Corporate Finance: Analyzing Investment Decisions with WACC and NPV

VerifiedAdded on 2020/05/28

|9

|1402

|28

Homework Assignment

AI Summary

This corporate finance assignment delves into several key areas of financial analysis, including the calculation of Weighted Average Cost of Capital (WACC) and Net Present Value (NPV) for a hypothetical project. The assignment begins by calculating the WACC for a company, considering both the cost of equity and the cost of bonds. Subsequently, it proceeds to analyze a proposed project, determining its NPV under normal conditions, as well as under best-case and worst-case scenarios. The analysis involves detailed cash flow projections, including the consideration of depreciation, taxes, and terminal value. The student then provides recommendations based on the NPV results and discusses the factors that influence investment decisions, emphasizing the importance of financial analysis in determining project feasibility. The assignment concludes with a discussion on the importance of considering various scenarios and the role of a financial analyst in presenting the findings to management.

Running head: CORPORATE FINANCE

Corporate finance

Name of the student

Name of the university

Student ID

Author note

Corporate finance

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCE

Table of Contents

Answer a.....................................................................................................................................2

Answer b....................................................................................................................................3

Answer c.....................................................................................................................................5

Answer d....................................................................................................................................7

Reference....................................................................................................................................8

Table of Contents

Answer a.....................................................................................................................................2

Answer b....................................................................................................................................3

Answer c.....................................................................................................................................5

Answer d....................................................................................................................................7

Reference....................................................................................................................................8

