Chinese Business: OFDI Growth Path, Strategies and Challenges Analysis

VerifiedAdded on 2020/05/16

|14

|3331

|52

Essay

AI Summary

This essay provides a comprehensive analysis of China's outward foreign direct investment (OFDI). It begins with an introduction to the rapid economic transformation of China and its integration into the global economy, highlighting the shift from an inward to an outward FDI focus. The essay explores the historical growth path of Chinese OFDI, supported by figures and statistics, and examines the motivations behind this growth, including government support, technological advancements, and strategic asset seeking. It further delves into the strategies employed by Chinese enterprises, such as joint ventures, wholly owned subsidiaries, and cross-border acquisitions. The essay also addresses the challenges faced by Chinese OFDI, including cultural differences and lack of skilled personnel, and concludes with a future forecast, projecting China's potential to become the world's largest investor. The essay offers recommendations for sustaining and enhancing Chinese OFDI, such as diversification and strategic investment in high-yielding assets, and emphasizes the importance of regional investment to reduce risks and promote portfolio diversity. The essay is a valuable resource for understanding the dynamics of Chinese OFDI.

Running head: CHINESE BUSINESS

Chinese business

Name of the student

Name of the University

Author note

Chinese business

Name of the student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CHINESE BUSINESS

Introduction:

During the last two decades Chinese economy has faced remarkable growth and rapid

transformation in their economy. With the help of the Open Door policy by the Chinese central

government during the 1978, the Chinese economy has started to integrate itself with the global

economy (Huang et al. 2016). China started to participate in the international trade in greater

magnitude and within three decades it becomes the second largest country in economic terms in

the world. With the accession of Chinese economy in the world trade organisation (WTO) the

growth rate accelerated to a great extent (Hopewell 2015). With higher Ease of Doing Business

index, china gained huge amount of Foreign Direct Investment (FDI) from the western

economies that has aided the economy to become where it is now (Ahmad, Musheer and Singh

2017). However, during the last one decade, a special phenomenon has arisen in the case of

Chinese economy, where the outward Foreign Direct Investment (OFDI) of the country has

suppressed the Inward FDI of the Chinese economy. This has highlighted that china is moving

towards from a loan taker to loan giver through transforming itself into an investor (Chang et al.

2016). Despite the fact that OFDI of the Chinese economy has been rising subsequently over the

year, various Chinese organisations has fall short of their objectives. Thus, it is important to

discuss about the OFDI of the Chinese economy and trace out the factors that are affecting it.

This essay will provide a framework that will discuss the OFDI activities of the Chinese

economy and it will highlight various motivating factors of the same. Besides this, the essay will

highlight the Chinese OFDI growth path and try to forecast the future of Chinese economy which

is aiming to become a global investor.

Chinese OFDI growth path:

Introduction:

During the last two decades Chinese economy has faced remarkable growth and rapid

transformation in their economy. With the help of the Open Door policy by the Chinese central

government during the 1978, the Chinese economy has started to integrate itself with the global

economy (Huang et al. 2016). China started to participate in the international trade in greater

magnitude and within three decades it becomes the second largest country in economic terms in

the world. With the accession of Chinese economy in the world trade organisation (WTO) the

growth rate accelerated to a great extent (Hopewell 2015). With higher Ease of Doing Business

index, china gained huge amount of Foreign Direct Investment (FDI) from the western

economies that has aided the economy to become where it is now (Ahmad, Musheer and Singh

2017). However, during the last one decade, a special phenomenon has arisen in the case of

Chinese economy, where the outward Foreign Direct Investment (OFDI) of the country has

suppressed the Inward FDI of the Chinese economy. This has highlighted that china is moving

towards from a loan taker to loan giver through transforming itself into an investor (Chang et al.

2016). Despite the fact that OFDI of the Chinese economy has been rising subsequently over the

year, various Chinese organisations has fall short of their objectives. Thus, it is important to

discuss about the OFDI of the Chinese economy and trace out the factors that are affecting it.

This essay will provide a framework that will discuss the OFDI activities of the Chinese

economy and it will highlight various motivating factors of the same. Besides this, the essay will

highlight the Chinese OFDI growth path and try to forecast the future of Chinese economy which

is aiming to become a global investor.

Chinese OFDI growth path:

2CHINESE BUSINESS

Traditional perspective of the FDI from the developed nation argues that it is sourced by

the developed nations in order to exploit the cheap raw materials and labour in the developing

nations. However, when it comes to OFDI, then it differs fundamentally. Owing to the fact that

most of the outward FDI of the developing nations are disbursed to the developed countries with

a substantial portion to the developing economy it aids to identify strategic assets (Xiongfeng et

al 2016). Besides this, OFDI from the developing nations like china it aids to find out managerial

and technological skill instead offering them superior technology grown in the home nation.

When it comes to Chinese economy, then it has been observed that the country has fostered itself

as one of the fastest growing economy with an annual growth rate of 6.7% (Blanchard, Oliver

and Francesco 2016). According to the (Naughton and Barry 1996) with ever increasing amount

of international trade, the country has become one of the nations that has highest amount of

foreign exchange in its reserves. Besides this, statistically there has been substantial growth in

the GDP of the country during the last two decades, which has aided the nation to become where

it is now.

