Financial Accounting Report: Principles, Analysis, and Client Data

VerifiedAdded on 2020/11/23

|25

|4718

|70

Report

AI Summary

This report provides a comprehensive overview of financial accounting, encompassing its purpose, regulations, accounting rules, and fundamental concepts and conventions. It delves into the core aspects of financial accounting, including the process of recording, classifying, and summarizing financial data to ascertain a business's financial position. The report explores the regulations governing financial accounting, including professional regulations and international standards like IFRS. It details accounting rules such as the double-entry system and the golden rules, along with accounting principles such as economic entity, time period, monetary unit, cost, full disclosure, going concern, matching, revenue recognition, materiality, and conservatism. The report also provides practical application through the analysis of client data, including ledger accounts, and other financial statements. The report concludes with a reference section for further study.

FINANCIAL ACCOUNTING

AND PRICIPLES

AND PRICIPLES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Financial accounting and its purpose.................................................................................1

2. Regulations regarding Financial Accounting.....................................................................2

3. Accounting rules.................................................................................................................3

4. Accounting concepts and conventions...............................................................................4

CLIENT 1........................................................................................................................................5

CLIENT 2........................................................................................................................................7

CLIENT 3........................................................................................................................................9

CLIENT 4......................................................................................................................................13

CLIENT 5......................................................................................................................................14

CLIENT 6......................................................................................................................................16

REFERENCES:.............................................................................................................................17

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Financial accounting and its purpose.................................................................................1

2. Regulations regarding Financial Accounting.....................................................................2

3. Accounting rules.................................................................................................................3

4. Accounting concepts and conventions...............................................................................4

CLIENT 1........................................................................................................................................5

CLIENT 2........................................................................................................................................7

CLIENT 3........................................................................................................................................9

CLIENT 4......................................................................................................................................13

CLIENT 5......................................................................................................................................14

CLIENT 6......................................................................................................................................16

REFERENCES:.............................................................................................................................17

INTRODUCTION

The financial accounting involves identifying, classifying, summarising the financial data

in a significant manner, to make it useful for its users and interpreting the results to ascertain the

financial position of business (Financial reporting standard, 2017). It is mandatory for all

organisation either it is small or large to follow accounting rules, regulations and conventions.

“DNS Accounting” is an accounting firm in U.K is a small accountancy firm working as

accounting and auditing in U.K. In order to prepare the books of accounts in effective and

efficient manner then, it is crucial to follow the accounting terminology. In this report,

Introduction of Financial Accounting and its purpose, rules- regulations and principles of

Financial accounting and its concepts and conventions are mentioned in one part and in second

part analysation of numerical data is presented.

MAIN BODY

1. Financial accounting and its purpose

Financial Accounting: It is a branch of accounting which is engaged with recording,

classifying, summarising the financial data in proper manner, in order to present a present a

proper analysation of financial data and to ascertain the financial position of business. Moreover

under financial accounting only those transactions are to be recorded which are related to

financial character. Financial accounting involves several stages to record , analysing and

ascertaining the financial data. First stage begins from recording of financial transactions in

journal(in form of entries) after that in ledger (in form of separate accounts), after that in trial

balance(classification and interpretation of journal and ledger) and finally in consolidate Profit

and Loss accounts and Balance sheet. the final accounts shows the net profit or net loss of

business incurred in financial year and on other hand balance sheet shows the final financial

position of the business. Moreover there are some purpose of financial accounting:

To prepare and maintain the the financial transactions of business.

To ascertain the financial position of business: By analysing the financial data and

balance sheet.

To shows the financial position of business: With the help of balance sheet which

shows the net assets and net liabilities of business at the end of financial year.

1

The financial accounting involves identifying, classifying, summarising the financial data

in a significant manner, to make it useful for its users and interpreting the results to ascertain the

financial position of business (Financial reporting standard, 2017). It is mandatory for all

organisation either it is small or large to follow accounting rules, regulations and conventions.

“DNS Accounting” is an accounting firm in U.K is a small accountancy firm working as

accounting and auditing in U.K. In order to prepare the books of accounts in effective and

efficient manner then, it is crucial to follow the accounting terminology. In this report,

Introduction of Financial Accounting and its purpose, rules- regulations and principles of

Financial accounting and its concepts and conventions are mentioned in one part and in second

part analysation of numerical data is presented.

MAIN BODY

1. Financial accounting and its purpose

Financial Accounting: It is a branch of accounting which is engaged with recording,

classifying, summarising the financial data in proper manner, in order to present a present a

proper analysation of financial data and to ascertain the financial position of business. Moreover

under financial accounting only those transactions are to be recorded which are related to

financial character. Financial accounting involves several stages to record , analysing and

ascertaining the financial data. First stage begins from recording of financial transactions in

journal(in form of entries) after that in ledger (in form of separate accounts), after that in trial

balance(classification and interpretation of journal and ledger) and finally in consolidate Profit

and Loss accounts and Balance sheet. the final accounts shows the net profit or net loss of

business incurred in financial year and on other hand balance sheet shows the final financial

position of the business. Moreover there are some purpose of financial accounting:

To prepare and maintain the the financial transactions of business.

To ascertain the financial position of business: By analysing the financial data and

balance sheet.

To shows the financial position of business: With the help of balance sheet which

shows the net assets and net liabilities of business at the end of financial year.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To ascertain the profit and loss: By presenting the profit and loss account that shows

net profit or net loss incurred during a financial era.

To provide a financial report in a significant manner to its internal and external

users: Moreover, internal users includes board of directors, equity owners,

management etc. and external users includes government organisations, tax authorities,

financial organisations and potential investors.

Presentation: To present the financial data in such a way that must be relevant, reliable,

consistent, and comparable so that ascertainment of financial position becomes easier.