2CORPORATE FINANCE

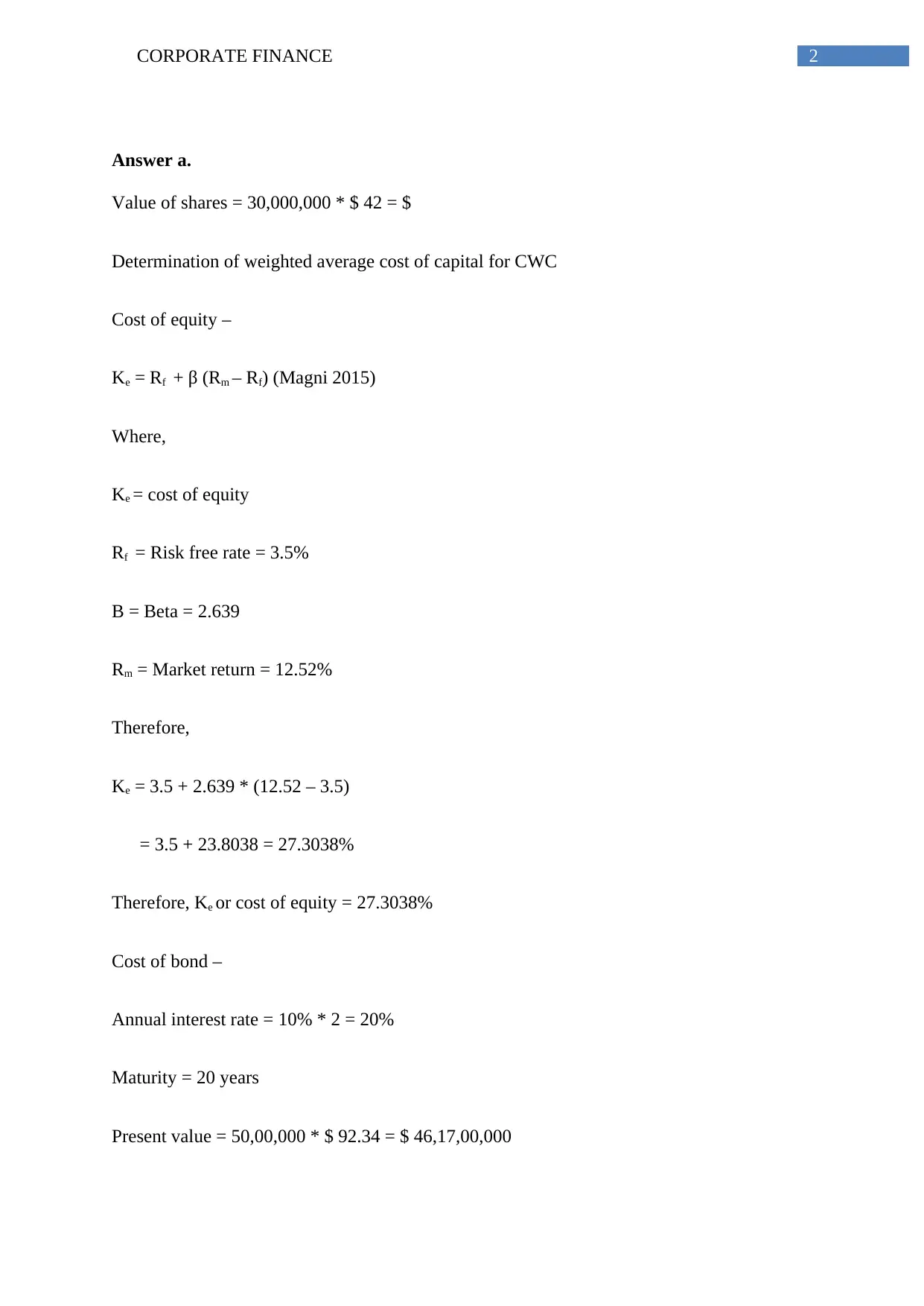

Answer a.

Value of shares = 30,000,000 * $ 42 = $

Determination of weighted average cost of capital for CWC

Cost of equity –

Ke = Rf + β (Rm – Rf) (Magni 2015)

Where,

Ke = cost of equity

Rf = Risk free rate = 3.5%

Β = Beta = 2.639

Rm = Market return = 12.52%

Therefore,

Ke = 3.5 + 2.639 * (12.52 – 3.5)

= 3.5 + 23.8038 = 27.3038%

Therefore, Ke or cost of equity = 27.3038%

Cost of bond –

Annual interest rate = 10% * 2 = 20%

Maturity = 20 years

Present value = 50,00,000 * $ 92.34 = $ 46,17,00,000

Answer a.

Value of shares = 30,000,000 * $ 42 = $

Determination of weighted average cost of capital for CWC

Cost of equity –

Ke = Rf + β (Rm – Rf) (Magni 2015)

Where,

Ke = cost of equity

Rf = Risk free rate = 3.5%

Β = Beta = 2.639

Rm = Market return = 12.52%

Therefore,

Ke = 3.5 + 2.639 * (12.52 – 3.5)

= 3.5 + 23.8038 = 27.3038%

Therefore, Ke or cost of equity = 27.3038%

Cost of bond –

Annual interest rate = 10% * 2 = 20%

Maturity = 20 years

Present value = 50,00,000 * $ 92.34 = $ 46,17,00,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCE

