Mortgage Affordability and Serviceability Calculation

VerifiedAdded on 2020/05/11

|58

|14633

|472

AI Summary

This assignment provides a detailed walkthrough of a mortgage application assessment. It includes calculations for depreciation, variable income (rental), non-taxable income, and various commitment types. The document also outlines the serviceability calculations using NDI ratios, monthly repayments, and maximum loan amounts at different interest rates. It serves as an example to understand how lenders evaluate mortgage applications.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Assignment

Certificate IV in Finance and Mortgage Broking

(CIVMB_AS_v3A3)

Student identification(student to complete)

Please complete the fields shaded grey.

Student number

Assignment result (assessor to complete)

Result — first submission (Details for each activity are shown in the table below)

Parts that must be resubmitted:

Result — resubmission (if applicable)

CIVMB_AS_v3A3

Certificate IV in Finance and Mortgage Broking

(CIVMB_AS_v3A3)

Student identification(student to complete)

Please complete the fields shaded grey.

Student number

Assignment result (assessor to complete)

Result — first submission (Details for each activity are shown in the table below)

Parts that must be resubmitted:

Result — resubmission (if applicable)

CIVMB_AS_v3A3

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

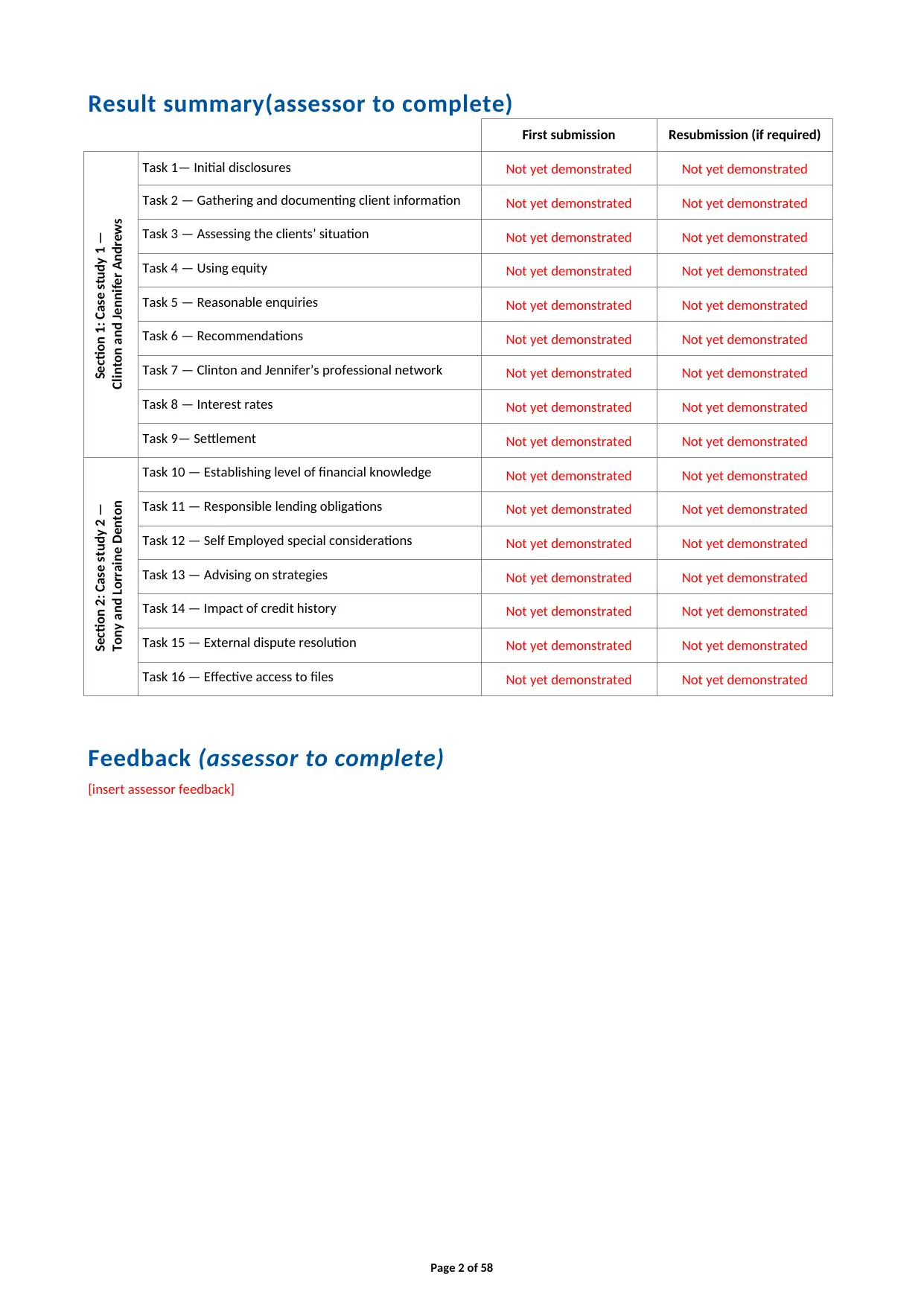

Result summary(assessor to complete)

First submission Resubmission (if required)

Section 1: Case study 1 —

Clinton and Jennifer Andrews

Task 1— Initial disclosures Not yet demonstrated Not yet demonstrated

Task 2 — Gathering and documenting client information Not yet demonstrated Not yet demonstrated

Task 3 — Assessing the clients’ situation Not yet demonstrated Not yet demonstrated

Task 4 — Using equity Not yet demonstrated Not yet demonstrated

Task 5 — Reasonable enquiries Not yet demonstrated Not yet demonstrated

Task 6 — Recommendations Not yet demonstrated Not yet demonstrated

Task 7 — Clinton and Jennifer’s professional network Not yet demonstrated Not yet demonstrated

Task 8 — Interest rates Not yet demonstrated Not yet demonstrated

Task 9— Settlement Not yet demonstrated Not yet demonstrated

Section 2: Case study 2 —

Tony and Lorraine Denton

Task 10 — Establishing level of financial knowledge Not yet demonstrated Not yet demonstrated

Task 11 — Responsible lending obligations Not yet demonstrated Not yet demonstrated

Task 12 — Self Employed special considerations Not yet demonstrated Not yet demonstrated

Task 13 — Advising on strategies Not yet demonstrated Not yet demonstrated

Task 14 — Impact of credit history Not yet demonstrated Not yet demonstrated

Task 15 — External dispute resolution Not yet demonstrated Not yet demonstrated

Task 16 — Effective access to files Not yet demonstrated Not yet demonstrated

Feedback (assessor to complete)

[insert assessor feedback]

Page 2 of 58

First submission Resubmission (if required)

Section 1: Case study 1 —

Clinton and Jennifer Andrews

Task 1— Initial disclosures Not yet demonstrated Not yet demonstrated

Task 2 — Gathering and documenting client information Not yet demonstrated Not yet demonstrated

Task 3 — Assessing the clients’ situation Not yet demonstrated Not yet demonstrated

Task 4 — Using equity Not yet demonstrated Not yet demonstrated

Task 5 — Reasonable enquiries Not yet demonstrated Not yet demonstrated

Task 6 — Recommendations Not yet demonstrated Not yet demonstrated

Task 7 — Clinton and Jennifer’s professional network Not yet demonstrated Not yet demonstrated

Task 8 — Interest rates Not yet demonstrated Not yet demonstrated

Task 9— Settlement Not yet demonstrated Not yet demonstrated

Section 2: Case study 2 —

Tony and Lorraine Denton

Task 10 — Establishing level of financial knowledge Not yet demonstrated Not yet demonstrated

Task 11 — Responsible lending obligations Not yet demonstrated Not yet demonstrated

Task 12 — Self Employed special considerations Not yet demonstrated Not yet demonstrated

Task 13 — Advising on strategies Not yet demonstrated Not yet demonstrated

Task 14 — Impact of credit history Not yet demonstrated Not yet demonstrated

Task 15 — External dispute resolution Not yet demonstrated Not yet demonstrated

Task 16 — Effective access to files Not yet demonstrated Not yet demonstrated

Feedback (assessor to complete)

[insert assessor feedback]

Page 2 of 58

Before you begin

Read everything in this document before you start your assignment forCertificate IV in Finance and

Mortgage Broking (CIVMB_AS_v3A3).

About this document

This document includes the following parts:

• Part 1: Instructions for completing and submitting this assignment

• Section 1: Case study 1 — Clinton and JenniferAndrews

– Task 1 — Initial disclosures

– Task 2 — Gathering and documenting client information

– Task 3 — Assessing the clients’ situation

– Task 4 — Using equity

– Task 5 — Reasonable enquiries

– Task 6 — Recommendations

– Task 7 — Clinton and Jennifer’s professional network

– Task 8 — Interest rates

– Task 9 — Settlement

• Section 2: Case study 2 — Tony and Lorraine Denton

– Task 10 — Establishing level of financial knowledge

– Task 11 — Responsible lending obligations

– Task 12 — Self Employed special considerations

– Task 13 — Advising on strategies

– Task 14 — Impact of credit history

– Task 15 — External dispute resolution

– Task 16 — Effective access to files

• Appendix 1:Client information collection tool/Fact Finder.

• Appendix 2:Serviceability calculator.

How to use the study plan

We recommend that you use the study plan for this subject; it will help you manage your time

effectively and complete the assignment within your enrolment period. Your study plan is in the

KapLearn Certificate IV in Finance and Mortgage Broking (CIVMBv3) subject room.

Page 3 of 58

Read everything in this document before you start your assignment forCertificate IV in Finance and

Mortgage Broking (CIVMB_AS_v3A3).

About this document

This document includes the following parts:

• Part 1: Instructions for completing and submitting this assignment

• Section 1: Case study 1 — Clinton and JenniferAndrews

– Task 1 — Initial disclosures

– Task 2 — Gathering and documenting client information

– Task 3 — Assessing the clients’ situation

– Task 4 — Using equity

– Task 5 — Reasonable enquiries

– Task 6 — Recommendations

– Task 7 — Clinton and Jennifer’s professional network

– Task 8 — Interest rates

– Task 9 — Settlement

• Section 2: Case study 2 — Tony and Lorraine Denton

– Task 10 — Establishing level of financial knowledge

– Task 11 — Responsible lending obligations

– Task 12 — Self Employed special considerations

– Task 13 — Advising on strategies

– Task 14 — Impact of credit history

– Task 15 — External dispute resolution

– Task 16 — Effective access to files

• Appendix 1:Client information collection tool/Fact Finder.

• Appendix 2:Serviceability calculator.

How to use the study plan

We recommend that you use the study plan for this subject; it will help you manage your time

effectively and complete the assignment within your enrolment period. Your study plan is in the

KapLearn Certificate IV in Finance and Mortgage Broking (CIVMBv3) subject room.

Page 3 of 58

Part 1: Instructions for completing and submitting

this assignment

Completing the assignment

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your work

regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows: Studentnumber_SubjectCode_Submissionnumber

(e.g. 12345678_CIVMBv3A3_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that everything is

clear and unambiguous.

The assignment

This assignment is split into 16 Tasks, over 3 Sections. To finish this assignment, you must complete

all 16 tasks.

The information and data needed to complete Sections 1 and 2 is presented in case studies at the

beginning of those sections.

Word count

The word count shown with each question is indicative only. You will not be penalised for exceeding the

suggested word count. Please do not include additional information which is outside the scope of the

question.

Additional research

When completing the Client Information Collection Tool in Appendix 1, assumptions are permitted,

although they must not be in conflict with the information provided in the Case Study.

You may also be required to source additional information from other organisations in the finance industry

to find the right products or services to meet your client’s requirements or to calculate any service fees that

may be applicable.

Page 4 of 58

this assignment

Completing the assignment

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your work

regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows: Studentnumber_SubjectCode_Submissionnumber

(e.g. 12345678_CIVMBv3A3_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that everything is

clear and unambiguous.

The assignment

This assignment is split into 16 Tasks, over 3 Sections. To finish this assignment, you must complete

all 16 tasks.

The information and data needed to complete Sections 1 and 2 is presented in case studies at the

beginning of those sections.

Word count

The word count shown with each question is indicative only. You will not be penalised for exceeding the

suggested word count. Please do not include additional information which is outside the scope of the

question.

Additional research

When completing the Client Information Collection Tool in Appendix 1, assumptions are permitted,

although they must not be in conflict with the information provided in the Case Study.

You may also be required to source additional information from other organisations in the finance industry

to find the right products or services to meet your client’s requirements or to calculate any service fees that

may be applicable.

Page 4 of 58

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

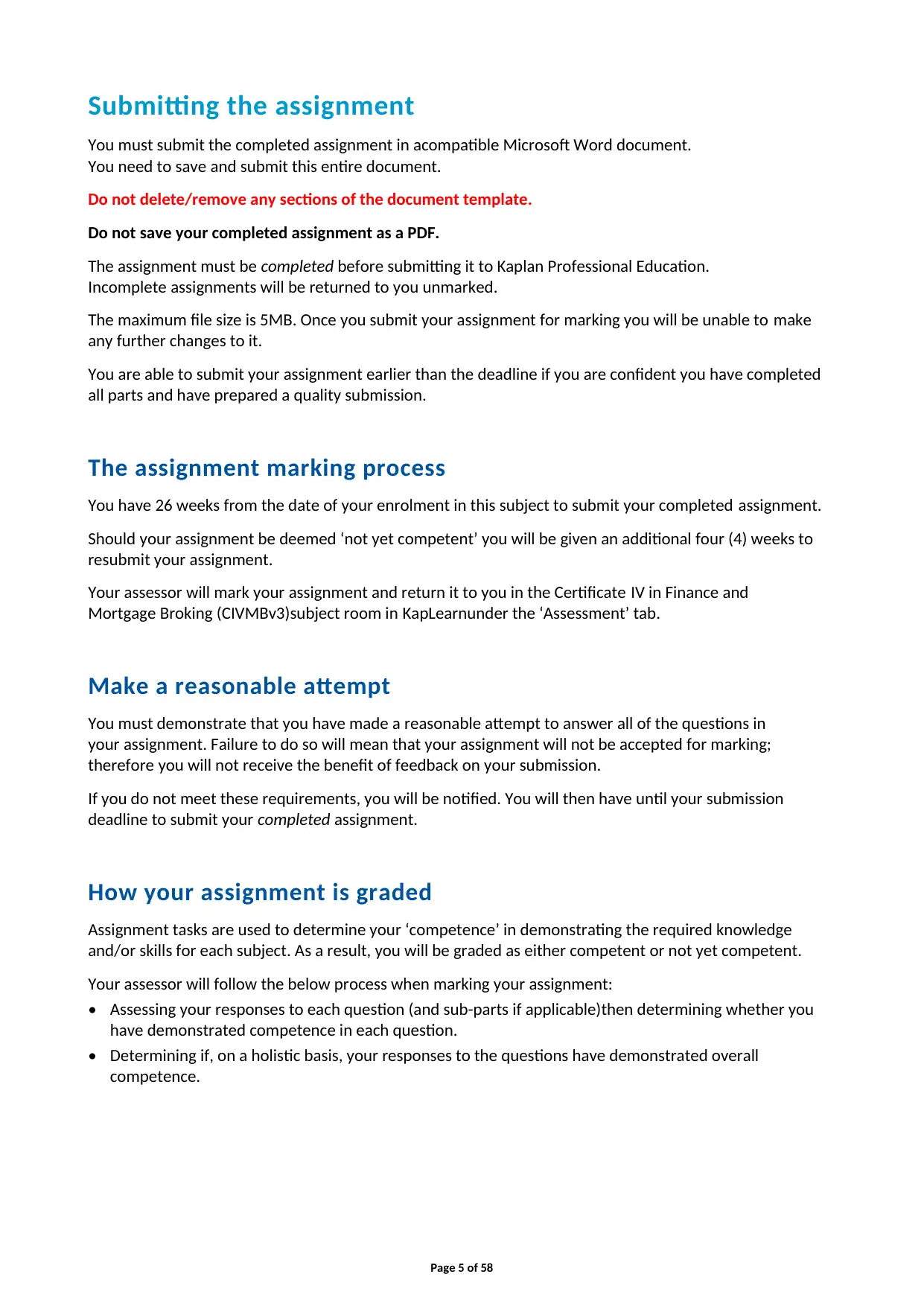

Submitting the assignment

You must submit the completed assignment in acompatible Microsoft Word document.

You need to save and submit this entire document.

Do not delete/remove any sections of the document template.

Do not save your completed assignment as a PDF.

The assignment must be completed before submitting it to Kaplan Professional Education.

Incomplete assignments will be returned to you unmarked.

The maximum file size is 5MB. Once you submit your assignment for marking you will be unable to make

any further changes to it.

You are able to submit your assignment earlier than the deadline if you are confident you have completed

all parts and have prepared a quality submission.

The assignment marking process

You have 26 weeks from the date of your enrolment in this subject to submit your completed assignment.

Should your assignment be deemed ‘not yet competent’ you will be given an additional four (4) weeks to

resubmit your assignment.

Your assessor will mark your assignment and return it to you in the Certificate IV in Finance and

Mortgage Broking (CIVMBv3)subject room in KapLearnunder the ‘Assessment’ tab.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your assignment. Failure to do so will mean that your assignment will not be accepted for marking;

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your submission

deadline to submit your completed assignment.

How your assignment is graded

Assignment tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either competent or not yet competent.

Your assessor will follow the below process when marking your assignment:

• Assessing your responses to each question (and sub-parts if applicable)then determining whether you

have demonstrated competence in each question.

• Determining if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

Page 5 of 58

You must submit the completed assignment in acompatible Microsoft Word document.

You need to save and submit this entire document.

Do not delete/remove any sections of the document template.

Do not save your completed assignment as a PDF.

The assignment must be completed before submitting it to Kaplan Professional Education.

Incomplete assignments will be returned to you unmarked.

The maximum file size is 5MB. Once you submit your assignment for marking you will be unable to make

any further changes to it.

You are able to submit your assignment earlier than the deadline if you are confident you have completed

all parts and have prepared a quality submission.

The assignment marking process

You have 26 weeks from the date of your enrolment in this subject to submit your completed assignment.

Should your assignment be deemed ‘not yet competent’ you will be given an additional four (4) weeks to

resubmit your assignment.

Your assessor will mark your assignment and return it to you in the Certificate IV in Finance and

Mortgage Broking (CIVMBv3)subject room in KapLearnunder the ‘Assessment’ tab.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your assignment. Failure to do so will mean that your assignment will not be accepted for marking;

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your submission

deadline to submit your completed assignment.

How your assignment is graded

Assignment tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either competent or not yet competent.

Your assessor will follow the below process when marking your assignment:

• Assessing your responses to each question (and sub-parts if applicable)then determining whether you

have demonstrated competence in each question.

