Audit, Assurance and Compliance for Wesfarmers Limited

VerifiedAdded on 2023/06/07

|16

|3732

|107

AI Summary

This report evaluates the audit report of Wesfarmers Limited in 2018, including adherence to auditor independence requirements, non-audit services, key audit matters, audit committee, and more.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head A D ASS RA C A D C M A C: U IT, U N E N O PLI N E

Audit Assurance and Compliance,

ame of the StudentN :

ame of the niversityN U :

Author s ote’ N :

Course DI :

Audit Assurance and Compliance,

ame of the StudentN :

ame of the niversityN U :

Author s ote’ N :

Course DI :

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1A D ASS RA C A D C M A CU IT, U N E N O PLI N E

Executive Summary:

he current report is developed in the conte t of esfarmers imited in which detailedT x W L ,

evaluation of its audit report is conducted n accordance with the annual report of. I

esfarmers imited in it is evident that the auditor rnst oung has not failed toW L 2018, , E & Y ,

include any material aspects or information having material collision on the fi nancial reporting

of the organisation All information is disclosed and e plained properly by the auditor of. x

esfarmers regarding the material factors that might have adverse impact on the businessW

operations.

Executive Summary:

he current report is developed in the conte t of esfarmers imited in which detailedT x W L ,

evaluation of its audit report is conducted n accordance with the annual report of. I

esfarmers imited in it is evident that the auditor rnst oung has not failed toW L 2018, , E & Y ,

include any material aspects or information having material collision on the fi nancial reporting

of the organisation All information is disclosed and e plained properly by the auditor of. x

esfarmers regarding the material factors that might have adverse impact on the businessW

operations.

2A D ASS RA C A D C M A CU IT, U N E N O PLI N E

Table of Contents

ntroductionI :.................................................................................................................................3

Adherence to the auditor s independence requirement’ :.........................................................3

on audit servicesN - :....................................................................................................................4

Auditor s remuneration’ :...............................................................................................................5

ey audit mattersK :.........................................................................................................................5

Audit committee:..........................................................................................................................8

Audit opinion:.............................................................................................................................9

Difference in responsibilities between management and auditor:................................................9

Material subsequent events:...................................................................................................10

valuation of material information by the auditorsE :....................................................................10

Missing material information:....................................................................................................11

ollow up questionsF - :..................................................................................................................11

Conclusion:...............................................................................................................................12

References:...............................................................................................................................13

Table of Contents

ntroductionI :.................................................................................................................................3

Adherence to the auditor s independence requirement’ :.........................................................3

on audit servicesN - :....................................................................................................................4

Auditor s remuneration’ :...............................................................................................................5

ey audit mattersK :.........................................................................................................................5

Audit committee:..........................................................................................................................8

Audit opinion:.............................................................................................................................9

Difference in responsibilities between management and auditor:................................................9

Material subsequent events:...................................................................................................10

valuation of material information by the auditorsE :....................................................................10

Missing material information:....................................................................................................11

ollow up questionsF - :..................................................................................................................11

Conclusion:...............................................................................................................................12

References:...............................................................................................................................13

3A D ASS RA C A D C M A CU IT, U N E N O PLI N E

Introduction:

Auditing denotes the procedure of investigating and assessing the fi nancial reports

published by the organisations in order to verify that these reports are free from fi nancial

frauds material misstatements errors and others hus the auditors are required to, , . T ,

improve audit report quality through revelation of the material related information pertaining-

to the fi nancial statements ecker Stead and Stead esides they need to provide(B , 2016). B ,

such information to the stakeholders in a language which would be easy for understanding, .

n the current era the audit committees have taken various initiatives for improving audit reportI ,

quality herefore it is necessary for the auditors to consider enhanced issues in the fi nancial. T ,

statements that would help in ensuring better audit quality he current report would. T

emphasise on the latest annual report of esfarmers imited associated with numerousW L

audit aspects of the fi nancial reports herefore it is noteworthy to mention that the. T ,

organisation has rnst oung as its audit partnerE & Y .

Adherence to the auditor’s independence requirement:

efore providing audit services all the auditing fi rms need to conform to the necessaryB ,

guidelines and norms related to auditor independence n other words it could be stated. I ,

that the auditors need not be associated with the audit client when they provide audit

operations ouwers(L et al As evident from the directors report section of the annual. 2015). ’

report of esfarmers in rnst oung did not have convention of the auditorW 2018, E & Y

independence requirements in compliance with the Corporations Act while providing, 2001,

audit operations he directors of the organisation have stated that rnst oung has adhered. T E & Y

to all the necessary professional principles and guidelines of the auditing standards Some of.

Introduction:

Auditing denotes the procedure of investigating and assessing the fi nancial reports

published by the organisations in order to verify that these reports are free from fi nancial

frauds material misstatements errors and others hus the auditors are required to, , . T ,

improve audit report quality through revelation of the material related information pertaining-

to the fi nancial statements ecker Stead and Stead esides they need to provide(B , 2016). B ,

such information to the stakeholders in a language which would be easy for understanding, .

n the current era the audit committees have taken various initiatives for improving audit reportI ,

quality herefore it is necessary for the auditors to consider enhanced issues in the fi nancial. T ,

statements that would help in ensuring better audit quality he current report would. T

emphasise on the latest annual report of esfarmers imited associated with numerousW L

audit aspects of the fi nancial reports herefore it is noteworthy to mention that the. T ,

organisation has rnst oung as its audit partnerE & Y .

Adherence to the auditor’s independence requirement:

efore providing audit services all the auditing fi rms need to conform to the necessaryB ,

guidelines and norms related to auditor independence n other words it could be stated. I ,

that the auditors need not be associated with the audit client when they provide audit

operations ouwers(L et al As evident from the directors report section of the annual. 2015). ’

report of esfarmers in rnst oung did not have convention of the auditorW 2018, E & Y

independence requirements in compliance with the Corporations Act while providing, 2001,

audit operations he directors of the organisation have stated that rnst oung has adhered. T E & Y

to all the necessary professional principles and guidelines of the auditing standards Some of.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4A D ASS RA C A D C M A CU IT, U N E N O PLI N E

the principles include adhering to the guidelines of ‘’

Accounting Professional and Ethical

Standards Board’s APES 110 Code of Ethics for Professional Accountants’’ and

“

Corporations Act 2001 hese are followed so that the auditor independence could be”. T

maintained properly ( dard and CourteauBé 2015).