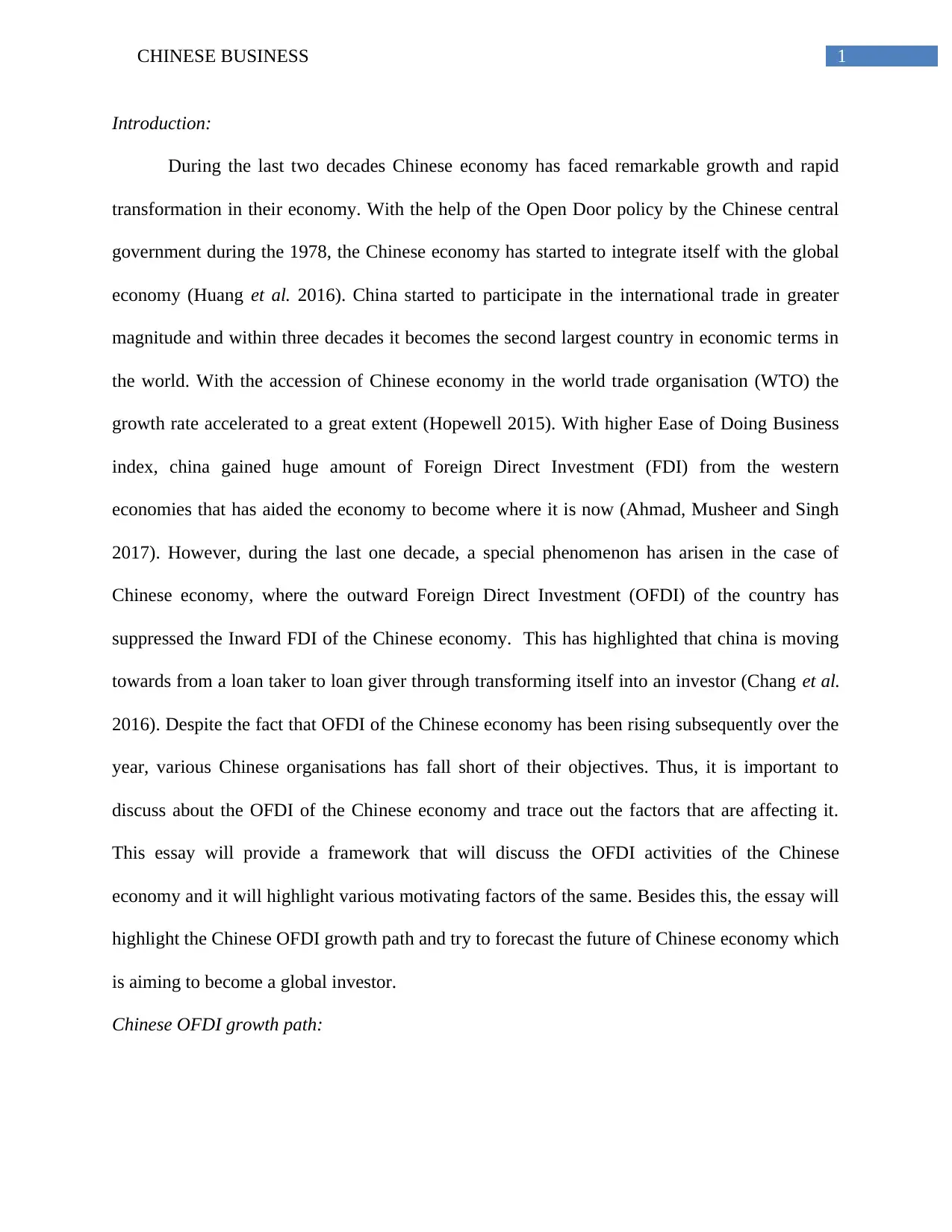

Moving forward, it can be seen that these key factors has aided the country to have higher

amount of the OFDI. From figure 1, it can be seen that Chinese economy has increased its OFDI

largely over the period 2000 to 2013. As one of the emerging nations, the country has increased

its OFDI from 2000 to 2013 by 44% ("MOFCOM Department of Outward Investment And

Economic Cooperation Comments On China’s Outward Investment Cooperation In January-

October 2017 -" 2018). According to the same source, Chinese OFDI has increased by 14.1%

from the previous year to the 102.9 USD; whereas the inward FDI increased to 119.6 billion

USD by 1.7%.

Traditional perspective of the FDI from the developed nation argues that it is sourced by

the developed nations in order to exploit the cheap raw materials and labour in the developing

nations. However, when it comes to OFDI, then it differs fundamentally. Owing to the fact that

most of the outward FDI of the developing nations are disbursed to the developed countries with

a substantial portion to the developing economy it aids to identify strategic assets (Xiongfeng et

al 2016). Besides this, OFDI from the developing nations like china it aids to find out managerial

and technological skill instead offering them superior technology grown in the home nation.

When it comes to Chinese economy, then it has been observed that the country has fostered itself

as one of the fastest growing economy with an annual growth rate of 6.7% (Blanchard, Oliver

and Francesco 2016). According to the (Naughton and Barry 1996) with ever increasing amount

of international trade, the country has become one of the nations that has highest amount of

foreign exchange in its reserves. Besides this, statistically there has been substantial growth in

the GDP of the country during the last two decades, which has aided the nation to become where

it is now.

Moving forward, it can be seen that these key factors has aided the country to have higher

amount of the OFDI. From figure 1, it can be seen that Chinese economy has increased its OFDI

largely over the period 2000 to 2013. As one of the emerging nations, the country has increased

its OFDI from 2000 to 2013 by 44% ("MOFCOM Department of Outward Investment And

Economic Cooperation Comments On China’s Outward Investment Cooperation In January-

October 2017 -" 2018). According to the same source, Chinese OFDI has increased by 14.1%

from the previous year to the 102.9 USD; whereas the inward FDI increased to 119.6 billion

USD by 1.7%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CHINESE BUSINESS

Till 2013, most of the Chinese OFDI was aimed towards the Asian economies, however,

over the time china has reduced its investment to 50% in this region ("The Story Behind The

Shine | Michaelhill.Com" 2018). With higher amount of capital and monetary stock, the

economy has become potent enough to penetrate the European economies. Presently, European

countries have become the second largest recipient of the Chinese investment and it has given

the china an upper hand to diversify its investment further leading towards greater sustainability.

Figure 1: OFDI of emerging economies

Source: ("China’s Overseas Investments, Explained in 10 Graphics | World Resources Institute"

2018)