• Determining if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

Page 5 of 58

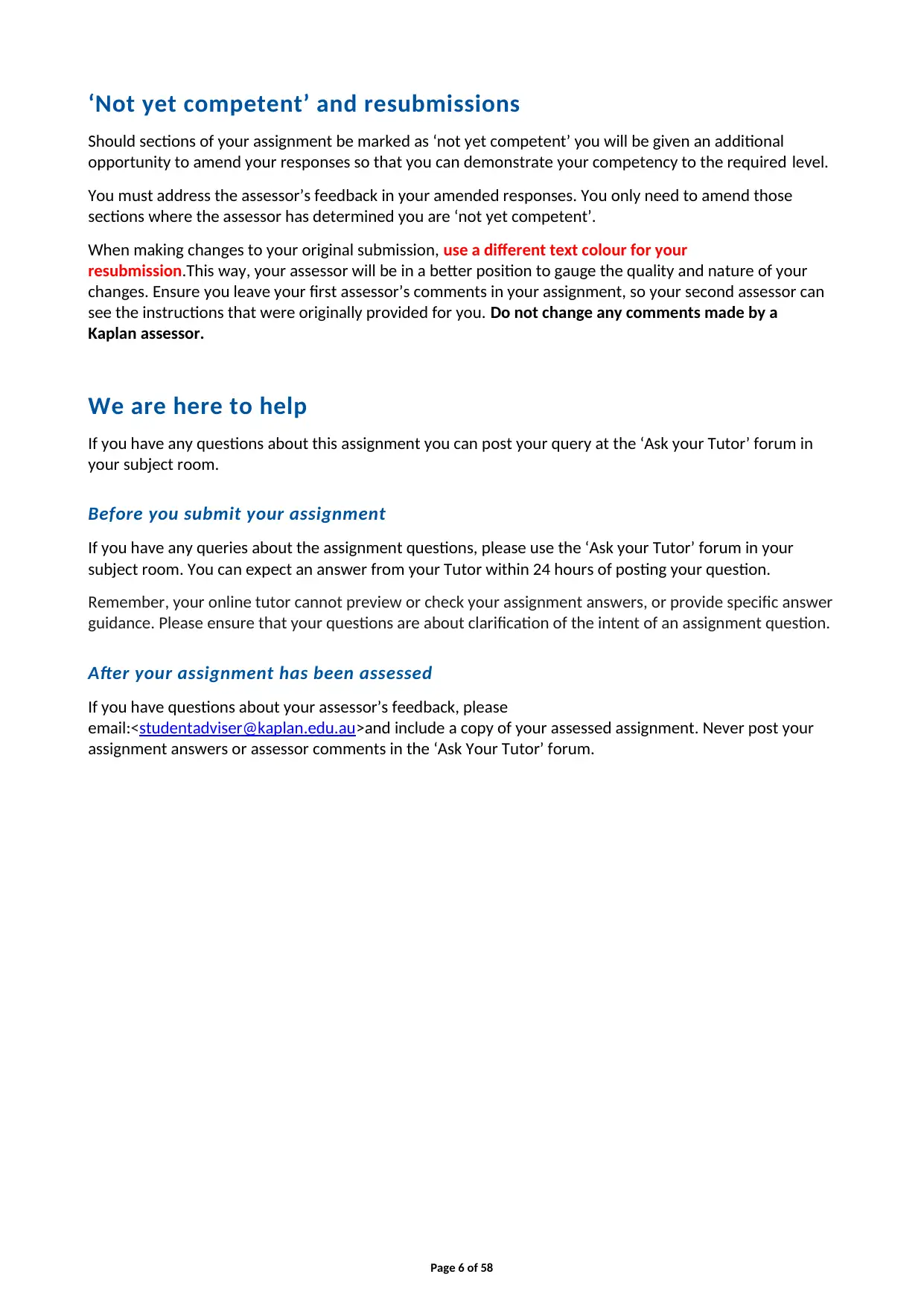

‘Not yet competent’ and resubmissions

Should sections of your assignment be marked as ‘not yet competent’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required level.

You must address the assessor’s feedback in your amended responses. You only need to amend those

sections where the assessor has determined you are ‘not yet competent’.

When making changes to your original submission, use a different text colour for your

resubmission.This way, your assessor will be in a better position to gauge the quality and nature of your

changes. Ensure you leave your first assessor’s comments in your assignment, so your second assessor can

see the instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

We are here to help

If you have any questions about this assignment you can post your query at the ‘Ask your Tutor’ forum in

your subject room.

Before you submit your assignment

If you have any queries about the assignment questions, please use the ‘Ask your Tutor’ forum in your

subject room. You can expect an answer from your Tutor within 24 hours of posting your question.

Remember, your online tutor cannot preview or check your assignment answers, or provide specific answer

guidance. Please ensure that your questions are about clarification of the intent of an assignment question.

After your assignment has been assessed

If you have questions about your assessor’s feedback, please

email:<studentadviser@kaplan.edu.au>and include a copy of your assessed assignment. Never post your

assignment answers or assessor comments in the ‘Ask Your Tutor’ forum.

Page 6 of 58

Should sections of your assignment be marked as ‘not yet competent’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required level.

You must address the assessor’s feedback in your amended responses. You only need to amend those

sections where the assessor has determined you are ‘not yet competent’.

When making changes to your original submission, use a different text colour for your

resubmission.This way, your assessor will be in a better position to gauge the quality and nature of your

changes. Ensure you leave your first assessor’s comments in your assignment, so your second assessor can

see the instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

We are here to help

If you have any questions about this assignment you can post your query at the ‘Ask your Tutor’ forum in

your subject room.

Before you submit your assignment

If you have any queries about the assignment questions, please use the ‘Ask your Tutor’ forum in your

subject room. You can expect an answer from your Tutor within 24 hours of posting your question.

Remember, your online tutor cannot preview or check your assignment answers, or provide specific answer

guidance. Please ensure that your questions are about clarification of the intent of an assignment question.

After your assignment has been assessed

If you have questions about your assessor’s feedback, please

email:<studentadviser@kaplan.edu.au>and include a copy of your assessed assignment. Never post your

assignment answers or assessor comments in the ‘Ask Your Tutor’ forum.

Page 6 of 58

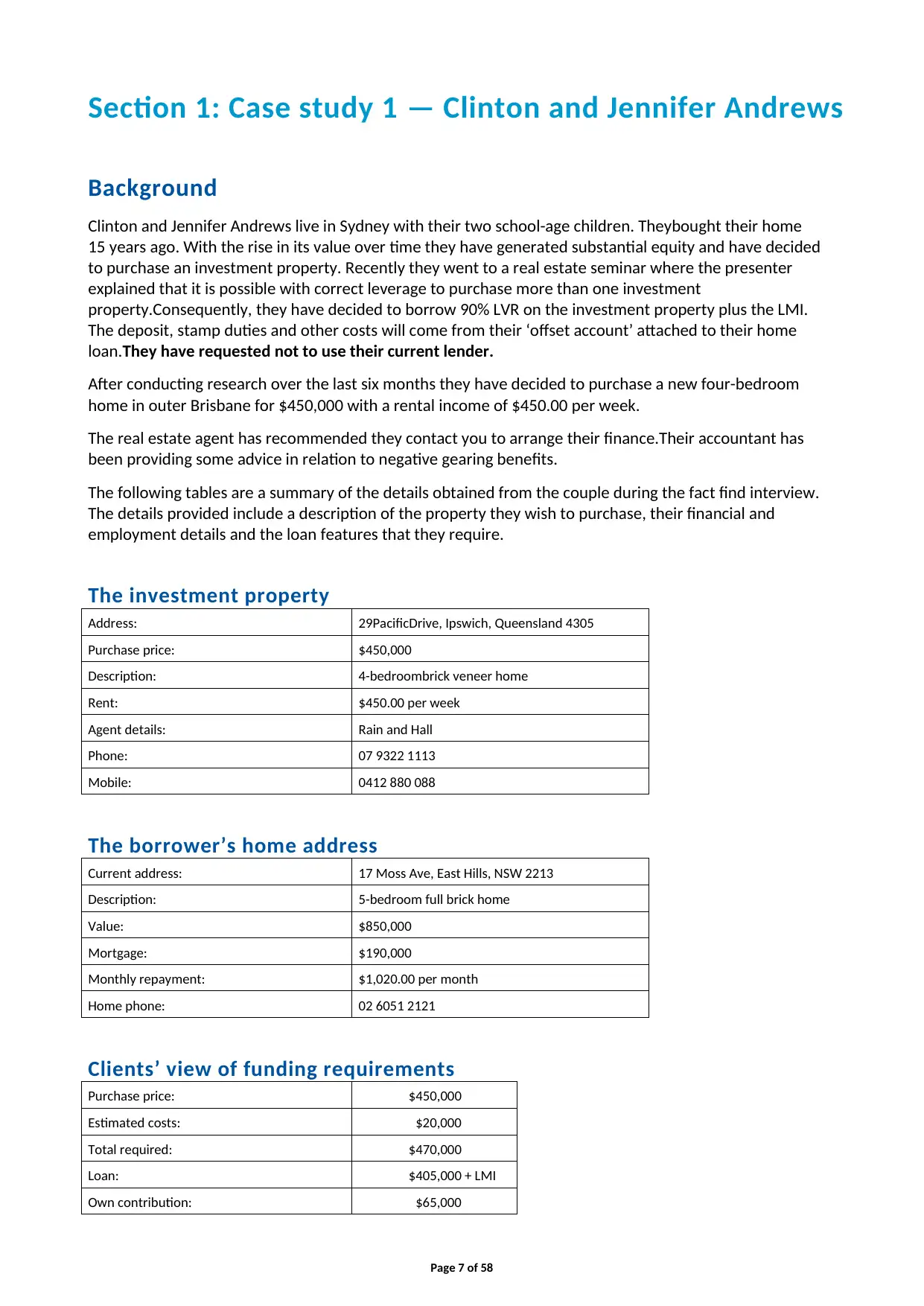

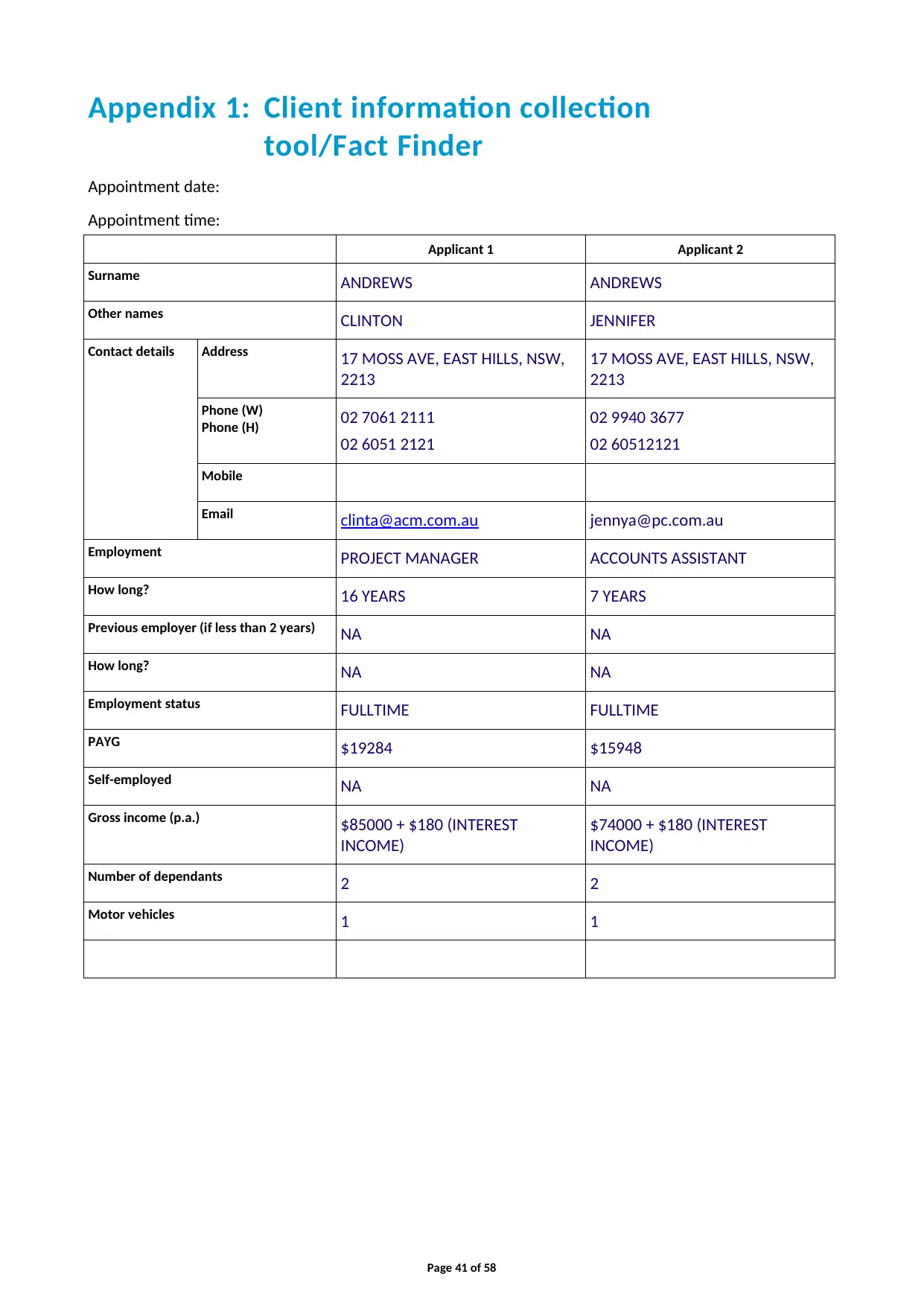

Section 1: Case study 1 — Clinton and Jennifer Andrews

Background

Clinton and Jennifer Andrews live in Sydney with their two school-age children. Theybought their home

15 years ago. With the rise in its value over time they have generated substantial equity and have decided

to purchase an investment property. Recently they went to a real estate seminar where the presenter

explained that it is possible with correct leverage to purchase more than one investment

property.Consequently, they have decided to borrow 90% LVR on the investment property plus the LMI.

The deposit, stamp duties and other costs will come from their ‘offset account’ attached to their home

loan.They have requested not to use their current lender.

After conducting research over the last six months they have decided to purchase a new four-bedroom

home in outer Brisbane for $450,000 with a rental income of $450.00 per week.

The real estate agent has recommended they contact you to arrange their finance.Their accountant has

been providing some advice in relation to negative gearing benefits.

The following tables are a summary of the details obtained from the couple during the fact find interview.

The details provided include a description of the property they wish to purchase, their financial and

employment details and the loan features that they require.

The investment property

Address: 29PacificDrive, Ipswich, Queensland 4305

Purchase price: $450,000

Description: 4-bedroombrick veneer home

Rent: $450.00 per week

Agent details: Rain and Hall

Phone: 07 9322 1113

Mobile: 0412 880 088

The borrower’s home address

Current address: 17 Moss Ave, East Hills, NSW 2213

Description: 5-bedroom full brick home

Value: $850,000

Mortgage: $190,000

Monthly repayment: $1,020.00 per month

Home phone: 02 6051 2121

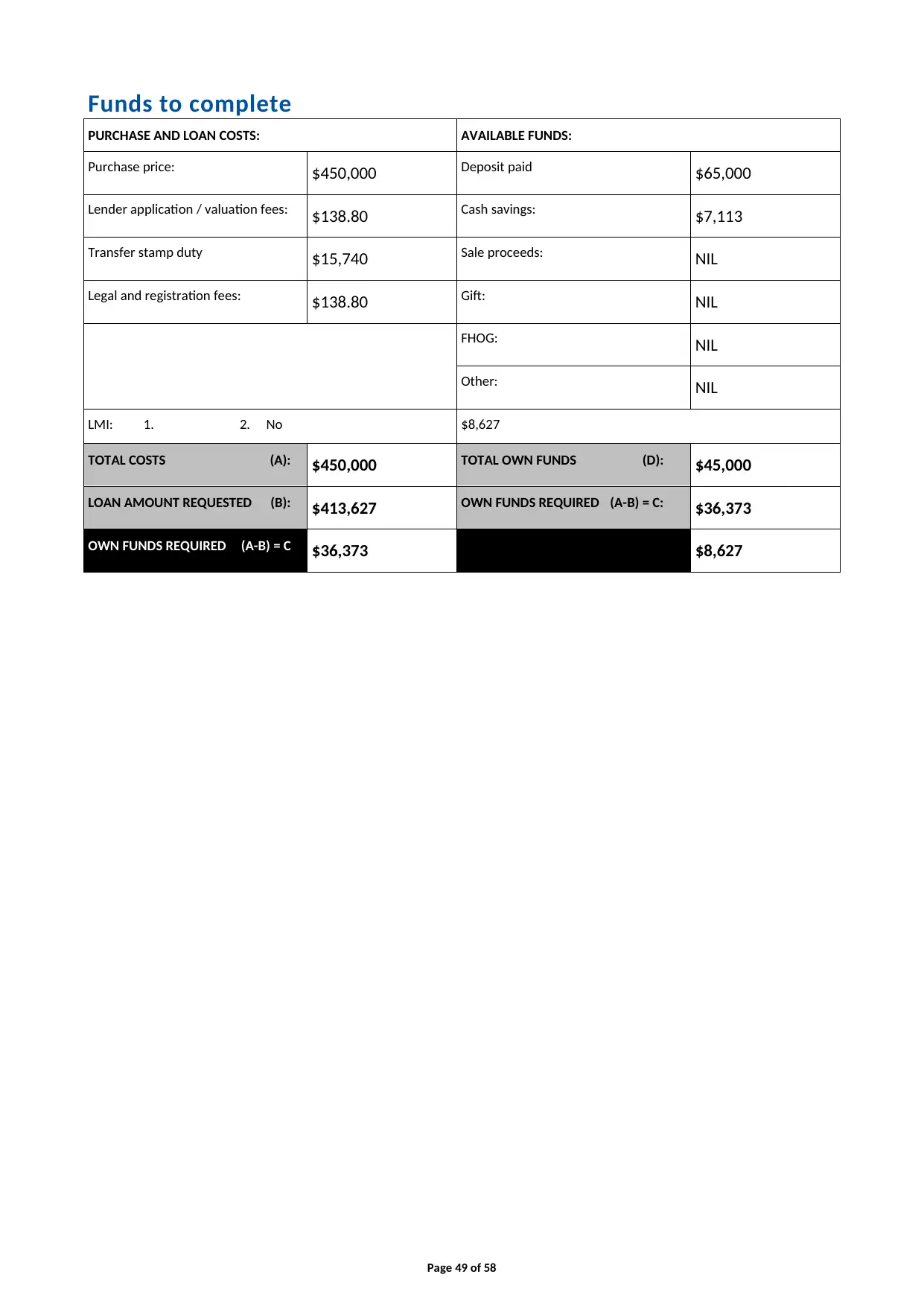

Clients’ view of funding requirements

Purchase price: $450,000

Estimated costs: $20,000

Total required: $470,000

Loan: $405,000 + LMI

Own contribution: $65,000

Page 7 of 58

Background

Clinton and Jennifer Andrews live in Sydney with their two school-age children. Theybought their home

15 years ago. With the rise in its value over time they have generated substantial equity and have decided

to purchase an investment property. Recently they went to a real estate seminar where the presenter

explained that it is possible with correct leverage to purchase more than one investment

property.Consequently, they have decided to borrow 90% LVR on the investment property plus the LMI.

The deposit, stamp duties and other costs will come from their ‘offset account’ attached to their home

loan.They have requested not to use their current lender.

After conducting research over the last six months they have decided to purchase a new four-bedroom

home in outer Brisbane for $450,000 with a rental income of $450.00 per week.

The real estate agent has recommended they contact you to arrange their finance.Their accountant has

been providing some advice in relation to negative gearing benefits.

The following tables are a summary of the details obtained from the couple during the fact find interview.

The details provided include a description of the property they wish to purchase, their financial and

employment details and the loan features that they require.

