Financial Analysis Report: Rio Tinto PLC for Masters in Finance

VerifiedAdded on 2020/05/16

|13

|2488

|60

Report

AI Summary

This report presents a financial analysis of Rio Tinto PLC, a major mining and metals company. The analysis covers the company's description, ownership structure, and key personnel. It delves into key financial ratios such as Return on Assets (ROA), Return on Equity (ROE), and debt ratios, providing calculations and interpretations. The report examines stock movements from the ASX website, comparing Rio Tinto's performance with the All Ordinaries Index. It includes details of a recent announcement regarding the acquisition of Aluminium Dunkerque. The report calculates the company's beta and required rate of return. The Weighted Average Cost of Capital (WACC) is computed, and the impact of a higher WACC is discussed. An evaluation of the optimal debt structure and dividend policy is presented, concluding with a recommendation for potential investors. The analysis is supported by references to relevant financial literature and data.

Running head: FINANCE FOR BUSINESS - MASTERS

Finance for business – Masters

Name of the student

Name of the university

Author note

Finance for business – Masters

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE FOR BUSINESS – MASTERS 1

Table of Contents

1. Company description.................................................................................................2

2. Ownership structure...................................................................................................2

3. Key ratios...................................................................................................................3

4. Information from ASX website..................................................................................4

5. Recent announcement................................................................................................7

6. Stock field..................................................................................................................7

7. WACC (weighted average cost of capital).................................................................8

8. Optimal debt structure................................................................................................9

9. Dividend policy..........................................................................................................9

10. Recommendation..................................................................................................10

Reference.........................................................................................................................11

Table of Contents

1. Company description.................................................................................................2

2. Ownership structure...................................................................................................2

3. Key ratios...................................................................................................................3

4. Information from ASX website..................................................................................4

5. Recent announcement................................................................................................7

6. Stock field..................................................................................................................7

7. WACC (weighted average cost of capital).................................................................8

8. Optimal debt structure................................................................................................9

9. Dividend policy..........................................................................................................9

10. Recommendation..................................................................................................10

Reference.........................................................................................................................11

FINANCE FOR BUSINESS – MASTERS 2

1. Company description

Rio Tinto Plc is the largest mining and metal company that was incorporated on 30th

March 1962. The main business of the company is to find and processing the mining

and mineral resources. Various segments of the company include Aluminium, iron ore,

diamonds, copper minerals, energy and other operations. The company carries out its

activities all over the world and are widely represented in North America and Australia.

Further, the company is strongly responded towards the increasing demand of the

community under which it carries out its business for responding towards climatic

chance and sustainability. It made the sustainable commitment to the sustainable

development that includes social wellbeing, environmental stewardship, governance

system and global transition (Rio Tinto 2018)

.

2. Ownership structure

i) Substantial shareholders

More than 20% holding – HSBC Custody Nominees (Australia) Limited holds

121,820,095 shares that is 28.72%

Greater than 5% of shares – J.P. Morgan Nominees Australia Limited hold

71,864,782 shares that is 16.94%, Citicorp Nominees Pty Ltd holds 24,176,758

shares that is 5.70% and National Nominees Limited holds 21,941,431 shares

that is 5.17%.

ii) Name of key persons

Chairman – Jan du Plessis

Board members – other key personnel included in the board of the company are

-

Chris Lynch – Financial officer

Robert Brown – Non-executive director

Megan Clark – Non-executive director

David Constable – Non-executive Director

Ann Godbehere – Non-executive Director

Sam Laidlaw – Non-executive director

1. Company description

Rio Tinto Plc is the largest mining and metal company that was incorporated on 30th

March 1962. The main business of the company is to find and processing the mining

and mineral resources. Various segments of the company include Aluminium, iron ore,

diamonds, copper minerals, energy and other operations. The company carries out its

activities all over the world and are widely represented in North America and Australia.

Further, the company is strongly responded towards the increasing demand of the

community under which it carries out its business for responding towards climatic

chance and sustainability. It made the sustainable commitment to the sustainable

development that includes social wellbeing, environmental stewardship, governance

system and global transition (Rio Tinto 2018)

.

2. Ownership structure

i) Substantial shareholders

More than 20% holding – HSBC Custody Nominees (Australia) Limited holds

121,820,095 shares that is 28.72%

Greater than 5% of shares – J.P. Morgan Nominees Australia Limited hold

71,864,782 shares that is 16.94%, Citicorp Nominees Pty Ltd holds 24,176,758

shares that is 5.70% and National Nominees Limited holds 21,941,431 shares

that is 5.17%.

ii) Name of key persons

Chairman – Jan du Plessis

Board members – other key personnel included in the board of the company are

-

Chris Lynch – Financial officer

Robert Brown – Non-executive director

Megan Clark – Non-executive director

David Constable – Non-executive Director

Ann Godbehere – Non-executive Director

Sam Laidlaw – Non-executive director

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE FOR BUSINESS – MASTERS 3

Anne Lauvergeon – Non-executive director

Hon. Paul Tellier – Non-executive director

Michael L’Estrange AO – Non-executive director

Simon Thompson – Non-executive director

John Verley – Non-executive director

Simon Henry - Non-executive director

CEO – Jean Sebastien Jacques

Any of the above mentioned key personnel does not hold substantial shares in

the company.

