Audit and Assurance - Threats, Safeguards, and Independence

VerifiedAdded on 2020/02/24

|6

|1041

|156

Homework Assignment

AI Summary

This assignment solution addresses various scenarios related to audit and assurance, focusing on threats to auditor independence and the implementation of safeguards. The solution analyzes five distinct situations, each presenting a potential threat to auditor objectivity, such as self-review and self-interest threats. For each scenario, the assignment identifies the specific threat, assesses its potential impact on the auditor's opinion, and proposes safeguards to mitigate the risk. These safeguards include measures like rotating audit personnel, assigning tasks to third parties, and establishing clear policies on auditor remuneration and benefits. The assignment also considers the impact of previous employment relationships and personal relationships on auditor independence, providing a comprehensive overview of ethical considerations in auditing. The analysis highlights the importance of maintaining objectivity and the challenges auditors face in upholding their professional responsibilities.

AUDIT & ASSURANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Audit

Answer-1

Situation Threats Safeguards Objective Assessment

Provision of Book

keeping services to

the subsidiaries of the

company to which

audit services are

being provided since

3 years.

The main threat to

audit independence

the self-review threat.

The threat is that the

subsidiaries will be

provided book

keeping services by

APG audit firm to

SFL Limited and

there is a risk that the

auditors may

manipulate the books

in order to present a

good position in the

consolidated financial

statements of the

holding company SFL

Ltd. as the APG firm

has been auditing the

parent company since

last 3 years and is

aware of all the

loopholes of the

financial statements

and is hence its

reviewing own work

shall be biased.

The safeguards for

this threat can be :

i. The audit team

should not be

assigned book

keeping of the

subsidiaries1.

ii. Book keeping

should be assigned to

a third party.

In the case where both

for holding and its

subsidiaries there is

only one auditor

appointed there could

be a case where his

audit procedures

could not be

sufficient. Hence

outsider team should

be appointed for book

keeping. In such case,

auditor independence

is difficult2.

1 Christine Jubb, Auditing and Assurance: A Business Risk Approach (Deakin University, 2012)

2 Karla, Johnstone, Audrey, Gramling & Larry E. Rittenberg, Auditing: A Risk Based-Approach

to Conducting a Quality Audit (Cengage Learning, 2014)

2

Answer-1

Situation Threats Safeguards Objective Assessment

Provision of Book

keeping services to

the subsidiaries of the

company to which

audit services are

being provided since

3 years.

The main threat to

audit independence

the self-review threat.

The threat is that the

subsidiaries will be

provided book

keeping services by

APG audit firm to

SFL Limited and

there is a risk that the

auditors may

manipulate the books

in order to present a

good position in the

consolidated financial

statements of the

holding company SFL

Ltd. as the APG firm

has been auditing the

parent company since

last 3 years and is

aware of all the

loopholes of the

financial statements

and is hence its

reviewing own work

shall be biased.

The safeguards for

this threat can be :

i. The audit team

should not be

assigned book

keeping of the

subsidiaries1.

ii. Book keeping

should be assigned to

a third party.

In the case where both

for holding and its

subsidiaries there is

only one auditor

appointed there could

be a case where his

audit procedures

could not be

sufficient. Hence

outsider team should

be appointed for book

keeping. In such case,

auditor independence

is difficult2.

1 Christine Jubb, Auditing and Assurance: A Business Risk Approach (Deakin University, 2012)

2 Karla, Johnstone, Audrey, Gramling & Larry E. Rittenberg, Auditing: A Risk Based-Approach

to Conducting a Quality Audit (Cengage Learning, 2014)

