ATM System Modelling: Sequence Diagram for Transaction Subsystem

VerifiedAdded on 2023/06/11

|18

|3089

|466

AI Summary

This article discusses the ATM system modelling and its sequence diagram for transaction subsystem. It covers the system documentation, transactions, components, operations, and feedback mechanism. It also provides insights into the database and backend processing system.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: OBJECT MODELING 1

ATM System Modelling

Author Name(s), First M. Last, Omit Titles and Degrees

Institutional Affiliation(s)

Author Note

Include any grant/funding information and a complete correspondence address.

ATM System Modelling

Author Name(s), First M. Last, Omit Titles and Degrees

Institutional Affiliation(s)

Author Note

Include any grant/funding information and a complete correspondence address.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

OBJECT MODELLING 2

Contents

System Modelling................................................................................................................5

Sequence diagram for the transaction subsystem of the ATM........................................5

System Documentation........................................................................................................9

System Transactions............................................................................................................9

Cash Withdrawal.............................................................................................................9

Cash Deposit....................................................................................................................9

Amount Transfer..............................................................................................................9

System Components............................................................................................................9

The card Reader...............................................................................................................9

The Keypad....................................................................................................................10

The Printer.....................................................................................................................10

The screen......................................................................................................................11

System Operations.............................................................................................................11

Authentication................................................................................................................11

ATM Withdrawal...........................................................................................................12

Depositing Funds...........................................................................................................12

Transfer Money.............................................................................................................13

Data communication..........................................................................................................13

Session handling................................................................................................................14

Contents

System Modelling................................................................................................................5

Sequence diagram for the transaction subsystem of the ATM........................................5

System Documentation........................................................................................................9

System Transactions............................................................................................................9

Cash Withdrawal.............................................................................................................9

Cash Deposit....................................................................................................................9

Amount Transfer..............................................................................................................9

System Components............................................................................................................9

The card Reader...............................................................................................................9

The Keypad....................................................................................................................10

The Printer.....................................................................................................................10

The screen......................................................................................................................11

System Operations.............................................................................................................11

Authentication................................................................................................................11

ATM Withdrawal...........................................................................................................12

Depositing Funds...........................................................................................................12

Transfer Money.............................................................................................................13

Data communication..........................................................................................................13

Session handling................................................................................................................14

OBJECT MODELLING 3

Feedback mechanism.........................................................................................................14

The database......................................................................................................................14

The backend processing system.........................................................................................15

Summary............................................................................................................................15

Conclusion.........................................................................................................................15

Recommendations..............................................................................................................15

Feedback mechanism.........................................................................................................14

The database......................................................................................................................14

The backend processing system.........................................................................................15

Summary............................................................................................................................15

Conclusion.........................................................................................................................15

Recommendations..............................................................................................................15

OBJECT MODELLING 4

Table of figures

Figure 1............................................................................................................................................5

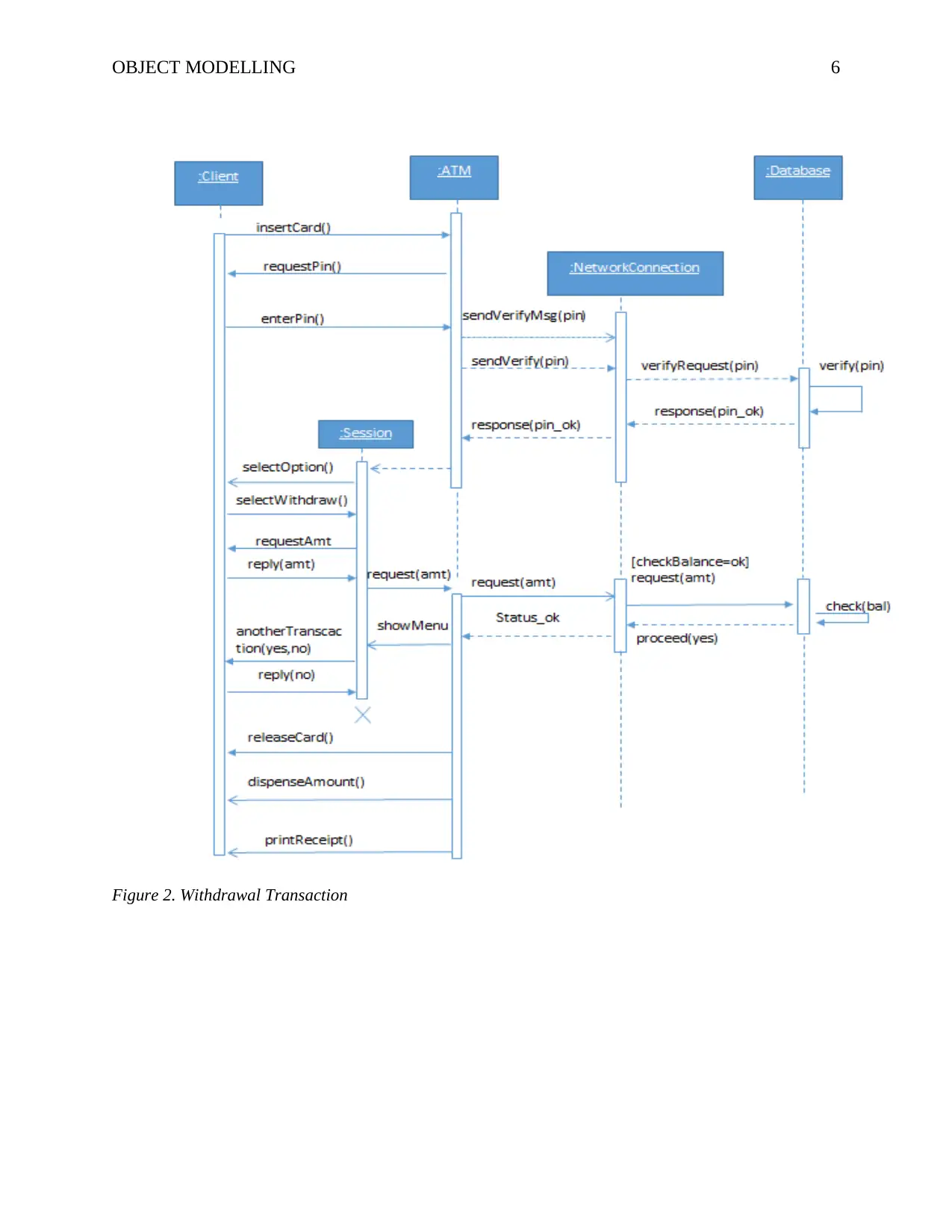

Figure 2. Withdrawal Transaction...................................................................................................6

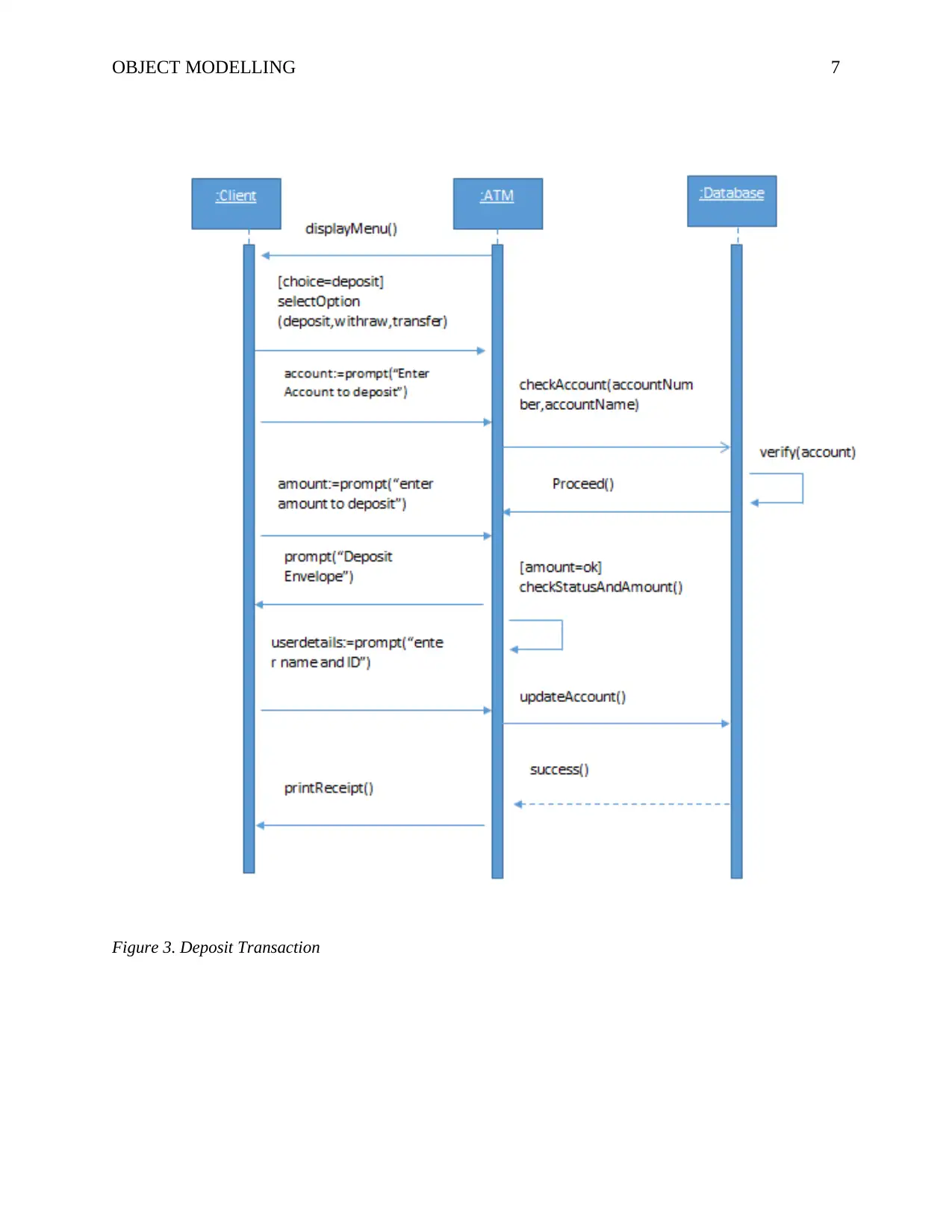

Figure 3. Deposit Transaction..........................................................................................................7

