Detailed Financial Plan for a Startup Fitness Academy

VerifiedAdded on 2023/04/10

|9

|1695

|430

Project

AI Summary

This project outlines a detailed financial plan for a fitness academy, encompassing key aspects such as an assumption sheet, sources and application of funds, and a comprehensive equipment list. It projects a pro forma cash flow statement, income statement, and ratio analysis to assess the academy's financial health. The plan assumes a strong economy and considers factors like membership and day pass revenue, staffing costs, and interest rates. It also includes an opening and closing balance sheet for the first two years. Key financial assumptions are presented, detailing interest rates, taxation rates, and customer behavior. The financial plan also includes a detailed breakdown of equipment costs, projected sales, operating expenses, and net profit. Ratio analysis is used to evaluate the company's performance over time, including current ratio, debt to equity ratio, gross margin, and ROI. The document concludes with a bibliography of the sources used for research.

ASSUMPTION SHEET 2

SOURCES AND APPLICATION OF FUNDS 3

DETAILED EQUIPMENT LIST 3

PRO FORMA CASH FLOW STATEMENT 5

PROJECTED INCOME STATEMENT 6

RATIO ANALYSIS 8

BIBLIOGRAPHY 9

SOURCES AND APPLICATION OF FUNDS 3

DETAILED EQUIPMENT LIST 3

PRO FORMA CASH FLOW STATEMENT 5

PROJECTED INCOME STATEMENT 6

RATIO ANALYSIS 8

BIBLIOGRAPHY 9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Plan

ASSUMPTION SHEET

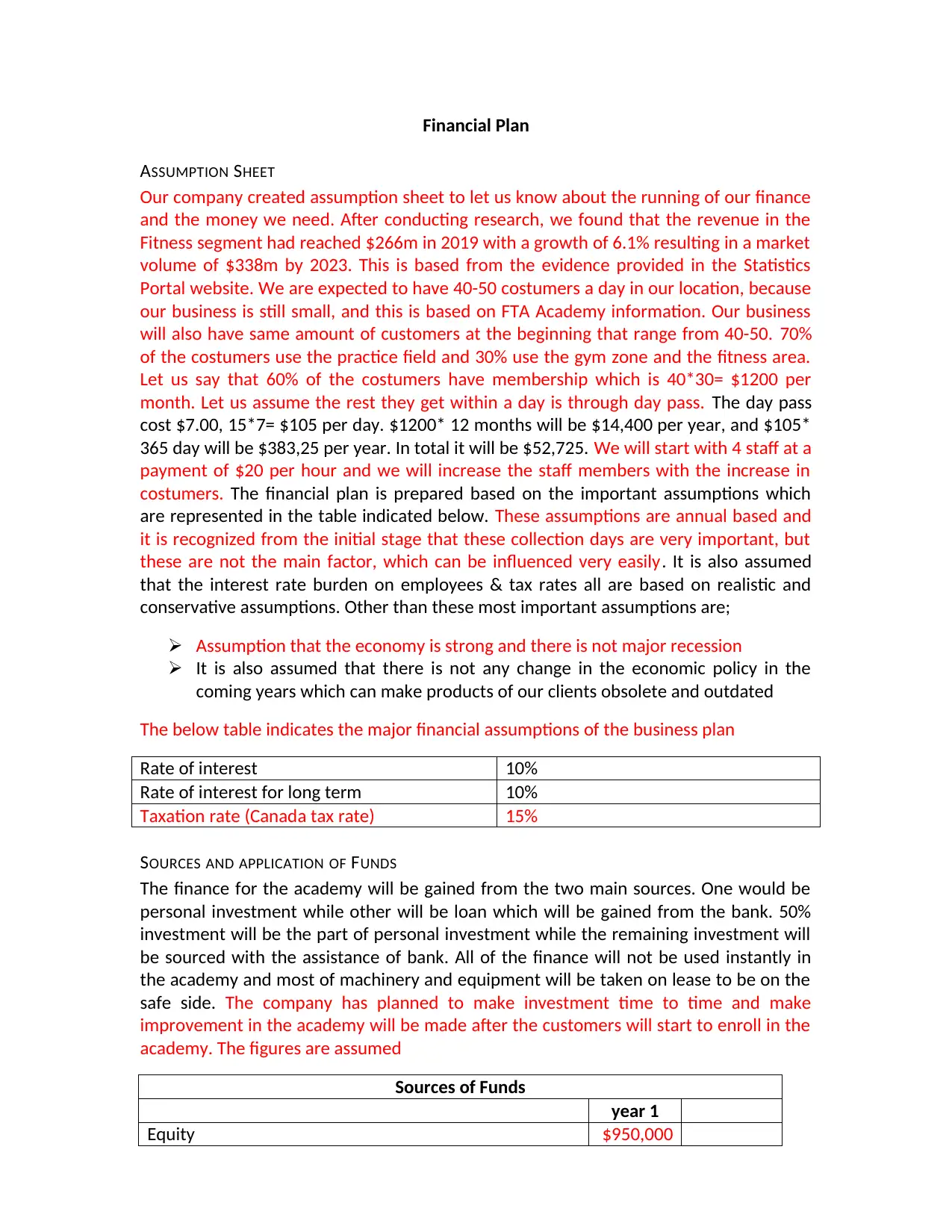

Our company created assumption sheet to let us know about the running of our finance

and the money we need. After conducting research, we found that the revenue in the

Fitness segment had reached $266m in 2019 with a growth of 6.1% resulting in a market

volume of $338m by 2023. This is based from the evidence provided in the Statistics

Portal website. We are expected to have 40-50 costumers a day in our location, because

our business is still small, and this is based on FTA Academy information. Our business

will also have same amount of customers at the beginning that range from 40-50. 70%

of the costumers use the practice field and 30% use the gym zone and the fitness area.