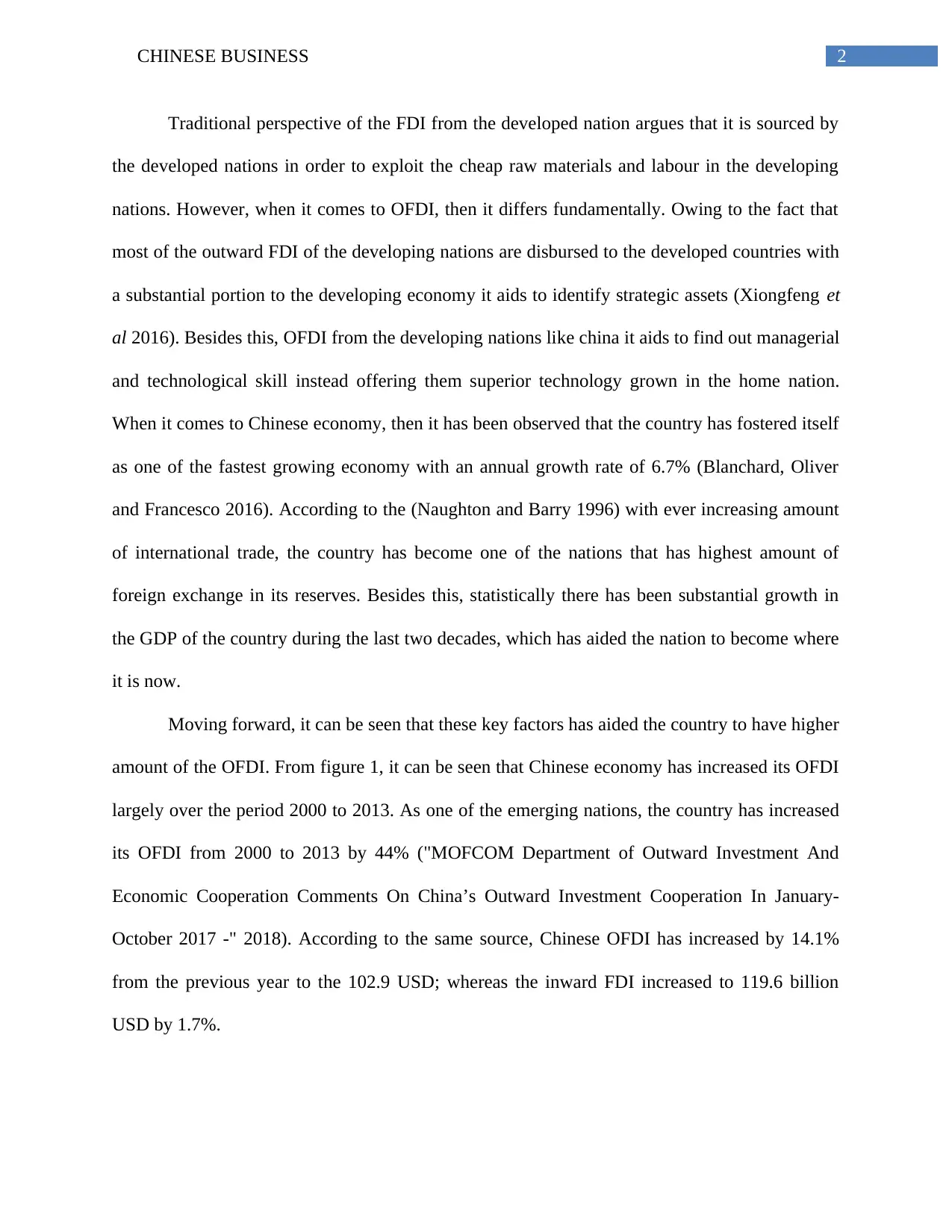

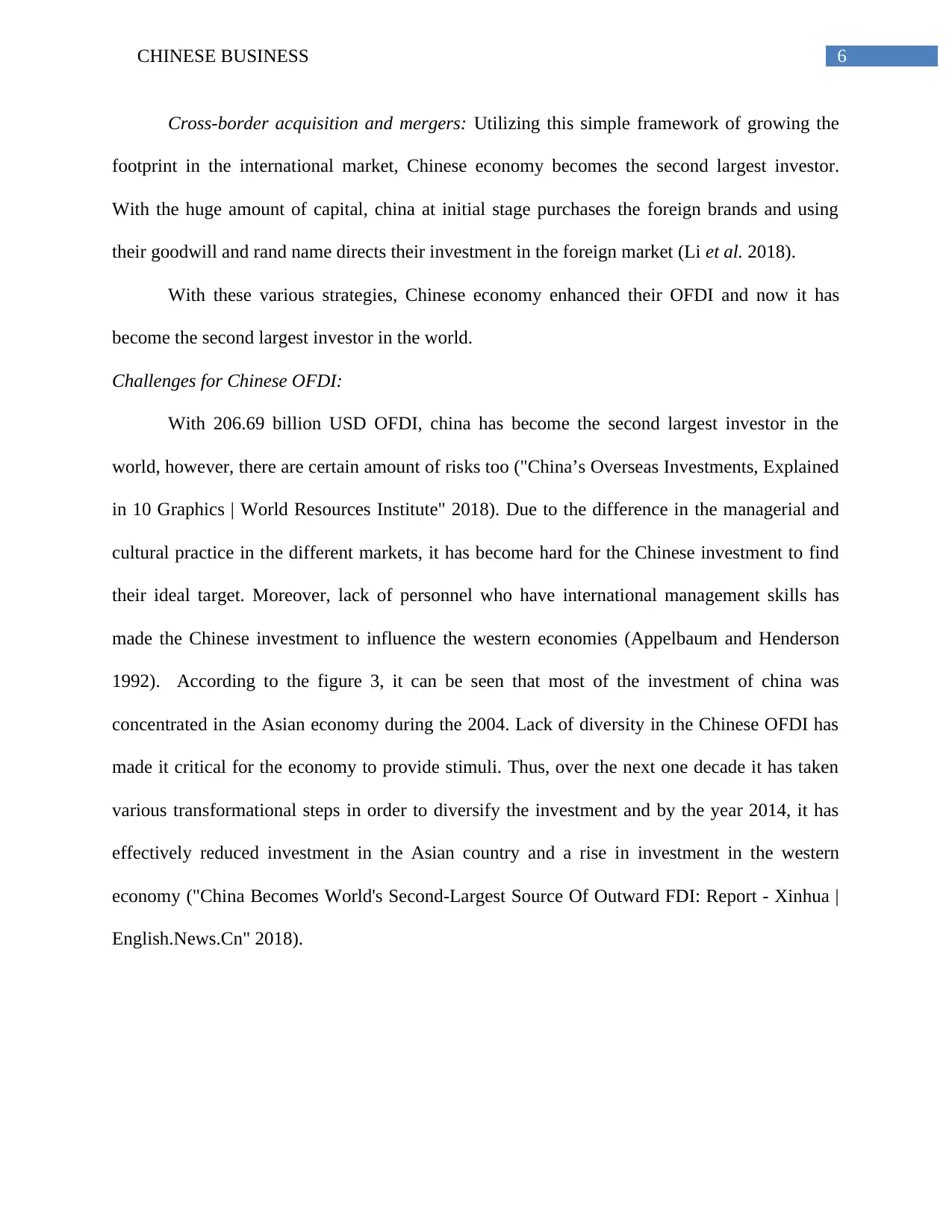

Figure 2 suggests that OFDI from Chinese economy is highly concentrated towards the