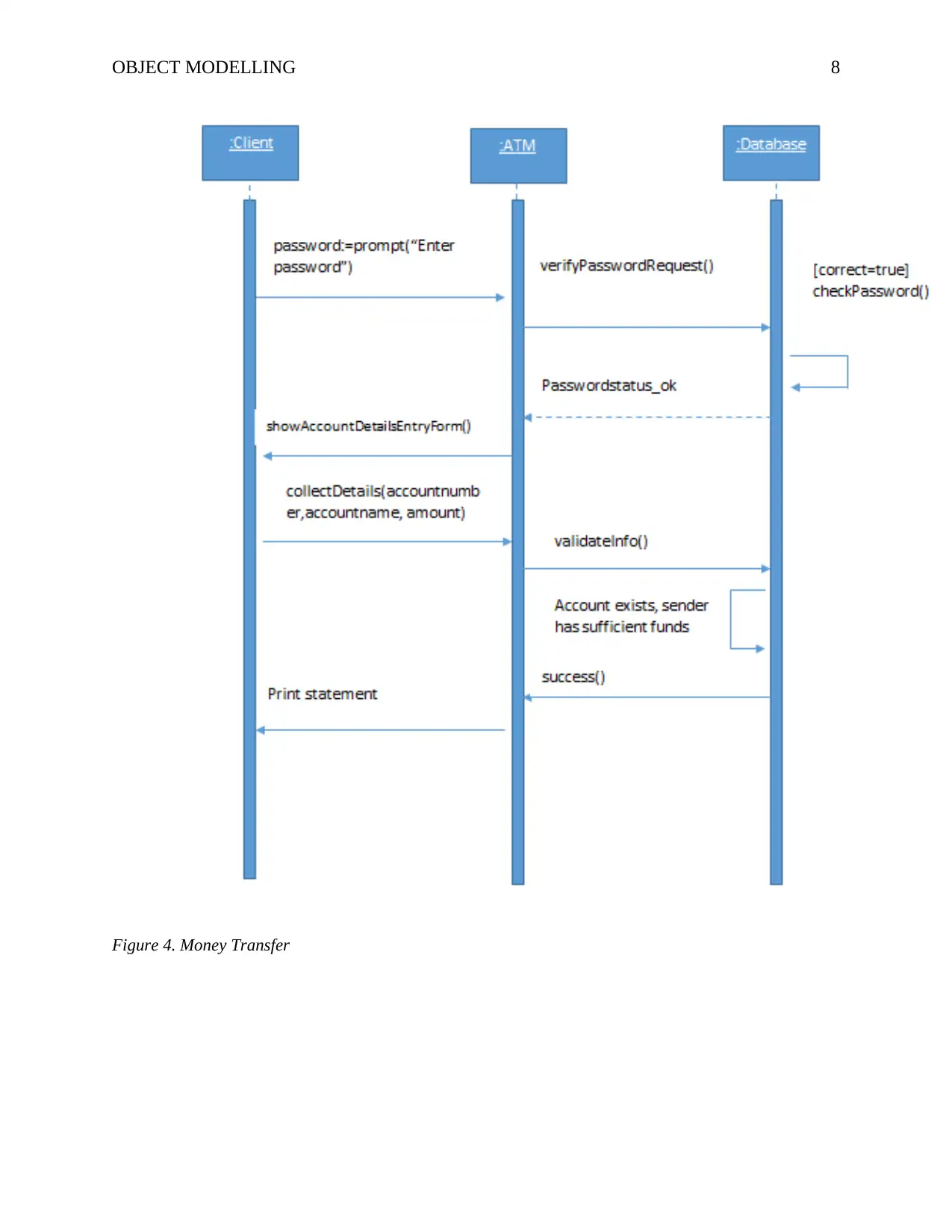

Figure 4. Money Transfer................................................................................................................8

Table of figures

Figure 1............................................................................................................................................5

Figure 2. Withdrawal Transaction...................................................................................................6

Figure 3. Deposit Transaction..........................................................................................................7

Figure 4. Money Transfer................................................................................................................8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

