Financial Statement Analysis and Valuation

VerifiedAdded on 2020/10/05

|15

|3783

|124

AI Summary

The provided report is an assignment on financial statement analysis and valuation. It discusses the importance of financial statements in a company's business operations and ability to generate profits in the long run. The report also summarizes different types of ratios for comparing the company's financial performance over two years, utilizing references from various academic sources.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL DECISION

MAKING

MAKING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Role of Accounting & Finance with in an organisation..............................................................3

TASK 2............................................................................................................................................9

Calculation of different ratios.....................................................................................................9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Role of Accounting & Finance with in an organisation..............................................................3

TASK 2............................................................................................................................................9

Calculation of different ratios.....................................................................................................9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Financial Decision Making is a process through which managers of organisations

evaluate different type of opportunities by analysing their financial statements such as Balance

Sheet, Income Statement and Cash Flow Statements. Financial Decision Making also enables

companies in making decisions by analysing risk & returns in different alternatives which further

helps in achieving long tern sustainable growth. Organisation prepare financial statements to find

out efficiency & profitability of their business performance. The below report explain role of

Accounting & Finance Function with in an organisation. After that, this report calculate various

types of ratios to check efficiency of financial performance of Alpha Limited by comparing and

evaluating ratios of two financial years.

TASK 1

Role of Accounting & Finance with in an organisation

Accounting

Accounting is an activity in which business organisations analyse, evaluate and interpret

their overall financial transactions. Companies prepare & maintain books of accounts to record

their financial transaction under accounting process. Every organisation complete the process of

accounting with the purpose of finding out their financial efficiency and profitability. Further,

companies prepare and maintain books of accounts to disclose its financial information so that its

external & internal user can make various decisions such as Investment Decisions, Production

Decisions and Pricing Decisions. Thus, Accounting plays a vital role in decision making.

Accountant of Tesco also maintain books of accounts to check performance of its all

stores. As Tesco is a multinational UK based company and offering variety of groceries and

other general products & services across the globe. Tesco offer its products & services through

departmental stores, Super Markets and Malls. Company make investment in establishment of its

stores in new countries for expansion for this company needs to check its financial soundness

and it is not without Accounting(Minnis and Sutherland, 2017).

Finance

Finance is process of maintaining and managing funds of companies so that they can use

them in an efficient manner. It also helps company in raising new funds with the use of different

Financial Decision Making is a process through which managers of organisations

evaluate different type of opportunities by analysing their financial statements such as Balance

Sheet, Income Statement and Cash Flow Statements. Financial Decision Making also enables

companies in making decisions by analysing risk & returns in different alternatives which further

helps in achieving long tern sustainable growth. Organisation prepare financial statements to find

out efficiency & profitability of their business performance. The below report explain role of

Accounting & Finance Function with in an organisation. After that, this report calculate various

types of ratios to check efficiency of financial performance of Alpha Limited by comparing and

evaluating ratios of two financial years.

TASK 1

Role of Accounting & Finance with in an organisation

Accounting

Accounting is an activity in which business organisations analyse, evaluate and interpret

their overall financial transactions. Companies prepare & maintain books of accounts to record

their financial transaction under accounting process. Every organisation complete the process of

accounting with the purpose of finding out their financial efficiency and profitability. Further,

companies prepare and maintain books of accounts to disclose its financial information so that its

external & internal user can make various decisions such as Investment Decisions, Production

Decisions and Pricing Decisions. Thus, Accounting plays a vital role in decision making.

Accountant of Tesco also maintain books of accounts to check performance of its all

stores. As Tesco is a multinational UK based company and offering variety of groceries and

other general products & services across the globe. Tesco offer its products & services through

departmental stores, Super Markets and Malls. Company make investment in establishment of its

stores in new countries for expansion for this company needs to check its financial soundness

and it is not without Accounting(Minnis and Sutherland, 2017).

Finance

Finance is process of maintaining and managing funds of companies so that they can use

them in an efficient manner. It also helps company in raising new funds with the use of different

sources. Chief Financial Officer of Tesco manage companies funds which in turn help company

in making its future financial plan and decision making.

Thus, Accounting & Finance both benefits firm in maximising profits, market share and

brand image. Further, both the function plays a crucial role in evaluating and analysing Financial

Health of Tesco(Vanauken, Ascigil and Carraher, 2016).

Role of Accounting

Two types of accounting is done with in an organisation Financial Accounting &

Management Accounting. Management Accounting plays a role in providing companies

financial information to its manager so that they can make future decisions whereas Financial

Accounting helps firm in achieving future goals and provide sufficient liquidity so that

companies can smoothly run their business.

According to the view point of (Berger, Minnis and Sutherland, 2017), Accounting

Function plays a significant role in resolving various problems by evaluating & analysing

different situations occurring in Tesco during its business process. Further, Different roles of

played by Accounting in Tesco are discussed below-

Cost Analysis- Cost Accounting Function of Accounting plays an important role in

analysing and evaluating cost each products & services offered by companies. Accountant of

Tesco use this function with the purpose of enhancing profits & sales volume by eliminating

extra cost. By recording cost of products accountant of Tesco can set its profit margin and can

achieve future sales target.

For Example- Accountant of Tesco wants to establish a new hyper store in a new country

with an objective of its business expansion. Than with cost accounting function accountant can

evaluate Cost required in construction of store such as cost of land, cost of furniture & interior

and various other facilities like air conditioning, staff members salary & marketing expenses.

Thus, Cost Accounting Function of accounting benefits Tesco in examining cost of

establishment of its stores with this company can achieve its future goals and profits(Lakis and

Masiulevičius, 2017).

Decision Making- Managers of Tesco makes various decisions so that company can run

its operations smoothly. All the decisions related to business operations cannot be run without

in making its future financial plan and decision making.

Thus, Accounting & Finance both benefits firm in maximising profits, market share and

brand image. Further, both the function plays a crucial role in evaluating and analysing Financial

Health of Tesco(Vanauken, Ascigil and Carraher, 2016).

Role of Accounting

Two types of accounting is done with in an organisation Financial Accounting &

Management Accounting. Management Accounting plays a role in providing companies

financial information to its manager so that they can make future decisions whereas Financial

Accounting helps firm in achieving future goals and provide sufficient liquidity so that

companies can smoothly run their business.