2

Audit

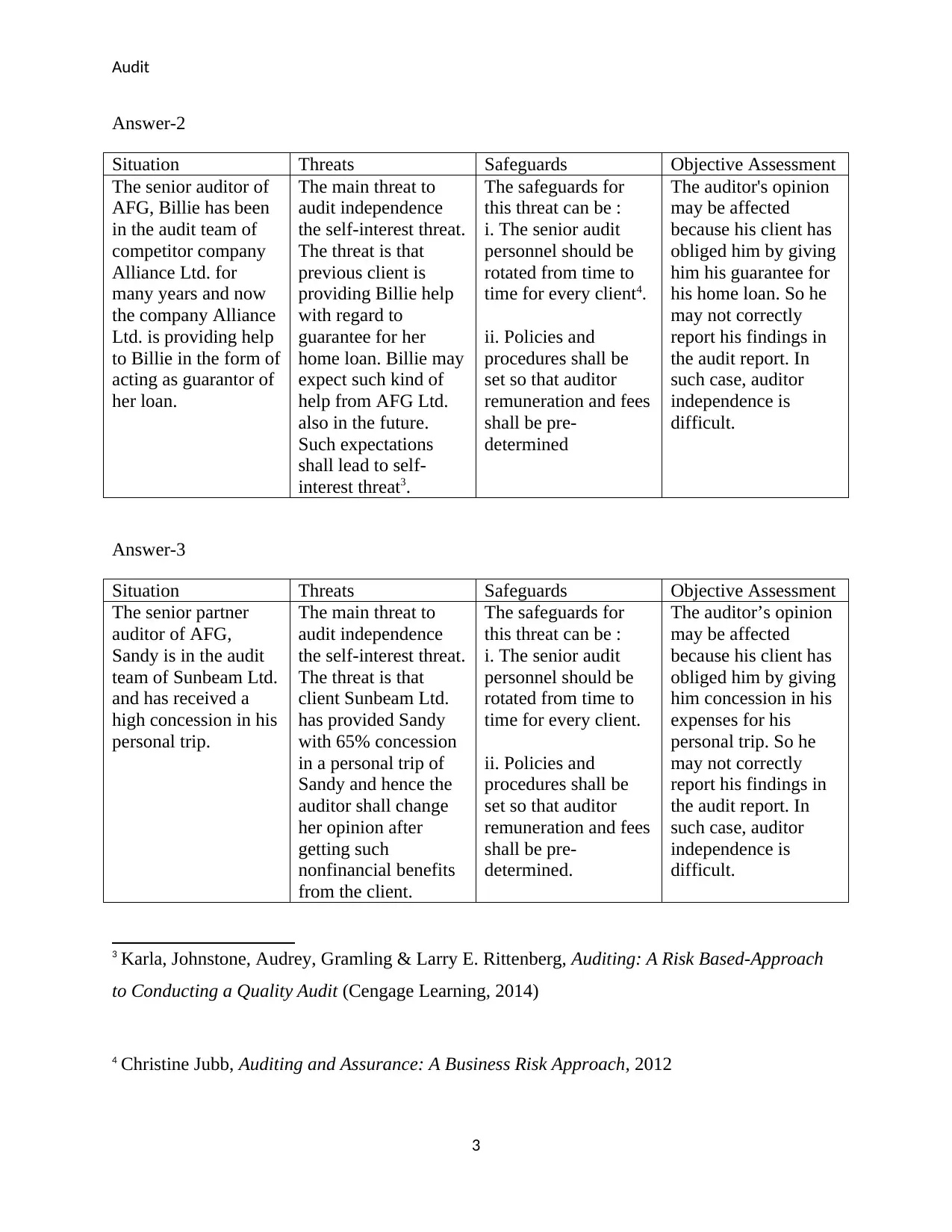

Answer-2

Situation Threats Safeguards Objective Assessment

The senior auditor of

AFG, Billie has been

in the audit team of

competitor company

Alliance Ltd. for

many years and now

the company Alliance

Ltd. is providing help

to Billie in the form of

acting as guarantor of

her loan.

The main threat to

audit independence

the self-interest threat.

The threat is that

previous client is

providing Billie help

with regard to

guarantee for her

home loan. Billie may

expect such kind of

help from AFG Ltd.

also in the future.

Such expectations

shall lead to self-

interest threat3.

The safeguards for

this threat can be :

i. The senior audit

personnel should be

rotated from time to

time for every client4.

ii. Policies and

procedures shall be

set so that auditor

remuneration and fees

shall be pre-

determined

The auditor's opinion

may be affected

because his client has

obliged him by giving

him his guarantee for

his home loan. So he

may not correctly

report his findings in

the audit report. In

such case, auditor

independence is

difficult.

