Audit, Assurance, and Compliance: Individual Assignment Report

VerifiedAdded on 2020/02/24

|10

|1424

|48

Report

AI Summary

This individual assignment report focuses on audit, assurance, and compliance, providing a detailed analysis of financial statements. The report begins with an analysis of various financial ratios, including current ratio, quick ratio, and inventory turnover, evaluating their trends over a three-year period and assessing their audit implications. The second part of the report delves into inherent risks, identifying potential misstatements related to inventory valuation and e-book revenue recognition. The report highlights complexities in transaction recording and revenue allocation. The final section addresses fraud risks, specifically examining cash receipt processes and the implementation of a new IT system, along with their impact on the audit process. The report provides a thorough examination of audit procedures, risk assessment, and compliance considerations.

Audit, Assurance, and Compliance

INDIVIDUAL ASSIGNMENT 1

1 | P a g e

INDIVIDUAL ASSIGNMENT 1

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Solution 1.........................................................................................................................................3

Solution 2.........................................................................................................................................6

Solution 3.........................................................................................................................................8

References......................................................................................................................................10

2 | P a g e

Solution 1.........................................................................................................................................3

Solution 2.........................................................................................................................................6

Solution 3.........................................................................................................................................8

References......................................................................................................................................10

2 | P a g e

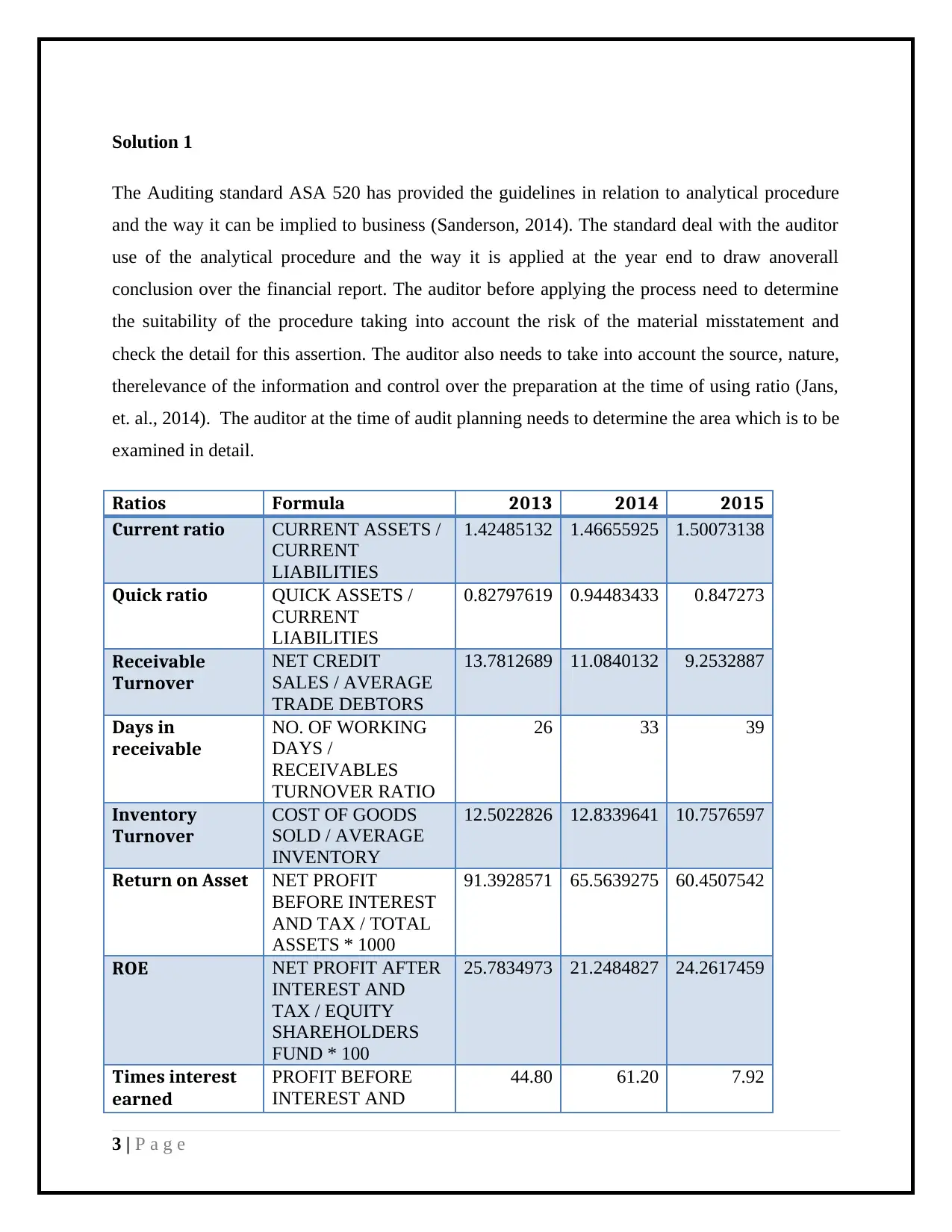

Solution 1

The Auditing standard ASA 520 has provided the guidelines in relation to analytical procedure

and the way it can be implied to business (Sanderson, 2014). The standard deal with the auditor

use of the analytical procedure and the way it is applied at the year end to draw anoverall

conclusion over the financial report. The auditor before applying the process need to determine

the suitability of the procedure taking into account the risk of the material misstatement and

check the detail for this assertion. The auditor also needs to take into account the source, nature,

therelevance of the information and control over the preparation at the time of using ratio (Jans,

et. al., 2014). The auditor at the time of audit planning needs to determine the area which is to be

examined in detail.

Ratios Formula 2013 2014 2015

Current ratio CURRENT ASSETS /

CURRENT

LIABILITIES

1.42485132 1.46655925 1.50073138

Quick ratio QUICK ASSETS /

CURRENT

LIABILITIES

0.82797619 0.94483433 0.847273

Receivable

Turnover

NET CREDIT

SALES / AVERAGE

TRADE DEBTORS

13.7812689 11.0840132 9.2532887

Days in

receivable

NO. OF WORKING

DAYS /

RECEIVABLES

TURNOVER RATIO

26 33 39

Inventory

Turnover

COST OF GOODS

SOLD / AVERAGE

INVENTORY

12.5022826 12.8339641 10.7576597

Return on Asset NET PROFIT

BEFORE INTEREST

AND TAX / TOTAL

ASSETS * 1000

91.3928571 65.5639275 60.4507542

ROE NET PROFIT AFTER

INTEREST AND

TAX / EQUITY

SHAREHOLDERS

FUND * 100

25.7834973 21.2484827 24.2617459

Times interest

earned

PROFIT BEFORE

INTEREST AND

44.80 61.20 7.92

3 | P a g e

The Auditing standard ASA 520 has provided the guidelines in relation to analytical procedure

and the way it can be implied to business (Sanderson, 2014). The standard deal with the auditor

use of the analytical procedure and the way it is applied at the year end to draw anoverall

conclusion over the financial report. The auditor before applying the process need to determine

the suitability of the procedure taking into account the risk of the material misstatement and

check the detail for this assertion. The auditor also needs to take into account the source, nature,

therelevance of the information and control over the preparation at the time of using ratio (Jans,

et. al., 2014). The auditor at the time of audit planning needs to determine the area which is to be

examined in detail.