According to the view point of (Berger, Minnis and Sutherland, 2017), Accounting

Function plays a significant role in resolving various problems by evaluating & analysing

different situations occurring in Tesco during its business process. Further, Different roles of

played by Accounting in Tesco are discussed below-

Cost Analysis- Cost Accounting Function of Accounting plays an important role in

analysing and evaluating cost each products & services offered by companies. Accountant of

Tesco use this function with the purpose of enhancing profits & sales volume by eliminating

extra cost. By recording cost of products accountant of Tesco can set its profit margin and can

achieve future sales target.

For Example- Accountant of Tesco wants to establish a new hyper store in a new country

with an objective of its business expansion. Than with cost accounting function accountant can

evaluate Cost required in construction of store such as cost of land, cost of furniture & interior

and various other facilities like air conditioning, staff members salary & marketing expenses.

Thus, Cost Accounting Function of accounting benefits Tesco in examining cost of

establishment of its stores with this company can achieve its future goals and profits(Lakis and

Masiulevičius, 2017).

Decision Making- Managers of Tesco makes various decisions so that company can run

its operations smoothly. All the decisions related to business operations cannot be run without

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

detailed information or financials of company. Managers of company makes decisions related to

expansion, diversification for this managers require information of Assets, Liabilities and cash

inflows & outflows of company. All this information is disclosed to managers with the help of

management accounting function.

Further, Management Accounting function is also used by company with the purpose of

policy formulation and it also helps managers in improving working condition. For Example-

Mangers of Tesco wants to increase their coverage in international market by reducing

competition for which they are thinking to formulate and effective marketing programme in

different languages. For the development of marketing strategy funds are required and for which

managers need detailed information of companies profits and cash availability. Which is possible

only if company is having a record of its financial information. Thus, Management Accounting

Function of Accounting plays a vital role in future decision making(Rouxelin, Wongsunwai and

Yehuda, 2017).

Accounting Function also enables companies mangers in deciding & evaluating different

investment alternatives so that they can use an alternative which gives higher profits and return.

Governmental Regulations- For running organisations operations in an ethical manner

companies are required to follow all the legal laws and provisions formulated by government. As

Tesco is a well recognised brand it is essential for company to pay its Taxes on time. Because, it

directly affects Brand Image of company. Accountant of company is required to assess accurate

income earned by company so that company can pay its Tax Liability. For assessment of actual

income earned from all outlets of organisation Auditing Function of Accounting is used.

According to Auditing Function auditor of company helps accountant in eliminating

errors in books of accounts of firm which helps company in evaluating its actual profits. This

function also helps Tesco in identifying applicability of different types of Taxes on business

activities of company. It also enable company in filling return on time(Moroney and Trotman,

2016).

Discloser of Financial Information- It is mandatory for every organisation to disclose

their financial performance to their internal & external users such as stakeholders (Customers,

Suppliers, Competitors, Government and Shareholders). Disclosing of financial information to

internal user helps managers in decision making related to production, marketing and pricing. As

expansion, diversification for this managers require information of Assets, Liabilities and cash

inflows & outflows of company. All this information is disclosed to managers with the help of

management accounting function.

Further, Management Accounting function is also used by company with the purpose of

policy formulation and it also helps managers in improving working condition. For Example-

Mangers of Tesco wants to increase their coverage in international market by reducing

competition for which they are thinking to formulate and effective marketing programme in

different languages. For the development of marketing strategy funds are required and for which

managers need detailed information of companies profits and cash availability. Which is possible

only if company is having a record of its financial information. Thus, Management Accounting

Function of Accounting plays a vital role in future decision making(Rouxelin, Wongsunwai and

Yehuda, 2017).

Accounting Function also enables companies mangers in deciding & evaluating different

investment alternatives so that they can use an alternative which gives higher profits and return.

Governmental Regulations- For running organisations operations in an ethical manner

companies are required to follow all the legal laws and provisions formulated by government. As

Tesco is a well recognised brand it is essential for company to pay its Taxes on time. Because, it

directly affects Brand Image of company. Accountant of company is required to assess accurate

income earned by company so that company can pay its Tax Liability. For assessment of actual

income earned from all outlets of organisation Auditing Function of Accounting is used.

According to Auditing Function auditor of company helps accountant in eliminating

errors in books of accounts of firm which helps company in evaluating its actual profits. This

function also helps Tesco in identifying applicability of different types of Taxes on business

activities of company. It also enable company in filling return on time(Moroney and Trotman,

2016).

Discloser of Financial Information- It is mandatory for every organisation to disclose

their financial performance to their internal & external users such as stakeholders (Customers,

Suppliers, Competitors, Government and Shareholders). Disclosing of financial information to

internal user helps managers in decision making related to production, marketing and pricing. As

Internal Users of company includes Managers, Employees and Board of Directors. Accountant of

Tesco is required to maintain books of accounts to asses amount of salaries given to employees.

For Example- if managers of company has to decide salary for staff members of each of its store

than company need to disclose their profits to managers and Board of Directors as Board of

Directors are also require to make decision related to Dividend Distribution.

Accounting function also play an essential role in disclosing amount of dividend Tesco is

distributing to its shareholders which further helps company in enhancing its brand image,

number of shareholders and profitability. As if company is offering high dividend than

shareholders will get attracted. Tesco is also able to know amount of retained earnings is

available which in turn helps managers in making expansion decisions(O'Hare, 2016).

Accounting in Making Budget- Budget is prepared by companies to achieve their future

goals & objectives. Preparation of Budget also requires cost & time but if company is having

detailed information of their past years financial data than it is easy for firm to prepare a future

financial plan. Budget of Tesco includes future information related to income & expenses of

company and that requires accounting details so, accounting also has a role in Budget

Preparation.

Accounting Function also benefits Tesco in calculating ratios. Current Ratio is calculated

by company to check its liquidity and for that details of current liabilities and assets are required.

Further, details of sales are creditors are required to calculate creditors ration and sales ratio.

Thus, Accounting Function also play a role in Calculation & Analysis of Ratios and comparing

ratios of two years.

