Chestnut Enterprises Audit: Procedures, Ethics, and Materiality

VerifiedAdded on 2023/06/06

|12

|2169

|380

Report

AI Summary

This document provides a detailed analysis of audit procedures and professional ethics in the context of Chestnut Enterprises. It evaluates the materiality level for the audit based on the provided trial balance, discussing relevant Australian Auditing Standards. The report includes a ratio analysis to identify potential misstatements, specifically focusing on accounts receivable, repair and maintenance expenditures, and overall expenditures. It outlines audit procedures for these accounts and addresses the importance of considering fraud risk according to ASA 240, regardless of the auditor's personal judgment about employee trustworthiness. The report concludes with recommendations to adjust the materiality level, perform substantive audit procedures, and thoroughly investigate fraud risks. Desklib offers this and many more solved assignments for students.

Running head: AUDIT AND PROFESSIONAL ETHICS

Auditing and Professional Ethics

Name of the Student:

Name of the University:

Authors Note:

Auditing and Professional Ethics

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDIT AND PROFESSIONAL ETHICS

Executive Summary:

In this document a detailed discussion shall be made on the audit procedures of certain account

balances and transactions after evaluating the balances provided in the Trial Balance of Chestnut

Enterprises. The Trial Balance of Chestnut Enterprises for the six months ended on December

2016 has been provided along with balances of previous year ending on June 30, 2016. Based on

the information provided about various account balances a brief discussion on important aspects

of auditing shall be made.

Executive Summary:

In this document a detailed discussion shall be made on the audit procedures of certain account

balances and transactions after evaluating the balances provided in the Trial Balance of Chestnut

Enterprises. The Trial Balance of Chestnut Enterprises for the six months ended on December

2016 has been provided along with balances of previous year ending on June 30, 2016. Based on

the information provided about various account balances a brief discussion on important aspects

of auditing shall be made.

2AUDIT AND PROFESSIONAL ETHICS

Contents

Executive Summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Part 1:...............................................................................................................................................3

Part 2:...............................................................................................................................................4

Part 3:...............................................................................................................................................6

Part 4:...............................................................................................................................................7

Part 5:...............................................................................................................................................8

Conclusion:......................................................................................................................................8

Recommendation:............................................................................................................................9

References:....................................................................................................................................10

Contents

Executive Summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Part 1:...............................................................................................................................................3

Part 2:...............................................................................................................................................4

Part 3:...............................................................................................................................................6

Part 4:...............................................................................................................................................7

Part 5:...............................................................................................................................................8

Conclusion:......................................................................................................................................8

Recommendation:............................................................................................................................9

References:....................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDIT AND PROFESSIONAL ETHICS

Introduction:

Considering the balances provided in Chestnut Trial Balance a detailed discussion on the

materiality level for the audit of the organization shall be made. Along with discussion on the

materiality level for the audit an elaborate audit plan for certain account balances will also be

made for the benefit of the readers in the document.

Part 1:

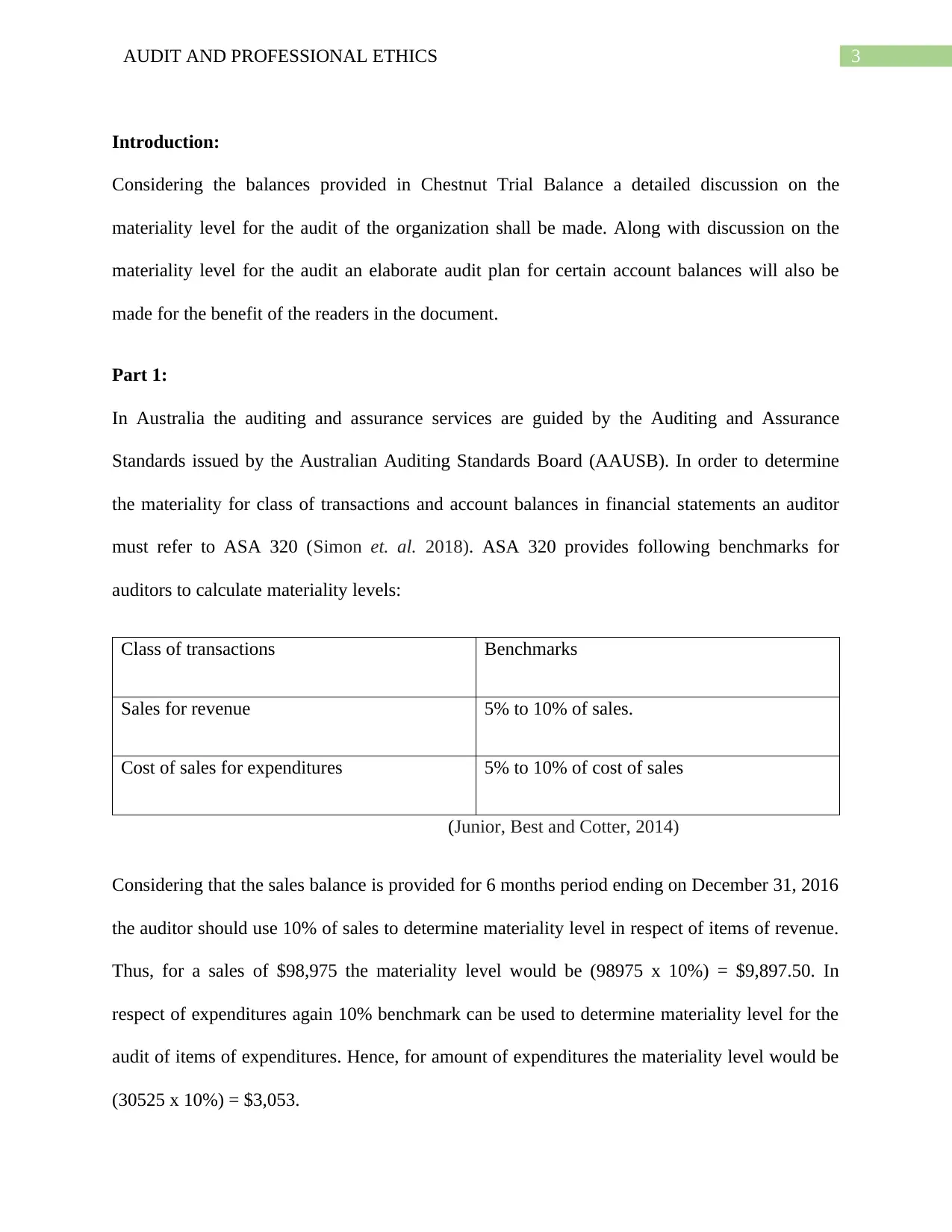

In Australia the auditing and assurance services are guided by the Auditing and Assurance

Standards issued by the Australian Auditing Standards Board (AAUSB). In order to determine

the materiality for class of transactions and account balances in financial statements an auditor

must refer to ASA 320 (Simon et. al. 2018). ASA 320 provides following benchmarks for

auditors to calculate materiality levels:

Class of transactions Benchmarks

Sales for revenue 5% to 10% of sales.

Cost of sales for expenditures 5% to 10% of cost of sales

(Junior, Best and Cotter, 2014)

Considering that the sales balance is provided for 6 months period ending on December 31, 2016

the auditor should use 10% of sales to determine materiality level in respect of items of revenue.

Thus, for a sales of $98,975 the materiality level would be (98975 x 10%) = $9,897.50. In

respect of expenditures again 10% benchmark can be used to determine materiality level for the

audit of items of expenditures. Hence, for amount of expenditures the materiality level would be

(30525 x 10%) = $3,053.

Introduction:

Considering the balances provided in Chestnut Trial Balance a detailed discussion on the

materiality level for the audit of the organization shall be made. Along with discussion on the

materiality level for the audit an elaborate audit plan for certain account balances will also be

made for the benefit of the readers in the document.

Part 1:

In Australia the auditing and assurance services are guided by the Auditing and Assurance

Standards issued by the Australian Auditing Standards Board (AAUSB). In order to determine

the materiality for class of transactions and account balances in financial statements an auditor

must refer to ASA 320 (Simon et. al. 2018). ASA 320 provides following benchmarks for

auditors to calculate materiality levels:

Class of transactions Benchmarks

Sales for revenue 5% to 10% of sales.

Cost of sales for expenditures 5% to 10% of cost of sales

(Junior, Best and Cotter, 2014)

Considering that the sales balance is provided for 6 months period ending on December 31, 2016

the auditor should use 10% of sales to determine materiality level in respect of items of revenue.

Thus, for a sales of $98,975 the materiality level would be (98975 x 10%) = $9,897.50. In

respect of expenditures again 10% benchmark can be used to determine materiality level for the

audit of items of expenditures. Hence, for amount of expenditures the materiality level would be

(30525 x 10%) = $3,053.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDIT AND PROFESSIONAL ETHICS

Thus, the material amount determined initially for the audit is quite high at $15,000. Hence, the

amount of $15,000 is not appropriate for determination of materiality level (Soh and Martinov-

Bennie, 2015).

The change in preliminary assessment would substantially increase the efforts on the part of the

auditor to verify transactions above the material amount. Since earlier it was quite high the

auditor would have to increase their efforts during the course of auditing. Cost of auditing would

obviously increase significantly subsequent to the change in material amount after preliminary

assessment.

Part 2:

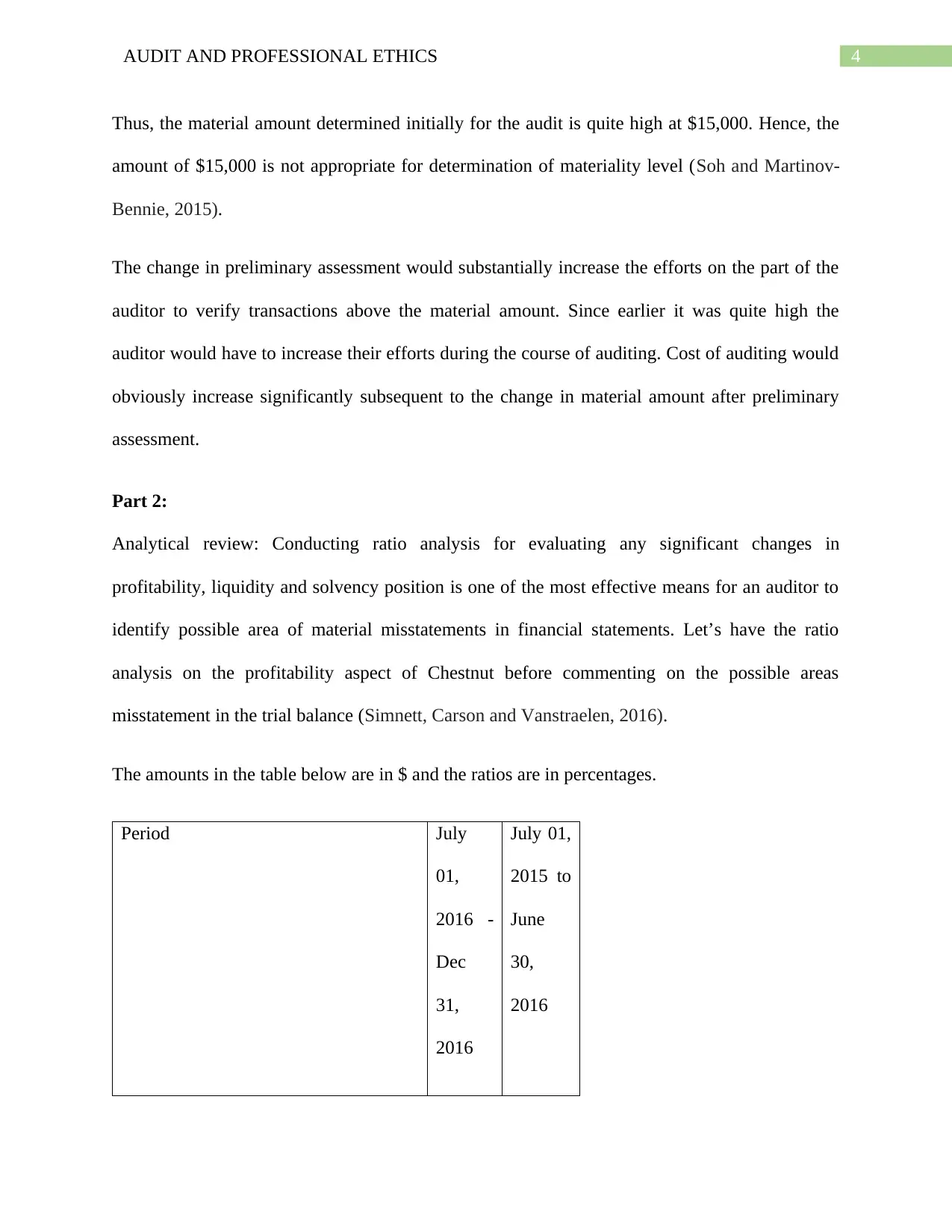

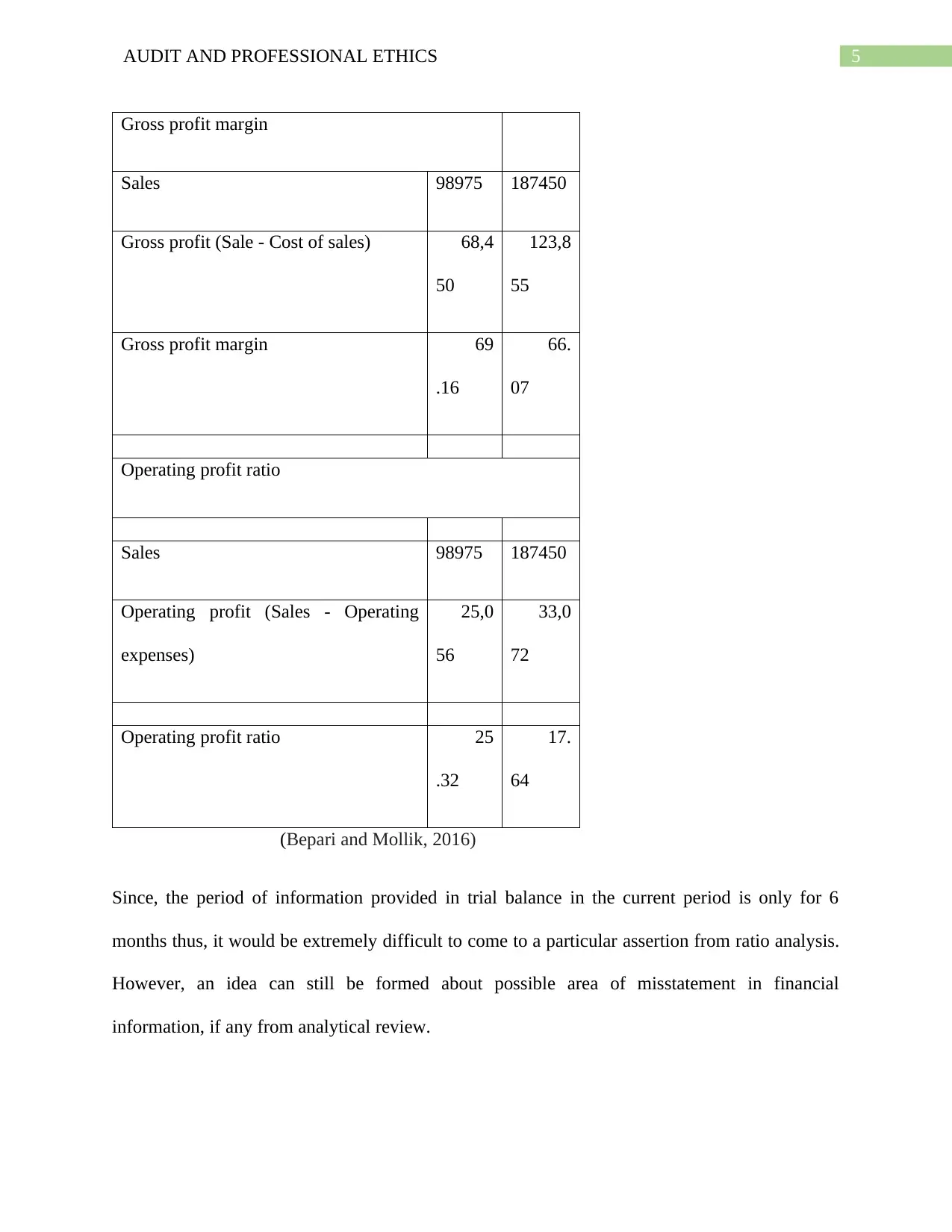

Analytical review: Conducting ratio analysis for evaluating any significant changes in

profitability, liquidity and solvency position is one of the most effective means for an auditor to

identify possible area of material misstatements in financial statements. Let’s have the ratio

analysis on the profitability aspect of Chestnut before commenting on the possible areas

misstatement in the trial balance (Simnett, Carson and Vanstraelen, 2016).

