University Audit Assurance and Compliance Report: DIPL Analysis

VerifiedAdded on 2020/03/01

|8

|1756

|83

Report

AI Summary

This report provides a comprehensive analysis of audit assurance and compliance, focusing on the financial performance of DIPL. It begins by applying analytical procedures to financial report information, examining key ratios like current, profit margin, and solvency ratios from 2013 to 2015, and explaining how these results influence audit planning decisions. The report then identifies inherent risk factors arising from DIPL's business operations, detailing how these factors can affect the risk of material misstatement in financial reports. Finally, it identifies and explains two key fraud risk factors relating to misstatements arising from fraudulent financial reporting, including asset loss and fraud incidence for workforce engagement. The report references several academic sources to support its findings and conclusions.

Running head: AUDIT ASSURANCE AND COMPLIANCE

Audit Assurance and Compliance

Name of Student:

Name of University:

Author’s Note:

Audit Assurance and Compliance

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDIT ASSURANCE AND COMPLIANCE

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................3

Answer to Question 3:.....................................................................................................................4

References........................................................................................................................................7

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................3

Answer to Question 3:.....................................................................................................................4

References........................................................................................................................................7

2AUDIT ASSURANCE AND COMPLIANCE

Answer to Question 1:

Application of analytical procedures to the financial report information of DIPL

The main types of the information provided in the report have been related to the

different types of the developments in the audit plan. The plan for the audit has been further seen

to be considered based on the audit cost at a reasonable level to consider the aversions which are

related to the clientele. The main analytical approach has been further seen to be considered

based on the different types the assumption which has been based on the various levels of the

report which has been considered based on the dissemination of the information in the financial

declarations (Kubuabola 2013).

The analytical considerations in the report have been considered with the downsizing of

the analysis with the reference point. This has been further considered for the financial statement

comparison for the various corporations. The main interpretations from the ratio have been

further able to signify on the different types of the consideration which has been related to the

audit planning (Ruhnke and Schmidt 2014).

