Business Economics: Australia and USA Macroeconomic Report (1995-2015)

VerifiedAdded on 2020/11/23

|28

|3728

|291

Report

AI Summary

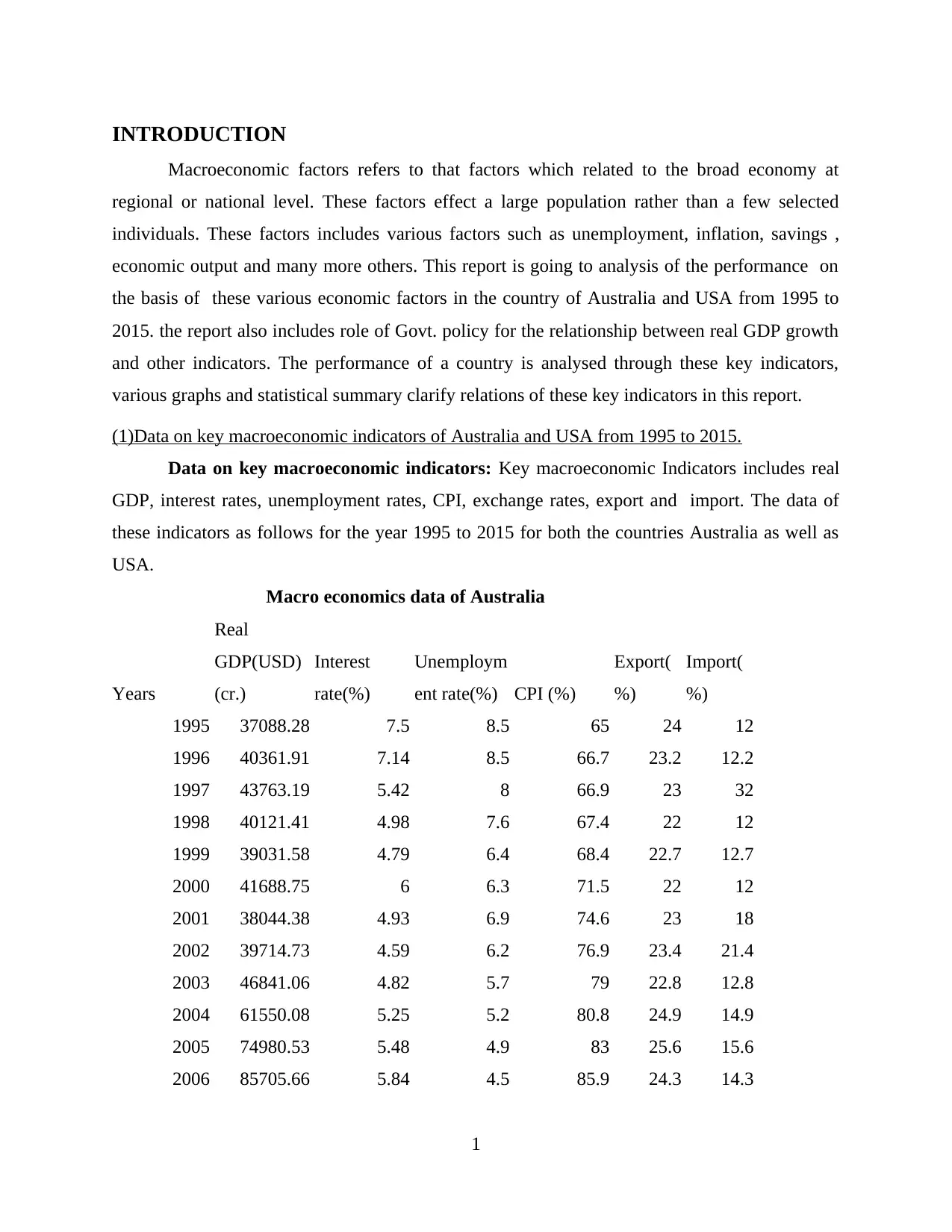

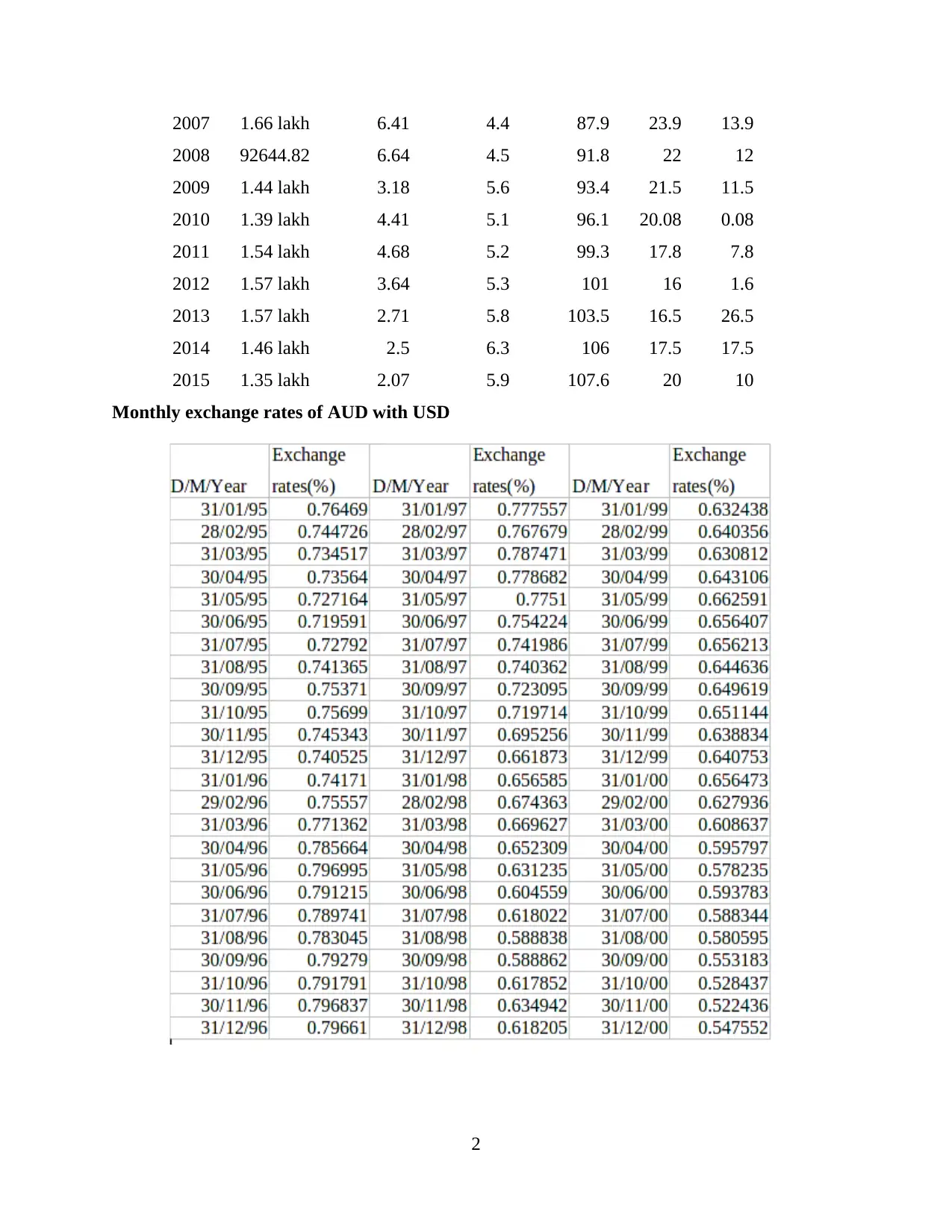