2. Regulations regarding Financial Accounting

Financial accounting regulatory frameworks pertains three types of regulations namely;

Professional regulations: The professional regulation pertains the valuation of

inventory use differently by different companies. Before the establishment of Accounting

Standard Board (ASB) the entities were free to select and follow the different accounting

methods and it leads to different results of profits figures, then it become very critical for users to

rely on company's annual reports. Then after the establishment of Accounting Standards Board

(ASB) the board issued several accounting standards and made mandatory for each entity to

follow these standards while preparing books of accounts. In case of international accounting

regulations, the regulations in form of accounting standards were issued by International

Accounting Standards Committee(IASC) to ensures international comparability and consistency

between the financial statements prepared by companies of two or more different nations

(Mangala and Kumari, 2015).

IFRS issued by the international accounting standard board(IASB) as a regulations regarding the

preparation of financial statements. IFRS 1 First time adoption of international financial

reporting standards: according to this standard company which decides to follow IFRS first time

to prepare financial statements then company uses the accounting policies presented in IFRS

financial statement throughout the year. The adoption of IFRS help the company to present its

financial statements comparable and consistent. So that the financial statements of that company

becomes comparable with other companies of different nations of world.

IFRS7 states the Disclosure of accounting information: Disclosing of financial statements to its

users is essential part which have to perform by the management of company as become

mandatory by IFRS following company. Disclosing it to its internal and external users. The

2

net profit or net loss incurred during a financial era.

To provide a financial report in a significant manner to its internal and external

users: Moreover, internal users includes board of directors, equity owners,

management etc. and external users includes government organisations, tax authorities,

financial organisations and potential investors.

Presentation: To present the financial data in such a way that must be relevant, reliable,

consistent, and comparable so that ascertainment of financial position becomes easier.

2. Regulations regarding Financial Accounting

Financial accounting regulatory frameworks pertains three types of regulations namely;

Professional regulations: The professional regulation pertains the valuation of

inventory use differently by different companies. Before the establishment of Accounting

Standard Board (ASB) the entities were free to select and follow the different accounting

methods and it leads to different results of profits figures, then it become very critical for users to

rely on company's annual reports. Then after the establishment of Accounting Standards Board

(ASB) the board issued several accounting standards and made mandatory for each entity to

follow these standards while preparing books of accounts. In case of international accounting

regulations, the regulations in form of accounting standards were issued by International

Accounting Standards Committee(IASC) to ensures international comparability and consistency

between the financial statements prepared by companies of two or more different nations

(Mangala and Kumari, 2015).

IFRS issued by the international accounting standard board(IASB) as a regulations regarding the

preparation of financial statements. IFRS 1 First time adoption of international financial

reporting standards: according to this standard company which decides to follow IFRS first time

to prepare financial statements then company uses the accounting policies presented in IFRS

financial statement throughout the year. The adoption of IFRS help the company to present its

financial statements comparable and consistent. So that the financial statements of that company

becomes comparable with other companies of different nations of world.

IFRS7 states the Disclosure of accounting information: Disclosing of financial statements to its

users is essential part which have to perform by the management of company as become

mandatory by IFRS following company. Disclosing it to its internal and external users. The

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

internal users includes board of directors, equity owners, employees etc. on the other hand

external users includes government authorities, tax authorities, potential investors etc. The

general public also needs the true financial information of public company as public company

generates funds from public by issuing shares and correct financial position of company depicts

in its financial statements of company (Keerasuntonpong and Cordery, 2016).

3. Accounting rules

In accounting terms mostly using double entry system because every transactions affect

two accounts. First is debited and second is credited, due to it's dual aspects. The golden rules of

accounting are as follows -

Debit the Receiver, Credit The Giver: This Rule is applied on personal accounts, when

a individual gives something to the company. The company recorded this individual as

credit in books of accounts and the receiver needs to be debited.

Debit what comes in, credit what goes out: This Rule used for real accounts including

machinery, land and building etc. In this principle already existing these accounts when

receiving something so add balance in existing account. When giving something that time

reduce balance from existing account.

Debit all expenses and losses, credit all incomes and gains: This Rule applied on

nominal account and including capital of the company. When credit all incomes and

gains so increase balance of capital and when debit all expenses and losses so decrease

balance of capital.

Accounting Principles:

Economic Entity assumptions: In this principle accountant keeps all the business

transactions separate from personal transactions. In accounting terms for legal purpose

they have different different entities (Maseda and et. al., 2016).

Time period Principle: This concept that a business results and it's operations are

reporting in standard period of time. It assumes that business should report their financial

statements (income statement/balance sheet) in specific time period.

Monetary unit principle: In financial accounting, only those transactions will evaluate

which can be expressed in monetary terms, the transactions which cannot be expressed in

monetary terms are not to be included in accounting.

3

external users includes government authorities, tax authorities, potential investors etc. The

general public also needs the true financial information of public company as public company

generates funds from public by issuing shares and correct financial position of company depicts

in its financial statements of company (Keerasuntonpong and Cordery, 2016).

3. Accounting rules

In accounting terms mostly using double entry system because every transactions affect

two accounts. First is debited and second is credited, due to it's dual aspects. The golden rules of

accounting are as follows -

Debit the Receiver, Credit The Giver: This Rule is applied on personal accounts, when

a individual gives something to the company. The company recorded this individual as

credit in books of accounts and the receiver needs to be debited.

Debit what comes in, credit what goes out: This Rule used for real accounts including

machinery, land and building etc. In this principle already existing these accounts when

receiving something so add balance in existing account. When giving something that time

reduce balance from existing account.

Debit all expenses and losses, credit all incomes and gains: This Rule applied on

nominal account and including capital of the company. When credit all incomes and

gains so increase balance of capital and when debit all expenses and losses so decrease

balance of capital.

