Exchange Rate Regime and Historical Exchange Rate Analysis of AUD/USD

VerifiedAdded on 2023/06/10

|9

|1443

|298

AI Summary

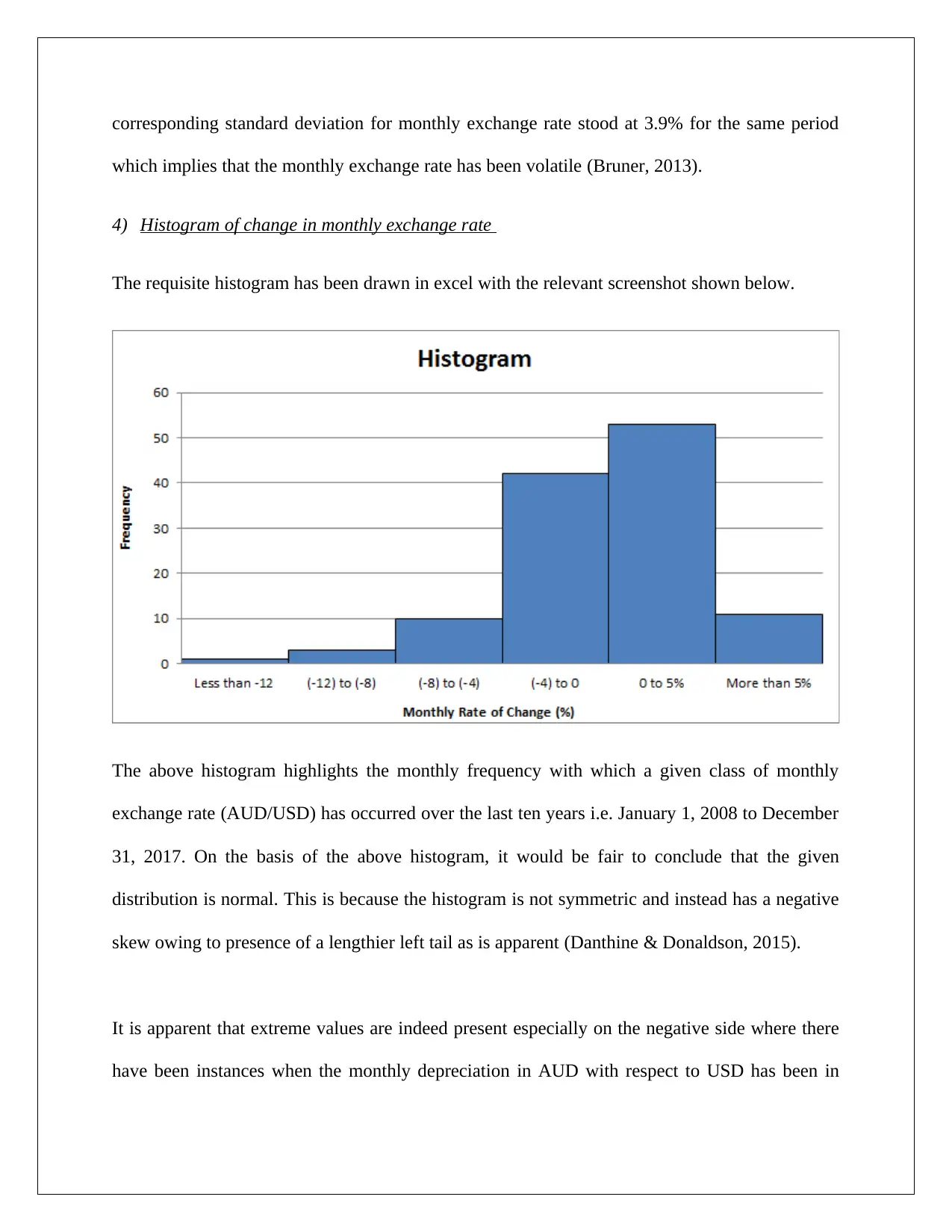

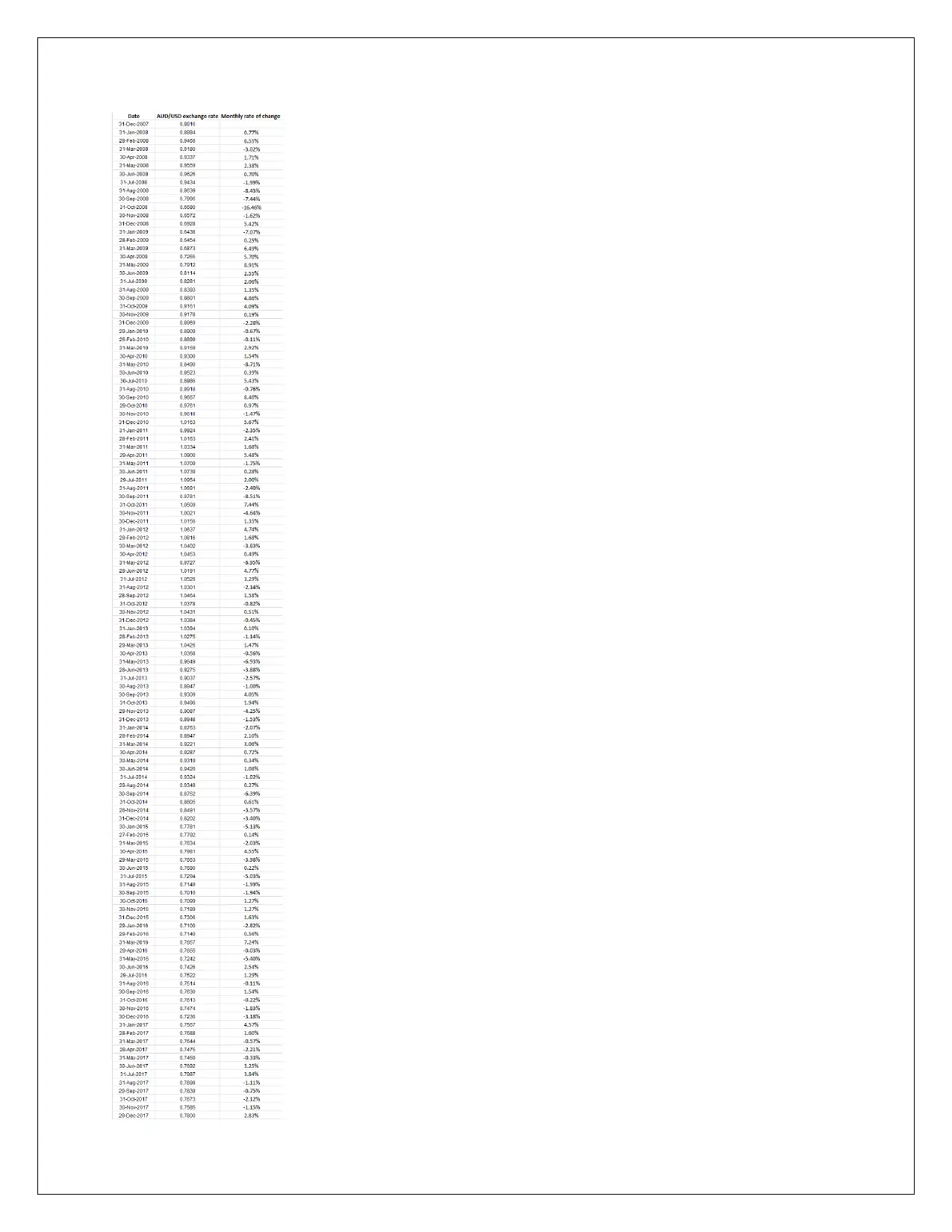

The report tends to outline the exchange rate regime of the chosen foreign currency i.e. United States dollar or USD. Further, the historical exchange rate change on a monthly basis for the last 10 years has been computed using the data from RBA. The standard deviation of these changes has come out as 3.9% and hence indicates volatility over the period with no clear trend. On the whole, AUD has depreciated against USD in the period under consideration. Also, the distribution of the exchange rate change is non-normal owing to presence of negative skew. One of the key reasons is events such as global financial crisis which resulted in extreme currency movements.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 9

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)