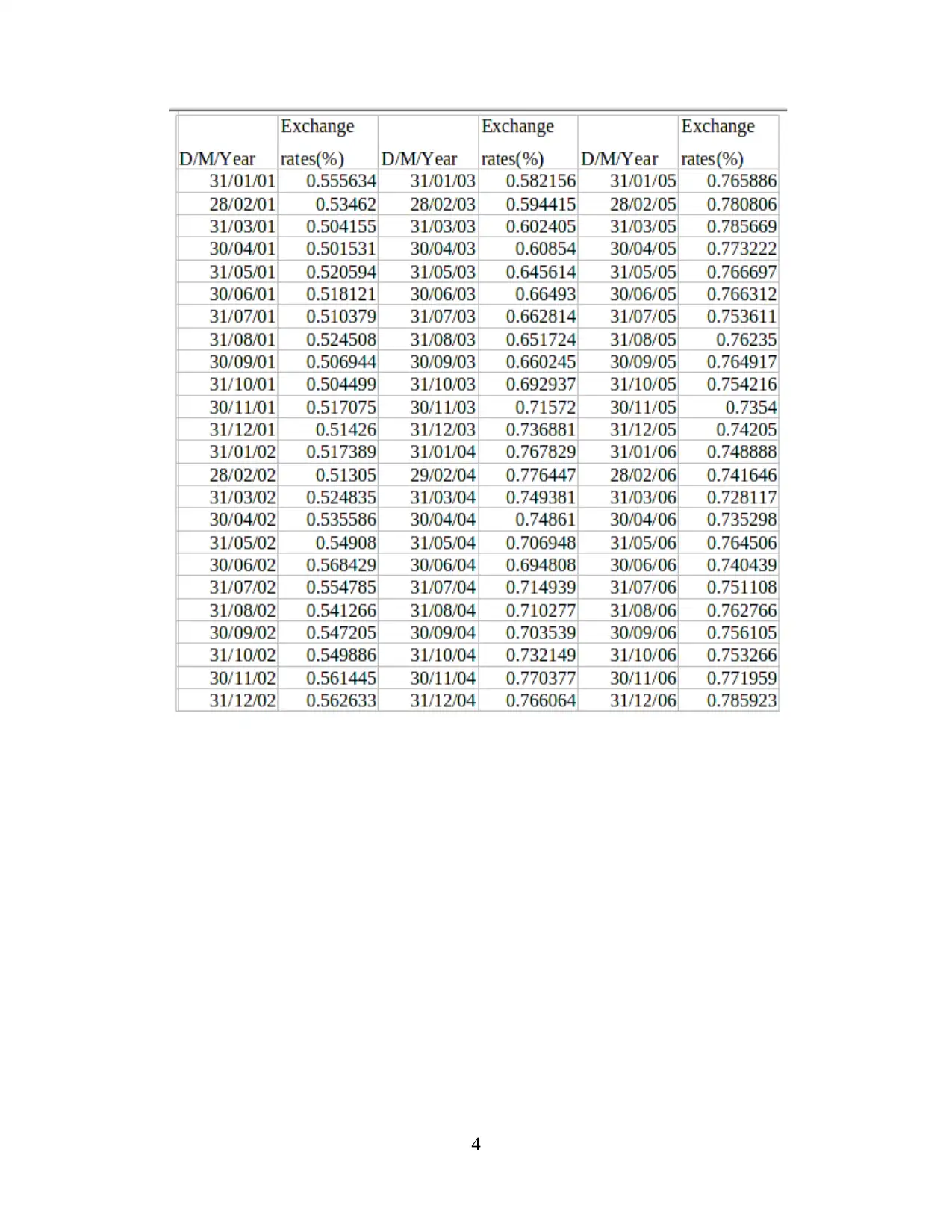

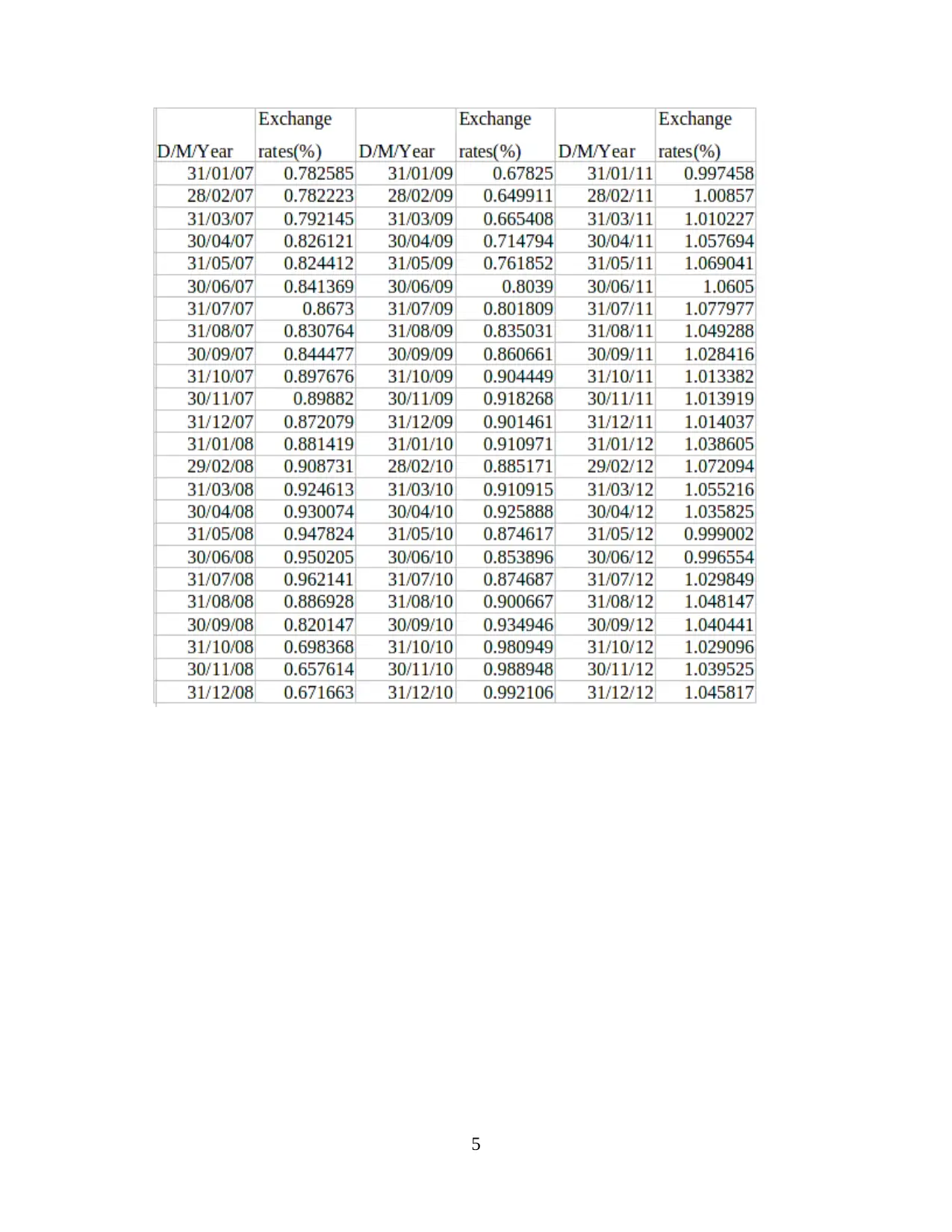

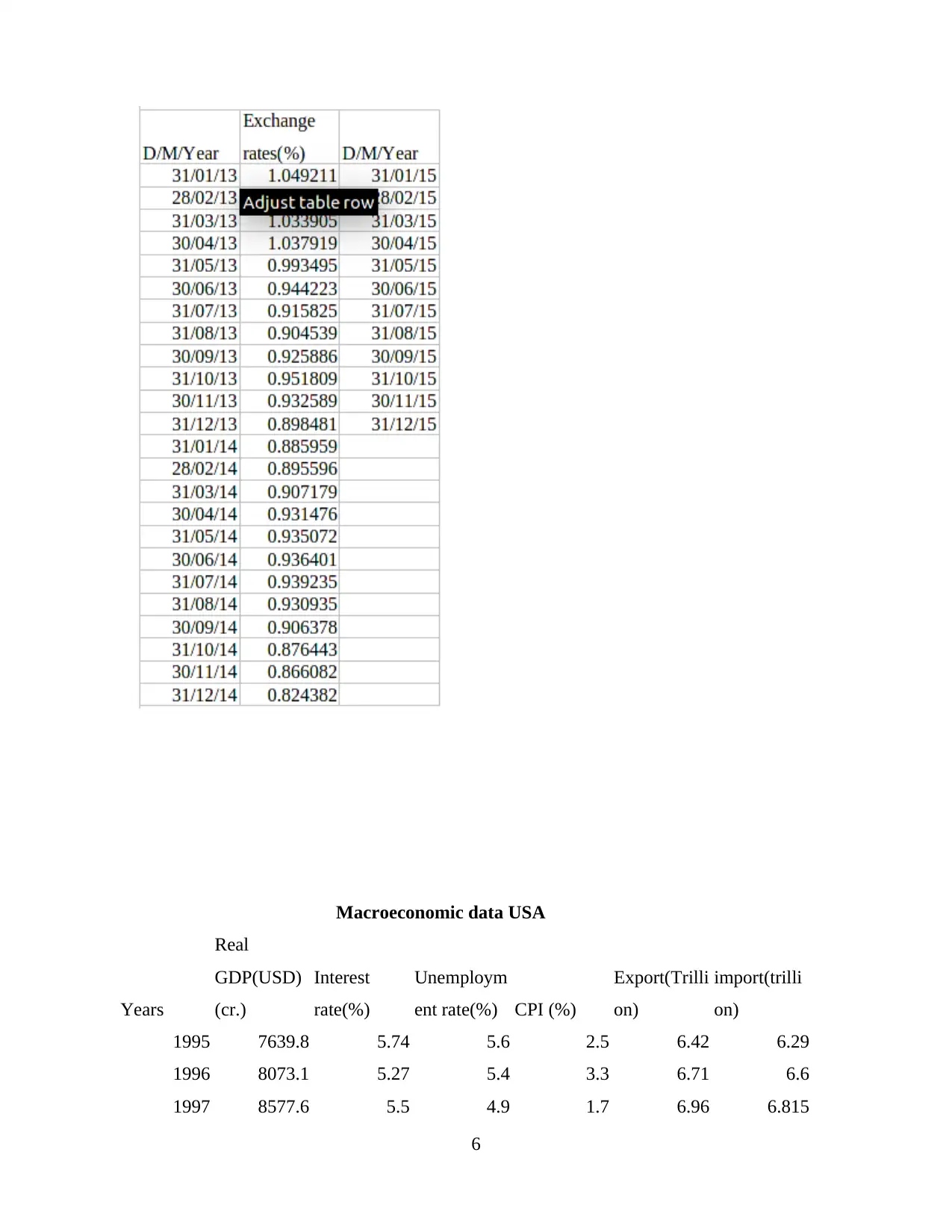

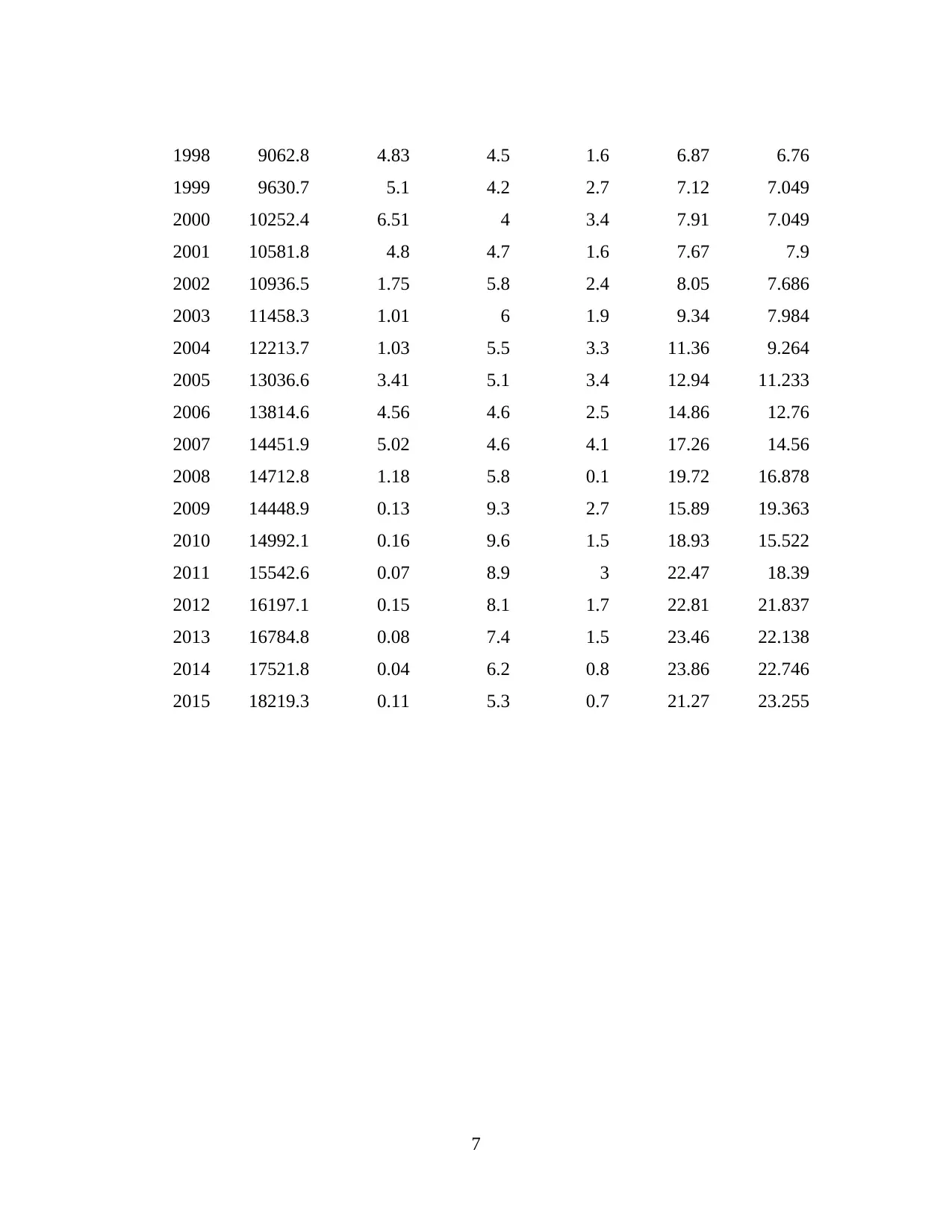

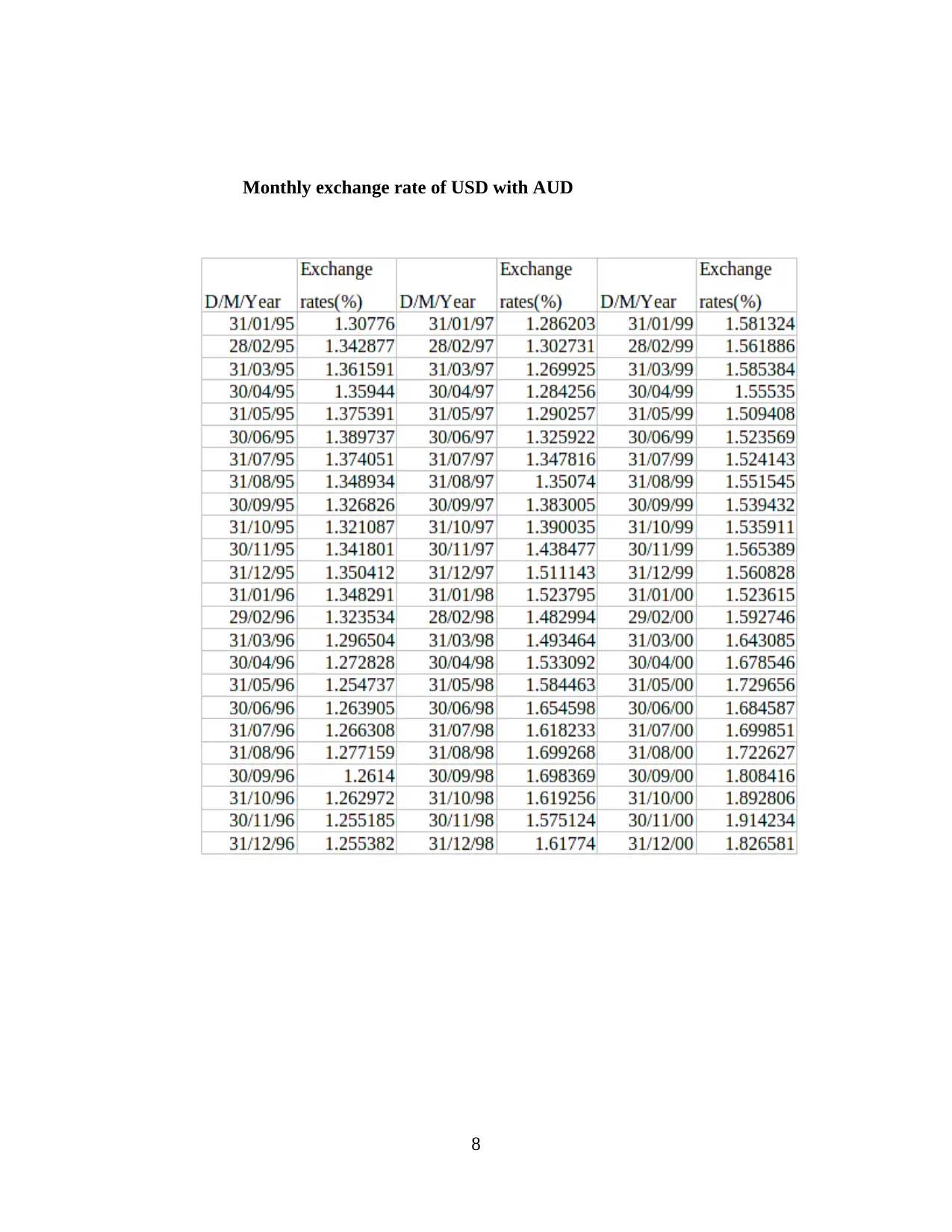

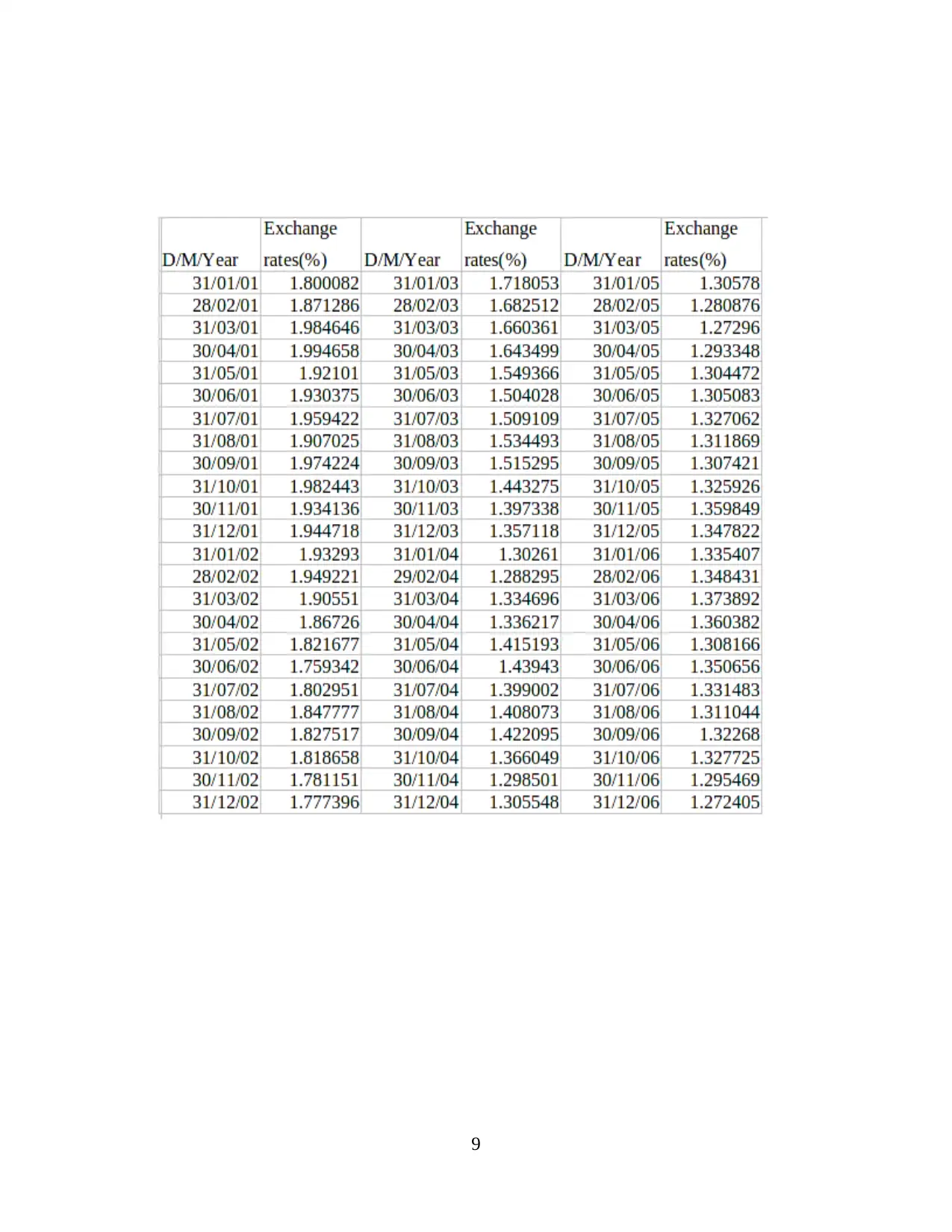