The amounts in the table below are in $ and the ratios are in percentages.

Period July

01,

2016 -

Dec

31,

2016

July 01,

2015 to

June

30,

2016

Thus, the material amount determined initially for the audit is quite high at $15,000. Hence, the

amount of $15,000 is not appropriate for determination of materiality level (Soh and Martinov-

Bennie, 2015).

The change in preliminary assessment would substantially increase the efforts on the part of the

auditor to verify transactions above the material amount. Since earlier it was quite high the

auditor would have to increase their efforts during the course of auditing. Cost of auditing would

obviously increase significantly subsequent to the change in material amount after preliminary

assessment.

Part 2:

Analytical review: Conducting ratio analysis for evaluating any significant changes in

profitability, liquidity and solvency position is one of the most effective means for an auditor to

identify possible area of material misstatements in financial statements. Let’s have the ratio

analysis on the profitability aspect of Chestnut before commenting on the possible areas

misstatement in the trial balance (Simnett, Carson and Vanstraelen, 2016).

The amounts in the table below are in $ and the ratios are in percentages.

Period July

01,

2016 -

Dec

31,

2016

July 01,

2015 to

June

30,

2016

5AUDIT AND PROFESSIONAL ETHICS

Gross profit margin

Sales 98975 187450

Gross profit (Sale - Cost of sales) 68,4

50

123,8

55

Gross profit margin 69

.16

66.

07

Operating profit ratio

Sales 98975 187450

Operating profit (Sales - Operating

expenses)

25,0

56

33,0

72

Operating profit ratio 25

.32

17.

64

(Bepari and Mollik, 2016)

Since, the period of information provided in trial balance in the current period is only for 6

months thus, it would be extremely difficult to come to a particular assertion from ratio analysis.

However, an idea can still be formed about possible area of misstatement in financial

information, if any from analytical review.

Gross profit margin

Sales 98975 187450

Gross profit (Sale - Cost of sales) 68,4

50

123,8

55

Gross profit margin 69

.16

66.

07

Operating profit ratio

Sales 98975 187450

Operating profit (Sales - Operating

expenses)

25,0

56

33,0

72

Operating profit ratio 25

.32

17.

64

(Bepari and Mollik, 2016)

Since, the period of information provided in trial balance in the current period is only for 6

months thus, it would be extremely difficult to come to a particular assertion from ratio analysis.

However, an idea can still be formed about possible area of misstatement in financial

information, if any from analytical review.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDIT AND PROFESSIONAL ETHICS