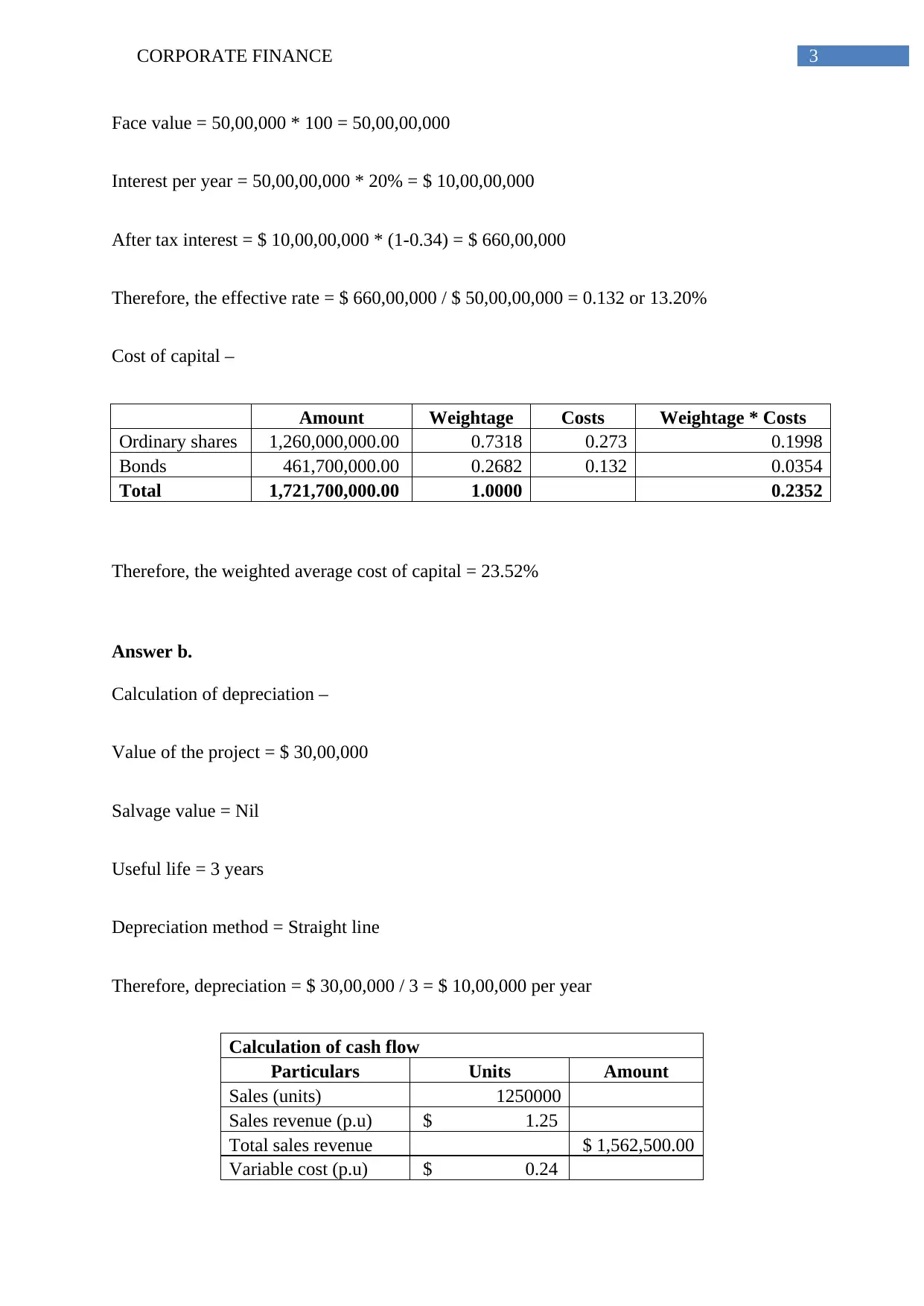

Face value = 50,00,000 * 100 = 50,00,00,000

Interest per year = 50,00,00,000 * 20% = $ 10,00,00,000

After tax interest = $ 10,00,00,000 * (1-0.34) = $ 660,00,000

Therefore, the effective rate = $ 660,00,000 / $ 50,00,00,000 = 0.132 or 13.20%

Cost of capital –

Amount Weightage Costs Weightage * Costs

Ordinary shares 1,260,000,000.00 0.7318 0.273 0.1998

Bonds 461,700,000.00 0.2682 0.132 0.0354

Total 1,721,700,000.00 1.0000 0.2352

Therefore, the weighted average cost of capital = 23.52%

Answer b.

Calculation of depreciation –

Value of the project = $ 30,00,000

Salvage value = Nil

Useful life = 3 years

Depreciation method = Straight line

Therefore, depreciation = $ 30,00,000 / 3 = $ 10,00,000 per year

Calculation of cash flow

Particulars Units Amount

Sales (units) 1250000

Sales revenue (p.u) $ 1.25

Total sales revenue $ 1,562,500.00

Variable cost (p.u) $ 0.24

Face value = 50,00,000 * 100 = 50,00,00,000

Interest per year = 50,00,00,000 * 20% = $ 10,00,00,000

After tax interest = $ 10,00,00,000 * (1-0.34) = $ 660,00,000

Therefore, the effective rate = $ 660,00,000 / $ 50,00,00,000 = 0.132 or 13.20%

Cost of capital –

Amount Weightage Costs Weightage * Costs

Ordinary shares 1,260,000,000.00 0.7318 0.273 0.1998

Bonds 461,700,000.00 0.2682 0.132 0.0354

Total 1,721,700,000.00 1.0000 0.2352

Therefore, the weighted average cost of capital = 23.52%

Answer b.