The investment property

Address: 29PacificDrive, Ipswich, Queensland 4305

Purchase price: $450,000

Description: 4-bedroombrick veneer home

Rent: $450.00 per week

Agent details: Rain and Hall

Phone: 07 9322 1113

Mobile: 0412 880 088

The borrower’s home address

Current address: 17 Moss Ave, East Hills, NSW 2213

Description: 5-bedroom full brick home

Value: $850,000

Mortgage: $190,000

Monthly repayment: $1,020.00 per month

Home phone: 02 6051 2121

Clients’ view of funding requirements

Purchase price: $450,000

Estimated costs: $20,000

Total required: $470,000

Loan: $405,000 + LMI

Own contribution: $65,000

Page 7 of 58

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

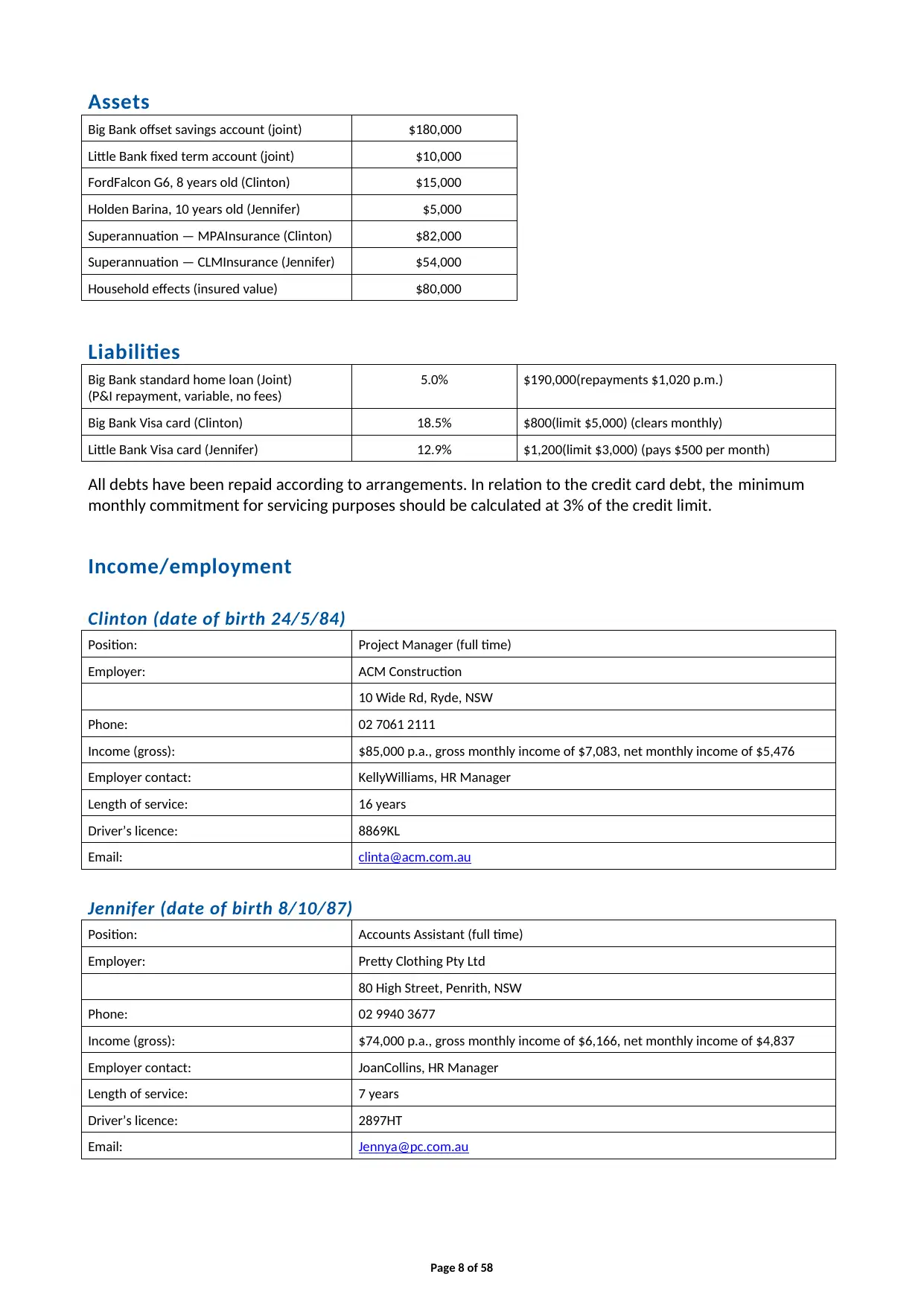

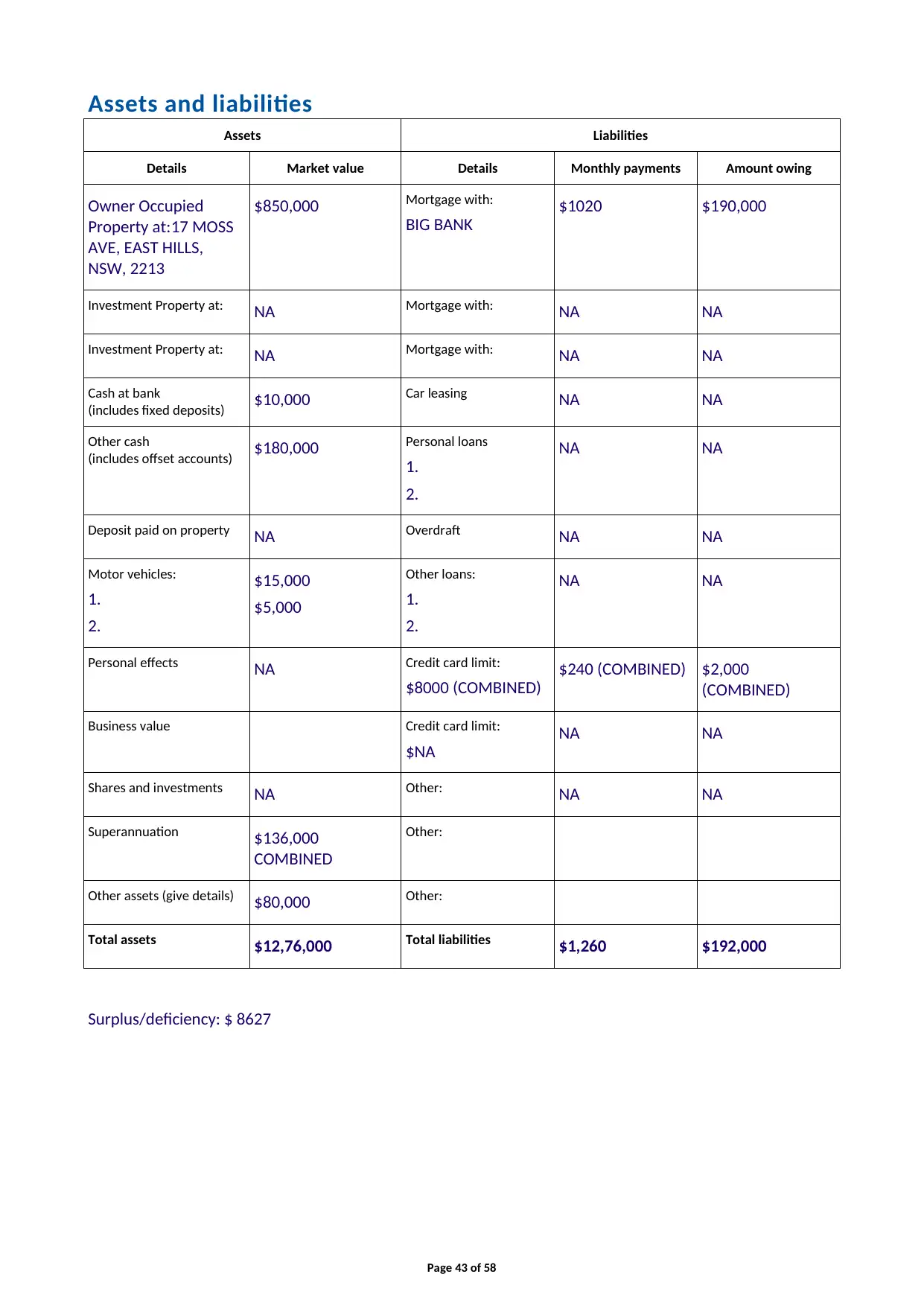

Assets

Big Bank offset savings account (joint) $180,000

Little Bank fixed term account (joint) $10,000

FordFalcon G6, 8 years old (Clinton) $15,000

Holden Barina, 10 years old (Jennifer) $5,000

Superannuation — MPAInsurance (Clinton) $82,000

Superannuation — CLMInsurance (Jennifer) $54,000

Household effects (insured value) $80,000

Liabilities

Big Bank standard home loan (Joint)

(P&I repayment, variable, no fees)

5.0% $190,000(repayments $1,020 p.m.)

Big Bank Visa card (Clinton) 18.5% $800(limit $5,000) (clears monthly)

Little Bank Visa card (Jennifer) 12.9% $1,200(limit $3,000) (pays $500 per month)

All debts have been repaid according to arrangements. In relation to the credit card debt, the minimum

monthly commitment for servicing purposes should be calculated at 3% of the credit limit.

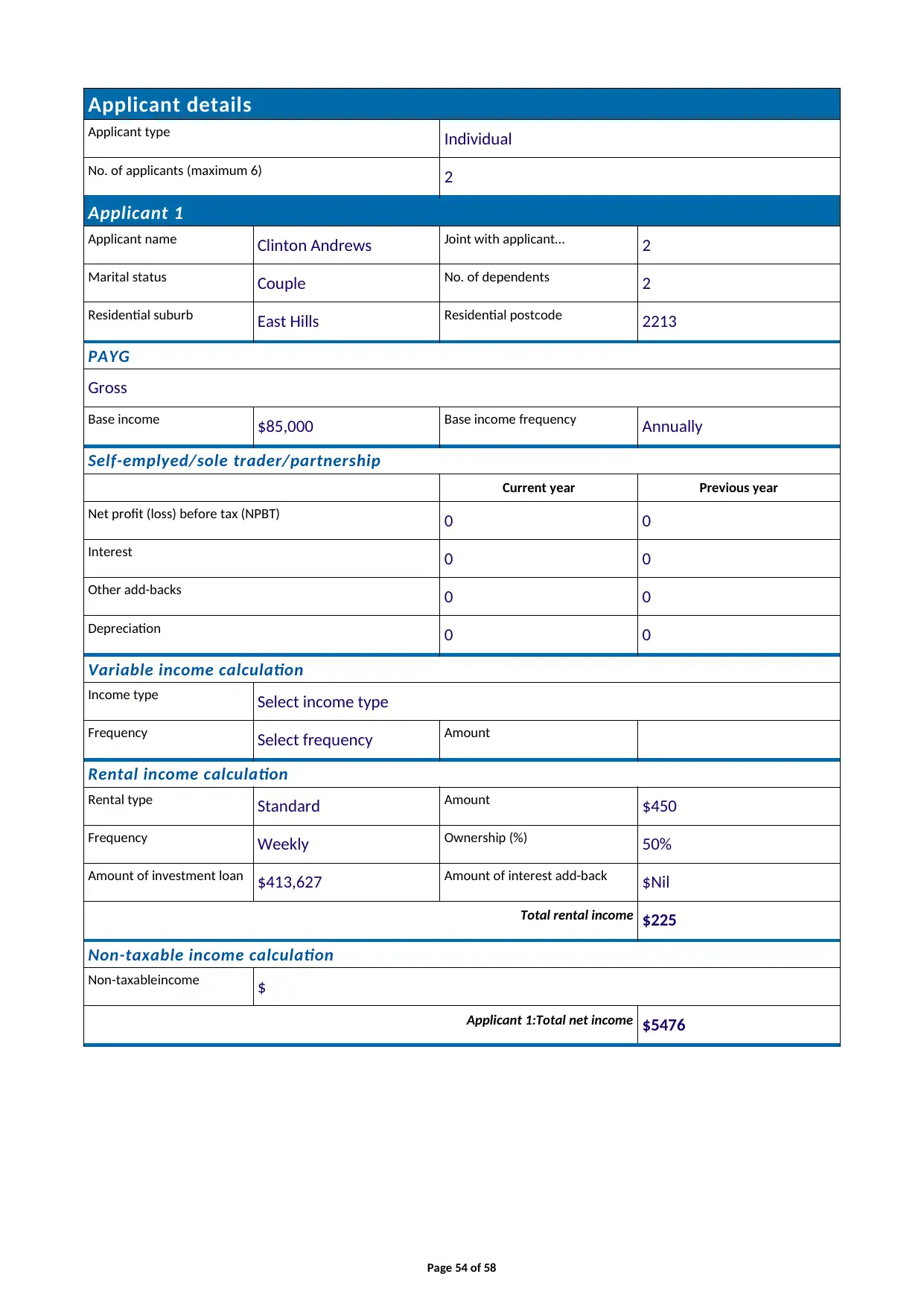

Income/employment

Clinton (date of birth 24/5/84)

Position: Project Manager (full time)

Employer: ACM Construction

10 Wide Rd, Ryde, NSW

Phone: 02 7061 2111

Income (gross): $85,000 p.a., gross monthly income of $7,083, net monthly income of $5,476

Employer contact: KellyWilliams, HR Manager

Length of service: 16 years

Driver’s licence: 8869KL

Email: clinta@acm.com.au

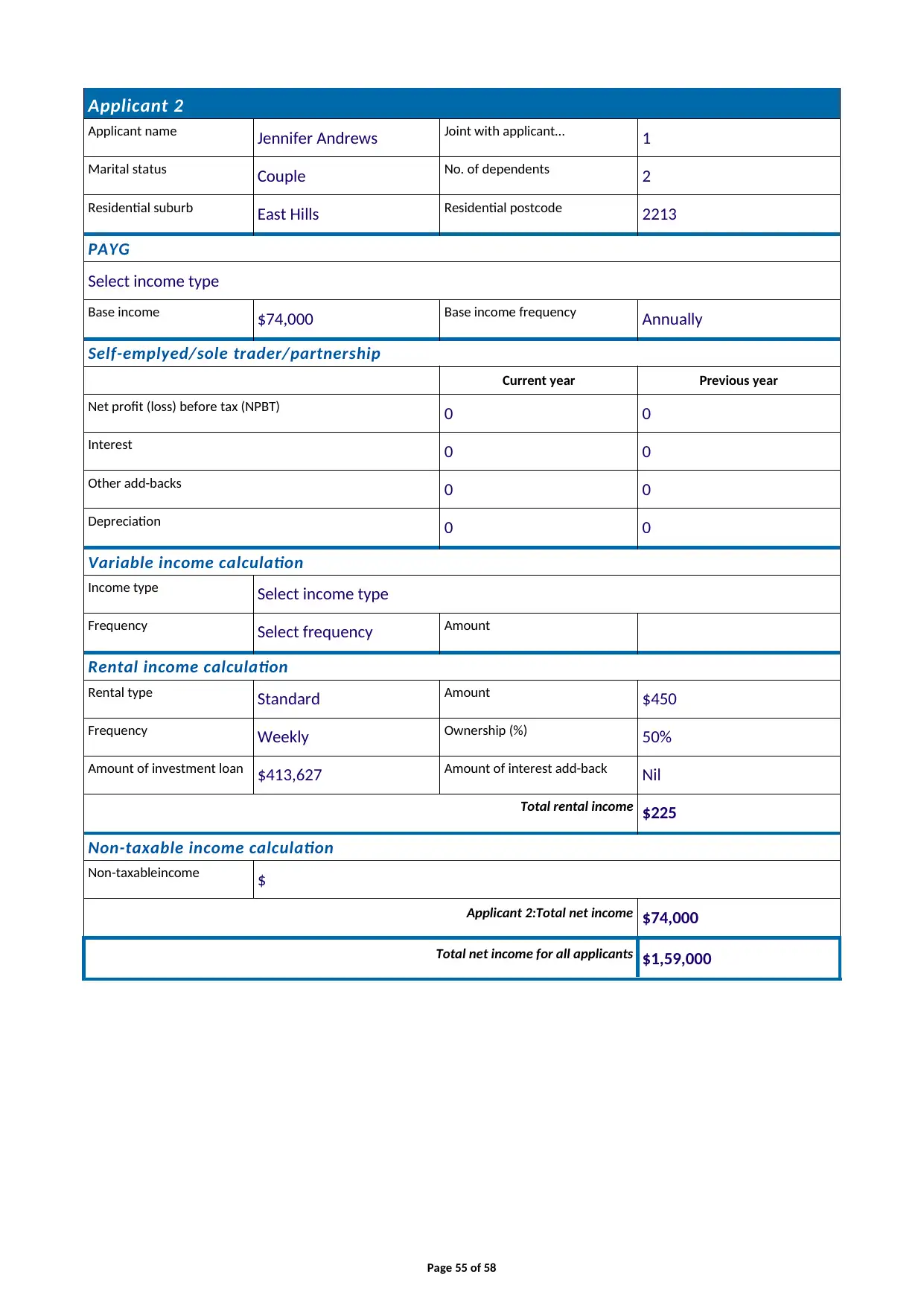

Jennifer (date of birth 8/10/87)

Position: Accounts Assistant (full time)

Employer: Pretty Clothing Pty Ltd

80 High Street, Penrith, NSW

Phone: 02 9940 3677

Income (gross): $74,000 p.a., gross monthly income of $6,166, net monthly income of $4,837

Employer contact: JoanCollins, HR Manager

Length of service: 7 years

Driver’s licence: 2897HT

Email: Jennya@pc.com.au

Page 8 of 58

Big Bank offset savings account (joint) $180,000

Little Bank fixed term account (joint) $10,000

FordFalcon G6, 8 years old (Clinton) $15,000

Holden Barina, 10 years old (Jennifer) $5,000

Superannuation — MPAInsurance (Clinton) $82,000

Superannuation — CLMInsurance (Jennifer) $54,000

Household effects (insured value) $80,000

Liabilities

Big Bank standard home loan (Joint)

(P&I repayment, variable, no fees)

5.0% $190,000(repayments $1,020 p.m.)

Big Bank Visa card (Clinton) 18.5% $800(limit $5,000) (clears monthly)

Little Bank Visa card (Jennifer) 12.9% $1,200(limit $3,000) (pays $500 per month)

All debts have been repaid according to arrangements. In relation to the credit card debt, the minimum

monthly commitment for servicing purposes should be calculated at 3% of the credit limit.

Income/employment

Clinton (date of birth 24/5/84)

Position: Project Manager (full time)

Employer: ACM Construction

10 Wide Rd, Ryde, NSW

Phone: 02 7061 2111

Income (gross): $85,000 p.a., gross monthly income of $7,083, net monthly income of $5,476

Employer contact: KellyWilliams, HR Manager

Length of service: 16 years

Driver’s licence: 8869KL

Email: clinta@acm.com.au

Jennifer (date of birth 8/10/87)

Position: Accounts Assistant (full time)

Employer: Pretty Clothing Pty Ltd

80 High Street, Penrith, NSW

Phone: 02 9940 3677

Income (gross): $74,000 p.a., gross monthly income of $6,166, net monthly income of $4,837

Employer contact: JoanCollins, HR Manager

Length of service: 7 years

Driver’s licence: 2897HT

Email: Jennya@pc.com.au

Page 8 of 58

Interest income

Approximately $30 per month from the $10,000 term deposit,interest of 3.5% p.a.