Accounting Principles:

Economic Entity assumptions: In this principle accountant keeps all the business

transactions separate from personal transactions. In accounting terms for legal purpose

they have different different entities (Maseda and et. al., 2016).

Time period Principle: This concept that a business results and it's operations are

reporting in standard period of time. It assumes that business should report their financial

statements (income statement/balance sheet) in specific time period.

Monetary unit principle: In financial accounting, only those transactions will evaluate

which can be expressed in monetary terms, the transactions which cannot be expressed in

monetary terms are not to be included in accounting.

3

Cost principle: Accounting involves consistency and comparability that is why it

requires to record the accounting transactions to be recorded at their historical values.

Full Disclosure principle: If any information important relating to financial statement

for an investor or lender so that information disclosed with in the notes of the statement.

That is why because basic accounting principle that in financial statements are attached

footnotes (Sever, Žager and Sačer, 2013).

Going concern principle: This principle defines that the will longer carry its business

operations in foreseeable future, financial statements will also prepared on this basis till

longer company survives.

Matching principle: In this accounting principle company would be use the accrual

basis of accounting. The matching principle requires the revenues of the financial year

must be matched with expenses of that financial year.

Revenue Recognition Principle: In this principle revenues are recognized as money is

actually received regarding product has been sold or a service has been performed.

Materiality: According to this concept to financial statements are prepared to maintain a

systematic record so it become useful to its users that is internal users and external users.

Helpful in making economical decision. Financial statements are the material and it's

information is known as materiality.

Conservatism: According to this principle expenses and liabilities are recorded as soon

as possible but when you are sure for revenues and assets.

4. Accounting concepts and conventions

Accounting concepts are basic accounting assumptions or regulations on the basis of

which books of accounts and final reports are prepared. While accounting conventions are

customs, methods and process on the basis of which financial statements are prepared by a firm,

these are having universal acceptance but changes with time. Partiality is impossible in applying

accounting concepts.

Consistency: According to this, accounting method, practices and policies on which

financial statements are based should be same in subsequent financial years. Because users of

financial information compares financial reports of a firm from one year to another. Thus it will

be easy for them. For instance, depreciation is charged according to straight line method,

4

requires to record the accounting transactions to be recorded at their historical values.

Full Disclosure principle: If any information important relating to financial statement

for an investor or lender so that information disclosed with in the notes of the statement.

That is why because basic accounting principle that in financial statements are attached

footnotes (Sever, Žager and Sačer, 2013).

Going concern principle: This principle defines that the will longer carry its business

operations in foreseeable future, financial statements will also prepared on this basis till

longer company survives.

Matching principle: In this accounting principle company would be use the accrual

basis of accounting. The matching principle requires the revenues of the financial year

must be matched with expenses of that financial year.

Revenue Recognition Principle: In this principle revenues are recognized as money is

actually received regarding product has been sold or a service has been performed.

Materiality: According to this concept to financial statements are prepared to maintain a

systematic record so it become useful to its users that is internal users and external users.

Helpful in making economical decision. Financial statements are the material and it's

information is known as materiality.

Conservatism: According to this principle expenses and liabilities are recorded as soon

as possible but when you are sure for revenues and assets.

4. Accounting concepts and conventions

Accounting concepts are basic accounting assumptions or regulations on the basis of

which books of accounts and final reports are prepared. While accounting conventions are

customs, methods and process on the basis of which financial statements are prepared by a firm,

these are having universal acceptance but changes with time. Partiality is impossible in applying

accounting concepts.

Consistency: According to this, accounting method, practices and policies on which

financial statements are based should be same in subsequent financial years. Because users of

financial information compares financial reports of a firm from one year to another. Thus it will

be easy for them. For instance, depreciation is charged according to straight line method,

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

valuation method of stock should be consistent over years. But in any case if change occurs in

accounting methods or procedure then it should be immediately reported in financial statements

(Howard and Warwick, 2013).

Material disclosure: 'Material' means any information which is very important and can

affect the financial decisions of users, auditors, and all the stakeholders. So every material

information and facts need to be disclosed in books of accounts to avoid mislead. These can be in

form of working or foot notes. Aim of this convention is to communicate useful information to

interested users. For example, provision for depreciation and bad debts, market price of assets

etc. Disclosure of material information should be there not of immaterial or insignificant

information because it can create extra burden on firm.