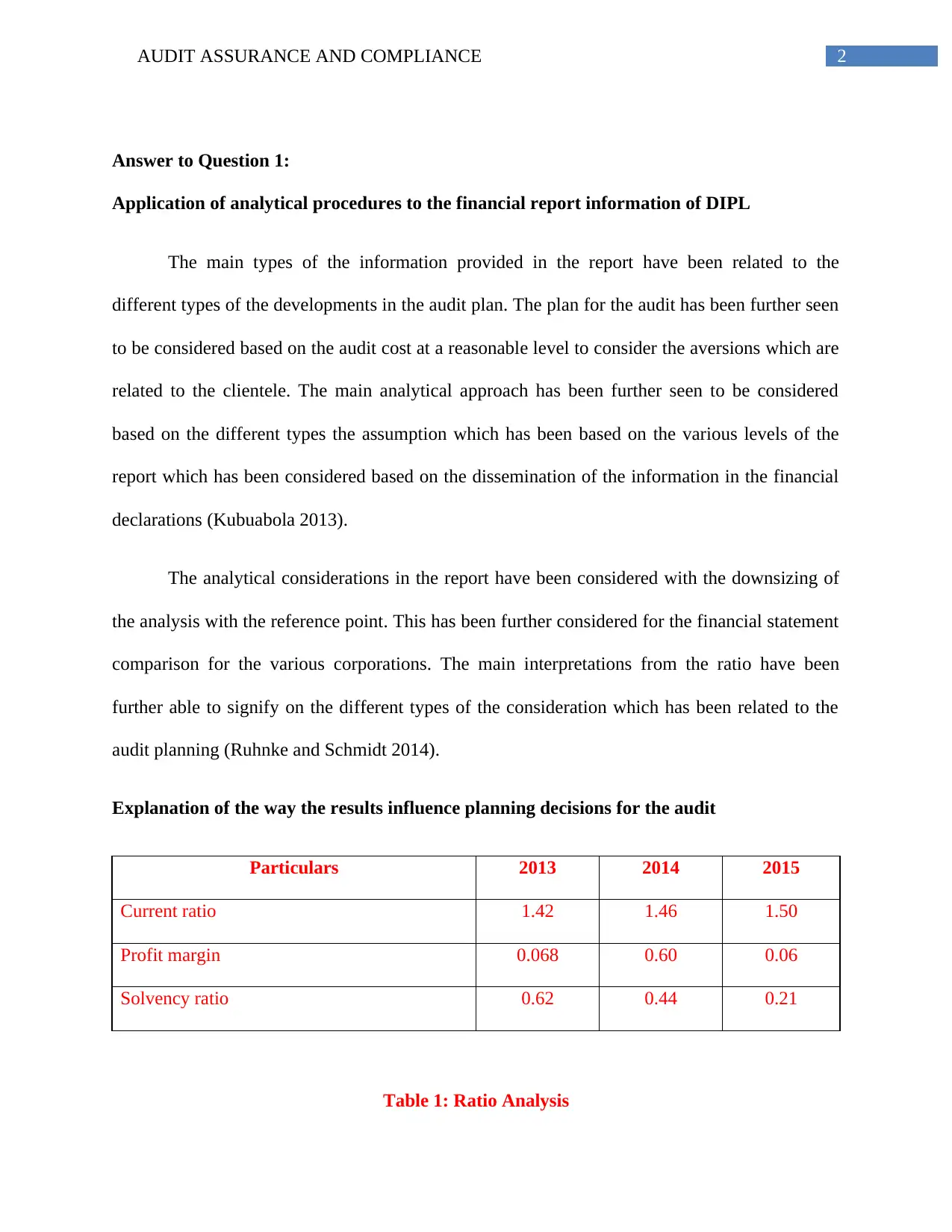

Explanation of the way the results influence planning decisions for the audit

Particulars 2013 2014 2015

Current ratio 1.42 1.46 1.50

Profit margin 0.068 0.60 0.06

Solvency ratio 0.62 0.44 0.21

Table 1: Ratio Analysis

Answer to Question 1:

Application of analytical procedures to the financial report information of DIPL

The main types of the information provided in the report have been related to the

different types of the developments in the audit plan. The plan for the audit has been further seen

to be considered based on the audit cost at a reasonable level to consider the aversions which are

related to the clientele. The main analytical approach has been further seen to be considered

based on the different types the assumption which has been based on the various levels of the

report which has been considered based on the dissemination of the information in the financial

declarations (Kubuabola 2013).

The analytical considerations in the report have been considered with the downsizing of

the analysis with the reference point. This has been further considered for the financial statement

comparison for the various corporations. The main interpretations from the ratio have been

further able to signify on the different types of the consideration which has been related to the

audit planning (Ruhnke and Schmidt 2014).

Explanation of the way the results influence planning decisions for the audit

Particulars 2013 2014 2015

Current ratio 1.42 1.46 1.50

Profit margin 0.068 0.60 0.06

Solvency ratio 0.62 0.44 0.21

Table 1: Ratio Analysis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDIT ASSURANCE AND COMPLIANCE

(Source: as created by Author)

It has been further seen that the results has been considered as per the planning of the

audit planning and it has been seen to be important for maintaining the analytical approach for

the consideration of the financial statements. The main instance of the outcomes for the ratio has

been considered with the current ratio of the firms for DIPL. This has been seen to be 1.42 in

2013, 1.46 in 2014 and 1.5 in the year 2015. The main form of the profit ration has been

considered based on the 0.068 in 2013, 0.60 in 2014 and 0.06 in 2015. The important

consideration for the profit margin has been able to depict the income earned thorugh the net

sales from the DIPL (Ruhnke and Schmidt 2014). The assessor needs to under that the various

considerations which have been seen to be conducive for understanding the expenses which has

been seen to be bases on the concept of low or high in the management with the curtailment of

the time and budget. The unfavourable and favourable changes relating to the factors have been

considered based on soundness of the financial position and the audit assessment. In 2013 and

2015 the solvency ratio has been considered as 0.62 and 0.21 (Yasin and Nelson 2013).

Answer to Question 2:

Identification of inherent risk factors that arise from nature of business operations of DIPL

The main factors of the auditing have been shown with the several incidences with

material misstatements in the financial announcement of a certain concern. The unsystematic and

systematic risk has been further considered based on the financial declarations and financial

misstatements of the corporation (Geertse et al. 2015). The main risks has been further detected

based on the non financial and the financial factors. The evaluator may consider the detection of

the risk which is seen to be based on the financial declarations which has been stated with the

(Source: as created by Author)

It has been further seen that the results has been considered as per the planning of the

audit planning and it has been seen to be important for maintaining the analytical approach for

the consideration of the financial statements. The main instance of the outcomes for the ratio has

been considered with the current ratio of the firms for DIPL. This has been seen to be 1.42 in

2013, 1.46 in 2014 and 1.5 in the year 2015. The main form of the profit ration has been

considered based on the 0.068 in 2013, 0.60 in 2014 and 0.06 in 2015. The important

consideration for the profit margin has been able to depict the income earned thorugh the net

sales from the DIPL (Ruhnke and Schmidt 2014). The assessor needs to under that the various

considerations which have been seen to be conducive for understanding the expenses which has

been seen to be bases on the concept of low or high in the management with the curtailment of

the time and budget. The unfavourable and favourable changes relating to the factors have been

considered based on soundness of the financial position and the audit assessment. In 2013 and

2015 the solvency ratio has been considered as 0.62 and 0.21 (Yasin and Nelson 2013).