Role of finance

Finance function play a crucial role in Tesco as it provides liquidity in firm and with this

function Finance Manager of Tesco can make various decisions such as Investment Decision,

Expansion Decision, Acquisition Decisions, Budgeting Decision and Various other decisions

related to fund management. Finance play a crucial role in business operation of Tesco, Which

are discussed below-

Financial Planning- Tesco does its future financial planning by preparing different types

of budgets such as cash budget, production budget and sales budget. This budgets are prepared

Tesco is required to maintain books of accounts to asses amount of salaries given to employees.

For Example- if managers of company has to decide salary for staff members of each of its store

than company need to disclose their profits to managers and Board of Directors as Board of

Directors are also require to make decision related to Dividend Distribution.

Accounting function also play an essential role in disclosing amount of dividend Tesco is

distributing to its shareholders which further helps company in enhancing its brand image,

number of shareholders and profitability. As if company is offering high dividend than

shareholders will get attracted. Tesco is also able to know amount of retained earnings is

available which in turn helps managers in making expansion decisions(O'Hare, 2016).

Accounting in Making Budget- Budget is prepared by companies to achieve their future

goals & objectives. Preparation of Budget also requires cost & time but if company is having

detailed information of their past years financial data than it is easy for firm to prepare a future

financial plan. Budget of Tesco includes future information related to income & expenses of

company and that requires accounting details so, accounting also has a role in Budget

Preparation.

Accounting Function also benefits Tesco in calculating ratios. Current Ratio is calculated

by company to check its liquidity and for that details of current liabilities and assets are required.

Further, details of sales are creditors are required to calculate creditors ration and sales ratio.

Thus, Accounting Function also play a role in Calculation & Analysis of Ratios and comparing

ratios of two years.

Role of finance

Finance function play a crucial role in Tesco as it provides liquidity in firm and with this

function Finance Manager of Tesco can make various decisions such as Investment Decision,

Expansion Decision, Acquisition Decisions, Budgeting Decision and Various other decisions

related to fund management. Finance play a crucial role in business operation of Tesco, Which

are discussed below-

Financial Planning- Tesco does its future financial planning by preparing different types

of budgets such as cash budget, production budget and sales budget. This budgets are prepared

by company on the basis availability of funds with it. For Example- If company is having enough

cash & profits than only it is able to project its future financials. Thus, finance function plays a

vital role in planning.

Further, various strategies are formulated by managers of Tesco to achieve its future

goals & objectives. Company can formulate this strategies if its managers knows where company

is investing its funds and from which types of resources it is raising capital. Thus, this function

also play a role in future business planning. Finance Function also has a role in projecting cash

position of Tesco(McInnis, Yu and Yust, 2018).

Money Management- Finance function helps Chief Financial Officer of Tesco in

evaluating different investment alternatives and it also helps company in analysing returns from

different alternatives. This analysis further helps company in making best investment decision.

This finance function is known as Investment Function. Investment Function enable company in

managing its cash. Thus, this function also benefits firm in reducing unnecessary cost and invest

that money in productive business operations of company. Thus, Investment Function of Finance

also helps company in investing its resources in productive activities so that Tesco can achieve

higher profits.

For Example- Tesco wants to raise funds for establishment of new stores and for that

company either can issue shares through initial public offering or can take loan from financial

institutions. With the help of investment function CFO of Tesco can check returns from both the

alternatives and select an alternative which is giving higher return. This function also benefits

company in analysing its cash inflows and out flows. Further, if company is having excess cash

than that cash is utilised in making future expansion which leads to profit maximisation and also

improves performance of company(The Role of Accounting in Business. 2016).

Risk Management- Financial function is having an essential role in minimising risk of

business organisations. Managers of Tesco analyse financial reports of firm such as Balance

Sheet, Income Statement, Cash Flow Statements and other financial reports. With this Financial

Analysis organisation is able to monitor and control affect of different types of risk. These risk

includes Interest Rate Risk, Change in Tax Rates, Changes in demand & supply and change in

exchange rate. By controlling all these risk Tesco makes various decisions so that it can gain

profits in adverse situations also.

cash & profits than only it is able to project its future financials. Thus, finance function plays a

vital role in planning.

Further, various strategies are formulated by managers of Tesco to achieve its future

goals & objectives. Company can formulate this strategies if its managers knows where company

is investing its funds and from which types of resources it is raising capital. Thus, this function

also play a role in future business planning. Finance Function also has a role in projecting cash

position of Tesco(McInnis, Yu and Yust, 2018).

Money Management- Finance function helps Chief Financial Officer of Tesco in

evaluating different investment alternatives and it also helps company in analysing returns from

different alternatives. This analysis further helps company in making best investment decision.

This finance function is known as Investment Function. Investment Function enable company in

managing its cash. Thus, this function also benefits firm in reducing unnecessary cost and invest

that money in productive business operations of company. Thus, Investment Function of Finance

also helps company in investing its resources in productive activities so that Tesco can achieve

higher profits.

For Example- Tesco wants to raise funds for establishment of new stores and for that

company either can issue shares through initial public offering or can take loan from financial

institutions. With the help of investment function CFO of Tesco can check returns from both the

alternatives and select an alternative which is giving higher return. This function also benefits

company in analysing its cash inflows and out flows. Further, if company is having excess cash

than that cash is utilised in making future expansion which leads to profit maximisation and also

improves performance of company(The Role of Accounting in Business. 2016).

Risk Management- Financial function is having an essential role in minimising risk of

business organisations. Managers of Tesco analyse financial reports of firm such as Balance

Sheet, Income Statement, Cash Flow Statements and other financial reports. With this Financial

Analysis organisation is able to monitor and control affect of different types of risk. These risk

includes Interest Rate Risk, Change in Tax Rates, Changes in demand & supply and change in

exchange rate. By controlling all these risk Tesco makes various decisions so that it can gain

profits in adverse situations also.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Tesco is offering its products & services in various countries across the globe company

is facing through Exchange Rate Risk and Risk of changing customers preferences as customers

of different countries are having different choices which indirectly affects demand of products

and services of Tesco. Thus, Finance Function is beneficial for company to operate its business

in different geographical locations. As these function manages different types risk it also

improves performance & operational efficiency of Tesco.

Financial Forecasting- Various finance functions such Dividend Function and

Investment Function helps Tesco in its future financial forecasting and with this organisation is

able to achieve its future goals and modify its goals & objectives according to changes made in

business environment of organisations. As Tesco is a retailer its forecasting is done by evaluating

sales volume and amount of various operating & non operating expenses(Camin and et.al.,

2016).