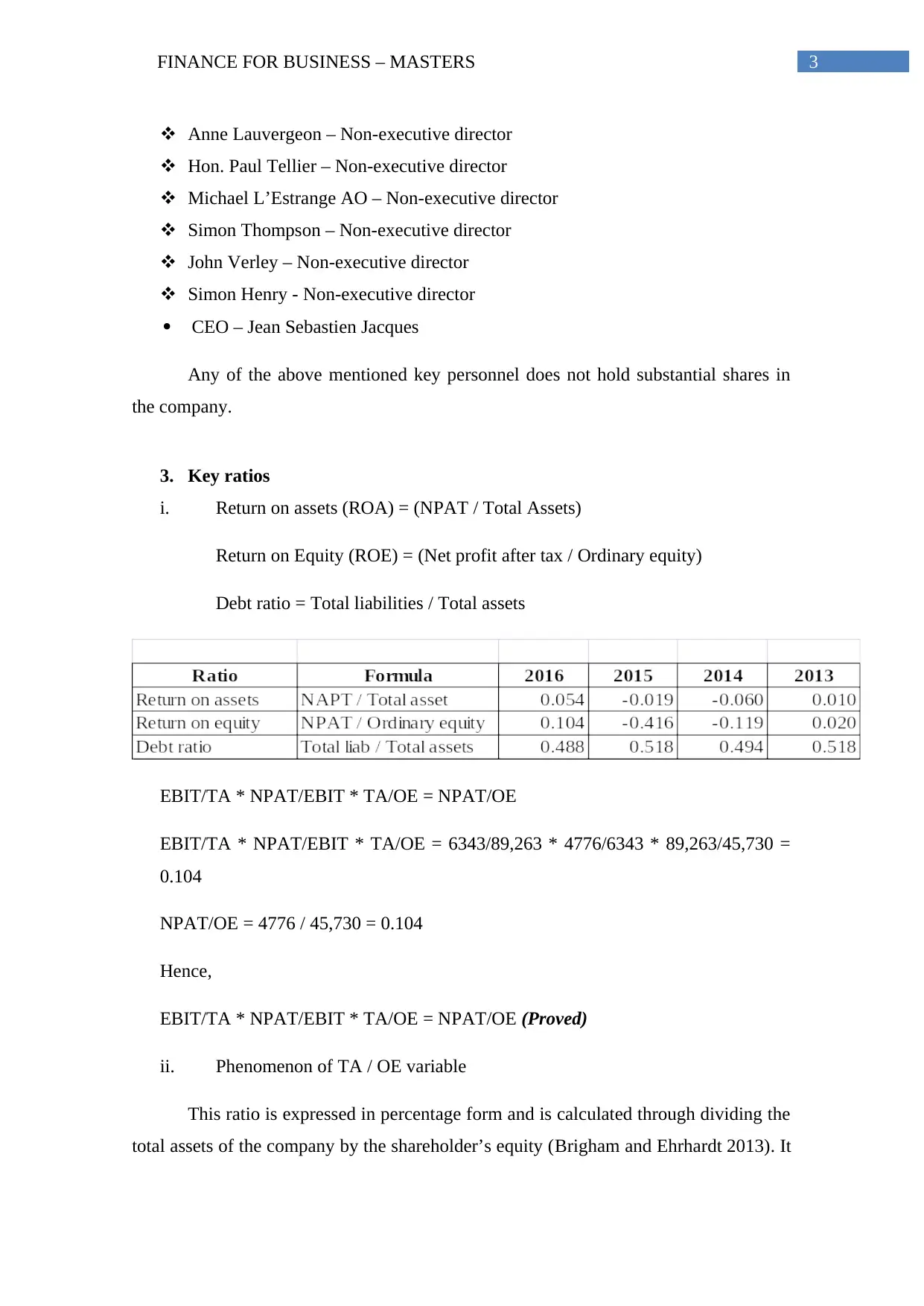

3. Key ratios

i. Return on assets (ROA) = (NPAT / Total Assets)

Return on Equity (ROE) = (Net profit after tax / Ordinary equity)

Debt ratio = Total liabilities / Total assets

EBIT/TA * NPAT/EBIT * TA/OE = NPAT/OE

EBIT/TA * NPAT/EBIT * TA/OE = 6343/89,263 * 4776/6343 * 89,263/45,730 =

0.104

NPAT/OE = 4776 / 45,730 = 0.104

Hence,

EBIT/TA * NPAT/EBIT * TA/OE = NPAT/OE (Proved)

ii. Phenomenon of TA / OE variable

This ratio is expressed in percentage form and is calculated through dividing the

total assets of the company by the shareholder’s equity (Brigham and Ehrhardt 2013). It

Anne Lauvergeon – Non-executive director

Hon. Paul Tellier – Non-executive director

Michael L’Estrange AO – Non-executive director

Simon Thompson – Non-executive director

John Verley – Non-executive director

Simon Henry - Non-executive director

CEO – Jean Sebastien Jacques

Any of the above mentioned key personnel does not hold substantial shares in

the company.

3. Key ratios

i. Return on assets (ROA) = (NPAT / Total Assets)

Return on Equity (ROE) = (Net profit after tax / Ordinary equity)

Debt ratio = Total liabilities / Total assets

EBIT/TA * NPAT/EBIT * TA/OE = NPAT/OE

EBIT/TA * NPAT/EBIT * TA/OE = 6343/89,263 * 4776/6343 * 89,263/45,730 =

0.104

NPAT/OE = 4776 / 45,730 = 0.104

Hence,

EBIT/TA * NPAT/EBIT * TA/OE = NPAT/OE (Proved)

ii. Phenomenon of TA / OE variable

This ratio is expressed in percentage form and is calculated through dividing the

total assets of the company by the shareholder’s equity (Brigham and Ehrhardt 2013). It

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE FOR BUSINESS – MASTERS 4

shows the relationship of total asset to the part owned by the shareholders. This ratio

further indicates the leverage of the company that is used for financing the company.

Though there is no specific ratio for TA to OE, it is valuable for comparing similar

businesses under the same industry. Higher ratio represents that the company’s debt

portion is considerably high to sustain in business. However, the high ratio can

represent that the return on the borrowed capital is more than the capital cost of the

company. Further, with the increase in the ratio the company may reach to the

unsustainable level as additional cost will increase the interest cost which in turn will

depreciate the value of the company.

iii. Reasons behind higher ROE than ROA

ROE as well as ROA both are the metrics for analysing the profit. When the

ROE is more as compared to the ROA, it states that the company’s total asset is more as

compared to the owner’s equity of the company. With the increase of the equity the debt

portion of the company reduces. However, if the ROE is more it represent that the

company is earning on its borrowing. In other words, the interest rate on debt is lower

that the return of the company. Therefore, if company raise additional debt only though

debt it would earn more as compared to the situation where the additional fund is raised

through debt and equity both.

