ITC508 - Object Modelling: ATM System Requirements and SDLC

VerifiedAdded on 2023/06/12

|14

|2958

|486

Project

AI Summary

This project provides a comprehensive object modelling analysis of an ATM system. It begins by identifying and describing the core functional and non-functional requirements, including aspects like authentication, transaction processing, adaptability, security, and usability. A UML use case model is presented to illustrate the system's interactions, followed by a UML domain model class diagram, highlighting key entities and relationships. Realistic assumptions are outlined to address environmental limitations. Finally, the document discusses the Software Development Life Cycle (SDLC) phases relevant to the ATM system, including requirements analysis, design, implementation, testing, deployment, and maintenance. The analysis also describes the ATM environment and application component design, emphasizing the user interface and data handling.

Running head: OBJECT MODELLING

OBJECT MODELLING

Name of the Student

Name of the University

Author Note

OBJECT MODELLING

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1OBJECT MODELLING

Table of Contents

Identifying & describing the core functional & non-functional requirements of the ATM.......2

Use Case Model for the IS (Information System)......................................................................5

UML Domain Model Class:.......................................................................................................9

SDLC........................................................................................................................................10

Bibliography:............................................................................................................................12

Table of Contents

Identifying & describing the core functional & non-functional requirements of the ATM.......2

Use Case Model for the IS (Information System)......................................................................5

UML Domain Model Class:.......................................................................................................9

SDLC........................................................................................................................................10

Bibliography:............................................................................................................................12

2OBJECT MODELLING

Identifying & describing the core functional & non-functional requirements of the ATM

The core functional & non-functional requirements of the Collin’s ATM based on the

provided details are listed as follows under the following two categories:

FUNCTIONAL REQUIREMENTS:

The core functional requirements of the system as per the demand has been listed as

follows:

Non-active Condition: Under, the scenario an invalid card is inserted, the screen should flash

the message in initial display.

System requirement: The core requirement of the system is installation of protocols for

information storage and execution process.

Authentication Procedure: In the scenario, when the card is inserted, the ATM card pin

should be inserted to validate the card and in the process enter the cash card mode.

Acceptance of card: The system requirement quotes the condition that the card will only be

accepted if the serial number & the code of bank are readable in the card. Contrary, if the

card is not readable and takes over 5 seconds than the process should be cancelled with an

error message flashing on the screen.

Accepting the serial number: The serial number on the card should be identified by the

system that it should be stored in core system’s memory.

Pin request: Successful recognition of the card will generate a screen requesting for the

card’s pin and only after its validation can the process.

Identifying & describing the core functional & non-functional requirements of the ATM

The core functional & non-functional requirements of the Collin’s ATM based on the

provided details are listed as follows under the following two categories:

FUNCTIONAL REQUIREMENTS:

The core functional requirements of the system as per the demand has been listed as

follows:

Non-active Condition: Under, the scenario an invalid card is inserted, the screen should flash

the message in initial display.

System requirement: The core requirement of the system is installation of protocols for

information storage and execution process.

Authentication Procedure: In the scenario, when the card is inserted, the ATM card pin

should be inserted to validate the card and in the process enter the cash card mode.

Acceptance of card: The system requirement quotes the condition that the card will only be

accepted if the serial number & the code of bank are readable in the card. Contrary, if the

card is not readable and takes over 5 seconds than the process should be cancelled with an

error message flashing on the screen.

Accepting the serial number: The serial number on the card should be identified by the

system that it should be stored in core system’s memory.

Pin request: Successful recognition of the card will generate a screen requesting for the

card’s pin and only after its validation can the process.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3OBJECT MODELLING

Pin processing: In case, wrong pin is entered by the user they will be offered a total of three

opportunities to correct their mistake after which the card will be captured by the system. On

positive response, the process will proceed.

Transactional queries: After validation of the pin, the user must be enquired about the type of

process they wish to proceed with be it withdrawal, deposit or any other.

After transaction: After the desired process of the user is completed, the system will flash a

message enquiring about the next step that will ask “whether the user wishes to continue or

exit the system”. Finally, whether the user wishes to get a physical receipt will be enquired

before completing the process

NON_FUNCTIONAL REQUIREMENTS:

The non-functional requirements of the system will enquiry about the scalability,

durability and other factors that has been listed as follows:

Adaptability: The system should show adaptability that is in dire circumstances (that would

not compromise with the security of the system), the system should show adaptability and

adopt the change.

