Financial Accounting Assignment: Ratio, Inventory, and Profit Analysis

VerifiedAdded on 2020/04/21

|6

|690

|55

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial accounting assignment, focusing on ratio analysis and inventory management. The assignment includes calculations and comparisons of key financial ratios such as inventory turnover and gross profit margin for PepsiCo Inc. and Coca-Cola Company. It also demonstrates the application of different inventory costing methods, specifically FIFO and weighted average, to determine the cost of goods sold and ending inventory for a hypothetical company, Baby Store. The analysis provides a detailed comparison of the impact of each method on gross profit, concluding that the weighted average method yields a slightly higher gross profit in this scenario. The solution includes all necessary calculations and references to support the findings.

Running head: FINANCIAL ACCOUNTING

Financial accounting

Name of the student

Name of the university

Author note

Financial accounting

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING

Table of Contents

Answer to P6 – 10 A..................................................................................................................2

a. Ratio calculation..............................................................................................................2

b. Comment.........................................................................................................................2

Answer to P6 – 11A...................................................................................................................3

a. Cost of goods available for sales.....................................................................................3

b. No of units sold during the year......................................................................................3

c. Cost of ending inventory and cost of goods sold............................................................3

d. Calculation of gross profit...............................................................................................4

Reference....................................................................................................................................5

Table of Contents

Answer to P6 – 10 A..................................................................................................................2

a. Ratio calculation..............................................................................................................2

b. Comment.........................................................................................................................2

Answer to P6 – 11A...................................................................................................................3

a. Cost of goods available for sales.....................................................................................3

b. No of units sold during the year......................................................................................3

c. Cost of ending inventory and cost of goods sold............................................................3

d. Calculation of gross profit...............................................................................................4

Reference....................................................................................................................................5