Non-audit services:

ased on the annual report of esfarmers in rnst oung has offered twoB W 2018, E & Y

types of non audit services to the organisation hese services primarily include ta- . T x

compliance service and other services or ta compliance service the auditor has received. F x ,

and for other services has been paid to the auditor herefore the total$683,000 , $343,000 . T ,

amount of non audit service fees rendered by esfarmers has been in and- W $1,026,000 2018

it has been of the overall audit fees incurred in the year esfarmers com au12.01% 2018 (W . .

owever esfarmers has ensured the necessary compliance for rnst oung with2018). H , W E & Y

all the necessary standards at the ti me of obtaining the non audit services his implies that- . T

the auditor has not compromised its independence as per the regulations mentioned in,

Corporations Act esides this esfarmers has not provided the auditor with any kind2001. B , W

of work that involves the review of work of the auditor itself in order to undertake

management decisions Moreover the various corporate governance norms and guidelines. ,

are followed while providing non audit services inally all these aspects imply the- . F ,

independence of the auditor radbury Raftery and Scott(B , 2018).

the principles include adhering to the guidelines of ‘’

Accounting Professional and Ethical

Standards Board’s APES 110 Code of Ethics for Professional Accountants’’ and

“

Corporations Act 2001 hese are followed so that the auditor independence could be”. T

maintained properly ( dard and CourteauBé 2015).

Non-audit services:

ased on the annual report of esfarmers in rnst oung has offered twoB W 2018, E & Y

types of non audit services to the organisation hese services primarily include ta- . T x

compliance service and other services or ta compliance service the auditor has received. F x ,

and for other services has been paid to the auditor herefore the total$683,000 , $343,000 . T ,

amount of non audit service fees rendered by esfarmers has been in and- W $1,026,000 2018

it has been of the overall audit fees incurred in the year esfarmers com au12.01% 2018 (W . .

owever esfarmers has ensured the necessary compliance for rnst oung with2018). H , W E & Y

all the necessary standards at the ti me of obtaining the non audit services his implies that- . T

the auditor has not compromised its independence as per the regulations mentioned in,

Corporations Act esides this esfarmers has not provided the auditor with any kind2001. B , W

of work that involves the review of work of the auditor itself in order to undertake

management decisions Moreover the various corporate governance norms and guidelines. ,

are followed while providing non audit services inally all these aspects imply the- . F ,

independence of the auditor radbury Raftery and Scott(B , 2018).

5A D ASS RA C A D C M A CU IT, U N E N O PLI N E

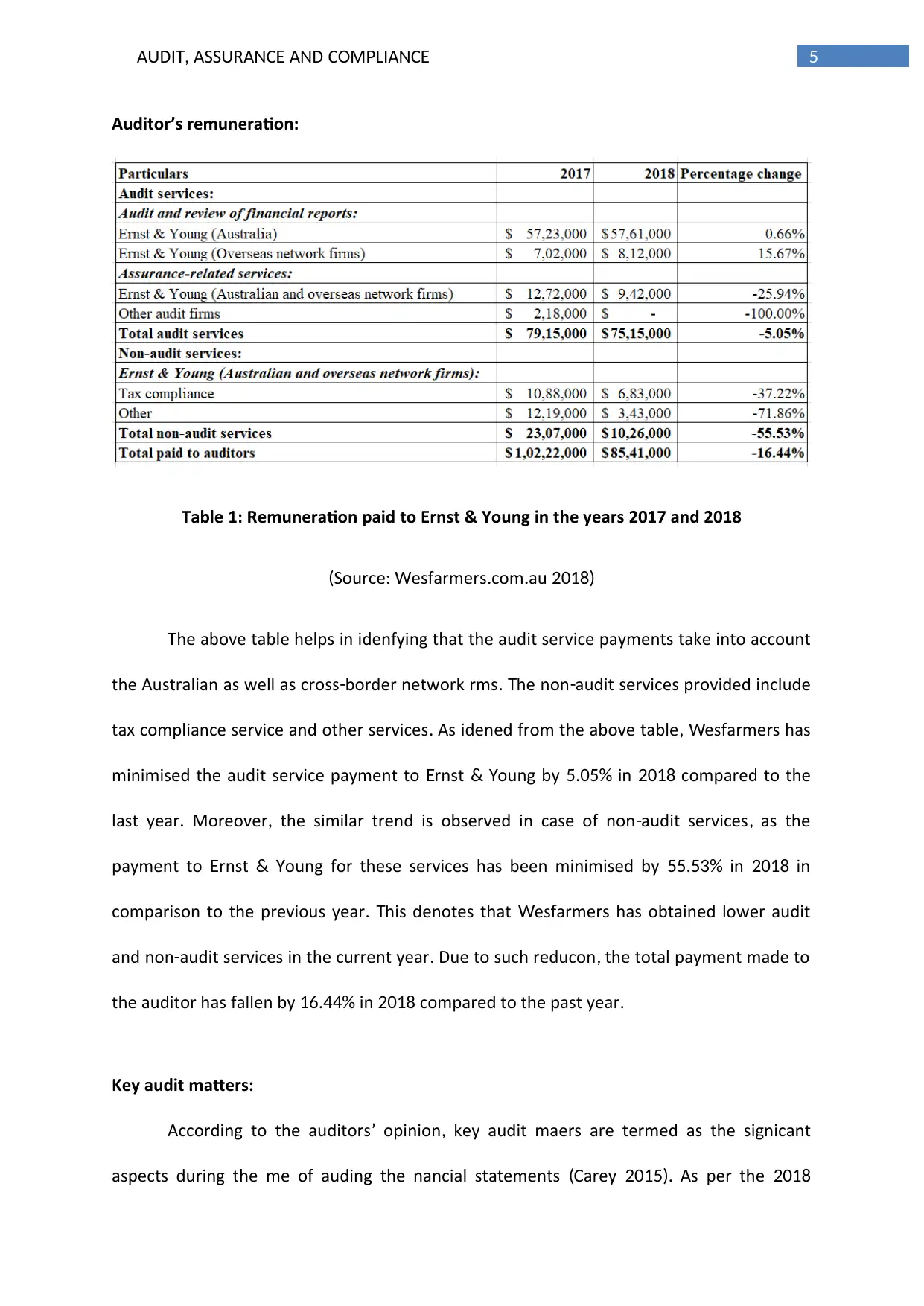

Auditor’s remuneration:

Table 1: Remuneration paid to Ernst & Young in the years 2017 and 2018

Source esfarmers com au( : W . . 2018)

he above table helps in identifying that the audit service payments take into accountT

the Australian as well as cross border network fi rms he non audit services provided include- . T -

ta compliance service and other services As identified from the above table esfarmers hasx . , W

minimised the audit service payment to rnst oung by in compared to theE & Y 5.05% 2018

last year Moreover the similar trend is observed in case of non audit services as the. , - ,

payment to rnst oung for these services has been minimised by in inE & Y 55.53% 2018

comparison to the previous year his denotes that esfarmers has obtained lower audit. T W

and non audit services in the current year Due to such reduction the total payment made to- . ,

the auditor has fallen by in compared to the past year16.44% 2018 .