Asian economy. Almost 68% of its OFDI is directed towards the Asian economy and second

largest share of the outward FDI of Chinese economy is enjoyed by the Latin America

("MOFCOM Department Of Outward Investment And Economic Cooperation Comments On

China’S Outward Investment Cooperation In January-October 2017 -" 2018). Natural resource

seeking tendency of the Chinese economy has provided the economy a stimuli to have higher

level of OFDI, though the per capita resource availability is much lower. Thus to ensure constant

Till 2013, most of the Chinese OFDI was aimed towards the Asian economies, however,

over the time china has reduced its investment to 50% in this region ("The Story Behind The

Shine | Michaelhill.Com" 2018). With higher amount of capital and monetary stock, the

economy has become potent enough to penetrate the European economies. Presently, European

countries have become the second largest recipient of the Chinese investment and it has given

the china an upper hand to diversify its investment further leading towards greater sustainability.

Figure 1: OFDI of emerging economies

Source: ("China’s Overseas Investments, Explained in 10 Graphics | World Resources Institute"

2018)

Figure 2 suggests that OFDI from Chinese economy is highly concentrated towards the

Asian economy. Almost 68% of its OFDI is directed towards the Asian economy and second

largest share of the outward FDI of Chinese economy is enjoyed by the Latin America

("MOFCOM Department Of Outward Investment And Economic Cooperation Comments On

China’S Outward Investment Cooperation In January-October 2017 -" 2018). Natural resource

seeking tendency of the Chinese economy has provided the economy a stimuli to have higher

level of OFDI, though the per capita resource availability is much lower. Thus to ensure constant

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CHINESE BUSINESS

flow of natural resource, Chinese economy has raised the outward FDI to the Asian nations that

are enriched with the resources (You, Kefei and Offiong 2015).

Figure 2: continental distribution of china’s OFDI

Source: ("China’s Overseas Investments, Explained in 10 Graphics | World Resources Institute"

2018)

Strong state control over the market and economy has helped the country to have higher

level of OFDI (Ash and Kueh 1996). Chinese multinational enterprises have boosted the OFDI

over the year to reach 184.3 billion USD. Presently the china invested in 5,410 enterprises in the

160 countries around the world and the overseas personnel dispatched count reached to 974,000

("China Becomes World's Second-Largest Source of Outward FDI: Report - Xinhua |

English.News.Cn" 2018). Considering this, it can be said that growth path of the Chinese OFDI

is highly agile and with constant governmental intervention makes it sustainable.

flow of natural resource, Chinese economy has raised the outward FDI to the Asian nations that

are enriched with the resources (You, Kefei and Offiong 2015).

Figure 2: continental distribution of china’s OFDI

Source: ("China’s Overseas Investments, Explained in 10 Graphics | World Resources Institute"

2018)

Strong state control over the market and economy has helped the country to have higher

level of OFDI (Ash and Kueh 1996). Chinese multinational enterprises have boosted the OFDI

over the year to reach 184.3 billion USD. Presently the china invested in 5,410 enterprises in the

160 countries around the world and the overseas personnel dispatched count reached to 974,000

("China Becomes World's Second-Largest Source of Outward FDI: Report - Xinhua |

English.News.Cn" 2018). Considering this, it can be said that growth path of the Chinese OFDI

is highly agile and with constant governmental intervention makes it sustainable.

5CHINESE BUSINESS

Motivation for rise in Chinese OFDI:

Various factors have helped the Chinese economy to have higher level of OFDI, which

are as follow:

Government support and export promotion programs to raise the level of OFDI

Constant research and development has helped the economy to come up with superior

technologies compared to its rivals

Entrepreneurial desire and slow start doctrine in core competencies has helped the

economy to penetrate the international market properly with flow of outward investment

(Pradhan 2017)

Strategic asset and natural asset seeking interest of the Chinese economy is one of the

main reasons that acted as the stimuli to the Chinese OFDI

Strategies for increasing Chinese OFDI:

During 2004, china was the leading country that has highest amount of FDI, however,

over the next one decade it has transformed itself as the second largest FDI investor. There are

various strategies that helped the country to avail this position, which are as follows (Wang et al.

2018):

IJV route: International joint venture is one of the best ways to make strong foot print in

the foreign market. Chins utilized this strategy and makes strong partnership with the foreign

nations ranging from Asian countries to western countries (Wang et al. 2018).

Wholly owned subsidiaries: Using this strategy, Chinese enterprises during initial stage

gain international recognition with their products and services and then direct their investments

to the foreign market (Piperopoulos et al. 2018).

Motivation for rise in Chinese OFDI:

Various factors have helped the Chinese economy to have higher level of OFDI, which

are as follow:

Government support and export promotion programs to raise the level of OFDI

Constant research and development has helped the economy to come up with superior

technologies compared to its rivals

Entrepreneurial desire and slow start doctrine in core competencies has helped the

economy to penetrate the international market properly with flow of outward investment

(Pradhan 2017)

Strategic asset and natural asset seeking interest of the Chinese economy is one of the

main reasons that acted as the stimuli to the Chinese OFDI

Strategies for increasing Chinese OFDI:

During 2004, china was the leading country that has highest amount of FDI, however,

over the next one decade it has transformed itself as the second largest FDI investor. There are

various strategies that helped the country to avail this position, which are as follows (Wang et al.

2018):

IJV route: International joint venture is one of the best ways to make strong foot print in

the foreign market. Chins utilized this strategy and makes strong partnership with the foreign

nations ranging from Asian countries to western countries (Wang et al. 2018).

Wholly owned subsidiaries: Using this strategy, Chinese enterprises during initial stage

gain international recognition with their products and services and then direct their investments

to the foreign market (Piperopoulos et al. 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CHINESE BUSINESS

Cross-border acquisition and mergers: Utilizing this simple framework of growing the

footprint in the international market, Chinese economy becomes the second largest investor.

