Finance Assignment: Capital Budgeting, Valuation, and Risk Analysis

VerifiedAdded on 2020/06/04

|17

|2051

|145

Homework Assignment

AI Summary

This finance assignment solution provides a detailed analysis of various financial concepts. It begins with an overview of funding sources, including equity, preference shares, and debt capital, and their respective advantages and disadvantages. The assignment then delves into the analysis of financial instruments, including futures contracts, and option valuation. It further explores the computation of expected return and standard deviation for common stocks, as well as the calculation of the required rate of return using the CAPM model. The core of the assignment focuses on capital budgeting techniques, such as payback period, discounted payback period, net present value (NPV), profitability index, internal rate of return (IRR), and modified internal rate of return (MIRR). The solution also addresses capital rationing, project selection, and the problems associated with it. Finally, it compares projects using replacement chains and equivalent annual annuity (EAA) to determine the most financially viable investment options, providing a comprehensive understanding of financial decision-making.

Principles of Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

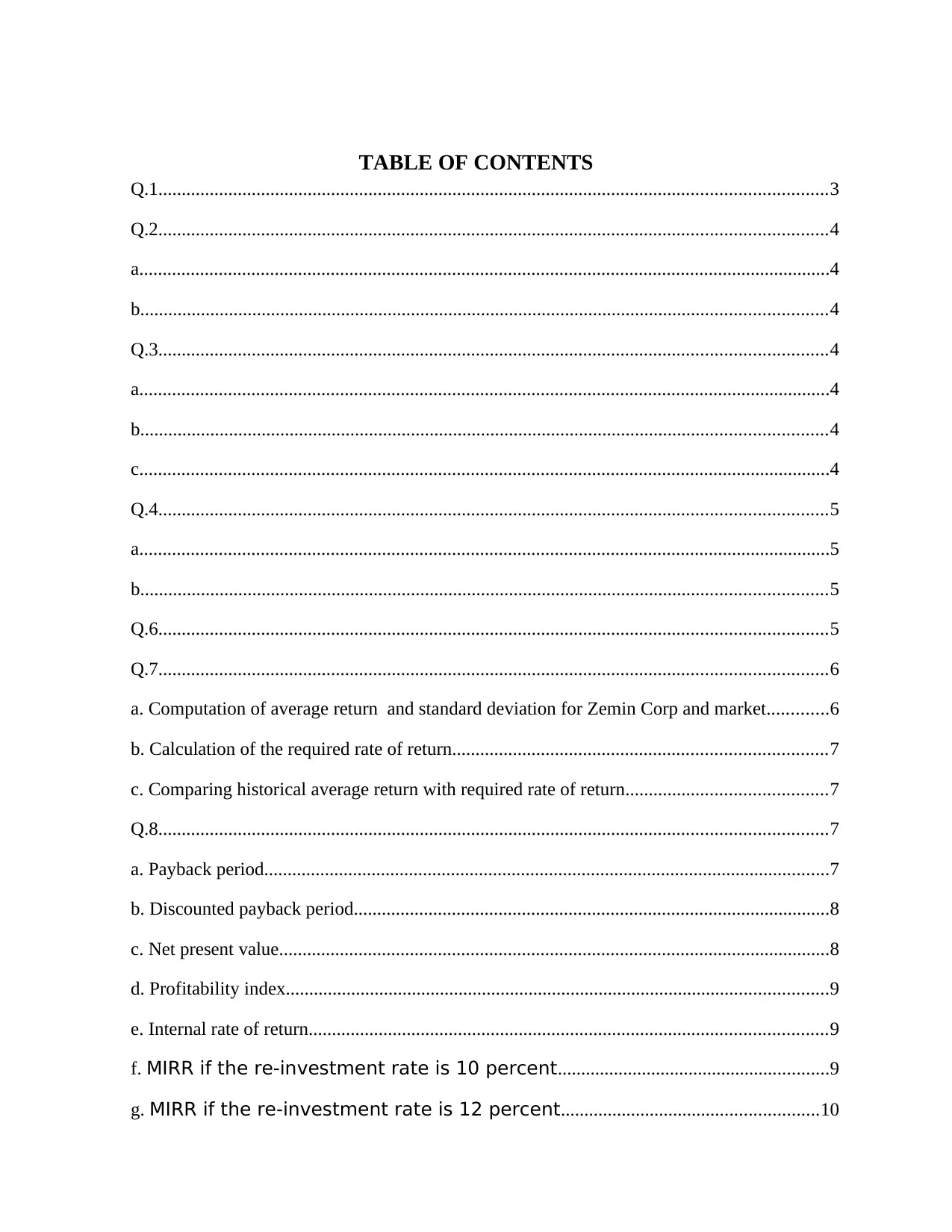

TABLE OF CONTENTS

Q.1...............................................................................................................................................3

Q.2...............................................................................................................................................4

a....................................................................................................................................................4

b...................................................................................................................................................4

Q.3...............................................................................................................................................4

a....................................................................................................................................................4

b...................................................................................................................................................4

c....................................................................................................................................................4

Q.4...............................................................................................................................................5

a....................................................................................................................................................5

b...................................................................................................................................................5

Q.6...............................................................................................................................................5

Q.7...............................................................................................................................................6

a. Computation of average return and standard deviation for Zemin Corp and market.............6

b. Calculation of the required rate of return................................................................................7

c. Comparing historical average return with required rate of return...........................................7

Q.8...............................................................................................................................................7

a. Payback period.........................................................................................................................7

b. Discounted payback period......................................................................................................8

c. Net present value......................................................................................................................8