Ratios Formula 2013 2014 2015

Current ratio CURRENT ASSETS /

CURRENT

LIABILITIES

1.42485132 1.46655925 1.50073138

Quick ratio QUICK ASSETS /

CURRENT

LIABILITIES

0.82797619 0.94483433 0.847273

Receivable

Turnover

NET CREDIT

SALES / AVERAGE

TRADE DEBTORS

13.7812689 11.0840132 9.2532887

Days in

receivable

NO. OF WORKING

DAYS /

RECEIVABLES

TURNOVER RATIO

26 33 39

Inventory

Turnover

COST OF GOODS

SOLD / AVERAGE

INVENTORY

12.5022826 12.8339641 10.7576597

Return on Asset NET PROFIT

BEFORE INTEREST

AND TAX / TOTAL

ASSETS * 1000

91.3928571 65.5639275 60.4507542

ROE NET PROFIT AFTER

INTEREST AND

TAX / EQUITY

SHAREHOLDERS

FUND * 100

25.7834973 21.2484827 24.2617459

Times interest

earned

PROFIT BEFORE

INTEREST AND

44.80 61.20 7.92

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

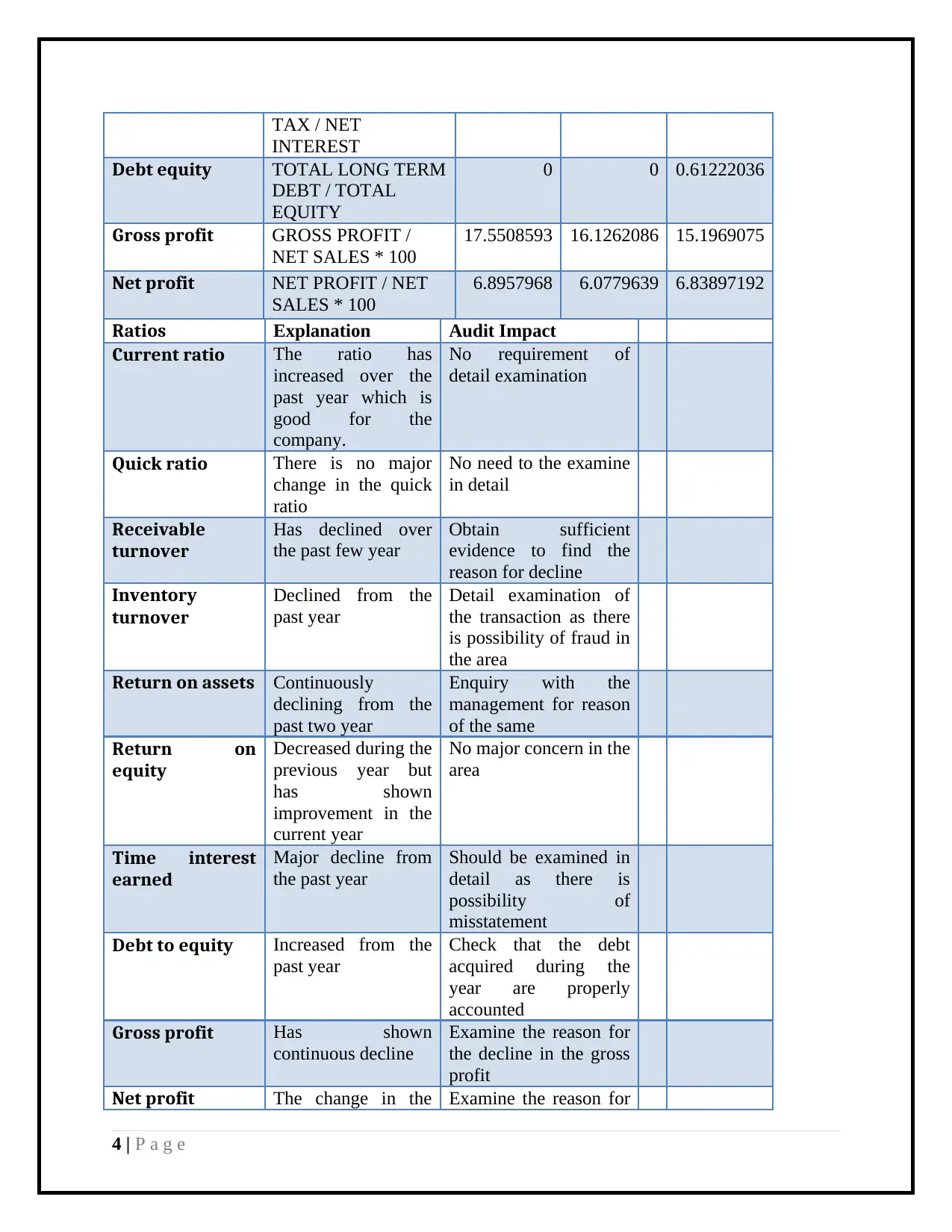

TAX / NET

INTEREST

Debt equity TOTAL LONG TERM

DEBT / TOTAL

EQUITY

0 0 0.61222036

Gross profit GROSS PROFIT /

NET SALES * 100

17.5508593 16.1262086 15.1969075

Net profit NET PROFIT / NET

SALES * 100

6.8957968 6.0779639 6.83897192

Ratios Explanation Audit Impact

Current ratio The ratio has

increased over the

past year which is

good for the

company.