Compatibility: The system should be compatible with the already existing infrastructure to

avoid any discomfort for the end-user while keeping the purpose understandable. The

information collected during the account opening should be compatible with the devised

system.

Efficiency: One of the most notable requirement of any system is efficiency and the devised

system also demands the same. The system should be capable of fulfilling the end-user

demand with suitable output by allowing them to use the available options with ease.

Pin processing: In case, wrong pin is entered by the user they will be offered a total of three

opportunities to correct their mistake after which the card will be captured by the system. On

positive response, the process will proceed.

Transactional queries: After validation of the pin, the user must be enquired about the type of

process they wish to proceed with be it withdrawal, deposit or any other.

After transaction: After the desired process of the user is completed, the system will flash a

message enquiring about the next step that will ask “whether the user wishes to continue or

exit the system”. Finally, whether the user wishes to get a physical receipt will be enquired

before completing the process

NON_FUNCTIONAL REQUIREMENTS:

The non-functional requirements of the system will enquiry about the scalability,

durability and other factors that has been listed as follows:

Adaptability: The system should show adaptability that is in dire circumstances (that would

not compromise with the security of the system), the system should show adaptability and

adopt the change.

Compatibility: The system should be compatible with the already existing infrastructure to

avoid any discomfort for the end-user while keeping the purpose understandable. The

information collected during the account opening should be compatible with the devised

system.

Efficiency: One of the most notable requirement of any system is efficiency and the devised

system also demands the same. The system should be capable of fulfilling the end-user

demand with suitable output by allowing them to use the available options with ease.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4OBJECT MODELLING

Flexibility: The discussed system should not limit itself to only the transactional operations

but also offer other features such as viewing last transactions, mobile accessing, change of

pin and others while offering flexibility in the process.

Scalability: The discussed system cannot be changed readily and hence should be capable of

standing overloads while fulfilling its purpose. In other words, the system should be capable

of delivering its services (such as withdrawal, deposit and others) even, when the traffic for

the system is too much to handle.

Security: One of the core requirements of the system is a strong security because, if the

system fails in the discussed area it will not only have a short-term side-effect but will also

affect the sustainability of the organisation in long-run. Hence, the system should offer

reliability and only offer its services when the card is validated through proper authentication.

User interface: The system should offer understandable interface options that is the dialogue

boxes & the options should be understandable to the user for execution of the needed

command to execute necessary option. The appearance on the screen should also gain the

attention of the user instantly so, that they can access the desired option without any hassle.

Usability: As discussed in the section above, the system should offer easy user interface,

however that would not be enough as the user would need an easy usability too. The system

should be accessible for the users and the outputs must be effective and efficient. The

acceptance of card should also be an easy and secure process. A tutorial option should be

available for the new users to understand the system.

Flexibility: The discussed system should not limit itself to only the transactional operations

but also offer other features such as viewing last transactions, mobile accessing, change of

pin and others while offering flexibility in the process.

Scalability: The discussed system cannot be changed readily and hence should be capable of

standing overloads while fulfilling its purpose. In other words, the system should be capable

of delivering its services (such as withdrawal, deposit and others) even, when the traffic for

the system is too much to handle.

Security: One of the core requirements of the system is a strong security because, if the

system fails in the discussed area it will not only have a short-term side-effect but will also

affect the sustainability of the organisation in long-run. Hence, the system should offer

reliability and only offer its services when the card is validated through proper authentication.

User interface: The system should offer understandable interface options that is the dialogue

boxes & the options should be understandable to the user for execution of the needed

command to execute necessary option. The appearance on the screen should also gain the

attention of the user instantly so, that they can access the desired option without any hassle.

Usability: As discussed in the section above, the system should offer easy user interface,

however that would not be enough as the user would need an easy usability too. The system

should be accessible for the users and the outputs must be effective and efficient. The

acceptance of card should also be an easy and secure process. A tutorial option should be

available for the new users to understand the system.

