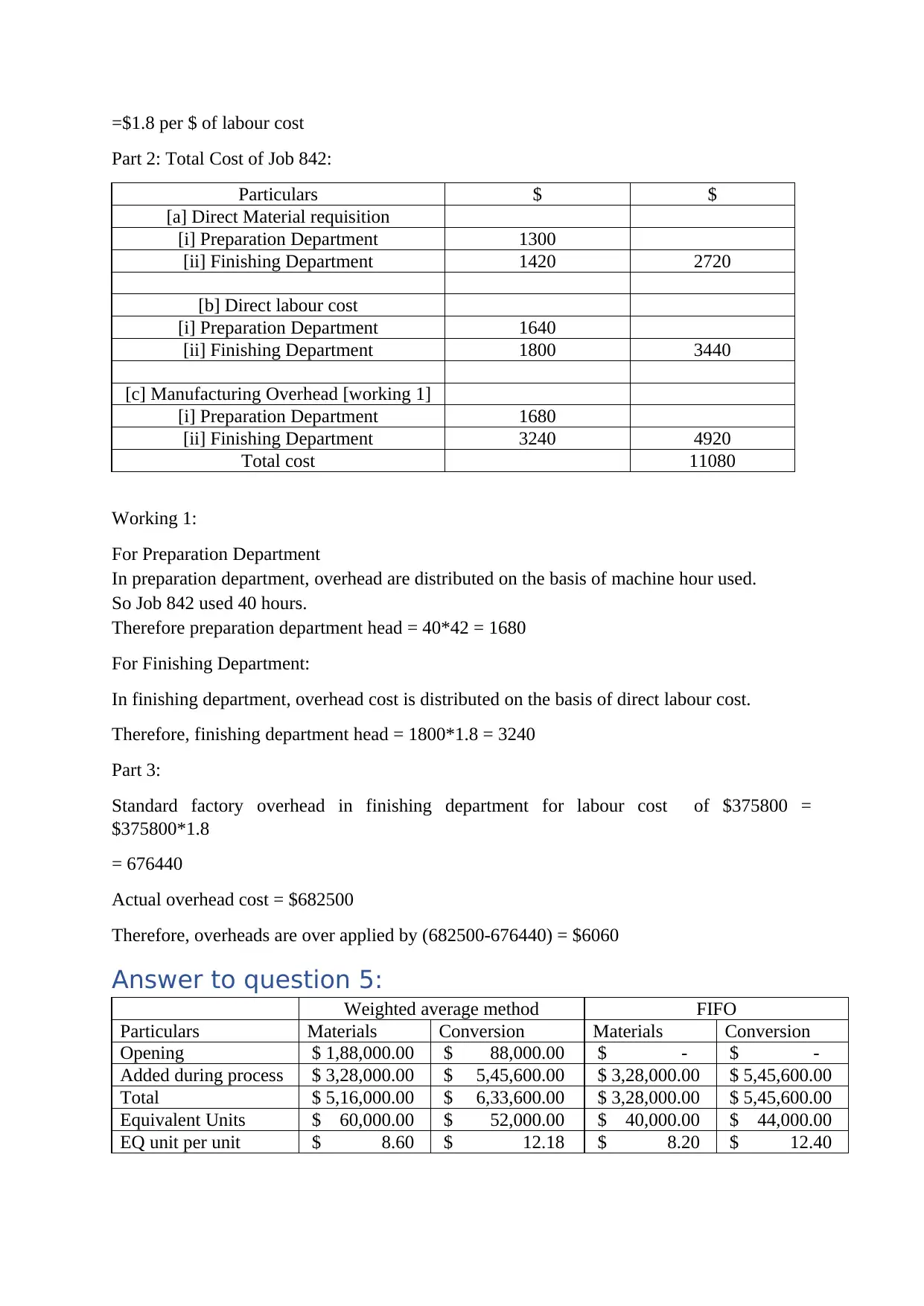

Part 2: Total Cost of Job 842:

Particulars $ $

[a] Direct Material requisition

[i] Preparation Department 1300

[ii] Finishing Department 1420 2720

[b] Direct labour cost

[i] Preparation Department 1640

[ii] Finishing Department 1800 3440

[c] Manufacturing Overhead [working 1]

[i] Preparation Department 1680

[ii] Finishing Department 3240 4920

Total cost 11080

Working 1:

For Preparation Department

In preparation department, overhead are distributed on the basis of machine hour used.