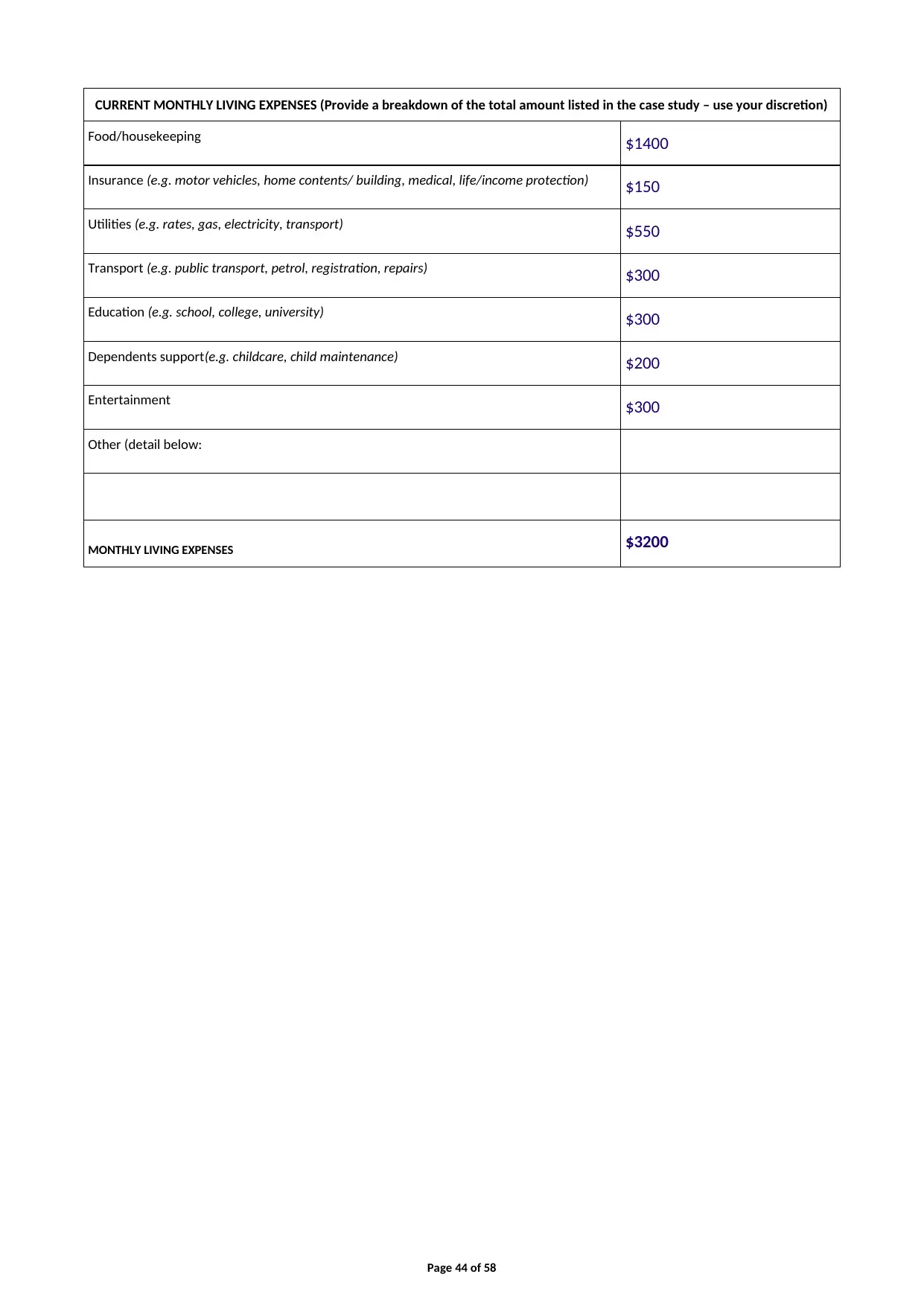

Expenditure

Monthly expenditure for living expenses— $3,200.

Solicitor’s details

Jackson & Williams

28West Street, Yagoona, NSW

Phone: 02 9283 1365

Fax: 02 9283 1802

Note:The solicitor has quoted $1,500 to cover estimates costs.

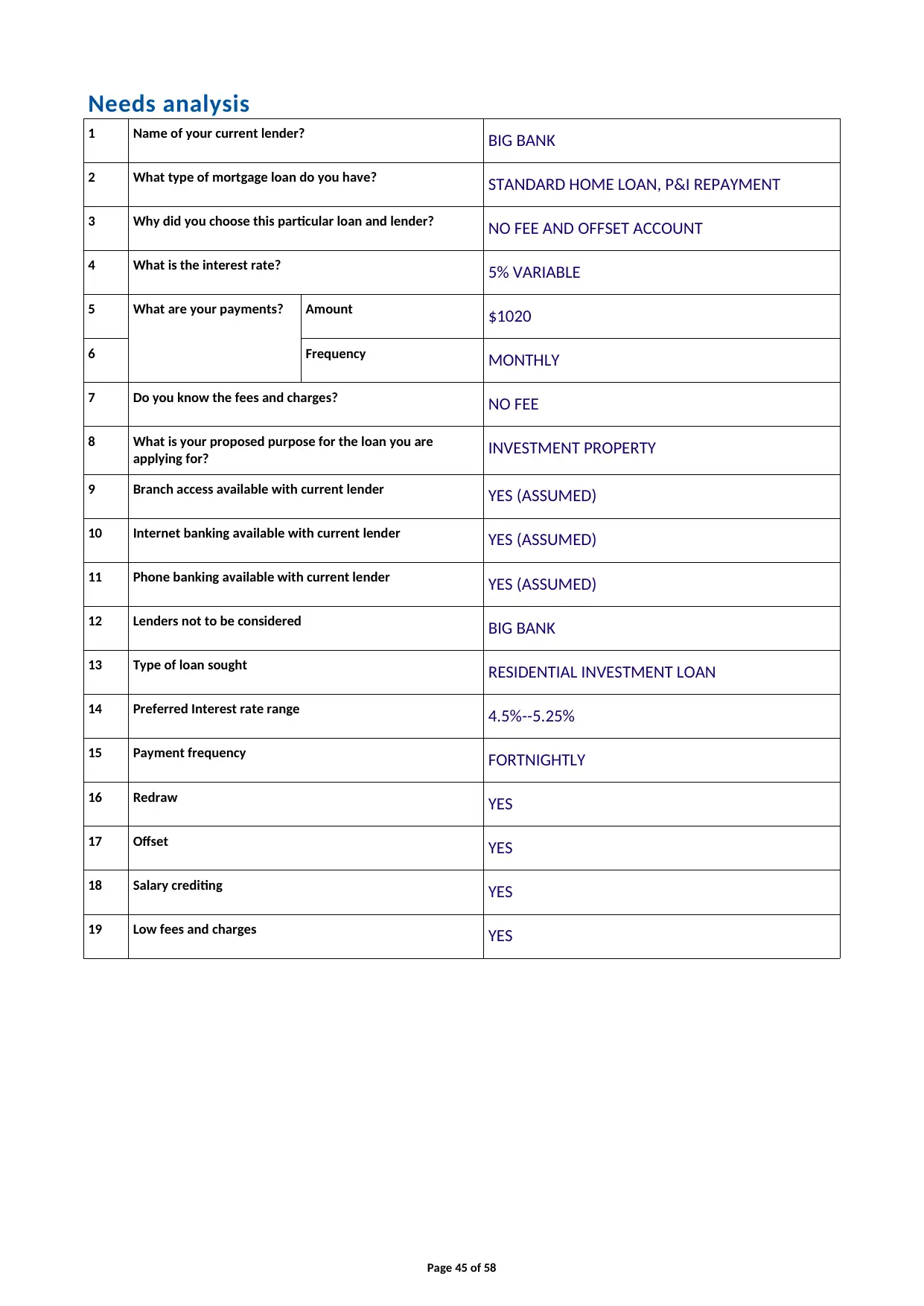

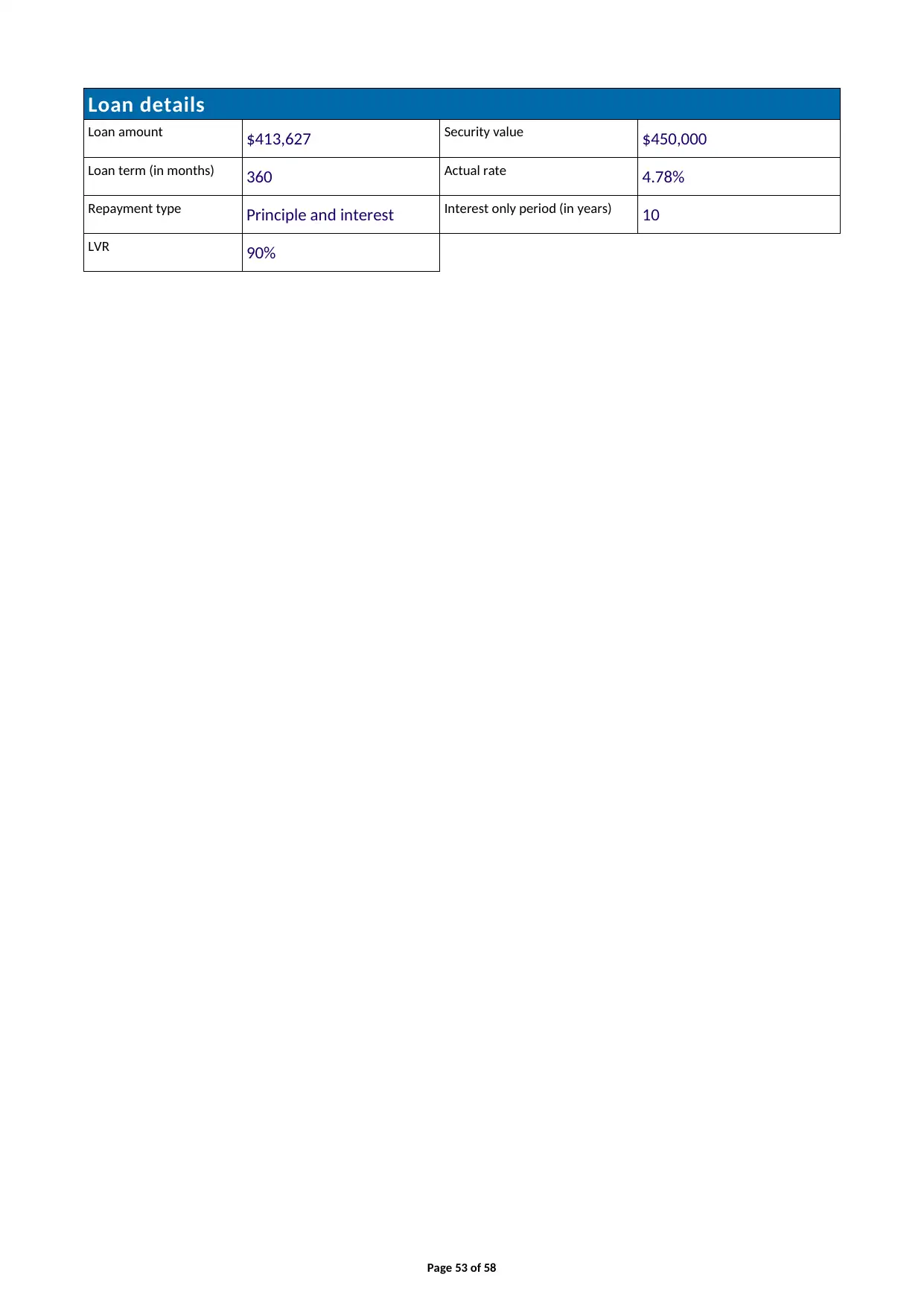

Proposed loan details

• application fee— $600.00 (includes valuation)

• 30-year term

• principal and interest

• residentialinvestment loan

• standard variable interest rate of 5.68% (comparison 5.82%), special offer rate of 4.78%

(5.16% comparison) (Note: Clinton& Jennifer will qualify for this special loan offer.)

• proposed settlement date — 6 weeks’ time

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• internet banking.

Page 9 of 58

Approximately $30 per month from the $10,000 term deposit,interest of 3.5% p.a.

Expenditure

Monthly expenditure for living expenses— $3,200.

Solicitor’s details

Jackson & Williams

28West Street, Yagoona, NSW

Phone: 02 9283 1365

Fax: 02 9283 1802

Note:The solicitor has quoted $1,500 to cover estimates costs.

Proposed loan details

• application fee— $600.00 (includes valuation)

• 30-year term

• principal and interest

• residentialinvestment loan

• standard variable interest rate of 5.68% (comparison 5.82%), special offer rate of 4.78%

(5.16% comparison) (Note: Clinton& Jennifer will qualify for this special loan offer.)

• proposed settlement date — 6 weeks’ time

• ability to make additional payments from time to time without penalty

• fortnightly repayment option

• redraw facility

• internet banking.

Page 9 of 58

Assignment tasks (student to complete)

Task 1 — Initial disclosures

Following a personal introduction and before you begin gathering information about the clients’ existing

financial situation or needs, there are certain disclosures you are required to make as a finance

broker.These disclosures include the way you are remunerated and the range and limitation of your

services.

1. There are four (4) documents listed in ASIC Information sheet INFO 146 ‘Responsible lending disclosure

obligations – Overview for credit licensees and representatives’that must be provided to customers.

Refer to this Information sheet and the information contained in your topic notes to answer part (a) and

(b) below.

(a) Identify which of these four (4) documents you must provide your client before you commence

providing credit assistance and explain the main disclosures relevant tothat document. (40 words)

Student response to Task 1: Question 1(a)

The documents that needs to be provided to the client are as given below:

1) Credit Guide

2) Quote

3) Poposal Document

4) Written assessment

(b) Identify which of these four documents you will provide the client should you intend to charge a

broker fee and explain what is required for it to be valid. (40 words)

Student response to Task 1: Question 1(b)

The documents that are to be given to the client for levying the fees for brokerage are as follows:

Name of the licensee and the contact details

The brokerage percentage that is to be levied from the client and the basis of the calculation.

The explanation and the details of the services for which the brokerage fees would be charged

The maximum amount that can be levied as brokerage.

The advisor should also explain whether the brokerage fee is to be paid one time or in a periodical manner.

Assessor feedback: Resubmission required?

No

Page 10 of 58

Task 1 — Initial disclosures

Following a personal introduction and before you begin gathering information about the clients’ existing

financial situation or needs, there are certain disclosures you are required to make as a finance

broker.These disclosures include the way you are remunerated and the range and limitation of your

services.

1. There are four (4) documents listed in ASIC Information sheet INFO 146 ‘Responsible lending disclosure

obligations – Overview for credit licensees and representatives’that must be provided to customers.

Refer to this Information sheet and the information contained in your topic notes to answer part (a) and

(b) below.

(a) Identify which of these four (4) documents you must provide your client before you commence

providing credit assistance and explain the main disclosures relevant tothat document. (40 words)

Student response to Task 1: Question 1(a)

The documents that needs to be provided to the client are as given below:

1) Credit Guide

2) Quote

3) Poposal Document

4) Written assessment

(b) Identify which of these four documents you will provide the client should you intend to charge a

broker fee and explain what is required for it to be valid. (40 words)

Student response to Task 1: Question 1(b)

The documents that are to be given to the client for levying the fees for brokerage are as follows:

Name of the licensee and the contact details

The brokerage percentage that is to be levied from the client and the basis of the calculation.

The explanation and the details of the services for which the brokerage fees would be charged

The maximum amount that can be levied as brokerage.

The advisor should also explain whether the brokerage fee is to be paid one time or in a periodical manner.

Assessor feedback: Resubmission required?

No

Page 10 of 58

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

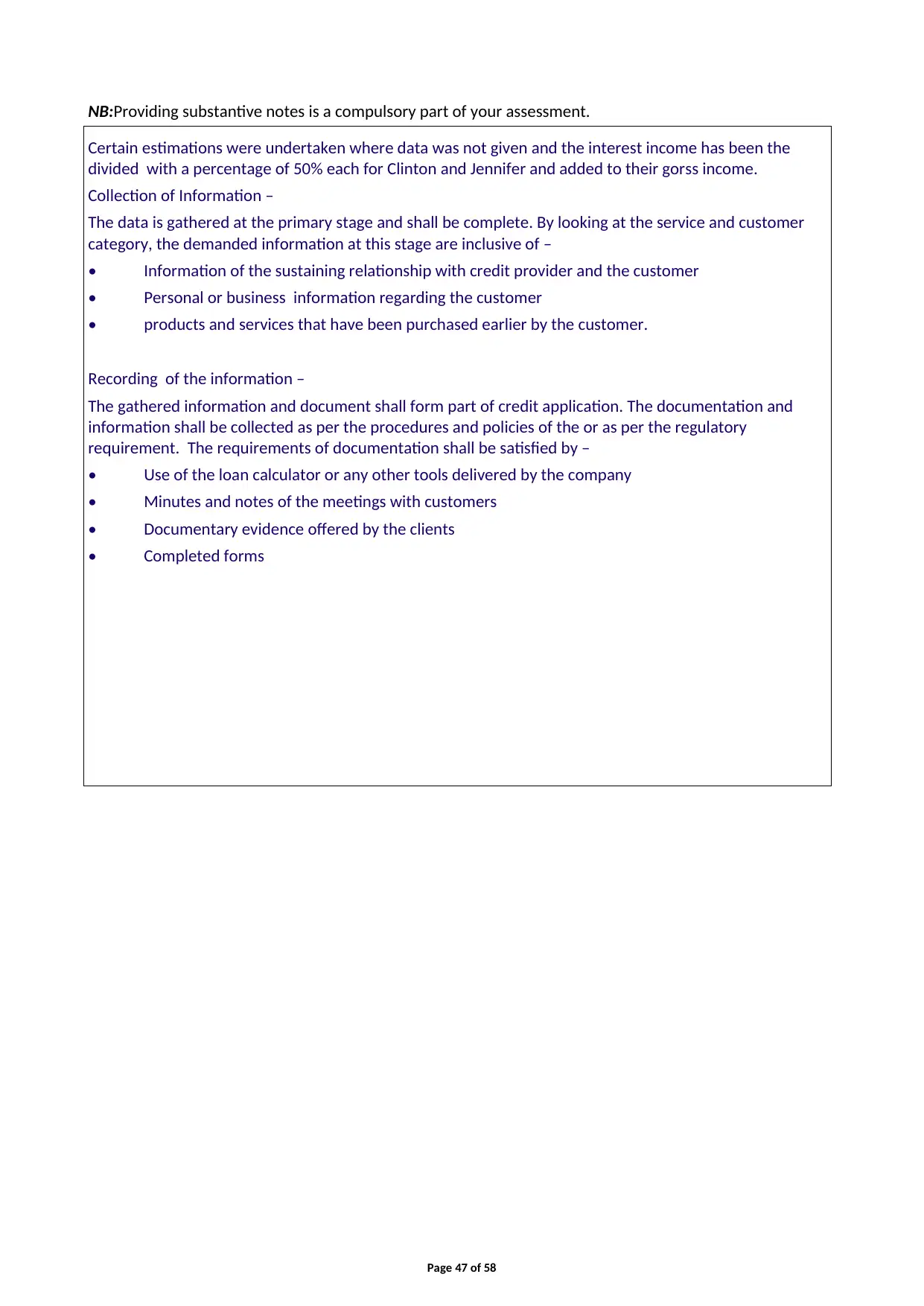

Task 2 — Gathering and documenting client information

Complete the Client Information Collection Tool (located at the end of the assignment in

Appendix 1)using the information provided in Case Study 1.

Note:Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback: Resubmission required?

No

Task 3 — Assessing the clients’ situation

1. Using theExcel or Online version of the Genworth Serviceability Calculator,calculate the Genworth NDI

for the borrowers. This will require you to enter all the data, including their future rental income.

<http://www.genworth.com.au/online-tools-forms-and-reports/lmi-tools/serviceability-calculator>.