2FINANCIAL ACCOUNTING

Answer to P6 – 10 A

a. Ratio calculation

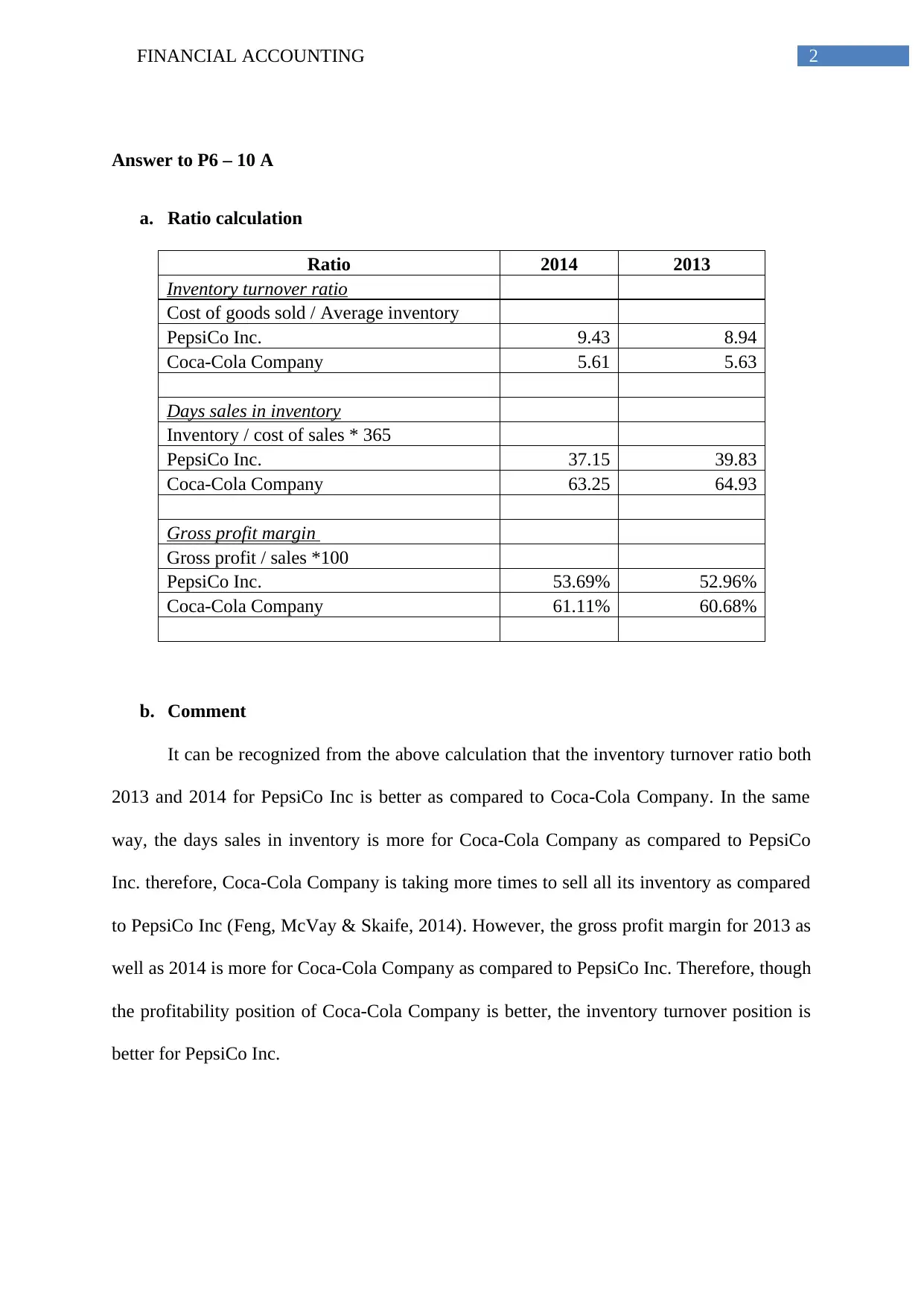

Ratio 2014 2013

Inventory turnover ratio

Cost of goods sold / Average inventory

PepsiCo Inc. 9.43 8.94

Coca-Cola Company 5.61 5.63

Days sales in inventory

Inventory / cost of sales * 365

PepsiCo Inc. 37.15 39.83

Coca-Cola Company 63.25 64.93

Gross profit margin

Gross profit / sales *100

PepsiCo Inc. 53.69% 52.96%

Coca-Cola Company 61.11% 60.68%

b. Comment

It can be recognized from the above calculation that the inventory turnover ratio both

2013 and 2014 for PepsiCo Inc is better as compared to Coca-Cola Company. In the same

way, the days sales in inventory is more for Coca-Cola Company as compared to PepsiCo

Inc. therefore, Coca-Cola Company is taking more times to sell all its inventory as compared

to PepsiCo Inc (Feng, McVay & Skaife, 2014). However, the gross profit margin for 2013 as

well as 2014 is more for Coca-Cola Company as compared to PepsiCo Inc. Therefore, though

the profitability position of Coca-Cola Company is better, the inventory turnover position is

better for PepsiCo Inc.

Answer to P6 – 10 A

a. Ratio calculation

Ratio 2014 2013

Inventory turnover ratio

Cost of goods sold / Average inventory

PepsiCo Inc. 9.43 8.94

Coca-Cola Company 5.61 5.63

Days sales in inventory

Inventory / cost of sales * 365

PepsiCo Inc. 37.15 39.83

Coca-Cola Company 63.25 64.93

Gross profit margin

Gross profit / sales *100

PepsiCo Inc. 53.69% 52.96%

Coca-Cola Company 61.11% 60.68%

b. Comment

It can be recognized from the above calculation that the inventory turnover ratio both

2013 and 2014 for PepsiCo Inc is better as compared to Coca-Cola Company. In the same

way, the days sales in inventory is more for Coca-Cola Company as compared to PepsiCo

Inc. therefore, Coca-Cola Company is taking more times to sell all its inventory as compared

to PepsiCo Inc (Feng, McVay & Skaife, 2014). However, the gross profit margin for 2013 as

well as 2014 is more for Coca-Cola Company as compared to PepsiCo Inc. Therefore, though

the profitability position of Coca-Cola Company is better, the inventory turnover position is