Let us say that 60% of the costumers have membership which is 40*30= $1200 per

month. Let us assume the rest they get within a day is through day pass. The day pass

cost $7.00, 15*7= $105 per day. $1200* 12 months will be $14,400 per year, and $105*

365 day will be $383,25 per year. In total it will be $52,725. We will start with 4 staff at a

payment of $20 per hour and we will increase the staff members with the increase in

costumers. The financial plan is prepared based on the important assumptions which

are represented in the table indicated below. These assumptions are annual based and

it is recognized from the initial stage that these collection days are very important, but

these are not the main factor, which can be influenced very easily. It is also assumed

that the interest rate burden on employees & tax rates all are based on realistic and

conservative assumptions. Other than these most important assumptions are;

Assumption that the economy is strong and there is not major recession

It is also assumed that there is not any change in the economic policy in the

coming years which can make products of our clients obsolete and outdated

The below table indicates the major financial assumptions of the business plan

Rate of interest 10%

Rate of interest for long term 10%

Taxation rate (Canada tax rate) 15%

SOURCES AND APPLICATION OF FUNDS

The finance for the academy will be gained from the two main sources. One would be

personal investment while other will be loan which will be gained from the bank. 50%

investment will be the part of personal investment while the remaining investment will

be sourced with the assistance of bank. All of the finance will not be used instantly in

the academy and most of machinery and equipment will be taken on lease to be on the

safe side. The company has planned to make investment time to time and make

improvement in the academy will be made after the customers will start to enroll in the

academy. The figures are assumed

Sources of Funds

year 1

Equity $950,000

ASSUMPTION SHEET

Our company created assumption sheet to let us know about the running of our finance

and the money we need. After conducting research, we found that the revenue in the

Fitness segment had reached $266m in 2019 with a growth of 6.1% resulting in a market

volume of $338m by 2023. This is based from the evidence provided in the Statistics

Portal website. We are expected to have 40-50 costumers a day in our location, because

our business is still small, and this is based on FTA Academy information. Our business

will also have same amount of customers at the beginning that range from 40-50. 70%

of the costumers use the practice field and 30% use the gym zone and the fitness area.

Let us say that 60% of the costumers have membership which is 40*30= $1200 per

month. Let us assume the rest they get within a day is through day pass. The day pass

cost $7.00, 15*7= $105 per day. $1200* 12 months will be $14,400 per year, and $105*

365 day will be $383,25 per year. In total it will be $52,725. We will start with 4 staff at a

payment of $20 per hour and we will increase the staff members with the increase in

costumers. The financial plan is prepared based on the important assumptions which

are represented in the table indicated below. These assumptions are annual based and

it is recognized from the initial stage that these collection days are very important, but

these are not the main factor, which can be influenced very easily. It is also assumed

that the interest rate burden on employees & tax rates all are based on realistic and

conservative assumptions. Other than these most important assumptions are;

Assumption that the economy is strong and there is not major recession

It is also assumed that there is not any change in the economic policy in the

coming years which can make products of our clients obsolete and outdated

The below table indicates the major financial assumptions of the business plan

Rate of interest 10%

Rate of interest for long term 10%

Taxation rate (Canada tax rate) 15%

SOURCES AND APPLICATION OF FUNDS

The finance for the academy will be gained from the two main sources. One would be

personal investment while other will be loan which will be gained from the bank. 50%

investment will be the part of personal investment while the remaining investment will

be sourced with the assistance of bank. All of the finance will not be used instantly in

the academy and most of machinery and equipment will be taken on lease to be on the

safe side. The company has planned to make investment time to time and make

improvement in the academy will be made after the customers will start to enroll in the

academy. The figures are assumed

Sources of Funds

year 1

Equity $950,000

Loans/Debt $950,000

Total sources of Funds

$1,900,00

0

Application of Funds

General startup cost

Organizational Cost $500,000

Prepaid Expenses 0

Opening inventory /Office supplies $100,000

Facility costs

Cost of equipments $200,000

Cost of forming policies $150,000

Cost of recruiting trainers $250,000

Total startup cost

$1,200,00

0

Leasehold Improvement $50,000

Equipment cost $20,069

Total Application of Funds

$1,270,06

9

Remaining Funds (Cash reserves) $629,931

DETAILED EQUIPMENT LIST

There are equipments, which are necessary to run the activities by the customers at

gym. Therefore, the detailed equipment list is prepared to ensure the availability of all

equipments in the fitness academy.

There is the need of more assets as the Academy will be providing services related

fitness; therefore, the users will use more equipment. In addition, users will also need

more than one pair at a time as without the equipments the operations of the academy

may be compromise. It has been estimated that the cost of equipment’s will be $10069

in the first year. In next year, cost will increase as these users and demand will increase.

Therefore, cost estimation also has been set as per the requirements. Given below is the

cost of each item for the academy with the prices mentioned.