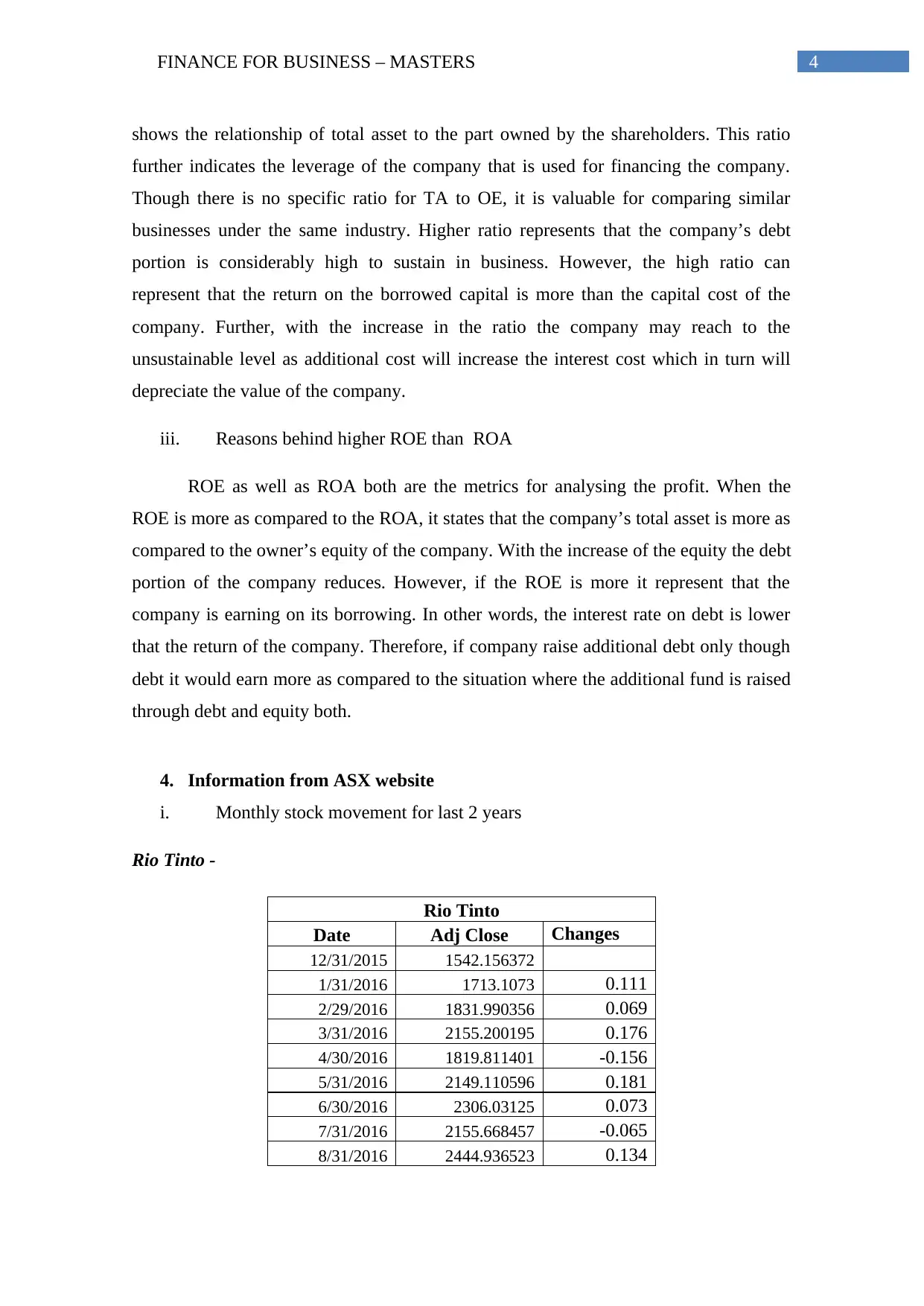

4. Information from ASX website

i. Monthly stock movement for last 2 years

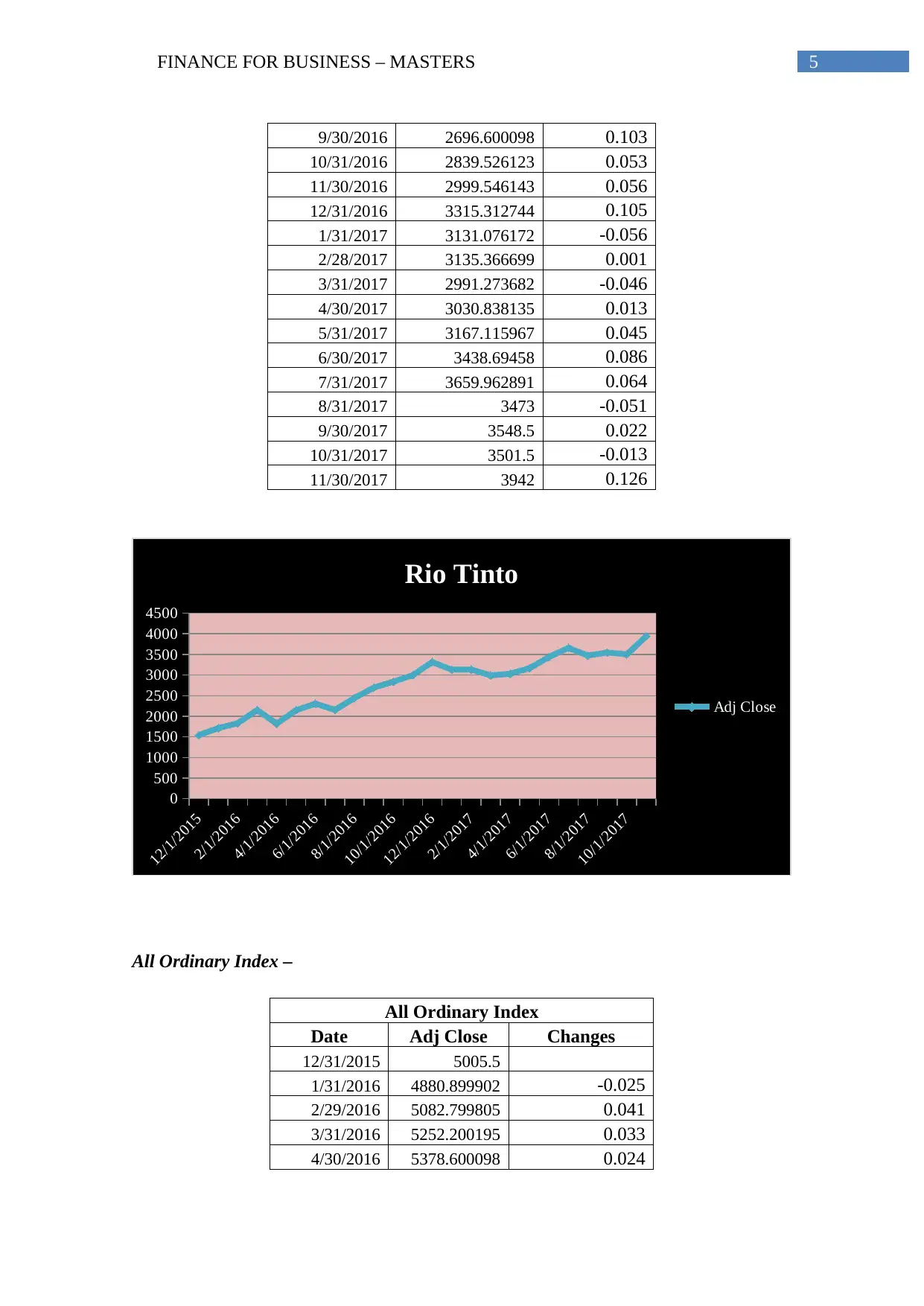

Rio Tinto -

Rio Tinto

Date Adj Close Changes

12/31/2015 1542.156372

1/31/2016 1713.1073 0.111

2/29/2016 1831.990356 0.069

3/31/2016 2155.200195 0.176

4/30/2016 1819.811401 -0.156

5/31/2016 2149.110596 0.181

6/30/2016 2306.03125 0.073

7/31/2016 2155.668457 -0.065

8/31/2016 2444.936523 0.134

shows the relationship of total asset to the part owned by the shareholders. This ratio

further indicates the leverage of the company that is used for financing the company.