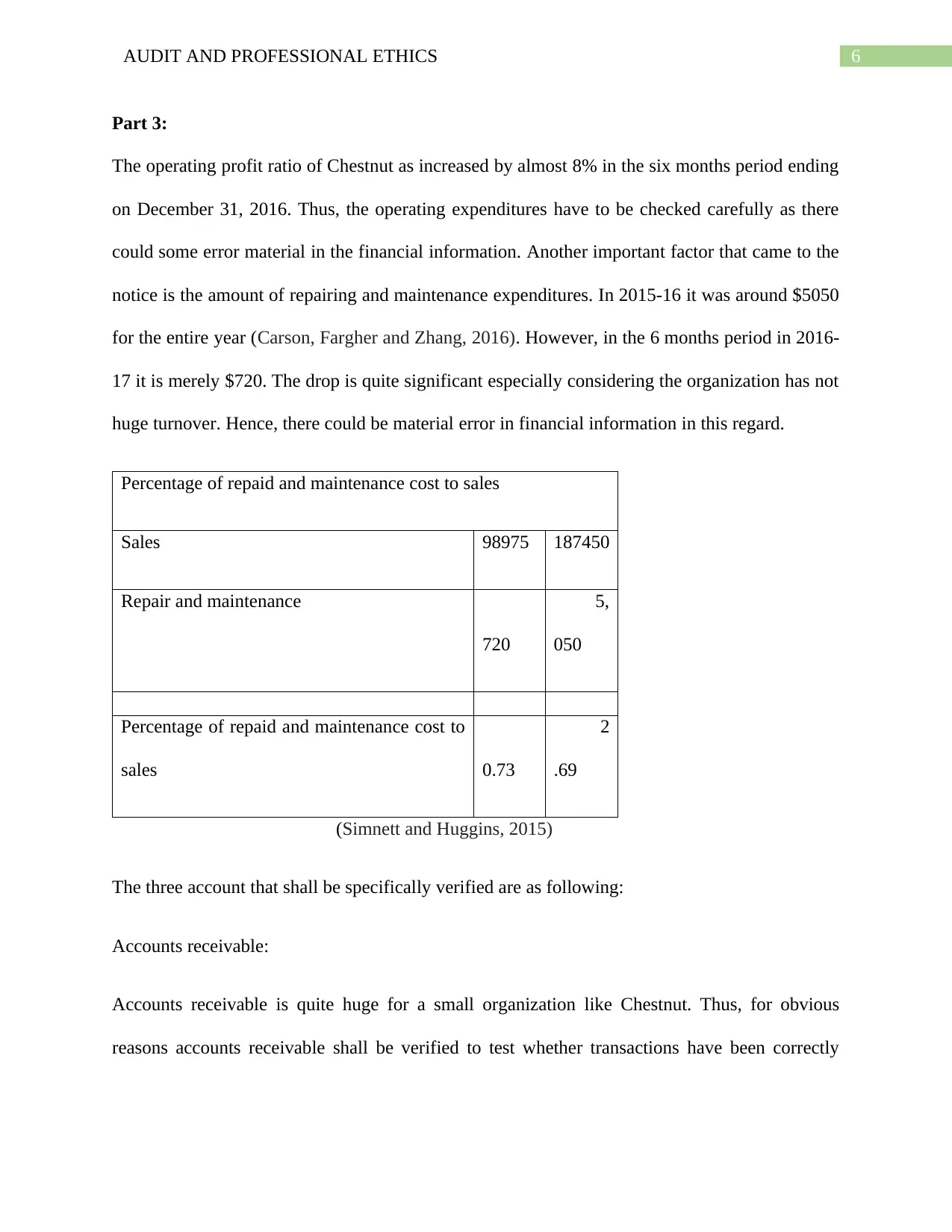

Part 3:

The operating profit ratio of Chestnut as increased by almost 8% in the six months period ending

on December 31, 2016. Thus, the operating expenditures have to be checked carefully as there

could some error material in the financial information. Another important factor that came to the

notice is the amount of repairing and maintenance expenditures. In 2015-16 it was around $5050

for the entire year (Carson, Fargher and Zhang, 2016). However, in the 6 months period in 2016-

17 it is merely $720. The drop is quite significant especially considering the organization has not

huge turnover. Hence, there could be material error in financial information in this regard.

Percentage of repaid and maintenance cost to sales

Sales 98975 187450

Repair and maintenance

720

5,

050

Percentage of repaid and maintenance cost to

sales 0.73

2

.69

(Simnett and Huggins, 2015)

The three account that shall be specifically verified are as following:

Accounts receivable:

Accounts receivable is quite huge for a small organization like Chestnut. Thus, for obvious

reasons accounts receivable shall be verified to test whether transactions have been correctly

Part 3:

The operating profit ratio of Chestnut as increased by almost 8% in the six months period ending

on December 31, 2016. Thus, the operating expenditures have to be checked carefully as there

could some error material in the financial information. Another important factor that came to the

notice is the amount of repairing and maintenance expenditures. In 2015-16 it was around $5050

for the entire year (Carson, Fargher and Zhang, 2016). However, in the 6 months period in 2016-

17 it is merely $720. The drop is quite significant especially considering the organization has not

huge turnover. Hence, there could be material error in financial information in this regard.

Percentage of repaid and maintenance cost to sales

Sales 98975 187450

Repair and maintenance

720

5,

050

Percentage of repaid and maintenance cost to

sales 0.73

2

.69

(Simnett and Huggins, 2015)

The three account that shall be specifically verified are as following:

Accounts receivable:

Accounts receivable is quite huge for a small organization like Chestnut. Thus, for obvious

reasons accounts receivable shall be verified to test whether transactions have been correctly

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDIT AND PROFESSIONAL ETHICS

recorded in accounts receivable ledger to reflect the correct amounts to be receivable for debtors.

The accounts receivable balance is $120,750 as on December 31, 2016 (Ellis, 2018).

Repair and maintenance:

As already mentioned repair and maintenance expenditures is significantly low in the current 6

months compared to the last year. Is it due to anything that the organization has done or has there

been any mistake on the part of the accountant to record the amount of repair and maintenance

expenditures is to be determined by the auditor?

Expenditures:

Cost of sales and other expenditures shall be verified to check whether there is any material error

in reporting these amounts in the trail balance. This is due to importance of the account balances

in determination of profit and loss of the organization (Fu, Carson and Simnett, 2015).