So Job 842 used 40 hours.

Therefore preparation department head = 40*42 = 1680

For Finishing Department:

In finishing department, overhead cost is distributed on the basis of direct labour cost.

Therefore, finishing department head = 1800*1.8 = 3240

Part 3:

Standard factory overhead in finishing department for labour cost of $375800 =

$375800*1.8

= 676440

Actual overhead cost = $682500

Therefore, overheads are over applied by (682500-676440) = $6060

Answer to question 5:

Weighted average method FIFO

Particulars Materials Conversion Materials Conversion

Opening $ 1,88,000.00 $ 88,000.00 $ - $ -

Added during process $ 3,28,000.00 $ 5,45,600.00 $ 3,28,000.00 $ 5,45,600.00

Total $ 5,16,000.00 $ 6,33,600.00 $ 3,28,000.00 $ 5,45,600.00

Equivalent Units $ 60,000.00 $ 52,000.00 $ 40,000.00 $ 44,000.00

EQ unit per unit $ 8.60 $ 12.18 $ 8.20 $ 12.40

Part 2: Total Cost of Job 842:

Particulars $ $

[a] Direct Material requisition

[i] Preparation Department 1300

[ii] Finishing Department 1420 2720

[b] Direct labour cost

[i] Preparation Department 1640

[ii] Finishing Department 1800 3440

[c] Manufacturing Overhead [working 1]

[i] Preparation Department 1680

[ii] Finishing Department 3240 4920

Total cost 11080

Working 1:

For Preparation Department

In preparation department, overhead are distributed on the basis of machine hour used.

So Job 842 used 40 hours.

Therefore preparation department head = 40*42 = 1680

For Finishing Department:

In finishing department, overhead cost is distributed on the basis of direct labour cost.

Therefore, finishing department head = 1800*1.8 = 3240

Part 3:

Standard factory overhead in finishing department for labour cost of $375800 =

$375800*1.8

= 676440

Actual overhead cost = $682500

Therefore, overheads are over applied by (682500-676440) = $6060

Answer to question 5:

Weighted average method FIFO

Particulars Materials Conversion Materials Conversion

Opening $ 1,88,000.00 $ 88,000.00 $ - $ -

Added during process $ 3,28,000.00 $ 5,45,600.00 $ 3,28,000.00 $ 5,45,600.00

Total $ 5,16,000.00 $ 6,33,600.00 $ 3,28,000.00 $ 5,45,600.00

Equivalent Units $ 60,000.00 $ 52,000.00 $ 40,000.00 $ 44,000.00

EQ unit per unit $ 8.60 $ 12.18 $ 8.20 $ 12.40

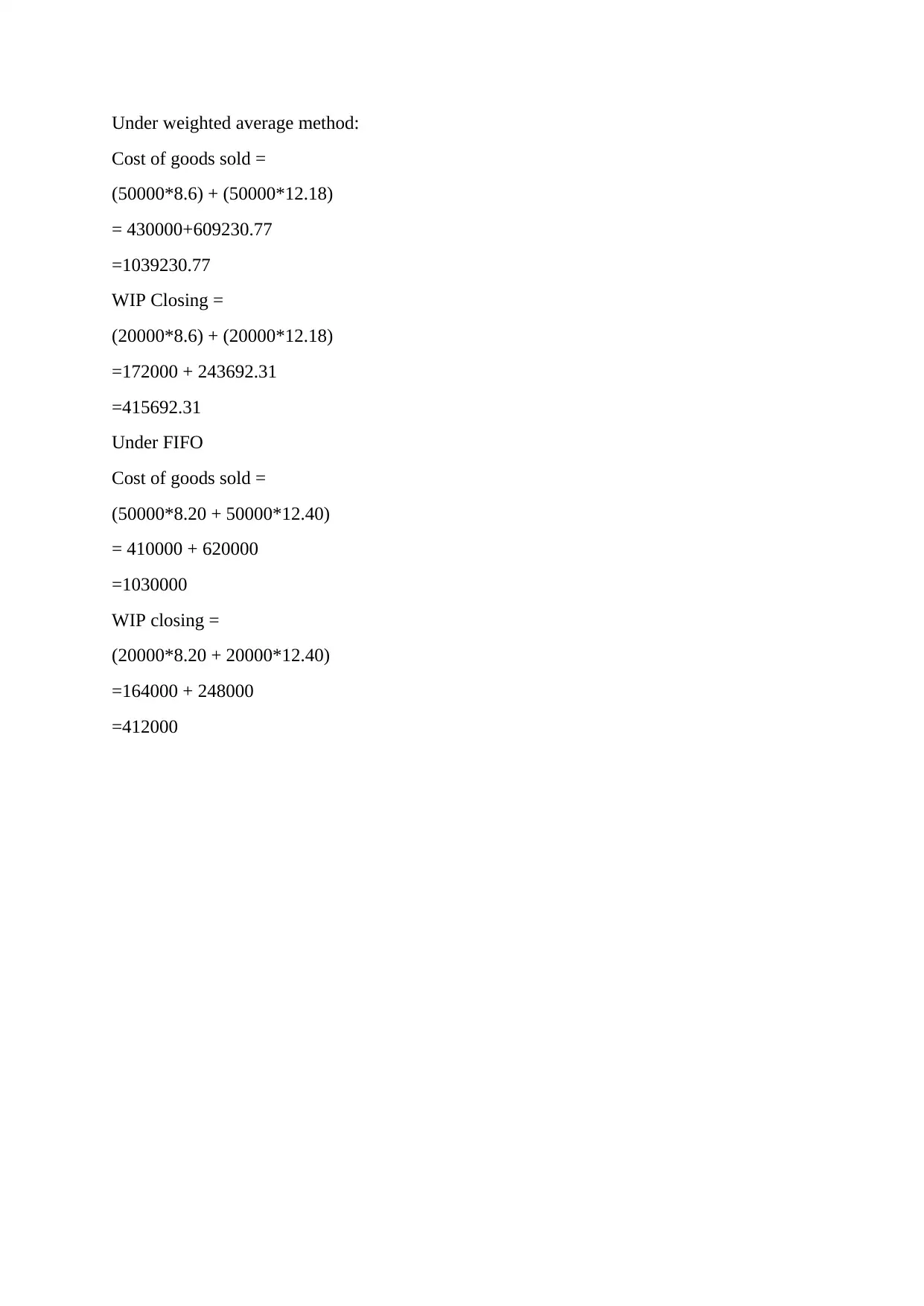

Under weighted average method:

Cost of goods sold =

(50000*8.6) + (50000*12.18)

= 430000+609230.77

=1039230.77

WIP Closing =

(20000*8.6) + (20000*12.18)

=172000 + 243692.31

=415692.31

Under FIFO

Cost of goods sold =

(50000*8.20 + 50000*12.40)

= 410000 + 620000

=1030000

WIP closing =

(20000*8.20 + 20000*12.40)

=164000 + 248000

=412000

Cost of goods sold =

(50000*8.6) + (50000*12.18)

= 430000+609230.77

=1039230.77

WIP Closing =

(20000*8.6) + (20000*12.18)

=172000 + 243692.31

=415692.31

Under FIFO

Cost of goods sold =

(50000*8.20 + 50000*12.40)

= 410000 + 620000

=1030000

WIP closing =

(20000*8.20 + 20000*12.40)

=164000 + 248000

=412000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Bibliography

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Mwangi, M. and Murigu, J.W., 2015. The determinants of financial performance in general

insurance companies in Kenya. European Scientific Journal, ESJ, 11(1).

Sun, J., Ding, L., Guo, J.M. and Li, Y., 2016. Ownership, capital structure and financing

decision: evidence from the UK. The British Accounting Review, 48(4), pp.448-463.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Mwangi, M. and Murigu, J.W., 2015. The determinants of financial performance in general

insurance companies in Kenya. European Scientific Journal, ESJ, 11(1).

Sun, J., Ding, L., Guo, J.M. and Li, Y., 2016. Ownership, capital structure and financing

decision: evidence from the UK. The British Accounting Review, 48(4), pp.448-463.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.