For Example- Manager of Tesco wants to make an estimation of its future sales volume

than company is able to forecast that only if it knows how much funds are available for

production.

Finance Function also play a role in controlling and managing all the available financial

resources of Tesco. Further, Finance function is a sources of Financial Management thus, with

this company is able to maximise its profitability and performance. This function also enable

firm in acquiring & utilising financial resources in the most effective manner so that company

can achieve its objectives. As this function helps company in allocating all its resources in

different departments. Further, Tesco is a international company so it is necessary for company

to allocate resources equally in all of its departments.

Finance Functions also has a significant role in developing financial framework of

organisation. Money is a crucial element in operating business of each & every organisation and

without it a company is not able to expand and diversify its business which in turn degraded

brand image of company. This function manages liquidity in the firm.

Finance Function also plays an important role in managing working capital of company

as it provides effective utilisation of resources. If companies working capital is managed than it

maximises production capacity which in turn enhances profits and market share of

company(Easton and Sommers, 2018).

is facing through Exchange Rate Risk and Risk of changing customers preferences as customers

of different countries are having different choices which indirectly affects demand of products

and services of Tesco. Thus, Finance Function is beneficial for company to operate its business

in different geographical locations. As these function manages different types risk it also

improves performance & operational efficiency of Tesco.

Financial Forecasting- Various finance functions such Dividend Function and

Investment Function helps Tesco in its future financial forecasting and with this organisation is

able to achieve its future goals and modify its goals & objectives according to changes made in

business environment of organisations. As Tesco is a retailer its forecasting is done by evaluating

sales volume and amount of various operating & non operating expenses(Camin and et.al.,

2016).

For Example- Manager of Tesco wants to make an estimation of its future sales volume

than company is able to forecast that only if it knows how much funds are available for

production.

Finance Function also play a role in controlling and managing all the available financial

resources of Tesco. Further, Finance function is a sources of Financial Management thus, with

this company is able to maximise its profitability and performance. This function also enable

firm in acquiring & utilising financial resources in the most effective manner so that company

can achieve its objectives. As this function helps company in allocating all its resources in

different departments. Further, Tesco is a international company so it is necessary for company

to allocate resources equally in all of its departments.

Finance Functions also has a significant role in developing financial framework of

organisation. Money is a crucial element in operating business of each & every organisation and

without it a company is not able to expand and diversify its business which in turn degraded

brand image of company. This function manages liquidity in the firm.

Finance Function also plays an important role in managing working capital of company

as it provides effective utilisation of resources. If companies working capital is managed than it

maximises production capacity which in turn enhances profits and market share of

company(Easton and Sommers, 2018).

Finance Function also includes Dividend Function through which Tesco is able to

disclose and set amount of dividend distributed by company to its shareholders. Which in turn

attracts customers and enhances market share of company.

TASK 2

Calculation of different ratios

Return on capital employed (ROCE)

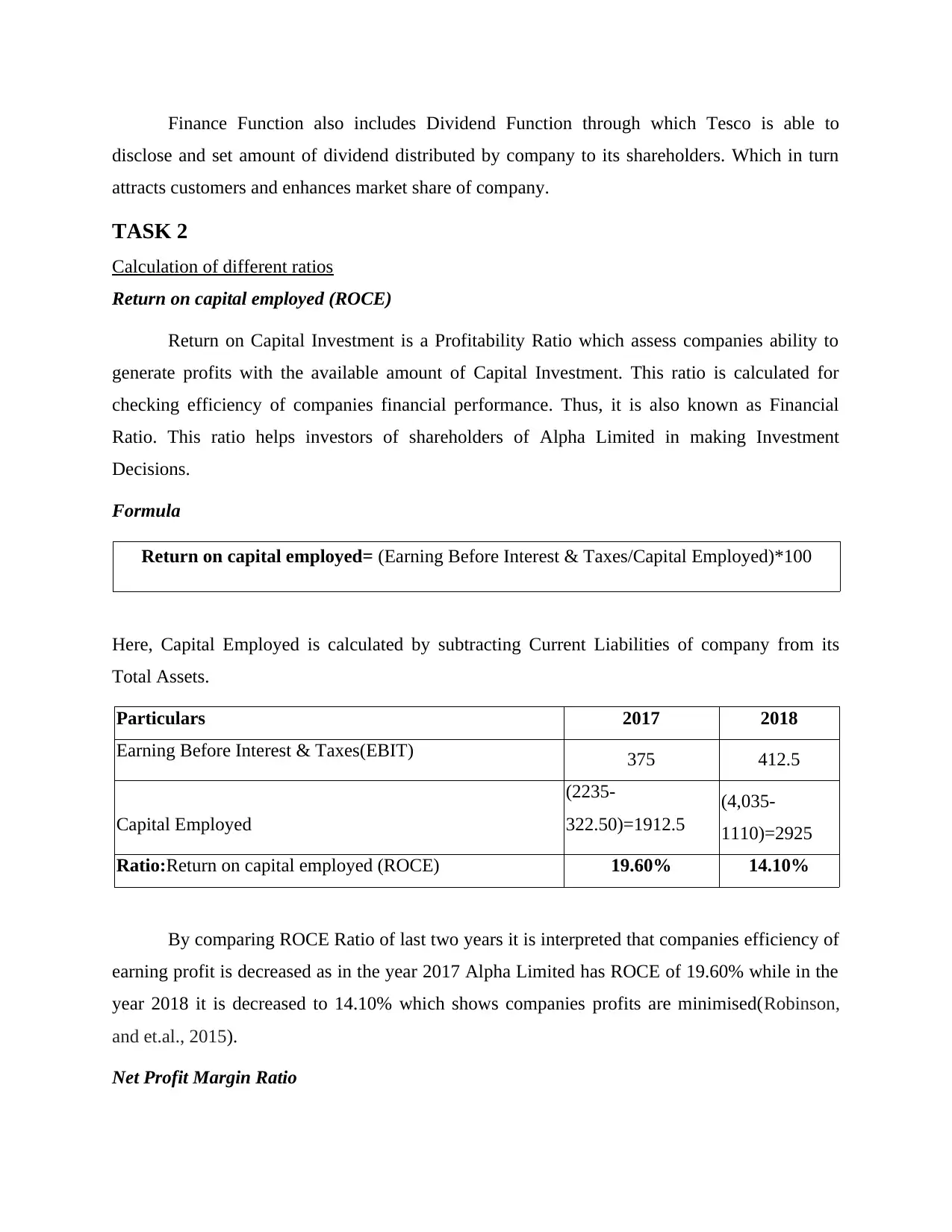

Return on Capital Investment is a Profitability Ratio which assess companies ability to

generate profits with the available amount of Capital Investment. This ratio is calculated for

checking efficiency of companies financial performance. Thus, it is also known as Financial

Ratio. This ratio helps investors of shareholders of Alpha Limited in making Investment

Decisions.