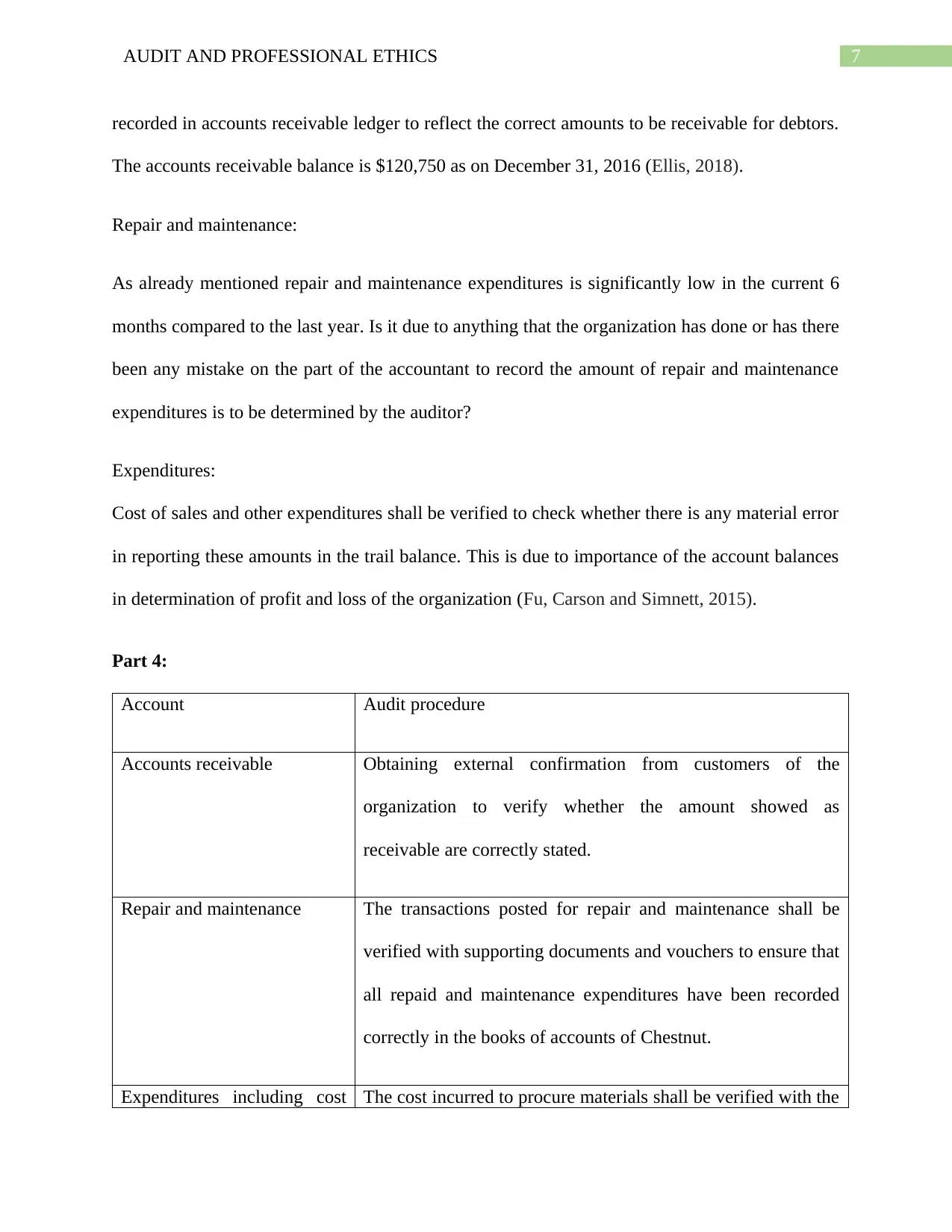

Part 4:

Account Audit procedure

Accounts receivable Obtaining external confirmation from customers of the

organization to verify whether the amount showed as

receivable are correctly stated.

Repair and maintenance The transactions posted for repair and maintenance shall be

verified with supporting documents and vouchers to ensure that

all repaid and maintenance expenditures have been recorded

correctly in the books of accounts of Chestnut.

Expenditures including cost The cost incurred to procure materials shall be verified with the

recorded in accounts receivable ledger to reflect the correct amounts to be receivable for debtors.

The accounts receivable balance is $120,750 as on December 31, 2016 (Ellis, 2018).

Repair and maintenance:

As already mentioned repair and maintenance expenditures is significantly low in the current 6

months compared to the last year. Is it due to anything that the organization has done or has there

been any mistake on the part of the accountant to record the amount of repair and maintenance

expenditures is to be determined by the auditor?

Expenditures:

Cost of sales and other expenditures shall be verified to check whether there is any material error

in reporting these amounts in the trail balance. This is due to importance of the account balances

in determination of profit and loss of the organization (Fu, Carson and Simnett, 2015).

Part 4:

Account Audit procedure

Accounts receivable Obtaining external confirmation from customers of the

organization to verify whether the amount showed as

receivable are correctly stated.

Repair and maintenance The transactions posted for repair and maintenance shall be

verified with supporting documents and vouchers to ensure that

all repaid and maintenance expenditures have been recorded

correctly in the books of accounts of Chestnut.

Expenditures including cost The cost incurred to procure materials shall be verified with the

8AUDIT AND PROFESSIONAL ETHICS

of sales entries posted in the books of accounts for cost of sales. Also

the auditor must check whether all necessary trade discounts

and rebates have been deducted at the time of payment and

accordingly entries have been recorded or not.

(Simnett, Zhou and Hoang, 2016)

