Auditing and Financial Reporting of BHP Billiton Ltd

VerifiedAdded on 2020/10/22

|13

|3328

|434

AI Summary

The assignment discusses the importance of auditing in ascertaining the real financial position of a company. It examines the auditing process of BHP Billiton Ltd and Group, highlighting their compliance with audit standards governed by AASB and UK regulations. The document also explores the role of auditors in ensuring the accuracy and reliability of financial reports, including their responsibilities to investigate and report on material weaknesses and errors. The summary concludes that the true financials are prepared by the organisation, and in the audit process done, the auditor is of view that Group and Company's financial statements are of true nature.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Audit, Assurance and

Compliance

Compliance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Executive Summary

Audit and compliance is one of the vital aspect in clarifying financial position of

company. BHP Billiton Ltd engaged in mining sector has been reviewed by auditor for the year

ended 30 June 2017. Full auditor's analysis is being explained and it reflects that responsibilities

are effectively met by auditor and financials are giving true and fair view of company and group.

Furthermore, professional accounting and auditing standards are followed by firm and auditor for

reflecting valuable information for intended users.

Audit and compliance is one of the vital aspect in clarifying financial position of

company. BHP Billiton Ltd engaged in mining sector has been reviewed by auditor for the year

ended 30 June 2017. Full auditor's analysis is being explained and it reflects that responsibilities

are effectively met by auditor and financials are giving true and fair view of company and group.

Furthermore, professional accounting and auditing standards are followed by firm and auditor for

reflecting valuable information for intended users.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

1. Auditor Independence Report.............................................................................................1

2. Non-audit services..............................................................................................................1

3. Analysis of Auditor’s remuneration in tabular form with percentage change...................1

4. Key Audit Matters..............................................................................................................3

5. Audit Committee................................................................................................................5

6. Audit Opinion.....................................................................................................................6

7. Directors’ and Management’s responsibilities distinguish from Auditor’s responsibilities in

financial report........................................................................................................................6

8. Material subsequent events.................................................................................................7

9. Effectiveness of material information reported by Auditor...............................................7

10. Non-disclosure of material information in effective way for intended users...................7

11. Asking follow-up questions to Auditor at an AGM.........................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

1. Auditor Independence Report.............................................................................................1

2. Non-audit services..............................................................................................................1

3. Analysis of Auditor’s remuneration in tabular form with percentage change...................1

4. Key Audit Matters..............................................................................................................3

5. Audit Committee................................................................................................................5

6. Audit Opinion.....................................................................................................................6

7. Directors’ and Management’s responsibilities distinguish from Auditor’s responsibilities in

financial report........................................................................................................................6

8. Material subsequent events.................................................................................................7

9. Effectiveness of material information reported by Auditor...............................................7

10. Non-disclosure of material information in effective way for intended users...................7

11. Asking follow-up questions to Auditor at an AGM.........................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Auditing and assurance are quite significant in business. Present report deals with BHP

Billiton Ltd and Group which is an ASX listed company engaged in mining, metals and

petroleum. Complete audit sections have been reviewed from annual report for the year ended 30

June 2017. Audit Committee with roles is described along with key audit matters. Moreover,

material information and effectiveness of it is provided. Hence, auditor's section is reviewed of

company in effective manner. Report will consider analysis of Auditor's review of company and

whether it has complied with independence requirement or not.

1. Auditor Independence Report

BHP Billiton Ltd's Auditor has complied with independence requirements which is

reflected in the declaration made by auditor himself. The Auditor says that there are no

contraventions with regards to independence. Auditor's requirements has been made as governed

by Australian Corporations Act 2001 with relating to audit. No contraventions have been made

of any professional code of conduct. The declaration is made under Section 307 C of Australian

Corporations Act 2001.

2. Non-audit services

The non-audit services were being undertaken by external auditor of BHP Billiton Ltd

which includes amount paid for non-audit services. Provisions were effectively met with

approval within procedure implemented in Policy on Provision of Audit and Other Services on

behalf of external auditor (Doan and McKie, 2017). The advice imparted by Risk and Audit

Committee (RAC) has been taken into consideration by Directors and have formed perspective

that provision made for such type of services are compatible with general standards of

independence of auditors and nature of non-audit services implies clearly that independence of

auditor was not obligated or compromised.