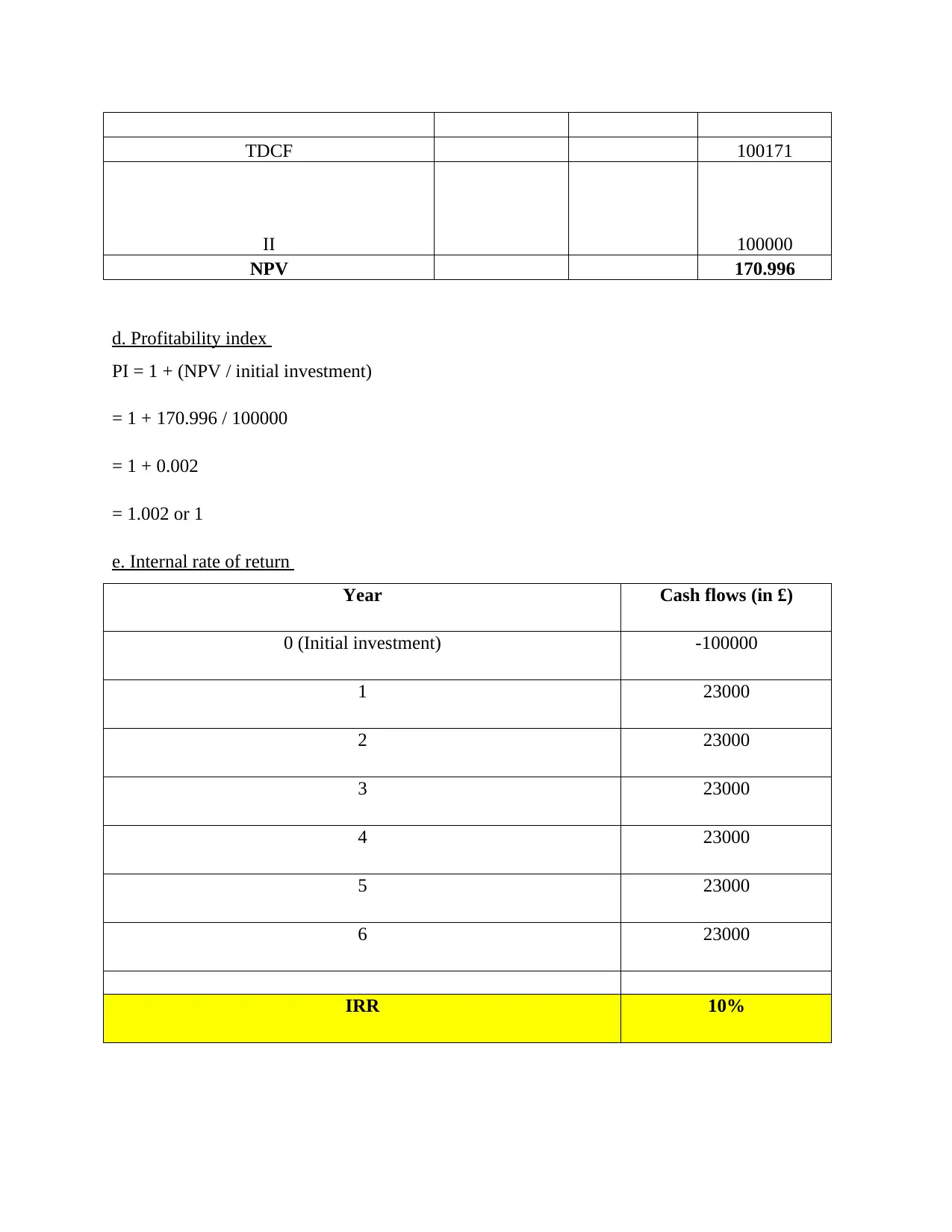

d. Profitability index....................................................................................................................9

e. Internal rate of return...............................................................................................................9

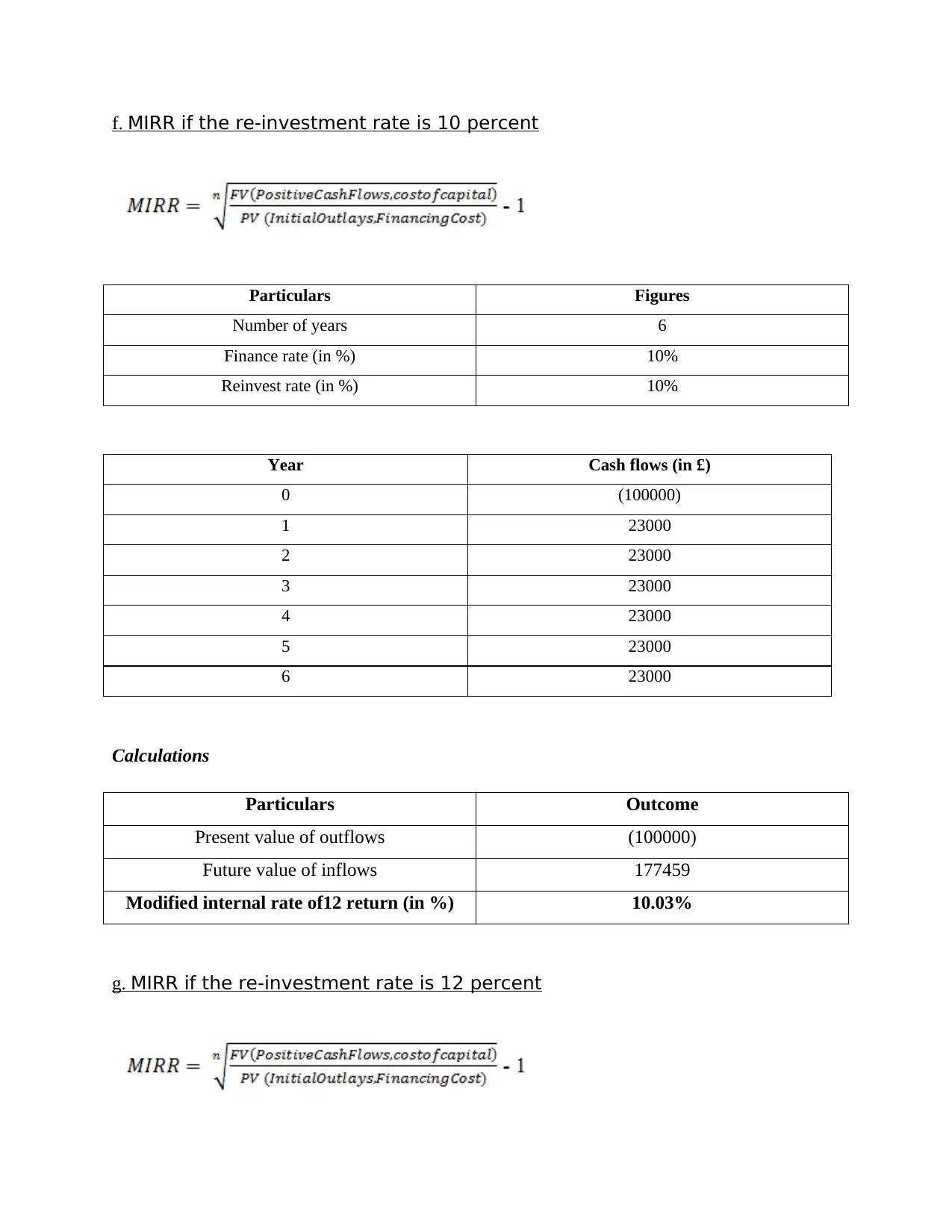

f. MIRR if the re-investment rate is 10 percent..........................................................9