OBJECT MODELLING 5

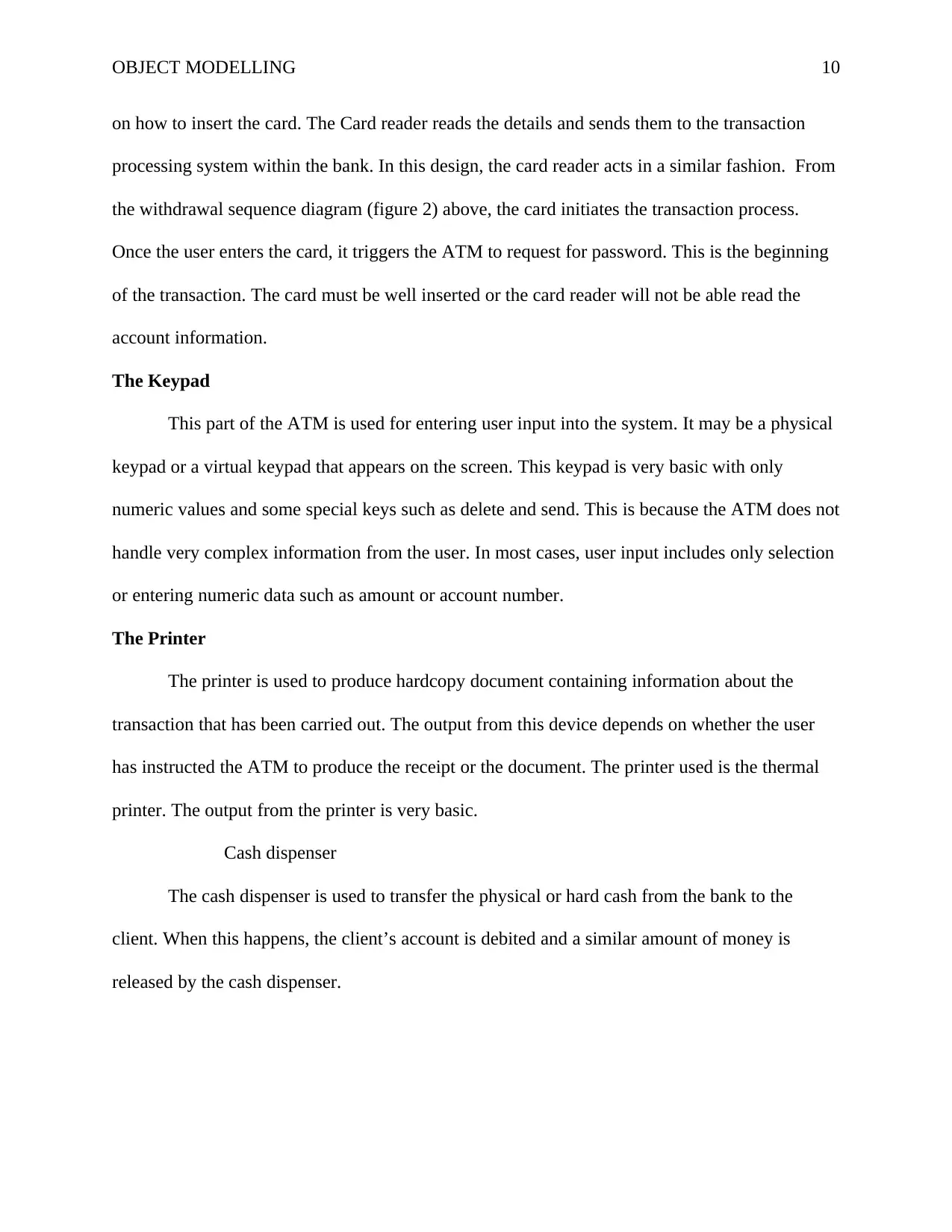

System Modelling

Sequence diagram for the transaction subsystem of the ATM

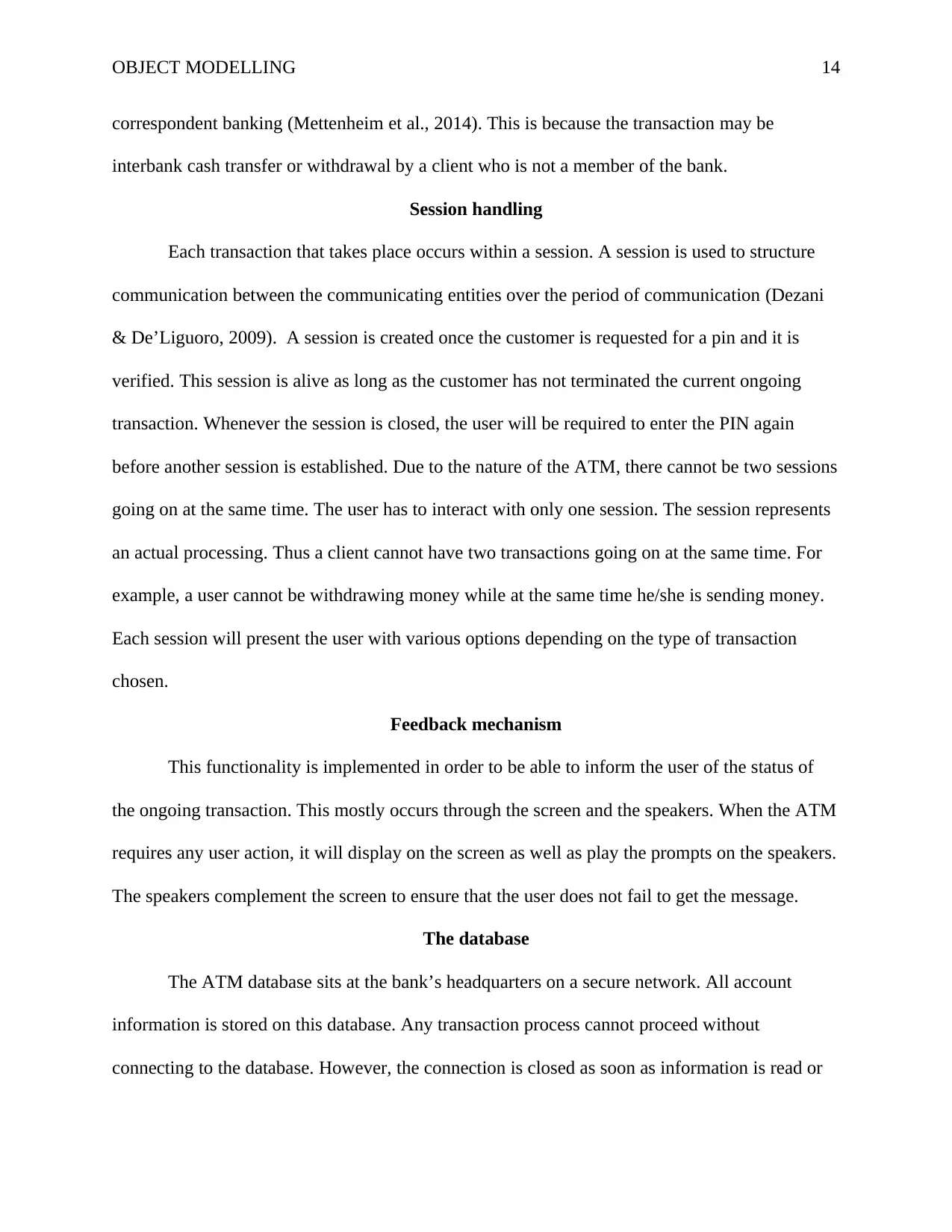

Sequnce diagrams allow engineers to model complex systems that interate functionality

that may be difficult to understand without proper visual representation (Campean & Yildirim,

2017). Thus by use of sequnce diagrams we can be able to show how a certain processing task is

carried out through sending messages between the interacting entities(Refsdal, Husa, & Stølen,

2005). From the use cases defined in the system design, we can be able to decompose the ATM

system into various subsystems. One major sub-system we can derive is the transaction module.

This part is composed of activities that involve the moving cash from one’s account to another or

from the account to physical cash and vice versa. The use case diagram is shown below.

Figure 1. Collins ATM Transaction Subsystem Use Cases

Withraw Cash

Withraw Cash

Withraw Cash

System Modelling

Sequence diagram for the transaction subsystem of the ATM

Sequnce diagrams allow engineers to model complex systems that interate functionality

that may be difficult to understand without proper visual representation (Campean & Yildirim,

2017). Thus by use of sequnce diagrams we can be able to show how a certain processing task is

carried out through sending messages between the interacting entities(Refsdal, Husa, & Stølen,

2005). From the use cases defined in the system design, we can be able to decompose the ATM

system into various subsystems. One major sub-system we can derive is the transaction module.

This part is composed of activities that involve the moving cash from one’s account to another or

from the account to physical cash and vice versa. The use case diagram is shown below.