No requirement of

detail examination

Quick ratio There is no major

change in the quick

ratio

No need to the examine

in detail

Receivable

turnover

Has declined over

the past few year

Obtain sufficient

evidence to find the

reason for decline

Inventory

turnover

Declined from the

past year

Detail examination of

the transaction as there

is possibility of fraud in

the area

Return on assets Continuously

declining from the

past two year

Enquiry with the

management for reason

of the same

Return on

equity

Decreased during the

previous year but

has shown

improvement in the

current year

No major concern in the

area

Time interest

earned

Major decline from

the past year

Should be examined in

detail as there is

possibility of

misstatement

Debt to equity Increased from the

past year

Check that the debt

acquired during the

year are properly

accounted

Gross profit Has shown

continuous decline

Examine the reason for

the decline in the gross

profit

Net profit The change in the Examine the reason for

4 | P a g e

INTEREST

Debt equity TOTAL LONG TERM

DEBT / TOTAL

EQUITY

0 0 0.61222036

Gross profit GROSS PROFIT /

NET SALES * 100

17.5508593 16.1262086 15.1969075

Net profit NET PROFIT / NET

SALES * 100

6.8957968 6.0779639 6.83897192

Ratios Explanation Audit Impact

Current ratio The ratio has

increased over the

past year which is

good for the

company.