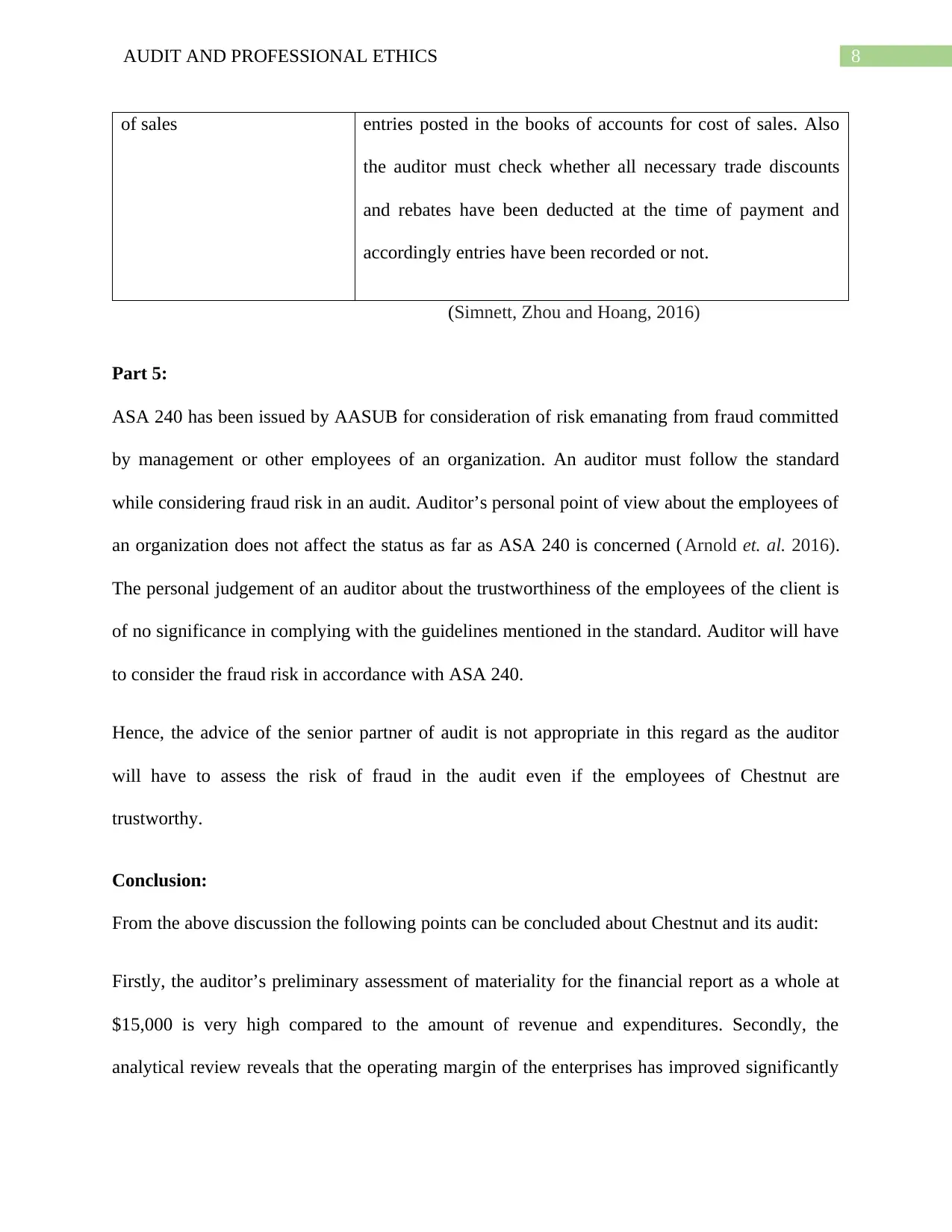

Part 5:

ASA 240 has been issued by AASUB for consideration of risk emanating from fraud committed

by management or other employees of an organization. An auditor must follow the standard

while considering fraud risk in an audit. Auditor’s personal point of view about the employees of

an organization does not affect the status as far as ASA 240 is concerned (Arnold et. al. 2016).

The personal judgement of an auditor about the trustworthiness of the employees of the client is

of no significance in complying with the guidelines mentioned in the standard. Auditor will have

to consider the fraud risk in accordance with ASA 240.

Hence, the advice of the senior partner of audit is not appropriate in this regard as the auditor

will have to assess the risk of fraud in the audit even if the employees of Chestnut are

trustworthy.

Conclusion:

From the above discussion the following points can be concluded about Chestnut and its audit:

Firstly, the auditor’s preliminary assessment of materiality for the financial report as a whole at

$15,000 is very high compared to the amount of revenue and expenditures. Secondly, the

analytical review reveals that the operating margin of the enterprises has improved significantly

of sales entries posted in the books of accounts for cost of sales. Also

the auditor must check whether all necessary trade discounts

and rebates have been deducted at the time of payment and

accordingly entries have been recorded or not.

(Simnett, Zhou and Hoang, 2016)

Part 5:

ASA 240 has been issued by AASUB for consideration of risk emanating from fraud committed

by management or other employees of an organization. An auditor must follow the standard

while considering fraud risk in an audit. Auditor’s personal point of view about the employees of

an organization does not affect the status as far as ASA 240 is concerned (Arnold et. al. 2016).

The personal judgement of an auditor about the trustworthiness of the employees of the client is

of no significance in complying with the guidelines mentioned in the standard. Auditor will have

to consider the fraud risk in accordance with ASA 240.

Hence, the advice of the senior partner of audit is not appropriate in this regard as the auditor

will have to assess the risk of fraud in the audit even if the employees of Chestnut are

trustworthy.

Conclusion:

From the above discussion the following points can be concluded about Chestnut and its audit:

Firstly, the auditor’s preliminary assessment of materiality for the financial report as a whole at

$15,000 is very high compared to the amount of revenue and expenditures. Secondly, the

analytical review reveals that the operating margin of the enterprises has improved significantly

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDIT AND PROFESSIONAL ETHICS

in the 6 months ending period in December, 2016. However, the repairing and maintenance

expenditures seems have been misstated in the period. Finally, the suggestion given by the audit

partner for not verifying the risk of fraud in the audit is not correct.

Recommendation:

The auditor must change the materiality level and lower the amount for financial statement as

whole to ensure that more number of transactions are verified and tested with substantive audit

procedures. The auditor must use substantive audit procedures on accounts receivable, repair and

maintenance and cost of sales along with other account heads. The suggestion of audit partner for

fraud risk purpose is not appropriate hence, must be ignored by the auditor. In fact the auditor

must use ASA 240 to verify whether there has been any fraud (Yao, Percy and Hu, 2015).

in the 6 months ending period in December, 2016. However, the repairing and maintenance

expenditures seems have been misstated in the period. Finally, the suggestion given by the audit

partner for not verifying the risk of fraud in the audit is not correct.