5OBJECT MODELLING

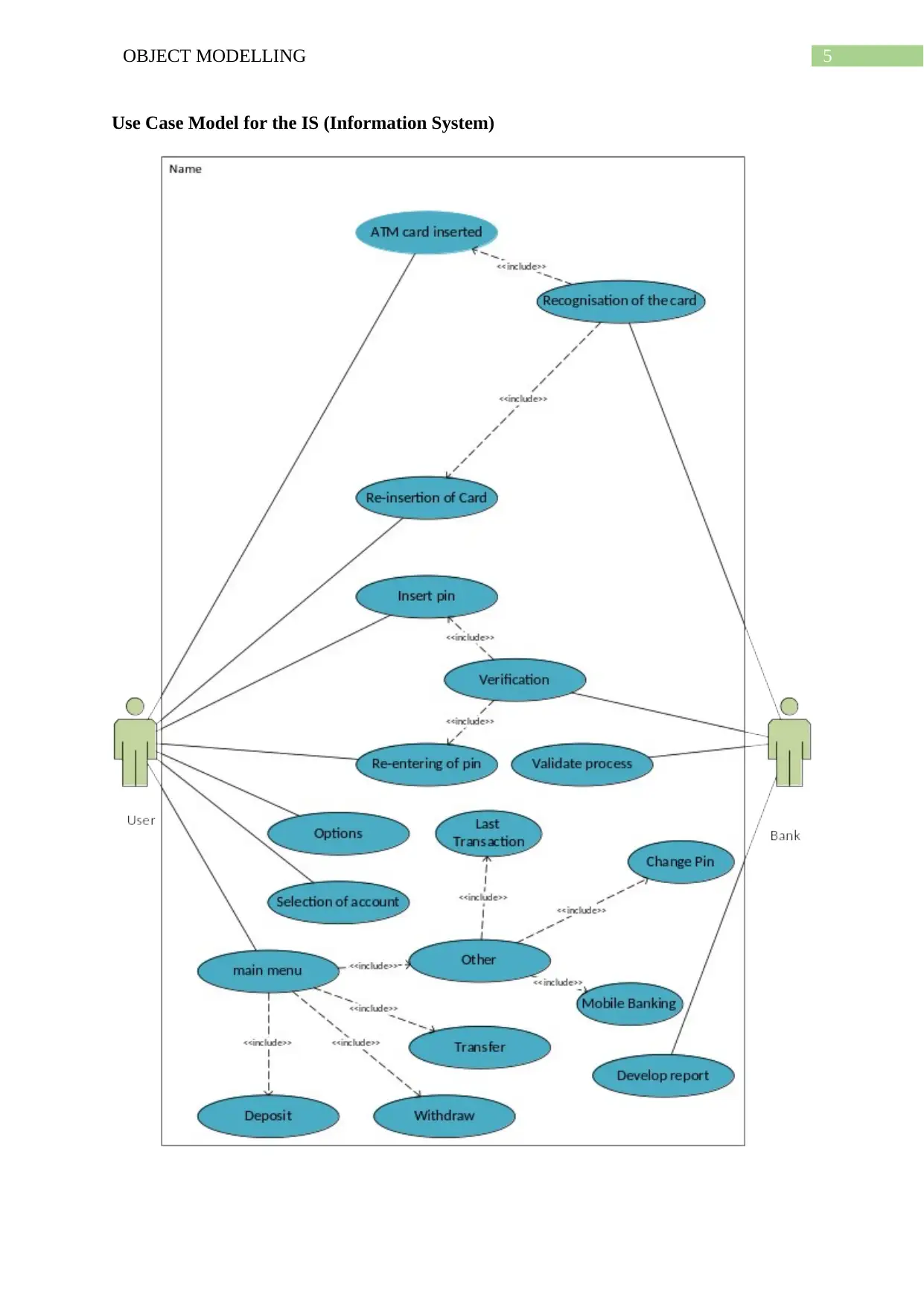

Use Case Model for the IS (Information System)

Use Case Model for the IS (Information System)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6OBJECT MODELLING

Figure 1: UML CASE MODEL

(Source: Created by Author)