No requirement of

detail examination

Quick ratio There is no major

change in the quick

ratio

No need to the examine

in detail

Receivable

turnover

Has declined over

the past few year

Obtain sufficient

evidence to find the

reason for decline

Inventory

turnover

Declined from the

past year

Detail examination of

the transaction as there

is possibility of fraud in

the area

Return on assets Continuously

declining from the

past two year

Enquiry with the

management for reason

of the same

Return on

equity

Decreased during the

previous year but

has shown

improvement in the

current year

No major concern in the

area

Time interest

earned

Major decline from

the past year

Should be examined in

detail as there is

possibility of

misstatement

Debt to equity Increased from the

past year

Check that the debt

acquired during the

year are properly

accounted

Gross profit Has shown

continuous decline

Examine the reason for

the decline in the gross

profit

Net profit The change in the Examine the reason for

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

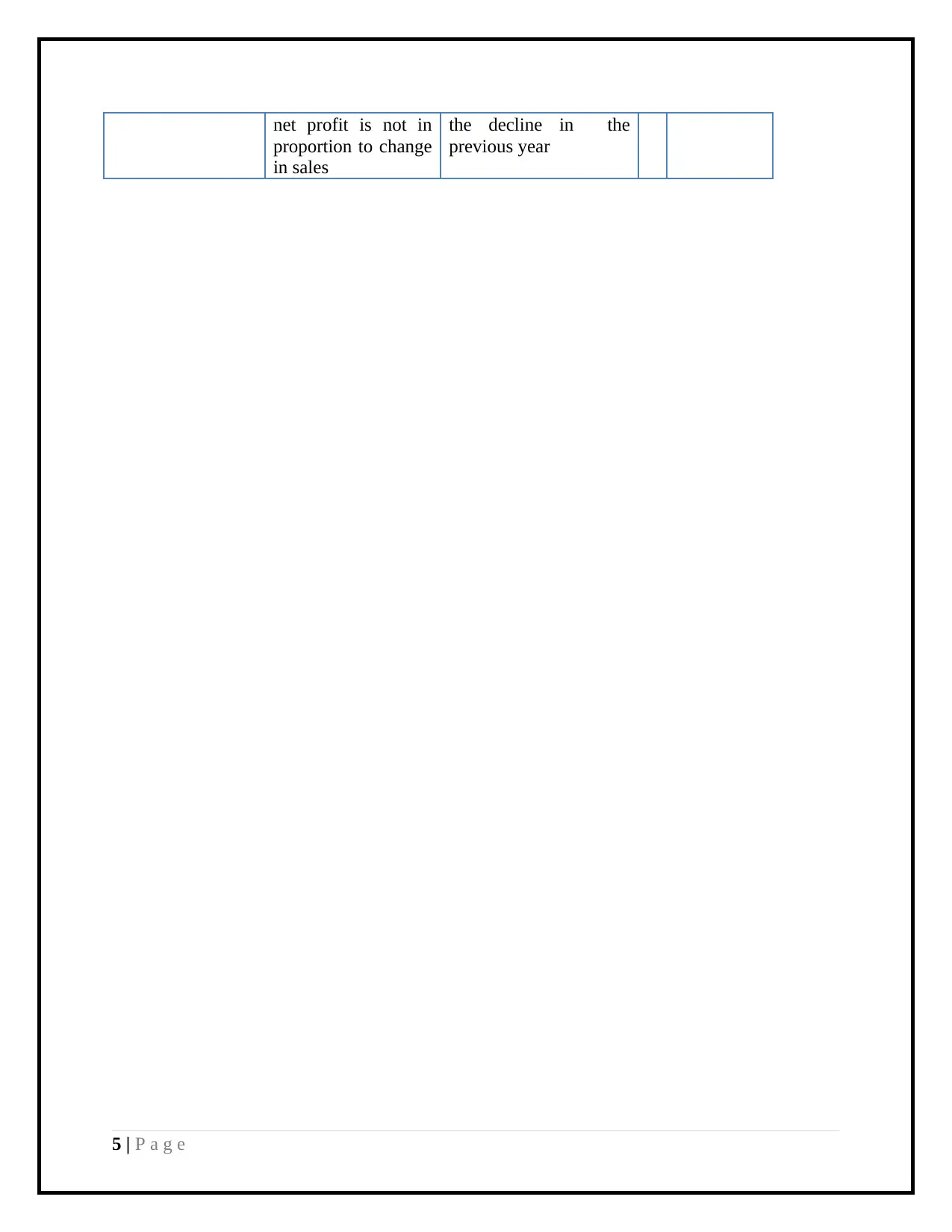

net profit is not in

proportion to change

in sales

the decline in the

previous year

5 | P a g e

proportion to change

in sales

the decline in the

previous year

5 | P a g e

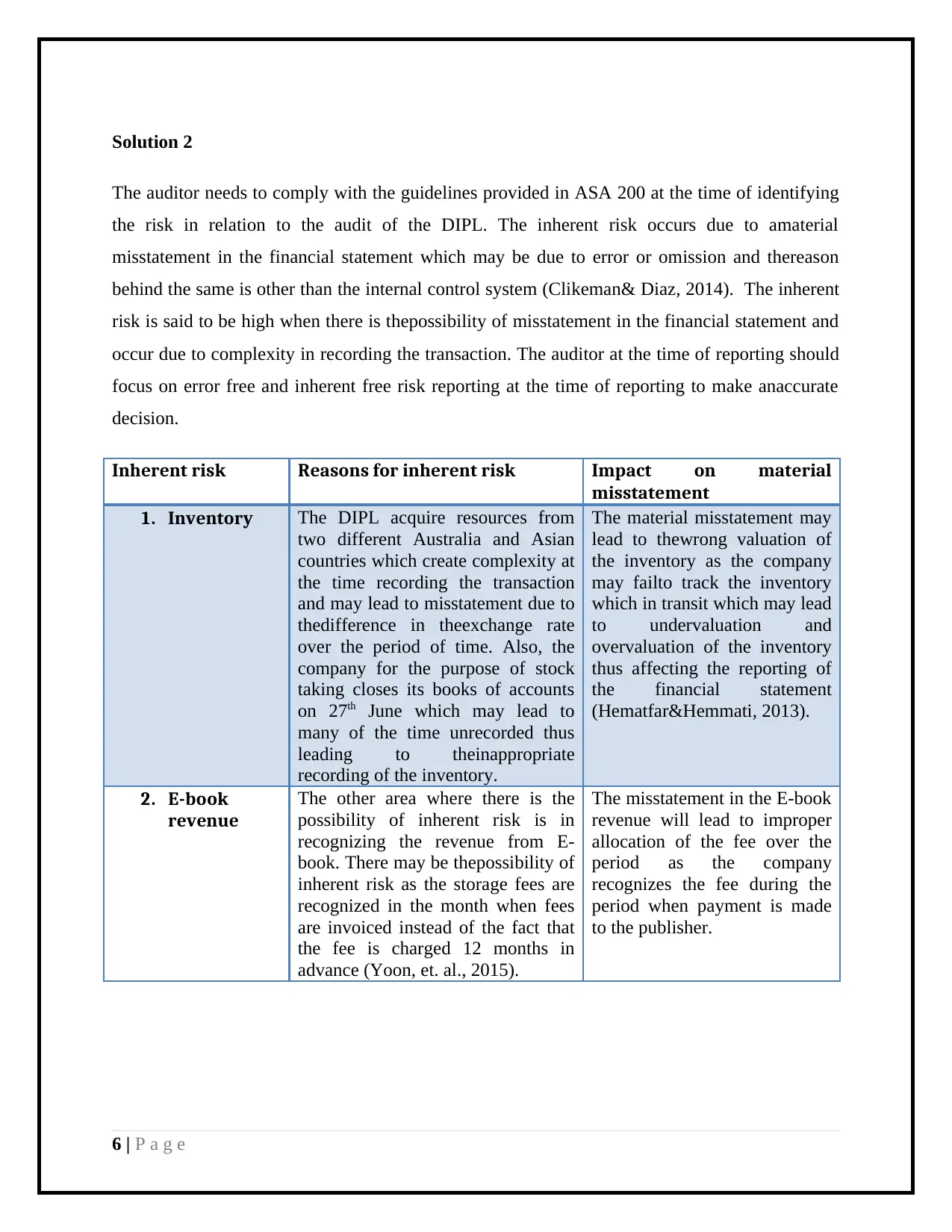

Solution 2

The auditor needs to comply with the guidelines provided in ASA 200 at the time of identifying

the risk in relation to the audit of the DIPL. The inherent risk occurs due to amaterial

misstatement in the financial statement which may be due to error or omission and thereason

behind the same is other than the internal control system (Clikeman& Diaz, 2014). The inherent

risk is said to be high when there is thepossibility of misstatement in the financial statement and