Formula

Return on capital employed= (Earning Before Interest & Taxes/Capital Employed)*100

Here, Capital Employed is calculated by subtracting Current Liabilities of company from its

Total Assets.

Particulars 2017 2018

Earning Before Interest & Taxes(EBIT) 375 412.5

Capital Employed

(2235-

322.50)=1912.5

(4,035-

1110)=2925

Ratio:Return on capital employed (ROCE) 19.60% 14.10%

By comparing ROCE Ratio of last two years it is interpreted that companies efficiency of

earning profit is decreased as in the year 2017 Alpha Limited has ROCE of 19.60% while in the

year 2018 it is decreased to 14.10% which shows companies profits are minimised(Robinson,

and et.al., 2015).

Net Profit Margin Ratio

disclose and set amount of dividend distributed by company to its shareholders. Which in turn

attracts customers and enhances market share of company.

TASK 2

Calculation of different ratios

Return on capital employed (ROCE)

Return on Capital Investment is a Profitability Ratio which assess companies ability to

generate profits with the available amount of Capital Investment. This ratio is calculated for

checking efficiency of companies financial performance. Thus, it is also known as Financial

Ratio. This ratio helps investors of shareholders of Alpha Limited in making Investment

Decisions.

Formula

Return on capital employed= (Earning Before Interest & Taxes/Capital Employed)*100

Here, Capital Employed is calculated by subtracting Current Liabilities of company from its

Total Assets.

Particulars 2017 2018

Earning Before Interest & Taxes(EBIT) 375 412.5

Capital Employed

(2235-

322.50)=1912.5

(4,035-

1110)=2925

Ratio:Return on capital employed (ROCE) 19.60% 14.10%

By comparing ROCE Ratio of last two years it is interpreted that companies efficiency of

earning profit is decreased as in the year 2017 Alpha Limited has ROCE of 19.60% while in the

year 2018 it is decreased to 14.10% which shows companies profits are minimised(Robinson,

and et.al., 2015).

Net Profit Margin Ratio

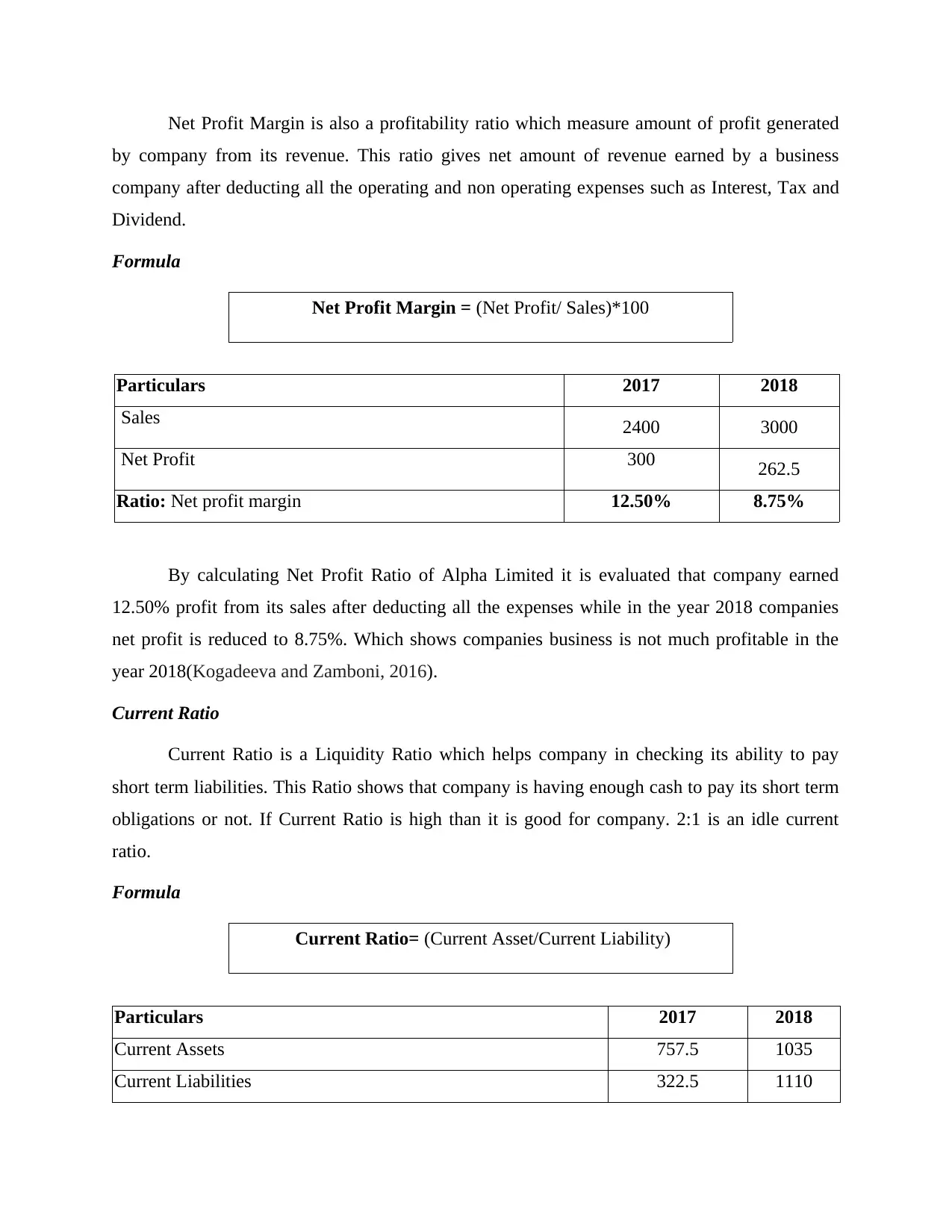

Net Profit Margin is also a profitability ratio which measure amount of profit generated

by company from its revenue. This ratio gives net amount of revenue earned by a business

company after deducting all the operating and non operating expenses such as Interest, Tax and

Dividend.