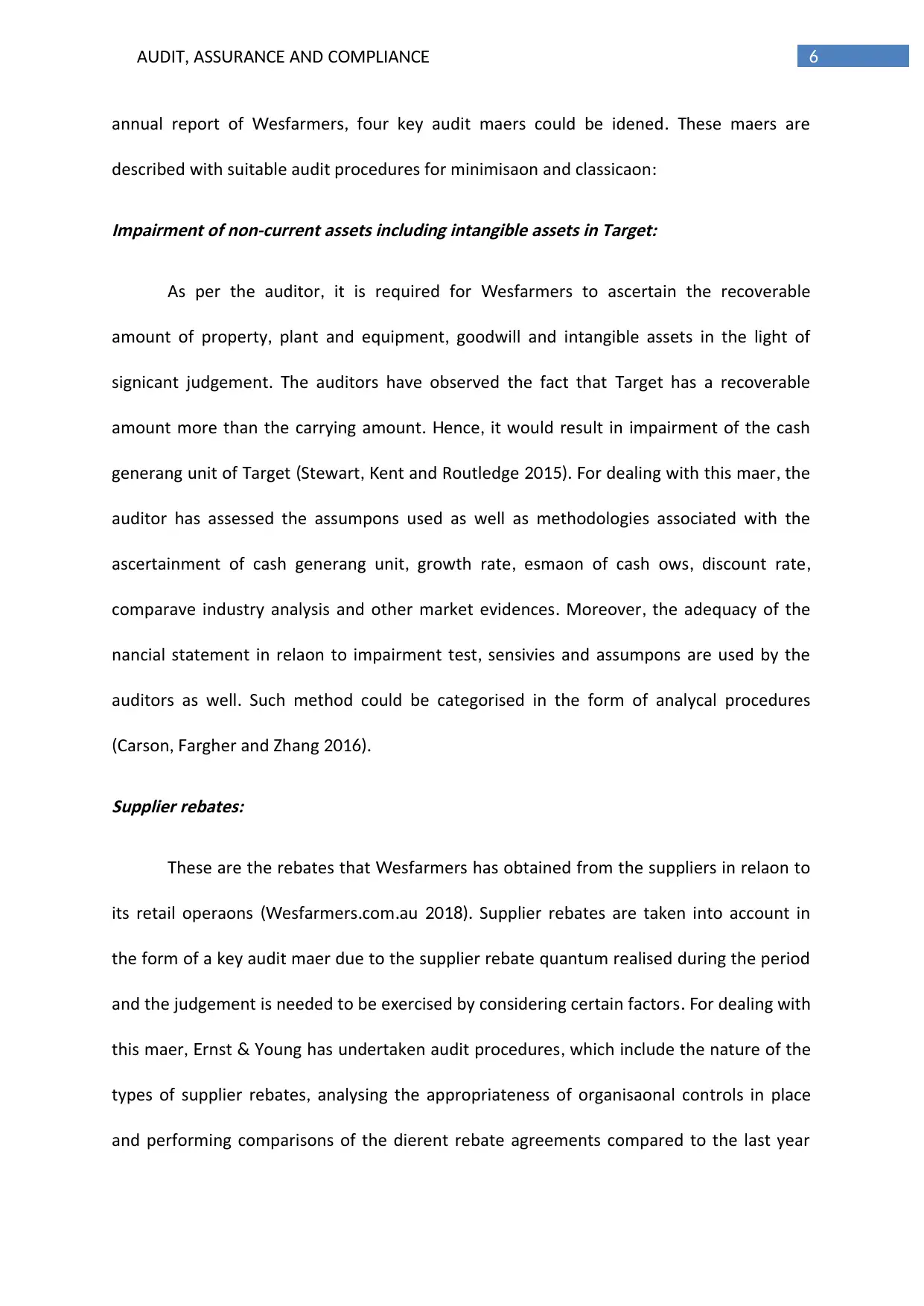

Key audit matters:

According to the auditors opinion key audit matters are termed as the significant’ ,

aspects during the ti me of auditing the fi nancial statements Carey As per the( 2015). 2018

Auditor’s remuneration:

Table 1: Remuneration paid to Ernst & Young in the years 2017 and 2018

Source esfarmers com au( : W . . 2018)

he above table helps in identifying that the audit service payments take into accountT

the Australian as well as cross border network fi rms he non audit services provided include- . T -

ta compliance service and other services As identified from the above table esfarmers hasx . , W

minimised the audit service payment to rnst oung by in compared to theE & Y 5.05% 2018

last year Moreover the similar trend is observed in case of non audit services as the. , - ,

payment to rnst oung for these services has been minimised by in inE & Y 55.53% 2018

comparison to the previous year his denotes that esfarmers has obtained lower audit. T W

and non audit services in the current year Due to such reduction the total payment made to- . ,

the auditor has fallen by in compared to the past year16.44% 2018 .

Key audit matters:

According to the auditors opinion key audit matters are termed as the significant’ ,

aspects during the ti me of auditing the fi nancial statements Carey As per the( 2015). 2018

6A D ASS RA C A D C M A CU IT, U N E N O PLI N E

annual report of esfarmers four key audit matters could be identified hese matters areW , . T

described with suitable audit procedures for minimisation and classification:

Impairment of non-current assets including intangible assets in Target:

As per the auditor it is required for esfarmers to ascertain the recoverable, W

amount of property plant and equipment goodwill and intangible assets in the light of, ,

significant judgement he auditors have observed the fact that arget has a recoverable. T T

amount more than the carrying amount ence it would result in impairment of the cash. H ,

generating unit of arget Stewart ent and Routledge or dealing with this matter theT ( , K 2015). F ,

auditor has assessed the assumptions used as well as methodologies associated with the

ascertainment of cash generating unit growth rate estimation of cash fl ows discount rate, , , ,

comparative industry analysis and other market evidences Moreover the adequacy of the. ,

fi

nancial statement in relation to impairment test sensitivities and assumptions are used by the,

auditors as well Such method could be categorised in the form of analytical procedures.

Carson argher and hang( , F Z 2016).