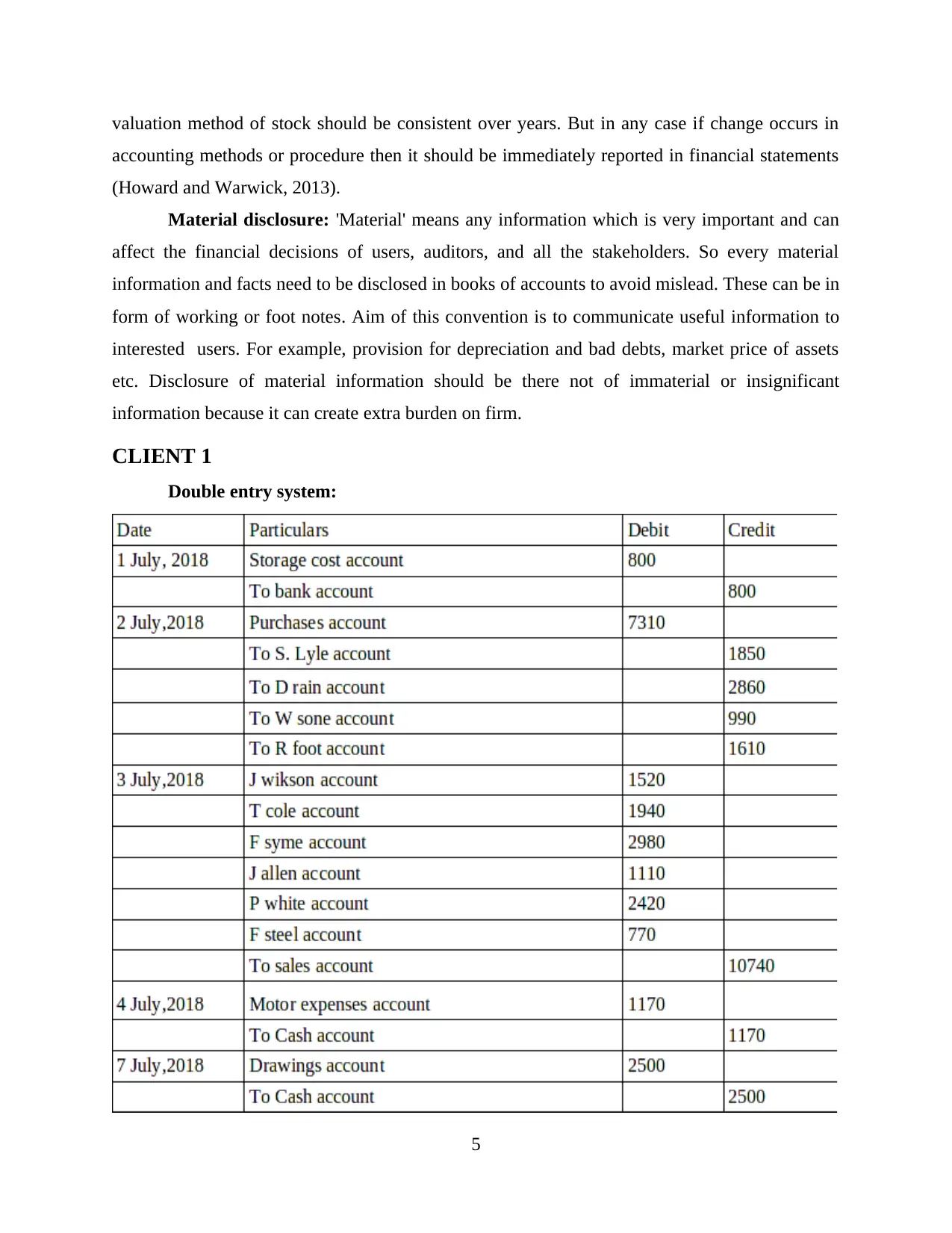

CLIENT 1

Double entry system:

5

accounting methods or procedure then it should be immediately reported in financial statements

(Howard and Warwick, 2013).

Material disclosure: 'Material' means any information which is very important and can

affect the financial decisions of users, auditors, and all the stakeholders. So every material

information and facts need to be disclosed in books of accounts to avoid mislead. These can be in

form of working or foot notes. Aim of this convention is to communicate useful information to

interested users. For example, provision for depreciation and bad debts, market price of assets

etc. Disclosure of material information should be there not of immaterial or insignificant

information because it can create extra burden on firm.