With the huge amount of capital, china at initial stage purchases the foreign brands and using

their goodwill and rand name directs their investment in the foreign market (Li et al. 2018).

With these various strategies, Chinese economy enhanced their OFDI and now it has

become the second largest investor in the world.

Challenges for Chinese OFDI:

With 206.69 billion USD OFDI, china has become the second largest investor in the

world, however, there are certain amount of risks too ("China’s Overseas Investments, Explained

in 10 Graphics | World Resources Institute" 2018). Due to the difference in the managerial and

cultural practice in the different markets, it has become hard for the Chinese investment to find

their ideal target. Moreover, lack of personnel who have international management skills has

made the Chinese investment to influence the western economies (Appelbaum and Henderson

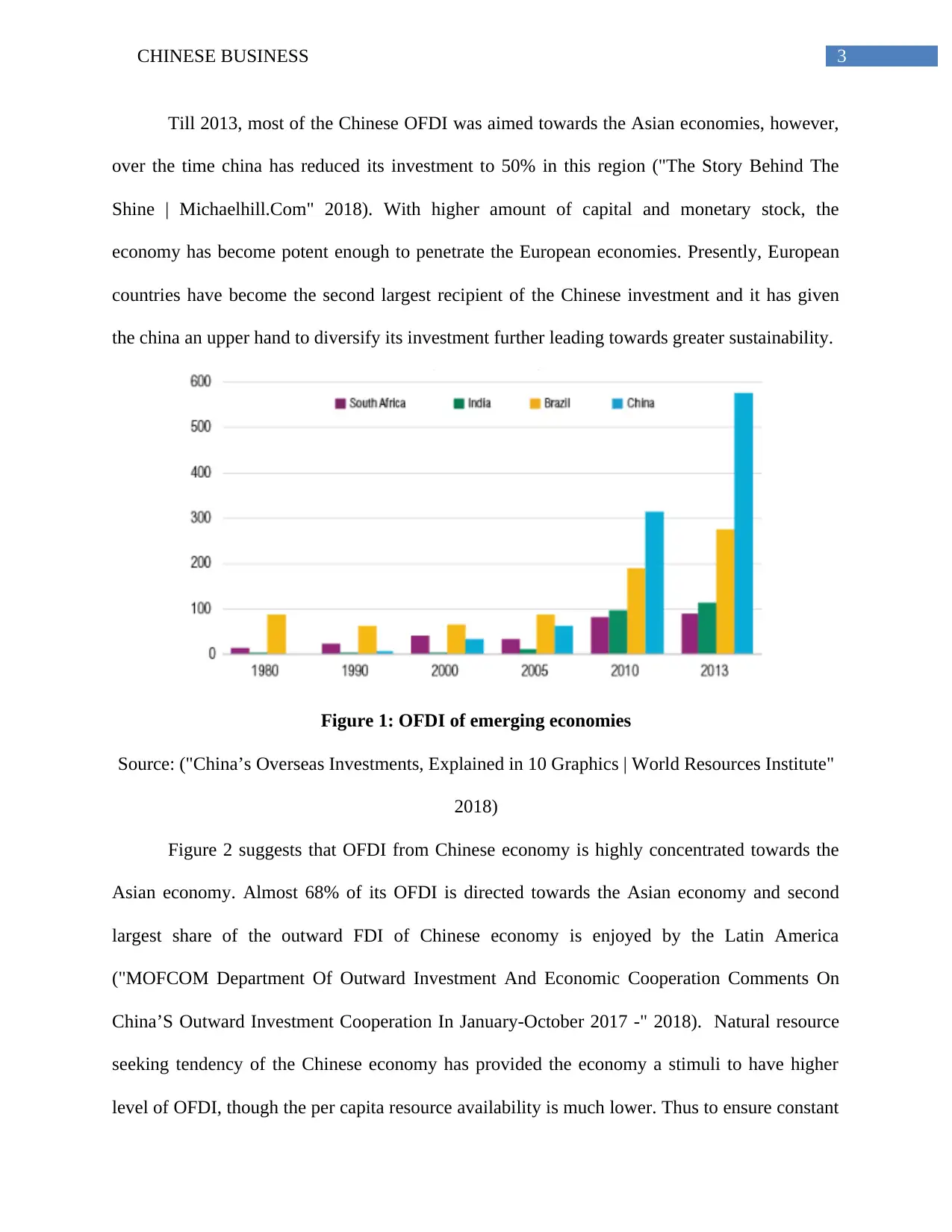

1992). According to the figure 3, it can be seen that most of the investment of china was

concentrated in the Asian economy during the 2004. Lack of diversity in the Chinese OFDI has

made it critical for the economy to provide stimuli. Thus, over the next one decade it has taken

various transformational steps in order to diversify the investment and by the year 2014, it has

effectively reduced investment in the Asian country and a rise in investment in the western

economy ("China Becomes World's Second-Largest Source Of Outward FDI: Report - Xinhua |

English.News.Cn" 2018).

Cross-border acquisition and mergers: Utilizing this simple framework of growing the

footprint in the international market, Chinese economy becomes the second largest investor.

With the huge amount of capital, china at initial stage purchases the foreign brands and using

their goodwill and rand name directs their investment in the foreign market (Li et al. 2018).

With these various strategies, Chinese economy enhanced their OFDI and now it has

become the second largest investor in the world.

Challenges for Chinese OFDI:

With 206.69 billion USD OFDI, china has become the second largest investor in the

world, however, there are certain amount of risks too ("China’s Overseas Investments, Explained

in 10 Graphics | World Resources Institute" 2018). Due to the difference in the managerial and

cultural practice in the different markets, it has become hard for the Chinese investment to find

their ideal target. Moreover, lack of personnel who have international management skills has

made the Chinese investment to influence the western economies (Appelbaum and Henderson

1992). According to the figure 3, it can be seen that most of the investment of china was

concentrated in the Asian economy during the 2004. Lack of diversity in the Chinese OFDI has

made it critical for the economy to provide stimuli. Thus, over the next one decade it has taken

various transformational steps in order to diversify the investment and by the year 2014, it has

effectively reduced investment in the Asian country and a rise in investment in the western

economy ("China Becomes World's Second-Largest Source Of Outward FDI: Report - Xinhua |

English.News.Cn" 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CHINESE BUSINESS

Figure 3: Geographical distribution of China’s OFDI during 2004 and 2013

Source: ("China’s Overseas Investments, Explained in 10 Graphics | World Resources Institute"

2018)

Chinese OFDI is maturing itself over the time and it is now the second largest investor.