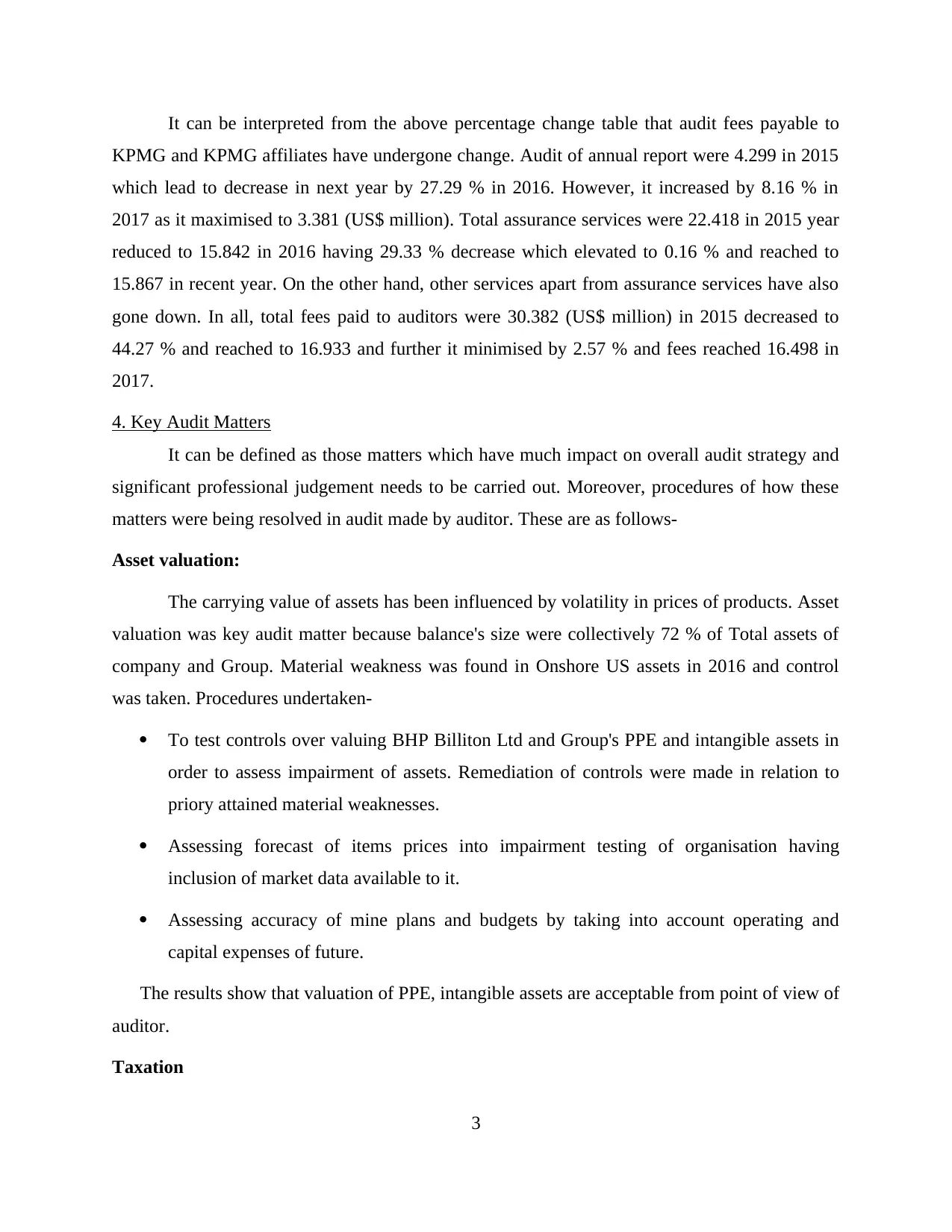

3. Analysis of Auditor’s remuneration in tabular form with percentage change

Auditor's Remuneration of BHP Billiton Ltd

Particulars 2016 2015 Inc/Dec % Change 2017 2016 Inc/Dec % Change

Fees payable to BHP

1

Auditing and assurance are quite significant in business. Present report deals with BHP

Billiton Ltd and Group which is an ASX listed company engaged in mining, metals and

petroleum. Complete audit sections have been reviewed from annual report for the year ended 30

June 2017. Audit Committee with roles is described along with key audit matters. Moreover,

material information and effectiveness of it is provided. Hence, auditor's section is reviewed of

company in effective manner. Report will consider analysis of Auditor's review of company and

whether it has complied with independence requirement or not.

1. Auditor Independence Report

BHP Billiton Ltd's Auditor has complied with independence requirements which is

reflected in the declaration made by auditor himself. The Auditor says that there are no

contraventions with regards to independence. Auditor's requirements has been made as governed

by Australian Corporations Act 2001 with relating to audit. No contraventions have been made

of any professional code of conduct. The declaration is made under Section 307 C of Australian

Corporations Act 2001.