Recommendation:

The auditor must change the materiality level and lower the amount for financial statement as

whole to ensure that more number of transactions are verified and tested with substantive audit

procedures. The auditor must use substantive audit procedures on accounts receivable, repair and

maintenance and cost of sales along with other account heads. The suggestion of audit partner for

fraud risk purpose is not appropriate hence, must be ignored by the auditor. In fact the auditor

must use ASA 240 to verify whether there has been any fraud (Yao, Percy and Hu, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDIT AND PROFESSIONAL ETHICS

References:

Arnold, B., Bateman, H., Ferguson, A. and Raftery, A., 2016. Partner-Scale Economies, Service

Bundling, and Auditor Independence in the Australian Self-Managed Superannuation (Pension)

Fund Industry. Auditing: A Journal of Practice & Theory, 36(2), pp.161-180.

Bepari, M.K. and Mollik, A.T., 2016. Stakeholders’ interest in sustainability assurance process:

An examination of assurance statements reported by Australian companies. Managerial Auditing

Journal, 31(6/7), pp.655-687.

Carson, E., Fargher, N. and Zhang, Y., 2016. Trends in auditor reporting in Australia: a synthesis

and opportunities for research. Australian Accounting Review, 26(3), pp.226-242.

Ellis, R., 2018. Quality assurance for university teaching: Issues and approaches. In Handbook of

Quality Assurance for University Teaching (pp. 21-36). Routledge.

Fu, Y., Carson, E. and Simnett, R., 2015. Transparency report disclosure by Australian audit

firms and opportunities for research. Managerial Auditing Journal, 30(8/9), pp.870-910.

Junior, R.M., Best, P.J. and Cotter, J., 2014. Sustainability reporting and assurance: A historical

analysis on a world-wide phenomenon. Journal of Business Ethics, 120(1), pp.1-11.

Simnett, R., Carson, E. and Vanstraelen, A., 2016. International archival auditing and assurance

research: Trends, methodological issues, and opportunities. Auditing: A Journal of Practice &

Theory, 35(3), pp.1-32.

Simnett, R. and Huggins, A.L., 2015. Integrated reporting and assurance: where can research add

value?. Sustainability Accounting, Management and Policy Journal, 6(1), pp.29-53.

References:

Arnold, B., Bateman, H., Ferguson, A. and Raftery, A., 2016. Partner-Scale Economies, Service

Bundling, and Auditor Independence in the Australian Self-Managed Superannuation (Pension)

Fund Industry. Auditing: A Journal of Practice & Theory, 36(2), pp.161-180.

Bepari, M.K. and Mollik, A.T., 2016. Stakeholders’ interest in sustainability assurance process:

An examination of assurance statements reported by Australian companies. Managerial Auditing

Journal, 31(6/7), pp.655-687.

Carson, E., Fargher, N. and Zhang, Y., 2016. Trends in auditor reporting in Australia: a synthesis

and opportunities for research. Australian Accounting Review, 26(3), pp.226-242.

Ellis, R., 2018. Quality assurance for university teaching: Issues and approaches. In Handbook of

Quality Assurance for University Teaching (pp. 21-36). Routledge.

Fu, Y., Carson, E. and Simnett, R., 2015. Transparency report disclosure by Australian audit

firms and opportunities for research. Managerial Auditing Journal, 30(8/9), pp.870-910.

Junior, R.M., Best, P.J. and Cotter, J., 2014. Sustainability reporting and assurance: A historical

analysis on a world-wide phenomenon. Journal of Business Ethics, 120(1), pp.1-11.

Simnett, R., Carson, E. and Vanstraelen, A., 2016. International archival auditing and assurance

research: Trends, methodological issues, and opportunities. Auditing: A Journal of Practice &

Theory, 35(3), pp.1-32.

Simnett, R. and Huggins, A.L., 2015. Integrated reporting and assurance: where can research add

value?. Sustainability Accounting, Management and Policy Journal, 6(1), pp.29-53.

11AUDIT AND PROFESSIONAL ETHICS

Simnett, R., Zhou, S. and Hoang, H., 2016. Assurance and other credibility enhancing

mechanisms for integrated reporting. In Integrated Reporting (pp. 269-286). Palgrave

Macmillan, London.

Simon, C.A., Smith, J.L. and Zimbelman, M.F., 2018. The Influence of Judgment

Decomposition on Auditors' Fraud Risk Assessments: Some Tradeoffs. The Accounting Review.

Soh, D.S. and Martinov-Bennie, N., 2015. Internal auditors’ perceptions of their role in

environmental, social and governance assurance and consulting. Managerial Auditing

Journal, 30(1), pp.80-111.

Yao, D.F.T., Percy, M. and Hu, F., 2015. Fair value accounting for non-current assets and audit

fees: Evidence from Australian companies. Journal of Contemporary Accounting &

Economics, 11(1), pp.31-45.

Simnett, R., Zhou, S. and Hoang, H., 2016. Assurance and other credibility enhancing

mechanisms for integrated reporting. In Integrated Reporting (pp. 269-286). Palgrave

Macmillan, London.

Simon, C.A., Smith, J.L. and Zimbelman, M.F., 2018. The Influence of Judgment

Decomposition on Auditors' Fraud Risk Assessments: Some Tradeoffs. The Accounting Review.

Soh, D.S. and Martinov-Bennie, N., 2015. Internal auditors’ perceptions of their role in

environmental, social and governance assurance and consulting. Managerial Auditing

Journal, 30(1), pp.80-111.

Yao, D.F.T., Percy, M. and Hu, F., 2015. Fair value accounting for non-current assets and audit

fees: Evidence from Australian companies. Journal of Contemporary Accounting &

Economics, 11(1), pp.31-45.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.