However, it needs to understand the post entry process in order to integrate itself with the various

economies (Buckley et al. 2018).

Future forecast of Chinese OFDI:

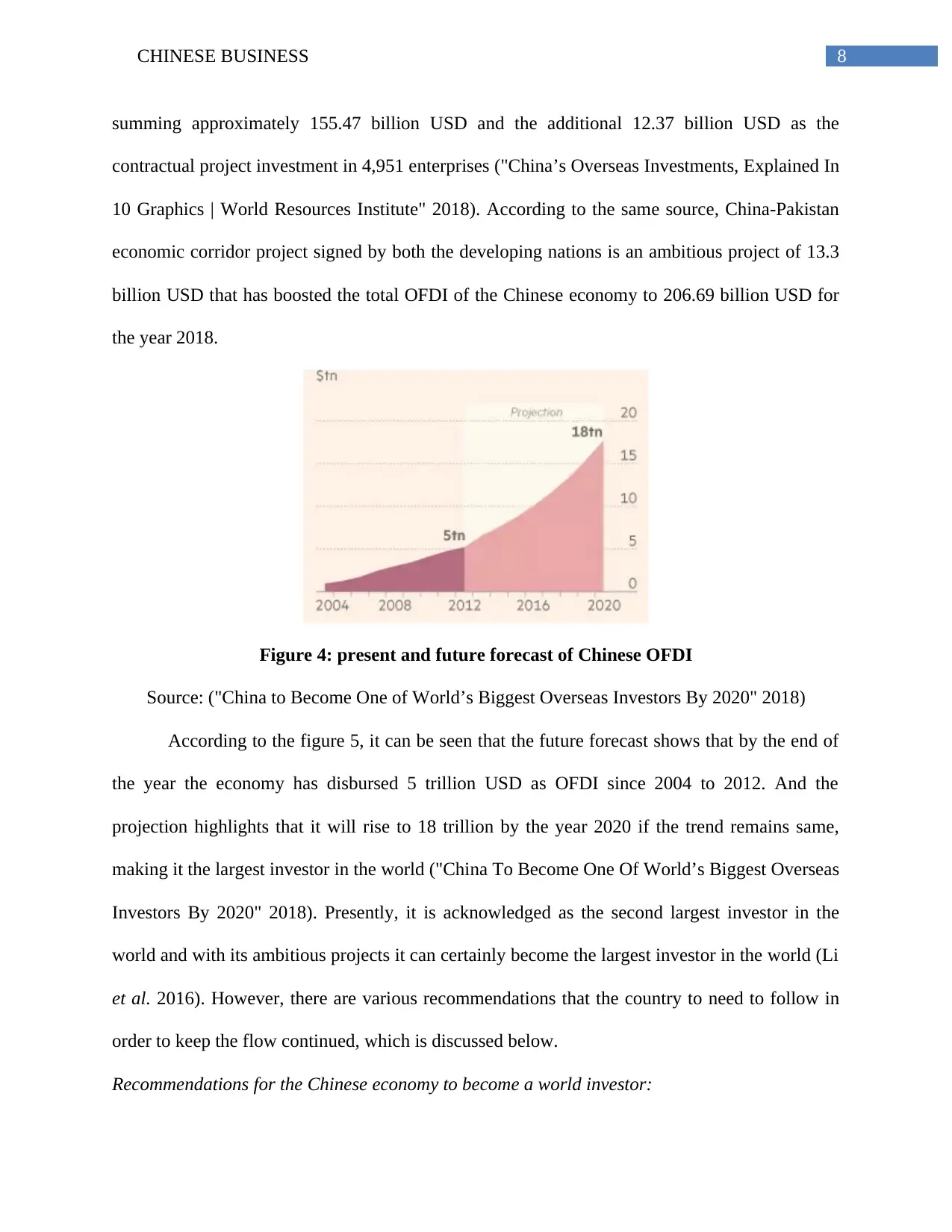

China has ever increasing amount of the OFDI and according to the trend, the country’s

outward FDI is rising at 17.9% annual rate. Considering the different industry, it has been

observed that the OFDI of the country is rising in the case of commercial service industry by

32.4%, manufacturing industry by 17.0%, retail and wholesale industry by 12.3% and

information transmission by 9.9% annually ("MOFCOM Department Of Outward Investment

And Economic Cooperation Comments On China’s Outward Investment Cooperation In

January-October 2017 -" 2018). Besides this, the country has signed deals of investment

Figure 3: Geographical distribution of China’s OFDI during 2004 and 2013

Source: ("China’s Overseas Investments, Explained in 10 Graphics | World Resources Institute"

2018)

Chinese OFDI is maturing itself over the time and it is now the second largest investor.

However, it needs to understand the post entry process in order to integrate itself with the various

economies (Buckley et al. 2018).

Future forecast of Chinese OFDI:

China has ever increasing amount of the OFDI and according to the trend, the country’s

outward FDI is rising at 17.9% annual rate. Considering the different industry, it has been

observed that the OFDI of the country is rising in the case of commercial service industry by

32.4%, manufacturing industry by 17.0%, retail and wholesale industry by 12.3% and

information transmission by 9.9% annually ("MOFCOM Department Of Outward Investment

And Economic Cooperation Comments On China’s Outward Investment Cooperation In

January-October 2017 -" 2018). Besides this, the country has signed deals of investment