2. Non-audit services

The non-audit services were being undertaken by external auditor of BHP Billiton Ltd

which includes amount paid for non-audit services. Provisions were effectively met with

approval within procedure implemented in Policy on Provision of Audit and Other Services on

behalf of external auditor (Doan and McKie, 2017). The advice imparted by Risk and Audit

Committee (RAC) has been taken into consideration by Directors and have formed perspective

that provision made for such type of services are compatible with general standards of

independence of auditors and nature of non-audit services implies clearly that independence of

auditor was not obligated or compromised.

3. Analysis of Auditor’s remuneration in tabular form with percentage change

Auditor's Remuneration of BHP Billiton Ltd

Particulars 2016 2015 Inc/Dec % Change 2017 2016 Inc/Dec % Change

Fees payable to BHP

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Billiton Group's

Auditors (assurance

services)

Audit of Annual

report 3.126 4.299 -1.173 -27.29% 3.381 3.126 0.255 8.16%

Auditing joint

ventures, subsidiaries

and associates 7.715 11.185 -3.47 -31.02% 7.04 7.715 -0.675 -8.75%

Auditing assurance

services 3.493 5.377 -1.884 -35.04% 3.597 3.493 0.104 2.98%

Assurance services

(other) 1.508 1.557 -0.049 -3.15% 1.849 1.508 0.341 22.61%

Total 15.842 22.418 -6.576 -29.33% 15.867 15.842 0.025 0.16%

Fees payable to BHP

Billiton Group's

Auditors (other

services)

Corporate finance

(other services) 0.276 6.871 -6.595 -95.98% 0.042 0.276 -0.234 -84.78%

All other services 0.815 1.093 -0.278 -25.43% 0.589 0.815 -0.226 -27.73%

Total other services 1.091 7.964 -6.873 -86.30% 0.631 1.091 -0.46 -42.16%

Total Fees paid to

Auditors 16.933 30.382 -13.449 -44.27% 16.498 16.933 -0.435 -2.57%

2

Auditors (assurance

services)

Audit of Annual

report 3.126 4.299 -1.173 -27.29% 3.381 3.126 0.255 8.16%

Auditing joint

ventures, subsidiaries

and associates 7.715 11.185 -3.47 -31.02% 7.04 7.715 -0.675 -8.75%

Auditing assurance

services 3.493 5.377 -1.884 -35.04% 3.597 3.493 0.104 2.98%

Assurance services

(other) 1.508 1.557 -0.049 -3.15% 1.849 1.508 0.341 22.61%

Total 15.842 22.418 -6.576 -29.33% 15.867 15.842 0.025 0.16%

Fees payable to BHP

Billiton Group's

Auditors (other

services)

Corporate finance

(other services) 0.276 6.871 -6.595 -95.98% 0.042 0.276 -0.234 -84.78%

All other services 0.815 1.093 -0.278 -25.43% 0.589 0.815 -0.226 -27.73%

Total other services 1.091 7.964 -6.873 -86.30% 0.631 1.091 -0.46 -42.16%

Total Fees paid to

Auditors 16.933 30.382 -13.449 -44.27% 16.498 16.933 -0.435 -2.57%

2

It can be interpreted from the above percentage change table that audit fees payable to

KPMG and KPMG affiliates have undergone change. Audit of annual report were 4.299 in 2015

which lead to decrease in next year by 27.29 % in 2016. However, it increased by 8.16 % in

2017 as it maximised to 3.381 (US$ million). Total assurance services were 22.418 in 2015 year

reduced to 15.842 in 2016 having 29.33 % decrease which elevated to 0.16 % and reached to

15.867 in recent year. On the other hand, other services apart from assurance services have also

gone down. In all, total fees paid to auditors were 30.382 (US$ million) in 2015 decreased to

44.27 % and reached to 16.933 and further it minimised by 2.57 % and fees reached 16.498 in

2017.

4. Key Audit Matters

It can be defined as those matters which have much impact on overall audit strategy and

significant professional judgement needs to be carried out. Moreover, procedures of how these

matters were being resolved in audit made by auditor. These are as follows-

Asset valuation:

The carrying value of assets has been influenced by volatility in prices of products. Asset

valuation was key audit matter because balance's size were collectively 72 % of Total assets of

company and Group. Material weakness was found in Onshore US assets in 2016 and control

was taken. Procedures undertaken-

To test controls over valuing BHP Billiton Ltd and Group's PPE and intangible assets in

order to assess impairment of assets. Remediation of controls were made in relation to

priory attained material weaknesses.