Description Estimated cost ($)

Dumbbells 500

Treadmills 659

Fitness Equipment 200

Power Tower 500

Stair Climbers 600

Recumbent Exercise 210

Inversion Table 200

Yoga mats 100

Weights and Barbells 600

Cardio Equipment 500

Boxing equipment’s 200

Total sources of Funds

$1,900,00

0

Application of Funds

General startup cost

Organizational Cost $500,000

Prepaid Expenses 0

Opening inventory /Office supplies $100,000

Facility costs

Cost of equipments $200,000

Cost of forming policies $150,000

Cost of recruiting trainers $250,000

Total startup cost

$1,200,00

0

Leasehold Improvement $50,000

Equipment cost $20,069

Total Application of Funds

$1,270,06

9

Remaining Funds (Cash reserves) $629,931

DETAILED EQUIPMENT LIST

There are equipments, which are necessary to run the activities by the customers at

gym. Therefore, the detailed equipment list is prepared to ensure the availability of all

equipments in the fitness academy.

There is the need of more assets as the Academy will be providing services related

fitness; therefore, the users will use more equipment. In addition, users will also need

more than one pair at a time as without the equipments the operations of the academy

may be compromise. It has been estimated that the cost of equipment’s will be $10069

in the first year. In next year, cost will increase as these users and demand will increase.

Therefore, cost estimation also has been set as per the requirements. Given below is the

cost of each item for the academy with the prices mentioned.

Description Estimated cost ($)

Dumbbells 500

Treadmills 659

Fitness Equipment 200

Power Tower 500

Stair Climbers 600

Recumbent Exercise 210

Inversion Table 200

Yoga mats 100

Weights and Barbells 600

Cardio Equipment 500

Boxing equipment’s 200

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

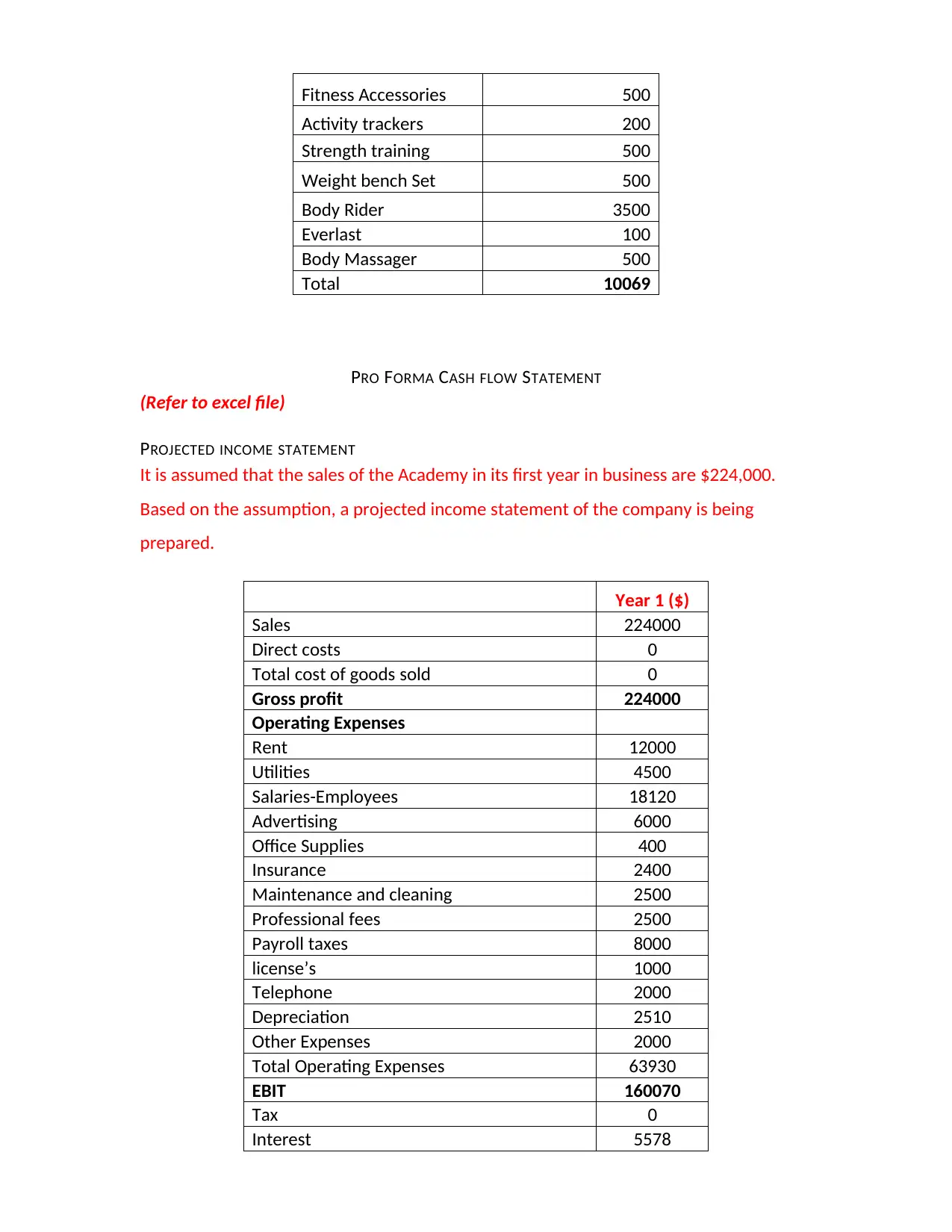

Fitness Accessories 500

Activity trackers 200

Strength training 500

Weight bench Set 500

Body Rider 3500

Everlast 100

Body Massager 500

Total 10069

PRO FORMA CASH FLOW STATEMENT

(Refer to excel file)

PROJECTED INCOME STATEMENT

It is assumed that the sales of the Academy in its first year in business are $224,000.