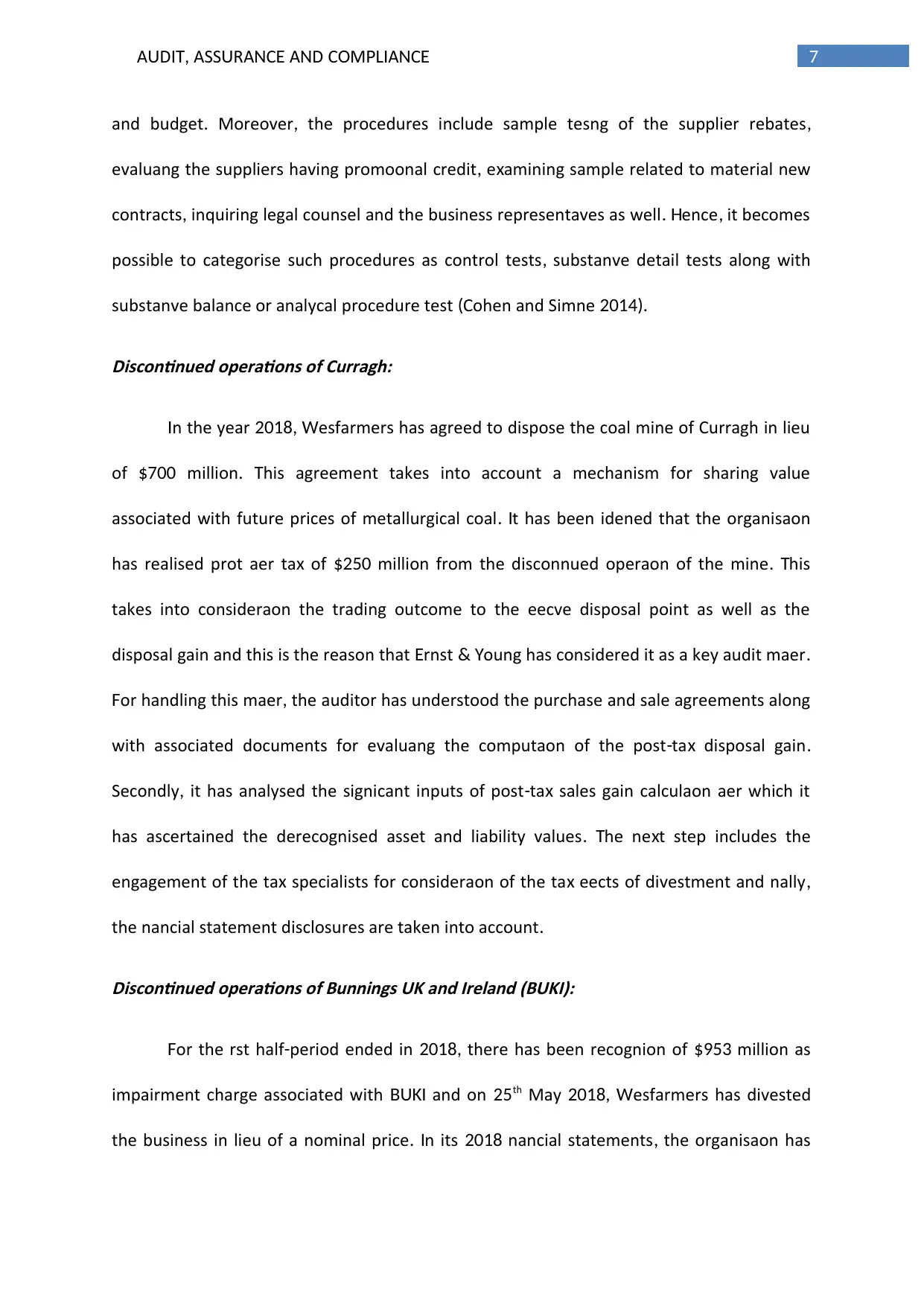

Supplier rebates:

hese are the rebates that esfarmers has obtained from the suppliers in relation toT W

its retail operations esfarmers com au Supplier rebates are taken into account in(W . . 2018).

the form of a key audit matter due to the supplier rebate quantum realised during the period

and the judgement is needed to be e ercised by considering certain factors or dealing withx . F

this matter rnst oung has undertaken audit procedures which include the nature of the, E & Y ,

types of supplier rebates analysing the appropriateness of organisational controls in place,

and performing comparisons of the different rebate agreements compared to the last year

annual report of esfarmers four key audit matters could be identified hese matters areW , . T

described with suitable audit procedures for minimisation and classification:

Impairment of non-current assets including intangible assets in Target:

As per the auditor it is required for esfarmers to ascertain the recoverable, W

amount of property plant and equipment goodwill and intangible assets in the light of, ,

significant judgement he auditors have observed the fact that arget has a recoverable. T T

amount more than the carrying amount ence it would result in impairment of the cash. H ,

generating unit of arget Stewart ent and Routledge or dealing with this matter theT ( , K 2015). F ,

auditor has assessed the assumptions used as well as methodologies associated with the

ascertainment of cash generating unit growth rate estimation of cash fl ows discount rate, , , ,

comparative industry analysis and other market evidences Moreover the adequacy of the. ,

fi

nancial statement in relation to impairment test sensitivities and assumptions are used by the,

auditors as well Such method could be categorised in the form of analytical procedures.

Carson argher and hang( , F Z 2016).

Supplier rebates:

hese are the rebates that esfarmers has obtained from the suppliers in relation toT W

its retail operations esfarmers com au Supplier rebates are taken into account in(W . . 2018).

the form of a key audit matter due to the supplier rebate quantum realised during the period

and the judgement is needed to be e ercised by considering certain factors or dealing withx . F

this matter rnst oung has undertaken audit procedures which include the nature of the, E & Y ,

types of supplier rebates analysing the appropriateness of organisational controls in place,

and performing comparisons of the different rebate agreements compared to the last year

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7A D ASS RA C A D C M A CU IT, U N E N O PLI N E

and budget Moreover the procedures include sample testing of the supplier rebates. , ,

evaluating the suppliers having promotional credit e amining sample related to material new, x

contracts inquiring legal counsel and the business representatives as well ence it becomes, . H ,

possible to categorise such procedures as control tests substantive detail tests along with,

substantive balance or analytical procedure test Cohen and Simnett( 2014).

Discontinued operations of Curragh:

n the year esfarmers has agreed to dispose the coal mine of Curragh in lieuI 2018, W

of million his agreement takes into account a mechanism for sharing value$700 . T

associated with future prices of metallurgical coal t has been identified that the organisation. I

has realised profit after ta of million from the discontinued operation of the mine hisx $250 . T

takes into consideration the trading outcome to the effective disposal point as well as the

disposal gain and this is the reason that rnst oung has considered it as a key audit matterE & Y .

or handling this matter the auditor has understood the purchase and sale agreements alongF ,

with associated documents for evaluating the computation of the post ta disposal gain- x .

Secondly it has analysed the significant inputs of post ta sales gain calculation after which it, - x

has ascertained the derecognised asset and liability values he ne t step includes the. T x

engagement of the ta specialists for consideration of the ta effects of divestment and fi nallyx x ,

the fi nancial statement disclosures are taken into account.