Figure 1. Collins ATM Transaction Subsystem Use Cases

Withraw Cash

Withraw Cash

Withraw Cash

OBJECT MODELLING 6

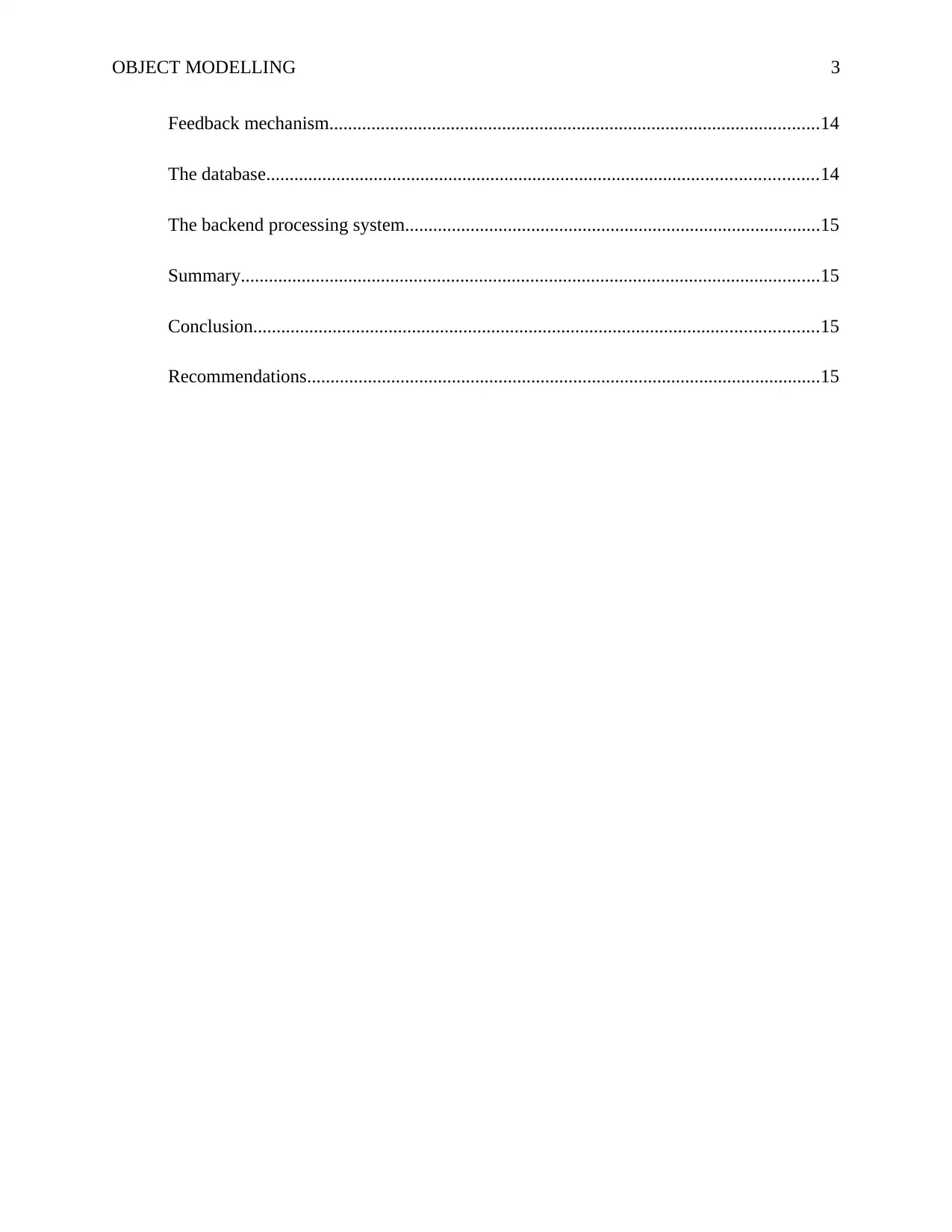

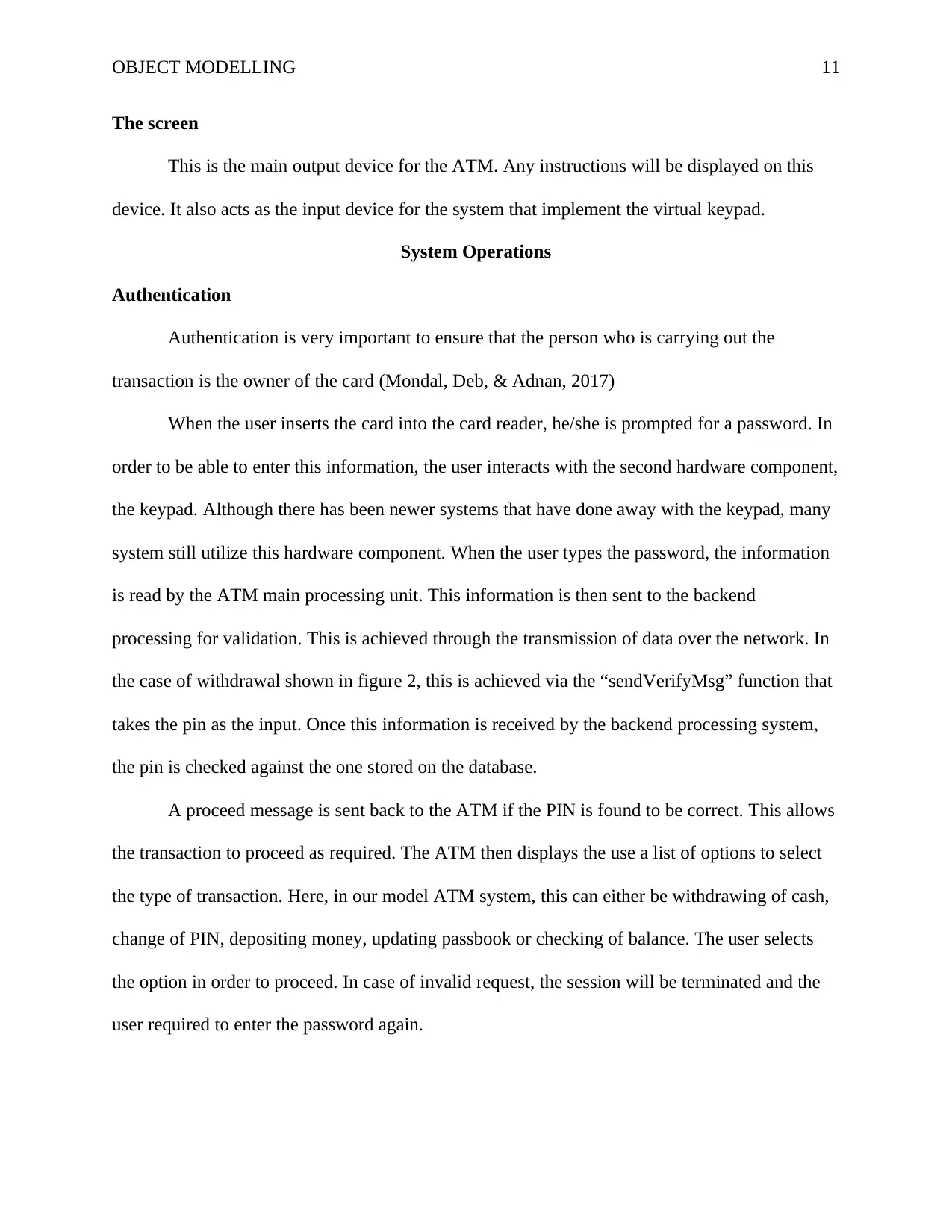

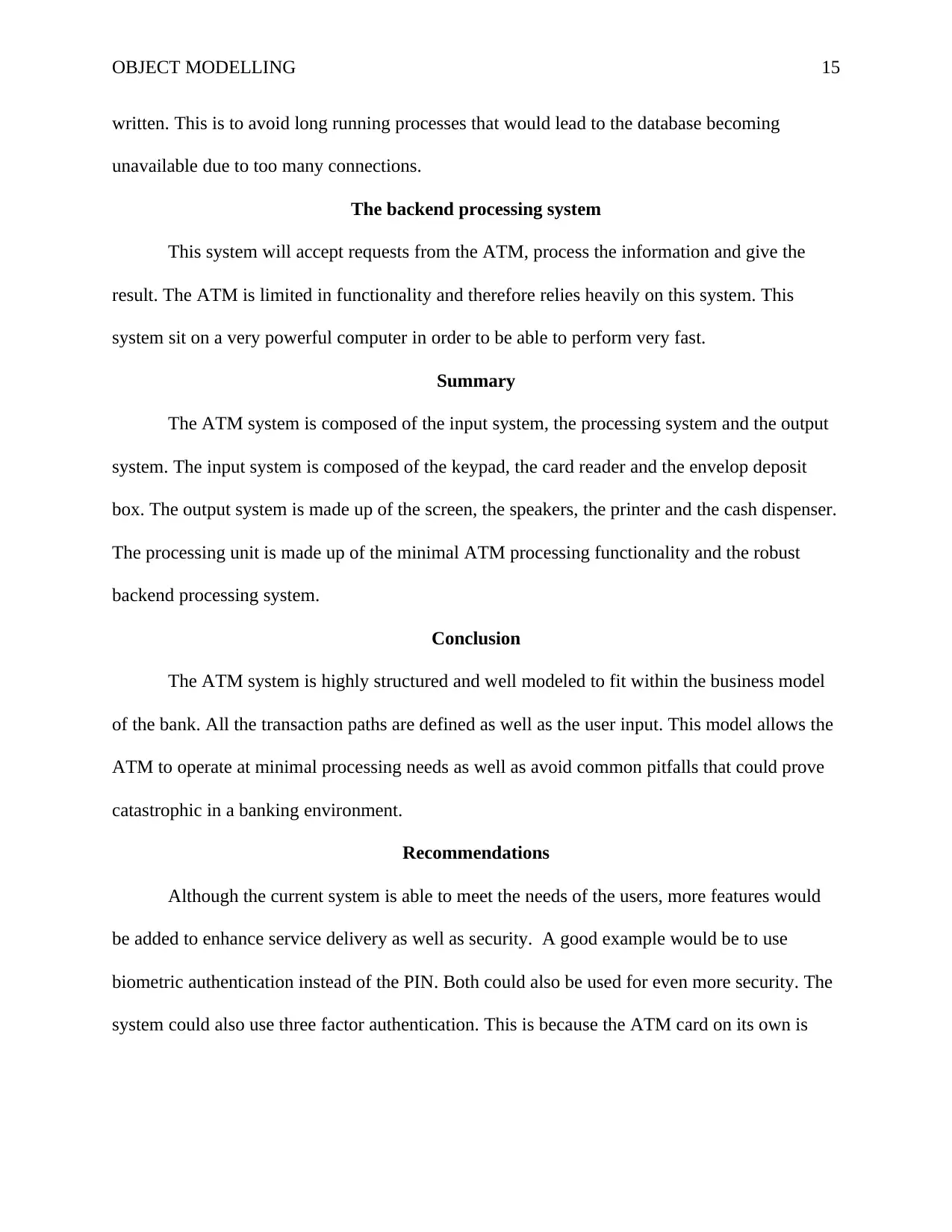

Figure 2. Withdrawal Transaction

Figure 2. Withdrawal Transaction

OBJECT MODELLING 7

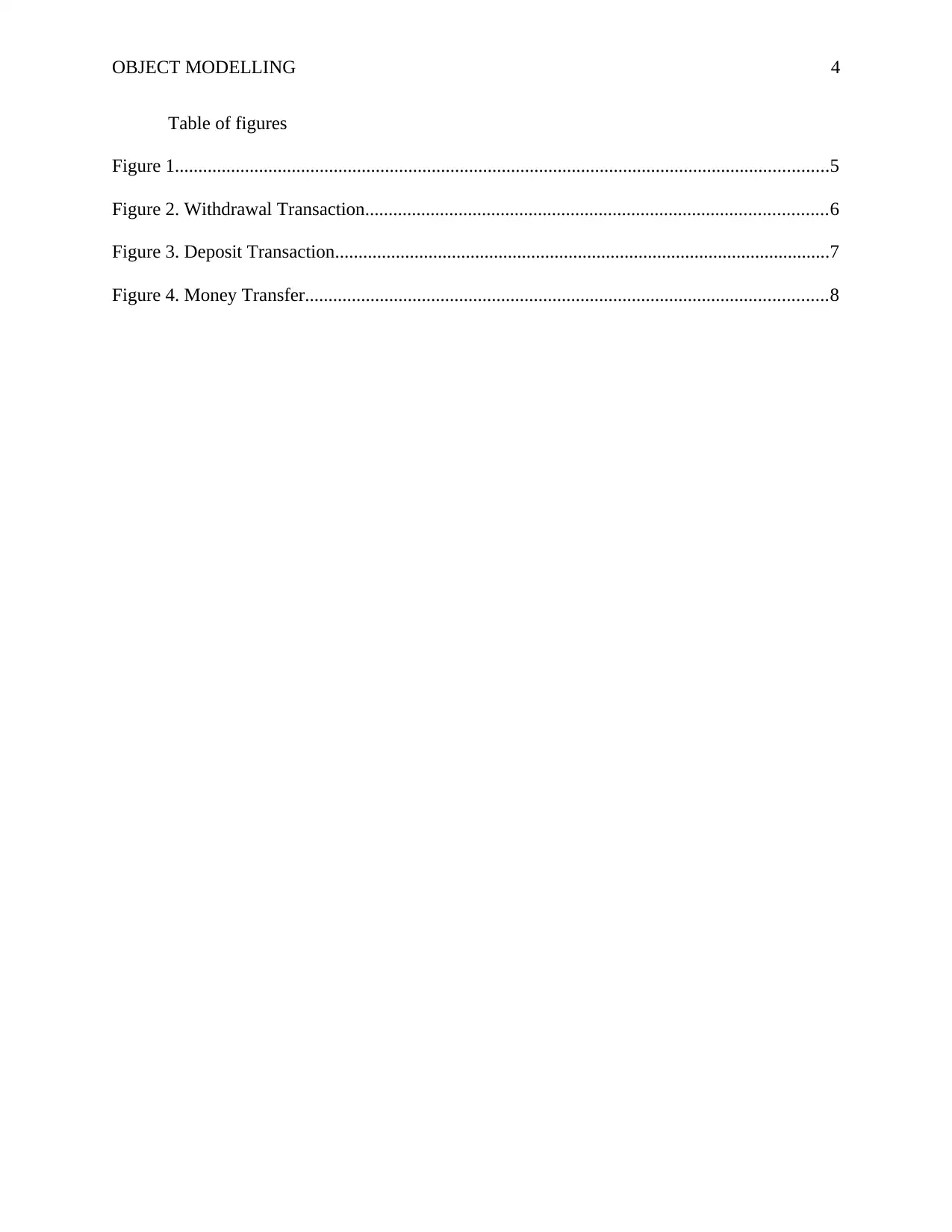

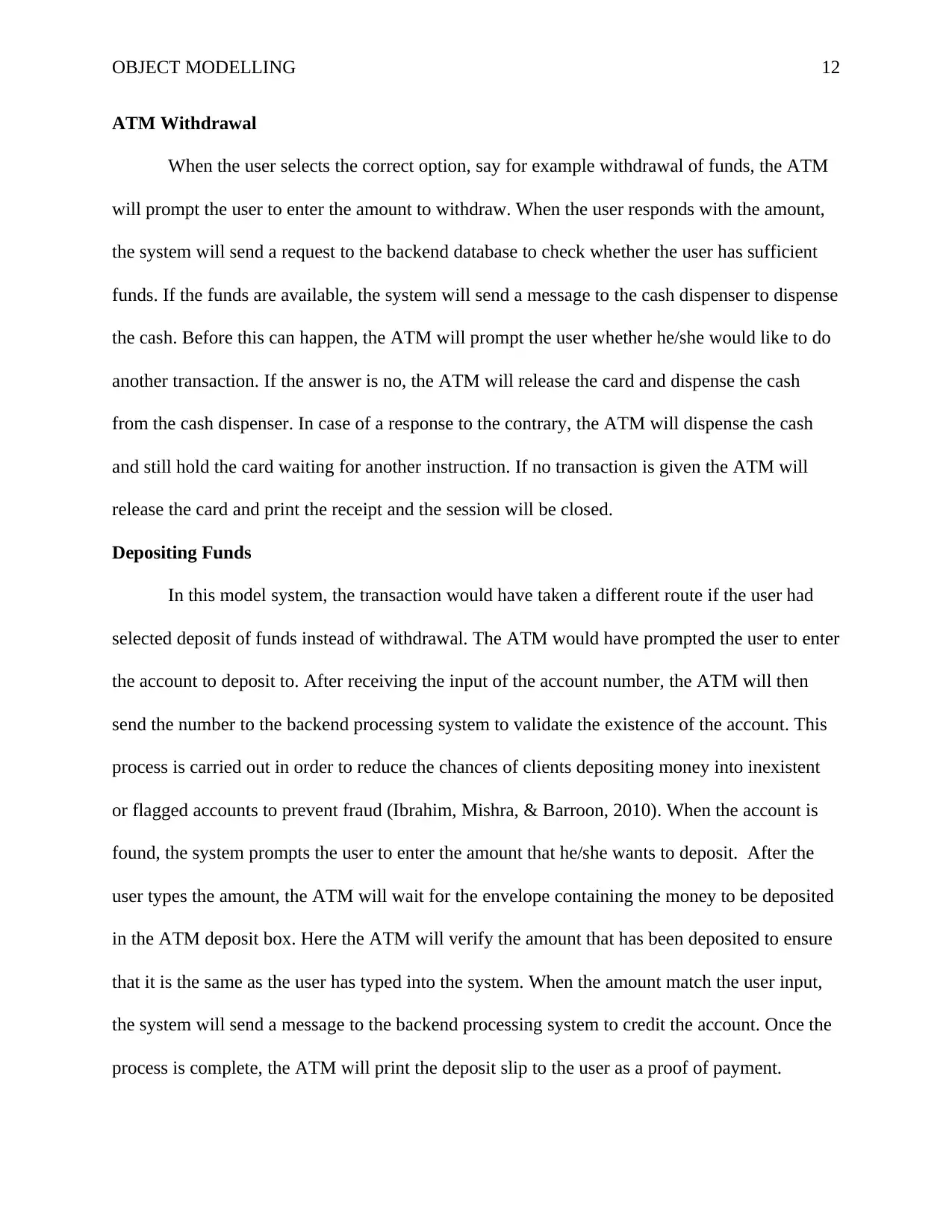

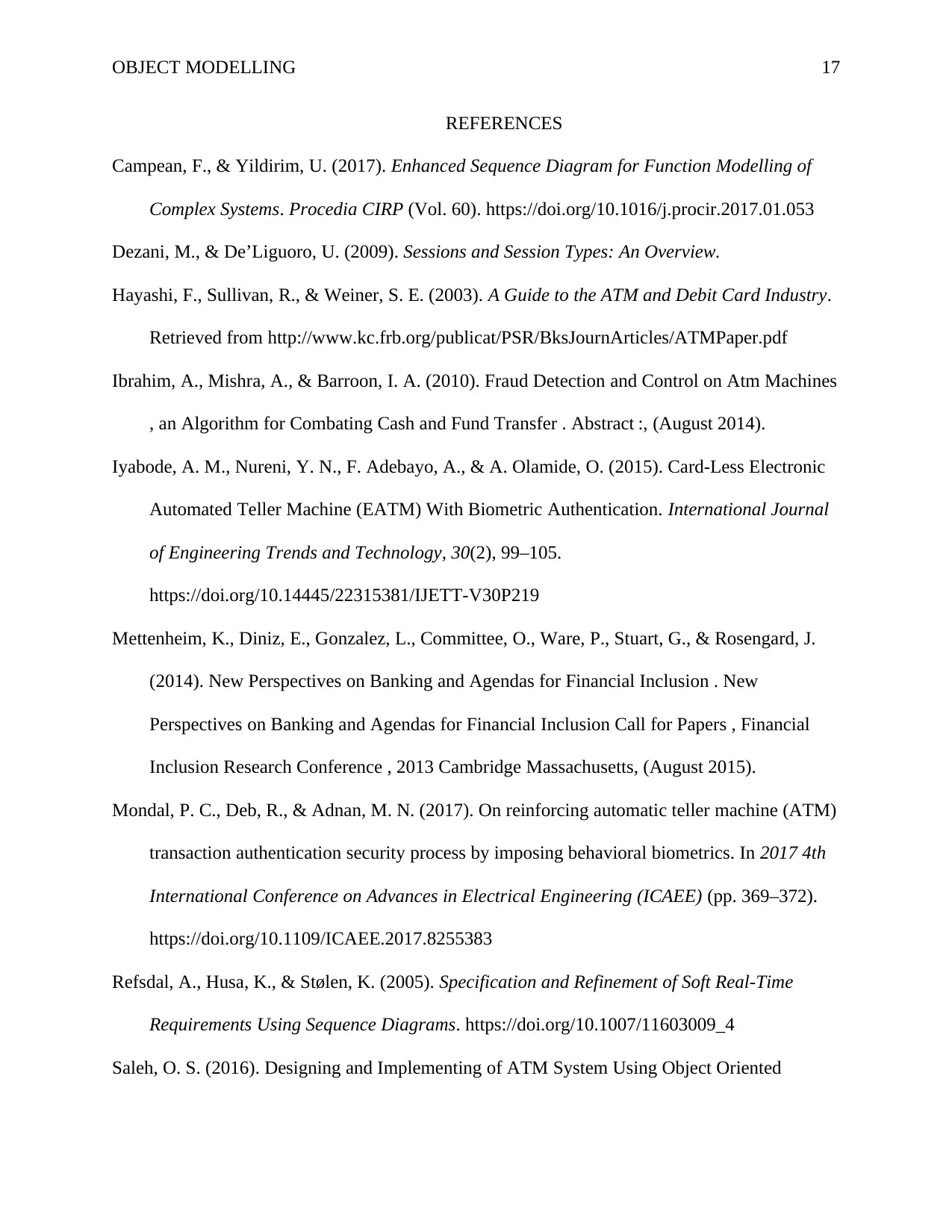

Figure 3. Deposit Transaction

Figure 3. Deposit Transaction

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

OBJECT MODELLING 8

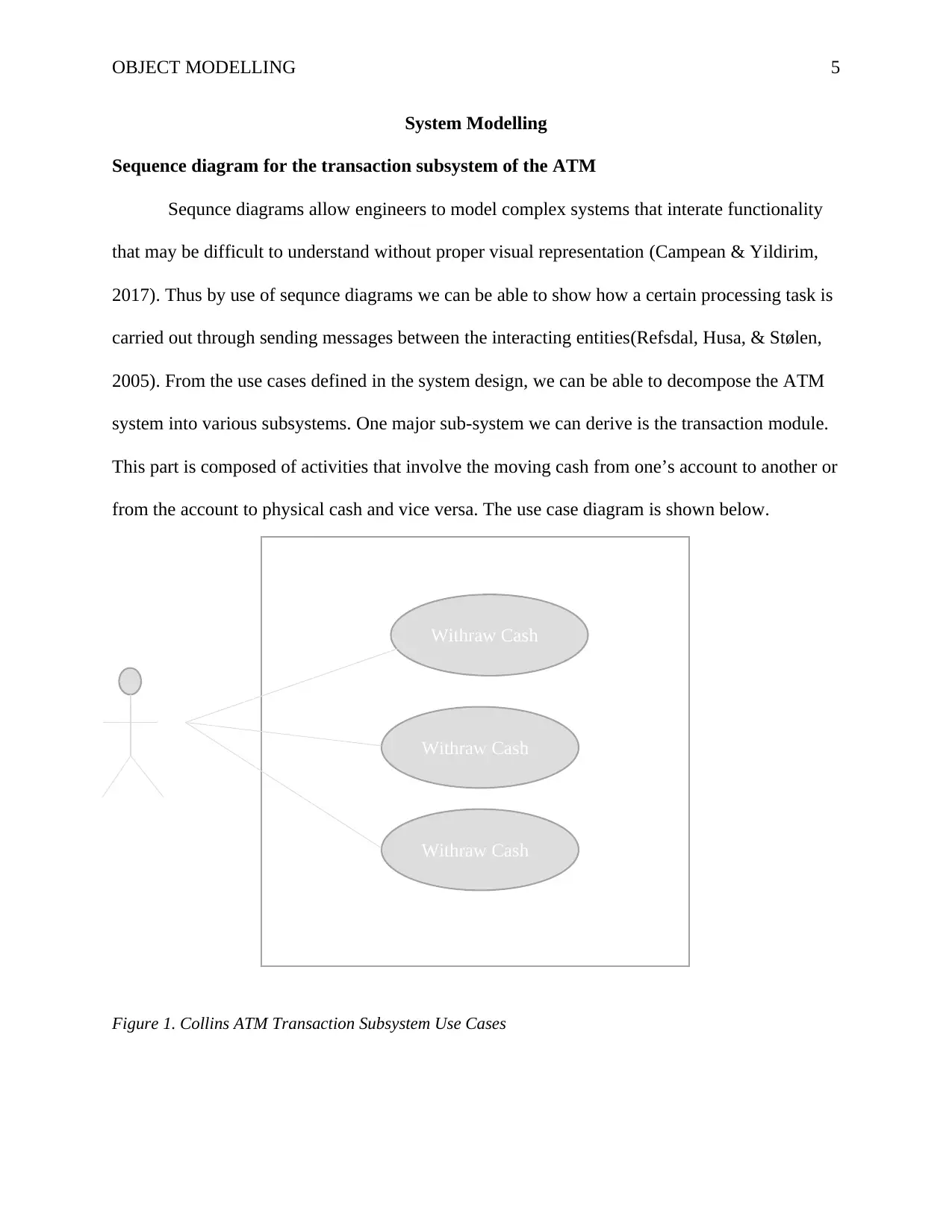

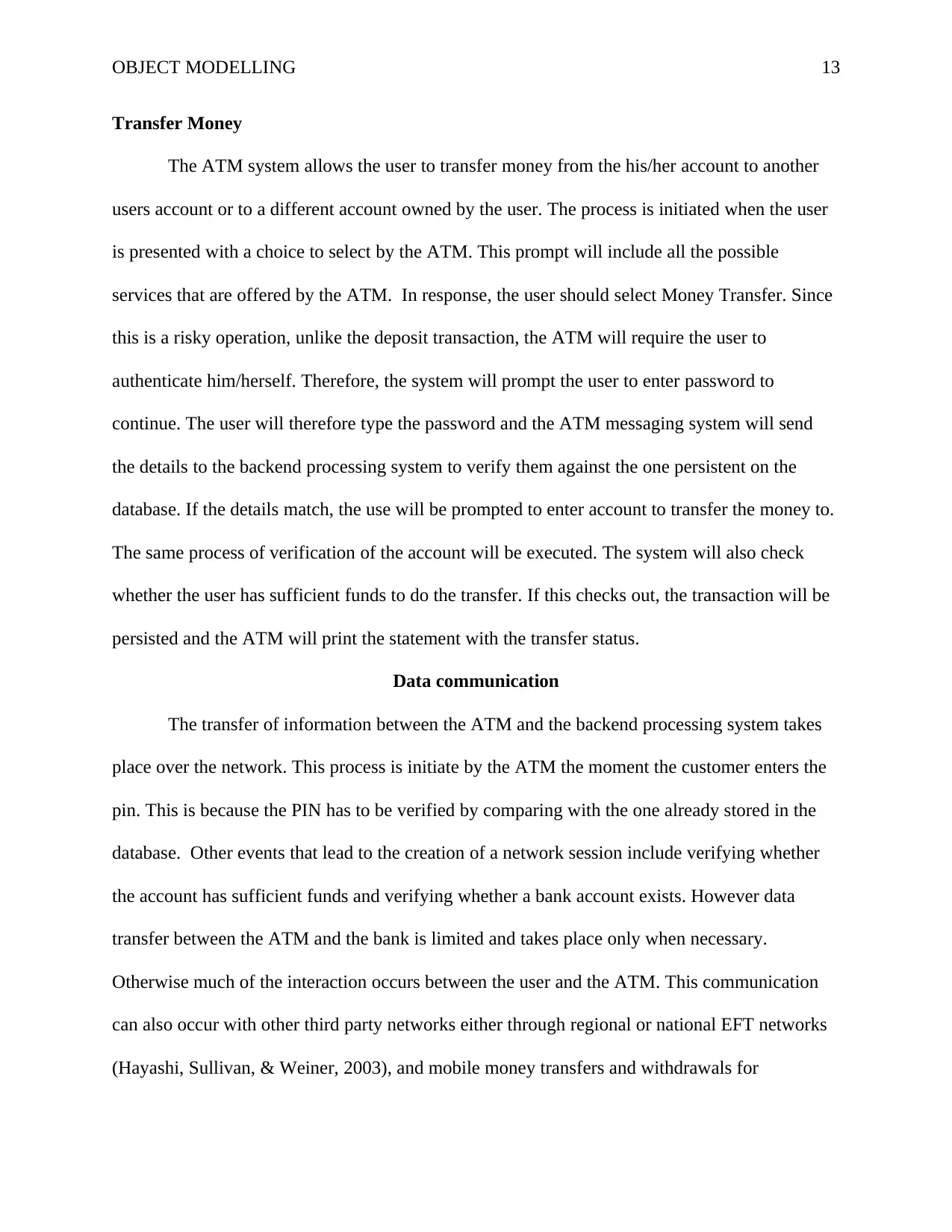

Figure 4. Money Transfer

Figure 4. Money Transfer

OBJECT MODELLING 9

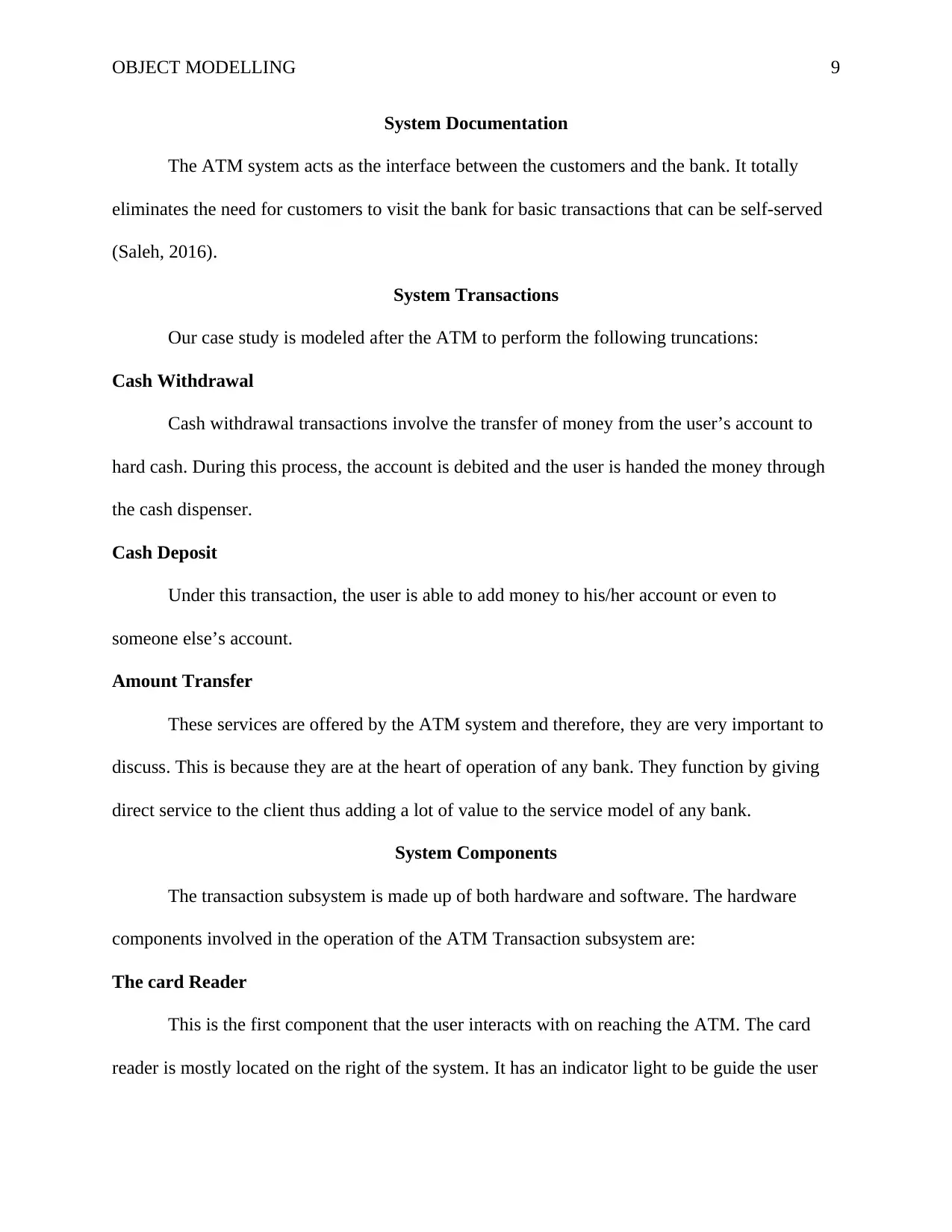

System Documentation

The ATM system acts as the interface between the customers and the bank. It totally

eliminates the need for customers to visit the bank for basic transactions that can be self-served

(Saleh, 2016).

System Transactions

Our case study is modeled after the ATM to perform the following truncations:

Cash Withdrawal

Cash withdrawal transactions involve the transfer of money from the user’s account to

hard cash. During this process, the account is debited and the user is handed the money through

the cash dispenser.