better for PepsiCo Inc.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING

Answer to P6 – 11A

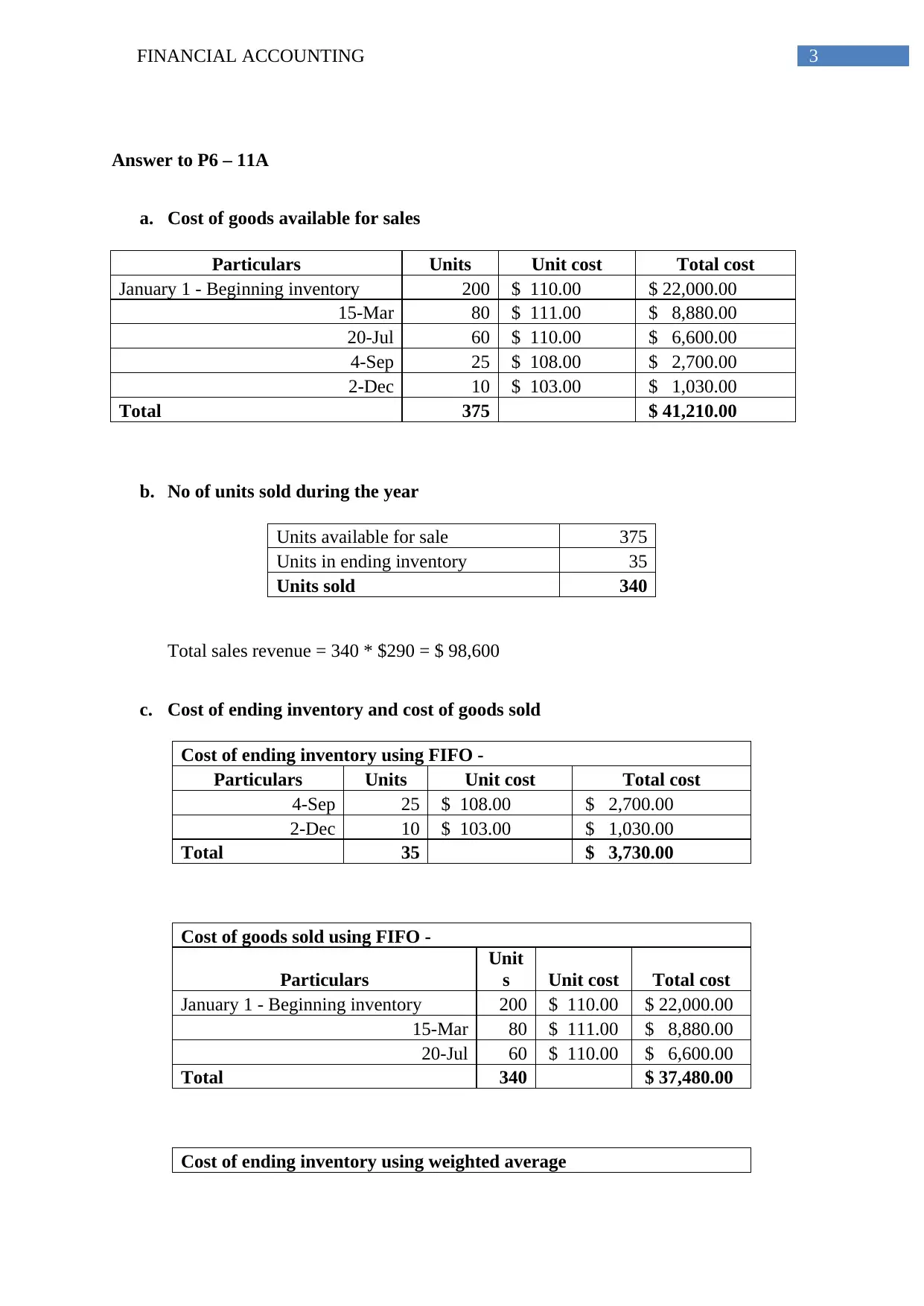

a. Cost of goods available for sales

Particulars Units Unit cost Total cost

January 1 - Beginning inventory 200 $ 110.00 $ 22,000.00

15-Mar 80 $ 111.00 $ 8,880.00

20-Jul 60 $ 110.00 $ 6,600.00

4-Sep 25 $ 108.00 $ 2,700.00

2-Dec 10 $ 103.00 $ 1,030.00

Total 375 $ 41,210.00

b. No of units sold during the year

Units available for sale 375

Units in ending inventory 35

Units sold 340

Total sales revenue = 340 * $290 = $ 98,600

c. Cost of ending inventory and cost of goods sold

Cost of ending inventory using FIFO -

Particulars Units Unit cost Total cost

4-Sep 25 $ 108.00 $ 2,700.00

2-Dec 10 $ 103.00 $ 1,030.00

Total 35 $ 3,730.00

Cost of goods sold using FIFO -

Particulars

Unit

s Unit cost Total cost

January 1 - Beginning inventory 200 $ 110.00 $ 22,000.00

15-Mar 80 $ 111.00 $ 8,880.00

20-Jul 60 $ 110.00 $ 6,600.00

Total 340 $ 37,480.00

Cost of ending inventory using weighted average

Answer to P6 – 11A

a. Cost of goods available for sales

Particulars Units Unit cost Total cost

January 1 - Beginning inventory 200 $ 110.00 $ 22,000.00

15-Mar 80 $ 111.00 $ 8,880.00

20-Jul 60 $ 110.00 $ 6,600.00

4-Sep 25 $ 108.00 $ 2,700.00

2-Dec 10 $ 103.00 $ 1,030.00

Total 375 $ 41,210.00

b. No of units sold during the year

Units available for sale 375

Units in ending inventory 35

Units sold 340

Total sales revenue = 340 * $290 = $ 98,600

c. Cost of ending inventory and cost of goods sold

Cost of ending inventory using FIFO -