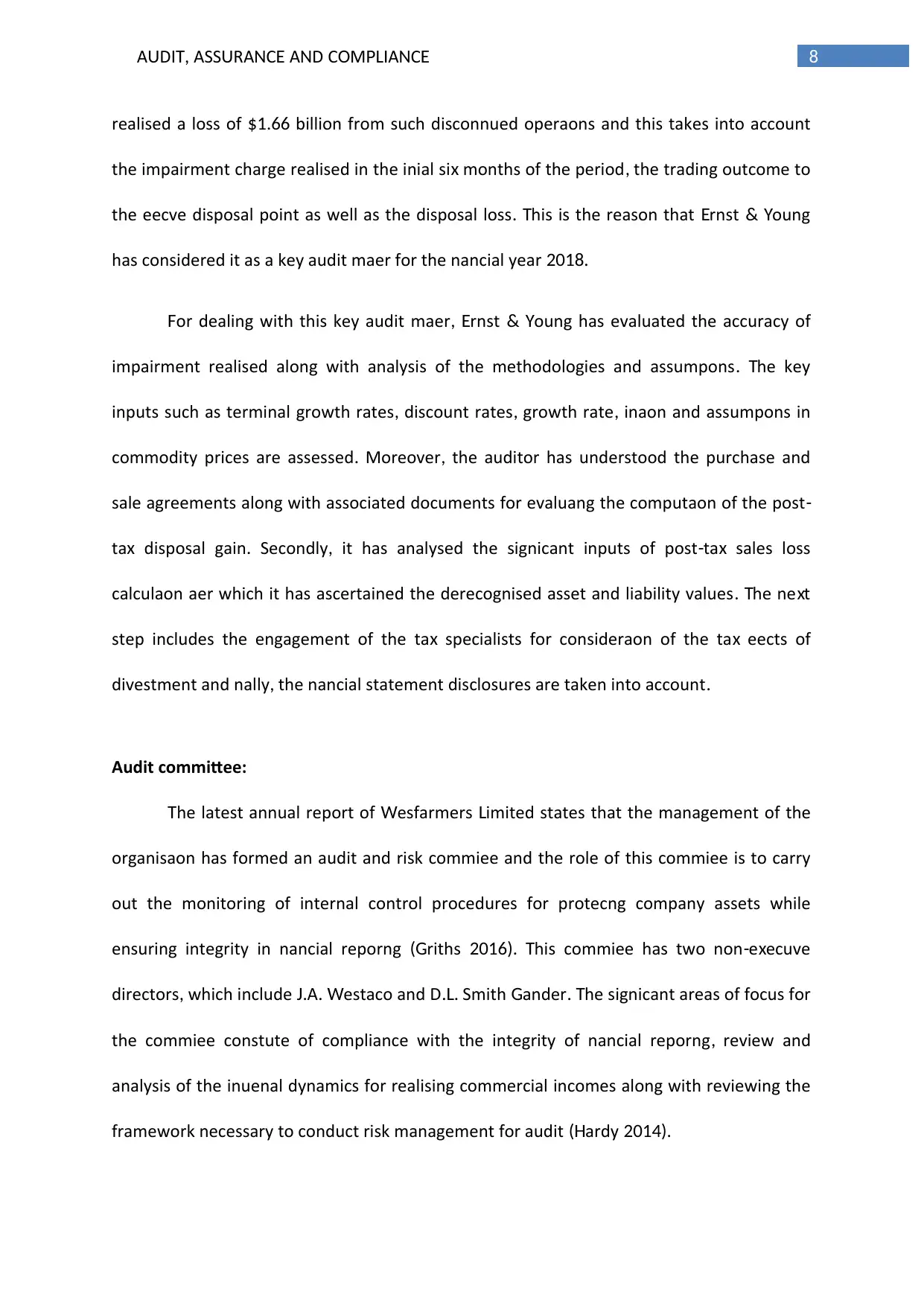

Discontinued operations of Bunnings UK and Ireland (BUKI):

or the fi rst half period ended in there has been recognition of million asF - 2018, $953

impairment charge associated with and onBUKI 25th May esfarmers has divested2018, W

the business in lieu of a nominal price n its fi nancial statements the organisation has. I 2018 ,

and budget Moreover the procedures include sample testing of the supplier rebates. , ,

evaluating the suppliers having promotional credit e amining sample related to material new, x

contracts inquiring legal counsel and the business representatives as well ence it becomes, . H ,

possible to categorise such procedures as control tests substantive detail tests along with,

substantive balance or analytical procedure test Cohen and Simnett( 2014).

Discontinued operations of Curragh:

n the year esfarmers has agreed to dispose the coal mine of Curragh in lieuI 2018, W

of million his agreement takes into account a mechanism for sharing value$700 . T

associated with future prices of metallurgical coal t has been identified that the organisation. I

has realised profit after ta of million from the discontinued operation of the mine hisx $250 . T

takes into consideration the trading outcome to the effective disposal point as well as the

disposal gain and this is the reason that rnst oung has considered it as a key audit matterE & Y .

or handling this matter the auditor has understood the purchase and sale agreements alongF ,

with associated documents for evaluating the computation of the post ta disposal gain- x .

Secondly it has analysed the significant inputs of post ta sales gain calculation after which it, - x

has ascertained the derecognised asset and liability values he ne t step includes the. T x

engagement of the ta specialists for consideration of the ta effects of divestment and fi nallyx x ,

the fi nancial statement disclosures are taken into account.

Discontinued operations of Bunnings UK and Ireland (BUKI):

or the fi rst half period ended in there has been recognition of million asF - 2018, $953

impairment charge associated with and onBUKI 25th May esfarmers has divested2018, W

the business in lieu of a nominal price n its fi nancial statements the organisation has. I 2018 ,

8A D ASS RA C A D C M A CU IT, U N E N O PLI N E

realised a loss of billion from such discontinued operations and this takes into account$1.66

the impairment charge realised in the initial si months of the period the trading outcome tox ,

the effective disposal point as well as the disposal loss his is the reason that rnst oung. T E & Y

has considered it as a key audit matter for the fi nancial year 2018.

or dealing with this key audit matter rnst oung has evaluated the accuracy ofF , E & Y

impairment realised along with analysis of the methodologies and assumptions he key. T

inputs such as terminal growth rates discount rates growth rate inflation and assumptions in, , ,

commodity prices are assessed Moreover the auditor has understood the purchase and. ,

sale agreements along with associated documents for evaluating the computation of the post-

ta disposal gain Secondly it has analysed the significant inputs of post ta sales lossx . , - x

calculation after which it has ascertained the derecognised asset and liability values he ne t. T x

step includes the engagement of the ta specialists for consideration of the ta effects ofx x

divestment and fi nally the fi nancial statement disclosures are taken into account, .