Cash Deposit

Under this transaction, the user is able to add money to his/her account or even to

someone else’s account.

Amount Transfer

These services are offered by the ATM system and therefore, they are very important to

discuss. This is because they are at the heart of operation of any bank. They function by giving

direct service to the client thus adding a lot of value to the service model of any bank.

System Components

The transaction subsystem is made up of both hardware and software. The hardware

components involved in the operation of the ATM Transaction subsystem are:

The card Reader

This is the first component that the user interacts with on reaching the ATM. The card

reader is mostly located on the right of the system. It has an indicator light to be guide the user

System Documentation

The ATM system acts as the interface between the customers and the bank. It totally

eliminates the need for customers to visit the bank for basic transactions that can be self-served

(Saleh, 2016).

System Transactions

Our case study is modeled after the ATM to perform the following truncations:

Cash Withdrawal

Cash withdrawal transactions involve the transfer of money from the user’s account to

hard cash. During this process, the account is debited and the user is handed the money through

the cash dispenser.

Cash Deposit

Under this transaction, the user is able to add money to his/her account or even to

someone else’s account.

Amount Transfer

These services are offered by the ATM system and therefore, they are very important to

discuss. This is because they are at the heart of operation of any bank. They function by giving

direct service to the client thus adding a lot of value to the service model of any bank.

System Components

The transaction subsystem is made up of both hardware and software. The hardware

components involved in the operation of the ATM Transaction subsystem are:

The card Reader

This is the first component that the user interacts with on reaching the ATM. The card

reader is mostly located on the right of the system. It has an indicator light to be guide the user

OBJECT MODELLING 10

on how to insert the card. The Card reader reads the details and sends them to the transaction

processing system within the bank. In this design, the card reader acts in a similar fashion. From

the withdrawal sequence diagram (figure 2) above, the card initiates the transaction process.

Once the user enters the card, it triggers the ATM to request for password. This is the beginning

of the transaction. The card must be well inserted or the card reader will not be able read the

account information.