occur due to complexity in recording the transaction. The auditor at the time of reporting should

focus on error free and inherent free risk reporting at the time of reporting to make anaccurate

decision.

Inherent risk Reasons for inherent risk Impact on material

misstatement

1. Inventory The DIPL acquire resources from

two different Australia and Asian

countries which create complexity at

the time recording the transaction

and may lead to misstatement due to

thedifference in theexchange rate

over the period of time. Also, the

company for the purpose of stock

taking closes its books of accounts

on 27th June which may lead to

many of the time unrecorded thus

leading to theinappropriate

recording of the inventory.

The material misstatement may

lead to thewrong valuation of

the inventory as the company

may failto track the inventory

which in transit which may lead

to undervaluation and

overvaluation of the inventory

thus affecting the reporting of

the financial statement

(Hematfar&Hemmati, 2013).

2. E-book

revenue

The other area where there is the

possibility of inherent risk is in

recognizing the revenue from E-

book. There may be thepossibility of

inherent risk as the storage fees are

recognized in the month when fees

are invoiced instead of the fact that

the fee is charged 12 months in

advance (Yoon, et. al., 2015).

The misstatement in the E-book

revenue will lead to improper

allocation of the fee over the

period as the company

recognizes the fee during the

period when payment is made

to the publisher.

6 | P a g e

The auditor needs to comply with the guidelines provided in ASA 200 at the time of identifying

the risk in relation to the audit of the DIPL. The inherent risk occurs due to amaterial