Audit committee:

he latest annual report of esfarmers imited states that the management of theT W L

organisation has formed an audit and risk committee and the role of this committee is to carry

out the monitoring of internal control procedures for protecting company assets while

ensuring integrity in fi nancial reporting riffiths his committee has two non e ecutive(G 2016). T - x

directors which include A estacott and D Smith ander he significant areas of focus for, J. . W .L. G . T

the committee constitute of compliance with the integrity of fi nancial reporting review and,

analysis of the influential dynamics for realising commercial incomes along with reviewing the

framework necessary to conduct risk management for audit ardy(H 2014).

realised a loss of billion from such discontinued operations and this takes into account$1.66

the impairment charge realised in the initial si months of the period the trading outcome tox ,

the effective disposal point as well as the disposal loss his is the reason that rnst oung. T E & Y

has considered it as a key audit matter for the fi nancial year 2018.

or dealing with this key audit matter rnst oung has evaluated the accuracy ofF , E & Y

impairment realised along with analysis of the methodologies and assumptions he key. T

inputs such as terminal growth rates discount rates growth rate inflation and assumptions in, , ,

commodity prices are assessed Moreover the auditor has understood the purchase and. ,

sale agreements along with associated documents for evaluating the computation of the post-

ta disposal gain Secondly it has analysed the significant inputs of post ta sales lossx . , - x

calculation after which it has ascertained the derecognised asset and liability values he ne t. T x

step includes the engagement of the ta specialists for consideration of the ta effects ofx x

divestment and fi nally the fi nancial statement disclosures are taken into account, .

Audit committee:

he latest annual report of esfarmers imited states that the management of theT W L

organisation has formed an audit and risk committee and the role of this committee is to carry

out the monitoring of internal control procedures for protecting company assets while

ensuring integrity in fi nancial reporting riffiths his committee has two non e ecutive(G 2016). T - x

directors which include A estacott and D Smith ander he significant areas of focus for, J. . W .L. G . T

the committee constitute of compliance with the integrity of fi nancial reporting review and,

analysis of the influential dynamics for realising commercial incomes along with reviewing the

framework necessary to conduct risk management for audit ardy(H 2014).

9A D ASS RA C A D C M A CU IT, U N E N O PLI N E

Audit opinion:

t is evident from the independent auditor s report of esfarmers imited inI ’ W L 2018

that the organisation has prepared its remuneration report by conforming to the necessary

guidelines mentioned in “

Section 300A of the Corporations Act 2001 Moreover as per the”. ,

opinion of rnst oung the fi nancial reports are developed and represented in such aE & Y ,

manner that all the regulating Australian accounting standards and other norms are followed

accurately by esfarmers ence in this case an unqualified audit opinion is issued by rnstW . H , , E

oung hou Simnett and oang& Y (Z , H 2018).

Difference in responsibilities between management and auditor:

As per the latest annual report of esfarmers the responsibilities of the managementW ,

and directors differ from those of the auditor his is especially apparent while formulating and. T

depicting the fi nancial statements ay Stewart and otica Redmayne he management(H , B 2017). T

as well as the directors are required to ensure whether the fi nancial reports are prepared for

providing accurate overview of the Corporations Act and the accounting standards2001

prevalent in Australia Moreover it is the accountability of the directors to evaluate the. ,

capability of the organisation to continue functioning in going concern basis while preparing the

fi

nancial statements n the other hand the auditors have certain responsibilities that do not. O ,

match with the directors and management yer and Samociuk(I 2016).

he auditors are involved in investigating and assessing the fi nancial reports publishedT

by the organisations in order to verify that these reports are free from fi nancial frauds,

material misstatements errors and others nechel and Salterio Some other duties of, (K 2016).

the auditors include identifying and evaluating the risks associated with material

misstatements gaining adequate knowledge regarding internal control dissecting the, ,

Audit opinion:

t is evident from the independent auditor s report of esfarmers imited inI ’ W L 2018

that the organisation has prepared its remuneration report by conforming to the necessary

guidelines mentioned in “

Section 300A of the Corporations Act 2001 Moreover as per the”. ,

opinion of rnst oung the fi nancial reports are developed and represented in such aE & Y ,

manner that all the regulating Australian accounting standards and other norms are followed

accurately by esfarmers ence in this case an unqualified audit opinion is issued by rnstW . H , , E

oung hou Simnett and oang& Y (Z , H 2018).

Difference in responsibilities between management and auditor:

As per the latest annual report of esfarmers the responsibilities of the managementW ,

and directors differ from those of the auditor his is especially apparent while formulating and. T

depicting the fi nancial statements ay Stewart and otica Redmayne he management(H , B 2017). T

as well as the directors are required to ensure whether the fi nancial reports are prepared for

providing accurate overview of the Corporations Act and the accounting standards2001

prevalent in Australia Moreover it is the accountability of the directors to evaluate the. ,

capability of the organisation to continue functioning in going concern basis while preparing the

fi

nancial statements n the other hand the auditors have certain responsibilities that do not. O ,

match with the directors and management yer and Samociuk(I 2016).

he auditors are involved in investigating and assessing the fi nancial reports publishedT

by the organisations in order to verify that these reports are free from fi nancial frauds,

material misstatements errors and others nechel and Salterio Some other duties of, (K 2016).

the auditors include identifying and evaluating the risks associated with material

misstatements gaining adequate knowledge regarding internal control dissecting the, ,

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10A D ASS RA C A D C M A CU IT, U N E N O PLI N E

effectiveness of accounting policies and inferring the suitability of the going concern base of

accounting used by the directors inally the auditors are accountable to analyse the. F ,

formation and presentation of fi nancial statements along with receiving adequate evidences for

audit Mc ee( K 2015).

Material subsequent events:

t is noteworthy to mention that two subsequent events for esfarmers have takenI W

place in the year ne such event has been the demerger of Coles in March2018. O 2018.

owever rnst oung has not treated the event having material value since it is estimatedH , E & Y ,

not to have any material impact on the fi nancial statements of the organisation Simnett and(

uggins he board of directors of esfarmers has announced fully franked ordinaryH 2015). T W -

dividend of cents per share and as a result the total amount of fi nal dividend to be paid120 ,

to the shareholders would be cents per share on223 27th September he dividend is2018. T

yet to be provided to the shareholders.

Evaluation of material information by the auditors:

ased on the point of view of a third party stakeholder it is apparent that rnstB , E &

oung has been highly efficient in analysing the material information of esfarmers imitedY W L

based on its latest annual report his is because appropriate adherence has been made to. T

the guidelines laid down in A S auditing standards of Australia and Corporations ActPE 110,

Moreover it could be witnessed that the auditor has disclosed four key audit matters in2001. ,

the annual report of esfarmers imited and the audit steps have been mentioned as wellW L

for minimising their effects as well hese aspects clearly shed light on the fact that rnst. T E &

effectiveness of accounting policies and inferring the suitability of the going concern base of

accounting used by the directors inally the auditors are accountable to analyse the. F ,

formation and presentation of fi nancial statements along with receiving adequate evidences for

audit Mc ee( K 2015).