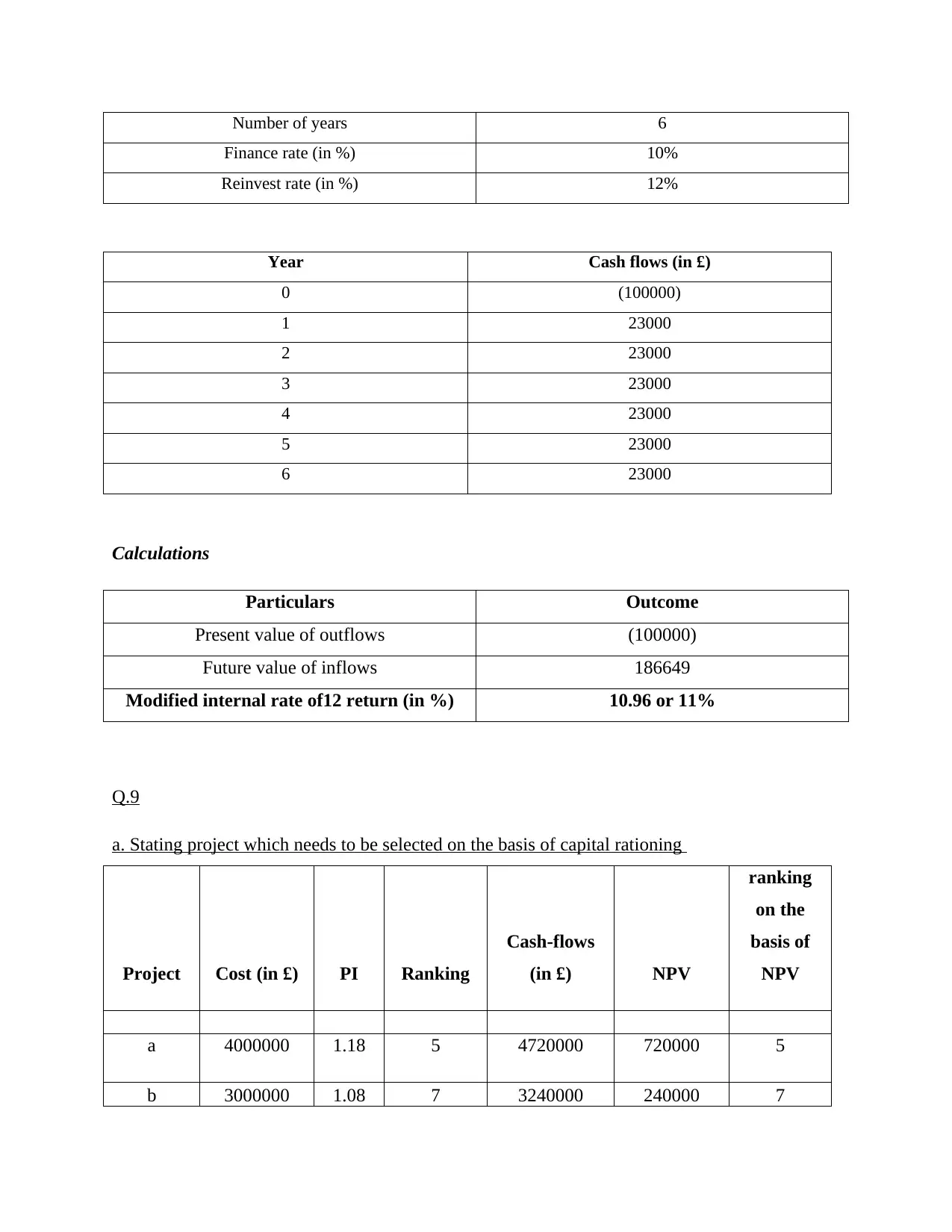

g. MIRR if the re-investment rate is 12 percent.......................................................10

Q.1...............................................................................................................................................3

Q.2...............................................................................................................................................4

a....................................................................................................................................................4

b...................................................................................................................................................4

Q.3...............................................................................................................................................4

a....................................................................................................................................................4

b...................................................................................................................................................4

c....................................................................................................................................................4

Q.4...............................................................................................................................................5

a....................................................................................................................................................5

b...................................................................................................................................................5

Q.6...............................................................................................................................................5

Q.7...............................................................................................................................................6

a. Computation of average return and standard deviation for Zemin Corp and market.............6

b. Calculation of the required rate of return................................................................................7

c. Comparing historical average return with required rate of return...........................................7

Q.8...............................................................................................................................................7

a. Payback period.........................................................................................................................7

b. Discounted payback period......................................................................................................8

c. Net present value......................................................................................................................8

d. Profitability index....................................................................................................................9

e. Internal rate of return...............................................................................................................9

f. MIRR if the re-investment rate is 10 percent..........................................................9

g. MIRR if the re-investment rate is 12 percent.......................................................10

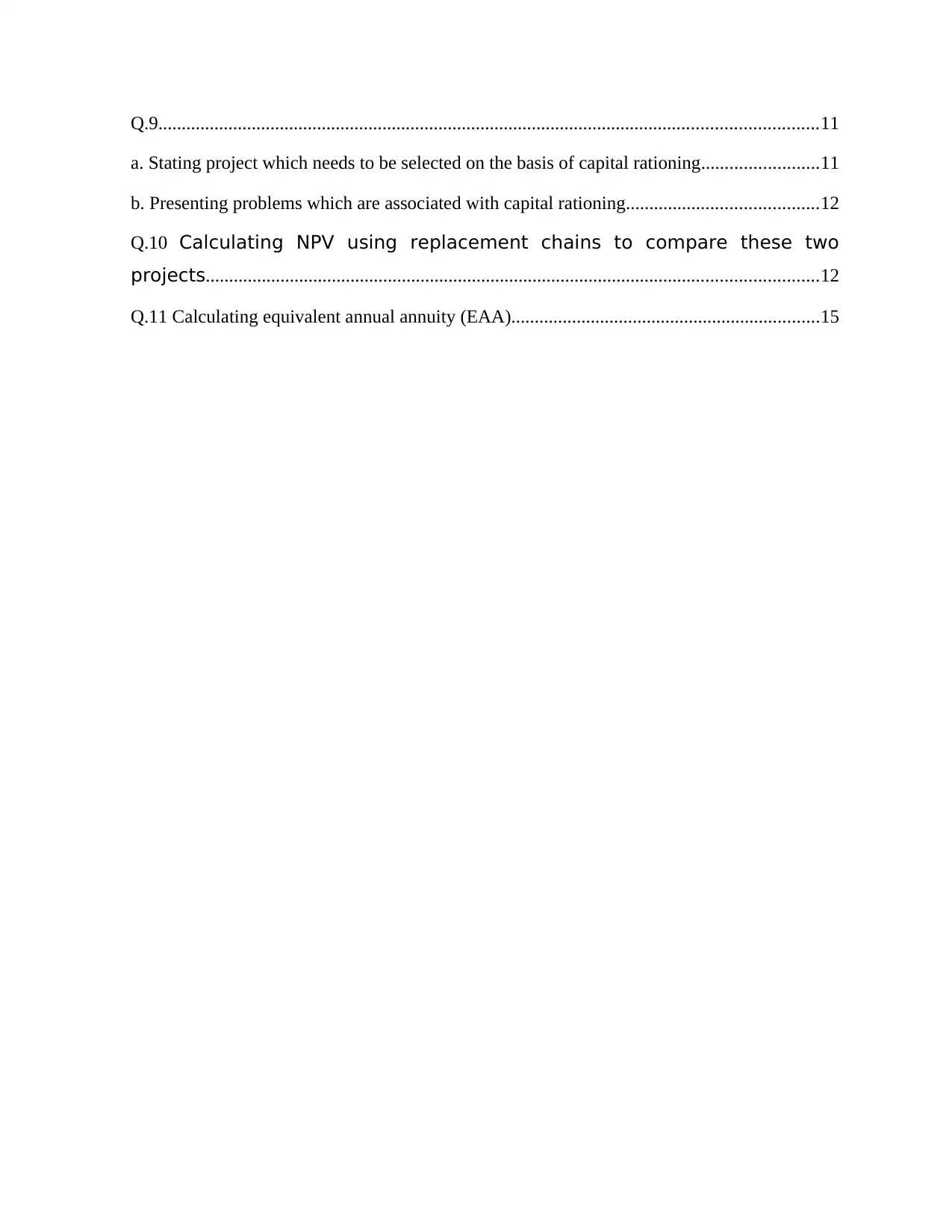

Q.9.............................................................................................................................................11

a. Stating project which needs to be selected on the basis of capital rationing.........................11

b. Presenting problems which are associated with capital rationing.........................................12