Though there is no specific ratio for TA to OE, it is valuable for comparing similar

businesses under the same industry. Higher ratio represents that the company’s debt

portion is considerably high to sustain in business. However, the high ratio can

represent that the return on the borrowed capital is more than the capital cost of the

company. Further, with the increase in the ratio the company may reach to the

unsustainable level as additional cost will increase the interest cost which in turn will

depreciate the value of the company.

iii. Reasons behind higher ROE than ROA

ROE as well as ROA both are the metrics for analysing the profit. When the

ROE is more as compared to the ROA, it states that the company’s total asset is more as

compared to the owner’s equity of the company. With the increase of the equity the debt

portion of the company reduces. However, if the ROE is more it represent that the

company is earning on its borrowing. In other words, the interest rate on debt is lower

that the return of the company. Therefore, if company raise additional debt only though

debt it would earn more as compared to the situation where the additional fund is raised

through debt and equity both.

4. Information from ASX website

i. Monthly stock movement for last 2 years

Rio Tinto -

Rio Tinto

Date Adj Close Changes

12/31/2015 1542.156372

1/31/2016 1713.1073 0.111

2/29/2016 1831.990356 0.069

3/31/2016 2155.200195 0.176

4/30/2016 1819.811401 -0.156

5/31/2016 2149.110596 0.181

6/30/2016 2306.03125 0.073

7/31/2016 2155.668457 -0.065

8/31/2016 2444.936523 0.134

FINANCE FOR BUSINESS – MASTERS 5

9/30/2016 2696.600098 0.103

10/31/2016 2839.526123 0.053

11/30/2016 2999.546143 0.056

12/31/2016 3315.312744 0.105

1/31/2017 3131.076172 -0.056

2/28/2017 3135.366699 0.001

3/31/2017 2991.273682 -0.046

4/30/2017 3030.838135 0.013

5/31/2017 3167.115967 0.045

6/30/2017 3438.69458 0.086

7/31/2017 3659.962891 0.064

8/31/2017 3473 -0.051

9/30/2017 3548.5 0.022

10/31/2017 3501.5 -0.013

11/30/2017 3942 0.126

12/1/2015

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

0

500

1000

1500

2000

2500

3000

3500

4000

4500

Rio Tinto

Adj Close

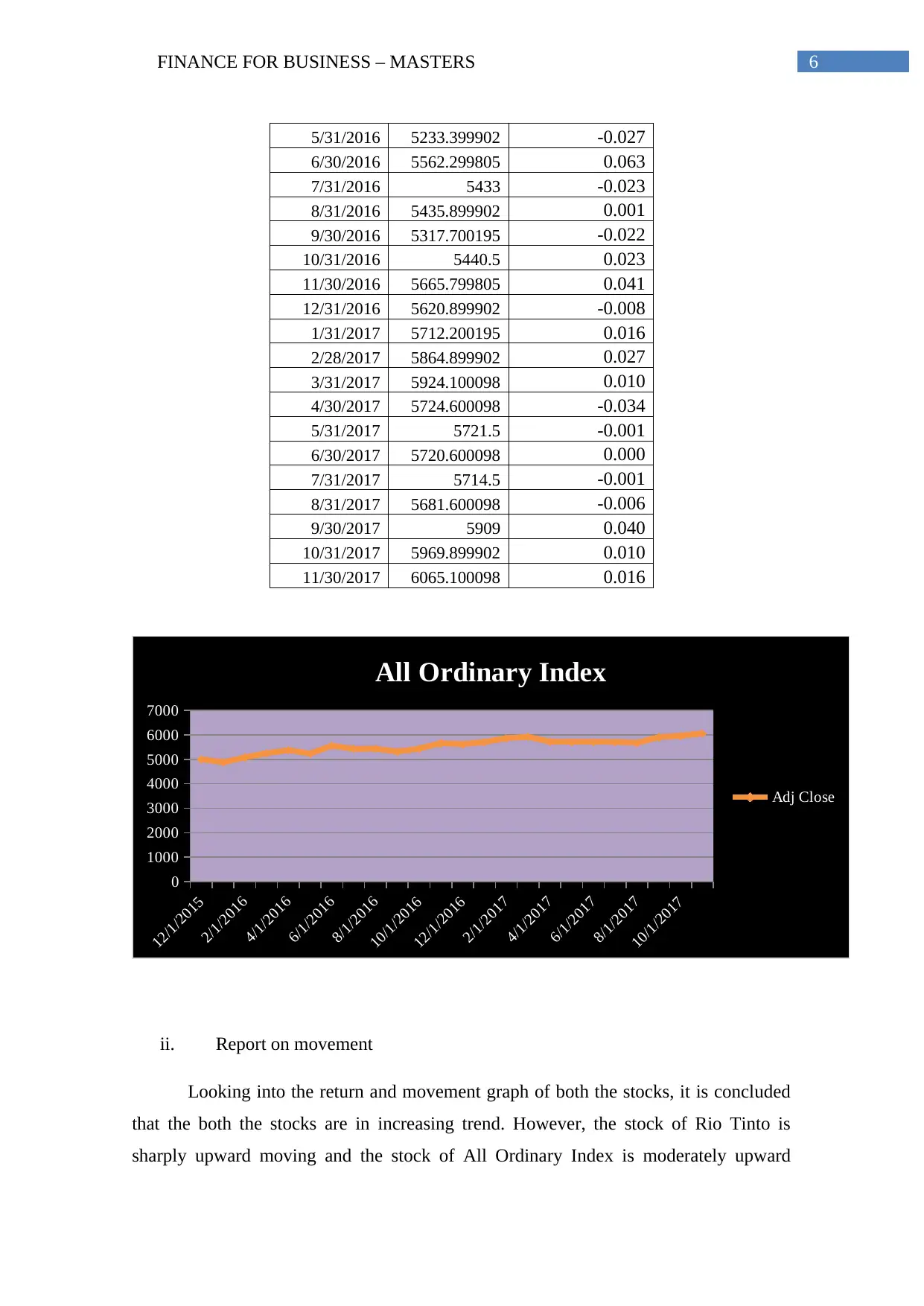

All Ordinary Index –

All Ordinary Index

Date Adj Close Changes

12/31/2015 5005.5

1/31/2016 4880.899902 -0.025

2/29/2016 5082.799805 0.041

3/31/2016 5252.200195 0.033

4/30/2016 5378.600098 0.024

9/30/2016 2696.600098 0.103

10/31/2016 2839.526123 0.053

11/30/2016 2999.546143 0.056

12/31/2016 3315.312744 0.105

1/31/2017 3131.076172 -0.056

2/28/2017 3135.366699 0.001

3/31/2017 2991.273682 -0.046

4/30/2017 3030.838135 0.013

5/31/2017 3167.115967 0.045

6/30/2017 3438.69458 0.086

7/31/2017 3659.962891 0.064

8/31/2017 3473 -0.051

9/30/2017 3548.5 0.022

10/31/2017 3501.5 -0.013

11/30/2017 3942 0.126

12/1/2015

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