Assessing forecast of items prices into impairment testing of organisation having

inclusion of market data available to it.

Assessing accuracy of mine plans and budgets by taking into account operating and

capital expenses of future.

The results show that valuation of PPE, intangible assets are acceptable from point of view of

auditor.

Taxation

3

KPMG and KPMG affiliates have undergone change. Audit of annual report were 4.299 in 2015

which lead to decrease in next year by 27.29 % in 2016. However, it increased by 8.16 % in

2017 as it maximised to 3.381 (US$ million). Total assurance services were 22.418 in 2015 year

reduced to 15.842 in 2016 having 29.33 % decrease which elevated to 0.16 % and reached to

15.867 in recent year. On the other hand, other services apart from assurance services have also

gone down. In all, total fees paid to auditors were 30.382 (US$ million) in 2015 decreased to

44.27 % and reached to 16.933 and further it minimised by 2.57 % and fees reached 16.498 in

2017.

4. Key Audit Matters

It can be defined as those matters which have much impact on overall audit strategy and

significant professional judgement needs to be carried out. Moreover, procedures of how these

matters were being resolved in audit made by auditor. These are as follows-

Asset valuation:

The carrying value of assets has been influenced by volatility in prices of products. Asset

valuation was key audit matter because balance's size were collectively 72 % of Total assets of

company and Group. Material weakness was found in Onshore US assets in 2016 and control

was taken. Procedures undertaken-

To test controls over valuing BHP Billiton Ltd and Group's PPE and intangible assets in

order to assess impairment of assets. Remediation of controls were made in relation to

priory attained material weaknesses.

Assessing forecast of items prices into impairment testing of organisation having

inclusion of market data available to it.

Assessing accuracy of mine plans and budgets by taking into account operating and

capital expenses of future.

The results show that valuation of PPE, intangible assets are acceptable from point of view of

auditor.

Taxation

3

BHP Billiton Ltd has been operating in various countries each having its own taxation

schemes (Annual Report of BHP Billiton Ltd. 2017). It includes royalties, corporation tax,

production based tax and employment taxes. Audit Procedures were as follows-

Testing controls relating to tax and tax related transactions.

Tax specialists in Australia, Chile and US were approached considering Group's

obligations of tax. Meetings were done on matters related to tax and similar rulings were

attained for assessing tax liability.

Consistency in relation to assumptions were used by estimating provisions such as tax

exposures including in Australia, Chile and US and potential outcomes have been arrived.

Comparisons were made with public statements assumptions.

Adequacy of disclosures were assessed with regards to tax matters.

Results were being attained to be acceptable of tax provisioning and disclosures of the same.

Samarco-

Samarco dam failure was made and complex accounting judgements were accomplished.

Losses were $0.3 billion and contingent liability disclosure was made. It was required to be

determined because of size of potential claims, uncertainty degree was high, level of judgements

when assessing legal claims and obligations. Procedures undertaken was:

Accounting disclosures which are associated with dam failure.

Evaluating whether there is existence of legal obligations under Samarco shareholders’

agreement or Brazilian law and determining that these are disclosed in financials or not

with due accounting standards.

Assumptions with regards to provision made by BHP Billiton Brazil of potential funding

obligations. It includes assessment of cash flows, discount rate, foreign exchange rates

and division's ability to meet obligations.

To instruct Auditor of Samarco and evaluating outcome of process and relevant

obligations required under framework and preliminary agreements.

Assessment of legal proceedings disclosing liabilities and obligations of Group.

4

schemes (Annual Report of BHP Billiton Ltd. 2017). It includes royalties, corporation tax,

production based tax and employment taxes. Audit Procedures were as follows-

Testing controls relating to tax and tax related transactions.

Tax specialists in Australia, Chile and US were approached considering Group's

obligations of tax. Meetings were done on matters related to tax and similar rulings were

attained for assessing tax liability.

Consistency in relation to assumptions were used by estimating provisions such as tax

exposures including in Australia, Chile and US and potential outcomes have been arrived.

Comparisons were made with public statements assumptions.

Adequacy of disclosures were assessed with regards to tax matters.

Results were being attained to be acceptable of tax provisioning and disclosures of the same.

Samarco-

Samarco dam failure was made and complex accounting judgements were accomplished.

Losses were $0.3 billion and contingent liability disclosure was made. It was required to be

determined because of size of potential claims, uncertainty degree was high, level of judgements

when assessing legal claims and obligations. Procedures undertaken was:

Accounting disclosures which are associated with dam failure.

Evaluating whether there is existence of legal obligations under Samarco shareholders’

agreement or Brazilian law and determining that these are disclosed in financials or not

with due accounting standards.