CLIENT 1

Double entry system:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

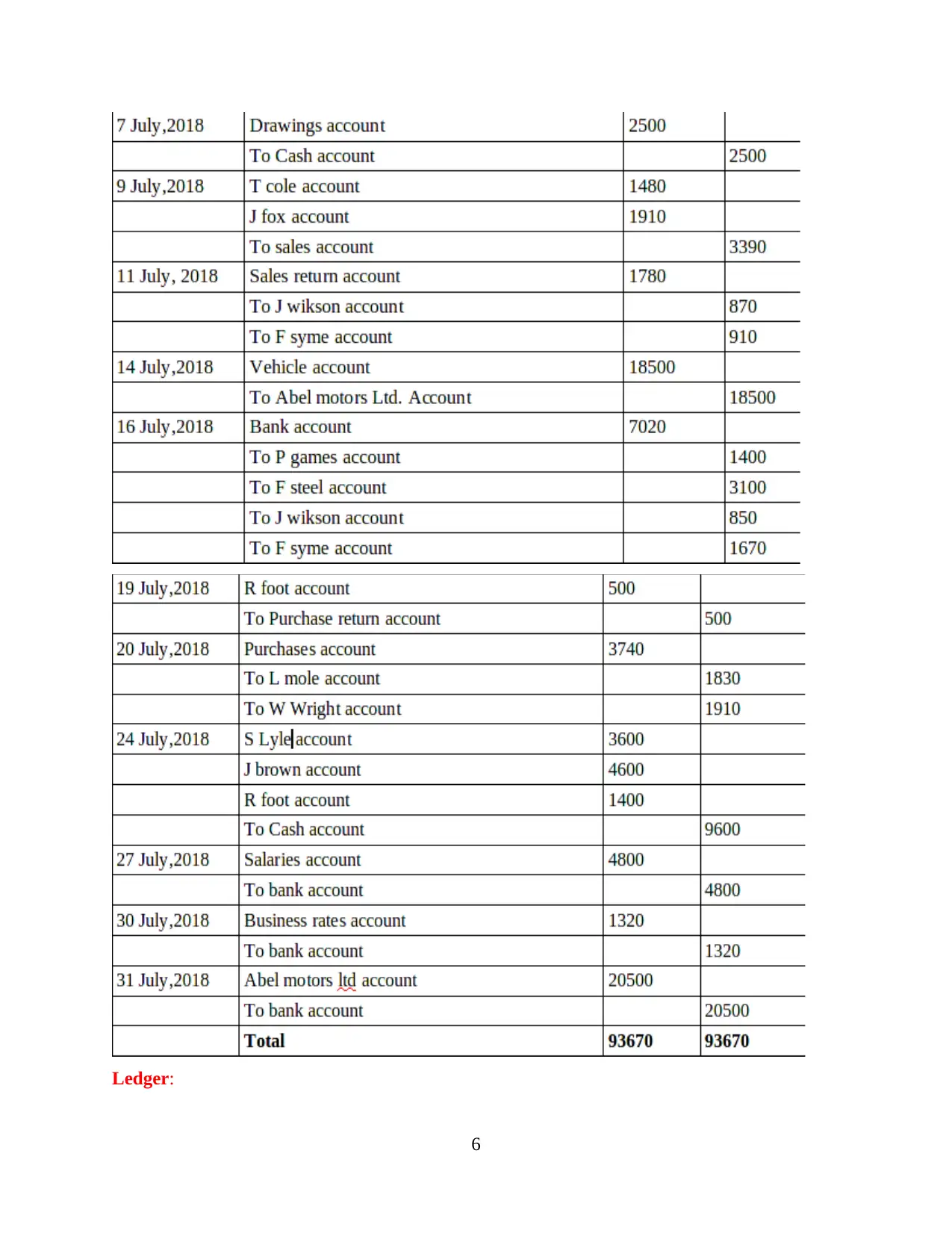

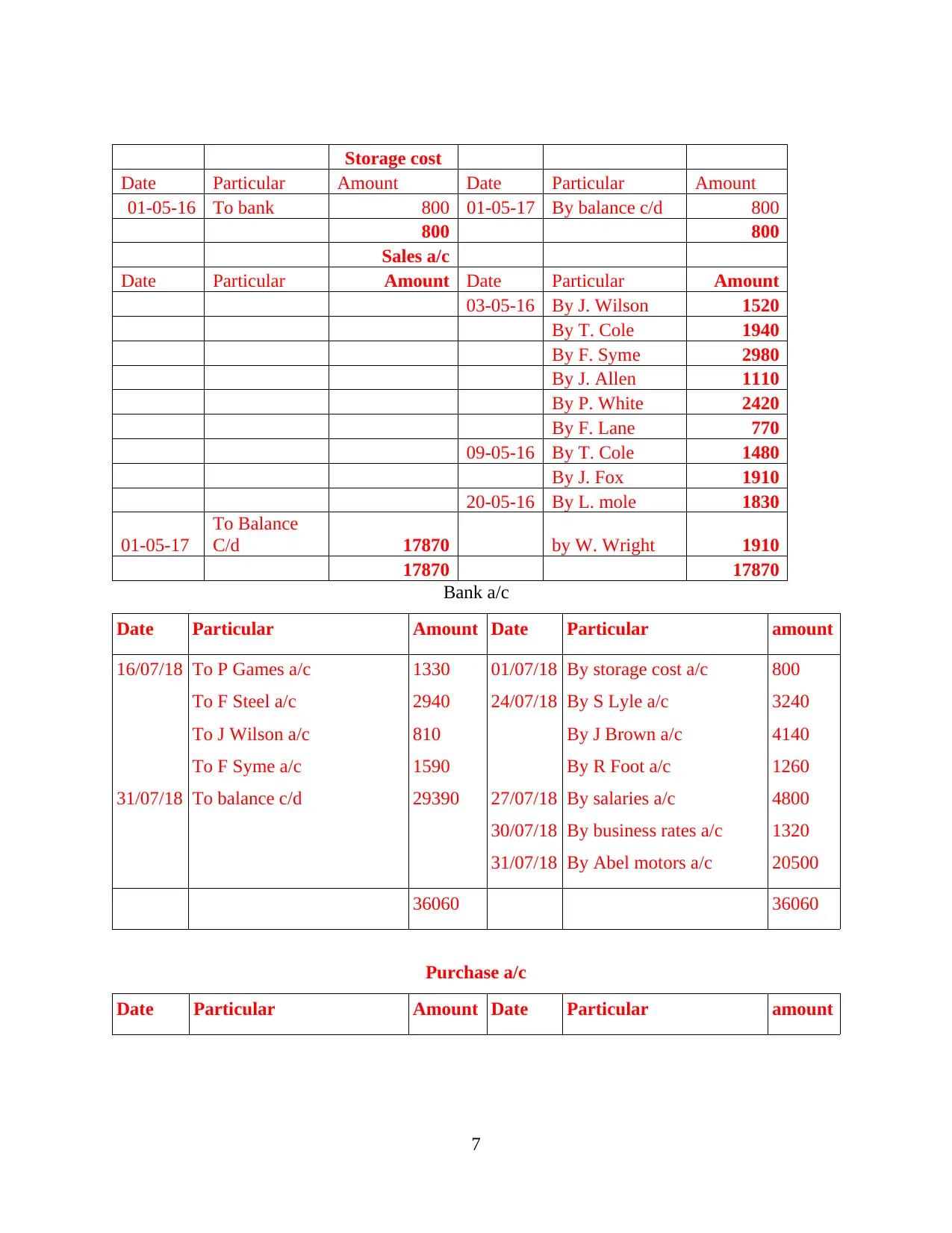

Ledger:

6

6

Storage cost

Date Particular Amount Date Particular Amount

01-05-16 To bank 800 01-05-17 By balance c/d 800

800 800

Sales a/c

Date Particular Amount Date Particular Amount

03-05-16 By J. Wilson 1520

By T. Cole 1940

By F. Syme 2980

By J. Allen 1110

By P. White 2420

By F. Lane 770

09-05-16 By T. Cole 1480

By J. Fox 1910

20-05-16 By L. mole 1830

01-05-17

To Balance

C/d 17870 by W. Wright 1910

17870 17870

Bank a/c

Date Particular Amount Date Particular amount

16/07/18

31/07/18

To P Games a/c

To F Steel a/c

To J Wilson a/c

To F Syme a/c

To balance c/d

1330

2940

810

1590

29390

01/07/18

24/07/18

27/07/18

30/07/18

31/07/18

By storage cost a/c

By S Lyle a/c

By J Brown a/c

By R Foot a/c

By salaries a/c

By business rates a/c

By Abel motors a/c

800

3240

4140

1260

4800

1320

20500

36060 36060

Purchase a/c

Date Particular Amount Date Particular amount

7

Date Particular Amount Date Particular Amount

01-05-16 To bank 800 01-05-17 By balance c/d 800

800 800

Sales a/c

Date Particular Amount Date Particular Amount

03-05-16 By J. Wilson 1520

By T. Cole 1940

By F. Syme 2980

By J. Allen 1110

By P. White 2420

By F. Lane 770

09-05-16 By T. Cole 1480

By J. Fox 1910

20-05-16 By L. mole 1830

01-05-17

To Balance

C/d 17870 by W. Wright 1910

17870 17870

Bank a/c

Date Particular Amount Date Particular amount

16/07/18

31/07/18

To P Games a/c

To F Steel a/c

To J Wilson a/c

To F Syme a/c

To balance c/d

1330

2940

810

1590

29390

01/07/18

24/07/18

27/07/18

30/07/18

31/07/18

By storage cost a/c

By S Lyle a/c

By J Brown a/c

By R Foot a/c

By salaries a/c

By business rates a/c

By Abel motors a/c

800

3240

4140

1260

4800

1320

20500

36060 36060

Purchase a/c

Date Particular Amount Date Particular amount