Answer-3

Situation Threats Safeguards Objective Assessment

The senior partner

auditor of AFG,

Sandy is in the audit

team of Sunbeam Ltd.

and has received a

high concession in his

personal trip.

The main threat to

audit independence

the self-interest threat.

The threat is that

client Sunbeam Ltd.

has provided Sandy

with 65% concession

in a personal trip of

Sandy and hence the

auditor shall change

her opinion after

getting such

nonfinancial benefits

from the client.

The safeguards for

this threat can be :

i. The senior audit

personnel should be

rotated from time to

time for every client.

ii. Policies and

procedures shall be

set so that auditor

remuneration and fees

shall be pre-

determined.

The auditor’s opinion

may be affected

because his client has

obliged him by giving

him concession in his

expenses for his

personal trip. So he

may not correctly

report his findings in

the audit report. In

such case, auditor

independence is

difficult.

3 Karla, Johnstone, Audrey, Gramling & Larry E. Rittenberg, Auditing: A Risk Based-Approach

to Conducting a Quality Audit (Cengage Learning, 2014)

4 Christine Jubb, Auditing and Assurance: A Business Risk Approach, 2012

3

Answer-2

Situation Threats Safeguards Objective Assessment

The senior auditor of

AFG, Billie has been

in the audit team of

competitor company

Alliance Ltd. for

many years and now

the company Alliance

Ltd. is providing help

to Billie in the form of

acting as guarantor of

her loan.

The main threat to

audit independence

the self-interest threat.

The threat is that

previous client is

providing Billie help

with regard to

guarantee for her

home loan. Billie may

expect such kind of

help from AFG Ltd.

also in the future.

Such expectations

shall lead to self-

interest threat3.

The safeguards for

this threat can be :

i. The senior audit

personnel should be

rotated from time to

time for every client4.

ii. Policies and

procedures shall be

set so that auditor

remuneration and fees

shall be pre-

determined

The auditor's opinion

may be affected

because his client has

obliged him by giving

him his guarantee for

his home loan. So he

may not correctly

report his findings in

the audit report. In

such case, auditor

independence is

difficult.

Answer-3

Situation Threats Safeguards Objective Assessment

The senior partner

auditor of AFG,

Sandy is in the audit

team of Sunbeam Ltd.

and has received a

high concession in his

personal trip.

The main threat to

audit independence

the self-interest threat.

The threat is that

client Sunbeam Ltd.

has provided Sandy

with 65% concession

in a personal trip of

Sandy and hence the

auditor shall change

her opinion after

getting such

nonfinancial benefits

from the client.

The safeguards for

this threat can be :

i. The senior audit

personnel should be

rotated from time to

time for every client.

ii. Policies and

procedures shall be

set so that auditor

remuneration and fees

shall be pre-

determined.

The auditor’s opinion

may be affected

because his client has

obliged him by giving

him concession in his

expenses for his

personal trip. So he

may not correctly

report his findings in

the audit report. In

such case, auditor

independence is

difficult.

3 Karla, Johnstone, Audrey, Gramling & Larry E. Rittenberg, Auditing: A Risk Based-Approach

to Conducting a Quality Audit (Cengage Learning, 2014)