Assumptions with regards to provision made by BHP Billiton Brazil of potential funding

obligations. It includes assessment of cash flows, discount rate, foreign exchange rates

and division's ability to meet obligations.

To instruct Auditor of Samarco and evaluating outcome of process and relevant

obligations required under framework and preliminary agreements.

Assessment of legal proceedings disclosing liabilities and obligations of Group.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Results are acceptable by considering provisioning level and disclosures.

Provisions related to closure and rehabilitation-

The nature of operations are made and organisation has liabilities for closing, restoring or

rehabilitate its sites. It was key audit matter as BHP Billiton Ltd and Group's size is large enough

and management estimation with regards to timing of future costs and cash flows. Procedures

were as follows:

To test key controls of estimating closure and provisioning of rehabilitation.

Working with specialists for assessment of estimates of reserves and production profile of

the same.

Legislative requirements were taken into account in relation to remuneration structure

and reporting lines.

Risk free rates were applied evaluating economic assumptions for calculating net present

value of provisions.

Results were acceptable regarding provisioning and rehabilitating level.

5. Audit Committee

Yes, there is an audit committee of BHP Billiton Ltd named as RAC governing various

rules and regulations to impart when preparing financial reports. There are four non-executive

directors such as Lindsay Maxsted (Chairman), Malcolm Broomhead, Anita Frew and Wayne

Murdy. Yes, Audit Committee Charter is present in company. Main role of is to assist the Board

in carrying out decisions made by CEO and for gaining assurance with regards to progress of

accomplishing corporate objectives within limits imposed by the Board (Boolaky and

Soobaroyen, 2017).

Responsibilities

The responsibilities of RAC are discharged by seeking integrity of organisation's

financial statement, appointing, performance and remuneration of External Auditor and process

of audit. Another responsibility is to make effective systems and risk management and internal

control. To oversee plans, objectivity and overall strategic performance and leadership of

Internal Audit function and to assess integrity of internal audit procedure. Further, to oversee,

capital management, funding, management planning and related matters.

5

Provisions related to closure and rehabilitation-

The nature of operations are made and organisation has liabilities for closing, restoring or

rehabilitate its sites. It was key audit matter as BHP Billiton Ltd and Group's size is large enough

and management estimation with regards to timing of future costs and cash flows. Procedures

were as follows:

To test key controls of estimating closure and provisioning of rehabilitation.

Working with specialists for assessment of estimates of reserves and production profile of

the same.

Legislative requirements were taken into account in relation to remuneration structure

and reporting lines.

Risk free rates were applied evaluating economic assumptions for calculating net present

value of provisions.

Results were acceptable regarding provisioning and rehabilitating level.

5. Audit Committee

Yes, there is an audit committee of BHP Billiton Ltd named as RAC governing various

rules and regulations to impart when preparing financial reports. There are four non-executive

directors such as Lindsay Maxsted (Chairman), Malcolm Broomhead, Anita Frew and Wayne

Murdy. Yes, Audit Committee Charter is present in company. Main role of is to assist the Board

in carrying out decisions made by CEO and for gaining assurance with regards to progress of

accomplishing corporate objectives within limits imposed by the Board (Boolaky and

Soobaroyen, 2017).

Responsibilities

The responsibilities of RAC are discharged by seeking integrity of organisation's

financial statement, appointing, performance and remuneration of External Auditor and process

of audit. Another responsibility is to make effective systems and risk management and internal

control. To oversee plans, objectivity and overall strategic performance and leadership of

Internal Audit function and to assess integrity of internal audit procedure. Further, to oversee,

capital management, funding, management planning and related matters.

5

Functions

The Committee examines that fair practices that have been followed by preparation of

fair, balanced and understandable financial statements. Long-term assets carrying value were

judged by RAC and examined impairment triggers for goodwill. Main considerations were

geological complexity, expected productions and volume, indicator governing fair value of asset

of long-term nature. Closure and rehabilitation provisions has been examined by RAC and

international review of closure cost and amount of future expenses are being analysed (Davies

and Aston, 2017).

6. Audit Opinion

In opinion of Auditor, BHP Billiton Ltd have been fully audited for the year ended 30

June 2017. The opinion discloses that financial statements prepared give fair view of Group's

affairs up to a major extent. The consolidated financials have been produced in accordance to

IFRS. Moreover, in KPMG UK's opinion, UK accounting standards which also includes FRS

101 Reduced Disclosure Framework and Article 4 of the IAS Regulation has been complied

with. KPMG Australia's opinion, true and fair view of financials are reflected and complying

with AAS (Australian Accounting Standards) and Australia Corporations Regulations 2001.