0

500

1000

1500

2000

2500

3000

3500

4000

4500

Rio Tinto

Adj Close

All Ordinary Index –

All Ordinary Index

Date Adj Close Changes

12/31/2015 5005.5

1/31/2016 4880.899902 -0.025

2/29/2016 5082.799805 0.041

3/31/2016 5252.200195 0.033

4/30/2016 5378.600098 0.024

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE FOR BUSINESS – MASTERS 6

5/31/2016 5233.399902 -0.027

6/30/2016 5562.299805 0.063

7/31/2016 5433 -0.023

8/31/2016 5435.899902 0.001

9/30/2016 5317.700195 -0.022

10/31/2016 5440.5 0.023

11/30/2016 5665.799805 0.041

12/31/2016 5620.899902 -0.008

1/31/2017 5712.200195 0.016

2/28/2017 5864.899902 0.027

3/31/2017 5924.100098 0.010

4/30/2017 5724.600098 -0.034

5/31/2017 5721.5 -0.001

6/30/2017 5720.600098 0.000

7/31/2017 5714.5 -0.001

8/31/2017 5681.600098 -0.006

9/30/2017 5909 0.040

10/31/2017 5969.899902 0.010

11/30/2017 6065.100098 0.016

12/1/2015

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

0

1000

2000

3000

4000

5000

6000

7000

All Ordinary Index

Adj Close

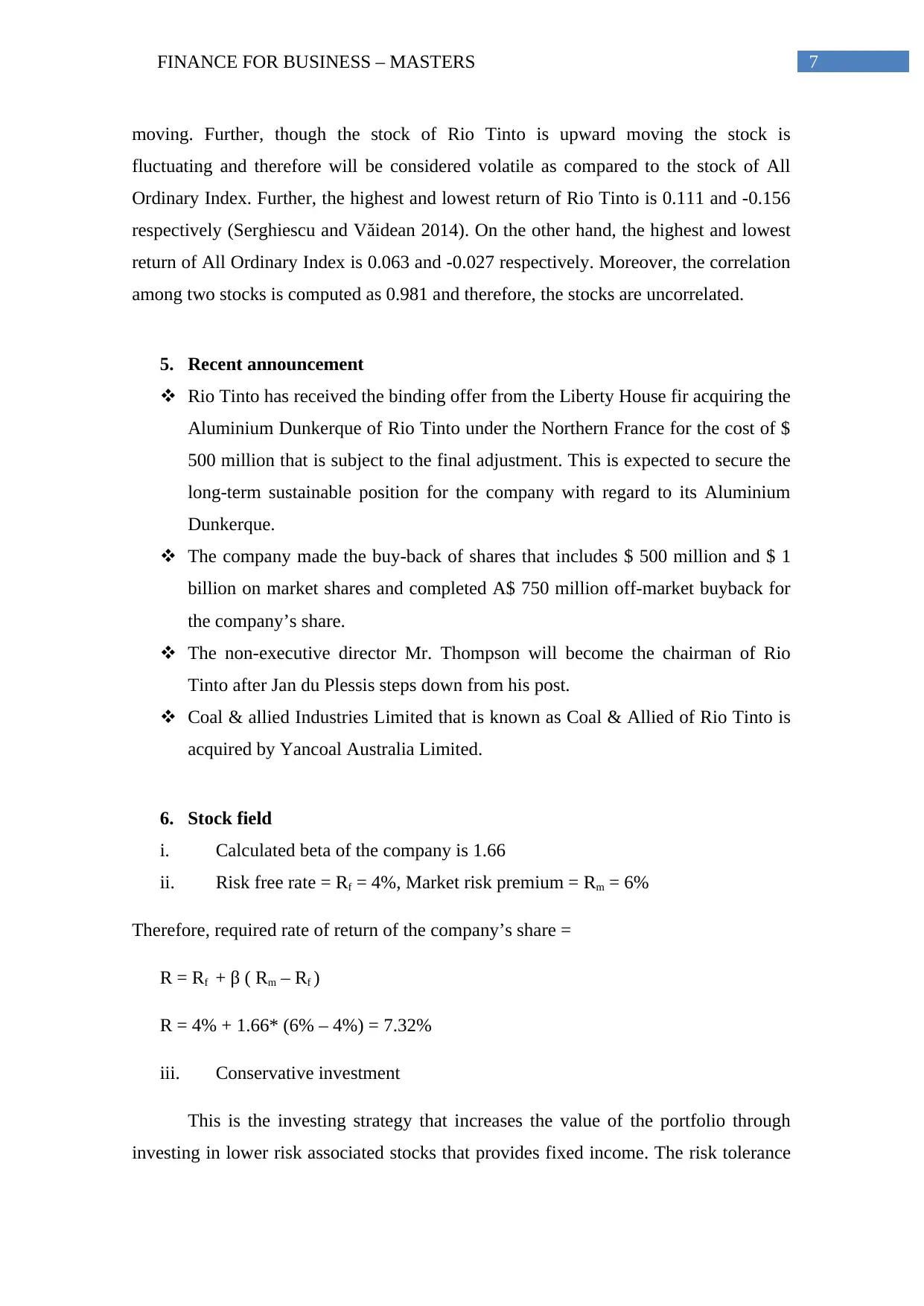

ii. Report on movement

Looking into the return and movement graph of both the stocks, it is concluded

that the both the stocks are in increasing trend. However, the stock of Rio Tinto is

sharply upward moving and the stock of All Ordinary Index is moderately upward

5/31/2016 5233.399902 -0.027

6/30/2016 5562.299805 0.063

7/31/2016 5433 -0.023

8/31/2016 5435.899902 0.001

9/30/2016 5317.700195 -0.022

10/31/2016 5440.5 0.023

11/30/2016 5665.799805 0.041

12/31/2016 5620.899902 -0.008

1/31/2017 5712.200195 0.016

2/28/2017 5864.899902 0.027

3/31/2017 5924.100098 0.010

4/30/2017 5724.600098 -0.034

5/31/2017 5721.5 -0.001

6/30/2017 5720.600098 0.000

7/31/2017 5714.5 -0.001

8/31/2017 5681.600098 -0.006

9/30/2017 5909 0.040

10/31/2017 5969.899902 0.010

11/30/2017 6065.100098 0.016

12/1/2015

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

0

1000

2000

3000

4000

5000

6000

7000

All Ordinary Index

Adj Close

ii. Report on movement

Looking into the return and movement graph of both the stocks, it is concluded

that the both the stocks are in increasing trend. However, the stock of Rio Tinto is

sharply upward moving and the stock of All Ordinary Index is moderately upward

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE FOR BUSINESS – MASTERS 7

moving. Further, though the stock of Rio Tinto is upward moving the stock is

fluctuating and therefore will be considered volatile as compared to the stock of All

Ordinary Index. Further, the highest and lowest return of Rio Tinto is 0.111 and -0.156

respectively (Serghiescu and Văidean 2014). On the other hand, the highest and lowest

return of All Ordinary Index is 0.063 and -0.027 respectively. Moreover, the correlation

among two stocks is computed as 0.981 and therefore, the stocks are uncorrelated.