Answer to Question 2:

Identification of inherent risk factors that arise from nature of business operations of DIPL

The main factors of the auditing have been shown with the several incidences with

material misstatements in the financial announcement of a certain concern. The unsystematic and

systematic risk has been further considered based on the financial declarations and financial

misstatements of the corporation (Geertse et al. 2015). The main risks has been further detected

based on the non financial and the financial factors. The evaluator may consider the detection of

the risk which is seen to be based on the financial declarations which has been stated with the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDIT ASSURANCE AND COMPLIANCE

accomplishment from the profit and the revenue generated with the sales. The present analysis

has been able to evaluate on the risks correlated to the omission and diverse errors in the

business operations (Lindeboom, van der Klaauw and Vriend 2016).

The accountants of the management and the total number of the transactions have been

further seen to be considered based on the omissions by the management. This has been directed

towards various types of the considerations revenue generated through the sales. The main

considerations have been further seen to be based on the essential planning along with the sales

activities (De George, Ferguson and Spear 2013).

Risk and way it might affect the risk of material misstatement in the financial report

The various types of the inherent risk and the way it can affect the material misstatement

has been stated below:

Excessive pressure on employees and management

Risks of errors or else incorrect misrepresentation

Integrity of the entire management

Unusual pressure on management

Nature of entity business

Answer to Question 3:

A) Identification and explanation of two key fraud risk factors relating to

misstatements arising from fraudulent financial reporting

Asset Loss The main risk has been indicated with the considerable losses pertaining to the

fraud. The dissatisfaction among the workforce will induce the fraud

accomplishment from the profit and the revenue generated with the sales. The present analysis

has been able to evaluate on the risks correlated to the omission and diverse errors in the

business operations (Lindeboom, van der Klaauw and Vriend 2016).

The accountants of the management and the total number of the transactions have been

further seen to be considered based on the omissions by the management. This has been directed

towards various types of the considerations revenue generated through the sales. The main

considerations have been further seen to be based on the essential planning along with the sales

activities (De George, Ferguson and Spear 2013).

Risk and way it might affect the risk of material misstatement in the financial report

The various types of the inherent risk and the way it can affect the material misstatement

has been stated below:

Excessive pressure on employees and management

Risks of errors or else incorrect misrepresentation

Integrity of the entire management

Unusual pressure on management

Nature of entity business

Answer to Question 3:

A) Identification and explanation of two key fraud risk factors relating to

misstatements arising from fraudulent financial reporting

Asset Loss The main risk has been indicated with the considerable losses pertaining to the

fraud. The dissatisfaction among the workforce will induce the fraud

5AUDIT ASSURANCE AND COMPLIANCE

involvement (Gay and Simnett 2015). The various expectations have led to

several types of the consideration which has been made as per the specified

performance based targets, leading to increased nature of fraud (Beasley et al.

2011).

Fraud incidence for

workforce

engagement

The main types of the fraud risk have been seen to be associated with the

various types of the operations of DIPL. Some of them have been seen with the

operations from the high pressure from the acquisition of novel accounting

system. The increased amount of pressure from the employees has been able to

carry installation process of the new IT systems which may be another reason

for the various types of the fraudulent activities. Based on the case study it has

been further determined that the process of IT implementation and improper

allocation of the transactions is recognised at the end of each year (Al-Rassas

2015).

Financial reporting

fraud

The fraud of financial reporting of the fraud has been further identified

with another risk factor. At the time of the excessive pressure it has been

seen with the specific announcement of the management to meet with the

certain goals for qualifying with the debt acquisition process. The high

risk of the financial announcements has been seen with improper

financial announcements. The total assets and the current assets of the

DIPL have increased considerably. The gross profit has been able to

show the loan amounting to 7.5 million and the loan agreement to

maintain the current ratio of 1.5. The debt equity ratio of the company

has been further discerned to be less than 1. The various requirements

have been further able to relate with the various considerations form the

involvement (Gay and Simnett 2015). The various expectations have led to

several types of the consideration which has been made as per the specified

performance based targets, leading to increased nature of fraud (Beasley et al.

2011).

Fraud incidence for

workforce

engagement

The main types of the fraud risk have been seen to be associated with the

various types of the operations of DIPL. Some of them have been seen with the

operations from the high pressure from the acquisition of novel accounting

system. The increased amount of pressure from the employees has been able to

carry installation process of the new IT systems which may be another reason

for the various types of the fraudulent activities. Based on the case study it has

been further determined that the process of IT implementation and improper

allocation of the transactions is recognised at the end of each year (Al-Rassas

2015).