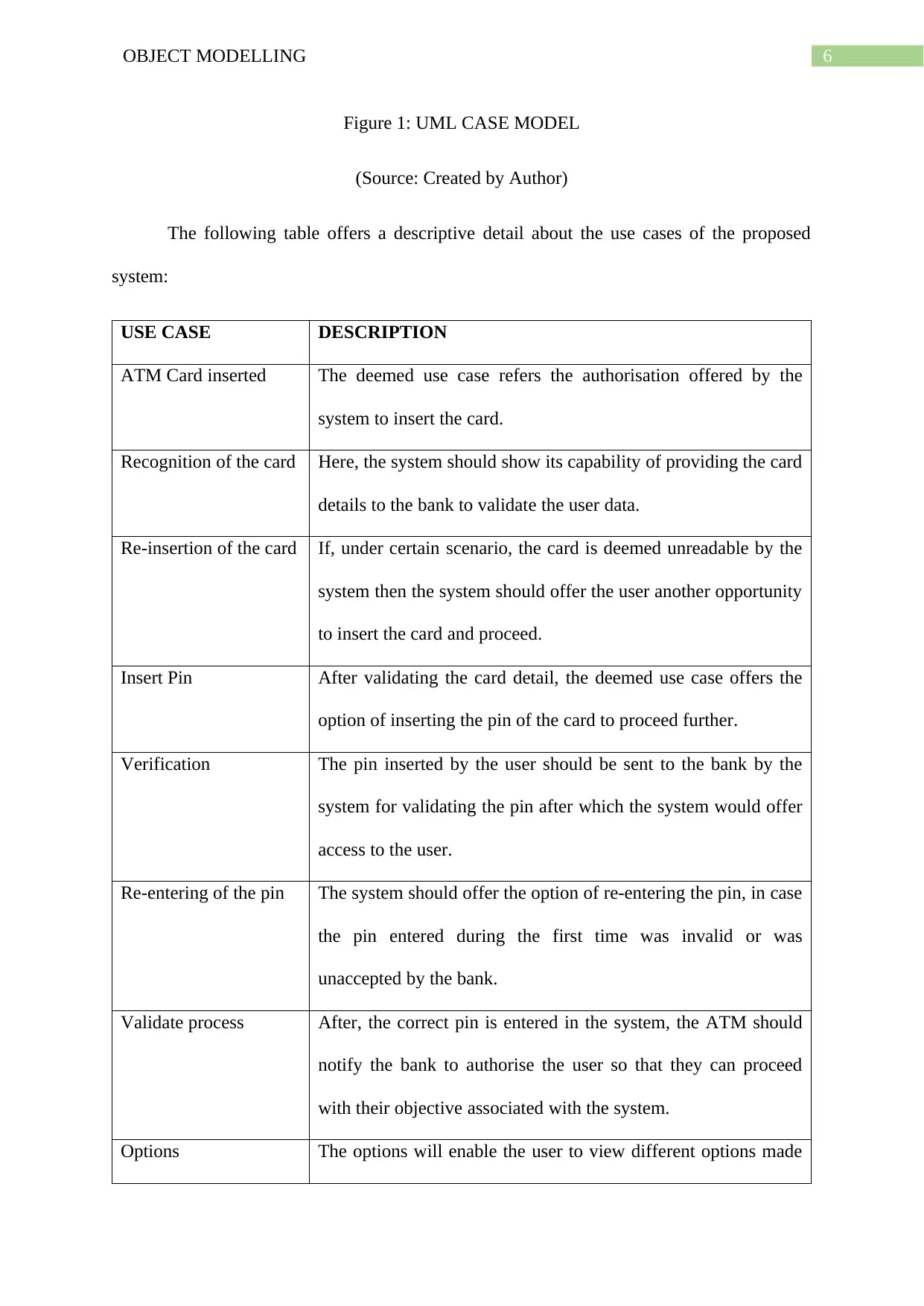

The following table offers a descriptive detail about the use cases of the proposed

system:

USE CASE DESCRIPTION

ATM Card inserted The deemed use case refers the authorisation offered by the

system to insert the card.

Recognition of the card Here, the system should show its capability of providing the card

details to the bank to validate the user data.

Re-insertion of the card If, under certain scenario, the card is deemed unreadable by the

system then the system should offer the user another opportunity

to insert the card and proceed.

Insert Pin After validating the card detail, the deemed use case offers the

option of inserting the pin of the card to proceed further.

Verification The pin inserted by the user should be sent to the bank by the

system for validating the pin after which the system would offer

access to the user.

Re-entering of the pin The system should offer the option of re-entering the pin, in case

the pin entered during the first time was invalid or was

unaccepted by the bank.

Validate process After, the correct pin is entered in the system, the ATM should

notify the bank to authorise the user so that they can proceed

with their objective associated with the system.

Options The options will enable the user to view different options made

Figure 1: UML CASE MODEL

(Source: Created by Author)

The following table offers a descriptive detail about the use cases of the proposed

system:

USE CASE DESCRIPTION

ATM Card inserted The deemed use case refers the authorisation offered by the

system to insert the card.

Recognition of the card Here, the system should show its capability of providing the card

details to the bank to validate the user data.