Based on the assumption, a projected income statement of the company is being

prepared.

Year 1 ($)

Sales 224000

Direct costs 0

Total cost of goods sold 0

Gross profit 224000

Operating Expenses

Rent 12000

Utilities 4500

Salaries-Employees 18120

Advertising 6000

Office Supplies 400

Insurance 2400

Maintenance and cleaning 2500

Professional fees 2500

Payroll taxes 8000

license’s 1000

Telephone 2000

Depreciation 2510

Other Expenses 2000

Total Operating Expenses 63930

EBIT 160070

Tax 0

Interest 5578

Activity trackers 200

Strength training 500

Weight bench Set 500

Body Rider 3500

Everlast 100

Body Massager 500

Total 10069

PRO FORMA CASH FLOW STATEMENT

(Refer to excel file)

PROJECTED INCOME STATEMENT

It is assumed that the sales of the Academy in its first year in business are $224,000.

Based on the assumption, a projected income statement of the company is being

prepared.

Year 1 ($)

Sales 224000

Direct costs 0

Total cost of goods sold 0

Gross profit 224000

Operating Expenses

Rent 12000

Utilities 4500

Salaries-Employees 18120

Advertising 6000

Office Supplies 400

Insurance 2400

Maintenance and cleaning 2500

Professional fees 2500

Payroll taxes 8000

license’s 1000

Telephone 2000

Depreciation 2510

Other Expenses 2000

Total Operating Expenses 63930

EBIT 160070

Tax 0

Interest 5578

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net Profit 58352

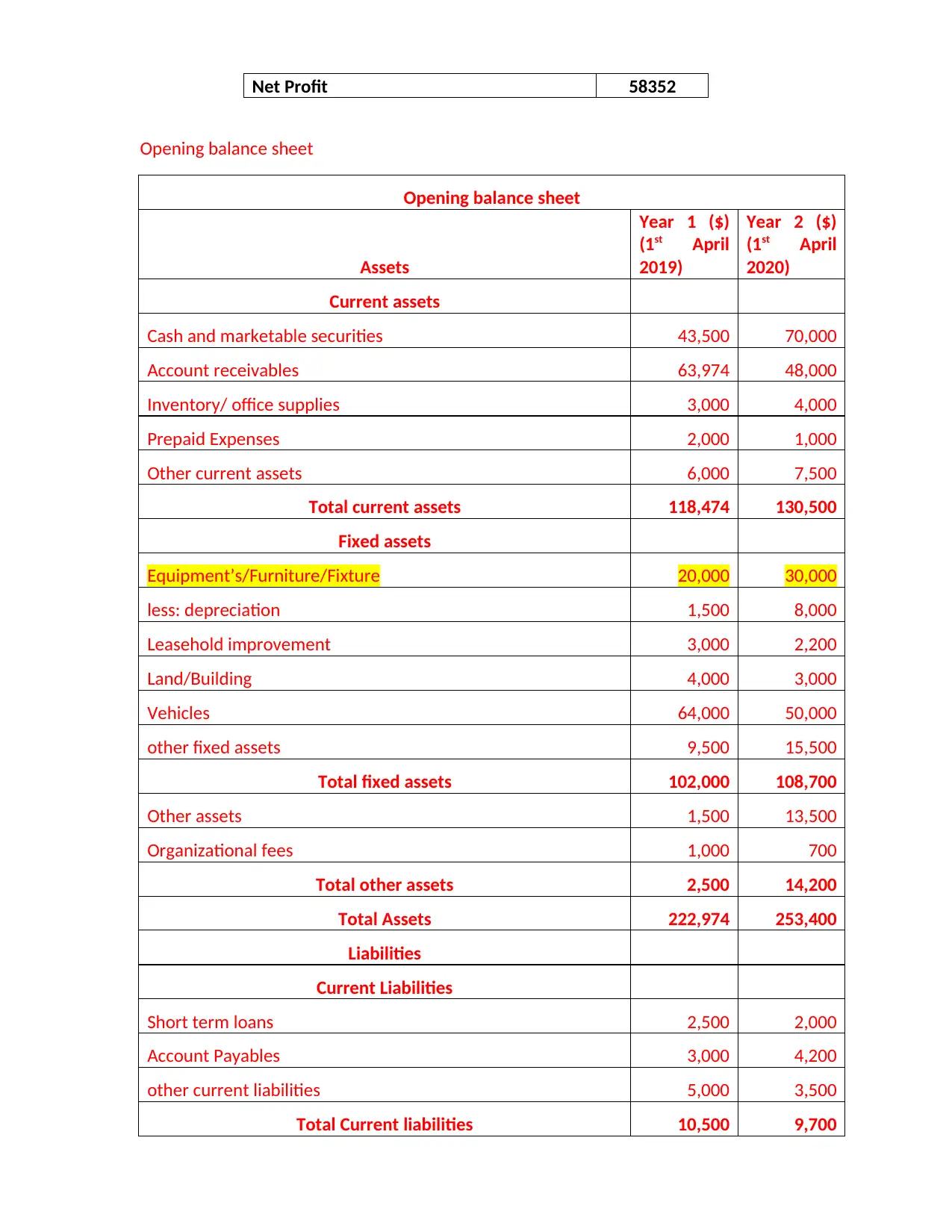

Opening balance sheet

Opening balance sheet

Assets

Year 1 ($)