8CHINESE BUSINESS

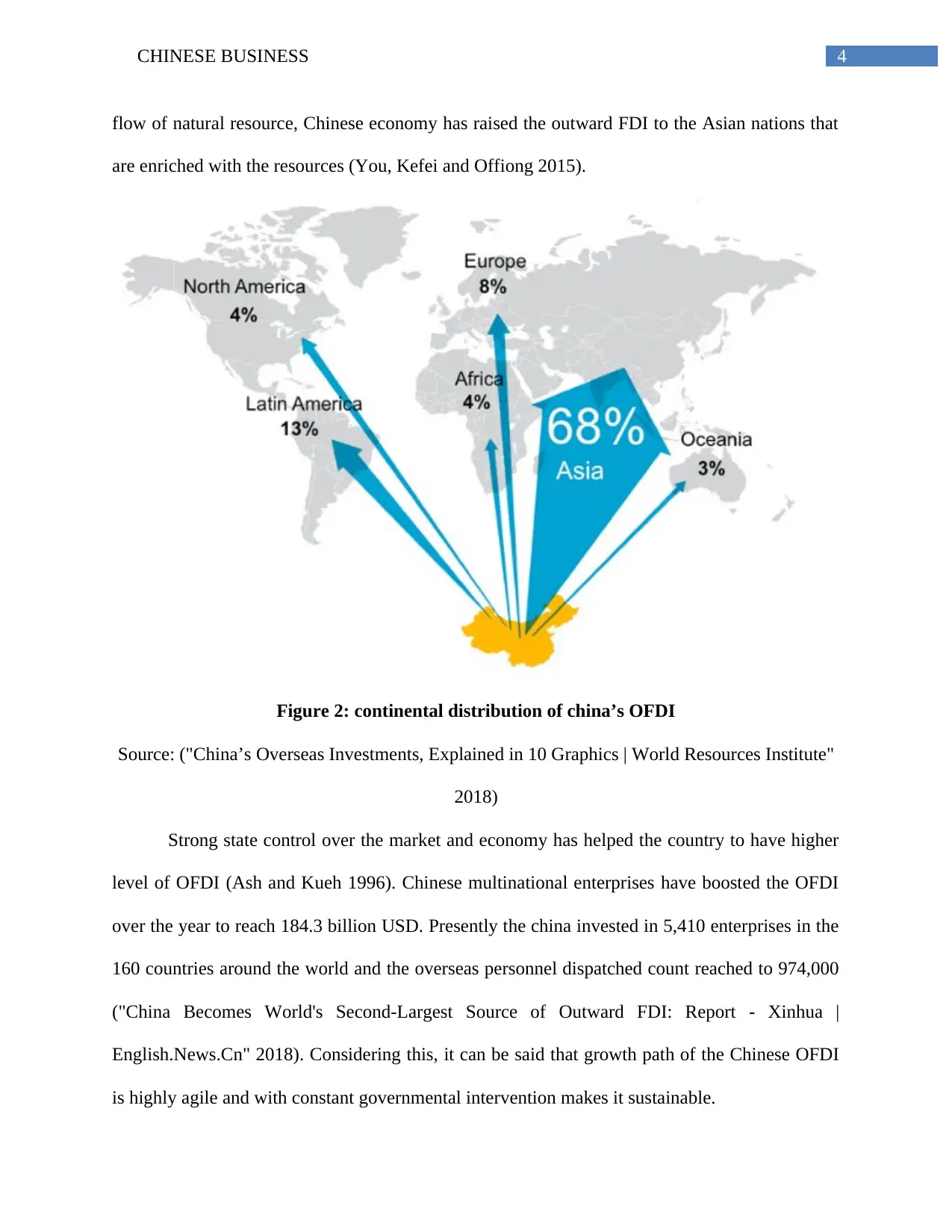

summing approximately 155.47 billion USD and the additional 12.37 billion USD as the

contractual project investment in 4,951 enterprises ("China’s Overseas Investments, Explained In

10 Graphics | World Resources Institute" 2018). According to the same source, China-Pakistan

economic corridor project signed by both the developing nations is an ambitious project of 13.3

billion USD that has boosted the total OFDI of the Chinese economy to 206.69 billion USD for

the year 2018.

Figure 4: present and future forecast of Chinese OFDI

Source: ("China to Become One of World’s Biggest Overseas Investors By 2020" 2018)

According to the figure 5, it can be seen that the future forecast shows that by the end of

the year the economy has disbursed 5 trillion USD as OFDI since 2004 to 2012. And the

projection highlights that it will rise to 18 trillion by the year 2020 if the trend remains same,

making it the largest investor in the world ("China To Become One Of World’s Biggest Overseas

Investors By 2020" 2018). Presently, it is acknowledged as the second largest investor in the

world and with its ambitious projects it can certainly become the largest investor in the world (Li

et al. 2016). However, there are various recommendations that the country to need to follow in

order to keep the flow continued, which is discussed below.

Recommendations for the Chinese economy to become a world investor:

summing approximately 155.47 billion USD and the additional 12.37 billion USD as the

contractual project investment in 4,951 enterprises ("China’s Overseas Investments, Explained In

10 Graphics | World Resources Institute" 2018). According to the same source, China-Pakistan

economic corridor project signed by both the developing nations is an ambitious project of 13.3

billion USD that has boosted the total OFDI of the Chinese economy to 206.69 billion USD for

the year 2018.

Figure 4: present and future forecast of Chinese OFDI

Source: ("China to Become One of World’s Biggest Overseas Investors By 2020" 2018)

According to the figure 5, it can be seen that the future forecast shows that by the end of

the year the economy has disbursed 5 trillion USD as OFDI since 2004 to 2012. And the

projection highlights that it will rise to 18 trillion by the year 2020 if the trend remains same,

making it the largest investor in the world ("China To Become One Of World’s Biggest Overseas

Investors By 2020" 2018). Presently, it is acknowledged as the second largest investor in the

world and with its ambitious projects it can certainly become the largest investor in the world (Li

et al. 2016). However, there are various recommendations that the country to need to follow in

order to keep the flow continued, which is discussed below.

Recommendations for the Chinese economy to become a world investor:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CHINESE BUSINESS

Chinese OFDI is growing at a large scale over the year and recently with ambitious

project with various economies, multinational enterprises, the economy is expected to high

demand of their investment too. However, there are various factors that need to be checked to

maintain the trend. Recommendations for keeping the Chinese OFDI are as follows:

China needs to diversify its OFDI in order to make it elastic

The country need to invest more on the high yielding assets in order to enhance the scope

of higher return

Though there is rise in FDI outflow, the Chinese economy need to invest more in the

neighbouring nation, which will not only reduce the scope of retaliation of Chinese

activities in the area, besides this it will provide diversity in the Chinese OFDI portfolio

Chinese economy mainly invest in the commercial projects, however it need to invest

more in the infrastructural development projects

Conclusion:

This essay has analyzed the OFDI performance of the Chinese economy and it tried to

find out the factors that are affecting the outward flow of the FDI for the Chinese economy.