4 Christine Jubb, Auditing and Assurance: A Business Risk Approach, 2012

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Audit

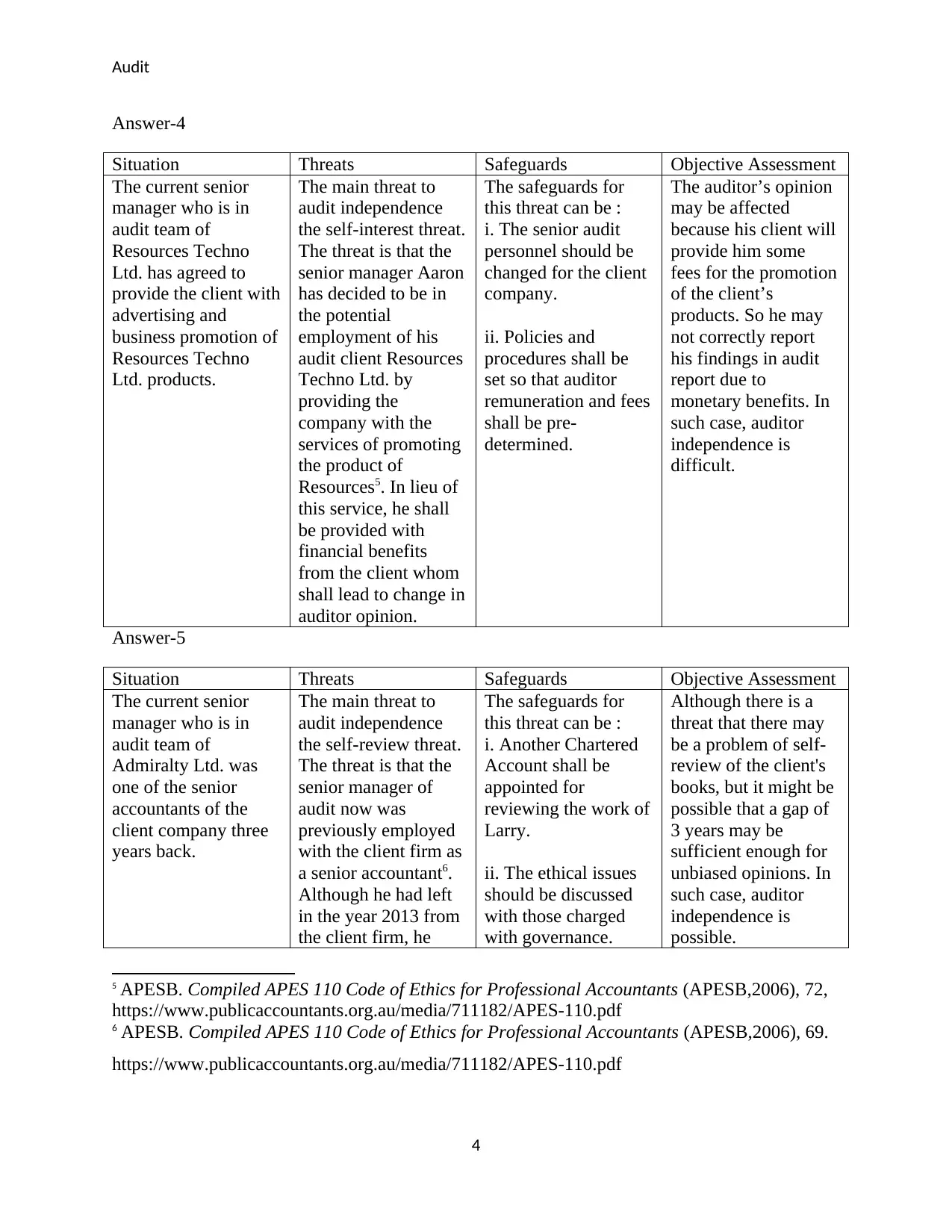

Answer-4

Situation Threats Safeguards Objective Assessment

The current senior

manager who is in

audit team of

Resources Techno

Ltd. has agreed to

provide the client with

advertising and

business promotion of

Resources Techno

Ltd. products.

The main threat to

audit independence

the self-interest threat.

The threat is that the

senior manager Aaron

has decided to be in

the potential

employment of his

audit client Resources

Techno Ltd. by

providing the

company with the

services of promoting

the product of

Resources5. In lieu of

this service, he shall

be provided with

financial benefits

from the client whom

shall lead to change in

auditor opinion.

The safeguards for

this threat can be :

i. The senior audit

personnel should be

changed for the client

company.

ii. Policies and

procedures shall be

set so that auditor

remuneration and fees

shall be pre-

determined.

The auditor’s opinion

may be affected

because his client will

provide him some

fees for the promotion

of the client’s

products. So he may

not correctly report

his findings in audit

report due to

monetary benefits. In

such case, auditor

independence is

difficult.

Answer-5

Situation Threats Safeguards Objective Assessment

The current senior

manager who is in

audit team of

Admiralty Ltd. was

one of the senior

accountants of the

client company three

years back.