Re-insertion of the card If, under certain scenario, the card is deemed unreadable by the

system then the system should offer the user another opportunity

to insert the card and proceed.

Insert Pin After validating the card detail, the deemed use case offers the

option of inserting the pin of the card to proceed further.

Verification The pin inserted by the user should be sent to the bank by the

system for validating the pin after which the system would offer

access to the user.

Re-entering of the pin The system should offer the option of re-entering the pin, in case

the pin entered during the first time was invalid or was

unaccepted by the bank.

Validate process After, the correct pin is entered in the system, the ATM should

notify the bank to authorise the user so that they can proceed

with their objective associated with the system.

Options The options will enable the user to view different options made

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7OBJECT MODELLING

available by the system.

Selection of Account After viewing the options the user must select the type of

account they want to proceed with be it savings, current or other

type of account.

Main Menu The main menu is made visible to the user for selection of

further process.

Deposit The system will offer the option of depositing the money in the

account of the user or the one user wishes to deposit their

money.

Withdraw The system will even flash withdrawal option from where the

user can proceed with withdrawal of their money.

Transfer The system will offer the option of transferring their money to

someone else’s account.

Other The screen will also host the deemed option which will take the

user to another section where they can use other services such as

pin change, mobile banking, last transaction and similar options.

Mobile Banking The system will enable the user to proceed with the task in hand

by using their mobile to further ensure security of the system.

Change Pin The system will allow the user to change the pin.

Last Transaction The system will offer the user to visit their last transaction

(limited to last 10 transaction).

Develop Report The system in association with the bank will publish the report

of the account of the user.

Table 1: USE CASE DESCRIPTION

available by the system.

Selection of Account After viewing the options the user must select the type of

account they want to proceed with be it savings, current or other

type of account.

Main Menu The main menu is made visible to the user for selection of

further process.

Deposit The system will offer the option of depositing the money in the

account of the user or the one user wishes to deposit their

money.

Withdraw The system will even flash withdrawal option from where the

user can proceed with withdrawal of their money.

Transfer The system will offer the option of transferring their money to

someone else’s account.

Other The screen will also host the deemed option which will take the

user to another section where they can use other services such as

pin change, mobile banking, last transaction and similar options.

Mobile Banking The system will enable the user to proceed with the task in hand

by using their mobile to further ensure security of the system.

Change Pin The system will allow the user to change the pin.

Last Transaction The system will offer the user to visit their last transaction

(limited to last 10 transaction).

Develop Report The system in association with the bank will publish the report

of the account of the user.