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

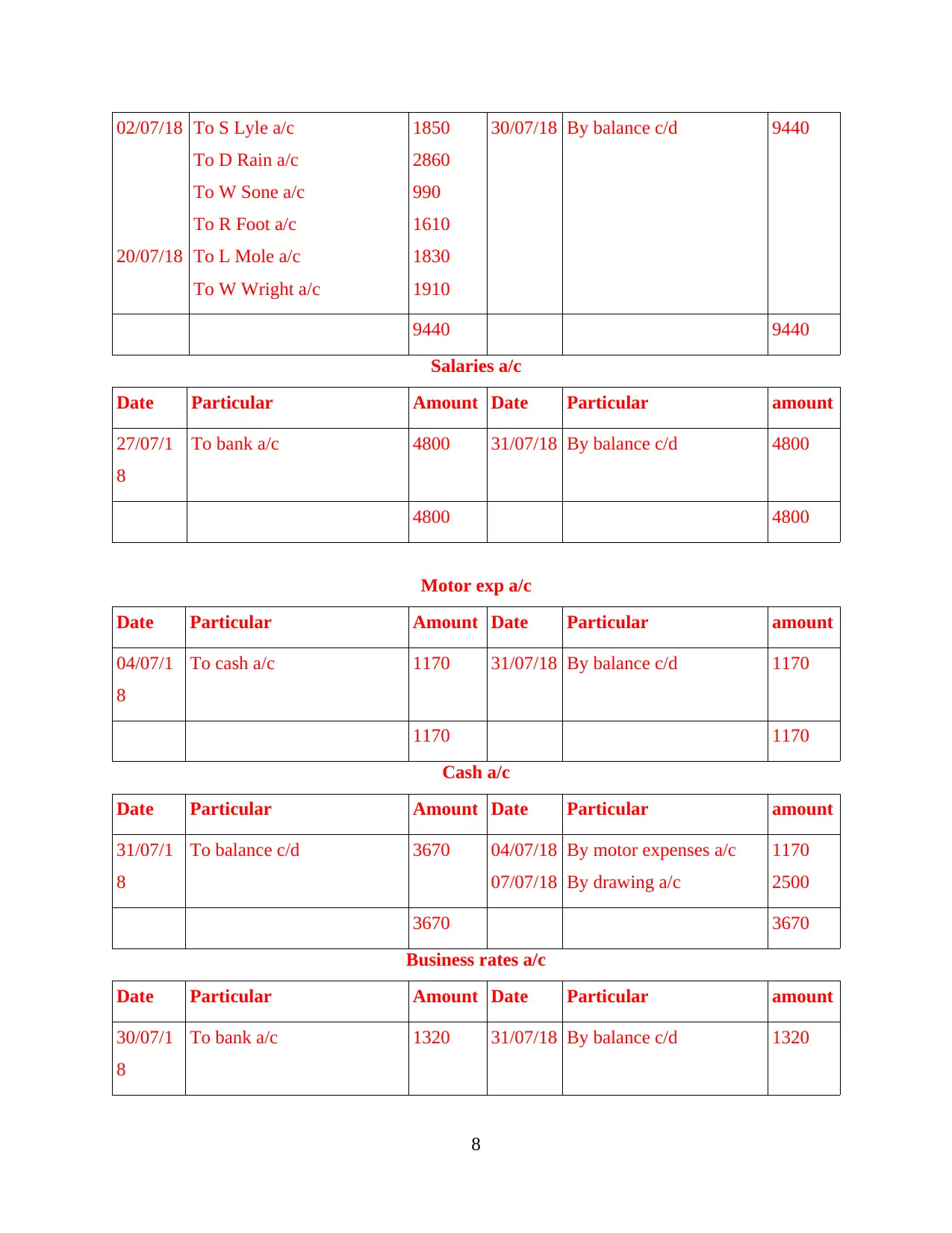

02/07/18

20/07/18

To S Lyle a/c

To D Rain a/c

To W Sone a/c

To R Foot a/c

To L Mole a/c

To W Wright a/c

1850

2860

990

1610

1830

1910

30/07/18 By balance c/d 9440

9440 9440

Salaries a/c

Date Particular Amount Date Particular amount

27/07/1

8

To bank a/c 4800 31/07/18 By balance c/d 4800

4800 4800

Motor exp a/c

Date Particular Amount Date Particular amount

04/07/1

8

To cash a/c 1170 31/07/18 By balance c/d 1170

1170 1170

Cash a/c

Date Particular Amount Date Particular amount

31/07/1

8

To balance c/d 3670 04/07/18

07/07/18

By motor expenses a/c

By drawing a/c

1170

2500

3670 3670

Business rates a/c

Date Particular Amount Date Particular amount

30/07/1

8

To bank a/c 1320 31/07/18 By balance c/d 1320

8

20/07/18

To S Lyle a/c

To D Rain a/c

To W Sone a/c

To R Foot a/c

To L Mole a/c

To W Wright a/c

1850

2860

990

1610

1830

1910

30/07/18 By balance c/d 9440

9440 9440

Salaries a/c

Date Particular Amount Date Particular amount

27/07/1

8

To bank a/c 4800 31/07/18 By balance c/d 4800

4800 4800

Motor exp a/c

Date Particular Amount Date Particular amount

04/07/1

8

To cash a/c 1170 31/07/18 By balance c/d 1170

1170 1170

Cash a/c

Date Particular Amount Date Particular amount

31/07/1

8

To balance c/d 3670 04/07/18

07/07/18

By motor expenses a/c

By drawing a/c

1170

2500

3670 3670

Business rates a/c

Date Particular Amount Date Particular amount

30/07/1

8

To bank a/c 1320 31/07/18 By balance c/d 1320

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1320 1320

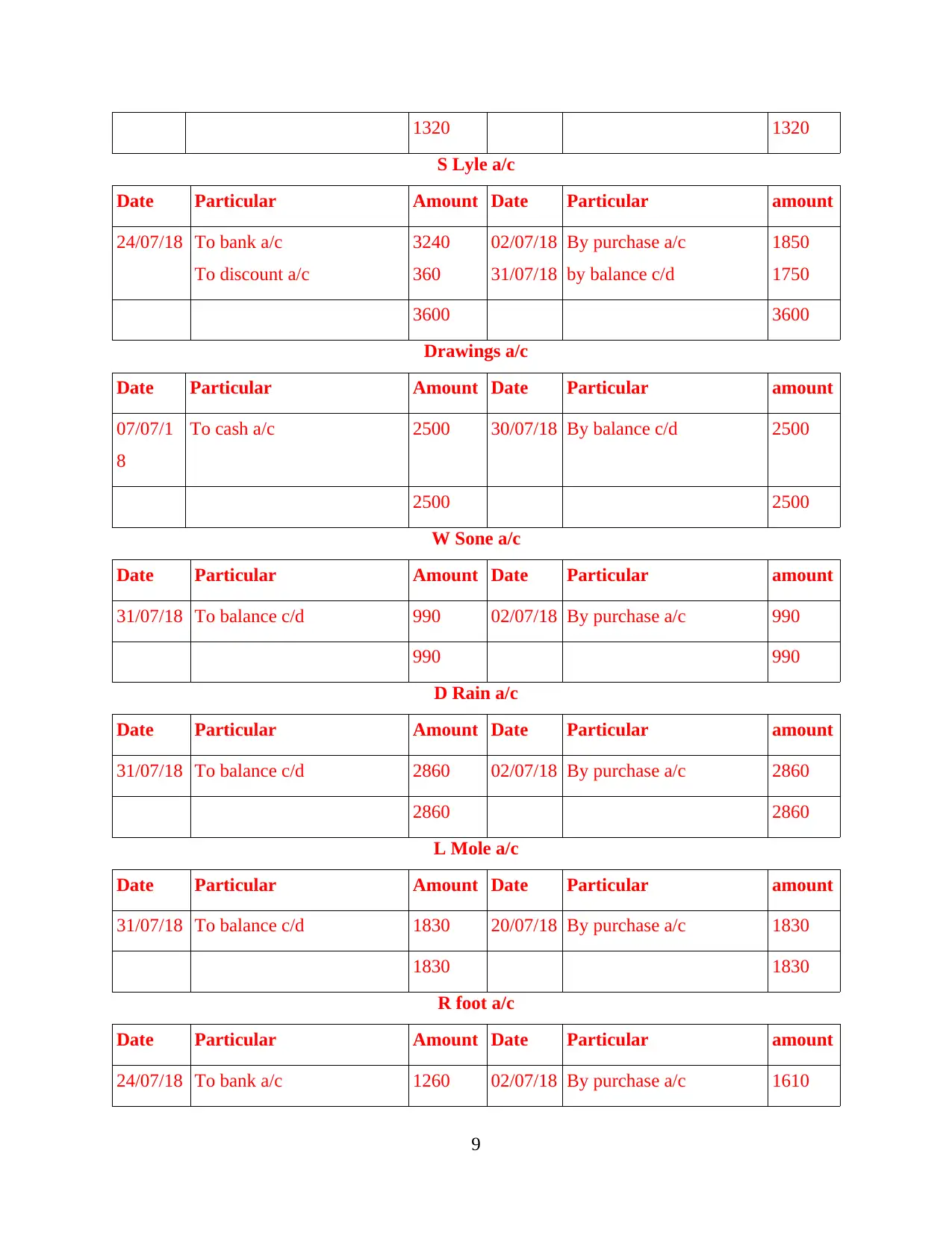

S Lyle a/c

Date Particular Amount Date Particular amount

24/07/18 To bank a/c