5. Recent announcement

Rio Tinto has received the binding offer from the Liberty House fir acquiring the

Aluminium Dunkerque of Rio Tinto under the Northern France for the cost of $

500 million that is subject to the final adjustment. This is expected to secure the

long-term sustainable position for the company with regard to its Aluminium

Dunkerque.

The company made the buy-back of shares that includes $ 500 million and $ 1

billion on market shares and completed A$ 750 million off-market buyback for

the company’s share.

The non-executive director Mr. Thompson will become the chairman of Rio

Tinto after Jan du Plessis steps down from his post.

Coal & allied Industries Limited that is known as Coal & Allied of Rio Tinto is

acquired by Yancoal Australia Limited.

6. Stock field

i. Calculated beta of the company is 1.66

ii. Risk free rate = Rf = 4%, Market risk premium = Rm = 6%

Therefore, required rate of return of the company’s share =

R = Rf + β ( Rm – Rf )

R = 4% + 1.66* (6% – 4%) = 7.32%

iii. Conservative investment

This is the investing strategy that increases the value of the portfolio through

investing in lower risk associated stocks that provides fixed income. The risk tolerance

moving. Further, though the stock of Rio Tinto is upward moving the stock is

fluctuating and therefore will be considered volatile as compared to the stock of All

Ordinary Index. Further, the highest and lowest return of Rio Tinto is 0.111 and -0.156

respectively (Serghiescu and Văidean 2014). On the other hand, the highest and lowest

return of All Ordinary Index is 0.063 and -0.027 respectively. Moreover, the correlation

among two stocks is computed as 0.981 and therefore, the stocks are uncorrelated.

5. Recent announcement

Rio Tinto has received the binding offer from the Liberty House fir acquiring the

Aluminium Dunkerque of Rio Tinto under the Northern France for the cost of $

500 million that is subject to the final adjustment. This is expected to secure the

long-term sustainable position for the company with regard to its Aluminium

Dunkerque.

The company made the buy-back of shares that includes $ 500 million and $ 1

billion on market shares and completed A$ 750 million off-market buyback for

the company’s share.

The non-executive director Mr. Thompson will become the chairman of Rio

Tinto after Jan du Plessis steps down from his post.

Coal & allied Industries Limited that is known as Coal & Allied of Rio Tinto is

acquired by Yancoal Australia Limited.

6. Stock field

i. Calculated beta of the company is 1.66

ii. Risk free rate = Rf = 4%, Market risk premium = Rm = 6%

Therefore, required rate of return of the company’s share =

R = Rf + β ( Rm – Rf )

R = 4% + 1.66* (6% – 4%) = 7.32%

iii. Conservative investment

This is the investing strategy that increases the value of the portfolio through

investing in lower risk associated stocks that provides fixed income. The risk tolerance

FINANCE FOR BUSINESS – MASTERS 8

level of the conservative investor are ranged low level to moderate level. The investors

with low risk tolerance level are generally not comfortable with stock market and prefer

to avoid it (Heikal, Khaddafi and Ummah 2014). However, the conservative strategy

may protect the investor against inflation but at the same time it may not earn

significant value over the time. As the beta of the company is considered quite high that

is 1.66 and the required rate of return is 7.32% that is also quite high the stock of the

company is not conservative investment (Hombert and Thesmar 2014).

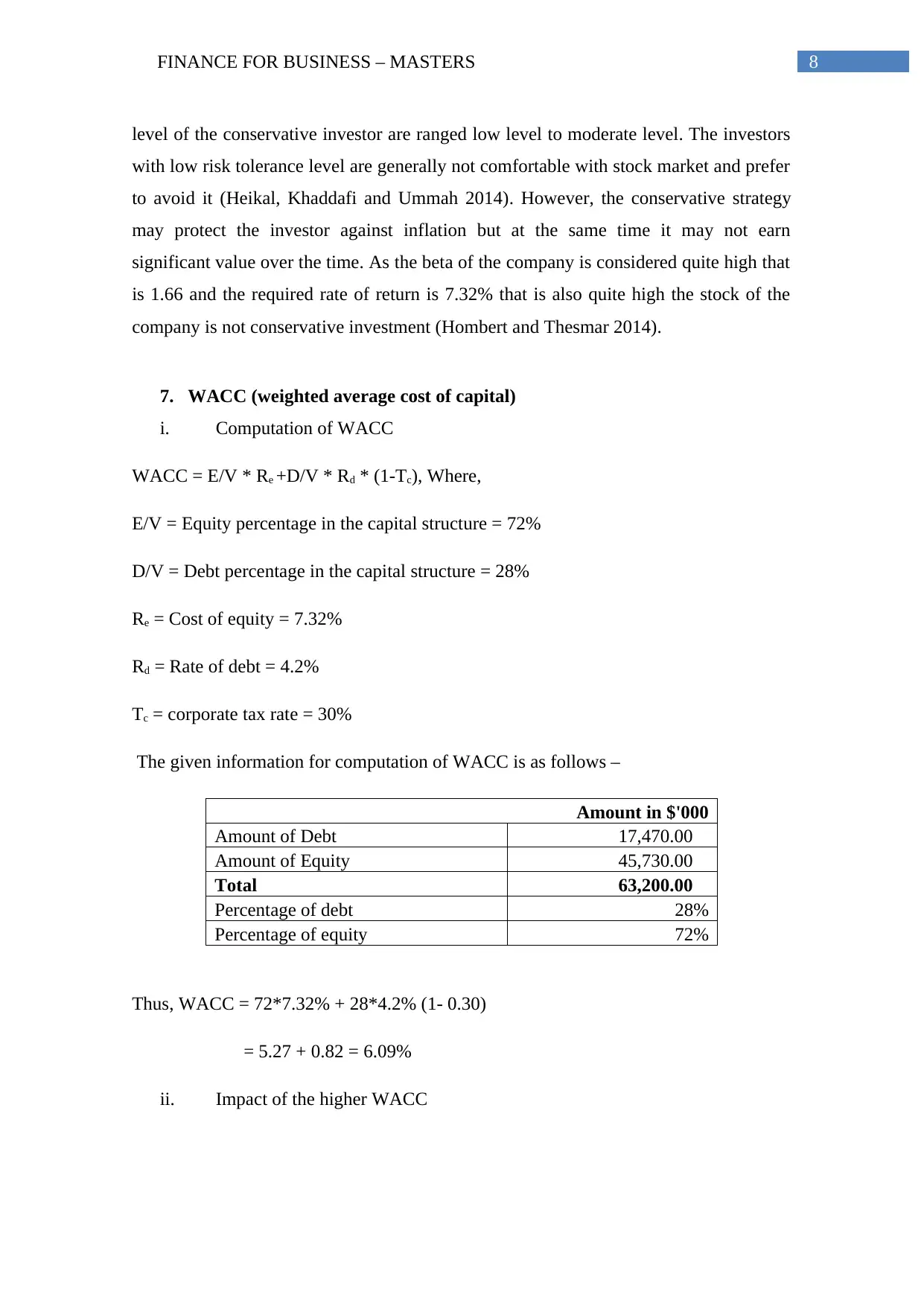

7. WACC (weighted average cost of capital)

i. Computation of WACC

WACC = E/V * Re +D/V * Rd * (1-Tc), Where,

E/V = Equity percentage in the capital structure = 72%

D/V = Debt percentage in the capital structure = 28%

Re = Cost of equity = 7.32%

Rd = Rate of debt = 4.2%

Tc = corporate tax rate = 30%

The given information for computation of WACC is as follows –

Amount in $'000

Amount of Debt 17,470.00

Amount of Equity 45,730.00

Total 63,200.00

Percentage of debt 28%

Percentage of equity 72%

Thus, WACC = 72*7.32% + 28*4.2% (1- 0.30)