misstatement in the financial statement which may be due to error or omission and thereason

behind the same is other than the internal control system (Clikeman& Diaz, 2014). The inherent

risk is said to be high when there is thepossibility of misstatement in the financial statement and

occur due to complexity in recording the transaction. The auditor at the time of reporting should

focus on error free and inherent free risk reporting at the time of reporting to make anaccurate

decision.

Inherent risk Reasons for inherent risk Impact on material

misstatement

1. Inventory The DIPL acquire resources from

two different Australia and Asian

countries which create complexity at

the time recording the transaction

and may lead to misstatement due to

thedifference in theexchange rate

over the period of time. Also, the

company for the purpose of stock

taking closes its books of accounts

on 27th June which may lead to

many of the time unrecorded thus

leading to theinappropriate

recording of the inventory.

The material misstatement may

lead to thewrong valuation of

the inventory as the company

may failto track the inventory

which in transit which may lead

to undervaluation and

overvaluation of the inventory

thus affecting the reporting of

the financial statement

(Hematfar&Hemmati, 2013).

2. E-book

revenue

The other area where there is the

possibility of inherent risk is in

recognizing the revenue from E-

book. There may be thepossibility of

inherent risk as the storage fees are

recognized in the month when fees

are invoiced instead of the fact that

the fee is charged 12 months in

advance (Yoon, et. al., 2015).

The misstatement in the E-book

revenue will lead to improper

allocation of the fee over the

period as the company

recognizes the fee during the

period when payment is made

to the publisher.