Q.10 Calculating NPV using replacement chains to compare these two

projects...................................................................................................................................12

Q.11 Calculating equivalent annual annuity (EAA)..................................................................15

a. Stating project which needs to be selected on the basis of capital rationing.........................11

b. Presenting problems which are associated with capital rationing.........................................12

Q.10 Calculating NPV using replacement chains to compare these two

projects...................................................................................................................................12

Q.11 Calculating equivalent annual annuity (EAA)..................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

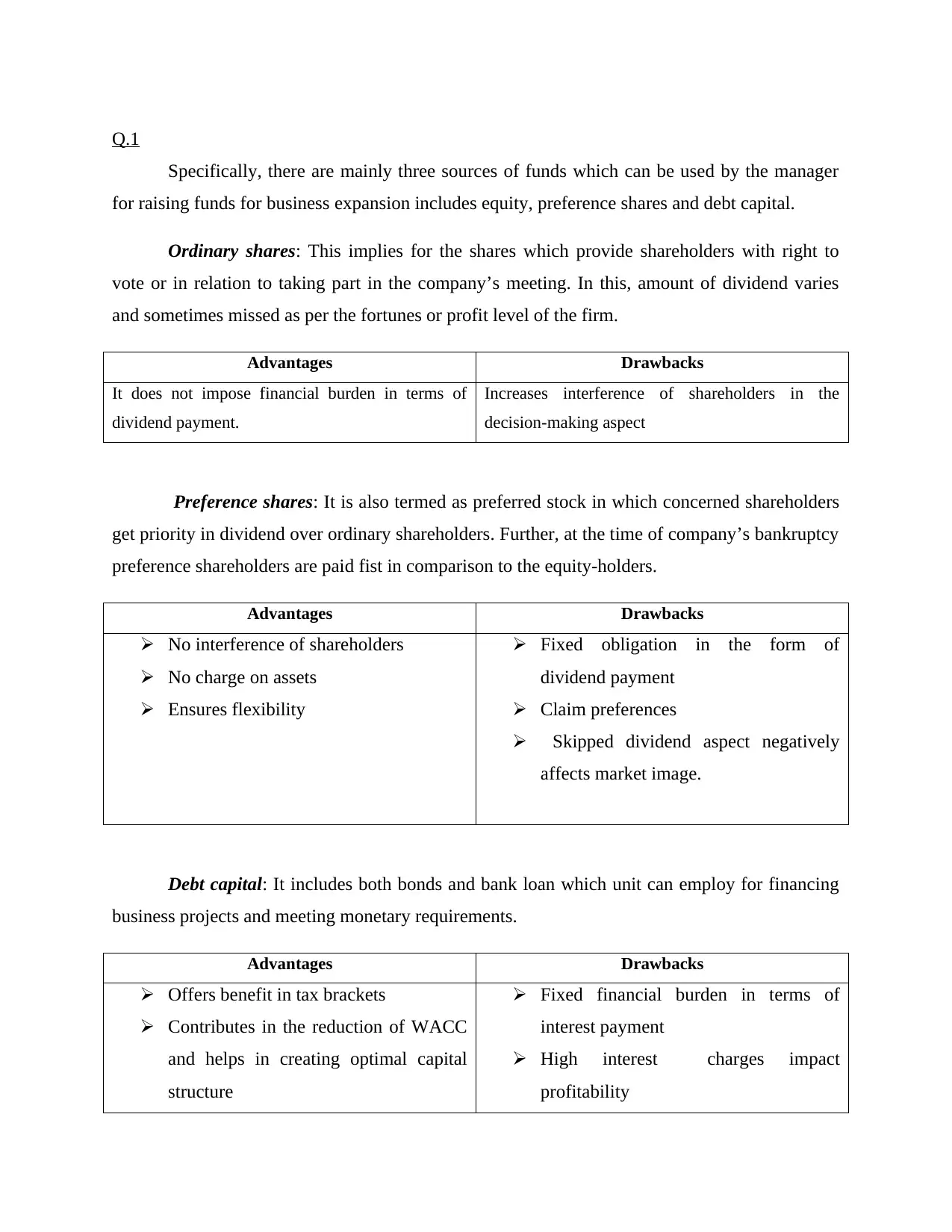

Q.1

Specifically, there are mainly three sources of funds which can be used by the manager

for raising funds for business expansion includes equity, preference shares and debt capital.

Ordinary shares: This implies for the shares which provide shareholders with right to

vote or in relation to taking part in the company’s meeting. In this, amount of dividend varies

and sometimes missed as per the fortunes or profit level of the firm.

Advantages Drawbacks

It does not impose financial burden in terms of

dividend payment.

Increases interference of shareholders in the

decision-making aspect

Preference shares: It is also termed as preferred stock in which concerned shareholders

get priority in dividend over ordinary shareholders. Further, at the time of company’s bankruptcy

preference shareholders are paid fist in comparison to the equity-holders.

Advantages Drawbacks

No interference of shareholders

No charge on assets

Ensures flexibility

Fixed obligation in the form of

dividend payment

Claim preferences

Skipped dividend aspect negatively

affects market image.

Debt capital: It includes both bonds and bank loan which unit can employ for financing

business projects and meeting monetary requirements.

Advantages Drawbacks

Offers benefit in tax brackets

Contributes in the reduction of WACC

and helps in creating optimal capital

structure

Fixed financial burden in terms of

interest payment

High interest charges impact

profitability

Specifically, there are mainly three sources of funds which can be used by the manager

for raising funds for business expansion includes equity, preference shares and debt capital.

Ordinary shares: This implies for the shares which provide shareholders with right to

vote or in relation to taking part in the company’s meeting. In this, amount of dividend varies

and sometimes missed as per the fortunes or profit level of the firm.

Advantages Drawbacks

It does not impose financial burden in terms of

dividend payment.

Increases interference of shareholders in the

decision-making aspect

Preference shares: It is also termed as preferred stock in which concerned shareholders

get priority in dividend over ordinary shareholders. Further, at the time of company’s bankruptcy

preference shareholders are paid fist in comparison to the equity-holders.

Advantages Drawbacks

No interference of shareholders

No charge on assets

Ensures flexibility

Fixed obligation in the form of

dividend payment

Claim preferences

Skipped dividend aspect negatively

affects market image.

Debt capital: It includes both bonds and bank loan which unit can employ for financing

business projects and meeting monetary requirements.