Table 1: USE CASE DESCRIPTION

8OBJECT MODELLING

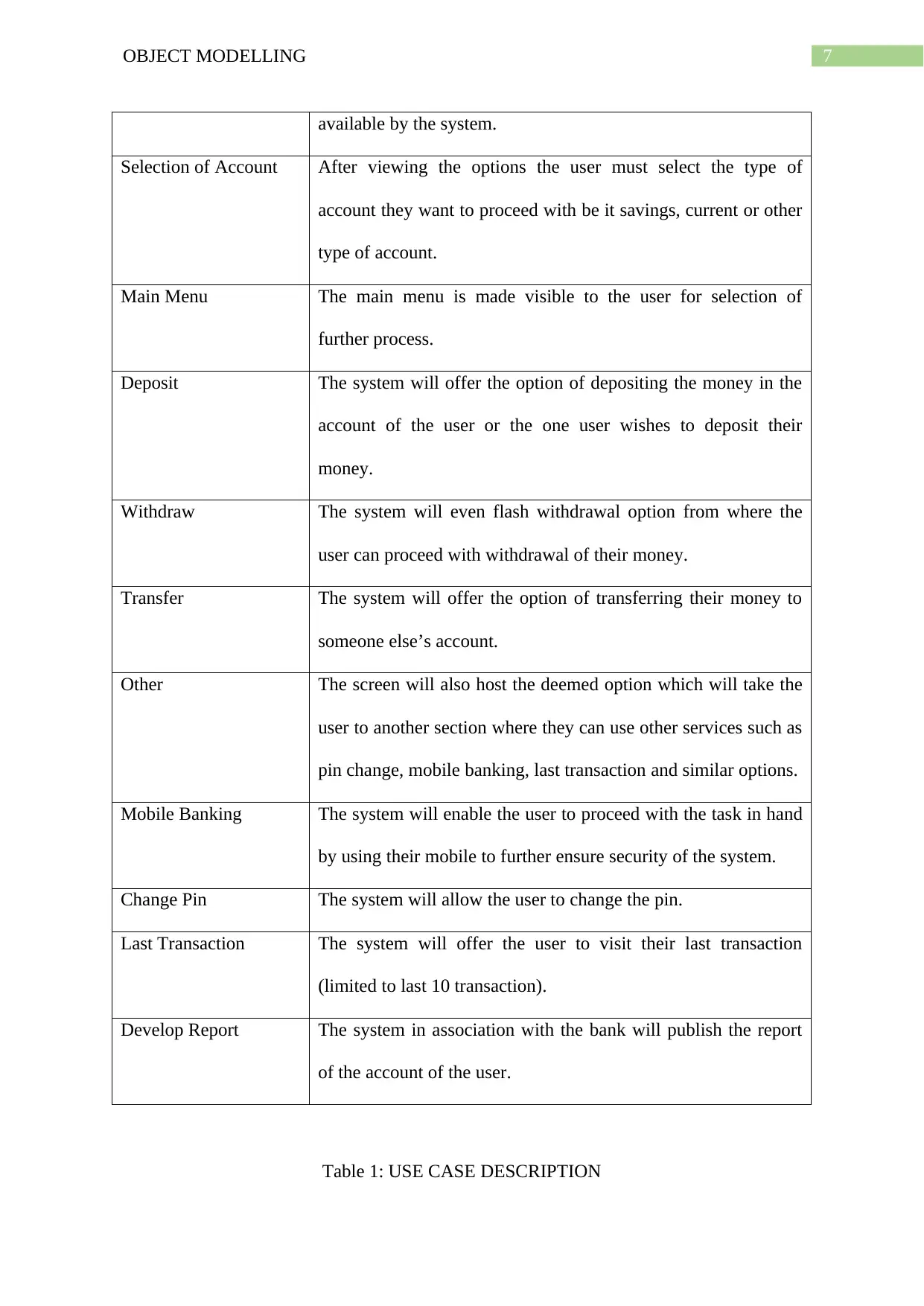

(Source: Created by Author)

Name of the Use Case Main Menu

Initiating incident The user enters the system and views the main menu to proceed

with their objective.

Description Post authorisation the system authorises the user to view and

access the main menu.

Participants System, user and bank

Sub-categorised use

case

The user can view different use cases such as deposit, transfer,

withdrawal and others. Others will further offer sub-use cases

such as the pin change, last transactions and mobile banking.

Pre-condition The precondition for the use case model is the selection of

account after which the user moves ahead with other processes.

Post-condition It will differ according to the option selected by the user which

may be deposit, transfer, pin change and other available options.

Activity flow The activity flows between the user and the system.

1st: The user enters the card and is verified by the system.

2nd: The user enters the pin which is again verified by the

system.

3rd: The user selects the main menu option after which the

available options are made visible by the system.

Adverse condition The card inserted by the user have no association with any valid

account.

The pin entered by the user in invalid.

Table 2: FULLY DEVELOPED CASE USE

(Source: Created by Author)

Name of the Use Case Main Menu

Initiating incident The user enters the system and views the main menu to proceed

with their objective.

Description Post authorisation the system authorises the user to view and

access the main menu.

Participants System, user and bank

Sub-categorised use

case

The user can view different use cases such as deposit, transfer,

withdrawal and others. Others will further offer sub-use cases

such as the pin change, last transactions and mobile banking.

Pre-condition The precondition for the use case model is the selection of

account after which the user moves ahead with other processes.

Post-condition It will differ according to the option selected by the user which

may be deposit, transfer, pin change and other available options.

Activity flow The activity flows between the user and the system.

1st: The user enters the card and is verified by the system.

2nd: The user enters the pin which is again verified by the

system.

3rd: The user selects the main menu option after which the

available options are made visible by the system.

Adverse condition The card inserted by the user have no association with any valid

account.

The pin entered by the user in invalid.