(1st April

2019)

Year 2 ($)

(1st April

2020)

Current assets

Cash and marketable securities 43,500 70,000

Account receivables 63,974 48,000

Inventory/ office supplies 3,000 4,000

Prepaid Expenses 2,000 1,000

Other current assets 6,000 7,500

Total current assets 118,474 130,500

Fixed assets

Equipment’s/Furniture/Fixture 20,000 30,000

less: depreciation 1,500 8,000

Leasehold improvement 3,000 2,200

Land/Building 4,000 3,000

Vehicles 64,000 50,000

other fixed assets 9,500 15,500

Total fixed assets 102,000 108,700

Other assets 1,500 13,500

Organizational fees 1,000 700

Total other assets 2,500 14,200

Total Assets 222,974 253,400

Liabilities

Current Liabilities

Short term loans 2,500 2,000

Account Payables 3,000 4,200

other current liabilities 5,000 3,500

Total Current liabilities 10,500 9,700

Opening balance sheet

Opening balance sheet

Assets

Year 1 ($)

(1st April

2019)

Year 2 ($)

(1st April

2020)

Current assets

Cash and marketable securities 43,500 70,000

Account receivables 63,974 48,000

Inventory/ office supplies 3,000 4,000

Prepaid Expenses 2,000 1,000

Other current assets 6,000 7,500

Total current assets 118,474 130,500

Fixed assets

Equipment’s/Furniture/Fixture 20,000 30,000

less: depreciation 1,500 8,000

Leasehold improvement 3,000 2,200

Land/Building 4,000 3,000

Vehicles 64,000 50,000

other fixed assets 9,500 15,500

Total fixed assets 102,000 108,700

Other assets 1,500 13,500

Organizational fees 1,000 700

Total other assets 2,500 14,200

Total Assets 222,974 253,400

Liabilities

Current Liabilities

Short term loans 2,500 2,000

Account Payables 3,000 4,200

other current liabilities 5,000 3,500

Total Current liabilities 10,500 9,700

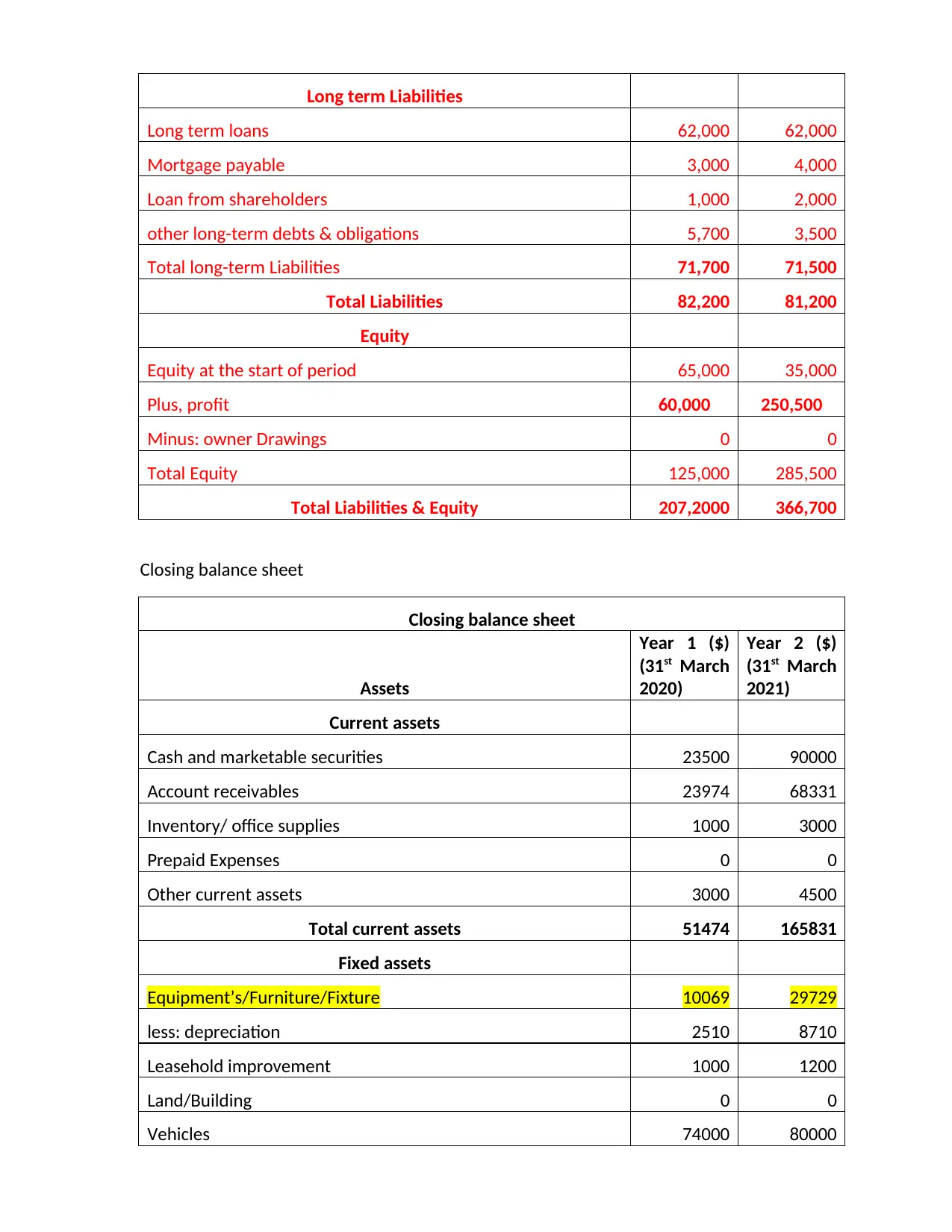

Long term Liabilities

Long term loans 62,000 62,000

Mortgage payable 3,000 4,000

Loan from shareholders 1,000 2,000

other long-term debts & obligations 5,700 3,500

Total long-term Liabilities 71,700 71,500

Total Liabilities 82,200 81,200

Equity

Equity at the start of period 65,000 35,000

Plus, profit 60,000 250,500

Minus: owner Drawings 0 0

Total Equity 125,000 285,500

Total Liabilities & Equity 207,2000 366,700

Closing balance sheet

Closing balance sheet

Assets

Year 1 ($)

(31st March

2020)

Year 2 ($)

(31st March

2021)

Current assets

Cash and marketable securities 23500 90000

Account receivables 23974 68331

Inventory/ office supplies 1000 3000

Prepaid Expenses 0 0

Other current assets 3000 4500

Total current assets 51474 165831

Fixed assets

Equipment’s/Furniture/Fixture 10069 29729

less: depreciation 2510 8710

Leasehold improvement 1000 1200

Land/Building 0 0

Vehicles 74000 80000

Long term loans 62,000 62,000

Mortgage payable 3,000 4,000

Loan from shareholders 1,000 2,000

other long-term debts & obligations 5,700 3,500

Total long-term Liabilities 71,700 71,500

Total Liabilities 82,200 81,200

Equity

Equity at the start of period 65,000 35,000

Plus, profit 60,000 250,500

Minus: owner Drawings 0 0

Total Equity 125,000 285,500

Total Liabilities & Equity 207,2000 366,700

Closing balance sheet

Closing balance sheet

Assets

Year 1 ($)

(31st March

2020)

Year 2 ($)

(31st March

2021)