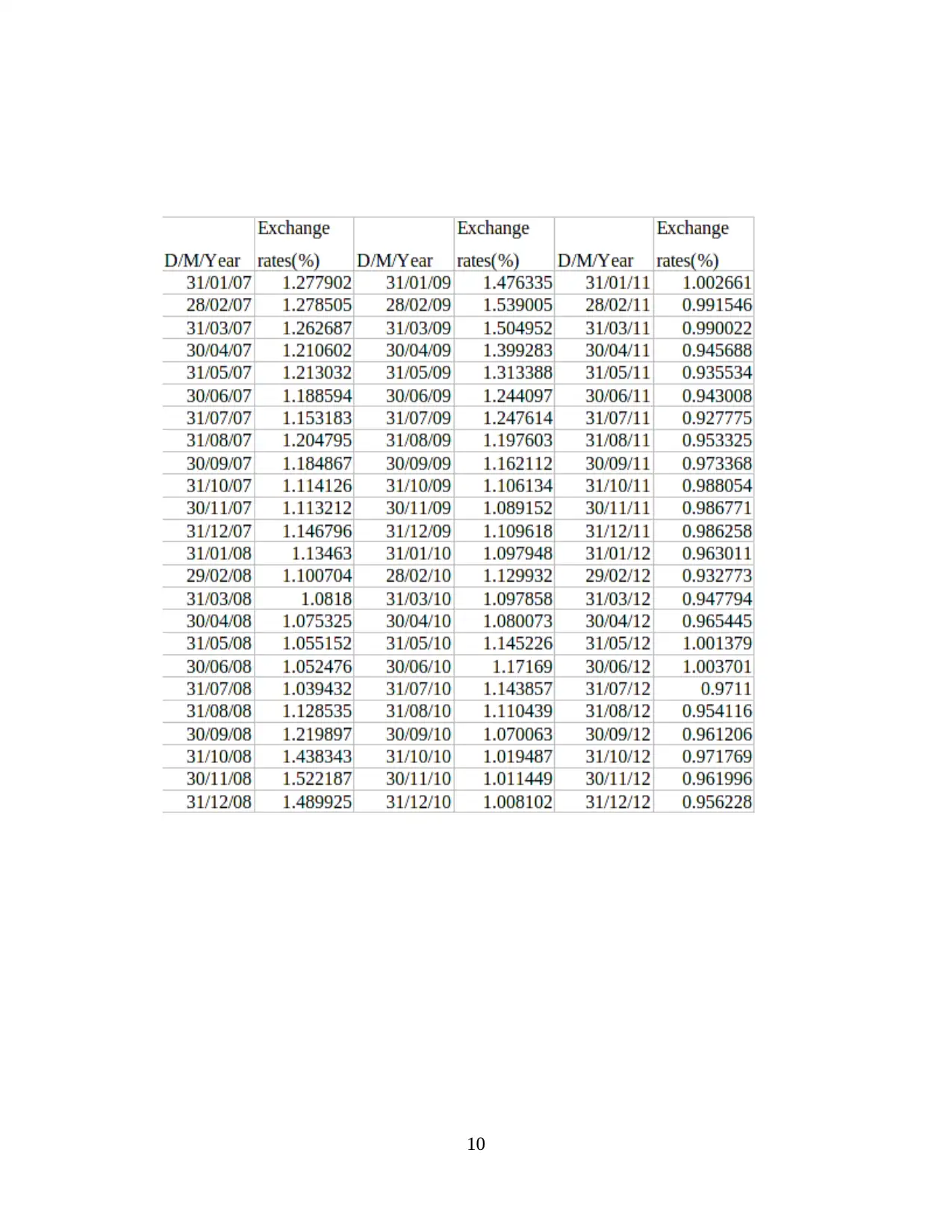

This report presents a comparative analysis of macroeconomic factors in Australia and the USA from 1995 to 2015. It begins with an introduction to macroeconomic indicators, including real GDP, interest rates, unemployment rates, CPI, exchange rates, and export/import data. The report then provides detailed data tables for both countries, spanning the specified time period. A summary of changes in macroeconomic factors for both Australia and the USA is included, highlighting trends in GDP growth, inflation, exchange rates, interest rates, unemployment, and net exports. The analysis extends to pairwise graphs illustrating relationships between key indicators like GDP growth, inflation, unemployment, and exchange rates. Finally, the report touches upon plausible economic explanations and government policies influencing these trends, although the provided text is incomplete in this section. The report aims to provide a comprehensive overview of the economic performance of Australia and the USA during the period, utilizing statistical data and graphical representations to clarify the relationships between key economic indicators. The report also includes the role of Govt. policy for the relationship between real GDP growth and other indicators.

1 out of 28

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)