Particulars Units Unit cost Total cost

4-Sep 25 $ 108.00 $ 2,700.00

2-Dec 10 $ 103.00 $ 1,030.00

Total 35 $ 3,730.00

Cost of goods sold using FIFO -

Particulars

Unit

s Unit cost Total cost

January 1 - Beginning inventory 200 $ 110.00 $ 22,000.00

15-Mar 80 $ 111.00 $ 8,880.00

20-Jul 60 $ 110.00 $ 6,600.00

Total 340 $ 37,480.00

Cost of ending inventory using weighted average

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING

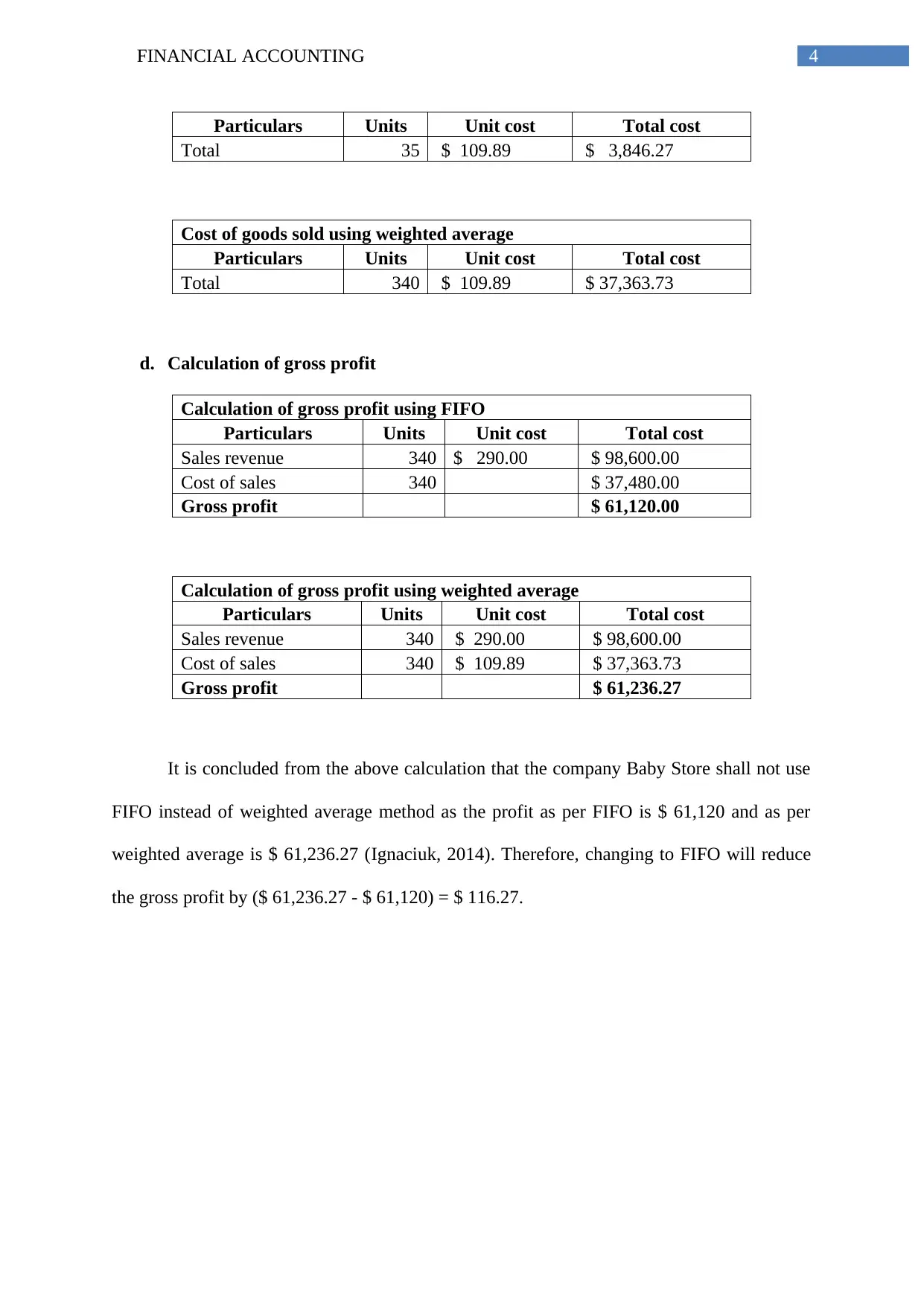

Particulars Units Unit cost Total cost

Total 35 $ 109.89 $ 3,846.27

Cost of goods sold using weighted average

Particulars Units Unit cost Total cost

Total 340 $ 109.89 $ 37,363.73

d. Calculation of gross profit

Calculation of gross profit using FIFO

Particulars Units Unit cost Total cost

Sales revenue 340 $ 290.00 $ 98,600.00

Cost of sales 340 $ 37,480.00

Gross profit $ 61,120.00

Calculation of gross profit using weighted average

Particulars Units Unit cost Total cost

Sales revenue 340 $ 290.00 $ 98,600.00

Cost of sales 340 $ 109.89 $ 37,363.73

Gross profit $ 61,236.27

It is concluded from the above calculation that the company Baby Store shall not use

FIFO instead of weighted average method as the profit as per FIFO is $ 61,120 and as per

weighted average is $ 61,236.27 (Ignaciuk, 2014). Therefore, changing to FIFO will reduce

the gross profit by ($ 61,236.27 - $ 61,120) = $ 116.27.

Particulars Units Unit cost Total cost

Total 35 $ 109.89 $ 3,846.27

Cost of goods sold using weighted average

Particulars Units Unit cost Total cost

Total 340 $ 109.89 $ 37,363.73