Formula

Net Profit Margin = (Net Profit/ Sales)*100

Particulars 2017 2018

Sales 2400 3000

Net Profit 300 262.5

Ratio: Net profit margin 12.50% 8.75%

By calculating Net Profit Ratio of Alpha Limited it is evaluated that company earned

12.50% profit from its sales after deducting all the expenses while in the year 2018 companies

net profit is reduced to 8.75%. Which shows companies business is not much profitable in the

year 2018(Kogadeeva and Zamboni, 2016).

Current Ratio

Current Ratio is a Liquidity Ratio which helps company in checking its ability to pay

short term liabilities. This Ratio shows that company is having enough cash to pay its short term

obligations or not. If Current Ratio is high than it is good for company. 2:1 is an idle current

ratio.

Formula

Current Ratio= (Current Asset/Current Liability)

Particulars 2017 2018

Current Assets 757.5 1035

Current Liabilities 322.5 1110

by company from its revenue. This ratio gives net amount of revenue earned by a business

company after deducting all the operating and non operating expenses such as Interest, Tax and

Dividend.

Formula

Net Profit Margin = (Net Profit/ Sales)*100

Particulars 2017 2018

Sales 2400 3000

Net Profit 300 262.5

Ratio: Net profit margin 12.50% 8.75%

By calculating Net Profit Ratio of Alpha Limited it is evaluated that company earned

12.50% profit from its sales after deducting all the expenses while in the year 2018 companies

net profit is reduced to 8.75%. Which shows companies business is not much profitable in the

year 2018(Kogadeeva and Zamboni, 2016).

Current Ratio

Current Ratio is a Liquidity Ratio which helps company in checking its ability to pay

short term liabilities. This Ratio shows that company is having enough cash to pay its short term

obligations or not. If Current Ratio is high than it is good for company. 2:1 is an idle current

ratio.

Formula

Current Ratio= (Current Asset/Current Liability)

Particulars 2017 2018

Current Assets 757.5 1035

Current Liabilities 322.5 1110

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

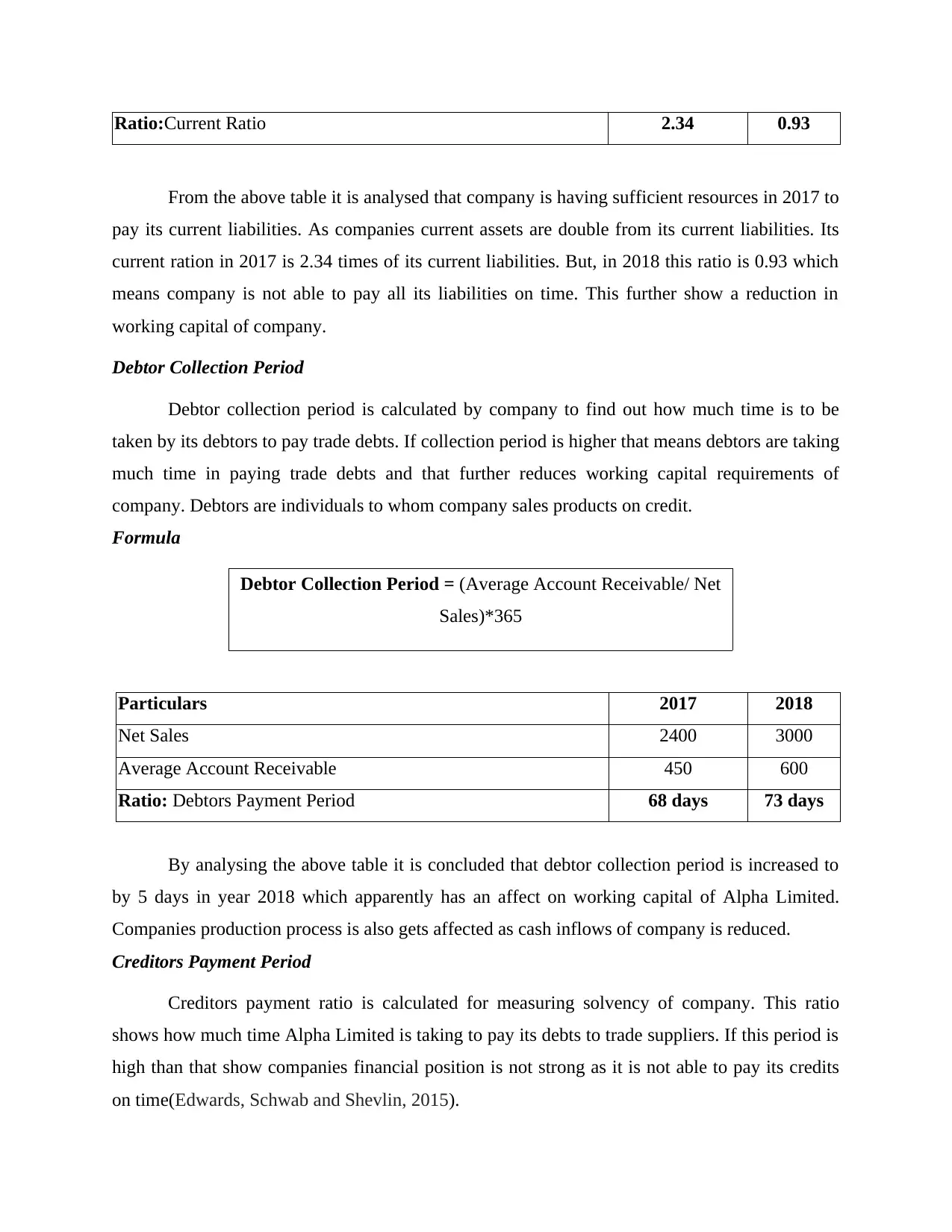

Ratio:Current Ratio 2.34 0.93

From the above table it is analysed that company is having sufficient resources in 2017 to

pay its current liabilities. As companies current assets are double from its current liabilities. Its

current ration in 2017 is 2.34 times of its current liabilities. But, in 2018 this ratio is 0.93 which

means company is not able to pay all its liabilities on time. This further show a reduction in

working capital of company.