Calculation of depreciation –

Value of the project = $ 30,00,000

Salvage value = Nil

Useful life = 3 years

Depreciation method = Straight line

Therefore, depreciation = $ 30,00,000 / 3 = $ 10,00,000 per year

Calculation of cash flow

Particulars Units Amount

Sales (units) 1250000

Sales revenue (p.u) $ 1.25

Total sales revenue $ 1,562,500.00

Variable cost (p.u) $ 0.24

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE FINANCE

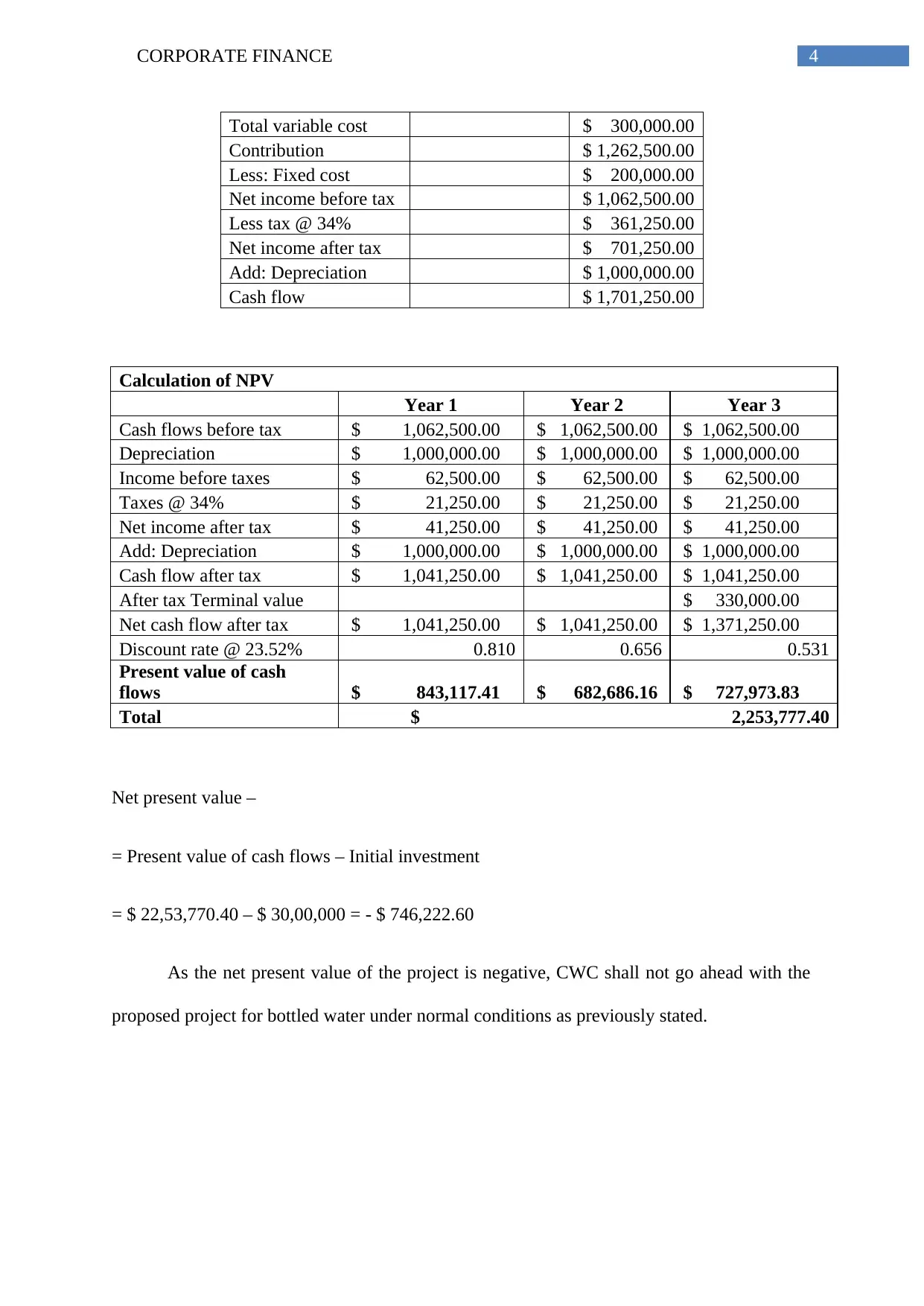

Total variable cost $ 300,000.00

Contribution $ 1,262,500.00

Less: Fixed cost $ 200,000.00

Net income before tax $ 1,062,500.00

Less tax @ 34% $ 361,250.00

Net income after tax $ 701,250.00

Add: Depreciation $ 1,000,000.00

Cash flow $ 1,701,250.00

Calculation of NPV

Year 1 Year 2 Year 3

Cash flows before tax $ 1,062,500.00 $ 1,062,500.00 $ 1,062,500.00

Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Income before taxes $ 62,500.00 $ 62,500.00 $ 62,500.00

Taxes @ 34% $ 21,250.00 $ 21,250.00 $ 21,250.00

Net income after tax $ 41,250.00 $ 41,250.00 $ 41,250.00

Add: Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Cash flow after tax $ 1,041,250.00 $ 1,041,250.00 $ 1,041,250.00

After tax Terminal value $ 330,000.00

Net cash flow after tax $ 1,041,250.00 $ 1,041,250.00 $ 1,371,250.00

Discount rate @ 23.52% 0.810 0.656 0.531

Present value of cash

flows $ 843,117.41 $ 682,686.16 $ 727,973.83

Total $ 2,253,777.40

Net present value –

= Present value of cash flows – Initial investment

= $ 22,53,770.40 – $ 30,00,000 = - $ 746,222.60

As the net present value of the project is negative, CWC shall not go ahead with the

proposed project for bottled water under normal conditions as previously stated.