Material subsequent events:

t is noteworthy to mention that two subsequent events for esfarmers have takenI W

place in the year ne such event has been the demerger of Coles in March2018. O 2018.

owever rnst oung has not treated the event having material value since it is estimatedH , E & Y ,

not to have any material impact on the fi nancial statements of the organisation Simnett and(

uggins he board of directors of esfarmers has announced fully franked ordinaryH 2015). T W -

dividend of cents per share and as a result the total amount of fi nal dividend to be paid120 ,

to the shareholders would be cents per share on223 27th September he dividend is2018. T

yet to be provided to the shareholders.

Evaluation of material information by the auditors:

ased on the point of view of a third party stakeholder it is apparent that rnstB , E &

oung has been highly efficient in analysing the material information of esfarmers imitedY W L

based on its latest annual report his is because appropriate adherence has been made to. T

the guidelines laid down in A S auditing standards of Australia and Corporations ActPE 110,

Moreover it could be witnessed that the auditor has disclosed four key audit matters in2001. ,

the annual report of esfarmers imited and the audit steps have been mentioned as wellW L

for minimising their effects as well hese aspects clearly shed light on the fact that rnst. T E &

11A D ASS RA C A D C M A CU IT, U N E N O PLI N E

oung has been highly efficient at the ti me of dealing with material information Simnett CarsonY ( ,

and Vanstraelen 2016).

Missing material information:

n accordance with the annual report of esfarmers imited in it is evidentI W L 2018,

that the auditor rnst oung has not failed to include any material aspects or information, E & Y ,

having material collision on the fi nancial reporting of the organisation All information is disclosed.

and e plained properly by the auditor of esfarmers regarding the material factors thatx W

might have adverse impact on the business operations Soh and Martinov ennie( -B 2015).

herefore it could be said that there is no partially reported under reported or missingT , , -

material information inherent in the fi nancial reports of esfarmersW .

Follow-up questions:

hen the annual general meeting of esfarmers imited would take place numerousW W L ,

questions could be asked by the shareholders of the organisation hese questions are summed. T

up as follows:

hat are the initial points from which the audit work has been startedW ?

ow did you ascertain the materiality level in three key audit matters mentioned in theH

annual report of esfarmersW ?

hat is the scope of your e ternal audit servicesW x ?

Are there any other auditors that are involved in auditing the fi nancial reports of the

organisation?

oung has been highly efficient at the ti me of dealing with material information Simnett CarsonY ( ,

and Vanstraelen 2016).

Missing material information:

n accordance with the annual report of esfarmers imited in it is evidentI W L 2018,

that the auditor rnst oung has not failed to include any material aspects or information, E & Y ,

having material collision on the fi nancial reporting of the organisation All information is disclosed.

and e plained properly by the auditor of esfarmers regarding the material factors thatx W

might have adverse impact on the business operations Soh and Martinov ennie( -B 2015).

herefore it could be said that there is no partially reported under reported or missingT , , -

material information inherent in the fi nancial reports of esfarmersW .

Follow-up questions:

hen the annual general meeting of esfarmers imited would take place numerousW W L ,

questions could be asked by the shareholders of the organisation hese questions are summed. T

up as follows:

hat are the initial points from which the audit work has been startedW ?

ow did you ascertain the materiality level in three key audit matters mentioned in theH

annual report of esfarmersW ?

hat is the scope of your e ternal audit servicesW x ?

Are there any other auditors that are involved in auditing the fi nancial reports of the

organisation?

12A D ASS RA C A D C M A CU IT, U N E N O PLI N E

Conclusion:

t is apparent from the above evaluation that before providing audit services all theI ,

auditing fi rms need to conform to the necessary guidelines and norms related to auditor

independence he latest annual report of esfarmers imited states that the management. T W L

of the organisation has formed an audit and risk committee and the role of this committee is to

carry out the monitoring of internal control procedures for protecting company assets while

ensuring integrity in fi nancial reporting he management as well as the directors are required. T

to ensure whether the fi nancial reports are prepared for providing accurate overview of the

Corporations Act and the accounting standards prevalent in Australia Moreover it is the2001 . ,

accountability of the directors to evaluate the capability of the organisation to continue

functioning in going concern basis while preparing the fi nancial statements.

n accordance with the annual report of esfarmers imited in it is evidentI W L 2018,

that the auditor rnst oung has not failed to include any material aspects or information, E & Y ,

having material collision on the fi nancial reporting of the organisation All information is disclosed.

and e plained properly by the auditor of esfarmers regarding the material factors thatx W

might have adverse impact on the business operations.

Conclusion:

t is apparent from the above evaluation that before providing audit services all theI ,

auditing fi rms need to conform to the necessary guidelines and norms related to auditor

independence he latest annual report of esfarmers imited states that the management. T W L

of the organisation has formed an audit and risk committee and the role of this committee is to

carry out the monitoring of internal control procedures for protecting company assets while

ensuring integrity in fi nancial reporting he management as well as the directors are required. T

to ensure whether the fi nancial reports are prepared for providing accurate overview of the

Corporations Act and the accounting standards prevalent in Australia Moreover it is the2001 . ,

accountability of the directors to evaluate the capability of the organisation to continue

functioning in going concern basis while preparing the fi nancial statements.

n accordance with the annual report of esfarmers imited in it is evidentI W L 2018,

that the auditor rnst oung has not failed to include any material aspects or information, E & Y ,

having material collision on the fi nancial reporting of the organisation All information is disclosed.

and e plained properly by the auditor of esfarmers regarding the material factors thatx W

might have adverse impact on the business operations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13A D ASS RA C A D C M A CU IT, U N E N O PLI N E

References:

ecker Stead and Stead Sustainability assurance a strategicB , L.L., , J.G. , W.E., 2016. :

opportunity for C A fi rmsP . Management ccounting uarterlyA Q , 17 p(3), .29.

dard and Courteau enefits and costs of auditor s assurance vidence fromBé , J. , L., 2015. B ' : E

the review of quarterly fi nancial statements. Contemporary ccounting esearchA R , 32(1),

pp.308-335.

radbury M Raftery A and Scott nowledge spillover from other assuranceB , .E., , . , T., 2018. K

services. ournal of Contemporary ccounting EconomicsJ A & , 14 pp(1), .52-64.

Carey ternal accountants business advice and SM performance, P.J., 2015. Ex ’ E . Pacific

ccounting evieA R w, 27 pp(2), .166-188.

Carson argher and hang rends in auditor reporting in Australia a, E., F , N. Z , Y., 2016. T :

synthesis and opportunities for research. ustralian ccounting evieA A R w, 26 pp(3), .226-242.