Debtor Collection Period

Debtor collection period is calculated by company to find out how much time is to be

taken by its debtors to pay trade debts. If collection period is higher that means debtors are taking

much time in paying trade debts and that further reduces working capital requirements of

company. Debtors are individuals to whom company sales products on credit.

Formula

Debtor Collection Period = (Average Account Receivable/ Net

Sales)*365

Particulars 2017 2018

Net Sales 2400 3000

Average Account Receivable 450 600

Ratio: Debtors Payment Period 68 days 73 days

By analysing the above table it is concluded that debtor collection period is increased to

by 5 days in year 2018 which apparently has an affect on working capital of Alpha Limited.

Companies production process is also gets affected as cash inflows of company is reduced.

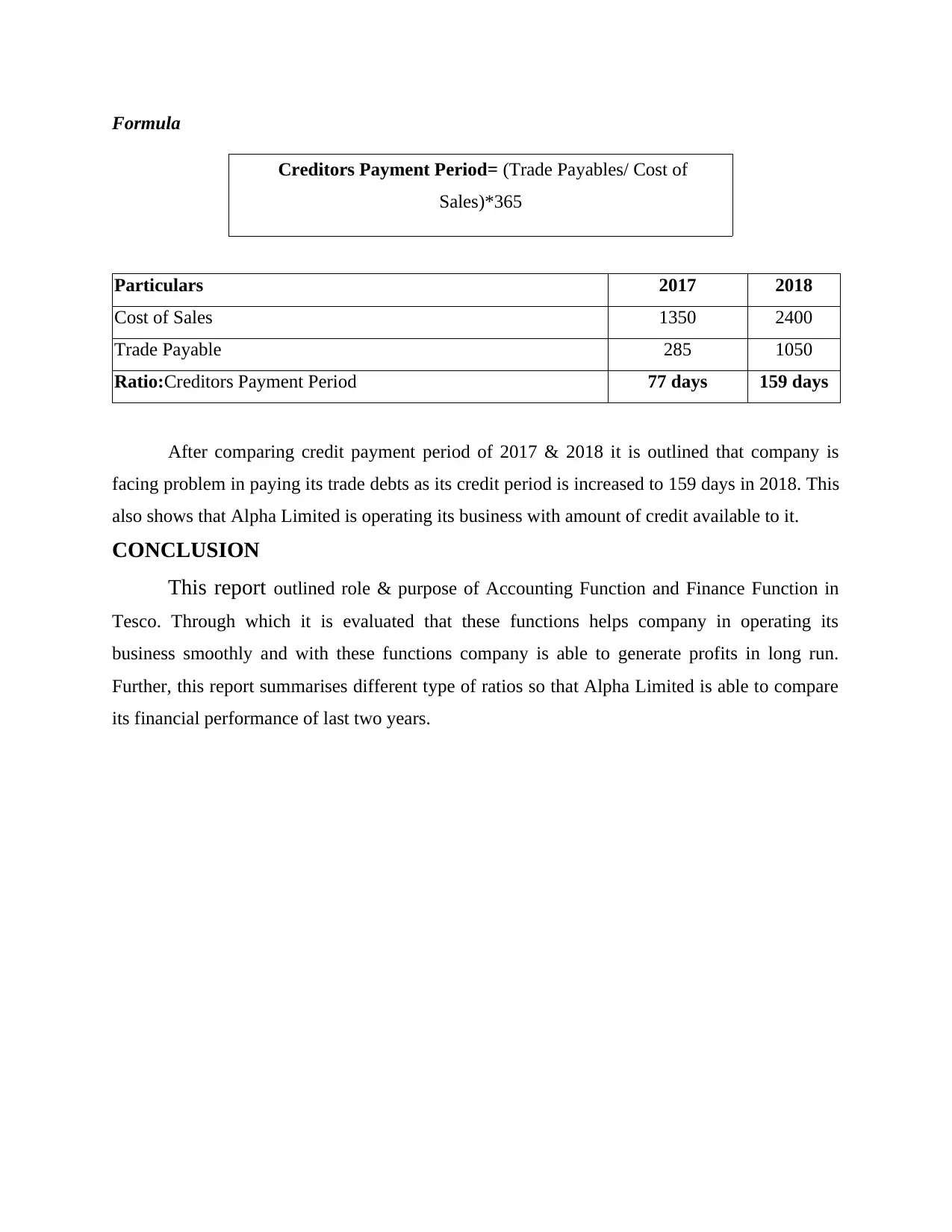

Creditors Payment Period

Creditors payment ratio is calculated for measuring solvency of company. This ratio

shows how much time Alpha Limited is taking to pay its debts to trade suppliers. If this period is

high than that show companies financial position is not strong as it is not able to pay its credits

on time(Edwards, Schwab and Shevlin, 2015).

From the above table it is analysed that company is having sufficient resources in 2017 to

pay its current liabilities. As companies current assets are double from its current liabilities. Its

current ration in 2017 is 2.34 times of its current liabilities. But, in 2018 this ratio is 0.93 which

means company is not able to pay all its liabilities on time. This further show a reduction in

working capital of company.

Debtor Collection Period

Debtor collection period is calculated by company to find out how much time is to be

taken by its debtors to pay trade debts. If collection period is higher that means debtors are taking

much time in paying trade debts and that further reduces working capital requirements of

company. Debtors are individuals to whom company sales products on credit.

Formula

Debtor Collection Period = (Average Account Receivable/ Net

Sales)*365

Particulars 2017 2018

Net Sales 2400 3000

Average Account Receivable 450 600

Ratio: Debtors Payment Period 68 days 73 days

By analysing the above table it is concluded that debtor collection period is increased to

by 5 days in year 2018 which apparently has an affect on working capital of Alpha Limited.

Companies production process is also gets affected as cash inflows of company is reduced.

Creditors Payment Period

Creditors payment ratio is calculated for measuring solvency of company. This ratio

shows how much time Alpha Limited is taking to pay its debts to trade suppliers. If this period is

high than that show companies financial position is not strong as it is not able to pay its credits

on time(Edwards, Schwab and Shevlin, 2015).