Once you have completed the calculations, copy the data into the Serviceability Calculator

(located at the end of this assignment in Appendix 2).

Do not upload the Excel spreadsheet as a separate file.

Assessor feedback: Resubmission required?

No

Page 11 of 58

Complete the Client Information Collection Tool (located at the end of the assignment in

Appendix 1)using the information provided in Case Study 1.

Note:Any assumptions you make should be listed and should not be in conflict with the case study

information already provided.

Assessor feedback: Resubmission required?

No

Task 3 — Assessing the clients’ situation

1. Using theExcel or Online version of the Genworth Serviceability Calculator,calculate the Genworth NDI

for the borrowers. This will require you to enter all the data, including their future rental income.

<http://www.genworth.com.au/online-tools-forms-and-reports/lmi-tools/serviceability-calculator>.

Once you have completed the calculations, copy the data into the Serviceability Calculator

(located at the end of this assignment in Appendix 2).

Do not upload the Excel spreadsheet as a separate file.

Assessor feedback: Resubmission required?

No

Page 11 of 58

2. Based on the information provided in the case study and using the tools available to you

(e.g. loan calculators, including those available on lenders’ websites), provide an assessment

of the clients’ borrowing ability. Consider and comment on the following issues:

(a) the maximum loan using the Genworth calculator

(b) deposit requirements for the loan required

(c) combined net monthly income, less cost of living expense as specified by the borrower

(d) do they require Lenders Mortgage Insurance (LMI) and if so, how much will it cost?

Refer to Genworth LMI estimator for this figure

(e) any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

Provide data to support your comments and conclusions.

(No word count requirement for questions (a) to (d)).

Question (e) (100 words)

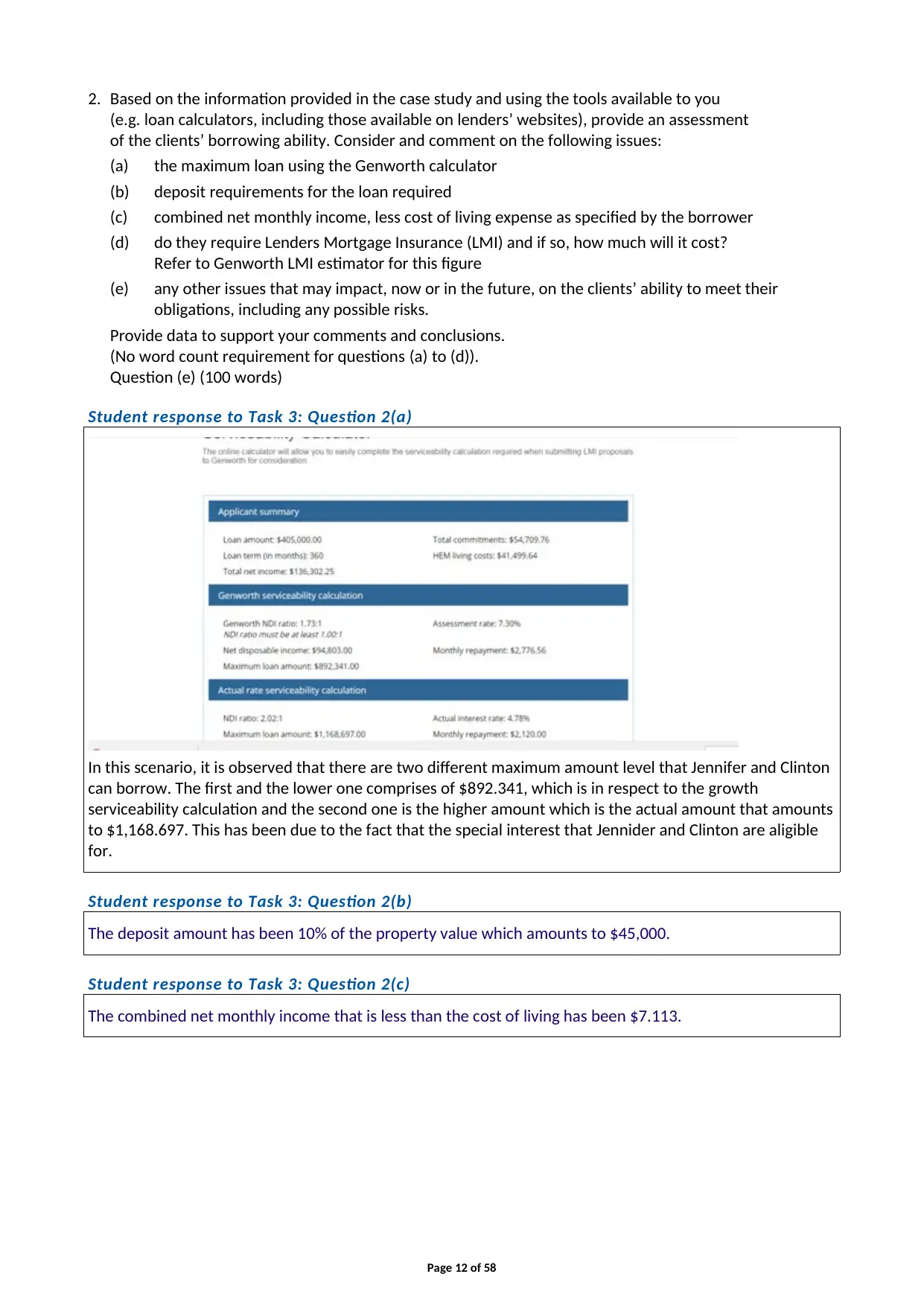

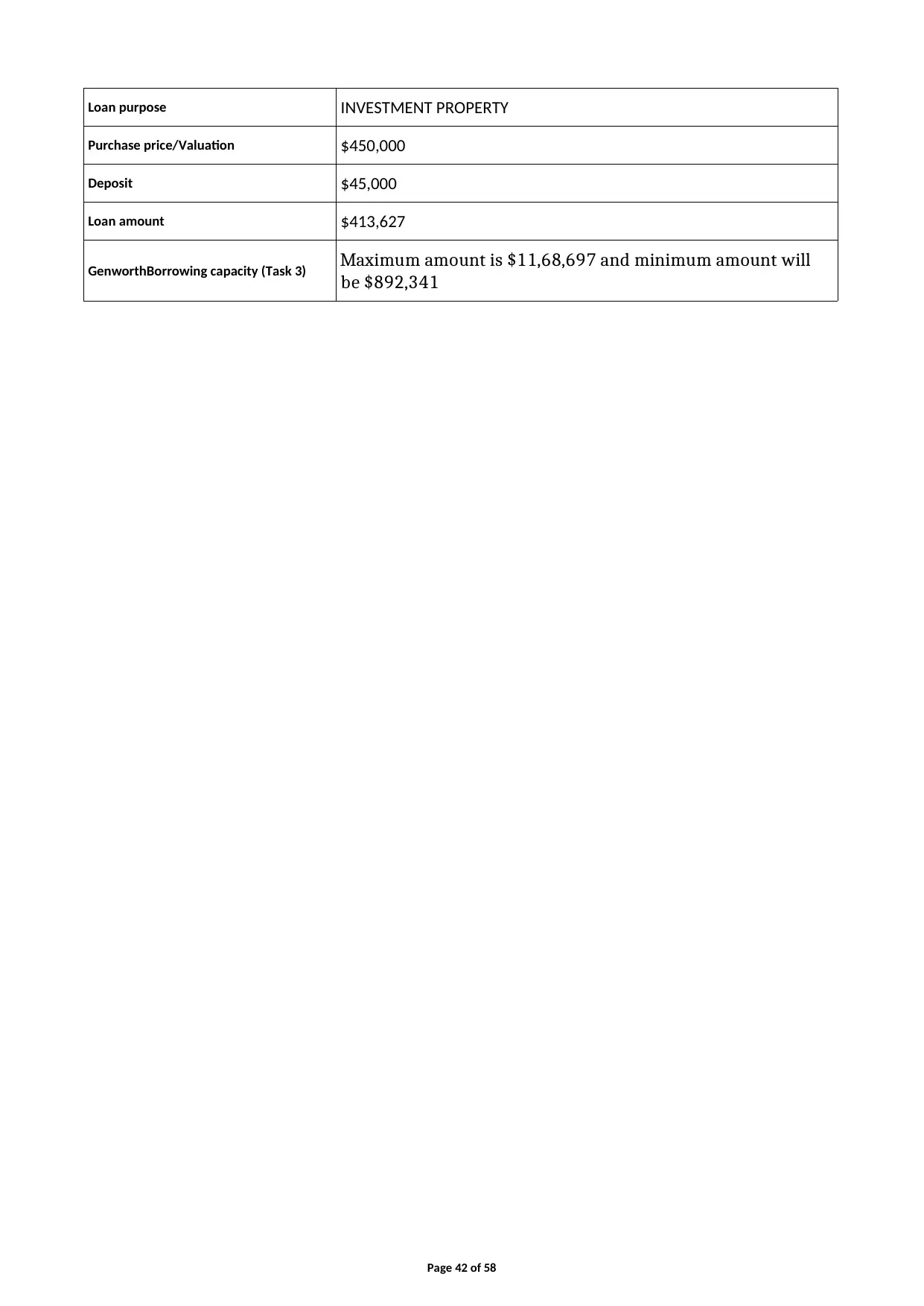

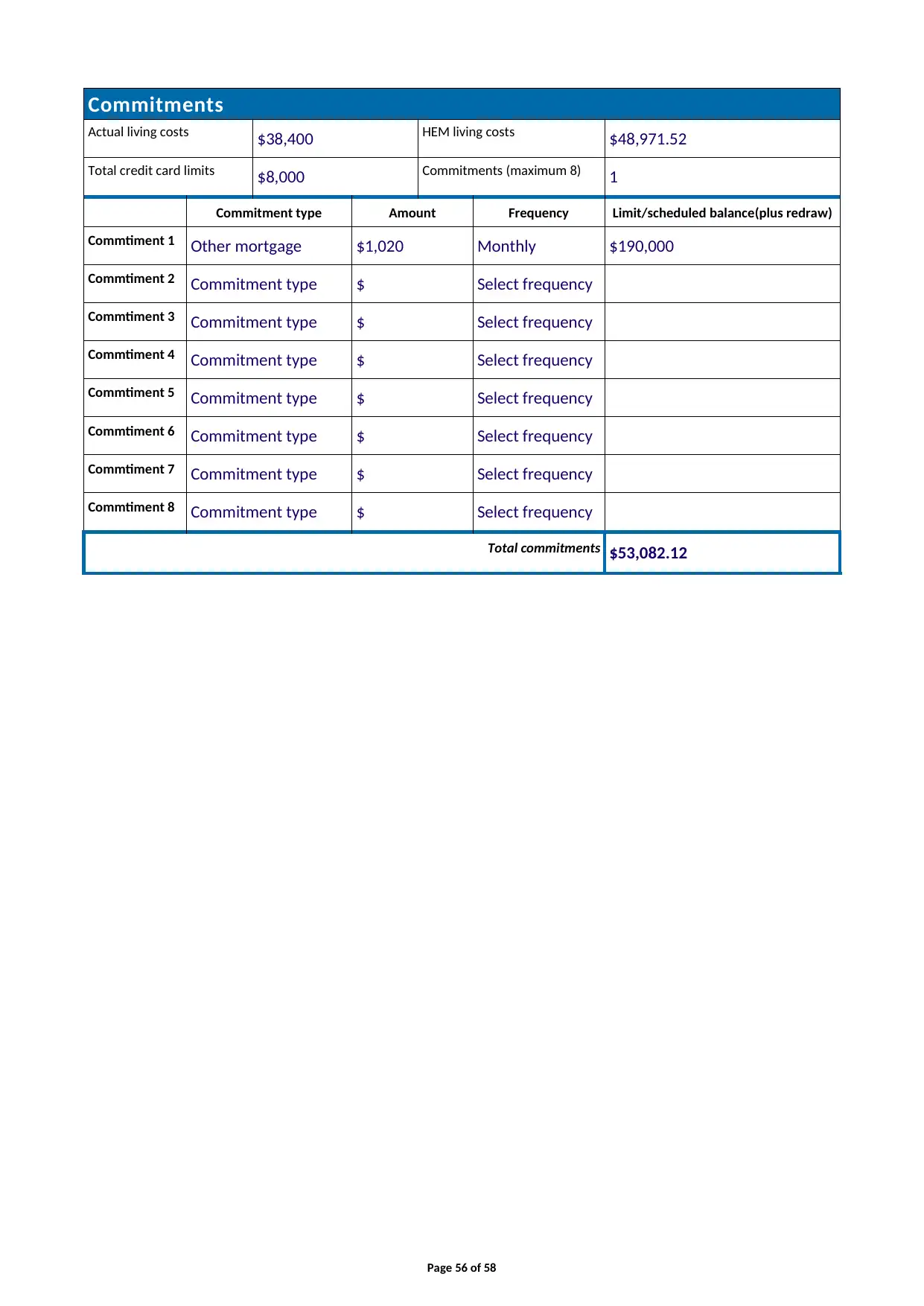

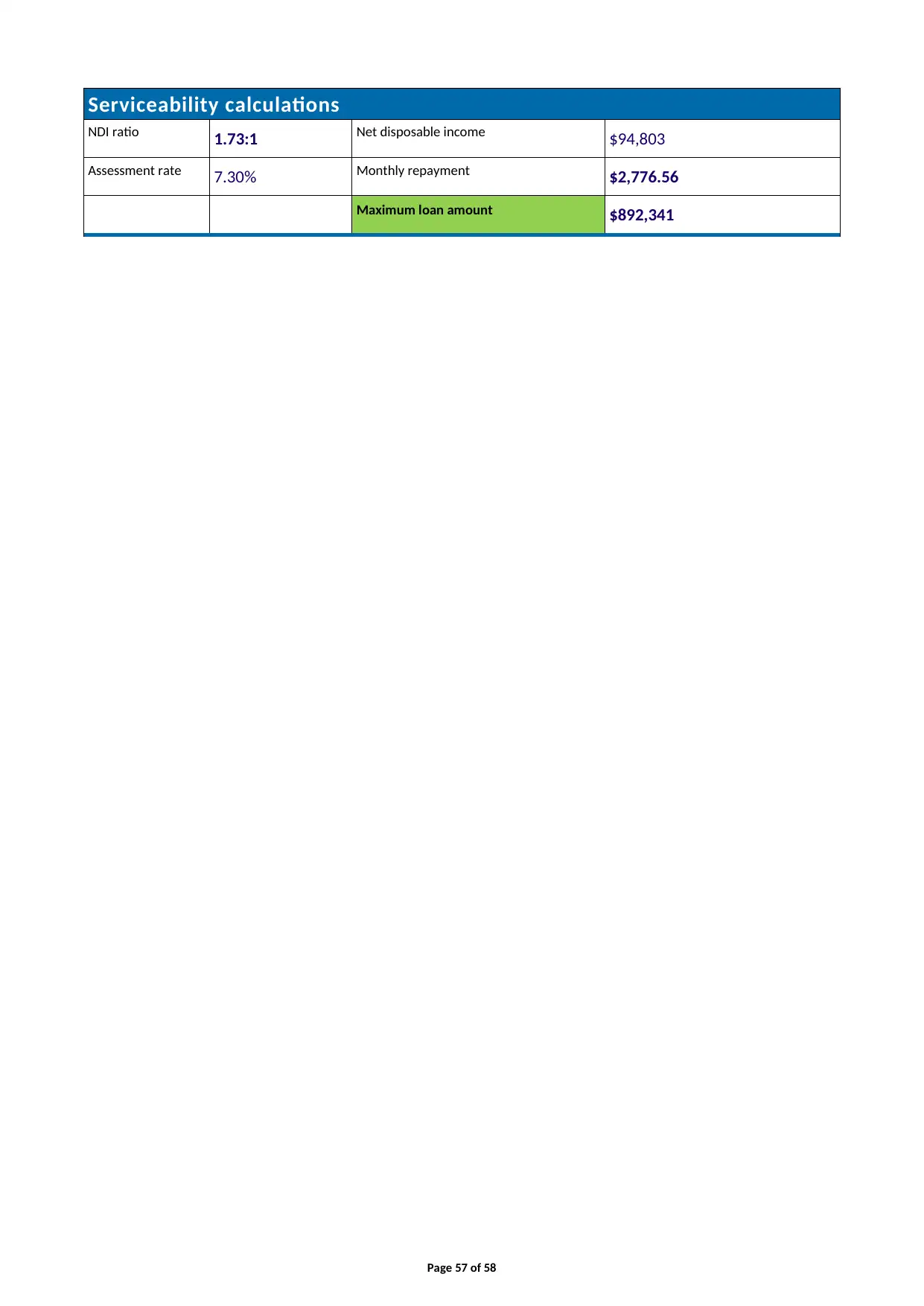

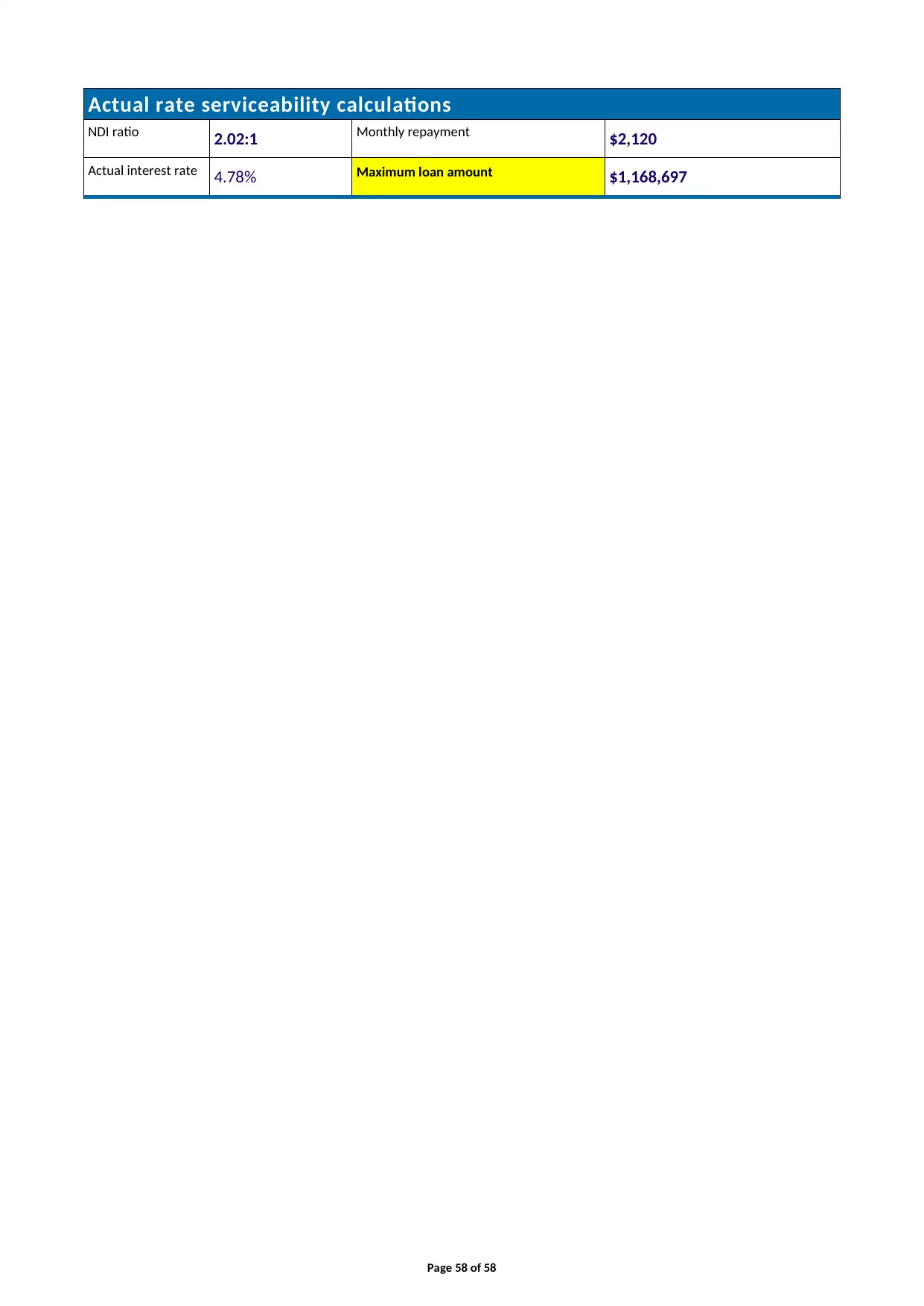

Student response to Task 3: Question 2(a)

In this scenario, it is observed that there are two different maximum amount level that Jennifer and Clinton

can borrow. The first and the lower one comprises of $892.341, which is in respect to the growth

serviceability calculation and the second one is the higher amount which is the actual amount that amounts

to $1,168.697. This has been due to the fact that the special interest that Jennider and Clinton are aligible

for.