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

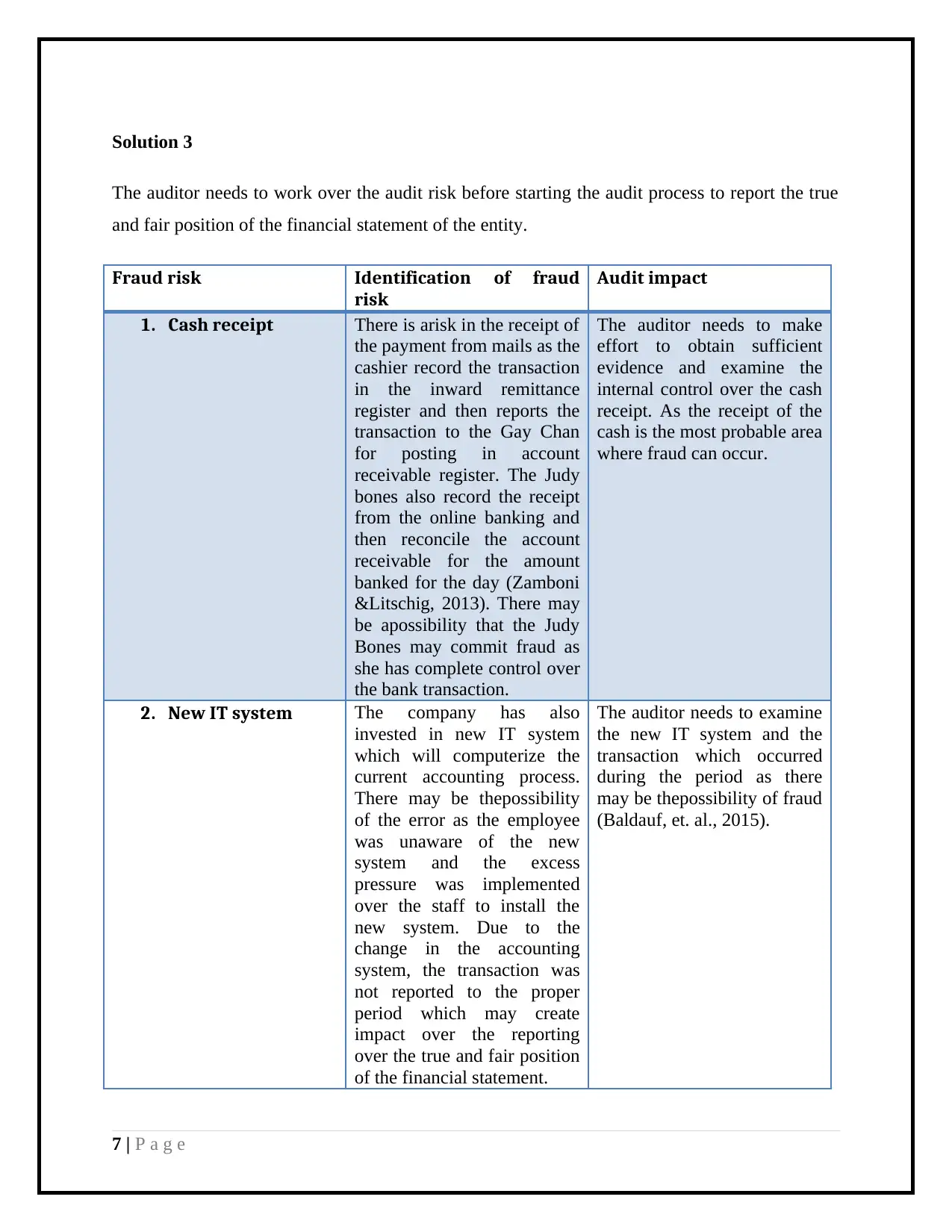

Solution 3

The auditor needs to work over the audit risk before starting the audit process to report the true

and fair position of the financial statement of the entity.

Fraud risk Identification of fraud

risk

Audit impact

1. Cash receipt There is arisk in the receipt of

the payment from mails as the

cashier record the transaction

in the inward remittance

register and then reports the

transaction to the Gay Chan

for posting in account

receivable register. The Judy

bones also record the receipt

from the online banking and

then reconcile the account

receivable for the amount

banked for the day (Zamboni

&Litschig, 2013). There may

be apossibility that the Judy

Bones may commit fraud as

she has complete control over

the bank transaction.

The auditor needs to make

effort to obtain sufficient

evidence and examine the

internal control over the cash

receipt. As the receipt of the

cash is the most probable area

where fraud can occur.

2. New IT system The company has also

invested in new IT system

which will computerize the

current accounting process.