Total variable cost $ 300,000.00

Contribution $ 1,262,500.00

Less: Fixed cost $ 200,000.00

Net income before tax $ 1,062,500.00

Less tax @ 34% $ 361,250.00

Net income after tax $ 701,250.00

Add: Depreciation $ 1,000,000.00

Cash flow $ 1,701,250.00

Calculation of NPV

Year 1 Year 2 Year 3

Cash flows before tax $ 1,062,500.00 $ 1,062,500.00 $ 1,062,500.00

Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Income before taxes $ 62,500.00 $ 62,500.00 $ 62,500.00

Taxes @ 34% $ 21,250.00 $ 21,250.00 $ 21,250.00

Net income after tax $ 41,250.00 $ 41,250.00 $ 41,250.00

Add: Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Cash flow after tax $ 1,041,250.00 $ 1,041,250.00 $ 1,041,250.00

After tax Terminal value $ 330,000.00

Net cash flow after tax $ 1,041,250.00 $ 1,041,250.00 $ 1,371,250.00

Discount rate @ 23.52% 0.810 0.656 0.531

Present value of cash

flows $ 843,117.41 $ 682,686.16 $ 727,973.83

Total $ 2,253,777.40

Net present value –

= Present value of cash flows – Initial investment

= $ 22,53,770.40 – $ 30,00,000 = - $ 746,222.60

As the net present value of the project is negative, CWC shall not go ahead with the

proposed project for bottled water under normal conditions as previously stated.

5CORPORATE FINANCE

Answer c.