Student response to Task 3: Question 2(b)

The deposit amount has been 10% of the property value which amounts to $45,000.

Student response to Task 3: Question 2(c)

The combined net monthly income that is less than the cost of living has been $7.113.

Page 12 of 58

(e.g. loan calculators, including those available on lenders’ websites), provide an assessment

of the clients’ borrowing ability. Consider and comment on the following issues:

(a) the maximum loan using the Genworth calculator

(b) deposit requirements for the loan required

(c) combined net monthly income, less cost of living expense as specified by the borrower

(d) do they require Lenders Mortgage Insurance (LMI) and if so, how much will it cost?

Refer to Genworth LMI estimator for this figure

(e) any other issues that may impact, now or in the future, on the clients’ ability to meet their

obligations, including any possible risks.

Provide data to support your comments and conclusions.

(No word count requirement for questions (a) to (d)).

Question (e) (100 words)

Student response to Task 3: Question 2(a)

In this scenario, it is observed that there are two different maximum amount level that Jennifer and Clinton

can borrow. The first and the lower one comprises of $892.341, which is in respect to the growth

serviceability calculation and the second one is the higher amount which is the actual amount that amounts

to $1,168.697. This has been due to the fact that the special interest that Jennider and Clinton are aligible

for.

Student response to Task 3: Question 2(b)

The deposit amount has been 10% of the property value which amounts to $45,000.

Student response to Task 3: Question 2(c)

The combined net monthly income that is less than the cost of living has been $7.113.

Page 12 of 58

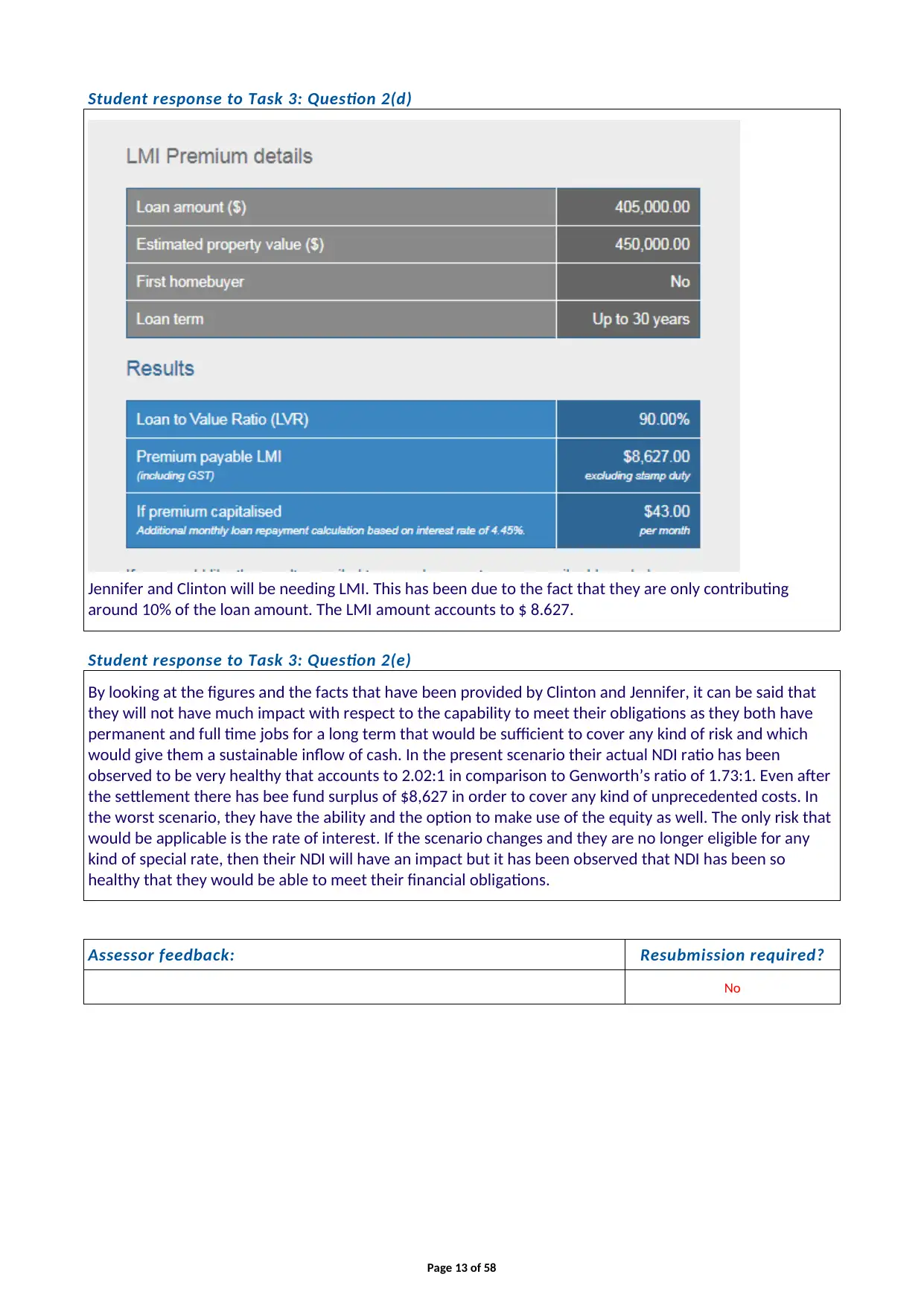

Student response to Task 3: Question 2(d)

Jennifer and Clinton will be needing LMI. This has been due to the fact that they are only contributing

around 10% of the loan amount. The LMI amount accounts to $ 8.627.

Student response to Task 3: Question 2(e)

By looking at the figures and the facts that have been provided by Clinton and Jennifer, it can be said that

they will not have much impact with respect to the capability to meet their obligations as they both have

permanent and full time jobs for a long term that would be sufficient to cover any kind of risk and which

would give them a sustainable inflow of cash. In the present scenario their actual NDI ratio has been

observed to be very healthy that accounts to 2.02:1 in comparison to Genworth’s ratio of 1.73:1. Even after

the settlement there has bee fund surplus of $8,627 in order to cover any kind of unprecedented costs. In

the worst scenario, they have the ability and the option to make use of the equity as well. The only risk that

would be applicable is the rate of interest. If the scenario changes and they are no longer eligible for any

kind of special rate, then their NDI will have an impact but it has been observed that NDI has been so

healthy that they would be able to meet their financial obligations.

Assessor feedback: Resubmission required?

No

Page 13 of 58

Jennifer and Clinton will be needing LMI. This has been due to the fact that they are only contributing

around 10% of the loan amount. The LMI amount accounts to $ 8.627.

Student response to Task 3: Question 2(e)

By looking at the figures and the facts that have been provided by Clinton and Jennifer, it can be said that

they will not have much impact with respect to the capability to meet their obligations as they both have

permanent and full time jobs for a long term that would be sufficient to cover any kind of risk and which

would give them a sustainable inflow of cash. In the present scenario their actual NDI ratio has been

observed to be very healthy that accounts to 2.02:1 in comparison to Genworth’s ratio of 1.73:1. Even after

the settlement there has bee fund surplus of $8,627 in order to cover any kind of unprecedented costs. In

the worst scenario, they have the ability and the option to make use of the equity as well. The only risk that

would be applicable is the rate of interest. If the scenario changes and they are no longer eligible for any

kind of special rate, then their NDI will have an impact but it has been observed that NDI has been so

healthy that they would be able to meet their financial obligations.

Assessor feedback: Resubmission required?

No

Page 13 of 58

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 4 — Using equity

1. Although Clinton and Jenniferhave chosen to borrow 90% LVR on the investment property plus the

LMI costs, what other option could you present that would avoid the cost of LMI?(100 words)

Student response to Task 4: Question 1

The Lender’s Mortgage Insurance (LMI) is a one-off insurance mode of payment which is to defend the

lenders in case the borrower is unable to make repayments and when the loan-to-valuation ratio (LVR) is

more than 80%. It can even be capitalised into the loan repayments. An increased deposit would mean a

smaller amount of loan so it will reduce the LVR. So in this scenario, Clinton and Jennfier have to reduce

LVR in order to avoid the LMI. They can utilise their equity or saving of the offset accounting to deposit

higher than 20%. Since their LVR is lower than 80%, they can evade the LMI cost which accounts to $8627.

Assessor feedback: Resubmission required?

No

2. Explain how it could be possible for Clinton and Jennifer to borrow 100% of the purchase price

($450,000) and obtain a tax benefit for the interest charged. (100 words)

Student response to Task 4: Question 2

The couple Jennifer and Clinton have an offset account of $180,000 and even they have an equity of

$610,000 on the home where they reside. It has to be noted that the couple still have a mortgage amount

of $190,000 on this house.

Therefore, in general it is seen that they can utilise their savings in order to pay off their loan for their

residential house and use their equity to receive 100% of the loan for the investment property. All of this

cost of interest will be tax deductible as the loan was taken out in order to purchase the investment

property.

Assessor feedback: Resubmission required?

No

Page 14 of 58

1. Although Clinton and Jenniferhave chosen to borrow 90% LVR on the investment property plus the

LMI costs, what other option could you present that would avoid the cost of LMI?(100 words)

Student response to Task 4: Question 1

The Lender’s Mortgage Insurance (LMI) is a one-off insurance mode of payment which is to defend the

lenders in case the borrower is unable to make repayments and when the loan-to-valuation ratio (LVR) is

more than 80%. It can even be capitalised into the loan repayments. An increased deposit would mean a

smaller amount of loan so it will reduce the LVR. So in this scenario, Clinton and Jennfier have to reduce

LVR in order to avoid the LMI. They can utilise their equity or saving of the offset accounting to deposit

higher than 20%. Since their LVR is lower than 80%, they can evade the LMI cost which accounts to $8627.

Assessor feedback: Resubmission required?

No

2. Explain how it could be possible for Clinton and Jennifer to borrow 100% of the purchase price

($450,000) and obtain a tax benefit for the interest charged. (100 words)

Student response to Task 4: Question 2

The couple Jennifer and Clinton have an offset account of $180,000 and even they have an equity of

$610,000 on the home where they reside. It has to be noted that the couple still have a mortgage amount

of $190,000 on this house.

Therefore, in general it is seen that they can utilise their savings in order to pay off their loan for their

residential house and use their equity to receive 100% of the loan for the investment property. All of this

cost of interest will be tax deductible as the loan was taken out in order to purchase the investment

property.

Assessor feedback: Resubmission required?

No

Page 14 of 58

Task 5 — Reasonable enquiries

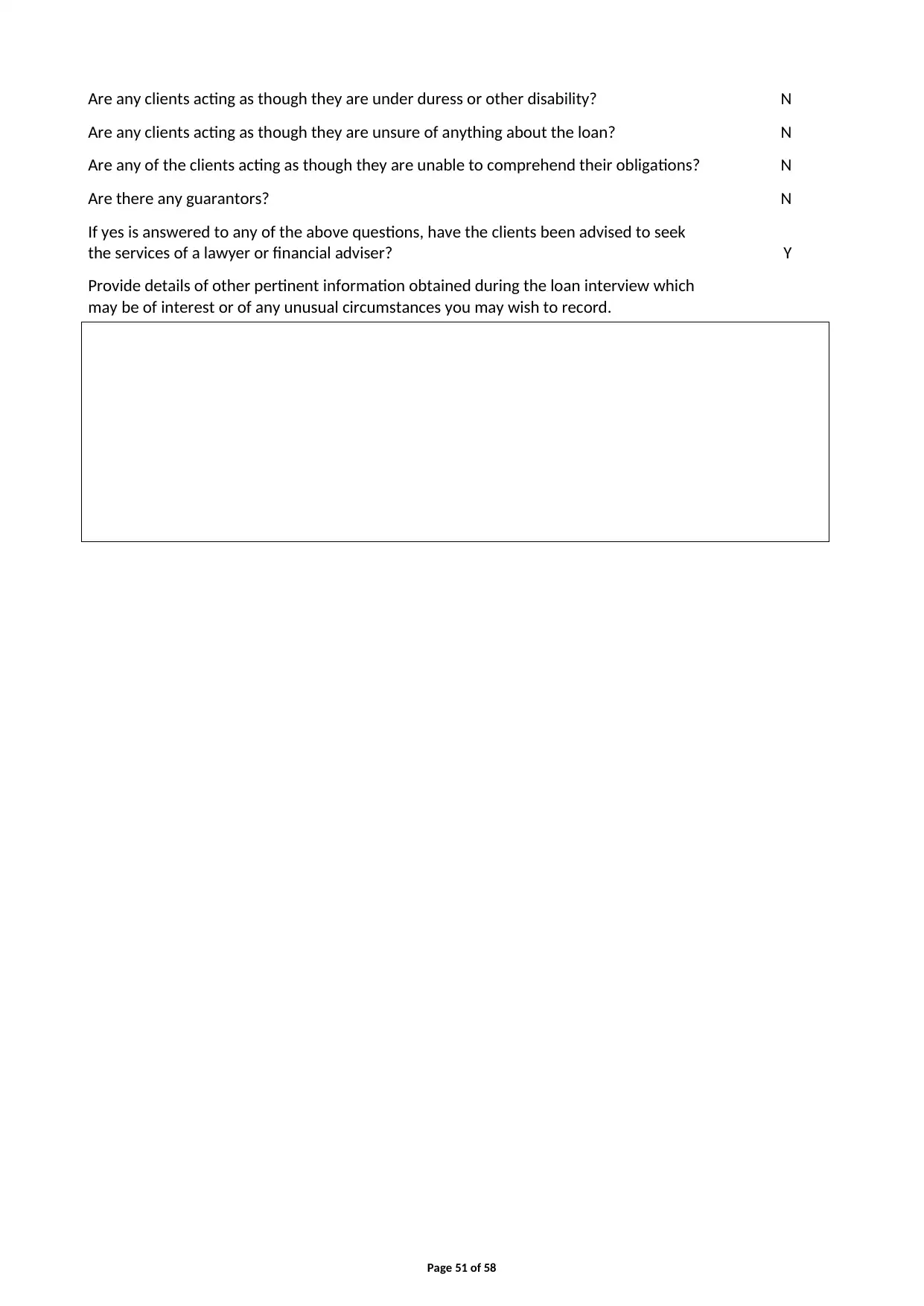

In the course of gathering information about the couple, you are required under the National Consumer

Credit Protection Act 2009 to make all ‘reasonable’ enquiries to determine a borrower’s objectives,

requirements and financial situation.

Identify at least six (6) ‘reasonable’ enquiries that you would make with the clients in the case study and

explain why these enquiries are important in terms of NCCP compliance. (200 words)

Student response to Task 5

The reasonable enquiries that would be undertaken by Clinton and Jennifer are detailed as follows:

(a) The amount of credit that is needed, the time period for the repayment and the intention whether

the demanded product has suitable characteristcs and the flexibility that can be made to ascertain

the objectives of Clinton and Jennifer.

(b) We would consider the main income source of the income inclusive of their salaries and the income

from interest by examining their pay slips and the tax returns in order to confirm that the couple

have the ability to repay the loan.

(c) The couple Clinton and Jennifer have given out their employment status and details and their

history with respect to their residence. We would even ask for their bank statement and examine

their credit history. This is to ascertain the likelihood that they would meet their obligaions for

repayment over the tenure of the loan.

(d) The valuations will be needed for the property that the couple would want to purchase as this will

be utilised by the banks to evaluate their degree of risk in granting the loan to the client.

(e) The appreciation of the risk by the borrower is related to the characteristics of a specific credit

product that requires to be noticed. We would even confirm with Clinton and Jennifer the amount

of deposit in order to compute the LVR as it would have an impact on their LMI.

(f) The reasonable foreseeable transformations in their financial and domestic scenarios that may

have an impact on their repayments, expenditure and income.

Assessor feedback: Resubmission required?

No

Page 15 of 58

In the course of gathering information about the couple, you are required under the National Consumer

Credit Protection Act 2009 to make all ‘reasonable’ enquiries to determine a borrower’s objectives,

requirements and financial situation.

Identify at least six (6) ‘reasonable’ enquiries that you would make with the clients in the case study and

explain why these enquiries are important in terms of NCCP compliance. (200 words)

Student response to Task 5

The reasonable enquiries that would be undertaken by Clinton and Jennifer are detailed as follows:

(a) The amount of credit that is needed, the time period for the repayment and the intention whether

the demanded product has suitable characteristcs and the flexibility that can be made to ascertain

the objectives of Clinton and Jennifer.

(b) We would consider the main income source of the income inclusive of their salaries and the income

from interest by examining their pay slips and the tax returns in order to confirm that the couple

have the ability to repay the loan.

(c) The couple Clinton and Jennifer have given out their employment status and details and their

history with respect to their residence. We would even ask for their bank statement and examine

their credit history. This is to ascertain the likelihood that they would meet their obligaions for

repayment over the tenure of the loan.

(d) The valuations will be needed for the property that the couple would want to purchase as this will

be utilised by the banks to evaluate their degree of risk in granting the loan to the client.

(e) The appreciation of the risk by the borrower is related to the characteristics of a specific credit

product that requires to be noticed. We would even confirm with Clinton and Jennifer the amount

of deposit in order to compute the LVR as it would have an impact on their LMI.

(f) The reasonable foreseeable transformations in their financial and domestic scenarios that may

have an impact on their repayments, expenditure and income.

Assessor feedback: Resubmission required?

No

Page 15 of 58

Task 6 — Recommendations

Note: Incorrect or uninformed advice can lead to significant financial detriment for your client and lead to

possible complaints against you for misleading or deceptive and misleading conduct.Therefore, all three (3)

questions of this task are ‘critical’ and you must demonstrate the required knowledge in each to be deemed

competent.

1. Based on the information presented in the case study, prepare a written proposal (letter or email)

outlining your proposal to clients. (750 words)

The style and language used in the proposal should be appropriate to the case study client’s level of

understanding. It should be clear and concise and written in language that is easy to understand,

while still remaining professional in its presentation.

You may base your response to this part of the assignment either on your knowledge of the products

currently offered by your own organisation or on the products offered by a lender you have researched.