Current assets

Cash and marketable securities 23500 90000

Account receivables 23974 68331

Inventory/ office supplies 1000 3000

Prepaid Expenses 0 0

Other current assets 3000 4500

Total current assets 51474 165831

Fixed assets

Equipment’s/Furniture/Fixture 10069 29729

less: depreciation 2510 8710

Leasehold improvement 1000 1200

Land/Building 0 0

Vehicles 74000 80000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

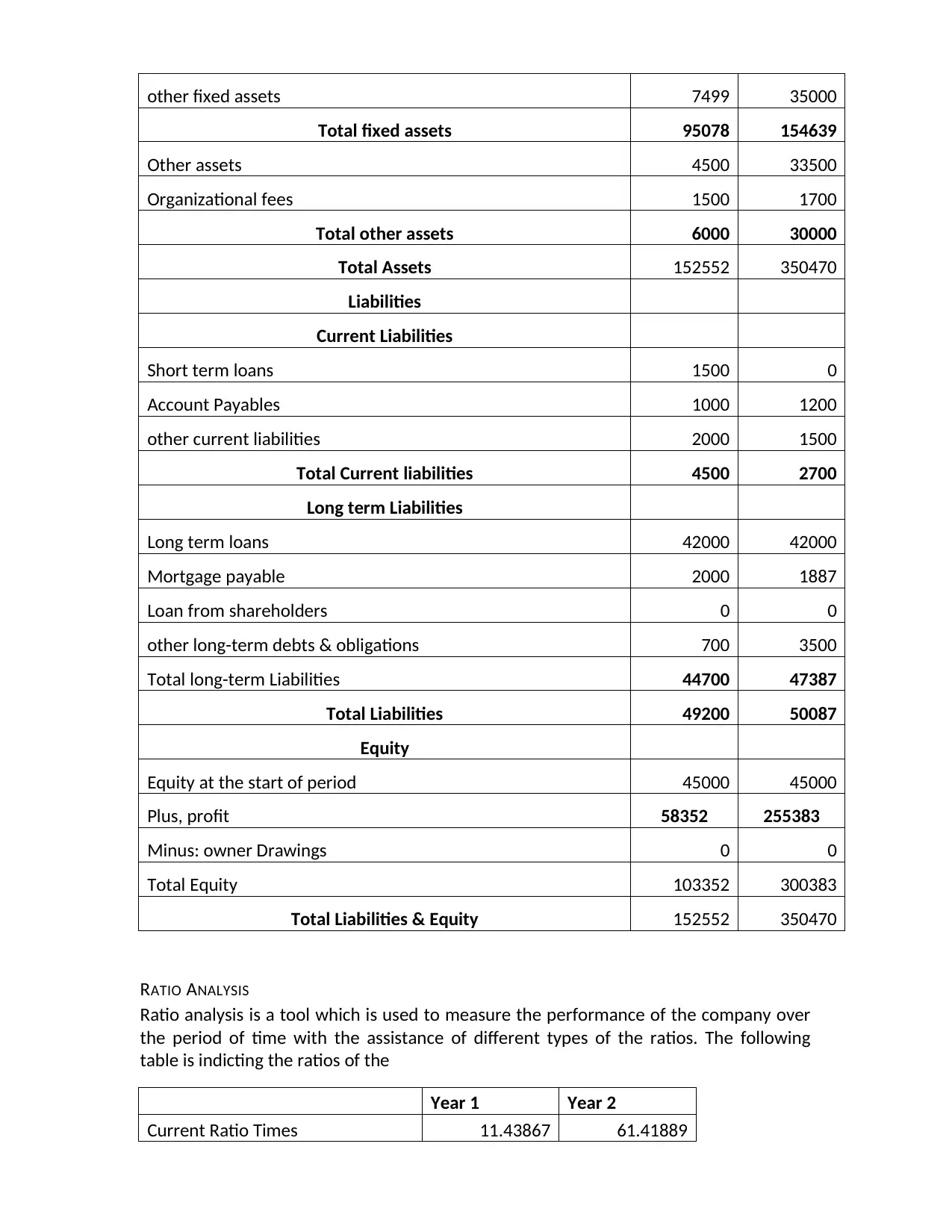

other fixed assets 7499 35000

Total fixed assets 95078 154639

Other assets 4500 33500

Organizational fees 1500 1700

Total other assets 6000 30000

Total Assets 152552 350470

Liabilities

Current Liabilities

Short term loans 1500 0

Account Payables 1000 1200

other current liabilities 2000 1500

Total Current liabilities 4500 2700

Long term Liabilities

Long term loans 42000 42000

Mortgage payable 2000 1887

Loan from shareholders 0 0

other long-term debts & obligations 700 3500

Total long-term Liabilities 44700 47387

Total Liabilities 49200 50087

Equity

Equity at the start of period 45000 45000

Plus, profit 58352 255383

Minus: owner Drawings 0 0

Total Equity 103352 300383

Total Liabilities & Equity 152552 350470

RATIO ANALYSIS

Ratio analysis is a tool which is used to measure the performance of the company over

the period of time with the assistance of different types of the ratios. The following

table is indicting the ratios of the

Year 1 Year 2

Current Ratio Times 11.43867 61.41889

Total fixed assets 95078 154639

Other assets 4500 33500

Organizational fees 1500 1700

Total other assets 6000 30000

Total Assets 152552 350470

Liabilities

Current Liabilities

Short term loans 1500 0

Account Payables 1000 1200

other current liabilities 2000 1500

Total Current liabilities 4500 2700

Long term Liabilities

Long term loans 42000 42000

Mortgage payable 2000 1887

Loan from shareholders 0 0

other long-term debts & obligations 700 3500

Total long-term Liabilities 44700 47387

Total Liabilities 49200 50087

Equity

Equity at the start of period 45000 45000

Plus, profit 58352 255383

Minus: owner Drawings 0 0

Total Equity 103352 300383

Total Liabilities & Equity 152552 350470

RATIO ANALYSIS

Ratio analysis is a tool which is used to measure the performance of the company over

the period of time with the assistance of different types of the ratios. The following