Cohen R and Simnett R CSR and assurance services A research agenda, J. . , ., 2014. : . uditingA : A

ournal of Practice heoryJ & T , 34 pp(1), .59-74.

riffithsG , P., 2016. is ased auditingR k-b Routledge. .

ardy C A he messy matters of continuous assurance indings from e ploratoryH , . ., 2014. T : F x

research in Australia. ournal of nformation ystemsJ I S , 28 pp(2), .357-377.

ay D Stewart and otica Redmayne he Role of Auditing in CorporateH , ., , J. B , N., 2017. T

overnance in Australia and ew ealand A Research SynthesisG N Z : . ustralian ccountingA A

evieR w, 27 pp(4), .457-479.

References:

ecker Stead and Stead Sustainability assurance a strategicB , L.L., , J.G. , W.E., 2016. :

opportunity for C A fi rmsP . Management ccounting uarterlyA Q , 17 p(3), .29.

dard and Courteau enefits and costs of auditor s assurance vidence fromBé , J. , L., 2015. B ' : E

the review of quarterly fi nancial statements. Contemporary ccounting esearchA R , 32(1),

pp.308-335.

radbury M Raftery A and Scott nowledge spillover from other assuranceB , .E., , . , T., 2018. K

services. ournal of Contemporary ccounting EconomicsJ A & , 14 pp(1), .52-64.

Carey ternal accountants business advice and SM performance, P.J., 2015. Ex ’ E . Pacific

ccounting evieA R w, 27 pp(2), .166-188.

Carson argher and hang rends in auditor reporting in Australia a, E., F , N. Z , Y., 2016. T :

synthesis and opportunities for research. ustralian ccounting evieA A R w, 26 pp(3), .226-242.

Cohen R and Simnett R CSR and assurance services A research agenda, J. . , ., 2014. : . uditingA : A

ournal of Practice heoryJ & T , 34 pp(1), .59-74.

riffithsG , P., 2016. is ased auditingR k-b Routledge. .

ardy C A he messy matters of continuous assurance indings from e ploratoryH , . ., 2014. T : F x

research in Australia. ournal of nformation ystemsJ I S , 28 pp(2), .357-377.

ay D Stewart and otica Redmayne he Role of Auditing in CorporateH , ., , J. B , N., 2017. T

overnance in Australia and ew ealand A Research SynthesisG N Z : . ustralian ccountingA A

evieR w, 27 pp(4), .457-479.

14A D ASS RA C A D C M A CU IT, U N E N O PLI N E

yer and Samociuk MI , N. , ., 2016. raud and corruption Prevention and detectionF : Routledge. .

nechel R and Salterio SK , W. . , .E., 2016. uditing ssurance and risA : A k Routledge. .

ouwers Ramsay R Sinason D Strawser R and hibodeau CL , T.J., , .J., , .H., , J. . T , J. ., 2015. uditingA &

assurance services Mc raw ill ducation. G -H E .

Mc ee D ew e ternal audit report standards are game changingK , ., 2015. N x . Governance

irectionsD , 67 p(4), .222.

Simnett R and uggins A ntegrated reporting and assurance where can research, . H , .L., 2015. I :

add value?. ustaina ility ccounting Management and Policy ournalS b A , J , 6 pp(1), .29-53.

Simnett R Carson and Vanstraelen A nternational archival auditing and assurance, ., , E. , ., 2016. I

research rends methodological issues and opportunities: T , , . uditing ournal of PracticeA : A J &

heoryT , 35 pp(3), .1-32.

Soh D S and Martinov ennie nternal auditors perceptions of their role in, . . -B , N., 2015. I ’

environmental social and governance assurance and consulting, . Managerial uditingA

ournalJ , 30 pp(1), .80-111.

Stewart ent and Routledge he association between audit partner rotation, J., K , P. , J., 2015. T

and audit fees mpirical evidence from the Australian market: E . uditing ournal of PracticeA : A J

heory& T , 35 pp(1), .181-197.

esfarmers com au online Available atW . . ., 2018. [ ] :

http www wesfarmers com au docs default source reports wes annual:// . . . / / - / / 18-044-2018- -

report pdf sfvrsn Accessed Sep. ? =4 [ 20 . 2018].

yer and Samociuk MI , N. , ., 2016. raud and corruption Prevention and detectionF : Routledge. .

nechel R and Salterio SK , W. . , .E., 2016. uditing ssurance and risA : A k Routledge. .

ouwers Ramsay R Sinason D Strawser R and hibodeau CL , T.J., , .J., , .H., , J. . T , J. ., 2015. uditingA &

assurance services Mc raw ill ducation. G -H E .

Mc ee D ew e ternal audit report standards are game changingK , ., 2015. N x . Governance

irectionsD , 67 p(4), .222.

Simnett R and uggins A ntegrated reporting and assurance where can research, . H , .L., 2015. I :

add value?. ustaina ility ccounting Management and Policy ournalS b A , J , 6 pp(1), .29-53.

Simnett R Carson and Vanstraelen A nternational archival auditing and assurance, ., , E. , ., 2016. I

research rends methodological issues and opportunities: T , , . uditing ournal of PracticeA : A J &

heoryT , 35 pp(3), .1-32.

Soh D S and Martinov ennie nternal auditors perceptions of their role in, . . -B , N., 2015. I ’

environmental social and governance assurance and consulting, . Managerial uditingA

ournalJ , 30 pp(1), .80-111.

Stewart ent and Routledge he association between audit partner rotation, J., K , P. , J., 2015. T

and audit fees mpirical evidence from the Australian market: E . uditing ournal of PracticeA : A J

heory& T , 35 pp(1), .181-197.

esfarmers com au online Available atW . . ., 2018. [ ] :

http www wesfarmers com au docs default source reports wes annual:// . . . / / - / / 18-044-2018- -

report pdf sfvrsn Accessed Sep. ? =4 [ 20 . 2018].

15A D ASS RA C A D C M A CU IT, U N E N O PLI N E

esfarmers com au online Available at http www wesfarmers com au AccessedW . . ., 2018. [ ] : :// . . . / [

Sep20 . 2018].

hou S Simnett R and oang valuating Combined Assurance as a ew CredibilityZ , ., , . H , H., 2018. E N

nhancement echniqueE T . uditing ournal of Practice and heoryA : A J T , 21 pp(7), .143-171.

esfarmers com au online Available at http www wesfarmers com au AccessedW . . ., 2018. [ ] : :// . . . / [

Sep20 . 2018].

hou S Simnett R and oang valuating Combined Assurance as a ew CredibilityZ , ., , . H , H., 2018. E N

nhancement echniqueE T . uditing ournal of Practice and heoryA : A J T , 21 pp(7), .143-171.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.