7. Directors’ and Management’s responsibilities distinguish from Auditor’s responsibilities in

financial report

Directors and Management's Responsibilities

The directors are responsible for making or preparing financials which represents true

and fair view of organisation's affairs in the best possible manner. All frameworks of accounting

professional bodies should be followed and director has the responsibility for keeping in mind

the same. Another duty is to implement necessary internal control so as to enable preparation of

true and fair view statements (Craig, Smieliauskas and Amernic, 2017). Moreover, they are

responsible for making error free statements, material misstatements should also be ignored. On

the other hand, to assess entire BHP Billiton Ltd and Group's ability to continue business for

long-run reflected by taking into account going concern concept. It includes disclosing the

material matters, related to going concern or either intend to liquidate company or stop

operations or have no option but to discharge business operations.

Auditor’s responsibilities

6

The Committee examines that fair practices that have been followed by preparation of

fair, balanced and understandable financial statements. Long-term assets carrying value were

judged by RAC and examined impairment triggers for goodwill. Main considerations were

geological complexity, expected productions and volume, indicator governing fair value of asset

of long-term nature. Closure and rehabilitation provisions has been examined by RAC and

international review of closure cost and amount of future expenses are being analysed (Davies

and Aston, 2017).

6. Audit Opinion

In opinion of Auditor, BHP Billiton Ltd have been fully audited for the year ended 30

June 2017. The opinion discloses that financial statements prepared give fair view of Group's

affairs up to a major extent. The consolidated financials have been produced in accordance to

IFRS. Moreover, in KPMG UK's opinion, UK accounting standards which also includes FRS

101 Reduced Disclosure Framework and Article 4 of the IAS Regulation has been complied

with. KPMG Australia's opinion, true and fair view of financials are reflected and complying

with AAS (Australian Accounting Standards) and Australia Corporations Regulations 2001.

7. Directors’ and Management’s responsibilities distinguish from Auditor’s responsibilities in

financial report

Directors and Management's Responsibilities

The directors are responsible for making or preparing financials which represents true

and fair view of organisation's affairs in the best possible manner. All frameworks of accounting

professional bodies should be followed and director has the responsibility for keeping in mind

the same. Another duty is to implement necessary internal control so as to enable preparation of

true and fair view statements (Craig, Smieliauskas and Amernic, 2017). Moreover, they are

responsible for making error free statements, material misstatements should also be ignored. On

the other hand, to assess entire BHP Billiton Ltd and Group's ability to continue business for

long-run reflected by taking into account going concern concept. It includes disclosing the

material matters, related to going concern or either intend to liquidate company or stop

operations or have no option but to discharge business operations.

Auditor’s responsibilities

6

The responsibility of auditor is to obtain the assurance that financial statements are error

free from fraud, misstatement or irregularities. Assurance is not a type of guarantee that will be

made in audits conducted according to Australian Auditing Standards will detect misstatement, if

it exists. Frauds, irregularities or errors may arise and could influence users of financial

information quite effectively and decision-making can also be impacted. Override of statements,

misrepresentations or omissions made intentionally may affect decision-making. Moreover, it is

required that auditor must present work in according to fairness of consolidated financials and

furthermore, strict compliance with AASB (Auditing and Assurance Standard Board) should be

adhered to. Thus, Director's and Management's responsibilities quite differ from that of Auditor's

responsibilities in the financial report.

8. Material subsequent events

Yes, there were subsequent events being analysed in 2017. On 17 August 2017, BHP

Billiton Ltd made an announcement that Board had make approval of investment $2.5 billion for

developing Spence Growth Option which includes copper concentrator construction extending

Spence useful life for 50 years. While, on 22 August, 2017, multiple currency bond repurchase

plan having global cap of $2.5 billion in next five years. Moreover, increased value of global cap

to $2.9 billion is expected in forthcoming years. On the same day, further announcement was

made with regards to Onshore US assets as Management and Board of Directors have made a

decision that Onshore US assets should be stopped as major benefits are not being imparted from

it. The above various statements have no impact on financials of 30 June, 2017.

9. Effectiveness of material information reported by Auditor

The material information has been effectively met by Company's Auditor. It can be

reflected from materiality for audit of consolidated financials set at $400 million in 2017 ($330

million) in 2016. It can be analysed that increase in profitability because products prices were

increased in the same year. Materiality has been assessed by taking previous three year average

group profit before tax. In audit, it was identified that excess amount of $20 million implies for

material misstatement. Moreover, misstatements have been believed that they are reported on

normal qualitative grounds.