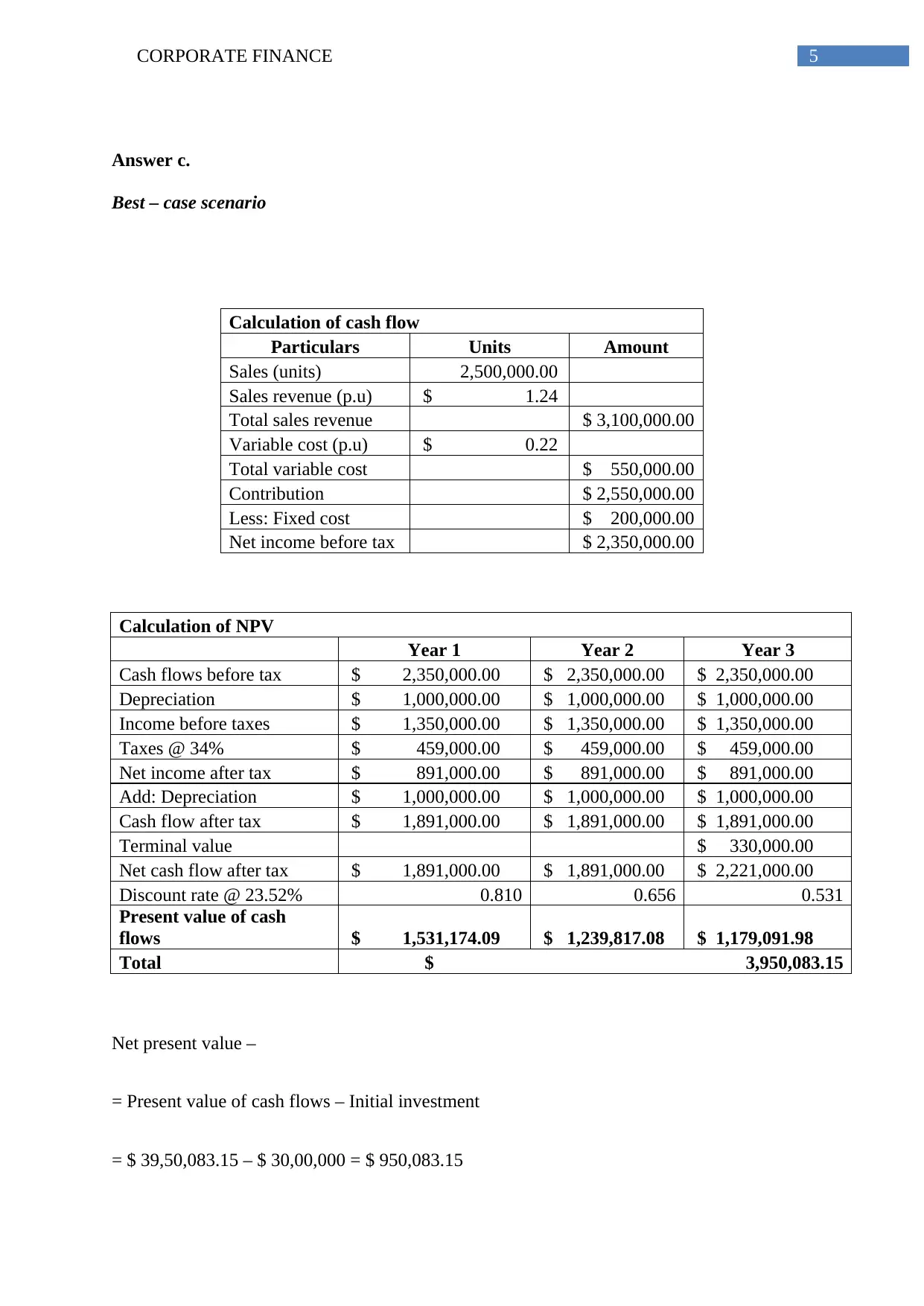

Best – case scenario

Calculation of cash flow

Particulars Units Amount

Sales (units) 2,500,000.00

Sales revenue (p.u) $ 1.24

Total sales revenue $ 3,100,000.00

Variable cost (p.u) $ 0.22

Total variable cost $ 550,000.00

Contribution $ 2,550,000.00

Less: Fixed cost $ 200,000.00

Net income before tax $ 2,350,000.00

Calculation of NPV

Year 1 Year 2 Year 3

Cash flows before tax $ 2,350,000.00 $ 2,350,000.00 $ 2,350,000.00

Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Income before taxes $ 1,350,000.00 $ 1,350,000.00 $ 1,350,000.00

Taxes @ 34% $ 459,000.00 $ 459,000.00 $ 459,000.00

Net income after tax $ 891,000.00 $ 891,000.00 $ 891,000.00

Add: Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Cash flow after tax $ 1,891,000.00 $ 1,891,000.00 $ 1,891,000.00

Terminal value $ 330,000.00

Net cash flow after tax $ 1,891,000.00 $ 1,891,000.00 $ 2,221,000.00

Discount rate @ 23.52% 0.810 0.656 0.531

Present value of cash

flows $ 1,531,174.09 $ 1,239,817.08 $ 1,179,091.98

Total $ 3,950,083.15

Net present value –

= Present value of cash flows – Initial investment

= $ 39,50,083.15 – $ 30,00,000 = $ 950,083.15

Answer c.

Best – case scenario

Calculation of cash flow

Particulars Units Amount

Sales (units) 2,500,000.00

Sales revenue (p.u) $ 1.24

Total sales revenue $ 3,100,000.00

Variable cost (p.u) $ 0.22

Total variable cost $ 550,000.00

Contribution $ 2,550,000.00

Less: Fixed cost $ 200,000.00

Net income before tax $ 2,350,000.00

Calculation of NPV

Year 1 Year 2 Year 3

Cash flows before tax $ 2,350,000.00 $ 2,350,000.00 $ 2,350,000.00

Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Income before taxes $ 1,350,000.00 $ 1,350,000.00 $ 1,350,000.00

Taxes @ 34% $ 459,000.00 $ 459,000.00 $ 459,000.00

Net income after tax $ 891,000.00 $ 891,000.00 $ 891,000.00

Add: Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Cash flow after tax $ 1,891,000.00 $ 1,891,000.00 $ 1,891,000.00

Terminal value $ 330,000.00

Net cash flow after tax $ 1,891,000.00 $ 1,891,000.00 $ 2,221,000.00

Discount rate @ 23.52% 0.810 0.656 0.531

Present value of cash

flows $ 1,531,174.09 $ 1,239,817.08 $ 1,179,091.98

Total $ 3,950,083.15

Net present value –

= Present value of cash flows – Initial investment

= $ 39,50,083.15 – $ 30,00,000 = $ 950,083.15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE FINANCE

As the net present value of the project under best case scenario is positive, CWC shall

go ahead with the proposed project for bottled water.