table is indicting the ratios of the

Year 1 Year 2

Current Ratio Times 11.43867 61.41889

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

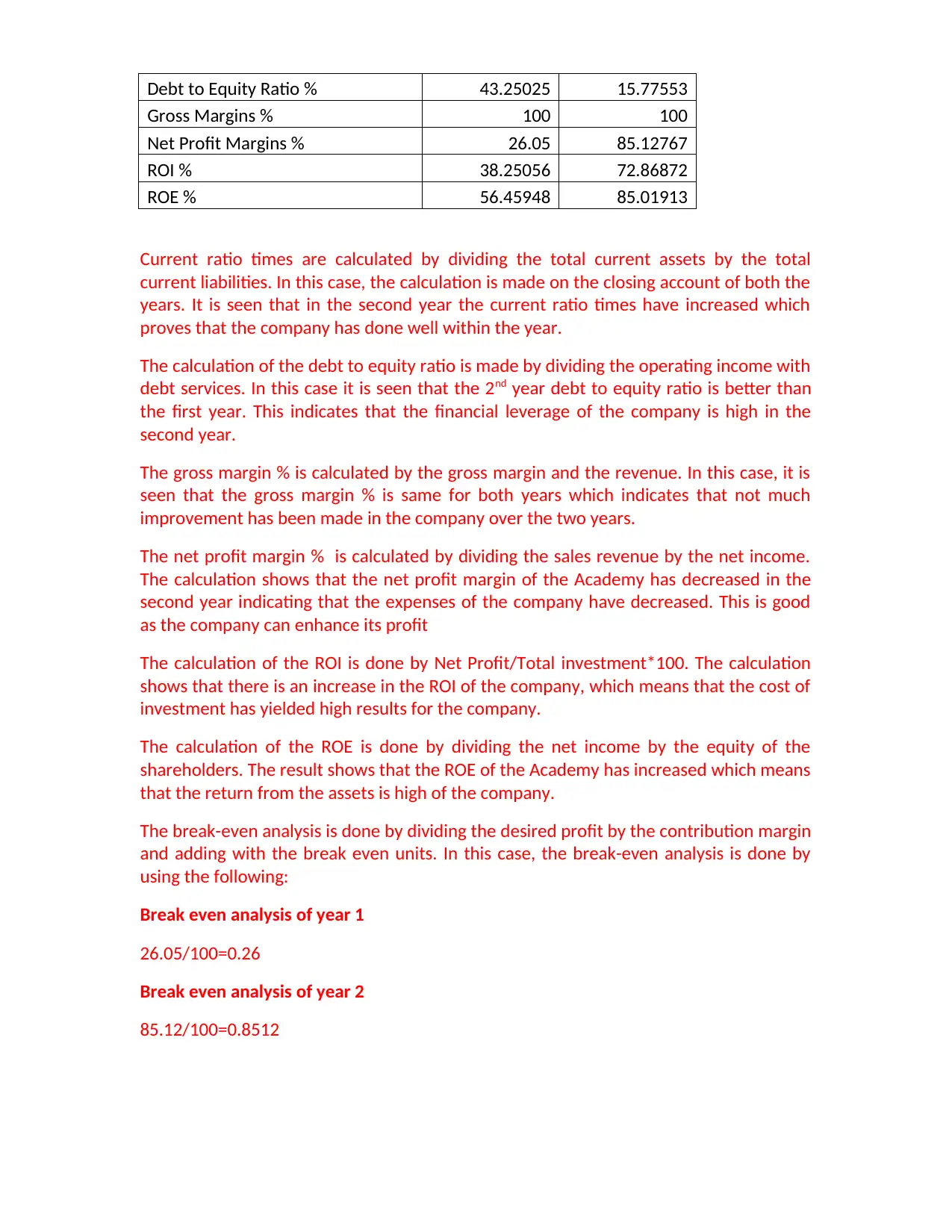

Debt to Equity Ratio % 43.25025 15.77553

Gross Margins % 100 100

Net Profit Margins % 26.05 85.12767

ROI % 38.25056 72.86872

ROE % 56.45948 85.01913

Current ratio times are calculated by dividing the total current assets by the total

current liabilities. In this case, the calculation is made on the closing account of both the

years. It is seen that in the second year the current ratio times have increased which

proves that the company has done well within the year.

The calculation of the debt to equity ratio is made by dividing the operating income with

debt services. In this case it is seen that the 2nd year debt to equity ratio is better than

the first year. This indicates that the financial leverage of the company is high in the

second year.

The gross margin % is calculated by the gross margin and the revenue. In this case, it is

seen that the gross margin % is same for both years which indicates that not much

improvement has been made in the company over the two years.

The net profit margin % is calculated by dividing the sales revenue by the net income.

The calculation shows that the net profit margin of the Academy has decreased in the

second year indicating that the expenses of the company have decreased. This is good

as the company can enhance its profit

The calculation of the ROI is done by Net Profit/Total investment*100. The calculation

shows that there is an increase in the ROI of the company, which means that the cost of

investment has yielded high results for the company.

The calculation of the ROE is done by dividing the net income by the equity of the

shareholders. The result shows that the ROE of the Academy has increased which means

that the return from the assets is high of the company.

The break-even analysis is done by dividing the desired profit by the contribution margin

and adding with the break even units. In this case, the break-even analysis is done by

using the following:

Break even analysis of year 1

26.05/100=0.26

Break even analysis of year 2

85.12/100=0.8512

Gross Margins % 100 100

Net Profit Margins % 26.05 85.12767

ROI % 38.25056 72.86872

ROE % 56.45948 85.01913

Current ratio times are calculated by dividing the total current assets by the total

current liabilities. In this case, the calculation is made on the closing account of both the

years. It is seen that in the second year the current ratio times have increased which