On the other hand, it is disclosed in financial report for the year ended 30 June, 2017 that

important components being located in Australia, Singapore, Brazil, US and Chile were being

7

free from fraud, misstatement or irregularities. Assurance is not a type of guarantee that will be

made in audits conducted according to Australian Auditing Standards will detect misstatement, if

it exists. Frauds, irregularities or errors may arise and could influence users of financial

information quite effectively and decision-making can also be impacted. Override of statements,

misrepresentations or omissions made intentionally may affect decision-making. Moreover, it is

required that auditor must present work in according to fairness of consolidated financials and

furthermore, strict compliance with AASB (Auditing and Assurance Standard Board) should be

adhered to. Thus, Director's and Management's responsibilities quite differ from that of Auditor's

responsibilities in the financial report.

8. Material subsequent events

Yes, there were subsequent events being analysed in 2017. On 17 August 2017, BHP

Billiton Ltd made an announcement that Board had make approval of investment $2.5 billion for

developing Spence Growth Option which includes copper concentrator construction extending

Spence useful life for 50 years. While, on 22 August, 2017, multiple currency bond repurchase

plan having global cap of $2.5 billion in next five years. Moreover, increased value of global cap

to $2.9 billion is expected in forthcoming years. On the same day, further announcement was

made with regards to Onshore US assets as Management and Board of Directors have made a

decision that Onshore US assets should be stopped as major benefits are not being imparted from

it. The above various statements have no impact on financials of 30 June, 2017.

9. Effectiveness of material information reported by Auditor

The material information has been effectively met by Company's Auditor. It can be

reflected from materiality for audit of consolidated financials set at $400 million in 2017 ($330

million) in 2016. It can be analysed that increase in profitability because products prices were

increased in the same year. Materiality has been assessed by taking previous three year average

group profit before tax. In audit, it was identified that excess amount of $20 million implies for

material misstatement. Moreover, misstatements have been believed that they are reported on

normal qualitative grounds.

On the other hand, it is disclosed in financial report for the year ended 30 June, 2017 that

important components being located in Australia, Singapore, Brazil, US and Chile were being

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

fully audited and specific audit procedures focusing on risk were taken into account. Moreover,

audit process was followed by taking into consideration all the aspects such as periodical visits to

sites, reviewing audit work papers and inter-office reporting were made in order to attain

financials fairness with respect to affairs of company in the best possible manner.

10. Non-disclosure of material information in effective way for intended users

Non-disclosure of information can have effect on the company if it is not listed in annual

report and intended users may not be able to make decisions. In report of BHP Billiton Ltd, it can

be found out that gas and oil reserves are unaudited and may impact on financials up to a high

extent. Reserves' estimates tend to change year after year as assumptions made for such reserves

and geological data produced may not happen and undergoes change. This can impact users of

financial information such as carrying amount of assets may be influenced because of change in

production levels. Moreover, depreciation and amortisation charged in Profit & Loss statement

may change as they are determined on a basis of units of production.

Removal of expenses already recorded on Statement of Financial Position may also

change because of change in ratios (Hay, Stewart and Botica Redmayne 2017). Site restoration,

decommissioning and provisions related to environment may undergo change in estimation of

expectations with relation to cost of activities. Carrying amount of deferred tax assets can also

change due to likely recovery of benefits of tax. Reserves and resources may require estimation

of quality and quantity of reserves on the basis of size, shape and depth of oil and gas reservoirs.

Hence, absence of such information may affect decision-making of intended users and as a

result, it is required that information should be fully audited and disclosure should also be made.

11. Asking follow-up questions to Auditor at an AGM

The questions are listed below-

Did you discuss relevant matters with Internal Audit Committee on behalf of

investigations made? If so, what was the result then?

Do you made regular site visits to understand internal and external affairs of company

and reported the audit matters thereof?

Did you analyse any vital deficiencies being found in Audit Committee and other

material weaknesses?

8

audit process was followed by taking into consideration all the aspects such as periodical visits to

sites, reviewing audit work papers and inter-office reporting were made in order to attain

financials fairness with respect to affairs of company in the best possible manner.

10. Non-disclosure of material information in effective way for intended users

Non-disclosure of information can have effect on the company if it is not listed in annual

report and intended users may not be able to make decisions. In report of BHP Billiton Ltd, it can

be found out that gas and oil reserves are unaudited and may impact on financials up to a high

extent. Reserves' estimates tend to change year after year as assumptions made for such reserves

and geological data produced may not happen and undergoes change. This can impact users of

financial information such as carrying amount of assets may be influenced because of change in

production levels. Moreover, depreciation and amortisation charged in Profit & Loss statement

may change as they are determined on a basis of units of production.