The main threat to

audit independence

the self-review threat.

The threat is that the

senior manager of

audit now was

previously employed

with the client firm as

a senior accountant6.

Although he had left

in the year 2013 from

the client firm, he

The safeguards for

this threat can be :

i. Another Chartered

Account shall be

appointed for

reviewing the work of

Larry.

ii. The ethical issues

should be discussed

with those charged

with governance.

Although there is a

threat that there may

be a problem of self-

review of the client's

books, but it might be

possible that a gap of

3 years may be

sufficient enough for

unbiased opinions. In

such case, auditor

independence is

possible.

5 APESB. Compiled APES 110 Code of Ethics for Professional Accountants (APESB,2006), 72,

https://www.publicaccountants.org.au/media/711182/APES-110.pdf

6 APESB. Compiled APES 110 Code of Ethics for Professional Accountants (APESB,2006), 69.

https://www.publicaccountants.org.au/media/711182/APES-110.pdf

4

Answer-4

Situation Threats Safeguards Objective Assessment

The current senior

manager who is in

audit team of

Resources Techno

Ltd. has agreed to

provide the client with

advertising and

business promotion of

Resources Techno

Ltd. products.

The main threat to

audit independence

the self-interest threat.

The threat is that the

senior manager Aaron

has decided to be in

the potential

employment of his

audit client Resources

Techno Ltd. by

providing the

company with the

services of promoting

the product of

Resources5. In lieu of

this service, he shall

be provided with

financial benefits

from the client whom

shall lead to change in

auditor opinion.

The safeguards for

this threat can be :

i. The senior audit

personnel should be

changed for the client

company.

ii. Policies and

procedures shall be

set so that auditor

remuneration and fees

shall be pre-

determined.

The auditor’s opinion

may be affected

because his client will

provide him some

fees for the promotion

of the client’s

products. So he may

not correctly report

his findings in audit

report due to

monetary benefits. In

such case, auditor

independence is

difficult.

Answer-5

Situation Threats Safeguards Objective Assessment

The current senior

manager who is in

audit team of

Admiralty Ltd. was

one of the senior

accountants of the

client company three

years back.

The main threat to

audit independence

the self-review threat.

The threat is that the

senior manager of

audit now was

previously employed

with the client firm as

a senior accountant6.

Although he had left

in the year 2013 from

the client firm, he

The safeguards for

this threat can be :

i. Another Chartered

Account shall be

appointed for

reviewing the work of

Larry.

ii. The ethical issues

should be discussed

with those charged

with governance.

Although there is a

threat that there may

be a problem of self-

review of the client's

books, but it might be

possible that a gap of

3 years may be

sufficient enough for

unbiased opinions. In

such case, auditor

independence is

possible.