The Keypad

This part of the ATM is used for entering user input into the system. It may be a physical

keypad or a virtual keypad that appears on the screen. This keypad is very basic with only

numeric values and some special keys such as delete and send. This is because the ATM does not

handle very complex information from the user. In most cases, user input includes only selection

or entering numeric data such as amount or account number.

The Printer

The printer is used to produce hardcopy document containing information about the

transaction that has been carried out. The output from this device depends on whether the user

has instructed the ATM to produce the receipt or the document. The printer used is the thermal

printer. The output from the printer is very basic.

Cash dispenser

The cash dispenser is used to transfer the physical or hard cash from the bank to the

client. When this happens, the client’s account is debited and a similar amount of money is

released by the cash dispenser.

on how to insert the card. The Card reader reads the details and sends them to the transaction

processing system within the bank. In this design, the card reader acts in a similar fashion. From

the withdrawal sequence diagram (figure 2) above, the card initiates the transaction process.

Once the user enters the card, it triggers the ATM to request for password. This is the beginning

of the transaction. The card must be well inserted or the card reader will not be able read the

account information.

The Keypad

This part of the ATM is used for entering user input into the system. It may be a physical

keypad or a virtual keypad that appears on the screen. This keypad is very basic with only

numeric values and some special keys such as delete and send. This is because the ATM does not

handle very complex information from the user. In most cases, user input includes only selection

or entering numeric data such as amount or account number.

The Printer

The printer is used to produce hardcopy document containing information about the

transaction that has been carried out. The output from this device depends on whether the user

has instructed the ATM to produce the receipt or the document. The printer used is the thermal

printer. The output from the printer is very basic.

Cash dispenser

The cash dispenser is used to transfer the physical or hard cash from the bank to the

client. When this happens, the client’s account is debited and a similar amount of money is

released by the cash dispenser.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

OBJECT MODELLING 11

The screen

This is the main output device for the ATM. Any instructions will be displayed on this

device. It also acts as the input device for the system that implement the virtual keypad.

System Operations

Authentication

Authentication is very important to ensure that the person who is carrying out the

transaction is the owner of the card (Mondal, Deb, & Adnan, 2017)

When the user inserts the card into the card reader, he/she is prompted for a password. In

order to be able to enter this information, the user interacts with the second hardware component,

the keypad. Although there has been newer systems that have done away with the keypad, many

system still utilize this hardware component. When the user types the password, the information

is read by the ATM main processing unit. This information is then sent to the backend

processing for validation. This is achieved through the transmission of data over the network. In

the case of withdrawal shown in figure 2, this is achieved via the “sendVerifyMsg” function that

takes the pin as the input. Once this information is received by the backend processing system,

the pin is checked against the one stored on the database.

A proceed message is sent back to the ATM if the PIN is found to be correct. This allows

the transaction to proceed as required. The ATM then displays the use a list of options to select

the type of transaction. Here, in our model ATM system, this can either be withdrawing of cash,

change of PIN, depositing money, updating passbook or checking of balance. The user selects

the option in order to proceed. In case of invalid request, the session will be terminated and the

user required to enter the password again.

The screen

This is the main output device for the ATM. Any instructions will be displayed on this

device. It also acts as the input device for the system that implement the virtual keypad.

System Operations

Authentication

Authentication is very important to ensure that the person who is carrying out the

transaction is the owner of the card (Mondal, Deb, & Adnan, 2017)

When the user inserts the card into the card reader, he/she is prompted for a password. In

order to be able to enter this information, the user interacts with the second hardware component,

the keypad. Although there has been newer systems that have done away with the keypad, many

system still utilize this hardware component. When the user types the password, the information

is read by the ATM main processing unit. This information is then sent to the backend

processing for validation. This is achieved through the transmission of data over the network. In

the case of withdrawal shown in figure 2, this is achieved via the “sendVerifyMsg” function that

takes the pin as the input. Once this information is received by the backend processing system,

the pin is checked against the one stored on the database.

A proceed message is sent back to the ATM if the PIN is found to be correct. This allows

the transaction to proceed as required. The ATM then displays the use a list of options to select

the type of transaction. Here, in our model ATM system, this can either be withdrawing of cash,

change of PIN, depositing money, updating passbook or checking of balance. The user selects

the option in order to proceed. In case of invalid request, the session will be terminated and the

user required to enter the password again.

OBJECT MODELLING 12

ATM Withdrawal

When the user selects the correct option, say for example withdrawal of funds, the ATM

will prompt the user to enter the amount to withdraw. When the user responds with the amount,

the system will send a request to the backend database to check whether the user has sufficient

funds. If the funds are available, the system will send a message to the cash dispenser to dispense

the cash. Before this can happen, the ATM will prompt the user whether he/she would like to do

another transaction. If the answer is no, the ATM will release the card and dispense the cash

from the cash dispenser. In case of a response to the contrary, the ATM will dispense the cash

and still hold the card waiting for another instruction. If no transaction is given the ATM will

release the card and print the receipt and the session will be closed.

Depositing Funds

In this model system, the transaction would have taken a different route if the user had

selected deposit of funds instead of withdrawal. The ATM would have prompted the user to enter

the account to deposit to. After receiving the input of the account number, the ATM will then

send the number to the backend processing system to validate the existence of the account. This

process is carried out in order to reduce the chances of clients depositing money into inexistent

or flagged accounts to prevent fraud (Ibrahim, Mishra, & Barroon, 2010). When the account is

found, the system prompts the user to enter the amount that he/she wants to deposit. After the

user types the amount, the ATM will wait for the envelope containing the money to be deposited

in the ATM deposit box. Here the ATM will verify the amount that has been deposited to ensure

that it is the same as the user has typed into the system. When the amount match the user input,

the system will send a message to the backend processing system to credit the account. Once the

process is complete, the ATM will print the deposit slip to the user as a proof of payment.

ATM Withdrawal

When the user selects the correct option, say for example withdrawal of funds, the ATM

will prompt the user to enter the amount to withdraw. When the user responds with the amount,

the system will send a request to the backend database to check whether the user has sufficient

funds. If the funds are available, the system will send a message to the cash dispenser to dispense

the cash. Before this can happen, the ATM will prompt the user whether he/she would like to do

another transaction. If the answer is no, the ATM will release the card and dispense the cash

from the cash dispenser. In case of a response to the contrary, the ATM will dispense the cash

and still hold the card waiting for another instruction. If no transaction is given the ATM will

release the card and print the receipt and the session will be closed.

Depositing Funds

In this model system, the transaction would have taken a different route if the user had

selected deposit of funds instead of withdrawal. The ATM would have prompted the user to enter

the account to deposit to. After receiving the input of the account number, the ATM will then

send the number to the backend processing system to validate the existence of the account. This

process is carried out in order to reduce the chances of clients depositing money into inexistent

or flagged accounts to prevent fraud (Ibrahim, Mishra, & Barroon, 2010). When the account is

found, the system prompts the user to enter the amount that he/she wants to deposit. After the

user types the amount, the ATM will wait for the envelope containing the money to be deposited

in the ATM deposit box. Here the ATM will verify the amount that has been deposited to ensure

that it is the same as the user has typed into the system. When the amount match the user input,

the system will send a message to the backend processing system to credit the account. Once the

process is complete, the ATM will print the deposit slip to the user as a proof of payment.

OBJECT MODELLING 13

Transfer Money

The ATM system allows the user to transfer money from the his/her account to another

users account or to a different account owned by the user. The process is initiated when the user

is presented with a choice to select by the ATM. This prompt will include all the possible

services that are offered by the ATM. In response, the user should select Money Transfer. Since

this is a risky operation, unlike the deposit transaction, the ATM will require the user to

authenticate him/herself. Therefore, the system will prompt the user to enter password to

continue. The user will therefore type the password and the ATM messaging system will send

the details to the backend processing system to verify them against the one persistent on the

database. If the details match, the use will be prompted to enter account to transfer the money to.

The same process of verification of the account will be executed. The system will also check

whether the user has sufficient funds to do the transfer. If this checks out, the transaction will be

persisted and the ATM will print the statement with the transfer status.

Data communication

The transfer of information between the ATM and the backend processing system takes

place over the network. This process is initiate by the ATM the moment the customer enters the

pin. This is because the PIN has to be verified by comparing with the one already stored in the

database. Other events that lead to the creation of a network session include verifying whether

the account has sufficient funds and verifying whether a bank account exists. However data

transfer between the ATM and the bank is limited and takes place only when necessary.

Otherwise much of the interaction occurs between the user and the ATM. This communication

can also occur with other third party networks either through regional or national EFT networks

(Hayashi, Sullivan, & Weiner, 2003), and mobile money transfers and withdrawals for

Transfer Money

The ATM system allows the user to transfer money from the his/her account to another

users account or to a different account owned by the user. The process is initiated when the user

is presented with a choice to select by the ATM. This prompt will include all the possible

services that are offered by the ATM. In response, the user should select Money Transfer. Since

this is a risky operation, unlike the deposit transaction, the ATM will require the user to

authenticate him/herself. Therefore, the system will prompt the user to enter password to

continue. The user will therefore type the password and the ATM messaging system will send

the details to the backend processing system to verify them against the one persistent on the

database. If the details match, the use will be prompted to enter account to transfer the money to.

The same process of verification of the account will be executed. The system will also check

whether the user has sufficient funds to do the transfer. If this checks out, the transaction will be

persisted and the ATM will print the statement with the transfer status.

Data communication

The transfer of information between the ATM and the backend processing system takes

place over the network. This process is initiate by the ATM the moment the customer enters the

pin. This is because the PIN has to be verified by comparing with the one already stored in the

database. Other events that lead to the creation of a network session include verifying whether

the account has sufficient funds and verifying whether a bank account exists. However data

transfer between the ATM and the bank is limited and takes place only when necessary.