proves that the company has done well within the year.

The calculation of the debt to equity ratio is made by dividing the operating income with

debt services. In this case it is seen that the 2nd year debt to equity ratio is better than

the first year. This indicates that the financial leverage of the company is high in the

second year.

The gross margin % is calculated by the gross margin and the revenue. In this case, it is

seen that the gross margin % is same for both years which indicates that not much

improvement has been made in the company over the two years.

The net profit margin % is calculated by dividing the sales revenue by the net income.

The calculation shows that the net profit margin of the Academy has decreased in the

second year indicating that the expenses of the company have decreased. This is good

as the company can enhance its profit

The calculation of the ROI is done by Net Profit/Total investment*100. The calculation

shows that there is an increase in the ROI of the company, which means that the cost of

investment has yielded high results for the company.

The calculation of the ROE is done by dividing the net income by the equity of the

shareholders. The result shows that the ROE of the Academy has increased which means

that the return from the assets is high of the company.

The break-even analysis is done by dividing the desired profit by the contribution margin

and adding with the break even units. In this case, the break-even analysis is done by

using the following:

Break even analysis of year 1

26.05/100=0.26

Break even analysis of year 2

85.12/100=0.8512

BIBLIOGRAPHY

(n.d.). Retrieved from https://www.statista.com/outlook/313/108/fitness/canada

Designblendz. (2018). 4 REASONS WHY GOOD ARCHITECTURE IS IMPORTANT. Retrieved

February 12, 2019, from https://www.designblendz.com/blog/4-reasons-why-

good-architecture-is-important

Robert Singer. (2017). Accounting for Leases Under the New Standard, Part 1. Retrieved

February 12, 2019, from https://www.cpajournal.com/2017/08/23/accounting-

leases-new-standard-part-1/

(n.d.). Retrieved from https://www.statista.com/outlook/313/108/fitness/canada

Designblendz. (2018). 4 REASONS WHY GOOD ARCHITECTURE IS IMPORTANT. Retrieved

February 12, 2019, from https://www.designblendz.com/blog/4-reasons-why-

good-architecture-is-important

Robert Singer. (2017). Accounting for Leases Under the New Standard, Part 1. Retrieved

February 12, 2019, from https://www.cpajournal.com/2017/08/23/accounting-

leases-new-standard-part-1/

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.