Advantages Drawbacks

Offers benefit in tax brackets

Contributes in the reduction of WACC

and helps in creating optimal capital

structure

Fixed financial burden in terms of

interest payment

High interest charges impact

profitability

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

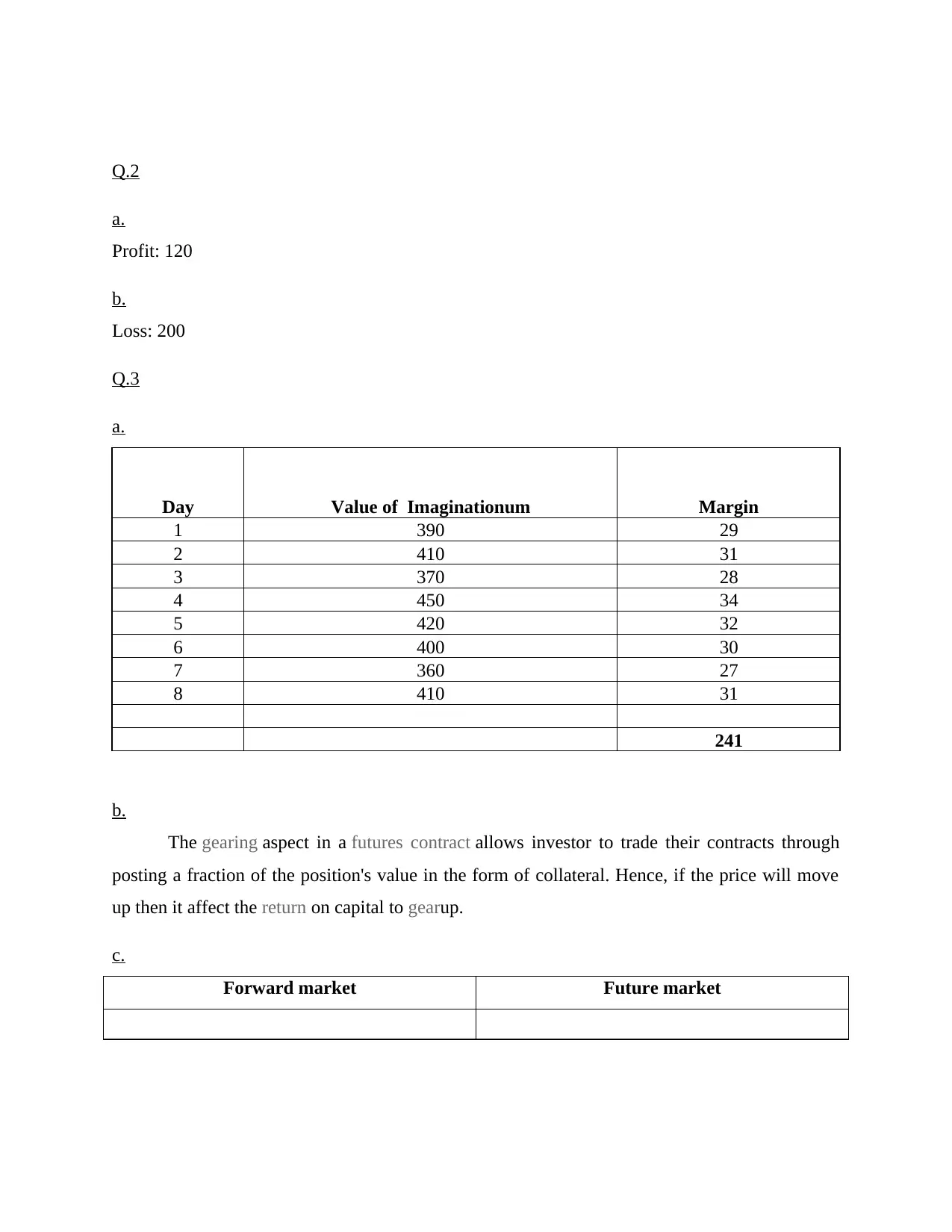

Q.2

a.

Profit: 120

b.

Loss: 200

Q.3

a.

Day Value of Imaginationum Margin

1 390 29

2 410 31

3 370 28

4 450 34

5 420 32

6 400 30

7 360 27

8 410 31

241

b.

The gearing aspect in a futures contract allows investor to trade their contracts through

posting a fraction of the position's value in the form of collateral. Hence, if the price will move

up then it affect the return on capital to gearup.

c.

Forward market Future market

a.

Profit: 120

b.

Loss: 200

Q.3

a.

Day Value of Imaginationum Margin

1 390 29

2 410 31

3 370 28

4 450 34

5 420 32

6 400 30

7 360 27

8 410 31

241

b.

The gearing aspect in a futures contract allows investor to trade their contracts through

posting a fraction of the position's value in the form of collateral. Hence, if the price will move

up then it affect the return on capital to gearup.

c.

Forward market Future market

It implies for the informal over –the-counter

financial market where contracts for future delivery

made.

In this market, commodities, stock, precious metals

etc are bought and sold at a predetermined price

within the specific time in future.

Q.4

a.

For the purpose of hedging, 450 exercise prices will be considered.

b.

Intrinsic value implies for the amount by which the strike price of an option is in-the

money.

Time value: It implies for an extrinsic value and reflects the amount which exceeds

intrinsic figure of an option.

In-the money call option: This implies for the call option where strike price of an

underlying assets are less than spot figure.

At-the money call option: When strike price is equal to spot price pertaining to an

underlying assets then it considered as at the money call option.

Out-the-money call option: It entails for the one where strike price of an option is higher

as compared to spot price.