Table 2: FULLY DEVELOPED CASE USE

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9OBJECT MODELLING

(Source: Created by Author)

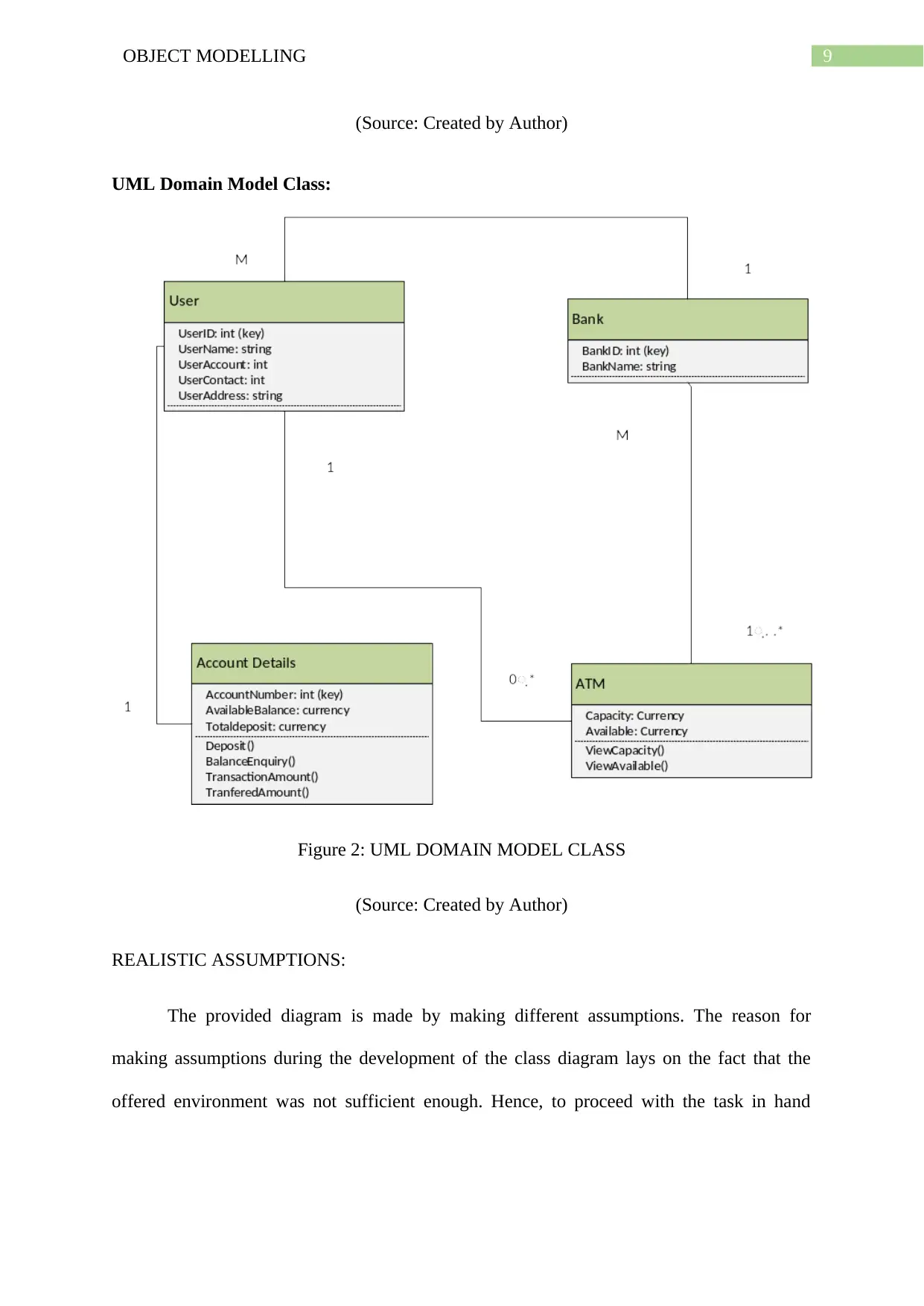

UML Domain Model Class:

Figure 2: UML DOMAIN MODEL CLASS

(Source: Created by Author)

REALISTIC ASSUMPTIONS:

The provided diagram is made by making different assumptions. The reason for

making assumptions during the development of the class diagram lays on the fact that the

offered environment was not sufficient enough. Hence, to proceed with the task in hand

(Source: Created by Author)

UML Domain Model Class:

Figure 2: UML DOMAIN MODEL CLASS

(Source: Created by Author)

REALISTIC ASSUMPTIONS:

The provided diagram is made by making different assumptions. The reason for

making assumptions during the development of the class diagram lays on the fact that the

offered environment was not sufficient enough. Hence, to proceed with the task in hand

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10OBJECT MODELLING

assumptions were made which greatly assisted in the creation of the discussed diagram which

can be further used to create class diagram of the subject that is the ATM system.