There may be thepossibility

of the error as the employee

was unaware of the new

system and the excess

pressure was implemented

over the staff to install the

new system. Due to the

change in the accounting

system, the transaction was

not reported to the proper

period which may create

impact over the reporting

over the true and fair position

of the financial statement.

The auditor needs to examine

the new IT system and the

transaction which occurred

during the period as there

may be thepossibility of fraud

(Baldauf, et. al., 2015).

7 | P a g e

The auditor needs to work over the audit risk before starting the audit process to report the true

and fair position of the financial statement of the entity.

Fraud risk Identification of fraud

risk

Audit impact

1. Cash receipt There is arisk in the receipt of

the payment from mails as the

cashier record the transaction

in the inward remittance

register and then reports the

transaction to the Gay Chan

for posting in account

receivable register. The Judy

bones also record the receipt

from the online banking and

then reconcile the account

receivable for the amount

banked for the day (Zamboni

&Litschig, 2013). There may

be apossibility that the Judy

Bones may commit fraud as

she has complete control over

the bank transaction.

The auditor needs to make

effort to obtain sufficient

evidence and examine the

internal control over the cash

receipt. As the receipt of the

cash is the most probable area

where fraud can occur.

2. New IT system The company has also

invested in new IT system

which will computerize the

current accounting process.

There may be thepossibility

of the error as the employee

was unaware of the new

system and the excess

pressure was implemented

over the staff to install the

new system. Due to the

change in the accounting

system, the transaction was

not reported to the proper

period which may create

impact over the reporting

over the true and fair position

of the financial statement.

The auditor needs to examine

the new IT system and the

transaction which occurred

during the period as there

may be thepossibility of fraud

(Baldauf, et. al., 2015).

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8 | P a g e

References

Baldauf, J., Steller, M., &Steckel, R. (2015). The Influence of Audit Risk and Materiality

Guidelines on Auditors’ Planning Materiality Assessment. Accounting and Finance

Research, 4(4), 97.

Clikeman, P. M., & Diaz, J. (2014). ABC Electronics: An Instructional Case Illustrating

Auditors' Use of Preliminary Analytical Procedures. Current Issues in Auditing, 8(1), I1-

I10.

Hematfar, M., &Hemmati, M. (2013). A Comparison of Risk-Based and Traditional

Auditing and their Effect on the Quality of Audit Reports.

Jans, M., Alles, M. G., &Vasarhelyi, M. A. (2014). A field study on the use of process

mining of event logs as an analytical procedure in auditing. The Accounting Review,

89(5), 1751-1773.

Sanderson, J. (2014). Audit issues. SMSF Guide: Current Issues and Strategies for the

Self-Managed Superannuation Funds Adviser, 377.

Yoon, K., Hoogduin, L., & Zhang, L. (2015). Big data as complementary audit evidence.

Accounting Horizons, 29(2), 431-438.

Zamboni, Y., &Litschig, S. (2013). Audit risk and rent extraction: Evidence from a

randomized evaluation in Brazil. UniversitatPompeuFabra.

9 | P a g e

Baldauf, J., Steller, M., &Steckel, R. (2015). The Influence of Audit Risk and Materiality

Guidelines on Auditors’ Planning Materiality Assessment. Accounting and Finance

Research, 4(4), 97.

Clikeman, P. M., & Diaz, J. (2014). ABC Electronics: An Instructional Case Illustrating

Auditors' Use of Preliminary Analytical Procedures. Current Issues in Auditing, 8(1), I1-

I10.

Hematfar, M., &Hemmati, M. (2013). A Comparison of Risk-Based and Traditional

Auditing and their Effect on the Quality of Audit Reports.

Jans, M., Alles, M. G., &Vasarhelyi, M. A. (2014). A field study on the use of process

mining of event logs as an analytical procedure in auditing. The Accounting Review,

89(5), 1751-1773.

Sanderson, J. (2014). Audit issues. SMSF Guide: Current Issues and Strategies for the

Self-Managed Superannuation Funds Adviser, 377.

Yoon, K., Hoogduin, L., & Zhang, L. (2015). Big data as complementary audit evidence.

Accounting Horizons, 29(2), 431-438.

Zamboni, Y., &Litschig, S. (2013). Audit risk and rent extraction: Evidence from a

randomized evaluation in Brazil. UniversitatPompeuFabra.

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10 | P a g e

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.