Removal of expenses already recorded on Statement of Financial Position may also

change because of change in ratios (Hay, Stewart and Botica Redmayne 2017). Site restoration,

decommissioning and provisions related to environment may undergo change in estimation of

expectations with relation to cost of activities. Carrying amount of deferred tax assets can also

change due to likely recovery of benefits of tax. Reserves and resources may require estimation

of quality and quantity of reserves on the basis of size, shape and depth of oil and gas reservoirs.

Hence, absence of such information may affect decision-making of intended users and as a

result, it is required that information should be fully audited and disclosure should also be made.

11. Asking follow-up questions to Auditor at an AGM

The questions are listed below-

Did you discuss relevant matters with Internal Audit Committee on behalf of

investigations made? If so, what was the result then?

Do you made regular site visits to understand internal and external affairs of company

and reported the audit matters thereof?

Did you analyse any vital deficiencies being found in Audit Committee and other

material weaknesses?

8

Are there any relevant items you find on error side and are unadjusted because of your

opinion that accounting carried out was wrong but with it management have not agreed

with you?

CONCLUSION

Hereby, it can be concluded that auditing is a vital part in ascertaining real financial

position of firm in prescribed manner. BHP Billiton Ltd and Group have been consistently

following all norms and procedures relating to audit and complying with audit standards

governed by AASB and UK regulations in its division of UK. Hence, material information and

independence auditor report has been disclosed reporting true financials for the year. The

outcome that can be generated from report is that, true financials are prepared by organisation

and in audit process done, auditor is of view that Group and Company's financial statements are

of true nature.

9

opinion that accounting carried out was wrong but with it management have not agreed

with you?

CONCLUSION

Hereby, it can be concluded that auditing is a vital part in ascertaining real financial

position of firm in prescribed manner. BHP Billiton Ltd and Group have been consistently

following all norms and procedures relating to audit and complying with audit standards

governed by AASB and UK regulations in its division of UK. Hence, material information and

independence auditor report has been disclosed reporting true financials for the year. The

outcome that can be generated from report is that, true financials are prepared by organisation

and in audit process done, auditor is of view that Group and Company's financial statements are

of true nature.

9

REFERENCES

Books and Journals

Boolaky, P. K. and Soobaroyen, T., 2017. Adoption of International Standards on Auditing

(ISA): Do Institutional Factors Matter?. International Journal of Auditing. 21(1). pp.59-81.

Craig, R., Smieliauskas, W. and Amernic, J., 2017. Estimation uncertainty and the IASB's

proposed conceptual framework. Australian Accounting Review. 27(1). pp.112-114.

Davies, M. and Aston, J., 2017. Auditing fundamentals. Pearson Higher Ed.

Doan, M. A. and McKie, D., 2017. Financial investigations: Auditing research accounts of

communication in business, investor relations, and public relations (1994–2016). Public

Relations Review. 43(2). pp.306-313.

Hay, D., Stewart, J. and Botica Redmayne, N., 2017. The Role of Auditing in Corporate

Governance in Australia and New Zealand: A Research Synthesis. Australian Accounting

Review. 27(4). pp.457-479.

Online

Annual Report of BHP Billiton Ltd. 2017. [PDF] Available Through:

<https://www.bhp.com/-/media/documents/investors/annual-reports/2017/

bhpannualreport2017.pdf>

10

Books and Journals

Boolaky, P. K. and Soobaroyen, T., 2017. Adoption of International Standards on Auditing

(ISA): Do Institutional Factors Matter?. International Journal of Auditing. 21(1). pp.59-81.

Craig, R., Smieliauskas, W. and Amernic, J., 2017. Estimation uncertainty and the IASB's

proposed conceptual framework. Australian Accounting Review. 27(1). pp.112-114.

Davies, M. and Aston, J., 2017. Auditing fundamentals. Pearson Higher Ed.

Doan, M. A. and McKie, D., 2017. Financial investigations: Auditing research accounts of

communication in business, investor relations, and public relations (1994–2016). Public

Relations Review. 43(2). pp.306-313.

Hay, D., Stewart, J. and Botica Redmayne, N., 2017. The Role of Auditing in Corporate

Governance in Australia and New Zealand: A Research Synthesis. Australian Accounting

Review. 27(4). pp.457-479.

Online

Annual Report of BHP Billiton Ltd. 2017. [PDF] Available Through:

<https://www.bhp.com/-/media/documents/investors/annual-reports/2017/

bhpannualreport2017.pdf>

10

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.