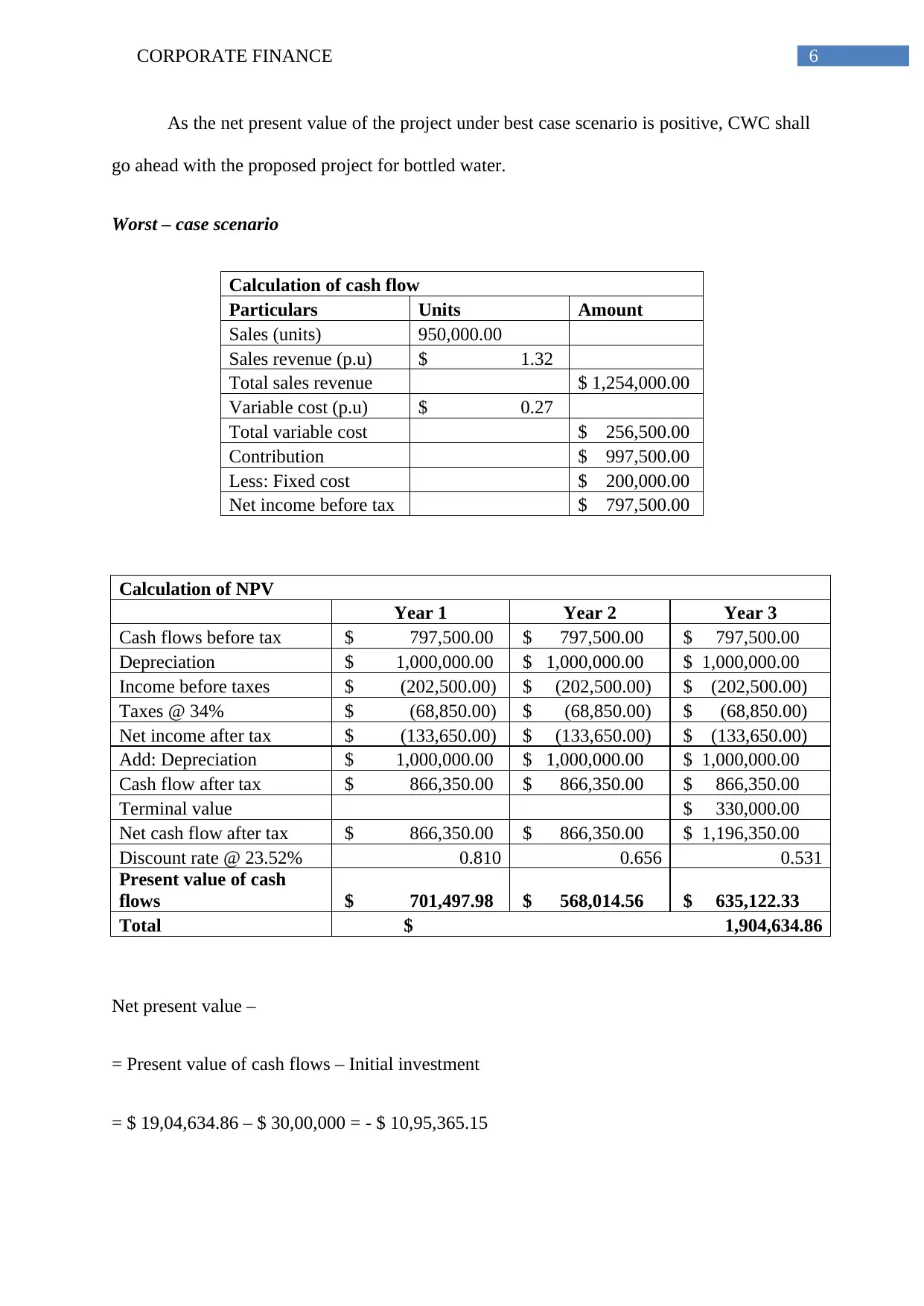

Worst – case scenario

Calculation of cash flow

Particulars Units Amount

Sales (units) 950,000.00

Sales revenue (p.u) $ 1.32

Total sales revenue $ 1,254,000.00

Variable cost (p.u) $ 0.27

Total variable cost $ 256,500.00

Contribution $ 997,500.00

Less: Fixed cost $ 200,000.00

Net income before tax $ 797,500.00

Calculation of NPV

Year 1 Year 2 Year 3

Cash flows before tax $ 797,500.00 $ 797,500.00 $ 797,500.00

Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Income before taxes $ (202,500.00) $ (202,500.00) $ (202,500.00)

Taxes @ 34% $ (68,850.00) $ (68,850.00) $ (68,850.00)

Net income after tax $ (133,650.00) $ (133,650.00) $ (133,650.00)

Add: Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Cash flow after tax $ 866,350.00 $ 866,350.00 $ 866,350.00

Terminal value $ 330,000.00

Net cash flow after tax $ 866,350.00 $ 866,350.00 $ 1,196,350.00

Discount rate @ 23.52% 0.810 0.656 0.531

Present value of cash

flows $ 701,497.98 $ 568,014.56 $ 635,122.33

Total $ 1,904,634.86

Net present value –

= Present value of cash flows – Initial investment

= $ 19,04,634.86 – $ 30,00,000 = - $ 10,95,365.15

As the net present value of the project under best case scenario is positive, CWC shall

go ahead with the proposed project for bottled water.