5 APESB. Compiled APES 110 Code of Ethics for Professional Accountants (APESB,2006), 72,

https://www.publicaccountants.org.au/media/711182/APES-110.pdf

6 APESB. Compiled APES 110 Code of Ethics for Professional Accountants (APESB,2006), 69.

https://www.publicaccountants.org.au/media/711182/APES-110.pdf

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

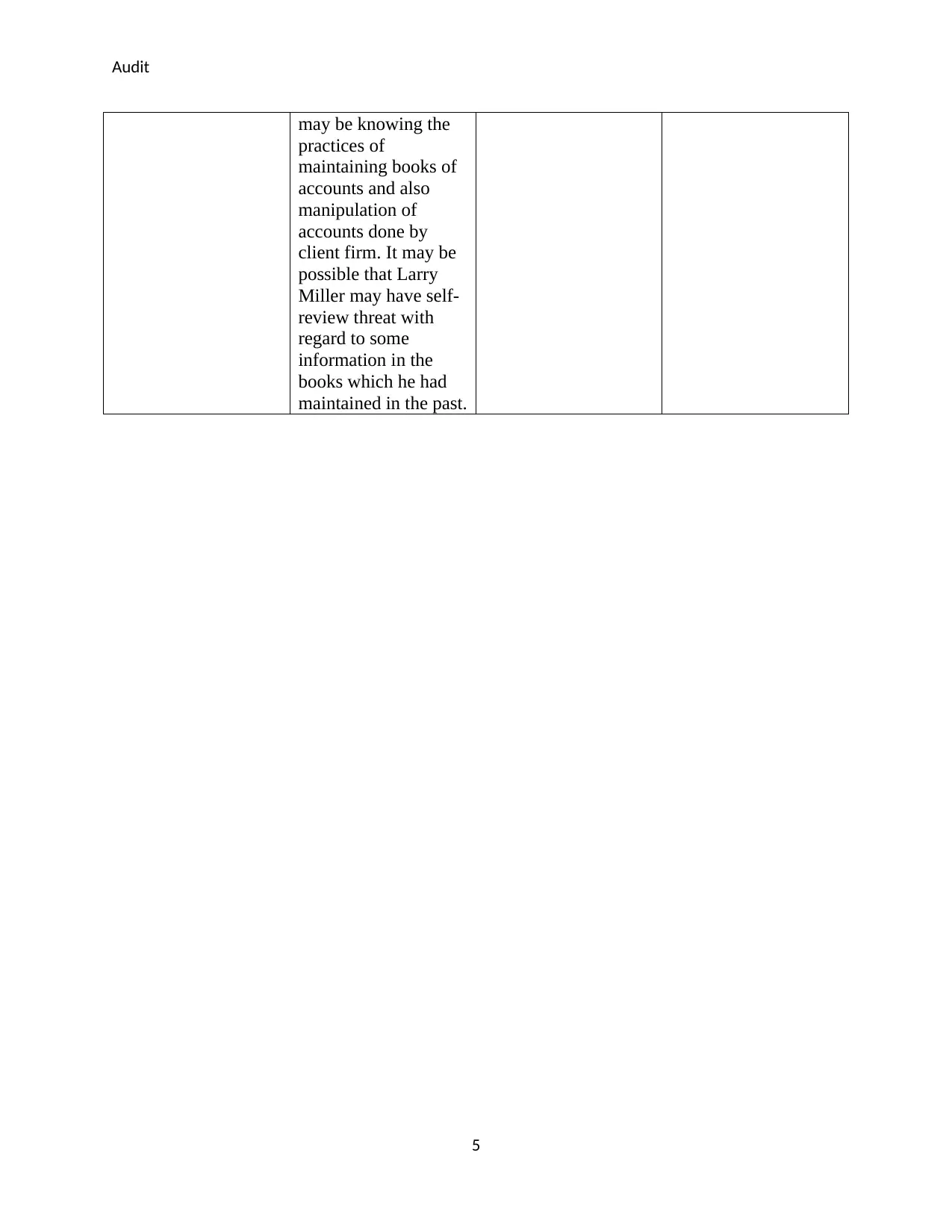

Audit

may be knowing the

practices of

maintaining books of

accounts and also

manipulation of

accounts done by

client firm. It may be

possible that Larry

Miller may have self-

review threat with

regard to some

information in the

books which he had

maintained in the past.

5

may be knowing the

practices of

maintaining books of

accounts and also

manipulation of

accounts done by

client firm. It may be

possible that Larry

Miller may have self-

review threat with

regard to some

information in the

books which he had

maintained in the past.

5

Audit

References

APESB. Compiled APES 110 Code of Ethics for Professional Accountants, 2006.

https://www.publicaccountants.org.au/media/711182/APES-110.pdf

Christine Jubb, Auditing and Assurance: A Business Risk Approach (Deakin University, 2012)

Karla, Johnstone, Audrey, Gramling & Larry E. Rittenberg, Auditing: A Risk Based-Approach to

Conducting a Quality Audit (Cengage Learning, 2014)

6

References

APESB. Compiled APES 110 Code of Ethics for Professional Accountants, 2006.

https://www.publicaccountants.org.au/media/711182/APES-110.pdf

Christine Jubb, Auditing and Assurance: A Business Risk Approach (Deakin University, 2012)

Karla, Johnstone, Audrey, Gramling & Larry E. Rittenberg, Auditing: A Risk Based-Approach to

Conducting a Quality Audit (Cengage Learning, 2014)

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.