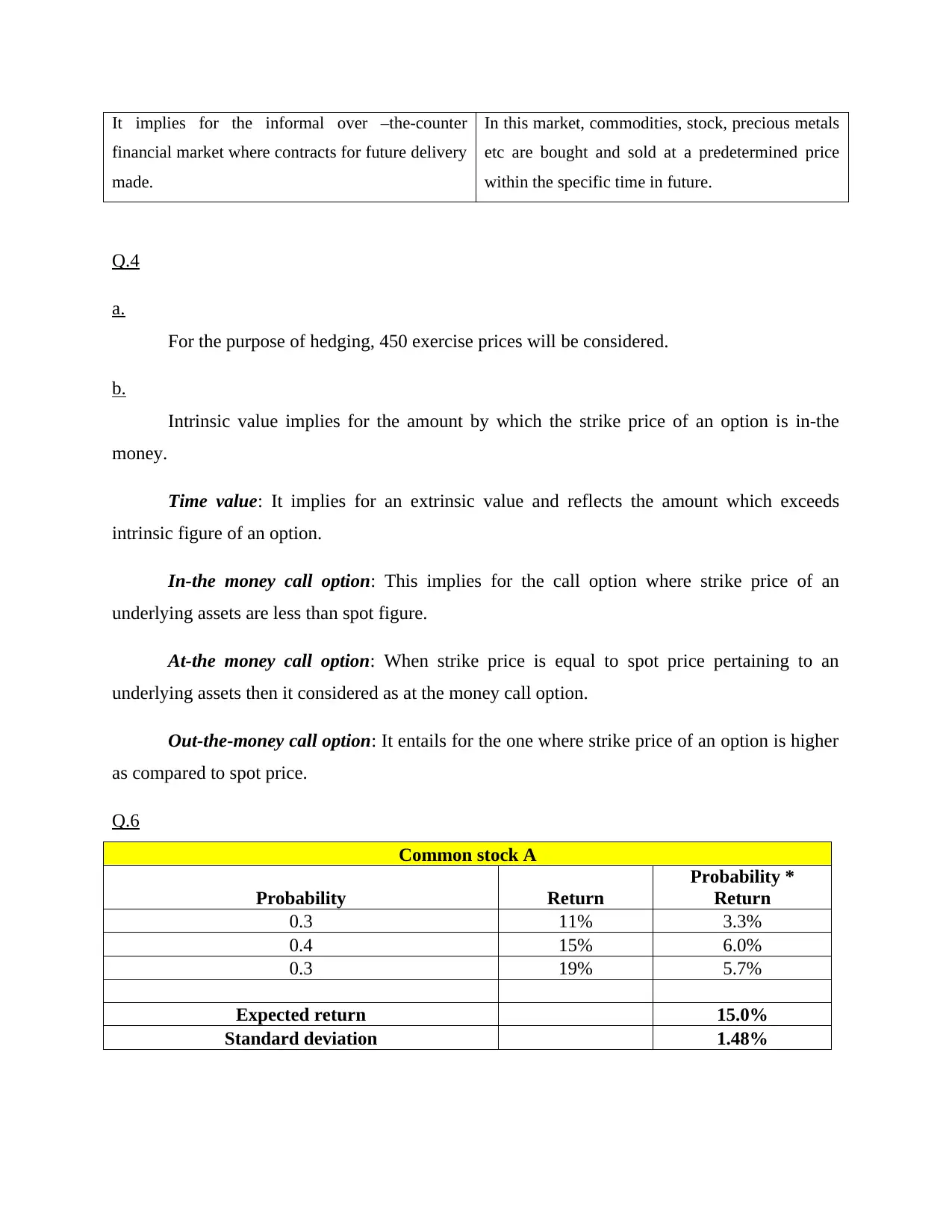

Q.6

Common stock A

Probability Return

Probability *

Return

0.3 11% 3.3%

0.4 15% 6.0%

0.3 19% 5.7%

Expected return 15.0%

Standard deviation 1.48%

financial market where contracts for future delivery

made.

In this market, commodities, stock, precious metals

etc are bought and sold at a predetermined price

within the specific time in future.

Q.4

a.

For the purpose of hedging, 450 exercise prices will be considered.

b.

Intrinsic value implies for the amount by which the strike price of an option is in-the

money.

Time value: It implies for an extrinsic value and reflects the amount which exceeds

intrinsic figure of an option.

In-the money call option: This implies for the call option where strike price of an

underlying assets are less than spot figure.

At-the money call option: When strike price is equal to spot price pertaining to an

underlying assets then it considered as at the money call option.

Out-the-money call option: It entails for the one where strike price of an option is higher

as compared to spot price.

Q.6

Common stock A

Probability Return

Probability *

Return

0.3 11% 3.3%

0.4 15% 6.0%

0.3 19% 5.7%

Expected return 15.0%

Standard deviation 1.48%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Common stock B

Probability Return

Probability *

Return

0.2 -5% -1.0%

0.3 6% 1.8%

0.3 14% 4.2%

0.2 22% 4.4%

Expected return 9.4%

Standard deviation 2.53%

Considering overall evaluation, it can be depicted that common stock A is better from

investment perspective over others. Moreover stock A is offering high returns such as 15% at

lower risk level (1.48%), so it considered as highly suitable.

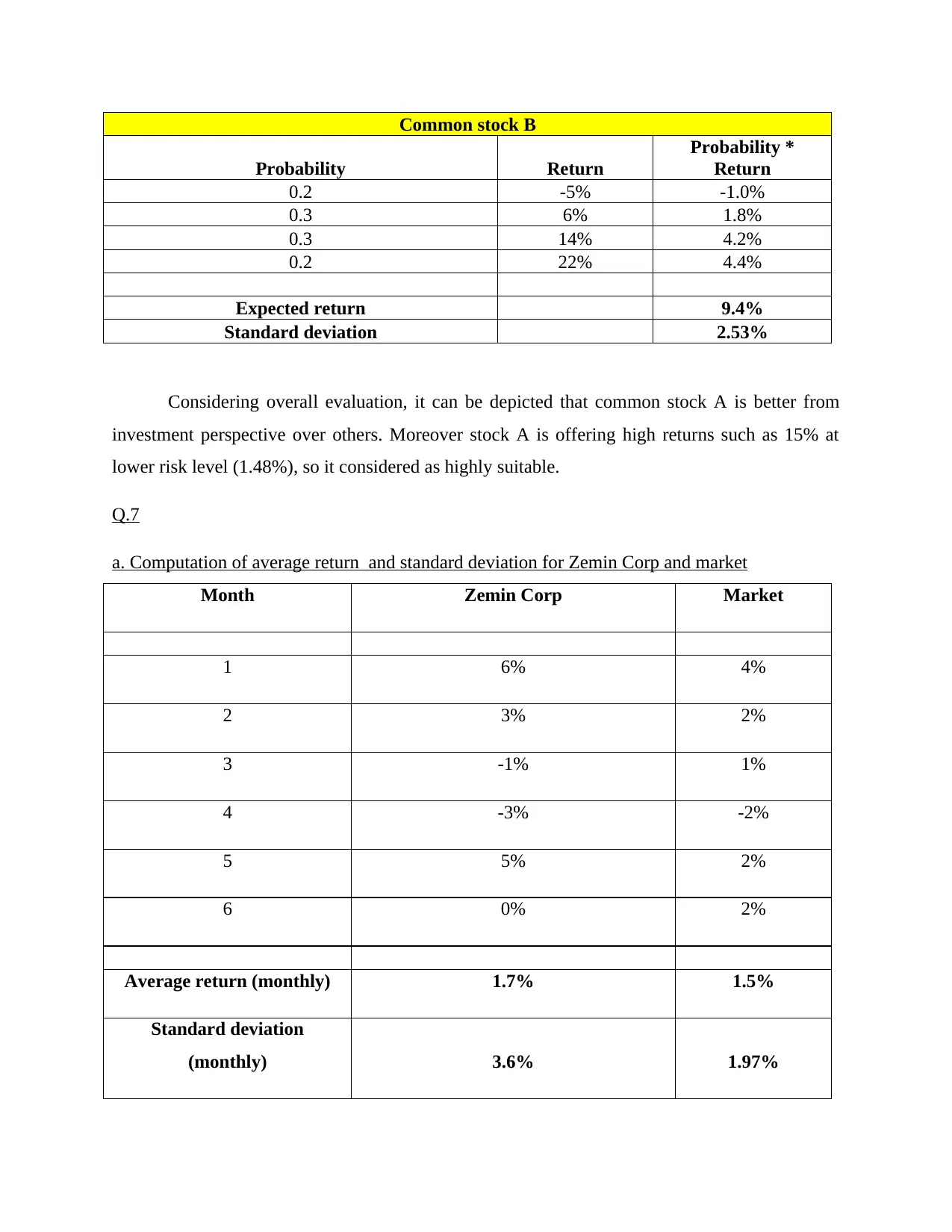

Q.7

a. Computation of average return and standard deviation for Zemin Corp and market

Month Zemin Corp Market

1 6% 4%

2 3% 2%

3 -1% 1%

4 -3% -2%

5 5% 2%

6 0% 2%

Average return (monthly) 1.7% 1.5%

Standard deviation

(monthly) 3.6% 1.97%

Probability Return

Probability *

Return

0.2 -5% -1.0%

0.3 6% 1.8%

0.3 14% 4.2%

0.2 22% 4.4%

Expected return 9.4%

Standard deviation 2.53%

Considering overall evaluation, it can be depicted that common stock A is better from

investment perspective over others. Moreover stock A is offering high returns such as 15% at

lower risk level (1.48%), so it considered as highly suitable.