Formula

Creditors Payment Period= (Trade Payables/ Cost of

Sales)*365

Particulars 2017 2018

Cost of Sales 1350 2400

Trade Payable 285 1050

Ratio:Creditors Payment Period 77 days 159 days

After comparing credit payment period of 2017 & 2018 it is outlined that company is

facing problem in paying its trade debts as its credit period is increased to 159 days in 2018. This

also shows that Alpha Limited is operating its business with amount of credit available to it.

CONCLUSION

This report outlined role & purpose of Accounting Function and Finance Function in

Tesco. Through which it is evaluated that these functions helps company in operating its

business smoothly and with these functions company is able to generate profits in long run.

Further, this report summarises different type of ratios so that Alpha Limited is able to compare

its financial performance of last two years.

Creditors Payment Period= (Trade Payables/ Cost of

Sales)*365

Particulars 2017 2018

Cost of Sales 1350 2400

Trade Payable 285 1050

Ratio:Creditors Payment Period 77 days 159 days

After comparing credit payment period of 2017 & 2018 it is outlined that company is

facing problem in paying its trade debts as its credit period is increased to 159 days in 2018. This

also shows that Alpha Limited is operating its business with amount of credit available to it.

CONCLUSION

This report outlined role & purpose of Accounting Function and Finance Function in

Tesco. Through which it is evaluated that these functions helps company in operating its

business smoothly and with these functions company is able to generate profits in long run.

Further, this report summarises different type of ratios so that Alpha Limited is able to compare

its financial performance of last two years.

REFERENCES

Books and Journals

Minnis, M. and Sutherland, A., 2017. Financial statements as monitoring mechanisms: Evidence

from small commercial loans. Journal of Accounting Research. 55(1). pp.197-233.

Vanauken, H.E., Ascigil, S. and Carraher, S., 2016. Turkish SMEs’ use of financial statements

for decision making. The Journal of Entrepreneurial Finance. 19(1). p.6.

Berger, P.G., Minnis, M. and Sutherland, A., 2017. Commercial lending concentration and bank

expertise: Evidence from borrower financial statements. Journal of Accounting and

Economics. 64(2-3). pp.253-277.

Lakis, V. and Masiulevičius, A., 2017. ACCEPTABLE AUDIT MATERIALITY FOR USERS

OF FINANCIAL STATEMENTS. Journal of Management. 2(31).

Rouxelin, F., Wongsunwai, W. and Yehuda, N., 2017. Aggregate cost stickiness in GAAP

financial statements and future unemployment rate. The Accounting Review. 93(3).

pp.299-325.

Moroney, R. and Trotman, K.T., 2016. Differences in auditors' materiality assessments when

auditing financial statements and sustainability reports. Contemporary Accounting

Research. 33(2). pp.551-575.

O'Hare, J., 2016. Analysing financial statements for non-specialists. Routledge.

McInnis, J.M., Yu, Y. and Yust, C.G., 2018. Does Fair Value Accounting Provide More Useful

Financial Statements than Current GAAP for Banks?. The Accounting Review. 93(6).

pp.257-279.

Kogadeeva, M. and Zamboni, N., 2016. SUMOFLUX: a generalized method for targeted 13C

metabolic flux ratio analysis. PLoS computational biology. 12(9). p.e1005109.

Camin, F., and et.al., 2016. Stable isotope ratio analysis for assessing the authenticity of food of

animal origin. Comprehensive Reviews in Food Science and Food Safety. 15(5). pp.868-

877.

Easton, M. and Sommers, Z., 2018. Financial Statement Analysis & Valuation, 5e.

Books and Journals

Minnis, M. and Sutherland, A., 2017. Financial statements as monitoring mechanisms: Evidence

from small commercial loans. Journal of Accounting Research. 55(1). pp.197-233.

Vanauken, H.E., Ascigil, S. and Carraher, S., 2016. Turkish SMEs’ use of financial statements

for decision making. The Journal of Entrepreneurial Finance. 19(1). p.6.

Berger, P.G., Minnis, M. and Sutherland, A., 2017. Commercial lending concentration and bank

expertise: Evidence from borrower financial statements. Journal of Accounting and

Economics. 64(2-3). pp.253-277.

Lakis, V. and Masiulevičius, A., 2017. ACCEPTABLE AUDIT MATERIALITY FOR USERS

OF FINANCIAL STATEMENTS. Journal of Management. 2(31).

Rouxelin, F., Wongsunwai, W. and Yehuda, N., 2017. Aggregate cost stickiness in GAAP

financial statements and future unemployment rate. The Accounting Review. 93(3).

pp.299-325.

Moroney, R. and Trotman, K.T., 2016. Differences in auditors' materiality assessments when

auditing financial statements and sustainability reports. Contemporary Accounting

Research. 33(2). pp.551-575.

O'Hare, J., 2016. Analysing financial statements for non-specialists. Routledge.

McInnis, J.M., Yu, Y. and Yust, C.G., 2018. Does Fair Value Accounting Provide More Useful

Financial Statements than Current GAAP for Banks?. The Accounting Review. 93(6).

pp.257-279.

Kogadeeva, M. and Zamboni, N., 2016. SUMOFLUX: a generalized method for targeted 13C

metabolic flux ratio analysis. PLoS computational biology. 12(9). p.e1005109.

Camin, F., and et.al., 2016. Stable isotope ratio analysis for assessing the authenticity of food of

animal origin. Comprehensive Reviews in Food Science and Food Safety. 15(5). pp.868-

877.

Easton, M. and Sommers, Z., 2018. Financial Statement Analysis & Valuation, 5e.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Robinson, T.R., and et.al., 2015. International financial statement analysis. John Wiley & Sons.

Edwards, A., Schwab, C. and Shevlin, T., 2015. Financial constraints and cash tax savings. The

Accounting Review. 91(3). pp.859-881.

Online

The Role of Accounting in Business, 2016. [Online] Available through:

<https://smallbusiness.chron.com/role-accounting-business-459.html>

Edwards, A., Schwab, C. and Shevlin, T., 2015. Financial constraints and cash tax savings. The

Accounting Review. 91(3). pp.859-881.

Online

The Role of Accounting in Business, 2016. [Online] Available through:

<https://smallbusiness.chron.com/role-accounting-business-459.html>

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.