Besides this, it has tried to forecast the future of Chinese OFDI and found that there is high

potential in front of the Chinese economy to become a world investor. Above analysis has found

that there is sharp rise in the OFDI of the Chinese economy and if the trend continues, then the

Chinese economy will be the largest investor in the world by 2020. The analysis has found that

most of the OFDI of the Chinese economy is disbursed to the Asian countries that possess risk in

the case of demand side shock. Besides this, Chinese economy needs to diversify its OFDI and

invest more in the high yielding assets. The report has also found that conventional motivations

like government support, global competition, idiosyncratic motivations helps the country to have

Chinese OFDI is growing at a large scale over the year and recently with ambitious

project with various economies, multinational enterprises, the economy is expected to high

demand of their investment too. However, there are various factors that need to be checked to

maintain the trend. Recommendations for keeping the Chinese OFDI are as follows:

China needs to diversify its OFDI in order to make it elastic

The country need to invest more on the high yielding assets in order to enhance the scope

of higher return

Though there is rise in FDI outflow, the Chinese economy need to invest more in the

neighbouring nation, which will not only reduce the scope of retaliation of Chinese

activities in the area, besides this it will provide diversity in the Chinese OFDI portfolio

Chinese economy mainly invest in the commercial projects, however it need to invest

more in the infrastructural development projects

Conclusion:

This essay has analyzed the OFDI performance of the Chinese economy and it tried to

find out the factors that are affecting the outward flow of the FDI for the Chinese economy.

Besides this, it has tried to forecast the future of Chinese OFDI and found that there is high

potential in front of the Chinese economy to become a world investor. Above analysis has found

that there is sharp rise in the OFDI of the Chinese economy and if the trend continues, then the

Chinese economy will be the largest investor in the world by 2020. The analysis has found that

most of the OFDI of the Chinese economy is disbursed to the Asian countries that possess risk in

the case of demand side shock. Besides this, Chinese economy needs to diversify its OFDI and

invest more in the high yielding assets. The report has also found that conventional motivations

like government support, global competition, idiosyncratic motivations helps the country to have

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CHINESE BUSINESS

higher level of OFDI. In addition to this, Chinese multinational enterprise’s strategic asset

seeking encouragement has helped the nation to become one of the largest investor in the world.

To conclude, it can be said that, given proposition in the question is true and if the trend

continues then, the country can certainly reflect itself in the role of global investor.

higher level of OFDI. In addition to this, Chinese multinational enterprise’s strategic asset

seeking encouragement has helped the nation to become one of the largest investor in the world.

To conclude, it can be said that, given proposition in the question is true and if the trend

continues then, the country can certainly reflect itself in the role of global investor.

11CHINESE BUSINESS

Reference:

"China Becomes World's Second-Largest Source Of Outward FDI: Report - Xinhua |

English.News.Cn". 2018. Xinhuanet.Com.

http://www.xinhuanet.com/english/2017-06/08/c_136350164.htm.

"China To Become One Of World’S Biggest Overseas Investors By 2020". 2018. Ft.Com.

https://www.ft.com/content/5136953a-1b3d-11e5-8201-cbdb03d71480.

"China’S Overseas Investments, Explained In 10 Graphics | World Resources Institute".

2018. Wri.Org. http://www.wri.org/blog/2015/01/china%E2%80%99s-overseas-investments-

explained-10-graphics.

"MOFCOM Department Of Outward Investment And Economic Cooperation Comments On

China’S Outward Investment Cooperation In January-October 2017 -".

2018. English.Mofcom.Gov.Cn.

http://english.mofcom.gov.cn/article/newsrelease/policyreleasing/201711/20171102674847.shtm

l.

"MOFCOM Department Official Of Outward Investment And Economic Cooperation Comments

On China’S Outward Investment And Cooperation In 2016 -". 2018. English.Mofcom.Gov.Cn.

http://english.mofcom.gov.cn/article/newsrelease/policyreleasing/201701/20170102503092.shtm

l.

Ahmad, Musheer, and Ram Singh. "AN EMPIRICAL STUDY ON EASE OF DOING

BUSINESS WITH SPECIFIC REFERENCE TO BRICS NATIONS." Pranjana: The Journal of

Management Awareness 20, no. 1 (2017).

Appelbaum, and Henderson. 1992. States and Development in the Asian Pacific Rim. Ebook.

Sage Publications.

Reference:

"China Becomes World's Second-Largest Source Of Outward FDI: Report - Xinhua |

English.News.Cn". 2018. Xinhuanet.Com.

http://www.xinhuanet.com/english/2017-06/08/c_136350164.htm.

"China To Become One Of World’S Biggest Overseas Investors By 2020". 2018. Ft.Com.

https://www.ft.com/content/5136953a-1b3d-11e5-8201-cbdb03d71480.

"China’S Overseas Investments, Explained In 10 Graphics | World Resources Institute".

2018. Wri.Org. http://www.wri.org/blog/2015/01/china%E2%80%99s-overseas-investments-

explained-10-graphics.

"MOFCOM Department Of Outward Investment And Economic Cooperation Comments On

China’S Outward Investment Cooperation In January-October 2017 -".

2018. English.Mofcom.Gov.Cn.

http://english.mofcom.gov.cn/article/newsrelease/policyreleasing/201711/20171102674847.shtm

l.

"MOFCOM Department Official Of Outward Investment And Economic Cooperation Comments

On China’S Outward Investment And Cooperation In 2016 -". 2018. English.Mofcom.Gov.Cn.

http://english.mofcom.gov.cn/article/newsrelease/policyreleasing/201701/20170102503092.shtm

l.

Ahmad, Musheer, and Ram Singh. "AN EMPIRICAL STUDY ON EASE OF DOING

BUSINESS WITH SPECIFIC REFERENCE TO BRICS NATIONS." Pranjana: The Journal of

Management Awareness 20, no. 1 (2017).

Appelbaum, and Henderson. 1992. States and Development in the Asian Pacific Rim. Ebook.

Sage Publications.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.