To discount a/c

3240

360

02/07/18

31/07/18

By purchase a/c

by balance c/d

1850

1750

3600 3600

Drawings a/c

Date Particular Amount Date Particular amount

07/07/1

8

To cash a/c 2500 30/07/18 By balance c/d 2500

2500 2500

W Sone a/c

Date Particular Amount Date Particular amount

31/07/18 To balance c/d 990 02/07/18 By purchase a/c 990

990 990

D Rain a/c

Date Particular Amount Date Particular amount

31/07/18 To balance c/d 2860 02/07/18 By purchase a/c 2860

2860 2860

L Mole a/c

Date Particular Amount Date Particular amount

31/07/18 To balance c/d 1830 20/07/18 By purchase a/c 1830

1830 1830

R foot a/c

Date Particular Amount Date Particular amount

24/07/18 To bank a/c 1260 02/07/18 By purchase a/c 1610

9

S Lyle a/c

Date Particular Amount Date Particular amount

24/07/18 To bank a/c

To discount a/c

3240

360

02/07/18

31/07/18

By purchase a/c

by balance c/d

1850

1750

3600 3600

Drawings a/c

Date Particular Amount Date Particular amount

07/07/1

8

To cash a/c 2500 30/07/18 By balance c/d 2500

2500 2500

W Sone a/c

Date Particular Amount Date Particular amount

31/07/18 To balance c/d 990 02/07/18 By purchase a/c 990

990 990

D Rain a/c

Date Particular Amount Date Particular amount

31/07/18 To balance c/d 2860 02/07/18 By purchase a/c 2860

2860 2860

L Mole a/c

Date Particular Amount Date Particular amount

31/07/18 To balance c/d 1830 20/07/18 By purchase a/c 1830

1830 1830

R foot a/c

Date Particular Amount Date Particular amount

24/07/18 To bank a/c 1260 02/07/18 By purchase a/c 1610

9

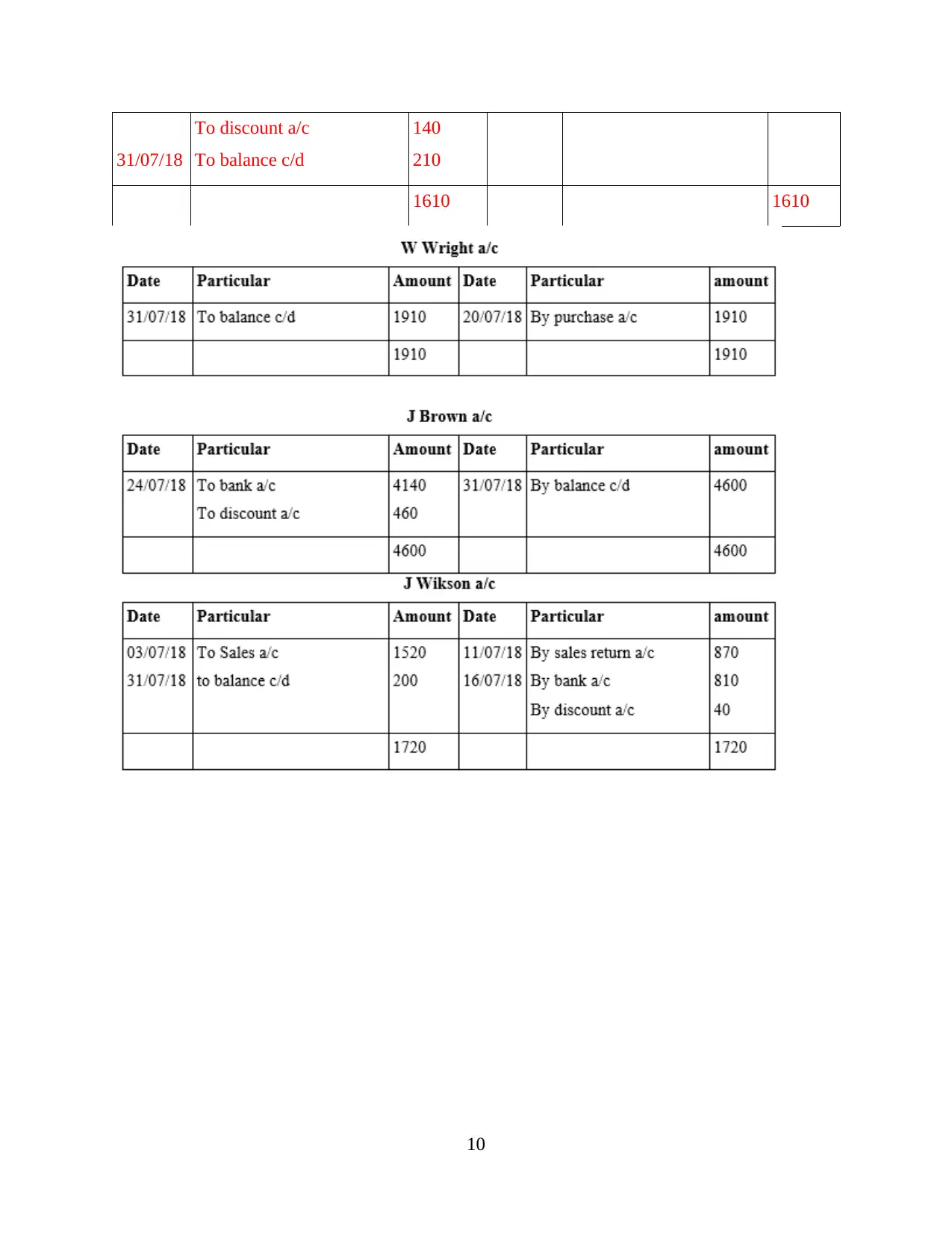

31/07/18

To discount a/c

To balance c/d

140

210

1610 1610

10

To discount a/c

To balance c/d

140

210

1610 1610

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.