= 5.27 + 0.82 = 6.09%

ii. Impact of the higher WACC

level of the conservative investor are ranged low level to moderate level. The investors

with low risk tolerance level are generally not comfortable with stock market and prefer

to avoid it (Heikal, Khaddafi and Ummah 2014). However, the conservative strategy

may protect the investor against inflation but at the same time it may not earn

significant value over the time. As the beta of the company is considered quite high that

is 1.66 and the required rate of return is 7.32% that is also quite high the stock of the

company is not conservative investment (Hombert and Thesmar 2014).

7. WACC (weighted average cost of capital)

i. Computation of WACC

WACC = E/V * Re +D/V * Rd * (1-Tc), Where,

E/V = Equity percentage in the capital structure = 72%

D/V = Debt percentage in the capital structure = 28%

Re = Cost of equity = 7.32%

Rd = Rate of debt = 4.2%

Tc = corporate tax rate = 30%

The given information for computation of WACC is as follows –

Amount in $'000

Amount of Debt 17,470.00

Amount of Equity 45,730.00

Total 63,200.00

Percentage of debt 28%

Percentage of equity 72%

Thus, WACC = 72*7.32% + 28*4.2% (1- 0.30)

= 5.27 + 0.82 = 6.09%

ii. Impact of the higher WACC

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE FOR BUSINESS – MASTERS 9

WACC takes into consideration proportion of all the capital included under the

capital structure. If the WACC of any company goes upward owing to increase of its

beta and the ROE the valuation and risk of the company will also go up. Higher level of

WACC also denotes that the company is associated with higher operation risk.

Therefore, the investors will need additional return to cover up the risks (Krüger,

Landier and Thesmar 2015).

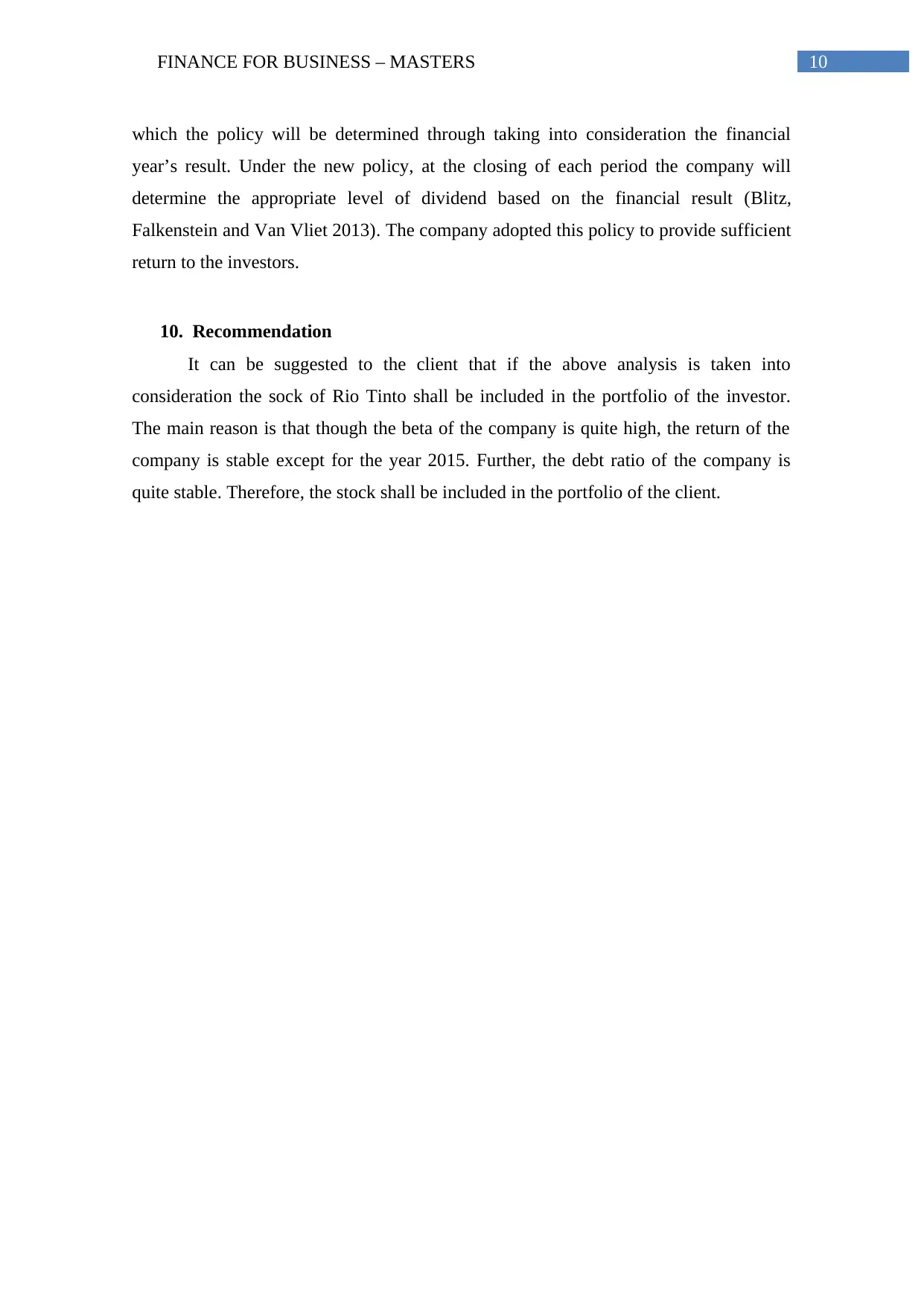

8. Optimal debt structure

i. Optimal structure for capital

Debt ratio Total liabilities / Total assets Year 2016 = 0.488 Year 2015 = 0.518

It is the financial measurement that the company uses for determining best mix

of equity and debt financing for using in expansions and operations. The main objective

of the optimum capital structure is to minimize the cost of the capital so that the

company becomes less dependent on the creditors and finance the core operations of the

company efficiently (Brusov, Filatova and Orekhova 2014). Though there is no ideal

capital structure as it depends on various factors like type of the industry, company

business and other economic factors. However, more or less 40% is considered as good

for any company. It is recognized that the company’s debt ratio is 51.8% and 48.8% for

2015 and 2016 respectively. Therefore, the company shall pay-off the liabilities to

improve the debt ratio (Morley 2013).

ii. Gearing ratio

For adjusting the gearing ratio the company repaid its long-term borrowing

amounting to $ 3670 million as the borrowings reduced from $ 21,140 to $ 17,470.