Worst – case scenario

Calculation of cash flow

Particulars Units Amount

Sales (units) 950,000.00

Sales revenue (p.u) $ 1.32

Total sales revenue $ 1,254,000.00

Variable cost (p.u) $ 0.27

Total variable cost $ 256,500.00

Contribution $ 997,500.00

Less: Fixed cost $ 200,000.00

Net income before tax $ 797,500.00

Calculation of NPV

Year 1 Year 2 Year 3

Cash flows before tax $ 797,500.00 $ 797,500.00 $ 797,500.00

Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Income before taxes $ (202,500.00) $ (202,500.00) $ (202,500.00)

Taxes @ 34% $ (68,850.00) $ (68,850.00) $ (68,850.00)

Net income after tax $ (133,650.00) $ (133,650.00) $ (133,650.00)

Add: Depreciation $ 1,000,000.00 $ 1,000,000.00 $ 1,000,000.00

Cash flow after tax $ 866,350.00 $ 866,350.00 $ 866,350.00

Terminal value $ 330,000.00

Net cash flow after tax $ 866,350.00 $ 866,350.00 $ 1,196,350.00

Discount rate @ 23.52% 0.810 0.656 0.531

Present value of cash

flows $ 701,497.98 $ 568,014.56 $ 635,122.33

Total $ 1,904,634.86

Net present value –

= Present value of cash flows – Initial investment

= $ 19,04,634.86 – $ 30,00,000 = - $ 10,95,365.15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE FINANCE

As the net present value of the project under worst case scenario is negative, CWC

shall not go ahead with the proposed project for bottled water.

Answer d

As a financial analyst, a discussion shall be conducted with the company management

to know their preference and clear them the factors associated with net present value. Further,

the analyst shall go through the financial information for analysing the past period’s sales

level and expected sales level of future (Gallo 2014).

The net present value is the technique used under capital budgeting for analysing the

acceptability of the project. It includes funding of the future cash flows of the option and then

discounting them for finding out the present value of the project and compares it with the

initial investment (Lee and Lee 2015). Computation of net present value is incomplete if the

income tax is not taken into consideration. Positive NPV represents that the estimated

earnings from the project exceeds the initial investment and therefore, the project shall not be

accepted or undertaken. On the contrary, the negative NPV represents that the estimated

earnings from the project is lower than the initial investment and therefore, the project shall

not be accepted or undertaken (Arrow et al. 2013).

Looking at the above scenarios and computation, it is found that only in case of best –

case scenario the NPV of the project is positive that is $ 950,083.15. In other 2 cases that is

under normal condition and under worst-case scenario the NPV of the project is negative.

Therefore, CWC shall undertake the project only under best-case scenario.

As the net present value of the project under worst case scenario is negative, CWC

shall not go ahead with the proposed project for bottled water.

Answer d

As a financial analyst, a discussion shall be conducted with the company management

to know their preference and clear them the factors associated with net present value. Further,

the analyst shall go through the financial information for analysing the past period’s sales

level and expected sales level of future (Gallo 2014).

The net present value is the technique used under capital budgeting for analysing the

acceptability of the project. It includes funding of the future cash flows of the option and then

discounting them for finding out the present value of the project and compares it with the

initial investment (Lee and Lee 2015). Computation of net present value is incomplete if the

income tax is not taken into consideration. Positive NPV represents that the estimated

earnings from the project exceeds the initial investment and therefore, the project shall not be

accepted or undertaken. On the contrary, the negative NPV represents that the estimated

earnings from the project is lower than the initial investment and therefore, the project shall

not be accepted or undertaken (Arrow et al. 2013).

Looking at the above scenarios and computation, it is found that only in case of best –

case scenario the NPV of the project is positive that is $ 950,083.15. In other 2 cases that is

under normal condition and under worst-case scenario the NPV of the project is negative.

Therefore, CWC shall undertake the project only under best-case scenario.

8CORPORATE FINANCE

Reference

Arrow, K., Cropper, M., Gollier, C., Groom, B., Heal, G., Newell, R., Nordhaus, W.,

Pindyck, R., Pizer, W., Portney, P. and Sterner, T., 2013. Determining benefits and costs for

future generations. Science, 341(6144), pp.349-350.

Gallo, A., 2014. A refresher on net present value. Harvard Business Review, 19.

Lee, I. and Lee, K., 2015. The Internet of Things (IoT): Applications, investments, and

challenges for enterprises. Business Horizons, 58(4), pp.431-440.

Magni, C.A., 2015. Investment, financing and the role of ROA and WACC in value

creation. European Journal of Operational Research, 244(3), pp.855-866.

Reference

Arrow, K., Cropper, M., Gollier, C., Groom, B., Heal, G., Newell, R., Nordhaus, W.,

Pindyck, R., Pizer, W., Portney, P. and Sterner, T., 2013. Determining benefits and costs for

future generations. Science, 341(6144), pp.349-350.

Gallo, A., 2014. A refresher on net present value. Harvard Business Review, 19.

Lee, I. and Lee, K., 2015. The Internet of Things (IoT): Applications, investments, and

challenges for enterprises. Business Horizons, 58(4), pp.431-440.

Magni, C.A., 2015. Investment, financing and the role of ROA and WACC in value

creation. European Journal of Operational Research, 244(3), pp.855-866.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.