d. Calculation of gross profit

Calculation of gross profit using FIFO

Particulars Units Unit cost Total cost

Sales revenue 340 $ 290.00 $ 98,600.00

Cost of sales 340 $ 37,480.00

Gross profit $ 61,120.00

Calculation of gross profit using weighted average

Particulars Units Unit cost Total cost

Sales revenue 340 $ 290.00 $ 98,600.00

Cost of sales 340 $ 109.89 $ 37,363.73

Gross profit $ 61,236.27

It is concluded from the above calculation that the company Baby Store shall not use

FIFO instead of weighted average method as the profit as per FIFO is $ 61,120 and as per

weighted average is $ 61,236.27 (Ignaciuk, 2014). Therefore, changing to FIFO will reduce

the gross profit by ($ 61,236.27 - $ 61,120) = $ 116.27.

5FINANCIAL ACCOUNTING

Reference

Feng, M., Li, C., McVay, S. E., & Skaife, H. (2014). Does ineffective internal control over

financial reporting affect a firm's operations? Evidence from firms' inventory

management. The Accounting Review, 90(2), 529-557.

Ignaciuk, P. (2014). Nonlinear inventory control with discrete sliding modes in systems with

uncertain delay. IEEE Transactions on Industrial Informatics, 10(1), 559-568.

Reference

Feng, M., Li, C., McVay, S. E., & Skaife, H. (2014). Does ineffective internal control over

financial reporting affect a firm's operations? Evidence from firms' inventory

management. The Accounting Review, 90(2), 529-557.

Ignaciuk, P. (2014). Nonlinear inventory control with discrete sliding modes in systems with

uncertain delay. IEEE Transactions on Industrial Informatics, 10(1), 559-568.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.