Further the company increased its equity by $ 1,602 as the equity is increased from $

44,128 to $ 45,730. Director’s report did not clarify anything regarding these

adjustments (Streby et al. 2014).

9. Dividend policy

The company has changed its dividend policy during the year. Earlier the

company used to apply progressive dividend policy and changed to the policy under

WACC takes into consideration proportion of all the capital included under the

capital structure. If the WACC of any company goes upward owing to increase of its

beta and the ROE the valuation and risk of the company will also go up. Higher level of

WACC also denotes that the company is associated with higher operation risk.

Therefore, the investors will need additional return to cover up the risks (Krüger,

Landier and Thesmar 2015).

8. Optimal debt structure

i. Optimal structure for capital

Debt ratio Total liabilities / Total assets Year 2016 = 0.488 Year 2015 = 0.518

It is the financial measurement that the company uses for determining best mix

of equity and debt financing for using in expansions and operations. The main objective

of the optimum capital structure is to minimize the cost of the capital so that the

company becomes less dependent on the creditors and finance the core operations of the

company efficiently (Brusov, Filatova and Orekhova 2014). Though there is no ideal

capital structure as it depends on various factors like type of the industry, company

business and other economic factors. However, more or less 40% is considered as good

for any company. It is recognized that the company’s debt ratio is 51.8% and 48.8% for

2015 and 2016 respectively. Therefore, the company shall pay-off the liabilities to

improve the debt ratio (Morley 2013).

ii. Gearing ratio

For adjusting the gearing ratio the company repaid its long-term borrowing

amounting to $ 3670 million as the borrowings reduced from $ 21,140 to $ 17,470.

Further the company increased its equity by $ 1,602 as the equity is increased from $

44,128 to $ 45,730. Director’s report did not clarify anything regarding these

adjustments (Streby et al. 2014).

9. Dividend policy

The company has changed its dividend policy during the year. Earlier the

company used to apply progressive dividend policy and changed to the policy under

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE FOR BUSINESS – MASTERS 10

which the policy will be determined through taking into consideration the financial

year’s result. Under the new policy, at the closing of each period the company will

determine the appropriate level of dividend based on the financial result (Blitz,

Falkenstein and Van Vliet 2013). The company adopted this policy to provide sufficient

return to the investors.

10. Recommendation

It can be suggested to the client that if the above analysis is taken into

consideration the sock of Rio Tinto shall be included in the portfolio of the investor.

The main reason is that though the beta of the company is quite high, the return of the

company is stable except for the year 2015. Further, the debt ratio of the company is

quite stable. Therefore, the stock shall be included in the portfolio of the client.

which the policy will be determined through taking into consideration the financial

year’s result. Under the new policy, at the closing of each period the company will

determine the appropriate level of dividend based on the financial result (Blitz,

Falkenstein and Van Vliet 2013). The company adopted this policy to provide sufficient

return to the investors.

10. Recommendation

It can be suggested to the client that if the above analysis is taken into

consideration the sock of Rio Tinto shall be included in the portfolio of the investor.

The main reason is that though the beta of the company is quite high, the return of the

company is stable except for the year 2015. Further, the debt ratio of the company is

quite stable. Therefore, the stock shall be included in the portfolio of the client.

FINANCE FOR BUSINESS – MASTERS 11

Reference

Blitz, D., Falkenstein, E.G. and Van Vliet, P., 2013. Explanations for the Volatility

Effect: An Overview Based on the CAPM Assumptions.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brusov, P., Filatova, T. and Orekhova, N., 2014. Mechanism of formation of the

company optimal capital structure, different from suggested by trade off theory. Cogent

Economics & Finance, 2(1), p.946150.

Heikal, M., Khaddafi, M. and Ummah, A., 2014. Influence analysis of return on assets

(ROA), return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER),

and current ratio (CR), against corporate profit growth in automotive in Indonesia Stock

Exchange. International Journal of Academic Research in Business and Social

Sciences, 4(12), p.101.Cooray, A., Dzhumashev, R. and Schneider, F., 2017. How does

corruption affect public debt? An empirical analysis. World development, 90, pp.115-

127.

Hombert, J. and Thesmar, D., 2014. Overcoming limits of arbitrage: Theory and

evidence. Journal of Financial Economics, 111(1), pp.26-44.

Krüger, P., Landier, A. and Thesmar, D., 2015. The WACC fallacy: The real effects of

using a unique discount rate. The Journal of Finance, 70(3), pp.1253-1285.

Morley, J., 2013. The Separation of Funds and Managers: A Theory of Investment Fund

Structure and Regulation. Yale LJ, 123, p.1228.

Rio Tinto., 2018. Home – Rio Tinto. [online] Available at: http://riotinto.com.au/

[Accessed 31 Jan. 2018].

Serghiescu, L. and Văidean, V.L., 2014. Determinant factors of the capital structure of a

firm-an empirical analysis. Procedia Economics and Finance, 15, pp.1447-1457.

Reference

Blitz, D., Falkenstein, E.G. and Van Vliet, P., 2013. Explanations for the Volatility

Effect: An Overview Based on the CAPM Assumptions.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brusov, P., Filatova, T. and Orekhova, N., 2014. Mechanism of formation of the

company optimal capital structure, different from suggested by trade off theory. Cogent

Economics & Finance, 2(1), p.946150.

Heikal, M., Khaddafi, M. and Ummah, A., 2014. Influence analysis of return on assets

(ROA), return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER),

and current ratio (CR), against corporate profit growth in automotive in Indonesia Stock

Exchange. International Journal of Academic Research in Business and Social

Sciences, 4(12), p.101.Cooray, A., Dzhumashev, R. and Schneider, F., 2017. How does

corruption affect public debt? An empirical analysis. World development, 90, pp.115-

127.

Hombert, J. and Thesmar, D., 2014. Overcoming limits of arbitrage: Theory and

evidence. Journal of Financial Economics, 111(1), pp.26-44.

Krüger, P., Landier, A. and Thesmar, D., 2015. The WACC fallacy: The real effects of

using a unique discount rate. The Journal of Finance, 70(3), pp.1253-1285.

Morley, J., 2013. The Separation of Funds and Managers: A Theory of Investment Fund

Structure and Regulation. Yale LJ, 123, p.1228.

Rio Tinto., 2018. Home – Rio Tinto. [online] Available at: http://riotinto.com.au/

[Accessed 31 Jan. 2018].

Serghiescu, L. and Văidean, V.L., 2014. Determinant factors of the capital structure of a

firm-an empirical analysis. Procedia Economics and Finance, 15, pp.1447-1457.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.