Otherwise much of the interaction occurs between the user and the ATM. This communication

can also occur with other third party networks either through regional or national EFT networks

(Hayashi, Sullivan, & Weiner, 2003), and mobile money transfers and withdrawals for

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

OBJECT MODELLING 14

correspondent banking (Mettenheim et al., 2014). This is because the transaction may be

interbank cash transfer or withdrawal by a client who is not a member of the bank.

Session handling

Each transaction that takes place occurs within a session. A session is used to structure

communication between the communicating entities over the period of communication (Dezani

& De’Liguoro, 2009). A session is created once the customer is requested for a pin and it is

verified. This session is alive as long as the customer has not terminated the current ongoing

transaction. Whenever the session is closed, the user will be required to enter the PIN again

before another session is established. Due to the nature of the ATM, there cannot be two sessions

going on at the same time. The user has to interact with only one session. The session represents

an actual processing. Thus a client cannot have two transactions going on at the same time. For

example, a user cannot be withdrawing money while at the same time he/she is sending money.

Each session will present the user with various options depending on the type of transaction

chosen.

Feedback mechanism

This functionality is implemented in order to be able to inform the user of the status of

the ongoing transaction. This mostly occurs through the screen and the speakers. When the ATM

requires any user action, it will display on the screen as well as play the prompts on the speakers.

The speakers complement the screen to ensure that the user does not fail to get the message.

The database

The ATM database sits at the bank’s headquarters on a secure network. All account

information is stored on this database. Any transaction process cannot proceed without

connecting to the database. However, the connection is closed as soon as information is read or

correspondent banking (Mettenheim et al., 2014). This is because the transaction may be

interbank cash transfer or withdrawal by a client who is not a member of the bank.

Session handling

Each transaction that takes place occurs within a session. A session is used to structure

communication between the communicating entities over the period of communication (Dezani

& De’Liguoro, 2009). A session is created once the customer is requested for a pin and it is

verified. This session is alive as long as the customer has not terminated the current ongoing

transaction. Whenever the session is closed, the user will be required to enter the PIN again

before another session is established. Due to the nature of the ATM, there cannot be two sessions

going on at the same time. The user has to interact with only one session. The session represents

an actual processing. Thus a client cannot have two transactions going on at the same time. For

example, a user cannot be withdrawing money while at the same time he/she is sending money.

Each session will present the user with various options depending on the type of transaction

chosen.

Feedback mechanism

This functionality is implemented in order to be able to inform the user of the status of

the ongoing transaction. This mostly occurs through the screen and the speakers. When the ATM

requires any user action, it will display on the screen as well as play the prompts on the speakers.

The speakers complement the screen to ensure that the user does not fail to get the message.

The database

The ATM database sits at the bank’s headquarters on a secure network. All account

information is stored on this database. Any transaction process cannot proceed without

connecting to the database. However, the connection is closed as soon as information is read or

OBJECT MODELLING 15

written. This is to avoid long running processes that would lead to the database becoming

unavailable due to too many connections.

The backend processing system

This system will accept requests from the ATM, process the information and give the

result. The ATM is limited in functionality and therefore relies heavily on this system. This

system sit on a very powerful computer in order to be able to perform very fast.

Summary

The ATM system is composed of the input system, the processing system and the output

system. The input system is composed of the keypad, the card reader and the envelop deposit

box. The output system is made up of the screen, the speakers, the printer and the cash dispenser.

The processing unit is made up of the minimal ATM processing functionality and the robust

backend processing system.

Conclusion

The ATM system is highly structured and well modeled to fit within the business model

of the bank. All the transaction paths are defined as well as the user input. This model allows the

ATM to operate at minimal processing needs as well as avoid common pitfalls that could prove

catastrophic in a banking environment.

Recommendations

Although the current system is able to meet the needs of the users, more features would

be added to enhance service delivery as well as security. A good example would be to use

biometric authentication instead of the PIN. Both could also be used for even more security. The

system could also use three factor authentication. This is because the ATM card on its own is

written. This is to avoid long running processes that would lead to the database becoming

unavailable due to too many connections.

The backend processing system

This system will accept requests from the ATM, process the information and give the

result. The ATM is limited in functionality and therefore relies heavily on this system. This

system sit on a very powerful computer in order to be able to perform very fast.

Summary

The ATM system is composed of the input system, the processing system and the output

system. The input system is composed of the keypad, the card reader and the envelop deposit

box. The output system is made up of the screen, the speakers, the printer and the cash dispenser.

The processing unit is made up of the minimal ATM processing functionality and the robust

backend processing system.

Conclusion

The ATM system is highly structured and well modeled to fit within the business model

of the bank. All the transaction paths are defined as well as the user input. This model allows the

ATM to operate at minimal processing needs as well as avoid common pitfalls that could prove

catastrophic in a banking environment.

Recommendations

Although the current system is able to meet the needs of the users, more features would

be added to enhance service delivery as well as security. A good example would be to use

biometric authentication instead of the PIN. Both could also be used for even more security. The

system could also use three factor authentication. This is because the ATM card on its own is

OBJECT MODELLING 16

subject to many security threats such as skimming and cloning (Iyabode, Nureni, F. Adebayo, &

A. Olamide, 2015), (Sharma & Rathore, 2012).

subject to many security threats such as skimming and cloning (Iyabode, Nureni, F. Adebayo, &

A. Olamide, 2015), (Sharma & Rathore, 2012).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

OBJECT MODELLING 17

REFERENCES

Campean, F., & Yildirim, U. (2017). Enhanced Sequence Diagram for Function Modelling of

Complex Systems. Procedia CIRP (Vol. 60). https://doi.org/10.1016/j.procir.2017.01.053

Dezani, M., & De’Liguoro, U. (2009). Sessions and Session Types: An Overview.

Hayashi, F., Sullivan, R., & Weiner, S. E. (2003). A Guide to the ATM and Debit Card Industry.

Retrieved from http://www.kc.frb.org/publicat/PSR/BksJournArticles/ATMPaper.pdf

Ibrahim, A., Mishra, A., & Barroon, I. A. (2010). Fraud Detection and Control on Atm Machines

, an Algorithm for Combating Cash and Fund Transfer . Abstract :, (August 2014).

Iyabode, A. M., Nureni, Y. N., F. Adebayo, A., & A. Olamide, O. (2015). Card-Less Electronic

Automated Teller Machine (EATM) With Biometric Authentication. International Journal

of Engineering Trends and Technology, 30(2), 99–105.

https://doi.org/10.14445/22315381/IJETT-V30P219

Mettenheim, K., Diniz, E., Gonzalez, L., Committee, O., Ware, P., Stuart, G., & Rosengard, J.

(2014). New Perspectives on Banking and Agendas for Financial Inclusion . New

Perspectives on Banking and Agendas for Financial Inclusion Call for Papers , Financial

Inclusion Research Conference , 2013 Cambridge Massachusetts, (August 2015).

Mondal, P. C., Deb, R., & Adnan, M. N. (2017). On reinforcing automatic teller machine (ATM)

transaction authentication security process by imposing behavioral biometrics. In 2017 4th

International Conference on Advances in Electrical Engineering (ICAEE) (pp. 369–372).

https://doi.org/10.1109/ICAEE.2017.8255383

Refsdal, A., Husa, K., & Stølen, K. (2005). Specification and Refinement of Soft Real-Time

Requirements Using Sequence Diagrams. https://doi.org/10.1007/11603009_4

Saleh, O. S. (2016). Designing and Implementing of ATM System Using Object Oriented

REFERENCES

Campean, F., & Yildirim, U. (2017). Enhanced Sequence Diagram for Function Modelling of

Complex Systems. Procedia CIRP (Vol. 60). https://doi.org/10.1016/j.procir.2017.01.053

Dezani, M., & De’Liguoro, U. (2009). Sessions and Session Types: An Overview.

Hayashi, F., Sullivan, R., & Weiner, S. E. (2003). A Guide to the ATM and Debit Card Industry.

Retrieved from http://www.kc.frb.org/publicat/PSR/BksJournArticles/ATMPaper.pdf

Ibrahim, A., Mishra, A., & Barroon, I. A. (2010). Fraud Detection and Control on Atm Machines

, an Algorithm for Combating Cash and Fund Transfer . Abstract :, (August 2014).

Iyabode, A. M., Nureni, Y. N., F. Adebayo, A., & A. Olamide, O. (2015). Card-Less Electronic

Automated Teller Machine (EATM) With Biometric Authentication. International Journal

of Engineering Trends and Technology, 30(2), 99–105.

https://doi.org/10.14445/22315381/IJETT-V30P219

Mettenheim, K., Diniz, E., Gonzalez, L., Committee, O., Ware, P., Stuart, G., & Rosengard, J.

(2014). New Perspectives on Banking and Agendas for Financial Inclusion . New

Perspectives on Banking and Agendas for Financial Inclusion Call for Papers , Financial

Inclusion Research Conference , 2013 Cambridge Massachusetts, (August 2015).

Mondal, P. C., Deb, R., & Adnan, M. N. (2017). On reinforcing automatic teller machine (ATM)

transaction authentication security process by imposing behavioral biometrics. In 2017 4th

International Conference on Advances in Electrical Engineering (ICAEE) (pp. 369–372).

https://doi.org/10.1109/ICAEE.2017.8255383

Refsdal, A., Husa, K., & Stølen, K. (2005). Specification and Refinement of Soft Real-Time

Requirements Using Sequence Diagrams. https://doi.org/10.1007/11603009_4

Saleh, O. S. (2016). Designing and Implementing of ATM System Using Object Oriented

OBJECT MODELLING 18

Approach, (July 2015).

Sharma, N., & Rathore, D. V. S. (2012). Analysis of Different Vulnerabilities in Auto Teller

Machine. Journal of Global Research in Computer Science, 3(3), 2010–2012.

Approach, (July 2015).

Sharma, N., & Rathore, D. V. S. (2012). Analysis of Different Vulnerabilities in Auto Teller

Machine. Journal of Global Research in Computer Science, 3(3), 2010–2012.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.