In your proposal, you should include:

• a summary of your understanding of the clients’ needs (this could be an outline summary of their

proposed loan structure)

• a summary of their current financial position (use information from the ‘funds to complete’ template

completed in Appendix 1)

• the product options you have considered that meet their needs (research two lenders and detail

their loan features; you can use the internet or if working in industry, internal software)

• the option you recommend and the reasons for the recommendation — explain how the

recommended product meets the clients’ needs (refer to the case study and explain why you are

recommending this lender)

• disclosures applicable to the situation (a summary of likely applicable disclosures is adequate).

Include disclosures in the Credit Guide and any conflicts of interest.

Note: List any assumptions you have made about the clients and their situation in order to complete this

part of the assignment. There are no rules regarding the format. Please use the format that best suits

you. Should you require it, an example of a written proposal format has been provided in topic 3.3.Note

that the credit guide in your resources is not a ‘written proposal’.

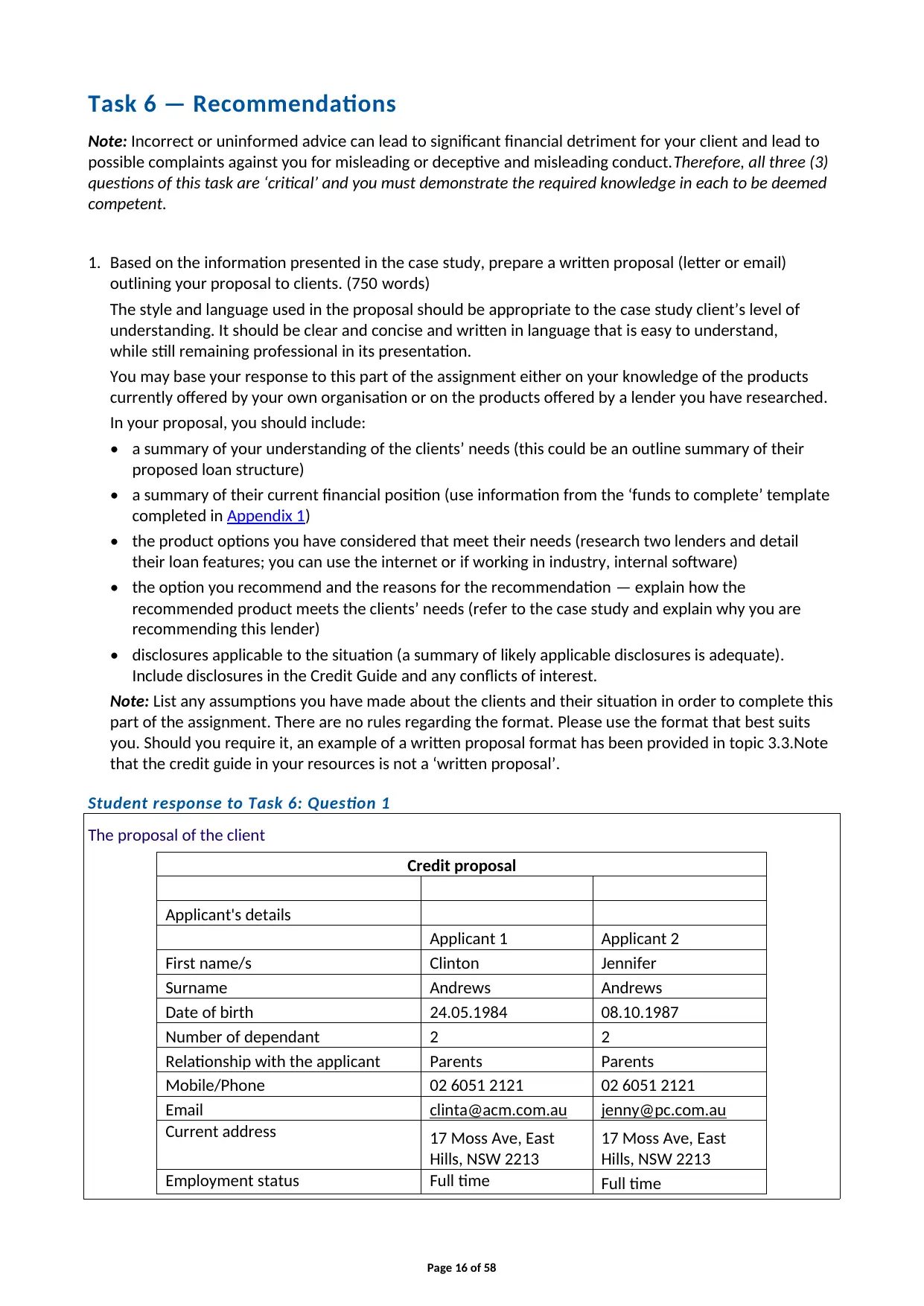

Student response to Task 6: Question 1

The proposal of the client

Credit proposal

Applicant's details

Applicant 1 Applicant 2

First name/s Clinton Jennifer

Surname Andrews Andrews

Date of birth 24.05.1984 08.10.1987

Number of dependant 2 2

Relationship with the applicant Parents Parents

Mobile/Phone 02 6051 2121 02 6051 2121

Email clinta@acm.com.au jenny@pc.com.au

Current address 17 Moss Ave, East

Hills, NSW 2213

17 Moss Ave, East

Hills, NSW 2213

Employment status Full time Full time

Page 16 of 58

Note: Incorrect or uninformed advice can lead to significant financial detriment for your client and lead to

possible complaints against you for misleading or deceptive and misleading conduct.Therefore, all three (3)

questions of this task are ‘critical’ and you must demonstrate the required knowledge in each to be deemed

competent.

1. Based on the information presented in the case study, prepare a written proposal (letter or email)

outlining your proposal to clients. (750 words)

The style and language used in the proposal should be appropriate to the case study client’s level of

understanding. It should be clear and concise and written in language that is easy to understand,

while still remaining professional in its presentation.

You may base your response to this part of the assignment either on your knowledge of the products

currently offered by your own organisation or on the products offered by a lender you have researched.

In your proposal, you should include:

• a summary of your understanding of the clients’ needs (this could be an outline summary of their

proposed loan structure)

• a summary of their current financial position (use information from the ‘funds to complete’ template

completed in Appendix 1)

• the product options you have considered that meet their needs (research two lenders and detail

their loan features; you can use the internet or if working in industry, internal software)

• the option you recommend and the reasons for the recommendation — explain how the

recommended product meets the clients’ needs (refer to the case study and explain why you are

recommending this lender)

• disclosures applicable to the situation (a summary of likely applicable disclosures is adequate).

Include disclosures in the Credit Guide and any conflicts of interest.

Note: List any assumptions you have made about the clients and their situation in order to complete this

part of the assignment. There are no rules regarding the format. Please use the format that best suits

you. Should you require it, an example of a written proposal format has been provided in topic 3.3.Note

that the credit guide in your resources is not a ‘written proposal’.

Student response to Task 6: Question 1

The proposal of the client

Credit proposal

Applicant's details

Applicant 1 Applicant 2

First name/s Clinton Jennifer

Surname Andrews Andrews

Date of birth 24.05.1984 08.10.1987

Number of dependant 2 2

Relationship with the applicant Parents Parents

Mobile/Phone 02 6051 2121 02 6051 2121

Email clinta@acm.com.au jenny@pc.com.au

Current address 17 Moss Ave, East

Hills, NSW 2213

17 Moss Ave, East

Hills, NSW 2213

Employment status Full time Full time

Page 16 of 58

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

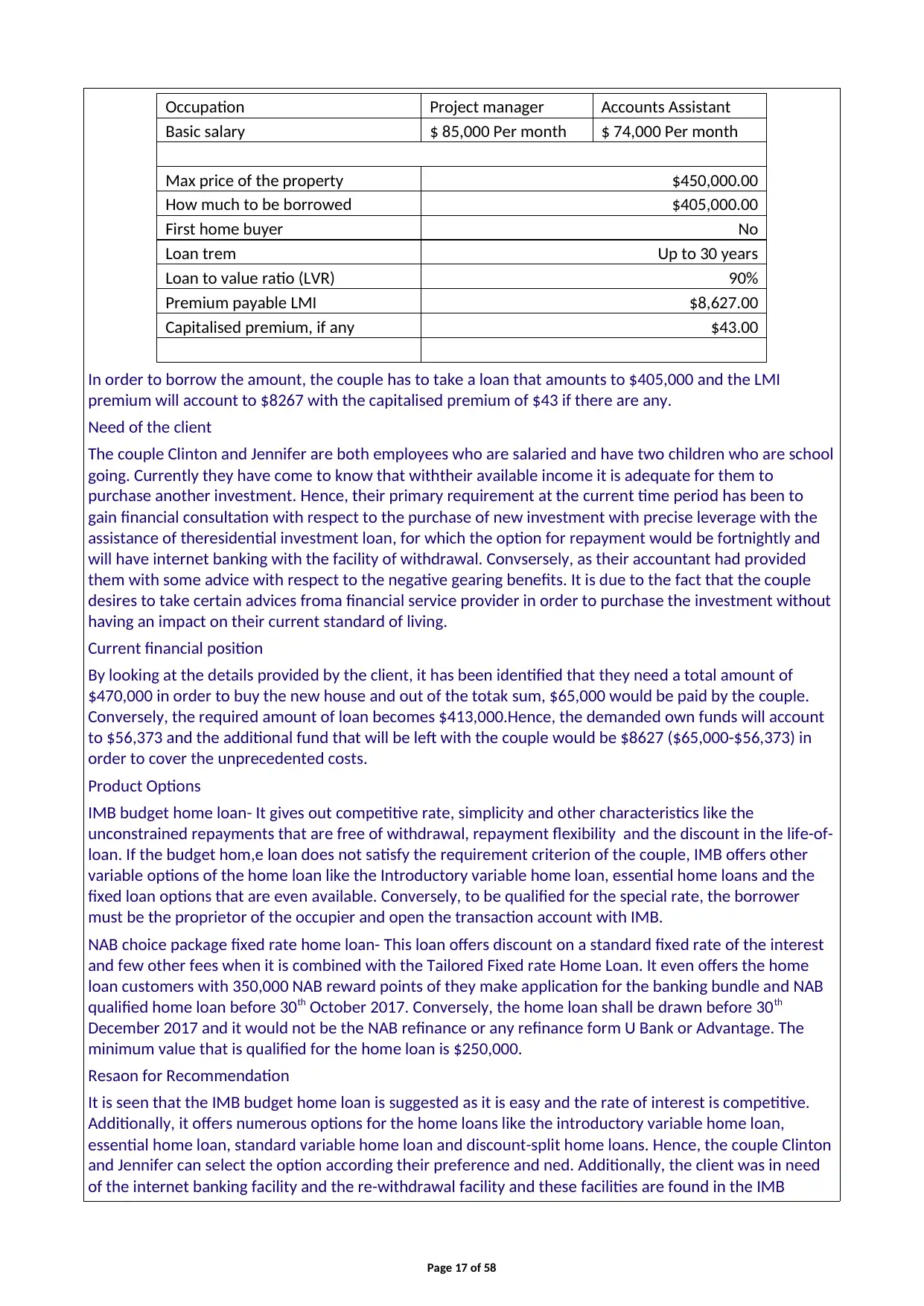

Occupation Project manager Accounts Assistant

Basic salary $ 85,000 Per month $ 74,000 Per month

Max price of the property $450,000.00

How much to be borrowed $405,000.00

First home buyer No

Loan trem Up to 30 years

Loan to value ratio (LVR) 90%

Premium payable LMI $8,627.00

Capitalised premium, if any $43.00

In order to borrow the amount, the couple has to take a loan that amounts to $405,000 and the LMI

premium will account to $8267 with the capitalised premium of $43 if there are any.

Need of the client

The couple Clinton and Jennifer are both employees who are salaried and have two children who are school

going. Currently they have come to know that withtheir available income it is adequate for them to

purchase another investment. Hence, their primary requirement at the current time period has been to

gain financial consultation with respect to the purchase of new investment with precise leverage with the

assistance of theresidential investment loan, for which the option for repayment would be fortnightly and

will have internet banking with the facility of withdrawal. Convsersely, as their accountant had provided

them with some advice with respect to the negative gearing benefits. It is due to the fact that the couple

desires to take certain advices froma financial service provider in order to purchase the investment without

having an impact on their current standard of living.

Current financial position

By looking at the details provided by the client, it has been identified that they need a total amount of

$470,000 in order to buy the new house and out of the totak sum, $65,000 would be paid by the couple.

Conversely, the required amount of loan becomes $413,000.Hence, the demanded own funds will account

to $56,373 and the additional fund that will be left with the couple would be $8627 ($65,000-$56,373) in

order to cover the unprecedented costs.

Product Options

IMB budget home loan- It gives out competitive rate, simplicity and other characteristics like the

unconstrained repayments that are free of withdrawal, repayment flexibility and the discount in the life-of-

loan. If the budget hom,e loan does not satisfy the requirement criterion of the couple, IMB offers other

variable options of the home loan like the Introductory variable home loan, essential home loans and the

fixed loan options that are even available. Conversely, to be qualified for the special rate, the borrower

must be the proprietor of the occupier and open the transaction account with IMB.

NAB choice package fixed rate home loan- This loan offers discount on a standard fixed rate of the interest

and few other fees when it is combined with the Tailored Fixed rate Home Loan. It even offers the home

loan customers with 350,000 NAB reward points of they make application for the banking bundle and NAB

qualified home loan before 30th October 2017. Conversely, the home loan shall be drawn before 30th

December 2017 and it would not be the NAB refinance or any refinance form U Bank or Advantage. The

minimum value that is qualified for the home loan is $250,000.

Resaon for Recommendation

It is seen that the IMB budget home loan is suggested as it is easy and the rate of interest is competitive.

Additionally, it offers numerous options for the home loans like the introductory variable home loan,

essential home loan, standard variable home loan and discount-split home loans. Hence, the couple Clinton

and Jennifer can select the option according their preference and ned. Additionally, the client was in need

of the internet banking facility and the re-withdrawal facility and these facilities are found in the IMB

Page 17 of 58

Basic salary $ 85,000 Per month $ 74,000 Per month

Max price of the property $450,000.00

How much to be borrowed $405,000.00

First home buyer No

Loan trem Up to 30 years

Loan to value ratio (LVR) 90%

Premium payable LMI $8,627.00

Capitalised premium, if any $43.00

In order to borrow the amount, the couple has to take a loan that amounts to $405,000 and the LMI

premium will account to $8267 with the capitalised premium of $43 if there are any.

Need of the client

The couple Clinton and Jennifer are both employees who are salaried and have two children who are school

going. Currently they have come to know that withtheir available income it is adequate for them to

purchase another investment. Hence, their primary requirement at the current time period has been to

gain financial consultation with respect to the purchase of new investment with precise leverage with the

assistance of theresidential investment loan, for which the option for repayment would be fortnightly and

will have internet banking with the facility of withdrawal. Convsersely, as their accountant had provided

them with some advice with respect to the negative gearing benefits. It is due to the fact that the couple

desires to take certain advices froma financial service provider in order to purchase the investment without

having an impact on their current standard of living.

Current financial position

By looking at the details provided by the client, it has been identified that they need a total amount of

$470,000 in order to buy the new house and out of the totak sum, $65,000 would be paid by the couple.

Conversely, the required amount of loan becomes $413,000.Hence, the demanded own funds will account

to $56,373 and the additional fund that will be left with the couple would be $8627 ($65,000-$56,373) in

order to cover the unprecedented costs.

Product Options

IMB budget home loan- It gives out competitive rate, simplicity and other characteristics like the

unconstrained repayments that are free of withdrawal, repayment flexibility and the discount in the life-of-

loan. If the budget hom,e loan does not satisfy the requirement criterion of the couple, IMB offers other

variable options of the home loan like the Introductory variable home loan, essential home loans and the

fixed loan options that are even available. Conversely, to be qualified for the special rate, the borrower

must be the proprietor of the occupier and open the transaction account with IMB.

NAB choice package fixed rate home loan- This loan offers discount on a standard fixed rate of the interest

and few other fees when it is combined with the Tailored Fixed rate Home Loan. It even offers the home

loan customers with 350,000 NAB reward points of they make application for the banking bundle and NAB

qualified home loan before 30th October 2017. Conversely, the home loan shall be drawn before 30th

December 2017 and it would not be the NAB refinance or any refinance form U Bank or Advantage. The

minimum value that is qualified for the home loan is $250,000.

Resaon for Recommendation

It is seen that the IMB budget home loan is suggested as it is easy and the rate of interest is competitive.

Additionally, it offers numerous options for the home loans like the introductory variable home loan,

essential home loan, standard variable home loan and discount-split home loans. Hence, the couple Clinton

and Jennifer can select the option according their preference and ned. Additionally, the client was in need

of the internet banking facility and the re-withdrawal facility and these facilities are found in the IMB

Page 17 of 58

Budget home loan.

On the other hand, the NAB choice package fixed rate home loan is suggested as it offers discount on the

standard fixed interest rate and few other fees when it is combined with the Tailored fixed rate home loan.

They would be able to receive 350,000 NAB reward points as it is very clear from the fact finder that they

are wanting to apply for the loan immediately that is before 30th October and it is estimated that the loan

will be drawn vefore 30thDecenber 2017. Additionally, the minimum qualified amount for the loan is

$250,000 and the requirement of the couple on the other hand has been $413,000.

Disclosures

By looking at the demands and the financial situation of Clinton and Jennifer, it is advisable that before

making application for the loanfrom any of the sources discussed above, the couple should understand

their needs and presence clearly. They would even take into consideration the schedule of repayment and

the rate of interest. Additionally, they shall look into the other sources before finalising anything that is

associated with the loan.

Conflict of Interest

One of the significant conflict of interest is that if the couple take the loan from NAB choice package fixed

rate of home loan, the provider of credit assistance would receive a commission at 1% of the total loan

amount. The other conflict of interest is that the accountant and the tax consultant of the couple is a close

relative to the solicitor. Hence, there are chances that the solicitor would not examine the client documents

in details.

Assessor feedback: Resubmission required?

No

2. (a) Describe the home buyer assistance scheme benefits and stamp duty concessions that are

available in your State or Territory, who would be eligible and what would be their benefit?

Note: Please identify what State or Territory you are from in your answer.(150 words).

Student response to Task 6: Question 2(a)

In New South Wales, the first purchaser of the loan is qualified for the home purchaser grants and

the concessions from the government.

The exemption of duty on the prevailing and the new homes are valued up to the value of $650,000

and on the vacant land accounting to $350,000.

The duty exemption on the new homes and the prevailing one are valued among the amount of

$650,000 and $800,000 and on the vacant land that accounts between $350,000 and $450,000.

If the amount of the new loan is lower than $600,000 or where the purchaser enters into the the

comprehensive buiding agreement, or is the proprietor for which the value is lower then $750,000,

then $10,000 would be available to the first purchaser as grant.

Assessor feedback: Resubmission required?

No

Page 18 of 58

On the other hand, the NAB choice package fixed rate home loan is suggested as it offers discount on the

standard fixed interest rate and few other fees when it is combined with the Tailored fixed rate home loan.

They would be able to receive 350,000 NAB reward points as it is very clear from the fact finder that they

are wanting to apply for the loan immediately that is before 30th October and it is estimated that the loan

will be drawn vefore 30thDecenber 2017. Additionally, the minimum qualified amount for the loan is

$250,000 and the requirement of the couple on the other hand has been $413,000.

Disclosures

By looking at the demands and the financial situation of Clinton and Jennifer, it is advisable that before

making application for the loanfrom any of the sources discussed above, the couple should understand

their needs and presence clearly. They would even take into consideration the schedule of repayment and

the rate of interest. Additionally, they shall look into the other sources before finalising anything that is

associated with the loan.