Q.7

a. Computation of average return and standard deviation for Zemin Corp and market

Month Zemin Corp Market

1 6% 4%

2 3% 2%

3 -1% 1%

4 -3% -2%

5 5% 2%

6 0% 2%

Average return (monthly) 1.7% 1.5%

Standard deviation

(monthly) 3.6% 1.97%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Annual Market return (1.5% *12) 18.0%

annual standard deviation (1.97% * SQRT of 12) 6.8%

b. Calculation of the required rate of return

Particulars Figures

Beta 1.54

Risk free return 4%

Annualized market return (1.5% * 12) 18.0%

Rf + beta (Rm – Rf) 25.6%

On the basis of CAPM model, in against to the risk undertaken, investors are expecting

25.6% return from the securities.

c. Comparing historical average return with required rate of return

Particulars Figures

Historical average return 20.0%

appropriate required return 25.6%

The above depicted table shows that historical return is near to the required rate of

return. Hence, in the long run investor might get high returns by investing money in such riskier

or volatile securities.

annual standard deviation (1.97% * SQRT of 12) 6.8%

b. Calculation of the required rate of return

Particulars Figures

Beta 1.54

Risk free return 4%

Annualized market return (1.5% * 12) 18.0%

Rf + beta (Rm – Rf) 25.6%

On the basis of CAPM model, in against to the risk undertaken, investors are expecting

25.6% return from the securities.

c. Comparing historical average return with required rate of return

Particulars Figures

Historical average return 20.0%

appropriate required return 25.6%

The above depicted table shows that historical return is near to the required rate of

return. Hence, in the long run investor might get high returns by investing money in such riskier

or volatile securities.

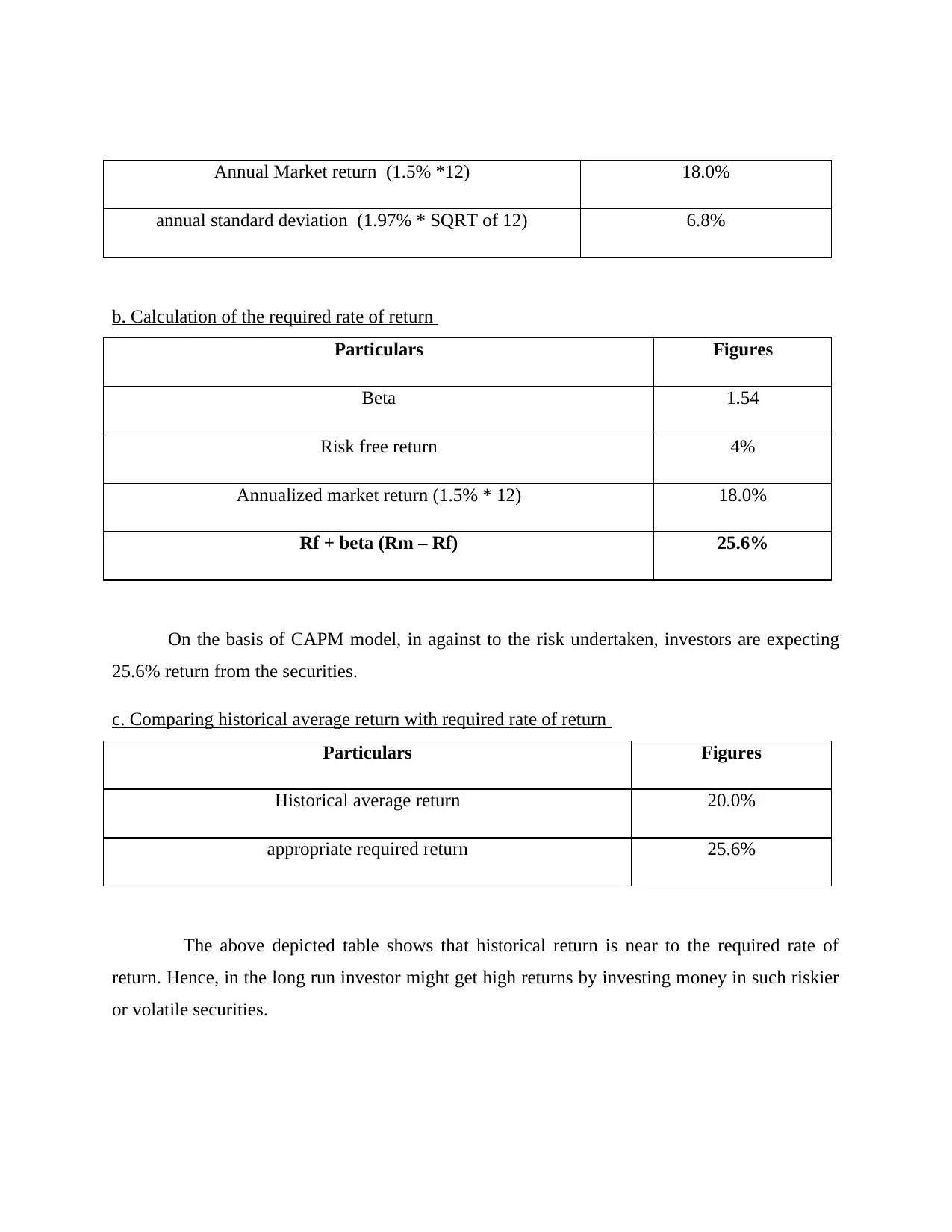

Q.8

a. Payback period

Cash- inflow / initial investment

= 23000 / 100000

= 4.3 years

b. Discounted payback period

Year Discounted cash-flow (in £)

Cumulative discounted cash-

flow (in £)

1 20909.09 20909.09

2 19008.26 39917.36

3 17280.24 57197.6

4 15709.31 72906.91

5 14281.19 87188.1

6 12982.9 100171

5 + 12811.9 / 12982.9

= 5.99 or 6 years

c. Net present value

Year

Cash flows

(in £)

PV factor

10%

PV of cash

flows (in £)

1 23000 0.909 20909.1

2 23000 0.826 19008.3

3 23000 0.751 17280.2

4 23000 0.683 15709.3

5 23000 0.621 14281.2

6 23000 0.564 12982.9

a. Payback period

Cash- inflow / initial investment

= 23000 / 100000

= 4.3 years

b. Discounted payback period

Year Discounted cash-flow (in £)

Cumulative discounted cash-

flow (in £)