Financial reporting

fraud

The fraud of financial reporting of the fraud has been further identified

with another risk factor. At the time of the excessive pressure it has been

seen with the specific announcement of the management to meet with the

certain goals for qualifying with the debt acquisition process. The high

risk of the financial announcements has been seen with improper

financial announcements. The total assets and the current assets of the

DIPL have increased considerably. The gross profit has been able to

show the loan amounting to 7.5 million and the loan agreement to

maintain the current ratio of 1.5. The debt equity ratio of the company

has been further discerned to be less than 1. The various requirements

have been further able to relate with the various considerations form the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDIT ASSURANCE AND COMPLIANCE

inappropriate reflection of the financial position (Mohd Yusof et al.

2014).

Unsuitable average

cost

On the basis of the evaluation of the raw material and inventory, the average

cost has been shown with the cost of paper which has been seen to be

considerably more than the average cost. The fraudulent risk considerations

have been further seen to be considered with the IT system, which has been able

to monitor the activities of the phases. The financial risk has been also based on

the evaluations of the different types of the financial statements monitored

simultaneously (Beattie, Fearnley and Hines 2013).

inappropriate reflection of the financial position (Mohd Yusof et al.

2014).

Unsuitable average

cost

On the basis of the evaluation of the raw material and inventory, the average

cost has been shown with the cost of paper which has been seen to be

considerably more than the average cost. The fraudulent risk considerations

have been further seen to be considered with the IT system, which has been able

to monitor the activities of the phases. The financial risk has been also based on

the evaluations of the different types of the financial statements monitored

simultaneously (Beattie, Fearnley and Hines 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDIT ASSURANCE AND COMPLIANCE

References

Al-Rassas, A.H., 2015. Internal monitoring mechanisms and earnings quality: Empirical

evidence from Malaysia (Doctoral dissertation, Universiti Utara Malaysia).

Beasley, M., Buckless, F., Glover, S. M. & Prawitt, D. F. (2011), Auditing Cases: An Interactive

Learning Approach, 5th ed., Pearson Education Australia.

Beattie, V., Fearnley, S. and Hines, T. (2013) ‘Perceptions of factors affecting audit quality in

the post-SOX UK regulatory environment’, Accounting and Business Research, 43(1), pp. 56–

81. doi: 10.1080/00014788.2012.703079.

De George, E. T., Ferguson, C. B. and Spear, N. A. (2013) ‘How much does IFRS cost? IFRS

adoption and audit fees’, Accounting Review, 88(2), pp. 429–462. doi: 10.2308/accr-50317.

Gay, G.E. and Simnett, R., 2015. Auditing and assurance services in Australia. 6th ed.,

McGraw-Hill Book Company.

Geertse, T. D., Holland, R., Timmers, J. M. H., Paap, E., Pijnappel, R. M., Broeders, M. J. M.

and den Heeten, G. J. (2015) ‘Value of audits in breast cancer screening quality assurance

programmes’, European Radiology, 25(11), pp. 3338–3347. doi: 10.1007/s00330-015-3744-x.

Kemp, S. (2016), Auditing Assurance and Ethics Handbook 2016 Australia, John Wiley & Sons

Australia.

Kubuabola, S. (2013) External Quality Audit, External Quality Audit. doi: 10.1016/B978-1-

84334-676-0.50005-4.

References

Al-Rassas, A.H., 2015. Internal monitoring mechanisms and earnings quality: Empirical

evidence from Malaysia (Doctoral dissertation, Universiti Utara Malaysia).

Beasley, M., Buckless, F., Glover, S. M. & Prawitt, D. F. (2011), Auditing Cases: An Interactive

Learning Approach, 5th ed., Pearson Education Australia.

Beattie, V., Fearnley, S. and Hines, T. (2013) ‘Perceptions of factors affecting audit quality in

the post-SOX UK regulatory environment’, Accounting and Business Research, 43(1), pp. 56–

81. doi: 10.1080/00014788.2012.703079.

De George, E. T., Ferguson, C. B. and Spear, N. A. (2013) ‘How much does IFRS cost? IFRS

adoption and audit fees’, Accounting Review, 88(2), pp. 429–462. doi: 10.2308/accr-50317.

Gay, G.E. and Simnett, R., 2015. Auditing and assurance services in Australia. 6th ed.,

McGraw-Hill Book Company.

Geertse, T. D., Holland, R., Timmers, J. M. H., Paap, E., Pijnappel, R. M., Broeders, M. J. M.

and den Heeten, G. J. (2015) ‘Value of audits in breast cancer screening quality assurance

programmes’, European Radiology, 25(11), pp. 3338–3347. doi: 10.1007/s00330-015-3744-x.

Kemp, S. (2016), Auditing Assurance and Ethics Handbook 2016 Australia, John Wiley & Sons

Australia.

Kubuabola, S. (2013) External Quality Audit, External Quality Audit. doi: 10.1016/B978-1-

84334-676-0.50005-4.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.