The most prominent assumption that was made was regarding to the connection

between the ATM and the bank along with the assumption that the bank has the user’s details

maintained in their database. The reason for making the discussed assumption lays on the fact

that the ATM cannot proceed with its task until and unless it has received the bank details of

the user to ensure the validity of the transaction. Hence, to validate the data of the user the

discussed assumption about the user data and database along with an electronic connection

between the ATM and bank were made.

SDLC

The following six phases are included in the SDLC (Software development Life

Cycle):

1. COLLECTING AND ANALYSING THE REQUIREMENTS: The discussed phase

includes identification and collection of the requirements followed by analysing them to

reach a suitable conclusion.

2. DESIGNING: The discussed phase involves identification of the design that satisfies

the requirements and is also compatible with the system it is to be installed in.

3. IMPLEMENTATION: The discussed phase involves actualisation of the proposed

design that needs to be installed in the subject system and proceed accordingly with the

implementation of the design.

4. TESTING: In the deemed phase the testing of the designed tool is done to ensure its

suitability with the subject system. The testing can be done in a prototype or even in a

simulation tool rather than using an actual system for testing.

assumptions were made which greatly assisted in the creation of the discussed diagram which

can be further used to create class diagram of the subject that is the ATM system.

The most prominent assumption that was made was regarding to the connection

between the ATM and the bank along with the assumption that the bank has the user’s details

maintained in their database. The reason for making the discussed assumption lays on the fact

that the ATM cannot proceed with its task until and unless it has received the bank details of

the user to ensure the validity of the transaction. Hence, to validate the data of the user the

discussed assumption about the user data and database along with an electronic connection

between the ATM and bank were made.

SDLC

The following six phases are included in the SDLC (Software development Life

Cycle):

1. COLLECTING AND ANALYSING THE REQUIREMENTS: The discussed phase

includes identification and collection of the requirements followed by analysing them to

reach a suitable conclusion.

2. DESIGNING: The discussed phase involves identification of the design that satisfies

the requirements and is also compatible with the system it is to be installed in.

3. IMPLEMENTATION: The discussed phase involves actualisation of the proposed

design that needs to be installed in the subject system and proceed accordingly with the

implementation of the design.

4. TESTING: In the deemed phase the testing of the designed tool is done to ensure its

suitability with the subject system. The testing can be done in a prototype or even in a

simulation tool rather than using an actual system for testing.

11OBJECT MODELLING

5. DEPLOYMENT: After successful testing of the proposed tool, it is installed in the

system in the discussed phase.

6. MAINTENANCE: After the tool is installed in the system, periodical maintenance

should be done to ensure proper operation of the system and even avoid lagging or faults in

the system during overload or any other dire situation.

Description of the environment

ATMs (Automated teller machine also goes by the name of alternative delivery

channel because it offers alternative of banking process while delivering a pre-designated set

of services and acting as a channel for the user and the banking services offered by the bank.

Designing of application component

The proposed application would contain a front end that would be connected to the

internet for collecting data of the user from the internet because the ATMs does not contain

any database to store the information of the user rather it collects it from bank when needed.

User Interface

It is one of the crucial factors as UI (user interface) decides the comfortability that the

user will enjoy while using the system. Hence, the UI should be designed appropriately so

that the user can perform system operations efficiently and in the process receive effective

response from the system.

Database

As stated above, the system does not contain any database and collects data from the

bank via internet when needed.

Software method

5. DEPLOYMENT: After successful testing of the proposed tool, it is installed in the

system in the discussed phase.

6. MAINTENANCE: After the tool is installed in the system, periodical maintenance

should be done to ensure proper operation of the system and even avoid lagging or faults in

the system during overload or any other dire situation.

Description of the environment

ATMs (Automated teller machine also goes by the name of alternative delivery

channel because it offers alternative of banking process while delivering a pre-designated set

of services and acting as a channel for the user and the banking services offered by the bank.

Designing of application component

The proposed application would contain a front end that would be connected to the

internet for collecting data of the user from the internet because the ATMs does not contain

any database to store the information of the user rather it collects it from bank when needed.

User Interface

It is one of the crucial factors as UI (user interface) decides the comfortability that the

user will enjoy while using the system. Hence, the UI should be designed appropriately so

that the user can perform system operations efficiently and in the process receive effective

response from the system.

Database

As stated above, the system does not contain any database and collects data from the

bank via internet when needed.

Software method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.