1 20909.09 20909.09

2 19008.26 39917.36

3 17280.24 57197.6

4 15709.31 72906.91

5 14281.19 87188.1

6 12982.9 100171

5 + 12811.9 / 12982.9

= 5.99 or 6 years

c. Net present value

Year

Cash flows

(in £)

PV factor

10%

PV of cash

flows (in £)

1 23000 0.909 20909.1

2 23000 0.826 19008.3

3 23000 0.751 17280.2

4 23000 0.683 15709.3

5 23000 0.621 14281.2

6 23000 0.564 12982.9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

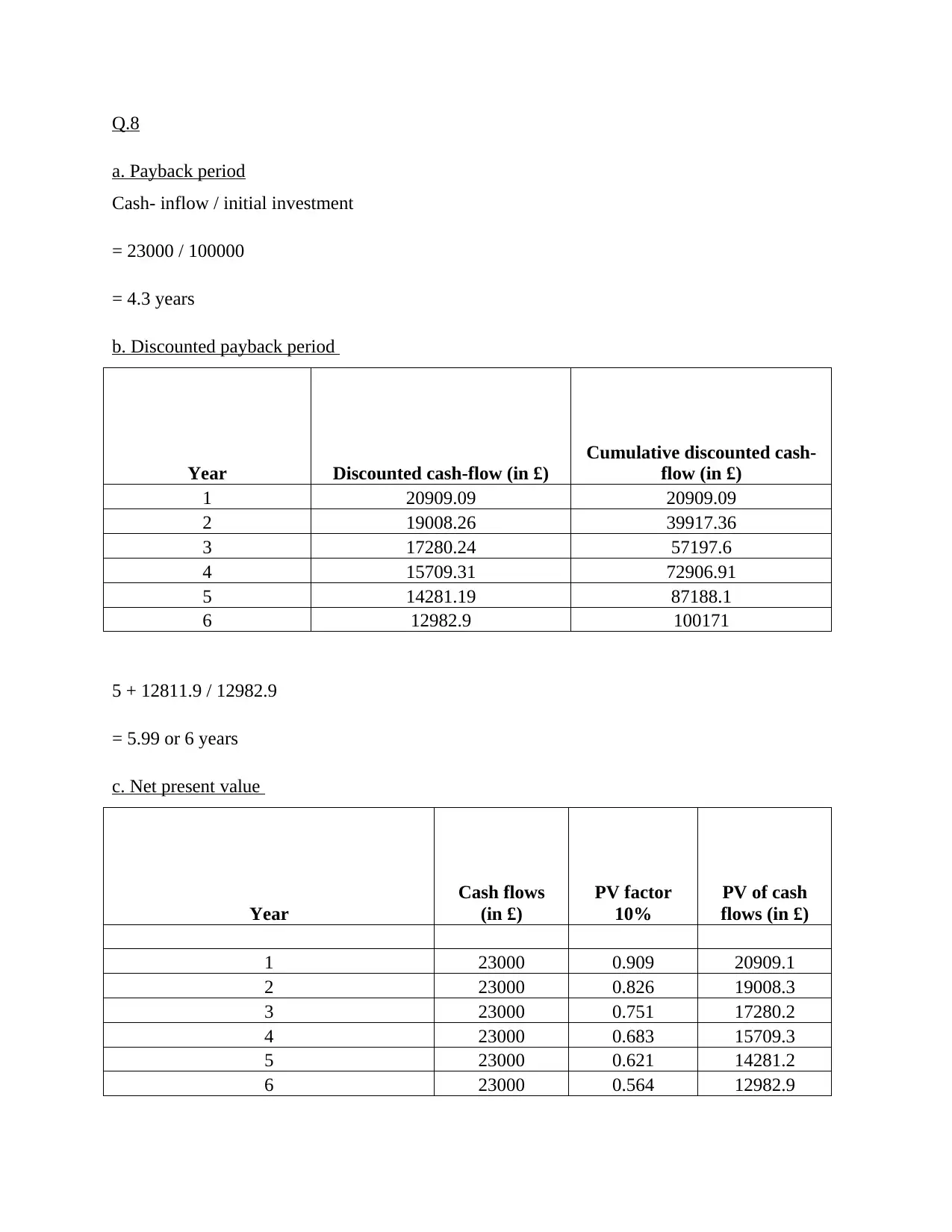

TDCF 100171

II 100000

NPV 170.996

d. Profitability index

PI = 1 + (NPV / initial investment)

= 1 + 170.996 / 100000

= 1 + 0.002

= 1.002 or 1

e. Internal rate of return

Year Cash flows (in £)

0 (Initial investment) -100000

1 23000

2 23000

3 23000

4 23000

5 23000

6 23000

IRR 10%

II 100000

NPV 170.996

d. Profitability index

PI = 1 + (NPV / initial investment)

= 1 + 170.996 / 100000

= 1 + 0.002

= 1.002 or 1

e. Internal rate of return

Year Cash flows (in £)

0 (Initial investment) -100000

1 23000

2 23000

3 23000

4 23000

5 23000

6 23000

IRR 10%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

f. MIRR if the re-investment rate is 10 percent

Particulars Figures

Number of years 6

Finance rate (in %) 10%

Reinvest rate (in %) 10%

Year Cash flows (in £)

0 (100000)

1 23000

2 23000

3 23000

4 23000

5 23000

6 23000

Calculations

Particulars Outcome

Present value of outflows (100000)

Future value of inflows 177459

Modified internal rate of12 return (in %) 10.03%

g. MIRR if the re-investment rate is 12 percent

Particulars Figures

Number of years 6

Finance rate (in %) 10%

Reinvest rate (in %) 10%

Year Cash flows (in £)

0 (100000)

1 23000

2 23000

3 23000

4 23000

5 23000

6 23000

Calculations

Particulars Outcome

Present value of outflows (100000)

Future value of inflows 177459

Modified internal rate of12 return (in %) 10.03%

g. MIRR if the re-investment rate is 12 percent

Number of years 6

Finance rate (in %) 10%

Reinvest rate (in %) 12%

Year Cash flows (in £)

0 (100000)

1 23000

2 23000

3 23000

4 23000

5 23000

6 23000

Calculations

Particulars Outcome

Present value of outflows (100000)

Future value of inflows 186649

Modified internal rate of12 return (in %) 10.96 or 11%

Q.9

a. Stating project which needs to be selected on the basis of capital rationing

Project Cost (in £) PI Ranking

Cash-flows

(in £) NPV

ranking

on the

basis of

NPV

a 4000000 1.18 5 4720000 720000 5

b 3000000 1.08 7 3240000 240000 7

Finance rate (in %) 10%

Reinvest rate (in %) 12%

Year Cash flows (in £)

0 (100000)

1 23000

2 23000

3 23000

4 23000

5 23000

6 23000

Calculations

Particulars Outcome

Present value of outflows (100000)

Future value of inflows 186649

Modified internal rate of12 return (in %) 10.96 or 11%

Q.9

a. Stating project which needs to be selected on the basis of capital rationing

Project Cost (in £) PI Ranking

Cash-flows

(in £) NPV

ranking

on the

basis of

NPV

a 4000000 1.18 5 4720000 720000 5

b 3000000 1.08 7 3240000 240000 7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.