Conflict of Interest

One of the significant conflict of interest is that if the couple take the loan from NAB choice package fixed

rate of home loan, the provider of credit assistance would receive a commission at 1% of the total loan

amount. The other conflict of interest is that the accountant and the tax consultant of the couple is a close

relative to the solicitor. Hence, there are chances that the solicitor would not examine the client documents

in details.

Assessor feedback: Resubmission required?

No

2. (a) Describe the home buyer assistance scheme benefits and stamp duty concessions that are

available in your State or Territory, who would be eligible and what would be their benefit?

Note: Please identify what State or Territory you are from in your answer.(150 words).

Student response to Task 6: Question 2(a)

In New South Wales, the first purchaser of the loan is qualified for the home purchaser grants and

the concessions from the government.

The exemption of duty on the prevailing and the new homes are valued up to the value of $650,000

and on the vacant land accounting to $350,000.

The duty exemption on the new homes and the prevailing one are valued among the amount of

$650,000 and $800,000 and on the vacant land that accounts between $350,000 and $450,000.

If the amount of the new loan is lower than $600,000 or where the purchaser enters into the the

comprehensive buiding agreement, or is the proprietor for which the value is lower then $750,000,

then $10,000 would be available to the first purchaser as grant.

Assessor feedback: Resubmission required?

No

Page 18 of 58

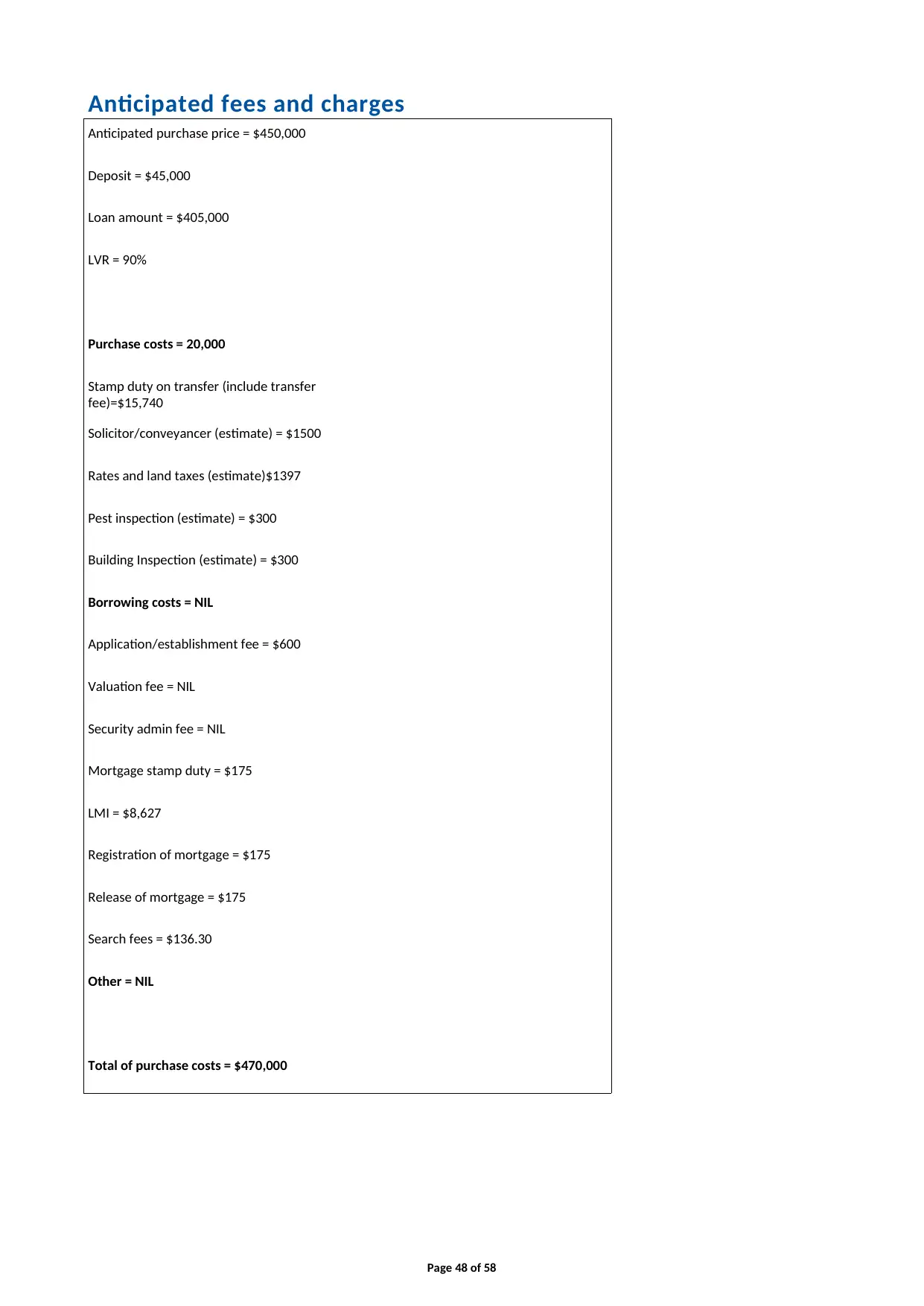

2. (b) Provide a summary of all additional costs and fees, that the couple should be made aware of.

(100 words)

Note: When considering your response, you can refer to your completed Appendix 1

which lists fees expected and charges. Apart from known costs, you can estimate other costs

(i.e. pest inspection, rate etc.).

Student response to Task 6: Question 2(b)

The other fees and the expenses that the couple Clinton and Jennifer should be aware of are as follows:

Rate and taxes- $1397

Stamp Duty- $15.740

Pest Inspection- $300

Building Inspaection- $300

Application and Establishment fee- $138.80

Mortgage Stamp Duty- $175

Assessor feedback: Resubmission required?

No

Page 19 of 58

(100 words)

Note: When considering your response, you can refer to your completed Appendix 1

which lists fees expected and charges. Apart from known costs, you can estimate other costs

(i.e. pest inspection, rate etc.).

Student response to Task 6: Question 2(b)

The other fees and the expenses that the couple Clinton and Jennifer should be aware of are as follows:

Rate and taxes- $1397

Stamp Duty- $15.740

Pest Inspection- $300

Building Inspaection- $300

Application and Establishment fee- $138.80

Mortgage Stamp Duty- $175

Assessor feedback: Resubmission required?

No

Page 19 of 58

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 7 — Clinton and Jennifer’s professional network

1. Name three (3) parties Clinton and Jennifer may wish you, as their broker, to keep informed of the

progress of their finance application who are not directly involved in the loan processing? (100 words)

Student response to Task 7: Question 1

Being a mortgage broker for the client Clinton and Jennifer, the following three parties who play a

significant role in the proceeding of the loan and they are as follows:

I) Solicitor/ Conveyancer: The legal component of the purchase of the property is taken care by a qualified

and licensed conveyancer. If they are ven a solicitor, then they can give out legal consultations as well.

Their function has been to construct the documents to guarantee that ownership transfer of the property

has satisfied the legal demands in Clinton and Jennifer’s territory or state.

II)Accountant and financial consultant: :A skilled personnel who assists the individuals handle their finances

by giving out advices and suggestions on finance associated issues likemortgages, insurance, investments,

college savings, taxes and retirement and estate planningrelying on the requests of the client. In this

scenario, Cliton and Jennifer is purchasing an investment property and their accountant has been providing

certain suggestions in association to negative gearing benefits.

III)Mortgage Broker: The mortgage broker is the link between the lender and the borrower (generally a

bank), who will discuss the loan on the borrower’s behalf. They undertake the work of the research on

numerous products in the market and legal jobs and also the method of settlement. Generally, the

motgagebroker does not levy any charge from broker as they receive commission from from the lender.

Assessor feedback: Resubmission required?

No

Page 20 of 58

1. Name three (3) parties Clinton and Jennifer may wish you, as their broker, to keep informed of the

progress of their finance application who are not directly involved in the loan processing? (100 words)

Student response to Task 7: Question 1

Being a mortgage broker for the client Clinton and Jennifer, the following three parties who play a

significant role in the proceeding of the loan and they are as follows:

I) Solicitor/ Conveyancer: The legal component of the purchase of the property is taken care by a qualified

and licensed conveyancer. If they are ven a solicitor, then they can give out legal consultations as well.

Their function has been to construct the documents to guarantee that ownership transfer of the property

has satisfied the legal demands in Clinton and Jennifer’s territory or state.

II)Accountant and financial consultant: :A skilled personnel who assists the individuals handle their finances

by giving out advices and suggestions on finance associated issues likemortgages, insurance, investments,

college savings, taxes and retirement and estate planningrelying on the requests of the client. In this

scenario, Cliton and Jennifer is purchasing an investment property and their accountant has been providing

certain suggestions in association to negative gearing benefits.

III)Mortgage Broker: The mortgage broker is the link between the lender and the borrower (generally a

bank), who will discuss the loan on the borrower’s behalf. They undertake the work of the research on

numerous products in the market and legal jobs and also the method of settlement. Generally, the

motgagebroker does not levy any charge from broker as they receive commission from from the lender.

Assessor feedback: Resubmission required?

No

Page 20 of 58

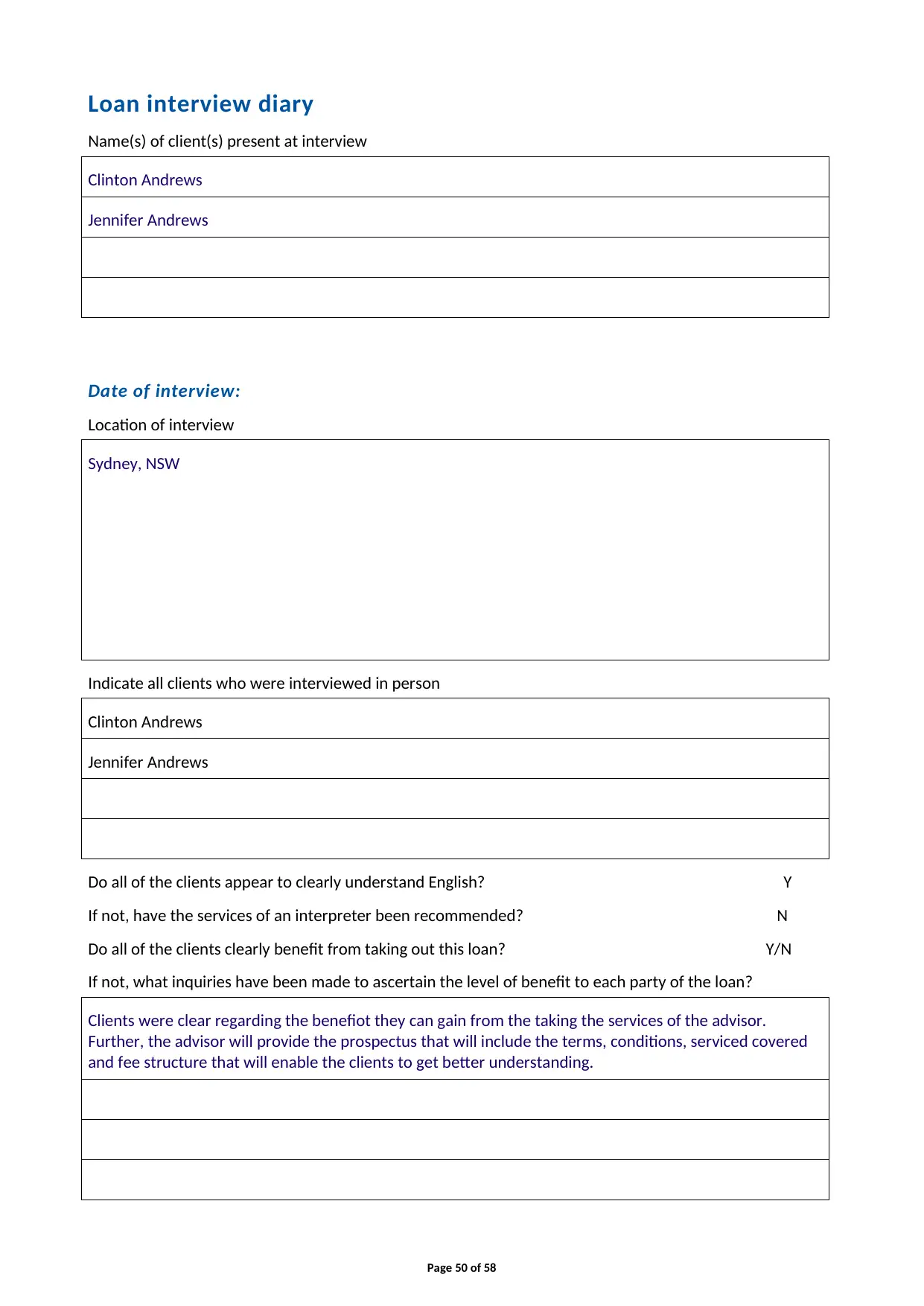

2. It is important that as a broker you understand the loan application process and how to effectively

manage the progress of a loan application. Outline to Clinton and Jennifer the process that will occur

from your first meeting through to post settlement. Please present nine (9) steps in the process.

(350 words)

Student response to Task 7: Question 2

After meeting with the client, Clinton and Jennifer, being the broker to the client, it is essential to assure

what is the mode with the help of which they would want to communicate with the broker and provide the

suitable time to contact them. After the confirmation of the time, it is eesntial to make sure that the

following nine steps in the method of granting a loan for them.

1) Gathering information: The primary application review is a key function for the purpose of the

processing of the loan that has beenfunctioning smoothly and on the closage of the time. This is the time

when togather all precise documentation from the couple , in order to restrict unprecendented delays and

problems.

2) Application for the loan:It is essential for the client to fill up the form for the loan application. Here

it is requested to provide the current bank statements, payslips and illumination of credit activity of the

customer as an assisting documents. It is essential toconverse with the client about the kind of product and

rate of interest as it is looking for it.

3) Get pre-approval: After evaluating the entire loan application ,the lender can provide a pre-

approval letter.It is a written letter that makes confirmation that the purchase price of the property that

can be bought by the couple.

4) Assesement process: During the security evaluation the lender may be in need of a valuation on the

property that is being purchased. It is possible to arrange a valuation on their part for the property

purchase.

5) Receiving approval: In this scenario, the home loan is approved unconditionally, a formal Letter of

Offer that will be given by the lender. After the offer has been granted, couplecan legallybe committed to

go through with the sale.

6) Insurance: After the approval of the loan, and before the closure of the documents can be

documented and it is needed to order an insurance binder for the new property. It is suitable to contact

with the insurance representative before time so that they are ready and do not postpone the closure.

7) Closing Disclosure: It is inclusive of the loan tenujre, estimated monthly payments, and the amount

Clinton and Jennifer would pay in fees and other expenses to attain their mortgage (closing costs). It is a

regulation to have the Closing Disclosure at least before three working days.

8) Loan settlement: It is essential Inform the couple about the loan settlement. In this scenario the

documentation of the loan is issued to the solicitor/conveyancer of the couple, who will then liaise with the

lender to program a date of settlement. The first loan repayment will generally be needed in one month

after the date of settlement.

9) Loan servicing: The steps undertaken to prevail a loan from the time it is closed until it has been

paid off, for instance billing Clinton and Jennifer, collection of payments, and making changes in the

agreement.

Assessor feedback: Resubmission required?

No

Page 21 of 58

manage the progress of a loan application. Outline to Clinton and Jennifer the process that will occur

from your first meeting through to post settlement. Please present nine (9) steps in the process.

(350 words)

Student response to Task 7: Question 2

After meeting with the client, Clinton and Jennifer, being the broker to the client, it is essential to assure

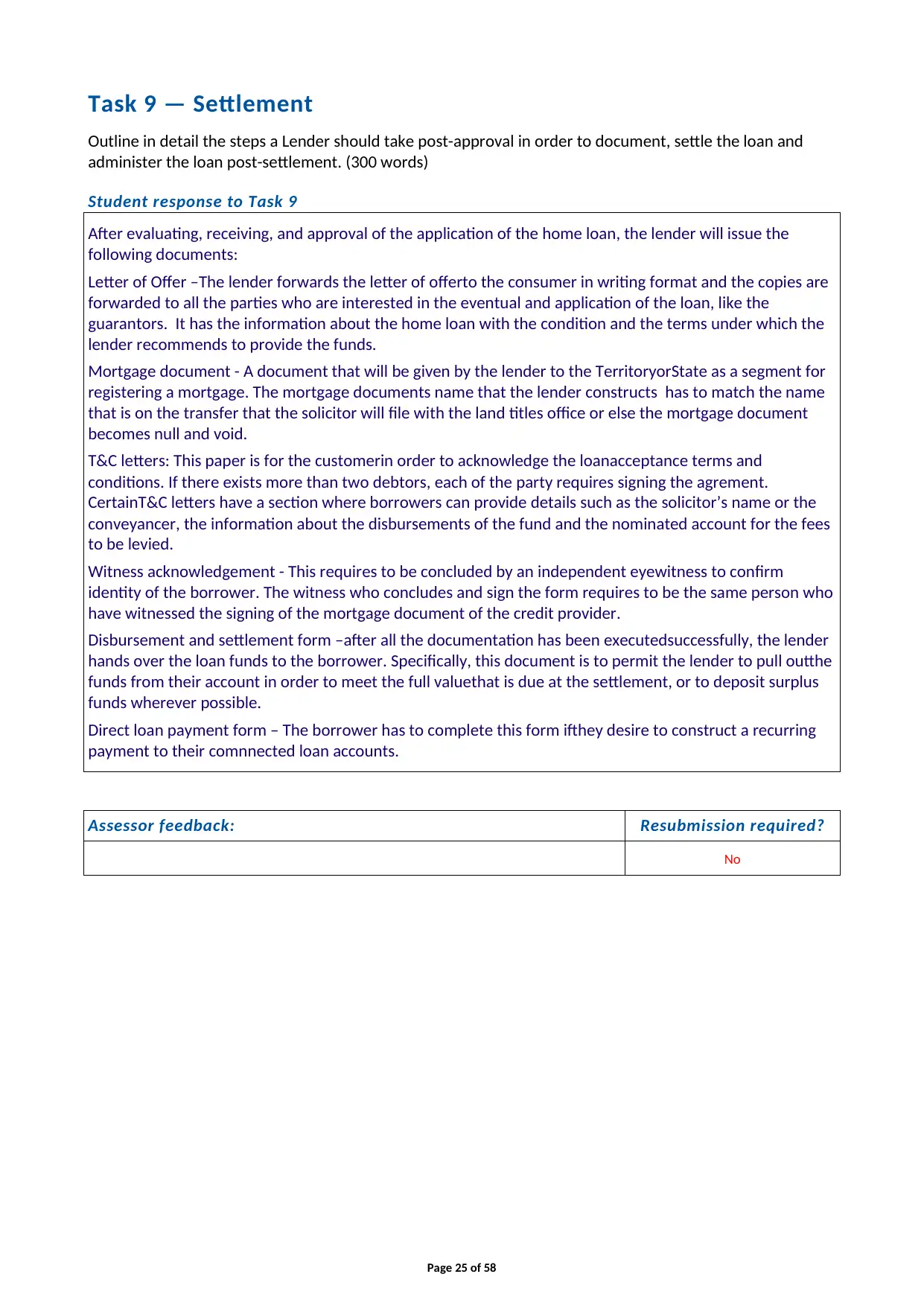

what is the mode with the help of which they would want to communicate with the broker and provide the